Attached files

| file | filename |

|---|---|

| EX-23.1 - CONSENT - The Future Education Group Inc. | future_ex2301.htm |

| EX-10.46 (2) - CONFIRMATION LETTER - The Future Education Group Inc. | future_s1a4-ex10462.htm |

| EX-10.46 (1) - LOAN SETTLEMENT AGREEMENT - The Future Education Group Inc. | future_s1a4-ex10461.htm |

| EX-10.45 - EXCLUSIVE BUSINESS COOPERATION AGREEMENT - The Future Education Group Inc. | future_s1a4-ex1045.htm |

| EX-10.44 - LOAN AGREEMENT - The Future Education Group Inc. | future_s1a4-ex1044.htm |

| EX-4.2 - AGREEMENT - The Future Education Group Inc. | future_s1a4-ex0402.htm |

| EX-1.1 - UNDERWRITING AGREEMENT - The Future Education Group Inc. | future_s1a4-ex0101.htm |

As filed with the Securities and Exchange Commission on June 15, 2016

Registration No. 333-204902

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

AMENDMENT NO. 4

TO

FORM S-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

The Future Education Group Inc.

(Exact name of Registrant as specified in its charter)

|

Nevada (State or other jurisdiction of |

8299 (Primary Standard Industrial |

47-1820841 (I.R.S. Employer |

Room 501, Gaohelanfeng Building, East 3rd Ring South Road,

Chaoyang District, Beijing

P. R. China

+8610-87663458

(Address, including zip code, and telephone number, including area code, of Registrant’s principal executive offices)

United States Corporation Agents

500 N. Rainbow Blvd., Suite 300A

Las Vegas, NV 89107

(800) 773-0888 ext. 5216

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Copies to:

|

Mitchell S. Nussbaum, Esq. Loeb & Loeb LLP 345 Park Avenue New York, New York 10154 (212) 407-4000

|

Ralph V. De Martino, Esq. Cavas S. Pavri, Esq. F. Alec Orudjev, Esq. Schiff Hardin LLP 901 K Street, Suite 700 Washington, DC 20001 (202) 778-6400 |

Approximate date of commencement of proposed sale to the public: As soon as practicable after the effective date of this Registration Statement.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. x

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | ¨ | Accelerated filer | ¨ |

| Non-accelerated filer | ¨ | Smaller reporting company | x |

CALCULATION OF REGISTRATION FEE

| Title of Each Class of Security Being Registered | Proposed Maximum Aggregate Offering Price |

Amount of Registration Fee |

| Class A common stock, par value $0.001 (1) | $3,910,000 | $393.74 |

| Underwriter warrants (2)(3) | – | – |

| Class A common stock underlying the Underwriter warrants | $374,000 | $37.67 |

| TOTAL | $4,284,000 | $431.41(4) |

(1) Estimated solely for the purpose of calculating the registration fee, pursuant to Rule 457(o) under the Securities Act of 1933, as amended, based on an estimate of the proposed maxim aggregate offering price, including the offering price of shares of common stock that the underwriters have an option to purchase to cover over-allotments, if any.

(2) We have agreed to issue, upon closing of this offering, warrants expiring five years following the effective date of this registration statement representing 10% of the aggregate number of shares of Class A common stock in the offering but not including the over-allotment option, or the “Underwriter Warrants,” to ViewTrade Securities Inc. The Underwriter Warrants will be exercisable at a per share exercise price equal to 110% of the public offering price.

(3) No fee required pursuant to Rule 457(g) under the Securities Act.

(4) Previously paid.

The Registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this Registration Statement shall hereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until the Registration Statement shall become effective on such date as the Commission, acting pursuant to such Section 8(a), may determine.

| The information contained herein is subject to completion or amendment. A registration statement relating to these securities has been filed with the Securities and Exchange Commission. These securities may not be sold until the registration statement becomes effective. This prospectus is not an offer to sell and is not a solicitation of an offer to buy in any state in which an offer, solicitation, or sale is not permitted. |

PRELIMINARY PROSPECTUS SUBJECT TO COMPLETION, DATED JUNE 15, 2016

THE FUTURE EDUCATION GROUP INC.

[*] Shares of Class A Common Stock

This is an initial public offering of The Future Education Group Inc. We are offering [*] shares of Class A common stock in this offering. It is currently estimated that the initial public offering price per share will be between $[*] and $[*].

Currently, there is no public market for our shares of Class A common stock. We have applied to list our Class A common stock on the NASDAQ Capital Market under the symbol “FEGI.”

We are an “emerging growth company” under applicable U.S. federal securities laws and may elect to comply with reduced public company reporting requirements.

Investing in our common stock involves a high degree of risk. You should read carefully the “Risk Factors” beginning on page 9 of this prospectus before investing in the shares of our common stock that are the subject of this offering.

______________________________________

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed upon the adequacy or accuracy of this prospectus. Any representation to the contrary is a criminal offense.

| Per Share | Total | |||||||

| Public offering price | $ | $ | ||||||

| Underwriting discount and commissions (1) | $ | $ | ||||||

| Proceeds, before expenses, to us | $ | $ | ||||||

(1) We refer you to “Underwriting” beginning on page of this prospectus for additional information regarding total underwriter compensation.

The underwriters have an option exercisable within forty-five (45) days from the date of this prospectus to purchase from us up to an additional fifteen percent (15%) of the number of shares of Class A common stock sold in the public offering at the public offering price, less the underwriting discount, solely to cover over-allotments. The shares of Class A common stock issuable upon exercise of the underwriters’ over-allotment option have been registered under the registration statement of which this prospectus forms a part. In addition to the underwriting discount, we have agreed to pay the expenses incurred in the offering together with a non-accountable expense allowance of one percent (1%) of the gross proceeds received in connection with this offering, not including the exercise of the over-allotment. See “Underwriting.”

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed upon the adequacy or accuracy of this prospectus. Any representation to the contrary is a criminal offense.

The underwriters expect to deliver the shares against payment on or about , 2016

Prospectus dated , 2016

VIEWTRADE SECURITIES

TABLE OF CONTENTS

| Page | |

| CONVENTIONS WHICH APPLY TO THIS PROSPECTUS | ii |

| SPECIAL NOTE ON FORWARD-LOOKING STATEMENTS | 1 |

| PROSPECTUS SUMMARY | 2 |

| RISK FACTORS | 9 |

| USE OF PROCEEDS | 29 |

| DIVIDEND POLICY | 29 |

| CAPITALIZATION | 30 |

| DILUTION | 31 |

| SELECTED FINANCIAL DATA | 32 |

| MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS | 33 |

| OUR CORPORATE STRUCTURE | 46 |

| BUSINESS | 49 |

| REGULATIONS | 66 |

| MANAGEMENT | 80 |

| CERTAIN RELATIONSHIPS AND RELATED PARTY TRANSACTIONS | 84 |

| POLICIES AND PROCEDURES FOR RELATED PARTY TRANSACTIONS | 86 |

| SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT | 87 |

| DESCRIPTION OF CAPITAL STOCK | 88 |

| SHARES ELIGIBLE FOR FUTURE SALE | 91 |

| DETERMINATION OF OFFERING PRICE | 92 |

| UNDERWRITING | 92 |

| LEGAL MATTERS | 95 |

| EXPERTS | 95 |

| WHERE YOU CAN FIND MORE INFORMATION | 95 |

| INDEX TO CONSOLIDATED FINANCIAL STATEMENTS | F-1 |

No dealer, salesperson or other person is authorized to give any information or to represent anything not contained in this prospectus. You must not rely on any unauthorized information or representations. This prospectus is an offer to sell only the shares offered hereby, but only under circumstances and in jurisdictions where it is lawful to do so. The information contained in this prospectus is current only as of its date.

| i |

CONVENTIONS WHICH APPLY TO THIS PROSPECTUS

In this prospectus, unless otherwise specified or if the context so requires:

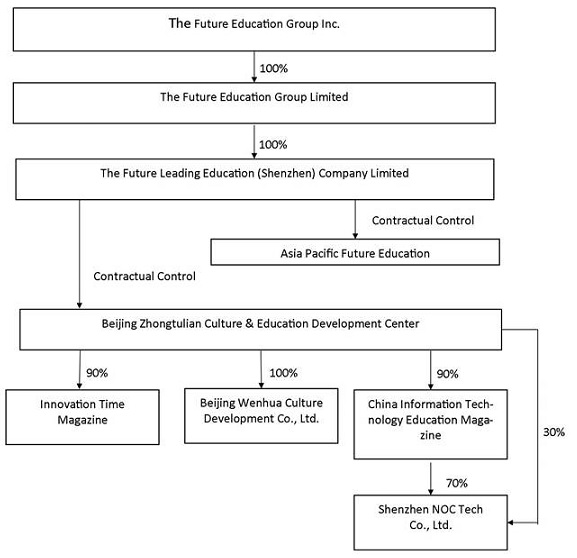

| · | “we,” “us,” “our company,” “Company” and “Group” refers to, The Future Education Group Inc., together with its subsidiaries; |

| · | “Future Education HK” refers to The Future Education Group Limited, a Hong Kong company which is our wholly owned subsidiary; |

| · | “WFOE” refers to The Future Leading Education (Shenzhen) Company Limited, a PRC company which is a wholly owned subsidiary of Future Education HK; |

| · | “APFE” refers to Shenzhen Asia-Pacific Future Education Technology Development Co., Ltd., a PRC company which has contractual relationships with WFOE; |

| · | “ZTL” refers to Beijing Zhongtulian Culture & Education Development Center., a PRC company which has contractual relationships with WFOE; |

| · | “PRC” or “China” refers to the People’s Republic of China; |

| · | “RMB” or “¥” refer to the legal currency of the People’s Republic of China; |

| · | “dollars,” “US$” or “$” refer to the legal currency of the United States; and |

| · | “common stock” refers to the Class A common stock and the Class B common stock. |

Unless otherwise indicated, our financial information presented in this prospectus has been prepared in accordance with United States Generally Accepted Accounting Principles, or U.S. GAAP. This prospectus contains translations of RMB amounts into U.S. dollars at specified rates solely for the convenience of the reader.

Throughout this prospectus, unless otherwise designated or the context suggests otherwise, all references to shares or Class A common stock and per share data reflect a 1 for 2 reverse stock split consummated on January 29, 2016.

Unless otherwise noted, the exchange rate used is RMB 6.23, RMB 6.14 and RMB 6.20, for the years ended December 31, 2015, 2014 and 2013, respectively, as determined by the average rates of the People’s Bank of China (the “PBOC”).

In addition to the shares of common stock to be sold to investors in this offering, this prospectus covers the securities acquirable upon exercise of the warrants we have agreed to issue to our underwriter, ViewTrade Securities Inc. (“ViewTrade”), in connection with this offering. See “Underwriting.”

| ii |

SPECIAL NOTE ON FORWARD-LOOKING STATEMENTS

This prospectus contains statements that are “forward-looking” and uses forward-looking terminology such as “anticipate,” “believe,” “could,” “estimate,” “expect,” “future,” “intend,” “may,” “ought to,” “plan,” “possible,” “potentially,” “predicts,” “project,” “should,” “will,” “would,” negatives of such terms or other similar statements. You should not place undue reliance on any forward-looking statement due to its inherent risk and uncertainties, both general and specific. Although we believe the assumptions on which the forward-looking statements are based are reasonable and within the bounds of our knowledge of our business and operations as of the date of this prospectus, any or all of those assumptions could prove to be inaccurate. As a result, the forward-looking statements based on those assumptions could also be incorrect. The forward-looking statements in this prospectus include, without limitation, statements relating to:

| · | our goals and strategies; |

| · | our future business development, results of operations and financial condition; |

| · | our ability to protect our intellectual property rights; |

| · | projected revenues, profits, earnings and other estimated financial information; |

| · | our ability to maintain strong relationships with our customers; |

| · | our planned use of proceeds; and |

| · | governmental policies regarding our industry. |

The forward-looking statements included in this prospectus are subject to known and unknown risks, uncertainties and assumptions about our businesses and business environments. These statements reflect our current views with respect to future events and are not a guarantee of future performance. Actual results of our operations may differ materially from information contained in the forward-looking statements as a result of risk factors, some of which are described under “Risk Factors” and elsewhere in this prospectus, and include, among other things:

| · | we have a limited operating history; |

| · | our business relies heavily upon obtaining licenses, permits and other regulatory approvals; |

| · | the need to protect our brand; and |

| · | we depend upon continued government support of education policies. |

These risks and uncertainties are not exhaustive. Other sections of this prospectus include additional factors which could adversely impact our business and financial performance. The forward-looking statements contained in this prospectus speak only as of the date of this prospectus or, if obtained from third-party studies or reports, the date of the corresponding study or report, and are expressly qualified in their entirety by the cautionary statements in this prospectus. Since we operate in an emerging and evolving environment and new risk factors and uncertainties emerge from time to time, you should not rely upon forward-looking statements as predictions of future events. Except as otherwise required by the securities laws we undertake no obligation to update or revise any forward-looking statements to reflect events or circumstances after the date of this prospectus or to reflect the occurrence of unanticipated events.

| 1 |

PROSPECTUS SUMMARY

The following summary does not contain all of the information you should consider before investing in our shares. You should read the following summary together with the entire prospectus carefully, including the “Risk Factors” section beginning on page 9 and the financial statements and the accompanying notes to those financial statements beginning on page F-1 before making an investment decision. Unless otherwise indicated, all information in this prospectus assumes no exercise of the underwriter’s over-allotment option or underwriter’s warrants. All references to shares, Class A common stock, Class B common stock, and per share data reflect 1 for 2 reverse stock split consummated on January 29, 2016.

Our Business

We provide educational content, we own copyrights for textbooks, publish national magazines related to intellectual property and the use of technology in education, and we host competitions, such as the Network Originality Competitions (the “NOC”), for the education market in the PRC. Starting in late 2014, we also began focusing on a new business where we develop online and mobile education platforms for K-12 students and provide integrated educational solutions to schools. Our products are designed to help students improve and strengthen their academic performance, confidence, motivation, and self-esteem. Chinese cultural and educational reforms focusing on the use of technology to provide top-quality education have provided opportunities to use the Internet and other media as a platform to promote cultural and educational development. Our business activities are carried out by Beijing Zhongtulian Culture & Education Development Center (“ZTL”) and its subsidiaries and Shenzhen Asia-Pacific Future Education Technology Development Co., Ltd. (“APFE”), both of which are variable interest entities (“VIEs”). ZTL was formed in 1998 and is based in Beijing, PRC and APFE was formed in 2014 and is based in Shenzhen PRC.

We operate our business in the PRC through certain contractual agreements between our subsidiary, The Future Leading Education (Shenzhen) Company Limited, or WFOE, and ZTL, and a separate series of contractual arrangements between WFOE and APFE. The contractual arrangements provide us with control over the business and affairs of ZTL and APFE. ZTL and APFE are variable interest entities, or VIEs, which means we have a controlling financial interest in the companies, but we do not own any equity interests in the companies.

Historically, mainly through ZTL and its subsidiaries, we have generated most of our revenue from what we refer to as our traditional lines of businesses, which consist of (1) publishing and distributing national magazines featuring topics on innovation, intellectual property and the use of technology in education; (2) hosting government approved competitions for K-12 and college students and teachers, known as NOC’s; (3) cooperating with qualified publishers and/or educational hardware manufacturers to distribute textbooks and digital educational hardware products, such as calculators, to schools throughout China; and (4) distributing an educational content database to educational institutions for use in their platform, with content that has been developed in-house and content that has been licensed from others.

Our online and mobile education platforms and integrated educational solutions business is conducted through APFE and consists of a series of five programs and platforms: (1) the NOC online learning platform for use by teachers and parents; (2) the NOC online competition platform; (3) FEG (Find Excellent Genius), an academic and personal evaluation system for K-12 students; (4) O-chat mobile application, which allows for interaction between teachers, students and their parents and provides a mobile platform for students to study, perform self-assessments and produce creative-work; and (5) the Future Classroom, a cloud-based e-classroom environment integrating teaching equipment, teaching innovation patterns and e-educational content, which can be customized to meet the specifications provided by a school.

In 2015, APFE entered into an agreement to acquire 100% ownership of Shanghai Bohao Information and Technology Company Limited (“Bohao”). Bohao has been engaged in the research and development of e-learning classroom software and hardware. As a result of such research, Bohao is able to provide the key elements of an integrated educational solution that we named the “Future Classroom.” The Future Classroom offers an integrated educational solution that is customized to meet the specifications provided by a school. A Future Classroom package includes hardware that is embedded with teaching patterns and software, and furniture, which is purchased from Bohao, and interactive cloud based educational content to be used by teachers in the classroom, which is developed and provided by us. The closing of the acquisition of Bohao was subject to a number of conditions, including, without limitation, completion of the registration of APFE with the relevant administration for industry and commerce reflecting the change in equity ownership and delivery of certain financial statements by Bohao, as well as payment of the balance of the purchase price by APFE on an agreed upon payment schedule. On February 6, 2016, APFE and Bohao agreed to terminate the acquisition agreement because APFE was unable to timely pay the balance of the purchase price. However, on March 16, 2016, we entered into a five-year strategic cooperation agreement with Bohao, whereby we exclusively sell and distribute the Future Classrooms to K-12 schools. Since its launch in the fourth quarter of 2015, we entered into sales contract with three schools to sell the Future Classroom. We are in the process of entering into letters of intent for the sale of the Future Classroom, which are only subject to government approval for funding. The sales price of a Future Classroom ranges between RMB300,000 to RMB1.2 million ($46,000 to $185,000) based on the hardware, as well as the educational programs and content the school specifies. We estimate that the average purchase price of Future Classroom is approximately RMB500,000 ($77,000).

| 2 |

By the second half of 2015, our management decided that we needed to change the manner in which we sold our educational content database. Previously we extracted certain data from our database, packaged the content and sold it for a one-time fee to customers. We decided to no longer continue sales of the content by this method and instead we intend to utilize the content for our online and mobile education platforms and for the Future Classroom. Since we decided to focus our marketing and sales efforts on our online and mobile education platforms and integrated educational solutions, we ceased sales of our digital educational products. As a result of the reduction in sales of the digital educational products, as well as the increase in our sales force, the hiring of third-party distributors and an increase in expenditures for product development, we experienced a 39.3% decrease in revenues and had a net loss of $4.55 million for the year ended December 31, 2015 compared to the year ended December 31, 2014. We expect a continued decrease in revenue from these business lines during 2016 as we continue to focus on the sale and distribution of the NOC online learning platform and the Future Classroom in anticipation for the start of the school year in the fall of 2016.

Industry Background and Market Opportunity

According to a report issued by the PRC Ministry of Finance (2016), the education expenditures of the PRC in 2015 was RMB135.7 billion. The government’s objective is to continue to promote education, science, technology, cultural reform and development. The general public expenditure budget of the PRC in 2016 is estimated to be approximately RMB8.6 trillion, an increase of 6.3% over the prior year’s budget. The educational system in the PRC is under pressure to reform and develop. On March 5, 2014, the second session of the 12th National People’s Congress concluded that the PRC government set education as a strategic priority with a focus on promoting equitable education development, with a continued increase in investment in educational resources. The government is expected to deepen comprehensive educational reforms by actively reforming the examination and enrollment systems, encouraging the development of private schools and accelerating the construction of a modern employment-oriented vocational education system.

The digitalization of educational content and delivery is also driving a substantial shift in the education market. Cloud computing-enabled, internet-based and mobile technologies are being adapted for educational uses and an increasing number of schools are implementing online or blended learning environments by utilizing digital content in classrooms. These trends are supported by widespread research which demonstrates improved efficacy in learning derived through online, interactive programs. An analysis conducted by the Department of Education in 2009 that surveyed more than one thousand empirical studies of online learning found that, on average, students in an online learning environment performed modestly better than those receiving face-to-face instruction. While the adoption of technology within the education market may differ significantly across districts and schools, due to varying resources and infrastructure, most schools are seeking to further expand the use of technology and online interactive programs and are seeking partners to help them create effective learning environments.

Competition

We compete with a number of PRC and international companies in the PRC market. In our online education business lines, many of our competitors are larger, more established companies, such as China Education Alliance, Inc. and New Oriental Education & Technology Group, Inc. Many of our competitors have diverse businesses and are better specialized in either the online educational field, onsite training, or both. In addition, there are many new local companies that are entering the education market in the PRC and are offering products and services at lower costs to increase their market share. In our other business lines, we compete with many other companies in the education market.

Our Strategy

Our objective is to be a leading provider of affordable and effective educational solutions in the PRC by providing web-based and mobile internet technology, integrated online and offline programs, including advanced educational content, e-learning classroom hardware, professional intelligence assessment and database analysis, all of which aim to establish an intelligence education ecosphere. To achieve this objective, our growth strategy is to:

| · | Develop and Market Our Online and Mobile Education Platforms and the Future Classroom. We intend to capitalize on the growing demand for interactive online and mobile educational resources. In the first quarter of 2016, we launched the NOC Online Learning Platform to Kindergartens located in Xinjiang, Anhui, Hubei, Hunan, and Guangdong provinces and we have substantially completed the FEG (Find Excellent Genius) assessment platform for grades 1 to 12. Commencing in the fourth quarter of 2015, we began marketing and selling the Future Classroom. We will continue to invest in developing new online platforms. See “Our Products, Services and Programs.” | |

| · | Increase Sales Penetration of our Online and Mobile Education Platforms and The Future Classroom in the PRC K-12 Market. We plan to continue adding full-time sales employees at our executive offices. However, instead of establishing sales centers throughout the PRC, we intend to develop relationships with third-party distributors in different cities throughout the PRC to sell our products, services and programs. We plan to market the Future Classroom to public schools through government bidding, and to promote our online products, such as the NOC Learning Platform and our FEG educational content database, through our employees and distributors who have access to networks of teachers, and parents in public and private schools. |

| 3 |

| · | Leverage the NOC Brand. After 13 years of development, we believe we have successfully grown the NOC brand name. We broadcast the NOC final competition on television every year. We intend to leverage the NOC brand name to market our online and mobile education platforms. | |

| · | Strategic Cooperation with Vendors. Future Classroom requires support from software and hardware vendors that have advanced technologies. We intend to establish long-term cooperation arrangements with key vendors who fit in with our strategic product development which is focused on further enhancing the Future Classroom. |

| · | Acquire New Businesses. Schools in the PRC have responded to the increasing public interest in improving education, in part, by investing in educational technologies, such as computer hardware and software, computer-assisted learning programs and professional development training, among other programs. We will continue to seek opportunities to acquire businesses with potential to accelerate our expansion plans. |

Principal Executive Offices

Our principal executive offices are located in Beijing, PRC and an additional office is located in Shenzhen, PRC. Our office in Beijing is located at Room 501, Gaohelanfeng Building, East 3rd Ring South Road, Chaoyang District, Beijing, P. R. China, and our telephone number is +86 10-87663458. Our Shenzhen office is located at Floor 1, Building A, Thunis Sci-Tech. Park, No. 13, Langshan Road, Hi-and-New Tech Park (North Zone), Nanshan District, Shenzhen, PRC.

Implications of Being an Emerging Growth Company

As a company with less than $1.0 billion in revenue during our last fiscal year, we qualify as an “emerging growth company” pursuant to the Jumpstart Our Business Startups Act of 2012 (the “JOBS Act”). An emerging growth company may take advantage of specified reduced reporting and other burdens that are otherwise applicable generally to public companies. These provisions include exemption from the auditor attestation requirement in the assessment of the emerging growth company’s internal control over financial reporting. The JOBS Act also provides that an emerging growth company need not comply with any new or revised financial accounting standard until such date that a non-reporting company is required to comply with such new or revised accounting standard. We have chosen to avail ourselves of all of the exemptions afforded by the JOBS Act. Furthermore, we are not required to present selected financial information or any management’s discussion herein for any period prior to the earliest audited period presented in connection with this prospectus.

We will remain an emerging growth company until the earliest of (a) the last day of our fiscal year during which we have total annual gross revenues of at least $1.0 billion; (b) the last day of our fiscal year following the fifth anniversary of the completion of this offering; (c) the date on which we have, during the previous 3-year period, issued more than $1.0 billion in non-convertible debt; or (d) the date on which we are deemed to be a “large accelerated filer” under the Securities Exchange Act of 1934, as amended (the “Exchange Act”). When we are no longer deemed to be an emerging growth company, we will not be entitled to the exemptions provided in the JOBS Act discussed above. If we choose to take advantage of any of these reduced reporting burdens, the information that we provide shareholders may be different than you might get from other public companies.

| 4 |

The Offering

| Common stock we are offering | [*] shares of Class A common stock. |

| Public offering price | We currently estimate that the initial public offering price will be between $[*] and $[*] per share. |

| Over-allotment option | We have granted a forty-five (45) day option (commencing from the date of this prospectus) to the underwriters to purchase an additional fifteen percent (15%) of the shares of Class A common stock offered in this offering to cover over-allotments, if any. |

| Common stock outstanding before this offering | 21,729,535 shares, which includes 6,529,535 shares of Class A common stock and 15,200,000 shares of Class B common stock. |

| Common stock outstanding after this offering | [*] shares, which includes [*] shares of Class A common stock and 15,200,000 shares of Class B common stock. Xiaoheng Ren, our chief executive officer and a director, and certain of her affiliates, will be deemed to beneficially own all of our issued and outstanding shares of Class B common stock and will be able to exercise approximately [*]% of the total voting power of our issued and outstanding capital stock, immediately following the completion of this offering. Each share of Class B common stock is entitled to five votes and is convertible into one share of Class A common stock. |

| Lock-up | We, our directors, executive officers and shareholders owning five percent (5%) or more of our common stock have agreed with the underwriter not to offer, issue, sell, contract to sell, encumber, grant any option for the sale of or otherwise dispose of any of our securities for a period of twelve (12) months following the closing of the offering of the shares. See “Underwriting” for more information. |

| Use of proceeds | We estimate that the net proceeds from this offering will be approximately $ million, or approximately $ million if the underwriters exercise their over-allotment option in full, based on an assumed initial public offering price of $ per share, which is the midpoint of the price range set forth on the cover page of this prospectus, after deducting the estimated underwriting discounts and commissions and estimated offering expenses payable by us. We intend to use the proceeds of this offering for further development of our online educational platform, and for working capital and other general corporate purposes. Proceeds of this offering in the amount of $600,000 shall be used to fund an escrow account for a period of 30 months following the closing date of this offering, which account shall be used in the event we shall have to indemnify the underwriters pursuant to the terms of the Underwriting Agreement. |

| Risk factors | Investment in our shares of common stock involves a high degree of risk. See “Risk Factors” in this prospectus beginning on page 9 for a discussion of factors and uncertainties that you should consider in evaluating an investment in our securities. |

| Proposed NASDAQ symbol | We have applied to list our Class A common stock on the NASDAQ Capital Market under the symbol “FEGI.” |

| 5 |

The number of shares of our Class A common stock to be outstanding after this offering is based on 6,529,535 shares of our Class A common stock outstanding as of June 13, 2016. Unless otherwise indicated, the information in this prospectus assumes no exercise of the underwriter’s over-allotment option to purchase additional shares of Class A common stock.

The number of shares of our Class A common stock to be outstanding immediately following this offering excludes:

| · | [*] shares of our Class A common stock issuable upon the exercise of the warrants issued in connection with this offering to the underwriters at an exercise price of $[*], assuming an initial public offering price of $ per share, which is the midpoint of the price range set forth on the cover page of this prospectus. |

| 6 |

Summary Consolidated Financial Information

You should read the following summary consolidated financial information in conjunction with our consolidated financial statements and related notes and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” included elsewhere in this prospectus.

The following summary of consolidated statements of operations and comprehensive (loss) income for the years ended December 31, 2015, 2014 and 2013, has been derived from our audited consolidated financial statements included elsewhere in this prospectus. The summary of consolidated statements of operations and comprehensive (loss) for the three months ended March 31, 2016 and 2015 and balance sheet information as of March 31, 2016 are derived from our unaudited consolidated financial statements included elsewhere in this prospectus.

The consolidated financial statements are prepared and presented in accordance U.S. GAAP. You should read the following summary financial data in conjunction with our audited and unaudited consolidated financial statements and related notes beginning on page F-1 of this prospectus. Our historical results for any period are not necessarily indicative of results to be expected in any future period.

| Three Months Ended March 31, | Years Ended December 31, | |||||||||||||||||||

| 2016 | 2015 | 2015 | 2014 | 2013 | ||||||||||||||||

| (Unaudited) | (Unaudited) | |||||||||||||||||||

| Revenue | $ | 317,228 | $ | 429,021 | $ | 3,318,334 | $ | 5,470,898 | $ | 3,337,396 | ||||||||||

| Costs of revenue | 47,406 | 77,748 | 818,366 | 822,334 | 639,116 | |||||||||||||||

| Gross profit | 269,822 | 351,273 | 2,499,968 | 4,648,564 | 2,698,280 | |||||||||||||||

| Operating expenses | ||||||||||||||||||||

| Selling expenses | 567,879 | 523,986 | 2,212,673 | 1,188,902 | 925,494 | |||||||||||||||

| General and administrative expenses | 557,555 | 586,258 | 3,312,508 | 1,738,521 | 691,340 | |||||||||||||||

| Research and development expenses | 439,393 | 142,640 | 1,169,659 | 54,966 | – | |||||||||||||||

| Total operating expenses | 1,564,827 | 1,252,884 | 6,694,840 | 2,982,389 | 1,616,834 | |||||||||||||||

| (Loss) income from operations | (1,295,005 | ) | (901,611 | ) | (4,194,872 | ) | 1,666,175 | 1,081,446 | ||||||||||||

| Other (expense) income | ||||||||||||||||||||

| Interest expenses | (110,955 | ) | (39,912 | ) | (305,915 | ) | (87,598 | ) | (1,045 | ) | ||||||||||

| Interest expenses, related parties | (10,776 | ) | (124,548 | ) | (385,164 | ) | (267,065 | ) | (4,035 | ) | ||||||||||

| Gain on step acquisition | – | – | – | – | 132,022 | |||||||||||||||

| Income (loss) from investments | – | – | – | 32,557 | (27,003 | ) | ||||||||||||||

| Other non-operating income (expense) | (714 | ) | 25,603 | 137,838 | 30,845 | (4,797 | ) | |||||||||||||

| Total other (expense) income, net | (122,445 | ) | (138,857 | ) | (553,241 | ) | (291,261 | ) | 95,142 | |||||||||||

| (Loss) income before income taxes | (1,417,450 | ) | (1,040,468 | ) | (4,748,113 | ) | 1,374,914 | 1,176,588 | ||||||||||||

| (Benefit) provision for income taxes | (8,142 | ) | (208,624 | ) | (191,976 | ) | 512,773 | 300,321 | ||||||||||||

| Net (loss) income | (1,409,308 | ) | (831,844 | ) | (4,556,137 | ) | 862,141 | 876,267 | ||||||||||||

| Other comprehensive (loss) income: | ||||||||||||||||||||

| Foreign currency translation adjustments | (48,562 | ) | (5,983 | ) | 66,363 | 178 | 14,130 | |||||||||||||

| Comprehensive (loss) income | $ | (1,360,746 | ) | $ | (837,827 | ) | $ | (4,489,774 | ) | $ | 862,319 | $ | 890,397 | |||||||

| (Loss) earnings per share - Basic and diluted | $ | (0.07 | ) | $ | (0.04 | ) | $ | (0.24 | ) | $ | 0.04 | $ | 0.04 | |||||||

The exchange rate used is US$ 1.00 = RMB6.53 and RMB6.14 for the three months ended March 31, 2016 and 2015, respectively, and RMB 6.23, RMB 6.14 and RMB 6.20 for the years ended December 31, 2015, 2014 and 2013, respectively. The exchange rates are determined by the average rates of the PBOC during the relevant period.

The following table sets forth our summary balance sheet data, as of March 31, 2016:

| · | on an actual basis; |

| · | on a pro forma, as adjusted basis to give effect to the issuance and sale of the shares of common stock offered in this offering at an assumed public offering price of $[*] per share, which is the midpoint of the price range set forth on the cover page of this prospectus, after deducting underwriting discounts, commissions and estimated offering expenses of $[*]. |

| 7 |

The pro forma as adjusted information presented in the summary balance sheet data is illustrative only and will change based on the actual initial public offering price and other terms of this offering determined at pricing. Each $1.00 increase or decrease in the assumed initial public offering price of $ per share, which is the midpoint of the price range set forth on the cover page of this prospectus, would increase or decrease each of cash and cash equivalents, total assets and total stockholders' equity (deficit) on a pro forma as adjusted basis by approximately $ million, assuming that the number of shares offered by us, as set forth on the cover page of this prospectus, remains the same. Similarly, each increase or decrease of 1.0 million shares offered by us at the assumed initial public offering price would increase or decrease each of cash and cash equivalents, total assets and total stockholders' equity (deficit) on a pro forma as adjusted basis by approximately $ million.

| As of March 31, 2016 | ||||||||

| Actual | Pro forma as adjusted | |||||||

| (unaudited) | (unaudited) | |||||||

| Balance Sheet Data: | ||||||||

| Working capital | $ | (3,860,705 | ) | $ | ||||

| Total assets | $ | 8,334,728 | $ | |||||

| Total liabilities | $ | 8,660,145 | $ | |||||

| Total equity | (325,417 | ) | $ | |||||

| Total liabilities and equity | 8,334,728 | $ | ||||||

The exchange rate used is US$ 1.00 = RMB 6.46, RMB 6.49 and RMB 6.12 as determined by spot rates of the PBOC as of March 31, 2016, December 31, 2015 and December 31, 2014, respectively.

| 8 |

RISK FACTORS

An investment in our common stock involves a high degree of risk. You should consider carefully the following risks and other information included in this prospectus before you decide whether to buy our common stock. If any of the events contemplated by the following discussion of risks should occur, our business, financial condition, results of operations and liquidity could suffer significantly. As a result, the market price of our common stock could decline, and you may lose all or part of the money you paid to buy our common stock. The following is a summary of all the material risks known to us; however, additional risks that we believe to be immaterial could also impair our business.

Risks Related to Our Business

Although historically we have generated net income, our decision to focus our sales and marketing efforts on our new online and mobile educational platform resulted in a decrease in sales in certain of our traditional lines of businesses and as a result, we incurred a net loss for the fiscal year 2015. As we transition our focus to our new online and mobile educational platform, we cannot assure you that we will regain profitability in the near term.

Although historically we have generated revenues through ZTL and had net income of $0.86 million and $0.88 million for the fiscal years ended December 31, 2014 and 2013, we booked a net loss of $ 4.55 million for the year ended December 31, 2015. This loss was the result of transitioning our focus away from third party offline distribution of our educational database and digital educational products to promoting our new business, an increase in professional expenses associated with this public offering and an increase in research and development (“R&D”) expenses related to the new business. We expect that our operating expenses will continue to increase as we expand our business. If we are not able to increase revenue and/or manage operating expenses in line with revenue forecasts, we may not be able to achieve profitability. Any significant failure to realize anticipated revenue growth from our new and existing lines of business and/or manage operating expenses in line with revenue forecasts, could result in continued operating losses. As such, we cannot assure you that we will achieve and maintain profitability.

Our business operations are closely tied with government policies. If there is any change in the direction of the government policies or any decrease in the strength of such support, our growth strategy will be negatively impacted and our financial situation will be materially adversely effected.

As a provider of educational content and materials, our business is not only highly regulated by the PRC government, but the growth of our business depends on the continued emphasis by the PRC government on access to quality education in the PRC. The educational system in China is undergoing substantial reform. Since 1986, several laws, action plans and policies have been put in place to mandate education, increase educational standards and change the orientation of the education system from one based on memory learning to a more individualized creative approach. As a result, our business, its current operations, brand and growth relies significantly on continued governmental support of education. If the mandates for educational reform begin to wane, it could significantly curtail our operations, reducing our revenues and negatively impacting our future potential for growth.

We cannot guarantee that our future teaching material will be approved by the Ministry of Education (the “MOE”), or the provincial authority for education administration, or its designated review and approval committee for teaching materials (collectively, the “Education Administration Authorities”), and be selected for entry into the national, provincial and local government’s catalog of teaching material. If we fail to provide materials that meet the stringent guidelines for approval, or if our materials are not selected for inclusion in the catalogs, our revenue growth within the business line may become stagnant and eventually will decline.

Since 1998, through ZTL, we have been in the business of creating content for teaching materials that can be used in the classroom. We currently own copyrights to two teaching materials that have been approved by the Education Administration Authorities and are included in the provincial and local government’s catalog of teaching material. These publications generally have an initial lifespan of up to six years, and thereafter, require updating to remain in the catalogs. If we fail to update these publications to meet the requirements of the Education Administration Authorities, the teaching materials will be excluded from the catalogs. Our inability to create content for teaching materials meeting the new academic standards for approval, selection and distribution to classrooms in the provinces where we primarily do business, will have a material adverse effect on future revenues in this business line.

China regulates media content extensively and we may be subject to government actions if our advertisements in our magazines do not comply with PRC advertising laws.

PRC advertising laws and regulations require advertisers, advertising operators and advertising distributors to ensure that the content of the advertisements they prepare or distribute is fair and accurate and is in full compliance with applicable laws, rules and regulations. Violation of these laws, rules or regulations may result in penalties, including fines, confiscation of advertising fees, orders to cease dissemination of the advertisements and orders to publish an advertisement correcting the misleading information. In circumstances involving serious violations, the PRC government may revoke a violator’s license for its advertising business operations.

| 9 |

Our business includes publishing advertisements in our magazines for clients, the content of which may not fully comply with applicable laws, rules and regulations. Further, for advertising content related to special types of products and services, such as alcohol, cosmetics, pharmaceuticals and medical procedures, we are required to confirm that our clients have obtained requisite government approvals, including operating qualifications, proof of quality inspection of the advertised products and services, government pre-approval of the content of the advertisement and filings with the local authorities. We endeavor to comply with such requirements by requesting relevant documents from these advertising clients. However, we cannot assure you that violations or alleged violations of the content requirements will not occur with respect to our operations. If the relevant PRC governmental agencies determine the content of the advertisements that we publish in our magazines violate any applicable laws, rules or regulations, we could be subject to penalties. Violations or alleged violations of the content requirements could also harm our reputation and impair our ability to conduct and expand our business.

If we fail to be authorized as the executing agency for the NOC in the future, or to strengthen and protect our brands, our operations and the financial situation will be materially affected.

Since 2003, we have acted as the executing agency for the NOC by marketing, developing and promoting the “NOC” brand. Each year, the hosting entities for the NOC announce the commencement of the NOC by issuing a notice to relevant participants, which specifies, among other things, the theme, the organization sponsorship, the executing agency for the NOC, and other detailed arrangements for the year. We have been the executing agency since the first NOC. We believe that the “NOC” brand is synonymous with stellar achievement, creativity, self-esteem and accomplishment throughout the PRC and has contributed significantly to our success in our other lines of business. We expect to leverage the NOC brand as part of our growth strategy as we begin to permeate the online education arena. It is critical that we maintain and protect our brand and our image, as we continue to launch new programs, projects and acquire new businesses. As we launch new business lines, and seek to increase visibility in our current business lines, the use of several marketing tools, sponsorship and support from traditional advertisers, schools and government officials will be important to our success. A number of factors could prevent us from successfully promoting our brand, including student and teacher dissatisfaction with our services, the failure of our marketing tools and strategies to attract new subscribers for our magazines or new students to our competitions, as well as teacher dissatisfaction with our teaching materials. If we are unable to continue to act as the executing agency of the NOC, and maintain and enhance the brand or utilize marketing tools in a cost-effective manner, our revenues and profitability may suffer. If we are unable to further enhance our brand recognition and increase awareness of our services, or if we incur excessive sales and marketing expenses, our business and results of operations may be materially and adversely affected.

If we fail to attract more students to participate in NOC activities, our operations and financial condition will be materially adversely affected.

The success of our “NOC” business line depends primarily on the number of students and teachers who participate each year. Therefore, our ability to continue to attract students and teachers is critical to the continued success and growth of our NOCs. We rely heavily on our relationships with provincial and local governments, schools, principals and teachers to promote and encourage participation in the NOC to parents, teachers and students. We must create an innovative theme for the NOC each year to attract the interest of the participants. In addition, parental support is critical for student participation as there are costs associated with competing. If we are unable to continue to attract teachers, parents and students to participate in the NOC competitions, not only will our revenues decline in this business line, but our brand will be harmed, which may have a material adverse effect on our business, financial condition and results of operations.

We may not be able to implement our growth strategy and future plans successfully.

Our growth strategy includes increasing sales, leveraging the NOC brand, developing new online platforms and acquiring companies that have services, products or technologies that extend or complement our existing business. The process to undertake a massive growth strategy like ours, is time-consuming and costly. We expect to expend significant resources and there is no guarantee that we will successfully execute our plans.

Failure to manage expansion effectively may affect our success in executing our business plan and may adversely affect our business, financial condition and results of operations. We may not realize the anticipated benefits of any or all of our strategies, or may not realize them in the time frame expected. In addition, future acquisitions may require us to issue additional equity securities, spend our cash, or incur debt, and amortization expenses related to intangible assets or write-offs of goodwill, any of which could adversely affect our results of operations.

| 10 |

We face significant competition and if we fail to compete effectively, we may lose our market share and our profitability may be adversely affected.

The education sector in China is rapidly evolving, highly fragmented and competitive, and we expect competition in this sector to persist and intensify. We face competition in each of our business lines and competition is particularly intense in some of the key geographic markets in which we operate, such as Beijing and Shenzhen.

We also face competition from companies that focus on one area of our business and are able to devote all of their resources to that business line. These companies may be able to more quickly adapt to changing technology, student preferences and market conditions in these markets than we can. These companies may, therefore, have a competitive advantage over us with respect to these business areas.

The increasing use of the Internet and advances in Internet and computer-related technologies are eliminating geographic and cost-entry barriers to providing educational services and products. As a result, many international companies that offer online test preparation and language training courses may decide to expand their presence in China or to try to penetrate the China market. Many of these international companies have strong education brands, and students and parents in China may be attracted to the offerings based in the country that the student wishes to study in or in which the selected language is widely spoken. In addition, many Chinese and smaller companies are able to use the Internet to quickly and cost-effectively offer their services and products to a large number of students with less capital expenditure than previously required.

Competition could result in loss of market share and revenues, lower profit margins and limit our future growth. A number of our current and potential future competitors may have greater financial and other resources than we have. These competitors may be able to devote greater resources than we can to the development, promotion and sale of their services and products, and respond more quickly than we can to changes in student needs, testing materials, admissions standards, market needs or new technologies. As a result, our net revenues and profitability may decrease. We cannot assure you that we will be able to compete successfully against current or future competitors. If we are unable to maintain our competitive position or otherwise respond to competitive pressures effectively, we may lose our market share and our profitability may be materially adversely affected.

Our success depends, to a large extent, on the skill and experience of our management in the media and education business. If any member of our senior management leaves, or if we fail to recruit suitable replacements, our operation and financial situation will be adversely affected.

Our success depends in large part on the continued employment of our senior management and key personnel who can effectively operate our business, as well as our ability to attract and retain skilled employees. Competition for highly skilled management, technical, research and development and other employees is intense in the education industry in the PRC and we may not be able to attract or retain highly qualified personnel in the future. If any of our employees leave, and we fail to effectively manage a transition to new personnel, or if we fail to attract and retain qualified and experienced professionals on acceptable terms, our business, financial conditions and results of operations could be adversely affected. Our success also depends on our having highly trained sales and marketing personnel to support and promote our current products as well as new service and product launches. We will need to continue to hire additional personnel as our business grows. A shortage in the number of people with these skills or our failure to attract them to our company could impede our ability to increase revenues from our existing products and services, ensure full compliance with applicable federal and state regulations, launch new product offerings and would have an adverse effect on our business and financial results.

We may not be able to adequately protect our intellectual property, which could cause us to be less competitive.

Our trademarks, trade names, copyrights, trade secrets and other intellectual property rights are important to our success. In connection with our business, we have registered four trademarks, 30 domain names and one software copyright registration in the PRC. We have also submitted three trademark applications for our business in the PRC. See “Regulations-Regulations on Intellectual Property Rights.” Unauthorized use of any of our intellectual property may adversely affect our business and reputation. We rely on a combination of copyright, trademark and trade secrets laws and confidentiality agreements with our employees, consultants and others to protect our intellectual property rights. Nevertheless, it may be possible for third parties to obtain and use our intellectual property without authorization, or use logos or trade names similar to ours. For example, there are a number of education service providers in China that use the Chinese characters for the phrase “Future Education” in their company names, which may dilute the value of our brand name and cause confusion among customers. The unauthorized use of intellectual property is widespread in China, and enforcement of intellectual property rights by Chinese regulatory agencies is inconsistent. Moreover, litigation may be necessary in the future to enforce our intellectual property rights. Future litigation could result in substantial costs and diversion of our management’s attention and resources and could disrupt our business. If we are unable to enforce our intellectual property rights, it could have a material adverse effect on our financial condition and results of operations. Given the relative unpredictability of China’s legal system and potential difficulties enforcing a court judgment in China, we may be unable to halt the unauthorized use of our intellectual property through litigation. Failure to adequately protect our intellectual property could materially adversely affect our competitive position, our ability to attract students and our results of operations.

| 11 |

We have borrowings payable to certain individuals the repayment of which may have a material adverse effect on our liquidity, financial conditions, results of operations and growth prospectus in the future.

To date, we have financed our daily operations primarily from cash flow from operations and financial support from certain unrelated individuals and related parties. As of March 31, 2016, our short-term borrowings from unrelated individuals and related party were $4.5 million and $0.4 million, respectively. In April 2016, certain holders of outstanding short-term borrowings in the amount of $4.5 million (including unpaid interest) agreed to accept our newly issued 1,471,890 Class A common stock at the price of $3.00 per share in full settlement of our obligations.

On December 15, 2013, we entered into a loan agreement with Xiaoheng Ren, our Chief Executive Officer and director in the amount of approximately $1.6 million to fund our daily operations, of which $1.2 million has been repaid as of March 31, 2016. In May 2016, Ms. Ren loaned an additional $0.8 million to fund our daily operations. The loan matures in two years. The interest rate varies based upon the PBOC benchmark lending rate during the two-year period. We may choose to re-pay the loan partially or in full at such time that we have sufficient cash flows.

In the event that Ms. Ren is no longer serving in a management position at our Company and demands repayment of the short-term borrowings or refuses to extend the loan agreement upon maturity, we may not have the cash available at the time to make the repayment, which could result in a default under the loan.

We will endeavor to obtain financing from other channels after this offering, including but not limited to cash flows from operations, borrowings from banks, sale of additional equity and issuance of debt. However, we cannot assure you that financing will be available in the amounts we require or on terms acceptable to us, if at all. The sale of additional equity, including convertible debt securities, would dilute the interests of our current shareholders. The incurrence of debt could result in operating and financial covenants that could restrict our operations. If we are unable to obtain sufficient funds as required, our liquidity would be negatively affected and our business, operations and prospects may be adversely affected.

Our operations are subject to seasonality.

There is higher demand for advertisements and hence more advertising expenditures in the second half of each year for our magazines. In order to meet annual sales targets, advertising customers tend to expand their advertising campaigns and increase advertising expenditures in the second half of each year to boost sales performance. Our magazine subscription revenue and advertising revenue are sensitive to local customer spending patterns as our advertising customers are likely to place advertisements according to seasonal shopping or spending patterns. Also, the Chinese New Year holidays in the first half of each year are the traditional slow season for the magazine industry as advertising customers tend to withhold and avoid launching large-scale printed advertisements in magazines during this time of the year when their readers traditionally leave the cities where they work and return to their home towns for festival celebrations.

Our educational programs, which are our primary source of revenues, are also seasonal. We tend to experience an increase in revenue from these lines in the second half of the year when the NOC and other competitions are held. Similarly, commissions from the distribution of revenues is subject to seasonality due to the fact that our textbook deliveries occur twice a year at the beginning of the spring and autumn semesters. We also expect our new online educational platforms will be subject to seasonality since the primary customers are K-12 schools or students, who will use the products during the school semester.

As a result, we generally record higher revenue in the second half as compared to the first half of each year. Any adverse change in the trends in spending patterns and other factors, conditions or events in the PRC, may affect our operational results.

We may have potential litigation.

The nature of our magazine and advertising businesses exposes us to the risk of litigation claims from parties whose activities are described in the magazines and who may perceive that references to them in the magazines are damaging to their reputations. Moreover, civil claims may be filed against us for fraud, defamation, negligence, copyright or trademark infringement or other violations due to the nature and content of the information or articles contained in the magazines. We also may be subject to claims resulting from the use of content by third parties in our online education platform and other educational products. No assurance can be given, however, that any claims and actions will not be initiated from or arise out of our business in the future. Expenses of litigation, possible losses from lawsuits and delays in proceedings in respect of outstanding and possible future claims may have a material adverse effect on our operations and financial performance in the future. We currently do not maintain any insurance coverage on contingent liabilities arising out of such claims.

| 12 |

Our Chairman of the Board and our Chief Executive Officer, individually and together, own a large percentage of our outstanding stock and could significantly influence the outcome of our corporate matters.

Under our amended articles of incorporation, our common stock is divided into Class A common stock and Class B common stock. Holders of Class A common stock are entitled to one vote per share, while holders of Class B common stock are entitled to five votes per share. Our Chairman owns 50% of our issued and outstanding shares of Class B common stock, and Ms. Ren, our Chief Executive Officer owns 41% of our issued and outstanding shares of Class B common stock. As a result, together, and individually they will be able to exercise significant influence over all matters that require us to obtain shareholder approval, including the election of directors to our board and approval of significant corporate transactions that we may consider, such as a merger or other sale of our company or its assets. This concentration of ownership in our shares by such individual or their affiliates will limit the other shareholders’ ability to influence corporate matters and may have the effect of delaying or preventing a third party from acquiring control over us.

Our lack of accounting personnel with education and experience in U.S. GAAP creates a material weakness in our internal control over financial reporting and could cause us to overlook or experience a delay in detecting a material misstatement of our financial statements.

Our books and records are maintained in accordance with Chinese GAAP and then converted into financial statements in accordance with U.S. GAAP. Our Chief Financial Officer, and the accountants under his supervision, are primarily responsible for preparing our books and records and converting such books and records into financial statements in accordance with U.S. GAAP. Mr. Luo and other accountants have limited knowledge and experience in preparing financial statements in accordance with U.S. GAAP and preparing financial reporting pursuant to the SEC rules and regulations. In this regard, certain members of our internal accounting team are not certified public accountants or certified management accountants in the U.S., and have not attended U.S. academic institutions or extended educational programs that would provide a sufficiently relevant education in U.S. GAAP. As a result, there is a possibility that a material misstatement of our annual or interim financial statements may not be prevented or detected on a timely basis.

If we are unable to establish appropriate internal financial reporting controls and procedures, it could cause us to fail to meet our reporting obligations, result in the restatement of our financial statements, harm our operating results, subject us to regulatory scrutiny and sanction, cause investors to lose confidence in our reported financial information and have a negative effect on the market price of our shares.

Effective internal controls are necessary for us to provide reliable financial reports and effectively prevent fraud. We maintain a system of internal control over financial reporting, which is defined as a process designed by, or under the supervision of, our principal executive officer and principal financial officer, or persons performing similar functions, and effected by our board of directors, management and other personnel, to provide reasonable assurance regarding the reliability of financial reporting and the preparation of financial statements for external purposes in accordance with U.S. GAAP.

As a public company, we will have significant additional requirements for enhanced financial reporting and internal controls. We will be required to document and test our internal control procedures in order to satisfy the requirements of Section 404 of the Sarbanes-Oxley Act of 2002, which requires annual management assessments of the effectiveness of our internal controls over financial reporting starting with our annual report on Form 10-K for the year ending December 31, 2017. In addition, an independent registered public accounting firm will be required to attest to the effectiveness of our internal control over financial reporting beginning with our annual report on Form 10-K following the date on which we cease to qualify as an emerging growth company if we become an accelerated filer or large accelerated filer. The process of designing and implementing effective internal controls is a continuous effort that requires us to anticipate and react to changes in our business and the economic and regulatory environments and to expend significant resources to maintain a system of internal controls that is adequate to satisfy our reporting obligations as a public company.

We cannot assure you that we will not, in the future, identify areas requiring improvement in our internal control over financial reporting. We cannot assure you that the measures we will take to remediate any areas in need of improvement will be successful or that we will implement and maintain adequate controls over our financial processes and reporting in the future as we continue our growth. If we are unable to establish appropriate internal financial reporting controls and procedures, it could cause us to fail to meet our reporting obligations, result in the restatement of our financial statements, harm our operating results, subject us to regulatory scrutiny and sanction, cause investors to lose confidence in our reported financial information and have a material adverse effect on the market price of our shares.

Lack of experience of our management team as officers of a publicly-traded company may hinder our ability to comply with the Sarbanes-Oxley Act.

It may be time-consuming, difficult and costly for us to develop and implement the internal controls and reporting procedures required by the Sarbanes-Oxley Act. We need to hire additional financial reporting, internal controls and other finance staff or consultants in order to develop and implement appropriate internal controls and reporting procedures. If we are unable to comply with the Sarbanes-Oxley Act’s internal controls requirements, we may not be able to obtain the independent registered public accounting firm certifications that the Sarbanes-Oxley Act requires publicly-traded companies to obtain.

| 13 |

Risks Relating to Our Structure and Regulations

If the PRC government determines that the contractual arrangements for operating our business do not comply with PRC laws, rules and regulations, we could face severe penalties.

Foreign investment in the businesses we operate, including magazine publishing and distribution, and development and operation of mobile education platforms, is currently prohibited or restricted in China. As a U.S. corporation, we are restricted or prohibited from directly owning all of the equity interests in any PRC company engaged in these businesses. See "Regulation." As a result, our business in China is operated by our VIEs, ZTL, and its subsidiaries, and APFE through contractual arrangements. APFE and ZTL and their subsidiaries hold the relevant licenses and permits to engage in the businesses in China and each of them is currently owned by PRC citizens and/or PRC companies. We have been and expect to continue to be dependent on APFE and ZTL to operate these businesses. We do not have any equity interest in ZTL or APFE, but control their operations and receive substantially all the economic benefits and bear substantially all the economic risks through a series of contractual arrangements. For more information regarding these contractual arrangements, see "Our Corporate History and Structure."

There are uncertainties regarding the interpretation and application of current and future PRC laws, rules and regulations, including but not limited to the laws, rules and regulations governing the validity and enforcement of our contractual arrangements with ZTL and APFE, and the laws, rules and regulations setting forth the prohibitions or restrictions on foreign investments in the businesses we operate.

Further, considering we are planning to develop online education and other internet-based business after the listing, our current contractual arrangements must also comply with laws and regulations applicable to the Internet industry. The Circular on Strengthening the Administration of Foreign Investment in and Operation of Value-added Telecommunications Business issued by the Ministry of Industry and Information Technology, or MIIT, in July 2006, or the MIIT Circular, reiterates restrictions on foreign investment in telecommunications businesses. Under the MIIT Circular, a PRC company that holds a license to conduct value-added telecommunications businesses, or a VATS License, in China is prohibited from leasing, transferring or selling the license to foreign investors in any form and from providing any assistance, including providing resources, sites or facilities, to foreign investors to conduct value-added telecommunications businesses illegally in China. Furthermore, the relevant trademarks and domain names that are used in a value-added telecommunications business must be owned by the local VATS License holder or its shareholder(s). The MIIT Circular further requires each VATS License holder to have appropriate facilities for its approved business operations and to maintain such facilities in the regions covered by its license. In addition, all value-added telecommunications service providers are required to maintain network and information security in accordance with the standards set forth under relevant PRC regulations. As confirmed by the Company, APFE will apply for a VATS License to carry out the online education platform business. Due to a lack of interpretative materials from the regulators, it is uncertain whether MIIT would consider our corporate structures and contractual arrangements as a kind of foreign investment in telecommunication services. Therefore, it is unclear what impact this circular will have on us or the other Chinese Internet companies that have adopted the same or similar corporate structures and contractual arrangements as ours.

In August 2011, the Ministry of Commerce, or MOFCOM, promulgated the Rules of Ministry of Commerce on Implementation of Security Review System of Mergers and Acquisitions of Domestic Enterprises by Foreign Investors, or the MOFCOM Security Review Rules, to implement the Notice of the General Office of the State Council on Establishing the Security Review System for Mergers and Acquisitions of Domestic Enterprises by Foreign Investors, or Circular No. 6, promulgated on February 3, 2011. Under these rules, a security review by MOFCOM is required for foreign investors’ mergers and acquisitions that have “national defense and security” implications and mergers and acquisitions by which foreign investors may acquire “de facto control” of domestic enterprises that have “national security” implications. The MOFCOM Security Review Rules further prohibit foreign investors from bypassing the security review requirement by structuring transactions through proxies, trusts, indirect investments, leases, loans, control through contractual arrangements or offshore transactions. There is no explicit provision or official interpretation stating that our businesses fall within the scope of transactions subject to security review. We do not believe we are required to submit our existing contractual arrangements to MOFCOM for a security review. However, as there is a lack of clear statutory interpretation regarding the implementation of the rules, there is no assurance that MOFCOM will have the same view as we do when applying these national security review-related circulars and rules.

The relevant PRC regulatory authorities have broad discretion in determining whether a particular contractual structure violates PRC laws and regulations. Although we believe we comply, and will continue to comply with current PRC regulations, the PRC government may not agree that these contractual arrangements comply with PRC licensing, registration or other regulatory requirements, with existing requirements or policies or with requirements or policies that may be adopted in the future. It is possible that a PRC court, arbitration tribunal or other regulatory authority may determine that such contractual arrangements are illegal or invalid. If the PRC government determines that we are not in compliance with applicable laws, it may levy fines on us, confiscate our income that they deem to have been obtained through illegal operations, revoke or refuse to renew any business and operating licenses required to conduct our operations in China, revoke the agreements constituting the contractual arrangements, require us to discontinue or restrict our operations, suspend the operation of our competition programs, require us to alter our ownership structure or operations, or impose additional conditions or restrictions on our business operations with which we may not be able to comply, or take other regulatory or enforcement actions against us that could be harmful to our business.

| 14 |

WFOE’s contractual arrangements may not be as effective in providing control over ZTL and APFE as direct ownership, and any failure by ZTL, APFE and their shareholders to perform their obligations under contractual arrangements would have material and adverse effects on our business.