Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - THOR INDUSTRIES INC | v443514_8k.htm |

| EX-99.3 - EXHIBIT 99.3 - THOR INDUSTRIES INC | v443514_ex99-3.htm |

| EX-99.2 - EXHIBIT 99.2 - THOR INDUSTRIES INC | v443514_ex99-2.htm |

| EX-99.1 - EXHIBIT 99.1 - THOR INDUSTRIES INC | v443514_ex99-1.htm |

Exhibit 99.4

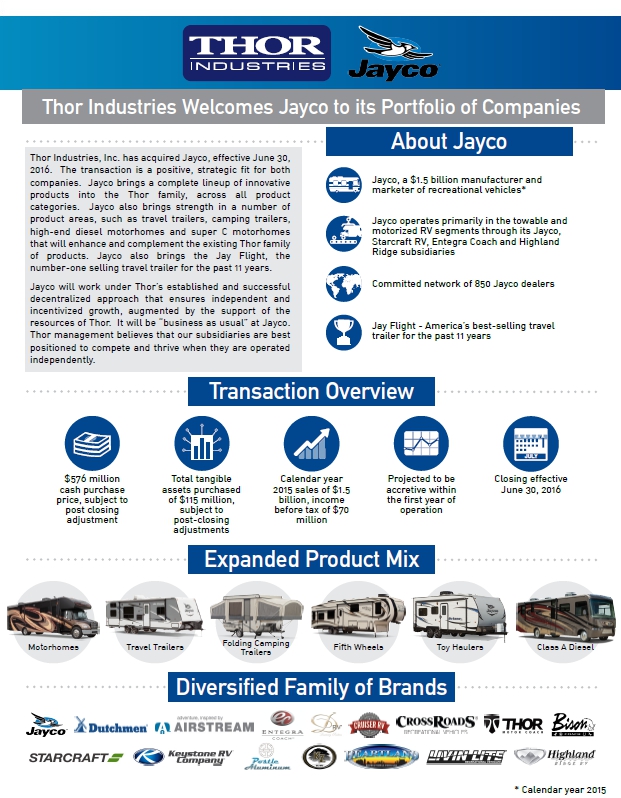

Thor Industries, Inc. has acquired Jayco, effective June 30, 2016. The transaction is a positive, strategic fit for both companies. Jayco brings a complete lineup of innovative products into the Thor family, across all product categories. Jayco also brings strength in a number of product areas, such as travel trailers, camping trailers, high-end diesel motorhomes and super C motorhomes that will enhance and complement the existing Thor family of products. Jayco also brings the Jay Flight, the number-one selling travel trailer for the past 11 years. Jayco will work under Thor’s established and successful decentralized approach that ensures independent and incentivized growth, augmented by the support of the resources of Thor. It will be “business as usual” at Jayco. Thor management believes that our subsidiaries are best positioned to compete and thrive when they are operated independently. Jay Flight - America’s best-selling travel trailer for the past 11 years Jayco operates primarily in the towable and motorized RV segments through its Jayco, Starcraft RV, Entegra Coach and Highland Ridge subsidiaries Committed network of 850 Jayco dealers $576 million cash purchase price, subject to post closing adjustment Calendar year 2015 sales of $1.5 billion, income before tax of $70 million Projected to be accretive within the first year of operation Closing effective June 30, 2016 Total tangible assets purchased of $115 million, subject to post-closing adjustments Thor Industries Welcomes Jayco to its Portfolio of Companies Diversi_ed Family of Brands Transaction Overview Expanded Product Mix About Jayco Jayco, a $1.5 billion manufacturer and marketer of recreational vehicles* JULY * Calendar year 2015 Motorhomes Travel Trailers Folding Camping Toy Haulers Trailers Fifth Wheels Class A Diesel

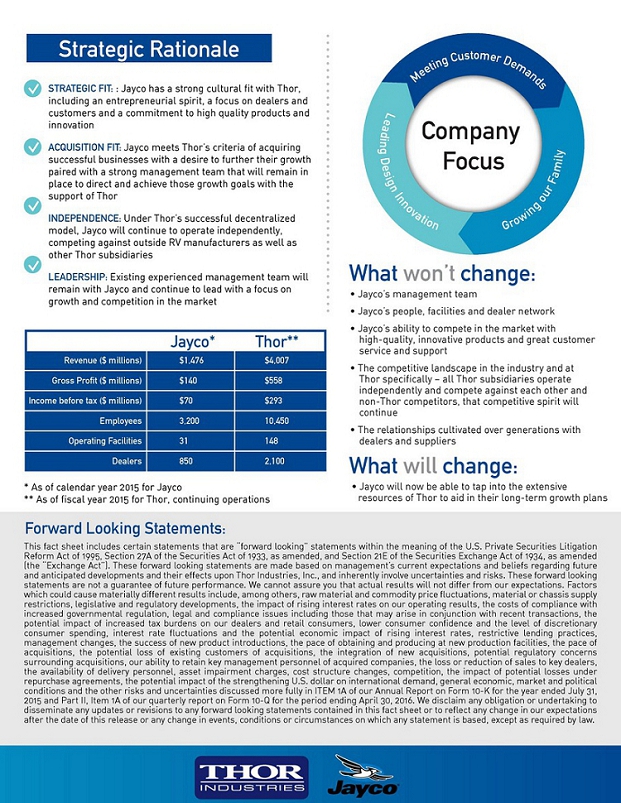

Company Focus Forward Looking Statements: What will change: • Jayco will now be able to tap into the extensive resources of Thor to aid in their long-term growth plans Strategic Rationale Meeting Customer Demands Growing our Family Leading Design Innovation STRATEGIC FIT: : Jayco has a strong cultural fit with Thor, including an entrepreneurial spirit, a focus on dealers and customers and a commitment to high quality products and innovation ACQUISITION FIT: Jayco meets Thor’s criteria of acquiring successful businesses with a desire to further their growth paired with a strong management team that will remain in place to direct and achieve those growth goals with the support of Thor INDEPENDENCE: Under Thor’s successful decentralized model, Jayco will continue to operate independently, competing against outside RV manufacturers as well as other Thor subsidiaries LEADERSHIP: Existing experienced management team will remain with Jayco and continue to lead with a focus on growth and competition in the market * As of calendar year 2015 for Jayco ** As of fiscal year 2015 for Thor, continuing operations Revenue ($ millions) Gross Pro_t ($ millions) Income before tax ($ millions) Employees Operating Facilities Dealers $1,476 $140 $70 3,200 31 850 $4,007 $558 $293 10,450 148 2,100 Jayco* Thor** What won’t change: • Jayco’s management team • Jayco’s people, facilities and dealer network • Jayco’s ability to compete in the market with high-quality, innovative products and great customer service and support • The competitive landscape in the industry and at Thor specifically – all Thor subsidiaries operate independently and compete against each other and non-Thor competitors, that competitive spirit will continue • The relationships cultivated over generations with dealers and suppliers This fact sheet includes certain statements that are “forward looking” statements within the meaning of the U.S. Private Securities Litigation Reform Act of 1995, Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). These forward looking statements are made based on management’s current expectations and beliefs regarding future and anticipated developments and their effects upon Thor Industries, Inc., and inherently involve uncertainties and risks. These forward looking statements are not a guarantee of future performance. We cannot assure you that actual results will not differ from our expectations. Factors which could cause materially different results include, among others, raw material and commodity price fluctuations, material or chassis supply restrictions, legislative and regulatory developments, the impact of rising interest rates on our operating results, the costs of compliance with increased governmental regulation, legal and compliance issues including those that may arise in conjunction with recent transactions, the potential impact of increased tax burdens on our dealers and retail consumers, lower consumer confidence and the level of discretionary consumer spending, interest rate fluctuations and the potential economic impact of rising interest rates, restrictive lending practices, management changes, the success of new product introductions, the pace of obtaining and producing at new production facilities, the pace of acquisitions, the potential loss of existing customers of acquisitions, the integration of new acquisitions, potential regulatory concerns surrounding acquisitions, our ability to retain key management personnel of acquired companies, the loss or reduction of sales to key dealers, the availability of delivery personnel, asset impairment charges, cost structure changes, competition, the impact of potential losses under repurchase agreements, the potential impact of the strengthening U.S. dollar on international demand, general economic, market and political conditions and the other risks and uncertainties discussed more fully in ITEM 1A of our Annual Report on Form 10-K for the year ended July 31, 2015 and Part II, Item 1A of our quarterly report on Form 10-Q for the period ending April 30, 2016. We disclaim any obligation or undertaking to disseminate any updates or revisions to any forward looking statements contained in this fact sheet or to reflect any change in our expectations after the date of this release or any change in events, conditions or circumstances on which any statement is based, except as required by law.