Attached files

As filed with the Securities and Exchange Commission on July 1, 2016

Registration No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

________________________

Form S-1

REGISTRATION STATEMENT UNDER THE SECURITIES ACT OF 1933

________________________

Guided Therapeutics, Inc.

(Exact name of registrant as specified in its charter)

________________________

| Delaware | 3845 | 58-2029543 | ||

| (State or other jurisdiction of incorporation or organization) | (Primary Standard Industrial Classification Code Number) | (I.R.S. Employer Identification Number) |

5835 Peachtree Corners East, Suite D

Norcross, Georgia 30092

(770) 242-8723

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices)

________________________

Gene S. Cartwright, Ph.D

President and Chief Executive Officer

Guided Therapeutics, Inc.

5835 Peachtree Corners East, Suite D

Norcross, Georgia 30092

(770) 242-8723

(Name, address, including zip code, and telephone number, including area code, of agent for service)

________________________

Copy to:

Joel T. May, Esq. and

Heith D. Rodman, Esq.

Jones Day

1420 Peachtree Street, N.E.

Suite 800

Atlanta, Georgia 30309-3053

(404) 581-3939

________________________

Approximate date of commencement of proposed sale to the public: From time to time following the effective date of this registration statement.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. R

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer,” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | ¨ | Accelerated filer | ¨ | Non-accelerated filer | ¨ | Smaller reporting company | ☒ |

________________________

CALCULATION OF REGISTRATION FEE

| Title of Each Class of Securities to be Registered (1) |

Proposed Maximum Aggregate Offering Price (2) |

Amount of Registration Fee (3) | |||||

| Series D preferred stock, par value $0.001 | $ | $ | |||||

| Warrants to purchase shares of common stock (4) | $ | $ | |||||

| Shares of common stock issuable upon conversion of Series D preferred stock | $ | $ | |||||

| Shares of common stock issuable upon exercise of the Warrants | $ | $ | |||||

| Total: | $ | 5,000,000 | $ | 503.50 | |||

| (1) | In the event of a stock split, stock dividend or other similar transaction involving the registrant’s common stock, the number of shares of common stock registered hereby shall be automatically increased to cover the additional common shares in accordance with Rule 416(a) under the Securities Act of 1933. |

| (2) | Estimated solely for the purpose of calculating the registration fee pursuant to Rule 457(g) under the Securities Act. |

| (3) | Calculated pursuant to Rule 457(o) under the Securities Act of 1933, on the basis of the maximum aggregate offering price of all of the securities to be registered. |

| (4) | No separate registration fee is payable pursuant to Rule 457(g) under the Securities Act. |

The registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until this registration statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

The information in this prospectus is not complete and may be changed. We may not sell or offer these securities until the registration statement filed with the Securities and Exchange Commission is declared effective. This prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

PRELIMINARY PROSPECTUS

Subject to completion, dated July 1, 2016

$5,000,000

5,000 Shares of Series D Convertible Preferred Stock

Warrants to Purchase up to _________ Shares of Common Stock

_________ Shares of Common Stock Underlying the Series D Preferred Stock

_________ Shares of Common Stock Underlying the Warrants

________________________

We are offering up to 5,000 shares of our Series D convertible preferred stock, together with warrants to purchase __________ shares of common stock, at a purchase price of $1,000 (and the shares issuable from time to time upon conversion of the Series D preferred stock and the exercise of the warrants) pursuant to this prospectus. The shares of Series D preferred stock and warrants are immediately separable and will be separately issued.

Subject to certain ownership limitations, the Series D preferred stock will be convertible at any time at the holder’s option into shares of our common stock at an initial conversion price of $____ per share. Subject to similar ownership limitations, each warrant will be immediately exercisable for _____ shares of our common stock, have an exercise price of $____ per share, and expire five years from the date of issuance. The warrants will be issued in book-entry form pursuant to a warrant agency agreement between us and our transfer agent.

Our common stock is quoted on the OTCQB marketplace under the symbol “GTHP.” The last reported sale price of our common stock on the OTCQB on June 15, 2016 was $0.01 per share. We will use our best efforts to have the warrants quoted on the OTCQB marketplace on or before the closing.

| Per Share/Warrant | Total | ||||||

| Offering Price | $ | 1,000 | $ | 5,000,000 | |||

| Placement Agent’s Fees (1) | $ | 90 | $ | 450,000 | |||

| Offering Proceeds, Before Expenses | $ | 910 | $ | 4,550,000 | |||

_____________________________

| (1) | We have agreed to issue the placement agent a warrant to purchase shares of common stock equal to an aggregate of up to 5% of the total shares of common stock underlying the Series D preferred stock sold in the offering and to reimburse to the placement agent for its reasonable, out-of-pocket expenses. See “Plan of Distribution” on page 18 for more information. |

We have retained Ladenburg Thalmann & Co., Inc. to act as our exclusive placement agent in connection with this offering and to use its “best efforts” to solicit offers to purchase the securities. The placement agent is not required to sell any specific number or dollar amount of securities but will use its best efforts to sell the securities offered. This best-efforts offering does not have a minimum purchase requirement and therefore is not certain to raise any specific amount.

Investing in our common stock involves a high degree of risk. These risks are described under the caption “Risk Factors” that begins on page 5 of this prospectus.

Neither the Securities and Exchange Commission, or SEC, nor any state securities commission has approved or disapproved of the securities that may be offered under this prospectus, nor have any of these organizations determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

Ladenburg Thalmann

The date of this prospectus is , 2016.

TABLE OF CONTENTS

| FORWARD-LOOKING STATEMENTS | ii |

| SUMMARY | 1 |

| RISK FACTORS | 5 |

| USE OF PROCEEDS | 15 |

| DILUTION | 15 |

| CAPITALIZATION | 17 |

| PLAN OF DISTRIBUTION | 18 |

| DESCRIPTION OF SECURITIES WE ARE OFFERING | 20 |

| DESCRIPTION OF SECURITIES | 22 |

| OUR BUSINESS | 26 |

| PROPERTIES | 34 |

| LEGAL PROCEEDINGS | 34 |

| MARKET FOR OUR COMMON STOCK AND RELATED STOCKHOLDER MATTERS | 34 |

| MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS | 35 |

| DIRECTORS AND EXECUTIVE OFFICERS | 42 |

| CORPORATE GOVERNANCE | 44 |

| EXECUTIVE COMPENSATION | 45 |

| SHARE OWNERSHIP OF DIRECTORS, OFFICERS AND CERTAIN BENEFICIAL OWNERS | 47 |

| CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS AND DIRECTOR INDEPENDENCE | 47 |

| LEGAL MATTERS | 48 |

| EXPERTS | 48 |

| WHERE YOU CAN GET MORE INFORMATION | 48 |

| i |

ABOUT THIS PROSPECTUS

You should rely only on the information contained in this prospectus or a prospectus supplement. We have not authorized any other person to provide you with different information. If anyone provides you with different or inconsistent information, you should not rely on it. This prospectus is an offer to sell only the common stock offered hereby, but only under circumstances and in jurisdictions where it is lawful to do so. You should assume that the information appearing in this prospectus is accurate only as of the date hereof. Our business, financial condition, results of operations and prospects may have changed.

The terms “Guided Therapeutics,” “Company,” “our,” “we,” and “us,” as used in this prospectus, refer to Guided Therapeutics, Inc. and its wholly owned subsidiary.

FORWARD-LOOKING STATEMENTS

Statements in this prospectus, which express “belief,” “anticipation” or “expectation,” as well as other statements that are not historical facts, are forward-looking statements. These forward-looking statements are subject to risks and uncertainties that could cause actual results to differ materially from historical results or anticipated results, including those identified in the foregoing “Risk Factors” and elsewhere in this prospectus. Examples of these uncertainties and risks include, but are not limited to:

| · | access to sufficient debt or equity capital to meet our operating and financial needs; |

| · | the extent of dilution of the holdings of our existing stockholders upon the issuance, conversion or exercise of securities issued as part of our capital raising efforts; |

| · | whether and when we or any potential strategic partners will obtain required regulatory approvals in the markets in which we plan to operate; |

| · | the effectiveness and ultimate market acceptance of our products and our ability to generate sufficient sales revenues to sustain our growth and strategy plans; |

| · | whether our products in development will prove safe, feasible and effective; |

| · | our need to achieve manufacturing scale-up in a timely manner, and our need to provide for the efficient manufacturing of sufficient quantities of our products; |

| · | the lack of immediate alternate sources of supply for some critical components of our products; |

| · | our ability to establish and protect the proprietary information on which we base our products, including our patent and intellectual property position; |

| · | the need to fully develop the marketing, distribution, customer service and technical support and other functions critical to the success of our product lines; |

| · | the dependence on potential strategic partners or outside investors for funding, development assistance, clinical trials, distribution and marketing of some of our products; and |

| · | other risks and uncertainties described from time to time in our reports filed with the SEC. |

Forward-looking statements should not be read as a guarantee of future performance or results, and will not necessarily be accurate indications of the times at, or by which, such performance or results will be achieved. Forward-looking information is based on information available at the time and/or management’s good faith belief with respect to future events, and is subject to risks and uncertainties that could cause actual performance or results to differ materially from those expressed in the statements.

Forward-looking statements speak only as of the date the statements are made. We assume no obligation to update forward-looking statements to reflect actual results, changes in assumptions or changes in other factors affecting forward-looking information except to the extent required by applicable securities laws. If we update one or more forward-looking statements, no inference should be drawn that we will make additional updates with respect thereto or with respect to other forward-looking statements.

| ii |

SUMMARY

This summary highlights information contained elsewhere in this prospectus. This summary is not complete and may not contain all of the information that may be important to you. We urge you to read the entire prospectus carefully, including the ‘‘Risk Factors’’ section, before making an investment decision. Unless otherwise noted, all share and per share data in this prospectus give effect to the 1:___ reverse stock split of our common stock implemented on ___________, 2016, and is based on 67,901,547 pre-reverse split shares outstanding as of June 15, 2016. For more information about our reverse stock split, see “Recent Developments.”

Our Company

We are a medical technology company focused on developing innovative medical devices that have the potential to improve healthcare. Our primary focus is the sales and marketing of our LuViva® Advanced Cervical Scan non-invasive cervical cancer detection device. The underlying technology of LuViva primarily relates to the use of biophotonics for the non-invasive detection of cancers. LuViva is designed to identify cervical cancers and precancers painlessly, non-invasively and at the point of care by scanning the cervix with light, then analyzing the reflected and fluorescent light.

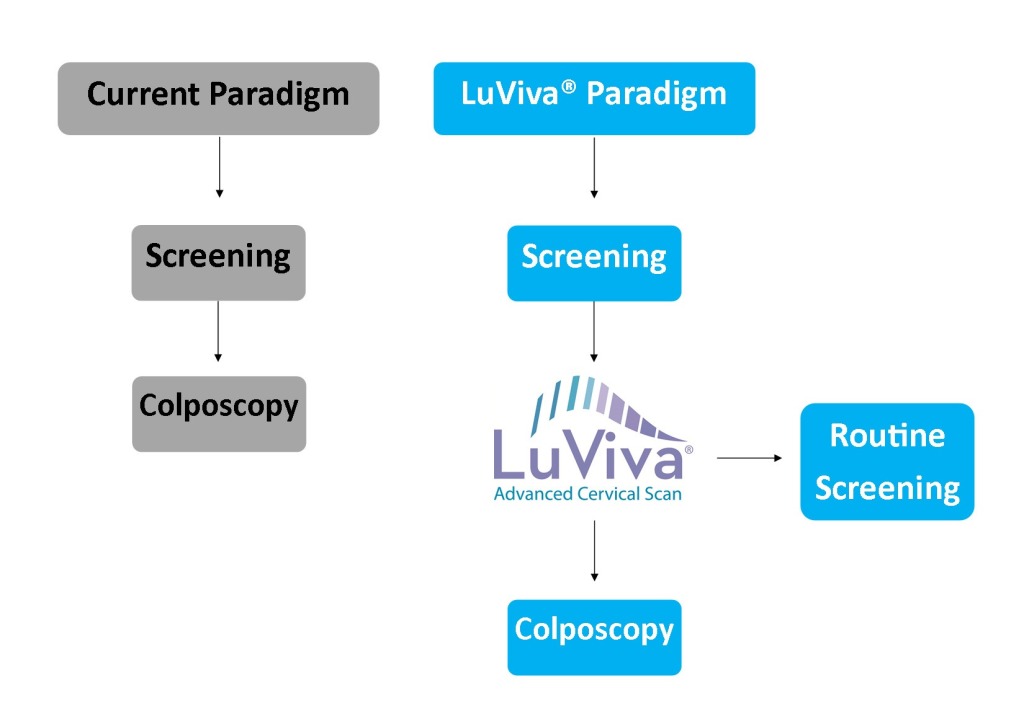

LuViva provides a less invasive and painless alternative to conventional tests for cervical cancer screening and detection. Additionally, LuViva improves patient well-being not only because it eliminates pain, but also because it is convenient to use and provides rapid results at the point of care. We focus on two primary applications for LuViva: first, as a cancer screening tool in the developing world, where infrastructure to support traditional cancer-screening methods is limited or non-existent, and second, as a triage following traditional screening in the developed world, where a high number of false positive results cause a high rate of unnecessary and ultimately costly follow-up tests.

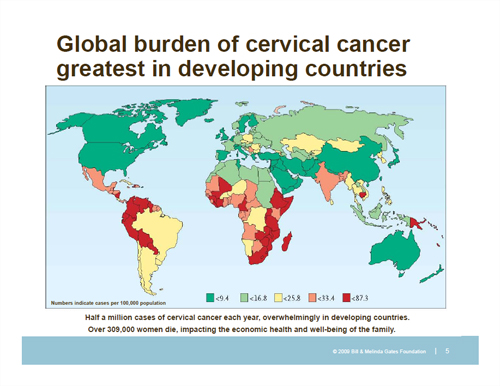

Screening for cervical cancer represents one of the most significant demands on the practice of diagnostic medicine. As cervical cancer is linked to a sexually transmitted disease—the human pampillomavirus (HPV)—every woman essentially becomes “at risk” for cervical cancer simply after becoming sexually active. In the developing world there are approximately 2.0 billion women aged 15 and older who are potentially eligible for screening with LuViva. Guidelines for screening intervals vary across the world, but U.S. guidelines call for screening every three years. Traditionally, the Pap smear screening test, or Pap test, is the primary cervical cancer screening methodology in the developed world. However, in developing countries, cancer screening using Pap tests is expensive and requires infrastructure and skill not currently existing, and not likely to be developed in the near future, in these countries.

We believe LuViva is the answer to the developing world’s cervical cancer screening needs. Screening for cervical cancer in the developing world often requires working directly with foreign governments or non-governmental agencies (NGOs). By partnering with governments or NGOs, we are able to provide immediate access to cervical cancer detection to large segments of a nation’s population as part of national or regional governmental healthcare programs, eliminating the need to develop expensive and resource-intensive infrastructures.

Manufacturing, Sales Marketing and Distribution

We manufacture LuViva at our Norcross, Georgia facility. Most of the components of LuViva are custom made for us by third-party manufacturers. We adhere to ISO 13485:2003 quality standards in our manufacturing processes.

Research, Development and Engineering

We have been engaged primarily in the research, development and testing of our LuViva non-invasive cervical cancer detection product and our core biophotonic technology. Since 2013, we have incurred about $7.0 million in research and development expenses, net of about $927,000 reimbursed through collaborative arrangements and government grants. Research and development costs were approximately $1.5 million and $2.8 million in 2015 and 2014, respectively

Patents

We have pursued a course of developing and acquiring patents and patent rights and licensing technology. Our success depends in large part on our ability to establish and maintain the proprietary nature of our technology through the patent process and to license from others patents and patent applications necessary to develop our products. As of December 31, 2015, we have 24 granted U.S. patents relating to our biophotonic cancer detection technology and six pending U.S. patent applications. We also have three granted patents that apply to our interstitial fluid analysis system.

We are a Delaware corporation, originally incorporated in 1992 under the name “SpectRx, Inc.,” and, on February 22, 2008, changed our name to Guided Therapeutics, Inc. At the same time, we renamed our wholly owned subsidiary, InterScan, which originally had been incorporated as “Guided Therapeutics.”

Since our inception, we have raised capital through the public and private sale of debt and equity, funding from collaborative arrangements, and grants.

Our prospects must be considered in light of the substantial risks, expenses and difficulties encountered by entrants into the medical device industry. This industry is characterized by an increasing number of participants, intense competition and a high failure rate. We have experienced operating losses since our inception and, as of March 31, 2016 we have an accumulated deficit of about $122.9 million. To date, we have engaged primarily in research and development efforts and the early stages of marketing our products. We do not have significant experience in manufacturing, marketing or selling our products. We may not be successful in growing sales for our products. Moreover, required regulatory clearances or approvals may not be obtained in a timely manner, or at all. Our products may not ever gain market acceptance and we may not ever generate significant revenues or achieve profitability. The development and commercialization of our products requires substantial development, regulatory, sales and marketing, manufacturing and other expenditures. We expect our operating losses to continue through at least the end of 2016 as we continue to expend substantial resources to complete commercialization of our products, obtain regulatory clearances or approvals, build our marketing, sales, manufacturing and finance capabilities, and conduct further research and development.

Our product revenues to date have been limited. In 2015 and 2014, the majority of our revenues were from the sale of LuViva devices and disposables, as well as some revenue from grants from the NIH and licensing agreement fees received. We expect that the majority of our revenue in 2016 will be derived from revenue from the sale of LuViva devices and disposables.

Our principal executive and operations facility is located at 5835 Peachtree Corners East, Suite D, Norcross, Georgia 30092, and our telephone number is (770) 242-8723.

Recent Developments

Reverse Stock Split. On May 18, 2016, our board determined to recommend that at our 2016 annual stockholders’ meeting, our stockholders grant the board the authority, in its discretion, to effect a reverse stock split by a ratio of not less than 1:10 and not more than 1:400, with no change in the number of authorized shares of our common stock, and all fractional shares created by the reverse stock split to be rounded to the nearest whole share. On May 26, 2016, our largest stockholder, John Imhoff, who is also one of our directors, agreed to vote his shares of common stock in favor of the reverse stock split. As of the record date for the 2016 annual meeting, Dr. Imhoff held approximately 19.26% of the outstanding shares of common stock. The reverse stock split will not be effective unless and until the board files an amendment to our certificate of incorporation, which must occur prior to the first anniversary of the 2016 annual meeting. It is our intent to effect the reverse stock split prior to the closing of this offering.

Warrant Restructuring. Between June 13, 2016 and June 14, 2016, we entered into various agreements with holders of certain warrants (including John Imhoff, the chairman of our board of directors) originally issued in May 2013, and with GPB Debt Holdings II LLC, holder of a warrant issued February 12, 2016, pursuant to which each holder separately agreed to exchange warrants for either (1) shares of common stock equal to 166% of the number of shares of common stock underlying the surrendered warrants, or (2) new warrants exercisable for 200% of the number of shares underlying the surrendered warrants, but without certain anti-dilution protections included with the surrendered warrants. As a result of the exchanges, we effectively eliminate any potential exponential increase in the number of underlying shares issuable upon exercise of our outstanding warrants. In total, for surrendered warrants then-exercisable for an aggregate of 115,237,788 shares of common stock (but subject to exponential increase upon operation of certain anti-dilution provisions), we issued or are obligated to issue 13,517,342 shares of common stock and new warrants that, if exercised as of June 14, 2016, would be exercisable for an aggregate of 214,189,622 shares of common stock.

In certain circumstances, in lieu of presently issuing all of the shares (for each holder that opted for shares of common stock), we and the holder further agreed that we will, subject to the terms and conditions set forth in the applicable warrant exchange agreement, from time to time, be obligated to issue the remaining shares to the holder. No additional consideration will be payable in connection with the issuance of the remaining shares.

The holders that elected to receive shares for their surrendered warrants have agreed that they will not sell shares on any trading day in an amount, in the aggregate, exceeding 20% of the composite aggregate trading volume of the common stock for that trading day. The holders that elected to receive new warrants will be required to surrender their old warrants upon consummation of this offering. The new warrants will have an initial exercise price equal to the exercise price of the surrendered warrants as of immediately prior to consummation of this offering, subject to customary “downside price protection” for as long as our common stock is not listed on a national securities exchange, and will expire five years from the date of issuance.

| 2 |

Shenghuo License Agreement. On June 5, 2016, we entered into a license agreement with Shenghuo Medical, LLC pursuant to which we granted Shenghuo an exclusive license to manufacture, sell and distribute LuViva in Taiwan, Brunei Darussalam, Cambodia, Laos, Myanmar, Philippines, Singapore, Thailand, and Vietnam. Shenghuo was already our exclusive distributor in China, Macau and Hong Kong, and the license extends to manufacturing in those countries as well. Under the terms of the license agreement, once Shenghuo is capable of manufacturing LuViva in accordance with ISO 13485 for medical devices, Shenghuo will pay us a royalty equal to $2.00 or 20% of the distributor price (subject to a discount under certain circumstances), whichever is higher, per disposable distributed within Shenghuo’s exclusive territories.

In connection with the license grant, Shenghuo will underwrite the cost of securing approval of LuViva with Chinese Food and Drug Administration. At its option, Shenghuo also will provide up to $1.0 million in furtherance of our efforts to secure regulatory approval for LuViva from the U.S. Food and Drug Administration, in exchange for the right to receive payments equal to 2% of our future sales in the United States, up to an aggregate of $4.0 million.

Pursuant to the license agreement, Shenghuo has the option, after our next annual meeting of stockholders, to have a designee appointed to our board of directors.

As partial consideration for, and as a condition to, the license, and to further align the strategic interests of the parties, we have agreed to issue a convertible note to Shenghuo, in exchange for an aggregate cash investment of $200,000. The note will provide for a payment to Shenghuo of $240,000, due upon consummation of any capital raising transaction by us within 90 days and with net cash proceeds of at least $1.0 million. Absent such a transaction, the payment will increase to $300,000 and will be payable by December 31, 2016. The note will accrue interest at 20% per year on any unpaid amounts due after that date. The note will be convertible into shares of our common stock at a conversion price per share of $0.017402, subject to customary anti-dilution adjustment. The note will be unsecured, and is expected to provide for customary events of default. We will also issue Shenghuo a five-year warrant exercisable immediately for approximately 13.8 million shares of common stock at an exercise price equal to the conversion price of the note, subject to customary anti-dilution adjustment.

Short Term Promissory Notes. On May 4, 2016 and May 26, 2016, Aquarius Opportunity Fund advanced us a total of $87,500 for 2% simple interest notes due the earlier of December 31, 2016 or consummation of this offering. Also on May 26, 2016, GPB Debt Holdings II LLC, holder of our outstanding senior secured convertible note, advanced as an additional $87,500, on the same terms as their note. We intend to offer each of them the opportunity to participate in the offering at least up to the extent of the outstanding principal and interest on these cash advances, by extinguishing all or a portion of the debt on a dollar-for-dollar basis.

Series C Exchanges. Between April 27, 2016 and May 3, 2016, we entered into various agreements with certain holders of our Series C preferred stock, including John Imhoff, one of our directors, pursuant to which those holders separately agreed to exchange each share of Series C preferred stock held for 2.25 shares of our newly created Series C1 preferred stock and 9,600 shares of our common stock. In connection with these exchanges, each holder also agreed to exchange the $1,000 stated value per share of the holder’s shares of Series C1 preferred stock for new securities that we issue in the next qualifying financing we undertake on a dollar-for-dollar basis. We expect this offering will be a qualifying financing. Finally, each holder agreed, except in the event of an additional $50,000 cash investment in the financing by the holder, to execute a customary “lockup” agreement in connection with the qualifying financing. In total, for 1,916 shares of Series C preferred stock surrendered, we issued 4,311 shares of Series C1 preferred stock and 18,396,800 shares of common stock.

The Series C1 preferred stock has terms that are substantially the same as the Series C preferred stock, except that the Series C1 preferred stock does not pay dividends (unless and to the extent declared on the common stock) or at-the-market “make-whole payments.” See “Description of Securities” for a description of the material terms of the Series C1 preferred stock.

Separately, on April 27, 2016, we entered into a rollover and amendment agreement with another holder of Series C preferred stock, Aquarius Opportunity Fund, pursuant to which Aquarius agreed to exchange any shares of Series C preferred stock (stated value plus make-whole dividend), as well as any remaining principal and accrued interest on our convertible promissory note Aquarius holds, for new securities that we issue in our next financing, all on a dollar-for-dollar basis, as long as the next financing involves at least $1 million in cash from investors unaffiliated with Aquarius. We expect this offering will be a qualifying financing. Aquarius also agreed to return to us for cancelation warrants exercisable for 722,211 shares of our common stock that it held. Except in the event of an additional $50,000 cash investment by Aquarius in the qualifying financing, Aquarius has agreed to execute a customary “lockup” agreement in connection with the financing. Finally, Aquarius, as the holder of a majority of the outstanding Series C preferred stock, agreed to amend the Series C stock purchase agreement to eliminate any participation rights held by the Series C shareholders and to waive operation of certain anti-dilution provisions of the Series C that would otherwise be triggered by the transactions described in “—Recent Developments.”

| 3 |

The Offering

| Issuer | Guided Therapeutics, Inc. |

| Securities offered | Up to 5,000 shares of Series D preferred stock and warrants exercisable for an aggregate of ____________ shares of our common stock. Each share of Series D preferred stock will be accompanied by a warrant to purchase _____ of a share of common stock. The shares of Series D preferred stock and the warrants are immediately separable and will be issued separately, but will be purchased together in this offering. This prospectus also covers the shares of common stock issuable upon conversion of the Series D preferred stock and upon the exercise of the warrants. |

| Offering price | $1,000 combined price for each share of Series D preferred stock and accompanying warrant |

| Description of Series D preferred stock | Series D preferred stock has a liquidation preference senior to our common stock but junior to our Series C preferred stock, is convertible at the option of the holder (subject to certain ownership limitations) into shares of our common stock at a conversion price of $_____ per share, subject to anti-dilution adjustment, and is redeemable under certain circumstances at our option. See “Description of Securities We Are Offering—Series D Preferred Stock” on page 20 . |

| Shares of common stock underlying the shares of Series D preferred stock | ____________ shares* |

| Description of warrants | The warrants will be immediately exercisable upon issuance (subject to certain ownership limitations) at an exercise price per share equal to $______ (__% of the closing bid price preceding pricing of the offering). The warrants will expire five years after the date of issuance. See “Description of Securities We Are Offering—Warrants” on page 20. |

| Shares of common stock underlying the warrants | ____________ shares* |

| Shares of common stock outstanding before this offering | 67,901,547 shares.* See “Dilution” on page 15. |

| Common stock to be outstanding after this offering | ____________ shares, assuming all shares of Series D preferred stock are sold.* See “Dilution” on page 15. |

| Use of proceeds | We intend to apply any proceeds received in connection with the offering to increase inventory of LuViva to meet current demand for the product, and to support general working capital and operations. However, we will retain broad discretion over the use of the net proceeds and may use the money for other corporate purposes. See “Use of Proceeds” on page 15. |

| Market for the common stock | Our common stock is quoted on the OTCQB marketplace under the symbol “GTHP.” See “Market for Our Common Stock and Related Stockholder Matters” on page 34. |

| Risk factors | You should read “Risk Factors” on page 5 for an explanation of the risks of investing in this offering. |

| * | Share numbers are based on an assumed conversion or exercise price per share of the Series D preferred stock of $0.01, which was the last reported sale price for our common stock on June 15, 2016 and, with regard to shares outstanding, are as of such date, and exclude: |

| · | 104,356 shares of common stock reserved for future issuance under our 1995 Stock Plan; |

| · | 433,385,611 shares of common stock reserved for issuance upon conversion of, or issuance as dividends on, our Series C and Series C1 convertible preferred stock, which we assume will be exchanged for shares of Series D preferred stock and warrants as part of this offering; |

| · | 151,583,843 shares reserved for issuance upon conversion of our outstanding convertible debt; |

| · | 233,615,051 shares of common stock issuable upon the exercise of outstanding warrants or warrants to be exchanged for outstanding warrants |

| · | 5,205,101 shares reserved for issuance pursuant to contractual obligations; and |

| · | up to ______ shares of common stock issuable upon exercise of warrants sold as part of this offering,

including up to ______ shares of common stock issuable upon exercise of warrants to be issued to the placement agent. |

| 4 |

RISK FACTORS

Your investment in shares of our common stock involves substantial risks. In consultation with your own advisers, you should carefully consider, among other matters, the factors set forth below before deciding whether an investment in shares of our common stock is suitable for you. If any of the risks contained in this prospectus develop into actual events, our business, financial condition, liquidity, results of operations and prospects could be materially and adversely affected, the market price of our common stock could decline and you may lose all or part of your investment. Some statements in this prospectus, including statements in the following risk factors, constitute forward-looking statements. See “Forward-Looking Statements” in this prospectus.

Risks Related to this Offering

As a new investor, you will incur substantial dilution as a result of this offering and future equity issuances.

Our net tangible book value deficiency as of March 31, 2016 was approximately $7.3 million, or $1.37 per share of common stock. Net tangible book value per share represents total tangible assets less total liabilities, divided by the number of shares of common stock outstanding. On a pro form basis after giving effect to the assumed sale of 5,000 shares of Series D preferred stock in this offering at a public offering price of $1,000 per share, and assuming the conversion of all the shares of Series D preferred stock sold in the offering at an assumed conversion price of $0.01 per share, which was the last reported sale price of our common stock on June 15, 2016 (and excluding shares of common stock issuable upon exercise of the warrants), and after deducting estimated placement agent fees and estimated offering expenses payable by us, if you purchase securities in this offering, you will suffer immediate and substantial dilution of approximately $0.006 per share in the net tangible book value of the common stock underlying the Series D preferred stock that you acquire. See “Dilution” for a more detailed discussion of the dilution you will incur if you participate in this offering. In addition to this offering, subject to market conditions and other factors, it is likely that we will pursue additional capital to finance our operations. Accordingly, we may conduct substantial future offerings of equity securities. The exercise of outstanding options and warrants and future equity issuances, including future public offerings or future private placements of equity securities, would result in further dilution to investors.

The actual offering amount, the offering price and the net proceeds to us, if any, in this offering may be substantially less than the amounts set forth above.

Because there is no minimum offering amount or offering price required as a condition to closing in this offering, the actual public offering amount, offering price and net proceeds to us, if any, in this offering are not presently determinable and may be substantially less than the amounts set forth above. We are not required to sell any specific number or dollar amount of the securities offered in this offering, but the placement agent will use its best efforts to sell the securities offered.

Sales of a significant number of shares of our common stock in the public markets, or the perception that such sales could occur, could depress the market price of our common stock.

If our stockholders (including those persons who may become stockholders upon conversion of outstanding convertible securities or exercise of outstanding warrants or options) sell substantial amounts of our common stock, or the public market perceives that stockholders might sell substantial amounts of our common stock, the market price of our common stock could decline significantly. Such sales also might make it more difficult for us to sell equity or equity-related securities in the future at a time and price that our management deems appropriate.

We will have broad discretion over the use of the proceeds of this offering and may not realize a return.

We will have considerable discretion in the application of the net cash proceeds of this offering. We intend to use the net cash proceeds to increase inventory of LuViva to meet current demand for the product, and to support general working capital and operations. However, we will retain broad discretion over the use of the net proceeds and may use the money for other corporate purposes. We may use the net cash proceeds for purposes that do not yield a significant return, if any, for our stockholders.

There is no public market for the Series D preferred stock or warrants being offered in this offering.

There is no established public trading market for the Series D preferred stock or warrants being offered in this offering. We do not expect a market to develop for the Series D preferred stock or the warrants. In addition, we do not intend to apply for listing of the Series D preferred stock or warrants on any securities exchange or expect the Series D preferred stock to trade on the OTCQB marketplace, although we will use our best efforts to have the warrants quoted on the OTCQB marketplace on or before the closing. Without an active market, the liquidity of the Series D preferred stock and warrants will be limited.

| 5 |

Risks Related to Our Business

Although we are required to raise funds in this offering in order to continue as a going concern, there is no assurance that such funds can be raised on terms that we would find acceptable, on a timely basis, or at all.

Additional debt or equity financing is required for us to continue as a going concern. If this offering is unsuccessful or insufficient, we may seek to obtain additional funds for the financing of our cervical cancer detection business through additional debt or equity financings and/or new collaborative arrangements. Any required additional funding may not be available on terms attractive to us, on a timely basis, or at all.

If we cannot obtain additional funds or achieve profitability, we may not be able to continue as a going concern.

Because we must obtain additional funds through financing transactions or through new collaborative arrangements in order to grow the revenues of our cervical cancer detection product line, there exists substantial doubt about our ability to continue as a going concern. Therefore, it will be necessary to raise additional funds. There can be no assurance that we will be able to raise these additional funds. If we do not secure additional funding when needed, we will be unable to conduct all of our product development efforts as planned, which may cause us to alter our business plan in relation to the development of our products. Even if we obtain additional funding, we will need to achieve profitability thereafter.

Our independent registered public accountants’ report on our consolidated financial statements as of and for the year ended December 31, 2015, indicated that there was substantial doubt about our ability to continue as a going concern because we had suffered recurring losses from operations and had an accumulated deficit of $122.6 million at December 31, 2015. At March 31, 2016, we had an accumulated deficit of 122.9 million, summarized as follows:

| Accumulated deficit, from inception to 12/31/2013 | $ | 103.0 million |

| Preferred dividends | $ | 0.2 million |

| Net Loss for fiscal year 2014, ended 12/31/2014 | $ | 9.9 million |

| Accumulated deficit, from inception to 12/31/2014 | $ | 113.1 million |

| Preferred dividends and deemed dividends | $ | 2.6 million |

| Net Loss for fiscal year 2015, ended 12/31/2015 | $ | 6.9 million |

| Accumulated deficit, from inception to 12/31/2015 | $ | 122.6 million |

| Net Income for year to date ended 3/31/2016 | $ | 0.1 million |

| Accumulated deficit, from inception to 3/31/2016 | $ | 122.9 million |

Our management has implemented reductions in operating expenditures and reductions in some development activities. We have determined to make cervical cancer detection the focus of our business. We are managing the development of our other programs only when funds are made available to us via grants or contracts with government entities or strategic partners. However, there can be no assurance that we will be able to successfully implement or continue these plans.

If we cannot obtain additional funds when needed, we will not be able to implement our business plan.

We require substantial additional capital to develop our products, including completing product testing and clinical trials, obtaining all required regulatory approvals and clearances, beginning and scaling up manufacturing, and marketing our products. We have historically financed our operations though the public and private sale of debt and equity, funding from collaborative arrangements, and grants. Any failure to achieve adequate funding in a timely fashion would delay our development programs and could lead to abandonment of our business plan. To the extent we cannot obtain additional funding, our ability to continue to manufacture and sell our current products, or develop and introduce new products to market, will be limited. Further, financing our operations through the public or private sale of debt or equity may involve restrictive covenants or other provisions that could limit how we conduct our business or finance our operations. Financing our operations through collaborative arrangements generally means that the obligations of the collaborative partner to fund our expenditures are largely discretionary and depend on a number of factors, including our ability to meet specified milestones in the development and testing of the relevant product. We may not be able to obtain an acceptable collaboration partner, and even if we do, we may not be able to meet these milestones, or the collaborative partner may not continue to fund our expenditures.

We do not have a long operating history, especially in the cancer detection field, which makes it difficult to evaluate our business.

Although we have been in existence since 1992, we have only recently begun to commercialize our cervical cancer detection technology. Because limited historical information is available on our revenue trends and manufacturing costs, it is difficult to evaluate our business. Our prospects must be considered in light of the substantial risks, expenses, uncertainties and difficulties encountered by entrants into the medical device industry, which is characterized by increasing intense competition and a high failure rate.

| 6 |

We have a history of losses, and we expect losses to continue.

We have never been profitable and we have had operating losses since our inception. We expect our operating losses to continue as we continue to expend substantial resources to complete commercialization of our products, obtain regulatory clearances or approvals, build our marketing, sales, manufacturing and finance capabilities, and conduct further research and development. The further development and commercialization of our products will require substantial development, regulatory, sales and marketing, manufacturing and other expenditures. We have only generated limited revenues from product sales. Our accumulated deficit was approximately $122.9 million at March 31, 2016.

Our ability to sell our products is controlled by government regulations, and we may not be able to obtain any necessary clearances or approvals.

The design, manufacturing, labeling, distribution and marketing of medical device products are subject to extensive and rigorous government regulation in most of the markets in which we sell, or plan to sell, our products, which can be expensive and uncertain and can cause lengthy delays before we can begin selling our products in those markets.

In foreign countries, including European countries, we are subject to government regulation, which could delay or prevent our ability to sell our products in those jurisdictions.

In order for us to market our products in Europe and some other international jurisdictions, we and our distributors and agents must obtain required regulatory registrations or approvals. We must also comply with extensive regulations regarding safety, efficacy and quality in those jurisdictions. We may not be able to obtain the required regulatory registrations or approvals, or we may be required to incur significant costs in obtaining or maintaining any regulatory registrations or approvals we receive. Delays in obtaining any registrations or approvals required for marketing our products, failure to receive these registrations or approvals, or future loss of previously obtained registrations or approvals would limit our ability to sell our products internationally. For example, international regulatory bodies have adopted various regulations governing product standards, packaging requirements, labeling requirements, import restrictions, tariff regulations, duties and tax requirements. These regulations vary from country to country. In order to sell our products in Europe, we must maintain ISO 13485:2003 certification and CE mark certification, which is an international symbol of quality and compliance with applicable European medical device directives. Failure to maintain ISO 13485:2003 certification or CE mark certification or other international regulatory approvals would prevent us from selling in some countries in the European Union.

In the United States, we are subject to regulation by the FDA, which could prevent our ability to sell our products domestically.

In order for us to market our products in the United States, we must obtain clearance or approval from the FDA. We cannot be sure that:

| · | we, or any collaborative partner, will make timely filings with the FDA; |

| · | the FDA will act favorably or quickly on these submissions; |

| · | we will not be required to submit additional information or perform additional clinical studies; or |

| · | we will not face other significant difficulties and costs necessary to obtain FDA clearance or approval. |

It can take several years from initial filing of a PMA application and require the submission of extensive supporting data and clinical information. The FDA may impose strict labeling or other requirements as a condition of its clearance or approval, any of which could limit our ability to market our products domestically. Further, if we wish to modify a product after FDA approval of a PMA application, including changes in indications or other modifications that could affect safety and efficacy, additional clearances or approvals will be required from the FDA. Any request by the FDA for additional data, or any requirement by the FDA that we conduct additional clinical studies, could result in a significant delay in bringing our products to market domestically and require substantial additional research and other expenditures. Similarly, any labeling or other conditions or restrictions imposed by the FDA could hinder our ability to effectively market our products domestically. Further, there may be new FDA policies or changes in FDA policies that could be adverse to us.

Even if we obtain clearance or approval to sell our products, we are subject to ongoing requirements and inspections that could lead to the restriction, suspension or revocation of our clearance.

We, as well as any potential collaborative partners, will be required to adhere to applicable regulations in the markets in which we operate and sell our products, regarding good manufacturing practice, which include testing, control, and documentation requirements. Ongoing compliance with good manufacturing practice and other applicable regulatory requirements will be strictly enforced applicable regulatory agencies. Failure to comply with these regulatory requirements could result in, among other things, warning letters, fines, injunctions, civil penalties, recall or seizure of products, total or partial suspension of production, failure to obtain premarket clearance or premarket approval for devices, withdrawal of approvals previously obtained, and criminal prosecution. The restriction, suspension or revocation of regulatory approvals or any other failure to comply with regulatory requirements would limit our ability to operate and could increase our costs.

| 7 |

We depend on a limited number of customers and any reduction, delay or cancellation of an order from these customers or the loss of any of these customers could cause our revenue to decline.

Each year we have had one or a few customers that have accounted for substantially all of our limited revenues. As a result, the termination of a purchase order with any one of these customers may result in the loss of substantially all of our revenues. We are constantly working to develop new relationships with existing or new customers, but despite these efforts we may not be successful at generating new orders to maintain similar revenues as current purchase orders are filled. In addition, since a significant portion of our revenues is derived from a relatively few customers, any financial difficulties experienced by any one of these customers, or any delay in receiving payments from any one of these customers, could have a material adverse effect on our business, results of operations, financial condition and cash flows.

To successfully market and sell our products internationally, we must address many issues with which we have limited experience.

All of our sales of LuViva to date have been to customers outside of the United States. We expect that substantially all of our business will continue to come from sales in foreign markets, through increased penetration in countries where we currently sell LuViva, combined with expansion into new international markets. However, international sales are subject to a number of risks, including:

● difficulties in staffing and managing international operations;

● difficulties in penetrating markets in which our competitors’ products may be more established;

● reduced or no protection for intellectual property rights in some countries;

● export restrictions, trade regulations and foreign tax laws;

● fluctuating foreign currency exchange rates;

● foreign certification and regulatory clearance or approval requirements;

● difficulties in developing effective marketing campaigns for unfamiliar, foreign countries;

● customs clearance and shipping delays;

● political and economic instability; and

● preference for locally produced products.

If one or more of these risks were realized, it could require us to dedicate significant resources to remedy the situation, and even if we are able to find a solution, our revenues may still decline.

To market and sell LuViva internationally, we depend on distributors and they may not be successful.

We currently depend almost exclusively on third-party distributors to sell and service LuViva internationally and to train our international customers, and if these distributors terminate their relationships with us or under-perform, we may be unable to maintain or increase our level of international revenue. We will also need to engage additional international distributors to grow our business and expand the territories in which we sell LuViva. Distributors may not commit the necessary resources to market, sell and service LuViva to the level of our expectations. If current or future distributors do not perform adequately, or if we are unable to engage distributors in particular geographic areas, our revenue from international operations will be adversely affected

Our success largely depends on our ability to maintain and protect the proprietary information on which we base our products.

Our success depends in large part upon our ability to maintain and protect the proprietary nature of our technology through the patent process, as well as our ability to license from others patents and patent applications necessary to develop our products. If any of our patents are successfully challenged, invalidated or circumvented, or our right or ability to manufacture our products was to be limited, our ability to continue to manufacture and market our products could be adversely affected. In addition to patents, we rely on trade secrets and proprietary know-how, which we seek to protect, in part, through confidentiality and proprietary information agreements. The other parties to these agreements may breach these provisions, and we may not have adequate remedies for any breach. Additionally, our trade secrets could otherwise become known to or be independently developed by competitors.

| 8 |

As of March 31, 2016, we have been issued, or have rights to, 24 U.S. patents (including those under license). In addition, we have filed for, or have rights to, six U.S. patents (including those under license) that are still pending. There are additional international patents and pending applications. One or more of the patents we hold directly or license from third parties, including those for our cervical cancer detection products, may be successfully challenged, invalidated or circumvented, or we may otherwise be unable to rely on these patents. These risks are also present for the process we use or will use for manufacturing our products. In addition, our competitors, many of whom have substantial resources and have made substantial investments in competing technologies, may apply for and obtain patents that prevent, limit or interfere with our ability to make, use and sell our products, either in the United States or in international markets.

The medical device industry has been characterized by extensive litigation regarding patents and other intellectual property rights. In addition, the U.S. Patent and Trademark Office, or USPTO, may institute interference proceedings. The defense and prosecution of intellectual property suits, USPTO proceedings and related legal and administrative proceedings are both costly and time consuming. Moreover, we may need to litigate to enforce our patents, to protect our trade secrets or know-how, or to determine the enforceability, scope and validity of the proprietary rights of others. Any litigation or interference proceedings involving us may require us to incur substantial legal and other fees and expenses and may require some of our employees to devote all or a substantial portion of their time to the proceedings. An adverse determination in the proceedings could subject us to significant liabilities to third parties, require us to seek licenses from third parties or prevent us from selling our products in some or all markets. We may not be able to reach a satisfactory settlement of any dispute by licensing necessary patents or other intellectual property. Even if we reached a settlement, the settlement process may be expensive and time consuming, and the terms of the settlement may require us to pay substantial royalties. An adverse determination in a judicial or administrative proceeding or the failure to obtain a necessary license could prevent us from manufacturing and selling our products.

We may not be able to generate sufficient sales revenues to sustain our growth and strategy plans.

Our cervical cancer diagnostic activities have been financed to date through a combination of government grants, strategic partners and direct investment. Growing revenues for this product is the main focus of our business. In order to effectively market the cervical cancer detection product, additional capital will be needed.

Additional product lines involve the modification of the cervical cancer detection technology for use in other cancers. These product lines are only in the earliest stages of research and development and are currently not projected to reach market for several years. Our goal is to receive enough funding from government grants and contracts, as well as payments from strategic partners, to fund development of these product lines without diverting funds or other necessary resources from the cervical cancer program.

Because our products, which use different technology or apply technology in different ways than other medical devices, are or will be new to the market, we may not be successful in launching our products and our operations and growth would be adversely affected.

Our products are based on new methods of cancer detection. If our products do not achieve significant market acceptance, our sales will be limited and our financial condition may suffer. Physicians and individuals may not recommend or use our products unless they determine that these products are an attractive alternative to current tests that have a long history of safe and effective use. To date, our products have been used by only a limited number of people, and few independent studies regarding our products have been published. The lack of independent studies limits the ability of doctors or consumers to compare our products to conventional products.

If we are unable to compete effectively in the highly competitive medical device industry, our future growth and operating results will suffer.

The medical device industry in general and the markets in which we expect to offer products in particular, are intensely competitive. Many of our competitors have substantially greater financial, research, technical, manufacturing, marketing and distribution resources than we do and have greater name recognition and lengthier operating histories in the health care industry. We may not be able to effectively compete against these and other competitors. A number of competitors are currently marketing traditional laboratory-based tests for cervical cancer screening and diagnosis. These tests are widely accepted in the health care industry and have a long history of accurate and effective use. Further, if our products are not available at competitive prices, health care administrators who are subject to increasing pressures to reduce costs may not elect to purchase them. Also, a number of companies have announced that they are developing, or have introduced, products that permit non-invasive and less invasive cancer detection. Accordingly, competition in this area is expected to increase.

| 9 |

Furthermore, our competitors may succeed in developing, either before or after the development and commercialization of our products, devices and technologies that permit more efficient, less expensive non-invasive and less invasive cancer detection. It is also possible that one or more pharmaceutical or other health care companies will develop therapeutic drugs, treatments or other products that will substantially reduce the prevalence of cancers or otherwise render our products obsolete.

We have limited manufacturing experience, which could limit our growth.

We do not have manufacturing experience that would enable us to make products in the volumes that would be necessary for us to achieve significant commercial sales, and we rely upon our suppliers. In addition, we may not be able to establish and maintain reliable, efficient, full scale manufacturing at commercially reasonable costs in a timely fashion. Difficulties we encounter in manufacturing scale-up, or our failure to implement and maintain our manufacturing facilities in accordance with good manufacturing practice regulations, international quality standards or other regulatory requirements, could result in a delay or termination of production. In the past, we have had substantial difficulties in establishing and maintaining manufacturing for our products and those difficulties impacted our ability to increase sales. Companies often encounter difficulties in scaling up production, including problems involving production yield, quality control and assurance, and shortages of qualified personnel.

Since we rely on sole source suppliers for several of the components used in our products, any failure of those suppliers to perform would hurt our operations.

Several of the components used in our products or planned products, are available from only one supplier, and substitutes for these components could not be obtained easily or would require substantial modifications to our products. Any significant problem experienced by one of our sole source suppliers may result in a delay or interruption in the supply of components to us until that supplier cures the problem or an alternative source of the component is located and qualified. Any delay or interruption would likely lead to a delay or interruption in our manufacturing operations. For our products that require premarket approval, the inclusion of substitute components could require us to qualify the new supplier with the appropriate government regulatory authorities. Alternatively, for our products that qualify for premarket notification, the substitute components must meet our product specifications.

Because we operate in an industry with significant product liability risk, and we have not specifically insured against this risk, we may be subject to substantial claims against our products.

The development, manufacture and sale of medical products entail significant risks of product liability claims. We currently have no product liability insurance coverage beyond that provided by our general liability insurance. Accordingly, we may not be adequately protected from any liabilities, including any adverse judgments or settlements, we might incur in connection with the development, clinical testing, manufacture and sale of our products. A successful product liability claim or series of claims brought against us that result in an adverse judgment against or settlement by us in excess of any insurance coverage could seriously harm our financial condition or reputation. In addition, product liability insurance is expensive and may not be available to us on acceptable terms, if at all.

The availability of third party reimbursement for our products is uncertain, which may limit consumer use and the market for our products.

In the United States and elsewhere, sales of medical products are dependent, in part, on the ability of consumers of these products to obtain reimbursement for all or a portion of their cost from third-party payors, such as government and private insurance plans. Any inability of patients, hospitals, physicians and other users of our products to obtain sufficient reimbursement from third-party payors for our products, or adverse changes in relevant governmental policies or the policies of private third-party payors regarding reimbursement for these products, could limit our ability to sell our products on a competitive basis. We are unable to predict what changes will be made in the reimbursement methods used by third-party health care payors. Moreover, third-party payors are increasingly challenging the prices charged for medical products and services, and some health care providers are gradually adopting a managed care system in which the providers contract to provide comprehensive health care services for a fixed cost per person. Patients, hospitals and physicians may not be able to justify the use of our products by the attendant cost savings and clinical benefits that we believe will be derived from the use of our products, and therefore may not be able to obtain third-party reimbursement.

Reimbursement and health care payment systems in international markets vary significantly by country and include both government-sponsored health care and private insurance. We may not be able to obtain approvals for reimbursement from these international third-party payors in a timely manner, if at all. Any failure to receive international reimbursement approvals could have an adverse effect on market acceptance of our products in the international markets in which approvals are sought.

| 10 |

We have a substantial amount of indebtedness, which may adversely affect our cash flow and our ability to operate our business.

Our outstanding indebtedness, including ordinary course accounts payable and accrued payroll liabilities, was $4.0 million at March 31, 2016. We currently are required to make approximately $21,000 in monthly payments of interest and, beginning August 2016, $239,583 in quarterly payments of principal on our outstanding senior secured convertible note. The outstanding principal and accrued interest on our secured promissory note is due on August 31, 2016. In connection with the Shenghuo license agreement, we have agreed to issue Shenghuo a convertible note in principal amount of $240,000, due upon consummation of any capital raising transaction by us within 90 days and with net cash proceeds of at least $1.0 million. Absent such a transaction, the payment will increase to $300,000 and will be payable by December 31, 2016.

The terms of our indebtedness could have negative consequences to us, such as:

| · | we may be unable to obtain additional financing to fund working capital, operating losses, capital expenditures or acquisitions on terms acceptable to us, or at all; |

| · | the amount of our interest expense may increase if we are unable to make payments when due; |

| · | our assets might be subject to foreclosure if we default on our secured debt (see “—We have outstanding debt that is collateralized by a general security interest in all of our assets, including our intellectual property. If we were to fail to repay the debt when due, the holders would have the right to foreclose on these assets.”); |

| · | our vendors or employees may, and some have, instituted proceedings to collect on amounts owed them; |

| · | we have to use a substantial portion of our cash flows from operations to repay our indebtedness, including ordinary course accounts payable and accrued payroll liabilities, which reduces the amount of money we have for future operations, working capital, inventory, expansion, or general corporate or other business activities; and |

| · | we may be unable to refinance our indebtedness on terms acceptable to us, or at all. |

Our ability to meet our expenses and debt obligations will depend on our future performance, which will be affected by financial, business, economic, regulatory and other factors. We will be unable to control many of these factors, such as economic conditions. We cannot be certain that our earnings will be sufficient to allow us to pay the principal and interest on our debt and meet any other obligations. If we do not have enough money to service our debt, we may be required, but unable, to refinance all or part of our existing debt, sell assets, borrow money or raise equity on terms acceptable to us, if at all.

We have outstanding debt that is collateralized by a general security interest in all of our assets, including our intellectual property. If we were to fail to repay the debt when due, the holders would have the right to foreclose on these assets.

At June 15, 2016, we had notes outstanding that are collateralized by a security interest in our current and future inventory and accounts receivable. We also had a note outstanding that is collateralized by a security interest in all of our assets, including our intellectual property. When the debt is repaid, the holders’ security interests on our assets will be extinguished. However, if an event of default occurs under the notes prior to their repayment, the holders may exercise their rights to foreclose on these secured assets for the payment of these obligations. Under “cross-default” provisions in each of the notes, an event of default under one note is automatically an event of default under the other notes. Any such default and resulting foreclosure would have a material adverse effect on our business, financial condition and results of operations.

We are subject to restrictive covenants under the terms of our outstanding secured debt. If we were to default under the terms of these covenants, the holders would have the right to foreclose on the assets that secure the debt.

The instruments governing our outstanding secured debt contain restrictive covenants. For example, our senior secured convertible note prohibits us from incurring additional indebtedness for borrowed money, repurchasing any outstanding shares of our common stock, or paying any dividends on our capital stock, in each case without the note holder's prior written consent, If we were to breach any of these covenants, the holder could declare an event of default on the note, and exercise its rights to foreclose on the assets securing the note.

Our success depends on our ability to attract and retain scientific, technical, managerial and finance personnel.

Our ability to operate successfully and manage our future growth depends in significant part upon the continued service of key scientific, technical, managerial and finance personnel, as well as our ability to attract and retain additional highly qualified personnel in these fields. We may not be able to attract and retain key employees when necessary, which would limit our operations and growth. Only our Chief Executive Officer and our Senior Vice President of Engineering have employment contracts with us, and none of our employees are covered by key person or similar insurance. In addition, if we are able to successfully develop and commercialize our products, we will need to hire additional scientific, technical, marketing, managerial and finance personnel. We face intense competition for qualified personnel in these areas, many of whom are often subject to competing employment offers.

| 11 |

We are significantly influenced by our directors, executive officers and their affiliated entities.

Our directors, executive officers and entities affiliated with them controlled 15.31 %, of the voting power of our outstanding common stock as of June 15, 2016. These stockholders, acting together, would be able to exert significant influence on substantially all matters requiring approval by our stockholders, including the election of directors and the approval of mergers and other business combination transactions.

Certain provisions of our certificate of incorporation that authorize the issuance of additional shares of preferred stock may make it more difficult for a third party to effect a change in control.

Our certificate of incorporation authorizes our board of directors to issue up to 9.0 million shares of preferred stock. Our undesignated shares of preferred stock may be issued in one or more series, the terms of which may be determined by the board without further stockholder action. These terms may include, among other terms, voting rights, including the right to vote as a series on particular matters, preferences as to liquidation and dividends, repurchase rights, conversion rights, redemption rights and sinking fund provisions. The issuance of any preferred stock could diminish the rights of holders of our common stock, and therefore could reduce the value of our common stock. In addition, specific rights granted to future holders of preferred stock could be used to restrict our ability to merge with or sell assets to a third party. The ability of our board to issue preferred stock could make it more difficult, delay, discourage, prevent or make it more costly to acquire or effect a change in control, which in turn could prevent our stockholders from recognizing a gain in the event that a favorable offer is extended and could materially and negatively affect the market price of our common stock.

Risks Related to Our Common Stock

Our board of directors has asked our stockholders to approve a proposal to authorize our board to effect a reverse stock split of our common stock. There are risks associated with a reverse stock split, if it is effected.

On May 18, 2016, our board determined to recommend that at our 2016 annual stockholders’ meeting, our stockholders grant the board the authority, in its discretion, to effect a reverse stock split by a ratio of not less than 1:10 and not more than 1:400, with no change in the number of authorized shares of our common stock, and all fractional shares created by the reverse stock split to be rounded to the nearest whole share. On May 26, 2016, our largest stockholder, John Imhoff, who is also one of our directors, agreed to vote his shares of common stock in favor of the reverse stock split. As of the record date for the 2016 annual meeting, Dr. Imhoff held 10,361,179 shares, or 19.26%, of the outstanding shares of common stock.

We intend to effect the reverse stock split prior to the consummation of this offering; however, there are no assurances that the reverse stock split will be implemented. If the reverse stock split is effected, there are certain risks associated with the reverse stock split, including the following:

| · | We would have additional authorized shares of common stock that the board could issue in future without stockholder approval, and such additional shares could be issued, among other purposes, in financing transactions or to resist or frustrate a third-party transaction that is favored by a majority of the independent stockholders. This could have an anti-takeover effect, in that additional shares could be issued, within the limits imposed by applicable law, in one or more transactions that could make a change in control or takeover of us more difficult. |

| · | There can be no assurance that the reverse stock split, if completed, will achieve the benefits that we hope it will achieve. The total market capitalization of our common stock after the reverse stock split may be lower than the total market capitalization before the reverse stock split. |

The reverse stock split may decrease the liquidity of the shares of our common stock.

The liquidity of the shares of our common stock may be affected adversely by the reverse stock split given the reduced number of shares that will be outstanding following the reverse stock split, especially if the market price of our common stock does not increase as a result of the reverse stock split. In addition, the reverse stock split may increase the number of stockholders who own odd lots of our common stock, creating the potential for such stockholders to experience an increase in the cost of selling their shares and greater difficulty effecting such sales.

| 12 |

Following the reverse stock split, the resulting market price of our common stock may not attract new investors, including institutional investors, and may not satisfy the investing requirements of those investors. Consequently, the trading liquidity of our common stock may not improve.

Although we believe that a higher market price of our common stock may help generate greater or broader investor interest, there can be no assurance that the reverse stock split will result in a share price that will attract new investors, including institutional investors. In addition, there can be no assurance that the market price of our common stock will satisfy the investing requirements of those investors. As a result, the trading liquidity of our common stock may not necessarily improve.

The number of shares of our common stock issuable upon the conversion of our outstanding convertible debt and preferred stock or exercise of outstanding warrants and options (excluding the convertible stock or warrants in this offering) is substantial.

As of June 15, 2016, our outstanding convertible debt was convertible into an aggregate of 151,583,843 shares of our common stock, and the outstanding shares of our Series C and Series C1 preferred stock were convertible into an aggregate of 433,385,611 shares of common stock. Also, as of that date we had warrants outstanding that were exercisable for an aggregate of 233,615,051 shares, contractual obligations to issue 5,205,101 shares, and outstanding options to purchase 104,356 shares. The shares of common stock issuable upon conversion or exercise of these securities would have constituted approximately 91.8 % of the total number of shares of common stock then issued and outstanding.