Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - FEI CO | d198971d8k.htm |

| EX-99.1 - EX-99.1 - FEI CO | d198971dex991.htm |

May 27, 2016 Acquisition of FEI Company Exhibit 99.2 The world leader in serving science

Safe Harbor Statement / Use of Non-GAAP Financial Measures The following constitutes a “Safe Harbor” statement under the Private Securities Litigation Reform Act of 1995: This communication contains forward-looking statements that involve a number of risks and uncertainties. Important factors that could cause actual results to differ materially from those indicated by forward-looking statements include risks and uncertainties relating to: the need to develop new products and adapt to significant technological change; implementation of strategies for improving growth; general economic conditions and related uncertainties; dependence on customers’ capital spending policies and government funding policies; the effect of exchange rate fluctuations on international operations; the effect of healthcare reform legislation; use and protection of intellectual property; the effect of changes in governmental regulations; and the effect of laws and regulations governing government contracts, as well as the possibility that expected benefits related to the proposed FEI transaction may not materialize as expected; the FEI transaction not being timely completed, if completed at all; prior to the completion of the transaction, FEI’s business experiencing disruptions due to transaction-related uncertainty or other factors making it more difficult to maintain relationships with employees, customers, licensees, other business partners or governmental entities, difficulty retaining key employees, and the parties being unable to successfully implement integration strategies or to achieve expected synergies and operating efficiencies within the expected time-frames or at all. Additional important factors that could cause actual results to differ materially from those indicated by such forward-looking statements are set forth in Thermo Fisher’s Annual Report on Form 10-K for the year ended December 31, 2015 and its subsequent Quarterly Reports on Form 10-Q, including its Quarterly Report on Form 10-Q for the quarter ended April 2, 2016, each of which is on file with the SEC and available in the “Investors” section of Thermo Fisher’s website under the heading “SEC Filings,” and in other documents Thermo Fisher files with the SEC, and in FEI’s Annual Report on Form 10-K for the year ended December 31, 2015 and its subsequent Quarterly Reports on Form 10-Q, including its Quarterly Report on Form 10-Q for the quarter ended April 3, 2016, each of which is on file with the SEC and available in the investor relations section of FEI’s website, investor.fei.com, under the heading “SEC Filings,” and in other documents FEI files with the SEC. While Thermo Fisher or FEI may elect to update forward-looking statements at some point in the future, Thermo Fisher and FEI specifically disclaim any obligation to do so, even if estimates change and, therefore, you should not rely on these forward-looking statements as representing either Thermo Fisher’s or FEI’s views as of any date subsequent to today. Use of Non-GAAP Financial Measures In addition to the financial measures prepared in accordance with generally accepted accounting principles (GAAP), we use certain non-GAAP financial measures, including adjusted EPS and adjusted operating income, which exclude certain acquisition-related costs, including charges for the sale of inventories revalued at the date of acquisition and significant transaction costs; restructuring and other costs/income; and amortization of acquisition-related intangible assets. Adjusted EPS also excludes certain other gains and losses that are either isolated or cannot be expected to occur again with any regularity or predictability, tax provisions/benefits related to the previous items, benefits from tax credit carryforwards, the impact of significant tax audits or events and the results of discontinued operations. We exclude the above items because they are outside of our normal operations and/or, in certain cases, are difficult to forecast accurately for future periods. We believe that the use of non-GAAP measures helps investors to gain a better understanding of our core operating results and future prospects, consistent with how management measures and forecasts the company’s performance, especially when comparing such results to previous periods or forecasts.

In connection with the transaction, FEI intends to file relevant materials with the Securities and Exchange Commission (the “SEC”), including a preliminary proxy statement on Schedule 14A. Promptly after filing its definitive proxy statement with the SEC, FEI will mail the definitive proxy statement and a proxy card to each stockholder entitled to vote at the special meeting relating to the transaction. INVESTORS AND SECURITY HOLDERS OF FEI ARE URGED TO READ THESE MATERIALS (INCLUDING ANY AMENDMENTS OR SUPPLEMENTS THERETO) AND ANY OTHER RELEVANT DOCUMENTS IN CONNECTION WITH THE TRANSACTION THAT FEI WILL FILE WITH THE SEC WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT FEI AND THE TRANSACTION. The definitive proxy statement, the preliminary proxy statement and other relevant materials in connection with the transaction (when they become available), and any other documents filed by FEI with the SEC, may be obtained free of charge at the SEC’s website (http://www.sec.gov) or through the investor relations section of FEI’s website (http://investor.fei.com). Participants in the Solicitation FEI and its directors, executive officers and other members of its management and employees as well as Thermo Fisher and its directors and executive officers may be deemed to be participants in the solicitation of proxies from FEI’s stockholders with respect to the merger. Information about FEI’s directors and executive officers and their ownership of FEI’s common stock is set forth in the proxy statement for FEI’s 2016 Annual Meeting of Stockholders filed with the SEC on March 28, 2016. Information about Thermo Fisher’s directors and executive officers is set forth in the proxy statement for Thermo Fisher’s 2016 Annual Meeting of Stockholders filed with the SEC on April 5, 2016. Stockholders may obtain additional information regarding the direct and indirect interests of the participants in the solicitation of proxies in connection with the merger, including the interests of FEI’s directors and executive officers in the merger, which may be different than those of FEI’s stockholders generally, by reading the proxy statement and other relevant documents regarding the merger when they become available, which will be filed with the SEC. Additional Information Regarding the Transaction

Acquisition of FEI – Creating Value for Our Shareholders FEI – the leader in high-performance electron microscopy Outstanding strategic fit with Thermo Fisher Scientific and strengthens our Analytical Instruments offering Net purchase price of $4.2B to be funded with cash and new debt Financially compelling and expected to be significantly accretive to adjusted EPS in first full year after close Expected to close by early 2017

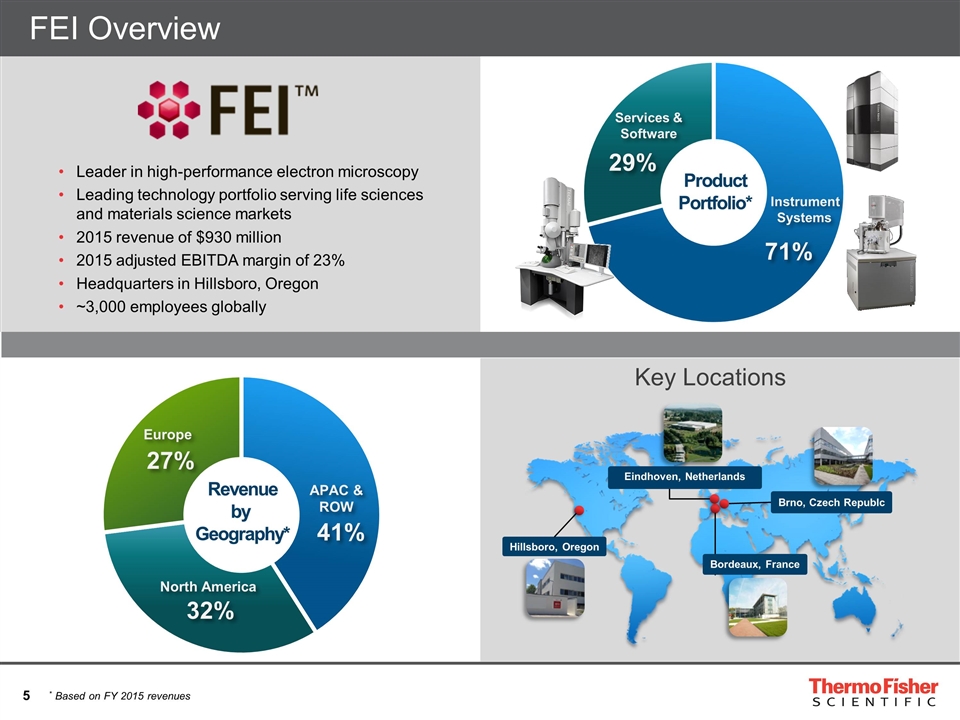

Services & Software 29% Instrument Systems 71% Product Portfolio* Revenue by Geography* North America 32% Europe 27% 41% APAC & ROW FEI Overview Leader in high-performance electron microscopy Leading technology portfolio serving life sciences and materials science markets 2015 revenue of $930 million 2015 adjusted EBITDA margin of 23% Headquarters in Hillsboro, Oregon ~3,000 employees globally * Based on FY 2015 revenues Brno, Czech Republc Hillsboro, Oregon Eindhoven, Netherlands Bordeaux, France Key Locations

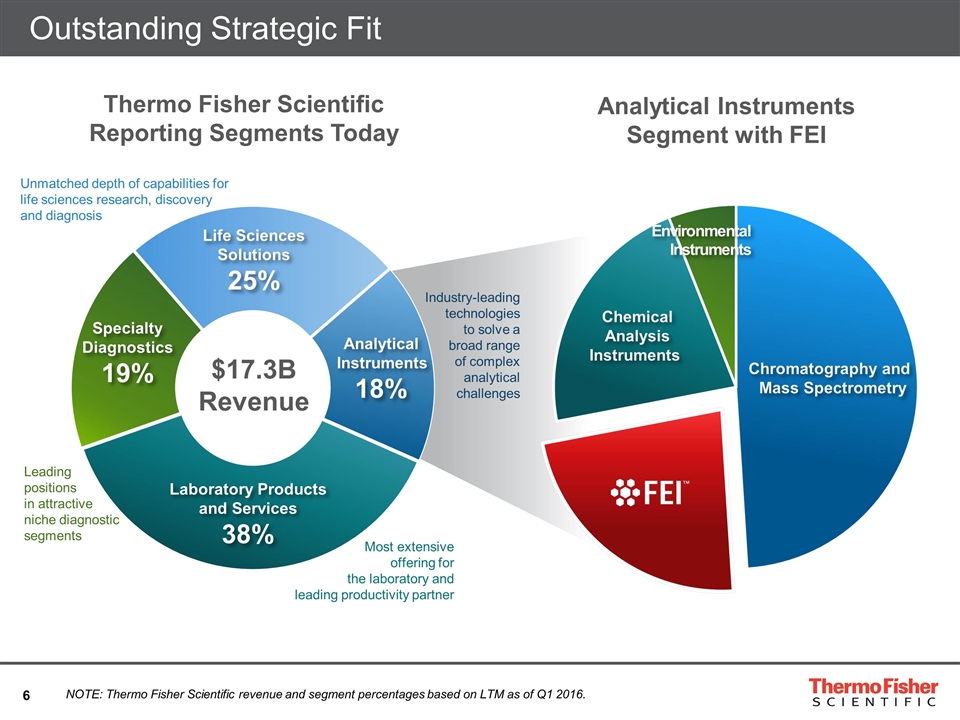

Outstanding Strategic Fit Life Sciences Solutions 25% Specialty Diagnostics 19% Analytical Instruments 18% Laboratory Products and Services 38% $17.3B Revenue Thermo Fisher Scientific Reporting Segments Today Analytical Instruments Segment with FEI NOTE: Thermo Fisher Scientific revenue and segment percentages based on LTM as of Q1 2016. Chemical Analysis Instruments Environmental Instruments Chromatography and Mass Spectrometry Leading positions in attractive niche diagnostic segments Industry-leading technologies to solve a broad range of complex analytical challenges Most extensive offering for the laboratory and leading productivity partner Unmatched depth of capabilities for life sciences research, discovery and diagnosis

Strategic Rationale for Acquisition of FEI Enhances Thermo Fisher Scientific’s unique customer value proposition Leading electron microscopy platform complements mass spectrometry leadership to accelerate advancements in structural biology Combined technology portfolio creates new opportunities in attractive materials science market Thermo Fisher’s unmatched global reach opens new opportunities for FEI Proprietary, global services business generates high-margin, recurring revenue stream Delivers attractive financial benefits to create shareholder value

Offering Industry-Leading Products, Software and Services Life Sciences Materials Science Services High resolution analysis in structural biology and cellular and tissue biology for academic and biopharma customers Supports academic and industrial customers’ R&D in metals, physical chemistry and new materials Physical and electrical semiconductor defect analysis in labs and near-line for integrated device manufacturers and foundries Proprietary services delivered globally by over 800 service personnel Scanning electron microscopy (SEM) Transmission electron microscopy (TEM) Dual Beam (FIB/SEM) Focused Ion (FIB) Software Key Products

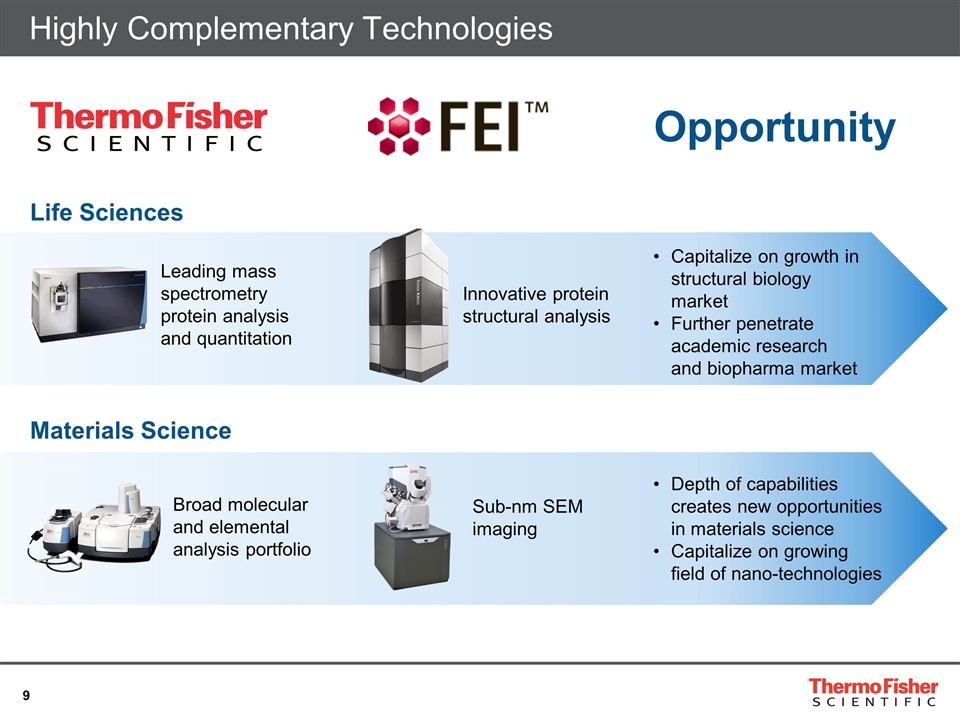

Highly Complementary Technologies Leading mass spectrometry protein analysis and quantitation Innovative protein structural analysis Broad molecular and elemental analysis portfolio Sub-nm SEM imaging Life Sciences Materials Science Opportunity Capitalize on growth in structural biology market Further penetrate academic research and biopharma market Depth of capabilities creates new opportunities in materials science Capitalize on growing field of nano-technologies

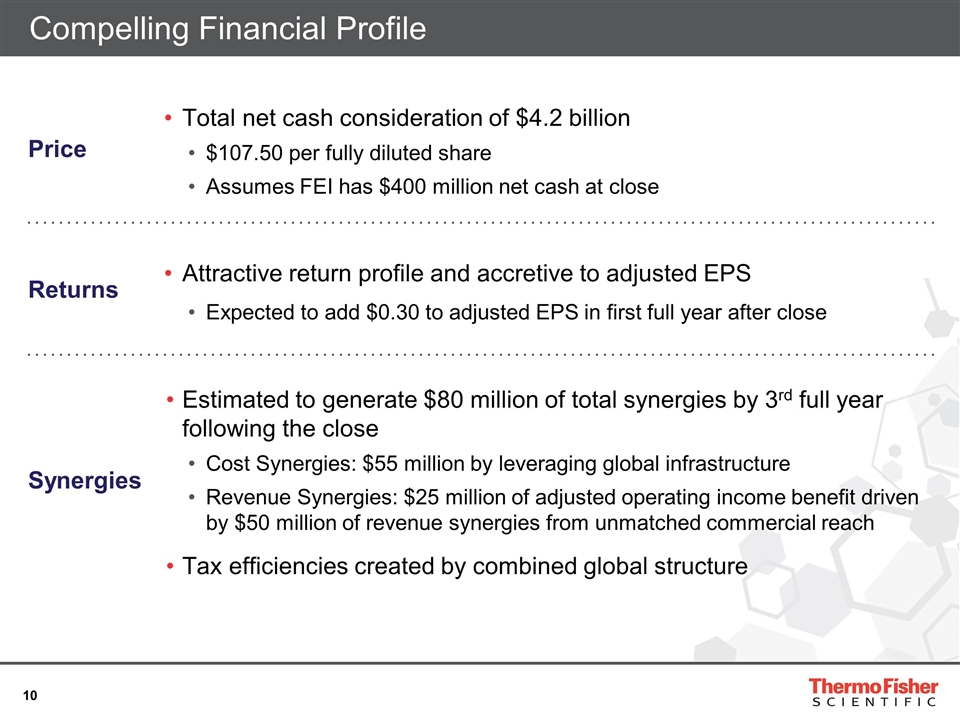

Compelling Financial Profile Price Total net cash consideration of $4.2 billion $107.50 per fully diluted share Assumes FEI has $400 million net cash at close Returns Attractive return profile and accretive to adjusted EPS Expected to add $0.30 to adjusted EPS in first full year after close Synergies Estimated to generate $80 million of total synergies by 3rd full year following the close Cost Synergies: $55 million by leveraging global infrastructure Revenue Synergies: $25 million of adjusted operating income benefit driven by $50 million of revenue synergies from unmatched commercial reach Tax efficiencies created by combined global structure

Transaction Overview Financing Fully committed bridge facility in place Permanent financing from available cash and issuance of new debt Leverage Pro forma leverage ratio expected to be approximately 3.6x at close Our strong free cash flow will allow for rapid repayment of debt Path to Completion FEI shareholder approval Customary closing conditions including applicable regulatory approvals Expected to be completed by early 2017 NOTE: Leverage Ratio = Total debt to trailing twelve months adjusted EBITDA

Acquisition of FEI – Creating Value for Our Shareholders FEI – the leader in high-performance electron microscopy Outstanding strategic fit with Thermo Fisher Scientific and strengthens our Analytical Instruments offering Net purchase price of $4.2B to be funded with cash and new debt Financially compelling and expected to be significantly accretive to adjusted EPS in first full year after close Expected to close by early 2017