Attached files

| file | filename |

|---|---|

| EX-10.91 - EXHIBIT 10.91 - Protea Biosciences Group, Inc. | v442685_ex10-91.htm |

| EX-23.1 - EXHIBIT 23.1 - Protea Biosciences Group, Inc. | v442685_ex23-1.htm |

| EX-14.1 - EXHIBIT 14.1 - Protea Biosciences Group, Inc. | v442685_ex14-1.htm |

| EX-10.92 - EXHIBIT 10.92 - Protea Biosciences Group, Inc. | v442685_ex10-92.htm |

| EX-4.19 - EXHIBIT 4.19 - Protea Biosciences Group, Inc. | v442685_ex4-19.htm |

| EX-4.18 - EXHIBIT 4.18 - Protea Biosciences Group, Inc. | v442685_ex4-18.htm |

| EX-3.2 - EXHIBIT 3.2 - Protea Biosciences Group, Inc. | v442685_ex3-2.htm |

As filed with the Securities and Exchange Commission on June 22, 2016

Registration No. 333-211674

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

AMENDMENT 1 to

FORM S-1

REGISTRATION STATEMENT UNDER THE SECURITIES ACT OF 1933

PROTEA BIOSCIENCES GROUP, INC.

(Exact name of registrant as specified in its charter)

| Delaware | 2834 | 20-2903252 | ||

|

(State or Other Jurisdiction of Incorporation or Organization) |

(Primary Standard Industrial Classification Code Number) |

(I.R.S. Employer Identification No.) |

1311 Pineview Drive, Suite 501

Morgantown, West Virginia 26505

1-304-292-2226

(Address, including zip code, and telephone number, including area code,

of registrant’s principal executive offices)

Stephen Turner

Chief Executive Officer

Protea Biosciences Group, Inc.

1311 Pineview Drive, Suite 501

Morgantown, West Virginia 26505

1-304-292-2226

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Copies to:

|

Stephen A. Weiss, Esq. Barrett S. DiPaolo, Esq. CKR Law LLP 1330 Avenue of the Americas New York, New York 10019 Tel: (212) 259-7300 Fax: (212) 259-8200 |

Richard A. Friedman, Esq. Stephen A. Cohen, Esq. Sichenzia Ross Friedman Ference LLP 61 Broadway, 32nd Floor New York, New York 10006 Telephone: (212) 930-9700 Facsimile: (212) 930-9725 |

Approximate date of commencement of proposed sale to the public: From time to time after the effective date of this Registration Statement.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933 check the following box. x

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering.¨

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering.¨

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering.¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | ¨ | Accelerated filer | ¨ |

| Non-accelerated filer | ¨ | Smaller reporting company | x |

| Title of Each Class of Securities to be Registered | Amount to be Registered |

Proposed Maximum Aggregate Offering Price |

Amount of Registration Fee |

||||||||

| Common stock, par value $0.0001 per share | 3,565,000 shares | (1) | $ | 19,607,500 | (5) | $ | 1,974.48 | ||||

| Common stock offered for selling stockholders | 530,119 shares | (2) | 2,915,655 | (3) | 293.61 | ||||||

| Representative’s common stock purchase warrants | N/A | (4) | |||||||||

| Common stock issuable upon exercise of Representative’s purchase warrants | 155,000 shares | (4) | $ | 1,065,625 | (5) | $ | 107.31 | ||||

| Total | 4,250,119 shares | $ | 23,588,780 | $ | 2,375.40 | (3) | |||||

| (1) | Gives retroactive effect to a 1-for-25 reverse stock split to be effected prior to the effective date of this Registration Statement and assumes a public offering price of $5.50 per share. The proposed maximum aggregate offering price assumes an offering of 3,100,000 shares of common stock and the full exercise of the underwriters’ over-allotment option to purchase up to an additional 465,000 shares, and is estimated solely for the purpose of calculating the amount of the registration fee in accordance with Rule 457(o) under the Securities Act of 1933, as amended. Includes the offering price of additional shares that the underwriters have the option to purchase to cover over-allotments. |

| (2) | Consists (after giving retroactive effect to the proposed 1-for-25 reverse stock split) of (a) 318,889 outstanding shares of the registrant’s common stock and (b) 211,230 shares of common stock issuable upon exercise of outstanding common stock purchase warrants. Commencing 90 days after the date of the prospectus forming part of this Registration Statement, the selling stockholders may sell such shares. Pursuant to Rule 416 under the Securities Act of 1933, as amended, to the extent that such outstanding shares and warrants provide for an increase in amount issuable or exercisable to prevent dilution resulting from stock splits, stock dividends, or similar transactions, this registration statement shall be deemed to cover such additional shares of common stock issuable in connection with any such provision. |

| (3) | Estimated solely for the purpose of calculating the registration fee pursuant to Rule 457(c) under the Securities Act of 1933, as amended, based on the average of the high and low bid prices of the registrant’s common stock as reported by OTC Markets on June 21, 2016. The shares offered hereunder may be sold by the selling stockholders from time to time in the open market, through privately negotiated transactions or a combination of these methods, at market prices prevailing at the time of sale or at negotiated prices. |

| (4) | We have agreed to issue, upon closing of this offering, compensation warrants exercisable commencing on a date which is six months after the effective date of the registration statement of which this prospectus forms a part and expiring five years following the effective date of the registration statement of which this prospectus forms a part representing 5% of the aggregate number of shares of common stock issued in the offering but not including the over-allotment option, or the “representative warrants,” to Laidlaw & Co. (UK) Ltd., as Representative of the underwriters. Resales of the representative warrants on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, as amended (the “Securities Act”) are registered hereby. Resales of common stock issuable upon exercise of the representative warrants are also being similarly registered on a delayed or continuous basis hereby. See “Underwriting.” |

| (5) | Estimated solely for the purpose of calculating the registration fee pursuant to Rule 457(g) under the Securities Act, based on an estimated proposed maximum aggregate offering price of $5.50 for the common stock issuable upon exercise of the representative’s common stock purchase warrant. We have calculated the proposed maximum aggregate offering price of the common stock underlying the representative’s warrants by assuming that such warrants are exercisable to purchase shares of common stock at a price per share equal to 100% of the price per share sold in this offering. |

The registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933, as amended, or until the Registration Statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

EXPLANATORY NOTE

This Registration Statement contains two forms of prospectuses: one to be used in connection with a public offering of up to 3,100,000 shares of our common stock (excluding 465,000 shares of common stock which may be sold upon exercise of the underwriters’ over-allotment option) through the underwriters named on the cover page of this prospectus (the “Prospectus”) and one to be used in connection with the potential resale by certain selling stockholders of an aggregate of 530,119 shares of our common stock (the “Selling Security holder Prospectus”), consisting of (i) 318,889 shares of our common stock and (ii) 211,230 shares of our common stock issuable upon exercise of outstanding warrants held by certain of the selling stockholders. The Prospectus and Selling Security holder Prospectus will be identical in all respects except for the alternate pages for the Selling Security holder Prospectus included herein which are labeled “Alternate Page for Selling Security holder Prospectus.”

The Selling Security holder Prospectus is substantively identical to the Prospectus, except for the following principal points:

| · | they contain different outside and inside front covers; |

| · | they contain different Offering sections in the Prospectus Summary section on page 3; |

| · | they contain different Use of Proceeds sections on page 22; |

| · | the Capitalization section on page 24 is deleted from the Selling Security holder Prospectus; |

| · | a Selling Security holder section is included in the Selling Security holder Prospectus beginning on page 81; |

| · | the Underwriting section from the Prospectus on page 70 is deleted from the Selling Security holder Prospectus and a Plan of Distribution is inserted in its place on page 84; and |

| · | the Legal Matters section in the Selling Security holder Prospectus on page 86 deletes the reference to counsel for the underwriters; |

The registrant has included in this Registration Statement, after the financial statements, a set of alternate pages to reflect the foregoing differences of the Selling Security holder Prospectus as compared to the Prospectus.

The information in this preliminary prospectus is not complete and may be changed. These securities may not be sold until the registration statement filed with the Securities and Exchange Commission is effective. This preliminary prospectus is not an offer to sell these securities and is not soliciting an offer to buy these securities in any state or other jurisdiction where the offer or sale is not permitted.

Subject to Completion, dated May 27, 2016

PRELIMINARY PROSPECTUS

Protea Biosciences Group, Inc.

3,100,000 Shares of Common Stock

We are offering for sale a total of 3,100,000 shares of our common stock for the account of our company, the net proceeds of which will be used primarily for working capital and to expand our business.

We intend to list our common stock on the Nasdaq Capital Market under the symbol “PRGB.” No assurance can be given that our Nasdaq listing application will be approved. Our common stock is currently traded on the OTCQB marketplace of OTC Markets Group Inc. The last reported sale price of our common stock as reported on the OTCQB on June 21, 2016 was $0.17, which after giving effect to a 1 for 25 reverse stock split described below, equates to $4.25. However, in this prospectus, we assume that the price per share in this offering, on a post-split basis, will be in the range of $4.50 to $6.50, and we have used the midpoint of such range ($5.50) for the assumptions set forth herein.

We will effect a reverse stock split of our outstanding shares of common stock prior to or upon the effective date of the registration statement of which this prospectus forms a part. However, following the stock split, our common stock may not trade at a price consistent with such reverse split. We expect to affect a one-for-25 reverse split of our outstanding shares of our common stock, which reverse stock split was approved by our stockholders in December 2015.

Investing in our common stock involves a high degree of risk. See “Risk Factors” beginning on page 10 of this prospectus for a discussion of information that should be considered in connection with an investment in our common stock.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

We are an “emerging growth company” as that term is used in the Jumpstart Our Business Startups Act of 2012, and we have elected to comply with certain reduced public company reporting requirements.

| Per Share | Total | |||||||

| Public offering price | $ | $ | ||||||

| Underwriting discounts and commissions (1) | ||||||||

| Proceeds to us, before expenses | $ | $ | ||||||

| (1) | Does not include a non-accountable expense allowance equal to 1% of the gross proceeds of this offering payable to Laidlaw & Company (UK) Ltd., the representative of the underwriters. See “Underwriting” for a complete description of compensation payable to the underwriters. |

We have granted a 45 day option to the underwriters to purchase up to 465,000 additional shares of common stock, at the public offering price less underwriting discounts and commissions, to cover over -allotments, if any. If the over-allotment option is exercised in full, the total proceeds to us, after deducting underwriting discounts and commissions and before expenses, will be approximately $__________.

The underwriters expect to deliver the shares against payment therefor on or about ________, 2016.

LAIDLAW & COMPANY (UK) LTD.

The date of this prospectus is _______, 2016

You should rely only on the information contained in this prospectus or any prospectus supplement or amendment. We have not authorized any other person to provide you with information that is different from, or adds to, that contained in this prospectus. If anyone provides you with different or inconsistent information, you should not rely on it. We take no responsibility for, and can provide no assurance as to the reliability of, any other information that others may give you. The selling stockholders are offering to sell and seeking offers to buy our common stock only in jurisdictions where offers and sales are permitted. You should assume that the information contained in this prospectus is accurate only as of the date of this prospectus, regardless of the time of delivery of this prospectus or of any sale of our common stock. Our business, financial condition, results of operations and prospects may have changed since that date. We are not making an offer of any securities in any jurisdiction.

TABLE OF CONTENTS

| ABOUT THIS PROSPECTUS | 1 |

| MARKET DATA | 1 |

| SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS | 1 |

| PROSPECTUS SUMMARY | 3 |

| RISK FACTORS | 10 |

| USE OF PROCEEDS | 22 |

| DIVIDEND POLICY | 23 |

| CAPITALIZATION | 24 |

| DILUTION | 25 |

| MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS | 27 |

| MARKET FOR COMMON EQUITY AND RELATED STOCKHOLDER MATTERS | 34 |

| BUSINESS | 37 |

| MANAGEMENT | 53 |

| PRINCIPAL STOCKHOLDERS | 59 |

| CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS | 62 |

| DESCRIPTION OF SECURITIES | 63 |

| SHARES ELIGIBLE FOR FUTURE SALE | 68 |

| UNDERWRITING | 70 |

| SELLING STOCKHOLDERS’ PLAN OF DISTRIBUTION | |

| DISCLOSURE OF COMMISSION POSITION OF INDEMNIFICATION FOR SECURITIES ACT LIABILITIES | |

| EXPERTS | 77 |

| LEGAL MATTERS AND INTERESTS OF NAMED EXPERTS | 77 |

| WHERE YOU CAN FIND MORE INFORMATION | 78 |

‘No dealer, salesperson or other person is authorized to give any information or to represent anything not contained in this prospectus. You must not rely on any unauthorized information or representations. This prospectus is an offer to sell only the shares offered hereby, but only under circumstances and in jurisdictions where it is lawful to do so. The information contained in this prospectus is current only as of its date.

Throughout this prospectus, unless otherwise designated or the context suggests otherwise,

| · | all references to the “Company,” the “registrant,” “Protea,” “we,” “our,” or “us” in this prospectus mean Protea Biosciences Group, Inc. and its consolidated subsidiaries; |

| · | all shares, common stock, and per share data assumes and gives pro forma retroactive effect to a one-for-25 reverse stock split of Protea’s outstanding capital stock that will be consummated immediately prior to the effective date of the registration statement of which this prospectus is a part; |

| · | assumes a public offering price of our common stock (after giving effect to such reverse stock split) of $5.50 per share, the mid-range of the estimated $4.50 to $6.50 per share; |

| · | “year” or “fiscal year” mean the year ending December 31st |

| · | all dollar or $ references when used in this prospectus refer to United States dollars. |

Market data and certain industry data and forecasts used throughout this prospectus were obtained from internal company surveys, market research, consultant surveys, publicly available information, reports of governmental agencies and industry publications and surveys. Industry surveys, publications, consultant surveys and forecasts generally state that the information contained therein has been obtained from sources believed to be reliable, but the accuracy and completeness of such information is not guaranteed. We have not independently verified any of the data from third party sources, nor have we ascertained the underlying economic assumptions relied upon therein. Similarly, internal surveys, industry forecasts and market research, which we believe to be reliable based on our management’s knowledge of the industry, have not been independently verified. Forecasts are particularly likely to be inaccurate, especially over long periods of time. Statements as to our market position are based on the most currently available data. While we are not aware of any misstatements regarding the industry data presented in this prospectus, our estimates involve risks and uncertainties and are subject to change based on various factors, including those discussed under the heading “Risk Factors” in this prospectus.

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

This prospectus contains “forward-looking statements.” Forward-looking statements reflect the current view about future events. When used in this prospectus, the words “anticipate,” “believe,” “estimate,” “expect,” “future,” “intend,” “plan,” or the negative of these terms and similar expressions, as they relate to us or our management, identify forward-looking statements. Such statements, include, but are not limited to, statements contained in this prospectus relating to our business strategy, our future operating results and liquidity and capital resources outlook. Forward-looking statements are based on our current expectations and assumptions regarding our business, the economy and other future conditions. Because forward–looking statements relate to the future, they are subject to inherent uncertainties, risks and changes in circumstances that are difficult to predict. Our actual results may differ materially from those contemplated by the forward-looking statements. They are neither statements of historical fact nor guarantees of assurance of future performance. We caution you therefore against relying on any of these forward-looking statements. Important factors that could cause actual results to differ materially from those in the forward-looking statements include, without limitation:

| · | the results of clinical trials and the regulatory approval process; |

| · | our ability to raise capital to fund continuing operations; |

| · | market acceptance of any products that may be approved for commercialization; |

| · | our ability to protect our intellectual property rights; |

| · | the impact of any infringement actions or other litigation brought against us; |

| · | competition from other providers and products; our ability to develop and commercialize new and improved products and services; |

| · | changes in government regulation; |

| · | our ability to complete capital raising transactions; |

| · | and other factors (including the risks contained in the section of this prospectus entitled “Risk Factors”) relating to our industry, our operations and results of operations. |

Should one or more of these risks or uncertainties materialize, or should the underlying assumptions prove incorrect, actual results may differ significantly from those anticipated, believed, estimated, expected, intended or planned.

Factors or events that could cause our actual results to differ may emerge from time to time, and it is not possible for us to predict all of them. We cannot guarantee future results, levels of activity, performance or achievements. Except as required by applicable law, including the securities laws of the United States, we do not intend to update any of the forward-looking statements to conform these statements to actual results.

2

This summary provides a brief overview of the key aspects of our business and our securities. The reader should read the entire prospectus carefully, especially the risks of investing in our common stock discussed under “Risk Factors.” Some of the statements contained in this prospectus, including statements under “Summary” and “Risk Factors” as well as those noted in the documents incorporated herein by reference, are forward-looking statements and may involve a number of risks and uncertainties. Our actual results and future events may differ significantly based upon a number of factors. The reader should not put undue reliance on the forward-looking statements in this document, which speak only as of the date on the cover of this prospectus.

Except as otherwise indicated, all share and per share amounts in this prospectus assumes and gives retroactive effect to a 1-for-25 reverse stock split which will occur prior to the effectiveness of the registration statement of which this prospectus is a part. We have estimated that the initial offering price of our common stock will range between $4.50 and $6.50 per share and have assumed an initial offering price of $5.50, representing the mid-point of such range. However, based on our current pre-offering closing market price at June 21, 2016 of $0.17 per share, in order to offer our shares of common stock within the price range referred to above and list our shares on the Nasdaq Capital Market or other national securities exchange approved by our underwriters, prior to the effective date of the registration statement of which this prospectus is a part, we may be required to obtain stockholder approval to increase such reverse stock split to an amount in excess of 1-for-25.

About Our Business

Protea is an emerging growth, molecular information company that has developed a revolutionary platform technology, which enables the direct analysis, mapping and display of biologically active molecules in living cells and tissue samples. The technology platform offers new, unprecedented capabilities useful to the pharmaceutical, diagnostic, clinical research, agricultural and life science industries.

“Molecular information” refers to the generation and bioinformatic processing of very large data sets, known as “big data,” obtained by applying the Company’s technology to identify and characterize the proteins, metabolites, lipids and other molecules which are the biologically active molecular products of all living cells and life forms.

Our technology is used to improve pharmaceutical development and life science research productivity and outcomes, and to extend and add value to other technologies that are used in research and development (“R&D”), such as three-dimensional tissue models, biomarker discovery, synthetic biologicals and mass spectrometry. In particular, the Company believes that its ability to rapidly provide comprehensive molecular image-based datasets addresses a universal need of the pharmaceutical, diagnostic and clinical research and life science industries.

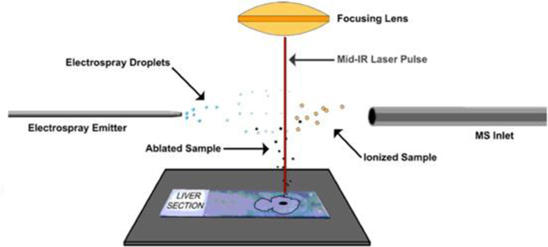

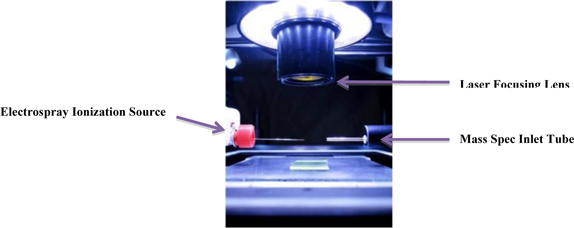

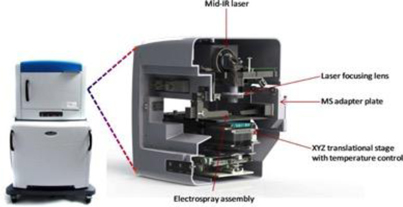

Known as LAESI® (Laser Ablation Electrospray Ionization), our technology platform is exclusively licensed from The George Washington University (“GWU”). We have subsequently completed the development of the first fully automated LAESI instruments and requisite proprietary software suites, used for LAESI data analysis and for molecular imaging – the direct analysis and visualization of molecules in cells and tissue. LAESI technology is currently the subject of eleven issued patents and over 40 peer-reviewed publications.

LAESI is intended to meet the broad need of the biologist for the direct, unbiased identification and characterization of molecules in biological samples. By virtue of LAESI’s improved speed and the comprehensive datasets it generates, the Company is pursuing its vision of what it believes will be a new era of human molecular information, where the molecular networks of human disease will be clearly elucidated, with data more rapidly available, thereby accelerating pharmaceutical development and improving healthcare.

Our Business Strategy and Products and Services

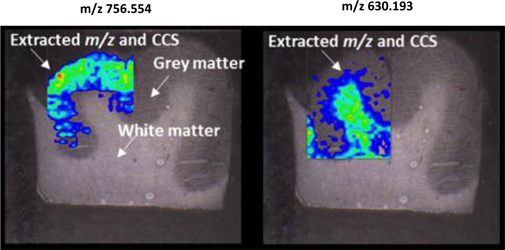

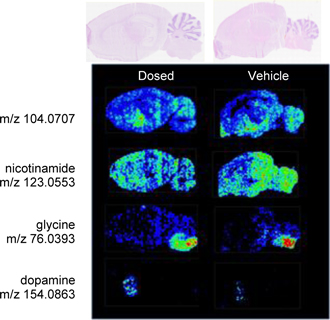

Protea has applied its core technology to establish commercial leadership in the emerging field of mass spectrometry imaging (“MSI”) services. MSI is a revolutionary capability that for the first time enables the identification of all classes of biologically active molecules produced by cells and combines this with the ability to instantly spatially-display the molecules in tissue histology sections. MSI can be performed with no sample preparation and no labeling or antibody techniques, thereby integrating direct molecular identification with tissue pathology.

The Company intends to achieve its business objectives by leveraging its core MSI technology and associated bioanalytical mass spectrometry platforms to improve the availability, comprehensiveness and usefulness of molecular information to address the needs of pharmaceutical research, biomarker discovery, agriculture and other life science research markets.

The Company’s commercial development is centered in three business lines:

| · | Molecular Information Services – the Company believes that it is the commercial leader in providing multimodal MSI, combining LAESI, MALDI, and optical microscopy. Our proprietary services enable the identification and quantitation of both small molecules (e.g., lipids and metabolites) and large molecules (e.g. proteins) and our services portfolio, inclusive of MSI, proteomics, metabolomics, lipidomics and bioinformatics is unique in the industry. Our clients include major pharmaceutical, chemical and biotechnology companies; | |

3

| · | LAESI Instruments, Software and Consumables – we offer our proprietary LAESI DP-1000 instrument, software and bioanalytical consumables to corporate and academic research laboratories; and |

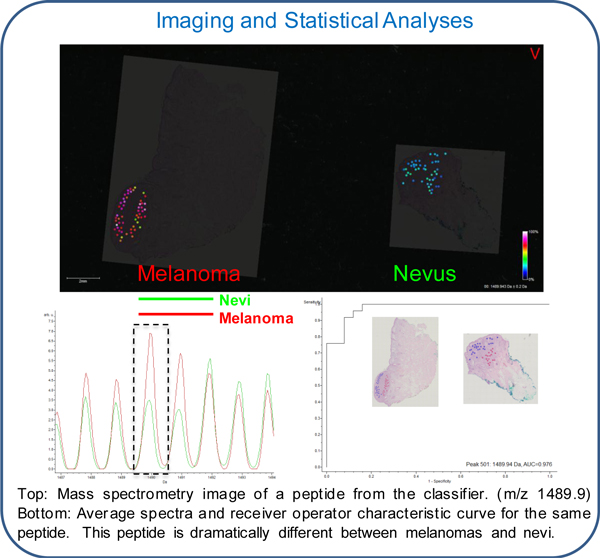

| · | Molecular Diagnostics and Clinical Research – we apply our multimodal MSI technologies and workflows in partnership with top-tier medical research institutions to co-develop new, molecular diagnostic tests that the company believes can be used to improve the diagnosis and prognosis of cancer and provide requisite information useful in predicting the outcome of cancer treatment. Our current test development programs target the differential diagnosis and prognosis of malignant melanoma and the molecular profiling of subpopulations of cells in lung adenocarcinoma. |

Molecular Information Services

We believe we are the commercial leader in the offering of MSI services. Our clients send their tissue and biofluid samples directly to the Company’s laboratory, where samples are analyzed by the Company’s state of the art mass spectrometry instrumentation, scientific staff and bioinformatics capabilities. We combine our proprietary LAESI platform with matrix-assisted laser desorption ionization (“MALDI”), and liquid chromatography mass spectrometry (LCMS) workflows. Our clients include major pharmaceutical, biotechnology, chemical and medical device and consumer products companies, and both academic and government institutions. The services unit is operated within a Quality by Design environment, which is necessary to meet the internal research and development standards of pharmaceutical and clinical research clients.

The Company’s MSI services represent a revolutionary capability that for the first time enables the identification of all classes of biologically-active molecules produced by cells, and combines this with the ability to instantly spatially-display the molecules (both two- and three-dimensional) in tissue histology sections. MSI can be performed without sample preparation, labeling or antibody techniques, thereby integrating direct molecular identification with tissue pathology for the first time. Since the sample is not touched, data is unbiased and more rapidly available. Providing molecular information that rapidly answers questions critical to the drug development process, such as, “is my drug actually getting inside the target cells,” “is my immune modulating agent changing the molecular output of the tumor cell,” or “how long did it take for the drug to enter the target cells” as well as questions of drug concentration and duration.

We have, in collaboration with industry leaders, developed advanced bioanalytical workflows for the characterization of protein biotherapeutics, such as monoclonal antibodies, to address regulatory requirements for safety, efficacy, and bioactivity in manufacturing and storage of these products. To this end, we have applied proteomics and metabolomics technologies along with LAESI direct analysis to aid in optimizing the expression systems used to produce monoclonal antibodies for drug discovery purposes. Key collaborations and partnerships have been formed to address the bioinformatics analysis required including statistical and pathway analysis.

In January 2014, the Company, as a subcontractor to GWU, was awarded a multi-year project with the Defense Advanced Research Projects Agency (“DARPA”). In addition to Protea, The Stanford Research Institute International and GE Global Research also collaborate on the project entitled, “New Tools for Comparative Systems Biology of Threat Agent Action Mechanisms.” A $15 million five year project, the goal of DARPA’s Rapid Threat Assessment (“RTA”) program is to develop new tools and methods to elucidate the mechanism of action of a threat agent, drug, biologic or chemical on living cells within 30 days from exposure. Uncovering the mechanism of action of such agents in 30 days, compared to the years currently required, could be key to the development of effective countermeasures. The molecular networks within living cells are vast and complex. Conventional approaches fail to capture the system-wide response of a living cell to a threat agent. The Company believes this technology will be applicable to preclinical drug research as well.

LAESI instruments, software and consumables

LAESI technology was invented in the laboratory of Professor Akos Vertes, Ph.D., Dept. of Chemistry, GWU, in 2007 and was exclusively-licensed to Protea in 2008. The LAESI DP-1000 instrument, the Company’s prototype embodiment of its proprietary LAESI technology, integrates with laboratory instruments known as mass spectrometers. LAESI employs a proprietary (patented) method that utilizes the water content in a sample (native or applied) to transition the sample into a gas state, where it can be analyzed by a mass spectrometer. LAESI accomplishes this without requiring the sample to be touched. By eliminating sample preparation, the biological sample can be analyzed without the possible contamination, bias or sample loss that occurs with current techniques, which require the introduction of chemicals or the destruction of the sample itself in order to enable analysis by mass spectrometry.

4

This technology enables the direct identification of proteins, lipids and metabolites in tissues, cells and biofluids such as serum and urine. Data is available in seconds to minutes, allowing rapid time to results and the capacity to analyze thousands of samples in a single work period. As an example, a researcher testing a new drug’s effects on living cells can analyze changes in the cells’ metabolism across a specific time course, thereby almost immediately obtaining data as to the activity of the new drug. The Company believes that LAESI technology has the potential to significantly improve the availability of molecular information in pharmaceutical research as well as many other fields including agriculture, pathology, biomarker discovery, biodefense and forensics.

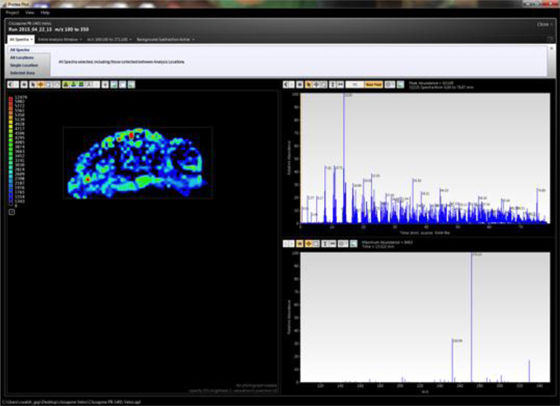

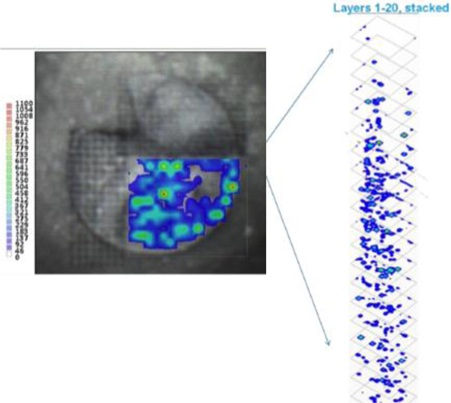

LAESI instruments employ proprietary software developed by the Company that creates “molecular maps” - the ability to instantly display the distribution of molecules throughout tissue sample in both two- and three-dimensional imaging. The Company currently offers the LAESI Desktop Software and ProteaPlot software that facilitates operating the instrument and the storage and display of datasets in a user friendly, intuitive software environment. The ProteaPlot software includes tools for post-processing of LAESI-MS data, generation of molecular maps/images and mass spectral comparison for regions of interest. LAESI software displays the data obtained by mass spectrometry analysis combined with actual images of the tissue and cell samples. Thus, mass spectrometry data can be integrated with a sample’s tissue architecture.

We have developed and brought to market related, proprietary consumable products for use in molecular analysis including REDIchipsTM (Resonance-Enhanced Desorption Ionization - sample target plates with nanopost array surfaces for matrix-free laser desorption ionization of small molecules) and ProgentaTM (acid labile surfactants use to solubilize proteins for mass spectrometry analysis).

Molecular Diagnostics and Clinical Research

The Company is employing both its proprietary LAESI platform and MALDI methodologies to create comprehensive, tissue-based molecular profiles to improve the differential diagnosis of cancer. Our bioinformatics capability allows the integration of the Company’s MSI data files with related pathology, gene expression and demographic datasets, with the purpose of improving human disease state detection, assessment and management. The Company has entered into collaborative research partnerships with top tier academic centers to develop and validate new, proprietary, MSI–based cancer diagnostic tests.

We have established a collaborative research partnership with the Memorial Sloan-Kettering Cancer Center and the Dana-Farber Cancer Institute. The first target of the collaboration is early stage lung adenocarcinoma. The objectives of the collaboration are to demonstrate that different cancer cell sub-groups within a lung cancer will have different molecular profiles and will behave differently. The goal is to define these molecular differences and to identify the sub-group of cancer cells with the worst prognosis that are most likely to recur thereby enabling earlier treatment intervention, and to use these findings to achieve lung adenocarcinoma tumor cell “molecular profiling,” leading to more precise treatment selection and higher survivor rates.

We established a collaborative research initiative with The Yale University School of Medicine that employs our MSI technology to differentiate benign melanocytic nevi from malignant melanoma. We believe that our core MSI technology can identify unique protein expression profiles that can discriminate between benign melanocytic nevi and malignant melanoma.

In April 2016 we entered into an exclusive license agreement for technology with Yale University related to the differential diagnosis of melanoma, specifically designated as a "Method of Differentiating Benign Melanocytic Nevi from Malignant Melanoma." The technology was co-invented by Dr. Rossitza Lazova, of the Department of Dermatology at Yale School of Medicine, and Dr. Erin Seeley our Clinical Imaging Principal Investigator. Under the terms of the license agreement, we have been granted the exclusive worldwide rights to commercialize the technology. We are obligated to pay expenses for the preparation, filing and prosecution of future related patent applications governed by the license agreement and related license fees. Unless earlier terminated in accordance with its terms, the Yale license agreement expires upon the later of 20 years from the effective date or the end of the term of the last underlying patent to expire.

To support our MSI–based diagnostic development, we developed new software known as “Histology Guided Mass Spec Imaging (HG-MSI)” that enables pathologists to combine traditional microscopy and histology with high resolution mass spectrometry molecular imaging. Clinicians can share, annotate and direct the analysis of specific tissue morphologies and cell subpopulations by MSI. Molecular profiling data are collected from discrete locations within a tissue section using a histology stained section as a guide. The digital tissue scans are visually analyzed by pathologists by logging onto a secure website portal and they then annotate specific cellular areas for further analysis.

We intend to expand our collaborations with major medical research centers to develop additional molecular profiles for the improved differential diagnosis and prognosis of cancer.

Recent Developments

We entered into a Memorandum of Understanding (the “MOU”) with Agilent Technologies, Inc. (NYSE: A) (“Agilent”), to develop new bioanalytical workflows in order to meet the emerging needs of the growing biopharmaceutical industry. Under the terms of the MOU, Protea, using Agilent instrumentation combined with its expertise, will develop workflows to improve the characterization of protein therapeutics including monoclonal antibodies and new methods for the field of metabolomics. We believe, along with Agilent, that the field of biotherapeutics is advancing rapidly and is in need of new, innovative solutions that identify changes in the metabolic profiles of cells due to disease processes and drug interactions.

5

We have announced new workflows to support the bioanalytical needs of immuno-oncology, an emerging frontier of cancer treatment that utilizes the body’s own immune system to fight diseases. Our new workflows help provide both visual and analytical certainty of therapeutic efficacy and apply the Company’s core MSI technology to the analysis of drug target tissues and tumor microenvironments.

We have commercialized a consumable product out of the DARPA research grant that is currently being sold to research laboratories performing small molecule analysis. This product called REDIchip (Resonance-Enhanced Desorption Ionization - sample target plates with nanopost array surfaces for matrix-free laser desorption ionization of small molecules) enables researchers to rapidly profile small molecules and metabolites utilizing a MALDI platform. This product does not require the addition of a traditional chemical matrix, but is able to detect and quantitate small molecules due to the highly structured nanopost array. These products are being used with researchers investigating metabolites and small molecule drugs, and they have potential applications within clinical mass spectrometry pain panel management operations.

In April 2016 we entered into an exclusive license agreement for technology with Yale University related to the differential diagnosis of melanoma, specifically designated as a "Method of Differentiating Benign Melanocytic Nevi from Malignant Melanoma." The technology was co-invented by Dr. Rossitza Lazova, of the Department of Dermatology at Yale School of Medicine, and Dr. Erin Seeley our Clinical Imaging Principal Investigator. Under the terms of the license agreement, we have been granted the exclusive worldwide rights to commercialize the technology. We are obligated to pay expenses for the preparation, filing and prosecution of future related patent applications governed by the license agreement and related license fees. Unless earlier terminated in accordance with its terms, the Yale license agreement expires upon the later of 20 years from the effective date or the end of the term of the last underlying patent to expire.

Risk Factors

Our business is subject to a number of risks. You should be aware of these risks before making an investment decision. These risks are discussed more fully in the section of this prospectus titled “Risk Factors,” which begins page of this prospectus and includes:

| · | We have a history of losses; |

| · | We will be required to raise additional financing; |

| · | We have a significant amount of indebtedness; |

| · | We may be unable to protect our intellectual property; |

| · | Market acceptance of our products is still uncertain; |

| · | We face significant competition; and |

| · | Investors in this offering will incur substantial dilution . |

The Reverse Stock Split

In order to seek to qualify the listing of our shares of common stock on the Nasdaq Capital Market or another national securities exchange, on December 1, 2015, we obtained shareholder approval to seek discretionary authority to effect a reverse stock split of our issued and outstanding shares of common stock within a range of between (i) one-for-15 to (ii) one-for-25, as determined at the discretion of our board of directors to be in our best interests without further approval from our stockholders.

We intend to consummate a one-for-25 reverse stock split immediately prior to the effective date of the registration statement of which this prospectus is a part. No fractional shares of common stock were issued in connection with the reverse stock split, and all such fractional interests will be rounded down to the nearest whole number. Issued and outstanding stock options, convertible notes and warrants will be split on the same basis and exercise prices will be adjusted accordingly.

Unless otherwise indicated, all information presented in this prospectus gives retroactive effect to such 1-for-25 reverse stock split and all share price, per share, convertible note conversion prices and stock option and warrant exercise price data set forth in this prospectus has been adjusted to give effect to the one-for-25 reverse stock split.

As of May 26, 2016 and December 31, 2015 we had issued and outstanding a total of (i) 133,720,519 and 133,146,250 shares of our common stock, respectively, and (ii) warrants to purchase a total of 80,807,644 and 71,342,894 shares of our common stock, respectively, at certain exercise prices ranging from $0.25 to $2.25 per share.

As a result of the proposed 1-for-25 reverse stock split, (i) all outstanding 133,720,519 shares of our common stock, prior to the consummation of such reverse stock split, will be reduced to 5,348,820 shares and (ii) all shares of our common stock issuable upon exercise of outstanding 80,807,644 warrants, prior to the consummation of the reverse stock split, will be reduced to 3,232,305 shares with a corresponding increase in the exercise prices of such warrants to prices ranging from $6.25 to $56.25 per share.

Notwithstanding the above, based on our current pre-offering closing market price on the OTCQB at June 21, 2016 of $0.17 per share, in order to offer our shares of common stock within a price range of between $4.50 and $6.50 per share and meet the requirements to list our shares on the Nasdaq Capital Market or other national securities exchange approved by our underwriters, prior to the effective date of the registration statement of which this prospectus is a part, we may be required to obtain stockholder approval to increase such reverse stock split to an amount in excess of 1-for-25. There can be no assurance that such stockholder approval will be obtained. See “Risk Factors’ elsewhere in this prospectus.

Additional information regarding our issued and outstanding securities may be found in the section of this prospectus titled “Description of Securities.”

6

Related Party Indebtedness

As of the date of this prospectus, we are indebted to certain members of our board of directors or their affiliates for loans and advances made to our Company over the past five years in the aggregate amount of $2,676,500. We are currently in discussions with members of our Board of Directors, including Stephen Turner, our President and CEO, to repay (on a pro-rata basis), out of the net proceeds of this offering and on a date which shall be 30 days following the listing of our common stock on the Nasdaq Capital Market, an aggregate of $669,125, or 25% of the total of $2,676,500 of related party advances from such persons. See “Use of Proceeds”. The balance of such indebtedness to our directors and their affiliates would be evidenced by interest-bearing notes due as to principal and accrued interest over a one year period. There can be no assurance that we will be successful in completing the contemplated agreements or the terms and conditions of any such arrangements. Any such agreements may be subject to completion of this offering. In addition, we agreed to issue to certain of our directors, three year warrants to purchase up to 120,000 shares of common stock at an exercise price of $10.00 per share (after giving effect to the reverse stock split), in consideration of their extension of their personal guarantees of our bank line of credit. See “Certain Relationships and Related Transactions” elsewhere in this prospectus.

Organizational History

We were incorporated as SRKP 5, Inc., in Delaware on May 24, 2005. Prior to the Reverse Merger (as defined below) and split-off (as described below), our business was to provide software solutions to deliver geo-location targeted coupon advertising to mobile internet devices.

On September 2, 2011, we entered into an Agreement and Plan of Merger (the “Merger Agreement”) with Protea Biosciences, Inc., a Delaware corporation (“PBI”), and our wholly-owned subsidiary formed to complete the merger. Under the terms of the Merger Agreement, our subsidiary merged with and into PBI, as a result of which PBI became our wholly owned subsidiary (the “Reverse Merger”). In the Reverse Merger, each share of PBI common stock was automatically converted into one share of our common stock, all shares of PBI common stock in treasury were canceled and we assumed all of PBI’s rights and obligations for outstanding convertible securities and warrants. Upon the Reverse Merger, we discontinued our prior business, and our business became the business of PBI and its subsidiaries.

7

Corporate Information

Our principal executive office is located 1311 Pineview Drive, Suite 501, Morgantown, West Virginia 26505. Our telephone number is 1-304-292-2226. Our web address is http://proteabio.com. Information included on our website is not part of this prospectus.

Implications of Being an Emerging Growth Company

We are an "emerging growth company," as defined in the Jumpstart Our Business Startups Act of 2012. We will remain an emerging growth company until the earlier of (i) December 31, 2019, the last day of the fiscal year following the fifth anniversary of the date of the first sale of our common stock pursuant to an effective registration statement under the Securities Act; (ii) the last day of the fiscal year in which we have total annual gross revenues of $1 billion or more; (iii) the date on which we have issued more than $1 billion in nonconvertible debt during the previous three years; or (iv) the date on which we are deemed to be a large accelerated filer under applicable SEC rules. We expect that we will remain an emerging growth company for the foreseeable future, but cannot retain our emerging growth company status indefinitely and will no longer qualify as an emerging growth company on or before December 31, 2019. We refer to the Jumpstart Our Business Startups Act of 2012 herein as the "JOBS Act," and references herein to "emerging growth company" have the meaning associated with it in the JOBS Act. For so long as we remain an emerging growth company, we are permitted and intend to rely on exemptions from specified disclosure requirements that are applicable to other public companies that are not emerging growth companies.

These exemptions include:

| · | being permitted to provide only two years of audited financial statements, in addition to any required unaudited interim financial statements, with correspondingly reduced "Management's Discussion and Analysis of Financial Condition and Results of Operations" disclosure; | |

| · | not being required to comply with the requirement of auditor attestation of our internal controls over financial reporting; |

| · | not being required to comply with any requirement that may be adopted by the Public Company Accounting Oversight Board regarding mandatory audit firm rotation or a supplement to the auditor's report providing additional information about the audit and the financial statements; | |

| · | reduced disclosure obligations regarding executive compensation; and | |

| · | not being required to hold a nonbinding advisory vote on executive compensation and shareholder approval of any golden parachute payments not previously approved. |

For as long as we continue to be an emerging growth company, we expect that we will take advantage of the reduced disclosure obligations available to us as a result of that classification. We have taken advantage of certain of those reduced reporting burdens in this prospectus. Accordingly, the information contained herein may be different than the information you receive from other public companies in which you hold stock.

An emerging growth company can take advantage of the extended transition period provided in Section 7(a)(2)(B) of the Securities Act for complying with new or revised accounting standards. This allows an emerging growth company to delay the adoption of certain accounting standards until those standards would otherwise apply to private companies. We have irrevocably elected to avail ourselves of this extended transition period and, as a result, we will not be required to adopt new or revised accounting standards on the dates on which adoption of such standards is required for other public reporting companies.

We are also a "smaller reporting company" as defined in Rule 12b-2 of the Securities Exchange Act of 1934, as amended, or the Exchange Act, and have elected to take advantage of certain of the scaled disclosure available for smaller reporting companies.

8

THE OFFERING

| Common stock outstanding prior to the offering | 5,348,820 shares (1) |

| Common stock offered by the Company | 3,100,000 shares | |

| Over-allotment option | The underwriters have an option for a period of 45 days to purchase up to 465,000 additional shares of our common stock to cover over-allotments, if any. | |

| Use of proceeds | We estimate that the net proceeds to us from this offering will be approximately $15,000,000 or approximately $17,352,900 if the underwriters exercise their option to purchase additional shares in full, after deducting the underwriting discounts and commissions and estimated offering expenses payable by us. We intend to use the net proceeds of this offering to reduce our indebtedness by approximately $1,324,125 (including, approximately $669,125 owed to certain of our stockholders and directors), to fund research and development of new products, to increase our sales and marketing efforts, to build infrastructure, including hiring of additional personnel, and for working capital and other general corporate purposes. For additional information, please refer to the section entitled “Use of Proceeds’ on page 22 of this prospectus. | |

| Proposed Nasdaq Stock Market symbol: | PRGB. Our common stock is currently quoted on the OTCQB under the symbol “PRGB.” | |

| Risk Factors | You should carefully consider the information set forth in this prospectus and, in particular, the specific factors set forth in the “Risk Factors” section beginning on page 10 of this prospectus before deciding whether or not to invest in shares of our common stock. |

| (1) | Represents shares of our common stock outstanding as of March 31, 2016. Does not include: |

| · | 394,203 shares of common stock issuable upon the exercise of outstanding stock options, at a weighted average exercise price of $17.25 per share; | |

| · | 3,141,890 shares of common stock issuable upon the exercise of outstanding warrants at a weighted average exercise price of $17.64 per share; | |

| · | 120,000 shares of common stock issuable upon the exercise of warrants we intend to issue to certain of our directors at an exercise price of $10.00 per share; | |

| · | 40,242 shares of common stock issuable upon conversion of $400,000 of convertible notes and 235,000 shares of common stock issuable upon conversion of $1,468.750 of convertible notes issued in May and June 2016; | |

| · | 90,415 shares of our common stock underlying warrants issued to the representative of the underwriters, in their capacity as placement agent in two private placements consummated in the fourth quarter of 2015, the first quarter of 2016, and May and June 2016, respectively, and | |

| · | shares of our common stock underlying the warrants to be issued to the representative of the underwriters in connection with this offering. |

Except as otherwise indicated, all information in this prospectus assumes and gives effect to:

| · | A 1-for-25 reverse split of our common stock, which will occur prior to the effectiveness of the registration statement of which this prospectus is a part. |

| · | no exercise by the underwriters of their option to purchase up to an additional 465,000 shares of our common stock. |

| · | no exercise of the of the representative’s warrants described above. |

9

Our business is subject to many risks and uncertainties, which may affect our future financial performance. If any of the events or circumstances described below occur, our business and financial performance could be adversely affected, our actual results could differ materially from our expectations, and the price of our stock could decline. The risks and uncertainties discussed below are not the only ones we face. There may be additional risks and uncertainties not currently known to us or that we currently do not believe are material that may adversely affect our business and financial performance. You should carefully consider the risks described below, together with all other information included in this prospectus including our financial statements and related notes, before making an investment decision. The statements contained in this prospectus that are not historic facts are forward-looking statements that are subject to risks and uncertainties that could cause actual results to differ materially from those set forth in or implied by forward-looking statements. If any of the following risks actually occurs, our business, financial condition or results of operations could be harmed. In that case, the trading price of our common stock could decline, and investors in our securities may lose all or part of their investment.

Risks Related to Our Business

We are an emerging growth company with a limited operating history and limited sales to date.

The Company is subject to all of the risks inherent in the establishment of an emerging growth company including the absence of an operating history and the risk that we may be unable to successfully develop, manufacture and sell our products. There can be no assurance that the Company will be able to execute its business plan, including without limitation the Company’s plans to develop, then manufacture, market and sell its technologies, products and services. The Company has engaged in limited manufacturing operations to date and although the Company believes that its plans to conduct manufacturing of its products internally will work, there is no assurance that this will be the case. The Company began to sell products and services in the fourth quarter of 2007 and sales to date are limited. There can be no assurance that the Company’s sales projections and marketing plans will be achieved as anticipated and planned. It is likely that losses will be incurred during the early stages of operations. The Company believes that its future success will depend on its ability to develop and introduce its instruments and services for mass spec molecular imaging, to meet a wide range of customer needs and achieve market acceptance. The Company cannot assure prospective investors that it will be able to successfully develop and market its products or that it will recover the initial investment that must be made to develop and market such products.

We have incurred net losses since inception.

We incurred a net loss of $1,085,496 for the quarter ended March 31, 2016, $9,574,434 for the year ended December 31, 2015 and $11,474,770 for the year ended December 31, 2014. As of March 31, 2016, the Company has an accumulated deficit of $80,683,152 since inception. Our independent registered public accountants issued an opinion on our audited financial statements as of and for the year ended December 31, 2015 that contains an explanatory paragraph regarding substantial doubt about our ability to continue as a going concern. We can provide no assurance as to when, or if, we will be profitable in the future. Even if the Company achieves profitability, it may not be able to sustain such profitability

We must raise additional working capital.

At the present time, our ability to continue as a going concern is dependent upon raising capital from financing transactions. To stay in business, we will need to raise additional working capital through public or private sales of our equity securities, debt financing or short-term bank loans, or a combination of the foregoing. We are currently in the process of seeking to obtain additional working capital through the private placement of additional bridge notes and warrants. Based on our current spending levels, management estimates that the Company will need to raise approximately $6,000,000 in additional working capital to maintain current operations through the next twelve calendar months.

There can be no assurance that we will be able to raise sufficient additional working capital financing to sustain our operations on acceptable terms, or at all. If such financing is not available on satisfactory terms or is not available at all, we may be required to delay, scale back or eliminate the development of business opportunities and our operations and our financial condition may be materially adversely affected. Debt financing, if obtained, may involve agreements that include covenants limiting or restricting our ability to take specific actions such as incurring additional debt and could increase our expenses and require that our assets be provided as a security for such debt. Debt financing would also be required to be repaid regardless of our operating results. Equity financing, if obtained, could result in dilution to our then existing stockholders.

10

Issuance of common stock to fund our operations or upon the conversion of convertible debt or equity securities or exercise of outstanding warrants and options may dilute your investment.

We have been operating at a loss since inception and our working capital requirements continue to be significant. We have been supporting our business through the sale of debt and equity since inception. We will need additional funding for developing products and services, increasing our sales and marketing capabilities, technologies and assets, as well as for working capital requirements and other operating and general corporate purposes. Our working capital requirements depend and will continue to depend on numerous factors including the timing of revenues, the expense involved in development of our products, and capital improvements. If we are unable to generate sufficient revenue and cash flow from operations, we will need to seek additional financing through the sale of additional shares of common stock, warrants and/or convertible debt securities to provide the capital required to maintain or expand our operations, which may have the effect of diluting our existing stockholders or restricting our ability to run our business.

As of the date of this prospectus, we have warrants to purchase an aggregate of 3,155,930 shares of common stock issued and outstanding, as adjusted for the reverse stock split. The Company also has reserved an aggregate of 166,000 shares of common stock for issuance under its 2002 Equity Incentive Plan (the “2002 Plan”) and 500,000 shares of common stock have been reserved for issuance under the Company’s 2013 Equity Incentive Plan (the “2013 Plan”). As of the date of this prospectus, options to purchase an aggregate of 394,203 shares of common stock have been granted and are outstanding under the 2002 Plan and the 2013 Plan, collectively.

We have significant short-term indebtedness.

As of June 20, 2016, we have total indebtedness of $10,282,400, which includes $5,766,965 that is due within twelve months. Of this short-term component, $2,676,500 is owed to certain members of the Company’s Board of Directors or their affiliates, $961,226 is represented by notes owed primarily to three governmental agencies of the State of West Virginia, $1,739,568 is represented by convertible notes issued in 2016, $389,671 is related to capitalized leases. We are currently in discussions with existing directors holding $2,676,500 of related party indebtedness to defer payment of an estimated $ 2,007,375 or 75% of the total amount owed to them. Although we have allocated an estimated $1,324,125 of the net proceeds of this offering to reduce our indebtedness (including approximately $669,125 owed to certain of our stockholders and directors) there can be no assurance that the maturity dates of the balance of our obligations owed to the existing directors and shareholders, and the governmental agencies of the State of West Virginia can or will be extended, if required, nor do we know the final terms and conditions of any extensions, if any. If such obligations are not extended, we will be required to apply additional net proceeds of this offering to further reduce our debt obligations. See “Use of Proceeds” “Management’s Discussion and Analysis of Financial Condition and Results of Operations,” and “Certain Relationships and Related Transactions” elsewhere in this prospectus.

We depend on the pharmaceutical and biotechnology industries.

Over the past several years, some areas of our businesses have grown significantly as a result of an increase in the sales of our bioanalytical instrument platform known as “LAESI®” and the increase in pharmaceutical, academic and clinical research laboratory outsourcing of their clinical drug research support activities. We believe that due to the significant investment in facilities and personnel required to support drug development, pharmaceutical, academic and clinical research laboratories look to purchase our bioanalytical instrument platforms and solutions technology to meet and administer their drug research requirements. Our revenues depend greatly on the expenditures made by these pharmaceutical and academic/clinical research laboratory companies in research and development. In some instances, companies in these industries are reliant on their ability to raise capital in order to fund their research and development projects. Accordingly, economic factors and industry trends that affect our clients in these industries also affect our business. If companies in these industries were to reduce the number of research and development projects they conduct or outsource, our business could be materially adversely affected.

Changes in government regulation or in practices relating to the pharmaceutical industry could change the need for the services we provide.

Governmental agencies throughout the world, but particularly in the United States, strictly regulate the drug development process. Changes in regulation, such as regulatory submissions to meet the internal research and development standards of pharmaceutical research, a relaxation in existing regulatory requirements, the introduction of simplified drug approval procedures or an increase in regulatory requirements that we may have difficulty satisfying or that make our services less competitive, could substantially change the demand for our services. Also, if the government increases efforts to contain drug costs and pharmaceutical companies profits from new drugs, our customers may spend less, or reduce their growth in spending on research and development.

We may be affected by health care reform.

In March 2010, the United States Congress enacted the Patient Protection and Affordable Care Act (“PPACA”) which is intended over time to expand health insurance coverage and impose health industry cost containment measures. PPACA legislation and the accompanying regulations may significantly impact the pharmaceutical and biotechnology industries as it is implemented over the next several years. In addition, the U.S. Congress, various state legislatures and European and Asian governments may consider various types of health care reform in order to control growing health care costs. We are unable to predict what legislative proposals will be adopted in the future, if any.

Implementation of health care reform legislation may have certain benefits but also may contain costs that could limit the profits that can be made from the development of new drugs. This could adversely affect research and development expenditures by pharmaceutical and biotechnology companies, which could in turn decrease the business opportunities available to us both in the United States and abroad. In addition, new laws or regulations may create a risk of liability, increase our costs or limit our service offerings.

11

A reduction in research and development budgets at pharmaceutical companies and clinical research institutions may adversely affect our business.

Our customers include researchers at pharmaceutical companies and academic/clinical research laboratory institutions. Our ability to continue to grow and win new business is dependent in large part upon the ability and willingness of the pharmaceutical and biotechnology industries to continue to spend on research and development and to outsource their product equipment and service needs. Fluctuations in the research and development budgets of these researchers and their organizations could have a significant effect on the demand for our products and services. Research and development budgets fluctuate due to changes in available resources, mergers of pharmaceutical companies and spending priorities and institutional budgetary policies of academic/clinical research organizations. Our business could be adversely affected by any significant decrease in life sciences research and development expenditures by pharmaceutical and academic/clinical research companies. Similarly, economic factors and industry trends that affect our clients in these industries also affect our business.

We rely on a limited number of key customers, the importance of which may vary dramatically from year to year, and a loss of one or more of these key customers may adversely affect our operating results.

A small number of customers have accounted for a substantial portion of our revenues in 2015. Five customers accounted for approximately 52% of our gross revenue in fiscal 2015 and five customers accounted for approximately 42% of our gross revenues in fiscal 2014. One large pharmaceutical company accounted for 20% of our gross revenue in 2015, and this customer will continue to be a significant contributor to revenue in 2016. The loss of a significant amount of business from one of our major customers would materially and adversely affect our results of operations until such time, if ever, as we are able to replace the lost business. Significant clients or projects in any one period may not continue to be significant clients or projects in other periods. In any given year, there is a possibility that a single pharmaceutical or academic/ clinical research laboratory company may account for 5% or more of our gross revenue or that our business may be dependent on one or more large projects. To the extent that we are dependent on any single customer, we are subject to the risks faced by that customer to the extent that such risks impede the customer's ability to stay in business and make timely payments to us.

We may bear financial risk if we underprice our contracts or overrun cost estimates.

Since some of our contracts are structured as fixed price or fee-for-service, we bear the financial risk if we initially underprice our contracts or otherwise overrun our cost estimates. Such underpricing or significant cost overruns could have a material adverse effect on our business, results of operations, financial condition, and cash flows.

A default in our credit facility could materially and adversely affect our operating results and our financial condition.

The Company has an outstanding line of credit with United Bank. This credit facility requires us to adhere to certain contractual covenants. If there were an event of default under our credit facility that was not cured or waived, the lenders of the defaulted debt could cause all amounts outstanding with respect to that debt to be due and payable immediately. Although the outstanding balance of this line of credit is currently payable on demand, the amount due and the status of the payment terms have been unchanged since the first quarter of 2014. We cannot assure that our assets or cash flow would be sufficient to fully repay borrowings under the credit facility, either upon the bank’s demand or upon an event of default, or that we would be able to refinance or restructure the payments becoming due on the credit facility. Please see Note 3 to the Consolidated Financial Statements, “Bank Line of Credit,” for additional detail regarding our credit facility.

We might incur expenses to develop products that are never successfully commercialized.

We have incurred and expect to continue to incur research and development and other expenses in connection with our products business. The potential products to which we devote resources might never be successfully developed or commercialized by us for numerous reasons including:

| · | inability to develop products that address our customers’ needs; | |

| · | competitive products with superior performance; | |

| · | patent conflicts or unenforceable intellectual property rights; | |

| · | demand for the particular product; | |

| · | other factors that could make the product uneconomical; and | |

| · | termination of pre-existing license agreements. |

Incurring expenses for a potential product that is not successfully developed and/or commercialized could have a material adverse effect on our business, financial condition, prospects and stock price.

12

Our business uses biological and hazardous materials, which could injure people or violate laws, resulting in liability that could adversely impact our financial condition and business.

Our activities involve the controlled use of potentially harmful biological materials as well as hazardous materials and chemicals. We cannot completely eliminate the risk of accidental contamination or injury from the use, storage, handling or disposal of these materials. In the event of contamination or injury, we could be held liable for damages that result and any liability could exceed our insurance coverage and ability to pay. Any contamination or injury could also damage our reputation, which is critical to obtaining new business. In addition, we are subject to federal, state and local laws and regulations governing the use, storage, handling and disposal of these materials and specified waste products. The cost of compliance with these laws and regulations is significant and if changes are made to impose additional requirements, these costs could increase and have an adverse impact on our financial condition and results of operations.

Hardware or software failures, delays in the operations of our computer and communications systems or the failure to implement system enhancements could harm our business.

Our success depends on the efficient and uninterrupted operation of our computer and communications systems. A failure of our network or data gathering procedures could impede the processing of data, delivery of databases and services, client orders and day-to-day management of our business and could result in the corruption or loss of data. While all of our operations have disaster recovery plans in place, they might not adequately protect us. Despite any precautions we take, damage from fire, floods, hurricanes, power loss, telecommunications failures, computer viruses, break-ins and similar events at our computer facilities could result in interruptions in the flow of data to our servers and from our servers to our clients. In addition, any failure by our computer environment to provide our required data communications capacity could result in interruptions in our service. In the event of a delay in the delivery of data, we could be required to transfer our data collection operations to an alternative provider of server hosting services. Such a transfer could result in delays in our ability to deliver our products and services to our clients. Additionally, significant delays in the planned delivery of system enhancements, improvements and inadequate performance of the systems once they are completed could damage our reputation and harm our business. Finally, long-term disruptions in the infrastructure caused by events such as natural disasters, the outbreak of war, the escalation of hostilities and acts of terrorism, particularly involving cities in which we have offices, could adversely affect our businesses. Although we carry property and business interruption insurance, our coverage might not be adequate to compensate us for all losses that may occur.

We rely on third parties for important services.

We depend on third parties to provide us with services critical to our business. The failure of any of these third parties to adequately provide the needed services including, without limitation, licensed intellectual property rights, could have a material adverse effect on our business.

We license a significant portion of our intellectual property from third parties; if the Company fails to remain in compliance with these agreements the Company’s business may be adversely affected.

The Company has entered into a number of technology license agreements with various universities for the exclusive use of a significant portion of the patent-based intellectual property that the Company uses. Generally, the license agreements imposes, and we expect that future license agreements will impose, various diligence, milestone payment, royalty and other obligations on us. If we fail to comply with our obligations under these agreements, or if we file for bankruptcy, we may be required to make certain payments to the licensor, we may lose the exclusivity of our license, or the licensor may have the right to terminate the license, in which event we would not be able to develop or market products covered by the license. Additionally, the milestone and other payments associated with these licenses could materially and adversely affect our business, financial condition and results of operations. While the Company is currently in compliance with the respective terms of these agreements, if there are one or more breaches thereunder, such as the failure to pay the applicable royalties, and one or more of these agreements are terminated, the Company will not be able to use such technology and the Company’s business may be adversely affected.

In some cases, patent prosecution of our licensed technology may be controlled solely by the licensor. If our licensors fail to obtain and maintain patent or other protection for the proprietary intellectual property we in-license from them, we could lose our rights to the intellectual property or our exclusivity with respect to those rights, and our competitors could market competing products using the intellectual property. In certain cases, we may control the prosecution of patents resulting from licensed technology. In the event we breach any of our obligations related to such prosecution, we may incur significant liability to our licensing partners. Licensing of intellectual property is of critical importance to our business and involves complex legal, business and scientific issues. Disputes may arise regarding intellectual property subject to a licensing agreement, including, but not limited to:

| · | the scope of rights granted under the license agreement and other interpretation-related issues; |

| · | the extent to which our technology and processes infringe on intellectual property of the licensor that is not subject to the licensing agreement; |

| · | the sublicensing of patent and other rights; |

| · | our diligence obligations under the license agreement and what activities satisfy those diligence obligations; |

13

| · | the ownership of inventions and know-how resulting from the joint creation or use of intellectual property by our licensors and us and our collaborators; and |