Attached files

| file | filename |

|---|---|

| EX-32.1 - CERTIFICATION - JOHN WILEY & SONS, INC. | exhibit32_1.htm |

| EX-10.16 - FISCAL YEAR 2017 ANNUAL STATEGIC MILESTONES PLAN - JOHN WILEY & SONS, INC. | exhibit10_16.htm |

| EX-10.15 - FISCAL YEAR 2017 EAIP - JOHN WILEY & SONS, INC. | exhibit10_15.htm |

| EX-10.14 - FISCAL YEAR 2017 ELTIP - JOHN WILEY & SONS, INC. | exhibit10_14.htm |

| EX-32.2 - CERTIFICATION - JOHN WILEY & SONS, INC. | exhibit32_2.htm |

| EX-31.2 - CERTIFICATION - JOHN WILEY & SONS, INC. | exhibit31_2.htm |

| EX-31.1 - CERTIFICATION - JOHN WILEY & SONS, INC. | exhibit31_1.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 10-K

[x] ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF

THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended: April 30, 2016

OR

[ ] TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934 (FEE REQUIRED)

For the transition period from to

Commission file number 001-11507

JOHN WILEY & SONS, INC.

(Exact name of Registrant as specified in its charter)

|

NEW YORK

|

13-5593032

|

|

|

State or other jurisdiction of incorporation or organization

|

I.R.S. Employer Identification No.

|

|

|

111 River Street, Hoboken, NJ

|

07030

|

|

|

Address of principal executive offices

|

Zip Code

|

|

|

(201) 748-6000

|

||

|

Registrant’s telephone number including area code

|

||

|

Securities registered pursuant to Section 12(b) of the Act: Title of each class

|

Name of each exchange on which registered

|

|

|

Class A Common Stock, par value $1.00 per share

|

New York Stock Exchange

|

|

|

Class B Common Stock, par value $1.00 per share

|

New York Stock Exchange

|

|

|

Securities registered pursuant to Section 12(g) of the Act:

|

||

|

None

|

1

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

Yes |X| No | |

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Exchange Act.

Yes | | No |X |

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Yes |X| No | |

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files).

Yes |X| No | |

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. | |

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See definitions of “large accelerated filer,” ”accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer |X| Accelerated filer | | Non-accelerated filer | | Smaller reporting company | |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

Yes | | No |X|

The aggregate market value of the voting stock held by non-affiliates of the registrant, computed by reference to the closing price as of the last business day of the registrant’s most recently completed second fiscal quarter, October 31, 2015, was approximately $2,331.2 million. The registrant has no non-voting common stock.

The number of shares outstanding of the registrant’s Class A and Class B Common Stock as of May 31, 2016 was 48,109,204 and 9,475,140 respectively.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the registrant’s definitive proxy statement for use in connection with its annual meeting of stockholders scheduled to be held on September 22, 2016, are incorporated by reference into Part III of this Form 10-K.

2

JOHN WILEY AND SONS, INC. AND SUBSIDIARIES

FORM 10-K

FOR THE FISCAL YEAR ENDED APRIL 30, 2016

INDEX

|

PART I

|

PAGE

|

|

|

ITEM 1.

|

Business

|

4

|

|

ITEM 1A.

|

Risk Factors

|

4-11

|

|

ITEM 1B.

|

Unresolved Staff Comments

|

11

|

|

ITEM 2.

|

Properties

|

12

|

|

ITEM 3.

|

Legal Proceedings

|

13

|

|

ITEM 4

|

Mine Safety Disclosures – Not Applicable

|

|

|

PART II

|

||

|

ITEM 5.

|

Market for the Company’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities

|

13

|

|

ITEM 6.

|

Selected Financial Data

|

14

|

|

ITEM 7.

|

Management’s Discussion and Analysis of Financial Condition and Results of Operations

|

15-55

|

|

ITEM 7A.

|

Quantitative and Qualitative Disclosures About Market Risk

|

55-58

|

|

ITEM 8.

|

Financial Statements and Supplementary Data

|

59-98

|

|

ITEM 9.

|

Changes in and Disagreements with Accountants on Accounting and Financial Disclosure

|

99

|

|

ITEM 9A.

|

Controls and Procedures

|

99

|

|

ITEM 9B.

|

Other Information

|

99

|

|

PART III

|

||

|

ITEM 10.

|

Directors, Executive Officers and Corporate Governance

|

99-102

|

|

ITEM 11.

|

Executive Compensation

|

102

|

|

ITEM 12.

|

Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters

|

102-103

|

|

ITEM 13.

|

Certain Relationships and Related Transactions, and Director Independence

|

103

|

|

ITEM 14.

|

Principal Accounting Fees and Services

|

103

|

|

|

||

|

PART IV

|

||

|

ITEM 15.

|

Exhibits, Financial Statement Schedules and Reports on Form 8-K

|

104-106

|

|

SIGNATURES

|

|

3

PART I

|

Item 1.

|

Business

|

The Company, founded in 1807, was incorporated in the state of New York on January 15, 1904. As used herein the term “Company” means John Wiley & Sons, Inc., and its subsidiaries and affiliated companies, unless the context indicates otherwise.

The Company is a global provider of knowledge and knowledge-enabled services that improve outcomes in areas of research, professional practice and education. Through the Research segment, the Company provides digital and print scientific, technical, medical and scholarly journals, reference works, books, database services and advertising. The Professional Development segment provides digital and print books, corporate learning solutions, employment assessment and training services, and test prep and certification. In Education, the Company provides print and digital content, and education solutions including online program management services for higher education institutions and course management tools for instructors and students. The Company takes full advantage of its content from all three businesses in developing and cross-marketing products to its diverse customer base of researchers, professionals, students, and educators. The use of technology enables the Company to make its content efficiently more accessible to its customers around the world. The Company’s operations are primarily located in the United States, Canada, Europe, Asia, and Australia.

Further description of the Company’s business is incorporated herein by reference in the Management’s Discussion and Analysis section of this 10-K.

Employees

As of April 30, 2016, the Company employed approximately 4,700 persons on a full-time equivalent basis worldwide.

Financial Information About Business Segments

The note entitled “Segment Information” of the Notes to Consolidated Financial Statements and pages 15 through 55 of the Management’s Discussion and Analysis section of this Form 10-K are incorporated herein by reference.

Financial Information About Foreign and Domestic Operations and Export Sales

The note entitled “Segment Information” of the Notes to Consolidated Financial Statements and pages 15 and 55 of the Management’s Discussion and Analysis section of this Form 10-K are incorporated herein by reference.

|

Item 1A.

|

Risk Factors

|

You should carefully consider all of the information set forth in this Form 10-K, including the following risk factors, before deciding to invest in any of the Company’s securities. The risks below are not the only ones the Company faces. Additional risks not currently known to the Company or that the Company presently deems immaterial may also impair its business operations. The Company’s business, financial condition, results of operations or prospects could be materially adversely affected by any of these risks.

4

Cautionary Statement Under the Private Securities Litigation Reform Act of 1995:

This Form 10-K for the year ended April 30, 2016 contains certain forward-looking statements concerning the Company’s operations, performance and financial condition. In addition, the Company provides forward-looking statements in other materials released to the public as well as oral forward-looking information. Statements which contain the words anticipate, expect, believes, estimate, project, forecast, plan, outlook, intend and similar expressions constitute forward-looking statements that involve risk and uncertainties. Reliance should not be placed on forward-looking statements, as actual results may differ materially from those in any forward-looking statements.

Any such forward-looking statements are based upon a number of assumptions and estimates that are inherently subject to uncertainties and contingencies, many of which are beyond the control of the Company, and are subject to change based on many important factors. Such factors include, but are not limited to (i) the level of investment in new technologies and products; (ii) subscriber renewal rates for the Company’s journals; (iii) the financial stability and liquidity of journal subscription agents; (iv) the consolidation of book wholesalers and retail accounts; (v) the market position and financial stability of key retailers; (vi) the seasonal nature of the Company’s education business and the impact of the used-book market; (vii) worldwide economic and political conditions; (viii) the Company’s ability to protect its copyrights and other intellectual property worldwide; (ix) the ability of the Company to successfully integrate acquired operations and realize expected opportunities and (x) other factors detailed from time to time in the Company’s filings with the Securities and Exchange Commission. The Company undertakes no obligation to update or revise any such forward-looking statements to reflect subsequent events or circumstances.

Operating and Administrative Costs and Expenses

In general, any significant increase in the costs of goods and services provided to the Company may adversely affect the Company’s costs of operation. The Company has a significant investment in its employee base around the world. The Company offers competitive salaries and benefits in order to attract and retain the highly skilled workforce needed to sustain and develop new products and services required for growth. Employment and benefit costs are affected by competitive market conditions for qualified individuals, and factors such as healthcare and retirement benefit costs. The Company is a large paper purchaser, and paper prices may fluctuate significantly from time-to-time. To reduce the impact of paper price increases, the Company relies upon multiple suppliers. As of April 30, 2016, the Company’s consolidated paper inventory was approximately $4.9 million and there were no outstanding multi-year supply contracts.

Protection of Intellectual Property Rights

A substantial portion of the Company’s publications are protected by copyright, held either in the Company’s name, in the name of the author of the work, or in the name of a sponsoring professional society. Such copyrights protect the Company’s exclusive right to publish the work in many countries abroad for specified periods, in most cases the author’s life plus 70 years, but in any event a minimum of 50 years for works published after 1978. The ability of the Company to continue to achieve its expected results depends, in part, upon the Company’s ability to protect its intellectual property rights. The Company’s results may be adversely affected by lack of legal and/or technological protections for its intellectual property in some jurisdictions and markets.

5

Maintaining the Company’s Reputation

The Company’s professional customers worldwide rely upon many of the Company’s publications to perform their jobs. It is imperative that the Company consistently demonstrates its ability to maintain the integrity of the information included in its publications. Adverse publicity, whether or not valid, may reduce demand for the Company’s publications.

Trade Concentration and Credit Risk

In the journal publishing business, subscriptions are primarily sourced through journal subscription agents who, acting as agents for library customers, facilitate ordering by consolidating the subscription orders/billings of each subscriber with various publishers. Cash is generally collected in advance from subscribers by the subscription agents and is principally remitted to the Company between the months of December and April. Although at fiscal year-end the Company had minimal credit risk exposure to these agents, future calendar-year subscription receipts from these agents are highly dependent on their financial condition and liquidity. Subscription agents account for approximately 22% of total annual consolidated revenue and no one agent accounts for more than 11% of total annual consolidated revenue.

The Company’s non-journal subscription business is not dependent upon a single customer. Although no one non-journal customer accounts for more than 9% of total consolidated revenue and 12% of accounts receivable at April 30, 2016, the top 10 non-journal customers account for approximately 16% of total consolidated revenue and approximately 26% of accounts receivable at April 30, 2016. The Company maintains approximately $25 million of trade credit insurance, subject to certain limitations, covering balances due from certain named customers which expires in May, 2017.

Changes in Laws and Regulations That Could Adversely Affect the Company’s Business

The Company maintains operations in Asia, Australia, Canada, Europe and the United States. The conduct of our business, including the sourcing of content, distribution, sales, marketing and advertising is subject to various laws and regulations administered by governments around the world. Changes in laws, regulations or government policies, including tax regulations and accounting standards, may adversely affect the Company’s future financial results.

The scientific research publishing industry generates much of its revenue from paid customer subscriptions to online and print journal content. There is debate within government, academic and library communities whether such journal content should be made available for free, immediately or following a period of embargo after publication, referred to as “open access”. For instance, certain governments have implemented mandates that require journal articles derived from government-funded research to be made available to the public at no cost after an embargo period. Open access can be achieved in two ways: Green, which enables authors to publish articles in subscription based journals and self–archive the author accepted version of the article for free public use after an embargo period, and Gold, which enables authors to publish their articles in journals that provide immediate free access to the article on the publisher’s website following payment of an article publication fee. These mandates have the potential to put pressure on subscription-based publications. If such regulations are widely implemented the Company’s operating results could be adversely affected. To date, the majority of governments that have taken a position on Open access have favored the green model and have generally specified embargo periods of twelve months. The publishing community generally takes the view that this period should be sufficient to protect subscription revenues provided that publishers’ platforms offer sufficient added value to the article. Governments in Europe have been more supportive of the gold model, which thus far is generating incremental revenue for publishers with active open access programs. A number of European administrations are showing interest in a business model which combines the purchasing of subscription content with the purchase of open access publishing for authors in their country. This development removes an element of risk by fixing revenues from that market, provided that the terms and price negotiated are acceptable.

6

Business Transformation and Restructuring

The Company is transforming portions of its business from a traditional publishing model to being a global provider of content-enabled solutions with a focus on digital products and services. The acquisition of Deltak.edu, LLC (“Deltak”), Inscape Holdings, Inc. (“Inscape”), Efficient Learning Systems, Inc. (“ELS”), Profiles International (“Profiles”) and CrossKnowledge Group Limited (“CrossKnowledge”), along with the divestment of the Company’s consumer publishing programs, are examples of strategic initiatives that were implemented as part of the Company’s business transformation. The Company will continue to explore opportunities to develop new business models and enhance the efficiency of its organizational structure. The rapid pace and scope of change increases the risk that not all of our strategic initiatives will deliver the expected benefits within the anticipated timeframes. In addition, these efforts may somewhat disrupt the Company’s business activities which could adversely affect its operating results.

The Company continues to restructure and realign its cost base with current and anticipated future market conditions. Significant risks associated with these actions that may impair the Company’s ability to achieve the anticipated cost reductions or that may disrupt its business include delays in the implementation of anticipated workforce reductions in highly regulated locations outside of the U.S.; decreases in employee morale; the failure to meet operational targets due to the loss of key employees; and disruptions of third parties to whom we have outsourced business functions. In addition, the Company’s ability to achieve the anticipated cost savings and other benefits from these actions within the expected timeframe is subject to many estimates and assumptions. These estimates and assumptions are subject to significant economic, competitive and other uncertainties, some of which are beyond our control. If these estimates and assumptions are incorrect, if we experience delays, or if other unforeseen events occur, our business and results of operations could be adversely affected.

Outsourcing of Business Processes

The Company has outsourced certain business functions, principally in technology, content management and certain transactional functions, to third-party service providers to achieve cost savings and efficiencies. If these third-party service providers do not perform effectively, the Company may not be able to achieve the expected cost savings and depending on the function involved, may experience business disruption or processing inefficiencies, all with potential adverse effects on the Company’s operating results.

7

Introduction of New Technologies, Products and Services

The Company must continue to invest in technology and other innovations to adapt and add value to its products and services to remain competitive. There are uncertainties whenever developing new products and services, and it is often possible that such new products and services may not be launched or if launched, may not be profitable or as profitable as existing products and services.

A common trend facing each of the Company’s businesses is the digitization of content and proliferation of distribution channels through the internet and other electronic means, which are replacing traditional print formats. The trend to digital content has also created contraction in the print book retail market which increases the risk of bankruptcy for certain retail customers, potentially leading to the disruption of short-term product supply to consumers as well as potential bad debt write-offs. New distribution channels, such as digital formats, the internet, online retailers and growing delivery platforms (e.g. tablets and e-readers), combined with the concentration of retailer power, present both threats and opportunities to the Company’s traditional publishing models, potentially impacting both sales volumes and pricing. In addition, there is an enhanced risk associated with the illegal unauthorized replication and distribution of digital products.

Student Demand for Lower Cost Textbooks in Higher Education

The Company’s Education business publishes educational content for undergraduate, graduate and advanced placement students, lifelong learners and in Australia secondary school students. Due to growing student demand for less expensive textbooks, many college bookstores, online retailers and other entities offer used or rental textbooks to students at lower prices than new textbooks. It is uncertain how such sales of lower priced textbooks will impact the Company’s operating results.

Factors that Reduce Enrollment at Colleges and Universities

Enrollment in U.S. colleges and universities can be adversely affected by many factors, including changes in government and private student loan and grant programs, uncertainty about current and future economic conditions, general decreases in family income and net worth and a perception of uncertain job prospects for recent graduates. In addition, enrollment levels at colleges and universities outside the United States are influenced by the global and local economic climate, local political conditions and other factors that make predicting foreign enrollment levels difficult. Reductions in expected levels of enrollment at colleges and universities both within and outside the United States could adversely affect demand for our higher education products.

Information Technology Risks

Information technology is a key part of the Company’s business strategy and operations. As a business strategy, Wiley’s technology enables the Company to provide customers with new and enhanced products and services and is critical to the Company’s success in migrating from print to digital business models. Information technology is also a fundamental component of all our business processes; collecting and reporting business data; and communicating internally and externally with customers, suppliers, employees and others.

We are continually improving and upgrading our computer systems and software. We are in the process of implementing a new Enterprise Resource Planning system as part of a multi-year plan to integrate and upgrade our operational and financial systems and processes. The implementation of this global system will occur in phases over the next several years. Implementation of a new enterprise resource planning system involves risks and uncertainties. Any disruptions, delays, or deficiencies in the design or implementation of a new system, could result in increased costs, disruptions in operations or delays in the collection of cash from our customers, as well as have an adverse effect on our ability to timely report our financial results, all of which could materially adversely affect our business, financial condition, and results of operations.

8

Information technology system failures, network disruptions and breaches of data security could significantly disrupt the operations of the Company. Management has designed and implemented policies, processes and controls to mitigate risks of information technology failure and to provide security from unauthorized access to our systems. In addition, the Company has in place disaster recovery plans to maintain business continuity. The size and complexity of our information technology and information security systems, and those of our third-party vendors with whom we contract, make such systems potentially vulnerable to cyber-attacks common to most industries from inadvertent or intentional actions by employees, vendors, or malicious third-parties. Such attacks are of ever-increasing levels of sophistication and are made by groups and individuals with a wide range of motives. While the Company has taken steps to address these risks, there can be no assurance that a system failure, disruption or data security breach would not adversely affect the Company’s business and operating results.

Competition for Market Share and Author and Society Relationships

The Company operates in highly competitive markets. Success and continued growth depends greatly on developing new products and the means to deliver them in an environment of rapid technological change. Attracting new authors and professional societies, while retaining our existing business relationships, are critical to our success.

Interest Rate and Foreign Exchange Risk

Non-U.S. revenues, as well as our substantial non-U.S. net assets, expose the Company’s results to foreign currency exchange rate volatility. The percentage of Consolidated Revenue for fiscal year 2016 recognized in the following currencies (on an equivalent U.S. dollar basis) were: approximately 57% U.S dollar; 28% British pound sterling; 8% euro and 7% other currencies. In addition, our interest-bearing loans and borrowings are subject to risk from changes in interest rates. These risks and the measures we have taken to help contain them are discussed in the Market Risk section of this 10-K. The Company from time-to-time uses derivative instruments to hedge such risks. Notwithstanding our efforts to foresee and mitigate the effects of changes in fiscal circumstances, we cannot predict with certainty changes in currency and interest rates, inflation or other related factors affecting our business.

Changes in Tax Legislation

The Company is subject to tax laws within the jurisdictions in which it does business. Changes in tax legislation could have a material impact on the Company’s financial results. There have been recent proposals to reform U.S. tax laws that would significantly impact how U.S. multinational corporations are taxed on earnings outside of the U.S. This could have a material impact on the Company’s financial results since a substantial portion of the Company’s income is earned outside the U.S. In addition, the Company is subject to audit by tax authorities. Although we believe our tax estimates are reasonable, the final determination of tax audits could be materially different from our historical income tax provisions and accruals and have a material impact on the Company’s net income, cash flow and financial position. See Note 12 (“Tax Audits”) for further details on the Company’s income tax audit in Germany.

9

Business Risk in Developing, Emerging and Other Foreign Markets

The Company sells its products to customers in the Middle East (including Iran and Syria), Africa (including Sudan), Cuba, and other developing markets where it does not have operating subsidiaries. The Company does not own any assets or liabilities in these markets except for trade receivables. Challenges and uncertainties associated with operating in developing markets has a higher relative risk due to political instability, economic volatility, crime, terrorism, corruption, social and ethnic unrest, and other factors. In fiscal year 2016, the Company recorded revenue and net profits of $3.7 million and $1.0 million, respectively, related to sales to Cuba, Sudan, Syria and Iran. While sales in these markets are not material to the Company’s business results, adverse developments related to the risks associated with these markets may cause actual results to differ from historical and forecasted future operating results.

The Company has certain technology development operations in Russia related to software development and architecture, digital content production and system testing services. Due to the political instability within the region, there is the potential for future government embargos and sanctions which could disrupt the Company’s operations in the area. While the Company has developed business continuity plans to address these issues, further adverse developments in the region could have a material impact on the Company’s business and operating results.

Approximately 14% of Research journal articles are sourced from authors in China. Any restrictions on exporting intellectual property could adversely affect the company’s business and operating results.

Liquidity and Global Economic Conditions

Changes in global financial markets have not had, nor do we anticipate they will have, a significant impact on our liquidity. Due to our significant operating cash flow, financial assets, access to capital markets and available lines of credit and revolving credit agreements, we continue to believe that we have the ability to meet our financing needs for the foreseeable future. As market conditions change, we will continue to monitor our liquidity position. However, there can be no assurance that our liquidity or our results of operations will not be affected by possible future changes in global financial markets and global economic conditions. Unprecedented market conditions including illiquid credit markets, volatile equity markets, dramatic fluctuations in foreign currency rates and economic recession could affect future results.

Effects of Increases in Pension Costs and Funding Requirements

The Company provides defined benefit pension plans for certain employees worldwide. The Company’s Board of Directors approved amendments to the U.S., Canada and U.K. defined benefit plans that froze the future accumulation of benefits effective June 30, 2013, December 31, 2015 and April 30, 2015, respectively. The funding requirements and costs of these plans are dependent upon various factors, including the actual return on plan assets, discount rates, plan participant population demographics and changes in pension regulations. Changes in these factors affect the Company’s plan funding, cash flow and results of operations.

10

Effects of Inflation and Cost Increases

The Company, from time to time, experiences cost increases reflecting, in part, general inflationary factors. There is no guarantee that the Company can increase selling prices or reduce costs to fully mitigate the effect of inflation on company costs.

Ability to Successfully Integrate Key Acquisitions

The Company’s growth strategy includes title, imprint and other business acquisitions, including knowledge-enabled services which complement the Company’s existing businesses. Acquisitions may have a substantial impact on the Company’s revenues, costs, cash flows, and financial position. Acquisitions involve risks and uncertainties, including difficulties in integrating acquired operations and in realizing expected opportunities; diversions of management resources and loss of key employees; challenges with respect to operating new businesses; debt incurred in financing such acquisitions; and other unanticipated problems and liabilities.

Valuation of Goodwill and Intangible Assets

At April 30, 2016, the Company had $951.7 million of goodwill and $877.0 million of intangible assets on its balance sheet. The intangible assets are principally comprised of content and publishing rights, customer relationships, and brands and trademarks. Failure to achieve business objectives and financial projections could result in an asset impairment charge, which would result in a non-cash charge to operating expenses. Goodwill and intangible assets with indefinite lives are tested for impairment on an annual basis and also when events or changes in circumstances indicate that impairment may have occurred. Intangible assets with determinable lives are tested for impairment only when events or changes in circumstances indicate that an impairment may have occurred. Determining whether an impairment exists can be difficult as a result of increased uncertainty and current market dynamics, and requires significant management estimates and judgment. In addition, the potential for goodwill impairment is increased during periods of economic uncertainty. An asset impairment charge could have a material adverse effect on the Company’s business, operating results and financial condition.

Attracting and Retaining Key Employees

The Company is highly dependent on the continued services of its Chief Executive Officer, Chief Financial Officer and other senior officers and key employees. The loss of the services of skilled personnel for any reason and the Company’s inability to replace them with suitable candidates quickly or at all, as well as any negative market perception resulting from such loss, could have a material adverse effect on the Company’s business, operating results and financial condition. In addition, we are dependent upon our ability to continue to attract new employees with key skills to support business growth.

|

Item 1B.

|

Unresolved Staff Comments

|

None

11

Item 2. Properties

The Company occupies office, warehouse, and distribution facilities in various parts of the world, as listed below (excluding those locations with less than 10,000 square feet of floor area, none of which is considered material property). All of the buildings and the equipment owned or leased are believed to be in good operating condition and are suitable for the conduct of its business.

|

Location

|

Purpose

|

Owned or Leased

|

Approx. Sq. Ft.

|

|

United States:

|

|||

|

New Jersey

|

Corporate Headquarters

|

Leased

|

415,000

|

|

Office & Warehouse

|

Leased

|

185,000

|

|

|

Indiana

|

Office

|

Leased

|

108,000

|

|

California

|

Office

|

Leased

|

19,000

|

|

Massachusetts

|

Office

|

Leased

|

34,000

|

|

Illinois

|

Office

|

Leased

|

51,000

|

|

Florida

|

Office

|

Leased

|

49,000

|

|

Minnesota

|

Offices

|

Leased

|

36,000

|

|

Texas

|

Offices

|

Leased

|

29,000

|

|

Colorado

|

Office

|

Leased

|

15,000

|

|

International:

|

|||

|

Australia

|

Offices

|

Leased

|

59,000

|

|

Canada

|

Office

|

Leased

|

12,000

|

|

England

|

Warehouses

|

Leased

|

297,000

|

|

Offices

|

Leased

|

80,000

|

|

|

Offices

|

Owned

|

70,000

|

|

|

Germany

|

Office

|

Owned

|

59,000

|

|

Office

|

Leased

|

24,000

|

|

|

Singapore

|

Offices

|

Leased

|

44,000

|

|

Russia

|

Office

|

Leased

|

21,000

|

|

India

|

Warehouse

|

Leased

|

16,000

|

|

China

|

Office

|

Leased

|

14,000

|

12

|

Item 3.

|

Legal Proceedings

|

The Company is involved in routine litigation in the ordinary course of its business. In the opinion of management, the ultimate resolution of all pending litigation will not have a material effect upon the financial condition or results of operations of the Company.

Over the past few years, the Company has from time to time faced claims from photographers or agencies that the Company has used photographs without licenses or beyond licensed permissions. The Company has insurance coverage for a significant portion of such claims. The Company does not believe that its exposure to such claims either individually or in the aggregate is material.

PART II

|

Item 5.

|

Market for the Company’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities

|

The Company’s Class A and Class B shares are listed on the New York Stock Exchange under the symbols JWa and JWb, respectively. Dividends per share and the market price range (based on daily closing prices) by fiscal quarter for the past two fiscal years were as follows:

|

Class A Common Stock

|

Class B Common Stock

|

|||||

|

Market Price

|

Market Price

|

|||||

|

Dividends

|

High

|

Low

|

Dividends

|

High

|

Low

|

|

|

2016

|

||||||

|

First Quarter

|

$0.30

|

$58.66

|

$51.68

|

$0.30

|

$58.74

|

$52.54

|

|

Second Quarter

|

0.30

|

53.18

|

48.16

|

0.30

|

52.93

|

48.25

|

|

Third Quarter

|

0.30

|

54.29

|

40.29

|

0.30

|

53.80

|

41.25

|

|

Fourth Quarter

|

0.30

|

50.74

|

40.21

|

0.30

|

50.85

|

40.18

|

|

2015

|

||||||

|

First Quarter

|

$0.29

|

$62.05

|

$54.52

|

$0.29

|

$61.80

|

$54.35

|

|

Second Quarter

|

0.29

|

60.42

|

51.45

|

0.29

|

61.08

|

52.04

|

|

Third Quarter

|

0.29

|

62.85

|

56.48

|

0.29

|

62.75

|

56.37

|

|

Fourth Quarter

|

0.29

|

65.21

|

56.88

|

0.29

|

65.10

|

56.74

|

On a quarterly basis, the Board of Directors considers the payment of cash dividends based upon its review of earnings, the financial position of the Company, and other relevant factors. As of April 30, 2016, the approximate number of holders of the Company’s Class A and Class B Common Stock were 847 and 74 respectively, based on the holders of record.

During the fourth quarter of fiscal year 2016, the Company made the following purchases of Class A Common Stock under its stock repurchase program.

|

Total Number

of Shares Purchased

|

Average

Price Paid

Per Share

|

Total Number of Shares Purchased as part of a Publicly Announced Program

|

Maximum Number of Shares that May be Purchased Under the Program

|

||||

|

February 2016

|

-

|

-

|

-

|

963,022

|

|||

|

March 2016

|

118,036

|

$47.12

|

118,036

|

845,006

|

|||

|

April 2016

|

98,150

|

$48.00

|

98,150

|

746,836

|

|||

|

Total

|

216,186

|

$47.52

|

216,186

|

13

Item 6. Selected Financial Data

|

For the Years Ended April 30,

|

|||||

|

Dollars in millions (except per share data)

|

2016

|

2015

|

2014

|

2013

|

2012

|

|

Revenue

|

$1,727.0

|

$1,822.4

|

$1,775.2

|

$1,760.8

|

$1,782.7

|

|

Operating Income (a-b)

|

188.1

|

237.7

|

206.7

|

199.4

|

280.4

|

|

Net Income (a-c)

|

145.8

|

176.9

|

160.5

|

144.2

|

212.7

|

|

Working Capital (d)

|

(111.1)

|

(62.8)

|

60.1

|

(32.2)

|

(66.3)

|

|

Deferred Revenue in Working Capital (d)

|

(426.5)

|

(372.1)

|

(385.7)

|

(363.0)

|

(342.0)

|

|

Total Assets

|

2,921.1

|

3,004.2

|

3,077.4

|

2,806.4

|

2,532.9

|

|

Long-Term Debt

|

605.0

|

650.1

|

700.1

|

673.0

|

475.0

|

|

Shareholders’ Equity

|

1,037.1

|

1,055.0

|

1,182.2

|

988.4

|

1,017.6

|

|

Per Share Data

|

|||||

|

Earnings Per Share (a-c)

|

|||||

|

Diluted

|

$2.48

|

$2.97

|

$2.70

|

$2.39

|

$3.47

|

|

Basic

|

$2.51

|

$3.01

|

$2.73

|

$2.43

|

$3.53

|

|

Cash Dividends

|

|||||

|

Class A Common

|

$1.20

|

$1.16

|

$1.00

|

$0.96

|

$0.80

|

|

Class B Common

|

$1.20

|

$1.16

|

$1.00

|

$0.96

|

$0.80

|

|

a)

|

In fiscal years 2016, 2015, 2014 and 2013, the Company recorded restructuring charges of $28.6 million ($0.8 per share), $28.8 million ($0.34 per share), $42.7 million ($0.48 per share) and $29.3 million ($0.33 per share), respectively, and related impairment charges in fiscal years 2014 and 2013 of $4.8 million ($0.06 per share) and $30.7 million ($0.35 per share), respectively.

|

|

b)

|

In fiscal year 2013, the Company recorded a gain, net of losses, on the sale of certain Professional Development consumer publishing programs of $6.0 million ($0.04 per share).

|

|

c)

|

Certain tax benefits and charges included in fiscal year results are as follows:

|

|

·

|

Fiscal years 2016, 2014, 2013 and 2012 include tax benefits of $5.9 million ($0.10 per share), $10.6 million ($0.18 per share), $8.4 million ($0.14 per share), and $8.8 million ($0.14 per share), respectively, principally associated with consecutive tax legislation enacted in the United Kingdom that reduced the U.K. corporate income tax rates.

|

|

·

|

Fiscal year 2015 includes a non-recurring tax benefit of $3.1 million ($0.05 per share) related to tax deductions claimed on the write-up of certain foreign tax assets to fair market value.

|

|

·

|

Fiscal year 2012 includes a tax benefit of $7.5 million ($0.12 per share) related to the reversal of an income tax reserve recorded in conjunction with the Blackwell acquisition.

|

|

d)

|

The primary driver of the negative working capital is unearned deferred revenue related to subscriptions for which cash has been collected in advance. Cash received in advance for subscriptions is used by the Company for a number of purposes including acquisitions; debt repayments; funding operations; dividend payments; and purchasing treasury shares. The deferred revenue will be recognized in income over the term of the subscription; when the related issue is shipped or made available online, or the service is rendered.

|

14

|

Item 7.

|

Management’s Discussion and Analysis of Business, Financial Condition and Results of Operations

|

The Company is a global provider of knowledge and knowledge-enabled services that improve outcomes in areas of research, professional practice and education. Through the Research segment, the Company provides digital and print scientific, technical, medical and scholarly journals, reference works, books, database services and advertising. The Professional Development segment provides digital and print books, corporate learning solutions, post and pre-employment assessment and training services, and test preparation and certification. In Education, the Company provides print and digital content, and education solutions including online program management services for higher education institutions and course management tools for instructors and students. The Company takes full advantage of its content from all three businesses in developing and cross-marketing products to its diverse customer base of researchers, professionals, students, and educators. The use of technology enables the Company to make its content efficiently more accessible to its customers around the world. The Company’s operations are primarily located in the United States, Canada, Europe, Asia, and Australia.

Business growth comes from a combination of organic growth from existing brands and titles; title, imprint and other business acquisitions which complement the Company’s existing businesses; designing and implementing new methods of delivering products to our customers; and the development of new products and services. The Company’s revenue declined at a compound annual rate of 0.2% over the past five years.

Core Business Segments

Research:

The Company’s Research business serves the world’s research and scholarly communities and is the largest publisher for professional and scholarly societies. Research’s mission is to support researchers, professionals and learners in the discovery and use of research knowledge to help them achieve their goals in research, learning and practice. Research products include scientific, technical, medical and scholarly research journals, books, reference works, databases, clinical decision support tools, laboratory manuals and workflow tools, in the publishing areas of the physical sciences and engineering, health sciences, social science and humanities and life sciences. Research customers include academic, corporate, government, and public libraries; researchers; scientists; clinicians; engineers and technologists; scholarly and professional societies; and students and professors. The Company’s Research products are sold and distributed globally in digital and print formats through multiple channels, including research libraries and library consortia, independent subscription agents, direct sales to professional society members, bookstores, online booksellers and other customers. Publishing centers include Australia, China, Germany, India, the United Kingdom and the United States. Research accounted for approximately 56% of total Company revenue in fiscal year 2016 which declined at a compound annual rate of 1% over the past five years.

Research revenue by product type includes: Journal Subscriptions; Author-Funded Access; Other Journal Revenue, which includes publishing service charges for article customization charges, sales of journal licensing rights, journal reprint revenue, backfiles and individual articles. In addition, Print Books; Digital Books; and Other Books and Reference Revenue, which includes, advertising, book licensing rights, distribution services and the sale of protocols.

15

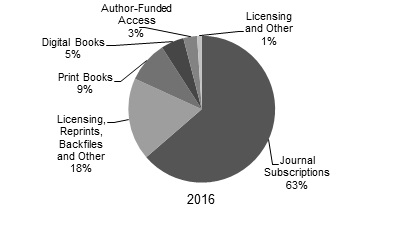

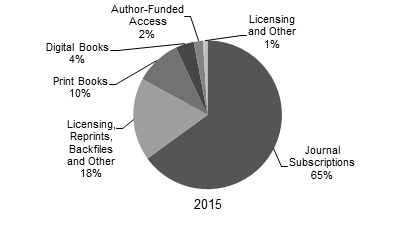

The graph below presents Research revenue by product type for fiscal year 2016 and 2015:

Key growth strategies for the Research business include evolving and developing new licensing models for the Company’s institutional customers; developing new funded access revenue streams; focusing resources on high-growth and emerging markets; and developing new digital products, services and workflow solutions to meet the needs of researchers, authors, societies and corporate customers.

Approximately 50% of Journal Subscription revenue is derived from publishing rights owned by the Company. Publishing alliances also play a major role in Research’s success. Approximately 50% of Journal Subscription revenue is derived from publication rights which are owned by professional societies and published by the Company pursuant to a long-term contract or owned jointly with a professional society. These society alliances bring mutual benefit, with the societies gaining Wiley’s publishing, marketing, sales and distribution expertise, while Wiley benefits from being affiliated with prestigious societies and their members. The Company publishes the journals of many prestigious societies, including the American Cancer Society, the American Heart Association, the British Journal of Surgery Society, the European Molecular Biology Organization, the American Anthropological Association, the American Geophysical Union and the German Chemical Society.

The Company transitioned from issue-based to time-based digital journal subscription agreements for calendar year 2016. Under this new model, the Company provides access to all journal content published within a calendar year and recognizes revenue on a straight-line basis over the calendar year. Under the Company’s previous licensing model, a customer subscribed to a discrete number of online journal issues and revenue was recognized as each issue was made available online. The change shifted approximately $37 million of revenue from fiscal year 2016 to the remainder of calendar year 2016 (fiscal year 2017). The change had no impact on free cash flow. The Company made these changes to significantly simplify the contracting and administration of digital journal subscriptions.

The Company’s Research business is a provider of content and services in evidence-based medicine (EBM). Through the Company’s alliance with The Cochrane Collaboration, the Company publishes The Cochrane Library, a premier source of high-quality independent evidence to inform healthcare decision-making, which provides the foundation for the Company’s growing suite of EBM products designed to improve patient healthcare. EBM facilitates the effective management of patients through clinical expertise informed by best practice evidence that is derived from medical literature.

Wiley Online Library, the online publishing platform for the Company’s Research business, is one of the world’s broadest and deepest multidisciplinary collections of online resources covering life, health and physical sciences, social science and the humanities. Designed with extensive input from scholars around the world, Wiley Online Library delivers seamless integrated access to over 7 million articles from 1,700 journals, 19,000 online books, and hundreds of multi-volume reference works, laboratory protocols and databases. Wiley Online Library provides the user with intuitive navigation, enhanced discoverability, expanded functionality and a range of personalization options. Access to abstracts is free, full content is accessible through licensing agreements or as individual article purchases. Large portions of the content are provided free or at nominal cost to nations in the developing world through partnerships with certain non-profit organizations. Wiley Online Library also provides the Company with revenue growth opportunities through new applications and business models, online advertising, deeper market penetration and individual sales and pay-per-view options.

16

Full content Access on Wiley Online Library is sold through licenses with academic and corporate libraries, consortia and other academic, government and corporate customers. The Company offers a range of licensing options including customized suites of journal publications for individual customer needs as well as subscriptions for individual journal and online book publications. Licenses are typically sold in durations of one to three years. Through the Article Select and PayPerView programs, the Company provides fee-based access to non-subscribed journal content, book chapters and major reference work articles.

Wiley Online Library takes advantage of technology to update content frequently and to add new features and resources on an ongoing basis to increase the productivity of scientists, professionals and students. Two examples are EarlyView, through which customers can access individual articles well in advance of print publication, and the Wiley Journals Apps service, which enables users to access articles and related content from over 200 titles on a tablet or other mobile device.

Wiley Open Access is the Company’s publishing program for open-access research articles. Under the Wiley Open Access business model, research articles submitted by authors are published in open-access journals. All research articles published in Wiley Open Access journals are freely available to the general public on Wiley Online Library to read, download and share. A publication service fee is charged upon acceptance of a research article by the Company, which may be paid by the individual author or by the author’s funder or institution. To actively support researchers and members who wish to publish in Wiley Open Access journals, an academic or research institution, society or corporation may fund the fee directly. In return for the service fee, the Company provides its customary publishing, editing, peer review, technology and distribution services. All accepted open-access articles are subject to the same rigorous peer-review process applied to the Company’s subscription based journals which are supported by the Company’s network of prestigious journals and societies. In addition to Wiley Open Access, the Company provides authors with the opportunity to make their individual research articles that were published within the Company’s paid subscription journals freely available to the general public through OnlineOpen on payment of an Article Payment Charge.

Professional Development (“PD”):

The Company’s Professional Development business acquires, develops and publishes professional information and content delivered through print and digital books, test preparation, assessments, online learning solutions and certification and training services. Communities served include business, finance, accounting, workplace learning, management, leadership, technology, behavioral health, engineering/architecture and education. Professional Development’s mission is to create products and services that help professionals worldwide learn, achieve results, and enhance their skills throughout their careers enabling corporations to maximize their investment in employees, having them become more effective in the workplace. Products are developed in print and digitally for worldwide distribution through multiple channels, including chain and online booksellers, libraries, colleges and universities, corporations, direct to consumer, websites, distributor networks and other online applications. Publishing centers include Australia, Germany, India, the United Kingdom and the United States. Professional Development accounted for approximately 23% of total Company revenue in fiscal year 2016 which declined at a compound annual rate of 1% over the past five years, including the impact of the divested consumer publishing programs in fiscal year 2013 and the acquisitions of Inscape in fiscal year 2012, Efficient Learning Systems, Inc. in fiscal year 2013, Profiles in fiscal year 2014 and CrossKnowledge in fiscal year 2015.

17

Professional Development revenue by product type includes Print Books; Digital Books; Online Test Preparation and Certification; Assessments; and Corporate Learning.

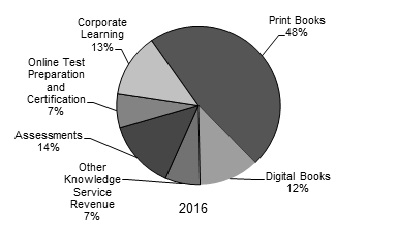

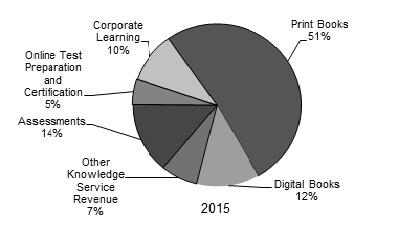

The graph below presents PD revenue by product type for fiscal year 2016 and 2015:

Key growth strategies for the Professional Development business include: developing and acquiring products and services to drive corporate development and professional career development; developing leading brands and franchises; executing strategic acquisitions and partnerships; innovating digital book formats while expanding their global discoverability and distribution; and creating advertising opportunities on the Company’s branded websites and online applications. Several of the more recent acquisitions that focus on achieving these growth strategies are described in more detail below.

In May 2014, the Company acquired CrossKnowledge for approximately $166 million in cash, net of cash acquired. CrossKnowledge is a learning solutions provider focused on leadership and managerial skills development that offers subscription-based, digital learning solutions for global corporations, universities, and small and medium-sized enterprises. CrossKnowledge’s solutions include a variety of managerial and leadership skills assessments, courses, certifications, content and executive training programs that are delivered on a cloud-based LMS platform with over 19,000 learning objects in 17 languages. CrossKnowledge serves over seven million end-users in 80 countries. CrossKnowledge generated revenue of $50.7 million in fiscal year 2016.

In April 2014, the Company acquired Profiles International (“Profiles”) for approximately $48 million in cash, net of cash acquired. Profiles provides pre-employment assessment and selection tools that enable employers to optimize candidate selections and develop the full potential of their employees. Solutions include pre-hire assessments, including those designed to measure and match personality, knowledge, skills, managerial fit, loyalty, and values; and post-hire assessments, focused on measuring sales and managerial effectiveness, employee performance and career potential. Profiles serves approximately 4,000 corporate clients and millions of end users in over 120 countries, with assessments available in 32 languages. Profiles generated revenue of $20.3 million in fiscal year 2016.

18

In 2012, the Company acquired Efficient Learning Systems, Inc. (“ELS”) for approximately $24 million in cash, net of cash acquired. ELS is an e-learning system provider focused in the areas of professional finance and accounting. ELS’ flagship product, CPAExcel, is a modular, digital platform comprised of online self-study, videos, mobile apps, and sophisticated planning tools that has helped over 65,000 professionals prepare for the CPA exam since 1998. The acquisition enhanced Wiley’s position in the growing CPA test preparation market and provided the Company with a scalable platform that can be leveraged globally across other areas of its Professional Development business. In 2013, the Company also acquired Elan Guides for approximately $2.5 million. Elan Guides provides content in multiple formats to help prepare candidates for the CFA examinations. The fiscal year 2016 revenue associated with these businesses was approximately $14.1 million.

In 2012, Wiley acquired Inscape Holdings, Inc. (“Inscape”), a leading provider of assessment-based employee training solutions, for approximately $85 million in cash, net of cash acquired. The acquisition combined Wiley’s deep well of valuable content and global reach in leadership and training with Inscape’s talent development content, technology and distribution network, including the innovative EPIC online assessment-delivery platform and an elite global authorized distributor network of over 1,700 independent consultants, trainers, and coaches. Inscape’s solution-focused products are used in thousands of organizations, including major government agencies and Fortune 500 companies. Inscape generated revenue of $29.3 million in fiscal year 2016.

Inscape’s solutions-focused DiSC® offerings complement Wiley’s existing offerings, such as Kouzes and Posner’s Leadership Practices Inventory® and The Five Behaviors of a Cohesive TeamTM, in the growing workplace learning industry. The combined assessment offerings increased the Company’s presence in the professional training and development arena. We believe Inscape’s competitive strengths will also advance a number of Professional Development’s major strategic goals. As a workplace learning business with more than 90% of revenue from a proprietary digital platform, Inscape enables Wiley to move more rapidly into digital delivery within the growing workplace learning and assessment market and build a significant market position in the category of leadership development. Inscape also enhanced Wiley’s global presence, serving customers around the world in more than 30 languages each year, with approximately 28% of fiscal year 2016 revenue generated outside the U.S through Inscape’s dedicated global distributor network.

Publishing Alliances and Programs:

Publishing alliances and franchise products are central to the Company’s strategy. Professional Development alliance partners include Bloomberg Press, the American Institute of Architects, the Leader to Leader Institute, Fisher Investments, the CFA Institute, ACT (American College Test), Autodesk and many others.

The Company also promotes an active and growing Professional Development custom publishing program. Custom publications are typically used by organizations for internal promotional or incentive programs. The Company’s custom publications include digital and print books written specifically for a customer and customizations of Professional Development’s existing publications to include custom cover art, such as imprints, messages and slogans. Of special note are customized For Dummies publications, which leverage the power of this well-known brand to meet the specific information needs of a wide range of organizations around the world.

Education:

The Company’s Education business produces educational content and solutions, including course management tools for instructors and students and online program services for higher education institutions. Education’s mission is to help teachers teach and students learn by delivering personalized content, tools and services that demonstrate results to students, faculty and institutions throughout the world. Education offers learning solutions, innovative products and services principally delivered through college bookstores, online distributors and directly to institutions and more recently direct-to-student, with customers having access to content in digital and custom print formats, as well as the traditional print textbook. Education’s cost-effective, flexible solutions are available in each of its publishing disciplines, including sciences, engineering, computer science, mathematics, business and accounting, statistics, geography, hospitality and the culinary arts, education, psychology and modern languages.

19

Education accounted for approximately 21% of total Company revenue in fiscal year 2016 and generated revenue growth at a compound annual rate of 3% over the past five years, including the acquisition of Deltak in fiscal year 2013.

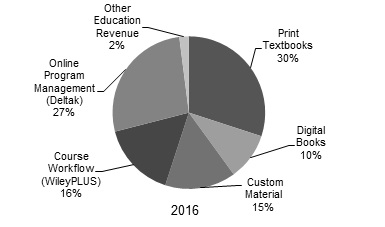

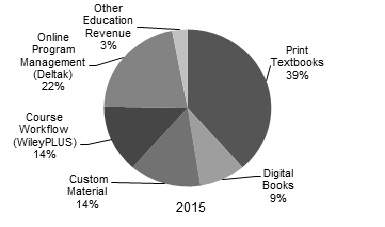

Education revenue by product type includes Print Textbooks; Digital Books; Online Program Management (Deltak); Custom Material; Course Workflow (WileyPLUS), and Other Education revenue which includes revenue from the licensing of publishing content rights and other content adaptions.

The graph below presents Education revenue by product type for fiscal year 2016 and 2015:

The Company continues to transform the Education business from a content publisher to an education solutions provider. Education’s key growth strategies include developing and acquiring digital products and solutions across the educational value chain; continuing the transformation of the business from traditional print products to digital and custom products and services; focusing on institutional relationships and direct-to-student digital products; and developing the Company’s online education services model acquired with Deltak.

In 2012, the Company acquired Deltak for approximately $220 million in cash, net of cash acquired. Deltak works in close partnership with leading colleges and universities to develop and support online degree and certificate programs. These new services position the Company as an online education services provider. Wiley now provides a complete solution to help higher education institutions transition their programs into valuable online experiences. Deltak offers market research to validate degree or certification program demand; instructional design; marketing; student recruitment; and retention services. Deltak uses its Engage Learning Management System and Student Relationship Platform to enhance the quality and efficacy of online and hybrid programs. The Company now has access to high-growth markets and a variety of capabilities and technologies for its expansion into custom online courses and curriculum development. The Company leverages its strong reputation and financial stability for new program investment, to accelerate growth globally, to access professional consumers and corporations and to expand content and faculty development offerings. As of April 30, 2016, the Company had 38 partners and 226 degree programs under contract. Deltak generated revenue of $96.5 million in fiscal year 2016.

20

Strategic partnerships and relationships with companies such as Microsoft®, Blackboard, Canvas, Snapwiz and the Culinary Institute of America are an important component of Education’s growth strategy. The ability to join Wiley’s product development, sales, marketing, distribution and technology with a partner’s content, technology and/or brand name has contributed to Education’s success.

Education offers high-quality online learning solutions including Course Workflow (WileyPLUS), a research-based, online environment for effective teaching and learning that is integrated with a complete digital textbook. WileyPLUS improves student learning through instant feedback, personalized learning plans, and self-evaluation tools as well as a full range of course-oriented activities, including online planning, presentations, study, homework and testing. In selected courses, WileyPlus includes a personalized adaptive learning component, Orion, which is based on cognitive science. Orion helps to build student proficiency on topics while improving the effectiveness of their study time. It assists educators in identifying areas that need reinforcement and measures student engagement and proficiency throughout the course.

Education promotes and supports the customization of its content. Wiley Custom Learning Solutions is a full-service custom publishing program that offers an array of tools and services designed to put creation of customized content in instructors’ hands. Our suite of custom products empowers users to create high-quality, affordable education solutions tailored to meet individual classroom needs. Through Wiley Custom Select, an online custom textbook system, instructors can easily build print and digital materials tailored to their specific course needs and add their own content to create a customized solution derived from any one of the Company’s three business segments.

Knowledge-Enabled Products and Services:

Journal Products:

The Company publishes approximately 1,700 Research and Professional Development journals. Journal Subscription revenue and other related publishing income, such as Author-Funded Access, advertising, backfile sales, the licensing of publishing rights, journal reprints and individual article sales accounted for approximately 48% of the Company’s consolidated fiscal year 2016 revenue. The journal portfolio includes titles owned by the Company, in which case they may or may not be sponsored by a professional society; titles owned jointly with a professional society; and titles owned by professional societies and published by the Company pursuant to long-term contracts.

The Company sells journal subscriptions directly through Company sales representatives; indirectly through independent subscription agents; through promotional campaigns; and through memberships in professional societies for those journals that are sponsored by societies. Journal subscriptions are primarily licensed through contracts for digital content delivered through the Company’s online platform, Wiley Online Library. Contracts are negotiated by the Company directly with customers or their subscription agents. Licenses range from one to three years in duration and typically cover calendar years. Print journals are generally mailed to subscribers directly from independent printers. The Company does not own or manage printing facilities. The print journal content is also available online via Wiley Online Library. Subscription revenue is generally collected in advance, and deferred until the Company has fulfilled its obligation to the customer at which time the revenue is earned. The Company transitioned from issue-based to time-based digital journal subscription agreements for calendar year 2016. Under this new model, the Company provides access to all journal content published within a calendar year and recognizes revenue on a straight-line basis over the calendar year. Under the Company’s previous licensing model, a customer subscribed to a discrete number of online journal issues and revenue was recognized as each issue was made available online. The Company made these changes to simplify the contracting and administration of digital journal subscriptions. Print journal subscription revenue is recognized once the related issue is shipped.

21

Societies that sponsor or own such journals generally receive a royalty and/or other consideration. The Company may procure editorial services from such societies on a pre-negotiated fee basis. The Company also enters into agreements with outside independent editors of journals that define the duties of the editors, and the fees and expenses for their services. Contributors of articles to the Company’s journal portfolio transfer publication rights to the Company or a professional society, as applicable. Journal articles may be based on funded research through government or charitable grants. In certain cases the terms of the grant may require the grant holder to make articles (either the published version or an earlier unedited version) available free of charge to the general public, typically after an embargo period. Funded open access under the Company’s Wiley Open Access and OnlineOpen business models facilitate the ability of the grant holder to comply.

Book Products:

Book products and other book publishing revenue, such as advertising and the sale of publishing rights, accounted for approximately 41% of the Company’s consolidated fiscal year 2016 revenue. Materials for book publications are obtained from authors throughout most of the world through the efforts of an editorial staff, outside editorial advisors, and advisory boards. Most materials are originated by the authors themselves or as a result of suggestion or solicitations by editors and advisors. The Company enters into agreements with authors that state the terms and conditions under which the materials will be published, the name in which the copyright will be registered, the basis for any royalties, and other matters. Most of the authors are compensated with royalties, which vary depending on the nature of the product. The Company may make advance payments against future royalties to authors of certain publications. Royalty advances are reviewed for recoverability and a reserve for loss is maintained, if appropriate.

The Company continues to add new titles, revise existing titles, and discontinue the sale of others in the normal course of its business, and also creates adaptations of original content for specific markets based on customer demand. The Company’s general practice is to revise its textbooks approximately every three years, if warranted, and to revise other titles as appropriate. Subscription-based products are updated on a more frequent basis.

Professional books are sold to bookstores and online booksellers serving the general public; wholesalers who supply such bookstores; warehouse clubs; college bookstores; individual practitioners; and research institutions, libraries (including public, professional, academic, and other special libraries), industrial organizations, and government agencies. The Company employs sales representatives who call upon independent bookstores, national and regional chain bookstores and wholesalers. Sales of professional books also result from direct mail campaigns, telemarketing, online access, advertising and reviews in periodicals. Trade sales are generally made on a returnable basis with certain restrictions. The Company provides for estimated future returns on sales made during the year based on historical return experience and current market trends.

Adopted education textbooks and related supplementary material and digital products are sold primarily to bookstores and online booksellers, serving both for-profit, nonprofit educational institutions and direct-to-students. The Company employs sales representatives who call on faculty responsible for selecting books to be used in courses, and on the bookstores that serve such institutions and their students. Textbook sales are generally made on a returnable basis with certain restrictions. The textbook business is seasonal, with the majority of textbook sales occurring during the June through August and November through January periods. There are active used and rental textbook markets, which adversely affect the sale of new textbooks.

The Company generally contracts with independent printers and binderies globally for their services. The Company purchases its paper from independent suppliers and printers. The fiscal year 2016 weighted average U.S. paper prices decreased approximately 1% from fiscal year 2015. Approximately 75% of the Company’s paper inventory is held in the United States. Management believes that adequate printing and binding facilities, sources of paper and other required materials are available to it, and that it is not dependent upon any single supplier. Printed book products are distributed from both Company-operated warehouses and independent distributors.

22

The Company develops content in a digital format that can be used for both digital and print products, resulting in productivity and efficiency savings, and enabling print-on-demand delivery. Book content is available online through Wiley Online Library, WileyPLUS, Wiley Custom Select and other proprietary platforms. Digital books are delivered to intermediaries including Amazon, Apple and Google, for re-sale to individuals in various industry-standard formats, which are now the preferred deliverable for licensees of all types, including foreign language publishers. Digital books are also licensed to libraries through aggregators. Specialized formats for digital textbooks go to distributors servicing the academic market, and digital book collections are sold by subscription through independent third-party aggregators servicing distinct communities. Custom deliverables are provided to corporations, institutions and associations to educate their employees, generate leads for their products, and extend their brands. Content from digital books is also used to create website articles, mobile apps, newsletters and promotional collateral. This continual re-use of content improves margins, speeds delivery and helps satisfy a wide range of customer needs. The Company’s online presence not only enables it to deliver content online, but also to sell more books. The growth of online booksellers benefits the Company because they provide unlimited virtual “shelf space” for the Company’s entire backlist.

Marketing and distribution services are made available to other publishers under agency arrangements. The Company also engages in co-publishing titles with international publishers and receives licensing revenue from photocopies, reproductions, translations, and digital uses of its content.

Solutions: