Attached files

| file | filename |

|---|---|

| 8-K - CURRENT REPORT ON FORM 8-K - Boreal Water Collection Inc. | boreal_8k.htm |

Exhibit 99.1

SUPREME COURT OF THE STATE OF NEW YORK

COUNTY OF Sullivan

-----------------------------------------------------------------------------------------X

| Red Woods Investments, LLC, | ||

| Plaintiff, | ||

| -against- | Index No. 2016-659 | |

| Boreal Water Collection, Inc., Jeff Bank f/k/a The First National Bank of Jeffersonville, and "John Doe #1" through "John Doe *10" the last ten names being fictitious and unknown to Plaintiff, the persons or parties intended being the tenants, occupants, persons or corporations, if any, having or claiming an interest or lien upon the premises described in the complaint, | ||

| Defendants, |

-----------------------------------------------------------------------------------------X

SUMMONS

Venue: Sullivan County

The basis of the Venue designated is the County in which the Real Property Is Located

Defendant: Boreal Water Collection, Inc.

Address: 4494-4496 State Road 42 North, Kiamesha, New York 12751

Defendant: Jeff Bank f/k/a The First National Bank of Jeffersonville

Address: 4866 State Route 52, Jeffersonville, New York 12748

To the Above Named Defendant:

YOU ARE HEREBY SUMMONED to answer the Complaint in this action and to serve a copy of your answer on the Plaintiffs attorneys within twenty (20) days after the service of this Summons, exclusive of the day of service (or within thirty (30) days after the service is complete if this summons is not personally delivered to you within the State of New York) and in case of your failure to appear or answer, judgment will be taken against you by default for the relief demanded in the Complaint and interest from February 1, 2014, together with costs and disbursements of this action.

Dated: April 12, 2016

The nature of the action is: Foreclosure.

The relief sought is foreclosure of real property damages in an amount to be determined by the court

/s/ Carl L. Finger, Esq.

Carl L. Finger, Esq.

Finger & Finger, A Professional Corporation

Attorneys for the Plaintiff

158 Grand Street

White Plains, New York 10601

(914) 949-0308

Upon your failure to appear, judgment in default will be taken against you in a sum to be determined

by the court, together with interest, costs and disbursements of this action.

| 1 |

SUPREME COURT OF THE STATE OF NEW YORK

COUNTY OF Sullivan

-----------------------------------------------------------------------------------------X

| Red Woods Investments, LLC, | ||

| Plaintiff, | ||

| -against- | Index No. | |

| Boreal Water Collection, Inc., Jeff Bank f/k/a The First National Bank of Jeffersonville, and "John Doe #1" through "John Doe *10" the last ten names being fictitious and unknown to Plaintiff, the persons or parties intended being the tenants, occupants, persons or corporations, if any, having or claiming an interest or lien upon the premises described in the complaint, | ||

| Defendants, |

-----------------------------------------------------------------------------------------X

NOTICE

OF COMMENCEMENT OF ACTION

SUBJECT TO MANDATORY ELECTRONIC

PLEASE TAKE NOTICE that the matter captioned above, which has been commenced by filing of the accompanying documents with the County Clerk, is subject to mandatory electronic filing pursuant to Section 202.5-bb of the Uniform Rules for the Trial Courts. This notice being served as required by Subdivision (b) (3) of that Section.

The New York State Courts Electronic Filing System ("NYSEF") is designed for the electronic filing of documents with the County Clerk and the court and for the electronic service of those documents, court documents, and court notices upon counsel and self-represented parties. Counsel and/or parties who do not notify the court of a claimed exemption (see below) as required by Section 202.5-bb(e) must immediately record their representation within the e-filed matter on the Consent page in NYSCEF. Failure to do so may result in an inability to receive electronic notice of document filings.

Exemptions from Mandatory e-filing are limited to: 1) attorneys who certify in good that that they lack the computer equipment and (along with all employees) the requisite knowledge to comply; and 2) self-represented parties who choose not to participate in e-filing. For additional information about electronic filing, including access to Section 202.5-bb, consult the NYSCEF website at www.nycourts.gov/efile or contact the NF Resource Center at 646-386-3033 or efile@courts.state.ny.us.

Dated: April 12, 2016

/s/ Carl L. Finger, Esq.

Carl L. Finger, Esq.

Finger & Finger, A Professional Corporation

Attorneys for the Plaintiff

158 Grand Street

White Plains, New York 10601

(914) 949-0308

| 2 |

SUPREME COURT OF THE STATE OF NEW YORK

COUNTY OF Sullivan

-----------------------------------------------------------------------------------------X

| Red Woods Investments, LLC, | ||

| Plaintiff, | ||

| -against- | Index No. | |

| Boreal Water Collection, Inc., Jeff Bank f/k/a The First National Bank of Jeffersonville, and "John Doe #1" through "John Doe *10" the last ten names being fictitious and unknown to Plaintiff, the persons or parties intended being the tenants, occupants, persons or corporations, if any, having or claiming an interest or lien upon the premises described in the complaint, | ||

| Defendants, |

-----------------------------------------------------------------------------------------X

NOTICE OF PENDENCY

NOTICE IS HEREBY GIVEN that an action has been commenced and is now pending in this Court upon the complaint of the above-named Plaintiff, Red Woods Investments, LLC against the above-named Defendants Boreal Water Collection, Inc. for the foreclosure of a certain mortgage in the amount of Nine Hundred Thousand Dollars $900,000.00 dated August 27, 2013, recorded on September 5, 2013 in Control Number 2013-6935:

AND NOTICE IS FURTHER GIVEN, that the premises affected by said foreclosure action, at the commencement of this action and at the time of filing of this notice, are situated in the County of Erie, in the City of Orchard Park, State of New York, and are more particularly described as follows and more particularly described in the Schedule A, annexed hereto:

Section, Block, Lot: 9, 140.2 and 41

Street Address: 44944496 State Road 42 North Kiamesha, New York 12751

The Clerk of the County of Sullivan, State of New York, is .hereby directed to index this Notice against Boreal Water Collection, Inc.

Dated: White Plains, New York

April 12, 2016

/s/ Carl L. Finger, Esq.

Carl L. Finger, Esq.

Finger & Finger, A Professional Corporation

Attorneys for the Plaintiff

158 Grand Street

White Plains, New York 10601

(914) 949-0308

| 3 |

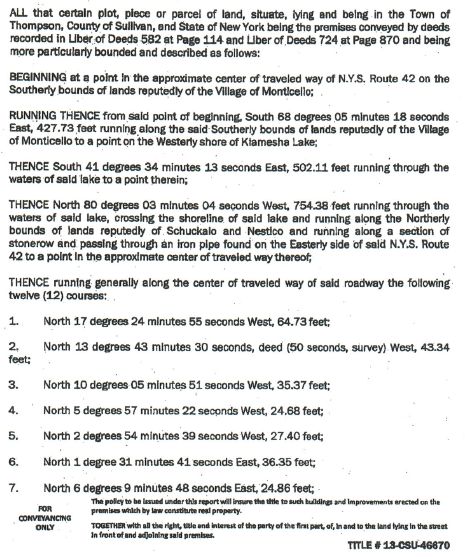

EXHIBIT A

ALL that certain plot, piece or parcel of land situate, lying and being in the Town of Thompson, County of Sullivan and State of New York, being the premises conveyed by deeds recorded in Liber of Deeds 582 at Page 114 and Liber of Deeds 724 at Page 870 and being more particularly bounded and described as follows:

BEGINNING at a point in the approximate center of traveled way of N.Y.S. Route 42 on the Southerly bounds of lands reputedly of the Village of Monticello;

RUNNING THENCE from said point of beginning, South 68 degrees 05 minutes 18 seconds East, 427.73 feet running along the said Southerly bounds of lands reputedly of the Village of Monticello to a point on the Westerly shore-of Kiamesha Lake;

THENCE South 41 degrees 34 minutes 13 seconds East, 502.11 feet running through the waters of said lake to a point therein;

THENCE North 80 degrees 03 minutes 04 seconds West, 754.38 feet running through the waters of said lake, crossing the shoreline of said lake and running along the Northerly bounds of lands reputedly of Schuckalo and Nestico and running along a section of stonerow and passing through an iron pipe found on the Easterly side of said N.Y.S. Route 42 to a point in the approximate center of traveled way thereof

THENCE running generally along the center of traveled way of said roadway the following twelve (12) courses:

1. North 17 degrees 24 minutes 55 seconds West, 64.73 feet;

2. North 13 degrees 43 minutes 30 seconds, deed (50 seconds, survey) West, 43.34 feet;

3. North 10 degrees 05 minutes 51 seconds West, 35.37 feet;

4. North 5 degrees 57 minutes 22 seconds West, 24.68 feet

5. North 2 degrees 54 minutes 39 seconds West, 27.40 feet;

6. North 1 degree 31 minutes 41 seconds East, 36.35 feet;

7. North 6 degrees 9 minutes 48 seconds East, 24.86 feet;

8. North 9 degrees 08 minutes 24 seconds East, 30.10 feet;

9. North 12 degrees 42 minutes 20 seconds East, 26.78 feet;

10. North 15 degrees 48 minutes 49 seconds East, 27.65 feet;

11. North 20 degrees 50 minutes 00 seconds East, 31.66 feet;

12. North 25 degrees 34 minutes East, 45.72 feet to the point or place of BEGINNING

Property Address:

4494-4498 State Road

42 North

Kiamesha, NY 12751

Section: 9

Block: 1

Lot 40.2 and 41

County: Sullivan

Municipality: Thompson

| 4 |

SUPREME

COURT OF THE STATE OF NEW YORK:

COUNTY OF Sullivan

Red Woods Investments, LLC,

Plaintiff,

-against-

Boreal Water Collection, Inc.,

Defendants.

NOTICE OF PENDENCY

Finger

& Finger, A Professional Corporation

Attorneys for Plaintiff

RED WOODS INVESTMENTS, LLC

158 Grand Street

White Plains, New York 10601

0 (914) 949-0308

F (914) 949-3608

To:

Signature: /s/ Carl L. Finger, Esq. Rule 130-1.1-a.

Carl L. Finger, Esq.

| SERVICE OF A COPY OF THE WITHIN | IS HEREBY ADMITTED |

|

DATED: ,20 |

|

| ATTORNEYS FOR |

_________NOTICE OF ENTRY: PLEASE TAKE NOTICE THAT THE WITHIN IS A TRUE COPY OF THE ORDER / JUDGMENT DULY ENTERED IN TILE OFFICE OF THE CLERK OF THE WITHIN NAMED COURT ON

_______ NOTICE OF SETTLEMENT: PLEASE TAKE NOTICE THAT AN ORDER / JUDGMENT OF WHICH THE WITHIN IS A TRUE COPY WILL BE PRESENTED FOR SETTLEMENT TO THE HON. , ONE OF THE JUSTICES OF THE WITHIN COURT, AT THE SUPREME COURT

NEW YORK COUNTY, ON , 2013, at 9:30 a.m.

Dated:

White Plains, New York

May 7, 2015

| 5 |

SUPREME COURT OF THE STATE OF NEW YORK

COUNTY OF Sullivan

-----------------------------------------------------------------------------------------X

| Red Woods Investments, LLC, | ||

| Plaintiff, | ||

| -against- | Index No. | |

| Boreal Water Collection, Inc., Jeff Bank f/k/a The First National Bank of Jeffersonville, and "John Doe #1" through "John Doe *10" the last ten names being fictitious and unknown to Plaintiff, the persons or parties intended being the tenants, occupants, persons or corporations, if any, having or claiming an interest or lien upon the premises described in the complaint, | ||

| Defendants, |

-----------------------------------------------------------------------------------------X

VERIFIED COMPLAINT

Plaintiff, Red Woods Investments, LLC, by its attorneys, FINGER AND FINGER, A PROFESSIONAL CORPORATION, complaining of the defendants, hereby alleges:

AS AND FOR A FIRST CAUSE OF ACTION

1. At all times herein mentioned Plaintiff Red Woods Investments, LLC (referred to herein as “Plaintiff”) is and was a foreign limited liability company.

1. Upon information and belief, at all times herein mentioned Defendant Boreal Water Collection, Inc. (referred to herein as jointly as "Defendant" or "Borrower") was and now is an entity duly organized and existing under the laws of the State of New York and authorized to do business in the State of New York.

2. Upon information and belief, at all times herein mentioned Defendant had a principal place of business, at 4494-4496 State Road 42 North, Kiamesha, New York 12751.

3. Defendants John Doe No. 1 through John Doe No. 10 are the fictitious names of persons or parties currently unknown to Plaintiff, representing tenants, occupants, persons, parties or corporations, if any, having or claiming an interest or lien upon the Property (defined herein).

| 6 |

4. Defendant, at all times herein mentioned, was the owner of the parcel of real property located at 4494-4496 State Road 42 North, Kiamesha, New York 12751, also known as Section 9, Block 1, Lot 40.2 and 41, and more particularly described herein (Exhibit A, the "Property").

5. On or about August 27, 2013, Woodbridge Mortgage Investment Fund 1, LLC, a Delaware LLC ("Lender") loaned to Defendant the principal sum of Nine Hundred Thousand $900,000(the "Loan").

6. On or about August 27, 2013, to evidence its indebtedness to Plaintiff, Defendant duly executed, acknowledged, and delivered to Lender a Promissory Note (Exhibit B, the "Note").

7. To secure payment of the Note, on or about August 27, 2013, Defendant, as mortgagor, executed and delivered to Lender, as mortgagee, a certain Mortgage, Assignment of Leases and Rents, Security Agreement and Fixture Filing (Exhibit C, the "Mortgage").

8. Among other conditions, rights, duties and privileges as fully set forth therein and as detailed below, the Mortgage encumbers the Property and was recorded in the Office of the County Clerk of Sullivan County (Exhibit C).

9. The Mortgage was recorded on or about September 5, 2013 in the office of the Clerk of the County of Sullivan, as Instrument No. 2013-6935.

10. Any applicable recording tax was duly paid at the time of recording the Mortgage.

11. Defendant agreed to pay back the Loan in accordance with the terms of the party's agreements, including, among others, the Note and Mortgage.

12. The Note, the Mortgage, and all other agreements, instruments and documents, at any time executed and delivered in connection therewith, each as may have been amended, restated, supplemented or otherwise modified from time to time, shall be collectively referred to hereinafter as the "Loan Documents."

| 7 |

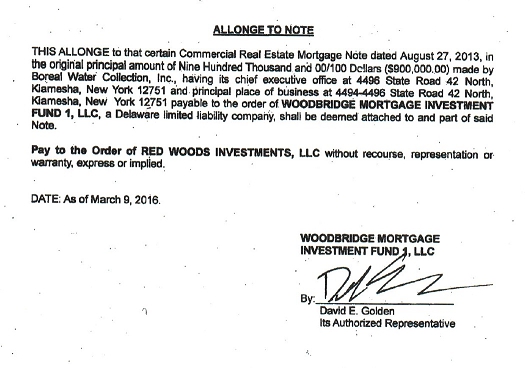

13. Pursuant to an agreement between Plaintiff and Lender, Plaintiff became the owner and holder of the Note, the Mortgage, and the other Loan Documents by assignment dated March 9, 2016 (Exhibit D, the "Assignment"). The Assignment has been submitted for recording.

14. Lender also delivered to Plaintiff an Allonge to Note rendering the Note and Loan payable to Plaintiff (Exhibit E, the "Allonge").

15. Plaintiff became and remains the owner and holder of the Note, the Mortgage, and the other Loan Documents and the Assignment has been submitted for recording.

16. Defendant failed to comply with the terms of the Note, the Mortgage, and the other Loan documents and defaulted thereunder because, among other things, Defendant failed to make the required payments due thereunder commencing August 27, 2015 as follows:

a. Failure to pay principal due

17. The principal balance due under the Loan Documents is Nine Hundred Thousand, $900,000 plus late charges and interest at that default rate from August 27, 2015 and legal fees and costs and other expenses incurred pursuant to the applicable provision of the Loan Documents.

18. Defendant has failed and/or refused to pay the indebtedness owed Plaintiff pursuant to the Loan Documents.

19. Plaintiff has performed all of its obligations under the Loan Documents.

20. Among other things the Mortgage and Loan Documents contain express covenants providing in substance as follows:

a. Upon the occurrence of an event of default, the entire unpaid balance shall become due and payable at the option of the Plaintiff;

| 8 |

b. In the event of a foreclosure, the Property may be sold in one or more parcels in any order or manner, as provided by law;

c. Defendant will pay all taxes, assessments, sewer rents or water rates, insurance premiums, and/or other charges affecting the Property in default thereof Plaintiff may pay same.

21. Plaintiff has paid or may be compelled during the pendency of this action to pay local taxes, assessments, sewer rents or water rates, insurance premiums, and/or other charges affecting the Property.

22. Each of the Defendants, and John Doe and Jane Doe, in the caption has or claims to have or may claim to have some interest in or lien upon said mortgage on the Property or some part thereof, which interest or lien, if any, has accrued subsequent to and/or is subject to and subordinate to the lien of the Mortgage.

23. Jeff Bank f/k/a The First National Bank of Jeffersonville is the holder of a subordinate mortgage date October 8, 2015 and record October 23, 2015 as Instrument Number 2015-7294 (Exhibit F, "Subordinate Mortgage").

24. In accordance - with the loan from Lender to Defendant, Defendant executed documents including but not limited to the promissory note, mortgage, guaranty, and other documents (hereinafter "Loan Documents"). Provident Trust Group f/b/o Priscilla Faulkner loaned funds to Lender on or about September 30, 2013. On or about said date Lender borrowed certain funds from Provident Trust Group f/b/o Priscilla Faulkner. Lender pledged the Loan Documents as collateral for the loan to Lender from the Collateral Assignees. However, the Loan Documents themselves were not assigned and the mortgage was not assigned in whole or in part to the Collateral Assignees.

| 9 |

25. No other action or proceeding has been commenced or maintained or is now pending at law or otherwise for foreclosure of said Mortgage and Loan Documents or for recovery of the Loan or any part thereof.

26. Plaintiff requests that upon sale of the Property pursuant to the judgment of foreclosure demanded herein, the Property be sold subject to the following:

a. Any state of facts that an inspection of the Property would disclose;

b. Any state of facts that an accurate survey of the Property would show;

c. Covenants, restrictions, easements, and public utility agreements of record, if any;

d. Building and zoning ordinances of the municipality in which the mortgaged Property is located and possible violations of same;

e. Unpaid taxes and assessments, if any;

f. Any rights of tenants or persons in possession of the Property or a portion thereof;

g. Any equity of redemption of the United States of America to redeem the premises within 120 days from the date of foreclosure sale; and

h. Prior lien(s) of record, if any.

27. Plaintiff requests that in the event that Plaintiff possesses any other lien(s) against the Property either by way of judgment or otherwise, such other lien(s) shall not be merged into Plaintiffs cause(s) of set forth in this Verified Complaint, but that Plaintiff may enforce such other lien(s) and/or seek determination of priority thereof in any independent action(s) or proceeding(s), including, without limitation, and surplus money proceedings.

28. Plaintiff shall not be deemed to have waived, altered, released or changed the election hereinbefore made, by reason of any payment, before or after the date of the commencement of this action, of any or all of the defaults mentioned herein, and such election shall continue and remain effective.

| 10 |

29. Pursuant to the Loan Documents the Defendant is liable to Plaintiff for the attorneys' fees and other expenses incurred by Plaintiff in connection with this action and enforcing its rights under the Loan Documents.

AS AND FOR A SECOND CAUSE OF ACTION

30. Plaintiff repeats and realleges each of the foregoing allegations as if fully set forth herein.

31. The Loan Documents provide that Defendant gave and Plaintiff maintains a security interest in and on all fixtures and personal property attached to the Property (the "Security Interest").

32. Defendant expressly authorized, in the Loan Documents, the filing of a financing statement, fixture filing, or similar filing, without Defendant's signature, to perfect the Security Interest.

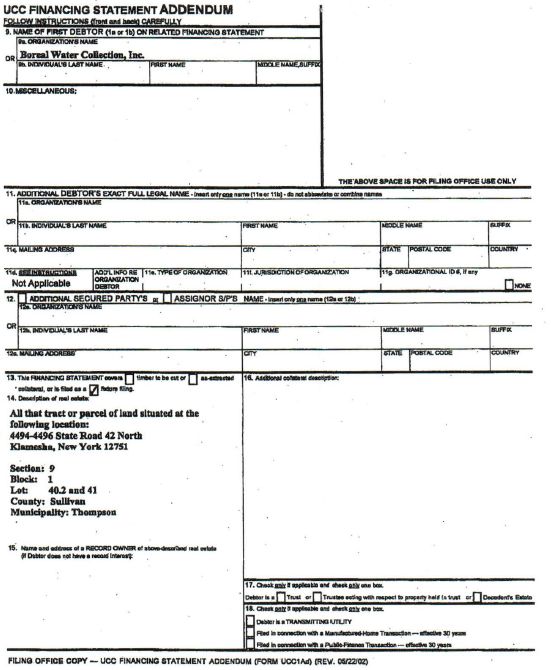

33. The Security Interest is described in a certain UCC Financing Statement (Exhibit G, the "Financing Statement").

34. For the reasons set forth herein, and by reason of Defendant's defaults under the Loan Documents, Plaintiff is entitled to foreclose on the Security Interest.

| 11 |

Wherefore, Plaintiff demands judgment:

| (a) | on the First Cause of Action that the Defendants, and each of them, and all persons claiming under them or any of them, subsequent to the commencement of this action and the filing of a notice of pendency thereof, be barred mid foreclosed of any from all estate, right, title, interest, claim, lien and equity of redemption of, and to the said mortgaged Property and each and every part and parcel thereof; that the said Property may be decreed to be sold in one or more parcels, according to law, in "as is" physical order and condition, subject to the items set forth in this complaint; that the monies arising from the sale thereof may be brought into Court; that Plaintiff may be paid the amount due on the Note and Mortgage as hereinbefore set forth, with interest and late charges to the time of such payment and the expenses of such sale, plus reasonable attorneys' fees, together with the costs, allowance and disbursements of this action, and together with any sums incurred by Plaintiff pursuant to any term or provision of the Note and Mortgage set forth in this complaint, or to protect the liens of Plaintiffs Mortgage, together with interest upon said sums from the dates of the respective payments and advances thereof, so far as the amount of such monies properly applicable thereto will pay the same; that upon Plaintiffs application this Court forthwith appoint a receiver of the rents and profits of said Property, during the pendency of this action with the usual powers and duties; and that in the event that Plaintiff possesses any other liens against said mortgaged Property either by way of judgment or otherwise, Plaintiff requests that such other liens shall not be merged in Plaintiff's causes of action set forth in this complaint but that Plaintiff shall be permitted to enforce said other liens and/or seek determination of priority thereof in any independent actions or proceedings, including, without limitation, any surplus money proceedings, adjudicating Defendants liable, jointly and severally, to pay any deficiency which may remain after applying the foreclosure sale proceeds, net of expenses, to the indebtedness then owed under the Loan Documents, and that Plaintiff may have such other and further relief, or both, in the Property, as may be just and equitable; |

| (a) | on the Second Cause of Action that the defendants, and each of them, and all persons claiming under them or any of them be barred and foreclosed of and from all estate, right, title, interest, claim, lien and equity of redemption of, in and to the items covered by the UCC Financing Statement; that the monies arising from the sale thereof may be brought into Court; that the Plaintiff may be paid the amount due on its Note and security agreement hereinbefore set forth with interest to the time of such payment and the expenses of such sale; together with reasonable attorneys' fees and the legal expenses for pursuing, searching for, receiving, taking, keeping, storing, advertising and selling the items of personal property covered by said security agreement (chattel mortgage) together with any monies advanced and paid by Plaintiff to protect the rights of Plaintiff in and to said personal property covered by said security agreement (chattel mortgage) with interest upon said amounts from the date of respective payments and advances thereof so far as the amount of such monies properly applicable thereto will pay the same; and the Defendants be directed to surrender possession of the items covered by said security agreement (chattel mortgage) to the purchaser at the foreclosure sale; and |

| 12 |

| (b) | such other, further and different relief as the Court deems just, proper and equitable, together with the costs and disbursements of this action, all together with the costs and disbursements of this action. |

Dated: White Plains, NY April 13, 2016

/s/ Carl L. Finger, Esq.

Carl L. Finger, Esq.

Finger & Finger, A Professional Corporation

Attorneys for the Plaintiff

158 Grand Street

White Plains, New York 10601

(914) 949-0308

| 13 |

| 14 |

EXHIBIT A

| 15 |

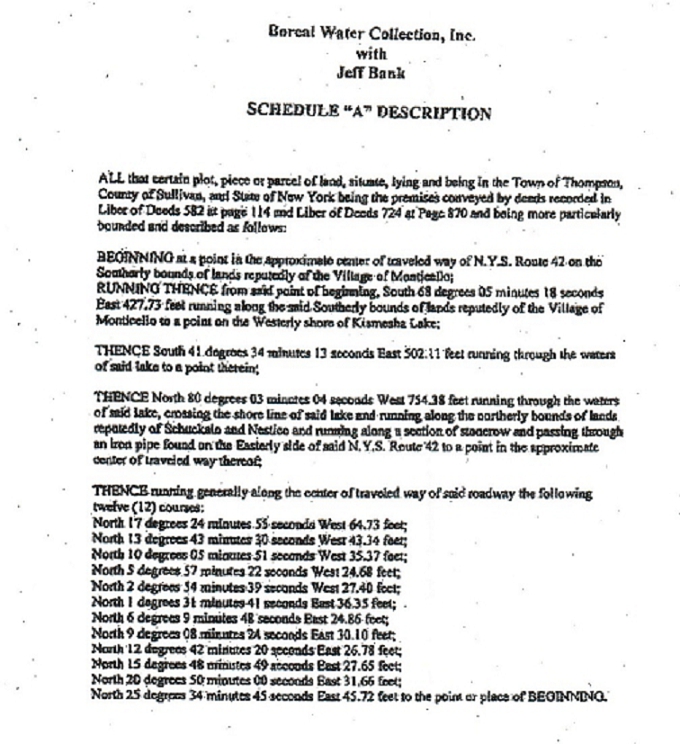

Schedule A

| 16 |

Schedule A (Cont.)

8. North 9 degrees 08 minutes 24 seconds East, 30,10 feet;.

9. North 12 degrees 42 minutes 20 seconds East, 26.78 feet;

10. North 15 degrees 48 minutes 49 seconds East, 27.65 feet;

11. North 20 degrees 50 minutes 00 seconds East, 31.66 feet;

12. North 25 degrees 34 minutes 45 seconds East, 45.72 feet to the point or place of BEGINNING.

| 17 |

EXHIBIT B

| 18 |

COMMERCIAL REAL ESTATE MORTGAGE NOTE

| $900,000 | As of August 27, 2013 |

FOR VALUE RECEIVED, the undersigned Boreal Water Collection, Inc., a Nevada Corporation, having its chief executive office at 4496 State Road 42 North, Kiamesha, New York 12751 and principal place of business at 44944496 State Road 42 North, Kiamesha, New York 12751 ("Maker"), promises to pay to the order of Woodbridge Mortgage Investment Fund 1, LLC, a Delaware LLC, having an address at 14225 Ventura Boulevard, Suite 100, Sherman Oaks, CA 91423 (the "Lender") (the Lender and each successor, owner and holder of this Note being generally Called the "Holder") the sum of Nine Hundred Thousand AND 00/100 DOLLARS ($900,000) together with the following: (i) interest thereon (based upon a 360-day year and the actual number of days in each month) at the rate and in the manner hereinafter provided, from the date hereof to, but not including, the date this Note is paid in full; (ii) all amounts which may be or become due under the Mortgage (as that term is defined in this Note) or under any other document securing the indebtedness evidenced by this Note; (iii) all costs and expenses, including attorneys' and appraisers' reasonable fees (including, but not limited to, allocable costs of staff counsel), incurred in the collection of this Note (including, without limitation against any maker, endorser, guarantor, surety or other party obligated to pay the indebtedness evidenced by this Note) or the foreclosure of the Mortgage, or in protecting or sustaining the lien of the Mortgage or in any litigation or controversy arising from or connected with this Note, the Mortgage or any of the other Security Documents (as that term is defined in this Note); (iv) all taxes or duties assessed upon the indebtedness evidenced by this Note or by the Mortgage or upon the Mortgaged Property (as defined in the Mortgage) or upon any other collateral securing payment or any guaranty of payment of the indebtedness evidenced by this Note, calculated in the manner hereinafter set forth and payable as follows:

Interest Rate

| 1. | The Principal Balance shall bear interest at rate per annum equal to Twelve percent (12%) commencing on the date hereof and continuing to August 26, 2014 or the sooner imposition of the Default Rate (as hereinafter defined). |

Payments

| (i) | On the date hereof, the Maker is paying to the Lender the interest which will accrue on the Principal Balance from the date hereof through August 31, 2013, in the amount of $1,500.00; |

| (ii) | Commencing on October 1, 2013 and on the first day of each successive month thereafter to and including August 1, 2014, there shall be due and payable, in arrears, fixed sums in the amount of Nine Thousand and 00/100 DOLLARS ($9,000.00), each, which shall be applied to the payment of interest then due, computed as aforesaid; and |

| (iii) | On the Maturity Date the Principal Balance together with all accrued interest thereon shall be due and payable. |

All interest shall be computed on a daily basis and calculated on the basis of a three hundred sixty (360) day year for the actual number of days elapsed (i.e. 365/360 accrual/year basis), and paid in arrears on the Principal Balance.

| 19 |

| 1. | The following terms as used herein shall have the following meanings: |

| (i) | The term "Business Day" shall mean any day on which commercial banks are open for business or are permitted to be open for business in the State of New York. |

| (ii) | The term "Maturity Date" shall mean August 26, 2014. |

| (iii) | The term "Mortgage" shall mean that certain Mortgage, Assignment of Leases and Rents, Security Agreement and Fixture Filing of even date herewith executed by Maker to Lender in the principal sum of $900,000 and to be recorded in the Sullivan County Clerk's Office, Sullivan County, New York. |

| (iv) | The term "Other Security Documents" shall mean all and any of the documents other than this Note or the Mortgage now or hereafter executed by the Maker in favor of the Lender, which wholly or partially secure or guaranty payment of this Note. |

| (v) | The term "Principal Balance" shall mean the outstanding principal balance of this Note from time to time. |

| (vi) | The term "Property" shall mean the real property encumbered by the Mortgage. |

2. In addition to any late payment charge which may be due hereunder, if the Maker shall be in default under any of the terms, covenants or conditions contained herein beyond the expiration of any applicable grace period or if the Debt is declared immediately due and payable by Leader pursuant to the provisions of this Note, the Mortgage or the Other Security Documents or if the Debt is not paid in full on the Maturity Date, Maker shall thereafter pay interest on the Principal Balance from the date thereof until such default shall have been cured or the Principal Balance shall have been paid in full at a rate per annum equal to twenty four percent (24%) per annum (the "Default Rate"), provided, however, that such interest rate shall in no event exceed the maximum interest rate which Maker may by law pay.

3. If the Lender shall deem applicable to this Note, any requirement of any law of the United States of America, any regulation, order, interpretation, ruling, official directive or guideline (whether or not having the force of law) of the Board of Governors of the Federal Reserve System, the Comptroller of the Currency, the Federal Deposit Insurance Corporation or any other board or governmental or administrative agency of the United States of America which shall impose, increase, modify or make applicable thereto or cause to be included in, any reserve, special deposit, calculation used in the computation of regulatory capital standards, assessment or other requirement which imposes on the Lender any cost that is attributable to the maintenance hereof then, and in each such event, the Lender shall notify the Maker thereof and the Maker shall pay the Lender, within thirty (30) days of receipt of such notice, such amount as will compensate the Lender for any such cost, which determination may be based upon the Lender's reasonable allocation of the aggregate of such costs resulting from such events. In the event any such cost is a continuing cost, a fee payable to the Lender may be imposed upon the Maker periodically for so long as any such cost is deemed applicable to the Lender, in an amount determined by the Lender to be necessary to compensate the Lender for any such cost. The determination by the Lender of the existence and amount of any such cost shall, in the absence of manifest error, be conclusive.

4. Anything in this Note, the Mortgage, any of the Other Security Documents to the contrary notwithstanding, the Maker shall indemnify and hold the Lender harmless and defend the Lender at the Maker's sale cost and expense against any loss or liability, cost or expense (including, without limitation, reasonable attorneys' fees, and disbursements of the Lender's counsel, whether in-house staff, retained firms or otherwise), and all claims, actions, procedures and suits arising out of or in connection with:

| (i) | any ongoing matters arising out of this Note, the Mortgage, any of the Other Security Documents or the transaction contemplated hereby or thereby, including, but not limited to, all costs of appraisal or reappraisal of all or any portion of any collateral for the Debt (x) following a default hereunder or (y) as required by any applicable law or regulation, or of the granting by the Lender, in its reasonable discretion, of any lease non-disturbance agreements, |

| 20 |

| (ii) | (ii) any amendment to, or restructuring of, the Debt, this Note, the Mortgage or any of the Other Security Documents, and |

| (iii) | any and all lawful action that may be taken by the Lender in connection with the enforcement of the provisions of this Note, the Mortgage or any of the Other Security Documents, whether or not suit is filed in connection with the same, or in connection with the Maker, any guarantor of all or any portion of the Debt and/or any partner; joint venturer or shareholder thereof becoming subject of a voluntary or involuntary federal or state bankruptcy, insolvency or similar proceeding. |

All sums expended by the Lender on account of any of the foregoing shall be reimbursable within ten (10) days of receipt of notice and demand therefor, and if not reimbursed by the Maker pursuant hereto, shall be deemed additional principal evidenced hereby and shall bear interest at the Default Rate set forth at paragraph 2 above.

5. If not sooner paid, all amounts owing under this Note shall be due and payable in full on August 26, 2014 (the "Maturity Date"). Notwithstanding anything herein to the contrary, in the event the Maker shall have complied with all of its obligations during the term of the Loan and further that the collateral securing the Loan remains sufficient in the commercially reasonable discretion of the Lender, the Maker may exercise an option to extend the Maturity Date by a period of one additional year by making a payment of an additional commitment fee in the amount of $54,000.00 at the time of such exercise. The terms and provisions of the documents evidencing the Loan, including the interest rate, shall remain in full force and effect during the extended period. Notification under this paragraph shall be made by Maker in writing to the Lender not less than Sixty (60) days prior to the Maturity Date.

6. In the event that any installment to be paid under the terms of this Note or any payment to be paid under the Mortgage or under any of the other Security Documents (as that term is defined in this Note) is not paid within Five (5) days from the due date, the holder hereof may charge and collect a "late charge" equal to 5% of such delinquent installment or other payment. Such late charges shall be charged on a monthly basis for each installment and shall accrue until paid in full. Maker agrees that such "late charge" is an agreed reasonable estimate of the amount of the expenses of holder incident to handling such delinquent payment, which expenses may be difficult for the parties to quantify, and which "late charge" constitutes agreed upon liquidated damages in addition to the payment of interest.

7. It is hereby expressly agreed that the principal balance of this Note, together with all interest accrued and unpaid hereon and all other sums due under this Note and the Mortgage (hereinafter collectively referred to as the "Debt"), shall become immediately due and payable at the option of the holder on the happening of any default or event by which (each such event being hereinafter referred to as an “Event of Default”, under the terms hereof or of the Mortgage or the terms of any other document now or hereafter executed by Maker or others in favor of the holder, which wholly or partially secure or guaranty payment of this Note (the "Other Security Documents") may or shall become due and payable, and that all of the terms, covenants and provisions contained in the Mortgage and the Other Security Documents which are to be kept and performed by Maker are hereby made part of this Note to the same extent and with the same force and effect as if they were fully set forth herein.

8. Upon occurrence of an Event of Default or, in any event, after the Maturity Date, the interest rate of this Note shall increase, at holder's option, until payment (including any period of time occurring after judgment), to a Default Rate being the lower of; (a) the highest rate allowed by law above the interest rate that would otherwise be in effect under this Note; or (b) a rate equal to twenty four percent (24%) per annum.

| 21 |

9. The undersigned will pay on demand all attorneys' and appraisers' fees, out-of-pocket expenses incurred by the holder's attorneys and all costs incurred by the holder in the administration and collection of all obligations of the maker to the holder, including, without limitation, costs and expenses associated with travel on behalf of the holder, which costs and expenses are directly or indirectly related to the preservation, protection, collection, or enforcement of any of the holder's rights against the maker or any endorser or guarantor and against any collateral given to the holder to secure this Note or any other obligations of the maker or any endorser or guarantor, to the holder (whether or not suit is instituted by or against the holder or any legal appearances are made in any court on behalf of the holder). The obligation to pay all costs, expenses and attorneys' and appraisers' fees set forth in this Note shall expressly include those as may be incurred by the holder to collect the indebtedness due hereunder after judgment in favor of the holder including, without limitation, those incurred by the holder to foreclose any judgment lien, or to realize upon any collateral or to otherwise obtain payment and satisfaction of such judgment.

10. The maker and each endorser, guarantor and surety of this Note hereby give the Lender a security interest, lien and right of set off for all their respective liabilities upon and against all their deposits, deposit accounts, credits, collateral and property, now or hereafter in the possession, safekeeping, custody or control of Lender and its affiliates or in transit to them. At any time, without demand or notice, Lender may set off the same or any part thereof and apply the same to any liability or obligation of maker or any guarantor even though unmatured. Maker and each endorser, guarantor and surety hereby agrees and acknowledges that holder may apply and reapply any and all payments received by holder against any indebtedness owing by maker or by such endorser, guarantor or surety to holder in such order as holder may elect, in its sole discretion, notwithstanding any direction as to such application by maker, such endorser, guarantor or surety or by any trustee in bankruptcy or other representative of such party.

11. The maker and each endorser, guarantor and surety of this Note hereby waive demand, protest, presentment for payment, notice of nonpayment, notice of protest, notice of dishonor and diligence in bringing suit against any party, and do hereby consent to (i) all renewals, extensions or modifications of this Note, the Mortgage or the other Security Documents (including any affecting the time of payment), (ii) all advances under this Note, the Mortgage or the other Security Documents, (iii) the release, surrender, exchange or substitution of all or any part of the security for the indebtedness evidenced by this Note, or the taking of any additional security, (iv) the release of any or all other persons from liability, whether primary or contingent, for the indebtedness evidenced by this Note or for any related obligations, (v) the granting of any other indulgences to any such person, and (vi) all defenses based upon suretyship or impairment of collateral, whether now existing or arising hereafter. Any such renewal, extension, modification, advance, release, surrender, exchange, substitution, taking or indulgence may take place without notice to any such person, and, whether or not any such notice is given, shall not affect the liability of any such person.

12. No delay or omission by the holder in exercising or enforcing any of the holder's powers, rights, privileges, remedies or discretion hereunder shall operate as a waiver thereof on that occasion or on any other occasion. No waiver of any Event of Default hereunder shall operate as a waiver of any other Event of Default hereunder, or as a continuing waiver. No requirement hereof may be waived except in a writing, signed by holder. This Note may not be modified except by an instrument in writing executed by the maker and the holder hereof:

| 22 |

13. All notices, demands, or other communications made pursuant to this Note shall be in writing. Any notice to the maker or to the holder shall be deemed to have been given if mailed, by certified or registered mail, postage prepaid, return receipt requested, or if delivered by nationally recognized, overnight air courier return receipt requested, service, charges prepaid, to the maker or any endorser, guarantor or surety at the address of the maker appearing in the first paragraph of this Note and to the Lender addressed to Woodbridge Mortgage Investment Fund 1, LLC, a Delaware LLC, 14225 , Ventura Boulevard, Suite 100, Sherman Oaks, CA 91423, or at such other address as such party shall have specified by not less than five (5) days prior written notice to the other party. No notation on a check or other method of payment or associated correspondence shall be effective to bind the holder, as evidence of an accord and satisfaction or otherwise, unless it is sent by certified mail, postage prepaid to the attention of the "General Counsel" of the holder at the address of such holder or such other address, if any, specified by holder, in a written notice sent to maker and it unless it is otherwise enforceable under applicable law.

14. This Note is secured by a Mortgage, Assignment of Leases and Rents, Security Agreement and Fixture Filing of even date herewith (the "Mortgage") from the maker, as Mortgagor, to the Lender, as Mortgagee, in the principal amount of $900,000, and by certain other collateral security documentation to be recorded in the Office of the Clerk of the County of Sullivan (Division of Land Records), New York and perfected by filing with the New York Secretary of State and all other applicable Uniform Commercial Code filing offices. The Mortgage constitutes a valid first lien on the Maker's fee interest in certain property more particularly described therein, known as 4494-4496 State Road 42 North, Kiameshi, New York 12751. This Note is being executed and delivered in New York, and shall be governed by and construed in accordance with the substantive laws of the State of New York (without regard to principles of conflicts of law), to the maximum extent the parties may so lawfully agree.

15. It is the intention of parties hereto to comply strictly with all applicable usury laws; and, accordingly, in no event and upon no contingency shall any party be entitled to receive, collect, or apply as interest, any interest, fees, charges, or other payments equivalent to interest, in excess of the maximum amount which may be charged from time to time under applicable law; and, in the event that any party ever receives, collects, or applies as interest any such excess, such amount which would be excessive interest shall be applied to the reduction of the principal amount of the indebtedness evidenced hereby; and, if the principal amount of the indebtedness evidenced hereby and all interest thereon is paid in full, any remaining excess shall forthwith be paid to the maker or other party lawfully entitled thereto. In determining whether or not the interest paid or payable, under any special contingency, exceeds the maximum which may be lawfully charged, the maker and the party receiving such payment shall, to the maximum extent permitted under applicable law, characterize any non-principal payment as an expense, fee or premium, rather than as interest. Any provision hereof or of any other agreement between the parties hereto that operates to bind; obligate, or compel the maker to pay interest in excess of such maximum rate, shall be construed to require the payment of the maximum rate only.

16. (a) Maker shall have the right to prepay this Note in whole or in part without penalty of any kind.

(b) Any and all prepayments shall be credited first to accrued interest to the date of the prepayment, then to escrow payments and other charges accrued pursuant to this Note and the Mortgage and then to the unpaid principal installments of this Note in the inverse order of their maturity and shall not affect the obligation to pay the regular installments required hereunder, until the entire indebtedness has been paid. The covenants of the maker set forth in this paragraph, and the guaranty of maker's obligations by any guarantors or endorsers, shall survive the payment or discharge of this Note and/or the satisfaction of the Mortgage and any other instruments or collateral securing this Note.

| 23 |

17. If the maturity of this Note shall be accelerated for any reason, then a tender of payment by Maker, or by anyone on behalf of Maker, of the amount necessary to satisfy all sums due hereunder shall be deemed to be a voluntary prepayment tender this Note, any such prepayment, to the extent permitted by law, shall require payment of the Prepayment Premium , if any, set forth in section 14 above.

18. Lender may assign this Note, the Mortgage and the Other Security Documents or may issue participation interests or enter into participation interests with other parties for all or any portion of the indebtedness evidenced by this Note or the other Security Documents.

19. If the Note is now, or hereafter shall be, signed by more than one person, it shall be the joint and several obligation of all such persons (including, without limitation, all makers, endorsers, guarantors and sureties, if any) and shall be binding on all such persons and their respective heirs, executors, administrators, legal representatives, successors and assigns. This Note shall be binding upon the undersigned and upon its successors, assigns, and representatives, and shall inure to the benefit of the holder and its successors and assigns.

20. THE MAKER, AND EACH GUARANTOR AND OTHER SURETY OF THIS NOTE HEREBY ACKNOWLEDGE AND AGREE THAT IF THIS NOTE IS LOST OR DESTROYED A COPY OF THIS NOTE MAY BE INTRODUCED INTO EVIDENCE IN ANY COURT BY THE HOLDER INSTEAD OF THE ORIGINAL TO PROVE THE CONTENTS HEREOF AND SAID PARTIES HEREBY IRREVOCABLY WAIVE ANY OBJECTION TO INTRODUCTION INTO EVIDENCE OF SUCH A COPY. MAKER, AND EACH GUARANTOR AND OTHER SURETY FURTHER ACKNOWLEDGE AND AGREE THAT LENDER WILL RELY UPON THE WAIVERS AND ACKNOWLEDGEMENTS SET FORTH IN THIS NOTE IN MAKING THE LOAN(S) TO THE MAKER EVIDENCED BY THIS NOTE.

21. THE MAKER, AND EACH GUARANTOR AND OTHER SURETY OF THIS NOTE VOLUNTARILY, INTENTIONALLY AND IRREVOCABLY WAIVE ALL RIGHT TO A TRIAL BY JURY IN ANY PROCEEDING HEREAFTER INSTITUTED BY OR AGAINST THE LENDER, THE MAKER OR ANY GUARANTOR OR OTHER SURETY IN RESPECT OF THIS NOTE OR ARISING OUT OF ANY SECURITY DOCUMENTS, INSTRUMENT OR AGREEMENT EVIDENCING, GOVERNING OR SECURING THIS NOTE.

Signature page follows.

| 24 |

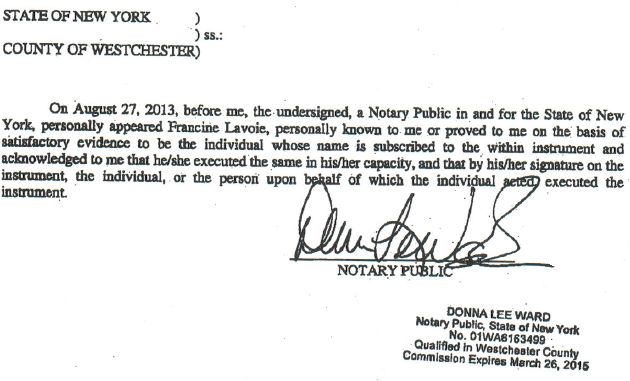

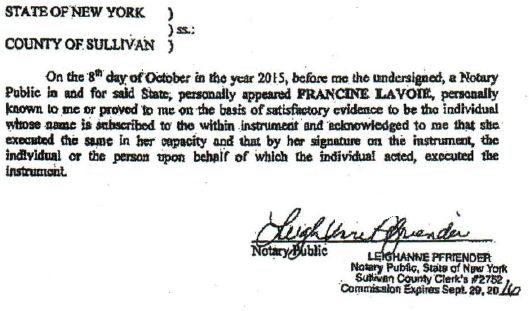

IN WITNESS WHEREOF, the undersigned has executed this Note as of the day and year first above written.

| Boreal Water Collection, Inc. | |

| /s/ Francine Lavoie |

| 25 |

| 26 |

EXHIBIT C

| 27 |

| 28 |

THIS MORTGAGE made as of the August 27, 2013, by Boreal Water Collection, Inc., a Nevada Corporation organized and existing under the laws of the State of Nevada, having an office at 4494-4496 State Road 42 North, Kiamesha, New York 12751 (hereinafter referred to as the "Mortgagor") and Woodbridge Mortgage Investment Fund 1. LLC, a Delaware LLC, having its principal place of business at 14225 Ventura Boulevard, Suite 100, Sherman Oaks, CA 91423 (hereinafter referred to as the "Mortgagee").

WITNESSETH:

WHEREAS, the Mortgagor is the owner of a fee estate in the premises described in Exhibit A attached hereto (the "Premises");

NOW, THEREFORE, to secure the payment of an indebtedness in the principal sum of Nine Hundred Thousand and NO/100 ($900,000) DOLLARS, lawful money of the United States of America, to be paid with interest according to a certain Note dated the date hereof given by the Mortgagor to the Mortgagee (the "Note") (said indebtedness, interest and all other sums which may or shall become due hereunder, collectively, the "Debt"), the Mortgagor has mortgaged, given, granted, bargained, sold, aliened, enfeoffed, conveyed, confirmed and assigned, and by these presents does mortgage, give, grant, bargain, sell, alien, enfeoff, convey, confirm and assign unto the Mortgagee forever all right, title and interest of the Mortgagor now owned, or hereafter acquired, in and to the following property, tights and interest (such property, rights and interests, collectively, the "Mortgaged Property"):

(a) The Premises;

(b) all buildings and improvements now or hereafter located - on the Premises (the "Improvements");

(c) all of the estate, right; title, claim or demand of any nature whatsoever of the Mortgagor, either in law or in equity, in possession or expectancy, in and to the Mortgaged Property or any part thereof;

(d) all easements, rights-of-way, gores of land, streets, ways, alleys, passages, sewer rights, waters, water courses, water rights and powers, and all estates, rights, titles, interests, privileges, liberties, tenements, hereditaments, and appurtenances of any nature whatsoever, in any way belonging, relating or pertaining to the Mortgaged Property (including, without limitation, any and all development rights, air rights or similar or comparable rights of any nature whatsoever now or hereafter appurtenant to the Premises or now or hereafter transferred to the Premises) and all land lying in the bed of any street, road or avenue, opened or proposed, in front of or adjoining the Premises to the center line thereof;

(e) all machinery, apparatus, equipment, fittings, fixtures and other property of every kind and nature whatsoever and all additions thereto and renewals and replacements thereof, and all substitutions therefor now owned or hereafter acquired by the Mortgagor, or in which the Mortgagor has or shall have an interest, now or hereafter located upon or in, or attached to, any portion of the Mortgaged Property or appurtenances thereto, and used or usable in connection with the present or future operation and occupancy of the Mortgaged Property and all building equipment, materials and supplies of any nature whatsoever owned by the Mortgagor, or in which the Mortgagor has or shall have an interest, now or hereafter located upon the Mortgaged Property and whether stored at the Mortgaged Property or off-site (collectively, the "Equipment"), and the right, title and interest of the Mortgagor in and to any of the Equipment which may be subject to any security agreements (as defined in the Uniform Commercial Code of New York), superior in lien to lien of this Mortgage and all proceeds and products of any of the above;

| 29 |

(f) all awards or payments, including interest thereon, and the right to receive the same, which may be made with respect to the Mortgaged Property, whether from the exercise of the right of eminent domain (including any transfer made in lieu of the exercise of said right), or for any other injury to or decrease in the value of the Mortgaged Property;

(g) all leases and other agreements affecting the use or occupancy of the Mortgaged Property now or hereafter entered into (the "Leases") and the right to receive and apply the rents, issues and profits of the Mortgaged Property (the "Rents") to the payment of the Debt which Leases and, Rents are hereby absolutely and unconditionally assigned to Mortgagee;

(h) all right, title and interest of the Mortgagor in and to (i) all contracts from time to time executed by the Mortgagor or any manager or agent on its behalf relating to the ownership, construction, maintenance, repair, operation, occupancy, sale or financing of the Mortgaged Property or any part thereof and all agreements relating to the purchase or lease of any portion of the Mortgaged Property or any property which is adjacent or peripheral to the Mortgaged Property, together with the right to exercise such options and all leases of Equipment, (ii) all consents, licenses, building permits, certificates of occupancy and other governmental approvals relating to construction, completion, occupancy, use or operation of the Mortgaged Property or any part thereof, and (iii) all drawings, plans, specifications and similar or related items relating to the Mortgaged Property;

(i) all trade names, trademarks, logos, copyrights, good will and books and records relating to or used in connection with the operation of the Mortgaged Property or any part thereof; all general intangibles related to the operation of the Mortgaged Property now existing or hereafter

arising;

(j) all proceeds, both cash and non-cash, of the foregoing;

(k) all proceeds of and any unearned premiums on any insurance policies covering the Mortgaged Property, including, without limitation, the right to receive and apply the proceeds of any insurance, judgments, or settlements made in lieu thereof, for damage to the Mortgaged Property; and

(1) the right, in the name and on behalf of the Mortgagor, to appear in and defend any action or proceeding brought with respect to the Mortgaged Property and to commence any action or proceeding to protect the interest of the Mortgagee in the Mortgaged Property.

TO HAVE AND TO HOLD the above granted and described Mortgaged Property unto and to the proper use and benefit of the Mortgagee, and the successors and assigns of the Mortgagee, forever.

AND the Mortgagor covenants and agrees with and represents and warrants to the Mortgagee as follows:

1. Payment of Debt. The Mortgagor will pay the Debt at the time and in the manner provided for its payment in the Note and in this Mortgage.

| 30 |

2. Warranty of Title.

(a) Subject only to those exceptions to title specifically set forth in the title policy issued or to be issued by Chicago Title Insurance Company to the Mortgagee and insuring the lien of this Mortgage, the Mortgagor warrants the title to the Premises, the Improvements, the Equipment and the balance of the Mortgaged Property. The Mortgagor also represents and warrants that (i) the Mortgagor is now, and after giving effect to this Mortgage, will be in a solvent condition, (ii) the execution and delivery of this Mortgage by the Mortgagor does not constitute a "fraudulent conveyance" within the meaning of Title 11 of the United States Code as now constituted or under any other applicable statute, and (iii) no bankruptcy or insolvency proceedings are pending or contemplated by or against the Mortgagor.

(b) The Mortgagor (and the undersigned representative of the Mortgagor, if any) additionally represents and warrants that: (i) it has full power, authority and legal right to execute this Mortgage, and to mortgage, give, grant, bargain, sell, alien, enfeoff, convey, confirm and assign the Mortgaged Property pursuant to the terms hereof and to keep and observe all of the terms of this Mortgage on the Mortgagor's part to be performed, (ii) if the Mortgagor is a corporation, the Mortgagor is a duly organized and presently existing corporation and this Mortgage has been executed by authority of its Board of Directors and with the requisite consent of the holders of the outstanding shares of its capital stock entitled to vote thereon, if such consent is required under the provisions of the certificate of incorporation of the Mortgagor, (iii) if the Mortgagor is a partnership, the Mortgagor is a duly authorized and validly existing partnership and this Mortgage has been executed by a duly authorized general partner and (iv) if the Mortgagor is a limited liability company, this Mortgage has been authorized and executed in accordance with the provisions of the operating agreement of the Mortgagor.

3. Insurance.

The Mortgagor (i) will keep the Improvements and the Equipment insured against loss or damage by fine, standard extended coverage perils and such other hazards as the Mortgagee shall from time to time require in amounts approved by the Mortgagee, which amounts shall in no event be less than 100% of the full insurable value of the Improvements and the Equipment and shall be sufficient to meet all applicable co-insurance requirements, and (ii) will maintain rental and business interruption insurance and (iii) such other forms of insurance coverage with respect to the Mortgaged Property as the Mortgagee shall from time to time require in amounts approved by the Mortgagee. All policies of insurance (the "Policies") shall be issued by insurers having a minimum policy holders rating of "A" per the latest rating publication of Property and Casualty Insurers by A.M. Best Company and who are lawfully doing business in New York and are otherwise acceptable in all respects to the Mortgagee. All Policies shall contain the standard New York mortgagee non-contribution clause endorsement or an equivalent endorsement satisfactory to the Mortgagee naming the Mortgagee as the person to which all payments made by the insurer thereunder shall be paid and shall otherwise be in form and substance satisfactory in all respects to the Mortgagee Blanket insurance policies shall not be acceptable for the purposes of this paragraph unless otherwise approved to the contrary by the Mortgagee. The Mortgagor shall pay the premiums for the Policies as the same become due and payable. At the request of the Mortgagee, the Mortgagor will deliver the Policies to the Mortgagee. Not later than ten (10) days prior to the expiration date of each of the Policies, the Mortgagor will deliver to the Mortgagee a renewal policy or policies marked "premium paid" or accompanied by other evidence of payment of premium satisfactory to the Mortgagee. If at any time the Mortgagee is not in receipt of written evidence that all, insurance required hereunder is in force and effect, the Mortgagee shall have the right without notice to the Mortgagor to take such action as the Mortgagee deems necessary to protect its interest in the Mortgaged Property, including, without limitation, the obtaining of such insurance coverage as the Mortgagee in its sole discretion deems appropriate, and all expenses incurred by the Mortgagee in connection with such action or in obtaining such insurance and keeping it in effect shall be paid by the Mortgagor to the Mortgagee upon demand. The Mortgagor shall at all times comply with and shall cause the Improvements and Equipment and the use, occupancy, operation, maintenance, alteration, repair and restoration thereof to comply with the terms, conditions, stipulations and requirements of the Policies. If the Premises, or any portion of the Improvements Or the Equipment, is located in a Federally designated "special flood hazard area," in addition to the other Policies required under this paragraph, a flood insurance policy shall be delivered by the Mortgagor to the Mortgagee. If no portion of the Premises is located in a Federally designated "special flood hazard area" such fact shall be substantiated by a certificate inform satisfactory to the Mortgagee from a licensed surveyor, appraiser or professional engineer or other qualified person. If the Mortgaged Property shall be damaged or destroyed, in whole or in part, by fire or other property hazard or casualty, the Mortgagor shall give prompt notice thereof to the Mortgagee Sums paid to the Mortgagee by any insurer may be retained and applied by the Mortgagee toward payment of the Debt whether or not then due and payable in such order, priority and proportions as the Mortgagee in its discretion shall deem proper or, at the discretion of the Mortgagee, the same may be paid, either in whole or in part, to the Mortgagor for such purposes as the Mortgagee shall designate. If the Mortgagee shall receive and retain such insurance proceeds, the lien of this Mortgage shall be reduced only by the amount thereof received and retained by the Mortgagee and actually applied by the Mortgagee in reduction of the Debt The provisions of subsection 4 of Section 254 of the Real Property Law of New York covering the insurance of buildings against loss by fire shall not apply to this Mortgage. In addition, the Mortgagee must be named as first mortgagee and loss payee as to the Mortgaged Property under the insurance policy maintained by the Mortgagor for the Mortgaged Property.

| 31 |

4. Payment of Taxes, etc. The Mortgagor shall pay all taxes, assessments, water rates, sewer rents and other charges, including vault charges and license fees for the use of vaults, chutes and similar areas adjoining the Premises, now or hereafter levied or assessed against the Mortgaged Property, and all common charges, dues and assessments imposed pursuant to the Condominium Documents, all insurance premiums, water rates and sewer rents (the "Taxes") prior to the date upon which any fine, penalty, interest or cost may be added thereto or imposed by law for the nonpayment thereof. The Mortgagor shall deliver to the Mortgagee, upon request, receipted bills, cancelled checks and other evidence satisfactory to the Mortgagee evidencing the payment of the Taxes prior to the date upon which any fine, penalty, interest or cost may be added thereto or imposed by law for the nonpayment thereof.

5. At the option of the Mortgagee, the Mortgagor will pay to the Mortgagee on the day of each calendar month one-twelfth of an amount (the "Escrow Fund") which would be sufficient to pay the Taxes payable, or estimated by the Mortgagee to be payable, during the ensuing twelve (12) months. The Mortgagee will apply the Escrow Fund to the payment of Taxes which are required to be paid by the Mortgagor pursuant to the provisions of this Mortgage. If the amount of the Escrow Fund shall exceed the amount of the Taxes payable by the Mortgagor pursuant to the provisions of this Mortgage, the Mortgagee shall, in its discretion, (a) return any excess to the Mortgagor, or (b) credit such excess against future payments to be made to the Escrow Fund. In allocating such excess, the Mortgagee may deal with the person shown on the records of the Mortgagee to be the owner of the Mortgaged Property. If the Escrow Fund is not sufficient to pay the Taxes, as the same become payable, the Mortgagor shall pay to the Mortgagee, upon request, an amount which the Mortgagee shall estimate as sufficient to make up the deficiency. Until expended or applied as above provided, any amounts in the Escrow Fund may be commingled with the general funds of the Mortgagee and shall constitute additional security for the Debt and shall not bear interest.

| 32 |

6. Condemnation. Notwithstanding any taking by any public or quasi-public authority through eminent domain or otherwise, the Mortgagor shall continue to pay the Debt at the time and in the manner provided for its payment in the Note and this Mortgage and the Debt shall not be reduced until any award or payment therefor shall have been actually received and applied by the Mortgagee to the discharge of the Debt. The Mortgagee may apply the entire amount of any such award or payment to the discharge of the Debt whether or not then due and payable in such order, priority and proportions as the Mortgagee in its discretion shall deem proper. If the Mortgaged Property is sold, through foreclosure or otherwise, prior to the receipt by the Mortgagee of such award or payment, the Mortgagee shall have the right, whether or not a deficiency judgment on the Note shall have been sought, recovered or denied, to receive such award or payment, or a portion thereof sufficient to pay the Debt, whichever is less. The Mortgagor shall file and prosecute its claim or claims for any such award or payment in good faith and with due diligence and cause the same to be collected and paid over to the Mortgagee. The Mortgagor hereby irrevocably authorizes and empowers the Mortgagee, in the name of the Mortgagor or otherwise, to collect and receipt for any Such award or payment and to file and prosecute such claim or claims. Although it is hereby expressly agreed that the same shall not be necessary in any event, the Mortgagor shall, upon demand of the Mortgagee, make, execute and deliver any and all assignments and other instruments sufficient for the purpose of assigning any such award or payment to the Mortgagee, free and clear of any encumbrances of any kind or nature whatsoever.

7. Leases and Rents.

(a) Subject to the terms of this paragraph, the Mortgagee waives the right to enter the Mortgaged Property for the purpose of collecting the Rents, and grants the Mortgagor the right to collect the Rents. The Mortgagor shall hold the Rents, or an amount sufficient to discharge all current sums due on the Debt, in trust for use in payment of the Debt The right of the Mortgagor to collect the Rents may be revoked by the Mortgagee upon any default by the Mortgagor under the terms of the Note or this Mortgage by giving notice of such revocation to the Mortgagor. Following such notice the Mortgagee may retain and apply the Rents toward payment of the Debt in such order, priority and proportions as the Mortgagee, in its discretion, shall deem proper, or to the operation, maintenance and repair of the Mortgaged Property, and irrespective of whether the Mortgagee shall have commenced a foreclosure of this Mortgage or shall have applied or arranged for the appointment of a receiver. The Mortgagor shall not, without the consent of the Mortgagee, make, or suffer to be made, any Leases or cancel any Leases or modify or cancel any Leases or accept prepayments of installments of the Rents for a period of more than one (1) month in advance or further assign the whole or any part of the Rents. The Mortgagee shall have all of the rights against tenants of the Mortgaged Property as set forth in Section 291-f of the Real Property Law of New York. The Mortgagor shall (a) fulfill or perform each and every provision of the Leases on the part of the Mortgagor to be fulfilled or perforated, (b) promptly send copies of all notices of default which the Mortgagor shall send or receive under the leases to the Mortgagee, and (c) enforce, short of termination of the Leases, the performance or observance of the provisions thereof by the tenants thereunder. In addition to the rights which the Mortgagee may have herein, in the event of any default under this Mortgage, the Mortgagee, at its option, may require the Mortgagor to pay monthly in advance to the Mortgagee, or any receiver appointed to collect the Rents, the fair and reasonable rental value for the use and occupation of such part of the Mortgaged Property as may be in possession of the Mortgagor. Upon default in any such payment, the Mortgagor will vacate and surrender possession of the Mortgaged Property to the Mortgagee, or to such receiver, and, in default thereof. the Mortgagor may be evicted by summary proceedings or otherwise. Nothing contained in this paragraph shall be construed as imposing on the Mortgagee any of the obligations of the lessor under the Leases.

| 33 |

(b) Mortgagor acknowledges and agrees that, upon recordation of this Mortgage, Mortgagee's interest in the Rents shall be deemed to be fully perfected "chaste" and enforced as to Mortgagor and all third parties, including without limitation, any subsequently appointed trustee in any case under the U.S. Bankruptcy Code, without the necessity of (i) commencing a foreclosure action with respect to this Mortgage, (ii) furnishing notice to Mortgagor or tenants under the Leases, (iii) making formal demand for the Rents (iv) taking possession of the Mortgaged Property as a Mortgagee-En-possession, (v) obtaining the appointment of a receiver of rents and profits of the Mortgaged Property, (vi) sequestering or impounding the Rents, or (vii) taking any other affirmative action.

(c) For purposes of 11 U.S.C. Section 552 (b), Mortgagor and Mortgagee agree that this Mortgage shall constitute a "security agreement," that the security interest created by such security agreement extends to property of Borrower acquired before the commencement of a case in bankruptcy and to all amounts paid as Rents and that such security interest shall extend to all Rents acquired by the estate after the commencement of a case in bankruptcy.

(d) Mortgagor hereby further acknowledges and agrees that all Rents are and shall be deemed to be "Cash Collateral" under Section 363 of the U.S. Bankruptcy Code in the event that Mortgagor files a voluntary petition in bankruptcy or is made subject to any involuntary bankruptcy proceeding. Borrower may not use the Cash Collateral without the consent of Mortgagee and/or an order of any bankruptcy court pursuant to 11 U.S.C. 363(b) (2), and Mortgagor hereby waives any right it may have to assert that the Rents do not constitute Cash Collateral. No consent by Mortgagee to the use of Cash Collateral by Mortgagor shall be deemed to constitute Mortgagee's approval of the purpose for which such Cash Collateral was expended.

8. Maintenance of the Mortgaged Property. The Mortgagor shall cause the Mortgaged Property to be maintained in good condition and repair and will not commit or suffer to be committed any waste of the Mortgaged Property. The Improvements and the Equipment shall not be removed, demolished or materially altered (except for normal replacement of the Equipment) without the prior written consent of the Mortgagee. The Mortgagor shall promptly comply with all existing and future governmental laws, orders, ordinances, rules and regulations affecting the Mortgaged Property, or any portion thereof or the use thereof, including without limitation, the Americans with Disabilities Act of 1990 (42 U.S.C.A. Sec. 12101 et seq). The Mortgagor shall promptly repair, replace or rebuild any part of the Mortgaged Property which may be damaged or destroyed by fire or other property hazard or casualty (including any fire or other property hazard or casualty for which insurance was not obtained or obtainable) or which may be affected by any taking by any public or quasi-public authority through eminent domain or otherwise, and shall complete and pay for, within a reasonable time, any structure at any time in the process of construction or repair on the Premises. If such fire or other property hazard or casualty shall be covered by the Policies, the Mortgagor's obligation to repair, replace or rebuild such portion of the Mortgaged Property shall be contingent upon the Mortgagee paying the Mortgagor the proceeds of the Policies, or such portion thereof as shall be sufficient to complete such repair, replacement or rebuilding, whichever is less. The Mortgagor will not, without obtaining the prior consent of the Mortgagee, initiate, join in or consent to any private restrictive covenant, zoning ordinance, or other public or private restrictions, limiting or affecting the uses which may be made of the Mortgaged Property or any part thereof.

| 34 |

9. Environmental Provisions.

(a) For the purposes of this paragraph the following terms shall have the following meanings: (i) the term "Hazardous Material" shall mean any material or substance that, whether by its nature or use, is now or hereafter defined or regulated as a hazardous waste, hazardous substance, pollutant or contaminant under any Environmental Requirement, or which is toxic, explosive, corrosive, flammable, infectious, radioactive, carcinogenic, mutagenic or otherwise hazardous or which is or contains petroleum, gasoline, diesel fuel, another petroleum hydrocarbon product, asbestos, asbestos-containing materials or polychlorinated biphenyls, (ii) the "Environmental Requirements" shall collectively mean all present and future laws, statutes, common law, ordinances, rules, regulations, orders, codes, licenses, permits, decrees, judgments, directives or the equivalent of or by any Governmental Authority and relating to or addressing the protection of the environment or human health, and (iii) the term "Governmental Authority" shall mean the Federal government, or any state or other political subdivision thereof, or any agency, court or body of the Federal government, any state or other political subdivision thereof, exercising executive, legislative, judicial, regulatory or administrative functions.

(b) The Mortgagor hereby represents and warrants to the Mortgagee that, to the best of Mortgagor's knowledge, after diligent inquiry, (i) no Hazardous Material is currently located at, in, on, under or about the Mortgaged Property in manner which violates any Environmental Requirement, or which requires cleanup or corrective action of any kind under any Environmental Requirement, (ii) no releasing, emitting, discharging, leaching, dumping, disposing or transporting of any Hazardous Material from the Mortgaged Property onto any other property or from any other property onto or into the Mortgaged Property has occurred or is occurring in violation of any Environmental Requirement, (iii) no notice of violation, non-compliance, liability or potential liability, lien, complaint, suit, order or other notice with respect to the Mortgaged Property is presently outstanding under any Environmental Requirement, nor does the Mortgagor have knowledge or reason to believe that any such notice will be received or is being threatened, and (iv) the Mortgaged Property and the operation thereof are in full compliance with all Environmental Requirements.

(c) The Mortgagor shall comply, and shall cause all tenants or other occupants of the Mortgaged Property to comply, in all respects with all Environmental Requirements, and will not generate, store, handle, process, dispose of or otherwise use, and will not permit any tenant or other occupant of the Mortgaged Property to generate, store, handle, process, dispose of or otherwise use, Hazardous Materials at, in, on, or about the Mortgaged Property in a manner that could lead or potentially lead to the imposition on the Mortgagor, the Mortgagee or the Mortgaged Property of any liability or lien of any nature whatsoever under any Environmental Requirement. The Mortgagor shall notify the Mortgagee promptly in the event of any spill or other release of any Hazardous Material at, in, on, under or about the Mortgaged Property which is required to be reported to a Governmental Authority under any Environmental Requirement, will promptly forward to the Mortgagee copies of any notices received by the Mortgagor relating to alleged violations of any Environmental Requirement or any potential liability under any Environmental Requirement and will promptly pay when due any fine or assessment against the Mortgagee, the Mortgagor or the Mortgaged Property relating to any Environmental Requirement. If at any time it is it is determined that the operation or use of the Mortgaged Property is in violation of any applicable Environmental Requirement or that there are Hazardous Materials located at, in, on, under or about the Mortgaged Property which violate any applicable Environmental Requirement or that there are Hazardous Materials located at, in, on, under or about the Mortgaged Property which, under any Environmental Requirement, require special handling in collection, storage, treatment or disposal, or any form of cleanup or corrective action, the Mortgagor shall, within thirty (30) days after receipt of notice thereof from any Governmental Authority or from the Mortgagee, take, at the Mortgagor's sole cost and expense, such actions as may be necessary to fully comply in all respects with all Environmental Requirements, provided, however, that if such compliance cannot reasonably be Completed within such thirty (30) day period, the Mortgagor shall commence such necessary action within such thirty (30) day period and shall thereafter diligently and expeditiously proceed to fully comply in all respects and in a timely fashion with all Environmental Requirements.

| 35 |