Attached files

| file | filename |

|---|---|

| 8-K - 8-K - Jefferies Financial Group Inc. | d216424d8k.htm |

Leucadia National Corporation

June 2016

Note on Forward Looking Statements

This document contains “forward looking statements” within the meaning of the safe harbor provisions of Section 27A of the Securities Act of 1933 and Section 21E of the

Securities Exchange Act of 1934. Forward looking statements include statements about our future and statements that are not historical facts. These forward looking statements are usually preceded by the words “should,” “expect,”

“intend,” “may,” “will,” or similar expressions. Forward looking statements may contain expectations regarding revenues, earnings, operations, and other results, and may include statements of future performance, plans,

and objectives. Forward looking statements also include statements pertaining to our strategies for future development of our businesses and products. Forward looking statements represent only our belief or intentions regarding future events, many

of which by their nature are inherently uncertain. It is possible that the actual results may differ materially from the anticipated results indicated in these forward-looking statements. Information regarding important factors, including our Risk

Factors, that could cause actual results to differ, perhaps materially, from those in our forward looking statements is contained in reports we file with the SEC. You should read and interpret any forward looking statement together with reports we

file with the SEC.

June 2016 i

Table of Contents

Page

Leucadia Overview 1

Jefferies Overview 9

Leucadia Investments Overview 16

Appendix 32

June 2016 ii

Leucadia Overview

June

2016 1

Unique merchant and investment banking platform that builds shareholder value by creating, acquiring and

operating a diversified group of businesses

Leading diversified financial services and merchant banking platform

Jefferies

Other Financial Services, including Leucadia Asset Management

Leucadia Merchant Banking

Our strengths

Focus on “value”

We “get the call”

Sourcing via Jefferies

Diversification

Patience

Liquidity

June 2016 2

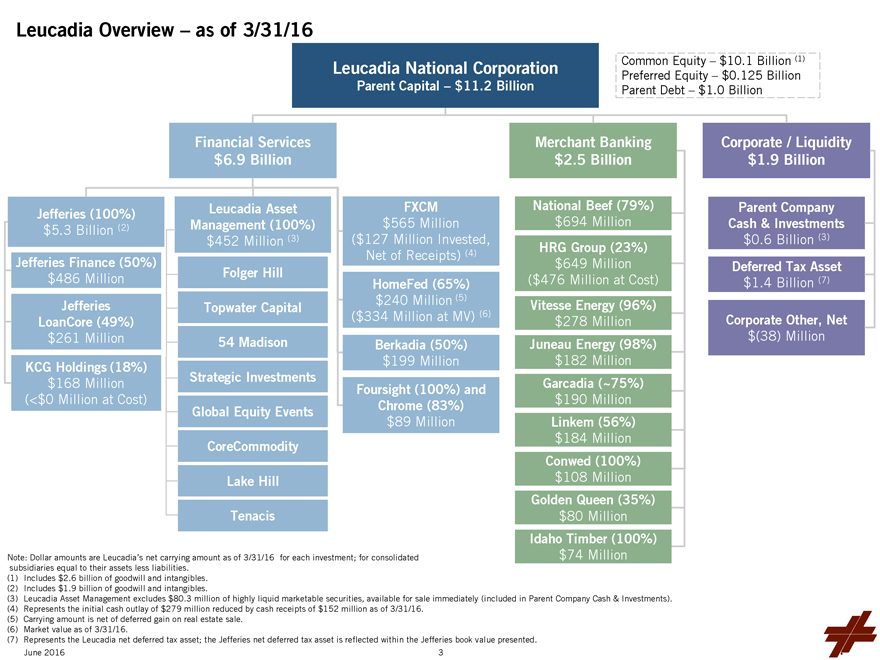

Leucadia Overview – as of 3/31/16

Leucadia National Corporation

Parent Capital – $11.2 Billion

Common Equity – $10.1 Billion (1)

Preferred Equity – $0.125 Billion

Parent Debt – $1.0 Billion

Jefferies (100%) $5.3 Billion (2)

Jefferies Finance (50%) $486 Million

Jefferies LoanCore (49%) $261 Million

KCG Holdings (18%) $168 Million (<$0 Million at Cost)

Financial Services $6.9 Billion

Leucadia Asset Management (100%) $452 Million (3)

Folger Hill Topwater

Capital 54 Madison Strategic Investments Global Equity Events CoreCommodity Lake Hill Tenacis

FXCM $565 Million ($127 Million Invested, Net of Receipts) (4)

HomeFed (65%) $240 Million (5) ($334 Million at MV) (6)

Berkadia (50%) $199

Million

Foursight (100%) and Chrome (83%) $89 Million

Merchant Banking $2.5

Billion

National Beef (79%) $694 Million

HRG Group (23%) $649 Million ($476

Million at Cost)

Vitesse Energy (96%) $278 Million

Juneau Energy (98%) $182

Million

Garcadia (~75%) $190 Million

Linkem (56%) $184 Million

Conwed (100%) $108 Million

Golden Queen (35%) $80 Million

Idaho Timber (100%) $74 Million

Corporate / Liquidity $1.9 Billion

Parent Company Cash & Investments $0.6 Billion (3)

Deferred Tax Asset $1.4 Billion (7)

Corporate Other, Net $(38) Million

Note: Dollar amounts are Leucadia’s

net carrying amount as of 3/31/16 for each investment; for consolidated subsidiaries equal to their assets less liabilities.

(1) Includes $2.6 billion of goodwill

and intangibles.

(2) Includes $1.9 billion of goodwill and intangibles.

(3)

Leucadia Asset Management excludes $80.3 million of highly liquid marketable securities, available for sale immediately (included in Parent Company Cash & Investments).

(4) Represents the initial cash outlay of $279 million reduced by cash receipts of $152 million as of 3/31/16.

(5) Carrying amount is net of deferred gain on real estate sale.

(6) Market value as of

3/31/16.

(7) Represents the Leucadia net deferred tax asset; the Jefferies net deferred tax asset is reflected within the Jefferies book value presented.

June 2016 3

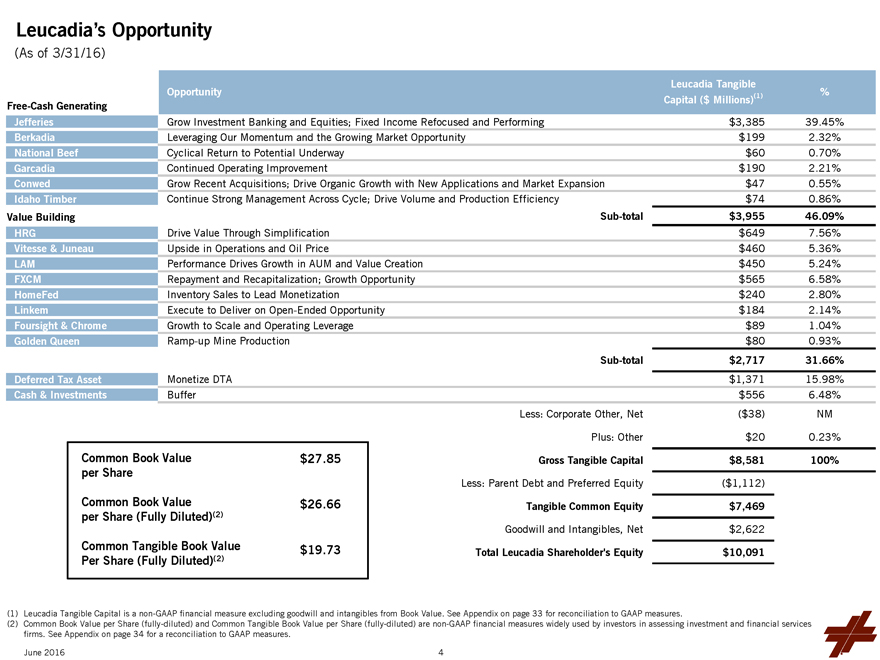

Leucadia’s Opportunity

(As of 3/31/16)

Free-Cash Generating Opportunity Leucadia Tangible Capital ($

Millions)(1) %

Jefferies Grow Investment Banking and Equities; Fixed Income Refocused and Performing $3,385 39.45%

Berkadia Leveraging Our Momentum and the Growing Market Opportunity $199 2.32%

National Beef

Cyclical Return to Potential Underway $60 0.70%

Garcadia Continued Operating Improvement $190 2.21%

Conwed Grow Recent Acquisitions; Drive Organic Growth with New Applications and Market Expansion $47 0.55%

Idaho Timber Continue Strong Management Across Cycle; Drive Volume and Production Efficiency $74 0.86%

Value Building Sub-total $3,955 46.09%

HRG Drive Value Through Simplification $649 7.56%

Vitesse & Juneau Upside in Operations and Oil Price $460 5.36%

LAM

Performance Drives Growth in AUM and Value Creation $450 5.24%

FXCM Repayment and Recapitalization; Growth Opportunity $565 6.58%

HomeFed Inventory Sales to Lead Monetization $240 2.80%

Linkem Execute to Deliver on

Open-Ended Opportunity $184 2.14%

Foursight & Chrome Growth to Scale and Operating Leverage $89 1.04%

Golden Queen Ramp-up Mine Production $80 0.93%

Sub-total $2,717 31.66%

Deferred Tax Asset Monetize DTA $1,371 15.98%

Cash & Investments Buffer $556 6.48%

Less: Corporate Other, Net ($38) NM

Plus: Other $20 0.23%

Gross Tangible Capital $8,581 100%

Less: Parent Debt and Preferred Equity ($1,112)

Tangible Common Equity $7,469

Goodwill and Intangibles, Net $2,622

Total Leucadia Shareholder’s Equity $10,091

Common Book Value per Share $27.85

Common Book Value per Share (Fully Diluted)(2) $26.66

Common Tangible Book

Value Per Share (Fully Diluted)(2) $19.73

(1) Leucadia Tangible Capital is a non-GAAP financial measure excluding goodwill and intangibles from Book Value. See

Appendix on page 33 for reconciliation to GAAP measures.

(2) Common Book Value per Share (fully-diluted) and Common Tangible Book Value per Share (fully-diluted)

are non-GAAP financial measures widely used by investors in assessing investment and financial services firms. See Appendix on page 34 for a reconciliation to GAAP measures.

June 2016 4

Leucadia Strategy and Overview

Leucadia Business Update

Jefferies recorded solid Equities and Fixed Income results in Q2

2016; Investment Banking backlog showing encouraging improvement

National Beef is benefiting from cyclical uplift – Q1 2016 pre-tax income of $21.4 million

and EBITDA of $44.9 million(1)

Our other businesses continue to perform well and, we believe, have significant upside value potential

FXCM’s business continues to recover and holds prospects for significant long-term value creation; mark-to-market GAAP income statement volatility will decline following the

2016 restructuring of Leucadia’s interest

Leucadia Asset Management provides the foundation of an asset management platform with long-term, growing fee

generation potential

(1) EBITDA is a non-GAAP measure. See Appendix on page 37 for a reconciliation to GAAP measures.

June 2016 5

A Unique and Diversified Financial Services and Merchant Banking Platform

Financial Services - Our historic sector; post-crisis opportunity

- Jefferies

Drive market share, margin expansion and earnings growth by growing Investment Banking, Equities and Fixed Income; Jefferies is delivering better results with lower risk and lower

volatility, with no meaningful loss of opportunity given changing competitive environment

Jefferies Finance and Jefferies LoanCore - maintain liquidity and risk

discipline; execute on the opportunity and momentum of our corporate and commercial real estate lending platforms over the medium-term

KCG Holdings - significant

interest in a leading global electronic market maker (>100% of cost recovered)

- Berkadia

3rd largest U.S. Primary and Master Servicer

Leader in multifamily lending in 2015

Become the best full-service mortgage banking firm in the industry

Build out geographic

coverage, products and capabilities to drive profitability and cash flow (>100% of cost recovered)

- FXCM

#1 retail foreign exchange broker by volume in Q4 2015

Opportunistic and well-structured

investment, with significant near and long-term value creation potential

Counter-cyclical performance relative to Jefferies’ core business

Amended agreements will support maximum values for assets sold, retain and motivate FXCM management and diminish volatility in reported results

- Leucadia Asset Management

Leverage Leucadia’s brand, Jefferies’ relationships and

Leucadia capital to own significant general partnership stakes in differentiated alternative asset management strategies (business model inherently avoids goodwill and acquisition costs)

June 2016

6

A Unique and Diversified Financial Services and Merchant Banking Platform (Continued)

- HomeFed

Otay Ranch’s 13,050 entitled units expected to be the market leader in San

Diego county (which had 2,000+ home sales in 2015) for years to come

Beginning to harvest ripening projects and assets

- Foursight and Chrome

Drive market share and originations, while maintaining a disciplined

approach to credit quality

Merchant Banking - Opportunistic value investments in businesses we understand

- National Beef

4th largest U.S. beef processor

Benefiting from greater availability of cattle off cyclical lows

Maintain core market share

and enhance profitability through efficiency and growth of value-added segments (tannery, consumer ready, Kansas City Steaks)

- HRG

Drive value through simplification and strategic focus, as well as growth of Spectrum Brands

-

Garcadia

12th largest auto dealership group in the U.S. in 2015 based on new sales volume

Enhance performance in existing dealerships

- Vitesse and Juneau

Drive cash flow on existing investments

Unlevered balance sheet provides significant operating

flexibility

June 2016

7

A Unique and Diversified Financial Services and Merchant Banking Platform (Continued)

- Linkem

Increase coverage through LTE network deployment

Prepare for launch in major Italian cities

- Conwed

Drive organic growth with new applications and market expansion

- Idaho Timber

Drive volume and production efficiency

- Golden Queen

Ramp-up to full production and operate as efficiently as possible

June 2016

8

Jefferies Overview

June

2016

9

Jefferies Strategic

Update

We are building a leading, client-focused global investment banking firm, with our focus to provide clients with the best ideas, expertise and execution in

global capital markets

Investment Banking and Equities have continued momentum and meaningful upside

Fixed Income has been refocused, reducing risk, balance sheet and capital utilization; results have improved, including a strong Q2 2016

Our priorities are margin expansion and earnings growth

June 2016

10

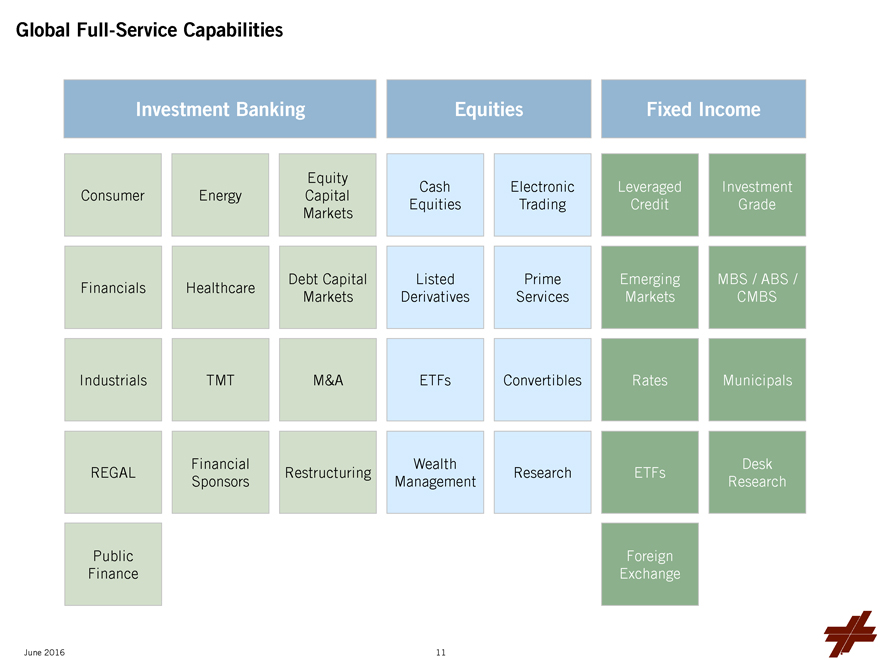

Global Full-Service Capabilities

Investment Banking

Consumer Energy Equity Capital Markets

Financials Healthcare Debt Capital Markets

Industrials TMT M&A

REGAL Financial Sponsors Restructuring

Public Finance

Equities

Cash Equities Electronic Trading

Listed Derivatives Prime Services

ETFs Convertibles

Wealth Management Research

Fixed Income

Leveraged Credit

Investment Grade

Emerging Markets

MBS / ABS / CMBS

Rates

Municipals

ETFs

Desk Research

Foreign Exchange

June 2016

11

Business Strategic Priorities

Investment Banking

Continue to increase managing director productivity

Capitalize on revenue opportunities in recently entered sectors

Capitalize on revenue

opportunities in recently entered countries/regions

Fixed Income

Deliver

improved margins and returns, capitalizing on the improved efficiency and focus resulting from the recent realignment of our Fixed Income businesses

Focus on

further developing our core businesses, such as global credit, which align well with our growing Investment Banking platform

Equities

Global electronic trading distribution - increase breadth of clients and penetration with existing clients including continuing momentum and cross-selling in EMEA and Asia

Prime brokerage - capitalize on U.S. opportunities to serve high ROA mid-sized prime brokerage clients that are increasingly underserved by the large bank holding

companies

Leverage the strength and depth of our European capabilities to grow distribution in Continental Europe

June 2016

12

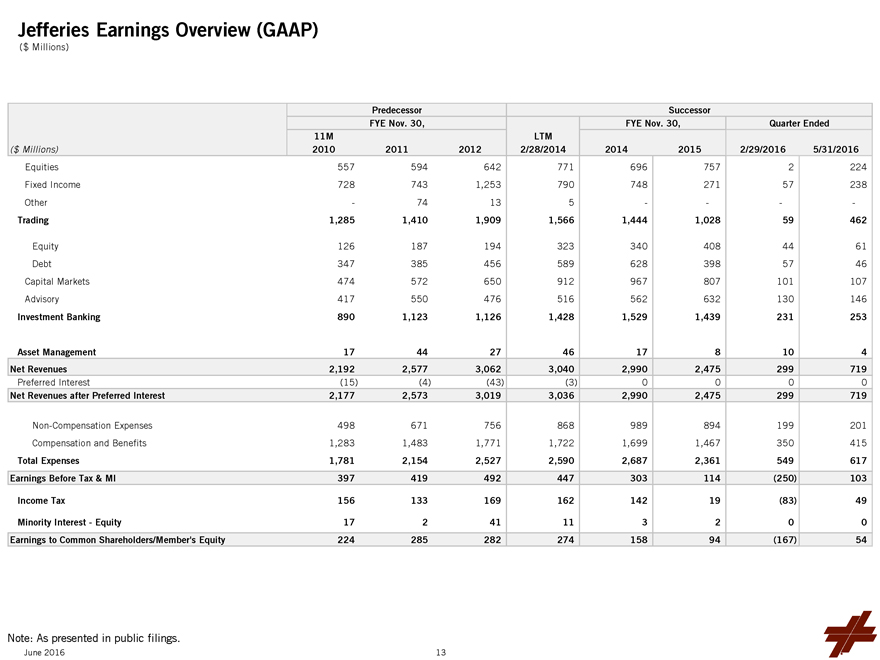

Jefferies Earnings Overview (GAAP)

($ Millions)

Predecessor Successor

FYE Nov. 30, FYE Nov. 30, Quarter Ended

($ Millions) 11M 2010 2011 2012 LTM 2/28/2014 2014

2015 2/29/2016 5/31/2016

Equities 557 594 642 771 696 757 2 224

Fixed Income

728 743 1,253 790 748 271 57 238

Other - 74 13 5 - - - -

Trading 1,285 1,410

1,909 1,566 1,444 1,028 59 462

Equity 126 187 194 323 340 408 44 61

Debt 347

385 456 589 628 398 57 46

Capital Markets 474 572 650 912 967 807 101 107

Advisory 417 550 476 516 562 632 130 146

Investment Banking 890 1,123 1,126

1,428 1,529 1,439 231 253

Asset Management 17 44 27 46 17 8 10 4

Net Revenues

2,192 2,577 3,062 3,040 2,990 2,475 299 719

Preferred Interest (15) (4) (43) (3) 0 0 0 0

Net Revenues after Preferred Interest 2,177 2,573 3,019 3,036 2,990 2,475 299 719

Non-Compensation Expenses 498 671 756 868 989 894 199 201

Compensation and

Benefits 1,283 1,483 1,771 1,722 1,699 1,467 350 415

Total Expenses 1,781 2,154 2,527 2,590 2,687 2,361 549 617

Earnings Before Tax & MI 397 419 492 447 303 114 (250) 103

Income Tax 156 133 169 162 142

19 (83) 49

Minority Interest - Equity 17 2 41 11 3 2 0 0

Earnings to Common

Shareholders/Member’s Equity 224 285 282 274 158 94 (167) 54

Note: As presented in public filings.

June 2016

13

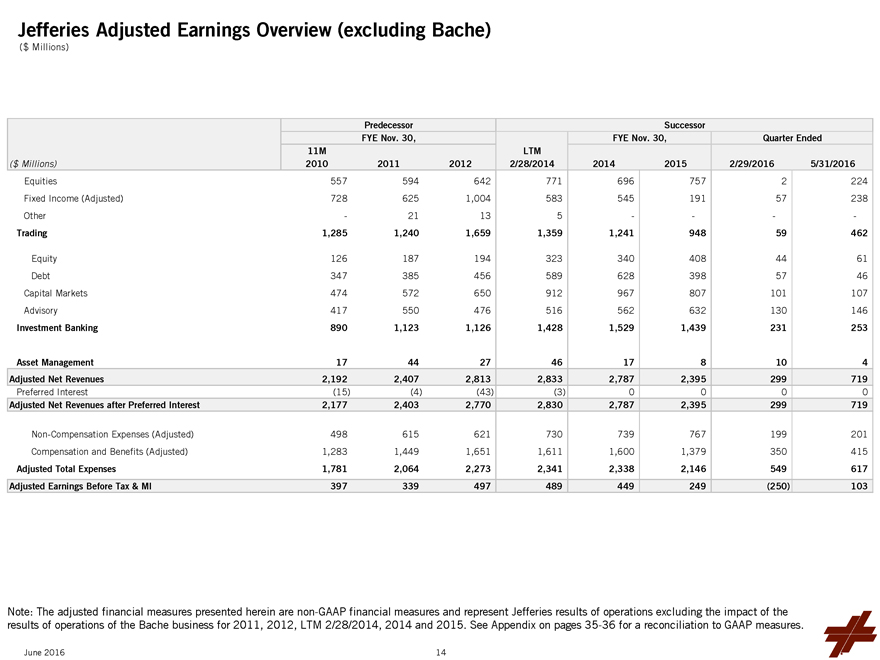

Jefferies Adjusted Earnings Overview (excluding Bache)

($ Millions)

Predecessor Successor

FYE Nov. 30, FYE Nov. 30, Quarter Ended

11M LTM

($ Millions) 2010 2011 2012 2/28/2014 2014 2015 2/29/2016 5/31/2016

Equities 557 594 642 771

696 757 2 224

Fixed Income (Adjusted) 728 625 1,004 583 545 191 57 238

Other

- 21 13 5 - - - -

Trading 1,285 1,240 1,659 1,359 1,241 948 59 462

Equity 126

187 194 323 340 408 44 61

Debt 347 385 456 589 628 398 57 46

Capital Markets

474 572 650 912 967 807 101 107

Advisory 417 550 476 516 562 632 130 146

Investment Banking 890 1,123 1,126 1,428 1,529 1,439 231 253

Asset Management

17 44 27 46 17 8 10 4

Adjusted Net Revenues 2,192 2,407 2,813 2,833 2,787 2,395 299 719

Preferred Interest (15) (4) (43) (3) 0 0 0 0

Adjusted Net Revenues after Preferred Interest

2,177 2,403 2,770 2,830 2,787 2,395 299 719

Non-Compensation Expenses (Adjusted) 498 615 621 730 739 767 199 201

Compensation and Benefits (Adjusted) 1,283 1,449 1,651 1,611 1,600 1,379 350 415

Adjusted

Total Expenses 1,781 2,064 2,273 2,341 2,338 2,146 549 617

Adjusted Earnings Before Tax & MI 397 339 497 489 449 249 (250) 103

Note: The adjusted financial measures presented herein are non-GAAP financial measures and represent Jefferies results of operations excluding the impact of the results of

operations of the Bache business for 2011, 2012, LTM 2/28/2014, 2014 and 2015. See Appendix on pages 35-36 for a reconciliation to GAAP measures.

June 2016 14

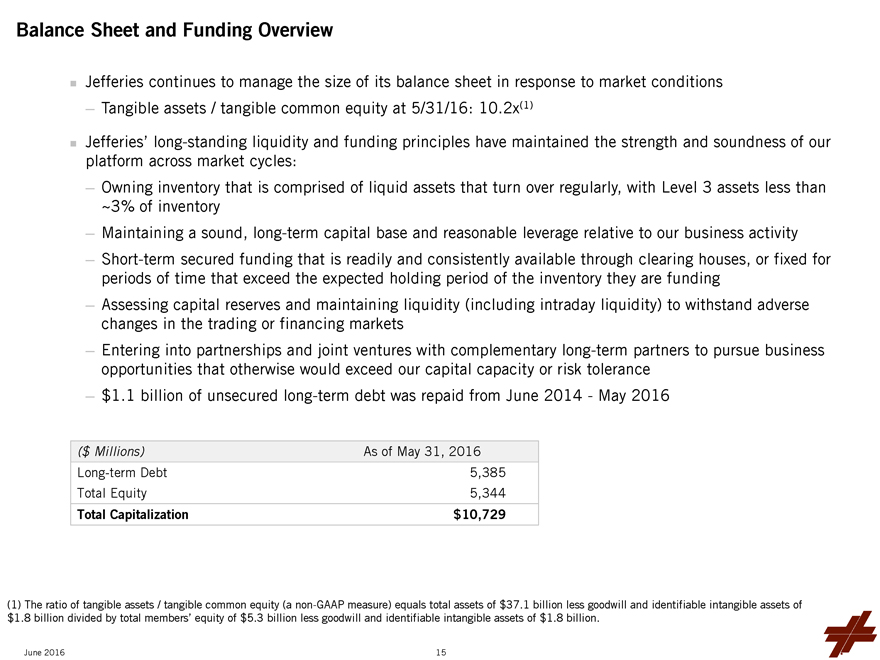

Balance Sheet and Funding Overview

Jefferies continues to manage the size of its balance sheet in response to market conditions

-

Tangible assets / tangible common equity at 5/31/16: 10.2x(1)

Jefferies’ long-standing liquidity and funding principles have maintained the strength and

soundness of our platform across market cycles:

- Owning inventory that is comprised of liquid assets that turn over regularly, with Level 3 assets less than ~3%

of inventory

- Maintaining a sound, long-term capital base and reasonable leverage relative to our business activity

- Short-term secured funding that is readily and consistently available through clearing houses, or fixed for periods of time that exceed the expected holding period of the

inventory they are funding

- Assessing capital reserves and maintaining liquidity (including intraday liquidity) to withstand adverse changes in the trading or

financing markets

- Entering into partnerships and joint ventures with complementary long-term partners to pursue business opportunities that otherwise would

exceed our capital capacity or risk tolerance

- $1.1 billion of unsecured long-term debt was repaid from June 2014 - May 2016

($ Millions) As of May 31, 2016

Long-term Debt 5,385

Total Equity 5,344

Total Capitalization $10,729

(1) The ratio of tangible assets / tangible common equity (a non-GAAP measure) equals total assets of $37.1 billion less goodwill and identifiable intangible assets of

$1.8 billion divided by total members’ equity of $5.3 billion less goodwill and identifiable intangible assets of $1.8 billion.

June 2016 15

Leucadia Investments Overview

June 2016 16

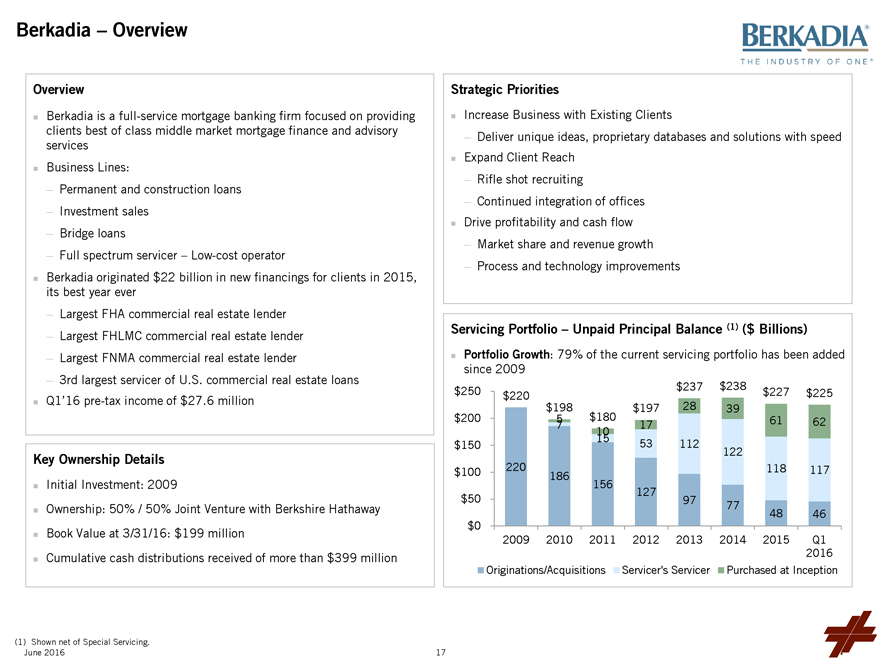

Berkadia - Overview

BERKADIA THE INDUSTRY OF ONE

Overview

Berkadia is a full-service mortgage banking firm focused on providing clients best of class middle market mortgage finance and advisory services

Business Lines:

- Permanent and construction loans

- Investment sales

- Bridge loans

- Full spectrum servicer - Low-cost operator

Berkadia originated $22 billion in new financings

for clients in 2015, its best year ever

- Largest FHA commercial real estate lender

- Largest FHLMC commercial real estate lender

- Largest FNMA commercial real estate lender

- 3rd largest servicer of U.S. commercial real estate loans

Q1’16

pre-tax income of $27.6 million

Key Ownership Details

Initial Investment:

2009

Ownership: 50% / 50% Joint Venture with Berkshire Hathaway

Book Value at

3/31/16: $199 million

Cumulative cash distributions received of more than $399 million

Strategic Priorities

Increase Business with Existing Clients

- Deliver unique ideas, proprietary databases and solutions with speed

Expand Client Reach

- Rifle shot recruiting

- Continued integration of offices

Drive profitability and cash flow

- Market share and revenue growth

- Process and technology improvements

Servicing Portfolio - Unpaid Principal Balance (1) ($

Billions)

Portfolio Growth: 79% of the current servicing portfolio has been added since 2009

$250 $200 $150 $100 $50 $0

$220 220

$198 5 7 186

$180 10 15 156

$197 17 53 127

$237 28 112 97

$238 39 122 77

$227 61 118 48

$225 62 117 46

2009 2010 2011 2012 2013 2014 2015 Q1 2016

Originations/Acquisitions Servicer’s Servicer Purchased at Inception

(1) Shown net of

Special Servicing.

June 2016 17

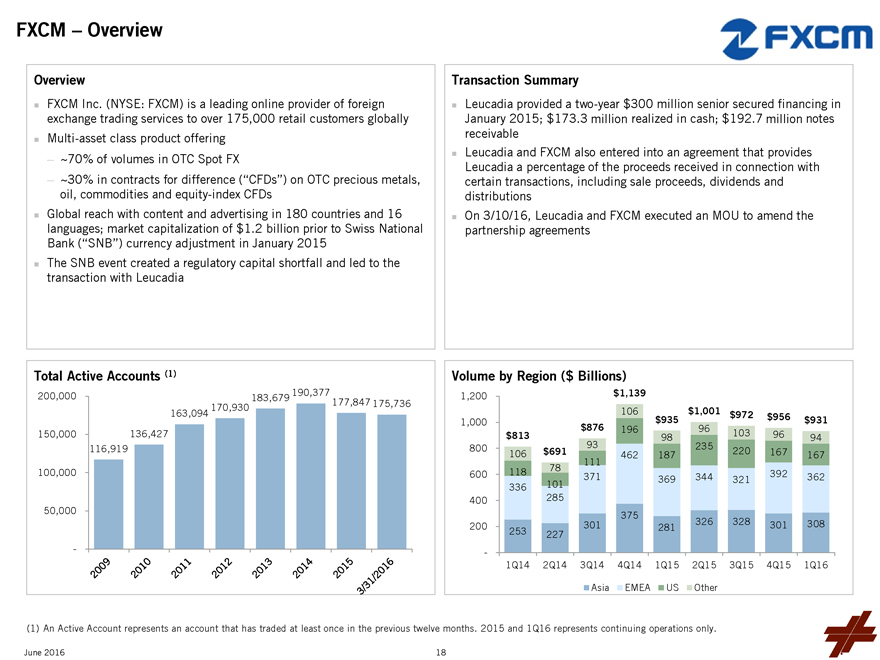

FXCM - Overview

FXCM

Overview

FXCM Inc. (NYSE: FXCM) is a leading online provider of foreign

exchange trading services to over 175,000 retail customers globally

Multi-asset class product offering

- ~70% of volumes in OTC Spot FX

- ~30% in contracts for difference (“CFDs”) on OTC

precious metals, oil, commodities and equity-index CFDs

Global reach with content and advertising in 180 countries and 16 languages; market capitalization of $1.2

billion prior to Swiss National

Bank (“SNB”) currency adjustment in January 2015

The SNB event created a regulatory capital shortfall and led to the transaction with Leucadia

Total Active Accounts (1)

200,000 150,000 100,000 50,000 -

116,919 136,427 163,094 170,930 183,679 190,377 177,847 175,736

2009 2010 2011 2012 2013 2014

2015 3/31/2016

Transaction Summary

Leucadia provided a two-year $300 million

senior secured financing in January 2015; $173.3 realized in cash; $192.7 notes receivable

Leucadia and FXCM also entered into an agreement that provides Leucadia

a percentage of the proceeds received in connection with certain transactions, including sale proceeds, dividends and distributions

On 3/10/16, Leucadia and FXCM

executed an MOU to amend the partnership agreements

Volume by Region ($ Billions)

1,200 1,000 800 600 400 200 -

$813 106 118 336 253

$691 78 101 285 227

$876 93 111 371 301

$1,139 106 196 462 375

$935 98 187 369 281

$1,001 96 235 344 326

$972 103 220 321 328

$956 96 167 392 301

$931 94 167 362 308

1Q14 2Q14 3Q14 4Q14 1Q15 2Q15 3Q15 4Q15 1Q16

Asia EMEA US Other

(1) An Active Account represents an account that has traded at least once in the previous twelve months. 2015 and 1Q16 represents continuing operations only.

June 2016 18

Leucadia Asset Management

Overview

Diversified alternative asset management platform - supporting and

developing focused funds managed by distinct management teams

Fee-generating assets, long-term stable cash flows, able to recycle capital

Goal of growing third party AUM, while earning a reasonable return on our capital

Compelling

edge - leverage Jefferies to source, and Leucadia to capitalize and syndicate

$452 million Leucadia book value in LAM products as of March 31, 2016, excluding $80

million of investments in marketable securities available for sale immediately; this does not reflect any potential value of the management companies executing these strategies

June 2016 19

Leucadia Asset Management (Continued)

Platforms and Strategies

Folger Hill Asset Management (Multi-Manager)

- Multi-manager discretionary long/short equity hedge fund platform; $873 million AUM

Topwater

Capital (Multi-Manager / First-loss)

- First-loss, scalable multi-manager and multi-strategy liquid securities fund; $818 million regulatory AUM

Strategic Investments Division (Quantitative Strategies)

- Systematic strategy with a

multi-quant approach across asset classes, geographies and time horizons; $1.1 billion AUM equivalent

Tenacis (Quantitative Strategies)

- Systematic macro fund encompassing equities, credit, FX, rates and volatility

CoreCommodity

Management (Commodity Strategies)

- Active strategies designed to provide enhanced commodity exposure; $4.8 billion AUM

Global Equity Events Opportunity Fund (Event-Driven Strategies)

- Event driven strategy

investing in merger arbitrage, relative value and stock loan arbitrage; $145 million AUM equivalent

54 Madison (Real Estate)

- Long-term, opportunistic real estate private equity fund providing equity capital for hotel, timeshare, resort, residential and specialty retail real estate development projects;

$500 million of fund commitments

Lake Hill

- Electronic trading of listed

options and futures across asset classes

Note: AUM figures as of Q1 2016 quarter end.

June 2016 20

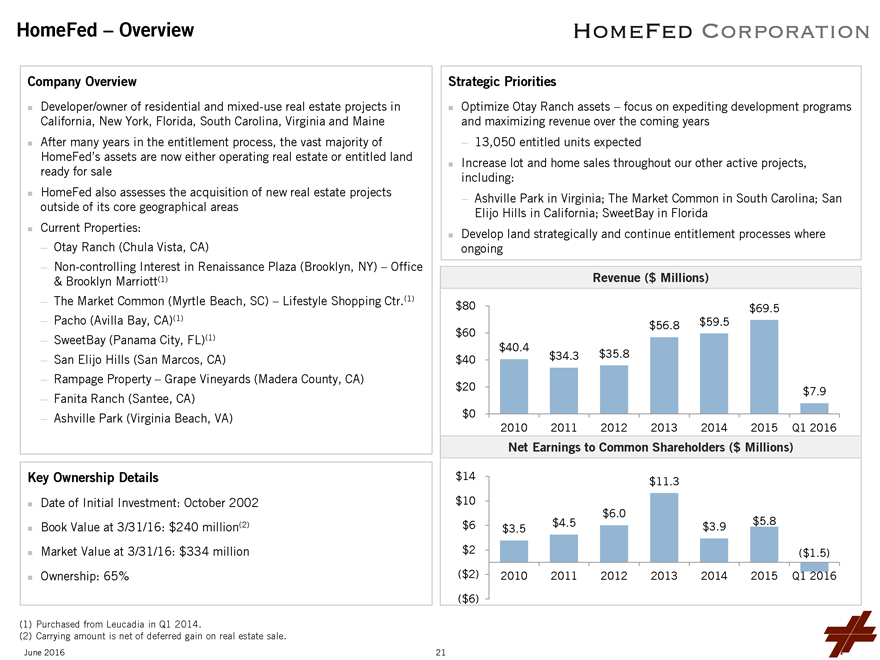

HomeFed - Overview

HOMEFED CORPORATION

Company Overview

Developer/owner of residential and mixed-use real estate projects in California, New York, Florida, South Carolina, Virginia and Maine

After many years in the entitlement process, the vast majority of HomeFed’s assets are now either operating real estate or entitled land ready for sale

HomeFed also assesses the acquisition of new real estate projects outside of its core geographical areas

Current Properties:

- Otay Ranch (Chula Vista, CA)

- Non-controlling Interest in Renaissance Plaza (Brooklyn, NY) - Office & Brooklyn Marriott(1)

- The Market Common (Myrtle Beach, SC) - Lifestyle Shopping Ctr.(1)

- Pacho (Avilla Bay,

CA)(1)

- SweetBay (Panama City, FL)(1)

- San Elijo Hills (San Marcos, CA)

- Rampage Property - Grape Vineyards (Madera County, CA)

- Fanita Ranch

(Santee, CA)

- Ashville Park (Virginia Beach, VA)

Key Ownership Details

Date of Initial Investment: October 2002

Book Value at 3/31/16: $240

million(2)

Market Value at 3/31/16: $334 million

Ownership: 65%

Strategic Priorities

Optimize Otay Ranch assets - focus on expediting development programs and

maximizing revenue over the coming years

- 13,050 entitled units expected

Increase lot and home sales throughout our other active projects, including:

- Ashville Park in Virginia; The Market Common in South Carolina; San Elijo Hills in California; SweetBay in Florida

Develop land strategically and continue entitlement processes where ongoing

Revenue ($

Millions)

$80 $60 $40 $20 $0

$40.4 $34.3 $35.8 $56.8 $59.5 $69.5 $7.9

2010 2011 2012 2013 2014 2015 Q1 2016

Net Earnings to Common Shareholders ($

Millions)

$14 $10 $6 $2 ($2) ($6)

$3.5 2010

$4.5 2011

$6.0 2012

$11.3 2013

$3.9 2014

$5.8 2015

($1.5) Q1 2016

(1) Purchased from Leucadia in Q1 2014.

(2) Carrying amount is net of deferred gain on real

estate sale.

June 2016 21

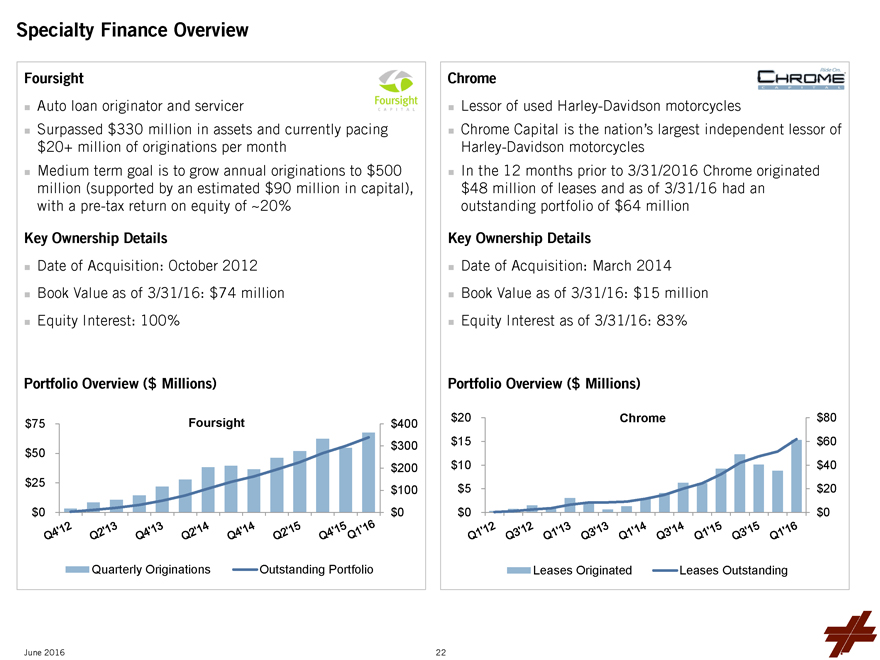

Specialty Finance Overview

Foursight

Auto loan originator and servicer

Surpassed $330 million in assets and currently pacing $20+ million of originations per month

Medium term goal is to grow annual originations to $500 million (supported by an estimated $90 million in capital), with a pre-tax return on equity of ~20%

Key Ownership Details

Date of Acquisition: October 2012

Book Value as of 3/31/16: $74 million

Equity Interest: 100%

Portfolio Overview ($ Millions)

$75 Foursight $400

$50 $300

$200

$25 $100

$0 $0

Q4’12 Q2’13 Q4’13 Q2’14 Q4’14 Q2’15 Q4’15 Q1’16

Quarterly Originations Outstanding Portfolio

Chrome

CHROME

Lessor of used Harley-Davidson motorcycles

Chrome Capital is the nation’s largest independent lessor of

Harley-Davidson motorcycles

In the 12 months prior to 3/31/2016 Chrome originated $48 million of leases and as of 3/31/16 had an outstanding portfolio of $64 million

Key Ownership Details

Date of Acquisition: March 2014

Book Value as of 3/31/16: $15 million

Equity Interest as of 3/31/16: 83%

Portfolio Overview ($ Millions)

$20 Chrome $80

$15 $60

$10 $40

$5 $20

$0 $0

Q1’12 Q3’12 Q1’13 Q3’13 Q1’14 Q3’14 Q1’15 Q3’15 Q1’16

Leases Originated Leases Outstanding

June 2016 22

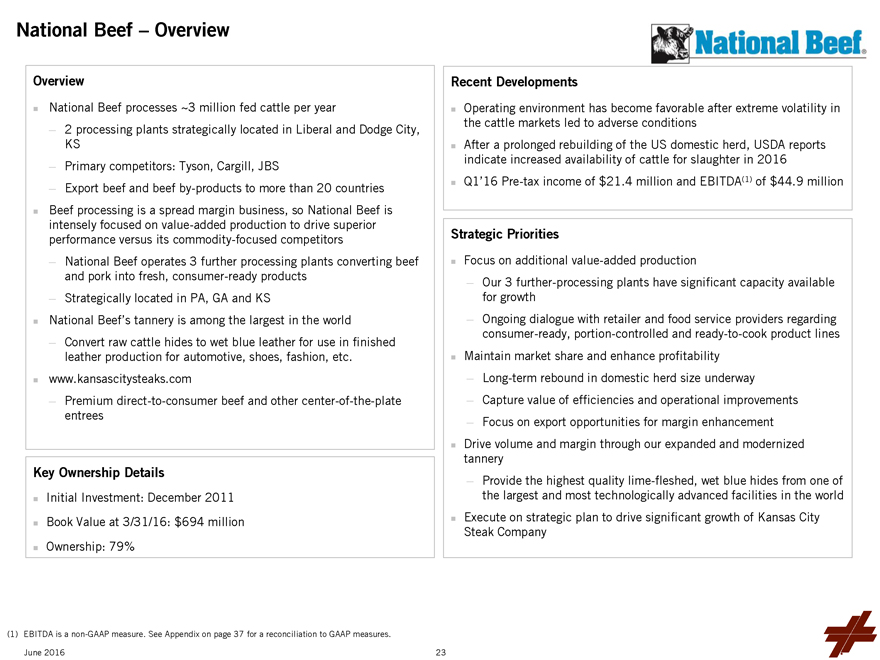

National Beef – Overview

National Beef

Overview

National Beef processes ~3 million fed cattle per year

— 2 processing plants strategically

located in Liberal and Dodge City, KS

— Primary competitors: Tyson, Cargill, JBS

— Export beef and beef by-products to more than 20 countries

Beef processing is a spread

margin business, so National Beef is intensely focused on value-added production to drive superior performance versus its commodity-focused competitors

—

National Beef operates 3 further processing plants converting beef and pork into fresh, consumer-ready products

— Strategically located in PA, GA and KS

National Beef’s tannery is among the largest in the world

— Convert

raw cattle hides to wet blue leather for use in finished leather production for automotive, shoes, fashion, etc.

www.kansascitysteaks.com

— Premium direct-to-consumer beef and other center-of-the-plate entrees

Key Ownership

Details

Initial Investment: December 2011

Book Value at 3/31/16: $694 million

Ownership: 79%

Recent Developments

Operating environment has become favorable after extreme volatility in the cattle markets led to adverse conditions

After a prolonged rebuilding of the US domestic herd, USDA reports indicate increased availability of cattle for slaughter in 2016

Q1’16 (1)

Pre-tax income of $21.4 million and EBITDA of $44.9 million

Strategic Priorities

Focus on additional value-added production

— Our 3 further-processing plants have significant capacity available for growth

—

Ongoing dialogue with retailer and food service providers regarding consumer-ready, portion-controlled and ready-to-cook product lines

Maintain market share and

enhance profitability

— Long-term rebound in domestic herd size underway

— Capture value of efficiencies and operational improvements

—

Focus on export opportunities for margin enhancement

Drive volume and margin through our expanded and modernized tannery

— Provide the highest quality lime-fleshed, wet blue hides from one of the largest and most technologically advanced facilities in the world

Execute on strategic plan to drive significant growth of Kansas City Steak Company

(1) EBITDA

is a non-GAAP measure. See Appendix on page 37 for a reconciliation to GAAP measures.

June 2016 23

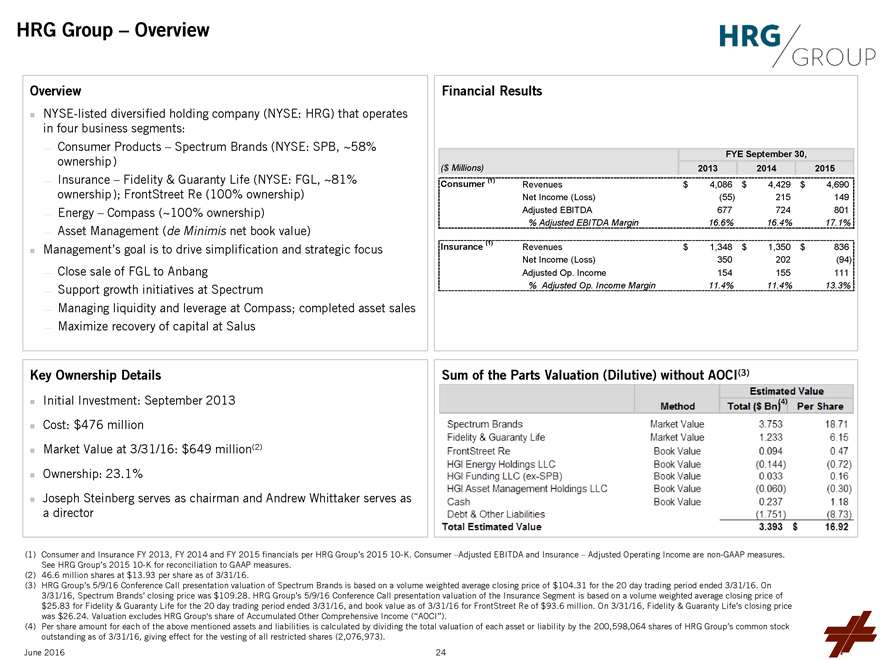

HRG Group – Overview

HRG GROUP

Overview

NYSE-listed diversified holding company (NYSE: HRG) that operates in four business segments:

— Consumer Products – Spectrum Brands (NYSE: SPB, ~58% ownership(1))

— Insurance – Fidelity & Guaranty Life (NYSE: FGL, ~81% ownership(1)); FrontStreet Re (100% ownership)

— Energy – Compass (~100% ownership)

— Asset Management (de Minimis net book

value)

Management’s goal is to drive simplification and strategic focus

— Close sale of FGL to Anbang

— Support growth initiatives at

Spectrum

Managing liquidity — and leverage at Compass; completed asset sales

— Maximize recovery of capital at Salus

Key Ownership Details

Initial Investment: September 2013

Cost: $476 million

Market Value at 3/31/16: $649 million(2)

Ownership: 23.1%

Joseph Steinberg serves as chairman and Andrew Whittaker serves as a director

Financial

Results

FYE September 30,

($ Millions) 2013 2014 2015

Consumer (1) Revenues $4,086 $4,429 $4,690

Net Income (Loss) (55) 215 149

Adjusted EBITDA 677 724 801

% Adjusted EBITDA Margin 16.6% 16.4% 17.1%

Insurance (1) Revenues $1,348 $1,350 $836

Net Income (Loss) 350 202 (94)

Adjusted Op. Income 154 155 111

% Adjusted Op. Income Margin 11.4% 11.4% 13.3%

Sum of the Parts Valuation (Dilutive) without AOCI(3)

Estimated Value

Method Total ($ Bn)(4) Per Share

Spectrum Brands Market Value 3.753 18.71

Fidelity & Guaranty Life Market Value 1.233 6.15

FrontStreet Re Book Value 0.094 0.47

HGI Energy Holdings LLC Book Value (0.144) (0.72)

HGI Funding LLC (ex-SPB)

Book Value 0.033 0.16

HGI Asset Management Holdings LLC Book Value (0.060) (0.30)

Cash Book Value 0.237 1.18

Debt & Other Liabilities (1.751) (8.73)

Total Estimated Value 3.393 $16.92

(1) Consumer and Insurance FY 2013, FY 2014 and FY 2015

financials per HRG Group’s 2015 10-K. Consumer –Adjusted EBITDA and Insurance – Adjusted Operating Income are non-GAAP measures. See HRG Group’s 2015 10-K for reconciliation to GAAP measures.

(2) 46.6 million shares at $13.93 per share as of 3/31/16.

(3) HRG Group’s 5/9/16

Conference Call presentation valuation of Spectrum Brands is based on a volume weighted average closing price of $104.31 for the 20 day trading period ended 3/31/16. On 3/31/16, Spectrum Brands’ closing price was $109.28. HRG Group’s

5/9/16 Conference Call presentation valuation of the Insurance Segment is based on a volume weighted average closing price of $25.83 for Fidelity & Guaranty Life for the 20 day trading period ended 3/31/16, and book value as of 3/31/16 for

FrontStreet Re of $93.6 million. On 3/31/16, Fidelity & Guaranty Life’s closing price was $26.24. Valuation excludes HRG Group’s share of Accumulated Other Comprehensive Income (“AOCI”).

(4) Per share amount for each of the above mentioned assets and liabilities is calculated by dividing the total valuation of each asset or liability by the 200,598,064 shares of

HRG Group’s common stock outstanding as of 3/31/16, giving effect for the vesting of all restricted shares (2,076,973).

June 2016 24

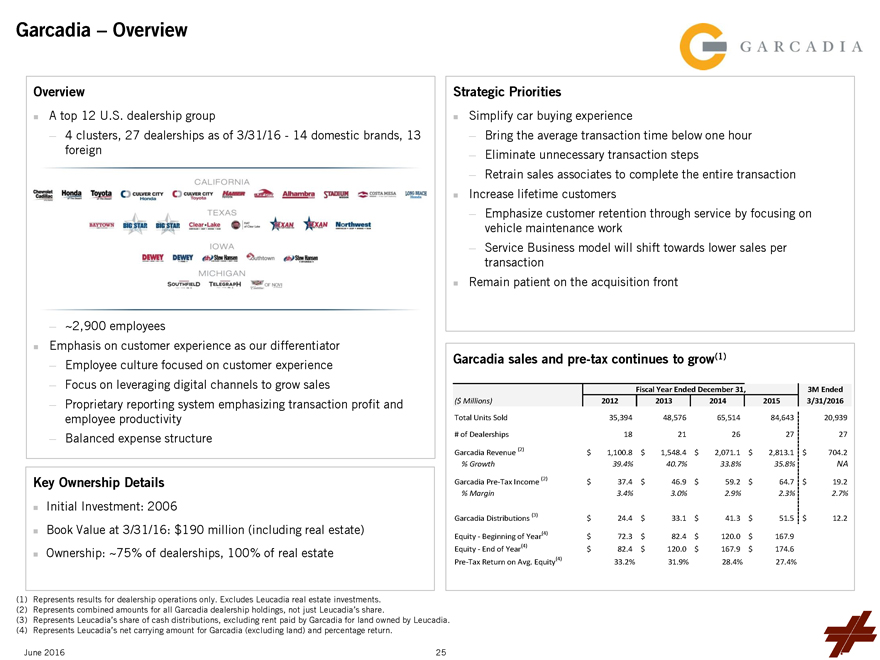

Garcadia – Overview

GARCADIA

Overview

A top 12 U.S. dealership group

— 4 clusters, 27 dealerships as of 3/31/16 - 14 domestic

brands, 13 foreign

— ~2,900 employees

Emphasis on customer experience as

our differentiator

— Employee culture focused on customer experience

— Focus on leveraging digital channels to grow sales

— Proprietary

reporting system emphasizing transaction profit and employee productivity

— Balanced expense structure

Key Ownership Details

Initial Investment: 2006

Book Value at 3/31/16: $190 million (including real estate)

Ownership: ~75% of dealerships,

100% of real estate

Strategic Priorities

Simplify car buying experience

— Bring the average transaction time below one hour

— Eliminate

unnecessary transaction steps

— Retrain sales associates to complete the entire transaction

Increase lifetime customers

— Emphasize customer retention through service by focusing on

vehicle maintenance work

— Service Business model will shift towards lower sales per transaction

Remain patient on the acquisition front

Garcadia sales and pre-tax continues to grow(1)

Fiscal Year Ended December 31, 3M Ended

($ Millions) 2012 2013 2014 2015

3/31/2016

Total Units Sold 35,394 48,576 65,514 84,643 20,939

# of

Dealerships 18 21 26 27 27

Garcadia Revenue (2) $1,100.8 $1,548.4 $2,071.1 $2,813.1 $704.2

% Growth 39.4% 40.7% 33.8% 35.8% NA

Garcadia Pre-Tax Income (2) $37.4 $46.9 $59.2 $64.7 $19.2

% Margin 3.4% 3.0% 2.9% 2.3% 2.7%

Garcadia Distributions (3) $24.4 $33.1

$41.3 $51.5 $12.2

Equity - Beginning of Year(4) $72.3 $82.4 $120.0 $167.9

Equity - End of Year(4) $82.4 $120.0 $167.9 $174.6

Pre-Tax Return on Avg.

Equity(4) 33.2% 31.9% 28.4% 27.4%

(1) Represents results for dealership operations only. Excludes Leucadia real estate investments.

(2) Represents combined amounts for all Garcadia dealership holdings, not just Leucadia’s share.

(3) Represents Leucadia’s share of cash distributions, excluding rent paid by Garcadia for land owned by Leucadia.

(4) Represents Leucadia’s net carrying amount for Garcadia (excluding land) and percentage return.

June 2016 25

Vitesse Energy – Overview

Company Overview

Denver-based oil and gas company led by Bob Gerrity, CEO, and Brian Cree, CFO

Formed in May 2014 – Leucadia has funded $258 million through March 31, 2016 for acquisitions and property development

Non-operating owner of oil and gas properties in the core of the Bakken field

Strategy –

acquire and develop leasehold properties and convert undeveloped drilling locations into cash flow producing assets

Partner with leading operators to drill and

complete economic new horizontal wells

— More than 75% of current activity with Burlington (COP), Oasis, XTO (Exxon), Liberty Resources, EOG, QEP and HESS

— Ability to non-consent wells without attractive economics at current oil prices without impact on future development

90% + of the Company’s value is in the ground (undeveloped drilling locations)

Key Market

Trends – Bakken

Rig activity in the Bakken has dropped significantly from 2015 peak

Operators have responded by focusing activity in the core of the Bakken, cutting costs and optimizing well designs

— Drilling and completion costs have decreased by 30%—40%

— Reserves per new

well have increased over 30%

— Well density continues to increase (more wells drilled on same acreage)

Operating costs continue to decline

— Economics in the core of the Bakken continue to be

positive

— Vitesse owns under 1% of the acreage in the Bakken, but is participating in approximately 25% of the current drilling activity

Strategic Priorities

Continue to participate in lower risk infill horizontal development

drilling in the core areas of the Bakken Oil field that produce good economics at $45/bbl oil prices

With lower oil prices, Bakken operators only drilling in

the core of the Bakken where Vitesse has focused its historical acquisition efforts

Recent Developments

Hedged 48% of current production through 2017 at prices above $50 per barrel

Upgraded core

ownership in the Bakken during 2015 by selectively acquiring distressed core assets

The drop in oil prices over 2015 and early 2016 resulted in reduced drilling

activity. Despite lower revenues, Vitesse’s assets continue to produce positive free cash flow

Current production greater than 3,000 boe / day

June 2016 26

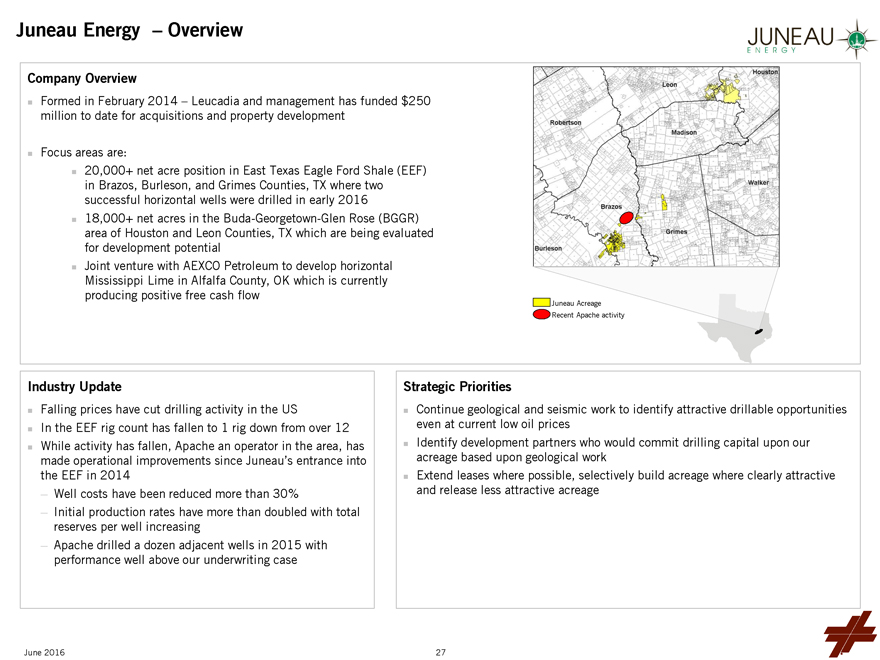

Juneau Energy – Overview

JUNEAU ENERGY

Company Overview

Formed in February 2014 – Leucadia and management has funded $250 million to date for acquisitions and property development

Focus areas are:

20,000+ net acre position in East Texas Eagle Ford Shale (EEF) in Brazos,

Burleson, and Grimes Counties, TX where two successful horizontal wells were drilled in early 2016

18,000+ net acres in the Buda-Georgetown-Glen Rose (BGGR) area

of Houston and Leon Counties, TX which are being evaluated for development potential

Joint venture with AEXCO Petroleum to develop horizontal Mississippi Lime in

Alfalfa County, OK which is currently producing positive free cash flow

Robertson

Leon

Houston

Madison

Walker

Grimes

Brazos

Burleson

Juneau Acreage

Recent Apache activity

Industry Update

Falling prices have cut drilling activity in the US

In the EEF rig count has

fallen to 1 rig down from over 12

While activity has fallen, Apache an operator in the area, has made operational improvements since Juneau’s entrance

into the EEF in 2014

— Well costs have been reduced more than 30%

—

Initial production rates have more than doubled with total reserves per well increasing

— Apache drilled a dozen adjacent wells in 2015 with performance well

above our underwriting case

Strategic Priorities

Continue geological and

seismic work to identify attractive drillable opportunities even at current low oil prices

Identify development partners who would commit drilling capital upon our

acreage based upon geological work

Extend leases where possible, selectively build acreage where clearly attractive and release less attractive acreage

June 2016 27

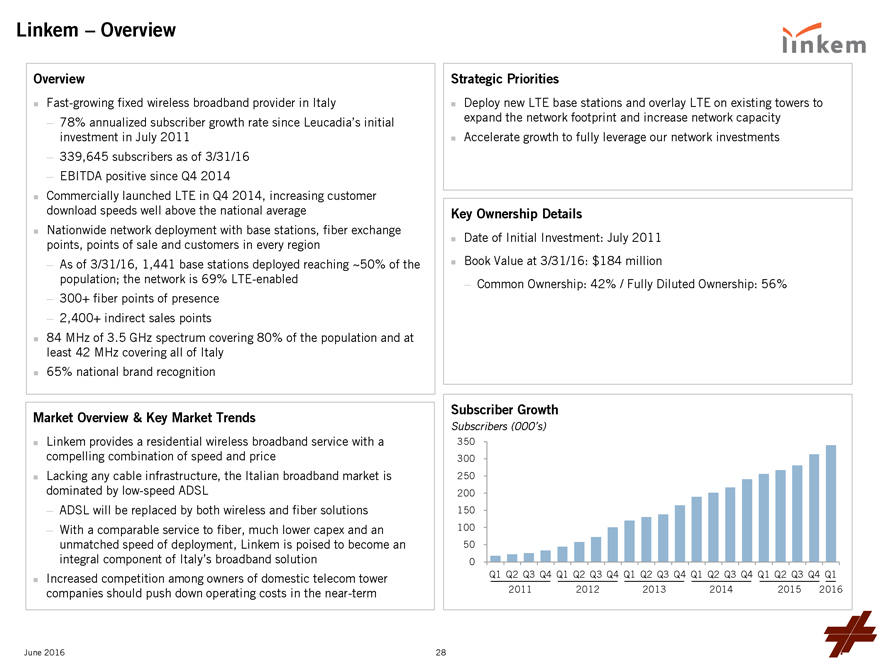

Linkem – Overview

linkem

Overview

Fast-growing fixed wireless broadband provider in Italy

— 78% annualized subscriber

growth rate since Leucadia’s initial investment in July 2011

— 339,645 subscribers as of 3/31/16

— EBITDA positive since Q4 2014

Commercially launched LTE in Q4 2014, increasing customer

download speeds well above the national average

Nationwide network deployment with base stations, fiber exchange points, points of sale and customers in every

region

— As of 3/31/16, 1,441 base stations deployed reaching ~50% of the population; the network is 69% LTE-enabled

— 300+ fiber points of presence

— 2,400+ indirect sales points

84 MHz of 3.5 GHz spectrum covering 80% of the population and at least 42 MHz covering all of Italy

65% national brand recognition

Market Overview & Key Market Trends

Linkem provides a residential wireless broadband service with a compelling combination of speed and price

Lacking any cable infrastructure, the Italian broadband market is dominated by low-speed ADSL

— ADSL will be replaced by both wireless and fiber solutions

— With

a comparable service to fiber, much lower capex and an unmatched speed of deployment, Linkem is poised to become an integral component of Italy’s broadband solution

Increased competition among owners of domestic telecom tower companies should push down operating costs in the near-term

Strategic Priorities

Deploy new LTE base stations and overlay LTE on existing towers to expand

the network footprint and increase network capacity

Accelerate growth to fully leverage our network investments

Key Ownership Details

Date of Initial Investment: July 2011

Book Value at 3/31/16: $184 million

— Common Ownership: 42% / Fully Diluted Ownership:

56%

Subscriber Growth

Subscribers (000’s)

350

300

250

200

150

100

50

0

Q1 Q2 Q3 Q4

Q1 Q2 Q3 Q4

Q1 Q2 Q3 Q4

Q1 Q2 Q3 Q4

Q1 Q2 Q3 Q4

Q1

2011 2012 2013 2014 2015 2016

June 2016 28

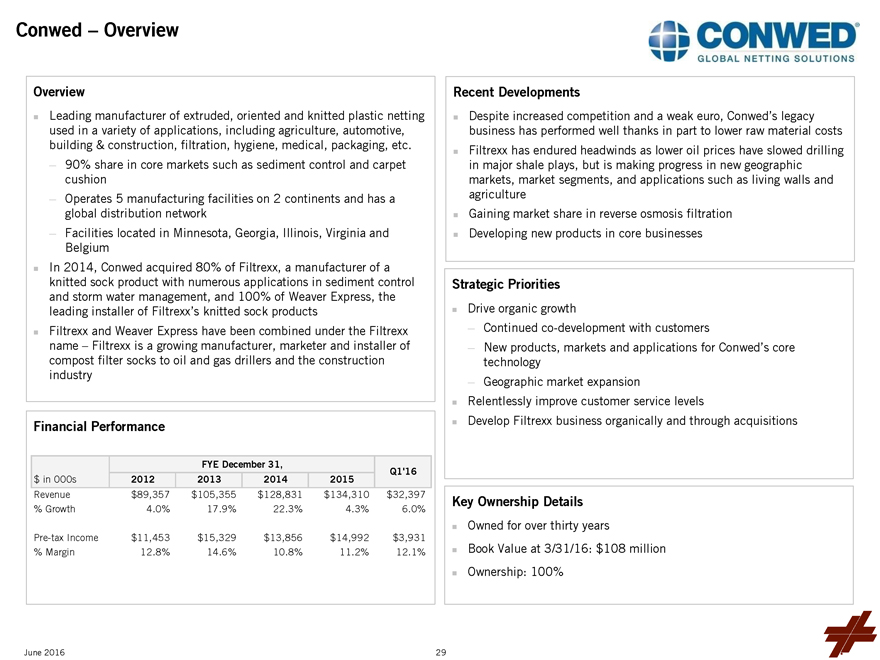

Conwed – Overview

CONWED

GLOBAL NETTING SOLUTIONS

Overview

Leading manufacturer of extruded, oriented and knitted plastic netting used in a

variety of applications, including agriculture, automotive, building & construction, filtration, hygiene, medical, packaging, etc.

— 90% share in core

markets such as sediment control and carpet cushion

— Operates 5 manufacturing facilities on 2 continents and has a global distribution network

— Facilities located in Minnesota, Georgia, Illinois, Virginia and Belgium

In 2014,

Conwed acquired 80% of Filtrexx, a manufacturer of a knitted sock product with numerous applications in sediment control and storm water management, and 100% of Weaver Express, the leading installer of Filtrexx’s knitted sock products

Filtrexx and Weaver Express have been combined under the Filtrexx name – Filtrexx is a growing manufacturer, marketer and installer of compost filter socks to

oil and gas drillers and the construction industry

Financial Performance

FYE

December 31, Q1’16

$ in 000s 2012 2013 2014 2015

Revenue $89,357

$105,355 $128,831 $134,310 $32,397

% Growth 4.0% 17.9% 22.3% 4.3% 6.0%

Pre-tax Income $11,453 $15,329 $13,856 $14,992 $3,931

% Margin 12.8% 14.6%

10.8% 11.2% 12.1%

Recent Developments

Despite increased competition and a

weak euro, Conwed’s legacy business has performed well thanks in part to lower raw material costs

Filtrexx has endured headwinds as lower oil prices have

slowed drilling in major shale plays, but is making progress in new geographic markets, market segments, and applications such as living walls and agriculture

Gaining market share in reverse osmosis filtration

Developing new products in

core businesses

Strategic Priorities

Drive organic growth

— Continued co-development with customers

— New products, markets and applications

for Conwed’s core technology

— Geographic market expansion

Relentlessly improve customer service levels

Develop Filtrexx business

organically and through acquisitions

Key Ownership Details

Owned for over

thirty years

Book Value at 3/31/16: $108 million

Ownership: 100%

June 2016 29

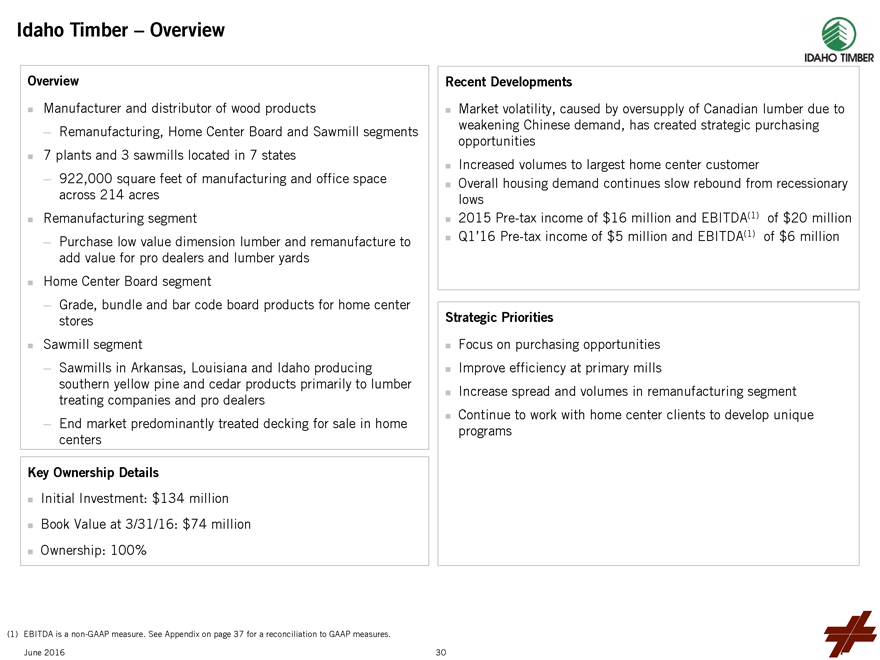

Idaho Timber - Overview

IDAHO TIMBER

Overview

Manufacturer and distributor of wood products

- Remanufacturing, Home Center Board and Sawmill

segments

7 plants and 3 sawmills located in 7 states

- 922,000 square feet of

manufacturing and office space across 214 acres

Remanufacturing segment

-

Purchase low value dimension lumber and remanufacture to add value for pro dealers and lumber yards

Home Center Board segment

- Grade, bundle and bar code board products for home center stores

Sawmill segment

- Sawmills in Arkansas, Louisiana and Idaho producing southern yellow pine and cedar products primarily to lumber treating companies and pro dealers

- End market predominantly treated decking for sale in home centers

Key Ownership Details

Initial Investment: $134 million

Book Value at 3/31/16: $74 million

Ownership: 100%

Recent Developments

Market volatility, caused by oversupply of Canadian lumber due to weakening Chinese demand, has created strategic purchasing opportunities

Increased volumes to largest home center customer

Overall housing demand continues slow rebound

from recessionary lows

2015 Pre-tax income of $16 million and EBITDA(1) of $20 million

Q1’16 Pre-tax income of $5 million and EBITDA(1) of $6 million

Strategic Priorities

Focus on purchasing opportunities

Improve efficiency at primary

mills

Increase spread and volumes in remanufacturing segment

Continue to work

with home center clients to develop unique programs

(1) EBITDA is a non-GAAP measure. See Appendix on page 37 for a reconciliation to GAAP measures.

June 2016

30

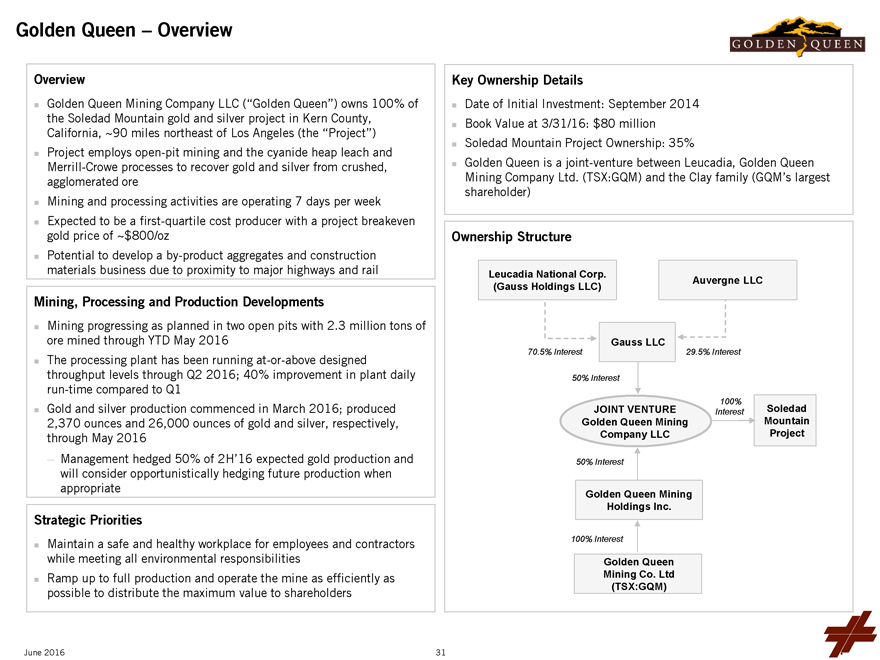

Golden Queen - Overview

Overview

Golden Queen Mining Company LLC (“Golden Queen”) owns 100%

of the Soledad Mountain gold and silver project in Kern County, California, ~90 miles northeast of Los Angeles (the “Project”)

Project employs open-pit

mining and the cyanide heap leach and Merrill-Crowe processes to recover gold and silver from crushed, agglomerated ore

Mining and processing activities are

operating 7 days per week

Expected to be a first-quartile cost producer with a project breakeven gold price of ~$800/oz

Potential to develop a by-product aggregates and construction materials business due to proximity to major highways and rail

Mining, Processing and Production Developments

Mining progressing as planned in two open pits

with 2.3 million tons of ore mined through YTD May 2016

The processing plant has been running at-or-above designed throughput levels through Q2 2016; 40%

improvement in plant daily run-time compared to Q1

Gold and silver production commenced in March 2016; produced 2,370 ounces and 26,000 ounces of gold and silver,

respectively, through May 2016

- Management hedged 50% of 2H’16 expected gold production and will consider opportunistically hedging future production when

appropriate

Strategic Priorities

Maintain a safe and healthy workplace for

employees and contractors while meeting all environmental responsibilities

Ramp up to full production and operate the mine as efficiently as possible to distribute

the maximum value to shareholders

Key Ownership Details

Date of Initial

Investment: September 2014

Book Value at 3/31/16: $80 million

Soledad

Mountain Project Ownership: 35%

Golden Queen is a joint-venture between Leucadia, Golden Queen Mining Company Ltd. (TSX:GQM) and the Clay family (GQM’s

largest shareholder)

Ownership Structure

Leucadia National Corp. (Gauss

Holdings LLC)

Auvergne LLC

Gauss LLC

70.5% Interest

29.5% Interest

50% Interest

JOINT VENTURE

Golden Queen Mining

Company LLC

100% Interest

Soledad Mountain Project

50% Interest

Golden Queen Mining Holdings Inc.

100% Interest

Golden Queen Mining Co. Ltd (TSX:GQM)

June 2016

31

Appendix

June 2016

32

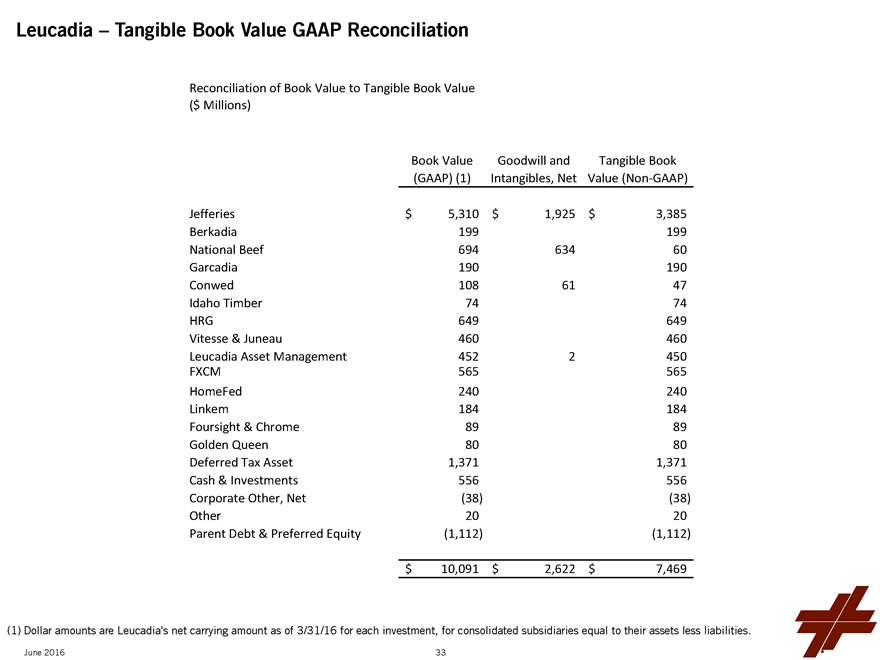

Leucadia - Tangible Book Value GAAP Reconciliation

Reconciliation of Book Value to Tangible Book Value

($ Millions)

Book Value (GAAP) (1)

Goodwill and Intangibles, Net

Tangible Book Value (Non-GAAP)

Jefferies $5,310 $1,925 $3,385

Berkadia 199 199

National Beef 694 634 60

Garcadia 190 190

Conwed 108 61 47

Idaho Timber 74 74

HRG 649 649

Vitesse & Juneau 460 460

Leucadia Asset Management 452 2 450

FXCM 565 565

HomeFed 240 240

Linkem 184 184

Foursight & Chrome 89 89

Golden Queen 80 80

Deferred Tax Asset 1,371 1,371

Cash & Investments 556 556

Corporate Other, Net (38) (38)

Other 20 20

Parent Debt & Preferred Equity (1,112) (1,112)

$10,091 $2,622 $7,469

(1) Dollar amounts are Leucadia’s net carrying amount as of 3/31/16

for each investment, for consolidated subsidiaries equal to their assets less liabilities.

June 2016

33

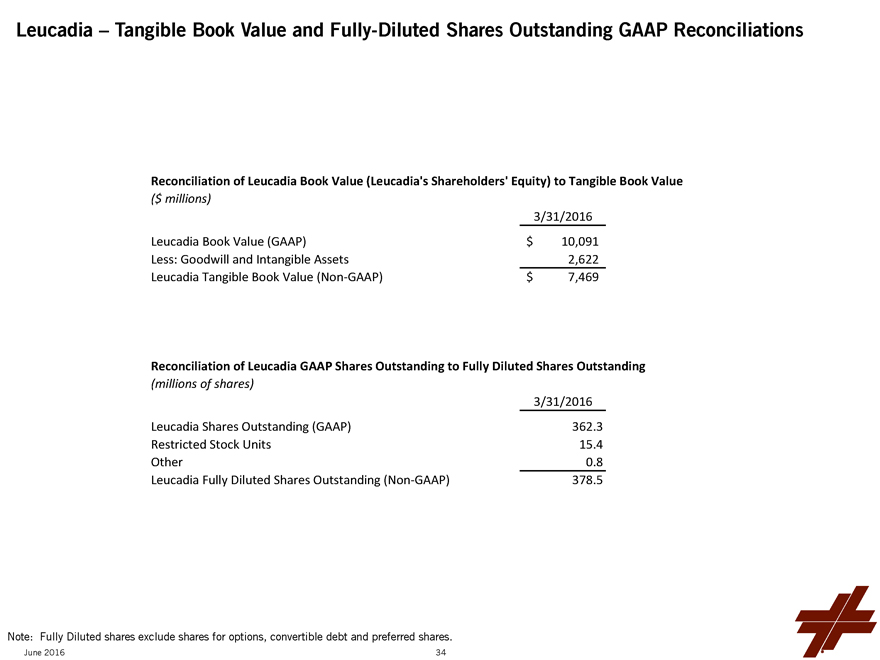

Leucadia - Tangible Book Value and Fully-Diluted Shares Outstanding GAAP Reconciliations

Reconciliation of Leucadia Book Value (Leucadia’s Shareholders’ Equity) to Tangible Book Value

($ millions)

3/31/2016

Leucadia Book Value (GAAP) $10,091

Less: Goodwill and Intangible Assets 2,622

Leucadia Tangible Book Value (Non-GAAP) $7,469

Reconciliation of Leucadia GAAP Shares

Outstanding to Fully Diluted Shares Outstanding

(millions of shares)

3/31/2016

Leucadia Shares Outstanding (GAAP) 362.3

Restricted Stock Units 15.4

Other 0.8

Leucadia Fully Diluted Shares Outstanding (Non-GAAP) 378.5

Note: Fully Diluted shares exclude

shares for options, convertible debt and preferred shares.

June 2016

34

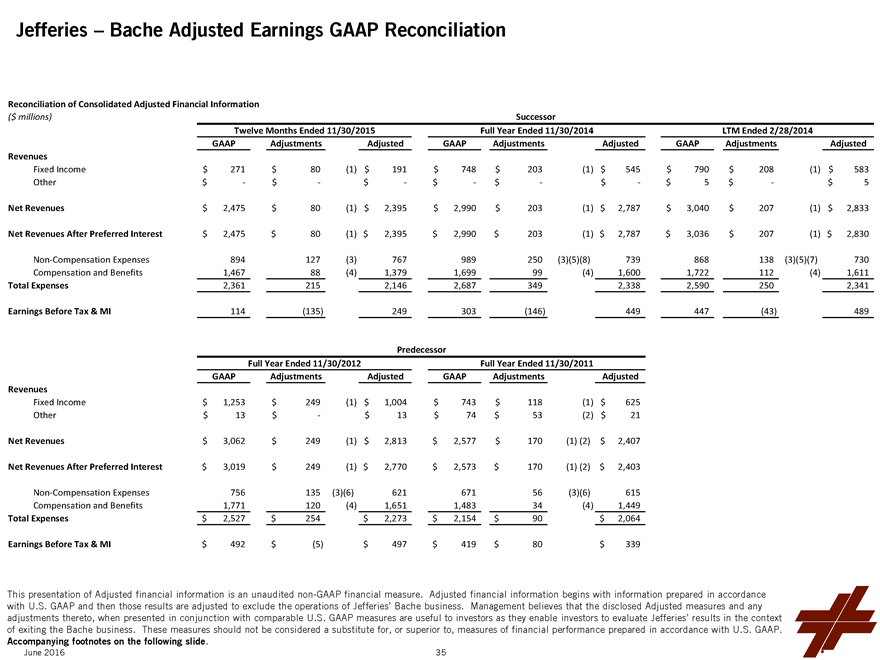

Jefferies - Bache Adjusted Earnings GAAP Reconciliation

Reconciliation of Consolidated Adjusted Financial Information

($ millions)

Successor

Twelve Months Ended 11/30/2015 Full Year Ended 11/30/2014 LTM Ended 2/28/2014

GAAP Adjustments Adjusted GAAP Adjustments Adjusted GAAP Adjustments Adjusted

Revenues

Fixed Income $ 271 $ 80 (1) $ 191 $ 748 $ 203 (1) $ 545 $ 790 $ 208

(1) $ 583

Other $ - $ - $ - $ - $ - $ - $ 5 $ - $ 5

Net Revenues $ 2,475 $ 80

(1) $ 2,395 $ 2,990 $ 203 (1) $ 2,787 $ 3,040 $ 207 (1) $ 2,833

Net Revenues After Preferred Interest $ 2,475 $ 80 (1) $ 2,395 $ 2,990 $ 203 (1) $ 2,787 $ 3,036 $

207 (1) $ 2,830

Non-Compensation Expenses 894 127 (3) 767 989 250 (3)(5)(8) 739 868 138 (3)(5)(7) 730

Compensation and Benefits 1,467 88 (4) 1,379 1,699 99 (4) 1,600 1,722 112 (4) 1,611

Total

Expenses 2,361 215 2,146 2,687 349 2,338 2,590 250 2,341

Earnings Before Tax & MI 114 (135) 249 303 (146) 449 447 (43) 489

Predecessor

Full Year Ended 11/30/2012 Full Year Ended 11/30/2011

GAAP Adjustments Adjusted GAAP Adjustments Adjusted Revenues

Fixed Income $ 1,253 $ 249 (1) $

1,004 $ 743 $ 118 (1) $ 625

Other $ 13 $ - $ 13 $ 74 $ 53 (2) $ 21

Net

Revenues $ 3,062 $ 249 (1) $ 2,813 $ 2,577 $ 170 (1)(2) $ 2,407

Net Revenues After Preferred Interest $ 3,019 $ 249 (1) $ 2,770 $ 2,573 $ 170 (1)(2) $ 2,403

Non-Compensation Expenses 756 135 (3)(6) 621 671 56 (3)(6) 615

Compensation

and Benefits 1,771 120 (4) 1,651 1,483 34 (4) 1,449

Total Expenses $ 2,527 $ 254 $ 2,273 $ 2,154 $ 90 $ 2,064

Earnings Before Tax & MI $ 492 $ (5) $ 497 $ 419 $ 80 $ 339

This presentation of Adjusted

financial information is an unaudited non-GAAP financial measure. Adjusted financial information begins with information prepared in accordance with U.S. GAAP and then those results are adjusted to exclude the operations of Jefferies’ Bache

business. Management believes that the disclosed Adjusted measures and any adjustments thereto, when presented in conjunction with comparable U.S. GAAP measures are useful to investors as they enable investors to evaluate Jefferies’ results in

the context of exiting the Bache business. These measures should not be considered a substitute for, or superior to, measures of financial performance prepared in accordance with U.S. GAAP.

Accompanying footnotes on the following slide.

June 2016 35

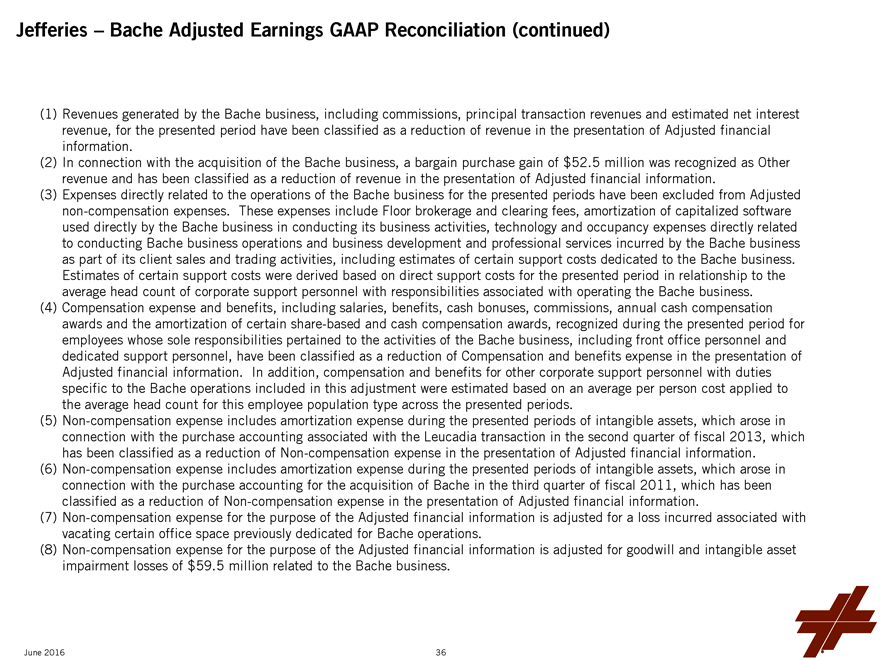

Jefferies - Bache Adjusted Earnings GAAP Reconciliation (continued)

(1) Revenues generated by the Bache business, including commissions, principal transaction revenues and estimated net interest revenue, for the presented period have been

classified as a reduction of revenue in the presentation of Adjusted financial information.

(2) In connection with the acquisition of the Bache business, a bargain

purchase gain of $52.5 million was recognized as Other revenue and has been classified as a reduction of revenue in the presentation of Adjusted financial information.

(3) Expenses directly related to the operations of the Bache business for the presented periods have been excluded from Adjusted non-compensation expenses. These expenses

include Floor brokerage and clearing fees, amortization of capitalized software used directly by the Bache business in conducting its business activities, technology and occupancy expenses directly related to conducting Bache business operations and

business development and professional services incurred by the Bache business as part of its client sales and trading activities, including estimates of certain support costs dedicated to the Bache business.

Estimates of certain support costs were derived based on direct support costs for the presented period in relationship to the average head count of corporate support personnel with

responsibilities associated with operating the Bache business.

(4) Compensation expense and benefits, including salaries, benefits, cash bonuses, commissions,

annual cash compensation awards and the amortization of certain share-based and cash compensation awards, recognized during the presented period for employees whose sole responsibilities pertained to the activities of the Bache business, including

front office personnel and dedicated support personnel, have been classified as a reduction of Compensation and benefits expense in the presentation of Adjusted financial information. In addition, compensation and benefits for other corporate

support personnel with duties specific to the Bache operations included in this adjustment were estimated based on an average per person cost applied to the average head count for this employee population type across the presented periods.

(5) Non-compensation expense includes amortization expense during the presented periods of intangible assets, which arose in connection with the purchase

accounting associated with the Leucadia transaction in the second quarter of fiscal 2013, which has been classified as a reduction of Non-compensation expense in the presentation of Adjusted financial information.

(6) Non-compensation expense includes amortization expense during the presented periods of intangible assets, which arose in connection with the purchase accounting for the

acquisition of Bache in the third quarter of fiscal 2011, which has been classified as a reduction of Non-compensation expense in the presentation of Adjusted financial information.

(7) Non-compensation expense for the purpose of the Adjusted financial information is adjusted for a loss incurred associated with vacating certain office space previously

dedicated for Bache operations.

(8) Non-compensation expense for the purpose of the Adjusted financial information is adjusted for goodwill and intangible asset

impairment losses of $59.5 million related to the Bache business.

June 2016

36

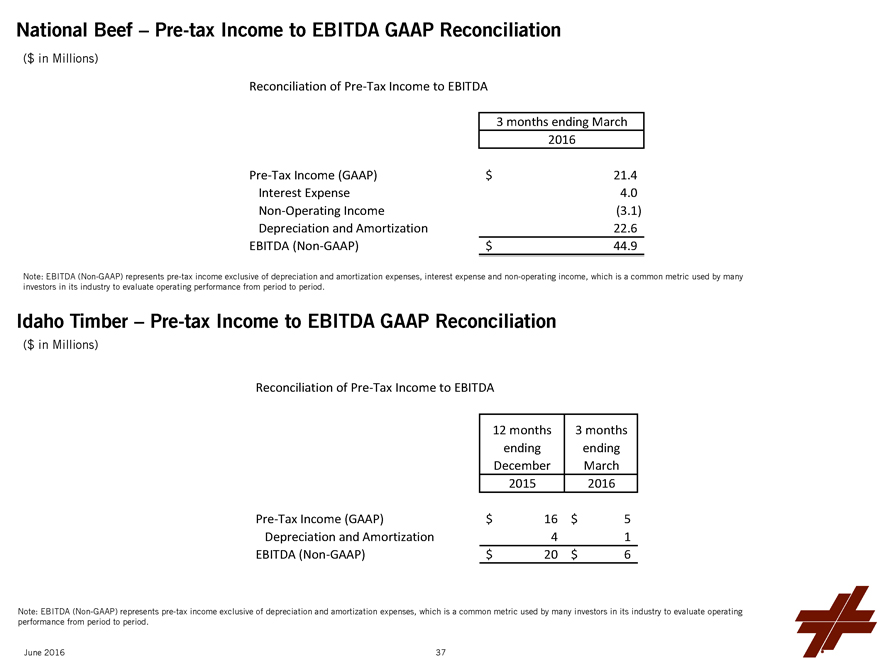

National Beef - Pre-tax Income to EBITDA GAAP Reconciliation

($ in Millions)

Reconciliation of Pre-Tax Income to EBITDA

3 months ending March

2016

Pre-Tax Income (GAAP) $21.4

Interest Expense 4.0

Non-Operating Income (3.1)

Depreciation and Amortization 22.6

EBITDA (Non-GAAP) $44.9

Note: EBITDA (Non-GAAP) represents pre-tax income exclusive of

depreciation and amortization expenses, interest expense and non-operating income, which is a common metric used by many investors in its industry to evaluate operating performance from period to period.

Idaho Timber - Pre-tax Income to EBITDA GAAP Reconciliation

($ in Millions)

Reconciliation of Pre-Tax Income to EBITDA

12 months ending December 2015

3 months ending March 2016

Pre-Tax Income (GAAP) $16 $5

Depreciation and Amortization 4 1

EBITDA (Non-GAAP) $20 $6

Note: EBITDA (Non-GAAP) represents pre-tax income exclusive of depreciation and amortization expenses, which is a common metric used by many investors in its industry to evaluate

operating performance from period to period.

June 2016

37