Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K INVESTOR PRESENTATION JUNE 2016 - SUN COMMUNITIES INC | form8-kinvestorpresentatio.htm |

INVESTOR PRESENTATION N A R E I T June 2016

Forward-looking Statements This presentation has been prepared for informational purposes only from information supplied by Sun Communities, Inc. (the "Company") and from third-party sources indicated herein. Such third-party information has not been independently verified. The Company makes no representation or warranty, expressed or implied, as to the accuracy or completeness of such information. This presentation contains various “forward-looking statements” within the meaning of the United States Securities Act of 1933, as amended, and the United States Securities Exchange Act of 1934, as amended, and we intend that such forward-looking statements will be subject to the safe harbors created thereby. For this purpose, any statements contained in this presentation that relate to expectations, beliefs, projections, future plans and strategies, trends or prospective events or developments and similar expressions concerning matters that are not historical facts are deemed to be forward-looking statements. Words such as “forecasts,” “intends,” “intend,” “intended,” “goal,” “estimate,” “estimates,” “expects,” “expect,” “expected,” “project,” “projected,” “projections,” “plans,” “predicts,” “potential,” “seeks,” “anticipates,” “anticipated,” “should,” “could,” “may,” “will,” “designed to,” “foreseeable future,” “believe,” “believes,” “scheduled,” “guidance” and similar expressions are intended to identify forward-looking statements, although not all forward looking statements contain these words. These forward-looking statements reflect our current views with respect to future events and financial performance, but involve known and unknown risks and uncertainties, both general and specific to the matters discussed in this presentation. These risks and uncertainties may cause our actual results to be materially different from any future results expressed or implied by such forward-looking statements. In addition to the risks disclosed under “Risk Factors” contained in our Annual Report on Form 10-K for the year ended December 31, 2015, and our other filings with the Securities and Exchange Commission from time to time, such risks and uncertainties include: changes in general economic conditions, the real estate industry and the markets in which we operate; difficulties in our ability to evaluate, finance, complete and integrate acquisitions, developments and expansions successfully; our liquidity and refinancing demands; our ability to obtain or refinance maturing debt; our ability to maintain compliance with covenants contained in our debt facilities; availability of capital; our failure to maintain effective internal control over financial reporting and disclosure controls and procedures; increases in interest rates and operating costs, including insurance premiums and real property taxes; risks related to natural disasters; general volatility of the capital markets and the market price of shares of our capital stock; our failure to maintain our status as a REIT; changes in real estate and zoning laws and regulations; legislative or regulatory changes, including changes to laws governing the taxation of REITs; litigation, judgments or settlements; our ability to maintain rental rates and occupancy levels; competitive market forces; and the ability of manufactured home buyers to obtain financing and the level of repossessions by manufactured home lenders. Readers are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date the statement was made. We undertake no obligation to publicly update or revise any forward-looking statements included in this presentation, whether as a result of new information, future events, changes in our expectations or otherwise, except as required by law. Although we believe that the expectations reflected in the forward-looking statements are reasonable, we cannot guarantee future results, levels of activity, performance or achievements. All written and oral forward-looking statements attributable to us or persons acting on our behalf are qualified in their entirety by these cautionary statements.

Key Highlights Leading owner of premier manufactured housing and recreational vehicle communities Consistent organic growth through market cycles Sustained industry-leading earnings growth, with low capital requirements Proven consolidator of accretive portfolios Enhancing growth through expansions Conservative balance sheet Strategy-driven outperformance 3

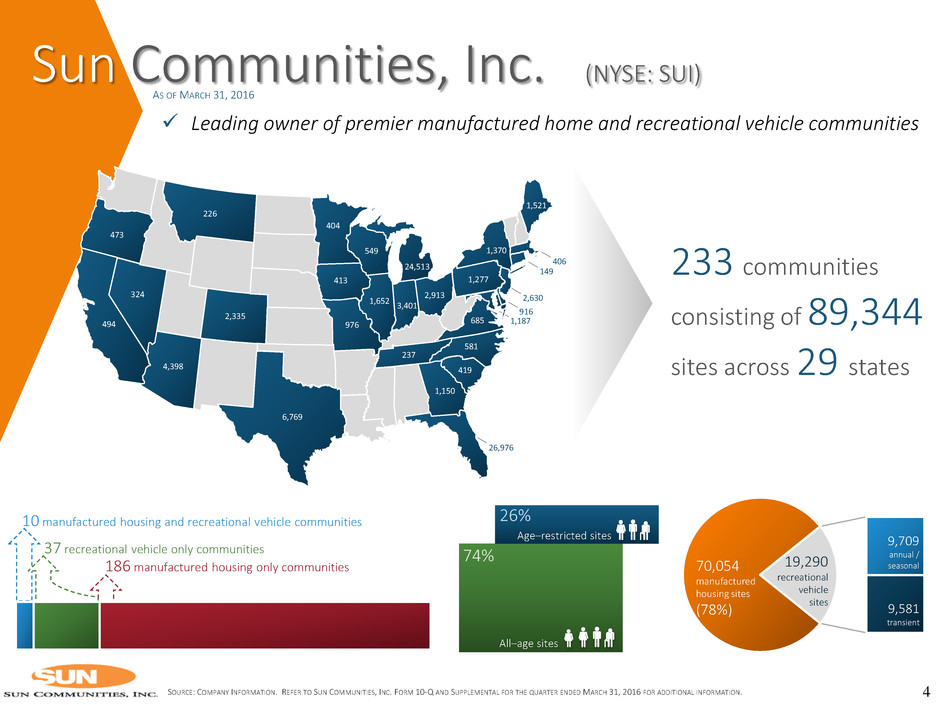

Sun Communities, Inc. (NYSE: SUI) 4 186 manufactured housing only communities 10 manufactured housing and recreational vehicle communities 37 recreational vehicle only communities 1,521 406 149 1,370 24,513 2,630 1,277 916 1,187 2,913 3,401 549 1,652 685 237 581 419 1,150 404 413 976 226 2,335 473 6,769 26,976 4,398 324 494 233 communities consisting of 89,344 sites across 29 states 70,054 manufactured housing sites (78%) 19,290 recreational vehicle sites 9,709 annual / seasonal 9,581 transient SOURCE: COMPANY INFORMATION. REFER TO SUN COMMUNITIES, INC. FORM 10-Q AND SUPPLEMENTAL FOR THE QUARTER ENDED MARCH 31, 2016 FOR ADDITIONAL INFORMATION. Leading owner of premier manufactured home and recreational vehicle communities AS OF MARCH 31, 2016 All–age sites Age–restricted sites 26% 74%

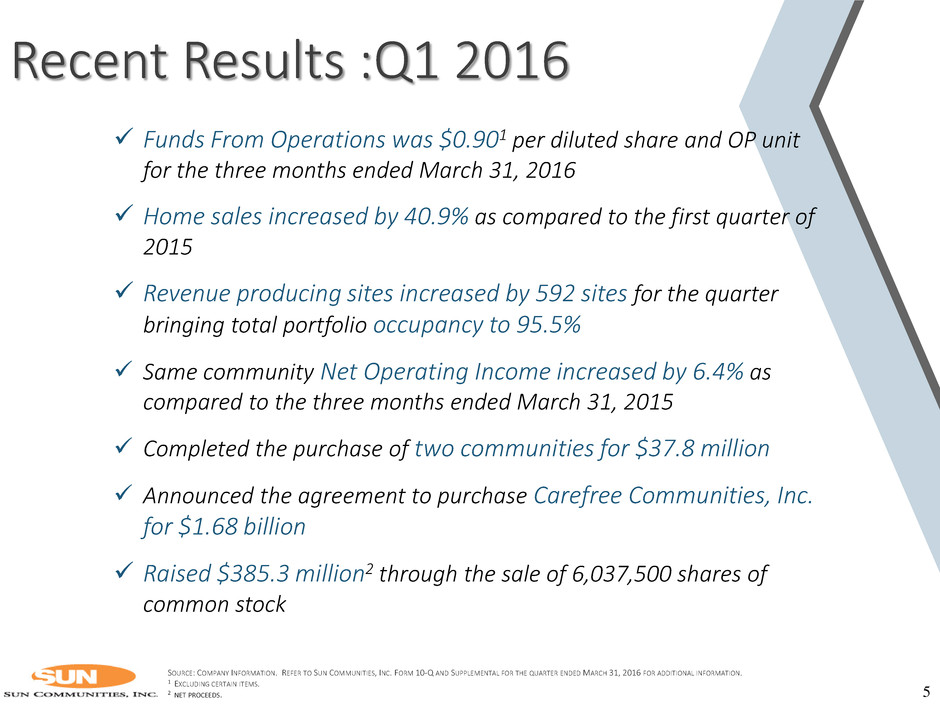

Recent Results :Q1 2016 5 Funds From Operations was $0.901 per diluted share and OP unit for the three months ended March 31, 2016 Home sales increased by 40.9% as compared to the first quarter of 2015 Revenue producing sites increased by 592 sites for the quarter bringing total portfolio occupancy to 95.5% Same community Net Operating Income increased by 6.4% as compared to the three months ended March 31, 2015 Completed the purchase of two communities for $37.8 million Announced the agreement to purchase Carefree Communities, Inc. for $1.68 billion Raised $385.3 million2 through the sale of 6,037,500 shares of common stock SOURCE: COMPANY INFORMATION. REFER TO SUN COMMUNITIES, INC. FORM 10-Q AND SUPPLEMENTAL FOR THE QUARTER ENDED MARCH 31, 2016 FOR ADDITIONAL INFORMATION. 1 EXCLUDING CERTAIN ITEMS. 2 NET PROCEEDS.

6 Consistent Organic Growth Low annual resident turnover results in stability of income and occupancy Strong and consistent rental growth creating a stable revenue stream Occupancy gains are a function of Sun’s integrated platform, including leasing, sales, and financing SOURCE: COMPANY INFORMATION. REFER TO SUN COMMUNITIES, INC. FORM 10-K AND SUPPLEMENTAL FOR THE RESPECTIVE YEARS ENDED SET FORTH ABOVE FOR ADDITIONAL INFORMATION. 0.7% 3.1% 3.6% 5.5% 5.9% 7.7% 9.1% 2009 2010 2011 2012 2013 2014 2015 Same Community NOI (change %) Same Community Occupancy 83.4% 84.3% 85.8% 86.7% 88.9% 93.2% 95.9% 2009 2010 2011 2012 2013 2014 2015 $404 $413 $425 $437 $445 $457 $472 2009 2010 2011 2012 2013 2014 2015 Monthly Same Community Rent (weighted average)

Strong Internal Growth 7 SUN’s average same community NOI growth has exceeded REIT industry average by 180 bps and apartment average by 160 bps over a 17 year period SOURCE: CITI INVESTMENT RESEARCH, APRIL, 2016. “REITS”- INCLUDES AN INDEX OF REITS ACROSS A VARIETY OF ASSET CLASSES INCLUDING SELF STORAGE, MIXED OFFICE, REGIONAL MALLS, SHOPPING CENTERS, MULTIFAMILY, STUDENT HOUSING, MANUFACTURED HOMES AND SPECIALTY. -8% -6% -4% -2% 0% 2% 4% 6% 8% 10% 12% 3Q 98 4Q 98 1Q 99 2Q 99 3Q 99 4Q 99 1Q 00 2Q 00 3Q 00 4Q 00 1Q 01 2Q 01 3Q 01 4Q 01 1Q 02 2Q 02 3Q 02 4Q 02 1Q 03 2Q 03 3Q 03 4Q 03 1Q 04 2Q 04 3Q 04 4Q 04 1Q 05 2Q 05 3Q 05 4Q 05 1Q 06 2Q 06 3Q 06 4Q 06 1Q 07 2Q 07 3Q 07 4Q 07 1Q 08 2Q 08 3Q 08 4Q 08 1Q 09 2Q 09 3Q 09 4Q 09 1Q 10 2Q 10 3Q 10 4Q 10 1Q 11 2Q 11 3Q 11 4Q 11 1Q 12 2Q 12 3Q 12 4Q 12 1Q 13 2Q 13 3Q 13 4Q 13 1Q 14 2Q 14 3Q 14 4Q 14 1Q 15 2Q 15 3Q 15 4Q 15 1Q 16 Sun Communities, Inc. Apartments Sun's Average (4.7%) Industry Average (2.9%) Apartment Average (3.1%) Same Community NOI (change %)

8 Stable Revenue with Low Capex Move-outs and Re-sales Stable and growing financial results driven by low turnover and tenure: The cost to move a home ranges between $4,000 and $10,000. This facilitates a low turnover of owner occupied sites Tenure of our residents in our communities is ~14 years1 Tenure of homes in our communities is over 40 years1 Capital Expenditures Manufactured housing is a low capex business relative to other asset classes as it is largely a land ownership business Capex as a percent of revenue2 Sun’s Percentage trends for manufactured homes and annual/seasonal RV’s No loss in revenue as home stays in the community Resident re-sales Home move-out 8.1% Overall Average 12.2% 8.8% 4.7% 3.6% Multi-family Student Housing Self-Storage Manufactured Housing 1 SOURCE: COMPANY INFORMATION. 5 YEAR AVERAGE. 2 SOURCE: COMPANY FILINGS. FOR THE YEAR ENDED DECEMBER 31, 2014. 4.9% 5.1% 4.7% 4.9% 4.6% 5.0% 5.9% 2.8% 2.3% 2.3% 2.5% 2.6% 2.6% 2.0% 2009 2010 2011 2012 2013 2014 2015

Extracting Value from Acquisitions 9 STRATEGIC ACQUISITIONS PROFESSIONAL OPERATIONAL MANAGEMENT CALL CENTER / DIGITAL MARKETING OUTREACH INCREASING MARKET RENT HOME SALES / RENTAL PROGRAM ADDING VALUE WITH EXPANSIONS REPOSITIONING WITH ADDITIONAL CAPEX SKILLED EXPENSE MANAGEMENT

Strategic Acquisitions 10 2011 2012 2013 2014 2015 2016 136 communities 54,811 sites 173 communities 63,697 sites 188 communities 69,789 sites 217 communities 79,554 sites 231 communities 88,612 sites • Further strengthened the MH portfolio with the 6 community Rudgate acquisition. • Acquired Palm Creek, an irreplaceable age restricted asset. • 17 MH and 1 RV community Kentland acquisition growing the portfolio. • Geographic and RV diversification with 10 RV resort Morgan acquisition entering 5 new states. • Closed 1st phase of “ALL” 59 high quality, age-restricted community acquisition, strengthening and diversifying the portfolio. • Final closing of “ALL” acquisition further enhancing the portfolio. • Acquired, for the year, 34 MH communities and 4 RV resorts. SOURCE: COMPANY INFORMATION. REFER TO SUN COMMUNITIES, INC. FORM 10-K AND SUPPLEMENTAL FOR THE RESPECTIVE YEARS ENDED SET FORTH ABOVE FOR ADDITIONAL INFORMATION. 1 EXCLUDES DISPOSED COMMUNITIES AND PROSPECTIVE CAREFREE ACQUISITION. Between Q2 2011 and Q1 2016, Sun has acquired communities valued in excess of $2.6 billion, increasing its number of sites and communities by 85%1 and 70%1, respectively 233 communities 89,344 sites • In Q1 acquired 1 MH community and 1 RV resort. • Entered into Carefree Communities acquisition agreement on March 22. The acquisition which will add 103 MH and RV communities and deepen Sun’s presence in key costal markets.

Acquisition Performance 11 83.4% 90.8% 92.5% 97.6% 98.5% YEAR 1 YEAR 2 YEAR 3 YEAR 4 YEAR 5 Occupancy $23.6M $26.0M $27.5M $29.3M $31.3M YEAR 1 YEAR 2 YEAR 3 YEAR 4 YEAR 5 Revenue NOI 2011 Acquisitions (26 COMMUNITIES) 2012 Acquisitions (11 COMMUNITIES) 91.4% 96.8% 97.1% 98.1% YEAR 1 YEAR 2 YEAR 3 YEAR 4 Occupancy $41.2M $44.8M $49.0M $53.3M YEAR 1 YEAR 2 YEAR 3 YEAR 4 Revenue NOI SOURCE: COMPANY INFORMATION. AS OF THE YEAR ENDED DECEMBER 31, 2015. 1 INCLUDES PARTIAL YEAR 2016 BUDGET. 1 1

Acquisition Performance RV Portfolio 12 $4.8M $5.9M $7.0M $8.5M YEAR 1 YEAR 2 YEAR 3 YEAR 4 Revenue NOI 2013 Morgan Acquisition (10 PROPERTIES) SOURCE: COMPANY INFORMATION. AS OF THE YEAR ENDED DECEMBER 31, 2015. 1 INCLUDES PARTIAL YEAR 2016 BUDGET. 1

Sun-N-Fun Sarasota, Florida Palos Verdes Shores San Pedro, California Sunset Harbor Key West, Florida Carefree Augments Sun’s Best-in-Class Portfolio High quality portfolio concentrated in prime coastal markets Increases size, scale and diversification Strong operating metrics and attractive growth Cost synergies and upside from integration with Sun’s platform 13 Sherkston Shores Ontario, Canada Sun-N-Fun Sarasota, Florida TRANSACTION IS EXPECTED TO CLOSE BY Q3 2016.

Carefree’s High Quality Portfolio 14 Age-Restricted Properties 52 communities 14,041 sites All-Age Properties 51 communities 13,513 sites Aggregate Portfolio 103 communities 27,554 sites Avg. Monthly Rent per MH Site $ 622 MH Occupancy 93.9% Number of States 8 Summary Statistics All -Age Age-Restricted 50.5% 49.5% All Age No. of FL Sites 5,643 No. of CA Sites 1,270 Age-Restricted No. of FL Sites 10,258 No. of CA Sites 3,615 Age-Restricted Concentration SOURCE: COMPANY INFORMATION. Geographic Exposure (by communities) FL (57%) CA (18%) Canada (15%) TX (4%) Other (6%)

Carefree Impact: Enhanced Scale, Geographic Footprint and Operating Metrics 15 Total Enterprise Value $7.045bn $1.699bn $8.744bn +24% Number of Communities 233 103 336 +44% Number of Sites 89,344 27,554 116,898 +31% Occupancy 96%3 97%3 97% Number of Expansion Sites 7,181 2,982 10,163 +42% Average Monthly Rent/ MH Site $488 4 $6224 $504 +3.4% PRE-TRANSACTION POST-TRANSACTION + = SOURCE: COMPANY FILINGS. 1 AS OF 3/31/2016. 2 CAREFREE AS OF 12/31/2015 3 OCCUPANCY DATA REFERS TOTAL PORTFOLIO MH AND RV, EXCLUDING TRANSIENT RV. 4 MONTHLY RENT PER SITE CALCULATED AS WEIGHTED AVERAGE MONTHLY RENT OF SAME COMMUNITY MH. 1 2

16 Carefree Impact: Increased Key Market Penetration 4,885 189 757 15,901 5,054 92 398 278 SUI will strengthen its presence in key, high-barrier markets with this acquisition CAREFREE PROPERTY ADDITIONS SUN COMMUNITIES PROPERTIES ONTARIO, CANADA FL 26,976 15,901 42,877 36.7% TX 6,769 757 7,526 6.4% CA 494 4,885 5,379 4.6% ON - 5,054 5,054 4.3% AZ 4,398 189 4,587 3.9% NJ 2,630 398 3,028 2.6% MA 406 278 684 0.6% NC 581 92 673 0.6% Other 47,090 - 47,090 40.3% TOTAL 89,344 27,554 116,898 100.0% POST-TRANSACTION PRE-TRANSACTION1 SOURCE: COMPANY INFORMATION. REFER TO SUN COMMUNITIES, INC. FORM 10-K AND SUPPLEMENTAL FOR THE QUARTER ENDED MARCH 31, 2016 FOR ADDITIONAL INFORMATION. 1 AS OF MARCH 31, 2016. 2 AS OF DECEMBER 31, 2015. 2

Expansions: 17 SOURCE: COMPANY INFORMATION. REFER TO SUN COMMUNITIES, INC. FORM 10-K AND SUPPLEMENTAL FOR THE YEAR ENDED DECEMBER 31, 2015 FOR ADDITIONAL INFORMATION. 1 BASED ON MOST RECENT ESTIMATION OF DEVELOPMENT COSTS AND EXPENSES AND ASSUMING A 6% CAP RATE EXITING IN FIVE YEARS. Inventory of over 7,100 (excludes 2,982 Carefree expansion sites) zoned and entitled sites available for expansion at 38 communities in 15 states 4,100 sites planned for development in the next 4 years Approximately 1,000 sites are expected to be developed by the end of 2016 Assuming a 100 site expansion at $25,000 per site, that is leased up in a year (8 sites/month), results in an unlevered return of 13%-15%1 Expanding in communities with strong demand evidenced by occupancy of ~95% Expansion lease-up is driven by sales, rental and relocation programs Strong Growth and Attractive Returns

Expansion Opportunities Supported by Rental Program 18 12.6% 13.5% 13.6% 14.0% 15.7% 15.6% 13.5% 70.8% 70.9% 71.7% 73.3% 74.0% 77.1% 81.6% 2009 2010 2011 2012 2013 2014 2015 Rental Occupancy Core Portfolio Occupancy 83.4% 84.3% 85.3% 87.3% 89.7% 92.6% 95.0% SOURCE: SUN’S DECEMBER 31, 2015 SUPPLEMENT 1 OPERATING EXPENSES INCLUDE REPAIRS AND REFURBISHMENT, TAXES AND INSURANCE, MARKETING, AND COMMISSIONS. Rental Program All-in 5 Year Unleveraged IRR: $42,000 Initial investment in new home Weighted average monthly rental rate $865 x 12 = $10,380 (3% annual increases) Monthly operating expenses1 $250 x 12 = $3,000 (2% annual increases) End of 5 year period sell the home and recoup > 95% of original purchase price All-in 5 year unlevered IRR is 15% -16% DRIVES OCCUPANCY SHOWCASES OUR COMMUNITIES KEY ONBOARDING AND CONVERSION TOOL

19 Net Debt / Total Enterprise Value2 Strong balance sheet management supported by consistently strong operations has led SUN to improving metrics Net Debt / Adjusted EBITDA1 Fixed Debt Percentage SOURCE: COMPANY INFORMATION. REFER TO SUN COMMUNITIES, INC. FORM 10-K AND SUPPLEMENTAL FOR THE RESPECTIVE YEAR ENDED AS WELL AS FORM 10-Q AND SUPPLEMENTAL FOR THE QUARTER ENDED MARCH 31, 2016 FOR ADDITIONAL INFORMATION. 1 THE COVERAGE RATIOS ARE CALCULATED USING THE TRAILING 12 MONTHS FOR THE PERIOD ENDED 3/31/2016 AND ADJUSTED TO EXCLUDE: DEPRECIATION AND AMORTIZATION; INCOME TAXES; INTEREST EXPENSE; TRANSACTION COSTS; EXTINGUISHMENT OF DEBT; DISTRIBUTIONS FROM AFFILIATES; GAIN ON DISPOSITIONS; AND GAIN ON SETTLEMENT. TTM 2016 HAS BEEN IMPACTED BY THE EQUITY RAISE IN ANTICIPATION OF THE CAREFREE ACQUISITION. 2 TOTAL ENTERPRISE VALUE INCLUDES COMMON SHARES OUTSTANDING (PER SUPPLEMENTAL DATA PACKAGE), OP UNITS AND PREFERRED OP UNITS, AS CONVERTED, OUTSTANDING AT THE END OF EACH RESPECTIVE PERIOD. Conservative Balance Sheet 76.9% 84.7% 76.9% 90.8% 92.0% 90.7% 2011 2012 2013 2014 2015 2016 2.4x 2.4x 2.7x 3.0x 3.1x 3.1x 2011 2012 2013 2014 2015 TTM 2016 9.7x 8.4x 7.2x 7.3x 6.6x 5.5x 2011 2012 2013 2014 2015 TTM 2016 61.5% 50.4% 45.8% 34.8% 34.0% 27.7% 2011 2012 2013 2014 2015 TTM 2016

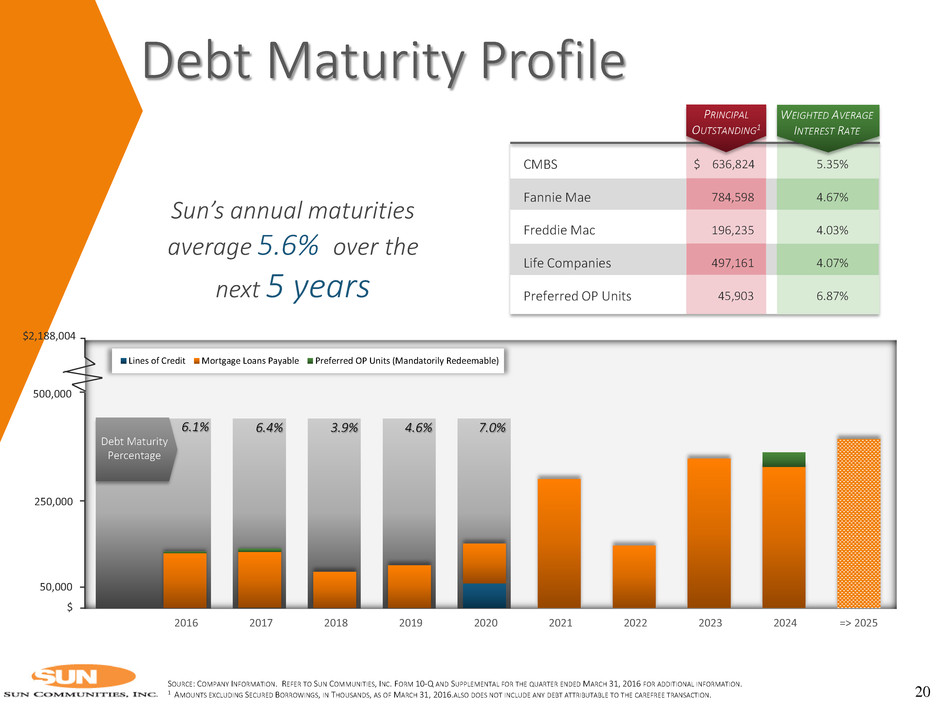

$ Debt Maturity Profile 20 SOURCE: COMPANY INFORMATION. REFER TO SUN COMMUNITIES, INC. FORM 10-Q AND SUPPLEMENTAL FOR THE QUARTER ENDED MARCH 31, 2016 FOR ADDITIONAL INFORMATION. 1 AMOUNTS EXCLUDING SECURED BORROWINGS, IN THOUSANDS, AS OF MARCH 31, 2016.ALSO DOES NOT INCLUDE ANY DEBT ATTRIBUTABLE TO THE CAREFREE TRANSACTION. 2016 2017 2018 2019 2020 2021 2022 2023 2024 => 2025 Lines of Credit Mortgage Loans Payable Preferred OP Units (Mandatorily Redeemable) $2,188,004 Debt Maturity Percentage 6.1% 500,000 50,000 250,000 6.4% 3.9% 4.6% 7.0% Sun’s annual maturities average 5.6% over the next 5 years WEIGHTED AVERAGE INTEREST RATE CMBS $ 636,824 5.35% Fannie Mae 784,598 4.67% Freddie Mac 196,235 4.03% Life Companies 497,161 4.07% Preferred OP Units 45,903 6.87% PRINCIPAL OUTSTANDING1

Strategy Driven Outperformance 21 275% 262% 181% 177% 175% 172% 155% 0% 50% 100% 150% 200% 250% 300% SUI SNL US REIT Manufactured Homes S&P 500 SNL US REIT Equity MSCI US REIT (RMS) S&P Small-Cap Russell 2000 5-year Total Returns by Index1 Sun has outperformed many major REIT and broader market indices over the last five years SOURCE: SNL 1 AS OF DECEMBER 31, 2015.

Key Highlights Leading owner of premier manufactured housing and recreational vehicle communities Consistent organic growth through market cycles Sustained industry-leading earnings growth, with low capital requirements Proven consolidator of accretive portfolios Enhancing growth through expansions Conservative balance sheet Strategy-driven outperformance 22

Appendix

Consistent NOI Growth Appendix 1 Manufactured housing is one of the most recession resistant sectors of the housing and commercial real estate sectors and has consistently outperformed multi-family in same site NOI growth since 20001 1 SOURCE: SNL.COM. AS OF DECEMBER 31, 2015. ASSUMES $100.00 NOI STARTING POINT FOR ALL SECTORS. $90 $100 $110 $120 $130 $140 $150 $160 $170 $180 $190 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 SUI Manufactured Housing Apartment Industrial Mall Office Strip Mall Self-Storage

Manufactured Housing vs. Multi-Family Sun’s Manufactured Homes VS. Sun’s manufactured homes provide nearly 15% more space at over 30% less cost per square foot RENT ~$8601 per month Multi-Family Housing ~$1,1002 per month SQUARE FOOTAGE PRICE ~1,250 sq. ft. ~1,1002 sq. ft. $0.69 per sq. ft. $1.00 per sq. ft. 1 SOURCE: COMPANY INFORMATION. REFER TO SUN COMMUNITIES, INC. FORM 10-K AND SUPPLEMENTAL FOR THE YEAR ENDED DECEMBER 31, 2015 FOR ADDITIONAL INFORMATION. 2 SOURCE: THE RENTPATH NETWORK. REPRESENTS AVERAGE RENT FOR A 2 BEDROOM APARTMENT IN MAJOR METROPOLITAN AREAS SUN OPERATES IN AS OF FEBRUARY 2016. Appendix 2

Manufactured Housing vs. Single Family 1 SOURCE: MANUFACTURED HOUSING INSTITUTE, QUICK FACTS: “TRENDS AND INFORMATION ABOUT THE MANUFACTURED HOUSING INDUSTRY, 2015.” REPRESENTS AVERAGE 2 BEDROOM HOUSEHOLD IN MAJOR METROPOLITAN AREAS SUN OPERATES IN AS OF FEBRUARY 2016. 2 SOURCE: US DEPARTMENT OF CENSUS. $54,900 REPRESENTS THE MEDIAN HOUSEHOLD INCOME IN MAJOR METROPOLITAN AREAS SUN OPERATES IN AS OF FEBRUARY 2016. Single-family Homes Manufactured Homes Average cost of Single Family1 is $345,800 or roughly 6 years median income The average single family home costs over 5x the price of a manufactured home Sun’s communities offer affordable options in attractive locations $63,100 $62,800 $60,500 $62,200 $64,000 $65,300 Manufactured Housing Median Household Income2 2009 2010 2011 2012 2013 2014 Single-family1 vs Manufactured 4.3x 4.3x 4.4x 4.7x 5.3x 5.0x Average cost of a new Manufactured Home is $65,300 or roughly 1 years median income Appendix 3 $270,900 $272,900 $267,900 $292,200 $324,500 $345,800 $0 $100,000 $200,000 $300,000 $400,000