Attached files

| file | filename |

|---|---|

| 8-K - 8-K - IEC ELECTRONICS CORP | a8-kinvestorpres05262016.htm |

Investor Presentation May 2016

IEC ELECTRONICS 2016© | CANNOT BE PRESENTED, REDISTRIBUTED, OR SHOWN TO ANYONE WITHOUT EXPRESS WRITTEN PERMISSION Safe Harbor Statement 2 This presentation contains certain statements that are, or may be deemed to be, forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995, and are made in reliance upon the protections provided by such Act for forward-looking statements. These forward-looking statements (such as when the Company describes what it "believes", "expects", or "anticipates" will occur, and other similar statements) include, but are not limited to, statements regarding future sales and operating results, future prospects, the capabilities and capacities of business operations, any financial or other guidance and all statements that are not based on historical fact, but rather reflect the Company's current expectations concerning future results and events. The ultimate correctness of these forward-looking statements is dependent upon a number of risks and events and is subject to uncertainties and other factors that may cause the Company's actual results, performance or achievements to be different from any future results, performance or achievements expressed or implied by these statements. The following important factors , among others, could affect future results and events, causing those results and events to differ materially from those views expressed or implied in the Company’s forward-looking statements: the success of strategic initiatives aimed at driving the Company’s turnaround; the success of the Company’s efforts to enhance its core business; the Company’s ability to successfully remediate a material weakness in the Company’s internal controls; litigation and governmental investigations or proceedings arising out of or relating to accounting and financial reporting matters; business conditions and growth or contraction in the Company’s customers’ industries, the electronic manufacturing services industry and the general economy; variability of the Company’s operating results; the Company’s ability to control its material, labor and other costs; the Company’s ability to manage its assets, including inventory; the Company’s dependence on a limited number of major customers; the potential consolidation of the Company’s customer base; availability of component supplies; dependence on certain industries; variability and timing of customer requirements; technological, engineering and other start-up issues related to new programs and products, uncertainties as to availability and timing of governmental funding for the Company’s customers; the impact of government regulations, including FDA regulations; the types and mix of sales to the Company’s customers; the Company’s ability to assimilate acquired businesses and to achieve the anticipated benefits of such acquisitions; intellectual property litigation and the outcome of arbitration proceedings with the Company’s former chief executive officer; unforeseen product failures and the potential product liability claims that may be associated with such failures; the availability of capital and other economic, business and competitive factors affecting the Company’s customers, its industry and business generally; failure or breach of the Company’s information technology systems; and natural disasters. Any one or more of these risks and uncertainties could cause future results or events to differ materially from those expressed or implied in these forward-looking statements. For a further list and description of risks, relevant factors and uncertainties that could cause future results or events to differ materially from those expressed or implied in these forward-looking statements, see the “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” sections in the Company’s most recent Annual Report on Form 10-K and the Company’s subsequently filed Securities and Exchange Commission reports.

IEC ELECTRONICS 2016© | CANNOT BE PRESENTED, REDISTRIBUTED, OR SHOWN TO ANYONE WITHOUT EXPRESS WRITTEN PERMISSION Delivering Advanced Capabilities 3 For Life-Saving and Mission Critical Products

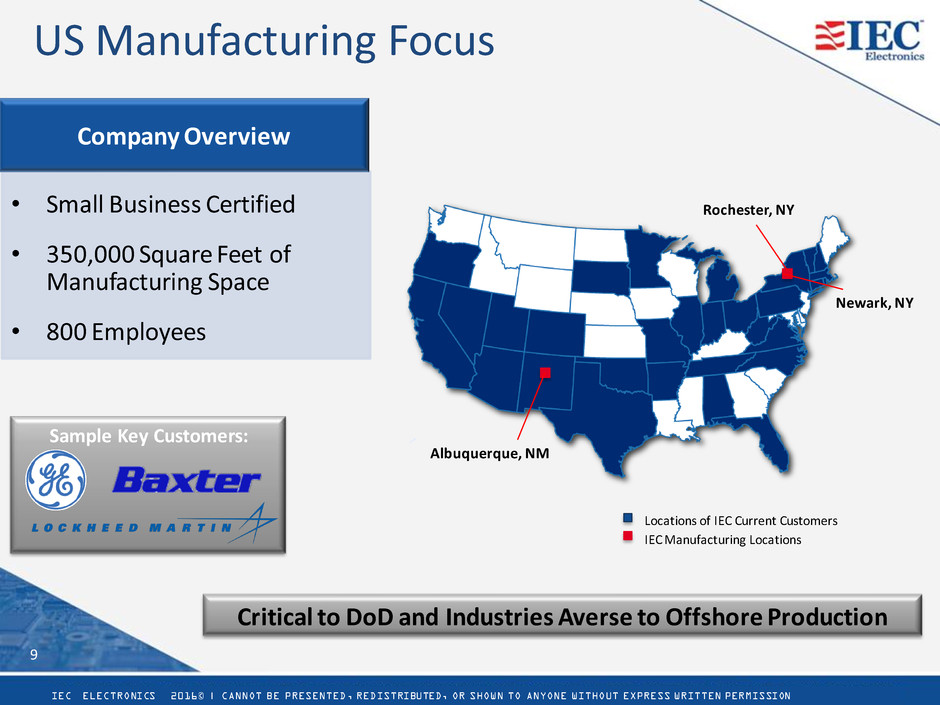

IEC ELECTRONICS 2016© | CANNOT BE PRESENTED, REDISTRIBUTED, OR SHOWN TO ANYONE WITHOUT EXPRESS WRITTEN PERMISSION IEC Differentiators 4 • Growing market sectors* - Medical - 7.4% CAGR - Industrial - 6.9% CAGR - Military - 6.2% CAGR • Proven performance with Marquee Blue Chip customers - Solve complex technical challenges - Simplify supply chain Life Saving & Mission Critical Products *Projected CAGR 2014-2019 Source: New Venture Research Corp. Rochester, NY Newark, NY Albuquerque, NM Locations of IEC Current Customers IEC Manufacturing Locations • Near-shoring trends occurring - Intellectual property protection - Supply chain risk reduction - Lower transportation costs • Defense industry requirements for domestic manufacturing • Highly responsive to volatile end market demand $5.6B TAM $8.2B TAM $5.2B TAM 100% US Manufacturing

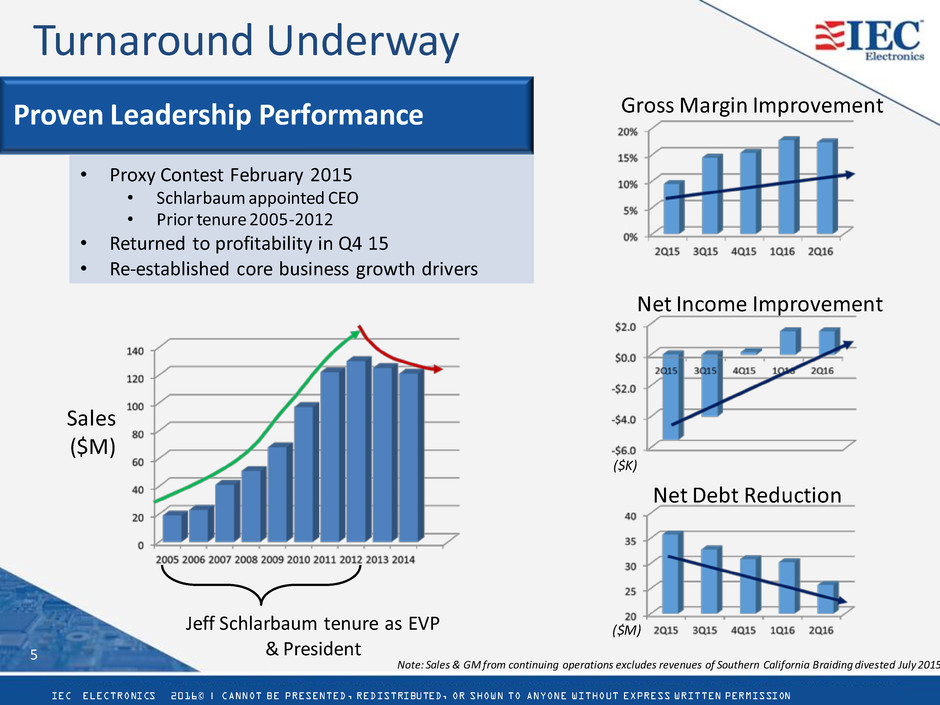

IEC ELECTRONICS 2016© | CANNOT BE PRESENTED, REDISTRIBUTED, OR SHOWN TO ANYONE WITHOUT EXPRESS WRITTEN PERMISSION Turnaround Underway 5 Jeff Schlarbaum tenure as EVP & President Proven Leadership Performance • Proxy Contest February 2015 • Schlarbaum appointed CEO • Prior tenure 2005-2012 • Returned to profitability in Q4 15 • Re-established core business growth drivers Sales ($M) ($K) ($M) Gross Margin Improvement Net Income Improvement Net Debt Reduction Note: Sales & GM from continuing operations excludes revenues of Southern California Braiding divested July 2015

IEC ELECTRONICS 2016© | CANNOT BE PRESENTED, REDISTRIBUTED, OR SHOWN TO ANYONE WITHOUT EXPRESS WRITTEN PERMISSION Unique Capabilities 6 Specialize in Complex Electronics and Highly Configurable Full System Assemblies Electronic Manufacturing Solutions • Develop Customized Stress Testing Platforms to Simulate a Product’s End Application • Engineering Solutions to Design New and Optimize Existing Products • Laboratories to Perform Counterfeit Component Detection & Complex Failure Analysis Solving Challenges for Critical Applications where Field Failure is not an Option

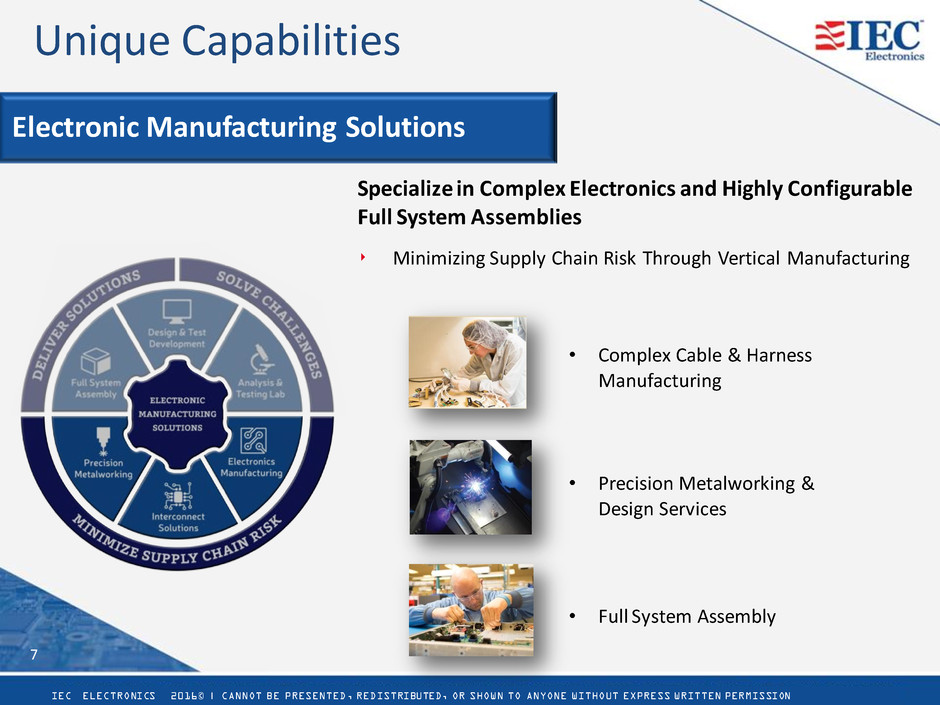

IEC ELECTRONICS 2016© | CANNOT BE PRESENTED, REDISTRIBUTED, OR SHOWN TO ANYONE WITHOUT EXPRESS WRITTEN PERMISSION Unique Capabilities 7 Specialize in Complex Electronics and Highly Configurable Full System Assemblies ‣ Minimizing Supply Chain Risk Through Vertical Manufacturing • Precision Metalworking & Design Services • Full System Assembly • Complex Cable & Harness Manufacturing Electronic Manufacturing Solutions

IEC ELECTRONICS 2016© | CANNOT BE PRESENTED, REDISTRIBUTED, OR SHOWN TO ANYONE WITHOUT EXPRESS WRITTEN PERMISSION Unique Capabilities 8 Specialize in Complex Electronics and Highly Configurable Full System Assemblies ‣ Delivering Broad Array of Manufacturing Solutions • Logistics and Fulfillment Directly to the End Customer • Full System Assembly & Custom Configuration • Products Such As • Encrypted Satellite Communication • Weapons Systems • Infusion Pumps • Ruggedized Industrial Controls Electronic Manufacturing Solutions

IEC ELECTRONICS 2016© | CANNOT BE PRESENTED, REDISTRIBUTED, OR SHOWN TO ANYONE WITHOUT EXPRESS WRITTEN PERMISSION US Manufacturing Focus 9 Rochester, NY Newark, NY Albuquerque, NM Sample Key Customers: Locations of IEC Current Customers IEC Manufacturing Locations Critical to DoD and Industries Averse to Offshore Production • Small Business Certified • 350,000 Square Feet of Manufacturing Space • 800 Employees Company Overview

IEC ELECTRONICS 2016© | CANNOT BE PRESENTED, REDISTRIBUTED, OR SHOWN TO ANYONE WITHOUT EXPRESS WRITTEN PERMISSION High-Margin Focus in Highly Regulated Markets 10 G ro ss M ar gi n (T TM )* 20% 6% 14% Consumer, Computing, Communications, Auto Medical, Industrial, Aerospace & Defense Portfolio Mix High Concentration High Concentration Mixed Portfolio *Source: Yahoo Finance as of May 2016 * Q1 & Q2 FY 16

IEC ELECTRONICS 2016© | CANNOT BE PRESENTED, REDISTRIBUTED, OR SHOWN TO ANYONE WITHOUT EXPRESS WRITTEN PERMISSION Shifting Revenue Mix 11 Communications/Other 2% % of Sales by Sector Aerospace & Defense 38% Medical 34% Industrial 26% Strategic Shift Towards More Balanced Revenue Composition; Increased Percentage of Revenue from High Growth Medical Sector Year Ended September 30, 2015 Communications/Other 6% Aerospace & Defense 43% Medical 23% Industrial 28% Year Ended September 30, 2014

IEC ELECTRONICS 2016© | CANNOT BE PRESENTED, REDISTRIBUTED, OR SHOWN TO ANYONE WITHOUT EXPRESS WRITTEN PERMISSION Progress Toward Initial Goals 12 Goal Status Phase I Unify all facilities under IEC brand and establish shared vision Divest non-core underperforming West Coast operation Restructure HQ facility to unlock greater efficiencies, productivity, and margin accretion Launch rebranding campaign and new website Reinvigorate existing customer relationships Phase II Diversify Albuquerque facility capabilities beyond aerospace/defense Implement new ERP system Reformulate new customer acquisition structure to drive organic growth Drive cross-selling opportunities amongst in-house verticals

IEC ELECTRONICS 2016© | CANNOT BE PRESENTED, REDISTRIBUTED, OR SHOWN TO ANYONE WITHOUT EXPRESS WRITTEN PERMISSION FINANCIALS 13

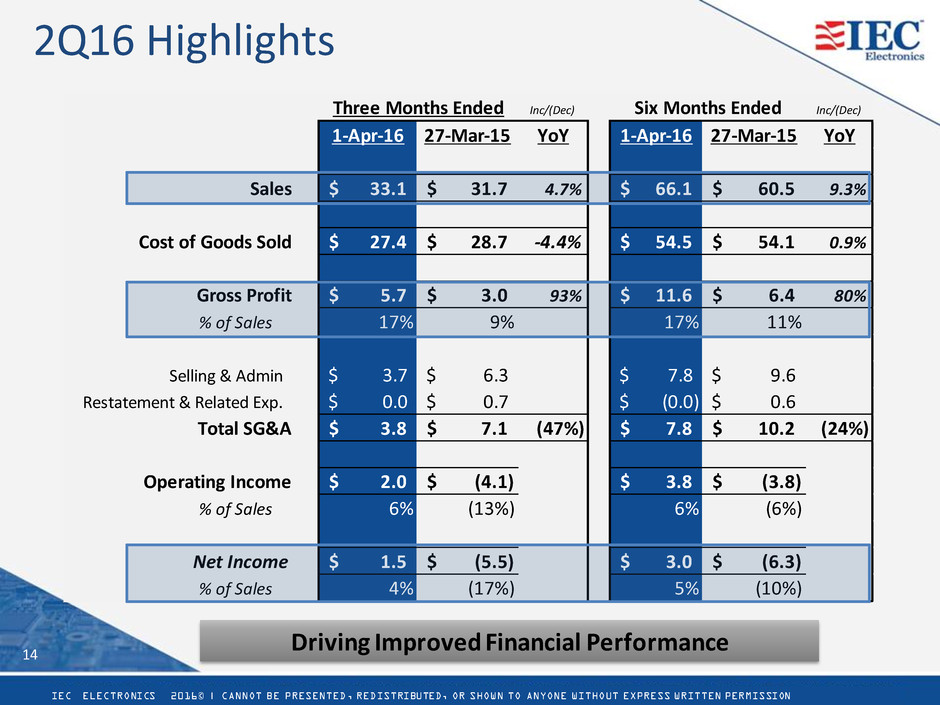

IEC ELECTRONICS 2016© | CANNOT BE PRESENTED, REDISTRIBUTED, OR SHOWN TO ANYONE WITHOUT EXPRESS WRITTEN PERMISSION Inc/(Dec) Inc/(Dec) 1-Apr-16 27-Mar-15 YoY 1-Apr-16 27-Mar-15 YoY Sales 33.1$ 31.7$ 4.7% 66.1$ 60.5$ 9.3% Cost of Goods Sold 27.4$ 28.7$ -4.4% 54.5$ 54.1$ 0.9% Gross Profit 5.7$ 3.0$ 93% 11.6$ 6.4$ 80% % of Sales 17% 9% 17% 11% Selling & Admin 3.7$ 6.3$ 7.8$ 9.6$ Restatement & Related Exp. 0.0$ 0.7$ (0.0)$ 0.6$ Total SG&A 3.8$ 7.1$ (47%) 7.8$ 10.2$ (24%) Operating Income 2.0$ (4.1)$ 3.8$ (3.8)$ % of Sales 6% (13%) 6% (6%) Net Income 1.5$ (5.5)$ 3.0$ (6.3)$ % of Sales 4% (17%) 5% (10%) Three Months Ended Six Months Ended 2Q16 Highlights 14 Driving Improved Financial Performance

IEC ELECTRONICS 2016© | CANNOT BE PRESENTED, REDISTRIBUTED, OR SHOWN TO ANYONE WITHOUT EXPRESS WRITTEN PERMISSION $28,000 $29,000 $30,000 $31,000 $32,000 $33,000 $34,000 $35,000 Q1 FY14 Q2 FY14 Q3 FY14 Q4 FY14 Q1 FY15 Q2 FY15 Q3 FY15 Q4 FY15 Q1 FY16 Q2 FY16 Sales Trend 15 Sales increase attributable to: • Restoring existing customer confidence • Strong medical sector demand Note: Sales from continuing operations excludes revenues of Southern California Braiding divested July 2015 YTD Q216 Sales Increased 9.3% Compared to YTD Q215

IEC ELECTRONICS 2016© | CANNOT BE PRESENTED, REDISTRIBUTED, OR SHOWN TO ANYONE WITHOUT EXPRESS WRITTEN PERMISSION 6.0% 8.0% 10.0% 12.0% 14.0% 16.0% 18.0% 20.0% 2013 2014 Q1 FY15 Q2 FY15 Q3 FY15 Q4 FY15 Q1 FY16 Q2 FY16 Gross Margin Trend 16 Gross margin increase attributable to: • Improved labor efficiency • Leveraged overhead • Lower excess & obsolete inventory expense Quarterly Results Note: Gross margin from continuing operations excludes revenues of Southern California Braiding divested July 2015 Q2 2016 Gross Profit Dollars Increased 93% YoY

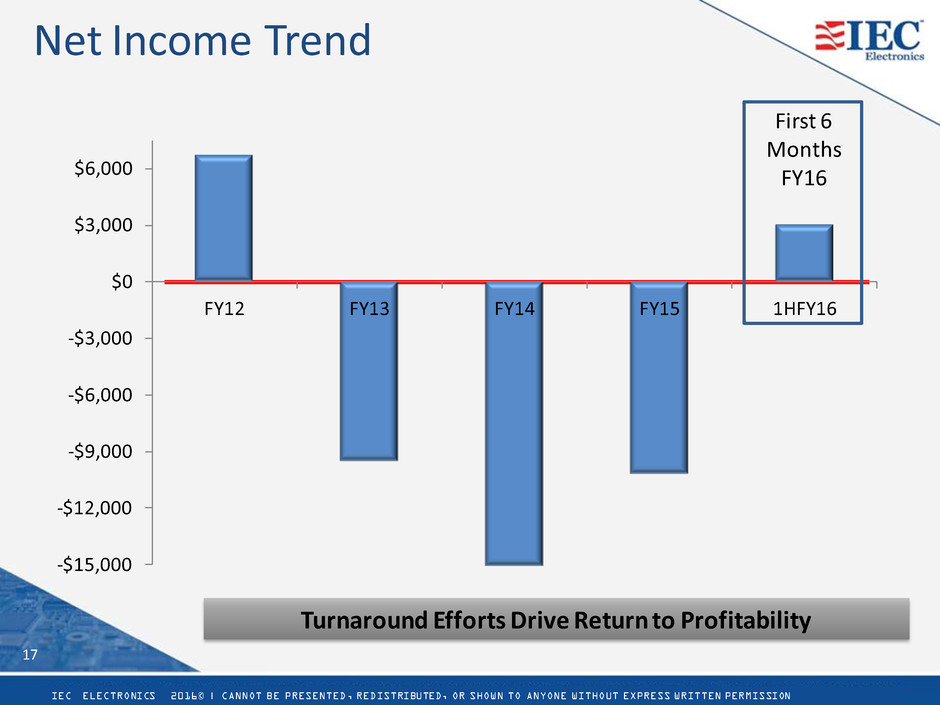

IEC ELECTRONICS 2016© | CANNOT BE PRESENTED, REDISTRIBUTED, OR SHOWN TO ANYONE WITHOUT EXPRESS WRITTEN PERMISSION Net Income Trend 17 Turnaround Efforts Drive Return to Profitability -$15,000 -$12,000 -$9,000 -$6,000 -$3,000 $0 $3,000 $6,000 FY12 FY13 FY14 FY15 1HFY16 First 6 Months FY16

IEC ELECTRONICS 2016© | CANNOT BE PRESENTED, REDISTRIBUTED, OR SHOWN TO ANYONE WITHOUT EXPRESS WRITTEN PERMISSION Financial Priorities 18 Priority Status 1. Reinstate Profitability and Margins • New management returning business to industry-leading margins 2. Improve Asset Management • Deliberate strategy to drive debt/EBITDA below 2X given current structure o $10M reduction in net debt YoY o $2.3M reduction in inventory QoQ 3. Re-establish Organic Growth • Enhancing relationships with current customers to capture greater share • Sharpened focus on most promising new customer opportunities

IEC ELECTRONICS 2016© | CANNOT BE PRESENTED, REDISTRIBUTED, OR SHOWN TO ANYONE WITHOUT EXPRESS WRITTEN PERMISSION Growth Strategy 19 ‣ Continued focus on high growth sectors • Medical sales outpacing other sectors ‣ Expanding share with existing customers • Growth with current customers has expanded since new management took over • Add growth opportunities through vertical services ‣ Invest in enhanced sales and marketing strategies to restore organic growth ‣ Opportunistically evaluate inorganic growth opportunities • Add unique capabilities

IEC ELECTRONICS 2016© | CANNOT BE PRESENTED, REDISTRIBUTED, OR SHOWN TO ANYONE WITHOUT EXPRESS WRITTEN PERMISSION Looking Forward 20 ‣ Restore value to IEC shareholders • New management is closely aligned with existing shareholders and customers, with a clear turnaround strategy firmly in place ‣ Drive organic growth • Existing customers reaffirmed their partnerships with IEC and many have committed to increasing their levels of business • Reestablishing disciplines that drove revenue growth in past years ‣ Return IEC brand to leadership position • Company delivering marked improvements in 2016 • Restore to previous operational excellence: ranked #3 Forbes Top 100 Best Small Companies in 2011, and #6 in 2012 • Recently received Supplier Excellence Award from Harris Corporation

Thank You