Attached files

| file | filename |

|---|---|

| 8-K - 8-K - BASIC ENERGY SERVICES, INC. | a8-kforinvestorpresentatio.htm |

NYSE: BAS Bank of America Merrill Lynch Energy Credit Conference New York, NY June 7, 2016 OUR LIFE’S WORK IS THE LIFE OF THE WELLTM

Forward-Looking Statements This presentation contains forward-looking statements. Basic has based these forward-looking statements largely on its current expectations and projections about future events and financial trends affecting the financial condition of its business. These forward-looking statements are subject to a number of risks, uncertainties and assumptions, including, among other things, the risk factors discussed in this presentation and other factors, most of which are beyond Basic’s control. The words “believe,” “may,” “estimate,” “continue,” “anticipate,” “intend,” “plan,” “expect” and similar expressions are intended to identify forward-looking statements. All statements other than statements of current or historical fact contained in this presentation are forward-looking statements. Although Basic believes that the forward-looking statements contained in this presentation are based upon reasonable assumptions, the forward-looking events and circumstances discussed in this presentation may not occur and actual results could differ materially from those anticipated or implied in the forward-looking statements. Important factors that may affect Basic’s expectations, estimates or projections include: a decline in or substantial volatility of oil and gas prices, and any related changes in expenditures by its customers; the effects of future acquisitions on its business; changes in customer requirements in markets or industries it serves; competition within its industry; general economic and market conditions; its access to current or future financing arrangements; its ability to replace or add workers at economic rates; and environmental and other governmental regulations. Additional important risk factors that could cause actual results to differ materially from expectations are disclosed in Item 1A of Basic’s Form 10-K for the year ended December 31, 2015 and subsequent Form 10-Q’s filed with the SEC. While Basic makes these statements and projections in good faith, neither Basic nor its management can guarantee that the transactions will be consummated or that anticipated future results will be achieved. Basic’s forward-looking statements speak only as of the date of this presentation. Unless otherwise required by law, Basic undertakes no obligation to publicly update or revise any forward-looking statements, whether as a result of new information, future events or otherwise.

Proven Growth Strategy Basic Energy Services supports its customers’ well site activities from cradle to grave Diversified service offering poised for future growth opportunities The right fleet, the right people and operations in the right basins to support long-term shareholder returns Our Life’s Work is the Life of the Well TM

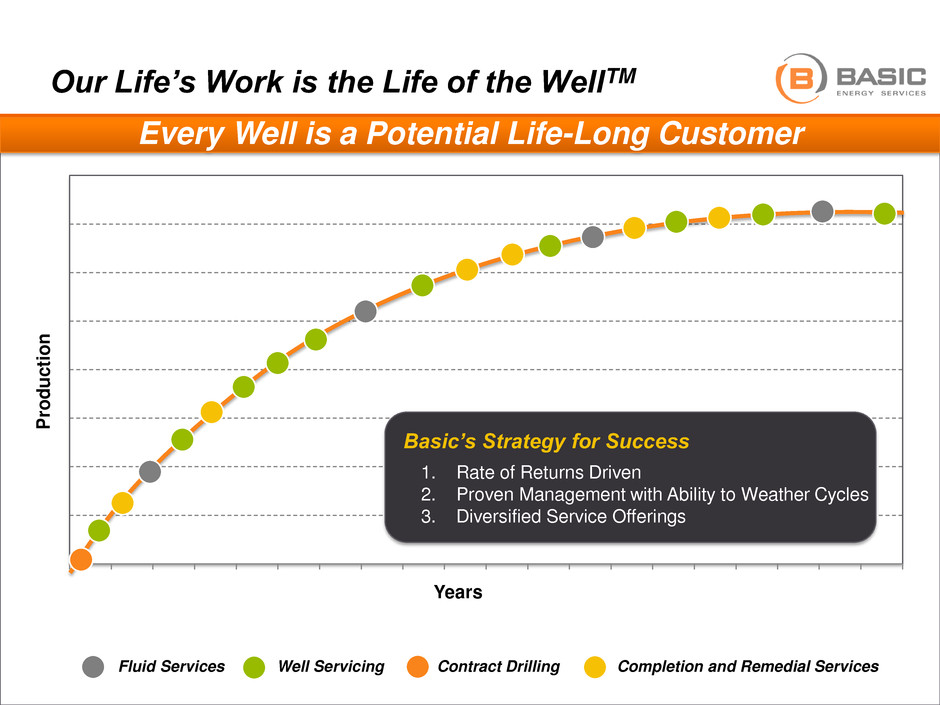

Years Pr o d u cti o n Our Life’s Work is the Life of the WellTM Every Well is a Potential Life-Long Customer Basic’s Strategy for Success 1. Rate of Returns Driven 2. Proven Management with Ability to Weather Cycles 3. Diversified Service Offerings BAS Service Segments Fluid Services Well Servicing Contract Drilling Completion and Remedial Services

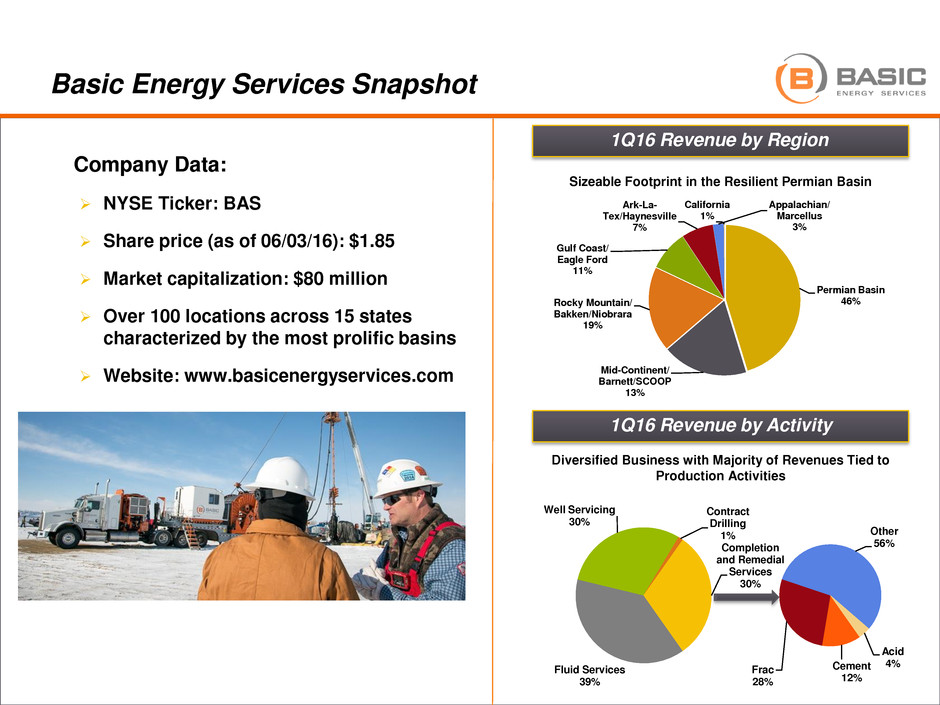

Company Data: NYSE Ticker: BAS Share price (as of 06/03/16): $1.85 Market capitalization: $80 million Over 100 locations across 15 states characterized by the most prolific basins Website: www.basicenergyservices.com Basic Energy Services Snapshot 1Q16 Revenue by Region 1Q16 Revenue by Activity Permian Basin 46% Mid-Continent/ Barnett/SCOOP 13% Rocky Mountain/ Bakken/Niobrara 19% Gulf Coast/ Eagle Ford 11% Ark-La- Tex/Haynesville 7% Appalachian/ Marcellus 3% California 1% Fluid Services 39% Well Servicing 30% Contract Drilling 1% Cement 12% Frac 28% Other 56% Acid 4% Completion and Remedial Services 30% Sizeable Footprint in the Resilient Permian Basin Diversified Business with Majority of Revenues Tied to Production Activities

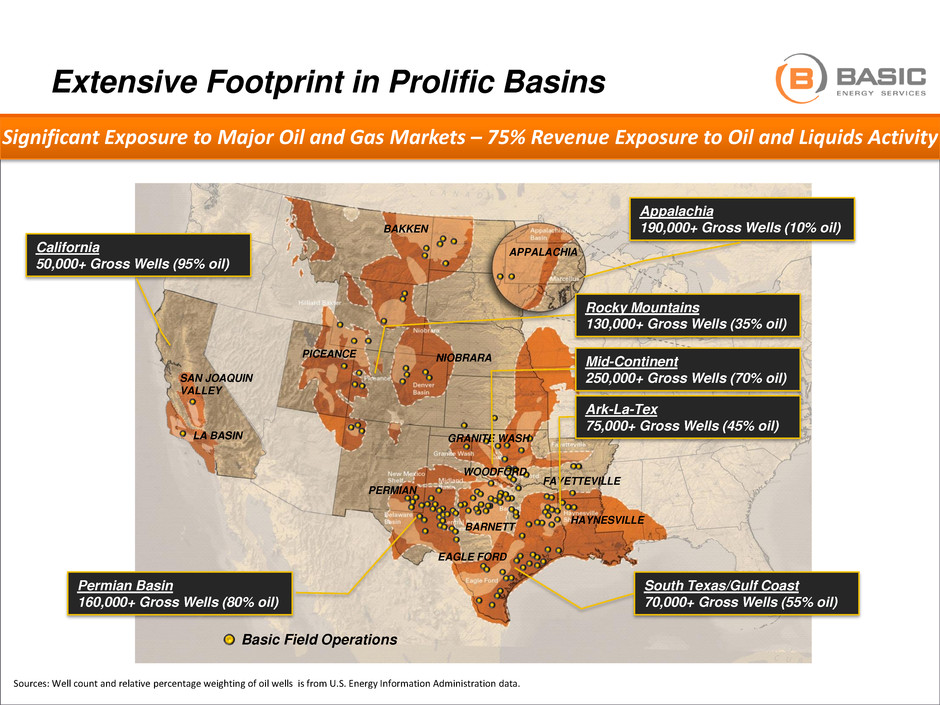

Sources: Well count and relative percentage weighting of oil wells is from U.S. Energy Information Administration data. Significant Exposure to Major Oil and Gas Markets – 75% Revenue Exposure to Oil and Liquids Activity Rocky Mountains 130,000+ Gross Wells (35% oil) Appalachia 190,000+ Gross Wells (10% oil) South Texas/Gulf Coast 70,000+ Gross Wells (55% oil) Permian Basin 160,000+ Gross Wells (80% oil) Extensive Footprint in Prolific Basins BAKKEN Basic Field Operations NIOBRARA PICEANCE PERMIAN APPALACHIA EAGLE FORD BARNETT HAYNESVILLE FAYETTEVILLE GRANITE WASH WOODFORD Mid-Continent 250,000+ Gross Wells (70% oil) Ark-La-Tex 75,000+ Gross Wells (45% oil) LA BASIN SAN JOAQUIN VALLEY California 50,000+ Gross Wells (95% oil)

How We Manage Through Cycles Upcycle Downcycle • Invest in new equipment • Expand into new markets • Maximize utilization to increase market share • Develop new service offerings • Match Capex to cash flow • Maximize utilization to protect market share • Right-size workforce and cost structure • Protect liquidity and extend runway Steps Taken to React to Lower Customer Spending • Optimizing infrastructure and operational efficiencies • 2016 capex to be lower than $40 million • Improve balance sheet and create shareholder value

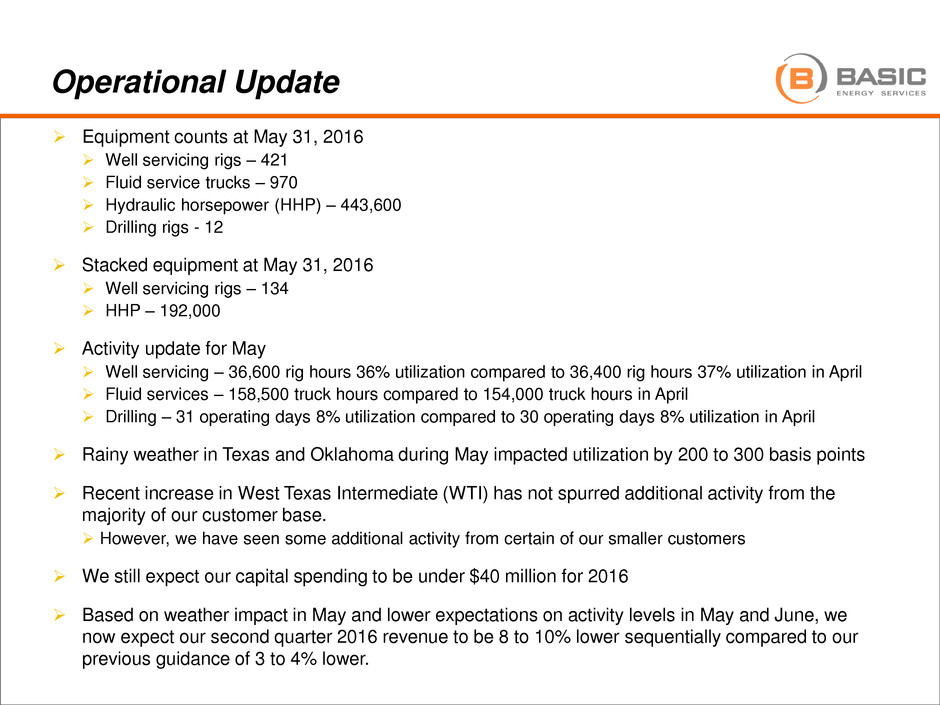

8 Operational Update Equipment counts at May 31, 2016 Well servicing rigs – 421 Fluid service trucks – 970 Hydraulic horsepower (HHP) – 443,600 Drilling rigs - 12 Stacked equipment at May 31, 2016 Well servicing rigs – 134 HHP – 192,000 Activity update for May Well servicing – 36,600 rig hours 36% utilization compared to 36,400 rig hours 37% utilization in April Fluid services – 158,500 truck hours compared to 154,000 truck hours in April Drilling – 31 operating days 8% utilization compared to 30 operating days 8% utilization in April Rainy weather in Texas and Oklahoma during May impacted utilization by 200 to 300 basis points Recent increase in West Texas Intermediate (WTI) has not spurred additional activity from the majority of our customer base. However, we have seen some additional activity from certain of our smaller customers We still expect our capital spending to be under $40 million for 2016 Based on weather impact in May and lower expectations on activity levels in May and June, we now expect our second quarter 2016 revenue to be 8 to 10% lower sequentially compared to our previous guidance of 3 to 4% lower.

0% 10% 20% 30% 40% 50% 60% $0 $10 $20 $30 $40 $50 $60 $70 $80 $90 1 Q 0 4 3 Q 1 Q 0 5 3 Q 1 Q 0 6 3 Q 1 Q 0 7 3 Q 1 Q 0 8 3 Q 1 Q 0 9 3 Q 1 Q 1 0 3 Q 1 Q 1 1 3 Q 1 Q 1 2 3 Q 1 Q 1 3 3 Q 1 Q 1 4 3 Q 1 Q 1 5 3 Q 1 Q 1 6 Segment Profits Gross Profit Gross Margin Specialized Completion & Remedial Services Support drilling, workover and production processes Pumping services for cementing, acidizing, squeeze-cementing (workover), fracturing and re-fracturing activities Fishing tools and rental equipment for drilling and workover processes Snubbing services to allow “live-well” completion and workover operations Coil tubing and nitrogen services for completion, remedial and P&A applications $0 $50 $100 $150 $200 $250 1 Q 0 4 3 Q 1 Q 0 5 3 Q 1 Q 0 6 3 Q 1 Q 0 7 3 Q 1 Q 0 8 3 Q 1 Q 0 9 3 Q 1 Q 1 0 3 Q 1 Q 1 1 3 Q 1 Q 1 2 3 Q 1 Q 1 3 3 Q 1 Q 1 4 3 Q 1 Q 1 5 3 Q 1 Q 1 6 Revenue M ill io n s M ill io n s Focused on Markets Traditionally Underserved by Larger Competitors

0% 5% 10% 15% 20% 25% 30% 35% 40% 45% $0 $5 $10 $15 $20 $25 $30 $35 $40 1 Q 0 4 3 Q 1 Q 0 5 3 Q 1 Q 0 6 3 Q 1 Q 0 7 3 Q 1 Q 0 8 3 Q 1 Q 0 9 3 Q 1 Q 1 0 3 Q 1 Q 1 1 3 Q 1 Q 1 2 3 Q 1 Q 1 3 3 Q 1 Q 1 4 3 Q 1 Q 1 5 3 Q 1 Q 1 6 Segment Profits Gross Profit Gross Margin Fluid Services Transportation and disposal of salt water produced as a by-product of oil and gas production Sale, transportation, storage and disposal of fluids used in fracturing, workover and drilling activity Rental of portable frac and test tanks used in fracturing, workover, drilling and industrial applications Oilfield wastewater (state-regulated, non- hazardous) disposal wellsazardous) disposal wells $0 $20 $40 $60 $80 $100 $120 1 Q 0 4 3 Q 1 Q 0 5 3 Q 1 Q 0 6 3 Q 1 Q 0 7 3 Q 1 Q 0 8 3 Q 1 Q 0 9 3 Q 1 Q 1 0 3 Q 1 Q 1 1 3 Q 1 Q 1 2 3 Q 1 Q 1 3 3 Q 1 Q 1 4 3 Q 1 Q 1 5 3 Q 1 Q 1 6 Revenue Basic’s Integrated Fluid Service Business Anchored by Expansive SWD Network M ill io n s M ill io n s Permian Basin 49% Rocky Mtns. 14% Mid- Continent 7% Gulf Coast 15% Ark-La-Tex 15% 970 Trucks by Market Area

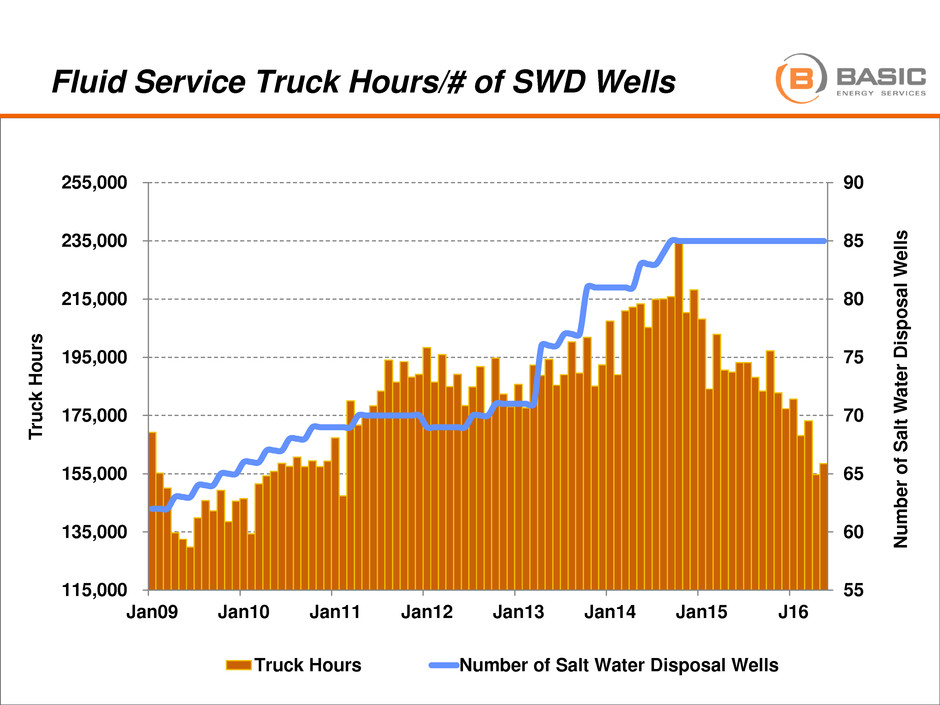

Fluid Service Truck Hours/# of SWD Wells 115,000 135,000 155,000 175,000 195,000 215,000 235,000 255,000 Jan09 Jan10 Jan11 Jan12 Jan13 Jan14 Jan15 J16 55 60 65 70 75 80 85 90 T ru ck H o u rs N u m b e r o f Sa lt W ate r D is p o sa l W e ll s Truck Hours Number of Salt Water Disposal Wells

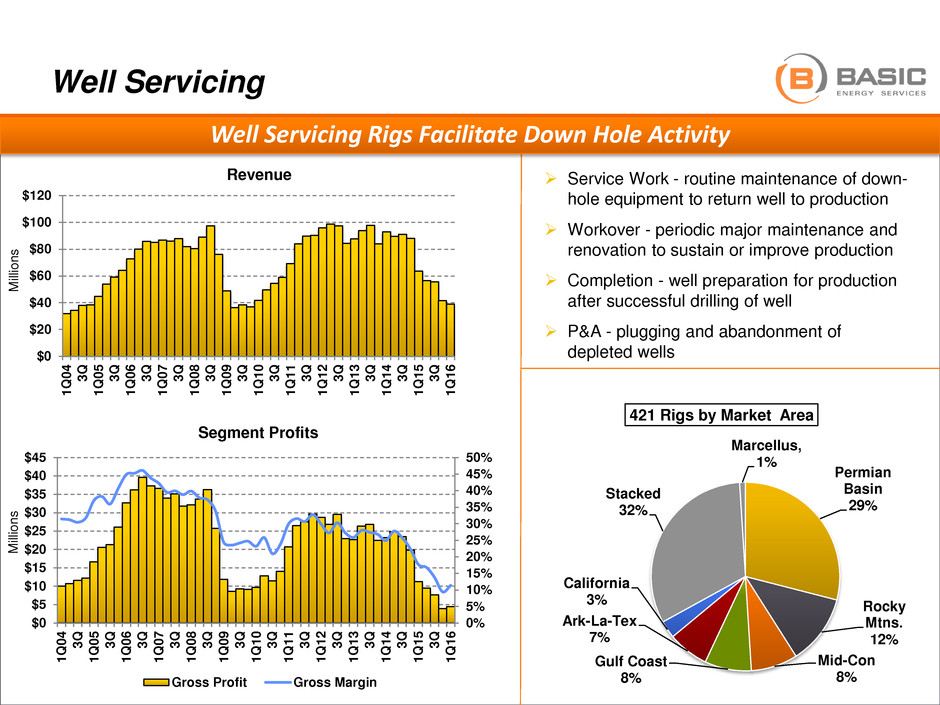

Permian Basin 29% Rocky Mtns. 12% Mid-Con 8% Gulf Coast 8% Ark-La-Tex 7% California 3% Stacked 32% Marcellus, 1% 421 Rigs by Market Area Well Servicing Service Work - routine maintenance of down- hole equipment to return well to production Workover - periodic major maintenance and renovation to sustain or improve production Completion - well preparation for production after successful drilling of well P&A - plugging and abandonment of depleted wells $0 $20 $40 $60 $80 $100 $120 1 Q 0 4 3 Q 1 Q 0 5 3 Q 1 Q 0 6 3 Q 1 Q 0 7 3 Q 1 Q 0 8 3 Q 1 Q 0 9 3 Q 1 Q 1 0 3 Q 1 Q 1 1 3 Q 1 Q 1 2 3 Q 1 Q 1 3 3 Q 1 Q 1 4 3 Q 1 Q 1 5 3 Q 1 Q 1 6 Revenue 0% 5% 10% 15% 20% 25% 30% 35% 40% 45% 50% $0 $5 $10 $15 $20 $25 $30 $35 $40 $45 1 Q 0 4 3 Q 1 Q 0 5 3 Q 1 Q 0 6 3 Q 1 Q 0 7 3 Q 1 Q 0 8 3 Q 1 Q 0 9 3 Q 1 Q 1 0 3 Q 1 Q 1 1 3 Q 1 Q 1 2 3 Q 1 Q 1 3 3 Q 1 Q 1 4 3 Q 1 Q 1 5 3 Q 1 Q 1 6 Segment Profits Gross Profit Gross Margin Well Servicing Rigs Facilitate Down Hole Activity M ill io n s M ill io n s

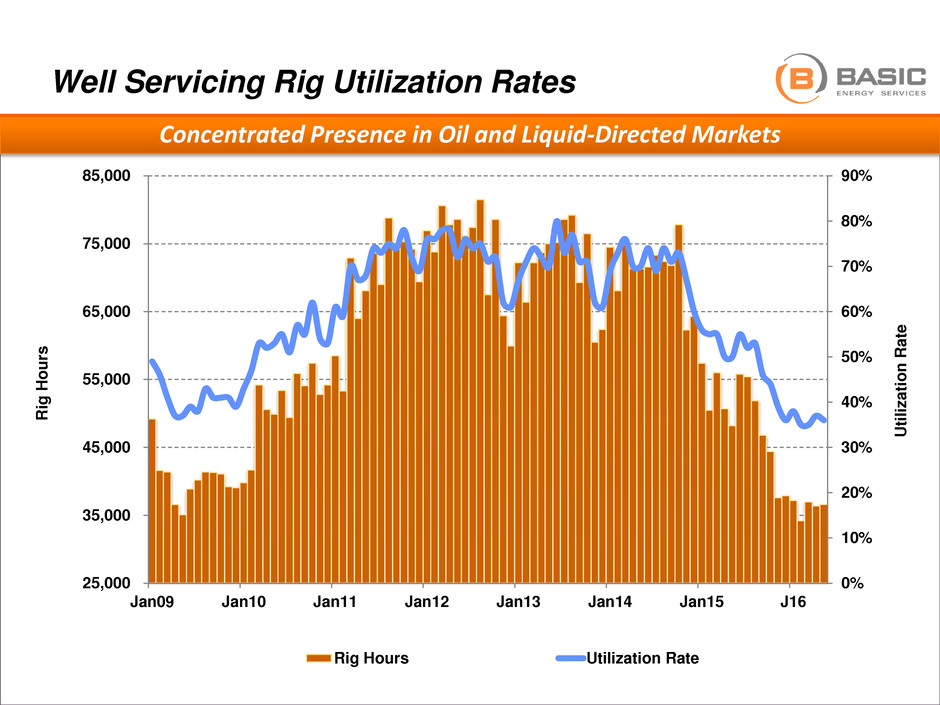

Well Servicing Rig Utilization Rates Concentrated Presence in Oil and Liquid-Directed Markets 25,000 35,000 45,000 55,000 65,000 75,000 85,000 Jan09 Jan10 Jan11 Jan12 Jan13 Jan14 Jan15 J16 0% 10% 20% 30% 40% 50% 60% 70% 80% 90% Rig Hour s U ti liz a tion R a te Rig Hours Utilization Rate

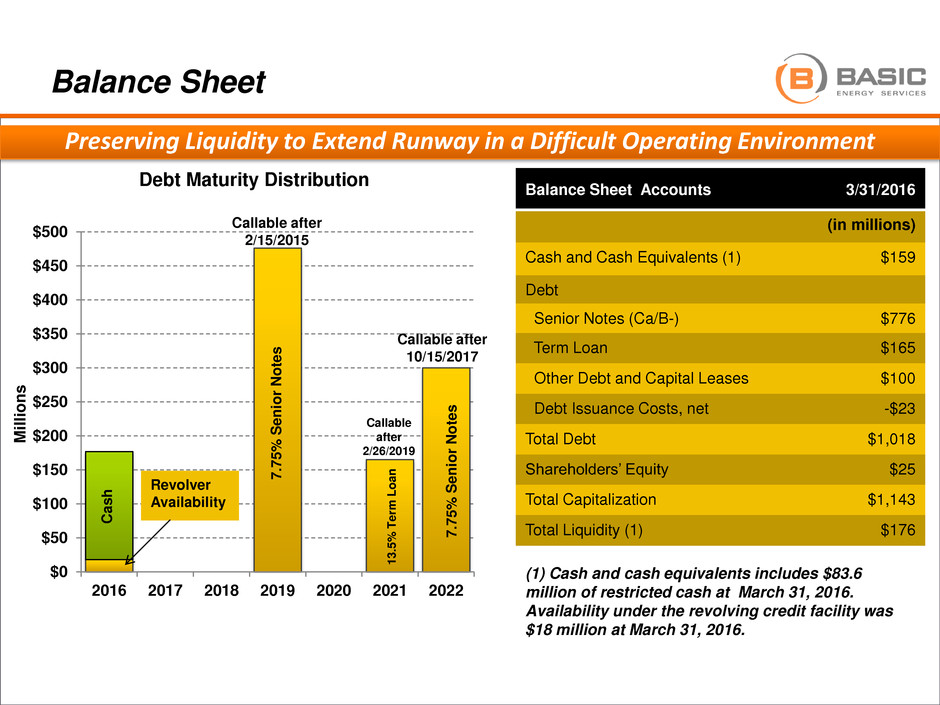

Balance Sheet $0 $50 $100 $150 $200 $250 $300 $350 $400 $450 $500 2016 2017 2018 2019 2020 2021 2022 Debt Maturity Distribution Revolver Availability 1 3 .5 % T e rm L o a n 7.75 % S e n ior N o te s M il li on s Preserving Liquidity to Extend Runway in a Difficult Operating Environment Balance Sheet Accounts 3/31/2016 (in millions) Cash and Cash Equivalents (1) $159 Debt Senior Notes (Ca/B-) $776 Term Loan $165 Other Debt and Capital Leases $100 Debt Issuance Costs, net -$23 Total Debt $1,018 Shareholders’ Equity $25 Total Capitalization $1,143 Total Liquidity (1) $176 7.75 % S e n ior N ote s Callable after 2/15/2015 Callable after 10/15/2017 C a s h Callable after 2/26/2019 (1) Cash and cash equivalents includes $83.6 million of restricted cash at March 31, 2016. Availability under the revolving credit facility was $18 million at March 31, 2016.

Back to Basics Diversified service offerings for both vertical and horizontal activity Returns driven through the cycles Operating in basins with high liquid yields and attractive economics Providing a safe work environment is a top priority Modern fleet matched to market needs Proven management team and local field leadership

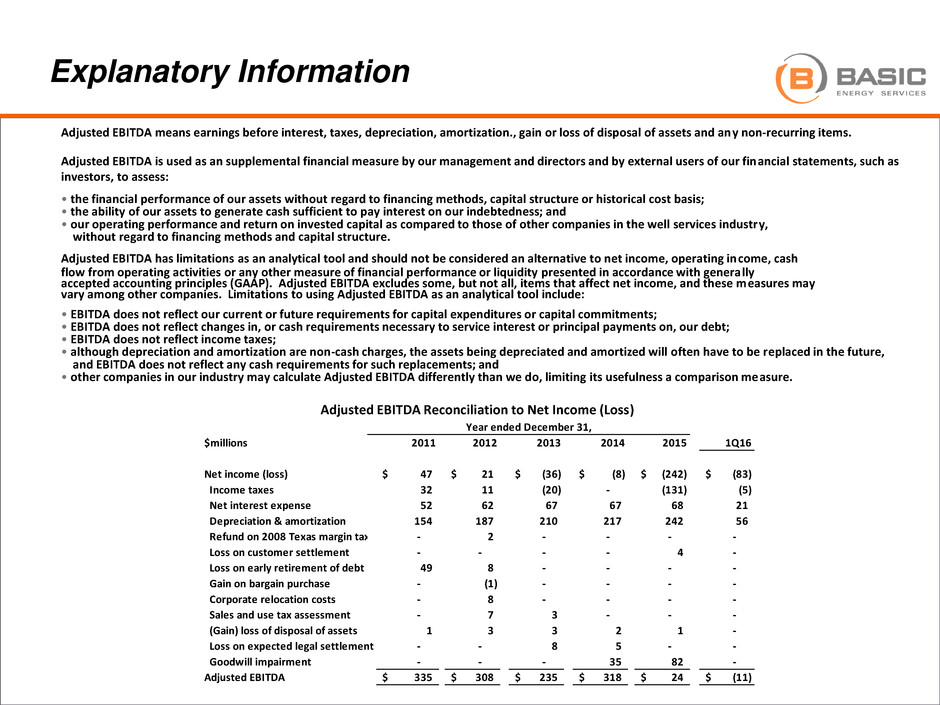

Explanatory Information Adjusted EBITDA means earnings before interest, taxes, depreciation, amortization., gain or loss of disposal of assets and any non-recurring items. Adjusted EBITDA is used as an supplemental financial measure by our management and directors and by external users of our financial statements, such as investors, to assess: • the financial performance of our assets without regard to financing methods, capital structure or historical cost basis; • the ability of our assets to generate cash sufficient to pay interest on our indebtedness; and • our operating performance and return on invested capital as compared to those of other companies in the well services industry, without regard to financing methods and capital structure. Adjusted EBITDA has limitations as an analytical tool and should not be considered an alternative to net income, operating income, cash flow from operating activities or any other measure of financial performance or liquidity presented in accordance with generally accepted accounting principles (GAAP). Adjusted EBITDA excludes some, but not all, items that affect net income, and these measures may vary among other companies. Limitations to using Adjusted EBITDA as an analytical tool include: • EBITDA does not reflect our current or future requirements for capital expenditures or capital commitments; • EBITDA does not reflect changes in, or cash requirements necessary to service interest or principal payments on, our debt; • EBITDA does not reflect income taxes; • although depreciation and amortization are non-cash charges, the assets being depreciated and amortized will often have to be replaced in the future, and EBITDA does not reflect any cash requirements for such replacements; and • other companies in our industry may calculate Adjusted EBITDA differently than we do, limiting its usefulness a comparison measure. Adjusted EBITDA Reconciliation to Net Income (Loss) $millions 2011 2012 2013 2014 2015 1Q16 Net income (loss) 47$ 21$ (36)$ (8)$ (242)$ (83)$ Income taxes 32 11 (20) - (131) (5) Net interest expense 52 62 67 67 68 21 Dep eci tion & ortization 154 187 210 217 242 56 Refu d o 2008 Texas margin taxes - 2 - - - - Los cus m r settlement - - - - 4 - L ss o rly retirement of debt 49 8 - - - - Gain o b rgain u chase - (1) - - - - Corpor relocation costs - 8 - - - - Sales and use tax assessment - 7 3 - - - (Gain) loss of disposal of assets 1 3 3 2 1 - Loss on expected legal settlement - - 8 5 - - Goodwill impairment - - - 35 82 - Adjusted EBITDA 335$ 308$ 235$ 318$ 24$ (11)$ Year ended December 31,