Attached files

| file | filename |

|---|---|

| 8-K - 8-K - SPARK NETWORKS INC | lov-8k_20160526.htm |

Investor Presentation May 2016 Exhibit 99.1

Except for statements of historical fact, the information presented herein may constitute forward looking statements within the meaning of and subject to the safe harbor created by the Private Securities Litigation Reform Act of 1995. In some cases, you can identify forward-looking statements by terminology such as "expect," "estimate," "anticipate," "intend," “goal,“ “strategy,” "believe," and similar expressions and variations thereof. Such forward-looking statements include statements regarding the intent, belief, current expectations or projections about future events of Spark Networks. Readers are cautioned that these forward-looking statements are not guarantees of future performance and involve known and unknown risks, uncertainties and other factors which may cause the actual results, performance or achievements of Spark Networks to be materially different from any future results, performance or achievements expressed or implied by such forward-looking statements. Such factors include without limitation, general economic and business conditions, the loss of market share, changes in the competitive landscape, failure to keep up with technological advances and other factors detailed in the Spark Networks’ filings with the Securities and Exchange Commission (“SEC”), including those contained in its filings on Forms 10-K and 10-Q under the headings “Risk Factors” and "Management's Discussion and Analysis of Financial Condition and Results of Operations”, as well as in Spark Networks’ other current and periodic reports filed from time to time with the SEC. These factors include factors over which Spark Networks has little or no control. All forward-looking statements are made as of the date hereof, based on information available to Spark Networks as of the date hereof, and Spark Networks undertakes no obligation to revise or update these forward-looking statements to reflect events or circumstances after the date hereof. Use of Non-GAAP Measures: The Company reports Adjusted EBITDA and Free Cash Flow as supplemental measures to generally accepted accounting principles ("GAAP"). These non-GAAP measures are some of the primary metrics by which we evaluate the performance of our businesses, budget, forecast and compensate management. We believe these measures provide management and investors with a consistent view, period to period, of the core earnings generated from on-going operations. Adjusted EBITDA excludes the impact of: (i) non-cash items such as stock-based compensation, asset impairments, non-cash currency translation adjustments related to an inter-company loan and (ii) one-time items that have not occurred in the past two years and are not expected to recur in the next two years. Free Cash Flow reflects operating cash flow less capital expenditures and capitalized wages. Adjusted EBITDA and Free Cash Flow should not be construed as substitutes for net income (loss) (as determined in accordance with GAAP) for the purpose of analyzing our operating performance or financial position, as Adjusted EBITDA and Free Cash Flow are not defined by GAAP. Safe Harbor

Company Highlights Market Leader with Highly Recognizable Brands in Jewish & Christian Markets Modern Technology Platform, Enabling Scalable Product Development Pursuing Large Opportunity in Millennial & International Mobile Markets Compelling Unit Economics & Deep Community Integration Driving Profitable Growth Firmly Positioned in the Niche / Serious Dating Segment

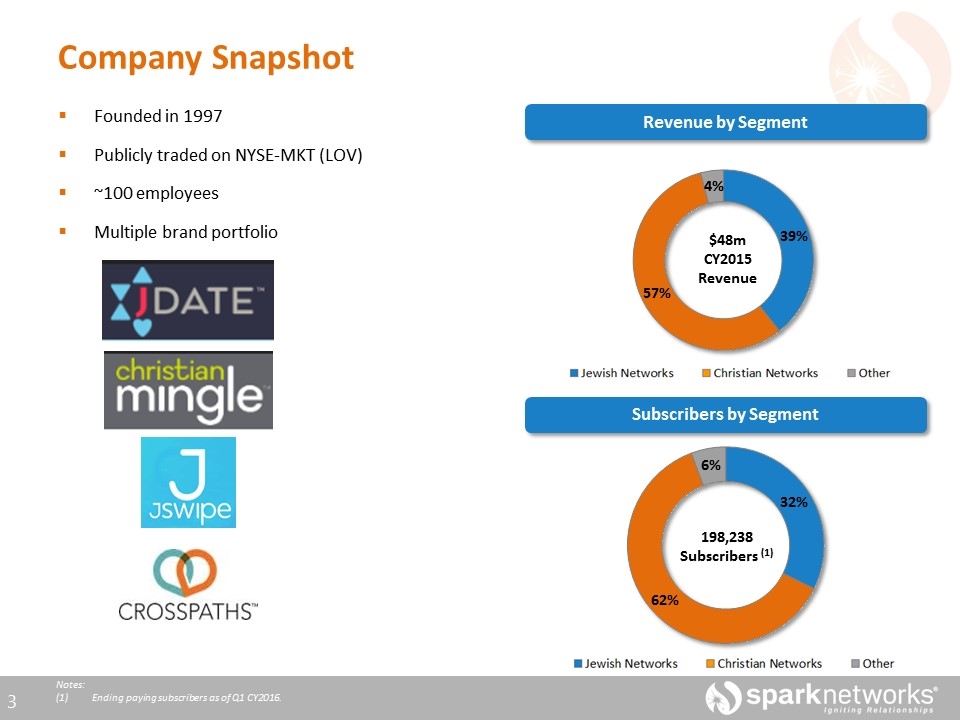

Founded in 1997 Publicly traded on NYSE-MKT (LOV) ~100 employees Multiple brand portfolio Company Snapshot Revenue by Segment Subscribers by Segment Notes: Ending paying subscribers as of Q1 CY2016.

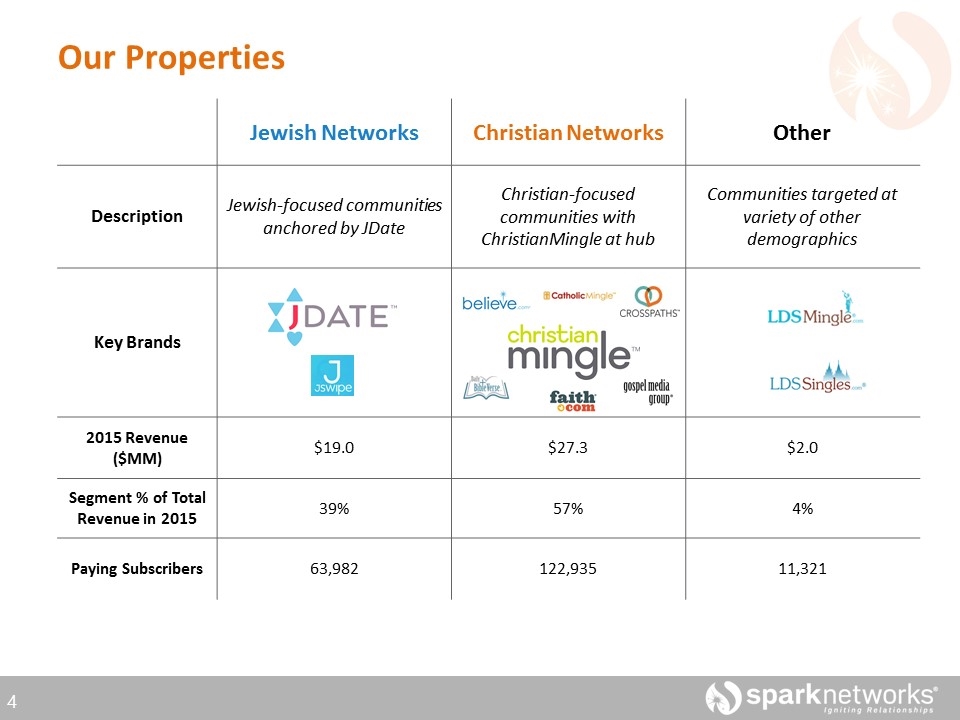

Our Properties Jewish Networks Christian Networks Other Description Jewish-focused communities anchored by JDate Christian-focused communities with ChristianMingle at hub Communities targeted at variety of other demographics Key Brands 2015 Revenue ($MM) $19.0 $27.3 $2.0 Segment % of Total Revenue in 2015 39% 57% 4% Paying Subscribers 63,982 122,935 11,321

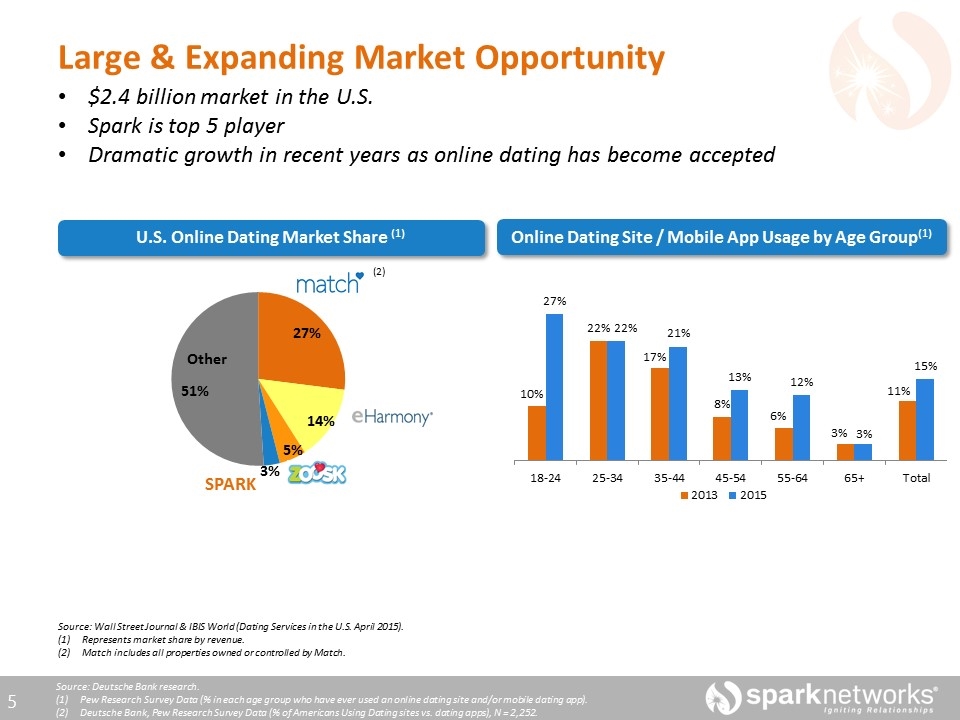

$2.4 billion market in the U.S. Spark is top 5 player Dramatic growth in recent years as online dating has become accepted Source: Wall Street Journal & IBIS World (Dating Services in the U.S. April 2015). Represents market share by revenue. Match includes all properties owned or controlled by Match. Large & Expanding Market Opportunity SPARK Other U.S. Online Dating Market Share (1) (2) Online Dating Site / Mobile App Usage by Age Group(1) Source: Deutsche Bank research. Pew Research Survey Data (% in each age group who have ever used an online dating site and/or mobile dating app). Deutsche Bank, Pew Research Survey Data (% of Americans Using Dating sites vs. dating apps), N = 2,252.

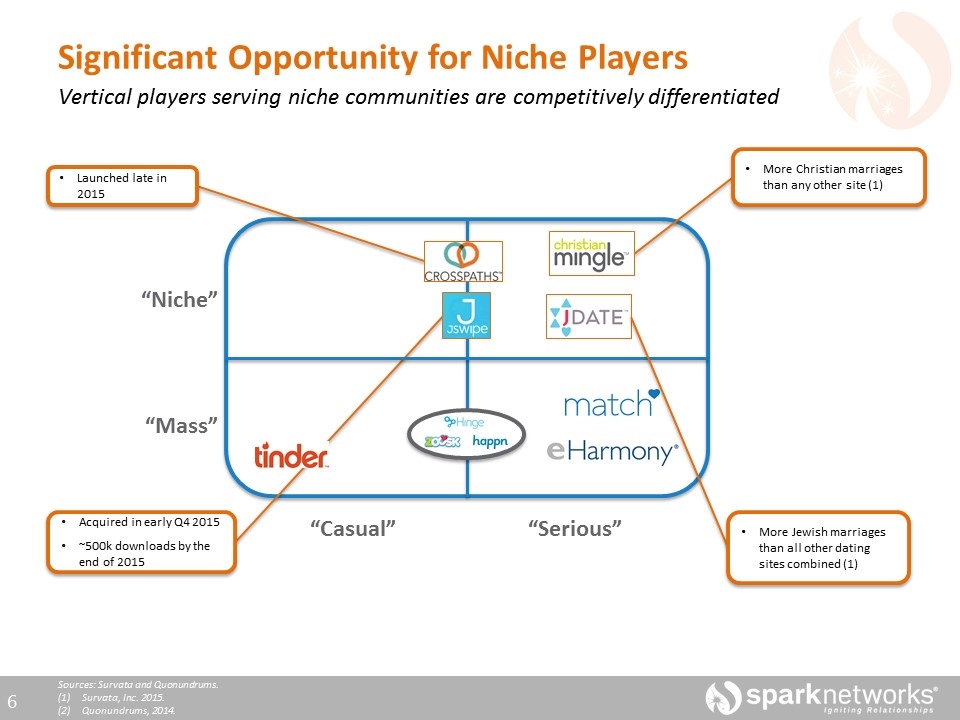

Vertical players serving niche communities are competitively differentiated Significant Opportunity for Niche Players “Niche” “Mass” “Casual” “Serious” Sources: Survata and Quonundrums. Survata, Inc. 2015. Quonundrums, 2014. Acquired in early Q4 2015 ~500k downloads by the end of 2015 Launched late in 2015 More Christian marriages than any other site (1) More Jewish marriages than all other dating sites combined (1)

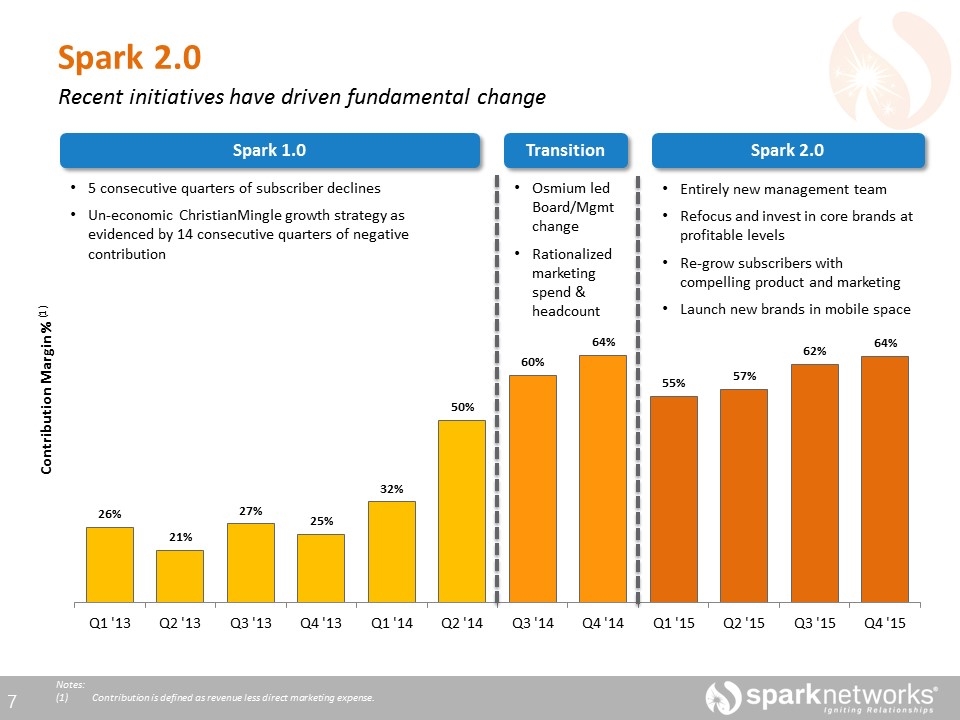

Spark 2.0 Recent initiatives have driven fundamental change Spark 1.0 Transition Spark 2.0 5 consecutive quarters of subscriber declines Un-economic ChristianMingle growth strategy as evidenced by 14 consecutive quarters of negative contribution Osmium led Board/Mgmt change Rationalized marketing spend & headcount Entirely new management team Refocus and invest in core brands at profitable levels Re-grow subscribers with compelling product and marketing Launch new brands in mobile space Contribution Margin % (1) Notes: Contribution is defined as revenue less direct marketing expense.

Growth Opportunities Leverage our new platform and competitive advantage with our core communities to drive growth Community Driven Relationship Program Expand & Monetize Mobile Opportunity Geographic Expansion 1 2 3

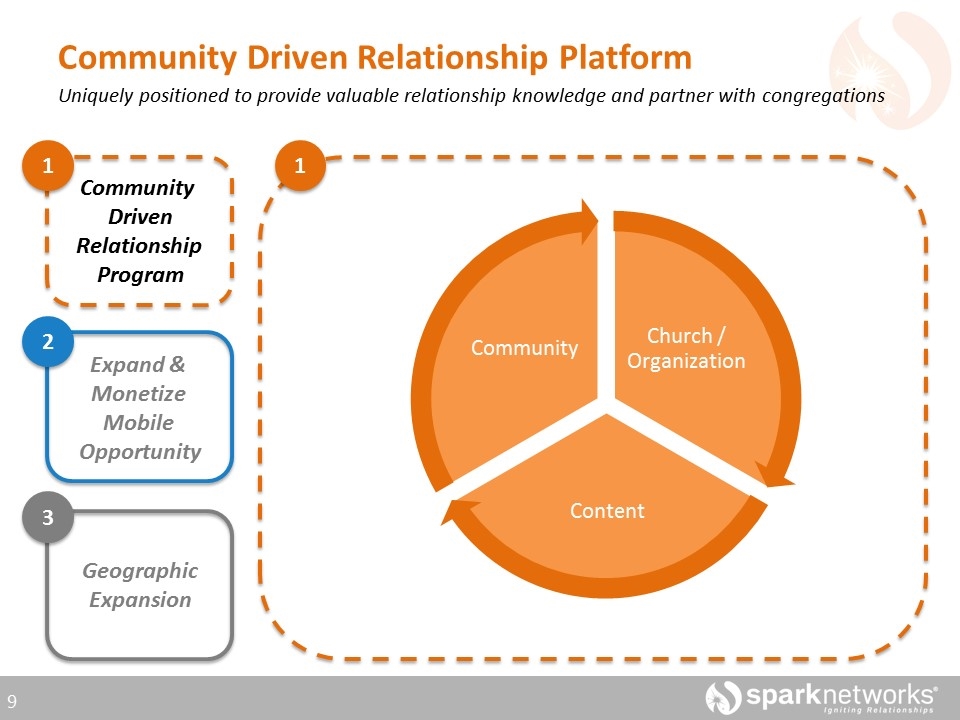

Community Driven Relationship Platform Uniquely positioned to provide valuable relationship knowledge and partner with congregations 1 1 2 3 Expand & Monetize Mobile Opportunity Community Driven Relationship Program Geographic Expansion Church / Organization Content Community

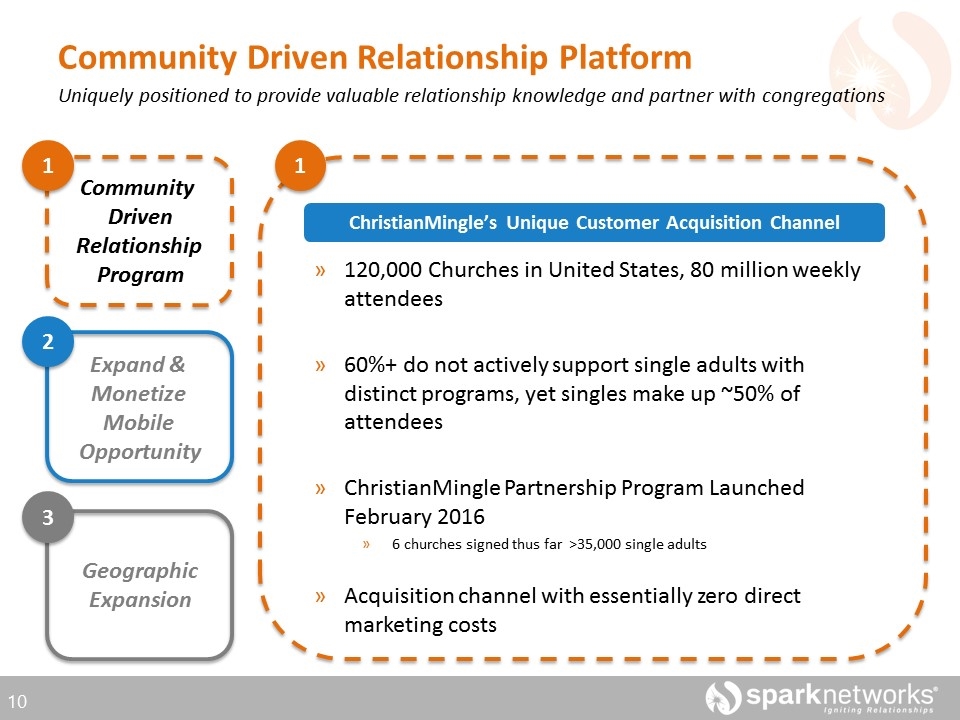

Community Driven Relationship Platform Uniquely positioned to provide valuable relationship knowledge and partner with congregations 1 1 2 3 Expand & Monetize Mobile Opportunity Community Driven Relationship Program Geographic Expansion 120,000 Churches in United States, 80 million weekly attendees 60%+ do not actively support single adults with distinct programs, yet singles make up ~50% of attendees ChristianMingle Partnership Program Launched February 2016 6 churches signed thus far >35,000 single adults Acquisition channel with essentially zero direct marketing costs ChristianMingle’s Unique Customer Acquisition Channel

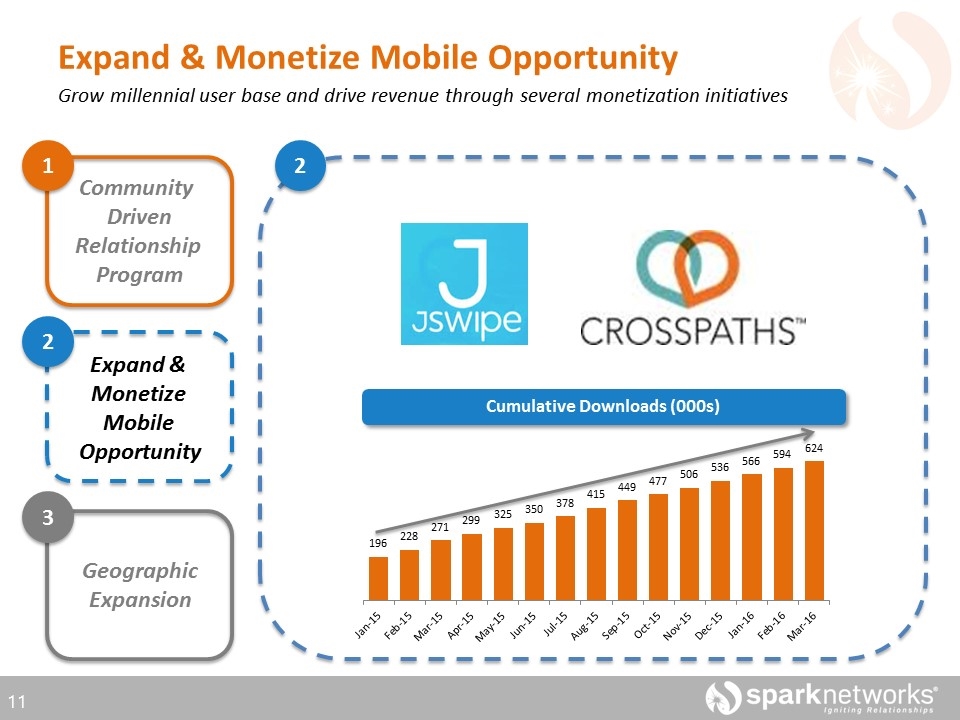

Expand & Monetize Mobile Opportunity Grow millennial user base and drive revenue through several monetization initiatives 2 1 2 3 Expand & Monetize Mobile Opportunity Community Driven Relationship Program Geographic Expansion Cumulative Downloads (000s)

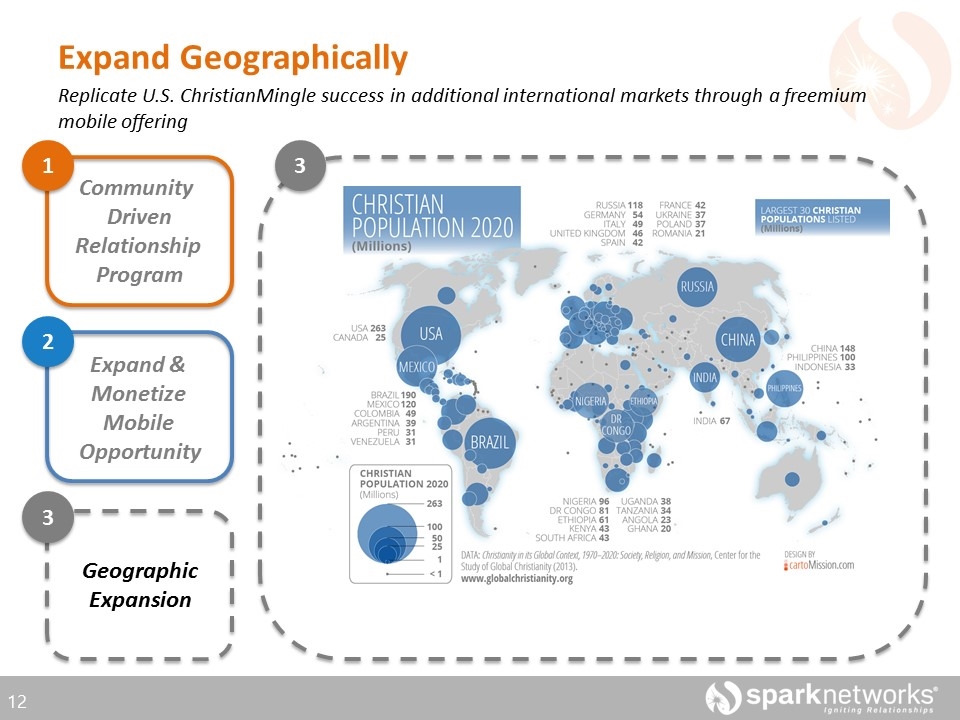

Expand Geographically Replicate U.S. ChristianMingle success in additional international markets through a freemium mobile offering 3 1 2 3 Expand & Monetize Mobile Opportunity Community Driven Relationship Program Geographic Expansion

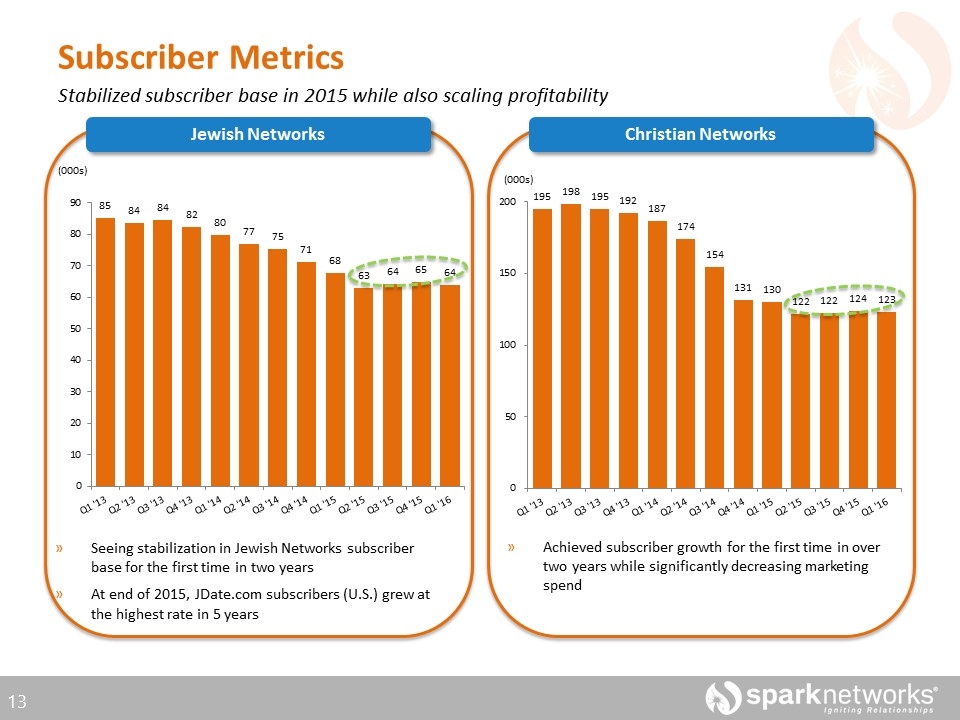

Achieved subscriber growth for the first time in over two years while significantly decreasing marketing spend Subscriber Metrics Jewish Networks Seeing stabilization in Jewish Networks subscriber base for the first time in two years At end of 2015, JDate.com subscribers (U.S.) grew at the highest rate in 5 years Christian Networks Stabilized subscriber base in 2015 while also scaling profitability

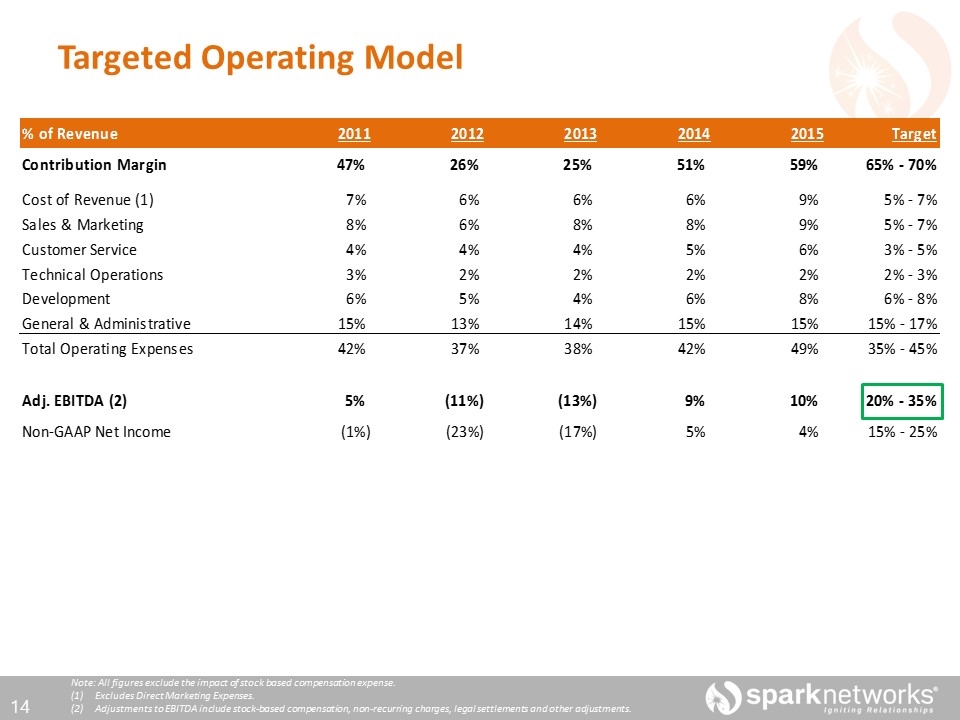

Targeted Operating Model Note: All figures exclude the impact of stock based compensation expense. Excludes Direct Marketing Expenses. Adjustments to EBITDA include stock-based compensation, non-recurring charges, legal settlements and other adjustments.

Company Highlights Market Leader with Highly Recognizable Brands in Jewish & Christian Markets Modern Technology Platform, Enabling Scalable Product Development Pursuing Large Opportunity in Millennial & International Mobile Markets Compelling Unit Economics & Deep Community Integration Driving Profitable Growth Firmly Positioned in the Niche / Serious Dating Segment