Attached files

| file | filename |

|---|---|

| EX-10.1 - EXHIBIT 10.1 - REVLON INC /DE/ | a51364480ex10_1.htm |

| EX-99.1 - EXHIBIT 99.1 - REVLON INC /DE/ | a51364480ex99_1.htm |

| EX-10.3 - EXHIBIT 10.3 - REVLON INC /DE/ | a51364480ex10_3.htm |

| EX-10.2 - EXHIBIT 10.2 - REVLON INC /DE/ | a51364480ex10_2.htm |

| EX-2.1 - EXHIBIT 2.1 - REVLON INC /DE/ | a51364480ex2_1.htm |

| 8-K - REVLON, INC. 8-K - REVLON INC /DE/ | a51364480.htm |

Exhibit 99.2

Forward Looking Statements Statements made in this presentation that are not historical facts, including statements about Revlon’s and Elizabeth Arden’s plans, projected financial results and liquidity, strategies, focus, beliefs and expectations, are forward-looking and subject to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. Forward-looking statements speak only as of the date they are made and, except for Revlon’s and Elizabeth Arden’s ongoing obligations under the U.S. federal securities laws, neither Revlon nor Elizabeth Arden undertakes any obligation to publicly update any forward-looking statement, whether to reflect actual results of operations; changes in financial condition; changes in results of operations and liquidity, changes in general U.S. or international economic or industry conditions; changes in estimates, expectations or assumptions; or other circumstances, conditions, developments or events arising after the date of this presentation. Revlon is providing the financial guidance in this presentation to provide investors with certain useful information to assist them with evaluating the acquisition. This information should not be considered in isolation or as a substitute for Revlon’s and Elizabeth Arden’s respective as reported financial results prepared in accordance with US GAAP. This guidance should be read in conjunction with Revlon’s and Elizabeth Arden’s respective financial statements and related footnotes filed with the SEC. Neither Revlon nor Elizabeth Arden expect to continue to provide financial guidance other than in connection with the pending acquisition and disclaim any obligation to update such information, as noted above. The forward-looking statements in this presentation include, without limitation, Revlon’s or Elizabeth Arden’s beliefs, expectations, guidance, focus and/or plans regarding future events, including, without limitation the following: (i) Revlon’s and Elizabeth Arden’s plans to consummate the acquisition and the related financing transactions, as well as the terms and conditions of such transactions, and as to the timing thereof; (ii) the expected strategic and financial benefits of such transactions, including, without limitation, the anticipated synergies and cost reductions; and (iii) the Company’s guidance for 2016, including that for 2016, on a standalone constant currency basis, without taking into account the pending acquisition, Revlon expects to generate net sales between $2.0 billion and $2.1 billion, implying a high single-digit growth rate, and between $400 million and $420 million in Adjusted EBITDA; and that for the twelve months ending December 31, 2016, the combined company would be expected to have annualized net sales of approximately $3 billion and, assuming full realization of approximately $140 million of expected multi-year synergies and cost reductions, Adjusted EBITDA of approximately $560 million; and that by the end of 2016 combined company Net Debt/Adjusted EBITDA is expected to be 4.2x. Actual results may differ materially from such forward-looking statements for a number of reasons, including as a result of the risks described and other items Revlon’s or Elizabeth Arden’s filings with the SEC, including Revlon’s and Elizabeth Arden’s respective Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q and Current Reports on Form 8-K filed with the SEC during 2015 and 2016 (which may be viewed on the SEC’s website at http://www.sec.gov or on Revlon, Inc.’s website at http://www.revloninc.com or on Elizabeth Arden’s website at http://corporate.elizabetharden.com, as applicable). Additional important factors that could cause actual results to differ materially from those indicated by forward-looking statements include risks and uncertainties relating to: (i) the acquisition not being timely completed, if completed at all; (ii) risks associated with the financing of the transaction; (iii) prior to the completion of the acquisition, Revlon’s or the Elizabeth Arden’s respective businesses experiencing disruptions due to transaction-related uncertainty or other factors making it more difficult to maintain relationships with employees, business partners or governmental entities; (iv) the parties being unable to successfully implement integration strategies or realize the anticipated benefits of the acquisition, including the possibility that the expected synergies and cost reductions from the proposed acquisition will not be realized or will not be realized within the expected time period; and/or (v) difficulties with, delays in or the inability to achieve the Company’s net sales and Adjusted EBITDA guidance for 2016, such as due to, among other things, unanticipated circumstances, trends or events affecting the Company's financial performance, including decreased consumer spending in response to weak economic conditions or weakness in the consumption of beauty-related products; lower than expected acceptance of the Company’s new products; adverse changes in foreign currency exchange rates; decreased sales of the Company's products as a result of increased competitive activities by the Company's competitors; and/or decreased performance by third party suppliers. Factors other than those referred to above could also cause Revlon’s or Elizabeth Arden’s results to differ materially from expected results. Additionally, the business and financial materials and any other statement or disclosure on, or made available through, Revlon’s or Elizabeth Arden’s websites or other websites referenced herein shall not be incorporated by reference into this presentation. With respect to projected full year 2016 Adjusted EBITDA for each of Revlon on a stand-alone basis and the combined company, we are unable to prepare a quantitative reconciliation to the most directly comparable GAAP measure without unreasonable effort, as, among other things, certain items that impact these measures, such as adjustments to the provision for income taxes, depreciation of fixed assets, amortization of intangibles, costs related to restructuring actions and interest expense, have not yet occurred, are out of our control and cannot be predicted.

Participants Scott BeattieElizabeth Arden (NASDAQ: RDEN) Chairman, President and Chief Executive Officer Rod R. LittleElizabeth Arden (NASDAQ: RDEN) Executive Vice President and Chief Financial Officer Juan FiguereoRevlon (nyse: rev)Executive Vice President and Chief Financial Officer Fabian GarciaRevlon (nyse: rev)President and Chief Executive Officer

Fabian Garcia Revlon President and Chief Executive Officer

Key Transaction Highlights Elizabeth Arden shareholders to receive $14.00 per shareAll-cash transaction50% premium to Elizabeth Arden closing price on June 16, 2016 Elizabeth Arden enterprise value of approximately $870 million Combined company expected to generate approximately $3 B in net sales Assuming full realization of $140 million of expected multi-year synergies, Adjusted EBITDA would be approximately $560 million $2.6 B in financing committed to fund the acquisition and refinance Elizabeth Arden’s debt and Revlon’s existing term loan and revolving credit facility Revlon’s senior notes will remain outstandingExpected pro-forma leverage of 4.2x Net Debt/Adjusted EBITDA at YE2016 Expected to close by end of 2016, subject to regulatory approval and customary closing conditions Note: See ‘Forward Looking Statements’ and ‘Basis of Presentation’

Combined company will be more competitive:Greater scaleExpanded presence in all key beauty categoriesDiversified across channels and geographiesStronger positioning in growing fragrances and skin care business linesElizabeth Arden prestige distribution and travel retail complements Revlon strength in mass and salonsHighly synergistic transaction leverages Revlon’s manufacturing capabilities, expands distribution and enhances purchasing scaleTimed to take advantage of favorable industry dynamics, Revlon’s strong growth and positive inflection point for Elizabeth Arden Strategic Rationale

Strong Positioning Across Growing Industry 5.3% 5.5% 4.3% 5.2% 2010 – 2015 CAGR1 2015 Global Consumption ($ billions) Significant presence in fastest-growing beauty industry categories Source: Euromonitor data. Represents retail value RSP (retail selling price)Note: Haircare includes hair color. Facial skincare includes face masks, facial cleaners, facial moisturizers, lip care, anti-agers, toners and acne treatments(1) CAGR is Compound Annual Growth Rate | Data based on US$ fixed exchange rate

Expanded Category Mix Revlon strength in color cosmetics and haircare complemented byElizabeth Arden expertise in prestige skin care, color cosmetics and fragrances Combined Company + = Consumer74% Professional24% Fragrances60% EA Brand40% Revlon Consumer49% Revlon Pro.17% EA Brand13% Fragrances221% Category Net Sales LTM1 March 2016 Source: Elizabeth Arden and Revlon SEC filingsNote: See “Basis of Presentation”“LTM” is last 12 monthsIncludes Elizabeth Arden ‘Fragrance’ segment and Revlon ‘Other’ Other2%

Iconic Brands Across All Categories

The combined company will have greater channel diversification, strongly positioned in all key beauty channels, including:Elizabeth Arden’s strong global reach in prestige distribution and travel retail augments Revlon’s existing presence in mass and salons Everywhere Customers Shop MassPrestigeTravel retailSpecialty retailersE-commerceDepartment storesSalonsSpasOthers

Broader Global Footprint Expanded presence across more than 130 countries worldwide positions the combined company to better compete globallyElizabeth Arden provides a growth platform for Revlon in the Asia Pacific region, including ChinaRevlon’s and Elizabeth Arden’s global footprints are highly complementary Combined Company Net Sales LTM March 2016 North America157% International43% Source: Elizabeth Arden and Revlon SEC filings | % of Net Sales LTM March 2016Note: See “Basis of Presentation”, “LTM” is last 12 months(1) North America includes U.S. only for Revlon

Scott Beattie Elizabeth Arden Chairman, President and Chief Executive Officer

Stronger Together Transaction delivers certain value to Elizabeth Arden shareholders 50% premium to closing price on June 16, 2016All cashCombination builds a more diversified company that will be a stronger player in the highly competitive environment for beauty productsRevlon is an excellent cultural fit with Elizabeth Arden, sharing the same consumer-centric mission and dedication to innovation, quality and excellence Larger scale of combined company will create growth opportunities for Elizabeth Arden and Revlon employeesFinancial strength of the combined company should attract new licenses and opportunities across all categories in the portfolio

Rod R. Little Elizabeth Arden Executive Vice President and Chief Financial Officer

Elizabeth Arden Gaining Momentum Focus on driving Elizabeth Arden brand growth through product innovation and improvements in execution capability Accelerate growth behind key pillar fragrances - including Juicy Couture, Britney Spears, Elizabeth Taylor, Curve and John VarvatosImprove go-to-market capability in key geographies such as Asia and EMEAOptimize and rationalize overhead structure to fuel brand growth and improve marginsCombination with Revlon will enhance and accelerate the initiatives underpinning our turnaround FQ2 20162 FQ3 20162 Elizabeth Arden – Adjusted Net Sales Growth1 EA Brand Fragrances Total EA Brand Fragrances Total Source: Elizabeth Arden public filings. (1) Growth rates represent quarter‐over‐quarter adjusted net sales growth on constant currency basis(2) “FQ” means Fiscal Quarter

Juan Figuereo Revlon Executive Vice President and Chief Financial Officer

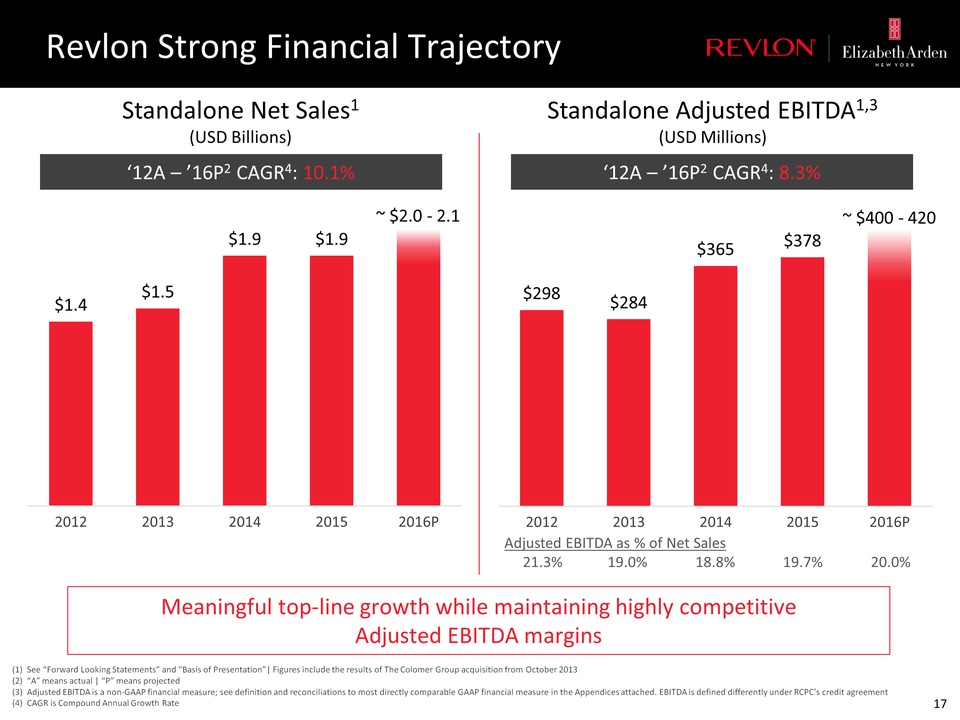

Revlon Strong Financial Trajectory ‘12A – ’16P2 CAGR4: 10.1% ‘12A – ’16P2 CAGR4: 8.3% Adjusted EBITDA as % of Net Sales 21.3% 19.0% 18.8% 19.7% 20.0% ~ $2.0 - 2.1 ~ $400 - 420 Standalone Adjusted EBITDA1,3(USD Millions) Standalone Net Sales1(USD Billions) Meaningful top-line growth while maintaining highly competitive Adjusted EBITDA margins (1) See “Forward Looking Statements” and “Basis of Presentation”| Figures include the results of The Colomer Group acquisition from October 2013(2) “A” means actual | “P” means projected(3) Adjusted EBITDA is a non-GAAP financial measure; see definition and reconciliations to most directly comparable GAAP financial measure in the Appendices attached. EBITDA is defined differently under RCPC’s credit agreement(4) CAGR is Compound Annual Growth Rate

Expected Multi-Year Synergies and Cost Reductions: Approximately $140 MillionCost-of-Goods-Sold and Indirect SpendProcurement: Negotiate better global raw material and component pricingOptimize manufacturing and distribution networks of the combined companyBack Office OverheadConsolidate back office supportIntegrate management structuresCommercial - Sales & Marketing Accelerate sharing of best practices across the combined organizationThe company anticipates that it will achieve additional growth opportunities in both sales channels and geographies Highly Synergistic

Financing and Process $2.6 billion in financing commitments received from BofA Merrill Lynch and Citigroup Global Markets Inc.Expected combined company Net Debt/Adjusted EBITDA1 of 4.2x at year end 2016The combined company will be well positioned to de-lever based on anticipated strong cash flowAcquisition expected to close by end of 2016, subject to customary closing conditions Note: See “Forward Looking Statements” and “Basis of Presentation”(1) Assumes full realization of approximately $140 million of expected multi-year synergies and cost reductions

Fabian Garcia Revlon President and Chief Executive Officer

Creates scale and diversificationExpands presence in fragrances and skin careProvides complementary brand and geographic expansionProvides channel diversificationHighly synergisticLeverages Revlon’s manufacturing capabilities and expands distribution scaleEnhanced purchasing scale Leading Global Beauty Company

Appendix

Revlon, Inc. (sometimes referred to as “Revlon”) is a public holding company with no business operations of its own. Revlon’s only material asset is all of the outstanding capital stock of Revlon Consumer Products Corporation (“Products Corporation” or “RCPC” and, together with Revlon, sometimes referred to as the “Company”), through which Revlon conducts all of its business operations. Revlon's net income/(loss) has historically consisted of the net income/(loss) of Products Corporation and includes certain expenses related to being a public holding company. This presentation reflects Revlon’s financial results unless otherwise noted. The financial data contained herein are both audited and unaudited and have been prepared from Revlon’s external reporting information, which is prepared in accordance with U.S. generally accepted accounting principles (“GAAP”). The financial data contained herein also includes Elizabeth Arden, Inc.’s external reporting information prepared in accordance with GAAP.This presentation includes references to Revlon’s Adjusted EBITDA. Revlon’s Adjusted EBITDA is a non-GAAP financial measure that is reconciled to its most directly comparable GAAP measure in the accompanying financial tables in this Appendix. With respect to projected full year 2016 Adjusted EBITDA for each of Revlon on a stand-alone basis and the combined company, we are unable to prepare a quantitative reconciliation to the most directly comparable GAAP measure without unreasonable effort, as, among other things, certain items that impact these measures, such as adjustments to the provision for income taxes, depreciation of fixed assets, amortization of intangibles, costs related to restructuring actions and interest expense, have not yet occurred, are out of our control and cannot be predicted. Revlon’s Adjusted EBITDA is defined as income from continuing operations before interest, taxes, depreciation, amortization, gains/losses on foreign currency fluctuations, gains/losses on the early extinguishment of debt and miscellaneous expenses (the foregoing being the “EBITDA Exclusions”). To reflect the impact of non-cash stock compensation expense and certain other non-operating items that are not directly attributable to the Company's underlying operating performance (the “Non-Operating Items”), the Company presents Revlon’s Adjusted EBITDA to exclude these Non-Operating Items and to exclude the impact of certain unusual items impacting the comparability of the Company’s period-over-period results as seen through the eyes of management (the “Unusual Items”). The tables presented in the Appendix identify the Non-Operating and Unusual Items excluded in the presentation of Revlon’s Adjusted EBITDA for all periods.The Company excludes the EBITDA Exclusions, Non-Operating Items and Unusual Items, as applicable, in calculating Revlon’s Adjusted EBITDA because the Company's management believes that some of these items may not occur in certain periods, the amounts recognized can vary significantly from period to period and these items do not facilitate an understanding of the Company's underlying operating performance. The Company's management utilizes Adjusted EBITDA as operating performance measure (in conjunction with GAAP and other non-GAAP measures) as an integral part of its reporting and planning processes and to, among other things –(i) monitor and evaluate the performance of the Company's business operations, financial performance and overall liquidity;(ii) facilitate management's internal comparisons of the Company's historical operating performance of its business operations;(iii) facilitate management's external comparisons of the results of its overall business to the historical operating performance of other companies that may have different capital structures and debt levels;(iv) review and assess the operating performance of the Company's management team and, together with other operational objectives, as a measure in evaluating employee compensation and bonuses;(v) analyze and evaluate financial and strategic planning decisions regarding future operating investments; and (vi) plan for and prepare future annual operating budgets and determine appropriate levels of operating investments. Basis of Presentation

The Company's management believes that Revlon’s Adjusted EBITDA is useful to third parties to provide them with disclosures of the Company's operating results on the same basis as that used by the Company's management. Additionally, the Company's management believes that Revlon’s Adjusted EBITDA provides useful information to third parties about the performance of the Company's overall business because such measures eliminate the effects of unusual or other infrequent charges that are not directly attributable to the Company's underlying operating performance. Additionally, the Company's management believes that providing this non-GAAP measure enhances the comparability for investors in assessing the Company’s financial reporting. Accordingly, the Company believes that the presentation of Revlon’s Adjusted EBITDA, when used in conjunction with GAAP financial measures, is a useful financial analysis measure, that is used by the Company's management, as described above, and therefore can assist third parties in assessing the Company's financial condition, operating performance and underlying strength. Revlon’s Adjusted EBITDA should not be considered in isolation or as a substitute for its most directly comparable as reported measure prepared in accordance with GAAP, such as net income/loss. Other companies may define EBITDA or Adjusted EBITDA differently. Also, while EBITDA is defined differently than Revlon’s Adjusted EBITDA, excluding certain non-recurring items, for RCPC’s credit agreement, certain financial covenants in its borrowing arrangements are tied to similar measures. This non-GAAP financial measure, as well as the other information in this presentation, should be read in conjunction with the Company's financial statements and related footnotes contained in the documents that the Company files with the U.S. Securities and Exchange Commission (the “SEC”).Elizabeth Arden presents Adjusted net sales in its quarterly earnings releases, which are available on www.sec.gov. Adjusted net sales is a non-GAAP financial measure and should be read in conjunction with Elizabeth Arden’s financial statements and related footnotes filed with the SEC. Adjusted net sales are adjusted for returns and markdowns under Elizabeth Arden’s 2014 Performance Improvement Plan.Net Debt is defined as total amounts outstanding under third party long-term debt arrangements, less cash and cash equivalents.Throughout this presentation, “A” indicates amounts actually achieved for completed reporting periods; “E” indicates amounts estimated by the Company’s management; and “P” indicates amounts derived from the Company’s internal management forecasts and projections. “E” and “P” are forward looking. Note: Rounding may cause immaterial differences. Basis of Presentation (cont’d)

Revlon, Inc. - Adjusted EBITDA Reconciliation Source: SEC filings and Company data.Note: See “Basis of Presentation” for more information.

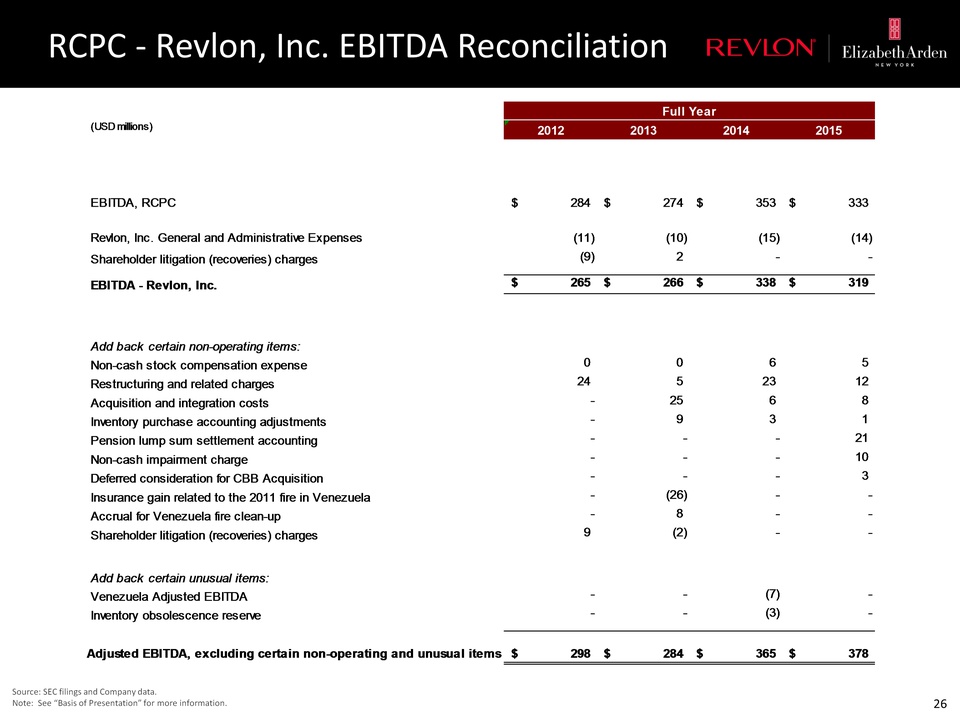

RCPC - Revlon, Inc. EBITDA Reconciliation Source: SEC filings and Company data.Note: See “Basis of Presentation” for more information.

This presentation may be deemed solicitation material in respect of the proposed acquisition of Elizabeth Arden by Revlon. In connection with the proposed transaction, Elizabeth Arden will file with the SEC and furnish to Elizabeth Arden’s shareholders a proxy statement and other relevant documents. BEFORE MAKING ANY VOTING DECISION, ELIZABETH ARDEN’S SHAREHOLDERS ARE URGED TO READ THE PROXY STATEMENT IN ITS ENTIRETY WHEN IT BECOMES AVAILABLE AND ANY OTHER DOCUMENTS TO BE FILED WITH THE SEC IN CONNECTION WITH THE PROPOSED Acquisition OR INCORPORATED BY REFERENCE IN THE PROXY STATEMENT BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT THE PROPOSED Acquisition AND THE PARTIES TO THE Acquisition. Elizabeth Arden’s shareholders will be able to obtain a free copy of documents filed with the SEC at the SEC’s website at http://www.sec.gov. In addition, Elizabeth Arden’s shareholders may obtain a free copy of Elizabeth Arden’s filings with the SEC from Elizabeth Arden’s website at http://corporate.elizabetharden.com or by directing a request to: Elizabeth Arden, Inc., Secretary, 2400 S.W. 145 Avenue, Miramar, Florida 33027.The directors, executive officers and certain other members of management and employees of Revlon and Elizabeth Arden may be deemed “participants” in the solicitation of proxies from shareholders of Elizabeth Arden in favor of the proposed acquisition. Information regarding the persons who may, under the rules of the SEC, be considered participants in the solicitation of the shareholders of Elizabeth Arden in connection with the proposed acquisition will be set forth in the proxy statement and the other relevant documents to be filed with the SEC. You can find information about Elizabeth Arden’s executive officers and directors in its Annual Report on Form 10-K for the fiscal year ended June 30, 2015 and in its definitive proxy statement filed with the SEC on Schedule 14A. You can find information about Revlon’s executive officers and directors in its Annual Report on Form 10-K for the fiscal year ended December 31, 2015 and in its definitive proxy statement filed with the SEC on Schedule 14A. Additional Information & Where to Find It