Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - Global Net Lease, Inc. | v441846_8k.htm |

Exhibit 99.1

June 2016 Investor Presentation

The GNL Advantage Best in Class Portfolio Mission critical assets Long - term leases with investment grade tenants Differentiated Strategy Focus on high quality markets of U.S. and Western Europe Ability to play market cycles in the US & Europe Advantages of GNL U.S & Europe Market S trategy Broader pool of high quality assets Lower level of competition in Europe Benefit from the outsized spreads between cap rates and cost of debt in Europe High percentage (78%) of GNL debt in GBP and Euro diversifies the risk of increased interest expense due to central bank action Currency Risk Mitigation Hedging programs in place in order to hedge asset value and cash flows back to USD Asset liability matching to reduce exposure to changes in asset value due to movements in currency rates Transparent cash flows allow GNL to protect future cash flows with FX forwards 2

Diversified by asset type, geography, tenant and tenant industry Focus on single tenant, net lease, income producing, mission critical assets in the U.S., U.K., Germany, the Netherlands, and Finland 72.3% of NOI derived from investment grade rated or implied investment grade rated tenants (1) 11.0 year weighted average remaining portfolio lease term (2) provides reliable cash flows with contractual and indexed rent growth (3) GNL is positioned to take advantage of broad net lease opportunities in both Western Europe and the U.S. Target markets nearly 3x the size of U.S. market with fewer competitors focused on owner - occupied real estate in Europe Proven track record across multiple economic cycles Externally advised by GNL Advisors (an AR - Global affiliate) and Moor Park Capital, providing a highly scalable acquisition and asset management platform with visible acquisition pipeline from proven, country focused proprietary origination network Strong and flexible capital structure Foreign exchange fluctuations hedged through asset / liability matching and quarterly rolling forward swaps on net income Investment Highlights High - Quality, Diversified Net Lease Portfolio Strong, Creditworthy Tenant Base with Attractive Lease Term Global Investment Strategy Experienced Management Team Flexible Balance Sheet ___________________________ Source: All portfolio and financial information derived from unaudited company internal records as of March 31 , 2016. Information shown based on USD equivalent amounts using exchange rates as of March 31, 2016, unless otherwise noted. 1. Based on NOI. Actual ratings reflect the tenant rating. Implied ratings are determined using a proprietary Moody’s analytical tool which compares the risk metrics of the non - rated company to those of a company with an a ctual rating . A tenant with a parent that has an investment grade rating is included in implied investment grade. Ratings information is as of March 31, 2016. 2. Based on s quare feet . As of March 31, 2016. 3. Refers to leases with fixed percent or actual increases, or country CPI - indexed increases. 3

0% 0% 0% 0% 2% 2% 8% 10% 21% 57% Portfolio Highlights Portfolio Overview Source: All portfolio and financial information derived from unaudited company internal records as of M arch 31, 2016. Information shown based on USD equivalent amounts using exchange rates as of March 31, 2016. 1. Actual ratings reflect the tenant rating. Implied ratings are determined using a proprietary Moody’s analytical tool, which compares the risk metrics of the non - rated company to those of a company with an actual rating . A tenant with a parent that has an investment grade rating is included in implied investment grade. Ratings information is as of March 31, 2016, unless otherwise noted. . * Represents Moody’s implied rating . ** Represents tenant parent rating . *** Represents lease guarantor rating. 2. Based on 2016 NOI. See the discussion under the captions, “Forward Looking Statements” and “Projections” in this investor presentation for mor e information. 3. Based on square f eet . 4. Fixed percent or actual increases, or country CPI - indexed increases . GNL owns a portfolio of 329 assets diversified across 5 countries, 86 tenants and 36 industries as of 3/31/2016. Lease Expiration Schedule (% of SF Per Year) Weighted Average Lease Term: 11.0 (3 ) years # of Properties 329 Total Square Feet (mm) 18.7 Number of Tenants 86 Number of Industries 36 Countries 5 Occupancy 100% Weighted Average Remaining Lease Term (3) 11.0 years % of NOI from Investment Grade Tenants (1)(2) 72.3% % of Portfolio NOI from Leases with Contractual Rent Increases (2)(4) 89.3% Tenant Rating (1) Country Property Type % of Portfolio NOI (2) Baa2 GER Office 5.3% **BBB US Distribution 4.7% AA+ US Office 4.4% **Aaa FIN Industrial 4.4% **BB US Retail 4.4% BBB+ US Office 3.1% ***AA - FIN Office 2.9% *A2 UK Distribution 2.8% Aa3 US Office 2.5% A3 UK Office 2.3% Top Ten Tenants The Portfolio’s Top Ten Tenants Represent 36.8% of P ortfolio NOI 4

GNL vs. Peers 60% 100% 100% 100% 100% 100% 93% 64% 36% 0% 20% 40% 60% 80% 100% GNL LXP NNN O SIR SRC GPT WPC U.S. Europe 40% 7% Geographic Breakdown (1) 11.0 7.8 9.0 10.0 10.6 10.9 11.3 12.7 0.0 2.0 4.0 6.0 8.0 10.0 12.0 14.0 GNL GPT WPC O SRC SIR NNN LXP Average Remaining Lease Term (Years ) (3) 100.0% 99.1% 98.7% 98.7% 98.5% 97.8% 97.8% 96.7% 90% 92% 94% 96% 98% 100% GNL NNN SRC GPT WPC SIR O LXP Occupancy 41.3% 21.4% 23.0% 32.8% 39.0% 0.0% 10.0% 20.0% 30.0% 40.0% 50.0% 60.0% 70.0% GNL SRC NNN WPC O LXP GPT % Investment Grade (4) Peer Average: 10.4 years Peer Average: 32.8% Peer Average: 98.3% ___________________________ Source: Company filings & Supplemental data as of 3/31/2016. Note: GNL represents Global Net Lease, GPT represents Gramercy Property Trust (which acquired CSG in 2015 ), LXP represents Lexington Realty Trust, NNN represents National Retail Properties, O represents Realty Income, SIR represents Select Income REIT, SRC represents Spirit Realty Capital and WPC represents W.P. Carey. All information based on annualized rent. 1. As a % of each company’s purchase price. 2. GPT’s international exposure includes JV’s and properties from CSG acquisition. 3. Peer group uses either revenue - based or square - footage based methods to calculate remaining lease term as disclosed in each company’s financial statements. 4. Actual ratings reflect the tenant rating. Implied ratings are determined using a proprietary Moody’s analytical tool, which compares the risk metrics of the non - rated company to those of a company with an actual r ating . A tenant with a parent that has an investment grade rating is included in implied investment grade Ratings information is as of March 31, 2016, unless otherwise noted. (2) N/A N/A 5

Portfolio Highlights ___________________________ Source: All portfolio and financial information derived from company internal records as of March 31, 2016. Information shown based on USD equivalent amounts using exchange rates as of March 31, 2016. 1. Based on annualized NOI . See the discussion under the captions “Forward Looking Statements” and “Projections” in this investor presentation for more in formation. 2. Actual ratings reflect the tenant rating. Implied Ratings are determined using a proprietary Moody’s analytical tool, which c omp ares the risk metrics of the non - rated company to those of a company with an actual r ating . A tenant with a parent that has an investment grade rating is included in implied investment grade. Ratings information is as of March 31, 2016, unless otherwise noted. Investment Grade , 41.3% Implied Investment Grade , 31.0% Non - Investment Grade , 27.7% Credit Rating (1) (2) Tenant Industry (1) 72% of NOI is derived from investment grade and implied investment grade tenants (1)(2) . U.S. , 59.8% UK , 18.9% Germany , 9.6% The Netherlands , 4.4% Finland , 7.3% Geography (1) Office 54% Retail 15% Industrial 19% Distribution 11% Other (Hotel) 1% Asset Type (1) Financial Services , 10.0% Discount Retail , 9.1% Technology , 8.0% Aerospace , 7.2% Energy , 7.0% Healthcare , 6.3% Utilities , 6.2% Freight, 5.4% Government Service , 5.1% Pharma, 4.8% All Other, 30.9% 6

Significant Global Opportunity GNL is well positioned to capitalize on net lease investment opportunities in the U.S. and Western Europe. Sovereign Debt Ratings (S&P) U.S. AA+ UK AAA Germany AAA Netherlands AAA Finland AA+ Belgium AA France AA Ireland A+ Poland BBB+ Spain BBB+ Italy BBB - Portugal BB+ ___________________________ 1. Standard’s & Poor’s Rating Agency as of 3/31/2016. 2. CBRE for the year ending 12/31/2013. Focus on the U.S. and countries in Western Europe with strong debt ratings Owner - Occupied Real Estate (2) $6.9 Trillion Global Net Lease Opportunity Owner - occupied real estate in the U.S. and Europe represents a $6.9 trillion market, $4.5 trillion located in Europe GNL is focused solely on net lease investment opportunities in U.S. and European countries with strong debt ratings Scarcity of net lease investors in Europe creates a less competitive acquisition environment and opportunity to acquire high - quality assets at attractive yields Market Focus (1) U.S. 36% Europe 64% $2.4tn $4.5tn No publicly traded pan European net lease REITs Over $100B of public Net Lease REITs focused on U.S. 7

Focused Investment Strategy Creates Value U.S., UK, Germany, Finland , Belgium, Netherlands, Luxembourg and France Tenant Credit Quality Geography Real Estate / Market Fundamentals Asset Type Investment Strategy – Key Criteria Business model evaluation Tenant credit review Real Estate financial analysis Review & benchmark underlying asset level trading performance Key due diligence metrics – valuation, insurance, legal, tax, accounting Disciplined Acquisition Process Structure & Pricing Single tenant, net lease, income producing, commercial properties Corporate headquarters or other mission critical assets Long - term leases tied to inflation indices for annual increases Maximize differential between cap rates and cost of funding Well - defined investment strategy and rigorous underwriting process used to assemble high quality diversified portfolio of long - term net leased properties in the U.S. and Europe. 1. Figures represent Global Net Lease’s total evaluations. Estimated Total Net Lease opportunities: ~$6.9 trillion Total Net Lease deals evaluated (1) : ~$19.7 billion Total Net Lease LOI’s submitted (1) : ~$6.8 billion Eventual acquisitions (1) : ~$2.6 billion 8

Balance Sheet As of March 31, 2016 (in Millions) Assets Total real estate investments, net $ 2,396.1 Cash and cash equivalents 45.8 Other Assets 59.4 Total Assets $ 2,501.3 Liabilities & Equity Gross mortgage notes payable $ 532.4 Credit facility 703.3 Total Debt ( Weighted Average Interest Rate of 2.50%) 1,235.7 Other Liabilities 76.7 Total Liabilities 1,312.4 Total Equity 1,188.9 Total Liabilities & Equity $ 2,501.3 9

First Quarter 2016 Key Highlights Source: All portfolio and financial information derived from company internal records as of March 31, 2016. Information shown based on USD equivalent amounts using exchange rates as of March 31, 2016 1. Effective January 1, 2016, we eliminated unrealized losses (gains) on foreign currency transactions in deriving AFFO. As a re sul t of this change, we revised the Q4 2015 amounts in our reconciliation of AFFO. AFFO for three months ended December 31, 2015 was previously reported as $30,187 when not adjusting for the unrealized losses (gai ns) on foreign currency transactions of $(1,903) for that period. 2. Based on March 31, 2016 share price of $8.56. 3. Based on enterprise value of $ 2.6 billion calculated using the March 31, 2016 closing share price of $8.56 and total combined net debt of $1.2 billion, including $ 532.4 million of mortgage debt. 4. Based on annualized adjusted EBITDA for Q1 2016 of $ 42.8m. 5. Credit facility has an initial maturity date of July 25, 2016 with two, one - year extensions subject to certain conditions. Weighted ave rage debt maturity assumes that the extensions are exercised. The company has provided notice to extend the maturity of the Credit Facility to July 28, 2017. Q1 2016 Q4 2015 Quarterly Performance: (in 000’s) Q1 2016 Q4 2015 % Change Cash NOI $46,522 $45,366 +2.5% AFFO $32,301 $28,115 (1) +14.9% Dividend Yield (2) : 8.29% Leverage Metrics: Net Debt / Enterprise Value (3) 45.1% US / Europe 22% / 78% European Debt (GBP/EUR) 46.4% / 53.6% Weighted Average Interest Rate 2.50% Fixed / Floating Rate Debt 64% / 36% Interest Coverage Ratio (4) 5.2x Weighted Average Debt Maturity (5) 2.87 years 10

Strong Governance Board of Directors is comprised of 75% independent directors Conflicts, audit, governance & nominating committees comprised of 100% independent directors PwC is external auditor and reports directly to audit committee Deloitte is internal auditor and reports directly to audit committee Company is supported by an experienced financial accounting and reporting team, and maintains its own financial reporting processes, controls and procedures 11

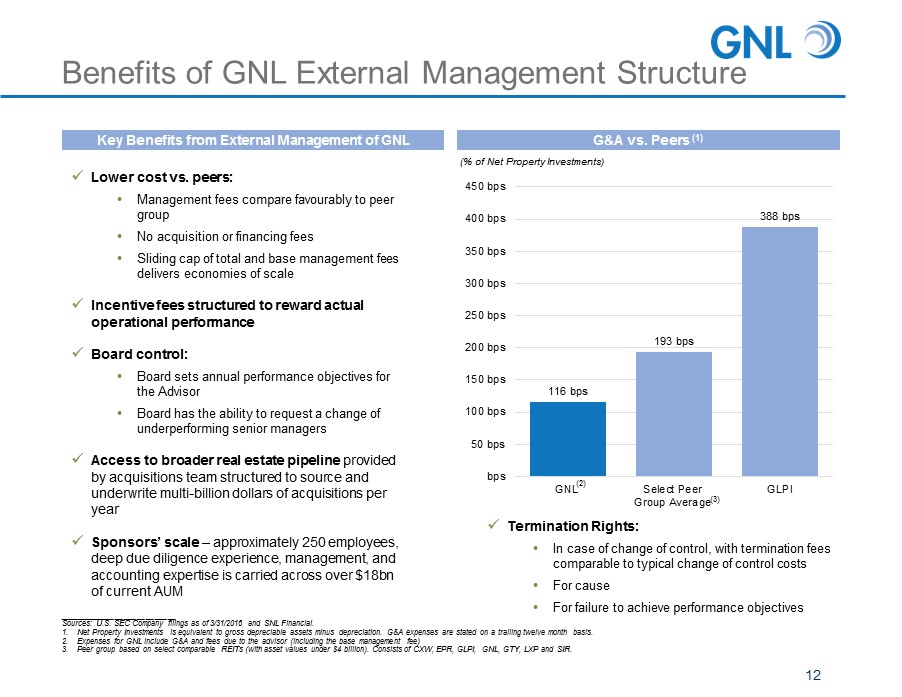

116 bps 193 bps 388 bps bps 50 bps 100 bps 150 bps 200 bps 250 bps 300 bps 350 bps 400 bps 450 bps GNL Select Peer Group Average GLPI Benefits of GNL External Management Structure 12 ___________________________ Sources: U.S. SEC Company filings as of 3/31/2016 and SNL Financial. 1. Net Property Investments is equivalent to gross depreciable assets minus depreciation. G&A expenses are stated on a trailing twe lve month basis. 2. Expenses for GNL include G&A and fees due to the advisor (including the base management fee) 3. Peer group based on select comparable REITs (with asset values under $4 billion ). Consists of CXW, EPR, GLPI, GNL, GTY, LXP and SIR. x Lower cost vs. peers: • Management fees compare favourably to peer group • No acquisition or financing fees • Sliding cap of total and base management fees delivers economies of scale x Incentive fees structured to reward actual operational performance x Board control: • Board sets annual performance objectives for the Advisor • Board has the ability to request a change of underperforming senior managers x Access to broader real estate pipeline provided by acquisitions team structured to source and underwrite multi - billion dollars of acquisitions per year x Sponsors’ scale – approximately 250 employees, deep due diligence experience, management, and accounting expertise is carried across over $18bn of current AUM G&A vs. Peers (1) Key Benefits from External Management of GNL (% of Net Property Investments) x Termination Rights: • In case of change of control, with termination fees comparable to typical change of control costs • For cause • For failure to achieve performance objectives (3) (2)

Management Agreement Fee Structure • Initial base fee of $18mm per annum (implied 0.75% of AUM) (1) • To be increased by 1.25% on new equity raised • Eliminated acquisition fees, financing fees, and reimbursement of internal acquisition expenses (2) • Incentive fee tied to Core AFFO (3) 15% of Core AFFO in excess of $0.78 per share and up to $1.02 per share (4) 25% of Core AFFO in excess of $1.02 per share Incentive fee hurdles expected to be increased by 1% – 3% annually Incentive fee will be paid 50% in cash and 50% in stock, with lock - ups expiring over a 3 - year period • 0.75% of AUM to be reduced by 0.03% for every additional $1 billion of AUM above $3 billion to a floor of 0.40% • Notwithstanding the foregoing, if AUM exceeds $10 billion, the fee cap will be subject to a floor of the lesser of 0.50% or the comparable G&A load of a peer set to be determined in good faith by the Board • Total fees are subject to a cap of 1.25% of AUM until the Company reaches $5 billion of AUM, after which the cap reduces linearly until AUM reaches $15 billion, at which the cap would be 0.95% of AUM (5) • Initial Term of 20 years • Following the Initial Term, automatically renewed for successive 5 - year terms Base Management Fee Incentive Fee Base Management Fee Cap Total Fee Cap Duration ___________________________ 1. Based on AUM at listing on 6/2/2015. 2. GNL covers third party Acquisition Expenses. 3. Core AFFO is a non - GAAP performance metric. See the discussion under the caption “Definitions” in this investor presentation for managements’ discussion regarding non - GAAP metrics. 4. Reflects Listing Tender adjustment. 5. Base management fee plus incentive fee. 13

GNL Objectives Complete asset recycling plan by year - end 2016 Secure analyst coverage for GNL by year - end 2016 Engage rating agencies with goal of securing Investment Grade rating in next 12 months Enhance debt structure A dd unsecured debt and ladder out maturities in next 12 months Continue meeting with institutional investors to broaden GNL’s institutional ownership base A possible Russell 2000 inclusion in June 2016 should enhance institutional ownership opportunities 14

Assembled high - quality net lease property portfolio Best - in - class portfolio metrics Strong balance sheet and interest coverage ratio Established local management presence and expertise in our markets Created in - place hedges to mitigate currency risk Strong governance programs in place Conclusion RWE – North Rhine, Germany Western Digital - San Jose, CA GSA - International Falls, MN Finnair – Helsinki, Finland 15

The Platform

GNL Board of Directors Sue Perrotty Chairperson Abby Wenzel Independent Edward Rendell Independent William Kahane Director GNL Management Team / Investment Committee Scott Bowman CEO & President Tim Salvemini CFO Shared Services Support Operations Investor Relations Accounting Legal Due Diligence IT Marketing Human Resources Financing Asset Management Moor Park Management Team / Investment Committee Jagdeep Kapoor CIO Shameel Kahn CEO Gary Wilder Executive Chairman AR Global Moor Park Acquisitions Team Legal Asset Management Finance / Operations United States Jason Slear Executive Vice President Brian Mansouri Vice President Europe Michael Glaser United Kingdom Javier Paz Valibuena Germany Greg Smith Nordics Diego Voss Benelux Jamal Dutheil France Akomea Poku - Kankam Senior Vice President & Counsel Ken Miles Transaction Counsel Jacqui Shimmin London David Layton Head of Asset Management Max Garelick Asset Management Analyst Paul Bergagna Vice President Karen Masey Assistant Property Manager Leah K usayeva Finance Manager Paschal Ferreira Chief Accounting Officer Shaun Riley Fund Controller Kyle Gray Analyst Samir Mody Property Manager Graydon Butler COO Sven Utermueller Investment Controller Enessa Bruk Operations Controller Broad, Multi - Disciplinary Management Footprint 17

I NSTITUTIONS A DVISORS D EVELOPERS R ELATIONSHIP B ROKERAGE F IRMS “B AD B ANK ” D EBT P OOLS Origination network targeted to transactions with advantaged position Disciplined and rigorous approach to underwriting Capacity to underwrite complexity and structure creatively Portfolios / large - scale transactions Investments with embedded value drivers Organizational scale and large footprint drives sourcing Country focused investment teams – local relationships Strong reputation with vendors Extensive market knowledge Execution experience across all real estate asset classes Ability to deliver with speed and volume in markets lacking institutional liquidity Superior Sourcing Network 18

Vigorous Asset Management Creates Value 11 full - time asset management personnel in the U.S. and Europe Combined executive leadership with local practitioners to provide superior asset management expertise across the U.S. and Europe. Checks Compliance / Negotiation Management Credit Tenant credit reviewed annually Building Systems HVAC, life safety, security, telephone, data, plumbing, electrical and mechanical systems are inspected bi - annually Building Structure Exterior walls, roof, elevator shafts, footings foundations, load - bearing walls, structural floors, columns and beams are inspected bi - annually Construction Improvement oversight, property expansion oversight (oversee work, negotiate TI allowance) Walkthroughs Perform an annual walkthrough of the property to evaluate condition and capital budgeting Service Agreements Property Managers are responsible for managing contracts with vendors Contracts are reviewed annually to ensure pricing is at market and service is satisfactory Mortgage Debt Ensure compliance with all mortgage documents including deferred maintenance, inspections and reporting Property Management Subs Provide consistent oversight on all property management companies hired. Ensure property management provided is compliant with policies and procedures 19

Legal Notices

Forward Looking Statements Certain statements made in this presentation are forward - looking statements . These forward - looking statements include statements regarding our intent, belief or current expectations and are based on various assumptions . These statements involve substantial risks and uncertainties . Actual results or events could differ materially from the plans, intentions and expectations disclosed in the forward - looking statements that we make . Forward - looking statements may include, but are not limited to, statements regarding stockholder liquidity and investment value and returns . The words "anticipates," "believes," "expects," "estimates," "projects," "plans," "intends," "may," "will," "would" and similar expressions are intended to identify forward - looking statements, although not all forward - looking statements contain these identifying words . Actual results may differ materially from those contemplated by the forward - looking statement . Further, forward - looking statements speak only as of the date they are made, and we undertake no obligation to update or reverse any forward - looking statement to reflect changed assumptions, the occurrence of unanticipated events on changes to future operating results, unless required to do so by law . 21

Risk Factors All of our executive officers are also officers, managers and/or holders of a direct or indirect controlling interest in our Adv isor and other entities affiliated with AR Global Investments, LLC. As a result, our executive officers, our Advisor and its affiliates face conflict s o f interest, including significant conflicts created by our Advisor's compensation arrangements with us and other investment programs advised by AR Global Inves tme nts, LLC’s affiliates and conflicts in allocating time among these investment programs and us. These conflicts could result in unanticip ate d actions. Because investment opportunities that are suitable for us may also be suitable for other AR Global Investments, LLC advised i nve stment programs, our Advisor and its affiliates face conflicts of interest relating to the purchase of properties and other investments and such c onf licts may not be resolved in our favor, which could reduce the investment return to our stockholders. We may be unable to pay or maintain cash dividends or increase dividends over time. We are obligated to pay fees which may be substantial to our Advisor and its affiliates. We depend on tenants for our rental revenue and, accordingly, our rental revenue is dependent upon the success and economic v iab ility of our tenants. Increases in interest rates could increase the amount of our debt payments and limit our ability to pay dividends to our stoc kho lders. We may be unable to raise additional debt or equity financing on attractive terms or at all. Adverse changes in exchange rates may reduce the value of our properties located outside of the United States. We may not generate cash flows sufficient to pay dividends to our stockholders, as such, we may be forced to borrow at unfavo rab le rates or depend on our Advisor to waive reimbursement of certain expense and fees to fund our operations. There is no assurance that our Advi sor will waive reimbursement of expenses or fees. Any of these dividends may reduce the amount of capital we ultimately invest in properties and other permitted investments an d n egatively impact the value of our common stock. We are subject to risks associated with our international investments, including risks associated with compliance with and ch ang es in foreign laws, fluctuations in foreign currency exchange rates and inflation. We are subject to risks associated with any dislocations or liquidity disruptions that may exist or occur in the credit marke ts of the United States of America and Europe from time to time. We may fail to continue to qualify, as a real estate investment trust for U.S. federal income tax purposes, which would resul t i n higher taxes, may adversely affect operations and would reduce our NAV and cash available for dividends. We may be deemed to be an investment company under the Investment Company Act of 1940, as amended, and thus subject to regula tio n under the Investment Company Act. We may be exposed to risks due to a lack of tenant diversity, investment types and geographic diversity. We may be exposed to changes in general economic, business and political conditions, including the possibility of intensified in ternational hostilities, acts of terrorism, and changes in conditions of United States of America or international lending, capital and financing mark ets . The following are some of the risks and uncertainties, although not all risks and uncertainties, that could cause our actual res ults to differ materially from those presented in our forward - looking statements. See the section entitled “Item 1A. Risk Factors” in the Company’s Annual Repo rt on Form 10 - K filed with the U.S. Securities and Exchange Commission (the “SEC”) on February 29, 2016 and the section entitled “Item 1A. Risk Factors” in the Company’s Quarterly Report on form 10 - Q filed with the SEC on May 6, 2016 for a discussion of the risks which should be considered in connection with your investment. 22

Projections This presentation includes estimated projections of future operating results . These projections were not prepared in accordance with published guidelines of the SEC or the guidelines established by the American Institute of Certified Public Accountants for preparation and presentation of financial projections . This information is not fact and should not be relied upon as being necessarily indicative of future results ; the projections were prepared in good faith by management and are based on numerous assumptions that may prove to be wrong . Important factors that may affect actual results and cause the projections to not be achieved include, but are not limited to, risks and uncertainties relating to the company and other factors described in the “Risk Factors” section of the Company’s Annual Report on Form 10 - K filed with the SEC on February 29 , 2016 , the Quarterly Report on Form 10 - Q filed for the quarter ended March 31 , 2016 filed on May 6 , 2016 , and in future filings with the SEC . The projections also reflect assumptions as to certain business decisions that are subject to change . As a result, actual results may differ materially from those contained in the estimates . Accordingly, there can be no assurance that the estimates will be realized . This presentation also contains estimates and information concerning our industry, including market position, market size, and growth rates of the markets in which we participate, that are based on industry publications and reports . This information involves a number of assumptions and limitations, and you are cautioned not to give undue weight to these estimates . We have not independently verified the accuracy or completeness of the data contained in these industry publications and reports . The industry in which we operate is subject to a high degree of uncertainty and risk due to variety of factors, including those described in the “ Risk Factors” section of the Company’s Annual Report on Form 10 - K filed with the SEC on February 29 , 2016 , the Quarterly Reports on Form 10 - Q filed for the quarters ended March 31 , 2016 filed on May 6 , 2016 , and in future filings with the SEC . These and other factors could cause results to differ materially from those expressed in these publications and reports . 23

Definitions Funds from operations (“FFO”) Due to certain unique operating characteristics of real estate companies, as discussed below, the National Association of Real Estate Investment Trusts ("NAREIT"), an industry trade group, has promulgated a measure known as funds from operations ("FFO"), which we believe to be an appropriate supplemental measure to reflect the operating performance of a REIT . The use of FFO is recommended by the REIT industry as a supplemental performance measure . FFO is not equivalent to net income or loss as determined under accounting principles generally accepted in the United States ("GAAP") . We define FFO, a non - GAAP measure, consistent with the standards established by the White Paper on FFO approved by the Board of Governors of NAREIT, as revised in February 2004 (the "White Paper") . The White Paper defines FFO as net income or loss computed in accordance with GAAP, excluding gains or losses from sales of property but including asset impairment writedowns, plus depreciation and amortization, and after adjustments for unconsolidated partnerships and joint ventures . Adjustments for unconsolidated partnerships and joint ventures are calculated to reflect FFO . Our FFO calculation complies with NAREIT's definition . The historical accounting convention used for real estate assets requires straight - line depreciation of buildings and improvements, and straight - line amortization of intangibles, which implies that the value of a real estate asset diminishes predictably over time, especially if not adequately maintained or repaired and renovated as required by relevant circumstances or as requested or required by lessees for operational purposes in order to maintain the value disclosed . We believe that, because real estate values historically rise and fall with market conditions, including inflation, interest rates, the business cycle, unemployment and consumer spending, presentations of operating results for a REIT using historical accounting for depreciation and certain other items may be less informative . Historical accounting for real estate involves the use of GAAP . Any other method of accounting for real estate such as the fair value method cannot be construed to be any more accurate or relevant than the comparable methodologies of real estate valuation found in GAAP . Nevertheless, we believe that the use of FFO, which excludes the impact of real estate related depreciation and amortization, among other things, provides a more complete understanding of our performance to investors and to management, and when compared year over year, reflects the impact on our operations from trends in occupancy rates, rental rates, operating costs, general and administrative expenses, and interest costs, which may not be immediately apparent from net income . However, FFO, core funds from operations ("Core FFO") and adjusted funds from operations (“AFFO”), as described below, should not be construed to be more relevant or accurate than the current GAAP methodology in calculating net income or in its applicability in evaluating our operating performance . The method utilized to evaluate the value and performance of real estate under GAAP should be construed as a more relevant measure of operational performance and considered more prominently than the non - GAAP FFO, Core FFO and AFFO measures and the adjustments to GAAP in calculating FFO, Core FFO and AFFO . Other REITs may not define FFO in accordance with the current NAREIT definition (as we do) or may interpret the current NAREIT definition differently than we do and/or calculate Core FFO and/or AFFO differently than we do . Consequently, our presentation of FFO, Core FFO and AFFO may not be comparable to other similarly titled measures presented by other REITs . 24

Definitions (cont’d) Funds from operations (“FFO”) (Cont’d) We consider FFO, Core FFO and AFFO useful indicators of our performance . Because FFO calculations exclude such factors as depreciation and amortization of real estate assets and gains or losses from sales of operating real estate assets (which can vary among owners of identical assets in similar conditions based on historical cost accounting and useful - life estimates), FFO facilitates comparisons of operating performance between periods and between other REITs in our peer group . Changes in the accounting and reporting promulgations under GAAP (for acquisition fees and expenses from a capitalization/depreciation model to an expensed - as - incurred model) that were put into effect in 2009 and other changes to GAAP accounting for real estate subsequent to the establishment of NAREIT's definition of FFO have prompted an increase in cash - settled expenses, specifically acquisition fees and expenses for all industries as items that are expensed under GAAP, that are typically accounted for as operating expenses . Core adjusted funds from operations (“Core AFFO”) Core FFO is FFO, excluding acquisition and transaction related costs as well as certain other costs that are considered to be non - core, such as charges relating to the Listing Note and listing related fees . The purchase of properties, and the corresponding expenses associated with that process, is a key operational feature of our business plan to generate operational income and cash flows in order to make dividend payments to stockholders . In evaluating investments in real estate, we differentiate the costs to acquire the investment from the operations derived from the investment . By excluding expensed acquisition and transaction related costs as well as non - core costs, we believe Core FFO provides useful supplemental information that is comparable for each type of real estate investment and is consistent with management's analysis of the investing and operating performance of our properties . 25

Definitions (cont’d) Adjusted funds from operations (“AFFO”) We exclude certain income or expense items from AFFO that we consider more reflective of investing activities, other non - cash income and expense items and the income and expense effects of other activities that are not a fundamental attribute of our business plan . These items include unrealized gains and losses, which may not ultimately be realized, such as gains or losses on derivative instruments, gains and losses on foreign currency transactions, gains or losses on contingent valuation rights, gains and losses on investments and early extinguishment of debt . In addition, by excluding non - cash income and expense items such as amortization of above - market and below - market leases intangibles, amortization of deferred financing costs, straight - line rent and equity - based compensation from AFFO, we believe we provide useful information regarding income and expense items which have no cash impact and do not provide liquidity to the company or require capital resources of the company . By providing AFFO, we believe we are presenting useful information that assists investors and analysts to better assess the sustainability of our ongoing operating performance without the impacts of transactions that are not related to the ongoing profitability of our portfolio of properties . We also believe that AFFO is a recognized measure of sustainable operating performance by the REIT industry . Further, we believe AFFO is useful in comparing the sustainability of our operating performance with the sustainability of the operating performance of other real estate companies that are not making a significant number of acquisitions . Investors are cautioned that AFFO should only be used to assess the sustainability of our operating performance excluding these activities, as it excludes certain costs that have a negative effect on our operating performance during the periods in which these costs are incurred . In calculating AFFO, we exclude certain expenses, which under GAAP are characterized as operating expenses in determining operating net income . These expenses are paid in cash by us, and therefore such funds will not be available to distribute to investors . All paid and accrued merger, acquisition and transaction related fees and certain other expenses negatively impact our operating performance during the period in which expenses are incurred or properties are acquired will also have negative effects on returns to investors, the ability to fund dividends or distributions in the future, and cash flows generated by us, unless earnings from operations or net sales proceeds from the disposition of other properties are generated to cover the purchase price of the property and certain other expenses . AFFO that excludes such costs and expenses would only be comparable to companies that did not have such activities . Further, under GAAP, certain contemplated non - cash fair value and other non - cash adjustments are considered operating non - cash adjustments to net income in determining cash flow from operating activities . In addition, we view fair value adjustments as items which are unrealized and may not ultimately be realized . We view both gains and losses from fair value adjustments as items which are not reflective of ongoing operations and are therefore typically adjusted for when assessing operating performance . Excluding income and expense items detailed above from our calculation of AFFO provides information consistent with management's analysis of the operating performance of the properties . Additionally, fair value adjustments, which are based on the impact of current market fluctuations and underlying assessments of general market conditions, but can also result from operational factors such as rental and occupancy rates, may not be directly related or attributable to our current operating performance . By excluding such changes that may reflect anticipated and unrealized gains or losses, we believe AFFO provides useful supplemental information . As a result, we believe that the use of FFO, Core FFO and AFFO, together with the required GAAP presentations, provide a more complete understanding of our performance relative to our peers and a more informed and appropriate basis on which to make decisions involving operating, financing, and investing activities . . 26

Definitions (cont’d) Adjusted Earnings before Interest, Taxes, Depreciation and Amortization, Net Operating Income, Cash Net Operating Income and Adjusted Cash Net Operating Income . We believe that earnings before interest, taxes, depreciation and amortization adjusted for acquisition and transaction - related expenses, other non - cash items and including our pro - rata share from unconsolidated joint ventures ("Adjusted EBITDA") is an appropriate measure of our ability to incur and service debt . Adjusted EBITDA should not be considered as an alternative to cash flows from operating activities, as a measure of our liquidity or as an alternative to net income as an indicator of our operating activities . Other REITs may calculate Adjusted EBITDA differently and our calculation should not be compared to that of other REITs . Net operating income ("NOI") is a non - GAAP financial measure equal to net income (loss), the most directly comparable GAAP financial measure, less discontinued operations, interest, other income and income from preferred equity investments and investment securities, plus corporate general and administrative expense, acquisition and transaction - related expenses, depreciation and amortization, other non - cash expenses and interest expense . NOI is adjusted to include our pro rata share of NOI from unconsolidated joint ventures . We use NOI internally as a performance measure and believe NOI provides useful information to investors regarding our financial condition and results of operations because it reflects only those income and expense items that are incurred at the property level . Therefore, we believe NOI is a useful measure for evaluating the operating performance of our real estate assets and to make decisions about resource allocations . Further, we believe NOI is useful to investors as a performance measure because, when compared across periods, NOI reflects the impact on operations from trends in occupancy rates, rental rates, operating costs and acquisition activity on an unlevered basis, providing perspective not immediately apparent from net income . NOI excludes certain components from net income in order to provide results that are more closely related to a property's results of operations . For example, interest expense is not necessarily linked to the operating performance of a real estate asset and is often incurred at the corporate level as opposed to the property level . In addition, depreciation and amortization, because of historical cost accounting and useful life estimates, may distort operating performance at the property level . NOI presented by us may not be comparable to NOI reported by other REITs that define NOI differently . We believe that in order to facilitate a clear understanding of our operating results, NOI should be examined in conjunction with net income (loss) as presented in our consolidated financial statements . NOI should not be considered as an alternative to net income (loss) as an indication of our performance or to cash flows as a measure of our liquidity . Cash NOI is NOI presented on a cash basis, which is NOI after eliminating the effects of straight - lining of rent and the amortization of above and below market leases . 27