Attached files

| file | filename |

|---|---|

| EX-99.1 - EX-99.1 - ZIMMER BIOMET HOLDINGS, INC. | d208796dex991.htm |

| 8-K - 8-K - ZIMMER BIOMET HOLDINGS, INC. | d208796d8k.htm |

Zimmer Biomet Announces Agreement to Acquire LDR David Dvorak President and CEO Christophe Lavigne LDR Co-Founder, Chairman, President and CEO Dan Florin SVP and CFO Adam Johnson Group President, Spine, CMF and Thoracic, and Dental June 7, 2016 Exhibit 99.2

Cautionary Statement Regarding Forward-Looking Statements This communication contains forward-looking information related to Zimmer Biomet, LDR and the acquisition of LDR by Zimmer Biomet that involves substantial risks and uncertainties that could cause actual results to differ materially from those expressed or implied by such statements. All statements other than statements of historical fact are, or may be deemed to be, forward-looking statements. In some cases, forward-looking statements can be identified by the use of forward-looking terms such as “anticipate,” “estimate,” “believe,” “continue,” “could,” “intend,” “may,” “plan,” “potential,” “predict,” “should,” “will,” “expect,” “objective,” “projection,” “forecast,” “goal,” “guidance,” “outlook,” “effort,” “target,” “would” or the negative of these terms or other comparable terms. Forward-looking statements in this release include, among other things, statements about the potential benefits of the proposed acquisition; anticipated accretion and growth rates; Zimmer Biomet's and LDR's plans, objectives, expectations and intentions; the financial condition, results of operations and businesses of Zimmer Biomet and LDR; and the anticipated timing of closing of the acquisition. These forward-looking statements are based on certain assumptions and analyses made by us in light of our experience and our perception of historical trends, current conditions and expected future developments, as well as other factors we believe are appropriate in the circumstances. These forward-looking statements also are based on the current expectations and beliefs of the respective managements of Zimmer Biomet and LDR and are subject to certain known and unknown risks and uncertainties that could cause actual results to differ materially from those described in the forward-looking statements. Risks and uncertainties include, among other things, risks related to the satisfaction of the conditions to closing the acquisition (including the failure to obtain necessary regulatory approvals) in the anticipated timeframe or at all, including uncertainties as to how many of LDR's stockholders will tender their shares of LDR common stock in the tender offer and the possibility that the acquisition does not close; risks related to the ability to realize the anticipated benefits of the acquisition, including the possibility that the expected benefits from the proposed acquisition will not be realized or will not be realized within the expected time period; the risk that the businesses will not be integrated successfully; disruption from the transaction making it more difficult to maintain business and operational relationships; negative effects of this announcement or the consummation of the proposed acquisition on the market price of Zimmer Biomet common stock and on Zimmer Biomet's operating results; significant transaction costs; unknown liabilities; the risk of litigation and/or regulatory actions related to the proposed acquisition; other business effects, including the effects of industry, market, economic, political or regulatory conditions; future exchange rates and interest rates; changes in tax and other laws, regulations and policies; future business combinations or disposals; the uncertainties inherent in research and development; and competitive developments. Readers are cautioned not to place undue reliance on any of these forward-looking statements. These forward-looking statements speak only as of the date hereof. Zimmer Biomet and LDR undertake no obligation to update any of these forward-looking statements as the result of new information or to reflect events or circumstances after the date of this communication or to reflect actual outcomes. A further description of risks and uncertainties relating to Zimmer Biomet and LDR can be found in their respective Annual Reports on Form 10-K for the fiscal year ended December 31, 2015 and in their subsequent Quarterly Reports on Form 10-Q and Current Reports on Form 8-K, all of which are filed with the U.S. Securities and Exchange Commission (the “SEC”) and available at www.sec.gov. Additional Information and Where to Find It The tender offer referenced in this communication has not yet commenced. This announcement is for informational purposes only and is neither an offer to purchase nor a solicitation of an offer to sell any shares of LDR common stock or any other securities, nor is it a substitute for the tender offer materials that Zimmer Biomet and its indirect subsidiary, LH Merger Sub, Inc., will file with the SEC. The solicitation and offer to purchase LDR common stock will only be made pursuant to an Offer to Purchase, a related letter of transmittal and certain other tender offer documents. At the time the tender offer is commenced, Zimmer Biomet and LH Merger Sub will file a tender offer statement on Schedule TO, including an Offer to Purchase, a related letter of transmittal and certain other tender offer documents, and LDR will file a Solicitation/Recommendation Statement on Schedule 14D-9, with the SEC, each with respect to the tender offer. THE TENDER OFFER STATEMENT (INCLUDING THE OFFER TO PURCHASE, THE RELATED LETTER OF TRANSMITTAL AND CERTAIN OTHER TENDER OFFER DOCUMENTS) AND THE SOLICITATION/RECOMMENDATION STATEMENT WILL CONTAIN IMPORTANT INFORMATION. LDR STOCKHOLDERS ARE URGED TO READ THE TENDER OFFER STATEMENT AND SOLICITATION/RECOMMENDATION STATEMENT, AS THEY MAY BE AMENDED FROM TIME TO TIME, AS WELL AS ANY OTHER RELEVANT DOCUMENTS FILED WITH THE SEC, WHEN THEY BECOME AVAILABLE, CAREFULLY AND IN THEIR ENTIRETY BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION THAT HOLDERS OF LDR SECURITIES SHOULD CONSIDER BEFORE MAKING ANY DECISION REGARDING TENDERING THEIR SECURITIES. The Offer to Purchase, the related Letter of Transmittal and certain other tender offer documents, as well as the Solicitation/Recommendation Statement, will be made available to all holders of LDR common stock at no expense to them. The tender offer materials and the Solicitation/Recommendation Statement will be made available for free at the SEC's website at www.sec.gov. Additional copies may be obtained (when available) for free by contacting Zimmer Biomet or LDR. Copies of the documents filed with the SEC by LDR will be available free of charge on LDR's website at www.ldr.com. Copies of the documents filed with the SEC by Zimmer Biomet will be available free of charge on Zimmer Biomet's website at www.zimmerbiomet.com. In addition to the Offer to Purchase, the related Letter of Transmittal and certain other tender offer documents, as well as the Solicitation/Recommendation Statement, Zimmer Biomet and LDR each file annual, quarterly and current reports and other information with the SEC. You may read and copy any reports or other information filed by Zimmer Biomet or LDR at the SEC public reference room at 100 F Street, N.E., Washington, D.C. 20549. Please call the SEC at 1-800-SEC-0330 for further information on the public reference room. Zimmer Biomet's and LDR's filings with the SEC are also available to the public from commercial document-retrieval services and at the website maintained by the SEC at www.sec.gov.

Spine Market 3 Agenda Transaction Summary 4 Transaction Overview 1 Overview of LDR 2

Highly Complementary Strategic Transaction Highly strategic and complementary acquisition that strengthens one of Zimmer Biomet’s key franchises: Spine Accelerated growth in the $10 billion Spine market, enabling Zimmer Biomet to gain a leading position in its fastest growing segment Creates comprehensive Spine portfolio with innovative surgical solutions that place Zimmer Biomet in an advantaged position to compete for large hospital vendor contracts Significant global opportunity for LDR products through Zimmer Biomet’s larger, global presence in both U.S. and key international markets Christophe Lavigne, Co-Founder, Chairman, President and CEO of LDR and Patrick Richard, Co-Founder of LDR and Executive Vice President and General Manager of LDR Médical, will remain with the Company in key leadership positions

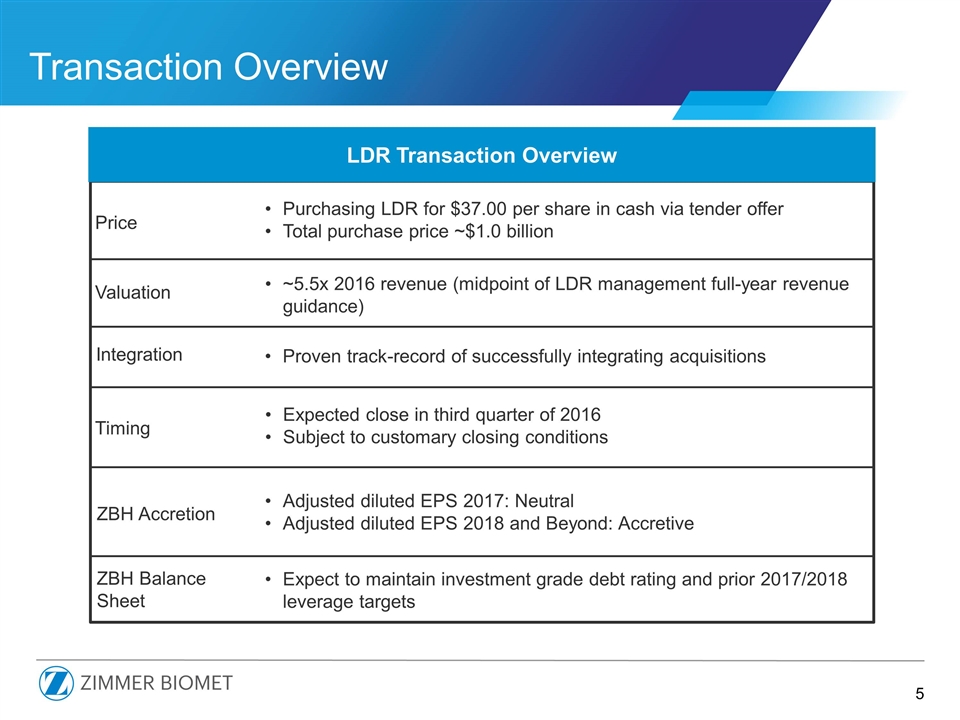

Purchasing LDR for $37.00 per share in cash via tender offer Total purchase price ~$1.0 billion Price ~5.5x 2016 revenue (midpoint of LDR management full-year revenue guidance) Valuation Expected close in third quarter of 2016 Subject to customary closing conditions Timing Adjusted diluted EPS 2017: Neutral Adjusted diluted EPS 2018 and Beyond: Accretive ZBH Accretion Expect to maintain investment grade debt rating and prior 2017/2018 leverage targets ZBH Balance Sheet Transaction Overview Integration Proven track-record of successfully integrating acquisitions LDR Transaction Overview

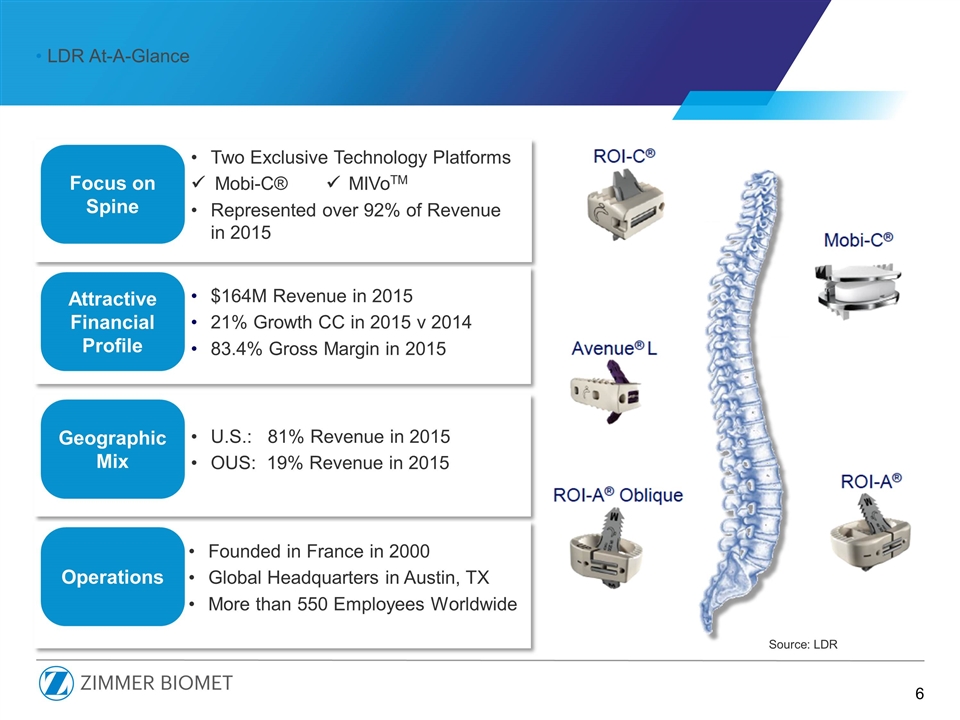

Overall Trial Success Through 5 Years Focus on Spine Two Exclusive Technology Platforms ü Mobi-C® ü MIVoTM Represented over 92% of Revenue in 2015 Attractive Financial Profile $164M Revenue in 2015 21% Growth CC in 2015 v 2014 83.4% Gross Margin in 2015 Geographic Mix U.S.: 81% Revenue in 2015 OUS: 19% Revenue in 2015 Operations Founded in France in 2000 Global Headquarters in Austin, TX More than 550 Employees Worldwide LDR At-A-Glance Source: LDR

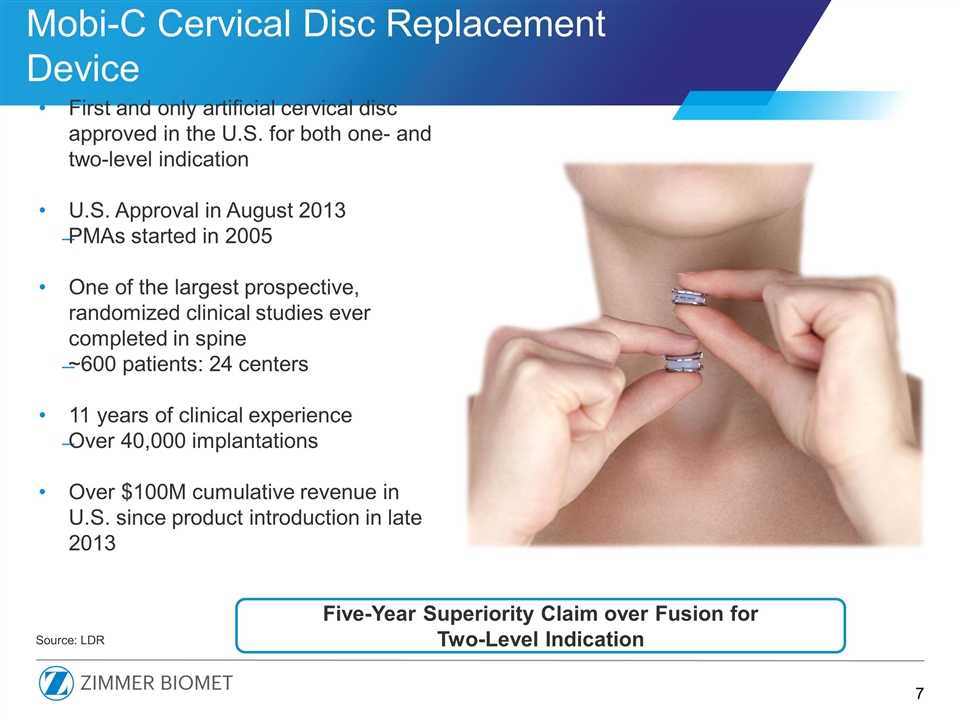

Mobi-C Cervical Disc Replacement Device First and only artificial cervical disc approved in the U.S. for both one- and two-level indication U.S. Approval in August 2013 PMAs started in 2005 One of the largest prospective, randomized clinical studies ever completed in spine ~600 patients: 24 centers 11 years of clinical experience Over 40,000 implantations Over $100M cumulative revenue in U.S. since product introduction in late 2013 Five-Year Superiority Claim over Fusion for Two-Level Indication Source: LDR

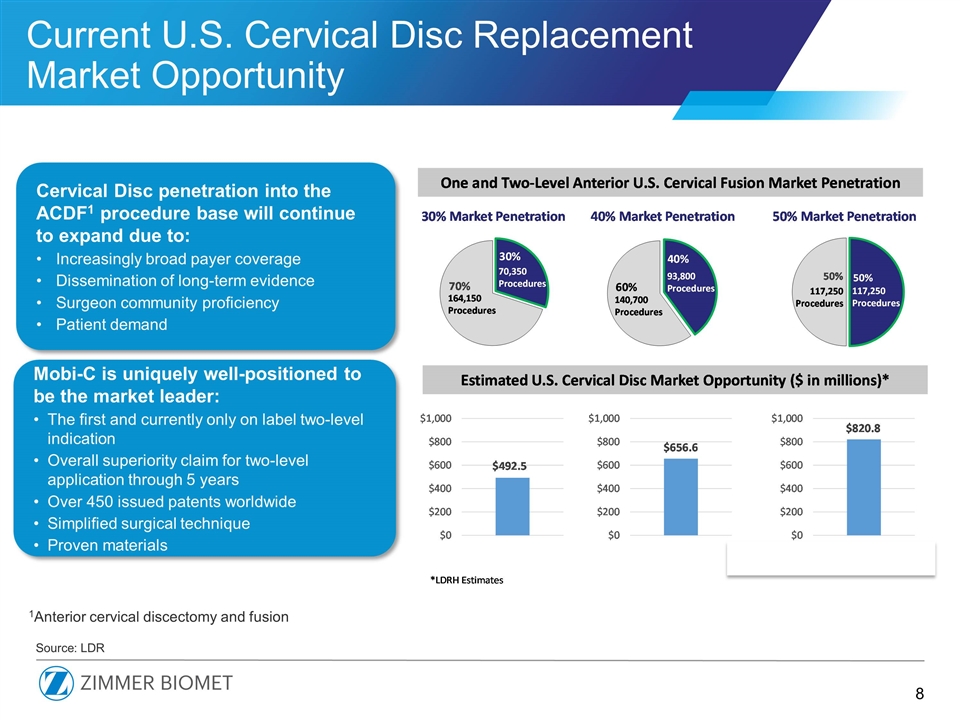

Current U.S. Cervical Disc Replacement Market Opportunity Mobi-C is uniquely well-positioned to be the market leader: The first and currently only on label two-level indication Overall superiority claim for two-level application through 5 years Over 450 issued patents worldwide Simplified surgical technique Proven materials Cervical Disc penetration into the ACDF1 procedure base will continue to expand due to: Increasingly broad payer coverage Dissemination of long-term evidence Surgeon community proficiency Patient demand Source: LDR 1Anterior cervical discectomy and fusion

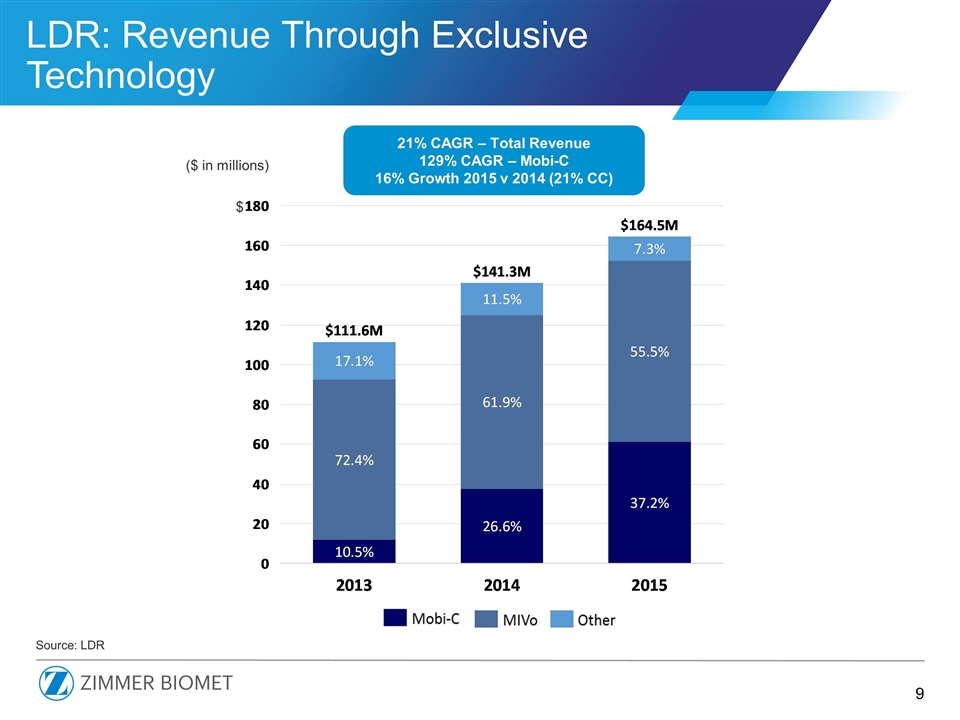

LDR: Revenue Through Exclusive Technology 21% CAGR – Total Revenue 129% CAGR – Mobi-C 16% Growth 2015 v 2014 (21% CC) Source: LDR ($ in millions) $

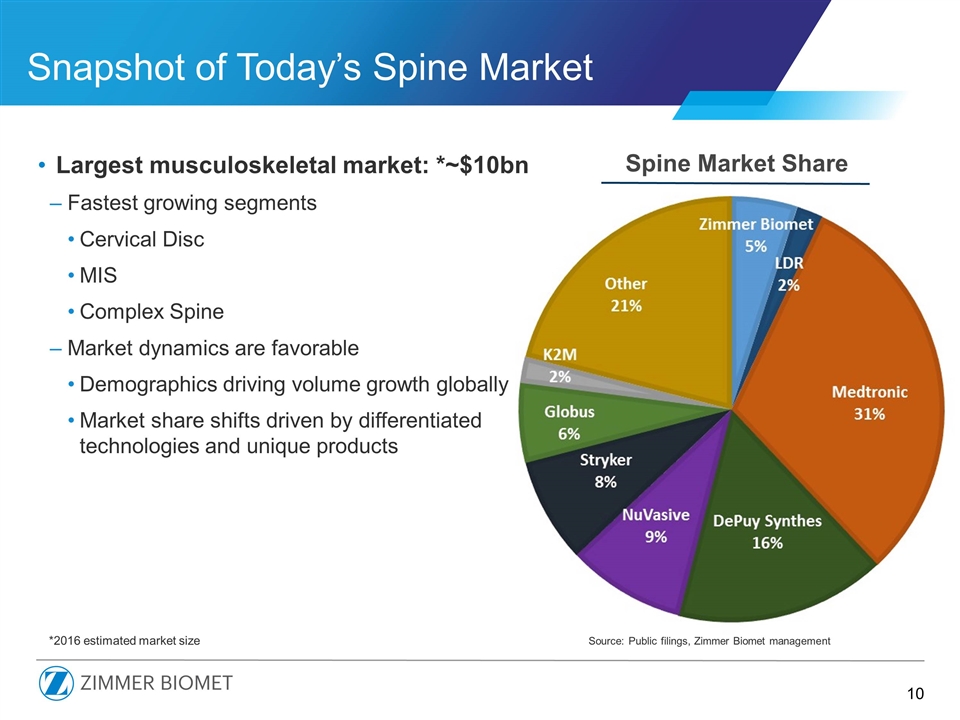

Largest musculoskeletal market: *~$10bn Fastest growing segments Cervical Disc MIS Complex Spine Market dynamics are favorable Demographics driving volume growth globally Market share shifts driven by differentiated technologies and unique products Snapshot of Today’s Spine Market Spine Market Share Source: Public filings, Zimmer Biomet management *2016 estimated market size

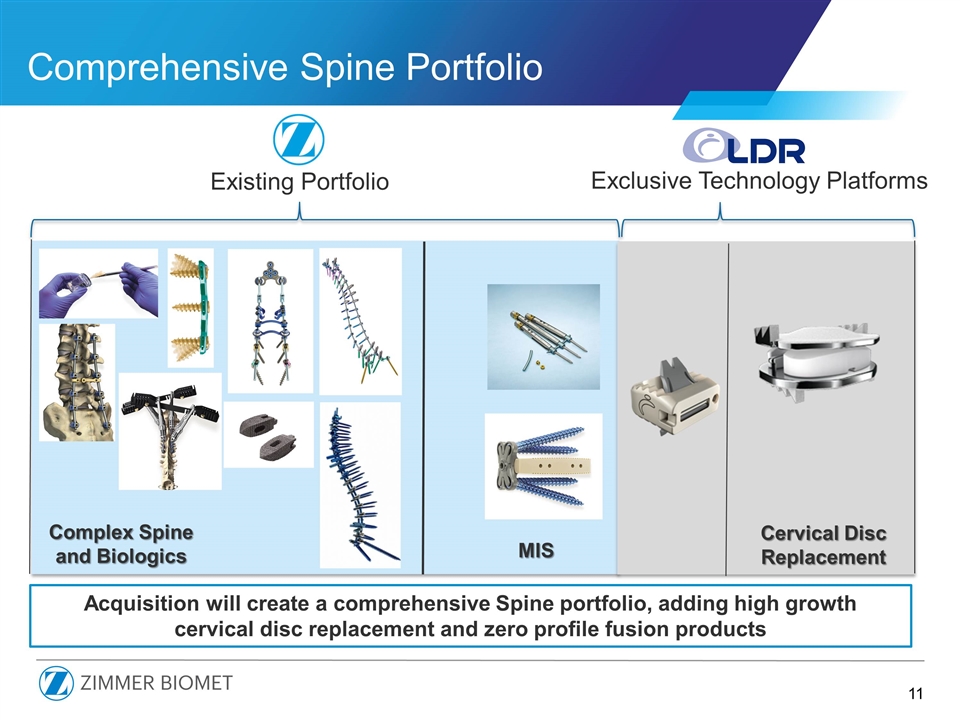

Comprehensive Spine Portfolio Acquisition will create a comprehensive Spine portfolio, adding high growth cervical disc replacement and zero profile fusion products Complex Spine and Biologics MIS Cervical Disc Replacement Exclusive Technology Platforms Existing Portfolio

Financial Summary Accelerates top-line growth with sustainable differentiated platform in Spine, the largest musculoskeletal market Prudent use of cash and new borrowing under revolving credit facility to fund the transaction – expect to launch debt offering in Q3 to repay credit facility Expect to maintain investment grade credit rating Reiterate 2016 pro-forma, constant currency revenue growth guidance of 2.0%-3.0% (1.0%-2.0% reported), with LDR revenue incremental Reiterate 2016 adjusted diluted EPS guidance of $7.85 - $8.00 Transaction is neutral to adjusted diluted EPS in 2017 and accretive thereafter

Transaction Summary Highly strategic and complementary acquisition that strengthens one of Zimmer Biomet’s key franchises: Spine Accelerated growth in the $10 billion Spine market, enabling Zimmer Biomet to gain a leading position in its fastest growing segment Creates comprehensive Spine portfolio with innovative surgical solutions that place Zimmer Biomet in an advantaged position to compete for large hospital vendor contracts Significant global opportunity for LDR products through Zimmer Biomet’s larger, global presence in both U.S. and key international markets Christophe Lavigne and Patrick Richard will remain with the Company in key leadership positions

Questions & Answers