Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - BARRETT BUSINESS SERVICES INC | v442947_8k.htm |

Exhibit 99.1

NASDAQ: BBSI | JUNE 2016 ANNUAL MEETING OF SHAREHOLDERS

FORWARD - LOOKING STATEMENTS 2 Statements in this presentation about future events or performance, including expectations for market opportunities, growth in new clients, rate of client retention, operating margins, workers’ compensation liability, and gross revenues and diluted earnings per share, are forward - looking statements which involve known and unknown risks, uncertainties and other factors that may cause the actual results o f t he Company to be materially different from any future results expressed or implied by such forward - looking statements. Factors that could affect future results include economic conditions in the Company's service areas, the effect of changes in the Company's mix of serv ice s on gross margin, the Company's ability to retain current clients and attract new clients, the availability of financing or other sourc es of capital, future workers' compensation claims experience, the effect of changes in the workers’ compensation regulatory environment in one or mor e of the Company’s primary markets , changes in executive management, ineffectiveness of the Company’s internal control over financial reporting, the Company’s relationship with its primary bank lender, current and future shareholder litigation, investigation of accounti ng and securities law issues by government agencies, the collectability of accounts receivable, the carrying value of deferred income tax assets and goodwill, and the effect of conditions in the global capital markets on the Company’s investment portfolio, among others. Other importa nt factors that may affect the Company’s future prospects are described in the Company’s 2015 Annual Report on Form 10 - K. Although forward - looking statements help to provide complete information about the Company, readers should keep in mind that forward - looking statements a re less reliable than historical information. The Company undertakes no obligation to update or revise forward - looking statements in thi s presentation to reflect events or changes in circumstances that occur after the date of this presentation .

CONTINUUM OF AN INDUSTRY Historically, the industry has been commodity - driven. PAYROLL DAY LABOR TEMP STAFFING MANAGED LABOR/ ONSITE PEO 3

OUR COMPETITIVE ADVANTAGE DAY LABOR PAYROLL TEMP STAFFING MANAGED LABOR/ ONSITE PEO CONSULTING/ KNOWLEDGE - BASED BBSI’S HIGHEST LEVERAGE POINT 4

HOW WE ARE POSITIONED We integrate management tools with expertise in human capital related to the structure and succession of organizations • Engage as a tactical subordinate • Minimal integration with the business TYPICAL OUTCOME: TOOLS, SYSTEMS, PROCESSES • Engage as an expert guide • Highly integrated with the business TYPICAL OUTCOME: WHITE PAPERS TYPICAL OUTCOME: ROAD MAP TO MORE EFFICIENTLY RUN BUSINESS 5

VISION & PURPOSE FOR APPROACHING THE MARKET BUSINESS FORMATION GRASSROOTS GROWTH INFLECTION POINT MANAGEMENT PLATFORM STABILITY 6

7 TIME VOLUME RE - LEVER INFLECTION POINT REINVENT WORKING OPS VALUE PROPOSITION TO OWNERS

MARKET OPPORTUNITY BBSI works with approximately 4,000 businesses – roughly 2% BBSI works with less than 1% of target market in U.S. 8

CAPTURING THE MARKET • Drive development in referral channels • Expand within existing markets • Penetrate adjacent markets to meet demand 9

PROCESS OF CLIENT ALIGNMENT 90%+ CLIENT RETENTION 10 90 BUSINESS TEAMS REFERRAL NETWORK 5,000 FIRST MEETINGS 1,250 NEW CLIENTS

ECONOMICS OF A BUSINESS TEAM • $500K spend per business team • Max capacity of ~90 clients at an average of 30 employees per client • 2 years runway to get to ~75% capacity • Ability to lever operating margins as we improve efficiencies through people and systems 11

FIELD STRUCTURE & FOOTPRINT • 55 branches in 12 states • Decentralized model supports relevancy • Most clients within 50 - mile radius of BBSI branch • Supports scalability: 90 teams across the organization 12

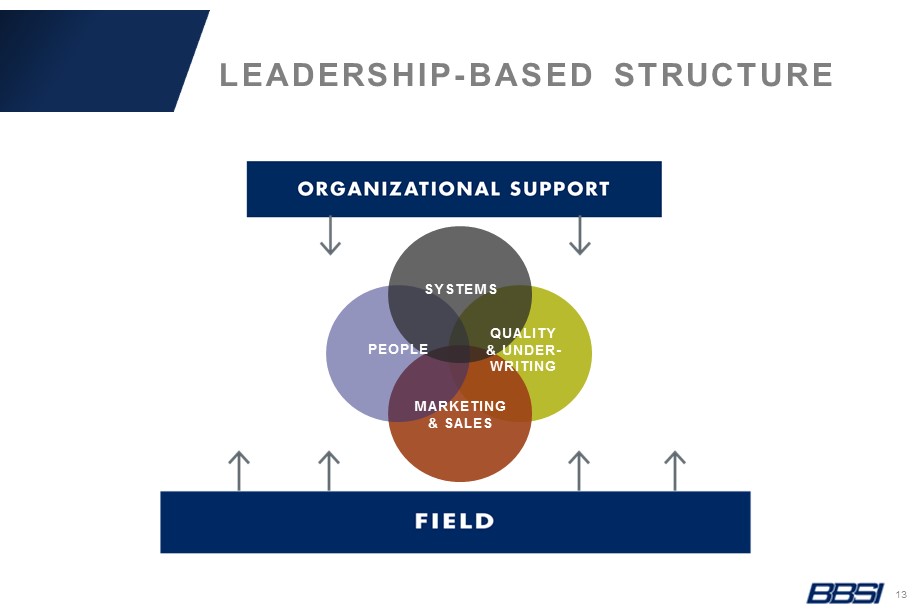

LEADERSHIP - BASED STRUCTURE 13 SYSTEMS PEOPLE MARKETING & SALES QUALITY & UNDER - WRITING

• Leadership is our DNA – it’s e ssential to our culture • Shapes profile of who we hire • Influences operational principles • Supports sustainable decentralized structure • Defines client engagement – we apply what we’ve learned to our clients’ success LEADERSHIP, NOT MANAGEMENT 14

• Seasoned, tenured professionals • Entrepreneurial, possessing drive and vision • Demonstrate an ownership mentality • Operationalize concepts with business acumen • Innately curious PROFILE OF A BBSI PROFESSIONAL 15

• ORGANIC GROWTH • New client stack • Runoff • Same store sales • LEVERAGE • Capacity utilization against management payroll • RISK • Decrease in relative frequency • Stable severity metrics 16 DRIVERS OF OUR GROWTH

$316 $404 $537 $636 $741 2011 2012 2013 2014 2015 ANNUAL NET REVENUE GROWTH 17 $Millions

$1,534 $2,087 $2,817 $3,357 $4,016 2011 2012 2013 2014 2015 Gross Revenues ($Millions) ~1,800 ~2,200 ~2,600 ~3,000 ~4,000 PEO Customers¹ ANNUAL GROSS REVENUE & PEO CLIENT GROWTH 18 1) PEO customers defined as the active number of customer Federal Employee Identification Numbers (FEINs). Please take into consideration that this operating statistic is a broad estimate of the Company’s actual client count. However, the Company does believe the number represents an effective p rox y for the health of its business.

$1.09 $1.47 $2.12 - $3.57 $3.47 2011 2012 2013 2014¹ 2015 ANNUAL DILUTED EPS PERFORMANCE 19 2016 Outlook • Gross revenue growth of ~18% vs. 2015 • Diluted EPS: $3.50 • Includes $6.4 million (~$0.57 per share) in accounting & legal costs associated with restatements, investigations & legal proceedings related to securities law issues 1) The net loss per share in 2014 is primarily due to expense associated with an increase in the Company’s reserve for workers’ com pensation claims liabilities of approximately $104.2 million.

Barrett Business Services, Inc. 8100 NE Parkway Drive, Suite 200 Vancouver, WA 98662 Tel (360) 828 - 0700 Company Contact Mike Elich, CEO Tom Carley , Interim CFO Investor Relations Liolios Group, Inc. Cody Slach Tel (949) 574 - 3860 BBSI@liolios.com BBSI CONTACTS