Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - Village Bank & Trust Financial Corp. | v441075_8k.htm |

Exhibit 99.1

and Trust Financial Corp. You're a Neighbor, Not a Number May 2016 Annual Shareholder Meeting

Agenda Results and Accomplishments 2016 Priorities Plan to Build a High Performing Organization Questions I II IV III

Cautionary Statement Regarding Forward - Looking Statements This presentation contains forward - looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. These forward - looking statements include, but are not limited to, statements about (i) the Company’s plans, objectives, expectations and intentions and other statements contained in this presentation that are not historical facts; and (ii) other statements identified by words such as “expects” “anticipates,” “intends,” “plans,” “believes,” “seeks,” “estimates,” “targets,” “projects,” or words of similar meaning generally intended to identify forward - looking statements. These forward - looking statements are based on the current beliefs and expectations of the Company’s management and are inherently subject to significant business, economic and competitive uncertainties and contingencies, many of which are beyond management’s control. In addition, these forward - looking statements are subject to assumptions with respect to future business strategies and decisions that are subject to change. Actual results may differ materially from the anticipated results discussed or implied in these forward - looking statements because of numerous possible uncertainties. The following factors, among others, could cause actual results to differ materially from the anticipated results or other expectations expressed in the forward - looking statements : (1) adverse governmental or regulatory policies may be enacted; (2) the interest rate environment may compress margins and adversely affect net interest income; (3) results may be adversely affected by continued diversification of assets and adverse changes to credit quality; (4) competition from other financial services companies in the Company’s markets could adversely affect operations; (5) a continuance of the current economic slowdown could adversely affect credit quality and loan originations; and (6) social and political conditions such as war, political unrest and terrorism or natural disasters could have unpredictable negative effects on our businesses and the economy. Additional factors, that could cause actual results to differ materially from those expressed in the forward - looking statements are discussed in the Company’s reports (such as our Annual Report on Form 10 - K, Quarterly Reports on Form 10 - Q and Current Reports on Form 8 - K) filed with the Securities and Exchange Commission and available on the SEC’s Web site www.sec.gov.

4 $(4,007) $(1,037) $646 $402 $1,608 $(5,000) $(3,000) $(1,000) $1,000 $3,000 2013 2014 2015 2016 Q1 Q1 2016 Annualized In Thousands Pretax Earnings

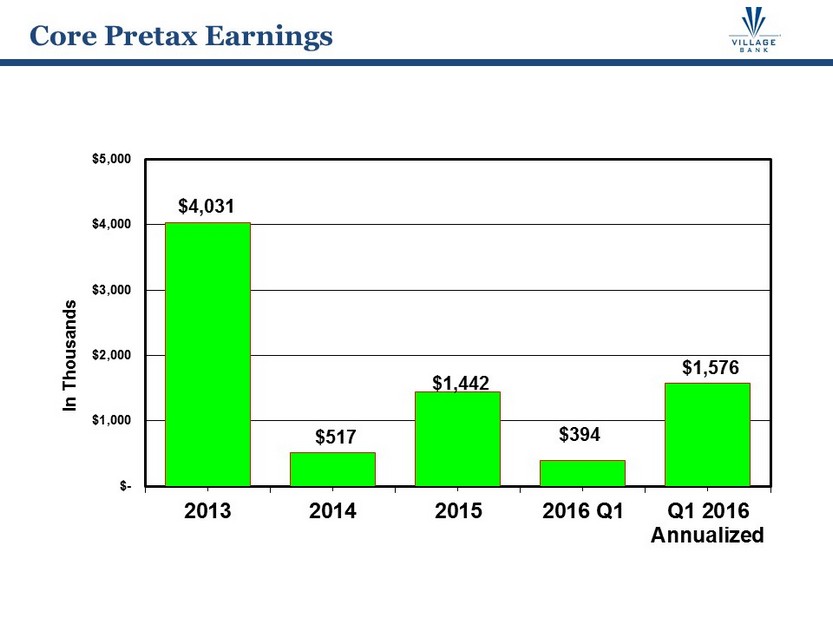

5 $4,031 $517 $1,442 $394 $1,576 $- $1,000 $2,000 $3,000 $4,000 $5,000 2013 2014 2015 2016 Q1 Q1 2016 Annualized In Thousands Core Pretax Earnings

6 4.19% 4.11% 4.20% 4.20% 4.34% 0.94% 0.91% 0.90% 0.89% 0.85% 3.36% 3.34% 3.45% 3.46% 3.63% 0.00% 0.50% 1.00% 1.50% 2.00% 2.50% 3.00% 3.50% 4.00% 4.50% 5.00% 2015 Q1 2015 Q2 2015 Q3 2015 Q4 2016 Q1 Yield on assets Rate on liabilities NIM Net Interest Margin

7 $1,173 $100 ($2,000) $0 $0 ($3,000) ($1,000) $1,000 2013 2014 2015 2016 Q1 2016 Expected In Thousands Provision for Loan Losses

8 $4,742 $1,610 $167 $(50) ($1,000) $0 $1,000 $2,000 $3,000 $4,000 $5,000 2013 2014 2015 2016 Q1 In Thousands Loan Net Charge - offs

9 $7,082 $1,244 $153 $101 ($2,000) $0 $2,000 $4,000 $6,000 $8,000 2013 2014 2015 2016 Q1 In Thousands Expenses Related to Foreclosed Assets

10 $35,389 $20,116 $9,967 $9,351 $0 $10,000 $20,000 $30,000 $40,000 2013 2014 2015 2016 Q1 In Thousands Nonperforming Assets

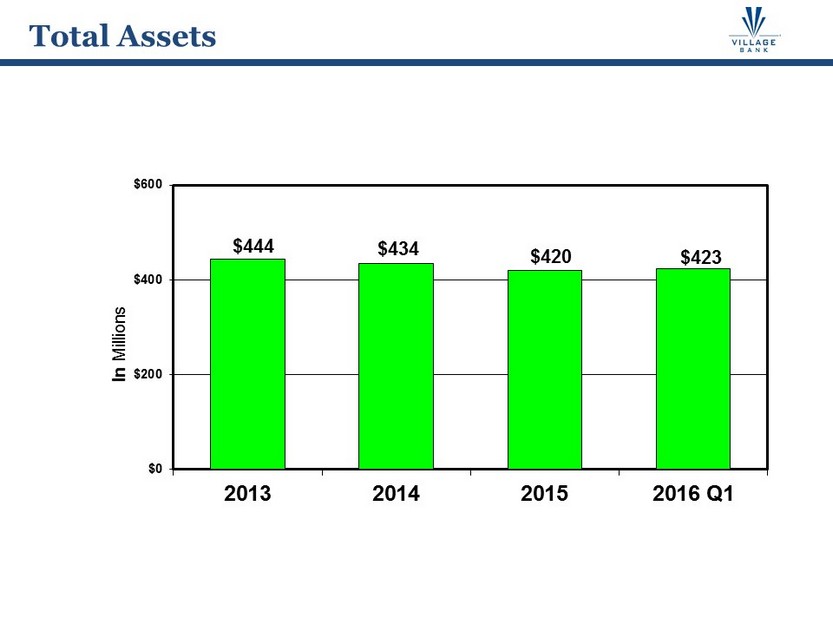

11 $444 $434 $420 $423 $0 $200 $400 $600 2013 2014 2015 2016 Q1 In Millions Total Assets

6.92% 7.18% 9.33% 9.50% 10.90% 12.08% 14.02% 14.20% 0.03 0.04 0.05 0.06 0.07 0.08 0.09 0.1 0.11 0.12 0.13 0.14 0.15 0.16 2013 2014 2015 2016 Q1 Leverage ratio Total risk based Bank Capital Ratios Required 12% Required 8%

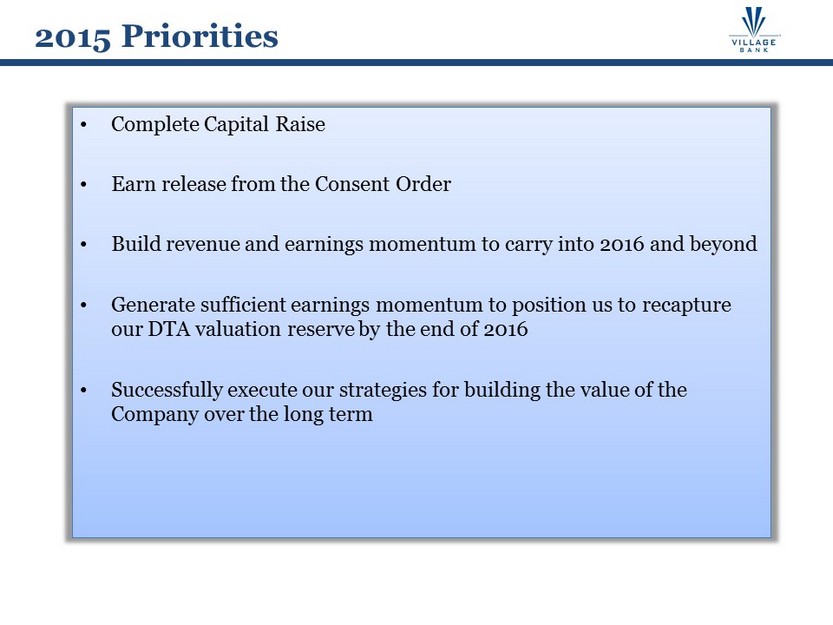

• Complete Capital Raise • Earn release from the Consent Order • Build revenue and earnings momentum to carry into 2016 and beyond • Generate sufficient earnings momentum to position us to recapture our DTA valuation reserve by the end of 2016 • Successfully execute our strategies for building the value of the Company over the long term 2015 Priorities

x Successful Accretive Capital Raise x Achieved regulatory compliance x Immediately accretive to book value per share x Reduced preferred dividends by over 61% or >$1 million per year x Improved holding company capital structure and liquidity x Preserved Deferred Tax Asset x Earned Release from Consent Order x Only remaining issue at this point is sale of old headquarters building x Cut problem assets in half x Generated Earnings Momentum x Increased commercial loan production 49% to $64 million x Hired experienced SBA lender and established Village Bank as a leader in SBA 504 program lending in the SBA’s Virginia Regional office x Bank service charge and interchange fee income grew by >10 % x Village Bank Mortgage pretax profit of $1.0 million x Bank noninterest expenses 3.5% lower x With sustained earnings momentum, we believe that we are positioned to recover all or a substantial portion of the DTA valuation allowance by the end of 2016 2015 Accomplishments

• Generate strong, quality earnings growth • Generate sufficient earnings to recover the DTA valuation allowance • Earn release from all regulatory agreements • Enhance our ability to grow organically by continuing to successfully execute our strategies for building the value of the Company over the long term 2016 Priorities

x Strong Organic Loan Growth x $10 million growth in commercial and consumer loans (17% annualized) x Strong pipelines heading into Q2 x Continued Earnings Momentum x $402,000 in earnings x Believe this keeps us on track to recover all or a substantial portion of the DTA valuation allowance by year end x Share Price Appreciation x 43% one year return on $13.87 offering price in 2015 capital raise (based on $19.90 share price 3/28/2016) x Continued progress on regulatory matters x Building the franchise for future growth x Hired experienced business banker from local bank x Several other excellent hires in key roles in commercial and retail banking x Continuing to recruit A players and the teams they need to succeed Q1 2016 Accomplishments

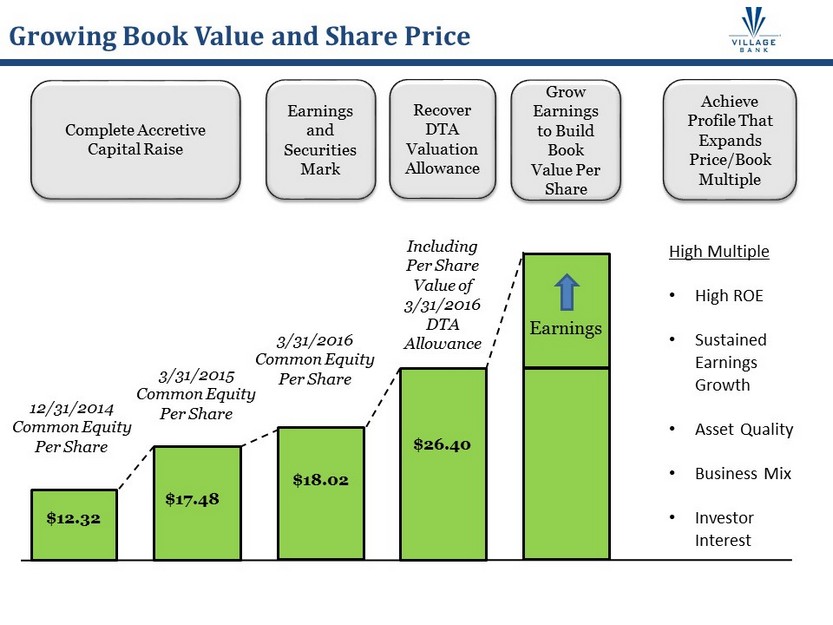

Complete Accretive Capital Raise Growing Book Value and Share Price $12.32 12/31/2014 Common Equity Per Share 3/31/2015 Common Equity Per Share $17.48 $18.02 Including Per Share Value of 3/31/2016 DTA Allowance Earnings High Multiple • High ROE • Sustained Earnings Growth • Asset Quality • Business Mix • Investor Interest Recover DTA Valuation Allowance Grow Earnings to Build Book Value Per Share Achieve Profile That Expands Price/Book Multiple 3/31/2016 Common Equity Per Share Earnings and Securities Mark $26.40

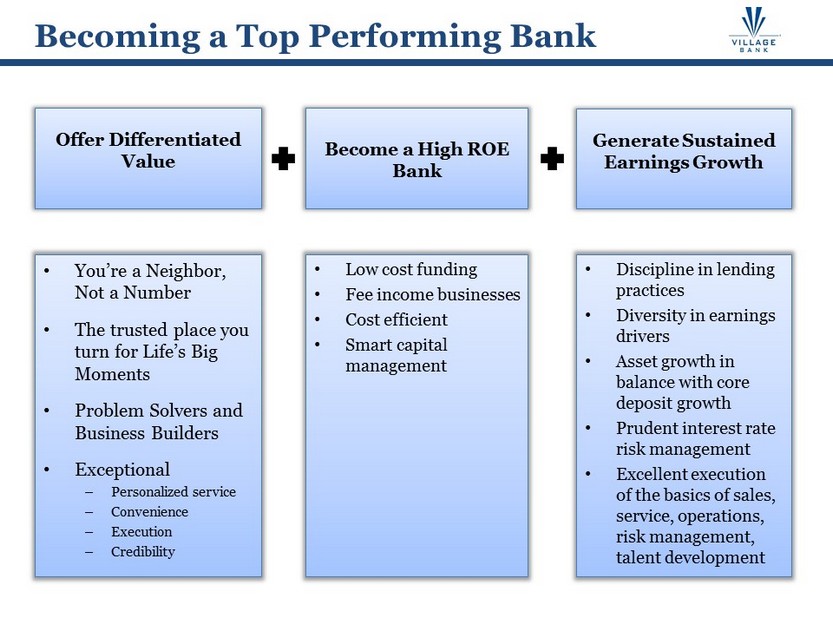

• Low cost funding • Fee income businesses • Cost efficient • Smart capital management • Discipline in lending practices • Diversity in earnings drivers • Asset growth in balance with core deposit growth • Prudent interest rate risk management • Excellent execution of the basics of sales, service, operations, risk management, talent development Becoming a Top Performing Bank Generate Sustained Earnings Growth Offer Differentiated Value Become a High ROE Bank • You’re a Neighbor, Not a Number • The trusted place y ou turn for Life’s Big Moments • Problem Solvers and Business Builders • Exceptional – P ersonalized service – Convenience – Execution – Credibility

A Path to 1% ROA, 10% ROE, Strong Share Price Growth 2015 NIBT Balance Sheet Growth & Mix Improvement $4,400k $950k Mortgage $2,300k Expense Reductions $1,500k $7,500k Rate Increases ($2,300k) Provision Change $9,000k $3,000k Fed Funds up 2.75% Fed Funds up 1.50% 2019 Goals 1%+ ROA 10%+ ROE $5MM+ in Net Income on $500MM in Assets $50MM in Equity FOMC Member Midpoint Forecast up 2.75% 2019 NIBT Goals Assumes no M&A Activity

Why Village? Village Bank and Trust Financial Corp. Great Market • Stable , diverse economy • Strong population, job & income growth • Excellent business climate & quality of life • Attractive market segments around which to grow business High Quality Franchise • Strong branch coverage with quality real estate in good locations • Excellent brand & loyalty from team, customers, investors, community leaders • Competitive products & services that can be best among community banks • Profitable mortgage banking business that enhances visibility and the brand image Strong Management • Seeing traction on both revenue growth and expense reduction • Demonstrated effectiveness in addressing asset quality and rebuilding the business • Breadth and depth of e xperience for a community bank DTA Recovery • Potential DTA recovery can increase book value • Tax liability protection for future earnings Future Growth Opportunities • Commercial banking expansion • Excellent platform for recruiting mortgage loan officers and growing production • Reinvest excess liquidity into higher yielding loans without new deposits/capital • Shrinking credit costs & additional productivity opportunities allow for revenue growth for some time without commensurate expense growth • Opportunity to continue to lower funding costs by growing low cost deposits