Attached files

| file | filename |

|---|---|

| 8-K - 8-K - HEALTHCARE TRUST OF AMERICA, INC. | a201607078-k.htm |

ANNUAL MEETING OF SHAREHOLDERS

July 7, 2016

www.htareit.com

NYSE: HTA

Exhibit 99.1

FORWARD LOOKING STATEMENTS

This document contains both historical and forward-looking statements. Forward-looking statements are based on current expectations, plans, estimates,

assumptions and beliefs, including expectations, plans, estimates, assumptions and beliefs about our company, the real estate industry and the debt and equity

capital markets. All statements other than statements of historical fact are, or may be deemed to be, forward-looking statements within the meaning of Section

27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended.

Forward-looking statements include information concerning possible or assumed future results of operations of our company. The forward-looking statements

included in this document are subject to numerous risks and uncertainties that could cause actual results to differ materially from those expressed or implied in

the forward-looking statements. Assumptions relating to the foregoing involve judgments with respect to, among other things, future economic, competitive and

market conditions and future business decisions, all of which are difficult or impossible to predict accurately and many of which are beyond our control. Although

we believe that the expectations reflected in such forward-looking statements are based on reasonable assumptions, our actual results and performance could

differ materially from those set forth in the forward-looking statements. Factors which could have a material adverse effect on our operations and future prospects

include, but are not limited to: changes in economic conditions affecting the healthcare property sector, the commercial real estate market and the credit market;

competition for acquisition of medical office buildings and other facilities that serve the healthcare industry; economic fluctuations in certain states in which our

property investments are geographically concentrated; retention of our senior management team; financial stability and solvency of our tenants; supply and

demand for operating properties in the market areas in which we operate; our ability to acquire properties, and to successfully operate those properties once

acquired; changes in property taxes; legislative and regulatory changes, including changes to laws governing the taxation of REITs and changes to laws governing

the healthcare industry; fluctuations in reimbursements from third party payors such as Medicare and Medicaid; changes in interest rates; the availability of capital

and financing; restrictive covenants in our credit facilities; changes in our credit ratings; our ability to remain qualified as a REIT; and the risk factors set forth in our

2015 Annual Report on Form 10-K filed on February 22, 2016.

Forward-looking statements speak only as of the date made. Except as otherwise required by the federal securities laws, we undertake no obligation to update any

forward-looking statements to reflect the events or circumstances arising after the date as of which they are made. As a result of these risks and uncertainties,

readers are cautioned not to place undue reliance on the forward looking statements included in this document or that may be made elsewhere from time to time

by, or on behalf of, us.

For definitions of terms and reconciliations for certain financial measures disclosed herein, including, but not limited to, funds from operations (FFO), normalized

funds from operations (normalized FFO), funds available for distribution (FAD), normalized funds available for distribution (normalized FAD), annualized base rents,

net operating income (NOI), cash net operating income (cash NOI), same-property cash NOI, adjusted earnings before interest, taxes, depreciation and

amortization (adjusted EBITDA), on-campus/aligned, and tenant retention, please see our company’s earnings press release issued on April 25, 2016 and our

company’s Supplemental Financial Package for the quarter ended March 31, 2016, each of which is available in the investor relations section of our company’s

website located at www.htareit.com.

1 www.htareit.com Annual Meeting of Stockholders | July 7, 2016

HEALTHCARE TRUST OF AMERICA (NYSE: HTA)

Largest Dedicated Owner of Medical Office For The Future of Healthcare

2 www.htareit.com Annual Meeting of Stockholders | July 7, 2016

1 Through April 2016

3 Shareholder returns from January 1, 2007 through May 31, 2016

All data as of March 31, 2016 unless otherwise stated

67%

Outpatient Real Estate Portfolio

(% of GLA)

Key Market Focus – Top 10

(% of Invested $)

Hospital

Campus

4.0%

4.0%

4.4%

4.5%

4.5%

4.8%

5.4%

5.7%

6.4%

9.8%

Atlanta, GA

Indianapolis, IN

Miami, FL

Albany, NY

Greenville, SC

Phoenix, AZ

Houston, TX

Dallas, TX

Hartford/New Haven, CT

Boston, MA

On-Campus/ Adjacent

33%

Core Community

Outpatient Academic

Med Center

61%

6%

33%

FOUNDED IN 2006 – EXPERIENCED MANANGEMENT

AND BOD DRIVING 10 YEARS OF VALUE CREATION

MOBs: CORE-CRITICAL REAL ESTATE WITH

HEALTHCARE TAILWINDS

PORTFOLIO SERVING THE FUTURE OF HEALTHCARE;

KEY MARKET CONCENTRATIONS

DEDICATED OPERATING PLATFORM DRIVES

CONSISTENT PERFORMANCE

PRUDENT GROWTH:

SCALABLE BUSINESS IN FRAGMENTED SECTOR

INVESTMENT GRADE COMPANY: CONSERVATIVE &

POSITIONED FOR GROWTH

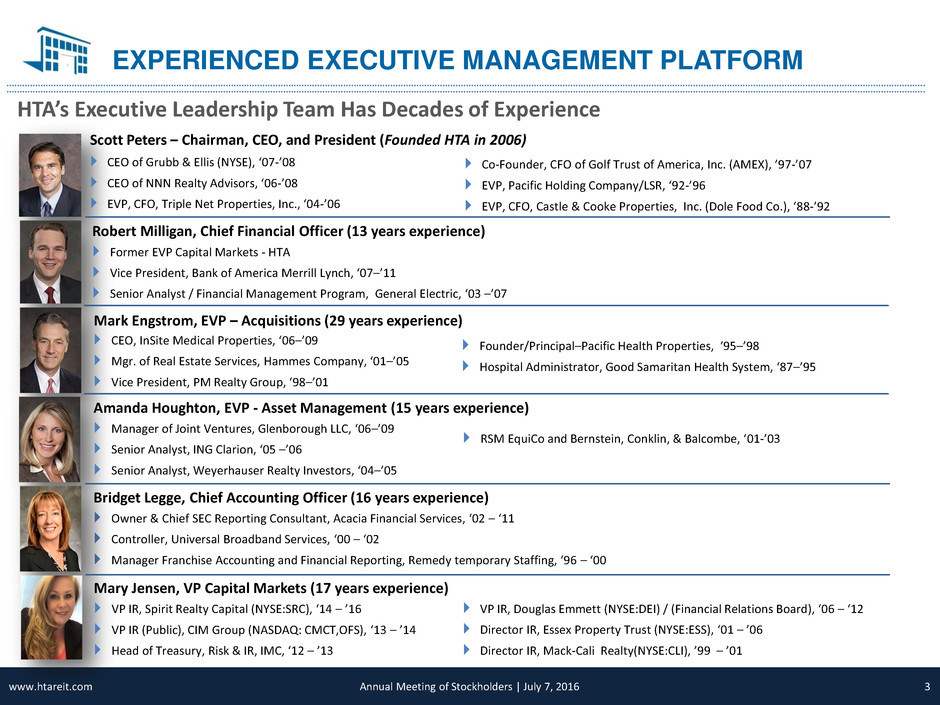

EXPERIENCED EXECUTIVE MANAGEMENT PLATFORM

Scott Peters – Chairman, CEO, and President (Founded HTA in 2006)

CEO of Grubb & Ellis (NYSE), ‘07-’08

CEO of NNN Realty Advisors, ‘06-’08

EVP, CFO, Triple Net Properties, Inc., ‘04-’06

Mark Engstrom, EVP – Acquisitions (29 years experience)

CEO, InSite Medical Properties, ‘06–’09

Mgr. of Real Estate Services, Hammes Company, ‘01–’05

Vice President, PM Realty Group, ‘98–’01

Amanda Houghton, EVP - Asset Management (15 years experience)

Manager of Joint Ventures, Glenborough LLC, ‘06–’09

Senior Analyst, ING Clarion, ‘05 –’06

Senior Analyst, Weyerhauser Realty Investors, ‘04–’05

Robert Milligan, Chief Financial Officer (13 years experience)

Former EVP Capital Markets - HTA

Vice President, Bank of America Merrill Lynch, ‘07–’11

Senior Analyst / Financial Management Program, General Electric, ‘03 –’07

Co-Founder, CFO of Golf Trust of America, Inc. (AMEX), ’97-’07

EVP, Pacific Holding Company/LSR, ‘92-’96

EVP, CFO, Castle & Cooke Properties, Inc. (Dole Food Co.), ‘88-’92

Founder/Principal–Pacific Health Properties, ‘95–’98

Hospital Administrator, Good Samaritan Health System, ‘87–’95

RSM EquiCo and Bernstein, Conklin, & Balcombe, ‘01-’03

HTA’s Executive Leadership Team Has Decades of Experience

3 www.htareit.com Annual Meeting of Stockholders | July 7, 2016

Bridget Legge, Chief Accounting Officer (16 years experience)

Owner & Chief SEC Reporting Consultant, Acacia Financial Services, ‘02 – ‘11

Controller, Universal Broadband Services, ‘00 – ‘02

Manager Franchise Accounting and Financial Reporting, Remedy temporary Staffing, ‘96 – ‘00

Mary Jensen, VP Capital Markets (17 years experience)

VP IR, Spirit Realty Capital (NYSE:SRC), ‘14 – ’16

VP IR (Public), CIM Group (NASDAQ: CMCT,OFS), ‘13 – ’14

Head of Treasury, Risk & IR, IMC, ‘12 – ’13

VP IR, Douglas Emmett (NYSE:DEI) / (Financial Relations Board), ‘06 – ‘12

Director IR, Essex Property Trust (NYSE:ESS), ‘01 – ’06

Director IR, Mack-Cali Realty(NYSE:CLI), ’99 – ’01

STRONG GOVERNANCE

Former Chairman and CEO of Golf Trust of America, Inc., a publicly traded REIT.

Served as Officer in various legal firms and real estate companies with a focus on real estate, finance, taxation, and acquisitions.

Lead Independent Director* since December 2014; Independent Director Since September 2006

W. Bradley

Blair, II*

Current Chairman and CEO of Verity Financial Group – Financial Advisory Firm focused on healthcare and technology

Formerly managing partner and board member for KPMG, LLP

Director for Targeted Medical Pharma, Inc.; former director Tenet Healthcare

Audit Committee Chairman; Independent Director Since 2006

Maurice J.

Dewald

Former Executive Officer for General Electric (25 years), including roles as Chief Marketing Officer of GE Company; and

EVP of GE Capital, led commercial lending and leasing in NA, largest segment of the biggest non-bank financial institution in the U.S

Independent Director Since 2016

Daniel S.

Henson

Currently serves as a partner in The Contrarian Group, an investment management company

Former CEO and CFO of WCH, Inc. (formerly Candlewood Hotels); Former CFO of the Irvine Company

Served in various C-level capacities with various real estate focused companies primarily in the hotel and multifamily sectors

Corporate Governance Chairman; Independent Director Since September 2006

Warren D. Fix

Founding CEO and President of Methodist Hospital System (Houston, Texas)

Elected to Modern Healthcare’s Hall of Fame in 2016 for his impact thru 35+ years healthcare administration

Former board member of Alexion Pharmaceuticals and Centerpulse, Inc.

Risk Committee Chairman; Independent Director Since April 2007

Larry L.

Mathis

Currently a Principal at American Oak Properties, LLC where he manages and develops real estate operating properties

Former Partner at Warmington Wescombe Realty Partners and Ernst & Young, LLP

Compensation Committee Chairman; Independent Director Since October 2006

Gary T.

Wescombe

Former Executive Officer for General Electric (36 years), including roles as President of GE’s Olympic Sponsorship and Corporate

Accounts and GM for Enterprise Selling, Sales Force Effectiveness, and Corporate Sales.

Serves on the Board of Polymer Group, Inc., a Blackstone portfolio company, and Capital Bank, N.A.

Independent Director Since March 2015

Peter N. Foss

4 www.htareit.com Annual Meeting of Stockholders | July 7, 2016

A DECADE OF SHAREHOLDER VALUE CREATION

195% relative total Shareholder

return (1/1/07—6/30/16)

11.5% Average Total Returns Since

First Distribution

Individuals who invested $1,000

with HTA in 2006 have an

investment worth over $2,950 with

reinvested dividends at 6/30/16

Significantly outperformed the RMS

and the S&P 500

Outperformed US HC REIT Index

and Direct Peers

INDUSTRY-LEADING PERFORMANCE – POSITIONED FOR THE NEXT 10 YEARS

5 www.htareit.com Annual Meeting of Stockholders | July 7, 2016

-75%

-25%

25%

75%

125%

175%

2007 2008 2009 2010 2011 2012 2013 2014 2015 2016

HTA Total Returns Compared to Peers

(Since Inception)

HTA SNL HC REIT HR The Big 3: HCP, VTR, HCN

Big 3: 158%

HC REIT: 155%

HR: 74%

HTA: 195%

-75%

-25%

25%

75%

125%

175%

2007 2008 2009 2010 2011 2012 2013 2014 2015 2016

HTA Total Returns Compared to Market

(Since Inception)

HTA US REIT Index (RMS) S&P 500

HTA: 195%

S&P: 79%

RMS: 56%

CORE CRITCAL REAL ESTATE WITH HEALTHCARE TAILWINDS

Healthcare is Fastest Growing Sector of U.S.

Economy

Healthcare employment is growing 2x faster than

any other sector

10,000 people turning 65 every day (4x as many

physician visits as younger population)

The Affordable Care Act will add 25 to 35 million

newly insured individuals

Healthcare Expenditures Increasing to 20% of U.S.

GDP

Healthcare Moving to Cost-effective Outpatient

Locations

Focus on cost-effective care – private insurers &

government payors

Outpatient is the economically efficient location

Health systems & providers focused on

convenience – Serving patients where they are

Mt. Sinai: “If our Beds Are Full, We have Failed”

6 www.htareit.com

Hospitals have been facing limitations on expansion and as a result, more procedures are being performed in outpatient facilities

Insurance companies and government healthcare programs have been directing patients to less-costly outpatient care

0

Source: American Hospital Association

0

500

1,000

1,500

2,000

2,500

100

105

110

115

120

125

130

19

89

19

90

19

91

19

92

19

93

19

94

19

95

19

96

19

97

19

98

19

99

20

00

20

01

20

02

20

03

20

04

20

05

20

06

20

07

20

08

20

09

20

10

20

11

20

12

OUTPATIENT VISITS ARE INCREASING OVER TIME

Inpatient Admissions/1000 Persons Outpatient Visits/1000 Persons

INPATIENT OUTPATIENT

OUTPATIENT TRENDS INCREASING

Annual Meeting of Stockholders | July 7, 2016

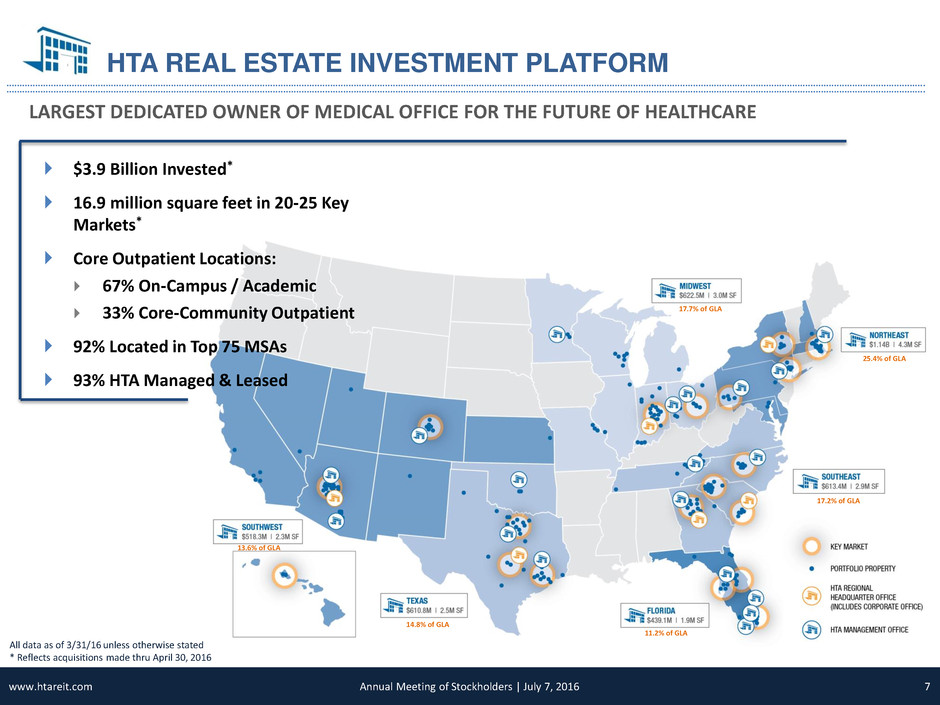

25.4% of GLA

17.7% of GLA

17.2% of GLA

11.2% of GLA

14.8% of GLA

13.6% of GLA

$3.9 Billion Invested*

16.9 million square feet in 20-25 Key

Markets*

Core Outpatient Locations:

67% On-Campus / Academic

33% Core-Community Outpatient

92% Located in Top 75 MSAs

93% HTA Managed & Leased

HTA REAL ESTATE INVESTMENT PLATFORM

LARGEST DEDICATED OWNER OF MEDICAL OFFICE FOR THE FUTURE OF HEALTHCARE

7 www.htareit.com

All data as of 3/31/16 unless otherwise stated

* Reflects acquisitions made thru April 30, 2016

Annual Meeting of Stockholders | July 7, 2016

STRATEGIC INVESTMENTS IN CORE-CRITICAL LOCATIONS

Hospital Campuses (61%) / Academic Medical Centers (6%)

Core Community Outpatient

Long-term steady demand supported by hospital infrastructure and

ancillary services

Limited developable land around hospital campuses

Designated healthcare cluster drives referral patterns

Hospital / University name recognition and reputation

Clinical, lab, research, and academic space shapes future delivery of

healthcare

Considerations: Health system can restrict tenants in on-campus

MOB’s; hospital campuses not always convenient for patients

Strategically located within the community and other healthcare

buildings

More than 2/3 of all physicians practice “off-campus” (source: Revista)

Favored location for independent multi-specialty physician group –

fastest growing segment of physicians (i.e., Westmed, ProHealth)

No restrictions – multiple providers and health system networks

compete for space

8 www.htareit.com Investor Presentation | April 2016

GREENVILLE, SC,

$179M, ACQUIRED 2009

Tufts & Boston University,

BOSTON, MA,

$250M, ACQUIRED 2014-2015

WHITE PLAINS, NY

$93M, ACQUIRED 2014

O

n

-Campus

-

6

7

%

3

3

%

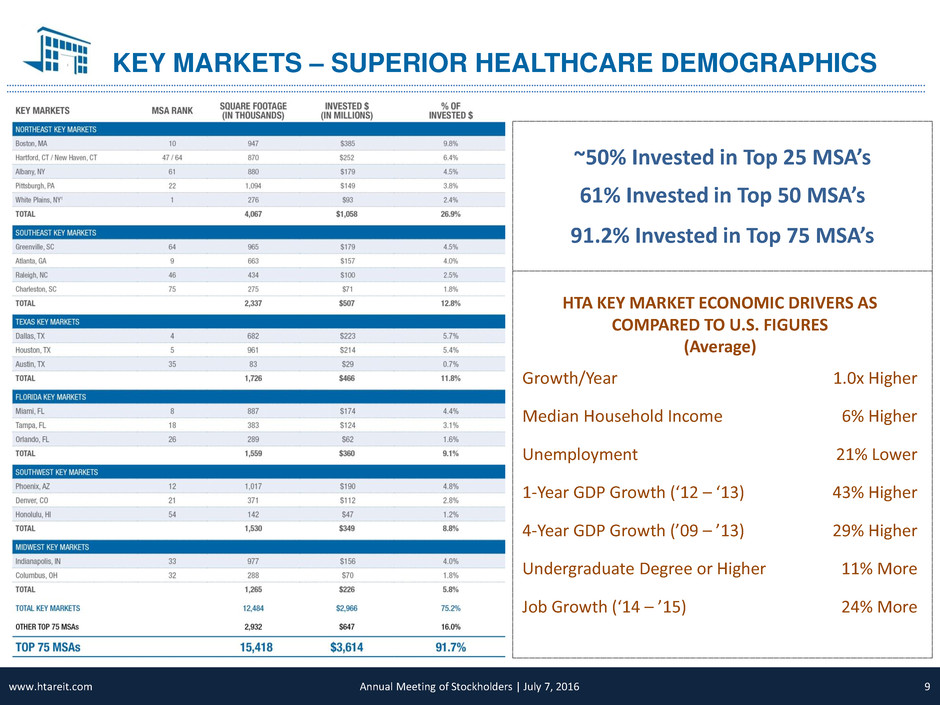

HTA KEY MARKET ECONOMIC DRIVERS AS

COMPARED TO U.S. FIGURES

(Average)

Growth/Year 1.0x Higher

Median Household Income 6% Higher

Unemployment 21% Lower

1-Year GDP Growth (‘12 – ‘13) 43% Higher

4-Year GDP Growth (’09 – ’13) 29% Higher

Undergraduate Degree or Higher 11% More

Job Growth (‘14 – ’15) 24% More

KEY MARKETS – SUPERIOR HEALTHCARE DEMOGRAPHICS

9

~50% Invested in Top 25 MSA’s

91.2% Invested in Top 75 MSA’s

61% Invested in Top 50 MSA’s

9 www.htareit.com Annual Meeting of Stockholders | July 7, 2016

SCALABLE BUSINESS IN A FRAGMENTED SPACE

10 www.htareit.com

$3.9 Billion Invested

* Acquisitions through April 30, 2016

$ millions

9%

46%

33%

5%

8%

REITs

Hospitals / Healthcare Systems

Providers / Private Owners

Private Equity / Developers

Government / Other

Large, Fragmented Industry with Ample

Investment Opportunities

Leading Investor of Medical Office Buildings

Target key markets with dynamic and growing

economies and health systems

Focus on critical locations primarily located directly on-

campus or in core-community outpatient locations

Underwrite well-occupied MOB assets with strong

same-store growth potential on HTA’s platform

Accretive to HTA’s cost of capital and commitment to a

low leveraged balance sheet

Capital Recycling

Since 2014, HTA has recycled $146M of assets

Recycling non-core assets: (i) outside of key markets, (ii)

single-tenanted in nature, or (iii) non-MOB’s

Generated gains of $32M ; Low teen levered IRR’s on

investments

Annual Meeting of Stockholders | July 7, 2016

$83 $36 $27

$413

$558

$456

$802

$68

$295

$398

$440

$272

$435

$0

$100

$200

$300

$400

$500

$600

$700

$800

$900

2007 2008 2009 2010 2011 2012 2013 2014 2015 2016*

Acquisitions Dispositions

INVESTMENT GRADE COMPANY

$562.3 million total liquidity from undrawn revolver and unrestricted cash as of 03/31/2016

Weighted average borrowing cost of 3.3%

Weighted average debt maturity of 4.8 years

Investment Grade Credit Ratings from Moody’s and Standard & Poor’s of Baa2 / BBB

Capital Structure 1

1 Based on total capitalization as of 03/31/2016

Balance Sheet Capacity

Debt Maturities ($mm)

$0

$100,000

$200,000

$300,000

$400,000

$500,000

2016 2017 2018 2019 2020 2021 2022 2023

Unsecured Secured

30%

Debt

24%

Unsecured

6%

Secured

70%

Equity

11 www.htareit.com Annual Meeting of Stockholders | July 7, 2016

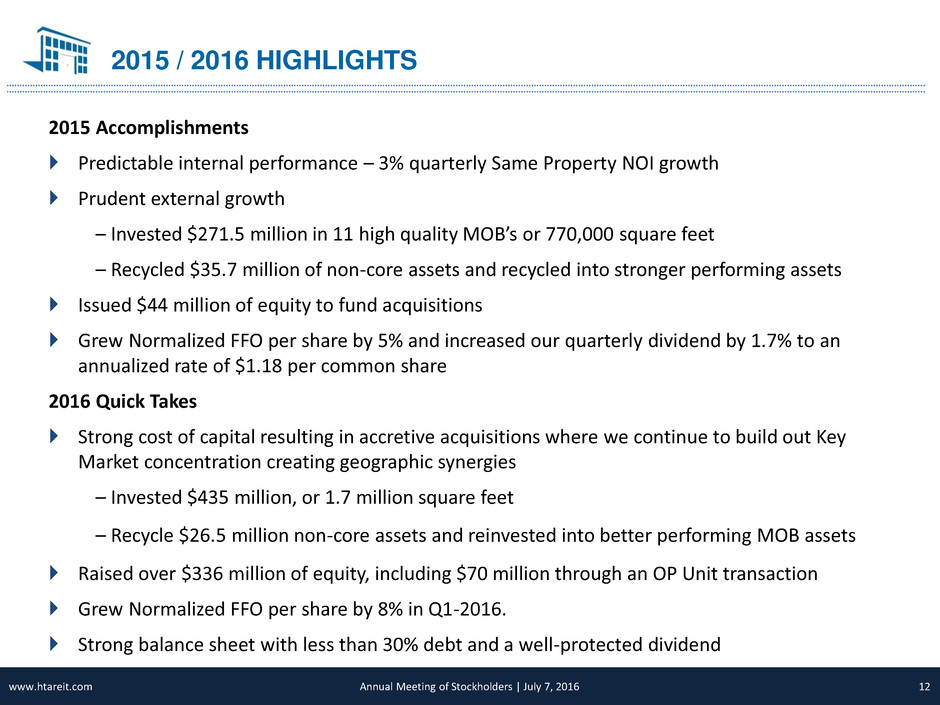

2015 / 2016 HIGHLIGHTS

12 www.htareit.com Annual Meeting of Stockholders | July 7, 2016

2015 Accomplishments

Predictable internal performance – 3% quarterly Same Property NOI growth

Prudent external growth

– Invested $271.5 million in 11 high quality MOB’s or 770,000 square feet

– Recycled $35.7 million of non-core assets and recycled into stronger performing assets

Issued $44 million of equity to fund acquisitions

Grew Normalized FFO per share by 5% and increased our quarterly dividend by 1.7% to an

annualized rate of $1.18 per common share

2016 Quick Takes

Strong cost of capital resulting in accretive acquisitions where we continue to build out Key

Market concentration creating geographic synergies

– Invested $435 million, or 1.7 million square feet

– Recycle $26.5 million non-core assets and reinvested into better performing MOB assets

Raised over $336 million of equity, including $70 million through an OP Unit transaction

Grew Normalized FFO per share by 8% in Q1-2016.

Strong balance sheet with less than 30% debt and a well-protected dividend

Leading owner of Medical Office Buildings

Healthcare Trust of America, Inc.

Thank You For Your Continued Support