Attached files

| file | filename |

|---|---|

| 8-K - 8-K - MERCURY SYSTEMS INC | a8-k2016061416williamblair.htm |

© 2016 Mercury Systems, Inc. William Blair Growth Stock Conference Mark Aslett President and CEO Gerry Haines Executive Vice President and CFO June 14, 2016

2 © 2016 Mercury Systems, Inc. Forward-looking safe harbor statement This presentation contains certain forward-looking statements, as that term is defined in the Private Securities Litigation Reform Act of 1995, including those relating to the products and services described herein. You can identify these statements by the use of the words “may,” “will,” “could,” “should,” “would,” “plans,” “expects,” “anticipates,” “continue,” “estimate,” “project,” “intend,” “likely,” “forecast,” “probable,” “potential,” and similar expressions. These forward-looking statements involve risks and uncertainties that could cause actual results to differ materially from those projected or anticipated. Such risks and uncertainties include, but are not limited to, continued funding of defense programs, the timing and amounts of such funding, general economic and business conditions, including unforeseen weakness in the Company’s markets, effects of continued geopolitical unrest and regional conflicts, competition, changes in technology and methods of marketing, delays in completing engineering and manufacturing programs, changes in customer order patterns, changes in product mix, continued success in technological advances and delivering technological innovations, changes in, or in the U.S. Government’s interpretation of, federal export control or procurement rules and regulations, market acceptance of the Company's products, shortages in components, production delays or unanticipated expenses due to performance quality issues with outsourced components, inability to fully realize the expected benefits from acquisitions and restructurings, or delays in realizing such benefits, challenges in integrating acquired businesses and achieving anticipated synergies, changes to export regulations, increases in tax rates, changes to generally accepted accounting principles, difficulties in retaining key employees and customers, unanticipated costs under fixed-price service and system integration engagements, and various other factors beyond our control. These risks and uncertainties also include such additional risk factors as are discussed in the Company's filings with the U.S. Securities and Exchange Commission, including its Annual Report on Form 10-K for the fiscal year ended June 30, 2015. The Company cautions readers not to place undue reliance upon any such forward-looking statements, which speak only as of the date made. The Company undertakes no obligation to update any forward-looking statement to reflect events or circumstances after the date on which such statement is made. Use of Non-GAAP (Generally Accepted Accounting Principles) Financial Measures In addition to reporting financial results in accordance with generally accepted accounting principles, or GAAP, the Company provides adjusted EBITDA, adjusted income from continuing operations, and adjusted EPS which are non-GAAP financial measures. Adjusted EBITDA, adjusted income from continuing operations, and adjusted EPS exclude certain non-cash and other specified charges. The Company believes these non-GAAP financial measures are useful to help investors better understand its past financial performance and prospects for the future. However, the presentation of adjusted EBITDA, adjusted income from continuing operations and adjusted EPS is not meant to be considered in isolation or as a substitute for financial information provided in accordance with GAAP. Management believes the adjusted EBITDA, adjusted income from continuing operations, and adjusted EPS financial measures assist in providing a more complete understanding of the Company’s underlying operational results and trends, and management uses these measures along with the corresponding GAAP financial measures to manage the Company’s business, to evaluate its performance compared to prior periods and the marketplace, and to establish operational goals. A reconciliation of GAAP to non-GAAP financial results discussed in this presentation is contained in the Appendix hereto.

3 © 2016 Mercury Systems, Inc. …to address the industry's challenges and opportunities Pioneering a next generation defense electronics company… • High-tech commercial business model • Secure processing subsystems • Serving defense Prime contractor outsourcing needs • Deployed on 300+ programs with 25+ Prime contractors • FY15 $235M revenue Growth YoY: 13% revenue, 89% Adj. EBITDA, 19% backlog • FY16 guidance(1): Growth YoY: 6.5-8% revenue, 15-18% Adj. EBITDA (1) The guidance included herein is from the Company’s most recent earnings release and is as of the date of that release. The Company is neither reconfirming such guidance as of the date of this presentation nor assuming any obligations to update or revise such guidance.

4 © 2016 Mercury Systems, Inc. Investor highlights Proven Management Team Pure play defense electronics company. Embedded on key growth programs aligned to DoD priorities Leading Positions on Well-funded Platforms Pacific pivot, aging platform modernization, foreign and international military sales, SOF quick reaction capabilities Aligned with Industry Growth Drivers Internally-funded R&D. IP retention. Commercial sales model. US development, manufacturing and support Next Generation Defense Electronics Business Model Secure processing subsystems, software and services for critical Defense and Intelligence applications Innovative Technology Leader Captive Prime outsourcing largest secular growth trend. RFM and secure processing content expansion on key DoD programs Low Risk Growth Strategy Scalable business, engineering and manufacturing platform to facilitate future acquisitions Business Platform Built to Scale Successful business transformation. Double-digit revenue growth with strong profitability

5 © 2016 Mercury Systems, Inc. Mercury’s vision is to be the… Leading commercial provider of secure processing subsystems designed and made in the USA

6 © 2016 Mercury Systems, Inc. …provider of outsourced defense electronics subsystems Acquisitions have transformed Mercury into a pure play… • Acquired capability expands total addressable market • Moved up the value chain • Facilitates greater customer outsourcing • Accelerates customer supply chain consolidation • Disintermediate traditional competitors • Low-risk content expansion organic growth strategy • Integrated acquisitions. Ready for future M&A SECURE PROCESSING SECURE PROCESSING DIGITIZATION DIGITIZATION RFM RFM RFM RFM RFM RFM Defense Electronic Subsystem

7 © 2016 Mercury Systems, Inc. Defense will likely remain a $500B+ industry… …despite the ongoing political and budget uncertainty Crowding Out of Defense Spending and Investment: Rising interest rates, healthcare and social spending; MilPer expense growth, aging military platforms’ O&M costs rising Defense Procurement Reform 3.0: Firm-fixed-price contracts and less government-funded R&D changing economics and competitive dynamics of defense industry Political Dysfunction: Sequestration-driven cuts and repeated Continuing Resolutions disrupting DoD budget process and spending Industry Has Cut Capacity to Innovate: Reduced headcount, fewer engineers and aging workforce; Less IR&D and growth investments, increased dividends and buybacks Challenging Global Security Environment: Resurgent Russia, Chinese militarization and power projection, ISIS threat, North Korean agitation, Middle East instability

8 © 2016 Mercury Systems, Inc. 530 495 496 496 534 547 556 564 570 581 500 512 525 537 551 524 585 522 480 500 520 540 560 580 600 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021 PBR16 2011 Budget Act PBR17 FY16 Enacted 2015 Budget Act Defense budgetary environment improving PBR17 adjusts FY17 to new budget caps but not FY18-21 Sources: National Defense Authorization Act of 2016, FY2017 President’s Budget Request. Numbers may not add due to rounding. Topline Base Authorization Budget vs. BCA Caps & Bipartisan Budget Act Agreement ($B)

9 © 2016 Mercury Systems, Inc. …representing ~19x addressable existing COTS merchant market Mercury is benefitting from Primes’ outsourcing… • Defense electronics is a $37 billion dollar market • Captive market is ~19x Commercial-Off-The-Shelf (COTS) merchant supply • Outsourcing trend not tied to increased defense spending • Primes outsourcing to more capable suppliers willing to invest, share risk Source: VDC Webcast: Budgetary & Strategic Shifts - Creating Opportunities for Merchant Embedded COTS Systems in Mil/Aero 1.3 1.4 1.6 1.7 1.8 1.9 32.7 33.1 33.6 33.8 34.2 35.1 0 5 10 15 20 25 30 35 40 2011 2012 2013 2014 2015 2016 Merchant Captive ~19x Total Global Market, COTS Systems, Merchant & Captive ($B)

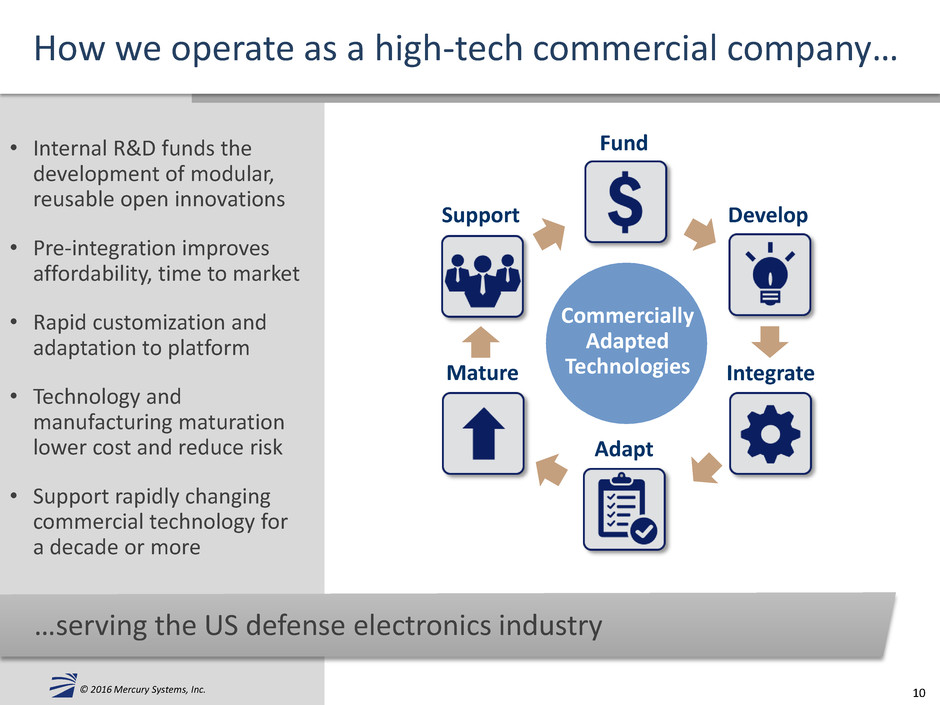

10 © 2016 Mercury Systems, Inc. …serving the US defense electronics industry How we operate as a high-tech commercial company… • Internal R&D funds the development of modular, reusable open innovations • Pre-integration improves affordability, time to market • Rapid customization and adaptation to platform • Technology and manufacturing maturation lower cost and reduce risk • Support rapidly changing commercial technology for a decade or more Fund Develop Integrate Mature Support Adapt Commercially Adapted Technologies

11 © 2016 Mercury Systems, Inc. …as customers seek affordable outsourced pre-integrated subsystems Business model built for speed, innovation and affordability… • Traditional COTS board model broken (“Plug-n-Pray”) – Product procurement cost low – Large hidden integration costs – Lower Prime IR&D spending – COTS lifecycle support difficult • Defense procurement reform – Less cost-plus Government- funded integration – Under firm fixed price, Prime bears risk and expense • Acquired and pre-integrating sensor chain technologies – More affordable, lower risk, simplifies supply chain – Open architectures and open middleware speed adoption Primes RFM Digital Secure Processing Mercury Pre-integrated Secure Subsystems Government Traditional COTS Model “Plug-n-Pray” Operating System COTS COTS COTS Proprietary Middleware Classified Prime/Gov’t IP 36+ months Time to Market 12 months Time to Market Open Middleware Application Ready Software Toolkit Classified Prime/Gov’t IP

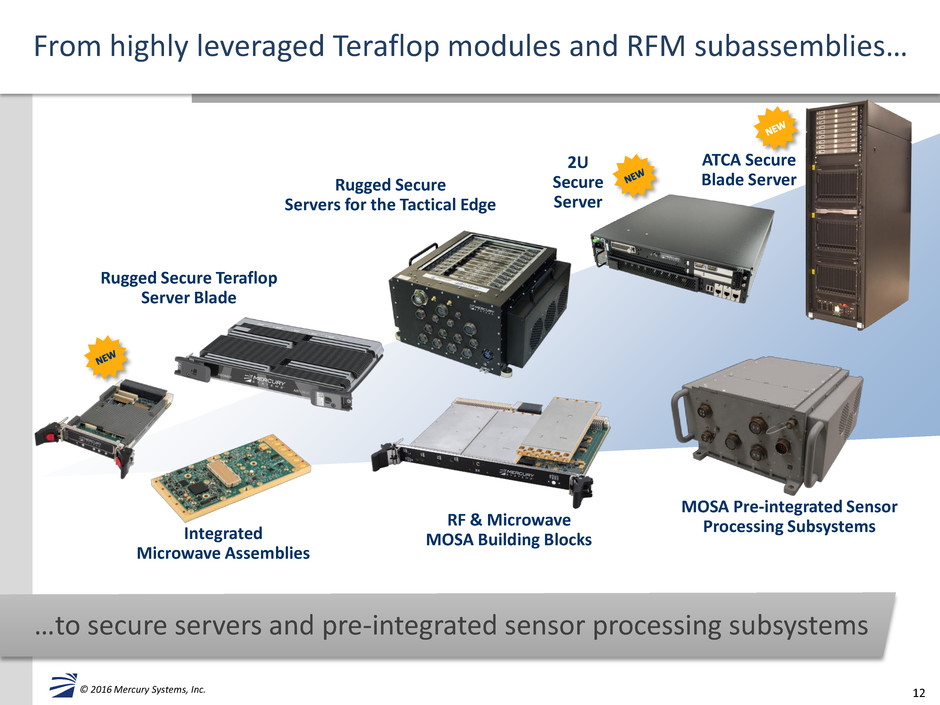

12 © 2016 Mercury Systems, Inc. From highly leveraged Teraflop modules and RFM subassemblies… …to secure servers and pre-integrated sensor processing subsystems Rugged Secure Teraflop Server Blade Rugged Secure Servers for the Tactical Edge ATCA Secure Blade Server Integrated Microwave Assemblies MOSA Pre-integrated Sensor Processing Subsystems RF & Microwave MOSA Building Blocks 2U Secure Server

13 © 2016 Mercury Systems, Inc. • Pre-integrated end-to-end sensor capability unique • Lower integration costs, time, risk • Facilitates Prime outsourcing • DoD mandate • Unique capabilities • Important relationships • Critical programs • 2-3 years ahead of traditional competitors • Intel server class embedded processing • SWaP optimized packaging •Multiple form factors driving TAM expansion Factors leading to a unique market position for Mercury • Processing supply chain integrity • Modern, scalable, redundant RFM manufacture and test • Authored OpenVPX standard • RFM Digital MOSA Modular Open System Architecture Designed and Made in USA Server-class Processing Performance Integrated Product Security End-to-End Subsystem Capability

14 © 2016 Mercury Systems, Inc. Mercury’s capabilities and opportunity for growth… …are aligned to DoD investment priorities Pacific Pivot: Platforms need improved sensors, autonomy, electronic protection and attack, on-board exploitation. Greater demand for onboard processing Aging Platform Modernization: Port customer software to available state-of-the-art open architectures to rapidly and affordably upgrade electronics on aging military platforms International and Foreign Military Sales: Upgrade subsystems with security for export to expand addressable market, grow revenues and access international customer R&D funding Special Operations Forces Quick Reaction Capability: Provide rapid reaction and affordable new capabilities to support anti-terror and other special forces missions globally

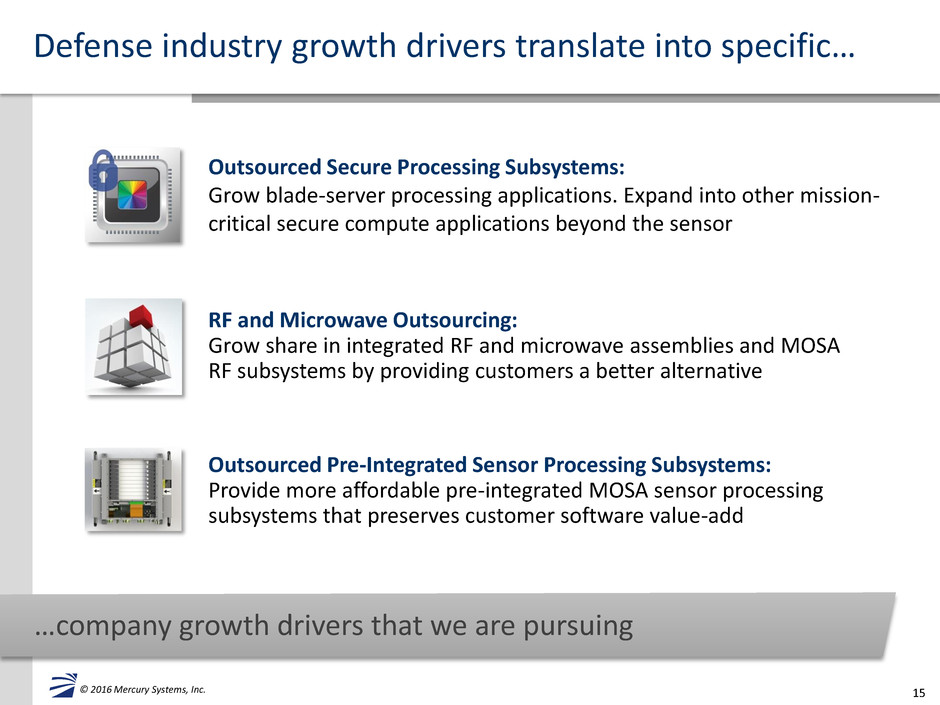

15 © 2016 Mercury Systems, Inc. Defense industry growth drivers translate into specific… …company growth drivers that we are pursuing Outsourced Secure Processing Subsystems: Grow blade-server processing applications. Expand into other mission- critical secure compute applications beyond the sensor Outsourced Pre-Integrated Sensor Processing Subsystems: Provide more affordable pre-integrated MOSA sensor processing subsystems that preserves customer software value-add RF and Microwave Outsourcing: Grow share in integrated RF and microwave assemblies and MOSA RF subsystems by providing customers a better alternative

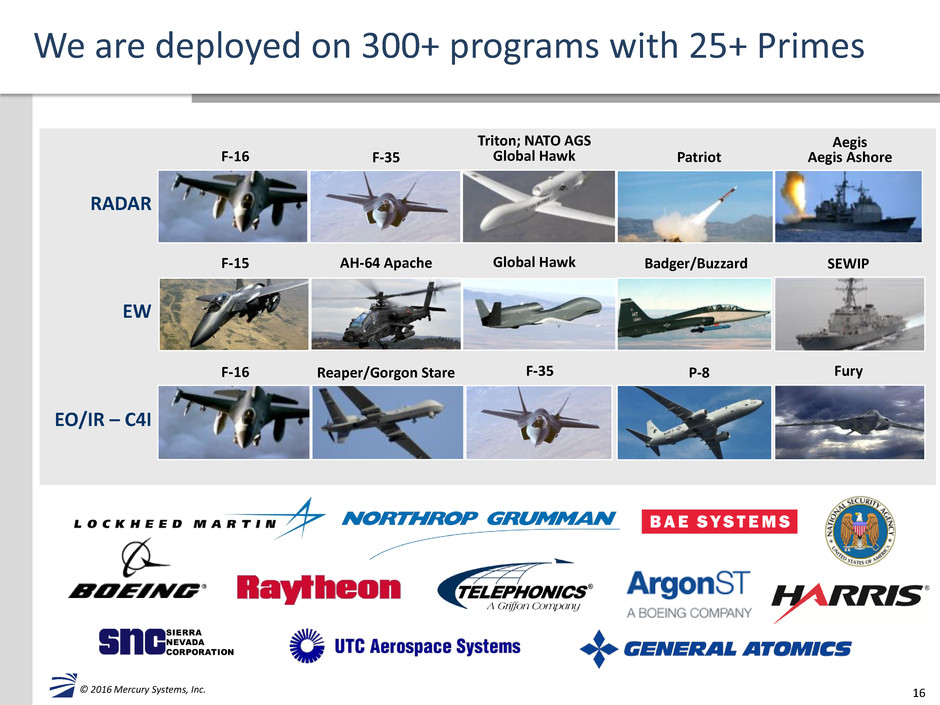

16 © 2016 Mercury Systems, Inc. We are deployed on 300+ programs with 25+ Primes RADAR EW EO/IR – C4I Triton; NATO AGS Global Hawk Aegis Aegis Ashore Patriot F-16 F-35 Global Hawk SEWIP Badger/Buzzard F-15 AH-64 Apache F-35 Fury P-8 F-16 Reaper/Gorgon Stare

17 © 2016 Mercury Systems, Inc. Acquisitions and investments driving significant opportunity growth • Low-risk content expansion growth strategy • Key production programs • Total potential value grew 2.3x to $3.7B in 3 years • Converted 1.3x of possible to probable value in 3 years • After 3 years, RFM now represents ~40% of our opportunity pipeline • Opportunities driven by Radar (66%) and EW (32%) Processing 2,225 RFM 1,492 Airborne 2,173 Naval 1,331 Ground 214 Radar 2,460 EO 68 EW 1,189 2,078 1,593 1,639 1,295 829 0 500 1,000 1,500 2,000 2,500 3,000 3,500 4,000 4,500 2012 2013-2015 Increase 2015 Key Programs Pipeline Value ($M) Processing RFM 3,718 Probable Possible Possible Bid 41% Won 59% Note: Refer to Appendix for definitions of “Bid”, “Won”, “Probable” and “Possible”. Probable and Possible values exclude FY15 and are as of December 2015. Numbers are rounded.

18 © 2016 Mercury Systems, Inc. © 2016 Mercury Systems, Inc. Strategy and investments have positioned Mercury well • Pioneering a next-generation defense electronics business model • Unique technology and capabilities on key production programs • Low-risk content expansion growth strategy with demonstrable progress • Largest secular growth trend captive Prime outsourcing • Above industry-average growth; dramatic improvement in profitability • Transformative acquisition drives strongly accretive growth

19 © 2016 Mercury Systems, Inc. Highly aligned with our existing strategy and business Microsemi carve-out strategic rationale • Creates Defense industry’s largest commercial embedded secure processing company • Adds secure solid-state storage to Mercury’s industry-leading pre-integrated sensor processing subsystems • Grows Mercury’s RF and Microwave business >65%, adding new capabilities, scale and synergies • Adds new capabilities in embedded security and custom microelectronics • Provides access to new high growth markets, customers and programs, such as precision- guided munitions and missiles SECURE PROCESSING SECURE PROCESSING DIGITIZATION DIGITIZATION RFM RFM RFM RFM RFM RFM SECURE STORAGE SECURE STORAGE Defense Electronic Subsystem (1) (1) (1) (1) Represents carve-out acquisition from Microsemi Corp. (1)

© 2016 Mercury Systems, Inc. Financial Overview Gerry Haines Executive Vice President & CFO

21 © 2016 Mercury Systems, Inc. Microsemi carve-out transaction overview Acquired 3 defense-oriented businesses from Microsemi Corporation Embedded Security, RF and Microwave, Custom Microelectronics Delivers growth, increased profitability, and strong cash flow generation Acquired businesses ~$100 million in revenue and $28 million adjusted EBITDA(3) Significantly accretive to adjusted EPS and adjusted EBITDA margin Combined adjusted EBITDA margin 23% Substantial cost synergies and achievable revenue synergies ~$10 million expected annual cost synergies by fiscal 2020; Expect ~2/3 to be achieved within 2 years Highly strategic transaction at attractive valuation consistent with Mercury's strategy $300 million purchase price; ~10.4x net of tax benefits(1) and ~7.6x net of expected cost synergies(2) (1) 10.4x calculated using $300M purchase price less $10M NPV tax benefit / $28M Adjusted EBITDA. $10M NPV tax benefit calculated assuming a 10% discount rate over 15 years. (2) 7.6x calculated using a net $290M purchase price after NPV of tax benefit / $28M Adjusted EBITDA plus $10M anticipated annual cost savings. (3) Adjusted EBITDA is $23.1M on LTM basis plus $4.7M of allocated indirect corporate costs from Seller that are not expected to continue.

22 © 2016 Mercury Systems, Inc. We are pioneering a next-generation business model… …creating an opportunity for growth and strong returns Mercury Model Characteristics Implications and Benefits Merchant supplier of secure processing subsystems Minimal competition at the subsystem level Commercially designed, made in USA, military ready High barriers to entry; strong margins Strategic sales model targets DoD production programs Decades-long platforms yield strong revenue streams 11 – 13% of revenue on Research and Development Innovative design for reuse. Retain IP rights Anticipates goals of DoD procurement reforms Largest secular growth trend: Prime outsourcing

23 © 2016 Mercury Systems, Inc. 194 209 235 224 249 5% $9.9M 11% $23.5M 19% $44.4M 17% $37.4M 21% $53.2M 0 50 100 150 200 250 300 FY13 FY14 FY15 LTM Q3 FY15 LTM Q3 FY16 Mercury Revenue ($M) Mercury Adj EBITDA (%, $M) Strong revenue growth and operating leverage… …yielded dramatic growth in adjusted EBITDA Notes: • Mercury standalone operations; fiscal years ended June 30; FY13-16 figures are reported in the Company’s Form 10-Ks and Form 10-Qs.

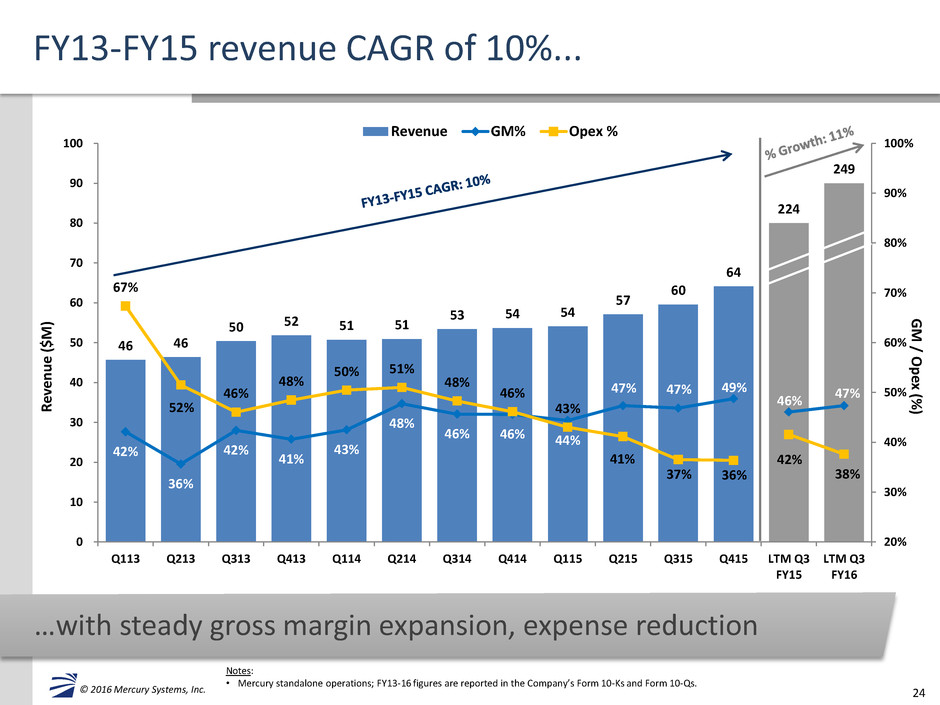

24 © 2016 Mercury Systems, Inc. FY13-FY15 revenue CAGR of 10%... …with steady gross margin expansion, expense reduction R ev en u e ($ M ) GM / O p ex (% ) Notes: • Mercury standalone operations; FY13-16 figures are reported in the Company’s Form 10-Ks and Form 10-Qs. 46 46 50 52 51 51 53 54 54 57 60 64 224 249 42% 36% 42% 41% 43% 48% 46% 46% 44% 47% 47% 49% 46% 47% 67% 52% 46% 48% 50% 51% 48% 46% 43% 41% 37% 36% 42% 38% 20% 30% 40% 50% 60% 70% 80% 90% 100% 0 10 20 30 40 50 60 70 80 90 100 Q113 Q213 Q313 Q413 Q114 Q214 Q314 Q414 Q115 Q215 Q315 Q415 LTM Q3 FY15 LTM Q3 FY16 Revenue GM% Opex %

25 © 2016 Mercury Systems, Inc. 1.2 0.6 4.7 3.5 3.3 5.2 7.8 7.2 8.0 10.7 11.5 14.2 37.4 3% 1% 9% 7% 7% 10% 15% 13% 15% 19% 19% 22% 17% 21% 0% 5% 10% 15% 20% 25% 0 5 10 15 20 25 Q1 FY13 Q2 FY13 Q3 FY13 Q4 FY13 Q1 FY14 Q2 FY14 Q3 FY14 Q4 FY14 Q1 FY15 Q2 FY15 Q3 FY15 Q4 FY15 LTM Q3 FY15 LTM Q3 FY16 Adj EBITDA $M Adj. EBITDA Margin (%) 53.2 FY13-FY15 Adjusted EBITDA CAGR of 111% Notes: • Mercury standalone operations; FY13-16 figures are reported in the Company’s Form 10-Ks and Form 10-Qs. • Adjusted EBITDA is income from continuing operations, less interest income and expense, income taxes, depreciation, amortization of acquired intangible assets, restructuring and other charges, impairment of long-lived assets, acquisition and financing costs, fair value adjustments from purchase accounting, litigation and settlement expenses and stock-based compensation costs.

26 © 2016 Mercury Systems, Inc. FY11-FY15 backlog CAGR of 24%... …yielded record backlog and revenue coverage exiting FY15 Notes: (1) Revenue Coverage Ratio = 12-month ending backlog/Next 12 months Revenue (or initial revenue estimate for current/future year). (2) Estimate based upon YoY revenue growth of 6% - 8% in FY16. 71 84 109 144 166 87 97 136 174 208 0 50 100 150 200 250 FY11 FY12 FY13 FY14 FY15 Mercury Ending Backlog ($M) 12-Month Ending Backlog Total Ending Backlog 61% 30% 43% 52% 66%-67% Estimate(2) Fwd Revenue Coverage Ratio⁽¹⁾

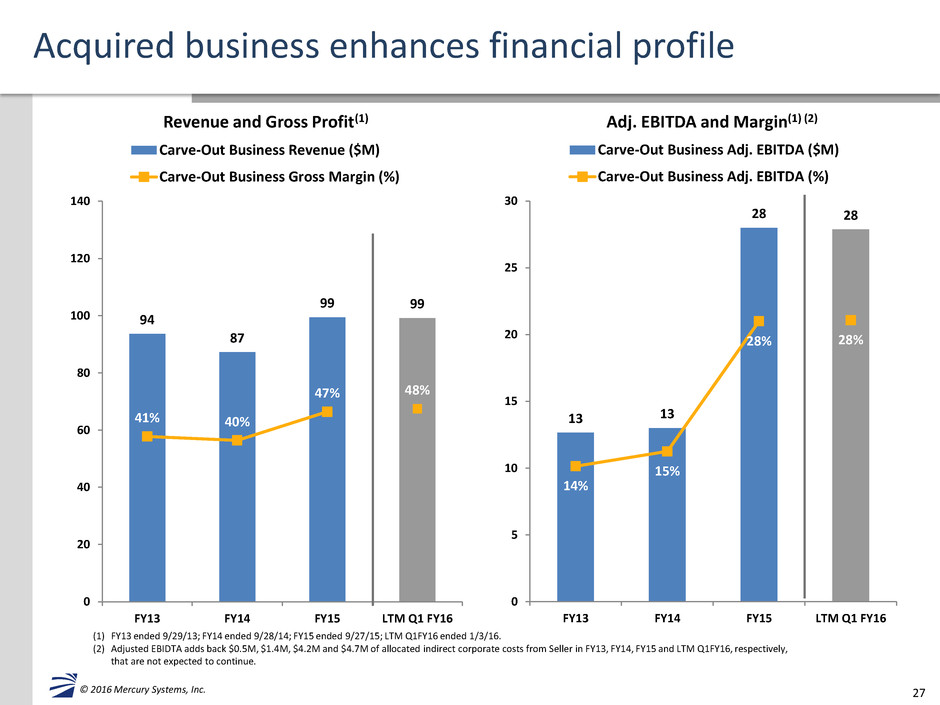

27 © 2016 Mercury Systems, Inc. 94 87 99 99 41% 40% 47% 48% 0 20 40 60 80 100 120 140 FY13 FY14 FY15 LTM Q1 FY16 Carve-Out Business Revenue ($M) Carve-Out Business Gross Margin (%) Acquired business enhances financial profile (1) FY13 ended 9/29/13; FY14 ended 9/28/14; FY15 ended 9/27/15; LTM Q1FY16 ended 1/3/16. (2) Adjusted EBIDTA adds back $0.5M, $1.4M, $4.2M and $4.7M of allocated indirect corporate costs from Seller in FY13, FY14, FY15 and LTM Q1FY16, respectively, that are not expected to continue. Revenue and Gross Profit(1) Adj. EBITDA and Margin(1) (2) 13 13 28 28 14% 15% 28% 28% 0 5 10 15 20 25 30 FY13 FY14 FY15 LTM Q1 FY16 Carve-Out Business Adj. EBITDA ($M) Carve-Out Business Adj. EBITDA (%)

28 © 2016 Mercury Systems, Inc. FY15 FY16 FY17 Production Years Probable Bid vs. Won Expansion Probable Possible Process RFM Total ($M) Total ($M) Aegis Sensor Processing FRP: FY14-25 Won 302 504 Processing Expansion FRP: FY19-25 Won/Bid 47 95 RFM FRP: FY16-25 Won/Bid 46 168 SEWIP Block 2 FRP: FY16-26 Won 231 326 Small Ship FRP: FY18-26 Won 67 94 Block 3 LRIP: FY18-20 Won 58 144 F-35 Existing LRIP: Up to FY21 Won 49 51 Processing LRIP: FY19-21 Bid 460 840 RFM LRIP: FY19-21 Bid 45 121 Buzzard/Badger FRP: FY14-25 Won 119 188 Patriot FRP: FY14-25 Won 70 117 Gorgon Stare FRP: FY14-20 Won 45 68 Others (Predator/Reaper, F-15 EW, E-2D Hawkeye, F-16 SABR, P-8, SIRFC/AIDEWS, BAMS/Triton, AWACS, LRDR, Classified) 540 1002 Total: vs. Nov. 2012 % Growth: $2,078 1,138 83% $3,718 1,593 133% Program focus driving substantial growth potential Mercury’s perspective on phase, timing and potential value EMD LRIP FRP FMS Note: Refer to Appendix for definitions of “Bid”, “Won”, “Probable” and “Possible”. Probable and Possible values exclude FY15 and are as of December 2015. Numbers are rounded.

29 © 2016 Mercury Systems, Inc. Q3 FY16 vs. Q3 FY15 Notes: (1) Includes $0.1M and $2.0M of acquisition and restructuring costs in Q3 of fiscal 2015 and fiscal 2016, respectively. GAAP ($M) Q3FY15 Q3FY16 Change Backlog $190 $220 16% Revenue $60 $66 11% Gross Margin (%) 47% 46% (1)pt Operating Expenses $21.8 $23.7 8.7% Adjusted EPS $0.22 $0.25 $0.03 Adj. EBITDA $11.5 $14.6 27%

30 © 2016 Mercury Systems, Inc. Q4 FY16 vs. Q4 FY15 Notes: (1) The guidance included herein is from the Company’s most recent earnings release and is as of the date of that release. The Company is neither reconfirming such guidance as of the date of this presentation nor assuming any obligations to update or revise such guidance. GAAP ($M) Q4FY15 Q4FY16⁽¹⁾ Change Revenue $64 $65.5-$68.5 2%-7% Gross Margin (%) 49% 46% (3)pt Operating Expenses $23.3 $24-$24 3%-3% Adjusted EPS $0.26 $0.20-$0.22 ($0.06)-($0.04) Adj. EBITDA $14.2 $12.0-$13.5 (15%)-(5%)

31 © 2016 Mercury Systems, Inc. FY16 vs. FY15 GAAP ($M) FY15 FY16⁽¹⁾ Change Revenue $235 $250-$253 6.5%-8% Gross Margin (%) 47% ~47% - Operating Expenses $91.9 ~$95 ~3% Adjusted EPS $0.82 $0.87-$0.89 $0.05-$0.07 Adj. EBITDA $44.4 $51.0-$52.5 15%-18% Notes: (1) The guidance included herein is from the Company’s most recent earnings release and is as of the date of that release. The Company is neither reconfirming such guidance as of the date of this presentation nor assuming any obligations to update or revise such guidance.

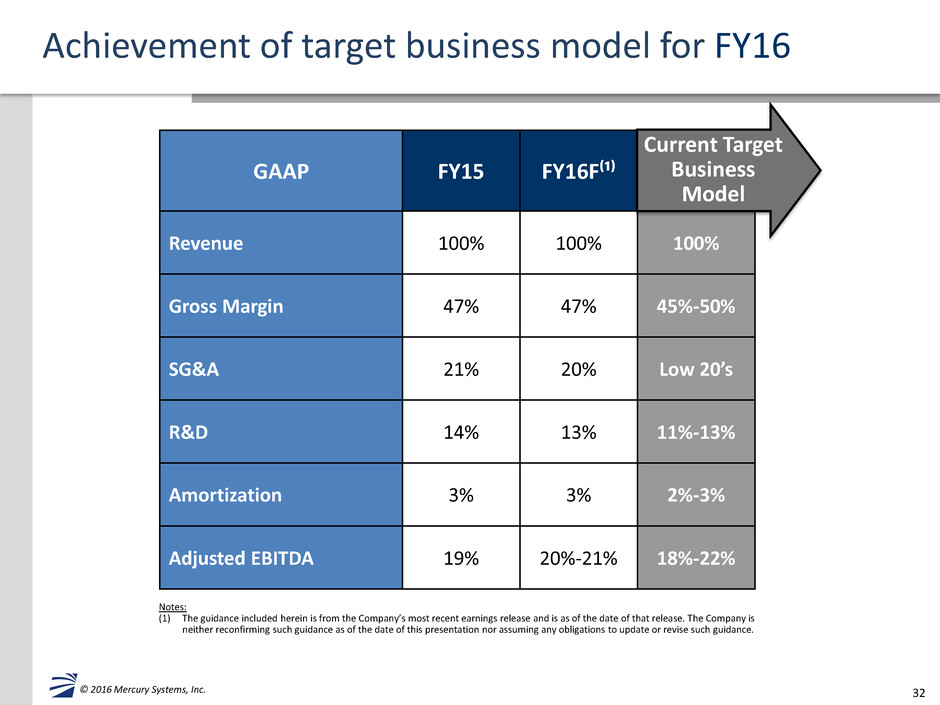

32 © 2016 Mercury Systems, Inc. Achievement of target business model for FY16 Notes: (1) The guidance included herein is from the Company’s most recent earnings release and is as of the date of that release. The Company is neither reconfirming such guidance as of the date of this presentation nor assuming any obligations to update or revise such guidance. GAAP FY15 FY16F⁽¹⁾ Revenue 100% 100% 100% Gross Margin 47% 47% 45%-50% SG&A 21% 20% Low 20’s R&D 14% 13% 11%-13% Amortization 3% 3% 2%-3% Adjusted EBITDA 19% 20%-21% 18%-22% Current Target Business Model

33 © 2016 Mercury Systems, Inc. Conservative balance sheet Ample liquidity, unused $100M credit facility, $400M Universal Shelf capacity Notes: (1) Discontinued operations numbers are Mercury Intelligence Systems, which was divested in January 2015. (2) $200 Term Loan A facility entered into on May 2, 2016 in connection with closing of Microsemi carve-out acquisition. FYE14 FYE15 Q3 FY16 (In millions) Actual Actual Actual ASSETS Cash & cash equivalents 47.3 77.6 84.2 Accounts receivable, net 59.7 53.8 68.7 Inventory, net 31.7 32.0 34.3 PP&E, net 14.1 13.2 13.5 Goodwill and intangibles, net 193.1 186.1 191.0 Other 21.6 27.3 23.0 Assets of discontinued operations(1) 6.2 0.0 0.0 TOTAL ASSETS 373.7 390.0 414.7 LIABILITIES AND S/E AP and other liabilities 44.2 39.9 47.0 Debt 0.0 0.0 0.0(2) Liabilities of discontinued operations(1) 2.4 0.0 0.0 Total liabilities 46.6 39.9 47.0 Stockholders' equity 327.1 350.1 367.7 TOTAL LIABILITIES AND S/E 373.7 390.0 414.7

34 © 2016 Mercury Systems, Inc. © 2016 Mercury Systems, Inc. Poised for continued, profitable growth • Recent acquisition transforms top and bottom line • Substantial cost synergies and revenue opportunities • Above average growth & profitability driven by strong, well-established programs • Record backlog enhances forward visibility, facilitates operational execution • Conservative balance sheet and strong cash flows support growth, future M&A • Improving defense environment enhances opportunity set

© 2016 Mercury Systems, Inc. Appendix

36 © 2016 Mercury Systems, Inc. Q4 FY16 guidance (as of April 26th) Notes: (1) The guidance included herein is from the Company’s most recent earnings release and is as of the date of that release. The Company is neither reconfirming such guidance as of the date of this presentation nor assuming any obligations to update or revise such guidance. ($Ms) Q4 FY15 Quarter Ending YoY 6/30/2016⁽¹⁾ Change Actual Range Revenue $64 $66-$69 2%-7% Adjusted EPS $0.26 $0.20-$0.22 ($0.06) to ($0.04) Adj EBITDA $14.2 $12.0-$13.5 (15%)-(5%) Adj EBITDA Adjustments: Income (loss) from continuing operations 6.1 Interest (income) expense, net 0.0 Tax provision (benefit) 1.9 Depreciation 1.5 Amortization of intangible assets 1.7 Restructuring and other charges 0.7 Impairment of long-lived assets 0.0 Acquisition and financing costs 0.3 Fair value adjustments from purchase accounting 0.0 Litigation and settlement expenses 0.0 Stock-based compensation expense 2.0 Adj EBITDA $14.2 $12.0-$13.5 (15%)-(5%)

37 © 2016 Mercury Systems, Inc. FY16 guidance (as of April 26th) Notes: (1) The guidance included herein is from the Company’s most recent earnings release and is as of the date of that release. The Company is neither reconfirming such guidance as of the date of this presentation nor assuming any obligations to update or revise such guidance. ($Ms) FY15 Year Ending YoY 6/30/2016⁽¹⁾ Change Actual Range Revenue $235 $250-$253 6.5%-8% Adjusted EPS $0.82 $0.87-$0.89 $0.05 to $0.07 Adj EBITDA $44.4 $51.0-$52.5 15%-18% Adj EBITDA Adjustments: Income (loss) from continuing operations 14.4 Interest (income) expense, net 0.0 Tax provision (benefit) 4.4 Depreciation 6.3 Amortization of intangible assets 7.0 Restructuring and other charges 3.2 Impairment of long-lived assets 0.0 Acquisition and financing costs 0.5 Fair value adjustments from purchase accounting 0.0 Litigation and settlement expenses 0.0 Stock-based compensation expense 8.6 Adj EBITDA $44.4 $51.0-$52.5 15%-18%

38 © 2016 Mercury Systems, Inc. Adjusted EPS reconciliation Notes: (1) Numbers shown are in cents. (000's) FY13 FY14 Q1 FY15 Q2 FY15 Q3 FY15 Q4 FY15 FY15 Q1 FY16 Q2 FY16 Q3 FY16 Diluted net earnings (loss) per share ⁽¹⁾ $ (0.46) $ (0.13) $ 0.02 $ 0.09 $ 0.14 $ 0.18 $ 0.44 $ 0.06 $ 0.14 $ 0.13 Income (loss) from continuing operations $ (13,782) $ (4,072) $ 717 $ 2,886 $ 4,694 $ 6,132 $ 14,429 $ 1,960 $ 4,793 $ 4,526 Amortization of intangible assets 8,222 7,328 1,762 1,762 1,744 1,740 7,008 1,713 1,638 1,754 Restructuring and other charges 7,060 5,443 1,268 1,162 27 718 3,175 338 221 409 Impairment of long-lived assets - - - - - - - - 231 - Acquisition and financing costs 318 - - - 200 251 451 2,298 25 1,725 Fair value adjustments from purchase accounting 2,293 - - - - - - - - - Litigation and settlement expenses - - - - - - - - - - Stock-based compensation expense 7,854 8,999 2,551 2,256 1,870 1,963 8,640 2,702 2,392 2,150 Impact to income taxes (8,776) (5,772) (1,956) (1,658) (1,088) (2,031) (6,733) (2,570) (1,475) (2,148) Adjusted income from continuing operations $ 3,189 $ 11,926 $ 4,342 $ 6,408 $ 7,447 $ 8,773 $ 26,970 $ 6,441 $ 7,825 $ 8,416 Diluted adjusted net earnings per share ⁽¹⁾ $ 0.10 $ 0.38 $ 0.13 $ 0.20 $ 0.22 $ 0.26 $ 0.82 $ 0.19 $ 0.23 $ 0.25 Weighted-average shares outstanding: Basic 30,128 31,000 31,635 32,052 32,298 32,436 32,114 32,778 33,120 33,251 Diluted 30,492 31,729 32,481 32,686 33,233 33,330 32,939 33,616 33,831 33,991

39 © 2016 Mercury Systems, Inc. Adjusted EBITDA reconciliation (000'S) FY13 FY14 Q1 FY15 Q2 FY15 Q3 FY15 Q4 FY15 FY15 Q1 FY16 Q2 FY16 Q3 FY16 Income (loss) from continuing operations $(13,782) $ (4,072) $ 717 $ 2,886 $ 4,694 $ 6,132 $ 14,429 $ 1,960 $ 4,793 $ 4,526 Interest expense (income), net 31 40 5 4 1 3 13 (22) (21) (36) Tax provision (benefit) (10,501) (1,841) - 1,047 1,469 1,850 4,366 1,264 1,680 2,473 Depreciation 8,445 7,625 1,700 1,590 1,510 1,532 6,332 1,588 1,620 1,565 Amortization of intangible assets 8,222 7,328 1,762 1,762 1,744 1,740 7,008 1,713 1,638 1,754 Restructuring and other charges 7,060 5,443 1,268 1,162 27 718 3,175 338 221 409 Impairment of long-lived assets - - - - - - - - 231 - Acquisition and financing costs 318 - - - 200 251 451 2,298 25 1,725 Fair value adjustments from purchase accounting 2,293 - - - - - - - - - Litigation and settlement expenses - - - - - - - - - - Stock-based compensation expense 7,854 8,999 2,551 2,256 1,870 1,963 8,640 2,702 2,392 2,150 Adjusted EBITDA $ 9,940 $ 23,522 $ 8,003 $ 10,707 $ 11,515 $ 14,189 $ 44,414 $ 11,841 $ 12,579 $ 14,566

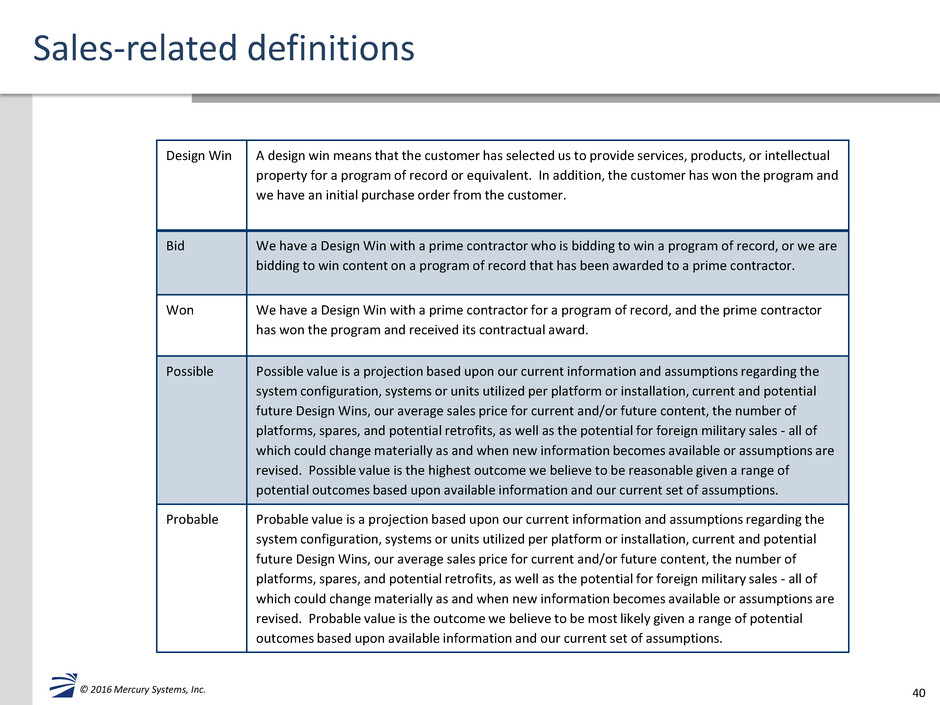

40 © 2016 Mercury Systems, Inc. Sales-related definitions Design Win A design win means that the customer has selected us to provide services, products, or intellectual property for a program of record or equivalent. In addition, the customer has won the program and we have an initial purchase order from the customer. Bid We have a Design Win with a prime contractor who is bidding to win a program of record, or we are bidding to win content on a program of record that has been awarded to a prime contractor. Won We have a Design Win with a prime contractor for a program of record, and the prime contractor has won the program and received its contractual award. Possible Possible value is a projection based upon our current information and assumptions regarding the system configuration, systems or units utilized per platform or installation, current and potential future Design Wins, our average sales price for current and/or future content, the number of platforms, spares, and potential retrofits, as well as the potential for foreign military sales - all of which could change materially as and when new information becomes available or assumptions are revised. Possible value is the highest outcome we believe to be reasonable given a range of potential outcomes based upon available information and our current set of assumptions. Probable Probable value is a projection based upon our current information and assumptions regarding the system configuration, systems or units utilized per platform or installation, current and potential future Design Wins, our average sales price for current and/or future content, the number of platforms, spares, and potential retrofits, as well as the potential for foreign military sales - all of which could change materially as and when new information becomes available or assumptions are revised. Probable value is the outcome we believe to be most likely given a range of potential outcomes based upon available information and our current set of assumptions.

41 © 2016 Mercury Systems, Inc. Glossary AEGIS Aegis Ballistic Missile Defense System EDM Engineering Development Model MOSA Modular Open Systems Architecture AESA Active Electronically Scanned Array EMD Engineering and Manufacturing Development O&M Operations & Maintenance AGS Alliance Ground Surveillance EO/IR Electro-optical / Infrared OpenVPX System-level specification for VPX, initiated by Mercury AIDEWS Advanced Integrated Defensive Electronic Warfare Suite EW Electronic Warfare PoR Program of Record AMC Advanced Microelectronics Center FAR Federal Acquisition Regulation RFM Radio Frequency / Microwave AS9100 Widely adopted and standardized quality management system for aerospace industry FMS Foreign Military Sales SABR Scalable Agile Beam Radar ATCA Advanced Telecommunications Architecture FRP Full Rate Production SEWIP Surface Electronic Warfare Improvement Program AWACS Airborne Warning and Control System IDIQ Indefinite Quantity / Indefinite Delivery SIGINT Signals Intelligence BAMS Broad Area Maritime Surveillance IMA Integrated Microwave Assembly SIRFC Suite of Integrated RF Countermeasures BCA Budget Control Act LRIP Low-Rate Initial Production SOF Special Operations Forces C4ISR Command, Control, Communications, Computers, Intelligence, Surveillance, Reconnaissance MCE Mercury Commercial Electronics SWaP Size Weight and Power COTS Commercial off-the Shelf MDS Mercury Defense Systems TAM Total Addressable Market DRFM Digital Radio Frequency Memory MILPER Military Personnel