Attached files

| file | filename |

|---|---|

| 8-K - AVENUE FINANCIAL HOLDINGS, INC. 8-K - Avenue Financial Holdings, Inc. | a51366223.htm |

| EX-99.1 - EXHIBIT 99.1 - Avenue Financial Holdings, Inc. | a51366223ex99_1.htm |

Exhibit 99.2

Shareholder MeetingJune 21,

2016

Forward-Looking Statements

Certain statements in this press release contain forward-looking

statements within the meaning of the federal securities laws. These

forward-looking statements reflect our current views with respect to,

among other things, future events and our financial performance. These

statements are often, but not always, made through the use of words or

phrases such as “may,” “should,” “could,” “predict,” “potential,”

“believe,” “will likely result,” “expect,” “continue,” “will,”

“anticipate,” “seek,” “estimate,” “intend,” “plan,” “projection,”

“would,” and “outlook,” or the negative version of those words or other

comparable words of a future or forward-looking nature. These

forward-looking statements are not historical facts, and are based on

current expectations, estimates and projections about our industry,

management’s beliefs and certain assumptions made by management, many of

which, by their nature, are inherently uncertain and beyond our control.

Accordingly, we caution you that any such forward-looking statements are

not guarantees of future performance and are subject to risks,

assumptions and uncertainties that are difficult to predict. Although we

believe that the expectations reflected in these forward-looking

statements are reasonable as of the date made, actual results may prove

to be materially different from the results expressed or implied by the

forward-looking statements.You should not place undue reliance on any

forward-looking statement. There are or will be important factors that

could cause our actual results to differ materially from those indicated

in these forward-looking statements, including, but are not limited to,

the following: market and economic conditions (including interest rate

environment, levels of public offerings, mergers and acquisitions, or

M&A, and venture capital financing activities) and the associated impact

on us; changes in management personnel; deterioration of our asset

quality; our overall management of interest rate risk, including

managing the sensitivity of our interest-earning assets and

interest-bearing liabilities to interest rates, and the impact to

earnings from a change in interest rates; our ability to execute our

strategy and to achieve organic loan and deposit growth; the adequacy of

reserves (including allowance for loan and lease losses) and the

appropriateness of our methodology for calculating such reserves;

volatility and direction of market interest rates; the sufficiency of

our capital, including sources of capital (such as funds generated

through retained earnings) and the extent to which capital may be used

or required; our overall investment plans, strategies and activities,

including our investment of excess cash/liquidity; operational,

liquidity and credit risks associated with our business; increased

competition in the financial services industry, nationally, regionally

or locally, which may adversely affect pricing and terms; the level of

client investment fees and associated margins; changes in the regulatory

environment; changes in trade, monetary and fiscal policies and laws;

governmental legislation and regulation, including changes in accounting

regulation or standards, the nature and timing of the adoption and

effectiveness of new requirements under the Dodd-Frank Act, Basel

guidelines, capital requirements and other applicable laws and

regulations; changes in interpretation of existing law and regulation;

further government intervention in the U.S. financial system; and other

factors that are discussed under the heading “Risk Factors” in our

filings with the Securities and Exchange Commission.The foregoing

factors should not be construed as exhaustive and should be read in

conjunction with other cautionary statements that are included in the

Company’s Form 10-K and subsequent periodic reports filed with the

Securities and Exchange Commission. Any forward-looking statement speaks

only as of the date on which it is made, and we do not undertake any

obligation to publicly update or review any forward-looking statement,

whether as a result of new information, future developments or

otherwise. New factors emerge from time to time, and it is not possible

for us to predict which will arise. In addition, we cannot assess the

impact of each factor on our business or the extent to which any factor,

or combination of factors, may cause actual results to differ materially

from those contained in any forward-looking statement.

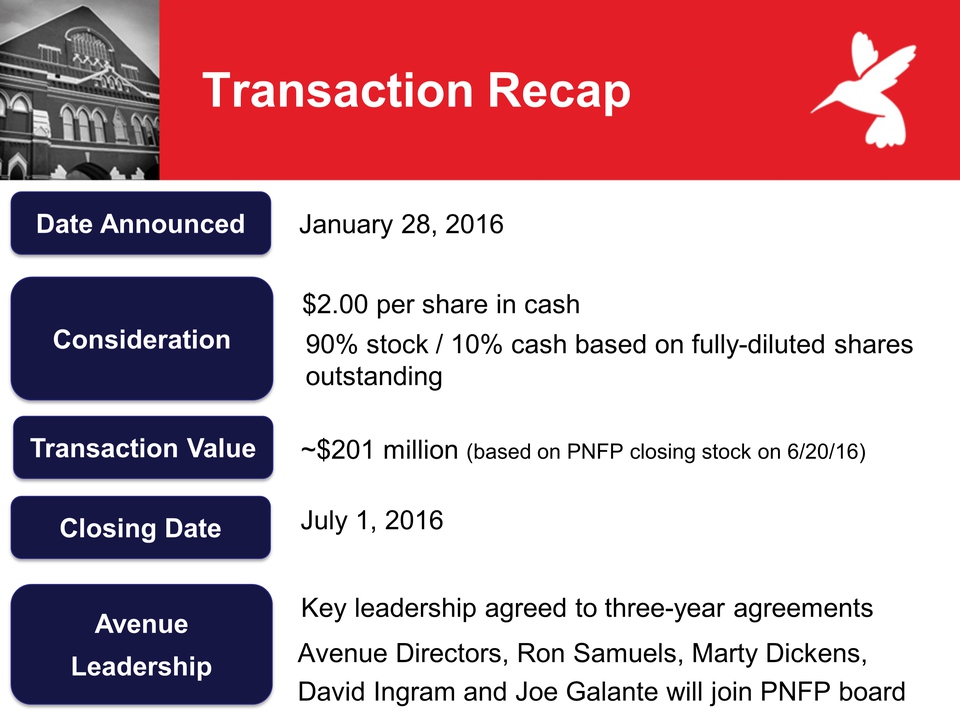

Transaction Recap January

28, 2016 Consideration Transaction Value AvenueLeadership $2.00 per

share in cash ~$201 million (based on PNFP closing stock on 6/20/16) Key

leadership agreed to three-year agreements Avenue Directors, Ron

Samuels, Marty Dickens,David Ingram and Joe Galante will join PNFP board

Date Announced 90% stock / 10% cash based on fully-diluted shares

outstanding Closing Date July 1, 2016

Timeline January 28, 2016:

Merger AnnouncedMay 13, 2016: FDIC Regulatory Approval ObtainedMay 19,

2016: TDFI Regulatory Approval ObtainedJune 21, 2016: Special Meeting

for Shareholder ApprovalJuly 1, 2016: Proposed Closing

DateSeptember/October 2016: Proposed Systems Conversion

Legal Closing Date Avenue

Financial Holdings merges into Pinnacle Financial PartnersAvenue Bank

merges into Pinnacle BankAvenue Bank name, brand and logo exists as a

division of Pinnacle BankAll Branches remain open with business as usual

Systems Conversion Date

Accounts converted to Pinnacle Bank systemsCool Springs and West End

branches closeNew signage

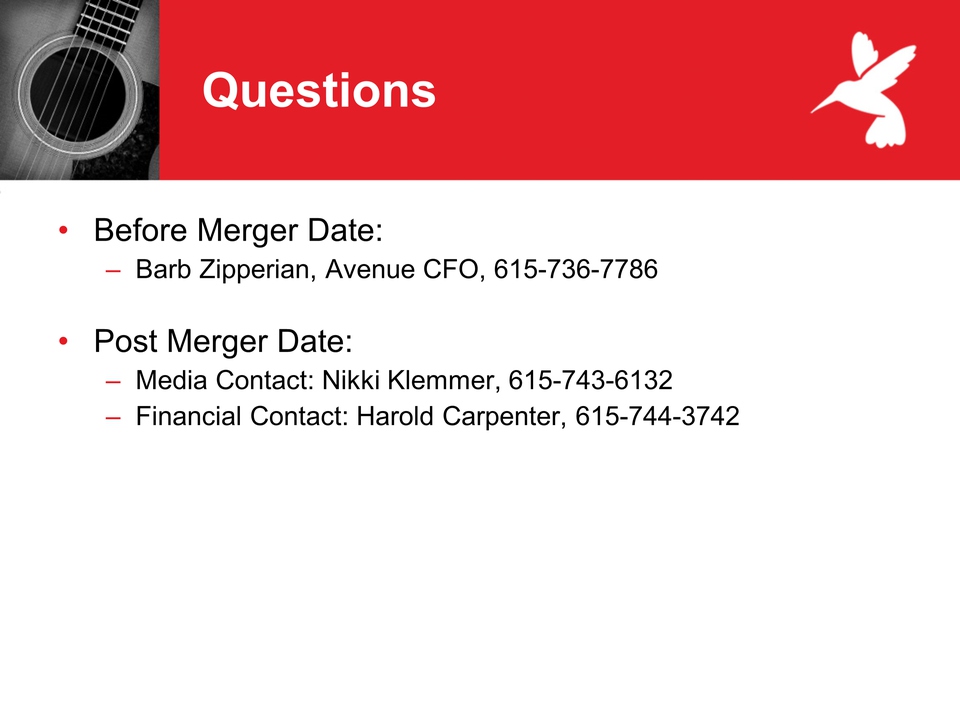

Questions Before Merger

Date:Barb Zipperian, Avenue CFO, 615-736-7786Post Merger Date:Media

Contact: Nikki Klemmer, 615-743-6132Financial Contact: Harold Carpenter,

615-744-3742

Avenue financial holdings Pinnacle FINANCIAL PARTNERS