Attached files

| file | filename |

|---|---|

| 8-K - 8-K - Enviva Partners, LP | a16-14196_18k.htm |

Exhibit 99.1

Enviva Partners, LP John Keppler – Chairman and CEO 2016 J.P. Morgan Energy Equity Conference June 29, 2016

Forward-Looking Statements and Cautionary Statements Forward-Looking Statements This presentation contains “forward-looking statements” within the meaning of the securities laws. All statements, other than statements of historical fact, included in this presentation that address activities, events or developments that Enviva Partners, LP (NYSE: EVA) (“Enviva,” “we,” or “us”) expects, believes or anticipates will or may occur in the future are forward-looking statements. The words “believe,” “expect,” “may,” “estimates,” “will,” “anticipate,” “plan,” “intend,” “foresee,” “should,” “would,” “could,” or other similar expressions are intended to identify forward-looking statements, which are generally not historical in nature. However, the absence of these words does not mean that the statements are not forward-looking. These statements are based on certain assumptions made by Enviva based on management’s expectations and perception of historical trends, current conditions, anticipated future developments and other factors believed to be appropriate. Although Enviva believes that these assumptions were reasonable when made, because assumptions are inherently subject to significant uncertainties and contingencies that are difficult or impossible to predict and are beyond its control, Enviva cannot give assurance that it will achieve or accomplish these expectations, beliefs or intentions. A number of the assumptions on which these forward-looking statements are based are subject to risks and uncertainties, many of which are beyond the control of Enviva, and may cause actual results to differ materially from those implied or expressed by the forward-looking statements. These risks and uncertainties include the factors discussed or referenced in our filings with the Securities and Exchange Commission (the “SEC”), including the Annual Report on Form 10-K and the Quarterly Reports on Form 10-Q most recently filed with the SEC, including those risks relating to financial performance and results, economic conditions and resulting capital restraints, availability of sufficient capital to execute Enviva’s business plan, impact of compliance with legislation and regulations and other important factors that could cause actual results to differ materially from those projected. When considering the forward-looking statements, you should keep in mind the risk factors and other cautionary statements in such filings. You are cautioned not to place undue reliance on forward-looking statements, which speak only as of the date on which such statement is made, and Enviva undertakes no obligation to correct or update any forward-looking statement, whether as a result of new information, future events or otherwise, except as required by applicable law. All forward-looking statements attributable to Enviva are qualified in their entirety by this cautionary statement. Industry and Market Data This presentation has been prepared by Enviva and includes market data and other statistical information from third-party sources, including independent industry publications, government publications or other published independent sources. Although Enviva believes these third-party sources are reliable as of their respective dates, Enviva has not independently verified the accuracy or completeness of this information. Some data is also based on Enviva’s good faith estimates, which are derived from its review of internal sources as well as the third-party sources described above. 2

Company Highlights:High-Growth MLP • • • • Critical supply chain partner for major power generators worldwide More than 40% of renewable energy production in the EU is from solid biomass1 Forecast demand growing rapidly with 17% CAGR through 2020 Supply not adequate for demand with few providers of any scale • • • Six fully-contracted, strategically located production plants and a deep-water marine terminal Strong fiber baskets deliver low-cost, growing natural resource, and stable pricing Embedded low cost to-port logistics and favorable long-term fixed rate shipping contracts • • • Take-or-pay contracts with weighted average remaining term of 8.0 years2 Creditworthy utilities and large scale power generators Recently signed a new 800,000 MTPY 9.5-year contract to supply the Lynemouth project in the UK • • Increased distribution more than 10% to $0.51 per unit for the first quarter of 2016 Aggregate distributions for 2016 of at least $2.10 per unit expected (not including impact from potential drop-downs)3, a 27% increase over the annualized minimum quarterly distribution from our IPO Visible sponsor-held drop-down inventory of contracted assets, including 420K MTPY long-term contract Additional production assets expected as MGT and other contracts become firm and new contracts are executed • • • • • Management team led by industry founders and seasoned public company executives Demonstrated expertise acquiring, building, operating, and contracting / re-contracting platform assets Management rewarded for sustained growth in per-unit distributable cash flow (1) (2) (3) Eurostat – Energy Statistics – quantities (t_nrg_quant); 2014 solid biofuels (excluding charcoal); 2014 renewable energies As of June 1, 2016, not including the Partnership’s Langerlo contract or EVA-MGT contract, or the contract with DONG Energy with the Hancock JV. On May 5, 2016, provided guidance of aggregate distributions for 2016 of at least $2.10 per unit 3 Experienced Management Team Substantial Growth Opportunities Long-Term Off-take Contracts Advantaged Assets Compelling Industry Fundamentals World’s largest supplier of utility-grade wood pellets to major power generators with 2.3 million metric tons per year (“MTPY”) of contracted production capacity

Enviva Solves a Growing, Unmet Challenge for Generators Austerity challenges, desire to eliminate coal, grid stability issues, and sustainability requirements limit alternatives… …But existing coal assets can be quickly and cost-effectively converted to biomass Wood pellets provide low-cost, drop-in solution driving large demand Major industrial economies in the UK and EU are far short of binding, national-level 2020 renewable targets Market growing rapidly: demand forecasted at ~17% CAGR to 2020(4) Enviva is Only Enterprise Supplier 2020 Industrial Pellet Volumes (in millions MTPY) (3) 100% 30 North 0.1 America Asia 75% Wind ore 50% ind Europe ion 25% Nuclear 0% NL UK BEL FR GER % Short DK £0 £50 £100 £150 £200 % of Target (1) Eurostat News Release – February 10, 2016; Share of renewables in energy consumption in the EU rose further to 16% in 2014 (2) Aurora Energy Research – Comparing energy technologies (February 2016) with data from DECC Electricity Generation Costs (December 2013). Total Cost of Energy (TCOE) is the per-MWh cost of building and operating a generating plant over an assumed financial life including intermittency value, security of supply value, balancing costs, and transmission costs. Data is for the UK and may not be representative of all the markets in which we or our customers operate. (3) Hawkins Wright: The Outlook for Wood Pellets – Demand, Supply, Costs and Prices; First quarter 2016. Worldwide demand expectation assumes conversion of the Langerlo power facility in Genk, Belgium 4 Solar Offshore ss Onsh W Bioma Convers 5.5 Supply Gap 9.6 24 18 23.7 Identified Supply 19.7 12 6 0 Demand Supply 2020 61% 53% 38% 38% 23% 3% Total Cost of Energy (per MWh)(2) Progress To Binding 2020 Renewables Targets (1)

Familiar Midstream Activities Truck Pipeline Rail Vessel Processing Washing Fractionating BP Valero Wellhead Oil, Gas, NGL, Coal Refineries Generators Drax E.ON Engie Processing Drying Densifying Truck Rail Vessel Wood Fiber • • Enviva performs activities similar to other midstream MLPs Qualifying income generated by aggregating a natural resource, processing it into fuel at production facilities, transporting pellets to deep water marine storage terminals, and delivering ratably to utility customers No direct exposure to crude oil or natural gas prices • 5 RENEWABLE CONVENTIONAL GATHERING GATHERING STORAGE STORAGE DOWNSTREAM MIDSTREAM UPSTREAM

Our Product is the Low-Cost, Drop-In Solution for Coal All figures £/MWh Solar5 Offshore Wind Onshore Wind Nuclear Biomass Conversion Biomass increasingly perceived as the cost-effective, essential complement to other renewables 0.8 0.7 0.3 (1) Enviva (2) CME Group (3) Union Pacific (4) Aurora Energy Research – Comparing energy technologies (February 2016) with data from DECC Electricity Generation Costs (Decembe r 2013). LCOE (Levelized Cost of Electricity) is the per-megawatthour cost of building and operating a generating plant over an assumed financial life. Total Cost of Energy (TCOE) is LCOE plus intermittency value, security of s upply value, balancing costs, and transmission costs. Data is for the UK and may not be representative of all the markets in which we or our customers operate. (5) Large scale PV 6 Intermittency Value Adjustment Security of Supply Value Adjustment Balancing Costs Transmission Costs 4.5 1.3 2.8 17.9 7.6 0.9 9.0 3.8 1.7 (1.7) Net System Cost Delta26.514.18.90(1.1) LCOE12210115890108 TCOE14911516790107 Total Cost of Energy4 (TCOE) Wood Pellet vs. Coal Attributes Wood Pellets (1) NYMEX CAPP Coal (2) Southern PRB Coal (3) Median Heat Content (BTU/lb) 8,000 12,000 8,600 Moisture 4 – 10% < 10% 26 – 30% Ash 0 – 2% < 13.5% 4.6 – 5.7% Sulfur 0 – 0.15% < 1.0% < 1.0%

Assets at a Glance Bethesda, MD Southampton, VA – 510K Port of Chesapeake, VA – 90K Northampton, NC – 500K Ahoskie, NC – 370K Amory, MS – 110K Wiggins, MS – 110K Cottondale, FL – 700K Port of Panama City, FL – 32K Port of Mobile, AL – 45K+ Startup: 3rd Party Agreement Startup: November 2011 Startup: 3rd Party Agreement 7 Storage and Terminaling Assets Port of Mobile Location: Mobile, AL, Cooper Marine & Timberlands ChipCo Terminal Storage: Flex barge storage with 45K+ MT of capacity Port of Chesapeake Location: Chesapeake, VA, wholly owned by Enviva Storage: Dome storage with 90K MT of capacity Port of Panama City Location: Panama City, FL, Port Panama City Storage: Flat warehouse storage with 32K MT of capacity Plant - Enviva Partners, LP Port - Enviva Partners, LP Enviva Headquarters Current Production Plants Amory Location: Amory, MS Startup: August 2010 (acquired) Annual Production: 110K MTPY Wiggins Location: Wiggins, MS Startup: October 2010 (acquired) Annual Production: 110K MTPY Ahoskie Location: Ahoskie, NC Startup: November 2011 Annual Production: 370K MTPY Southampton Location: Southampton, VA Startup: October 2013 Annual Production: 510K MTPY Northampton Location: Northampton, NC Startup: April 2013 Annual Production: 500K MTPY Cottondale Location: Cottondale, FL Startup: May 2008 (acquired January 2015) Annual Production: 700K MTPY

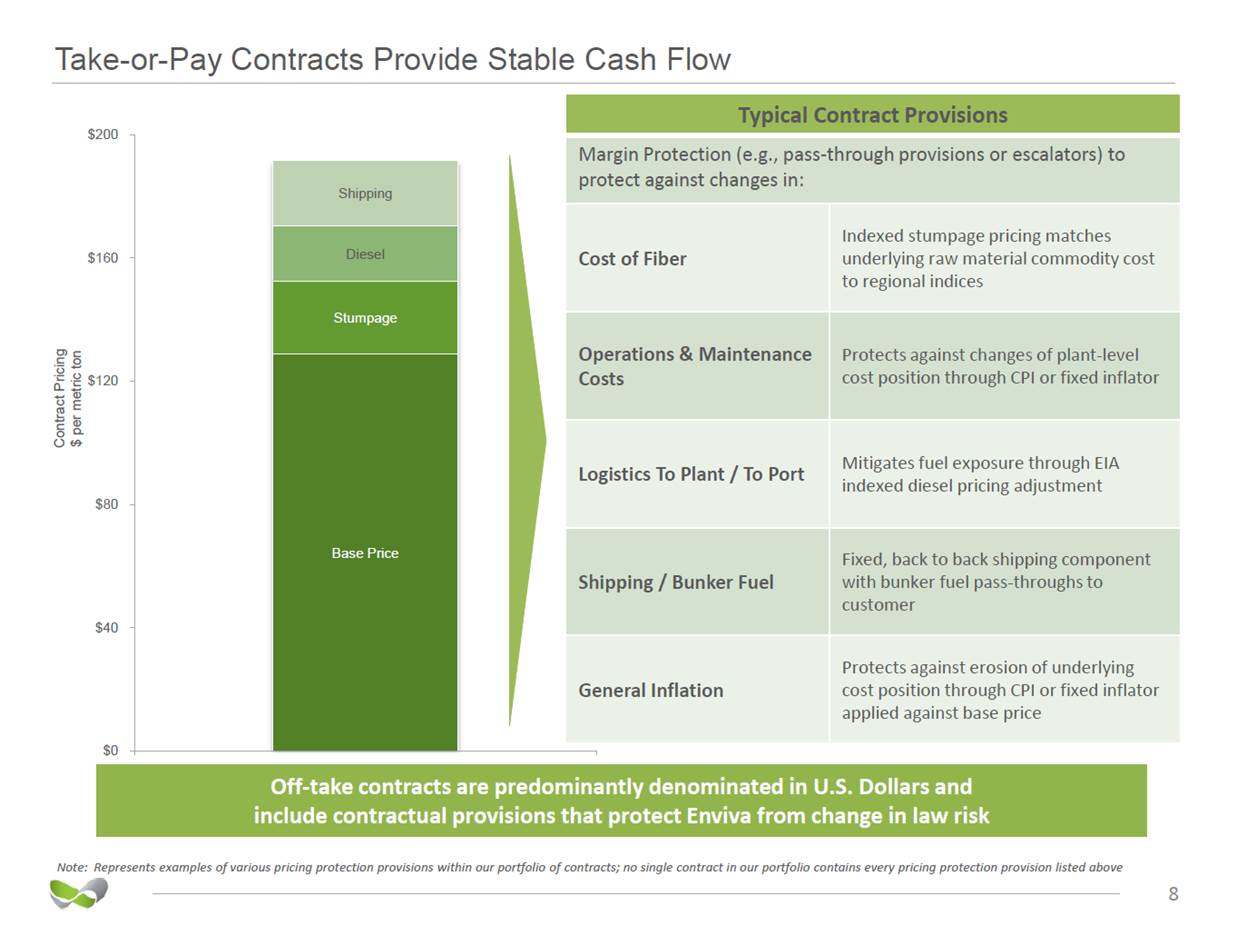

Take-or-Pay Contracts Provide Stable Cash Flow $200 $160 $120 indexed diesel pricing adjustment $80 $40 $0 Note: Represents examples of various pricing protection provisions within our portfolio of contracts; no single contract in our portfolio contains every pricing protection provision listed above 8 Contract Pricing $ per metric ton Off-take contracts are predominantly denominated in U.S. Dollars and include contractual provisions that protect Enviva from change in law risk Shipping Diesel Stumpage Base Price Typical Contract Provisions Margin Protection (e.g., pass-through provisions or escalators) to protect against changes in: Cost of Fiber Indexed stumpage pricing matches underlying raw material commodity cost to regional indices Operations & Maintenance Costs Protects against changes of plant-level cost position through CPI or fixed inflator Logistics To Plant / To Port Mitigates fuel exposure through EIA Shipping / Bunker Fuel Fixed, back to back shipping component with bunker fuel pass-throughs to customer General Inflation Protects against erosion of underlying cost position through CPI or fixed inflator applied against base price

Contracted Production Profile Partnership’s weighted average remaining term of off-take contracts is 8.0 years1 EVA Production Long-term Contracted Volumes Contracted volumes in the graph above do not include the Partnership’s Langerlo contract or EVA-MGT contract, or the contract with DONG Energy with the Hancock JV. (1) As of June 1, 2016, not including the Partnership’s Langerlo contract or EVA-MGT contract, or the contract with DONG Energy with the Hancock JV. (2) Production capacity of 2,310K MTPY as reported in Annual Report on Form 10-K for fiscal year ended December 31, 2015. Does not take into account opportunities the Partnership expects to have to increase production capacity 9 Organic increases in production capacity within our portfolio create additional sales opportunities 2,500 2,000 1,500 1,000 500 - 20162017201820192020 2 Sales strategy is to fully contract our production capacity under long-term agreements

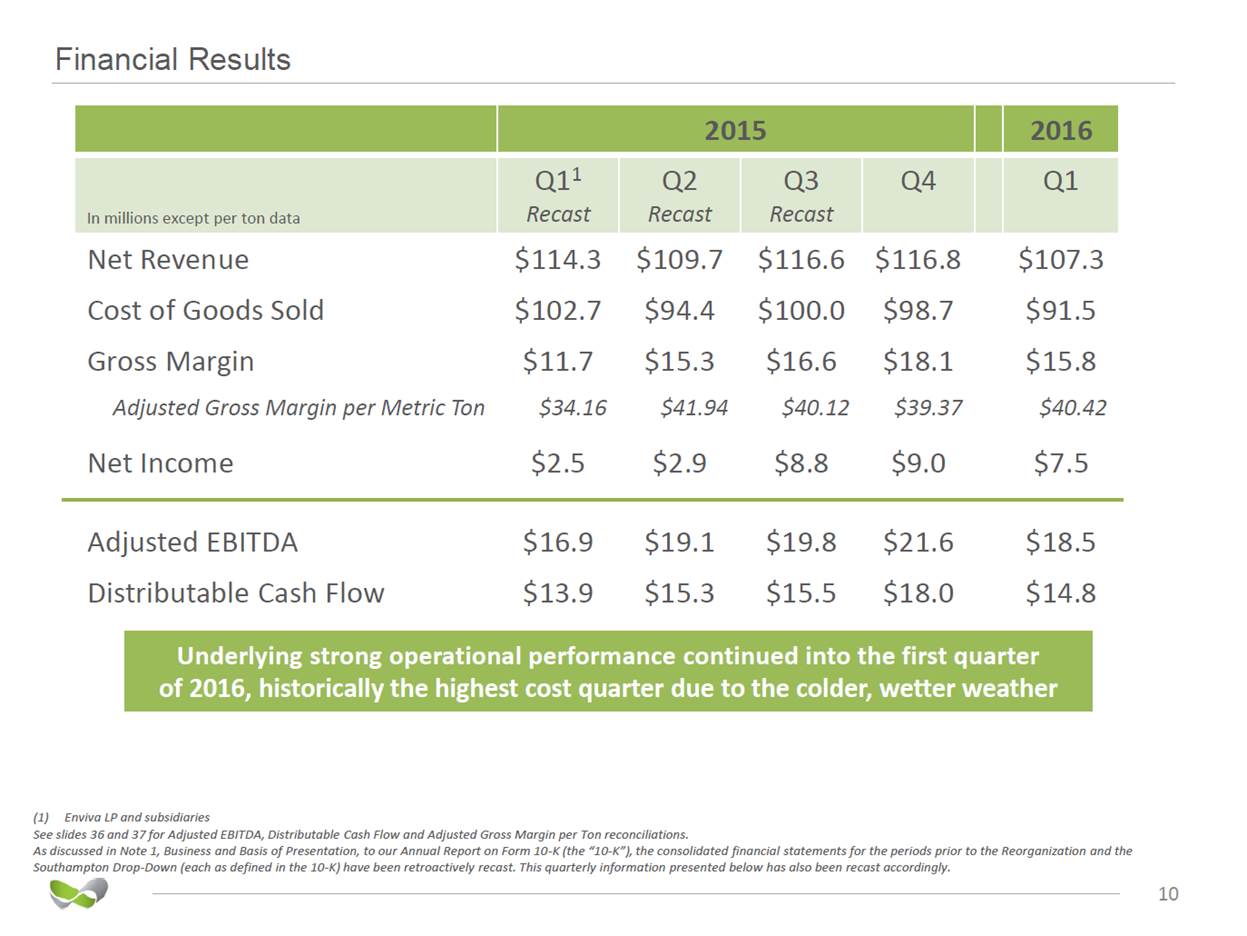

Financial Results (1) Enviva LP and subsidiaries See slides 36 and 37 for Adjusted EBITDA, Distributable Cash Flow and Adjusted Gross Margin per Ton reconciliations. As discussed in Note 1, Business and Basis of Presentation, to our Annual Report on Form 10-K (the “10-K”), the consolidated financial statements for the periods prior to the Reorganization and the Southampton Drop-Down (each as defined in the 10-K) have been retroactively recast. This quarterly information presented below has also been recast accordingly. 10 Underlying strong operational performance continued into the first quarter of 2016, historically the highest cost quarter due to the colder, wetter weather 2015 2016 In millions except per ton data Q11 Recast Q2 Recast Q3 Recast Q4 Q1 Net Revenue $114.3 $109.7 $116.6 $116.8 $107.3 Cost of Goods Sold $102.7 $94.4 $100.0 $98.7 $91.5 Gross Margin $11.7 $15.3 $16.6 $18.1 $15.8 Adjusted Gross Margin per Metric Ton $34.16 $41.94 $40.12 $39.37 $40.42 Net Income $2.5 $2.9 $8.8 $9.0 $7.5 Adjusted EBITDA $16.9 $19.1 $19.8 $21.6 $18.5 Distributable Cash Flow $13.9 $15.3 $15.5 $18.0 $14.8

2016 Outlook & Guidance (1) (2) (3) Based on number of common and subordinated units outstanding at the end of the first quarter of 2016 Prior to any distributions paid to our general partner Common and subordinated unit Guidance above was provided on May 5, 2016 See slide 38 for Adjusted EBITDA and Distributable Cash Flow reconciliations 11 Guidance above does not include impact of any potential acquisitions or drop-downs In millions except per unit figures 2016 Earnings per Unit1 $1.74 - $1.90 Net Income $43.0 - $47.0 Adjusted EBITDA $83.0 - $87.0 Maintenance Capex $4.1 Interest Expense $11.9 Distributable Cash Flow2 $67.0 - $71.0 Distributable Cash Flow per Unit1,2 $2.71 - $2.87 Distribution per Unit3 of at least $2.10

Multiple Growth Drivers (Subject to Five-Year ROFO) 12 Margin Expansion Optimizing Processes Fiber Mix Re-Contracting Acquisitions Contracted 3rd Party Plants Supply Chain New Contracts Robust Development Pipeline Uncontracted 3rd Party Plants Visible Drops Sampson Plant Wilmington Port Sponsor-Driven Growth MLP Growth

Sponsor Assets Contracted and Under Construction • Fully financed 515K MTPY “Build and Copy” replica of Northampton/Southampton plants Production will support new 10-year contract with DONG Energy commencing September 2016 Approximately $20 million estimated incremental Adjusted EBITDA1 • • Enviva Pellets Sampson (NC) Construction • Fully financed “Build and Copy” replica of Enviva Port of Chesapeake Port under construction, ~1 million MTPY throughput contracted with Sampson plant and 3rd party volumes Approximately $7 million estimated incremental Adjusted EBITDA1 • • Enviva Port of Wilmington (NC) Construction (1) For an explanation of why we are unable to reconcile these measures to the most directly comparable GAAP financial measur es, please see slide 39 13 Enviva Port of Wilmington (NC) Enviva Pellets Sampson (NC)

Visible Drops Provide Substantial Growth = + Growth ROFO Operational Assets (1) (2) (3) See reconciliation on slide 35 See reconciliation on slide 38. On May 5, 2016, provided adjusted EBITDA guidance for full-year 2016 in the range of $83 million to $87 million. For an explanation of why we are unable to reconcile these measures to the most directly comparable GAAP financial measures, please see slide 39 14 Fully Contracted and5 yearEBITDA Visible Adjusted EDITDA Growth 77.3, 83.0 - 87.0 20 7

Adjacent Markets Experiencing Rapid Demand Growth large, rapidly growing market Industrial Pellet Forecasted Demand1 Heating Pellet Forecasted Demand1 35,000 35,000 30,000 30,000 25,000 25,000 20,000 20,000 15,000 15,000 10,000 10,000 5,000 5,000 0 0 2015 2016 2018 2020 2015 2016 2018 2020 Europe Asia North America Europe Asia North America Other (1)Hawkins Wright: The Outlook for Wood Pellets – Demand, Supply, Costs and Prices; First quarter 2016. Industrial pellet demand expectation assumes conversion of the Langerlo power facility in Genk, Belgium North America industrial pellet demand was 100k tons in 2015 and forecasted to be 100k tons in each of 2016 -2020 15 Metric Tons in Thousands Metric Tons in Thousands Wood pellets are largely fungible across industrial and heating markets … but increasingly shipping to another Enviva primarily serves industrial market… CAGR: 17% CAGR: 5%

Growing Sponsor Development Pipeline • • • Significant opportunities to develop production facilities to serve growing European and Asian demand Sponsor signed an option and lease agreement for the right to build a pellet export terminal at the Port of Pascagoula Sponsor and John Hancock are contributing their rights to the Lucedale and Childersburg projects to their joint venture Wood Processing Pellet Plants Sampson, NC Capacity: 515K MT Hamlet, NC Capacity: 500K MT Laurens, SC Capacity: 500K MT Export Terminals Port of Wilmington, NC Childersburg, AL Capacity: 500K MT Shipping Abbeville, AL Capacity: 350K MT Lucedale, MS Capacity: 500K MT Import Terminals Port of St. Joe, FL Port of Jacksonville, FL Port of Pascagoula, MS Power Plants (1) Under Control assets are shown at estimated capacities and approximate locations. Sites Under Assessment assets are shown at approximate locations. 16 Fully-Financed & Under Construction Under Control Sites Under Assessment 2 - 3 million tons of additional export capacity to serve growing European and Asian markets Potential Industry Consolidation •Robust asset base across supply chain •Enviva has a proven track record of acquisitions •Complements existing development activity and enables entry to new geographies and markets M&A and Partnership Opportunities Across Value Chain Greenfield & Brownfield Development Pipeline (1)

Breaking the Fiber Logistics Barrier Unlocks North American Basis Differential Wood Chip Price (US$/Dry Ton) Sweden $135 Latvia1 $145 $151 Germany Japan $112 Southern US $63 Australia $138 Source: RISI World Timber Price Quarterly – April 2016 for fourth quarter of 2015 1. 2. Latvia price is CIF Sweden Sweden and Australia prices are as of second quarter of 2015 17 Like LNG liquefaction, pelleting can turn a stranded, cost advantaged natural resource into a globally traded commodity Annual Global Trade in Wood Products is Valued at over $250 billion

Market Size Growing Due to Application Diversity • Although the supply chain has been enabled by coal displacement and renewable heating applications, global availability of lost-cost fiber creates new markets Increasingly, customers are seeking to replace fossil fuel based hydrocarbons with bio-based hydrocarbons • Market Size Time 18 $/ton Increases Chemical / Polymer Cellulosic Manufactured Wood Products Heating Applications & CHP Coal Displacement & Power Generation

Enviva: A Compelling Story Compelling Industry Fundamentals Experienced Management Team Advantaged Assets Substantial Growth Opportunities Long-Term Off-take Contracts 19

Barge-to-Ship Loading at Enviva’s Operations in Mobile, AL Additional Materials

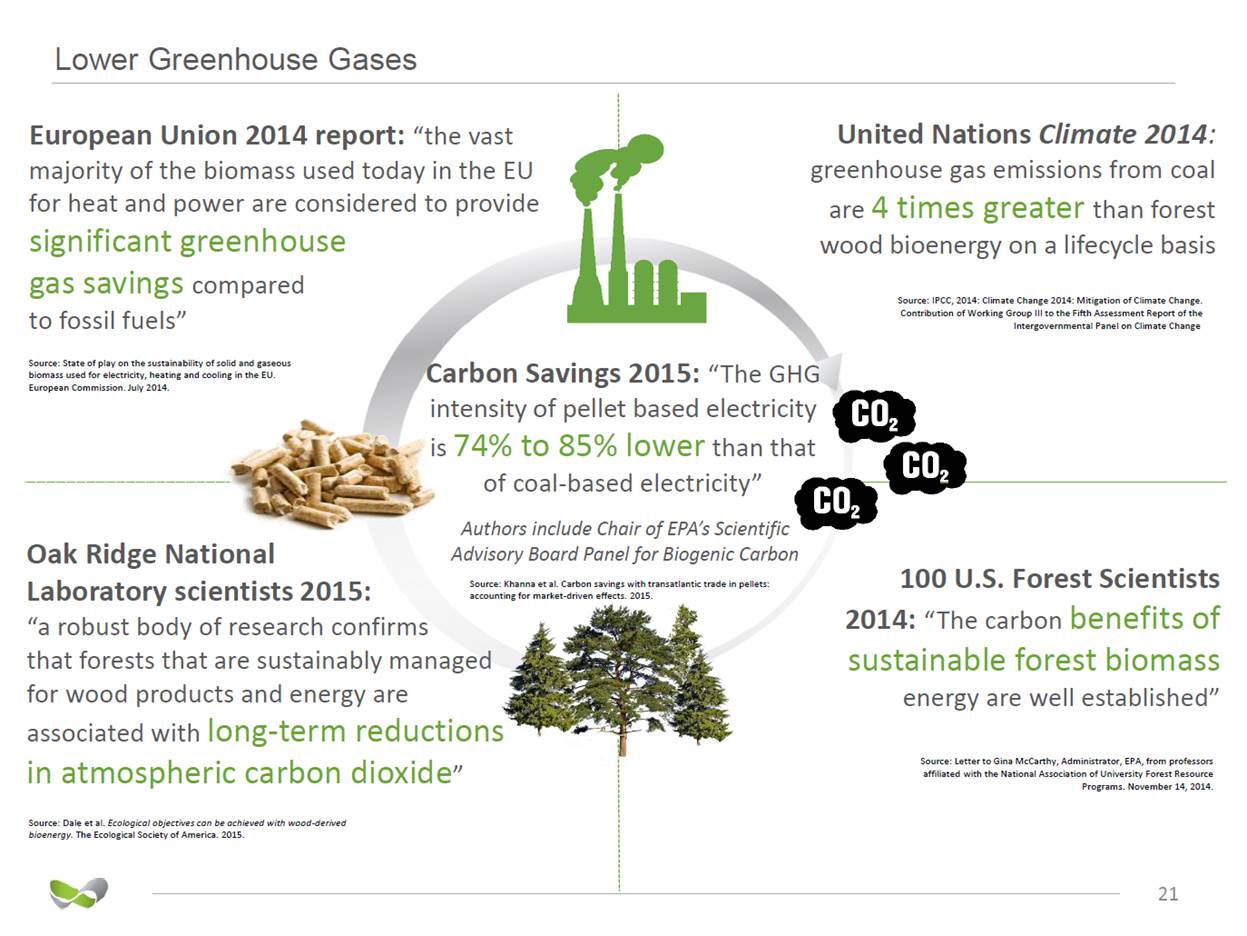

Lower Greenhouse Gases United Nations Climate 2014: greenhouse gas emissions from coal are 4 times greater than forest wood bioenergy on a lifecycle basis European Union 2014 report: “the vast majority of the biomass used today in the EU for heat and power are considered to provide significant greenhouse gas savings compared to fossil fuels” Source: IPCC, 2014: Climate Change 2014: Mitigation of Climate Change. Contribution of Working Group III to the Fifth Assessment Report of the Intergovernmental Panel on Climate Change Source: State of play on the sustainability of solid and gaseous biomass used for electricity, heating and cooling in the EU. European Commission. July 2014. Carbon Savings 2015: “The GHG intensity of pellet based electricity is 74% to 85% lower than that of coal-based electricity” Authors include Chair of EPA’s Scientific Advisory Board Panel for Biogenic Carbon Source: Khanna et al. Carbon savings with transatlantic trade in pellets: accounting for market-driven effects. 2015. Oak Ridge National Laboratory scientists 2015: 100 U.S. Forest Scientists 2014: “The carbon benefits of sustainable forest biomass energy are well established” “a robust body of research confirms that forests that are sustainably managed for wood products and energy are associated with long-term reductions in atmospheric carbon dioxide” Source: Dale et al. Ecological objectives can be achieved with wood-derived bioenergy. The Ecological Society of America. 2015. Source: Letter to Gina McCarthy, Administrator, EPA, from professors affiliated with the National Association of University Forest Resource Programs. November 14, 2014. 21 CO2 CO2 CO2

Our Activities Sustain Thriving, Healthy Forests the Enviva Forest Conservation Fund, a $5 million, 10-year program in Virginia and North Carolina. This program is sponsored by Enviva 1. 2. 3. Galik and Abt, Sustainability Guidelines and Forest Market Response: as assessment of European Union pellet demand in the Southeastern Unite d States. ECB Bioenergy. 2015. Modeled projection of forest response. U.S. Forest Service: U.S. Timber Productions, Trade, Consumption and Price Statistics 1965 – 2011 USDA - http://blogs.usda.gov/2015/06/08/study-finds-increasing-wood-pellet-demand-boosts-forest-growth-reduces-greenhouse-gas-emissions-creates-jobs/ 22 “Enviva is ensuring that North Carolina’s bottomland forests will be sustained and protected for generations to come” - The Honorable Pat McCrory, Governor of North Carolina, regarding designed to protect tens of thousands of acres of bottomland forests Holdings, LP. Independently Audited Certifications: “We show a substantial increase in the area of all forest types in the presence of increased pellet demand” - Duke University & NC State University1 U.S. pulpwood consumption has dropped 28% since 1988 and is at the same level as 1970 - U.S. Forest Service2 “An industry that can reduce greenhouse gas emissions, increase forest growth, and create jobs sounds too good to be true. But that is the reality of the emerging wood pellet market in the Southern U.S.”3 -USDA Acting Chief Economist Robert Johansson, 2015

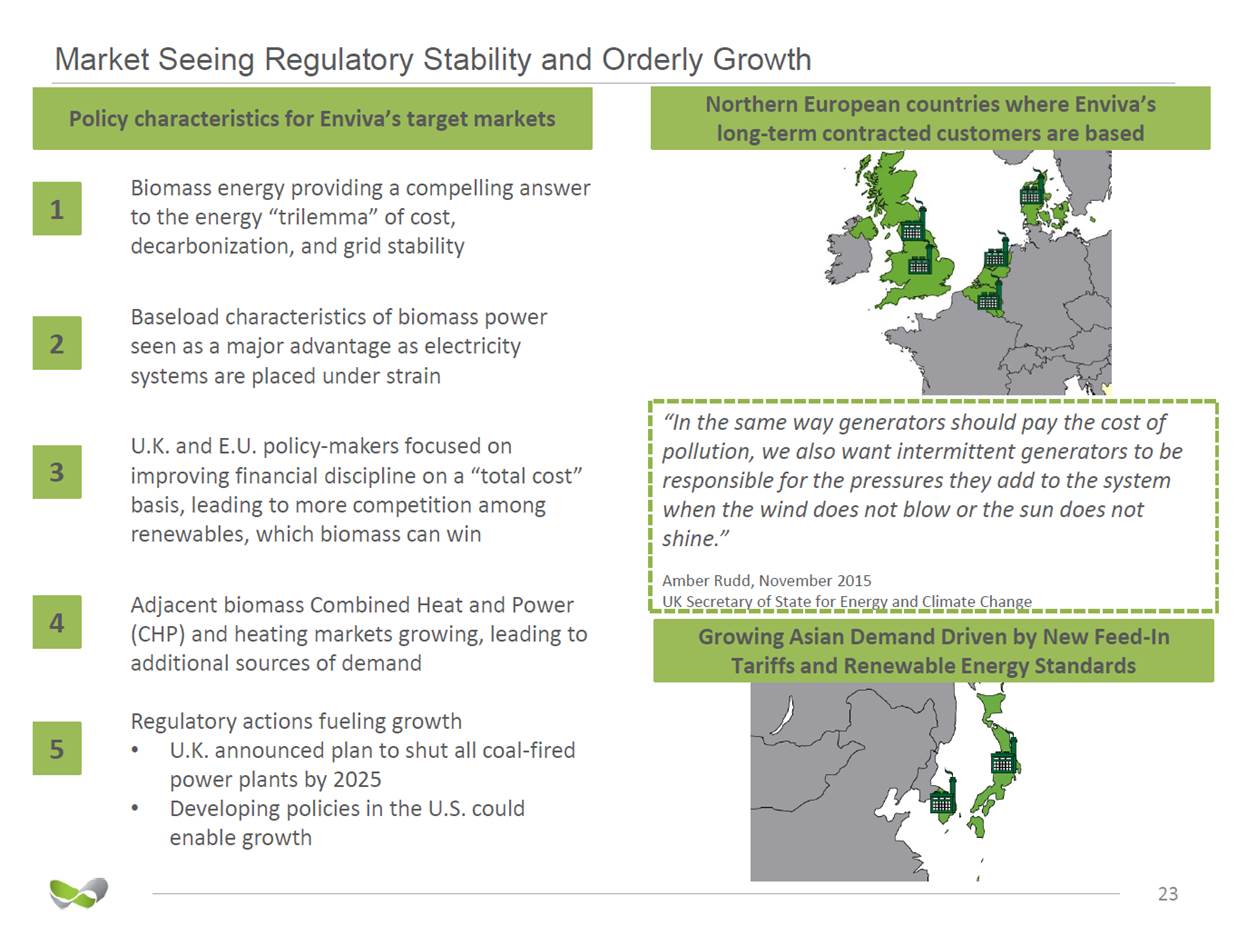

Market Seeing Regulatory Stability and Orderly Growth Biomass energy providing a compelling answer to the energy “trilemma” of cost, decarbonization, and grid stability Baseload characteristics of biomass power seen as a major advantage as electricity systems are placed under strain U.K. and E.U. policy-makers focused on improving financial discipline on a “total cost” basis, leading to more competition among renewables, which biomass can win Adjacent biomass Combined Heat and Power (CHP) and heating markets growing, leading to additional sources of demand Regulatory actions fueling growth • U.K. announced plan to shut all coal-fired power plants by 2025 Developing policies in the U.S. could enable growth • 23 5 Growing Asian Demand Driven by New Feed-In Tariffs and Renewable Energy Standards 4 3 “In the same way generators should pay the cost of pollution, we also want intermittent generators to be responsible for the pressures they add to the system when the wind does not blow or the sun does not shine.” Amber Rudd, November 2015 UK Secretary of State for Energy and Climate Change 2 1 Policy characteristics for Enviva’s target markets Northern European countries where Enviva’s long-term contracted customers are based

Brexit • “Brexit” not expected to impact the Partnership’s firm long-term off-take contracts – The primary mechanisms received by our customers in the UK to incentivize renewable power generation, the Contract for Difference (CfDs) and Renewable Obligation Certificates (ROCs), are based on UK law, not European Union regulations • The Partnership’s exposure to foreign currencies is limited: substantially all volumes from firm off-take contracts are denominated in U.S. Dollars – Only 160,000 MTPY (commencing in late 2017) of 2.3 million MTPY of production capacity is denominated in Pound Sterling • While long-term implications of “Brexit” on the UK economy are uncertain, the UK government has independently pushed towards decarbonization, regardless of European Union membership – UK renewable support mechanisms and policy on decarbonization are enshrined in UK law, including the Climate Change Act (2008) and Energy Act (2013) UK also announced plans to shut all coal-fired power plants by 2025 – • The nearly 1 million MTPY, 15-year off-take contract between the sponsor’s joint-venture and Macquarie-backed MGT facility in Teesside, UK contains a mix of Pound Sterling and U.S. Dollar-denominated volumes – The Partnership’s 375,000 MTPY contract with the sponsor’s joint venture to supply the MGT Teesside project in the UK is denominated in Pound Sterling Contract pricing reflected the assumed currency risks The contracts are expected to commence in 2019, ramping to full supply in 2021. Both contracts are subject to the MGT project reaching financial close – – 24

Supply Gap Created by Multiple Hurdles to Entry CAPITAL INVESTMENT REQUIRED IN: LIMITED SUPPLY CHAIN INFRASTRUCTURE Concentrated Customer Generation Set Fragmented Natural Resource Base Fiber Logistics Plant Ship Port Deep Process Capabilities Required Wood Aggregation Truck / Rail Loading Debarking & Chipping Size Reduction Wood Receiving & Storage Shipping Drying Port Storage Pelleting Commitment to Excellence in Safety, Sustainability & Reliability 25

Limited Competition • Pellet industry historically characterized by fragmented worldwide supply base Utility trade almost exclusively one-to-one agreements between standalone plants (Thousands of MTPY) Enviva (U.S.)* Pinnacle Pellet (Canada) German Pellets (U.S.) Drax Biomass (U.S.) Georgia Biomass (U.S.) FRAM Renewable Fuels (U.S.) Rentech (Canada) Pacific Bioenergy (Canada) Portucel (Navigator) (U.S.) Tanac (Brazil) Zilkha Biomass (U.S.) Westervelt (U.S.) • • Suppliers typically build smaller plants (100k MTPY or less) often with inexperienced sponsors • Enviva distinguishes itself with an industrial, enterprise-scale approach – Carefully assembled team of foresters, manufacturing experts, logisticians, and engineers Multi-plant profile allows for optimization Conservative balance sheet Multi-billion dollar financial investors experienced in energy and wood products sector 0 600 1,2001,800 2,400 3,000 – – – United States Canada Baltic States Europe Russia and East Europe Rest of the World 0 2,000 4,000 6,000 8,000 10,000 Current capacity Under construction or financed for completion by 2017 Source: Hawkins Wright: The Outlook for Wood Pellets – Demand, Supply, Costs and Prices; First quarter 2016 * Includes the Sampson plant (under construction) of Enviva Wilmington Holdings, LLC, a joint venture between a wholly-owned subsidiary of Enviva Holdings, LP (the “Sponsor”) and certain affiliates of John Hancock Life Insurance Company, but does not include other production plants being developed by the Sponsor or the joint venture. (1) Hawkins Wright supply and demand data. Assumption of $220/ton of installed capacity 26 $2.1 billion additional investment opportunity for experienced and well capitalized operator(1) Worldwide Industrial Pellet Producers and Regional Production

Advantaged Assets Port of Chesapeake, VA Southampton, VA Northampton, NC Ahoskie, NC Hardwood Roundwood Pine Roundwood Open / Farmland 1MM tons annual facility demand 475MM+ tons inventory 8MM+ tons net annual fiber excess (1) 65,000+ private landowners 1.4MM MT+ consolidated annual throughput ~75mi average distance to port Dedicated, Low-Cost, Haul to Wholly Owned Terminal $15 Stable Delivered Cost of Fiber (2) $50 $12 $40 $9 $30 Enviva’s 1.4MM Tons $6 $20 $3 $10 $-$0 '00 '01 '02 '03 '04 '05 '06 '07 '08 '09 '10 '11 '12 '13 '14 '15 250 500 750 1,0001,2501,5001,7502,000 MT/yr of Pellet Throughput 2,250 (1) FIA Data (2) Timber Mart-South-North Carolina 1991 – 2015 (3) Source: Enviva 27 $ / MT Port Costs North Carolina Pine Pulpwood 1991 - 2015 CAGR = 1.5% (2) North Carolina Hardwood Pulpwood 1991 - 2015 CAGR = 2.1% (2) Cost Advantage of Vertically Integrated Port (3) Operating Leverage of Northampton 7 mi. Robust Resource Availability Integrated Low-Cost Logistics

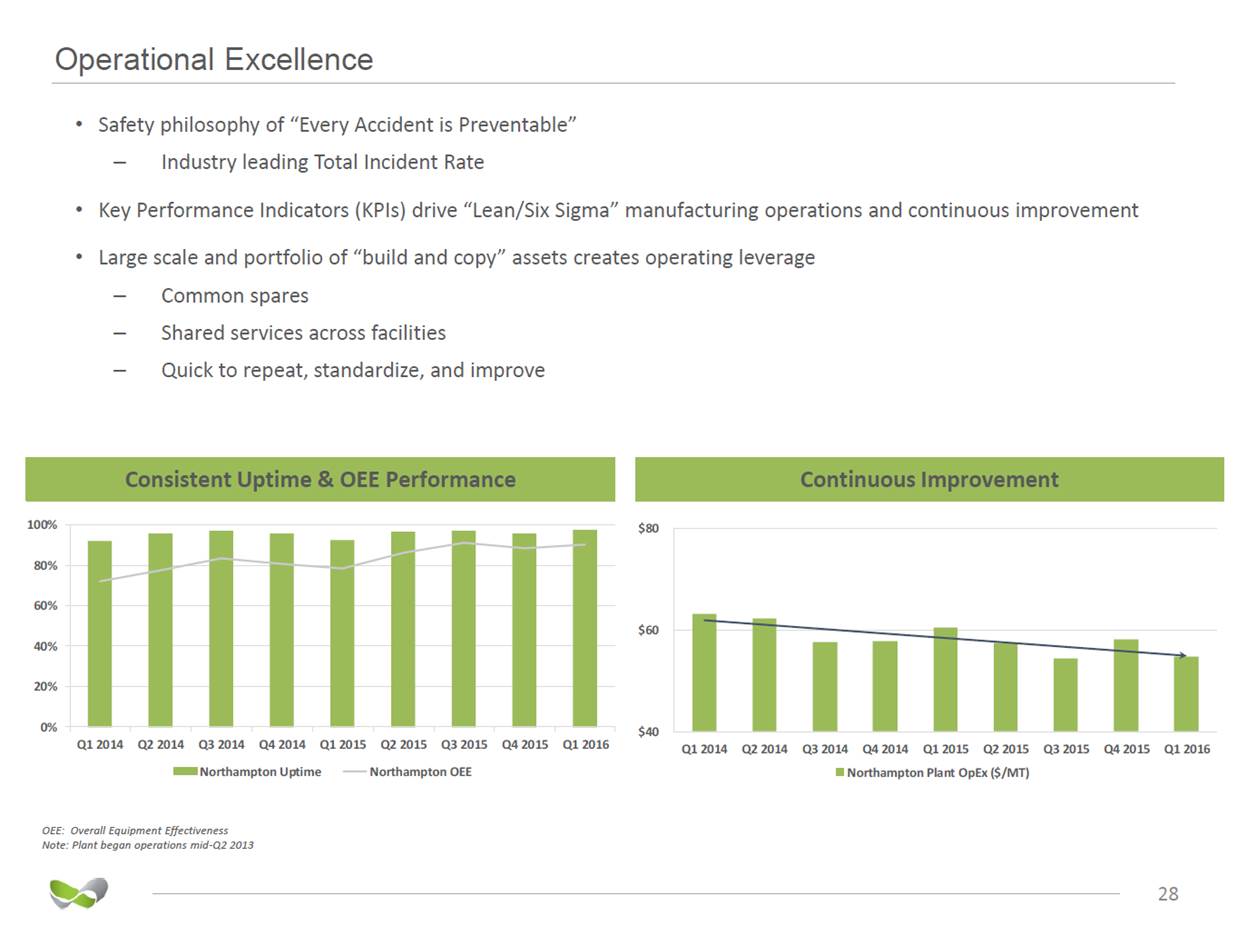

Operational Excellence • Safety philosophy of “Every Accident is Preventable” – Industry leading Total Incident Rate • Key Performance Indicators (KPIs) drive “Lean/Six Sigma” manufacturing operations and continuous improvement • Large scale and portfolio of “build and copy” assets creates operating leverage – – – Common spares Shared services across facilities Quick to repeat, standardize, and improve 100% $80 80% 60% $60 40% 20% 0% $40 Q1 2014 Q2 2014 Q3 2014 Q4 2014 Q1 2015 Q2 2015 Q3 2015 Q4 2015 Q1 2016 Q1 2014 Q2 2014 Q3 2014 Q4 2014 Q1 2015 Q2 2015 Q3 2015 Q4 2015 Q1 2016 Northampton Uptime Northampton OEE Northampton Plant OpEx ($/MT) OEE: Overall Equipment Effectiveness Note: Plant began operations mid-Q2 2013 28 Consistent Uptime & OEE Performance Continuous Improvement

Contract and Market Update • After successful conclusion of EU state-aid review process of its CfD, the purchaser of the 420 MW Lynemouth facility in the UK is expected to convert the facility to wood pellet fuel. The Partnership is contracted to provide 800 thousand metric tons per year to the facility commencing third quarter of 2017 continuing through the first quarter of 2027 Drax’s third 660 MW biomass unit, anticipated to require more than 2 million tons annually, is awaiting EU state-aid review of its CfD MGT Teesside project in the UK is expected to commence construction in Q2 2016. The Partnership and our sponsor are the sole suppliers of the nearly 1 million tons required annually of imported biomass, subject to MGT reaching financial close • • • In the Netherlands, the first of two rounds of applications in 2016 for the renewable incentive program commenced where utility scale, biomass co-firing projects were eligible and applied for the renewable incentive program. The budget for the program was substantially increased to 8.0 billion euros for 2016 from 3.5 billion euros in 2015. As part of the first application round in 2016, RWE’s Amer facility was awarded a subsidy to support co-firing biomass up to 50% of the facility. • South Korean demand expected to grow to 2.7 million tons a year in 20201 as the Renewable Portfolio Standard increases come into effect and several power generators consider new-build and full unit conversions to biomass Significant growth in Japanese wood pellet demand is expected to continue through 2030, when demand is expected to be about 10 million tons annually2 • (1) Hawkins Wright: The Outlook for Wood Pellets – Demand, Supply, Costs and Prices; First quarter 2016. 2020 worldwide demand expectation assumes the Langerlo facility conversion occurs (2) Argus Biomass Markets-Issue 16-015; April 13, 2016. Japanese biomass industry participant’s view. 29 Worldwide industrial wood pellet demand expected to grow to more than 29 million tons by 2020, a 17% annual growth rate1

Growth Supported by Committed Investors Invested • Principal owner of Enviva Holdings, LP Enviva Holdings, LP “Our Sponsor” Enviva Partners, LP NYSE: EVA capital with access for long-term and Sponsor Assets Development Finance, Construction, and Commissioning 30 Operations Attractive cost of to capital markets funding 5-year ROFO on JV Joint Venture •Separate entity that finances, develops, constructs, and commissions projects from Sponsor pipeline •Currently developing the “Wilmington Projects,” consisting of three 500,000 MTPY wood pellet production plants and a deep-water marine terminal in Wilmington, NC region •Sponsor can compel sale of assets to EVA if certain investment returns are achieved •Capital can be recycled for future growth Strong Development Engine & Customer Contract Pipeline • John Hancock is the US unit of ManuLife Financial and one of the world’s largest timberland investment managers • $11.4 billion and 6.3 million acres of timberlands under management $550 Million • $30 billion energy/power private investment firm to Date

Reg G Reconciliations

2015 Financial Information ENVIVA PARTNERS, LP AND SUBSIDIARIES CONSOLIDATED STATEMENTS OF INCOME (In thousands, except per unit amounts) 32 Year Ended December 31, 2015 2014 (Predecessor) Product sales $450,980 $286,641 Other revenue 6,394 3,495 Net revenue 457,374 290,136 Cost of goods sold, excluding depreciation and amortization 365,061 251,058 Depreciation and amortization 30,692 18,971 Total cost of goods sold 395,753 270,029 Gross margin 61,621 20,107 General and administrative expenses 18,360 10,792 Loss on disposal of assets 2,081 340 Income from operations 41,180 8,975 Other income (expense): Interest expense (10,551) (8,724) Related party interest expense (1,154) — Early retirement of debt obligation (4,699) (73) Other income 979 22 Total other expense, net (15,425) (8,775) Income before tax expense 25,755 200 Income tax (benefit) expense 2,623 15 Net income 23,132 185 Less net loss attributable to noncontrolling partners’ interests 42 79 Net income attributable to Enviva Partners, LP $23,174 $ 264 Less: Predecessor loss to May 4, 2015 (prior to IPO) $(2,132) $— Less: Pre-acquisition income from April 10, 2015 to December 10, 2015 from operations of Enviva Pellets Southampton Drop-Down allocated to General Partner 6,264 — Enviva Partners, LP partners’ interest in net income from May 5, 2015 to December 31, 2015 $19,042 $— Net income per common unit: Basic $ 0.80 — Diluted $ 0.79 — Net income per subordinated unit: Basic $ 0.80 — Diluted $ 0.79 — Weighted average number of limited partner units outstanding: Common – basic 11,988 — Common – diluted 12,258 — Subordinated – basic and diluted 11,905 — Distribution declared per limited partner unit for respective periods $1.1630 —

Q1 2016 Financial Information ENVIVA PARTNERS, LP AND SUBSIDIARIES CONDENSED CONSOLIDATED STATEMENTS OF INCOME (In thousands, except per unit amounts) (Unaudited) As discussed in Note 1, Business and Basis of Presentation, to our Annual Report on Form 10-K (the “10-K”), the consolidated financial statements for the periods prior to the Reorganization and the Southampton Drop-Down (each as defined in the 10-K) have been retroactively recast. This quarterly information presented below has also been recast accordingly 33 Three Months Ended March 31,2016 December 31,2015 September 30,2015 June 30,2015 March 31,2015 (Recast) (Recast) (Recast) Product sales $103,445 $115,123 $115,081 $107,195 $113,581 Other revenue 3,807 1,690 1,507 2,464 733 Net revenue 107,252 116,813 116,588 109,659 114,314 Cost of goods sold, excluding depreciation and amortization 84,616 92,049 92,437 86,175 94,400 Depreciation and amortization 6,881 6,640 7,568 8,225 8,259 Total cost of goods sold 91,497 98,689 100,005 94,400 102,659 Gross margin 15,755 18,124 16,583 15,259 11,655 General and administrative expenses 5,017 4,913 5,082 4,613 3,752 Loss (gain) on disposal of assets — 2,181 (128) 10 18 Income from operations 10,738 11,030 11,629 10,636 7,885 Other income (expense): Interest expense (3,181) (2,933) (2,910) (2,791) (1,917) Related party interest expense (209) (57) — (296) (801) Early retirement of debt obligation — — (4,699) Other income 131 889 75 4 11 Total other expense, net (3,259) (2,101) (2,835) (7,782) (2,707) Income before income tax (benefit) expense 7,479 8,929 8,794 2,854 5,178 Income tax (benefit) expense — (34) 1 (11) 2,667 Net income 7,479 8,963 8,793 2,865 2,511 Less net loss attributable to noncontrolling partners’ interests 15 12 14 8 8 Net income attributable to Enviva Partners, LP $7,494 $8,975 $8,807 $2,873 $2,519 Less: Predecessor (income) loss to May 4, 2015 (prior to IPO) $— $— $— $(4,651) $2,519 Less: Pre-acquisition income from April 10, 2015 to December 10, 2015 from operations of Enviva Pellets Southampton Drop-Down allocated to General Partner $— $2,030 $2,395 $1,839 $— Enviva Partners, LP partners’ interest in net income from May 5, 2015 to December 31, 2015 $7,494 $6,945 $6,412 $5,685 $— Net income per common unit: Basic $ 0.30 $0.29 $0.27 $0.24 — Diluted $ 0.29 $0.29 $0.27 $0.24 — Net income per subordinated unit: Basic $0.30 $0.29 $0.27 $0.24 — Diluted $ 0.29 $0.29 $0.27 $0.24 — Weighted average number of limited partner units outstanding: Common – basic 12,852 12,122 11,906 11,905 — Common – diluted 13,337 12,418 12,193 12,159 — Subordinated – basic and diluted 11,905 11,905 11,905 11,905 —

Non-GAAP Financial Measures Non-GAAP Financial Measures We view adjusted gross margin per metric ton, adjusted EBITDA, and distributable cash flow as important indicators of performance. Adjusted Gross Margin per Metric Ton We define adjusted gross margin per metric ton as gross margin per metric ton excluding depreciation and amortization included in cost of goods sold. We believe adjusted gross margin per metric ton is a meaningful measure because it compares our off-take pricing to our operating costs for a view of profitability and performance on a per metric ton basis. Adjusted gross margin per metric ton primarily will be affected by our ability to meet targeted production volumes and to control direct and indirect costs associated with procurement and delivery of wood fiber to our production plants and the production and distribution of wood pellets. Adjusted EBITDA We define adjusted EBITDA as net income or loss, excluding depreciation and amortization, interest expense, taxes, early retirement of debt obligation, non-cash unit compensation expense, asset impairments and disposals, and certain items of income or loss that we characterize as unrepresentative of our operations. Adjusted EBITDA is a supplemental measure used by our management and other users of our financial statements, such as investors, commercial banks, and research analysts, to assess the financial performance of our assets without regard to financing methods or capital structure. Distributable Cash Flow We define distributable cash flow as adjusted EBITDA less maintenance capital expenditures and interest expense net of amortization of debt issuance costs and original issue discount. We use distributable cash flow as a performance metric to compare cash generating performance of the Partnership from period to period and to compare the cash generating performance for specific periods to the cash distributions (if any) that are expected to be paid to our unitholders. Distributable cash flow has limitations as an analytical tool because it will not reflect changes in working capital balances. Adjusted gross margin per metric ton, adjusted EBITDA, and distributable cash flow are not financial measures presented in accordance with generally accepted accounting principles (“GAAP”). We believe that the presentation of these non-GAAP financial measures provides useful information to investors in assessing our financial condition and results of operations. Our non-GAAP financial measures should not be considered as alternatives to the most directly comparable GAAP financial measures. Each of these non-GAAP financial measures has important limitations as an analytical tool because it excludes some, but not all, items that affect the most directly comparable GAAP financial measure. You should not consider adjusted gross margin per metric ton, adjusted EBITDA, or distributable cash flow in isolation or as substitutes for analysis of our results as reported under GAAP. Our definitions of these non-GAAP financial measures may not be comparable to similarly titled measures of other companies, thereby diminishing their utility. 34

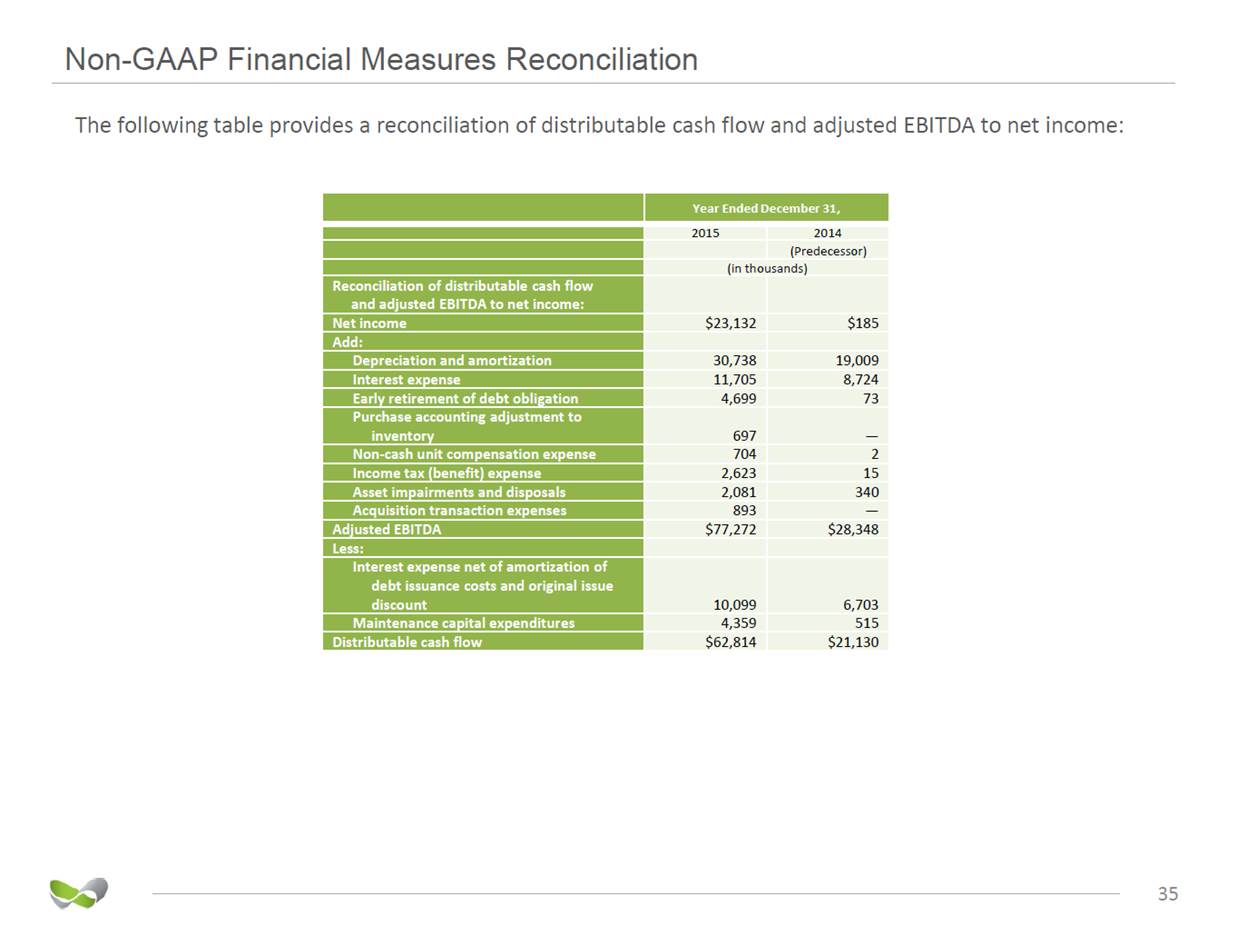

Non-GAAP Financial Measures Reconciliation The following table provides a reconciliation of distributable cash flow and adjusted EBITDA to net income: 35 Year Ended December 31, 2015 2014 (Predecessor) (in thousands) Reconciliation of distributable cash flow and adjusted EBITDA to net income: Net income $23,132 $185 Add: Depreciation and amortization 30,738 19,009 Interest expense 11,705 8,724 Early retirement of debt obligation 4,699 73 Purchase accounting adjustment to inventory 697 — Non-cash unit compensation expense 704 2 Income tax (benefit) expense 2,623 15 Asset impairments and disposals 2,081 340 Acquisition transaction expenses 893 — Adjusted EBITDA $77,272 $28,348 Less: Interest expense net of amortization of debt issuance costs and original issue discount 10,099 6,703 Maintenance capital expenditures 4,359 515 Distributable cash flow $62,814 $21,130

Non-GAAP Financial Measures Reconciliation (Cont.) The following table provides a reconciliation of distributable cash flow and adjusted EBITDA to net income: As discussed in Note 1, Business and Basis of Presentation, to our Annual Report on Form 10-K (the “10-K”), the consolidated financial statements for the periods prior to the Reorganization and the Southampton Drop-Down (each as defined in the 10-K) have been retroactively recast. This quarterly information presented below has also been recast accordingly 36 Three Months Ended March 31,2016 December 31,2015 September 30,2015 June 30,2015 March 31,2015 (Recast) (Recast) (Recast) (in thousands) Reconciliation of distributable cash flow and adjusted EBITDA to net income: Net income $7,479 $8,963 $8,793 $2,865 $2,511 Add: Depreciation and amortization 6,893 6,652 7,579 8,237 8,270 Interest expense 3,390 2,990 2,910 3,087 2,718 Early retirement of debt obligation — — — 4,699 — Purchase accounting adjustment to inventory — — — — 697 Non-cash unit compensation expense 681 341 180 183 — Income tax (benefit) expense — (34) 1 (11) 2,667 Asset impairments and disposals 1 2,181 (128) 10 18 Acquisition transaction expenses 53 461 432 — — Adjusted EBITDA $18,497 $21,554 $19,767 $19,070 $16,881 Less: Interest expense net of amortization of debt issuance costs and original issue discount 2,944 2,614 2,553 2,719 2,213 Maintenance capital expenditures 551 893 1,724 1,017 725 Distributable cash flow attributable to Enviva Partners, LP $15,002 $18,047 $15,490 $15,334 $13,943 Less: Distributable cash flow attributable to incentive distribution rights 156 — — — — Distributable cash flow attributable to Enviva Partners, LP limited partners $14,846 $18,047 $15,490 $15,334 $13,943

Non-GAAP Financial Measures Reconciliation (Cont.) The following table provides a reconciliation of adjusted gross margin per metric ton: As discussed in Note 1, Business and Basis of Presentation, to our Annual Report on Form 10-K (the “10-K”), the consolidated financial statements for the periods prior to the Reorganization and the Southampton Drop-Down (each as defined in the 10-K) have been retroactively recast. This quarterly information presented below has also been recast accordingly 37 Three Months Ended March 31,2016 December 31,2015 September 30,2015 June 30,2015 March 31,2015 (Recast) (Recast) (Recast) (in thousands, except per metric ton) Reconciliation of gross margin to adjusted gross margin per metric ton: Metric tons sold 560 629 602 560 583 Gross Margin $15,755 $18,124 $16,583 $15,259 $11,655 Depreciation and amortization 6,881 6,640 7,568 8,225 8,259 Adjusted gross margin $22,636 $24,764 $24,151 $23,484 $19,914 Adjusted gross margin per metric ton $40.42 $39.37 $40.12 $41.94 $34.16

Non-GAAP Financial Measures Reconciliation (Cont.) The following table provides a reconciliation of the estimated range of distributable cash flow and adjusted EBITDA to the estimated range of net income, in each case for the twelve months ending December 31, 2016 (in millions except per unit figures). Guidance provided May 5, 2016: (1) Based on number of common and subordinated units outstanding at the end of the first quarter of 2016 (2) Prior to any distributions paid to our general partner 38 Twelve Months Ending December 31, 2016 Estimated net income (loss) per common and subordinated unit1 $1.74 – 1.90 Estimated net income (loss) $43.0 – 47.0 Add: Depreciation and amortization 25.4 Interest expense 13.0 Non-cash unit compensation expense 1.2 Asset impairments and disposals 0.4 Estimated adjusted EBITDA $83.0 – 87.0 Less: Interest expense net of amortization of debt issuance costs and original issue discount 11.9 Maintenance capital expenditures 4.1 Estimated distributable cash flow2 $67.0 – 71.0 Estimated distributable cash flow per common and subordinated unit1,2 $2.71 – 2.87

Non-GAAP Financial Measures Reconciliation (Cont.) Our sponsor’s estimates of incremental adjusted EBITDA for each of the Sampson plant and the Wilmington terminal are based on numerous assumptions that are subject to significant risks and uncertainties. The assumptions underlying our sponsor’s estimates of incremental adjusted EBITDA generated by certain of its assets are inherently uncertain and subject to significant business, economic, financial, regulatory, and competitive risks and uncertainties that could cause actual results and amounts to differ materially from those estimates. For more information about such significant risks and uncertainties, please see the risk factors discussed or referenced in our filings with the Securities and Exchange Commission (the “SEC”), including the Annual Report on Form 10-K and the Quarterly Reports on Form 10-Q most recently filed with the SEC. A reconciliation of estimated incremental adjusted EBITDA to GAAP net income is not provided because forward-looking GAAP net income generated by each of the Sampson plant and the Wilmington terminal is not accessible and reconciling information is not available without unreasonable effort. The amount of interest expense with respect to the Sampson plant and the Wilmington terminal, in each case, is not accessible or estimable at this time. The amount of actual interest expense, as the case may be, incurred could be significant, such that the actual amount of net income generated by each of the Sampson plant and Wilmington terminal could vary substantially from the respective amounts of estimated incremental adjusted EBITDA. 39

enviva Contact: Ray Kaszuba Vice President and Treasurer +1240-482-3856 ir@envivapartners.com