Attached files

| file | filename |

|---|---|

| 8-K/A - REED'S, INC. | form8-ka.htm |

| EX-10.3 - REED'S, INC. | ex10-3.htm |

| EX-10.2 - REED'S, INC. | ex10-2.htm |

| EX-4.2 - REED'S, INC. | ex4-2.htm |

| EX-4.1 - REED'S, INC. | ex4-1.htm |

May 26, 2016

Christopher J. Reed

Chief Executive Officer

13000 South Spring Street

Los Angeles, California 90061

Dear Mr. Reed:

This letter (the “Agreement”) constitutes the agreement between Maxim Group LLC (“Maxim” or the “Placement Agent”) and Reeds, Inc., a Delaware corporation (the “Company”), that Maxim shall serve as the placement agent for the Company, on a “reasonable best efforts” basis, in connection with the proposed placement (the “Placement”) of an aggregate of 692,412 shares of (the “Shares”) of the Company’s common stock, par value $0.001 per share (“Common Stock”) and warrants to purchase up to 346,206 of the shares of Common Stock (each a “Warrant” and collectively, the “Warrants”). The Shares, the Warrants and the shares of Common Stock underlying the Warrants (the “Warrant Shares”) are hereinafter referred to collectively as the “Securities.” The terms of the Placement and the Securities shall be mutually agreed upon by the Company and the purchasers (each, a “Purchaser” and collectively, the “Purchasers”) and nothing herein constitutes that Maxim would have the power or authority to bind the Company or any Purchaser or an obligation for the Company to issue any Securities or complete the Placement. This Agreement and the documents executed and delivered by the Company and the Purchasers in connection with the Placement, including but not limited to the Purchase Agreement, the Registration Rights Agreement, and the Warrants, shall be collectively referred to herein as the “Transaction Documents.” The date of the closing of the Placement shall be referred to herein as the “Closing Date.” The Company expressly acknowledges and agrees that Maxim’s obligations hereunder are on a reasonable best efforts basis only and that the execution of this Agreement does not constitute a commitment by Maxim to purchase the Securities and does not ensure the successful placement of the Securities or any portion thereof or the success of Maxim with respect to securing any other financing on behalf of the Company. The Placement Agent may retain other brokers or dealers to act as sub-agents or selected-dealers on its behalf in connection with the Placement. The sale of the Securities to any Purchaser will be evidenced by a securities purchase agreement (the “Purchase Agreement”) between the Company and such Purchaser in a form reasonably acceptable to the Company and Maxim. Capitalized terms that are not otherwise defined herein have the meanings given to such terms in the Purchase Agreement. Prior to the signing of any Purchase Agreement, officers of the Company will be available to answer inquiries from prospective Purchasers.

SECTION 1. REPRESENTATIONS AND WARRANTIES INCORPORATED BY REFERENCE. Each of the representations and warranties (together with any related disclosure schedules thereto) made by the Company to the Purchasers in that certain Purchase Agreements dated as of May 26, 2016, between the Company and each Purchaser, is hereby incorporated herein by reference (as though fully restated herein) and is, as of the date of this Agreement, hereby made to, and in favor of, the Placement Agent.

SECTION 3. REPRESENTATIONS OF MAXIM. Maxim represents and warrants that it (i) is a member in good standing of FINRA, (ii) is registered as a broker/dealer under the Exchange Act, (iii) is licensed as a broker/dealer under the laws of the States applicable to the offers and sales of the Securities by Maxim, (iv) is and will be a body corporate validly existing under the laws of its place of incorporation, and (v) has full power and authority to enter into and perform its obligations under this Agreement. Maxim will immediately notify the Company in writing of any change in its status as such. Maxim covenants that it will use its reasonable best efforts to conduct the Transaction hereunder in compliance with the provisions of this Agreement and the requirements of applicable law.

| 1 |

SECTION 4. COMPENSATION.

In consideration of the services to be provided for hereunder, the Company shall pay to the Placement Agent or their respective designees of the following compensation with respect to the Securities which they are placing:

(a) A cash fee (the “Cash Fee”) equal to an aggregate of seven percent (7%) of the aggregate gross proceeds raised in the Placement. An advance (the “Advance”) of $15,000 has been received by the Placement Agent, which amount will be applied towards the Cash Fee at closing. The Cash Fee, minus Advance, shall be paid at the Closing of the Placement through a third party escrow agent from the gross proceeds of Placement.

(b) Subject to compliance with FINRA Rule 5110(f)(2)(D), the Company also agrees to reimburse Maxim for all travel and other out-of-pocket expenses, including the reasonable fees of legal counsel, in an amount not to exceed $35,000 (inclusive of the Advance). The Company will reimburse Maxim directly out of the Closing of the Placement. In the event this Agreement shall terminate prior to the consummation of the Placement, Maxim shall be entitled to reimbursement for actual expenses; provided, however, such expenses shall not exceed $35,000. Additionally, in accordance with FINRA Rule 5110(f)(2)(C), in the event this Agreement is terminated prior to consummation of the Placement, any portion of the Advance will be returned to the extent such out-of-pocket accountable expenses are not actually incurred.

(c) The Company, at the Closing, will grant to the Placement Agent, non-redeemable warrants covering a number of the securities equal to seven percent (7%) of the total number of Securities being sold and/or issued in the Placement (the “Placement Warrants”). The Placement Warrants will be immediately exercisable and expire five (5) years after the Closing. The Placement Warrants will be exercisable at a price per share equal to 110% of the price of the Securities paid by the Purchasers in connection with the Placement. To the extent that the Purchasers are granted registration rights with respect to their Securities (or components thereof), the Company will grant identical rights to the Placement Agent with respect to shares of Common Stock underlying the Placement Warrants. The Placement Agent will be entitled to customary demand and “piggyback” rights pursuant to FINRA Rule 5110, except that they be assigned, in whole or in part, to any successor, officer or member of the Placement Agent (or to officers or partners of any such successor or member) pursuant to FINRA Rule 5110(g)(2). The Placement Warrants may be exercised in whole or in part, and provide for “cashless exercise” and shall provide for customary anti-dilution and price protection.

(d) The Placement Agent reserves the right to reduce any item of compensation or adjust the terms thereof as specified herein in the event that a determination shall be made by FINRA to the effect that the Placement Agent’s aggregate compensation is in excess of FINRA Rules or that the terms thereof require adjustment.

SECTION 5. INDEMNIFICATION. The Company agrees to the indemnification and other agreements set forth in the Indemnification Provisions (the “Indemnification”) attached hereto as Addendum A, the provisions of which are incorporated herein by reference and shall survive the termination or expiration of this Agreement.

| 2 |

SECTION 6. ENGAGEMENT TERM. Maxim’s engagement hereunder will be until the earlier of (i) June 15, 2016 and (ii) the completion of the Placement. The engagement may be terminated by either the Company or Maxim at any time upon 15 days’ written notice after June 15, 2016. The date of termination of this Agreement is referred to herein as the “Termination Date” and the period of time during which this Agreement remains in effect is referred to herein as the “Term.” In the event, however, in the course of the Placement Agent’s performance of due diligence it deems it necessary to terminate the engagement, the Placement Agent may do so prior to the Termination Date. If within eighteen (18) months after the Termination Date, the Company completes any private financing of equity, equity-linked or debt or other capital raising activity (other than the exercise by any person or entity of any options, warrants or other convertible securities, including the Warrants and Placement Warrants) with any of the investors contacted by Maxim during the term of its engagement, then the Company will pay to Maxim upon the closing of such financing the compensation set forth in Section 4(a) hereof. Upon such termination, Maxim shall deliver to the Company a list of all investors contacted by Maxim during the term of its engagement. Notwithstanding anything to the contrary contained herein, the provisions concerning the Company’s obligation to pay any fees actually earned pursuant to Section 4 hereof and which are permitted to be reimbursed under FINRA Rule 5110(f)(2)(D), and the confidentiality, indemnification and contribution provisions contained herein and the Company’s obligations contained in the Indemnification Provisions will survive any expiration or termination of this Agreement. Notwithstanding anything to the contrary contained herein, the provisions concerning the Company’s obligation to pay any fees actually earned pursuant to Section 4 hereof which are permitted to be reimbursed under FINRA Rule 5110(f)(2)(D), and the confidentiality, indemnification and contribution provisions contained herein and the Company’s obligations contained in the Indemnification Provisions will survive any expiration or termination of this Agreement.

SECTION 7. MAXIM INFORMATION. The Company agrees that any information or advice rendered by Maxim in connection with this engagement is for the confidential use of the Company only in their evaluation of the Placement and, except as otherwise required by law, the Company will not disclose or otherwise refer to the advice or information in any manner without Maxim’s prior written consent.

SECTION 8. NO FIDUCIARY RELATIONSHIP. This Agreement does not create, and shall not be construed as creating rights enforceable by any person or entity not a party hereto, except those entitled hereto by virtue of the Indemnification Provisions hereof. The Company acknowledges and agrees that Maxim is not and shall not be construed as a fiduciary of the Company and shall have no duties or liabilities to the equity holders or the creditors of the Company or any other person by virtue of this Agreement or the retention of Maxim hereunder, all of which are hereby expressly waived.

SECTION 9. CLOSING. The obligations of the Placement Agent, and the closing of the sale of the Securities hereunder are subject to the accuracy, when made and on the Closing Date, of the representations and warranties on the part of the Company and its Subsidiaries contained herein and in the Purchase Agreement, to the accuracy of the statements of the Company and its Subsidiaries made in any certificates pursuant to the provisions hereof, to the performance by the Company and its Subsidiaries of their obligations hereunder, and to each of the following additional terms and conditions:

A. All corporate proceedings and other legal matters incident to the authorization, form, execution, delivery and validity of each of this Agreement, the Shares, the Warrants, and the shares of Common Stock underlying the Warrants, and all other legal matters relating to this Agreement and the transactions contemplated hereby shall be reasonably satisfactory in all material respects to counsel for the Placement Agent, and the Company shall have furnished to such counsel all documents and information that they may reasonably request to enable them to pass upon such matters.

B. The Placement Agent shall have received as of the Closing Date the favorable opinions of legal counsel to the Company identified in the Purchase Agreement, dated as of such Closing Date, including, without limitation, a negative assurance letter from Company Counsel, addressed to the Placement Agent in form and substance satisfactory to the Placement Agent.

| 3 |

C. (i) Neither the Company nor any of its Subsidiaries shall have sustained since the date of the latest audited or unaudited financial statements included in its SEC Reports, any material loss or interference with its business from fire, explosion, flood, terrorist act or other calamity, whether or not covered by insurance, or from any labor dispute or court or governmental action, order or decree, otherwise than as set forth in or contemplated by the Purchase Agreement and (ii) since such date there shall not have been any change in the capital stock or long-term debt of the Company or any of its Subsidiaries or any change, or any development involving a prospective change, in or affecting the business, general affairs, management, financial position, stockholders’ equity, results of operations or prospects of the Company and its Subsidiaries, otherwise than as set forth in or contemplated by the Purchase Agreement, the effect of which, in any such case described in clause (i) or (ii), is, in the judgment of the Placement Agent, so material and adverse as to make it impracticable or inadvisable to proceed with the sale or delivery of the Securities on the terms and in the manner contemplated by the Purchase Agreement.

D. The Securities are not registered under the Exchange Act. For so long as the Warrants remain outstanding, the Company covenants to maintain the registration of the Common Stock under Section 12(b) or 12(g) of the Exchange Act and to timely file (or obtain extensions in respect thereof and file within the applicable grace period) all reports required to be filed by the Company after the date hereof pursuant to Section 13 or 15(d) the Exchange Act with the Commission even if the Company is not then subject to the reporting requirements of Section 13 or 15(d) the Exchange Act. If at any time, Rule 144 (as defined below) is not available to cover such shares of Common Stock due to the failure of the Company to be currently reporting under the Securities Exchange Act of 1934 (“Public Information Failure”), then the Company shall pay in cash by wire transfer of immediately available funds an amount per month equal to two percent (2.0%) of the Subscription Amount of such holder of Securities on the date of such Public Information failure and on every thirtieth (30th) day (pro rated for periods totaling less than thirty days) thereafter until the earlier of (a) the date such Public Information Failure is cured and (b) such time that such public information is no longer required for the holder of Securities to transfer the Securities pursuant to Rule 144. The payments to which a holder of Securities shall be entitled pursuant to this section are referred to herein as “Public Information Failure Payments.” Public Information Failure Payments shall be paid on the earlier of (i) the last day of the calendar month during which such Public Information Failure Payments are incurred and (ii) the third (3rd) Business Day after the event or failure giving rise to the Public Information Failure Payments is cured. In the event the Company fails to make Public Information Failure Payments in a timely manner, such Public Information Failure Payments shall bear interest at the rate of 1.5% per month (prorated for partial months) until paid in full.

E. Subsequent to the execution and delivery of this Agreement and up to the Closing Date, there shall not have occurred any of the following: (i) trading in securities generally on the NYSE MKT shall have been suspended or minimum or maximum prices or maximum ranges for prices shall have been established on any such exchange or such market by the Commission or by such exchange or by any other regulatory body or governmental authority having jurisdiction, (ii) a banking moratorium shall have been declared by federal or state authorities or a material disruption has occurred in commercial banking or securities settlement or clearance services in the United States, (iii) the United States shall have become engaged in hostilities in which it is not currently engaged, the subject of an act of terrorism, there shall have been an escalation in hostilities involving the United States, or there shall have been a declaration of a national emergency or war by the United States, or (iv) there shall have occurred any other calamity or crisis or any change in general economic, political or financial conditions in the United States or elsewhere, if the effect of any such event in clause (iii) or (iv) makes it, in the sole judgment of the Placement Agent, impracticable or inadvisable to proceed with the sale or delivery of the Securities on the terms and in the manner contemplated by the Purchase Agreement.

| 4 |

F. No action shall have been taken and no statute, rule, regulation or order shall have been enacted, adopted or issued by any governmental agency or body which would, as of the Closing Date, prevent the issuance or sale of the Securities or materially and adversely affect or potentially and adversely affect the business or operations of the Company; and no injunction, restraining order or order of any other nature by any federal or state court of competent jurisdiction shall have been issued as of the Closing Date which would prevent the issuance or sale of the Securities or materially and adversely affect the business or operations of the Company.

G. The Company shall have entered into a Purchase Agreement and Registration Rights Agreement with each of the Purchasers and such agreements shall be in full force and effect and shall contain representations, warranties and covenants of the Company as agreed between the Company and the Purchasers.

H. FINRA shall have raised no objection to the fairness and reasonableness of the terms and arrangements of this Agreement. In addition, the Company shall, if requested by the Placement Agent, make or authorize Placement Agent’s counsel to make on the Company’s behalf, any Issuer Filing with FINRA as may be required with respect to the Placement and pay all filing fees required in connection therewith.

I. On or prior to the Closing Date, the Company shall have furnished to the Placement Agent such further information, certificates and documents as the Placement Agent may reasonably request.

J. The Company and the Placement Agent shall have entered into an escrow agreement with a commercial bank or trust company reasonably satisfactory to both parties pursuant to which the Purchasers shall deposit their subscription funds in an escrow account and the Company and the Placement Agent shall jointly authorize the disbursement of the funds from the escrow account. The Company shall pay the reasonable fees of the escrow agent.

K. The Company shall engage and, for a period of three (3) years after the Closing Date, shall maintain, at its expense, a transfer agent and, if necessary under the jurisdiction of its incorporation or the rules of any national securities exchange on which the Common Stock will be listed, a registrar (which, if permitted by applicable laws and rules may be the same entity as the transfer agent) for the Common Stock, which transfer agent and/or registrar is reasonably acceptable to the Placement Agent.

If any of the conditions specified in this Section 9 shall not have been fulfilled when and as required by this Agreement, or if any of the certificates, opinions, written statements or letters furnished to the Placement Agent or to Placement Agent’s counsel pursuant to this Section 9 shall not be reasonably satisfactory in form and substance to the Placement Agent and to Placement Agent’s counsel, all obligations of the Placement Agent hereunder may be cancelled by the Placement Agent at, or at any time prior to, the consummation of the Closing. Notice of such cancellation shall be given to the Company in writing or orally. Any such oral notice shall be confirmed promptly thereafter in writing.

SECTION 10. [RESERVED]

| 5 |

SECTION 11. GOVERNING LAW. This Agreement will be governed by, and construed in accordance with, the laws of the State of New York applicable to agreements made and to be performed entirely in such State. This Agreement may not be assigned by either party without the prior written consent of the other party. This Agreement shall be binding upon and inure to the benefit of the parties hereto, and their respective successors and permitted assigns. Any right to trial by jury with respect to any dispute arising under this Agreement or any transaction or conduct in connection herewith is waived. Each of the Placement Agent and the Company: (i) agrees that any legal suit, action or proceeding arising out of or relating to this Agreement and/or the transactions contemplated hereby shall be instituted exclusively in New York Supreme Court, County of New York, or in the United States District Court for the Southern District of New York, (ii) waives any objection which it may have or hereafter to the venue of any such suit, action or proceeding, and (iii) irrevocably consents to the jurisdiction of the New York Supreme Court, County of New York, and the United States District Court for the Southern District of New York in any such suit, action or proceeding. Each of the Placement Agent and the Company further agrees to accept and acknowledge service of any and all process which may be served in any such suit, action or proceeding in the New York Supreme Court, County of New York, or in the United States District Court for the Southern District of New York and agrees that service of process upon the Company mailed by certified mail to the Company’s address shall be deemed in every respect effective service of process upon the Company, in any such suit, action or proceeding, and service of process upon the Placement Agent mailed by certified mail to the Placement Agent’s address shall be deemed in every respect effective service process upon the Placement Agent, in any such suit, action or proceeding. Nothing contained herein shall be deemed to limit in any way any right to serve process in any manner permitted by law. If either party shall commence an action or proceeding to enforce any provisions of a Transaction Document, then the prevailing party in such action or proceeding shall be reimbursed by the other party for its attorneys fees and other costs and expenses incurred with the investigation, preparation and prosecution of such action or proceeding.

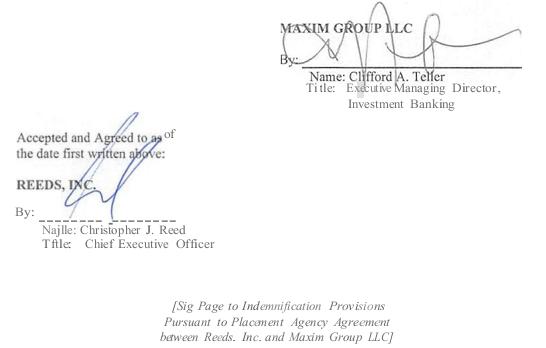

SECTION 12. ENTIRE AGREEMENT/MISC. This Agreement (including the attached Indemnification Provisions) embodies the entire agreement and understanding between the parties hereto, and supersedes all prior agreements and understandings, relating to the subject matter hereof. If any provision of this Agreement is determined to be invalid or unenforceable in any respect, such determination will not affect such provision in any other respect or any other provision of this Agreement, which will remain in full force and effect. This Agreement may not be amended or otherwise modified or waived except by an instrument in writing signed by both Maxim and the Company. The representations, warranties, agreements and covenants contained herein shall survive the closing of the Placement and delivery and/or exercise of Securities. This Agreement may be executed in two or more counterparts, all of which when taken together shall be considered one and the same agreement and shall become effective when counterparts have been signed by each party and delivered to the other party, it being understood that both parties need not sign the same counterpart. In the event that any signature is delivered by facsimile transmission or a .pdf format file, such signature shall create a valid and binding obligation of the party executing (or on whose behalf such signature is executed) with the same force and effect as if such facsimile or .pdf signature page were an original thereof. The Company agrees that the Placement Agent may rely upon, and is a third party beneficiary of, the representations and warranties, and applicable covenants set forth in any such purchase, subscription or other agreement with the Purchasers in the Placement. All amounts stated in this Agreement are in US dollars unless expressly stated.

SECTION 13. NOTICES. Any and all notices or other communications or deliveries required or permitted to be provided hereunder shall be in writing and shall be deemed given and effective on the earliest of (a) the date of transmission, if such notice or communication is sent to the email address specified on the signature pages attached hereto prior to 6:30 p.m. (New York City time) on a business day, (b) the next business day after the date of transmission, if such notice or communication is sent to the email address on the signature pages attached hereto on a day that is not a business day or later than 6:30 p.m. (New York City time) on any business day, (c) the third business day following the date of mailing, if sent by U.S. internationally recognized air courier service, or (d) upon actual receipt by the party to whom such notice is required to be given. The address for such notices and communications shall be as set forth on the signature pages hereto.

[The remainder of this page has been intentionally left blank.]

| 6 |

ADDENDUM A

INDEMNIFICATION PROVISIONS

In connection with the engagement of Maxim Group LLC (“Maxim”) by Reeds, Inc. (the “Company”) pursuant to a letter agreement dated April 28, 2016 between the Company and Maxim, as it may be amended from time to time in writing (the “Agreement”), the Company hereby agrees as follows:

1. The Company hereby agrees to indemnify and hold Maxim, its officers, directors, principals, employees, affiliates, and stockholders, and their successors and assigns, harmless from and against any and all loss, claim, damage, liability, deficiencies, actions, suits, proceedings, costs and legal expenses or expense whatsoever (including, but not limited to, reasonable legal fees and other expenses and reasonable disbursements incurred in connection with investigating, preparing to defend or defending any action, suit or proceeding, including any inquiry or investigation, commenced or threatened, or any claim whatsoever, or in appearing or preparing for appearance as witness in any proceeding, including any pretrial proceeding such as a deposition) (collectively the “Losses”) arising out of, based upon, or in any way related or attributed to, (i) any breach of a representation, warranty or covenant by the Company contained in this Agreement; or (ii) any activities or services performed hereunder by Maxim, unless it is finally judicially determined in a court of competent jurisdiction that such Losses were the primary and direct result of the willful misconduct, gross negligence or bad faith of Maxim in performing the services hereunder.

2. If Maxim receives written notice of the commencement of any legal action, suit or proceeding with respect to which the Company is or may be obligated to provide indemnification pursuant to this Section 2, Maxim shall, within twenty (20) days of the receipt of such written notice, give the Company written notice thereof (a “Claim Notice”). Failure to give such Claim Notice within such twenty (20) day period shall not constitute a waiver by Maxim of its right to indemnity hereunder with respect to such action, suit or proceeding; provided, however, the indemnification hereunder may be limited by any such failure to provide a Claim Notice to the Company that materially prejudices the Company. Upon receipt by the Company of a Claim Notice from Maxim with respect to any claim for indemnification which is based upon a claim made by a third party (“Third Party Claim”), the Company may assume the defense of the Third Party Claim with counsel of its own choosing, as described below. Maxim shall cooperate in the defense of the Third Party Claim and shall furnish such records, information and testimony and attend all such conferences, discovery proceedings, hearings, trial and appeals as may be reasonably required in connection therewith. Maxim shall have the right to employ its own counsel in any such action which shall be at the Company’s expense if (i) the Company and Maxim shall have mutually agreed in writing to the retention of such counsel, (ii) the Company shall have failed in a timely manner to assume the defense and employ counsel or experts reasonably satisfactory to Maxim in such litigation or proceeding or (iii) the named parties to any such litigation or proceeding (including any impleaded parties) include the Company and Maxim and representation of the Company and Maxim by the same counsel or experts would, in the reasonable opinion of Maxim, be inappropriate due to actual or potential differing interests between the Company and Maxim. The Company shall not satisfy or settle any Third Party Claim for which indemnification has been sought and is available hereunder, without the prior written consent of Maxim, which consent shall not be delayed and which shall not be required if Maxim is granted a release in connection therewith. The indemnification provisions hereunder shall survive the termination or expiration of this Agreement.

3. The Company further agrees, upon demand by Maxim, to prompt l y reimburse Maxim for, or pay. any loss, claim, damage, liability or expense as to which Maxim has been indemnified herein with such reimbursement to be made currently as any loss, damage, li ability or expense is incurred by Maxim. Notwithstanding the provisions of the aforementioned Indemnification, any such reimbursement or payment by the Company of fees, expenses, or disbursements incurred by Maxim shall be repaid by Maxim in the event of any proceeding in which a final judgment (after all appeals or the expiration of time to appeal) is entered in a court of competent jurisdiction against Maxim based solely upon its gross negligence, bad faith or willful misconduct in the performance of its duties hereunder, and provided further, that the Company shall not be required to make reimbursement or payment for any settlement effected without the Company·s prior written consent (which consent shall not be unreasonably withheld or delayed).

4. If for auy reason the foregoing indemnification is unavailable or is insufficient to hold such indemnified party hannless, the Company agrees to contribute t he amount paid or payable by such indemnified party in such proportion as to reflect not only the relative benefits received by the Company, as the case may be. on the one hand, and Maxim, on the other hand , but a lso the relative fault of the Company and Maxim as well as any relevant equitable considerations. ln no event shall Maxim contribute in excess of the fees actually received by it pursuant to the terms of this Agreement.

5. For purposes of this Agreement, each officer, director, stockholder, and employee or affiliate of Maxim and each person, if any, who controls Maxim (or any affi liate) within the meaning of either Section 15 of the Securities Act of 1933, as amended, or Section 20 of the Securities Exchange Act of 1934. as amended. shall have the same rights as Maxim with respect to matters of indemnification by the Company hereunder.