Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - AMERICAN REALTY CAPITAL - RETAIL CENTERS OF AMERICA, INC. | v441604_8k.htm |

Exhibit 99.1

First Quarter 2016 Investor Presentation A Public Non - Traded Real Estate Investment Trust* American Realty Capital – Retail Centers of America Publicly Registered Non - Traded Real Estate Investment Trust

IMPORTANT INFORMATION American Realty Capital – Retail Centers of America 2 Risk Factors Investing in our common stock involves a high degree of risk . You should purchase these securities only if you can afford a complete loss of your investment . See the section entitled “Risk Factors” in the Annual Report on Form 10 - K for a discussion of the risks which should be considered in connection with American Realty Capital – Retail Centers of America, Inc . (ARC – RCA or the “Company”) . Forward - Looking Statements This presentation may contain forward - looking statements . You can identify forward - looking statements by the use of forward - looking terminology such as “believes,” “expects,” “may,” “will,” “would,” “could,” “should,” “seeks,” “intends,” “plans,” “projects,” “estimates,” “anticipates,” “predicts,” or “potential” or the negative of these words and phrases or similar words or phrases . Please review the end of this presentation and the Company’s Annual Report on Form 10 - K for a more complete list of risk factors, as well as a discussion of forward - looking statements and other offering details.

ACQUISITION STRATEGY American Realty Capital – Retail Centers of America 3 Acquire Large Retail Assets Diversify by Tenant and Geography Obtain Lease Terms of 5 Years or Greater Buy Assets at Least 80% Leased at Time of Purchase Buy at Discount to Replacement Cost Focused on acquiring existing anchored, stabilized core retail properties; including power centers and lifestyle centers , that are at least 80.0% leased at the time of acquisition in core U.S. markets at a discount to replacement cost with the goal of realizing long term value through leasing up at market rents. Portfolio constructed with exit in mind, through listing on a national exchange or acquisition by a larger shopping center real estate investment trust (“REIT”).

PORTFOLIO UPDATE American Realty Capital – Retail Centers of America 4 Real Estate Investments, at Cost : $1.28 Billion Number of Properties: 35 Rentable Square Feet: 7.5 Million Percentage Leased: 93.9% Weighted Avg . Remaining Lease Term: 5.4 years Based on rentable square feet Data as of March 31, 2016 89% 11% Power Center Lifestyle Center

KEY

INITIATIVES American Realty Capital ¡V Retail Centers of America 5 á Review opportunities to increase NOI at existing

properties. á Significant leasing activity (both new and renewal of in-place leases) in 1Q 2016 assisted income and lease

duration at the portfolio level. á Assess capacity on the line of credit and consider additional leverage to complete acquisitions

and increase cash flow from operations. á Evaluate current portfolio for dispositions and/or joint venture opportunities.

á Investment team conducts on-going analysis to identify key markets in which RCA can harvest maximum value of assets.

á Monitor the publicly traded REIT market and evaluate liquidity options. Retail Centers of America American Realty Capital

KEY

INITIATIVES American Realty Capital ¡V Retail Centers of America 5 á Review opportunities to increase NOI at existing

properties. á Significant leasing activity (both new and renewal of in-place leases) in 1Q 2016 assisted income and lease

duration at the portfolio level. á Assess capacity on the line of credit and consider additional leverage to complete acquisitions

and increase cash flow from operations. á Evaluate current portfolio for dispositions and/or joint venture opportunities.

á Investment team conducts on-going analysis to identify key markets in which RCA can harvest maximum value of assets.

á Monitor the publicly traded REIT market and evaluate liquidity options. Retail Centers of America American Realty Capital

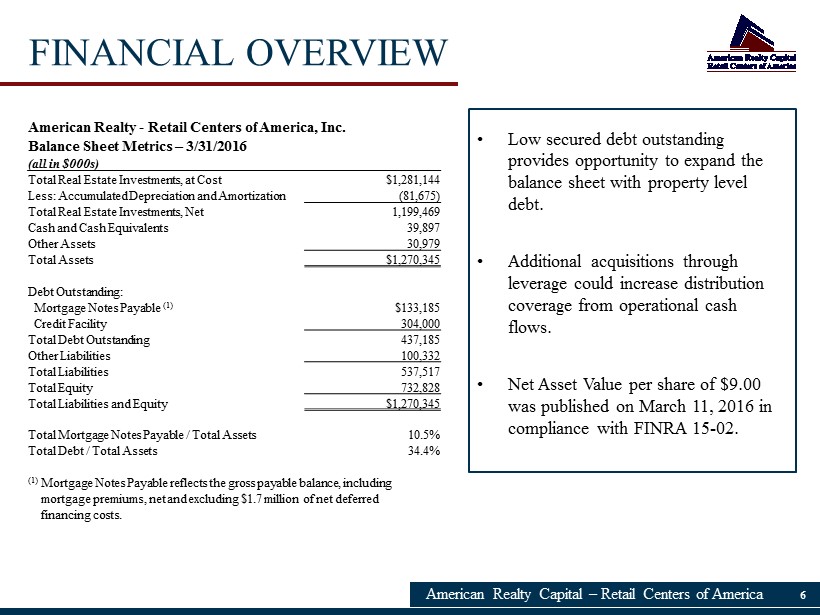

FINANCIAL OVERVIEW American Realty Capital – Retail Centers of America 6 • Low secured debt outstanding provides opportunity to expand the balance sheet with property level debt. • Additional acquisitions through leverage could increase distribution coverage from operational cash flows. • Net Asset Value per share of $9.00 was published on March 11, 2016 in compliance with FINRA 15 - 02. American Realty - Retail Centers of America, Inc. Balance Sheet Metrics – 3/31/2016 (all in $000s) Total Real Estate Investments, at Cost $1,281,144 Less: Accumulated Depreciation and Amortization (81,675) Total Real Estate Investments, Net 1,199,469 Cash and Cash Equivalents 39,897 Other Assets 30,979 Total Assets $1,270,345 Debt Outstanding: Mortgage Notes Payable (1) $133,185 Credit Facility 304,000 Total Debt Outstanding 437,185 Other Liabilities 100,332 Total Liabilities 537,517 Total Equity 732,828 Total Liabilities and Equity $1,270,345 Total Mortgage Notes Payable / Total Assets 10.5% Total Debt / Total Assets 34.4% (1) Mortgage Notes Payable reflects the gross payable balance, including mortgage premiums, net and excluding $1.7 million of net deferred financing costs.

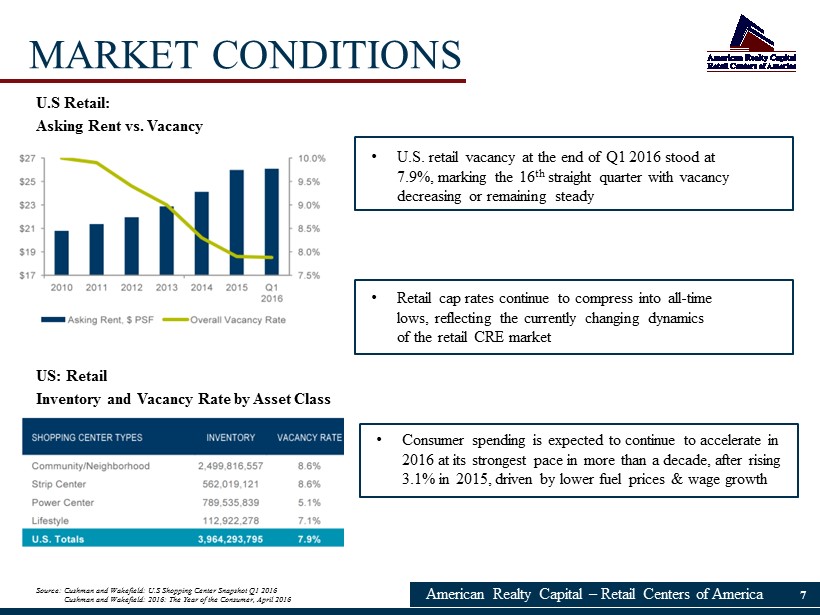

MARKET CONDITIONS American Realty Capital – Retail Centers of America 7 • U.S. retail vacancy at the end of Q1 2016 stood at 7.9%, marking the 16 th straight quarter with vacancy decreasing or remaining steady • Retail cap rates continue to compress into all - time lows, reflecting the currently changing dynamics of the retail CRE market • Consumer spending is expected to continue to accelerate in 2016 at its strongest pace in more than a decade, after rising 3.1% in 2015, driven by lower fuel prices & wage growth U.S Retail: Asking Rent vs. Vacancy US: Retail Inventory and Vacancy Rate by Asset Class Source: Cushman and Wakefield: U.S Shopping Center Snapshot Q1 2016 Cushman and Wakefield: 2016: The Year of the Consumer, April 2016

EXPERIENCED BOARD AND MANAGEMENT TEAM American Realty Capital – Retail Centers of America 8 Katie P. Kurtz CFO / Treasurer / Secretary Michael Weil CEO / President Kase Abusharkh CIO ARC – RCA is led by seasoned professionals with extensive and dynamic experience in real e state Leslie D. Michelson Lead Independent Director Audit Committee Chair Edward G. Rendell Independent Director Michael Weil Chairman Board of Directors Leadership

LINCOLN PROPERTY COMPANY American Realty Capital – Retail Centers of America 9 ◙ Founded in 1965 ◙ Among Largest Private Diversified Real Estate Firms in U.S. ◙ Full Service – development, sales, advisory and property management ◙ $32 Billion Real Estate Assets Under Management ◙ Properties located in more than 200 U.S. cities and 10 countries throughout Europe ◙ 6 ,000 Employees ◙ 40 Administrative Offices in U.S./Europe ◙ 300 Management Offices in 32 States Access to Lincoln Property Company* through Service Provider * Lincoln Retail REIT Services, LLC, a Delaware limited liability company (“Lincoln Retail ”), was organized specifically to provide real estate services to ARC – RCA on behalf of the Advisor . Lincoln Retail has agreed to engage the services of its affiliates as necessary, to maintain an adequate number of skilled an d licensed employees, in addition to all systems, equipment and software needed to carry out the services for which it has been engaged, exclusively for the benefit of ARC – RCA. Per the exclusive services agreement, Lincoln Retail is responsible for the services that it has undertaken to provide and its affiliates are not contractually bound to provide it with assistance. Li ncoln Property Company does not function as ARC – RCA’s service provider.

RISK FACTORS Our potential risks and uncertainties are presented in the section titled “Item 1A. Risk Factors” disclosed in our Annual Report on Form 10 - K for the year ended December 31, 2015 and updated in Quarterly Report on Form 10 - Q from time to time. The following are some of the risks and uncertainties, although not all risks and uncertainties, that could cause our actual results to differ materially from those presented in our forward looking statements: • All of our executive officers are also officers, managers or holders of a direct or indirect controlling interest in our Advisor, or other entities affiliated with AR Global Investments, LLC (the successor business to AR Capital, LLC, "AR Global" or the "Parent of ou r Sponsor"), the parent of our sponsor, American Realty Capital IV, LLC (our "Sponsor"). As a result, our executive officers, o ur Advisor and its affiliates face conflicts of interest, including conflicts created by our Advisor's and its affiliates' compe nsa tion arrangements with us and other investment programs advised by affiliates of the Parent of our Sponsor and conflicts in alloca tin g time among these investment programs and us, which could negatively impact our operating results. • Lincoln Retail and its affiliates have to allocate time between providing real estate - related services to our Advisor and other programs and activities in which they are presently involved or may be involved in the future. • We depend on tenants for revenue and, accordingly, our revenue is dependent upon the success and economic viability of our tenants. • Our tenants may not achieve the rental rate incentives in their lease agreements with us, which may impact our results of ope rat ions. • Increases in interest rates could increase the amount of our interest payments associated with our credit facility and limit our ability to pay distributions. • We are permitted to pay distributions of unlimited amounts from any source. There are no established limits on the amount of borrowings that we may use to fund distribution payments. American Realty Capital – Retail Centers of America 10

RISK FACTORS • We have not generated, and in the future may not generate, operating cash flows sufficient to cover 100 % of our distributions, and, as such, to maintain the level of distributions, we may need to fund some portion of distributions from borrowings, which may be at unfavorable rates, or depend on our Advisor to waive reimbursement of certain expenses or fees . There is no assurance that our Advisor will waive reimbursement of expenses or fees . • We may be unable to maintain cash distributions at the current rate or increase distributions over time . • We are obligated to pay fees, which may be substantial, to our Advisor and its affiliates . • No public market currently exists, or may ever exist, for shares of our common stock and our shares are, and may continue to be, illiquid . • We are subject to risks associated with any dislocation or liquidity disruptions that may exist or occur in the credit markets of the United States of America . • We may fail to continue to qualify to be treated as a REIT for U . S . federal income tax purposes, which would result in higher taxes, may adversely affect our operations and would reduce the value of an investment in our common stock and the cash available for distributions . • We may be deemed to be an investment company under the Investment Company Act of 1940 , as amended (the "Investment Company Act"), and thus be subject to regulation under the Investment Company Act . American Realty Capital – Retail Centers of America 11

▪ For account information, including balances and the status of submitted paperwork, please call us at (866) 902 - 0063 ▪ Financial Advisors may view client accounts, statements and tax forms at www.dstvision.com ▪ Shareholders may access their accounts at www.ar - global.com American Realty Capital – Retail Centers of America www.RetailCentersofAmerica.com