Attached files

| file | filename |

|---|---|

| EX-99.1 - EX-99.1 - People's United Financial, Inc. | d388076dex991.htm |

| 8-K - FORM 8-K - People's United Financial, Inc. | d388076d8k.htm |

| Exhibit 99.2

|

Acquisition of Suffolk Bancorp

June 27, 2016

|

|

Forward-Looking Statements

This communication contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995 including, but not limited to, People’s United’s and Suffolk’s expectations or predictions of future financial or business performance or conditions. Forward-looking statements are typically identified by words such as

“believe,” “expect,” “anticipate,” “intend,” “target,” “estimate,” “continue,” “positions,” “plan,” “predict,” “project,” “forecast,” “guidance,” “goal,” “objective,” “prospects,” “possible” or “potential,” by future conditional verbs such as

“assume,” “will,” “would,” “should,” “could” or “may”, or by variations of such words or by similar expressions. These forward-looking statements are subject to numerous assumptions, risks and uncertainties, which change over time, are difficult to predict and are generally beyond the control of either company. Forward-looking statements speak only as of the date they are made and we assume no duty to update forward-looking statements. Actual results may differ materially from current projections.

In addition to factors previously disclosed in People’s United’s and Suffolk’s reports filed with the SEC and those identified elsewhere in this communication, the following factors, among others, could cause actual results to differ materially from forward-looking statements or historical performance: ability to obtain regulatory approvals and meet other closing conditions to the merger, including approval by Suffolk shareholders on the expected terms and schedule, and including the risk that regulatory approvals required for the merger are not obtained or are obtained subject to conditions that are not anticipated; delay in closing the merger; difficulties and delays in integrating the Suffolk business or fully realizing cost savings and other benefits; business disruption following the merger; changes in asset quality and credit risk; the inability to sustain revenue and earnings growth; changes in interest rates and capital markets; inflation; customer acceptance of People’s United’s products and services; customer borrowing, repayment, investment and deposit practices; customer disintermediation; the introduction, withdrawal, success and timing of business initiatives; competitive conditions; the inability to realize cost savings or revenues or to implement integration plans and other consequences associated with mergers, acquisitions and divestitures; economic conditions; the impact, extent and timing of technological changes; capital management activities; litigation; increased capital requirements, other regulatory requirements or enhanced regulatory supervision; and other actions of the Federal Reserve Board and legislative and regulatory actions and reforms.

Annualized, pro forma, projected and estimated numbers are used for illustrative purpose only, are not forecasts and may not reflect actual results.

1

|

|

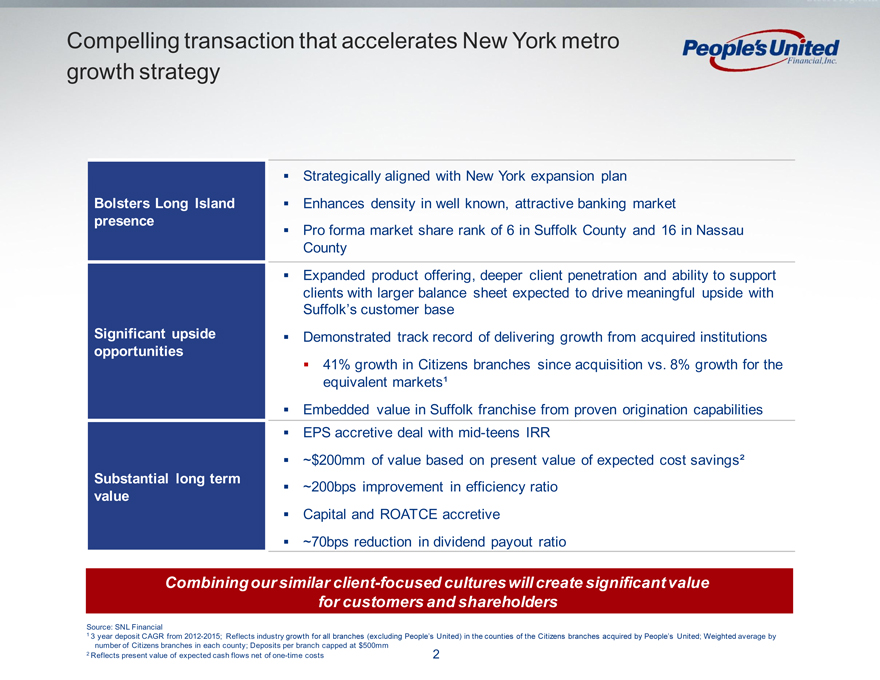

Compelling transaction that accelerates New York metro growth strategy

Strategically aligned with New York expansion plan

Bolsters Long Island Enhances density in well known, attractive banking market

presence

Pro forma market share rank of 6 in Suffolk County and 16 in Nassau

County

Expanded product offering, deeper client penetration and ability to support

clients with larger balance sheet expected to drive meaningful upside with

Suffolk’s customer base

Significant upside Demonstrated track record of delivering growth from acquired institutions

opportunities

41% growth in Citizens branches since acquisition vs. 8% growth for the

equivalent markets¹

Embedded value in Suffolk franchise from proven origination capabilities

EPS accretive deal with mid-teens IRR

~$200mm of value based on present value of expected cost savings²

Substantial long term ~200bps improvement in efficiency ratio

value

Capital and ROATCE accretive

~70bps reduction in dividend payout ratio

Combining our similar client-focused cultures will create significant value

for customers and shareholders

Source: SNL Financial

1 3 year deposit CAGR from 2012-2015; Reflects industry growth for all branches (excluding People’s United) in the counties of the Citizens branches acquired by People’s United; Weighted average by

number of Citizens branches in each county; Deposits per branch capped at $500mm

2 Reflects present value of expected cash flows net of one-time costs

2

|

|

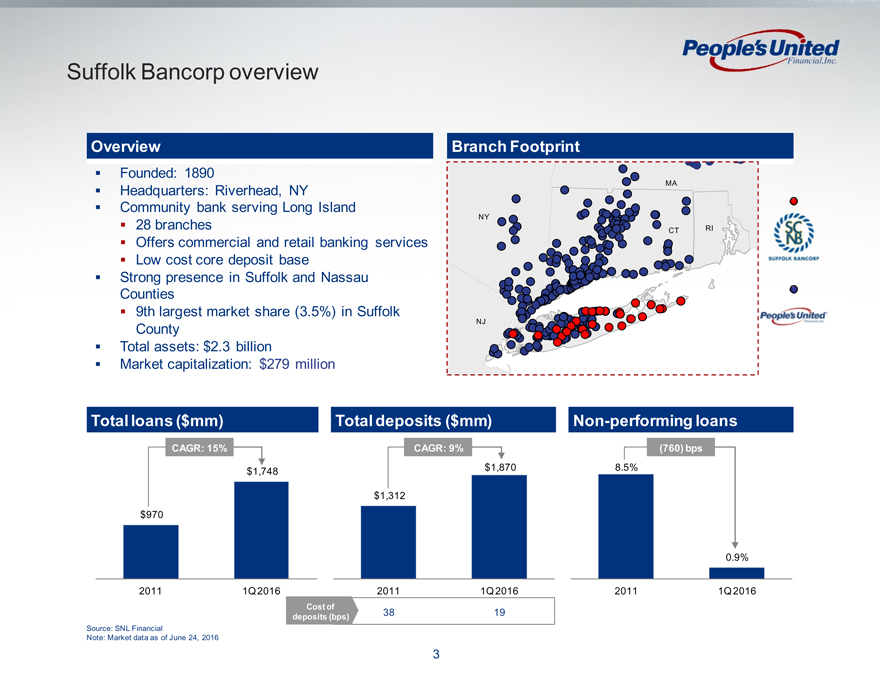

Suffolk Bancorp overview

Overview Branch Footprint

Founded: 1890

MAs

Headquarters: Riverhead, NY

Community bank serving Long Island

NY

28 branches CT RI

Offers commercial and retail banking services

Low cost core deposit base

Strong presence in Suffolk and Nassau

Counties

9th largest market share (3.5%) in Suffolk

NJ

County

Total assets: $2.3 billion

Market capitalization: $279 million

Total loans ($mm) Total deposits ($mm) Non-performing loans

CAGR: 15% CAGR: 9% (760) bps

$1,748 $1,870 8.5%

$1,312

$970

0.9%

2011 1Q 2016 2011 1Q 2016 2011 1Q 2016

Cost of

deposits (bps) 38 19

Source: SNL Financial

Note: Market data as of June 24, 2016

3

|

|

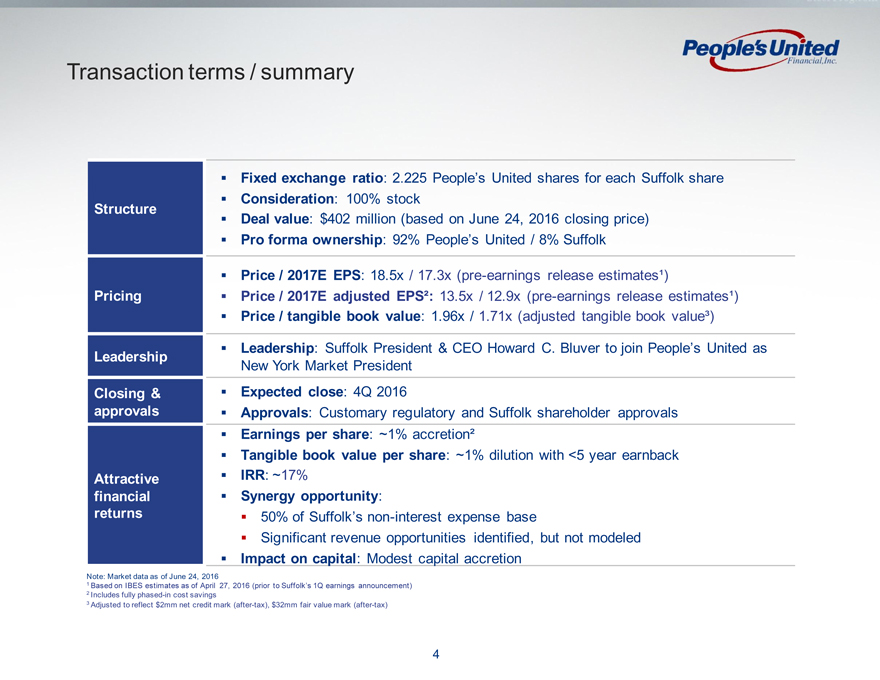

Transaction terms / summary

Fixed exchange ratio: 2.225 People’s United shares for each Suffolk share

Consideration: 100% stock

Structure

Deal value: $402 million (based on June 24, 2016 closing price)

Pro forma ownership: 92% People’s United / 8% Suffolk

Price / 2017E EPS: 18.5x / 17.3x (pre-earnings release estimates¹)

Pricing Price / 2017E adjusted EPS²: 13.5x / 12.9x (pre-earnings release estimates¹)

Price / tangible book value: 1.96x / 1.71x (adjusted tangible book value³)

Leadership Leadership: Suffolk President & CEO Howard C. Bluver to join People’s United as

New York Market President

Closing & Expected close: 4Q 2016

approvals Approvals: Customary regulatory and Suffolk shareholder approvals

Earningss per share: ~1% accretion²

Tangible book value per share: ~1% dilution with <5 year earnback

Attractive IRR: ~17%

financial Synergy opportunity:

returns 50% of Suffolk’s non-interest expense base

Significant revenue opportunities identified, but not modeled

Impact on capital: Modest capital accretion

Note: Market data as of June 24, 2016

1 Based on IBES estimates as of April 27, 2016 (prior to Suffolk’s 1Q earnings announcement)

2 Includes fully phased-in cost savings

3 Adjusted to reflect $2mm net credit mark (after-tax), $32mm fair value mark (after-tax)

4

|

|

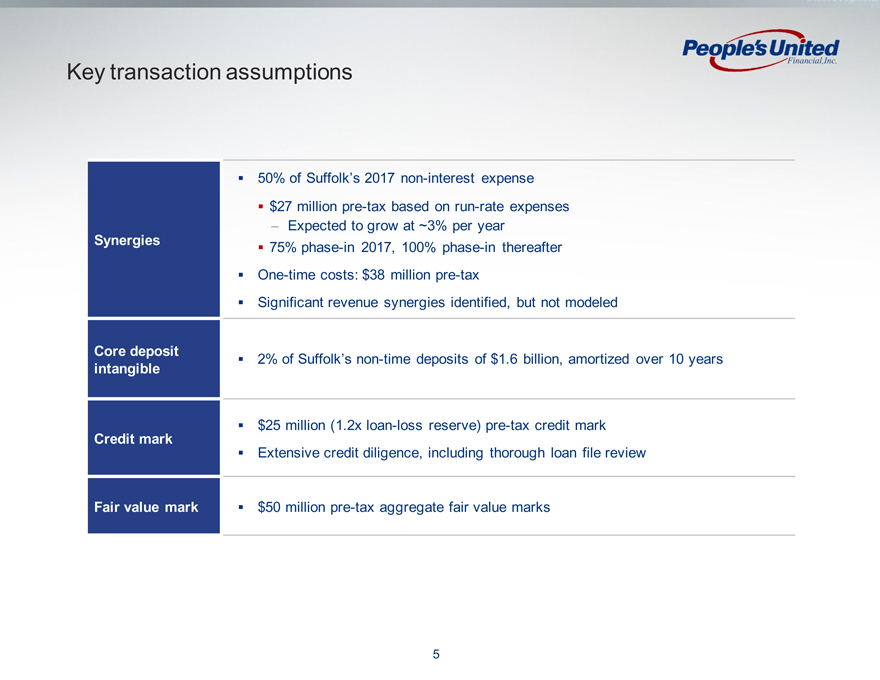

Key transaction assumptions

50% of Suffolk’s 2017 non-interest expense

$27 million pre-tax based on run-rate expenses

– Expected to grow at ~3% per year

Synergies 75% phase-in 2017, 100% phase-in thereafter

One-time costs: $38 million pre-tax

Significant revenue synergies identified, but not modeled

Core deposit 2% of Suffolk’s non-time deposits of $1.6 billion, amortized over 10 years

intangible

$25 million (1.2x loan-loss reserve) pre-tax credit mark

Credit mark

Extensive credit diligence, including thorough loan file review

Fair value mark $50 million pre-tax aggregate fair value marks

5

|

|

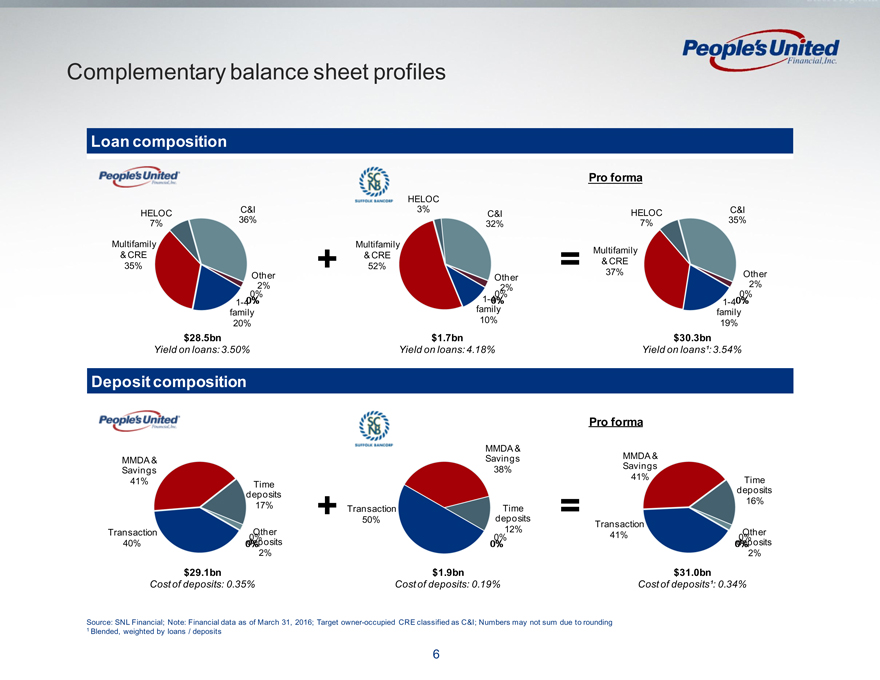

Complementary balance sheet profiles

Loan composition

Pro forma

HELOC

HELOC C&I 3% C&I HELOC C&I

7% 36% 32% 7% 35%

Multifamily Multifamily

& CRE & CRE Multifamily

35% + 52% = & CRE

Other Other 37% Other

2% 2% 2%

0% 0% 0%

1-40% 1-40% 1-40%

family family family

20% 10% 19%

$28.5bn $1.7bn $30.3bn

Yield on loans: 3.50% Yield on loans: 4.18% Yield on loans¹: 3.54%

Deposit composition

Pro forma

MMDA &

MMDA & Savings MMDA &

Savings 38% Savings

41% 41% Time

Time

deposits deposits

16%

17% + Transaction Time =

50% deposits Transaction

Transaction Other 12% 41% Other

0% 0% 0%

40% 0%deposits 0% 0%deposits

2% 2%

$29.1bn $1.9bn $31.0bn

Cost of deposits: 0.35% Cost of deposits: 0.19% Cost of deposits¹: 0.34%

Source: SNL Financial; Note: Financial data as of March 31, 2016; Target owner-occupied CRE classified as C&I; Numbers may not sum due to rounding

1 Blended, weighted by loans / deposits

6

|

|

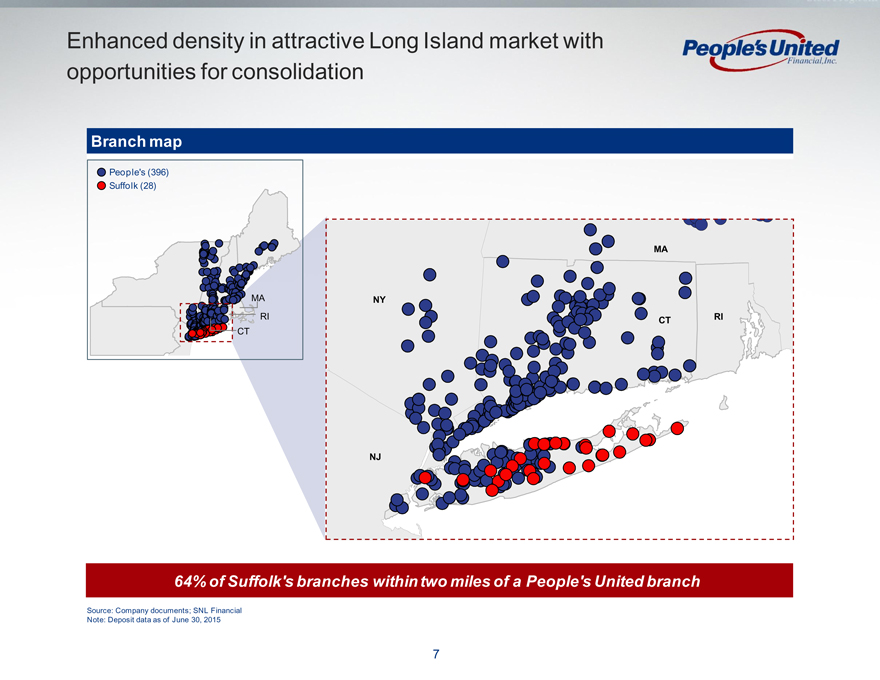

Enhanced density in attractive Long Island market with opportunities for consolidation

Branch map

People’s (396)

Suffolk (28)

ME

MA

VT NH

NY

MA NY

RI CT RI

PA CT

NJ

NJ

64% of Suffolk’s branches within two miles of a People’s United branch

Source: Company documents; SNL Financial

Note: Deposit data as of June 30, 2015

7

|

|

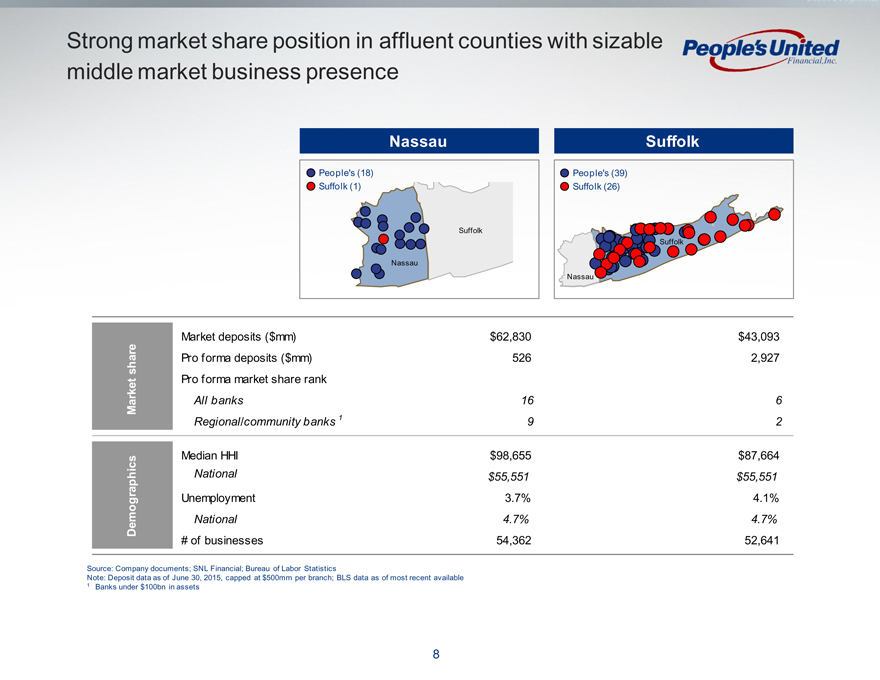

Strong market share position in affluent counties with sizable middle market business presence

Nassau Suffolk

People’s (18) People’s (39)

Suffolk (1) Suffolk (26)

Suffolk

Suffolk

Nassau

Nassau

Market deposits ($mm) $62,830 $43,093

re

a Pro forma deposits ($mm) 526 2,927

h

s

t Pro forma market share rank

e

Mark All banks 16 6

Regional/community banks 1 9 2

s Median HHI $98,655 $87,664

c

i

ph National $55,551 $55,551

a

ogr Unemployment 3.7% 4.1%

em National 4.7% 4.7%

D # of businesses 54,362 52,641

Source: Company documents; SNL Financial; Bureau of Labor Statistics

Note: Deposit data as of June 30, 2015, capped at $500mm per branch; BLS data as of most recent available

1 Banks under $100bn in assets

8

|

|

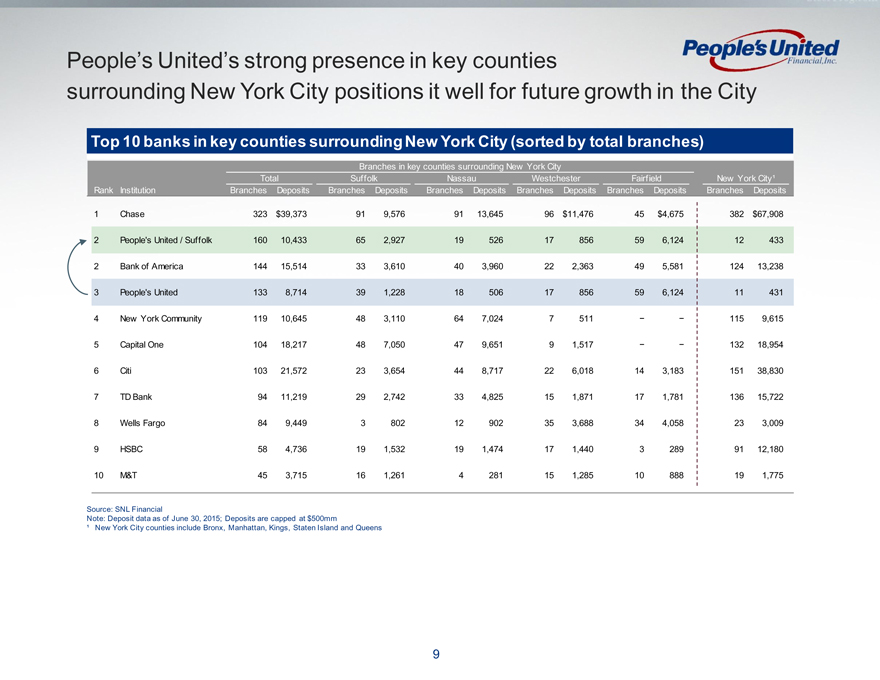

People’s United’s strong presence in key counties surrounding New York City positions it well for future growth in the City

Top 10 banks in key counties surrounding New York City (sorted by total branches)

Branches in key counties surrounding New York City

Total Suffolk Nassau Westchester Fairfield New York City¹

Rank Institution Branches Deposits Branches Deposits Branches Deposits Branches Deposits Branches Deposits Branches Deposits

1 Chase 323 $39,373 91 9,576 91 13,645 96 $11,476 45 $4,675 382 $67,908

2 People’s United / Suffolk 160 10,433 65 2,927 19 526 17 856 59 6,124 12 433

2 Bank of America 144 15,514 33 3,610 40 3,960 22 2,363 49 5,581 124 13,238

3 People’s United 133 8,714 39 1,228 18 506 17 856 59 6,124 11 431

4 New York Community 119 10,645 48 3,110 64 7,024 7 511 —— 115 9,615

5 Capital One 104 18,217 48 7,050 47 9,651 9 1,517 —— 132 18,954

6 Citi 103 21,572 23 3,654 44 8,717 22 6,018 14 3,183 151 38,830

7 TD Bank 94 11,219 29 2,742 33 4,825 15 1,871 17 1,781 136 15,722

8 Wells Fargo 84 9,449 3 802 12 902 35 3,688 34 4,058 23 3,009

9 HSBC 58 4,736 19 1,532 19 1,474 17 1,440 3 289 91 12,180

10 M&T 45 3,715 16 1,261 4 281 15 1,285 10 888 19 1,775

Source: SNL Financial

Note: Deposit data as of June 30, 2015; Deposits are capped at $500mm

¹ New York City counties include Bronx, Manhattan, Kings, Staten Island and Queens

9

|

|

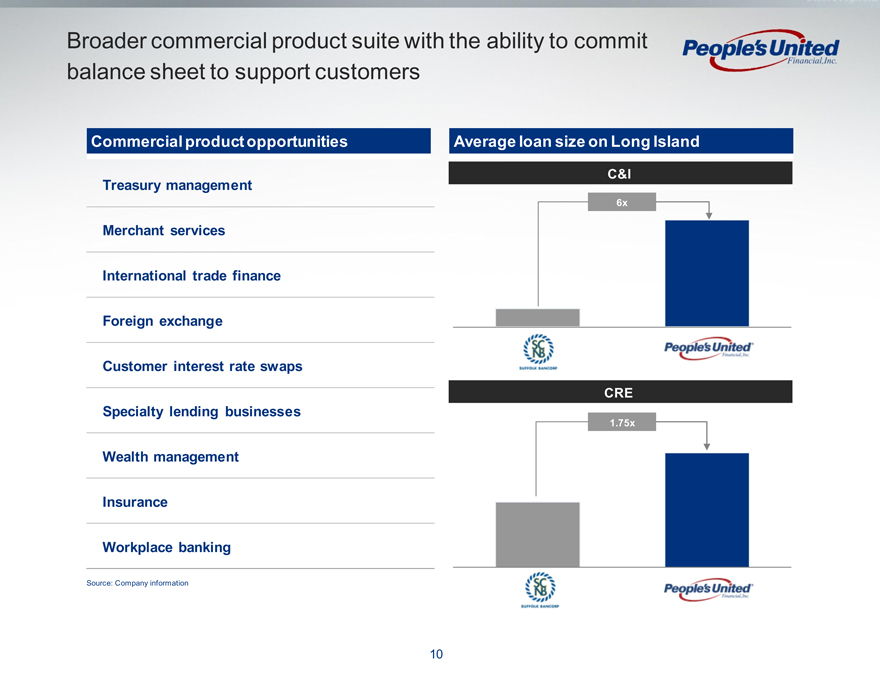

Broader commercial product suite with the ability to commit balance sheet to support customers

Commercial product opportunities

Treasury management

Merchant services

International trade finance

Foreign exchange

Customer interest rate swaps

Specialty lending businesses

Wealth management

Insurance

Workplace banking

Source: Company information

Average loan size on Long Island

C&I

6x

CRE

1.75x

10

|

|

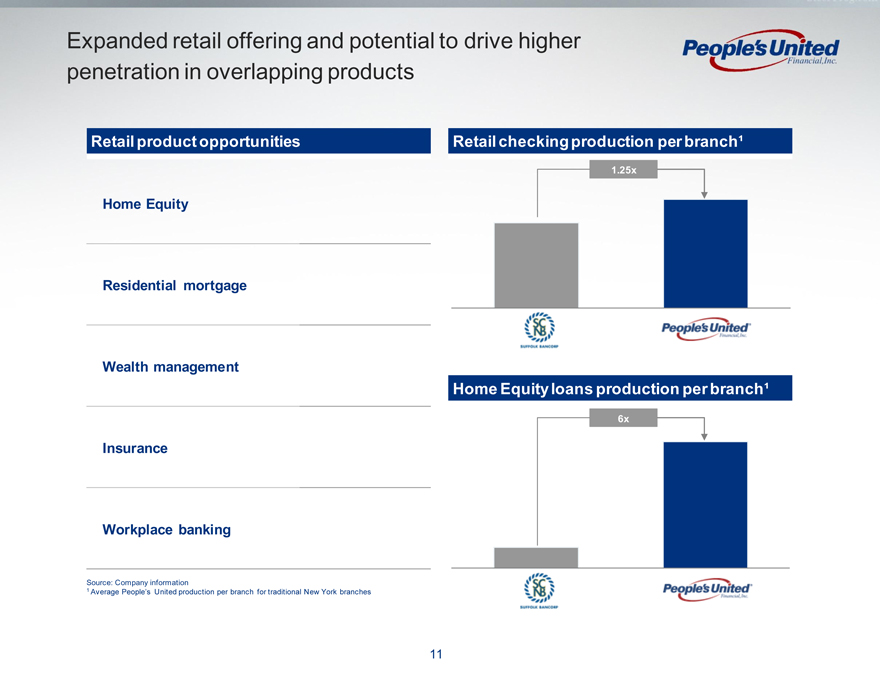

Expanded retail offering and potential to drive higher penetration in overlapping products

Retail product opportunities

Home Equity

Residential mortgage

Wealth management

Insurance

Workplace banking

Source: Company information

1 Average People’s United production per branch for traditional New York branches

Retail checking production per branch¹

1.25x

Home Equity loans production per branch¹

6x

11

|

|

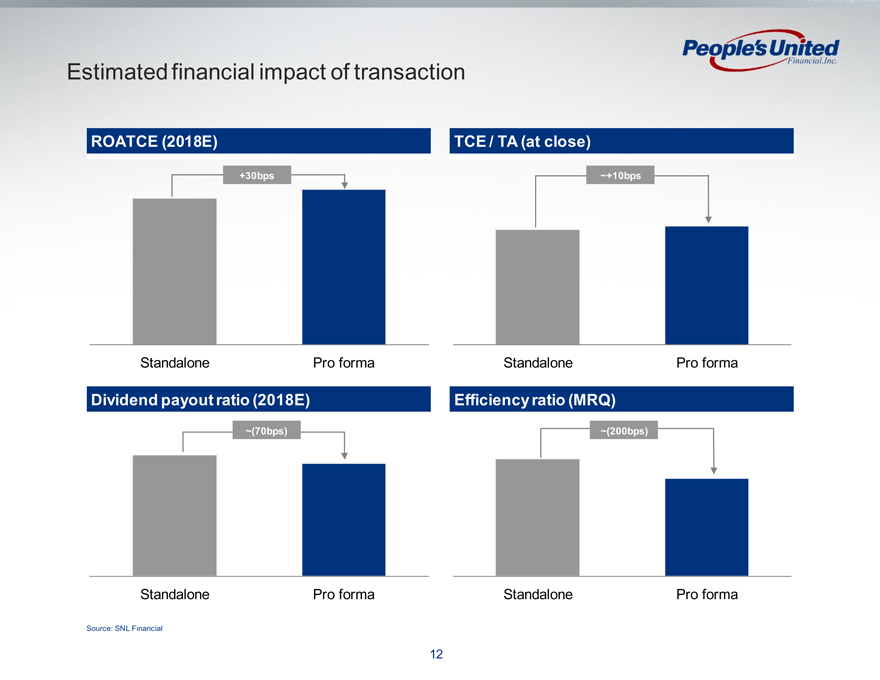

Estimated financial impact of transaction

ROATCE (2018E) TCE / TA (at close)

+30bps ~+10bps

Standalone Pro forma Standalone Pro forma

Dividend payout ratio (2018E) Efficiency ratio (MRQ)

~(70bps) ~(200bps)

Standalone Pro forma Standalone Pro forma

Source: SNL Financial

12

|

|

Summary

Bolsters Long Island presence and accelerates New York Metro expansion strategy

Generates attractive returns by realizing sizeable cost synergies

Significant upside opportunities from enhanced customer offering

13

|

|

Important Additional Information and Where to Find It

This communication is being made in respect of the proposed merger transaction involving People’s United and Suffolk. People’s United intends to file a registration statement on Form S-4 with the SEC, which will include a proxy statement of Suffolk and a prospectus of People’s United, and each party will file other documents regarding the proposed transaction with the SEC. A definitive proxy statement/prospectus will also be sent to the Suffolk shareholders seeking any required shareholder approval. This communication does not constitute an offer to sell or the solicitation of an offer to buy any securities or a solicitation of any vote or approval. Before making any voting or investment decision, investors and security holders of Suffolk are urged to carefully read the entire registration statement and proxy statement/prospectus, when they become available, and any other relevant documents filed with the SEC, as well as any amendments or supplements to these documents, because they will contain important information about the proposed transaction. The documents filed by People’s United and

Suffolk with the SEC may be obtained free of charge at the SEC’s website at www.sec.gov. In addition, the documents filed by People’s United may be obtained free of charge from People’s United at www.peoples.com under the tab “Investor Relations” and then under the heading “Financial Information”, and the documents filed by Suffolk may be obtained free of charge from Suffolk at www.scnb.com under the tab “Investor Relations” and then under the tab “SEC Filings.” Alternatively, these documents, when available, can be obtained free of charge from People’s United upon written request to People’s United Financial, Inc., 850 Main Street, Bridgeport, Connecticut 06604, Attn: Investor Relations, or by calling (203) 338-4581, or from Suffolk upon written request to Suffolk Bancorp, 4 West Second Street, Riverhead, New York 11901, Attn: Investor Relations, or by calling (631) 208-2400.

People’s United and Suffolk and certain of their respective directors and executive officers may be deemed to be participants in the solicitation of proxies from the shareholders of Suffolk in favor of the approval of the merger. Information regarding People’s United’s directors and executive officers is contained in People’s United’s Annual Report on Form 10-K for the year ended December 31, 2015 and its Proxy Statement on Schedule 14A, dated March 11, 2016, which are filed with the SEC. Information regarding Suffolk’s directors and executive officers is contained in Suffolk’s Annual Report on Form 10-K for the year ended December 31, 2015 and its Proxy Statement on Schedule 14A, dated April 6, 2016, which are filed with the SEC. Additional information regarding the interests of those participants and other persons who may be deemed participants in the transaction may be obtained by reading the registration statement and the proxy statement/prospectus when they become available. Free copies of these documents may be obtained as described in the preceding paragraph.

14

|

|

People’s United

Financial, Inc.