Attached files

| file | filename |

|---|---|

| EX-99.1 - EXHIBIT 99.1 - LIONS GATE ENTERTAINMENT CORP /CN/ | t1601632_ex99-1.htm |

| 8-K - FORM 8-K - LIONS GATE ENTERTAINMENT CORP /CN/ | t1601632_8k.htm |

Exhibit 99.2

JUNE 30, 2016

CAUTIONREGARDINGFORWARD-LOOKINGSTATEMENTS THISCOMMUNICATIONMAYCONTAINCERTAINFORWARD-LOOKINGSTATEMENTS,INCLUDINGCERTAINPLANS,EXPECTATIONS,GOALS,PROJECTIONS,ANDSTATEMENTSABOUTTHEBENEFITSOFTHEPROPOSEDTRANSACTION,THEMERGER PARTIES’PLANS,OBJECTIVES,EXPECTATIONSANDINTENTIONS,THEEXPECTEDTIMINGOFCOMPLETIONOFTHETRANSACTION,ANDOTHERSTATEMENTSTHATARENOTHISTORICALFACTS.SUCHSTATEMENTSARESUBJECTTONUMEROUS ASSUMPTIONS,RISKS,ANDUNCERTAINTIES.STATEMENTSTHATDONOTDESCRIBEHISTORICALORCURRENTFACTS,INCLUDINGSTATEMENTSABOUTBELIEFSANDEXPECTATIONS,AREFORWARD-LOOKINGSTATEMENTS.FORWARD-LOOKING STATEMENTSMAYBEIDENTIFIEDBYWORDSSUCHASEXPECT,ANTICIPATE,BELIEVE,INTEND,ESTIMATE,PLAN,TARGET,GOAL,ORSIMILAREXPRESSIONS,ORFUTUREORCONDITIONALVERBSSUCHASWILL,MAY,MIGHT,SHOULD,WOULD, COULD,ORSIMILARVARIATIONS.THEFORWARD-LOOKINGSTATEMENTSAREINTENDEDTOBESUBJECTTOTHESAFEHARBORPROVIDEDBYSECTION27AOFTHESECURITIESACTOF1933,SECTION21EOFTHESECURITIESEXCHANGEACTOF 1934,ANDTHEPRIVATESECURITIESLITIGATIONREFORMACTOF1995. WHILETHEREISNOASSURANCETHATANYLISTOFRISKSANDUNCERTAINTIESORRISKFACTORSISCOMPLETE,BELOWARECERTAINFACTORSWHICHCOULDCAUSEACTUALRESULTSTODIFFERMATERIALLYFROMTHOSECONTAINEDOR IMPLIEDINTHEFORWARD-LOOKINGSTATEMENTSINCLUDING:THESUBSTANTIALINVESTMENTOFCAPITALREQUIREDTOPRODUCEANDMARKETFILMSANDTELEVISIONSERIES;INCREASEDCOSTSFORPRODUCINGANDMARKETINGFEATURE FILMSANDTELEVISIONSERIES;BUDGETOVERRUNS,LIMITATIONSIMPOSEDBYOURCREDITFACILITIESANDNOTES;UNPREDICTABILITYOFTHECOMMERCIALSUCCESSOFOURMOTIONPICTURESANDTELEVISIONPROGRAMMING;RISKSRELATED TO OUR ACQUISITION AND INTEGRATION OF ACQUIRED BUSINESSES; THE EFFECTS OF DISPOSITIONS OF BUSINESSES OR ASSETS, INCLUDING INDIVIDUAL FILMS OR LIBRARIES; THE COST OF DEFENDING OUR INTELLECTUAL PROPERTY; TECHNOLOGICAL CHANGES AND OTHER TRENDS AFFECTING THE ENTERTAINMENTINDUSTRY; THE POSSIBILITYTHAT THE PROPOSED TRANSACTION DOES NOT CLOSE WHEN EXPECTED OR AT ALL BECAUSE REQUIRED REGULATORY, SHAREHOLDER OROTHERAPPROVALSARENOTRECEIVEDOROTHERCONDITIONS TOTHECLOSINGARENOTSATISFIEDONATIMELYBASISORATALL;THERISKTHATTHEFINANCING REQUIREDTOFUNDTHETRANSACTIONISNOT OBTAINED;POTENTIALADVERSEREACTIONSORCHANGESTOBUSINESSOREMPLOYEERELATIONSHIPS,INCLUDINGTHOSERESULTINGFROMTHEANNOUNCEMENTORCOMPLETIONOFTHETRANSACTION;UNCERTAINTIESASTOTHETIMING OFTHETRANSACTION;COMPETITIVERESPONSESTOTHETRANSACTION;THEPOSSIBILITYTHATTHEANTICIPATEDBENEFITSOFTHETRANSACTIONARENOTREALIZEDWHENEXPECTEDORATALL,INCLUDINGASARESULTOFTHEIMPACT OF,ORPROBLEMSARISINGFROM,THEINTEGRATIONOFTHETWOCOMPANIES;THEPOSSIBILITYTHATTHETRANSACTIONMAYBEMOREEXPENSIVETOCOMPLETETHANANTICIPATED,INCLUDINGASARESULTOFUNEXPECTEDFACTORSOR EVENTS;DIVERSIONOFMANAGEMENT’SATTENTIONFROMONGOINGBUSINESSOPERATIONSANDOPPORTUNITIES;POTENTIALADVERSEREACTIONSORCHANGESTOBUSINESSOREMPLOYEERELATIONSHIPS,INCLUDINGTHOSERESULTING FROM THE ANNOUNCEMENT OR COMPLETION OF THE TRANSACTION; LIONSGATE’S ABILITYTO COMPLETE THE ACQUISITION AND INTEGRATION OF STARZ SUCCESSFULLY; LITIGATION RELATING TO THE TRANSACTION; AND OTHER FACTORSTHATMAYAFFECTFUTURERESULTSOFLIONSGATEANDSTARZ.ADDITIONALFACTORSTHATCOULDCAUSERESULTSTODIFFERMATERIALLYFROMTHOSEDESCRIBEDABOVECANBEFOUNDINLIONSGATE’SANNUALREPORTON FORM10-KFORTHEYEARENDEDMARCH31,2016,ONFILEWITHTHESECURITIESANDEXCHANGECOMMISSION(THE“SEC”)ANDAVAILABLEINTHE“CORPORATE”SECTIONOFLIONSGATE’SWEBSITE,HTTP://WWW.LIONSGATE.COM,UNDER THEHEADING“REPORTS”ANDINOTHERDOCUMENTSLIONSGATEFILESWITHTHESEC,ANDINSTARZ’SANNUALREPORTONFORM10-KFORTHEYEARENDEDDECEMBER31,2015ANDINITSSUBSEQUENTQUARTERLYREPORTSONFORM10- Q, INCLUDING FOR THE QUARTER ENDED MARCH 31, 2016, EACH OF WHICH IS ON FILE WITH THE SEC AND AVAILABLE IN THE “STARZ CORPORATE” SECTION OF STARZ’S WEBSITE, HTTP://WWW.STARZ.COM, UNDER THE SUBSECTION “INVESTORRELATIONS”ANDTHENUNDERTHEHEADING“SECFILINGS”ANDINOTHERDOCUMENTSSTARZFILESWITHTHESEC. ALLFORWARD-LOOKING STATEMENTSSPEAK ONLYASOFTHEDATETHEYAREMADEANDAREBASEDON INFORMATION AVAILABLEATTHATTIME.NEITHERLIONSGATENORSTARZASSUMESANY OBLIGATIONTOUPDATEFORWARD- LOOKINGSTATEMENTSTOREFLECTCIRCUMSTANCESOREVENTSTHATOCCURAFTERTHEDATETHEFORWARD-LOOKINGSTATEMENTSWEREMADEORTOREFLECTTHEOCCURRENCEOFUNANTICIPATEDEVENTSEXCEPTASREQUIREDBY FEDERALSECURITIESLAWS.ASFORWARD-LOOKINGSTATEMENTSINVOLVESIGNIFICANTRISKSANDUNCERTAINTIES,CAUTIONSHOULDBEEXERCISEDAGAINSTPLACINGUNDUERELIANCEONSUCHSTATEMENTS. IMPORTANTADDITIONALINFORMATION INCONNECTIONWITHTHEPROPOSEDTRANSACTION,LIONSGATEWILLFILEWITHTHESECAREGISTRATIONSTATEMENTONFORMS-4THATWILLINCLUDEAJOINTPROXYSTATEMENTOFLIONSGATEANDSTARZANDAPROSPECTUSOF LIONSGATE,ASWELLASOTHERRELEVANTDOCUMENTSCONCERNINGTHEPROPOSEDTRANSACTION.THEPROPOSEDTRANSACTIONINVOLVINGLIONSGATEANDSTARZWILLBESUBMITTEDTOSTARZ’SSTOCKHOLDERSANDLIONSGATE’S STOCKHOLDERS FOR THEIR CONSIDERATION. THIS COMMUNICATION DOES NOT CONSTITUTE AN OFFER TO SELL OR THE SOLICITATION OF AN OFFER TO BUY ANY SECURITIES OR A SOLICITATION OF ANY VOTE OR APPROVAL. STOCKHOLDERSOFLIONSGATEANDSTOCKHOLDERSOFSTARZAREURGEDTOREADTHEREGISTRATIONSTATEMENTANDTHEJOINTPROXYSTATEMENT/PROSPECTUSREGARDINGTHETRANSACTIONWHENITBECOMESAVAILABLEAND ANYOTHERRELEVANTDOCUMENTSFILEDWITHTHESEC,ASWELLASANYAMENDMENTSORSUPPLEMENTSTOTHOSEDOCUMENTS,BECAUSETHEYWILLCONTAINIMPORTANTINFORMATION. STOCKHOLDERSWILLBEABLETOOBTAINA FREECOPYOFTHEDEFINITIVEJOINTPROXYSTATEMENT/PROSPECTUS,ASWELLASOTHERFILINGSCONTAININGINFORMATIONABOUTLIONSGATEANDSTARZ,WITHOUTCHARGE,ATTHESEC’SWEBSITE(HTTP://WWW.SEC.GOV).COPIESOF THE JOINTPROXY STATEMENT/PROSPECTUS AND THE FILINGSWITHTHE SECTHATWILLBEINCORPORATED BYREFERENCEIN THEJOINT PROXYSTATEMENT/PROSPECTUS CAN ALSO BE OBTAINED, WITHOUT CHARGE,BYDIRECTINGA REQUESTTOJAMESMARSH,SENIORVICEPRESIDENTOFLIONSGATEINVESTORRELATIONS,2700COLORADOAVENUE,SANTAMONICA,CALIFORNIA,90404,OR AT(310)255-3651. PARTICIPANTSINTHESOLICITATION LIONSGATE, STARZ, AND CERTAIN OF THEIR RESPECTIVE DIRECTORS, EXECUTIVE OFFICERS AND EMPLOYEES MAY BE DEEMED TO BE PARTICIPANTS IN THE SOLICITATION OF PROXIES IN RESPECT OF THE PROPOSED TRANSACTION. INFORMATIONREGARDINGLIONSGATE’SDIRECTORSANDEXECUTIVEOFFICERSISAVAILABLEINITSDEFINITIVEPROXYSTATEMENT,WHICHWASFILEDWITHTHESECONJULY29,2015,ANDCERTAINOFITSCURRENTREPORTSONFORM8-K. INFORMATIONREGARDINGSTARZ’SDIRECTORSANDEXECUTIVEOFFICERSISAVAILABLEINITSDEFINITIVEPROXYSTATEMENT,WHICHWASFILEDWITHSECONAPRIL29,2016,ANDCERTAINOFITSCURRENTREPORTSONFORM8-K. OTHER INFORMATION REGARDING THE PARTICIPANTS IN THE PROXY SOLICITATION AND A DESCRIPTION OF THEIR DIRECT AND INDIRECT INTERESTS, BY SECURITY HOLDINGS OR OTHERWISE, WILL BE CONTAINED IN THE JOINT PROXY STATEMENT/PROSPECTUSANDOTHERRELEVANTMATERIALSFILEDWITHTHESEC. FREECOPIESOFTHISDOCUMENTMAYBEOBTAINEDASDESCRIBEDINTHEPRECEDINGPARAGRAPH. DISCLAIMER 1

2 RATIONALE FOR LIONSGATE / STARZ COMBINATION “This transaction unites two companies with strong brands, complementary assets and leading positions within our industry. We expect the acquisition to be highly accretive, generate significant synergies and create a whole that is greater than the sum of its parts. Chris Albrecht and his team have built a world-class platform and programming leader, and we’re proud to marshal our resources in a deal that accelerates our growth and diversification, generates exciting new strategic content opportunities and creates significant value for our shareholders.” Jon Feltheimer, Chief Executive Officer, & Michael Burns, Vice Chairman, Lionsgate ®

• EXPANDS PORTFOLIO OF VALUABLE PREMIUM SCRIPTED PROGRAMMING • ONE OF THE LARGEST FILMED ENTERTAINMENT LIBRARIES IN THE WORLD, REFRESHED BY ANNUAL INVESTMENT OF $1.8 BN IN NEW TELEVISION & MOTION PICTURE CONTENT • PREMIUM CONTENT OFFERINGS ENHANCE RELATIONSHIPS WITH DOMESTIC & GLOBAL DISTRIBUTORS 3 CREATES WORLD-CLASS PREMIUM CONTENT POWERHOUSE SOURCE: COMPANY FILINGS

4 • LEADING PORTFOLIO OF OTT OFFERINGS SERVING A BROAD ARRAY OF CONSUMER INTERESTS • EFFICIENTLY EXPAND GLOBAL FOOTPRINT THROUGH INTERNATIONAL PARTNERSHIPS • ACHIEVE COST SAVINGS BY UTILIZING COMBINED OTT INFRASTRUCTURE & VENDOR RELATIONSHIPS CREATES GLOBAL OTT OPPORTUNITIES EXPANDS ESTABLISHED NETWORK PLATFORM • COMPELLING VALUE PROPOSITION TO CONSUMERS & DISTRIBUTION PARTNERS • STARZ IS THE #2 MOST-SUBSCRIBED PREMIUM PAY TV SERVICE IN THE US • LIONSGATE IP / LIBRARY ENHANCES CONTENT OFFERING • LEVERAGE LIONSGATE’S PRODUCTION & MARKETING EXPERTISE / RELATIONSHIPS EXPANDS ESTABLISHED NETWORK PLATFORM & CREATES GLOBAL OTT OPPORTUNITIES SOURCE: COMPANY FILINGS 24M SUBS 32M SUBS

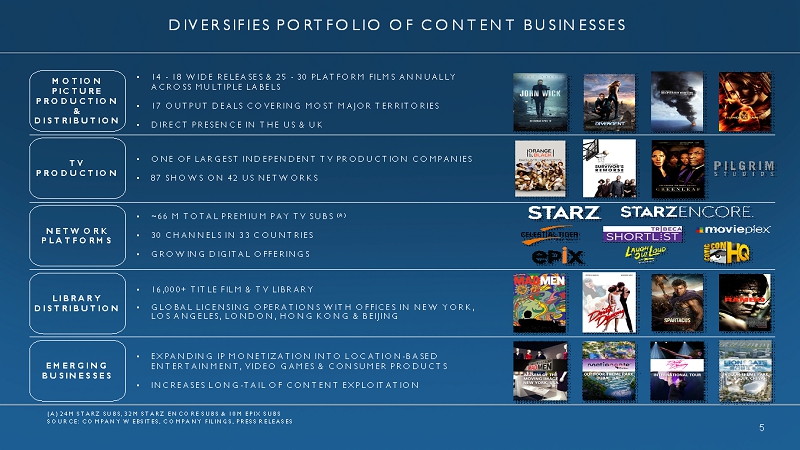

5 (A) 24M STARZ SUBS, 32M STARZ ENCORE SUBS & 10M EPIX SUBS SOURCE: COMPANY WEBSITES, COMPANY FILINGS, PRESS RELEASES DIVERSIFIES PORTFOLIO OF CONTENT BUSINESSES MOTION PICTURE PRODUCTION & DISTRIBUTION • 14 -18 WIDE RELEASES & 25 -30 PLATFORM FILMS ANNUALLY ACROSS MULTIPLE LABELS • 17 OUTPUT DEALS COVERING MOST MAJOR TERRITORIES • DIRECT PRESENCE IN THE US & UK TV PRODUCTION • ONE OF LARGEST INDEPENDENT TV PRODUCTION COMPANIES • 87 SHOWS ON 42 US NETWORKS NETWORK PLATFORMS • ~66 M TOTAL PREMIUM PAY TV SUBS (A) • 30 CHANNELS IN 33 COUNTRIES • GROWING DIGITAL OFFERINGS LIBRARY DISTRIBUTION • 16,000+ TITLE FILM & TV LIBRARY • GLOBAL LICENSING OPERATIONS WITH OFFICES IN NEW YORK, LOS ANGELES, LONDON, HONG KONG & BEIJING EMERGING BUSINESSES • EXPANDING IP MONETIZATION INTO LOCATION-BASED ENTERTAINMENT, VIDEOGAMES & CONSUMER PRODUCTS • INCREASES LONG-TAIL OF CONTENT EXPLOITATION

6 • NEARLY $2 BNANNUALLY IN GLOBAL BOX OFFICE • 90 ACADEMY AWARD NOMINATIONS & 20 WINS • WIDE RELEASE SLATE COMPLEMENTED BY PANTELION, CODEBLACK & LIONSGATE PREMIERE SPECIALTY LABELS • DISCIPLINED RISK MITIGATION STRATEGY A LEADING MOTION PICTURE STUDIO GENERATING ICONIC IP SOURCE: COMPANY WEBSITES, COMPANY FILINGS, PRESS RELEASES

7 • LIONSGATE / STARZ COMBINATION CREATES ONE OF THE WORLD’S LARGEST TV PRODUCTION COMPANIES WITH OVER $1 BN IN ANTICIPATED ANNUAL CONTENT INVESTMENT • 87 SHOWS ON 42 US NETWORKS • 215 EMMY AWARD NOMINATIONS & 32 WINS • TRUSTED PRODUCER OF PLATFORM-DEFINING SERIES • STRONG RECURRING CORE COMPETENCE IN SCRIPTED PROGRAMMING • INDUSTRY-LEADING NON-SCRIPTED BUSINESS ENHANCED BY PILGRIM STUDIOS INVESTMENT • PARTNERSHIPS WITH DIGITAL PLATFORMS FOR CREATION OF ORIGINAL PROGRAMMING SCALES & DIVERSIFIES TV PLATFORM THAT INCLUDES PREMIUM SCRIPTED, REALITY & SYNDICATED SERIES SOURCE: COMPANY WEBSITES, COMPANY FILINGS, PRESS RELEASES

8 RETAIN RIGHTS & MAXIMIZE VALUE OF ANCILLARIES MULTI-SEASON COMMITMENTS FOR INTERNATIONAL PRODUCTIONS SCALE CREATES OPERATING LEVERAGE ENHANCES TOUCH POINTS WITH GLOBAL DISTRIBUTORS ACHIEVES SIGNIFICANT BENEFITS BY PAIRING LEADING TV STUDIO WITH PREMIUM CHANNEL ®

9 • 16,000+ MOTION PICTURE TITLES & TELEVISION EPISODES • LIBRARY REVENUE CONTRIBUTION FROM DIGITAL, ON-DEMAND & TELEVISION PLATFORMSCONTINUES TO GROW • ABILITY TO EFFICIENTLY USE LIBRARY CONTENT TO SUPPORT OWN NETWORK / OTT PLATFORMS & MOBILE INITIATIVES • STRENGTH OF DISTRIBUTION DRIVES RECURRING FREE CASH FLOW • COMBINED PLATFORM DRIVES SUBSTANTIAL SYNERGIES COMBINED COMPANY IS BACKED BY ONE OF THE WORLD’S LARGEST FILM & TV LIBRARIES SOURCE: COMPANY FILINGS

? SIGNIFICANT EXPLOITATION OPPORTUNITIES FOR STARZ CONTENT 10 ? GROWING PRESENCE IN LOCATION-BASED ENTERTAINMENT & VIDEO GAMES EXHIBITIONS LIVE SHOWS THEME PARKS VIDEO GAMES WORLD-CLASS IP DRIVES GROWTH IN NEW BUSINESSES

• ~$4 BNCOMBINED REVENUE (A) • DIVERSIFIED EARNINGS • SIGNIFICANT SYNERGIES • SUBSTANTIALFREE CASH FLOW WITH STRONG VISIBILITY FROM CONTRACTED AFFILIATE REVENUES STARZ NETWORKS 60% LIONSGATE TV 12% LIONSGATE FILM 22% STARZ DISTRIBUTION 6% 11 (A) PRO FORMA TRAILING TWELVE MONTHS AS OF 3/31/2016 (B) REPRESENTS OPERATING INCOME BEFORE DEPRECIATION & AMORTIZATION AND G&A EXPENSE OF OPERATING SEGMENTS SHOWN SOURCE: COMPANY FILINGS FY2016A PFGROSS CONTRIBUTION (B) HIGHLY ACCRETIVE TRANSACTION CREATES IMMEDIATE & LONG-TERM VALUE FOR SHAREHOLDERS

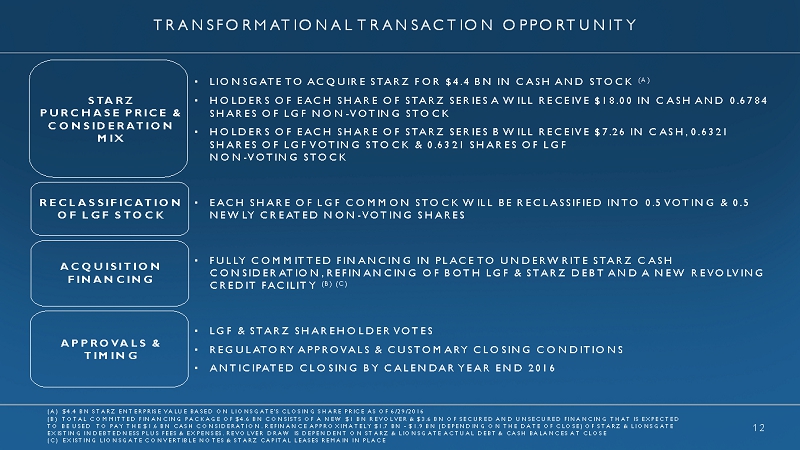

12 STARZ PURCHASE PRICE & CONSIDERATION MIX • LIONSGATE TO ACQUIRE STARZ FOR $4.4 BN IN CASH AND STOCK (A) • HOLDERS OF EACH SHARE OF STARZ SERIES A WILL RECEIVE $18.00 IN CASH AND 0.6784 SHARES OF LGF NON-VOTING STOCK • HOLDERS OF EACH SHARE OF STARZ SERIES B WILL RECEIVE $7.26 IN CASH, 0.6321 SHARES OF LGF VOTING STOCK & 0.6321 SHARES OF LGF NON-VOTING STOCK RECLASSIFICATION OF LGFSTOCK • EACH SHARE OF LGF COMMON STOCK WILL BE RECLASSIFIED INTO 0.5 VOTING & 0.5 NEWLY CREATED NON-VOTING SHARES ACQUISITION FINANCING • FULLY COMMITTED FINANCING IN PLACE TO UNDERWRITE STARZ CASH CONSIDERATION, REFINANCING OF BOTH LGF & STARZ DEBT AND A NEW REVOLVING CREDIT FACILITY (B) (C) APPROVALS& TIMING • LGF & STARZ SHAREHOLDER VOTES • REGULATORY APPROVALS & CUSTOMARY CLOSING CONDITIONS • ANTICIPATED CLOSING BY CALENDAR YEAR END 2016 (A) $4.4 BN STARZ ENTERPRISE VALUE BASED ON LIONSGATE’SCLOSING SHARE PRICE AS OF 6/29/2016 (B) TOTAL COMMITTED FINANCING PACKAGE OF $4.6 BN CONSISTS OF A NEW $1 BN REVOLVER & $3.6 BNOF SECURED AND UNSECURED FINANCING THAT IS EXPECTED TO BE USED TO PAY THE $1.6 BN CASH CONSIDERATION. REFINANCE APPROXIMATELY $1.7 BN-$1.9 BN (DEPENDING ON THE DATE OF CLOSE) OF STARZ & LIONSGATE EXISTING INDEBTEDNESS PLUS FEES & EXPENSES. REVOLVER DRAW IS DEPENDENT ON STARZ & LIONSGATEACTUAL DEBT & CASH BALANCES AT CLOSE (C) EXISTING LIONSGATECONVERTIBLE NOTES & STARZ CAPITAL LEASES REMAIN IN PLACE TRANSFORMATIONAL TRANSACTION OPPORTUNITY

13 • SIGNIFICANT SYNERGIES • SUBSTANTIAL FREE CASH FLOW • FOCUS ON DELEVERAGING THROUGH DISCIPLINED FINANCIAL POLICY (A) • PRUDENT BALANCE SHEET STRATEGY ENABLES CONTINUED STRATEGIC FLEXIBILITY STRONG FINANCIAL MERITS (A) ASSUMING A 12/31/2016 CLOSELEVERAGE EXCLUDING CONVERTIBLE NOTES & PRO FORMA SYNERGIES IS EXPECTED TO APPROXIMATE 5.0X -5.5X REDUCING BY AN ESTIMATED 1.5X OVER THE FOLLOWING 12-18 MONTHS. WE EXPECT THAT POST CLOSING, THE COMBINED COMPANY WILL SUSPEND THE QUARTERLY DIVIDEND WHILE FOCUSING ON DELEVERAGING AND GROWING OUR COMBINED CORE BUSINESSES

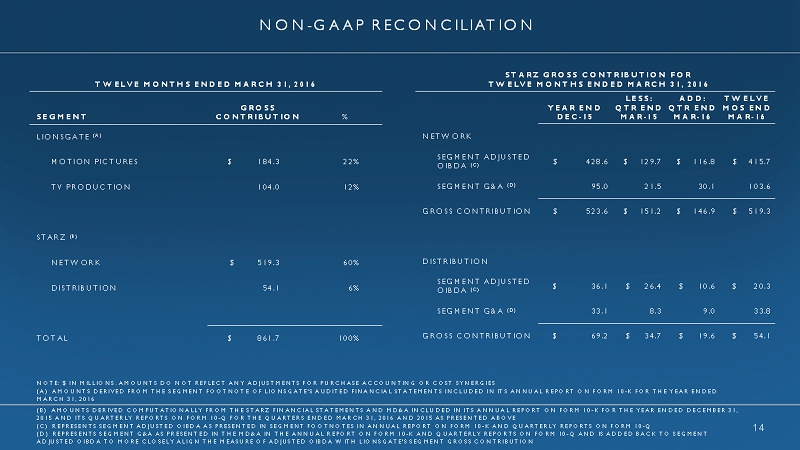

14 NON-GAAP RECONCILIATION TWELVE MONTHS ENDED MARCH 31, 2016 SEGMENT GROSS CONTRIBUTION % LIONSGATE (A) MOTION PICTURES $ 184.3 22% TV PRODUCTION 104.0 12% STARZ (B) NETWORK $ 519.3 60% DISTRIBUTION 54.1 6% TOTAL $ 861.7 100% STARZ GROSS CONTRIBUTION FOR TWELVE MONTHS ENDED MARCH 31, 2016 YEAR END DEC-15 LESS: QTR END MAR-15 ADD: QTR END MAR-16 TWELVE MOS END MAR-16 NETWORK SEGMENT ADJUSTED OIBDA (C) $ 428.6 $ 129.7 $ 116.8 $ 415.7 SEGMENT G&A (D) 95.0 21.5 30.1 103.6 GROSS CONTRIBUTION $ 523.6 $ 151.2 $ 146.9 $ 519.3 DISTRIBUTION SEGMENT ADJUSTED OIBDA (C) $ 36.1 $ 26.4 $ 10.6 $ 20.3 SEGMENT G&A (D) 33.1 8.3 9.0 33.8 GROSS CONTRIBUTION $ 69.2 $ 34.7 $ 19.6 $ 54.1 NOTE: $ IN MILLIONS. AMOUNTS DO NOT REFLECT ANY ADJUSTMENTS FOR PURCHASE ACCOUNTING OR COST SYNERGIES (A) AMOUNTS DERIVED FROM THE SEGMENT FOOTNOTE OF LIONSGATE'SAUDITED FINANCIAL STATEMENTS INCLUDED IN ITS ANNUAL REPORT ON FORM 10-K FOR THE YEAR ENDED MARCH 31, 2016 (B) AMOUNTS DERIVED COMPUTATIONALLY FROM THE STARZ FINANCIAL STATEMENTS AND MD&A INCLUDED IN ITS ANNUAL REPORT ON FORM 10-K FOR THE YEAR ENDED DECEMBER 31, 2015 AND ITS QUARTERLY REPORTS ON FORM 10-Q FOR THE QUARTERS ENDED MARCH 31, 2016 AND 2015 AS PRESENTED ABOVE (C) REPRESENTS SEGMENT ADJUSTED OIBDA AS PRESENTED IN SEGMENT FOOTNOTES IN ANNUAL REPORT ON FORM 10-K AND QUARTERLY REPORTS ON FORM 10-Q (D) REPRESENTS SEGMENT G&A AS PRESENTED IN THE MD&A IN THE ANNUAL REPORT ON FORM 10-K AND QUARTERLY REPORTS ON FORM 10-Q AND ISADDED BACK TO SEGMENT ADJUSTED OIBDA TO MORE CLOSELY ALIGN THE MEASURE OF ADJUSTED OIBDA WITH LIONSGATE'SSEGMENT GROSS CONTRIBUTION