Attached files

| file | filename |

|---|---|

| EX-99.1 - EXHIBIT 99.1 - FIRST BANCORP /NC/ | c442728_ex99-1.htm |

| EX-2.1 - EXHIBIT 2.1 - FIRST BANCORP /NC/ | c442728_ex2-1.htm |

| 8-K - FORM 8-K - FIRST BANCORP /NC/ | c442728_8k.htm |

Exhibit 99.2

First Bancorp Acquisition of Carolina Bank Holdings, Inc. June 22, 2016

Forward - Looking Statements Forward Looking Statements Information in this presentation contains “forward - looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995, such as statements relating to future plans and expectations, and are thus prospective. Such forward - looking statements include but are not limited to stateme nts with respect to plans, objectives, expectations, and intentions and other statements that are not historical facts, and other statements identified by words such as “believes ,” “expects,” “anticipates,” “estimates,” “intends,” “plans,” “targets,” and “projects,” as well as similar expressions. These statements involve risks and uncertainties that cou ld cause actual results to differ materially, including without limitation, reduced earnings due to larger than expected credit losses in the sectors of our loan portfolio secured b y r eal estate due to economic factors, including declining real estate values, increasing interest rates. increasing unemployment, or changes in payment behavior or other factors; redu ced earnings due to larger credit losses because our loans are concentrated by loan type, industry segment, borrower type, or location of the borrower or collateral; the rate of del inquencies and amount of loans charged - off; the adequacy of the level of our allowance for loan losses and the amount of loan loss provisions required in future periods, cos ts or difficulties related to the integration of our acquisitions may be greater than expected; results of examinations by our regulatory authorities, including the possibility that the regulator y a uthorities may, among other things, require us to increase our allowance for loan losses or writedown assets; the amount of our loan portfolio collateralized by real estate, and the weakness in the commercial real estate market; our ability to maintain appropriate levels of capital; adverse changes in asset quality and resulting credit ris k - related losses and expenses; increased funding costs due to market illiquidity, increased competition for funding, and increased regulatory requirements with regard to funding; s ign ificant increases in competitive pressure in the banking and financial services industries; changes in political conditions or the legislative or regulatory environment, incl udi ng the effect of financial reform legislation on the banking industry; general economic conditions, either nationally or regionally and especially in our primary service area, be com ing less favorable than expected resulting in, among other things, a deterioration in credit quality; our ability to retain our existing customers, including our deposit relation shi ps; changes occurring in business conditions and inflation; changes in monetary and tax policies; ability of borrowers to repay loans; risks associated with a failure in or breach of ou r o perational or security systems or infrastructure, or those of our third party vendors and other service providers or other third parties, including as a result of cyber attacks, which cou ld disrupt our businesses. result in the disclosure or misuse of confidential or proprietary information, damage our reputation, increase our costs and cause losses; changes in accou nting principles, policies or guidelines; changes in the assessment of whether a deferred tax valuation allowance is necessary; our reliance on secondary sources such as FHLB adv anc es, sales of securities and loans, federal funds lines of credit from correspondent banks and out - of - marker time deposits, to meet our liquidity needs; loss of consumer confiden ce and economic disruptions resulting from terrorist activities or other military actions; and changes in the securities markets. Additional factors that could cause our actual results to differ materially from those described in the forward - looking statements are disc ussed in the Company’s filings with the Securities and Exchange Commission (“SEC“), including without limitation its Annual Report on Form 10 - K, its Quarterly Reports o n Form 10 - Q, and its Current Reports Form 8 - K. all of which are filed with the SEC and available at the SEC’s Internet site (http://www.sec.gov). All subsequent written and ora l f orward - looking statements concerning the Company or any person acting on its behalf is expressly qualified in its entirety by the cautionary statements above. The forward - looking s tatements in this presentation speak only as of the date of the presentation and the Company does not assume any obligation to update such forward - looking statements. Non - GAAP Measures Statements included in this presentation include non - GAAP measures and should be read along with our News Release of April 27, 2016 reporting our operating results as of and for the quarter ended March 31, 2016, which provides a reconciliation of non - GAAP measures to GAAP measures. Management believes that these non - GAAP measures provide additional useful information that allows readers to evaluate the ongoing performance of the Company. Non - GAAP measures should n ot be considered as an alternative to any measure of performance or financial condition as promulgated under GAAP, and investors should consider the Company’s performa nce and financial condition as reported under GAAP and all other relevant information when assessing the performance or financial condition of the Company. Non - GAAP measures have limitations as analytical tools, and investors should not consider them in isolation or as a substitute for analysis of the Company’s results or financial conditi on as reported under GAAP . 2

Dollars in millions Source: SNL Financial Data as of or for the twelve months ended 3/31/16 Note: Core deposits defined as total deposits less deposits greater than $100,000 Overview of Carolina Bank Holdings, Inc. Branch Network Financial Highlights CLBH Retail Branch ( 8 ) CLBH Retail Mortgage Office (3 ) 3 Company Overview Headquarters Greensboro, NC Year Established 1996 Balance Sheet Total Assets $706 Total Loans 491 Deposits 601 Loans / Deposits 81.7% % Core Deposits 87.1 LTM Profitability ROAA 0.75% ROATCE 8.67 Net Interest Margin 3.71 Efficiency Ratio 75.1 Noninterest Inc. / Avg. Assets 1.82 Noninterest Exp. / Avg. Assets 4.03 Asset Quality NPAs / Assets 2.86% NPAs (excl. TDRs) / Assets 1.15 Reserves / Loans 1.22 Capitalization Tang. Com. Equity / Assets 8.88% Leverage Ratio 9.74 CET1 Ratio 12.62 Total Capital Ratio 14.40

(1) Based on FBNC stock price of $18.98 as of 6/21/16 and a cash payment of $20.00 per share (2) Based on FBNC common shares outstanding of 20,059,552 and CLBH common shares outstanding of 5,043,108 and a fixed exchange ratio of 1.002x Transaction Terms First Bancorp (Nasdaq: FBNC) Seller Carolina Bank Holdings, Inc. (Nasdaq: CLBH) Stock Consideration 1.002 shares of FBNC stock for each share of CLBH stock, for 75% of CLBH shares Aggregate Transaction Value $97.3 million Pro Forma Ownership FBNC: 84.1% / CLBH: 15.9% (2) Board Representation 2 CLBH Board members will join the Board of FBNC Required Approvals CLBH shareholder vote and customary regulatory approvals Late 4 th Quarter 2016 / Early 1 st Quarter 2017 Expected Closing Buyer 4 Indicative Price Per Share $19.26 (1) Cash Consideration $20.00 per share for 25% of CLBH shares

(1) Based on CLBH’s tangible book value per share of $12.45 as of 3/31/16 (2) Data for the twelve months ended 3/31/16 (3) Based on CLBH’s closing price of $15.97 on 6/21/16 and indicative price per share of $19.26 Transaction Multiples 5 Price / LTM EPS 18.5x (2) Price / TBV 155% (1) Market Premium 20.6% (3)

STRATEGIC RATIONALE » Branch overlap (3) and mortgage business provide efficiency opportunities » Low to mid - teens EPS accretion » T angible book value dilution of approximately 8% » Tangible book value earnback period of approximately 4.75 years » Positions our franchise for top tier financial performance Strategic Rationale » Accelerates First Bancorp’s expansion into growth markets » Third initiative of 2016 in attractive Piedmont Triad market » January 2016 hiring of banking team from competitor » March 2016 announcement of branch exchange agreement » June 2016 agreement to acquire Carolina Bank Holdings, Inc. » Comprehensive due diligence process completed on the loan portfolio » Similar cultures and customer bases » Familiar markets » Senior management teams bring complementary expertise and market knowledge » CLBH CEO and CFO expected to assist through integration period FINANCIALLY ATTRACTIVE LOW RISK 6

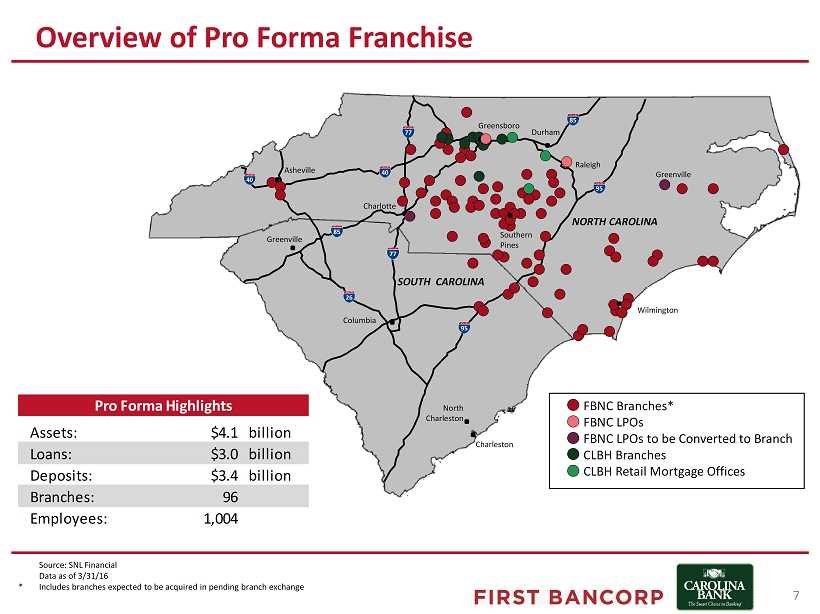

Asheville Greenville Charlotte Columbia Greensboro Durham Raleigh North Charleston Charleston NORTH CAROLINA SOUTH CAROLINA Wilmington FBNC Branches* FBNC LPOs FBNC LPOs to be Converted to Branch CLBH Branches CLBH Retail Mortgage Offices Source: SNL Financial Data as of 3/31/16 * Includes branches expected to be acquired in pending branch exchange Overview of Pro Forma Franchise 7 Southern Pines Greenville Pro Forma Highlights Assets: $4.1 billion Loans: $3.0 billion Deposits: $3.4 billion Branches: 96 Employees: 1,004

Source : SNL Financial, Fortune.com , The Greensboro Partnership, City of Greensboro, Bureau of Labor Statistics Unemployment data as of 4/30/16 Demographics deposit weighted by county; demographic data as of 6/30/15 * Includes all counties with current FBNC deposit presence Market Highlights – Greensboro, NC Greensboro Market Overview » 3 rd largest MSA in North Carolina, 74 th in the U.S. » Population of 754,836 » Total deposits of $11.6 billion dollars in the Greensboro MSA » Home to six colleges and universities » Primary economic drivers are nanotechnology, higher education, healthcare, transportation, global logistics sectors, textiles, tobacco and service industries Strong Corporate Presences in Greensboro, NC MSA 8 Demographically Accretive Greensboro Population vs. Legacy Markets * 13% 87% Greensboro MSA Legacy Markets 4.3% 4.8% FBNC CLBH 5.6% 6.8% FBNC CLBH ‘16 - ‘21 Proj . Pop. Growth ‘16 - ‘21 Proj . HHI Growth *

CLBH Combined Counties of Operation Deposit Market Share (1) Forsyth County Guilford County Randolph County Deposit market share data as of 6/30/15; pro forma for announced transactions (1) Includes Alamance County, Forsyth County, Guilford County and Randolph County, NC (2) Community bank defined as institutions with total assets less than $10.0 billion Strong Presence in Attractive North Carolina Markets 9 Alamance County FBNC Pro Forma x x x 5 th 4 th 4 th 5 th CLBH 8 th x x Deposits Market Rank Institution ($mm) Share Branches 1 BB&T Corp. $27,778 64.20% 37 2 Wells Fargo & Co. 4,654 10.76 57 3 Bank of America Corp. 1,789 4.13 28 4 SunTrust Banks Inc. 1,674 3.87 25 5 BNC Bancorp 1,301 3.01 27 6 Capital Bank Financial Corp. 1,050 2.43 23 7 First Citizens BancShares Inc. 920 2.13 18 8 Yadkin Financial Corp. 875 2.02 13 Pro Forma 807 1.87 16 9 Piedmont Federal Savings Bank 637 1.47 8 10 Carolina Bank Holdings Inc. 596 1.38 8 15 First Bancorp 211 0.49 8 x x 9 th 3 rd 3 rd x x x 5 th 3 rd 3 rd x Community Bank Deposit Market Share Rank (2)

10 Transaction Assumptions and Financial Impact Assumptions Financial Impact Pro Forma Capital Ratios at Close » Loan credit mark of $10.0 million, or 2.0% of gross loans » Based on comprehensive credit review performed by FBNC management and third party loan review firm » Cost savings of ~40% of CLBH noninterest expense » 75 % realized in 2017, 100% annually thereafter » Merger related charges of $9.2 million after - tax » Projected close Q4 ‘16 / Q1 ‘17 » Pro forma company over $4.0 billion in assets » Low to mid - teens GAAP EPS accretion » Tangible book value dilution of approximately 8% » T angible book value earnback period of approximately 4.75 years » IRR in excess of 20% » TCE / TA: 7.7% » Tier 1 Leverage Ratio: 9.4% » CET1 Ratio: 10.3% » Total Capital Ratio: 13.1%

Potential Future Opportunities Mortgage Banking Wealth Management & Trust Treasury Services SBA Lending Team Insurance Credit Cards x x x x x x x Lines of Business x 11

SHAREHOLDERS » Community banking model with a focus on serving clients » Increased branch presence in appealing North Carolina markets » Ability to provide enhanced products and services » Community bank market leader in North Carolina Benefits to the Combined Stakeholders » Strategically and financially attractive transaction » Successful Board and management team with strong community ties » Improved liquidity and dividend for CLBH shareholders » Opportunity for increased shareholder value for both companies » Similar cultures and markets allows for a simplified employee transition period » Larger organization creates opportunities for career advancement » Long - term dedicated management teams » Larger size increases public identity and recruiting capability CUSTOMERS EMPLOYEES 12

APPENDIX

North Carolina’s Most Populous Markets Source: Carolina Demography Asheville Charlotte Raleigh Winston - Salem Greensboro Fayetteville Greenville Less than 50 50 - 99 100 - 249 250 - 499 500 - 999 1,000 - 1,999 2,000 units or more Housing Units per Square Mile 14

C&D 12% 1 - 4 Family 38% Multifamily 3% Owner - Occupied CRE 19% Non Owner - Occupied CRE 17% C&I 6% Consumer & Other 5% C&D 12% 1 - 4 Family 35% Multifamily 5% Owner - Occupied CRE 18% Non Owner - Occupied CRE 20% C&I 10% Consumer & Other < 1% C&D 12% 1 - 4 Family 39% Multifamily 3% Owner - Occupied CRE 19% Non Owner - Occupied CRE 16% C&I 5% Consumer & Other 5% Source : SNL Financial Dollars in thousands Data as of or for the three months ended 3/31/16; CLBH data bank level (1) Excludes purchase accounting adjustments Pro Forma Loan Portfolio – Comparable Profile FBNC CLBH Pro Forma (1) Yield on Total Loans : 4.70% Yield on Total Loans : 4.68% Loan Portfolio Amount % of Total C&D $302,052 11.9 % 1-4 Family 997,436 39.2 Multifamily 73,791 2.9 Owner-Occupied CRE 484,906 19.1 Non Owner-Occupied CRE 408,240 16.1 C&I 139,559 5.5 Consumer & Other 137,081 5.4 Gross Loans & Leases $2,543,065 100.0 % Loan Portfolio Amount % of Total C&D $59,742 12.2 % 1-4 Family 169,658 34.5 Multifamily 23,056 4.7 Owner-Occupied CRE 88,960 18.1 Non Owner-Occupied CRE 96,260 19.6 C&I 50,022 10.2 Consumer & Other 3,575 0.7 Gross Loans & Leases $491,273 100.0 % Loan Portfolio Amount % of Total C&D $361,794 11.9 % 1-4 Family 1,167,094 38.5 Multifamily 96,847 3.2 Owner-Occupied CRE 573,866 18.9 Non Owner-Occupied CRE 504,500 16.6 C&I 189,581 6.2 Consumer & Other 140,656 4.6 Gross Loans & Leases $3,034,338 100.0 % 15

Demand Deposits 24% NOW Accounts 19% Money Market & Savings 33% Retail Time Deposits 13% Jumbo Time Deposits 11% Demand Deposits 22% NOW Accounts 10% Money Market & Savings 47% Retail Time Deposits 8% Jumbo Time Deposits 13% Demand Deposits 24% NOW Accounts 22% Money Market & Savings 30% Retail Time Deposits 14% Jumbo Time Deposits 10% Source: SNL Financial Dollars in thousands Data as of or for the three months ended 3/31/16; CLBH data bank level Note: Jumbo time deposits defined as time deposits greater than $ 100,000 Pro Forma Deposit Portfolio – Comparable Profile FBNC CLBH Pro Forma Cost of Total Deposits: 0.19% Cost of Total Deposits: 0.33% Deposit Composition Amount % of Total Demand Deposits $679,228 24.0 % NOW Accounts 607,617 21.5 Money Market & Savings 862,077 30.5 Retail Time Deposits 391,317 13.8 Jumbo Time Deposits 286,582 10.1 Total Deposits $2,826,821 100.0 % Deposit Composition Amount % of Total Demand Deposits $135,628 22.4 % NOW Accounts 59,749 9.9 Money Market & Savings 283,884 47.0 Retail Time Deposits 47,463 7.9 Jumbo Time Deposits 77,751 12.9 Total Deposits $604,475 100.0 % Deposit Composition Amount % of Total Demand Deposits $814,856 23.7 % NOW Accounts 667,366 19.4 Money Market & Savings 1,145,961 33.4 Retail Time Deposits 438,780 12.8 Jumbo Time Deposits 364,333 10.6 Total Deposits $3,431,296 100.0 % 16

82% 77% 81% 198% 238% 205% 0% 100% 200% 300% 400% FBNC CLBH Pro Forma Source : SNL Financial Data as of 3/31/16 Excludes purchase accounting adjustments (1) C&D concentration defined as 1 - 4 residential family construction loans and other construction loans and all land development loans a nd other land loans as a percent of total risk based capital (2) CRE concentration defined as C&D concentration plus loans securitized by multi - family properties, loans secured by other non - farm, n on - residential properties and loans to finance CRE as a percent of total risk based capital Loan Concentration CRE / C&D Concentration (%) (1)(2) 17 » Pro forma company remains well below regulator - recommended C&D and CRE concentrations of 100% and 300%, respectively C&D Concentration CRE Concentration

Additional Information About the Proposed Transaction Additional Information About the Proposed Transaction and Where to Find It This communication is being made in respect of the proposed transaction involving First Bancorp and Carolina Bank Holdings, I nc. . This material is not a solicitation of any vote or approval of Carolina Bank Holdings, Inc.’s shareholders and is not a substitute fo r the proxy statement/prospectus or any other documents which First Bancorp and Carolina Bank Holdings, Inc. may send to their respective sh areholders in connection with the proposed merger. This communication does not constitute an offer to sell or the solicitation of an offer to buy any securities. In connection with the proposed transaction, First Bancorp intends to file with the SEC a Registration Statement on Form S - 4 tha t will include a proxy statement of Carolina Bank Holdings, Inc. and a prospectus of First Bancorp, as well as other relevant documents conc ern ing the proposed transaction. Investors and security holders are also urged to carefully review and consider each of First Bancorp’s an d Carolina Bank Holdings, Inc.’s public filings with the SEC, including but not limited to their Annual Reports on Form 10 - K, their proxy statem ents, their Current Reports on Form 8 - K and their Quarterly Reports on Form 10 - Q. Both Carolina Bank Holdings, Inc. and First Bancorp will mail the joint proxy statement/prospectus to the shareholders of Carolina Bank Holdings, Inc. BEFORE MAKING ANY VOTING OR INVESTMENT DECISI ONS , INVESTORS AND SHAREHOLDERS OF CAROLINA BANK HOLDINGS, INC. ARE URGED TO CAREFULLY READ THE ENTIRE REGISTRATION STATEMENT AND PROXY STATEMENT/PROSPECTUS REGARDING THE PROPOSED MERGER WHEN IT BECOMES AVAILABLE AND ANY OTHER RELEVANT DOCUMENTS FILED WITH THE SEC, AS WELL AS ANY AMENDMENTS OR SUPPLEMENTS TO THOSE DOCUMENTS, BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT THE PROPOSED TRANSACTION. Investors and security holders may obtain a free copy of the proxy statement/prospectus (when available) and other filings containing information about First Bancorp and Carolina Ban k H oldings, Inc. at the SEC’s website at www.sec.gov. Investors and security holders may also obtain free copies of the documents filed with t he SEC by First Bancorp on its website at www.localfirstbank.com and by Carolina Bank Holdings, Inc. at www.carolinabank.com. First Bancorp, Carolina Bank Holdings, Inc. and certain of their respective directors and executive officers, under the SEC’s rules , m ay be deemed to be participants in the solicitation of proxies of Carolina Bank Holdings, Inc.’s shareholders in connection with th e p roposed transaction. Information about the directors and executive officers of First Bancorp and their ownership of First Bancorp co mmo n stock is set forth in the proxy statement for First Bancorp’s 2016 Annual Meeting of Shareholders, as filed with the SEC on Schedule 14A o n A pril 4, 2016. Information about the directors and executive officers of Carolina Bank Holdings, Inc. and their ownership of Carolina Bank H old ings, Inc.’s common stock is set forth in the proxy statement for Carolina Bank Holdings, Inc.’s 2016 Annual Meeting of Shareholders, as f ile d with the SEC on a Schedule 14A on April 5, 2016. Additional information regarding the interests of those participants and other persons w ho may be deemed participants in the transaction may be obtained by reading the joint proxy statement/prospectus regarding the proposed tr ansaction when it becomes available. Free copies of this document may be obtained as described in the preceding paragraph. 18