Attached files

| file | filename |

|---|---|

| EX-99.2 - EX-99.2 - WESTLAKE CHEMICAL CORP | d207234dex992.htm |

| EX-99.1 - EX-99.1 - WESTLAKE CHEMICAL CORP | d207234dex991.htm |

| 8-K - 8-K - WESTLAKE CHEMICAL CORP | d207234d8k.htm |

Creation of a North American Olefins and Vinyls Leader June 10, 2016 Westlake Chemical to Acquire Axiall Corporation 1 Exhibit 99.3

Forward-Looking Statements This communication contains forward-looking statements within the meaning of the federal securities laws. These forward-looking statements include, but are not limited to, statements regarding Westlake Chemical Corporation’s (“Westlake”) proposed transaction to acquire Axiall Corporation (“Axiall”) (including financing of the proposed transaction and the benefits, results, effects and timing thereof), all statements regarding Westlake’s and Axiall’s (and Westlake’s and Axiall’s combined) expected future financial position, results of operations, cash flows, dividends, financing plans, business strategy, budgets, capital expenditures, competitive positions, growth opportunities, plans and objectives of management, estimated synergies from the proposed transaction and statements containing the use of forward-looking words, such as “may,” “will,” “could,” “would,” “should,” “project,” “believe,” “anticipate,” “expect,” “estimate,” “continue,” “potential,” “plan,” “forecast,” “approximate,” “intend,” “upside,” and the like, or the use of future tense. Statements contained herein concerning the business outlook or future economic performance, anticipated profitability, revenues, expenses, dividends or other financial items, and product or services line growth of Westlake and Axiall (and the combined businesses of Westlake and Axiall), together with other statements that are not historical facts, are forward-looking statements that are estimates reflecting the best judgment of Westlake or Axiall based upon currently available information. Statements concerning current conditions may also be forward-looking if they imply a continuation of current conditions. Such forward-looking statements are inherently uncertain, and stockholders and other potential investors must recognize that actual results may differ materially from Westlake’s and/or Axiall’s expectations as a result of a variety of factors, including, without limitation, those discussed below. Such forward-looking statements are based upon management’s current expectations and include known and unknown risks, uncertainties and other factors, many of which Westlake and/or Axiall are unable to predict or control, that may cause Westlake’s and/or Axiall’s actual results, performance or plans to differ materially from any future results, performance or plans expressed or implied by such forward-looking statements. These statements involve risks, uncertainties and other factors discussed below and detailed from time to time in Westlake’s and/or Axiall’s filings with the Securities and Exchange Commission (the “SEC”). Risks and uncertainties related to the proposed business combination transaction include, but are not limited to: (i) the ultimate outcome of the proposed transaction between Westlake and Axiall, (ii) the ultimate outcome and results of integrating the operations of Westlake and Axiall if a transaction is consummated, (iii) the ability to obtain regulatory approvals and meet other closing conditions to the proposed transaction, including any necessary stockholder approvals, (iv) potential adverse reactions or changes to business relationships resulting from the announcement, pendency or completion of the proposed transaction, (v) competitive responses to the announcement or completion of the proposed transaction, costs and difficulties related to the integration of Axiall’s businesses and operations with Westlake’s businesses and operations, (vi) the inability to obtain, or delays in obtaining, cost savings and synergies from the proposed transaction, (vii) uncertainties as to whether the completion of the proposed transaction will have the accretive effect on Westlake’s earnings or cash flows that are expected, (viii) unexpected costs, liabilities, charges or expenses resulting from the proposed transaction, (ix) litigation relating to the proposed transaction, (x) the inability to retain key personnel, (xi) potential adverse effects on Westlake’s ability to operate Westlake’s business due to the increase in Westlake’s overall debt level contemplated by the proposed transaction, (xii) potential diminished productivity due to the impact of the potential transaction on Westlake’s and/or Axiall’s current and prospective employees, key management, customers, suppliers and business partner and (xiii) any changes in general economic and/or industry-specific conditions. In addition to the factors set forth above, other factors that may affect Westlake’s and/or Axiall’s plans, results or stock price are set forth in Westlake’s and Axiall’s respective Annual Reports on Form 10-K and reports on Forms 10-Q and 8-K. Many of these factors are beyond Westlake’s and/or Axiall’s control. Westlake and Axiall caution investors that any forward-looking statements made by Westlake and/or Axiall are not guarantees of future performance. Westlake and Axiall do not intend, and undertake no obligation, to publish revised forward-looking statements to reflect events or circumstances after the date of this communication or to reflect the occurrence of unanticipated events. 2

Additional Information and Where To Find It With respect to the 2016 Axiall annual meeting of stockholders, Axiall has filed a definitive proxy statement and other documents regarding the 2016 annual meeting of stockholders with the SEC and has mailed the definitive proxy statement and a WHITE proxy card to each stockholder of record entitled to vote at the 2016 annual meeting. With respect to the proposed merger, Axiall expects to announce a special meeting of stockholders soon to obtain stockholder approval in connection with the proposed merger between Westlake and Axiall. In connection with the special meeting, Axiall expects to file with the SEC a preliminary proxy statement and other relevant documents in connection with the proposed merger. INVESTORS OF AXIALL ARE ENCOURAGED TO READ THE DEFINITIVE PROXY STATEMENT FOR THE 2016 ANNUAL MEETING OF STOCKHOLDERS, THE PRELIMINARY PROXY STATEMENT FOR THE SPECIAL MEETING OF STOCKHOLDERS RELATED TO THE PROPOSED MERGER AND ANY OTHER RELEVANT DOCUMENTS FILED WITH THE SEC WHEN THEY BECOME AVAILABLE BECAUSE THOSE DOCUMENTS CONTAIN IMPORTANT INFORMATION. Investors and security holders may obtain the documents free of charge at the SEC’s website, www.sec.gov, and from Axiall at its website, www.axiall.com, or 1000 Abernathy Road NE, Suite 1200, Atlanta, GA 30328, Attention: General Counsel. Participants in the Merger Solicitation Axiall and certain of its respective directors, executive officers and other persons may be deemed to be participants in the solicitation of proxies in respect of the annual meeting of stockholders and the special meeting of stockholders. Information regarding Axiall’s directors and executive officers is available in Axiall’s proxy statement filed with the SEC on April 12, 2016 in connection with its 2016 annual meeting of stockholders. Other information regarding persons who may be deemed participants in the proxy solicitations and a description of their direct and indirect interests, by security holdings or otherwise, will be contained in the definitive proxy statement related to the proposed merger and other relevant materials to be filed with the SEC when they become available. 3

A Value Creating Combination Combination creates a North American Olefins and Vinyls leader #2 North American PVC capacity #3 North American Chlor-Alkali capacity Consistent with Westlake’s vertical integration strategy Combination expected to enhance margin stability Better positioned to capture value throughout the chain and earnings cycle Further downstream integration into PVC building products provides additional operational certainty and growth opportunities Complementary geographic and product positions Expanded manufacturing presence expected to enhance future opportunities and global growth potential Expected annual cost synergies of $100 million Transaction expected to be accretive in the first year following close 4 Source:IHS Chemical

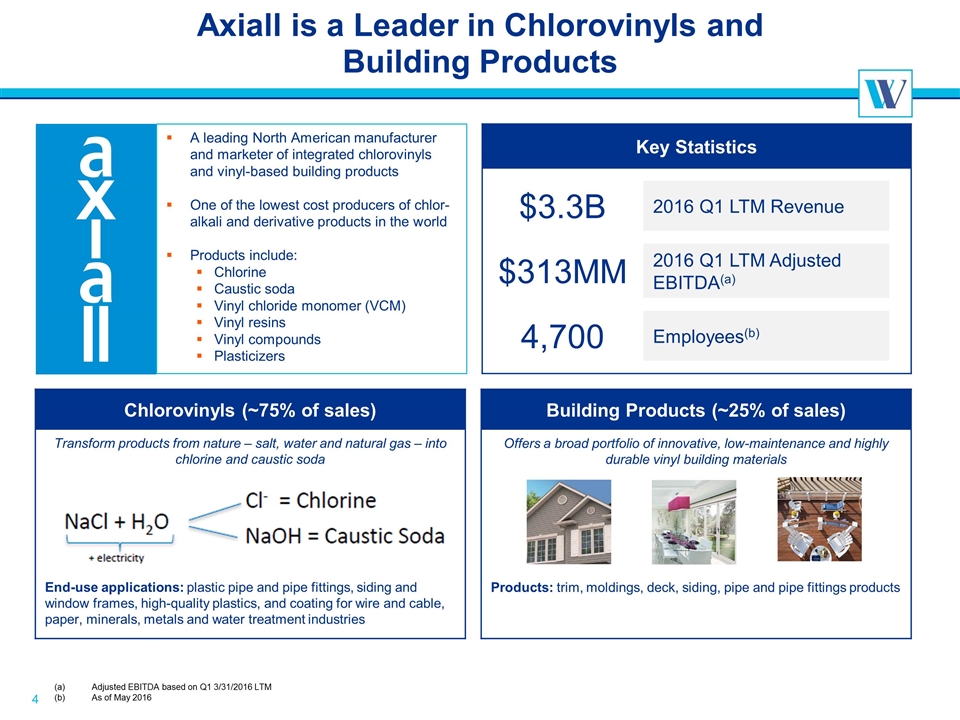

Axiall is a Leader in Chlorovinyls and Building Products 5 A leading North American manufacturer and marketer of integrated chlorovinyls and vinyl-based building products One of the lowest cost producers of chlor-alkali and derivative products in the world Products include: Chlorine Caustic soda Vinyl chloride monomer (VCM) Vinyl resins Vinyl compounds Plasticizers Key Statistics $3.3B 2016 Q1 LTM Revenue $313MM 2016 Q1 LTM Adjusted EBITDA(a) 4,700 Employees(b) Chlorovinyls (~75% of sales) Transform products from nature – salt, water and natural gas – into chlorine and caustic soda End-use applications: plastic pipe and pipe fittings, siding and window frames, high-quality plastics, and coating for wire and cable, paper, minerals, metals and water treatment industries Building Products (~25% of sales) Offers a broad portfolio of innovative, low-maintenance and highly durable vinyl building materials Products: trim, moldings, deck, siding, pipe and pipe fittings products (a)Adjusted EBITDA based on Q1 3/31/2016 LTM (b)As of May 2016

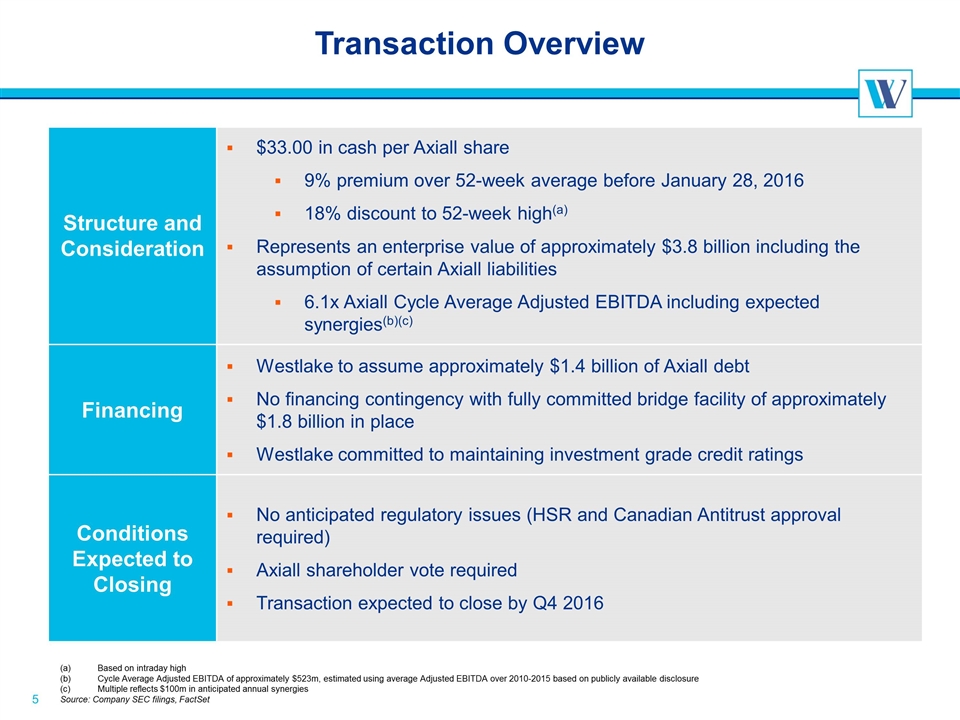

Transaction Overview Structure and Consideration $33.00 in cash per Axiall share 9% premium over 52-week average before January 28, 2016 18% discount to 52-week high(a) Represents an enterprise value of approximately $3.8 billion including the assumption of certain Axiall liabilities 6.1x Axiall Cycle Average Adjusted EBITDA including expected synergies(b)(c) Financing Westlake to assume approximately $1.4 billion of Axiall debt No financing contingency with fully committed bridge facility of approximately $1.8 billion in place Westlake committed to maintaining investment grade credit ratings Conditions Expected to Closing No anticipated regulatory issues (HSR and Canadian Antitrust approval required) Axiall shareholder vote required Transaction expected to close by Q4 2016 6 (a)Based on intraday high (b)Cycle Average Adjusted EBITDA of approximately $523m, estimated using average Adjusted EBITDA over 2010-2015 based on publicly available disclosure (c)Multiple reflects $100m in anticipated annual synergies Source: Company SEC filings, FactSet

Highly Integrated Chain in the U.S. Enhances Margin Stability for the Combined Company Key Combination Highlights 7 Creates a North American Chlorovinyls Leader with Enhanced Scale Value Creation by Capturing Synergy Opportunities Combination Builds on Westlake's History of Integration and Strategic Growth Strong Financial Profile 1 2 3 4 5

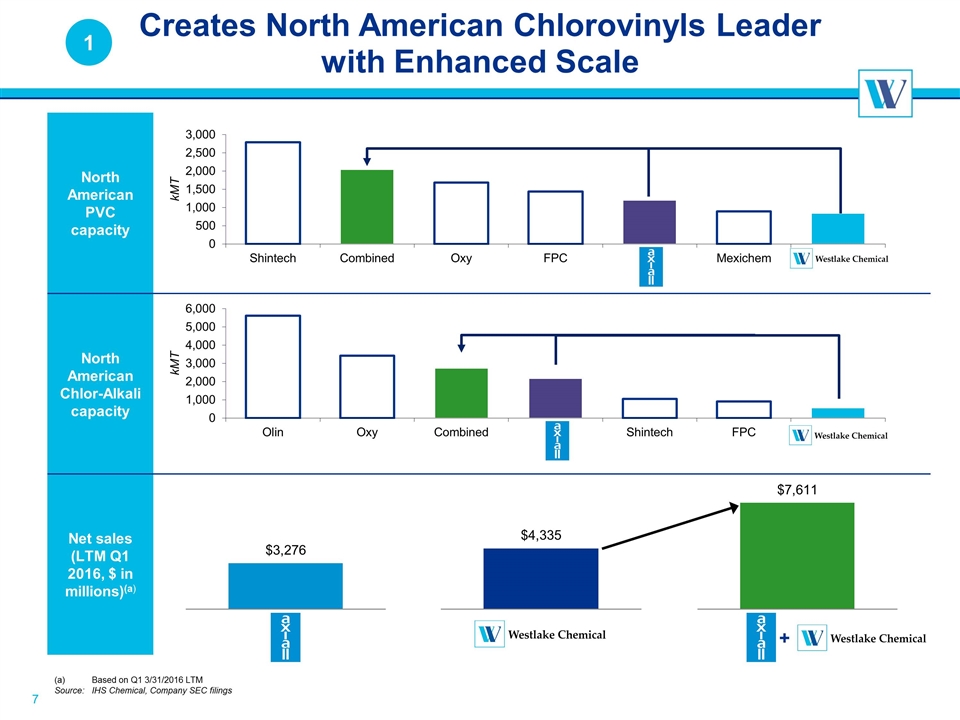

Creates North American Chlorovinyls Leader with Enhanced Scale 8 + (a)Based on Q1 3/31/2016 LTM Source:IHS Chemical, Company SEC filings North American PVC capacity North American Chlor-Alkali capacity Net sales (LTM Q1 2016, $ in millions)(a) 1

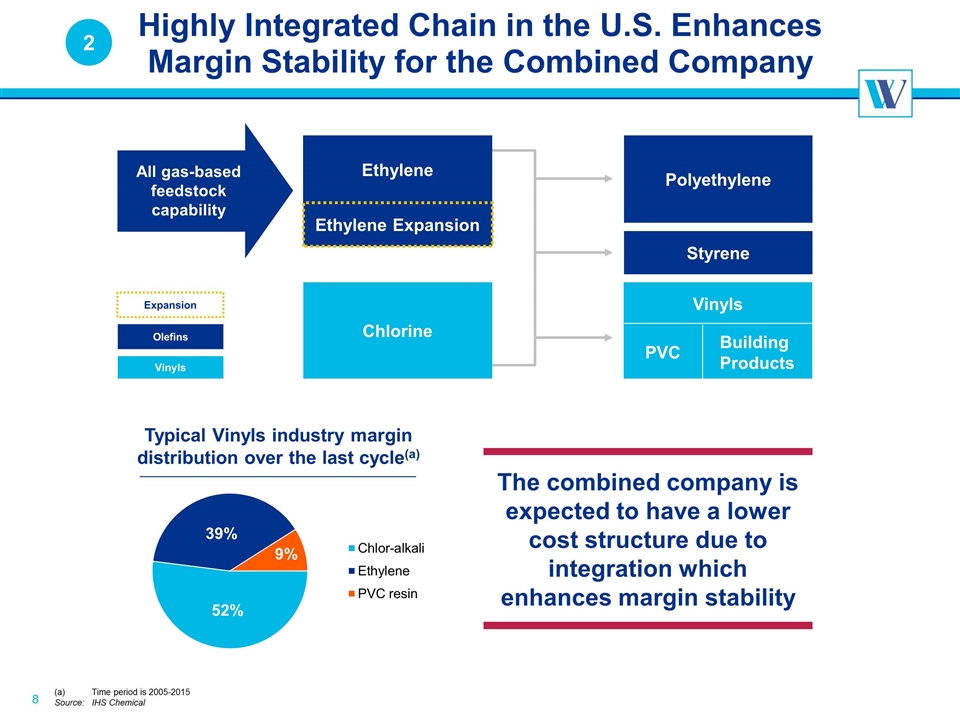

v Highly Integrated Chain in the U.S. Enhances Margin Stability for the Combined Company (a) Time period is 2005-2015 Source:IHS Chemical Polyethylene Styrene Chlorine Ethylene Vinyls PVC Building Products All gas-based feedstock capability Ethylene Expansion Typical Vinyls industry margin distribution over the last cycle(a) The combined company is expected to have a lower cost structure due to integration which enhances margin stability Expansion Olefins Vinyls 9 2

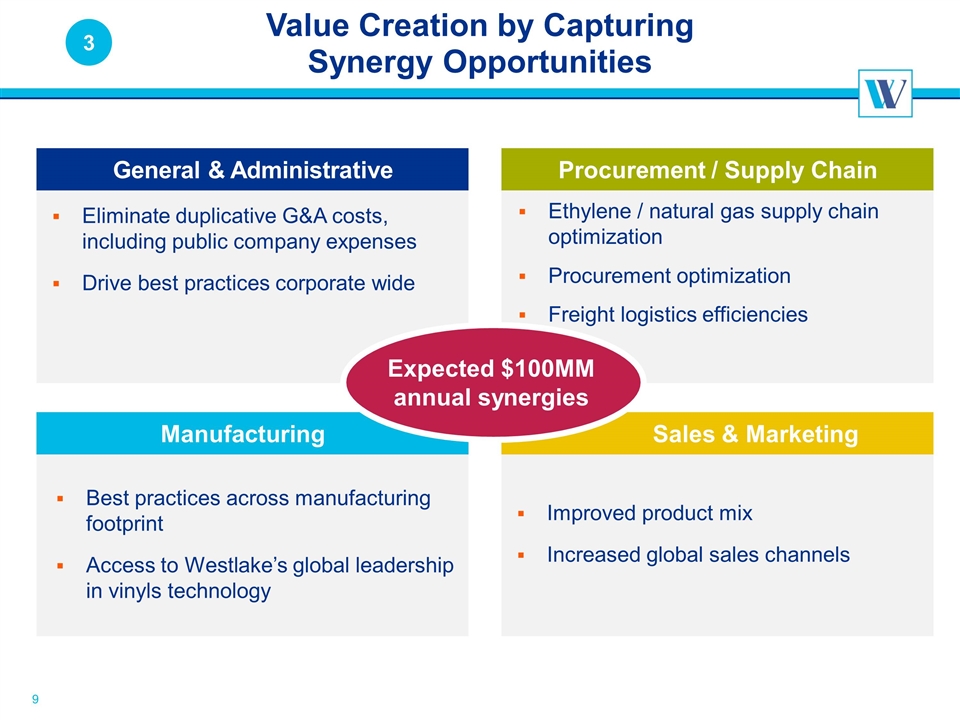

Sales & Marketing Manufacturing General & Administrative Procurement / Supply Chain Value Creation by Capturing Synergy Opportunities Improved product mix Increased global sales channels Eliminate duplicative G&A costs, including public company expenses Drive best practices corporate wide Ethylene / natural gas supply chain optimization Procurement optimization Freight logistics efficiencies Expected $100MM annual synergies Best practices across manufacturing footprint Access to Westlake’s global leadership in vinyls technology 10 3

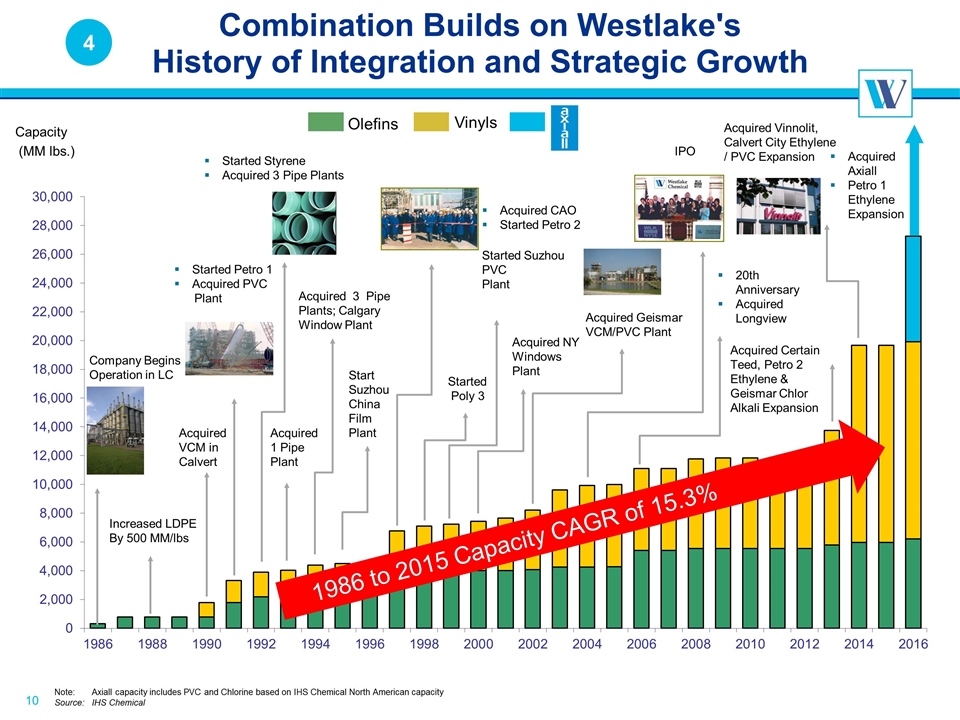

Acquired Axiall Petro 1 Ethylene Expansion Capacity (MM lbs.) Vinyls Olefins Company Begins Operation in LC Acquired VCM in Calvert Started Petro 1 Acquired PVC Plant Acquired Geismar VCM/PVC Plant Acquired 1 Pipe Plant Acquired 3 Pipe Plants; Calgary Window Plant Start Suzhou China Film Plant Increased LDPE By 500 MM/lbs Acquired CAO Started Petro 2 Started Poly 3 Started Suzhou PVC Plant Acquired NY Windows Plant Started Styrene Acquired 3 Pipe Plants IPO 20th Anniversary Acquired Longview Acquired Vinnolit, Calvert City Ethylene / PVC Expansion 1986 to 2015 Capacity CAGR of 15.3% 11 4 Combination Builds on Westlake's History of Integration and Strategic Growth Acquired Certain Teed, Petro 2 Ethylene & Geismar Chlor Alkali Expansion Note:Axiall capacity includes PVC and Chlorine based on IHS Chemical North American capacity Source:IHS Chemical

Strong Financial Profile 12 Expected strong financial profile and significant cash generation from combined company with the benefit of synergies Transaction expected to be accretive in the first year following close Westlake committed to investment grade credit ratings and continued conservative financial policy Transaction also supported by Westlake’s large cash balance position and unlevered balance sheet 5

A Value Creating Combination Combination creates a North American Olefins and Vinyls leader Consistent with Westlake’s vertical integration strategy Complementary geographic and product positions Expanded manufacturing presence expected to enhance future opportunities and global growth potential Expected annual cost synergies of $100 million Transaction expected to be accretive in the first year following close 13

Q & A 14