Attached files

| file | filename |

|---|---|

| EX-10.2 - STOCK AND WARRANT SUBSCRIPTION AGREEMENT - Exactus, Inc. | ex10-2.htm |

| EX-10.3 - WARRANT ISSUED TO POC CAPITAL, LLC - Exactus, Inc. | ex10-3.htm |

| EX-10.1 - MASTER SERVICES AGREEMENT - Exactus, Inc. | ex10-1.htm |

| 8-K - FORM 8-K - Exactus, Inc. | seti8k_june302016.htm |

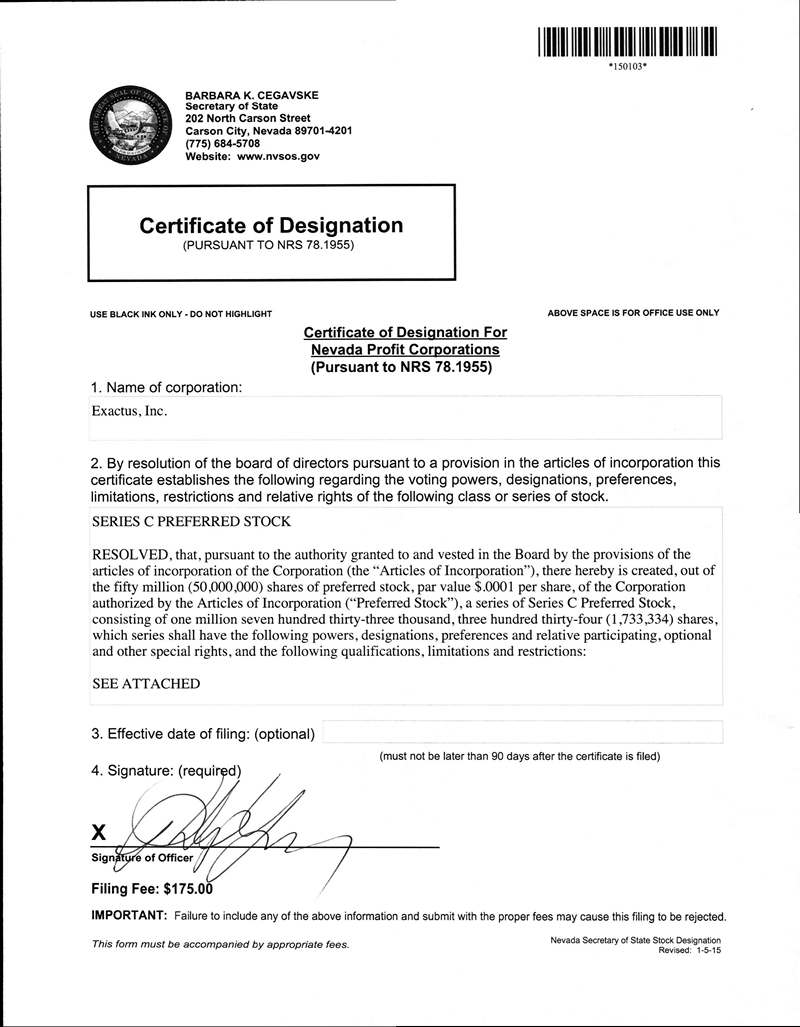

Exhibit 3.1

-1-

OF

EXACTUS, INC.

Pursuant to Section 78.1955 of the

SERIES C PREFERRED STOCK

On behalf of Exactus, Inc., a Nevada corporation (the “Corporation”), the undersigned hereby certifies that the following resolution has been duly adopted by the board of directors of the Corporation (the “Board”):

RESOLVED, that, pursuant to the authority granted to and vested in the Board by the provisions of the articles of incorporation of the Corporation (the “Articles of Incorporation”), there hereby is created, out of the fifty million (50,000,000) shares of preferred stock, par value $.0001 per share, of the Corporation authorized by the Articles of Incorporation (“Preferred Stock”), a series of Series C Preferred Stock, consisting of one million seven hundred thirty-three thousand, three hundred thirty-four (1,733,334) shares, which series shall have the following powers, designations, preferences and relative participating, optional and other special rights, and the following qualifications, limitations and restrictions:

1. Designation; Rank. This series of Preferred Stock shall be designated and known as “Series C Preferred Stock.” The number of shares constituting the Series C Preferred Stock shall be one million seven hundred thirty-three thousand, three hundred thirty-four (1,733,334) shares. Except as otherwise provided herein, the Series C Preferred Stock shall, with respect to rights on liquidation, winding up and dissolution, rank pari passu to the common stock, par value $0.0001 per share (the “Common Stock”).

2. Dividends. The holders of shares of Series C Preferred Stock have no dividend rights except as may be declared by the Board in its sole and absolute discretion, out of funds legally available for that purpose.

3. Liquidation Preference.

(a) In the event of any dissolution, liquidation or winding up of the Company (a “Liquidation”), whether voluntary or involuntary, the Holders of Series C Preferred Stock shall be entitled to participate in any distribution out of the assets of the Company on an equal basis per share with the holders of the Common Stock. For the purposes of such distribution, Holders of Series C Preferred Stock shall be treated as if all shares of Series C Preferred Stock had been converted to Common Stock immediately prior to the distribution.

(b) A sale of all or substantially all of the Corporation’s assets or an acquisition of the Corporation by another entity by means of any transaction or series of related transactions (including, without limitation, a reorganization, consolidated or merger) that results in the transfer of fifty percent (50%) or more of the outstanding voting power of the Corporation (a “Change in Control Event”), shall not be deemed to be a Liquidation for purposes of this Designation.

4. Optional Conversion of Series C Preferred Stock. The Holders of Series C Preferred Stock shall have conversion rights as follows:

(a) Conversion Right. Each share of Series C Preferred Stock shall be convertible at the option of the Holder thereof and without the payment of additional consideration by the Holder thereof, at any time, into shares of Common Stock on the Optional Conversion Date (as hereinafter defined) at a conversion rate of one (1) share of Common Stock (the “Conversion Rate”) for every one (1) share of Series C Preferred Stock.

-2-

(b) Mechanics of Optional Conversion. To effect the optional conversion of shares of Series C Preferred Stock in accordance with Section 4(a) of this Designation, any Holder of record shall make a written demand for such conversion (for purposes of this Designation, a “Conversion Demand”) upon the Corporation at its principal executive offices setting forth therein (i) the certificate or certificates representing such shares, and the proposed date of such conversion (for purposes of this Designation, the “Optional Conversion Date”). Upon receipt of the Conversion Demand, the Corporation shall give written notice (for purposes of this Designation, a “Conversion Notice”) to the Holder setting forth therein (i) the address of the place or places at which the certificate or certificates representing any shares not yet tendered are to be converted are to be surrendered; and (ii) whether the certificate or certificates to be surrendered are required to be endorsed for transfer or accompanied by a duly executed stock power or other appropriate instrument of assignment and, if so, the form of such endorsement or power or other instrument of assignment. The Conversion Notice shall be sent by first class mail, postage prepaid, to such Holder at such Holder’s address as may be set forth in the Conversion Demand or, if not set forth therein, as it appears on the records of the stock transfer agent for the Series C Preferred Stock, if any, or, if none, of the Corporation. On or before the Optional Conversion Date, each Holder of the Series C Preferred Stock so to be converted shall surrender the certificate or certificates representing such shares, duly endorsed for transfer or accompanied by a duly executed stock power or other instrument of assignment, if the Conversion Notice so provides, to the Corporation at any place set forth in such notice or, if no such place is so set forth, at the principal executive offices of the Corporation. As soon as practicable after the Optional Conversion Date and the surrender of the certificate or certificates representing such shares, the Corporation shall issue and deliver to such Holder, or its nominee, at such Holder’s address as it appears on the records of the stock transfer agent for the Series C Preferred Stock, if any, or, if none, of the Corporation, a certificate or certificates for the number of whole shares of Common Stock issuable upon such conversion in accordance with the provisions hereof.

(c) No Fractional Shares. No fractional shares of Common Stock or scrip shall be issued upon conversion of shares of Series C Preferred Stock. In lieu of any fractional share to which the Holder would be entitled but for the provisions of this Section 4(c) based on the number of shares of Series C Preferred Stock held by such Holder, the Corporation shall issue a number of shares to such Holder rounded up to the nearest whole number of shares of Common Stock. No cash shall be paid to any Holder of Series C Preferred Stock by the Corporation upon conversion of Series C Preferred Stock by such Holder.

(d) Reservation of Stock. The Corporation shall at all times when any shares of Series C Preferred Stock shall be outstanding, reserve and keep available out of its authorized but unissued Common Stock, such number of shares of Common Stock as shall from time to time be sufficient to effect the conversion of all outstanding shares of Series C Preferred Stock. If at any time the number of authorized but unissued shares of Common Stock shall not be sufficient to effect the conversion of all outstanding shares of the Series C Preferred Stock, the Corporation will take such corporate action as may, in the opinion of its counsel, be necessary to increase its authorized but unissued shares of Common Stock to such number of shares as shall be sufficient for such purpose.

(e) Limitation on Beneficial Ownership. Notwithstanding anything to the contrary contained in this Certificate of Designation, the Preferred Shares held by a Holder shall not be convertible by such Holder, and the Corporation shall not effect any conversion of any Preferred Shares held by such Holder, to the extent (but only to the extent) that such Holder or any of its affiliates would beneficially own in excess of 4.99% (the “Maximum Percentage”) of the Common Stock of the Corporation. To the extent the above limitation applies, the determination of whether the Preferred Shares held by such Holder shall be convertible (vis-à-vis other convertible, exercisable or exchangeable securities owned by such Holder or any of its affiliates) and of which such securities shall be convertible, exercisable or exchangeable (as among all such securities owned by such Holder and its affiliates) shall, subject to such Maximum Percentage limitation, be determined on the basis of the first submission to the Corporation for conversion, exercise or exchange (as the case may be). No prior inability of a Holder to convert Preferred Shares, or of the Corporation to issue shares of Common Stock to such Holder, pursuant to this Section 4(e) shall have any effect on the applicability of the provisions of this Section 4(e) with respect to any subsequent determination of convertibility or issuance (as the case may be). For purposes of this Section 4(e), beneficial ownership and all determinations and calculations (including, without limitation, with respect to calculations of percentage ownership) shall be determined in accordance with Section 13(d) of the 1934 Act and the rules and regulations promulgated thereunder. The provisions of this Section 4(e) shall be implemented in a manner otherwise than in strict conformity with the terms of this Section 4(e) to correct this Section 4(e) (or any portion hereof) which may be defective or inconsistent with the intended Maximum Percentage beneficial ownership limitation herein contained or to make changes or supplements necessary or desirable to properly give effect to such Maximum Percentage limitation. The limitations contained in this Section 4(e) shall apply to a successor holder of Preferred Shares. The holders of Common Stock shall be third party beneficiaries of this Section 4(e) and the Corporation may not waive this Section 4(e). For any reason at any time, upon the written or oral request of a Holder, the Corporation shall within two (2) Business Days confirm orally and in writing to such Holder the number of shares of Common Stock then outstanding, including by virtue of any prior conversion or exercise of convertible or exercisable securities into Common Stock, including, without limitation, pursuant to this Certificate of Designation. By written notice to the Corporation, any Holder may increase or decrease the Maximum Percentage to any other percentage not in excess of 9.99% specified in such notice; provided that (i) any such increase will not be effective until the 61st day after such notice is delivered to the Corporation, and (ii) any such increase or decrease will apply only to such Holder sending such notice and not to any other Holder.

-3-

(f) Issue Taxes. The converting Holder shall pay any and all issue and other non-income taxes that may be payable in respect of any issue or delivery of shares of Common Stock on conversion of shares of Series C Preferred Stock.

5. Voting. The holders of Series C Preferred Stock shall have the right to vote as-if-converted to Common Stock all matters submitted to a vote of holders of the Corporation’s common stock, including the election of directors, and all other matters as required by law. There is no right to cumulative voting in the election of directors. The holders of Series C Preferred Stock shall vote together with all other classes and series of common stock of the Corporation as a single class on all actions to be taken by the common stock holders of the Corporation except to the extent that voting as a separate class or series is required by law.

|

Exactus, Inc.

|

||

|

By:

|

/s/ Philip Young | |

|

Name: Philip Young

Title: CEO

|

||

|

|

||

-4-