Attached files

| file | filename |

|---|---|

| 8-K - 8-K - ANTARES PHARMA, INC. | atrs-8k_20160608.htm |

NASDAQ: ATRS Jefferies 2016 Healthcare Conference June 8, 2016 Robert F. Apple President and Chief Executive Officer Exhibit 99.1

Safe Harbor Statement This presentation contains forward-looking statements within the meaning of the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. Forward-looking statements are subject to certain risks and uncertainties that can cause actual results to differ materially from those described. Factors that may cause such differences include, but are not limited to: the timing of the launch of VIBEX® Sumatriptan Injection USP and the amount of revenue from the same, the timing and results of the phase 3 studies for QuickShot® Testosterone (QS T) and the Human Factors Study and acceptance of the data by the U.S. Food and Drug Administration (FDA); the Company’s ability to successfully complete a New Drug Application for QS T and submit to the FDA and approval of the same by the FDA; Teva and our ability to adequately and timely respond to the Complete Response Letter received from the FDA for the VIBEX® epinephrine pen ANDA and approval by the FDA of the same, the timing and therapeutic equivalence rating thereof, and any revenue pre or post FDA approval; the timing and outcome of paragraph IV patent litigation related to Teva’s exenatide and teriparatide ANDA’s, continued progress in ongoing development programs and actions by the FDA or other regulatory agencies with the respect to the Company’s products or product candidates of its partners including Teva’s ANDA filed for the exenatide pen and teriparatide pen; continued growth of prescriptions and sales of OTREXUP™; the timing and results of research projects, clinical trials, and product candidates in development including the development project with AMAG Pharmaceuticals for a subcutaneous auto injector for their product Makena®; continued growth in product, development, licensing and royalty revenue; the Company’s ability to obtain financial and other resources for its research, development, clinical, and commercial activities and other statements regarding matters that are not historical facts, and involve predictions. These statements involve known and unknown risks, uncertainties and other factors that may cause actual results, performance, achievements or prospects to be materially different from any future results, performance, achievements or prospects expressed in or implied by such forward-looking statements. In some cases you can identify forward-looking statements by terminology such as ''may'', ''will'', ''should'', ''would'', ''expect'', ''intend'', ''plan'', ''anticipate'', ''believe'', ''estimate'', ''predict'', ''potential'', ''seem'', ''seek'', ''future'', ''continue'', or ''appear'' or the negative of these terms or similar expressions, although not all forward-looking statements contain these identifying words. Additional information concerning these and other factors that may cause actual results to differ materially from those anticipated in the forward-looking statements is contained in the "Risk Factors" section of the Company's Annual Report on Form 10-K for the year ended December 31, 2015, and in the Company's other periodic reports and filings with the Securities and Exchange Commission. The Company cautions investors not to place undue reliance on the forward-looking statements contained in this presentation. All forward-looking statements are based on information currently available to the Company on the date hereof, and the Company undertakes no obligation to revise or update these forward-looking statements to reflect events or circumstances after the date of this presentation, except as required by law. ©2016 Copyright Antares Pharma, Inc. All Rights Reserved.

Antares Pharma A Growing, Revenue Generating State-of-the-Art Specialty Pharmaceutical Company An Innovative Leader In Self-Administered Injection Technology Four Drug/Drug-Device Products FDA Approved Since 2012 (most recently Sumatriptan and OTREXUP™) Two Additional Drug Device Combination Products in Advanced Clinical Development (QuickShot® Testosterone, Makena®) Three Partnership ANDA’s Under Active Review at FDA (Exenatide, Teriparatide and Epinephrine) Novel Drug Delivery Technology Can Provide Life Cycle Management Solutions (Makena®)

Top Line Highlights Q116 total revenue of $12.3 million vs. $8.3 million in Q115 – a 48% increase vs. the comparable period Multiple development pipeline products targeting therapeutic markets with ~ $8 Billion in annual revenue over next five years Recently announced last patient visit in QST 15-005 supplemental six month safety study for testosterone deficiency Strong balance sheet – ~$42 million in cash and no debt at March 31, 2016 (Q1 2016 cash burn ~$6 million)

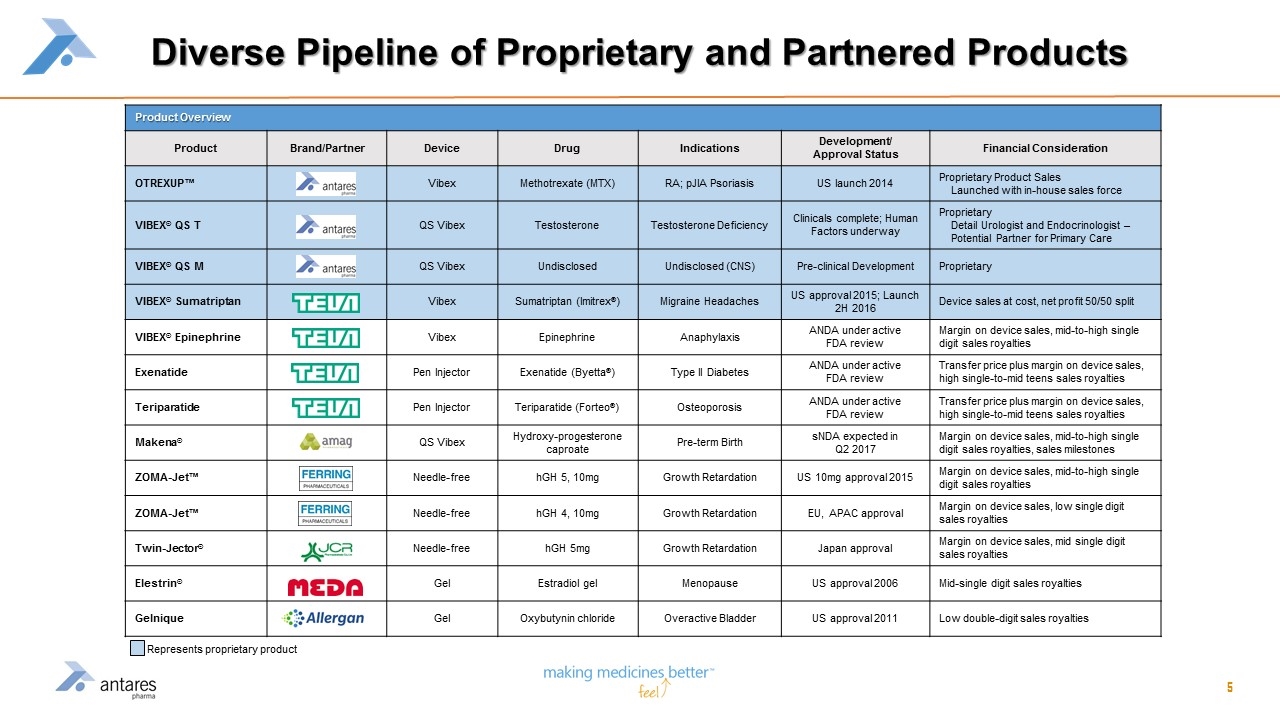

Diverse Pipeline of Proprietary and Partnered Products Product Overview Product Brand/Partner Device Drug Indications Development/ Approval Status Financial Consideration OTREXUP™ Vibex Methotrexate (MTX) RA; pJIA Psoriasis US launch 2014 Proprietary Product Sales Launched with in-house sales force VIBEX® QS T QS Vibex Testosterone Testosterone Deficiency Clinicals complete; Human Factors underway Proprietary Detail Urologist and Endocrinologist – Potential Partner for Primary Care VIBEX® QS M QS Vibex Undisclosed Undisclosed (CNS) Pre-clinical Development Proprietary VIBEX® Sumatriptan Vibex Sumatriptan (Imitrex®) Migraine Headaches US approval 2015; Launch 2H 2016 Device sales at cost, net profit 50/50 split VIBEX® Epinephrine Vibex Epinephrine Anaphylaxis ANDA under active FDA review Margin on device sales, mid-to-high single digit sales royalties Exenatide Pen Injector Exenatide (Byetta®) Type II Diabetes ANDA under active FDA review Transfer price plus margin on device sales, high single-to-mid teens sales royalties Teriparatide Pen Injector Teriparatide (Forteo®) Osteoporosis ANDA under active FDA review Transfer price plus margin on device sales, high single-to-mid teens sales royalties Makena® QS Vibex Hydroxy-progesterone caproate Pre-term Birth sNDA expected in Q2 2017 Margin on device sales, mid-to-high single digit sales royalties, sales milestones ZOMA-Jet™ Needle-free hGH 5, 10mg Growth Retardation US 10mg approval 2015 Margin on device sales, mid-to-high single digit sales royalties ZOMA-Jet™ Needle-free hGH 4, 10mg Growth Retardation EU, APAC approval Margin on device sales, low single digit sales royalties Twin-Jector® Needle-free hGH 5mg Growth Retardation Japan approval Margin on device sales, mid single digit sales royalties Elestrin® Gel Estradiol gel Menopause US approval 2006 Mid-single digit sales royalties Gelnique Gel Oxybutynin chloride Overactive Bladder US approval 2011 Low double-digit sales royalties Represents proprietary product

2016 Potential Value Drivers Sumatriptan mid-year launch by Teva Anticipate QuickShot® Testosterone NDA filing late 2016 Alliance Business progress: Makena® life cycle management collaboration with AMAG Growth of OTREXUP™ Continued progress on pipeline (Epinephrine, Exenatide, Teriparatide)

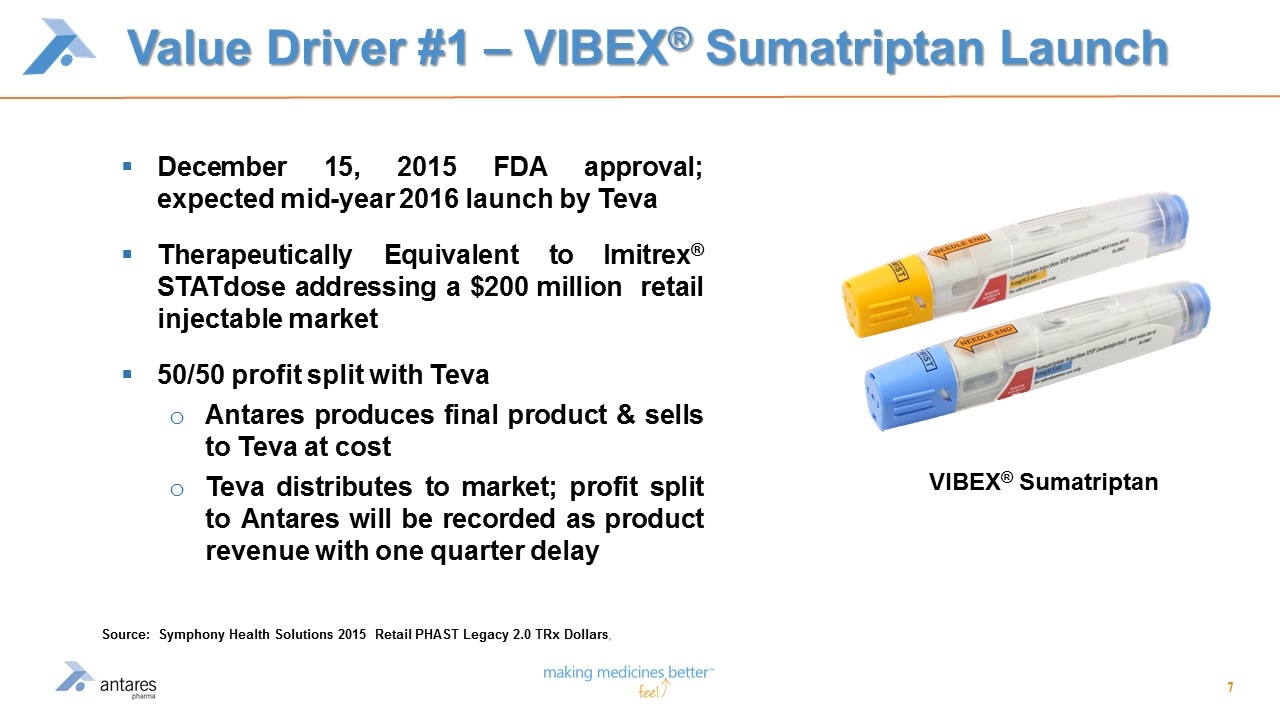

Value Driver #1 – VIBEX® Sumatriptan Launch December 15, 2015 FDA approval; expected mid-year 2016 launch by Teva Therapeutically Equivalent to Imitrex® STATdose addressing a $200 million retail injectable market 50/50 profit split with Teva Antares produces final product & sells to Teva at cost Teva distributes to market; profit split to Antares will be recorded as product revenue with one quarter delay VIBEX® Sumatriptan Source: Symphony Health Solutions 2015 Retail PHAST Legacy 2.0 TRx Dollars,

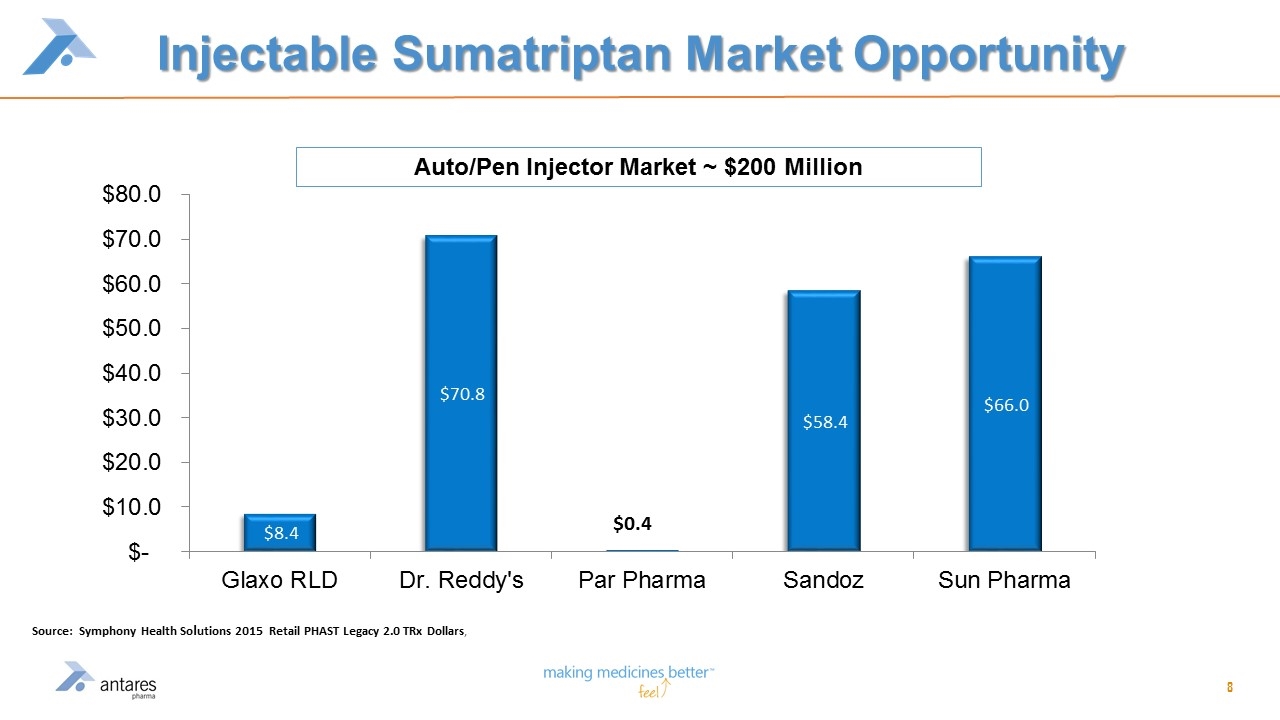

Injectable Sumatriptan Market Opportunity Source: Symphony Health Solutions 2015 Retail PHAST Legacy 2.0 TRx Dollars, Auto/Pen Injector Market ~ $200 Million

Value Driver #2 – NDA Filing For QuickShot® Testosterone NDA filing currently targeted for late Q416 Possible launch in late 2017 / early 2018 Final safety data from 52 week 003 study reported – most common included increased hematocrit, hypertension, upper respiratory tract infection, sinusitis, injection site bruising and headache. There were 3 SAE’s reported. Of 1,519 injections assessed for pain, there were 9 reported instances of pain with an average score of 1.3 on a scale of 10. Last patient completed treatment in six month supplemental safety study QST-15-005 on 5/31/16 Human Factors study currently underway QuickShot® Testosterone

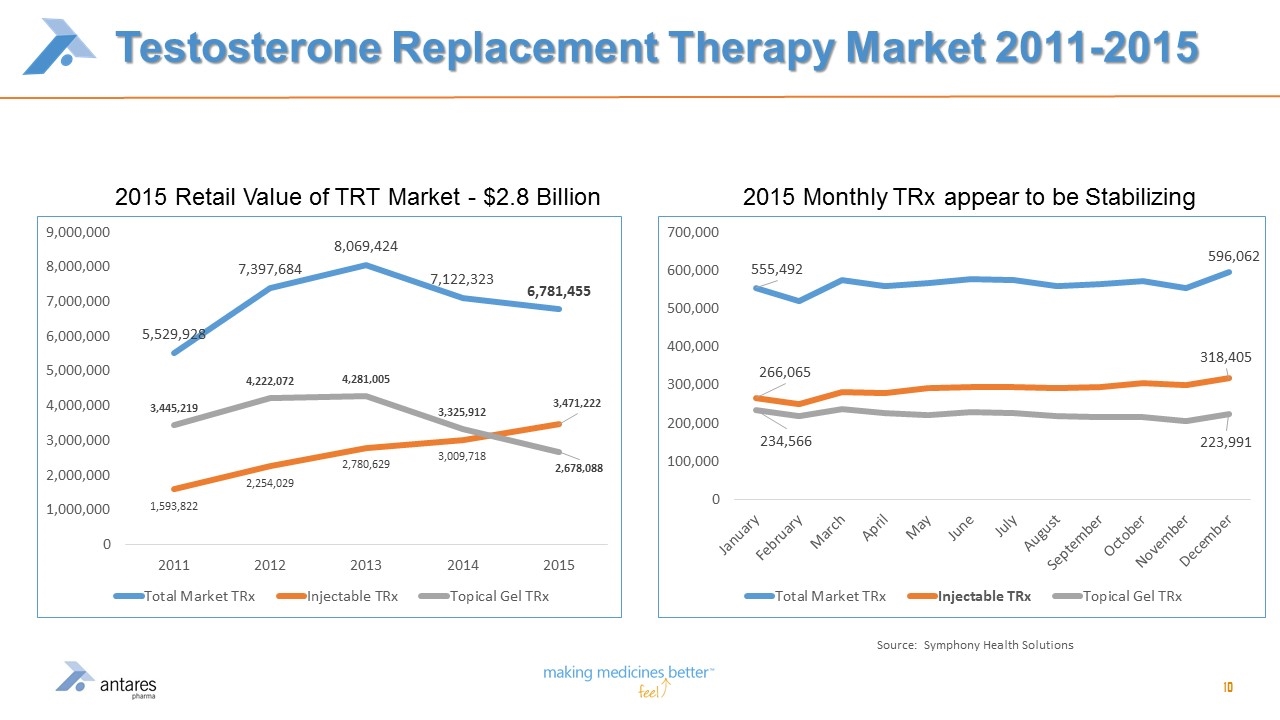

Testosterone Replacement Therapy Market 2011-2015 Source: Symphony Health Solutions 2015 Retail Value of TRT Market - $2.8 Billion 2015 Monthly TRx appear to be Stabilizing

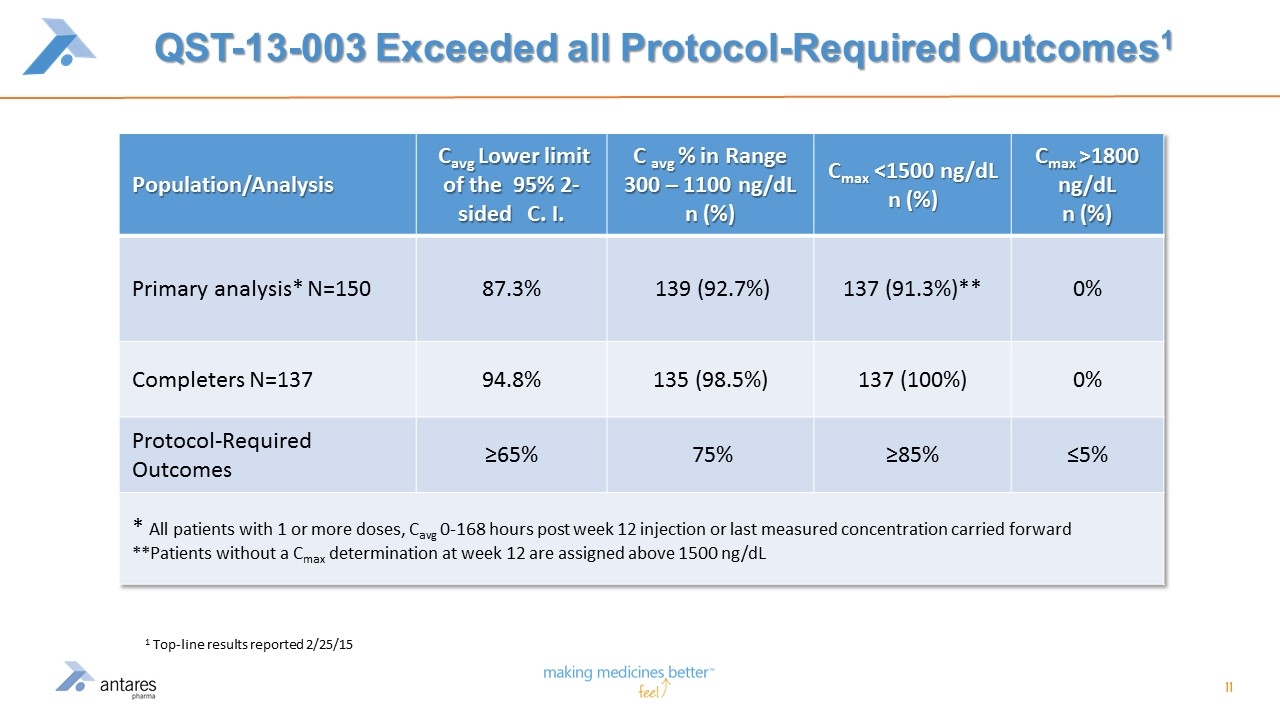

QST-13-003 Exceeded all Protocol-Required Outcomes1 Population/Analysis Cavg Lower limit of the 95% 2-sided C. I. C avg % in Range 300 – 1100 ng/dL n (%) Cmax <1500 ng/dL n (%) Cmax >1800 ng/dL n (%) Primary analysis* N=150 87.3% 139 (92.7%) 137 (91.3%)** 0% Completers N=137 94.8% 135 (98.5%) 137 (100%) 0% Protocol-Required Outcomes ≥65% 75% ≥85% ≤5% * All patients with 1 or more doses, Cavg 0-168 hours post week 12 injection or last measured concentration carried forward **Patients without a Cmax determination at week 12 are assigned above 1500 ng/dL 1 Top-line results reported 2/25/15

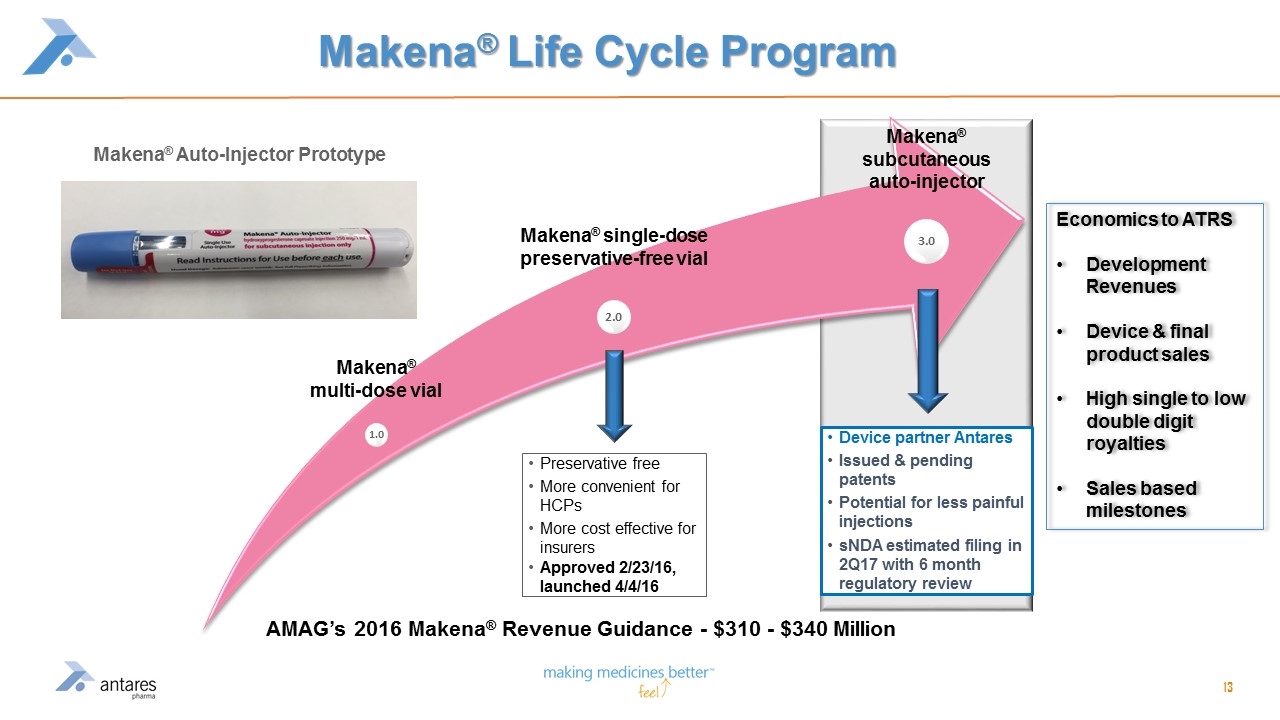

Value Driver #3 – Grow Alliance Business AMAG Makena® alliance (began in 2014) Developing a subcutaneous auto injector device Better patient compliance Potentially less painful injection (small gauge needle) and easier administration Currently Makena® is ~ $250 million product opportunity, expected to grow to approximately $310 - $340* in 2016 AMAG estimate sNDA filing in 2Q17 with a 6 month regulatory review Antares will sell devices to AMAG and will receive royalties and certain milestone payments based upon net sales benchmarks * AMAG 2016 Makena® Revenue Guidance Issued 1/11/16

Makena® Life Cycle Program Preservative free More convenient for HCPs More cost effective for insurers Approved 2/23/16, launched 4/4/16 Device partner Antares Issued & pending patents Potential for less painful injections sNDA estimated filing in 2Q17 with 6 month regulatory review Makena® subcutaneous auto-injector 1.0 2.0 3.0 Makena® single-dose preservative-free vial Makena® multi-dose vial AMAG’s 2016 Makena® Revenue Guidance - $310 - $340 Million Makena® Auto-Injector Prototype Economics to ATRS Development Revenues Device & final product sales High single to low double digit royalties Sales based milestones

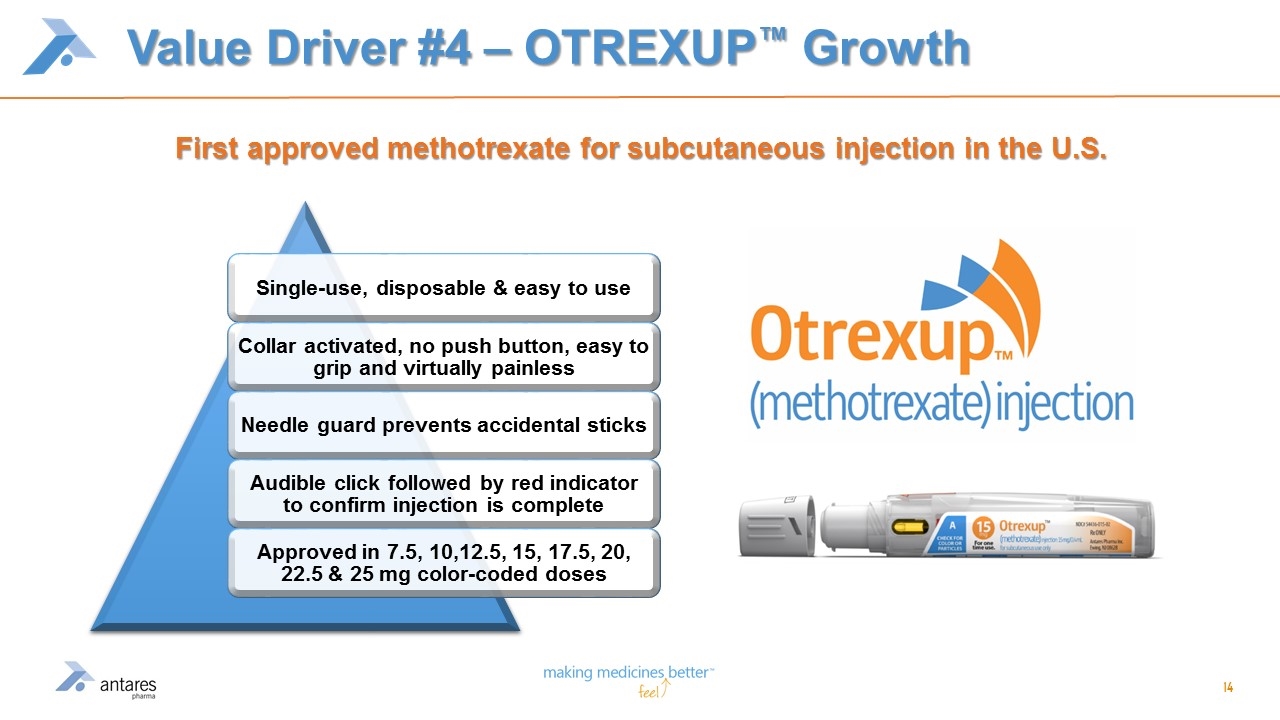

Value Driver #4 – OTREXUP™ Growth First approved methotrexate for subcutaneous injection in the U.S. Single-use, disposable & easy to use Collar activated, no push button, easy to grip and virtually painless Needle guard prevents accidental sticks Audible click followed by red indicator to confirm injection is complete Approved in 7.5, 10,12.5, 15, 17.5, 20, 22.5 & 25 mg color-coded doses

OTREXUP™ Q116 Revenues of $3.3 million are up 10% vs. Q115; flat vs Q4 2015 Committed to growing OTREXUP™: Changes in leadership of both sales and marketing organizations Modifying certain payer tactics Take advantage of new interim dosage strengths that have recently been launched

Near Term Pipeline Opportunities Epinephrine Auto Injector Exenatide Teriparatide

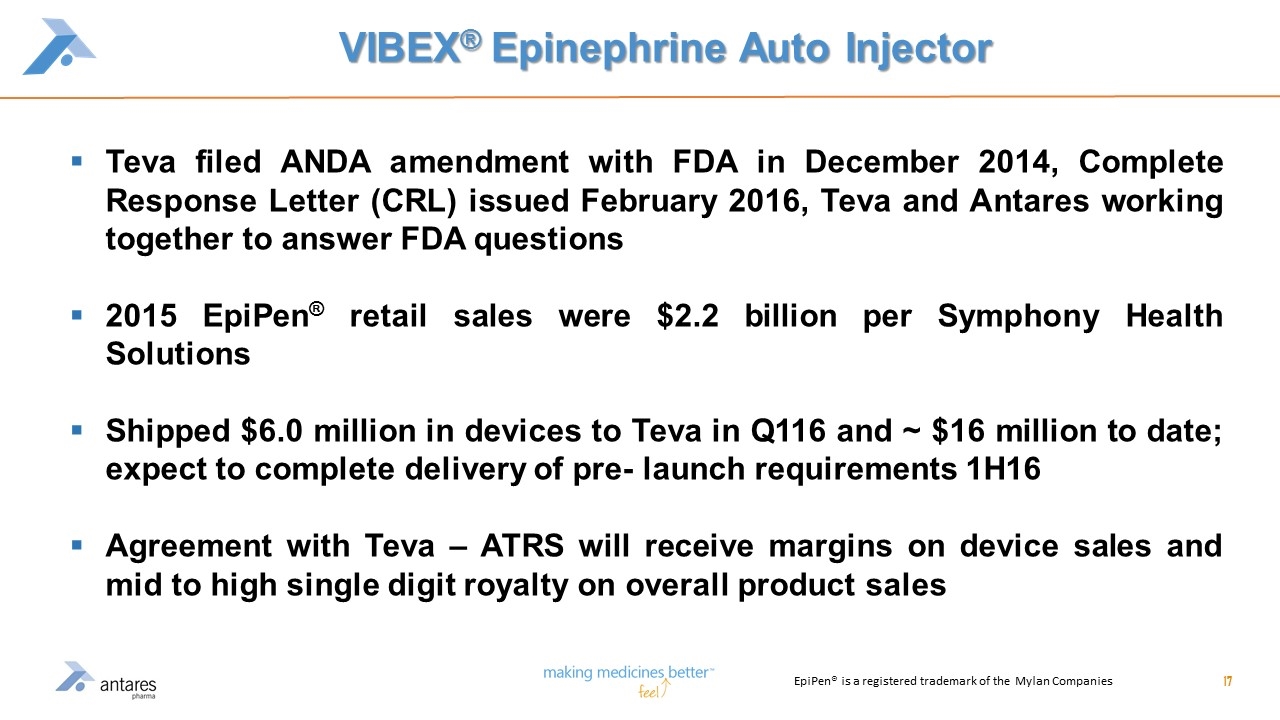

VIBEX® Epinephrine Auto Injector Teva filed ANDA amendment with FDA in December 2014, Complete Response Letter (CRL) issued February 2016, Teva and Antares working together to answer FDA questions 2015 EpiPen® retail sales were $2.2 billion per Symphony Health Solutions Shipped $6.0 million in devices to Teva in Q116 and ~ $16 million to date; expect to complete delivery of pre- launch requirements 1H16 Agreement with Teva – ATRS will receive margins on device sales and mid to high single digit royalty on overall product sales EpiPen® is a registered trademark of the Mylan Companies

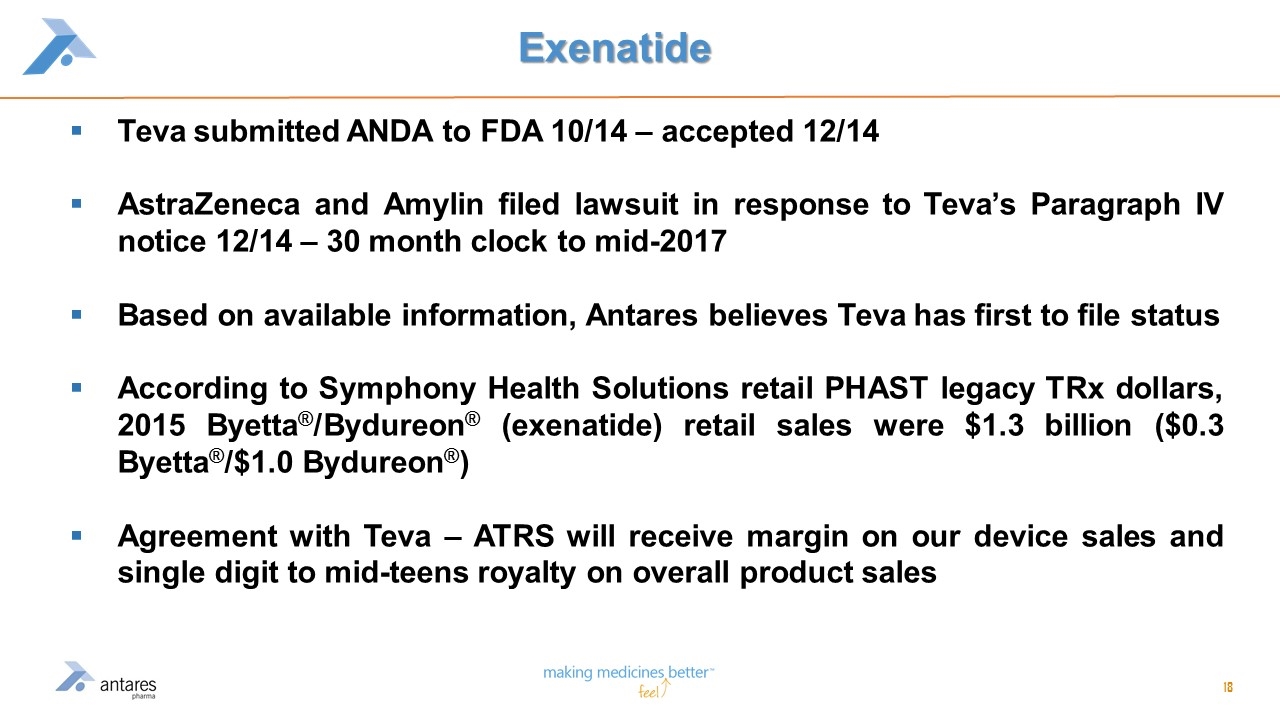

Exenatide Teva submitted ANDA to FDA 10/14 – accepted 12/14 AstraZeneca and Amylin filed lawsuit in response to Teva’s Paragraph IV notice 12/14 – 30 month clock to mid-2017 Based on available information, Antares believes Teva has first to file status According to Symphony Health Solutions retail PHAST legacy TRx dollars, 2015 Byetta®/Bydureon® (exenatide) retail sales were $1.3 billion ($0.3 Byetta®/$1.0 Bydureon®) Agreement with Teva – ATRS will receive margin on our device sales and single digit to mid-teens royalty on overall product sales

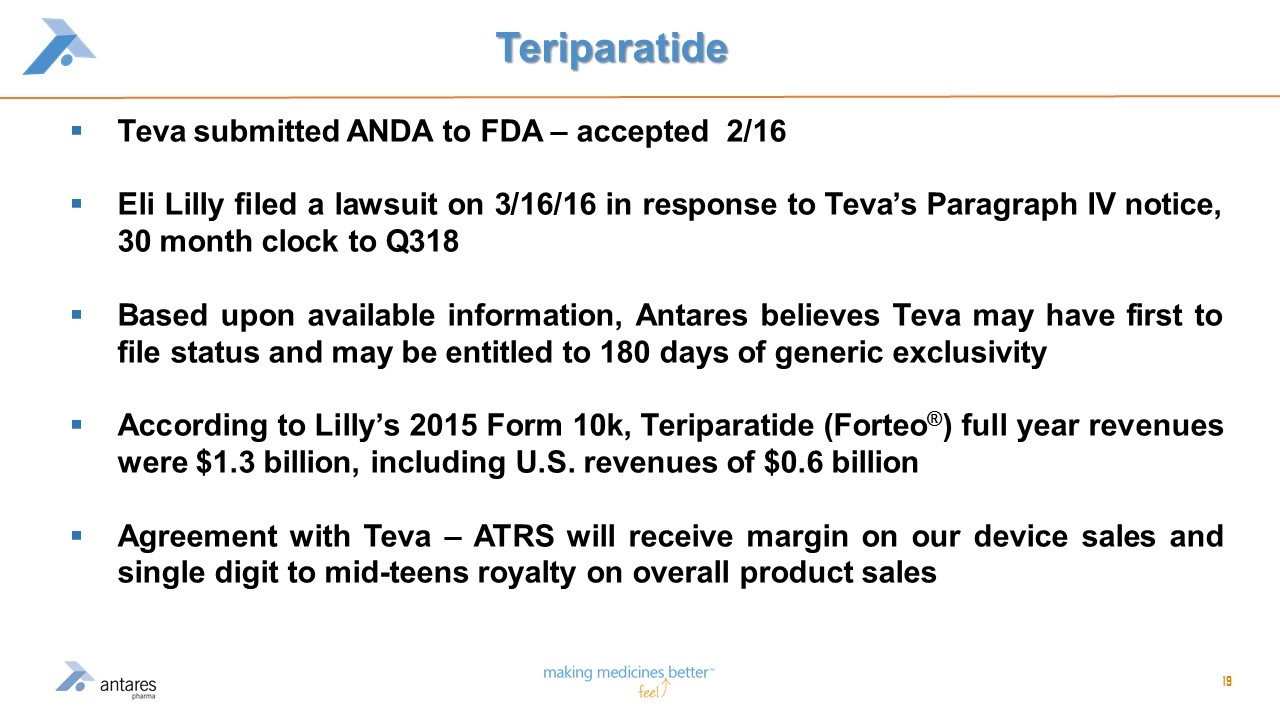

Teriparatide Teva submitted ANDA to FDA – accepted 2/16 Eli Lilly filed a lawsuit on 3/16/16 in response to Teva’s Paragraph IV notice, 30 month clock to Q318 Based upon available information, Antares believes Teva may have first to file status and may be entitled to 180 days of generic exclusivity According to Lilly’s 2015 Form 10k, Teriparatide (Forteo®) full year revenues were $1.3 billion, including U.S. revenues of $0.6 billion Agreement with Teva – ATRS will receive margin on our device sales and single digit to mid-teens royalty on overall product sales

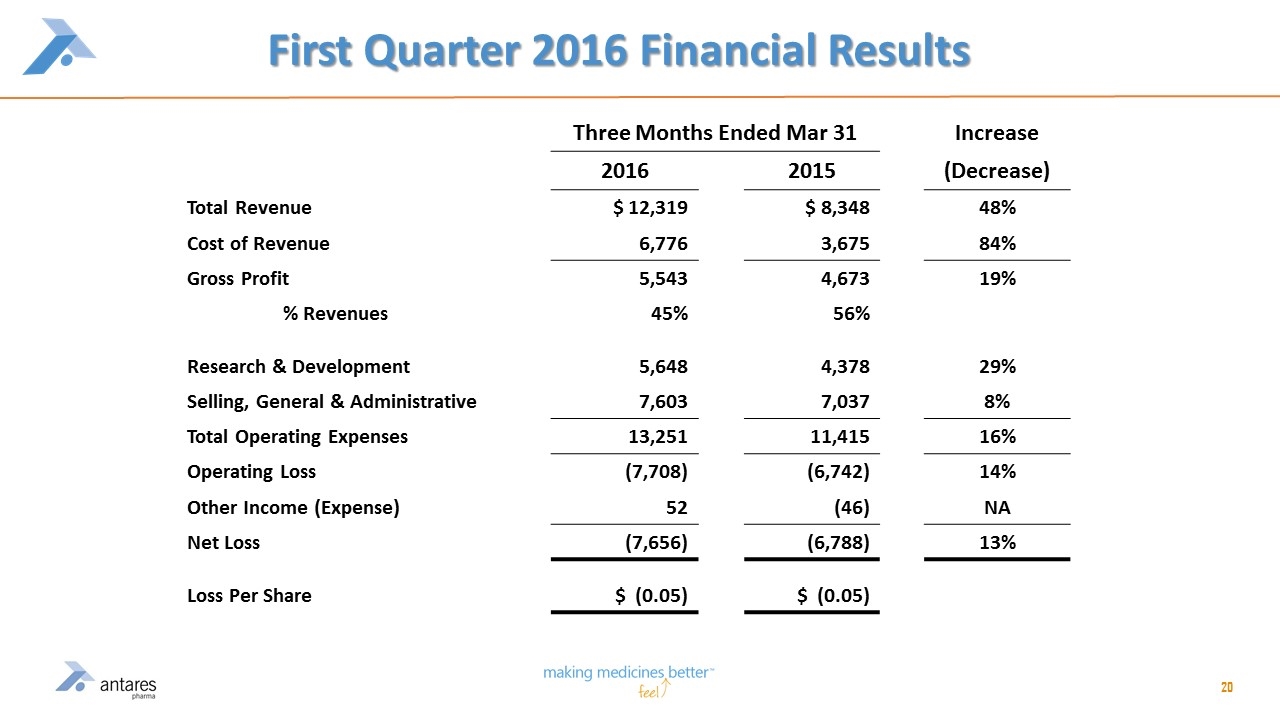

First Quarter 2016 Financial Results Three Months Ended Mar 31 Increase 2016 2015 (Decrease) Total Revenue $ 12,319 $ 8,348 48% Cost of Revenue 6,776 3,675 84% Gross Profit 5,543 4,673 19% % Revenues 45% 56% Research & Development 5,648 4,378 29% Selling, General & Administrative 7,603 7,037 8% Total Operating Expenses 13,251 11,415 16% Operating Loss (7,708) (6,742) 14% Other Income (Expense) 52 (46) NA Net Loss (7,656) (6,788) 13% Loss Per Share $ (0.05) $ (0.05)

Investment Considerations A growing, revenue generating company – $12.3 million in Q116 – a 48% increase over first quarter of last year Multiple development pipeline products targeting therapeutic markets with ~ $8 Billion in annual revenue over next five years Several potential value drivers in 2016: Sumatriptan launch Anticipated QST NDA filing late Q4 2016 Growth in development revenue (Makena®, Exenatide, Teriparatide) Growing Alliance Business Growth of OTREXUP™ Strong balance sheet – ~$42 million in cash and no debt at March 31, 2016 (Q1 2016 cash burn ~$6 million)

NASDAQ: ATRS Jefferies 2016 Healthcare Conference June 8, 2016 Robert F. Apple President and Chief Executive Officer