Attached files

| file | filename |

|---|---|

| EX-23.2 - EX-23.2 - TWILIO INC | a2228886zex-23_2.htm |

| EX-10.1 - EX-10.1 - TWILIO INC | a2228886zex-10_1.htm |

| EX-5.1 - EX-5.1 - TWILIO INC | a2228886zex-5_1.htm |

| EX-3.3 - EX-3.3 - TWILIO INC | a2228886zex-3_3.htm |

| EX-3.1 - EX-3.1 - TWILIO INC | a2228886zex-3_1.htm |

| EX-1.1 - EX-1.1 - TWILIO INC | a2228886zex-1_1.htm |

Use these links to rapidly review the document

TABLE OF CONTENTS

INDEX TO CONSOLIDATED FINANCIAL STATEMENTS

As filed with the Securities and Exchange Commission on June 13, 2016

Registration No. 333-211634

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Amendment No. 1

to

FORM S-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

Twilio Inc.

(Exact name of Registrant as specified in its charter)

| Delaware (State or other jurisdiction of incorporation or organization) |

7372 (Primary Standard Industrial Classification Code Number) |

26-2574840 (I.R.S. Employer Identification Number) |

645 Harrison Street, Third Floor

San Francisco, California 94107

(415) 390-2337

(Address, including zip code, and telephone number, including

area code, of Registrant's principal executive offices)

Jeff Lawson

Chief Executive Officer

Twilio Inc.

645 Harrison Street, Third Floor

San Francisco, California 94107

(415) 390-2337

(Name, address, including zip code, and telephone number, including

area code, of agent for service)

| Copies to: | ||||

| Anthony J. McCusker, Esq. Rezwan D. Pavri, Esq. Goodwin Procter LLP 135 Commonwealth Drive Menlo Park, California 94025 (650) 752-3100 |

Karyn Smith, Esq. Twilio Inc. 645 Harrison Street, Third Floor San Francisco, California 94107 (415) 390-2337 |

Christopher L. Kaufman, Esq. Tad J. Freese, Esq. Latham & Watkins LLP 140 Scott Drive Menlo Park, CA 94025 (650) 328-4600 |

||

Approximate date of commencement of proposed sale to the public:

As soon as practicable after this registration statement becomes effective.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act, check the following box: o

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of "large accelerated filer", "accelerated filer" and "smaller reporting company" in Rule 12b-2 of the Exchange Act. (Check one):

| Large accelerated filer o | Accelerated filer o | Non-accelerated filer ý (Do not check if a smaller reporting company) |

Smaller reporting company o |

CALCULATION OF REGISTRATION FEE

|

||||||||

| Title of Each Class of Securities to be Registered |

Amount to be Registered(1) |

Proposed Maximum Aggregate Offering Price Per Share(2) |

Proposed Maximum Aggregate Offering Price(1)(2) |

Amount of Registration Fee(3) |

||||

|---|---|---|---|---|---|---|---|---|

Class A common stock, $0.001 par value per share |

11,500,000 | $14.00 | $161,000,000 | $16,213 | ||||

|

||||||||

- (1)

- Includes

1,500,000 shares of Class A common stock that the underwriters have the option to purchase from the Registrant.

- (2)

- Estimated

solely for the purpose of calculating the registration fee in accordance with Rule 457(a) of the Securities Act of 1933, as

amended.

- (3)

- The Registrant previously paid $10,070 of the registration fee with the initial filing of this registration statement.

The Registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until the registration statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

The information in this preliminary prospectus is not complete and may be changed. These securities may not be sold until the registration statement filed with the Securities and Exchange Commission is effective. This preliminary prospectus is not an offer to sell nor does it seek an offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

Subject To Completion. Dated June 13, 2016.

10,000,000 Shares

Twilio Inc.

Class A Common Stock

This is an initial public offering of shares of Class A common stock of Twilio Inc.

Prior to this offering, there has been no public market for the common stock. It is currently estimated that the initial public offering price per share will be between $12.00 and $14.00. We intend to list the Class A common stock on the New York Stock Exchange under the symbol "TWLO".

We have two classes of common stock, Class A common stock and Class B common stock. The rights of the holders of Class A common stock and Class B common stock are identical, except voting and conversion rights. Each share of Class A common stock is entitled to one vote. Each share of Class B common stock is entitled to 10 votes and is convertible at any time into one share of Class A common stock. The holders of our outstanding Class B common stock will hold approximately 98.6% of the voting power of our outstanding capital stock following this offering, with our directors, executive officers and significant stockholders holding approximately 66.2%.

We are an "emerging growth company" as defined under the federal securities laws and, as such, we have elected to comply with reduced reporting requirements for this prospectus and may elect to do so in future filings.

See "Risk Factors" beginning on page 16 to read about factors you should consider before buying shares of the Class A common stock.

Neither the Securities and Exchange Commission nor any other regulatory body has approved or disapproved of these securities or passed upon the accuracy or adequacy of this prospectus. Any representation to the contrary is a criminal offense.

|

Per Share |

Total |

|||

Initial public offering price |

$ | $ | |||

Underwriting discount(1) |

$ | $ | |||

Proceeds, before expenses, to Twilio |

$ | $ |

- (1)

- See the section titled "Underwriting" for additional information regarding compensation payable to the underwriters.

To the extent that the underwriters sell more than 10,000,000 shares of Class A common stock, the underwriters have the option to purchase up to an additional 1,500,000 shares from Twilio at the initial public offering price less the underwriting discount.

Entities advised by T. Rowe Price Associates, Inc., certain of which are existing holders of shares of our capital stock, have indicated an interest in purchasing up to 1,500,000 shares of our Class A common stock in this offering at the initial public offering price. Because this indication of interest is not a binding agreement or commitment to purchase, such entities could determine to purchase more, less or no shares in this offering, or the underwriters could determine to sell more, less or no shares to such entities. The underwriters will receive the same discount on any shares of our Class A common stock purchased by such entities as they will from any other shares of Class A common stock sold to the public in this offering.

The underwriters expect to deliver the shares against payment in New York, New York on .

| Goldman, Sachs & Co. | J.P. Morgan | |||

Allen & Company LLC |

Pacific Crest Securities a division of KeyBanc Capital Markets |

|||

JMP Securities |

William Blair |

Canaccord Genuity |

||

Prospectus dated .

Through and including (the 25th day after the date of this prospectus), all dealers effecting transactions in these securities, whether or not participating in this offering, may be required to deliver a prospectus. This is in addition to a dealer's obligation to deliver a prospectus when acting as an underwriter and with respect to an unsold allotment or subscription.

We have not authorized anyone to provide any information or to make any representations other than those contained in this prospectus or in any free writing prospectuses we have prepared. We and the underwriters take no responsibility for, and can provide no assurance as to the reliability of, any other information that others may give you. We are offering to sell, and seeking offers to buy, shares of Class A common stock only in jurisdictions where offers and sales are permitted. The information contained in this prospectus is accurate only as of the date of this prospectus, regardless of the time of delivery of this prospectus or of any sale of the Class A common stock.

For investors outside the United States: Neither we nor any of the underwriters have done anything that would permit this offering or possession or distribution of this prospectus in any jurisdiction where action for that purpose is required, other than in the United States. Persons outside of the United States who come into possession of this prospectus must inform themselves about, and observe any restrictions relating to, the offering of the shares of Class A common stock and the distribution of this prospectus outside of the United States.

i

This summary highlights selected information that is presented in greater detail elsewhere in this prospectus. This summary does not contain all of the information you should consider before investing in our Class A common stock. You should read this entire prospectus carefully, including the sections titled "Risk Factors" and "Management's Discussion and Analysis of Financial Condition and Results of Operations" and our consolidated financial statements and the related notes included elsewhere in this prospectus, before making an investment decision. Unless the context otherwise requires, the terms "Twilio," "the company," "we," "us" and "our" in this prospectus refer to Twilio Inc. and its consolidated subsidiaries.

Software developers are reinventing nearly every aspect of business today. Yet as developers, we repeatedly encountered an area where we could not innovate — communications. Because communication is a fundamental human activity and vital to building great businesses, we wanted to incorporate communications into our software applications, but the barriers to innovation were too high. Twilio was started to solve this problem.

We believe the future of communications will be written in software, by the developers of the world — our customers. By empowering them, our mission is to fuel the future of communications.

Cloud platforms are a new category of software that enable developers to build and manage applications without the complexity of creating and maintaining the underlying infrastructure. These platforms have arisen to enable a fast pace of innovation across a range of categories, such as computing and storage. We are the leader in the Cloud Communications Platform category. We enable developers to build, scale and operate real-time communications within software applications.

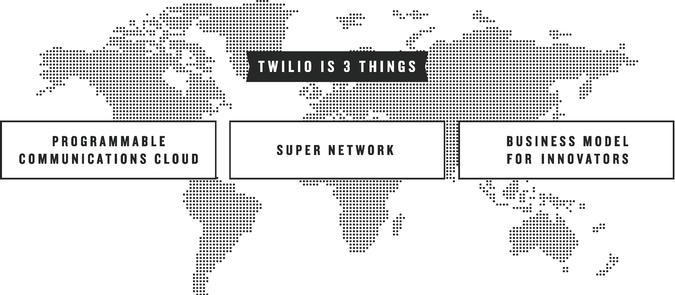

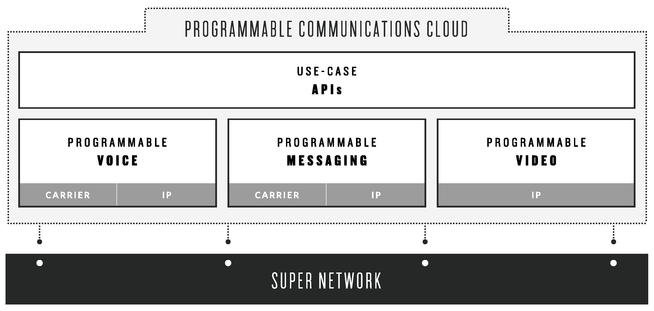

Our developer-first platform approach consists of three things: our Programmable Communications Cloud, Super Network and Business Model for Innovators. Our Programmable Communications Cloud software enables developers to embed voice, messaging, video and authentication capabilities into their applications via our simple-to-use Application Programming Interfaces, or APIs. We do not aim to provide complete business solutions, rather our Programmable Communications Cloud offers flexible building blocks that enable our customers to build what they need. The Super Network is our software layer that allows our customers' software to communicate with connected devices globally. It interconnects with communications networks around the world and continually analyzes data to optimize the quality and cost of communications that flow through our platform. Our Business Model for Innovators empowers developers by reducing friction and upfront costs, encouraging experimentation and enabling developers to grow as customers as their ideas succeed.

We had over 28,000 Active Customer Accounts as of March 31, 2016, representing organizations big and small, old and young, across nearly every industry, with one thing in common: they are competing by using the power of software to build differentiation through communications. With our platform, our customers are disrupting existing industries and creating new ones. For example, our customers have reinvented hired transportation by connecting riders and drivers, with communications as a critical part of each transaction. Our customers' software applications use our platform to notify a diner when a table is ready, a traveler when a flight is delayed or a shopper when a package has shipped. The range of applications that developers build with the Twilio platform has proven to be nearly limitless.

1

Our goal is for Twilio to be in the toolkit of every software developer in the world. As of March 31, 2016, over 900,000 developer accounts had been registered on our platform. Because big ideas often start small, we encourage developers to experiment and iterate on our platform. We love when developers explore what they can do with Twilio, because one day they may have a business problem that they will use our products to solve.

As our customers succeed, we share in their success through our usage-based revenue model. Our revenue grows as customers increase their usage of a product, extend their usage of a product to new applications or adopt a new product. We believe the most useful indicator of the increased activity from our existing customers is our Dollar-Based Net Expansion Rate, which was 155% for the year ended December 31, 2015. See the section titled "Management's Discussion and Analysis of Financial Condition and Results of Operations—Key Business Metrics—Dollar-Based Net Expansion Rate."

We have achieved significant growth in recent periods. For the years ended December 31, 2013, 2014 and 2015 and the three months ended March 31, 2016, our revenue was $49.9 million, $88.8 million, $166.9 million and $59.3 million, respectively. We incurred a net loss of $26.9 million, $26.8 million, $35.5 million and $6.5 million for the years ended December 31, 2013, 2014 and 2015 and the three months ended March 31, 2016, respectively.

Trends in Our Favor

Rise of Software Developers

Today, software is used to disrupt industries and transform products and services, thereby redefining how organizations engage with their customers. This shift has significantly increased the value and influence of software developers across organizations of all sizes and industries.

Differentiation Must Increasingly Be Built, Not Bought

In order for organizations to deliver differentiated customer experiences that build or extend competitive advantage, they are increasingly adding the software development competencies necessary to build applications that delight their customers. In fact, Gartner predicts that by 2020, 75% of application purchases supporting digital business will be "build, not buy."

Cloud Platforms As Building Blocks for Modern Applications

Cloud platforms, a new category of software that enables developers to build and manage applications without the complexity of creating and maintaining the underlying infrastructure, have arisen to enable the fast pace of innovation required by modern applications. These platforms typically provide global, scalable and cost-effective solutions. Cloud platforms are emerging across a range of categories, including analytics, communications, computing, mapping, payments and storage. These cloud platforms are enabling every organization, from small startups to Fortune 500 enterprises, to experiment, prototype and deploy next-generation applications.

Agility of Software Accelerates Pace of Innovation

The way organizations build, deploy and scale modern applications has fundamentally changed. Organizations must continuously bring new applications and features to market to differentiate themselves from their competitors and to build and extend their competitive advantage. Heightened consumer expectations for real-time, personalized interaction further necessitate rapid innovation. In order to satisfy these needs, developers must be empowered to freely experiment, quickly prototype and rapidly deploy new applications that are massively scalable. Legacy

2

infrastructure does not support this new paradigm for developers because it typically has been slow, complex and costly to implement, and inflexible to operate and iterate.

Contextual Communications Are Transforming Applications

Communication is fundamental to human activity and vital to building great businesses. While software has transformed business, communications technology has largely failed to evolve. In fact, the phone app on today's smartphones is merely a touch screen representation of the push-button phone invented in the 1960s.

Today, there is demand for communications to be embedded into applications where communications can be deeply integrated with the context of users' lives, such as personal and business identities, relationships, locations and daily schedules. This type of contextual communications enables developers to build the powerful applications that are differentiating organizations. Whether an application is designed to book a hotel, hail a ride or aid a delayed traveler, enabling users to seamlessly communicate in context is critical to a delightful experience. Contextual communications are transforming applications and replacing siloed communications applications, such as the phone app.

Limitations of Legacy Products

Legacy products were not designed with the software mindset and are therefore unable to address the foregoing trends. These products tend to be monolithic, costly, complicated, geopolitically bounded and impractical to scale, all of which hinder innovation. As a result, many innovative ideas have never even been attempted with legacy products, let alone realized. Over time, many attempts have been made to evolve the communications industry with software. However, we believe that no legacy product has truly empowered the global developer community to transform their applications with communications.

Twilio's mission is to fuel the future of communications. We enable developers to build, scale and operate real-time communications within software applications.

Our Programmable Communications Cloud, Super Network and Business Model for Innovators work together to create value for our customers and a competitive advantage for our company.

Our Programmable Communications Cloud. Our Programmable Communications Cloud consists of software products that can be used individually or in combination to build rich contextual communications within applications. Our Programmable Communications Cloud includes:

- •

- Programmable

Voice. Our Programmable Voice software products allow developers to build solutions to make and receive phone calls globally, and

incorporate advanced voice functionality such as text-to-speech, conferencing, recording and transcription. Programmable Voice, through our advanced call control software, allows developers to build

customized applications that address use cases such as contact centers, call tracking and analytics solutions and anonymized communications.

- •

- Programmable Messaging. Our Programmable Messaging software products allow developers to build solutions to send and receive text messages globally, and incorporate advanced messaging functionality such as emoji, picture messaging and localized languages. Our customers use Programmable Messaging, through software controls, to power use cases such as appointment reminders, delivery notifications, order confirmations and customer care.

3

- •

- Programmable

Video. Our recently introduced Programmable Video software products enable developers to build next-generation mobile and web

applications with embedded video, including for use cases such as customer care, collaboration and physician consultations.

- •

- Use Case

APIs. While developers can build a broad range of applications on our platform, certain use cases are more common. Our Use Case APIs

build upon the above products to offer more fully implemented functionality for a specific purpose, such as two-factor authentication, thereby saving developers significant time in building their

applications.

- •

- Add-on Marketplace. Launched in May 2016, our Add-on Marketplace allows third parties to integrate their capabilities directly into our Cloud Communications Platform, which allows us to further leverage our community to provide new and differentiated functionality for our customers.

Our Super Network. Our Programmable Communications Cloud is built on top of our global software layer, which we call our Super Network. Our Super Network interfaces intelligently with communications networks globally. We do not own any physical network infrastructure. We use software to build a high performance network that optimizes performance for our customers. Our Super Network breaks down the geopolitical boundaries and scale limitations of the physical network infrastructure.

Our platform has global reach, consisting of 22 cloud data centers in seven regions. We interconnect those cloud data centers with network service providers around the world, giving us redundant means to reach users globally. We are continually adding new network service provider relationships as we scale.

Our Super Network analyzes massive volumes of data from end users, their applications and the communications networks to optimize our customers' communications for quality and cost. With every new message and call, our Super Network becomes more robust, intelligent and efficient, enabling us to provide better performance at lower prices to our customers. Our Super Network's sophistication becomes increasingly difficult for others to replicate over time.

Our Business Model for Innovators. Big ideas often start small, and therefore developers need the freedom and tools to experiment and iterate on their ideas. In order to empower developers to experiment, our developer-first business model is low friction, eliminating the upfront costs, time and complexity that hinder innovation. Developers can begin building with a free trial. Once developers determine that our software meets their needs, they can flexibly increase consumption and pay based on usage. In short, we acquire developers like consumers and enable them to spend like enterprises.

Strengths of Our Platform Approach

Our platform was built by developers for developers, and our approach has the following strengths:

- •

- Developer Mind

Share. We are recognized as the leading platform for cloud communications, and we believe we set the standard for developers to build,

scale and operate real-time communications within software applications.

- •

- Composable. We are a platform company focused on providing software developers with the necessary building blocks to compose communications solutions that can be integrated into their applications. We believe this enables developers to build differentiated applications for a nearly limitless range of use cases.

4

- •

- Comprehensive. Our Programmable Communications Cloud offers a breadth of

functionality, including voice, messaging and video, all with global reach and across devices.

- •

- Easy to Get

Started. Developers can begin building with a free trial, allowing them to experiment and iterate on our platform. This approach

eliminates the upfront costs and complexity that typically hinder innovation.

- •

- Easy to

Build. We designed our APIs so developers could quickly learn, access and build upon our Programmable Communications Cloud.

- •

- Easy to

Scale. Our platform allows our customers to scale elastically without having to rearchitect their applications or manage communications

infrastructure.

- •

- Multi-Tenant

Architecture. Our multi-tenant architecture enables all of our customers to operate on our platform while securely partitioning their

application usage and data. In addition, our Solution Partner customers, which embed our products in the solutions they sell to other businesses, rely on our multi-tenant platform to independently

manage their own customers' activity.

- •

- Reliable. Our platform consists of fault-tolerant and globally-distributed systems

that have enabled our customers to operate their applications without significant failures or downtime.

- •

- Global. Customers can write an application once and configure it to operate in nearly every country in the world without any change to the code.

Gartner estimated that in 2015, $3.5 trillion would be spent on information technology globally, and 42% of all IT spending would be on communications. The $1.5 trillion spent on communications services represents almost five times the amount spent on enterprise software and nine times the amount spent on data centers. We believe the limitations of existing hardware- and network-centric communications products historically have anchored the communications technology market in high cost and low functionality. Over time, we believe that a meaningful portion of the $1.5 trillion spent on communications services will migrate from existing hardware- and network-centric communications products to contextual communications solutions that are integrated into software applications.

Our Programmable Communications Cloud includes a suite of software products, including Programmable Voice, Programmable Messaging, Programmable Video and Programmable Authentication. As a result, our platform currently addresses significant portions of several large markets that, in aggregate, have been estimated by IDC to be $45.6 billion in 2017.

Specifically, IDC estimates that, in 2017:

- •

- The Worldwide Application-to-Person SMS market will be $29.4 billion. Our Programmable Messaging products address portions of

this market.

- •

- Certain segments of the Worldwide Unified Communications and Collaboration market will be $14.1 billion. Our Programmable Voice

and Programmable Video products address portions of these market segments.

- •

- The Advanced Authentication segment of the Worldwide Identity and Access Management market will be $2.1 billion. Our Programmable Authentication products address portions of this market segment.

5

We are the leader in the Cloud Communications Platform category based on revenue, market share and reputation, and intend to continue to set the pace for innovation. We intend to pursue the following growth strategies:

- •

- Continue Significant Investment in our Technology

Platform. We will continue to invest in building new software capabilities and extending our platform to bring the power of contextual

communications to a broader range of applications, geographies and customers.

- •

- Grow Our Developer Community and Accelerate

Adoption. As of March 31, 2016, over 900,000 developer accounts had been registered on our platform, and we had over 90,000

paying customer accounts, of which over 28,000 were Active Customer Accounts. We categorize a customer account as an Active Customer Account in a quarter in which it generates at least $5 of revenue

during the last month of the quarter. We will continue to enhance our relationships with developers globally and seek to increase the number of developers on our platform. In addition to adding new

developers, we believe there is significant opportunity for revenue growth from existing paying customer accounts that we seek to grow into Active Customer Accounts.

- •

- Increase Our International

Presence. Our platform operates in over 180 countries today, making it as simple to communicate from São Paulo as it is

from San Francisco. We plan to grow internationally by expanding our operations outside of the United States and collaborating with international strategic partners.

- •

- Expand Focus on

Enterprises. We plan to drive greater awareness and adoption of Twilio from enterprises across industries. We intend to increase our

investment in sales and marketing to meet evolving enterprise needs globally, in addition to extending our enterprise-focused platform capabilities and use cases.

- •

- Further Enable Solution Partner

Customers. We have relationships with a number of Solution Partner customers that embed our products in the solutions that they sell to

other businesses. We intend to expand our relationships with existing Solution Partner customers and to add new Solution Partner customers.

- •

- Expand ISV Development Platform and SI

Partnerships. We intend to continue to invest and develop the ecosystem for our solutions in partnership with independent software

vendor (ISV) development platforms and system integrators, or SIs, to accelerate awareness and adoption of our platform.

- •

- Selectively Pursue Acquisitions and Strategic Investments. We may selectively pursue acquisitions and strategic investments in businesses and technologies that strengthen our platform.

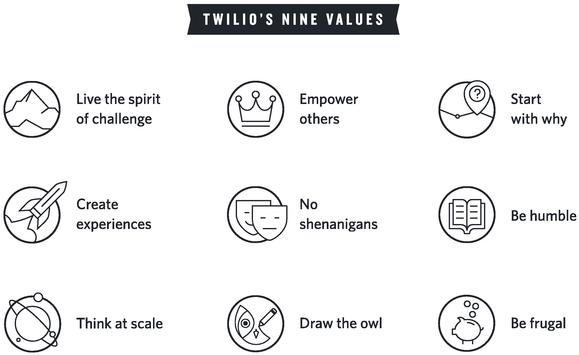

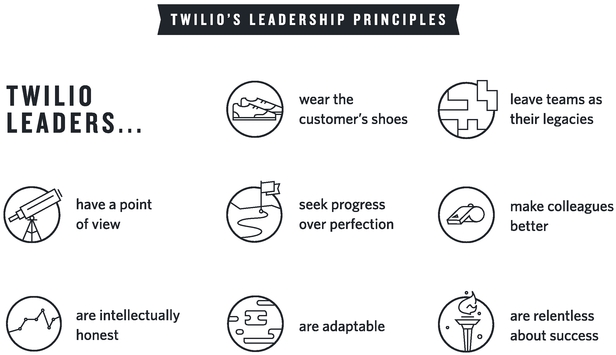

Our Values and Leadership Principles

Our core values are at the center of everything that we do. As a company built by developers for developers, these values guide us to work in a way that exemplifies many attributes of the developer ethos. Our values provide a guide for the way our teams work, communicate, set goals and make decisions.

We believe leadership is a behavior, not a position. In addition to our values, we have articulated the leadership traits we all strive to achieve. Our leadership principles apply to every Twilion, not just managers or executives, and provide a personal growth path for employees in their journeys to become better leaders.

6

The combination of core values and leadership principles has created a blueprint for how Twilions worldwide interact with customers and with each other, and for how they respond to new challenges and opportunities.

Our business is subject to numerous risks and uncertainties, including those highlighted in the section titled "Risk Factors" immediately following this prospectus summary. Some of these risks are:

- •

- The market for our products and platform is new and unproven, may decline or experience limited growth, and is dependent in part on

developers continuing to adopt our platform and use our products.

- •

- We have a history of losses and we are uncertain about our future profitability.

- •

- We have experienced rapid growth and expect our growth to continue, and if we fail to effectively manage our growth, then our

business, results of operations and financial condition could be adversely affected.

- •

- Our quarterly results may fluctuate, and if we fail to meet securities analysts' and investors' expectations, then the trading price

of our Class A common stock and the value of your investment could decline substantially.

- •

- If we are not able to maintain and enhance our brand and increase market awareness of our company and products, then our business,

results of operations and financial condition may be adversely affected.

- •

- Our business depends on customers increasing their use of our products and any loss of customers or decline in their use of our

products could materially and adversely affect our business, results of operations and financial condition.

- •

- If we are unable to attract new customers in a cost-effective manner, then our business, results of operations and financial condition

would be adversely affected.

- •

- If we do not develop enhancements to our products and introduce new products that achieve market acceptance, our business, results of

operations and financial condition could be adversely affected.

- •

- If we are unable to increase adoption of our products by enterprises, our business, results of operations and financial condition may

be adversely affected.

- •

- Our future success depends in part on our ability to drive the adoption of our products by international customers.

- •

- The market in which we participate is intensely competitive, and if we do not compete effectively, our business, results of operations

and financial condition could be harmed.

- •

- The dual class structure of our common stock will have the effect of concentrating voting control with certain stockholders, including our directors, executive officers and significant stockholders who will hold in the aggregate 66.2% of the voting power of our capital stock following the completion of this offering, which will limit or preclude your ability to influence corporate matters, including the election of directors, amendments of our organizational documents and any merger, consolidation, sale of all or substantially all of our assets or other major corporate transaction requiring stockholder approval.

7

Channels for Disclosure of Information

Investors, the media and others should note that, following the completion of this offering, we intend to announce material information to the public through filings with the Securities and Exchange Commission, or the SEC, the investor relations page on our website, press releases and public conference calls and webcasts.

Twilio Inc. was incorporated in Delaware in March 2008. Our principal executive offices are located at 645 Harrison Street, Third Floor, San Francisco, California 94107, and our telephone number is (415) 390-2337. Our website address is www.twilio.com. Information contained on, or that can be accessed through, our website does not constitute part of this prospectus and inclusions of our website address in this prospectus are inactive textual references only.

"Twilio" and "TwiML," and our other registered or common law trade names, trademarks, or service marks appearing in this prospectus are our property. Other trademarks and trade names referred to in this prospectus are the property of their respective owners.

Implications of Being an Emerging Growth Company

We are an "emerging growth company," as defined in the Jumpstart Our Business Startups Act of 2012. We will remain an emerging growth company until the earlier of (1) December 31, 2021 (the last day of the fiscal year following the fifth anniversary of our initial public offering), (2) the last day of the fiscal year in which we have total annual gross revenue of at least $1.0 billion, (3) the last day of the fiscal year in which we are deemed to be a "large accelerated filer", as defined in the Securities Exchange Act of 1934, or the Exchange Act, and (4) the date on which we have issued more than $1.0 billion in non-convertible debt during the prior three-year period. We refer to the Jumpstart Our Business Startups Act of 2012 herein as the "JOBS Act," and any reference herein to "emerging growth company" has the meaning ascribed to it in the JOBS Act.

An emerging growth company may take advantage of reduced reporting requirements that are otherwise applicable to public companies. These provisions include, but are not limited to:

- •

- being permitted to present only two years of audited financial statements and only two years of related "Management's Discussion and

Analysis of Financial Condition and Results of Operations" in this prospectus;

- •

- not being required to comply with the auditor attestation requirements of Section 404 of the Sarbanes-Oxley Act of 2002, as

amended;

- •

- reduced disclosure obligations regarding executive compensation in our periodic reports, proxy statements and registration statements,

including in this prospectus; and

- •

- exemptions from the requirements of holding a nonbinding advisory vote on executive compensation and stockholder approval of any golden parachute payments not previously approved.

We have elected to take advantage of certain of the reduced disclosure obligations in this prospectus and may elect to take advantage of other reduced reporting requirements in our future filings with SEC. As a result, the information that we provide to our stockholders may be different than you might receive from other public reporting companies in which you hold equity interests.

The JOBS Act also provides that an emerging growth company can take advantage of an extended transition period for complying with new or revised accounting standards. We have irrevocably elected not to avail ourselves of this exemption and, therefore, we will be subject to the same new or revised accounting standards as other public companies that are not emerging growth companies.

8

Class A common stock offered by us |

10,000,000 shares | |

Class A common stock to be outstanding after this offering |

10,000,000 shares |

|

Class B common stock to be outstanding after this offering |

72,200,793 shares |

|

Total Class A and Class B common stock to be outstanding after this offering |

82,200,793 shares |

|

Option to purchase additional shares of Class A common stock from us |

1,500,000 shares |

|

Use of proceeds |

We estimate that the net proceeds from the sale of shares of our Class A common stock in this offering will be approximately $116.4 million (or approximately $134.5 million if the underwriters' option to purchase additional shares of our Class A common stock from us is exercised in full), based upon the assumed initial public offering price of $13.00 per share, which is the midpoint of the estimated offering price range set forth on the cover page of this prospectus, and after deducting underwriting discounts and commissions and estimated offering expenses payable by us. |

|

|

The principal purposes of this offering are to increase our capitalization and financial flexibility, create a public market for our Class A common stock and enable access to the public equity markets for us and our stockholders. We currently intend to use the net proceeds from this offering for working capital or other general corporate purposes, including funding our growth strategies discussed in this prospectus. These uses and growth strategies include investments to grow our engineering, sales and marketing and customer support teams, to enhance our technology platform, to grow our developer community and accelerate adoption, to increase our international presence, to further enable our Solution Partner customers, to expand our focus on enterprises, and to expand ISV development platform and SI partnerships; however, we do not currently have any definitive or preliminary plans with respect to the use of proceeds for such purposes. We may also use a portion of the net proceeds to acquire businesses, products, services or technologies. However, we do not have agreements or commitments for any acquisitions at this time. See the section titled "Use of Proceeds." |

9

Voting Rights |

Shares of Class A common stock are entitled to one vote per share. Shares of Class B common stock are entitled to 10 votes per share. |

|

|

Holders of our Class A common stock and Class B common stock will generally vote together as a single class, unless otherwise required by law or our amended and restated certificate of incorporation. Each share of our Class B common stock will be convertible into one share of our Class A common stock at any time and will convert automatically upon certain transfers and upon the earlier of seven years from the date of this prospectus or the date the holders of two-thirds of our Class B common stock elect to convert the Class B common stock to Class A common stock. |

|

|

Upon completion of this offering, the holders of our outstanding Class B common stock will hold 98.6% of the voting power of our outstanding capital stock, with our directors, executive officers and significant stockholders holding 66.2% in the aggregate. These holders will have the ability to control the outcome of matters submitted to our stockholders for approval, including the election of our directors and the approval of any change in control transaction. See the sections titled "Principal Stockholders" and "Description of Capital Stock" for additional information. |

|

Proposed purchase by current stockholders |

Entities advised by T. Rowe Price Associates, Inc., certain of which are existing holders of shares of our capital stock, have indicated an interest in purchasing up to 1,500,000 shares of our Class A common stock in this offering at the initial public offering price. Because this indication of interest is not a binding agreement or commitment to purchase, such entities could determine to purchase more, less or no shares in this offering, or the underwriters could determine to sell more, less or no shares to such entities. The underwriters will receive the same discount on any shares of our Class A common stock purchased by such entities as they will from any other shares of Class A common stock sold to the public in this offering. |

|

New York Stock Exchange trading symbol |

"TWLO" |

The number of shares of our Class A and Class B common stock that will be outstanding after this offering is based on no shares of our Class A common stock and 72,200,793 shares of our Class B common stock (including convertible preferred stock on an as-converted basis) outstanding as of March 31, 2016, and excludes:

- •

- 16,704,752 shares of our Class B common stock issuable upon the exercise of options to purchase shares of our Class B common stock outstanding as of March 31, 2016, with a weighted-average exercise price of $5.57 per share;

10

- •

- 573,800 restricted stock units for shares of our Class B common stock that are releasable upon satisfaction of service and

liquidity conditions outstanding as of March 31, 2016;

- •

- 997,900 shares of our Class B common stock issuable upon the exercise of options to purchase shares of our common stock that were

granted after March 31, 2016, with a weighted-average exercise price of $10.69 per share;

- •

- 263,462 restricted stock units for shares of our Class B common stock that are releasable upon satisfaction of service and

liquidity conditions that were granted after March 31, 2016;

- •

- 780,397 shares of our Class A common stock reserved for issuance to fund and support the operations of Twilio.org, as adjusted on

May 13, 2016, of which none are currently issued and outstanding; and

- •

- 13,900,000 shares of our Class A common stock reserved for future issuance under our equity compensation plans, which will become

effective prior to the completion of this offering, consisting of:

- •

- 11,500,000 shares of our Class A common stock reserved for future issuance under our 2016 Stock Option and Incentive

Plan, or our 2016 Plan; and

- •

- 2,400,000 shares of our Class A common stock reserved for future issuance under our 2016 Employee Stock Purchase Plan, or our ESPP.

Our 2016 Plan and ESPP each provide for annual automatic increases in the number of shares reserved thereunder and our 2016 Plan also provides for increases to the number of shares of Class A common stock that may be granted thereunder based on shares underlying any awards under our 2008 Stock Option Plan, or our 2008 Plan, that expire, are forfeited or are otherwise terminated, as more fully described in the section titled "Executive Compensation—Employee Benefit and Stock Plans."

Except as otherwise indicated, all information in this prospectus assumes:

- •

- the amendment to our current certificate of incorporation to redesignate our outstanding common stock as Class B common stock

and create a new class of Class A common stock to be offered and sold in this offering;

- •

- the automatic conversion of all outstanding shares of our convertible preferred stock into an aggregate of 54,508,441 shares of our

Class B common stock, the conversion of which will occur immediately prior to the completion of this offering;

- •

- the filing and effectiveness of our amended and restated certificate of incorporation in Delaware and the effectiveness of our amended

and restated bylaws, each of which will occur immediately prior to the completion of this offering; and

- •

- no exercise by the underwriters of their option to purchase up to an additional 1,500,000 shares of our Class A common stock from us.

11

SUMMARY CONSOLIDATED FINANCIAL AND OTHER DATA

The following tables summarize our consolidated financial and other data. We have derived the summary consolidated statements of operations data for the years ended December 31, 2013, 2014 and 2015 from our audited consolidated financial statements included elsewhere in this prospectus. We have derived the summary consolidated statements of operations data for the three months ended March 31, 2015 and 2016 and our summary consolidated balance sheet data as of March 31, 2016 from our unaudited interim consolidated financial statements included elsewhere in this prospectus. The unaudited interim consolidated financial statements have been prepared on the same basis as the audited consolidated financial statements and reflect, in the opinion of management, all adjustments of a normal, recurring nature that are necessary for a fair statement of the unaudited interim consolidated financial statements. Our historical results are not necessarily indicative of the results that may be expected in the future, and the results for the three months ended March 31, 2016 are not necessarily indicative of the results to be expected for the full year or any other period. The following summary consolidated financial and other data should be read in conjunction with the section titled "Management's Discussion and Analysis of Financial Condition and Results of Operations" and our consolidated financial statements and the related notes included elsewhere in this prospectus.

| |

Year Ended December 31, |

Three Months Ended March 31, |

||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| |

2013 | 2014 | 2015 | 2015 | 2016 | |||||||||||

| |

|

|

|

(Unaudited) |

||||||||||||

| |

(In thousands, except share and per share data) |

|||||||||||||||

Consolidated Statements of Operations: |

||||||||||||||||

Revenue |

$ | 49,920 | $ | 88,846 | $ | 166,919 | $ | 33,365 | $ | 59,340 | ||||||

Cost of revenue(1)(2) |

25,868 | 41,423 | 74,454 | 15,545 | 26,827 | |||||||||||

| | | | | | | | | | | | | | | | | |

Gross profit |

24,052 | 47,423 | 92,465 | 17,820 | 32,513 | |||||||||||

| | | | | | | | | | | | | | | | | |

Operating expenses: |

||||||||||||||||

Research and development(1)(2) |

13,959 | 21,824 | 42,559 | 8,480 | 14,864 | |||||||||||

Sales and marketing(1) |

21,931 | 33,322 | 49,308 | 9,869 | 13,422 | |||||||||||

General and administrative(1)(2) |

15,012 | 18,960 | 35,991 | 8,265 | 10,593 | |||||||||||

| | | | | | | | | | | | | | | | | |

Total operating expenses |

50,902 | 74,106 | 127,858 | 26,614 | 38,879 | |||||||||||

| | | | | | | | | | | | | | | | | |

Loss from operations |

(26,850 | ) | (26,683 | ) | (35,393 | ) | (8,794 | ) | (6,366 | ) | ||||||

Other income (expenses), net |

(4 | ) | (62 | ) | 11 | 53 | (18 | ) | ||||||||

| | | | | | | | | | | | | | | | | |

Loss before (provision) benefit for income taxes |

(26,854 | ) | (26,745 | ) | (35,382 | ) | (8,741 | ) | (6,384 | ) | ||||||

(Provision) benefit for income taxes |

— | (13 | ) | (122 | ) | 81 | (84 | ) | ||||||||

| | | | | | | | | | | | | | | | | |

Net loss |

(26,854 | ) | (26,758 | ) | (35,504 | ) | (8,660 | ) | (6,468 | ) | ||||||

Deemed dividend to investors in relation to tender offer |

— | — | (3,392 | ) | — | — | ||||||||||

| | | | | | | | | | | | | | | | | |

Net loss attributable to common stockholders |

$ | (26,854 | ) | $ | (26,758 | ) | $ | (38,896 | ) | $ | (8,660 | ) | $ | (6,468 | ) | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

Net loss per share attributable to common stockholders, basic and diluted |

$ | (1.59 | ) | $ | (1.58 | ) | $ | (2.19 | ) | $ | (0.49 | ) | $ | (0.37 | ) | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

Weighted-average shares used in computing net loss per share attributable to common stockholders, basic and diluted |

16,916,035 | 16,900,124 | 17,746,526 | 17,749,487 | 17,483,198 | |||||||||||

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

Pro forma net loss per share attributable to common stockholders, basic and diluted (unaudited) |

$ | (0.45 | ) | $ | (0.45 | ) | $ | (0.54 | ) | $ | (0.14 | ) | $ | (0.09 | ) | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

Weighted-average shares used in computing pro forma net loss per share attributable to common stockholders, basic and diluted (unaudited) |

59,398,525 | 59,382,614 | 72,254,967 | 61,129,595 | 71,991,639 | |||||||||||

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

12

- (1)

- Includes stock-based compensation expense as follows:

| |

Year Ended December 31, |

Three Months Ended March 31, |

||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| |

2013 | 2014 | 2015 | 2015 | 2016 | |||||||||||

| |

|

|

|

(Unaudited) |

||||||||||||

| |

(In thousands) |

|||||||||||||||

Cost of revenue |

$ | 27 | $ | 39 | $ | 65 | $ | 14 | $ | 23 | ||||||

Research and development |

810 | 1,577 | 4,046 | 663 | 1,516 | |||||||||||

Sales and marketing |

753 | 1,335 | 2,389 | 420 | 734 | |||||||||||

General and administrative |

567 | 1,027 | 2,377 | 548 | 752 | |||||||||||

| | | | | | | | | | | | | | | | | |

Total |

$ | 2,157 | $ | 3,978 | $ | 8,877 | $ | 1,645 | $ | 3,025 | ||||||

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

- (2)

- Includes amortization of acquired intangibles as follows:

| |

Year Ended December 31, |

Three Months Ended March 31, |

||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| |

2013 | 2014 | 2015 | 2015 | 2016 | |||||||||||

| |

|

|

|

(Unaudited) |

||||||||||||

| |

(In thousands) |

|||||||||||||||

Cost of revenue |

$ | — | $ | — | $ | 239 | $ | 28 | $ | 70 | ||||||

Research and development |

— | — | 130 | 17 | 38 | |||||||||||

General and administrative |

— | — | 95 | 11 | 27 | |||||||||||

| | | | | | | | | | | | | | | | | |

Total |

$ | — | $ | — | $ | 464 | $ | 56 | $ | 135 | ||||||

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| |

As of March 31, 2016 | |||||||||

|---|---|---|---|---|---|---|---|---|---|---|

| |

Actual | Pro Forma(1) | Pro Forma as Adjusted(2)(3) |

|||||||

| |

(Unaudited, in thousands) |

|||||||||

Consolidated Balance Sheet Data: |

||||||||||

Cash and cash equivalents |

$ |

103,320 |

$ |

103,320 |

219,720 |

|||||

Working capital |

83,489 | 83,489 | 199,889 | |||||||

Property and equipment, net |

16,847 | 16,847 | 16,847 | |||||||

Total assets |

167,254 | 167,254 | 283,654 | |||||||

Total stockholders' equity |

114,351 | 114,351 | 230,751 | |||||||

- (1)

- The

pro forma column in the balance sheet data table above reflects (a) the redesignation of our outstanding common stock as

Class B common stock, (b) the automatic conversion of all outstanding shares of our convertible preferred stock into an aggregate of 54,508,441 shares of our Class B common stock,

which conversion will occur immediately prior to the completion of this offering, and (c) the filing and effectiveness of our amended and restated certificate of incorporation in Delaware.

- (2)

- The

pro forma as adjusted column in the balance sheet data table above gives effect to (a) the pro forma adjustments set forth above

and (b) the sale and issuance by us of 10,000,000 shares of our Class A common stock in this offering, based upon the assumed initial public offering price of $13.00 per share, which is

the midpoint of the estimated offering price range set forth on the cover page of this prospectus, and after deducting underwriting discounts and commissions and estimated offering expenses payable by

us.

- (3)

- Each $1.00 increase or decrease in the assumed initial public offering price of $13.00 per share, which is the midpoint of the estimated offering price range set forth on the cover page of this prospectus, would increase or decrease, as applicable, the amount of our cash and cash equivalents, working capital, total assets and total stockholders' equity by $9.3 million, assuming that the number of shares offered by us, as set forth on the cover page of this prospectus, remains the same, after deducting underwriting discounts and commissions payable by us. An increase or decrease of 1.0 million shares in the number of shares offered by us would increase or decrease, as applicable, the amount of our cash and cash equivalents, working capital, total assets and total stockholders' equity by $12.1 million, assuming an initial public offering price of $13.00 per share, which is the midpoint of the estimated offering price range set forth on the cover page of this prospectus, after deducting underwriting discounts and commissions payable by us.

13

| |

Year Ended December 31, |

Three Months Ended March 31, |

||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| |

2013 | 2014 | 2015 | 2015 | 2016 | |||||||||||

Number of Active Customer Accounts (as of end date of period) |

11,048 | 16,631 | 25,347 | 19,340 | 28,648 | |||||||||||

Base Revenue (in thousands) |

$ | 41,751 | $ | 75,697 | $ | 136,851 | $ | 25,931 | $ | 49,834 | ||||||

Base Revenue Growth Rate |

111 | % | 81 | % | 81 | % | 70 | % | 92 | % | ||||||

Dollar-Based Net Expansion Rate |

170 | % | 153 | % | 155 | % | 145 | % | 170 | % | ||||||

Number of Active Customer Accounts. We believe that the number of our Active Customer Accounts is an important indicator of the growth of our business, the market acceptance of our platform and future revenue trends. We define an Active Customer Account at the end of any period as an individual account, as identified by a unique account identifier, for which we have recognized at least $5 of revenue in the last month of the period. We believe that use of our platform by Active Customer Accounts at or above the $5 per month threshold is a stronger indicator of potential future engagement than trial usage of our platform or usage at levels below $5 per month. A single customer may constitute multiple unique Active Customer Accounts if it has multiple account identifiers, each of which is treated as a separate Active Customer Account.

In the years ended December 31, 2013, 2014 and 2015 and the three months ended March 31, 2016, revenue from Active Customer Accounts represented approximately 99% of total revenue in each period.

Base Revenue. We monitor Base Revenue as one of the more reliable indicators of future revenue trends. Base Revenue consists of all revenue other than revenue from Active Customer Accounts with large customers that have never entered into 12-month minimum revenue commitment contracts with us, which we refer to as Variable Customer Accounts. While almost all of our customer accounts exhibit some level of variability in the usage of our products, based on our experience, we believe Variable Customer Accounts are more likely to exhibit significant fluctuations in usage of our products from period to period, and therefore that revenue from Variable Customer Accounts may also fluctuate significantly from period to period. This behavior is best evidenced by the decision of such customers not to enter into contracts with us that contain minimum revenue commitments, even though they may spend significant amounts on the use of our products and they may be foregoing more favorable terms often available to customers that enter into committed contracts with us. This variability adversely affects our ability to rely upon revenue from Variable Customer Accounts when analyzing expected trends in future revenue.

For historical periods, we define a Variable Customer Account as an Active Customer Account that (i) is with a customer that had never signed a minimum revenue commitment contract with us for a term of at least 12 months and (ii) has met or exceeded 1% of our revenue in any quarter in the periods presented. To allow for consistent period-to-period comparisons, in the event a customer account qualified as a Variable Customer Account as of March 31, 2016, or a previously Variable Customer Account ceased to be an Active Customer Account as of such date, we included such customer account as a Variable Customer Account in all periods presented. For future reporting periods, we will define a Variable Customer Account as a customer account that (a) has been categorized as a Variable Customer Account in any prior quarter, as well as (b) any new customer account that (i) is with a customer that has never signed a minimum revenue commitment contract with us for a term of at least 12 months and (ii) meets or exceeds 1% of our revenue in a quarter. Once a customer account is deemed to be a Variable Customer Account in any period, it

14

remains a Variable Customer Account in subsequent periods unless such customer enters into a minimum revenue commitment contract with us for a term of at least 12 months.

In the three months ended March 31, 2016, we had nine Variable Customer Accounts, which represented 16% of our total revenue.

Dollar-Based Net Expansion Rate. Our ability to drive growth and generate incremental revenue depends, in part, on our ability to maintain and grow our relationships with customers that have Active Customer Accounts and to increase their use of the platform. An important way in which we track our performance in this area is by measuring the Dollar-Based Net Expansion Rate for our Active Customer Accounts, other than our Variable Customer Accounts. Our Dollar-Based Net Expansion Rate increases when such Active Customer Accounts increase usage of a product, extend usage of a product to new applications or adopt a new product. Our Dollar-Based Net Expansion Rate decreases when such Active Customer Accounts cease or reduce usage of a product or when we lower usage prices on a product. We believe measuring our Dollar-Based Net Expansion Rate on revenue generated from our Active Customer Accounts, other than our Variable Customer Accounts, provides a more meaningful indication of the performance of our efforts to increase revenue from existing customer accounts.

Our Dollar-Based Net Expansion Rate compares the revenue from Active Customer Accounts, other than Variable Customer Accounts, in a quarter to the same quarter in the prior year. To calculate the Dollar-Based Net Expansion Rate, we first identify the cohort of Active Customer Accounts, other than Variable Customer Accounts, that were Active Customer Accounts in the same quarter of the prior year. The Dollar-Based Net Expansion Rate is the quotient obtained by dividing the revenue generated from that cohort in a quarter, by the revenue generated from that same cohort in the corresponding quarter in the prior year. When we calculate Dollar-Based Net Expansion Rate for periods longer than one quarter, we use the average of the applicable quarterly Dollar-Based Net Expansion Rates for each of the quarters in such period.

15

Investing in our Class A common stock involves a high degree of risk. You should carefully consider the risks and uncertainties described below, together with all of the other information in this prospectus, including the section titled "Management's Discussion and Analysis of Financial Condition and Results of Operations" and our consolidated financial statements and related notes, before making a decision to invest in our Class A common stock. The risks and uncertainties described below may not be the only ones we face. If any of the risks actually occur, our business, financial condition, results of operations and prospects could be materially and adversely affected. In that event, the market price of our Class A common stock could decline, and you could lose part or all of your investment.

Risks Related to Our Business and Our Industry

The market for our products and platform is new and unproven, may decline or experience limited growth and is dependent in part on developers continuing to adopt our platform and use our products.

We were founded in 2008, and have been developing and providing a cloud-based platform that enables developers and organizations to integrate voice, messaging and video communications capabilities into their software applications. This market is relatively new and unproven and is subject to a number of risks and uncertainties. We believe that our revenue currently constitutes a significant portion of the total revenue in this market, and therefore, we believe that our future success will depend in large part on the growth, if any, of this market. The utilization of APIs by developers and organizations to build communications functionality into their applications is still relatively new, and developers and organizations may not recognize the need for, or benefits of, our products and platform. Moreover, if they do not recognize the need for and benefits of our products and platform, they may decide to adopt alternative products and services to satisfy some portion of their business needs. In order to grow our business and extend our market position, we intend to focus on educating developers and other potential customers about the benefits of our products and platform, expanding the functionality of our products and bringing new technologies to market to increase market acceptance and use of our platform. Our ability to expand the market that our products and platform address depends upon a number of factors, including the cost, performance and perceived value associated with such products and platform. The market for our products and platform could fail to grow significantly or there could be a reduction in demand for our products as a result of a lack of developer acceptance, technological challenges, competing products and services, decreases in spending by current and prospective customers, weakening economic conditions and other causes. If our market does not experience significant growth or demand for our products decreases, then our business, results of operations and financial condition could be adversely affected.

We have a history of losses and we are uncertain about our future profitability.

We have incurred net losses in each year since our inception, including net losses of $26.9 million, $26.8 million, $35.5 million and $6.5 million in 2013, 2014 and 2015 and the three months ended March 31, 2016, respectively. We had an accumulated deficit of $151.9 million as of March 31, 2016. We expect to continue to expend substantial financial and other resources on, among other things:

- •

- investments in our engineering team, the development of new products, features and functionality and enhancements to our platform;

- •

- sales and marketing, including expanding our direct sales organization and marketing programs, especially for enterprises and for organizations outside of the United States, and

16

- •

- expansion of our operations and infrastructure, both domestically and internationally; and

- •

- general administration, including legal, accounting and other expenses related to being a public company.

expanding our programs directed at increasing our brand awareness among current and new developers;

These investments may not result in increased revenue or growth of our business. We also expect that our revenue growth rate will decline over time. Accordingly, we may not be able to generate sufficient revenue to offset our expected cost increases and achieve and sustain profitability. If we fail to achieve and sustain profitability, then our business, results of operations and financial condition would be adversely affected.

We have experienced rapid growth and expect our growth to continue, and if we fail to effectively manage our growth, then our business, results of operations and financial condition could be adversely affected.

We have experienced substantial growth in our business since inception. For example, our headcount has grown from 386 employees on March 31, 2015 to 567 employees on March 31, 2016. In addition, we are rapidly expanding our international operations, and we established operations in three new countries between March 31, 2015 and March 31, 2016. We expect to continue to expand our international operations in the future. We have also experienced significant growth in the number of customers, usage and amount of data that our platform and associated infrastructure support. This growth has placed and may continue to place significant demands on our corporate culture, operational infrastructure and management.

We believe that our corporate culture has been a critical component of our success. We have invested substantial time and resources in building our team and nurturing our culture. As we expand our business and mature as a public company, we may find it difficult to maintain our corporate culture while managing this growth. Any failure to manage our anticipated growth and organizational changes in a manner that preserves the key aspects of our culture could hurt our chance for future success, including our ability to recruit and retain personnel, and effectively focus on and pursue our corporate objectives. This, in turn, could adversely affect our business, results of operations and financial condition.

In addition, in order to successfully manage our rapid growth, our organizational structure has become more complex. In order to manage these increasing complexities, we will need to continue to scale and adapt our operational, financial and management controls, as well as our reporting systems and procedures. The expansion of our systems and infrastructure will require us to commit substantial financial, operational and management resources before our revenue increases and without any assurances that our revenue will increase.

Finally, continued growth could strain our ability to maintain reliable service levels for our customers. If we fail to achieve the necessary level of efficiency in our organization as we grow, then our business, results of operations and financial condition could be adversely affected.

Our quarterly results may fluctuate, and if we fail to meet securities analysts' and investors' expectations, then the trading price of our Class A common stock and the value of your investment could decline substantially.

Our results of operations, including the levels of our revenue, cost of revenue, gross margin and operating expenses, have fluctuated from quarter to quarter in the past and may continue to vary significantly in the future. These fluctuations are a result of a variety of factors, many of which are outside of our control, may be difficult to predict and may or may not fully reflect the underlying

17

performance of our business. If our quarterly results of operations fall below the expectations of investors or securities analysts, then the trading price of our Class A common stock could decline substantially. Some of the important factors that may cause our results of operations to fluctuate from quarter to quarter include:

- •

- our ability to retain and increase revenue from existing customers and attract new customers;

- •

- fluctuations in the amount of revenue from our Variable Customer Accounts;

- •

- our ability to attract enterprises and international organizations as customers;

- •

- our ability to introduce new products and enhance existing products;

- •

- competition and the actions of our competitors, including pricing changes and the introduction of new products, services and

geographies;

- •

- the number of new employees;

- •

- changes in network service provider fees that we pay in connection with the delivery of communications on our platform;

- •

- changes in cloud infrastructure fees that we pay in connection with the operation of our platform;

- •

- changes in our pricing as a result of our optimization efforts or otherwise;

- •

- reductions in pricing as a result of negotiations with our larger customers;

- •

- the rate of expansion and productivity of our sales force, including our enterprise sales force, which has been a focus of our recent

expansion efforts;

- •

- change in the mix of products that our customers use;

- •

- change in the revenue mix of U.S. and international products;

- •

- the amount and timing of operating costs and capital expenditures related to the operations and expansion of our business, including

investments in our international expansion;

- •

- significant security breaches of, technical difficulties with, or interruptions to, the delivery and use of our products on our

platform;

- •

- the timing of customer payments and any difficulty in collecting accounts receivable from customers;

- •

- general economic conditions that may adversely affect a prospective customer's ability or willingness to adopt our products, delay a

prospective customer's adoption decision, reduce the revenue that we generate from the use of our products or affect customer retention;

- •

- changes in foreign currency exchange rates;

- •

- extraordinary expenses such as litigation or other dispute-related settlement payments;

- •

- sales tax and other tax determinations by authorities in the jurisdictions in which we conduct business;

- •

- the impact of new accounting pronouncements;

- •

- expenses in connection with mergers, acquisitions or other strategic transactions; and

- •

- fluctuations in stock-based compensation expense.

18

The occurrence of one or more of the foregoing and other factors may cause our results of operations to vary significantly. As such, we believe that quarter-to-quarter comparisons of our results of operations may not be meaningful and should not be relied upon as an indication of future performance. In addition, a significant percentage of our operating expenses is fixed in nature and is based on forecasted revenue trends. Accordingly, in the event of a revenue shortfall, we may not be able to mitigate the negative impact on our income (loss) and margins in the short term. If we fail to meet or exceed the expectations of investors or securities analysts, then the trading price of our Class A common stock could fall substantially, and we could face costly lawsuits, including securities class action suits.

Additionally, certain large scale events, such as major elections and sporting events, can significantly impact usage levels on our platform, which could cause fluctuations in our results of operations. We expect that significantly increased usage of all communications platforms, including ours, during certain seasonal and one-time events could impact delivery and quality of our products during those events. We also experienced increased expenses in the second quarter of 2015 due to our developer conference, SIGNAL, which we again hosted in the second quarter of 2016 and plan to host annually. Such annual and one-time events may cause fluctuations in our results of operations and may impact both our revenue and operating expenses.

If we are not able to maintain and enhance our brand and increase market awareness of our company and products, then our business, results of operations and financial condition may be adversely affected.

We believe that maintaining and enhancing the "Twilio" brand identity and increasing market awareness of our company and products, particularly among developers, is critical to achieving widespread acceptance of our platform, to strengthen our relationships with our existing customers and to our ability to attract new customers. The successful promotion of our brand will depend largely on our continued marketing efforts, our ability to continue to offer high quality products, our ability to be thought leaders in the cloud communications market and our ability to successfully differentiate our products and platform from competing products and services. Our brand promotion and thought leadership activities may not be successful or yield increased revenue. In addition, independent industry analysts often provide reviews of our products and competing products and services, which may significantly influence the perception of our products in the marketplace. If these reviews are negative or not as strong as reviews of our competitors' products and services, then our brand may be harmed.

From time to time, our customers have complained about our products, such as complaints about our pricing and customer support. If we do not handle customer complaints effectively, then our brand and reputation may suffer, our customers may lose confidence in us and they may reduce or cease their use of our products. In addition, many of our customers post and discuss on social media about Internet-based products and services, including our products and platform. Our success depends, in part, on our ability to generate positive customer feedback and minimize negative feedback on social media channels where existing and potential customers seek and share information. If actions we take or changes we make to our products or platform upset these customers, then their online commentary could negatively affect our brand and reputation. Complaints or negative publicity about us, our products or our platform could materially and adversely impact our ability to attract and retain customers, our business, results of operations and financial condition.

The promotion of our brand also requires us to make substantial expenditures, and we anticipate that these expenditures will increase as our market becomes more competitive and as we expand into new markets. To the extent that these activities increase revenue, this revenue still may not be enough to offset the increased expenses we incur. If we do not successfully maintain and

19

enhance our brand, then our business may not grow, we may see our pricing power reduced relative to competitors and we may lose customers, all of which would adversely affect our business, results of operations and financial condition.

Our business depends on customers increasing their use of our products and any loss of customers or decline in their use of our products could materially and adversely affect our business, results of operations and financial condition.