Attached files

| file | filename |

|---|---|

| EX-99.1 - EXHIBIT 99.1 - DYCOM INDUSTRIES INC | dyfy2016q3earningsreleasee.htm |

| 8-K - 8-K - DYCOM INDUSTRIES INC | dycom3q16results8-k.htm |

3rd Quarter Fiscal 2016 Results Conference Call May 25, 2016 Exhibit 99.2

2 Looking Statements and Non-GAAP Information This presentation contains “forward-looking statements”. Other than statements of historical facts, all statements contained in this presentation, including statements regarding the Company’s future financial position, future revenue, prospects, plans and objectives of management, are forward-looking statements. Words such as “outlook,” “believe,” “expect,” “anticipate,” “estimate,” “intend,” “should,” “could,” “project,” and similar expressions, as well as statements in future tense, identify forward-looking statements. You should not consider forward-looking statements as a guarantee of future performance or results. Forward-looking statements are based on information available at the time those statements are made and/or management’s good faith belief at that time with respect to future events. Such statements are subject to risks and uncertainties that could cause actual performance or results to differ materially from those expressed in or suggested by the forward-looking statements. Important factors, assumptions, uncertainties, and risks that could cause such differences are discussed in our most recent Annual Report on Form 10-K filed with the Securities and Exchange Commission (“SEC”) on September 4, 2015, our Quarterly Report on Form 10-Q filed with the SEC on February 26, 2016 and other filings with the SEC. The forward-looking statements in this presentation are expressly qualified in their entirety by this cautionary statement. The Company undertakes no obligation to update these forward-looking statements to reflect new information, or events or circumstances arising after such date. This presentation includes certain “Non-GAAP” financial measures as defined by Regulation G of the SEC. As required by the SEC, we have provided a reconciliation of those measures to the most directly comparable GAAP measures on the Regulation G slides included as slides 13 through 19 of this presentation. Non-GAAP financial measures should be considered in addition to, but not as a substitute for, our reported GAAP results.

3 Participants and Agenda Participants Steven E. Nielsen President & Chief Executive Officer H. Andrew DeFerrari Chief Financial Officer Richard B. Vilsoet General Counsel Agenda Introduction and Q3-16 Overview Industry Update Financial & Operational Highlights Outlook Conclusion Q&A

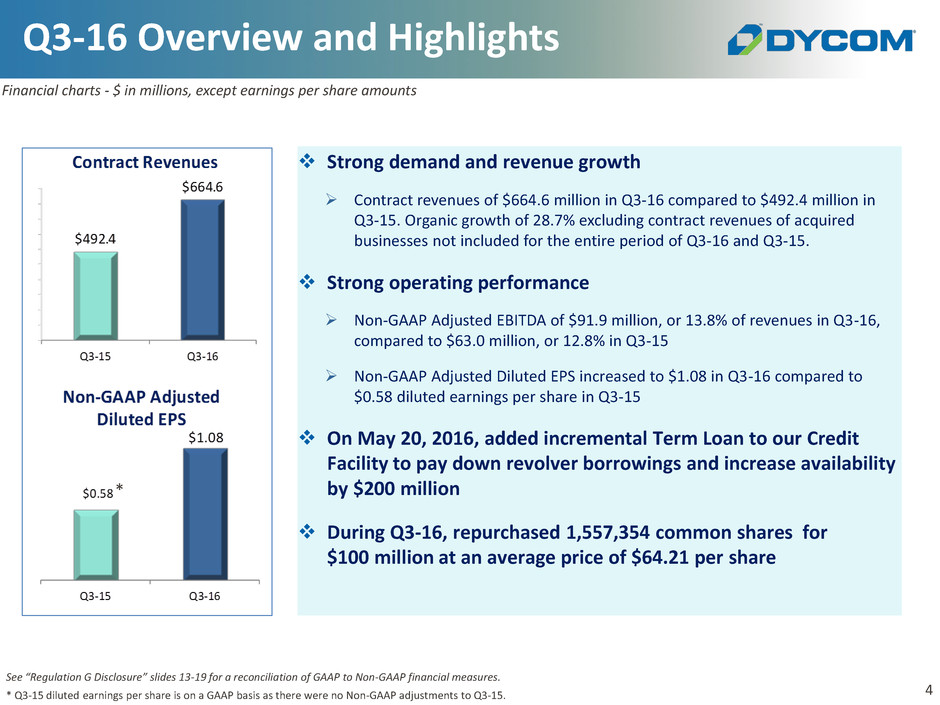

4 Strong demand and revenue growth Contract revenues of $664.6 million in Q3-16 compared to $492.4 million in Q3-15. Organic growth of 28.7% excluding contract revenues of acquired businesses not included for the entire period of Q3-16 and Q3-15. Strong operating performance Non-GAAP Adjusted EBITDA of $91.9 million, or 13.8% of revenues in Q3-16, compared to $63.0 million, or 12.8% in Q3-15 Non-GAAP Adjusted Diluted EPS increased to $1.08 in Q3-16 compared to $0.58 diluted earnings per share in Q3-15 On May 20, 2016, added incremental Term Loan to our Credit Facility to pay down revolver borrowings and increase availability by $200 million During Q3-16, repurchased 1,557,354 common shares for $100 million at an average price of $64.21 per share Financial charts - $ in millions, except earnings per share amounts Q3-16 Overview and Highlights See “Regulation G Disclosure” slides 13-19 for a reconciliation of GAAP to Non-GAAP financial measures. * Q3-15 diluted earnings per share is on a GAAP basis as there were no Non-GAAP adjustments to Q3-15. *

5 Industry increasing network bandwidth dramatically Major industry participants deploying significant wireline networks Newly deployed networks provisioning 1 gigabit speeds; speeds beyond 1 gigabit envisioned Industry developments have produced opportunities which in aggregate are without precedent Delivering valuable service to customers Currently providing services for 1 gigabit full deployments across the country in dozens of metropolitan areas to a number of customers Revenues and opportunities driven by this industry standard accelerated Customers are revealing with more specificity multi-year initiatives that are being implemented and managed locally Calendar 2016 performance to date and outlook clearly demonstrate we are currently in the early stages of a massive investment cycle in wireline networks Dycom’s scale, market position and financial strength position it well as opportunities continue to expand Industry Update

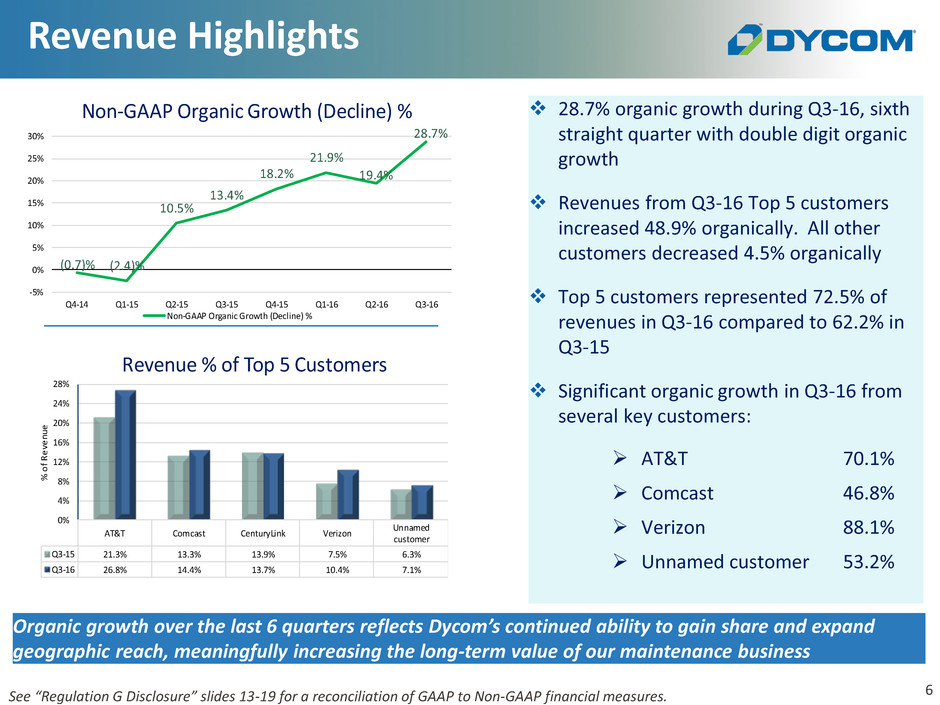

6 Revenue Highlights 28.7% organic growth during Q3-16, sixth straight quarter with double digit organic growth Revenues from Q3-16 Top 5 customers increased 48.9% organically. All other customers decreased 4.5% organically Top 5 customers represented 72.5% of revenues in Q3-16 compared to 62.2% in Q3-15 Significant organic growth in Q3-16 from several key customers: See “Regulation G Disclosure” slides 13-19 for a reconciliation of GAAP to Non-GAAP financial measures. Organic growth over the last 6 quarters reflects Dycom’s continued ability to gain share and expand geographic reach, meaningfully increasing the long-term value of our maintenance business AT&T Comcast CenturyLink Verizon Unnamed customer Q -15 21.3% 13.3% 13.9% 7.5% 6.3% 3-16 26.8% 14.4% 13.7% 10.4% 7.1% 0% 4% 8% 12% 16% 20% 24% 28% % o f Re ven ue Revenue % of Top 5 Customers (0.7)% (2.4)% 10.5% 13.4% 18.2% 21.9% 19.4% 28.7% -5% 0% 5% 10% 15% 20% 25% 30% Q4- 4 Q1-15 Q2-15 Q3-15 Q4-15 Q1-16 Q2-16 Q3-16 Non-GAAP Organic Growth (Decline) % Non-GAAP Organic Growth (Decline) % AT&T 70.1% Comcast 46.8% Verizon 88.1% Unnamed customer 53.2%

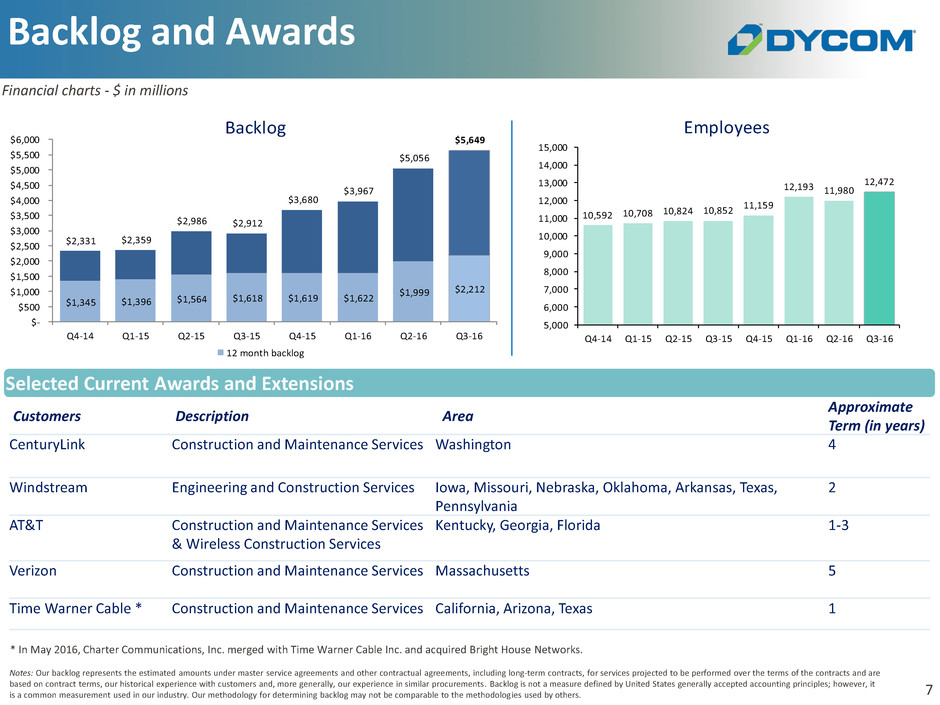

7 10,592 10,708 10,824 10,852 11,159 12,193 11,980 12,472 5,000 6, 7,000 8, 9,000 10, 1,000 12, 3,000 14, 5,000 Q4-14 Q1-15 Q2-15 Q3-15 Q4-15 Q1-16 Q2-16 Q3-16 Employees $1,345 $1,396 $1,564 $1,618 $1,619 $1,622 $1,999 $2,212 $2,331 $2,359 $2,986 $2,912 $3,680 $3,967 $5,056 $5,649 $- $500 $1,0 ,500 $2,0 ,500 $3,0 ,500 $4,0 ,500 $5,0 ,500 $6,0 Q4-14 Q1-15 Q2-15 Q3-15 Q4-15 Q1-16 Q2-16 Q3-16 Backlog 12 month backlog Customers Description Area Approximate Term (in years) CenturyLink Construction and Maintenance Services Washington 4 Windstream Engineering and Construction Services Iowa, Missouri, Nebraska, Oklahoma, Arkansas, Texas, Pennsylvania 2 AT&T Construction and Maintenance Services & Wireless Construction Services Kentucky, Georgia, Florida 1-3 Verizon Construction and Maintenance Services Massachusetts 5 Time Warner Cable * Construction and Maintenance Services California, Arizona, Texas 1 Backlog and Awards Notes: Our backlog represents the estimated amounts under master service agreements and other contractual agreements, including long-term contracts, for services projected to be performed over the terms of the contracts and are based on contract terms, our historical experience with customers and, more generally, our experience in similar procurements. Backlog is not a measure defined by United States generally accepted accounting principles; however, it is a common measurement used in our industry. Our methodology for determining backlog may not be comparable to the methodologies used by others. Selected Current Awards and Extensions Financial charts - $ in millions * In May 2016, Charter Communications, Inc. merged with Time Warner Cable Inc. and acquired Bright House Networks.

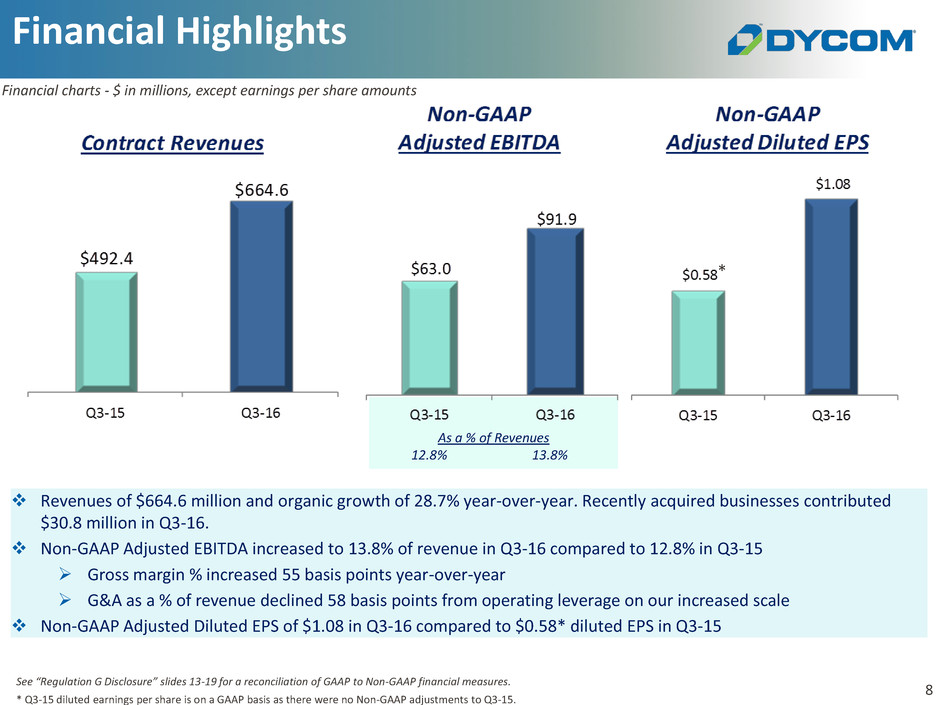

8 As a % of Revenues 12.8% 13.8% Revenues of $664.6 million and organic growth of 28.7% year-over-year. Recently acquired businesses contributed $30.8 million in Q3-16. Non-GAAP Adjusted EBITDA increased to 13.8% of revenue in Q3-16 compared to 12.8% in Q3-15 Gross margin % increased 55 basis points year-over-year G&A as a % of revenue declined 58 basis points from operating leverage on our increased scale Non-GAAP Adjusted Diluted EPS of $1.08 in Q3-16 compared to $0.58* diluted EPS in Q3-15 Financial Highlights See “Regulation G Disclosure” slides 13-19 for a reconciliation of GAAP to Non-GAAP financial measures. * Q3-15 diluted earnings per share is on a GAAP basis as there were no Non-GAAP adjustments to Q3-15. Financial charts - $ in millions, except earnings per share amounts *

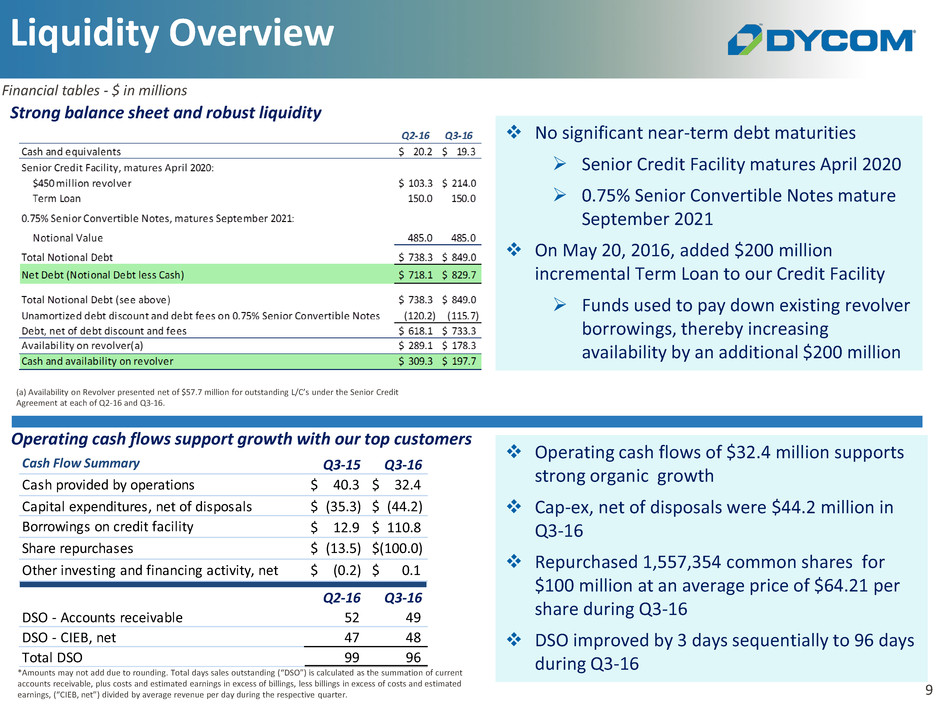

9 Strong balance sheet and robust liquidity Liquidity Overview (a) Availability on Revolver presented net of $57.7 million for outstanding L/C’s under the Senior Credit Agreement at each of Q2-16 and Q3-16. Financial tables - $ in millions Operating cash flows support growth with our top customers *Amounts may not add due to rounding. Total days sales outstanding (“DSO”) is calculated as the summation of current accounts receivable, plus costs and estimated earnings in excess of billings, less billings in excess of costs and estimated earnings, (“CIEB, net”) divided by average revenue per day during the respective quarter. No significant near-term debt maturities Senior Credit Facility matures April 2020 0.75% Senior Convertible Notes mature September 2021 On May 20, 2016, added $200 million incremental Term Loan to our Credit Facility Funds used to pay down existing revolver borrowings, thereby increasing availability by an additional $200 million Operating cash flows of $32.4 million supports strong organic growth Cap-ex, net of disposals were $44.2 million in Q3-16 Repurchased 1,557,354 common shares for $100 million at an average price of $64.21 per share during Q3-16 DSO improved by 3 days sequentially to 96 days during Q3-16 Q3-15 Q3-16 $ 40.3 $ 32.4 $ (35.3) $ (44.2) $ 12.9 $ 110.8 $ (13.5) $(100.0) $ (0.2) $ 0.1 Q2-16 Q3-16 52 49 47 48 99 96 Cash Flow Summary Borrowings on credit facility Capital expenditures, net of disposals Cash provided by operations O he nvesting and financing activity, net Share repurchases DSO - Accounts receivable DSO - CIEB, net T t l DSO

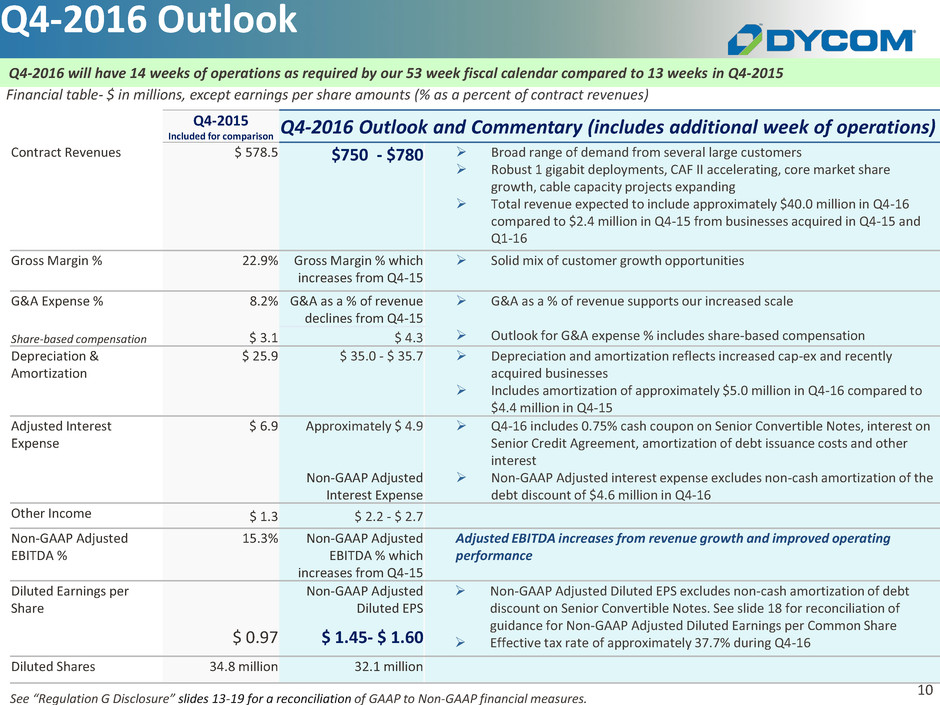

10 Q4-2015 Included for comparison Q4-2016 Outlook and Commentary (includes additional week of operations) Contract Revenues $ 578.5 $750 - $780 Broad range of demand from several large customers Robust 1 gigabit deployments, CAF II accelerating, core market share growth, cable capacity projects expanding Total revenue expected to include approximately $40.0 million in Q4-16 compared to $2.4 million in Q4-15 from businesses acquired in Q4-15 and Q1-16 Gross Margin % 22.9% Gross Margin % which increases from Q4-15 Solid mix of customer growth opportunities G&A Expense % 8.2% G&A as a % of revenue declines from Q4-15 G&A as a % of revenue supports our increased scale Outlook for G&A expense % includes share-based compensation Share-based compensation $ 3.1 $ 4.3 Depreciation & Amortization $ 25.9 $ 35.0 - $ 35.7 Depreciation and amortization reflects increased cap-ex and recently acquired businesses Includes amortization of approximately $5.0 million in Q4-16 compared to $4.4 million in Q4-15 Adjusted Interest Expense $ 6.9 Approximately $ 4.9 Non-GAAP Adjusted Interest Expense Q4-16 includes 0.75% cash coupon on Senior Convertible Notes, interest on Senior Credit Agreement, amortization of debt issuance costs and other interest Non-GAAP Adjusted interest expense excludes non-cash amortization of the debt discount of $4.6 million in Q4-16 Other Income $ 1.3 $ 2.2 - $ 2.7 Non-GAAP Adjusted EBITDA % 15.3% Non-GAAP Adjusted EBITDA % which increases from Q4-15 Adjusted EBITDA increases from revenue growth and improved operating performance Diluted Earnings per Share $ 0.97 Non-GAAP Adjusted Diluted EPS $ 1.45- $ 1.60 Non-GAAP Adjusted Diluted EPS excludes non-cash amortization of debt discount on Senior Convertible Notes. See slide 18 for reconciliation of guidance for Non-GAAP Adjusted Diluted Earnings per Common Share Effective tax rate of approximately 37.7% during Q4-16 Diluted Shares 34.8 million 32.1 million Q4-2016 Outlook See “Regulation G Disclosure” slides 13-19 for a reconciliation of GAAP to Non-GAAP financial measures. Financial table- $ in millions, except earnings per share amounts (% as a percent of contract revenues) Q4-2016 will have 14 weeks of operations as required by our 53 week fiscal calendar compared to 13 weeks in Q4-2015

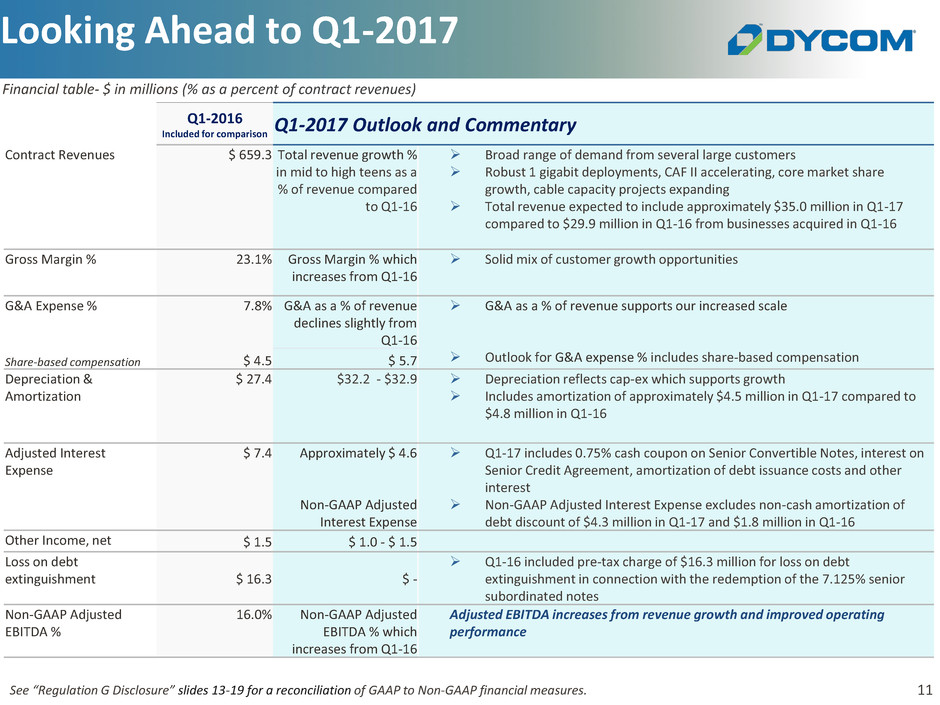

11 Looking Ahead to Q1-2017 Q1-2016 Included for comparison Q1-2017 Outlook and Commentary Contract Revenues $ 659.3 Total revenue growth % in mid to high teens as a % of revenue compared to Q1-16 Broad range of demand from several large customers Robust 1 gigabit deployments, CAF II accelerating, core market share growth, cable capacity projects expanding Total revenue expected to include approximately $35.0 million in Q1-17 compared to $29.9 million in Q1-16 from businesses acquired in Q1-16 Gross Margin % 23.1% Gross Margin % which increases from Q1-16 Solid mix of customer growth opportunities G&A Expense % 7.8% G&A as a % of revenue declines slightly from Q1-16 G&A as a % of revenue supports our increased scale Outlook for G&A expense % includes share-based compensation Share-based compensation $ 4.5 $ 5.7 Depreciation & Amortization $ 27.4 $32.2 - $32.9 Depreciation reflects cap-ex which supports growth Includes amortization of approximately $4.5 million in Q1-17 compared to $4.8 million in Q1-16 Adjusted Interest Expense $ 7.4 Approximately $ 4.6 Non-GAAP Adjusted Interest Expense Q1-17 includes 0.75% cash coupon on Senior Convertible Notes, interest on Senior Credit Agreement, amortization of debt issuance costs and other interest Non-GAAP Adjusted Interest Expense excludes non-cash amortization of debt discount of $4.3 million in Q1-17 and $1.8 million in Q1-16 Other Income, net $ 1.5 $ 1.0 - $ 1.5 Loss on debt extinguishment $ 16.3 $ - Q1-16 included pre-tax charge of $16.3 million for loss on debt extinguishment in connection with the redemption of the 7.125% senior subordinated notes Non-GAAP Adjusted EBITDA % 16.0% Non-GAAP Adjusted EBITDA % which increases from Q1-16 Adjusted EBITDA increases from revenue growth and improved operating performance See “Regulation G Disclosure” slides 13-19 for a reconciliation of GAAP to Non-GAAP financial measures. Financial table- $ in millions (% as a percent of contract revenues)

12 Conclusion Firm and strengthening end market opportunities Telephone companies deploying FTTX to enable video offerings and 1 gigabit connections Cable operators continuing to deploy fiber to small and medium businesses with overall cable capital expenditures, new build opportunities, and capacity expansion projects increasing Connect America Fund (“CAF”) II projects in planning, engineering, and construction, including meaningful assignments from one recipient for fixed wireless deployments Customers are consolidating supply chains creating opportunities for market share growth and increasing the long-term value of our maintenance business Encouraged that industry participants are committed to multi-year capital spending initiatives which in most cases are meaningfully accelerating and expanding in scope

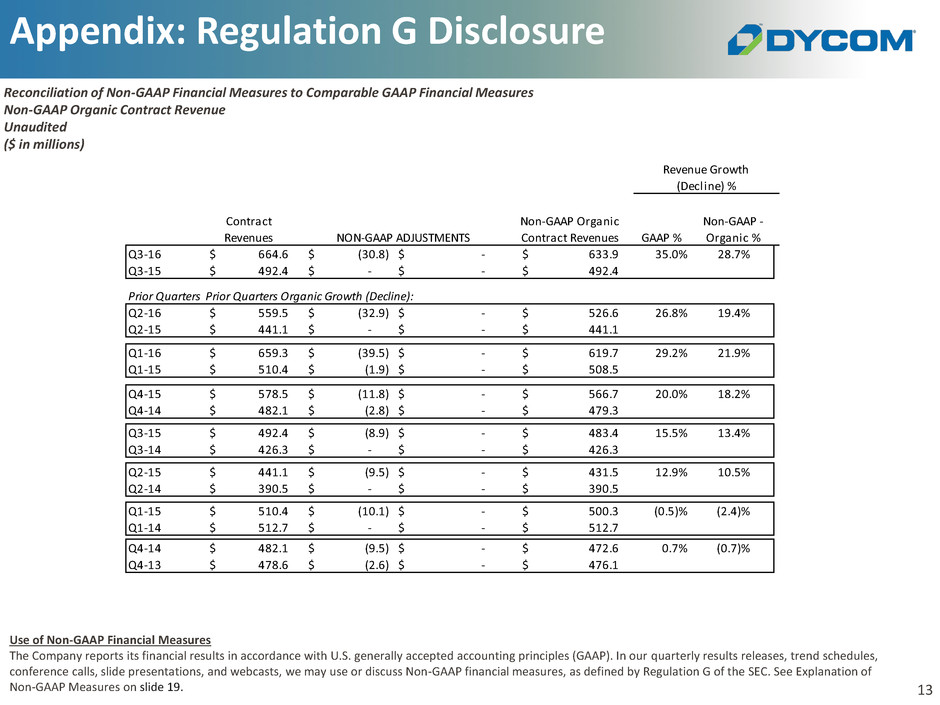

13 Appendix: Regulation G Disclosure Use of Non-GAAP Financial Measures The Company reports its financial results in accordance with U.S. generally accepted accounting principles (GAAP). In our quarterly results releases, trend schedules, conference calls, slide presentations, and webcasts, we may use or discuss Non-GAAP financial measures, as defined by Regulation G of the SEC. See Explanation of Non-GAAP Measures on slide 19. Reconciliation of Non-GAAP Financial Measures to Comparable GAAP Financial Measures Non-GAAP Organic Contract Revenue Unaudited ($ in millions) GAAP % Non-GAAP - Organic % Q3-16 664.6$ (30.8)$ -$ 633.9$ 35.0% 28.7% Q3-15 492.4$ -$ -$ 492.4$ Prior Quarters Organic Growth (Decline):P ior Qua ters Organic Growth (Decline): Q2-16 559.5$ (32.9)$ -$ 526.6$ 26.8% 19.4% Q2-15 441.1$ -$ -$ 441.1$ Q1-16 659.3$ (39.5)$ -$ 619.7$ 29.2% 21.9% Q1-15 510.4$ (1.9)$ -$ 508.5$ Q4-15 578.5$ (11.8)$ -$ 566.7$ 20.0% 18.2% Q4-14 482.1$ (2.8)$ -$ 479.3$ Q3-15 492.4$ (8.9)$ -$ 483.4$ 15.5% 13.4% Q3-14 426.3$ -$ -$ 426.3$ Q2-15 441.1$ (9.5)$ -$ 431.5$ 12.9% 10.5% Q2-14 390.5$ -$ -$ 390.5$ Q1-15 510.4$ (10.1)$ -$ 500.3$ (0.5)% (2.4)% Q1-14 512.7$ -$ -$ 512.7$ Q4-14 482.1$ (9.5)$ -$ 472.6$ 0.7% (0.7)% Q4-13 478.6$ (2.6)$ -$ 476.1$ Contract Revenues NON-GAAP ADJUSTMENTS Revenue Growth (Decline) % Non-GAAP Organic Contract Revenues

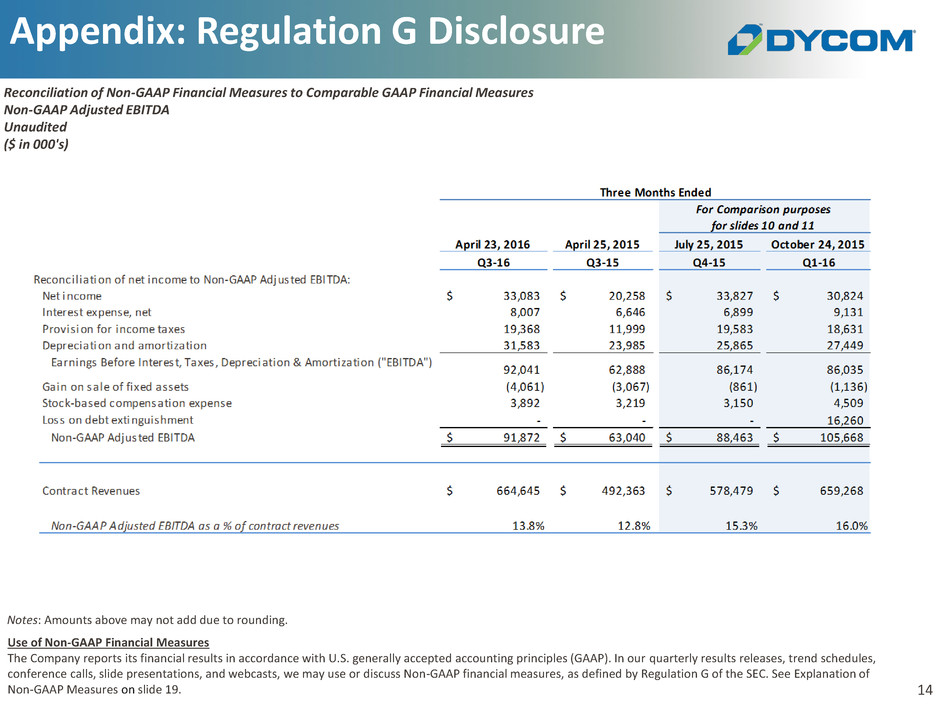

14 Notes: Amounts above may not add due to rounding. Reconciliation of Non-GAAP Financial Measures to Comparable GAAP Financial Measures Non-GAAP Adjusted EBITDA Unaudited ($ in 000's) Use of Non-GAAP Financial Measures The Company reports its financial results in accordance with U.S. generally accepted accounting principles (GAAP). In our quarterly results releases, trend schedules, conference calls, slide presentations, and webcasts, we may use or discuss Non-GAAP financial measures, as defined by Regulation G of the SEC. See Explanation of Non-GAAP Measures on slide 19. Appendix: Regulation G Disclosure

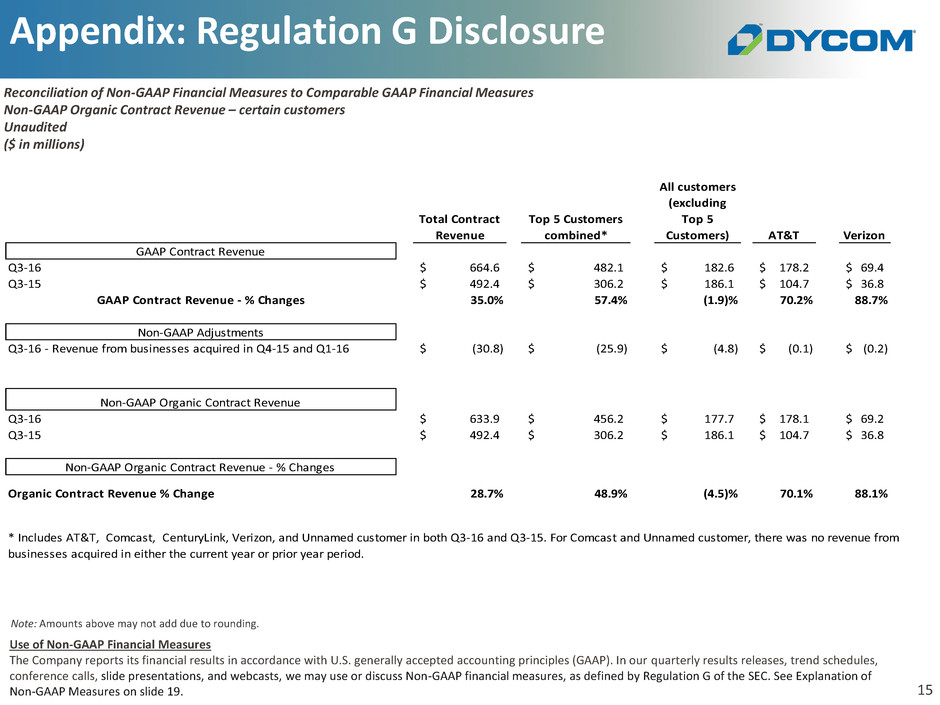

15 Note: Amounts above may not add due to rounding. Reconciliation of Non-GAAP Financial Measures to Comparable GAAP Financial Measures Non-GAAP Organic Contract Revenue – certain customers Unaudited ($ in millions) Use of Non-GAAP Financial Measures The Company reports its financial results in accordance with U.S. generally accepted accounting principles (GAAP). In our quarterly results releases, trend schedules, conference calls, slide presentations, and webcasts, we may use or discuss Non-GAAP financial measures, as defined by Regulation G of the SEC. See Explanation of Non-GAAP Measures on slide 19. Total Contract Revenue Top 5 Customers combined* All customers (excluding Top 5 Customers) AT&T Verizon GAAP Contract Revenue Q3-16 664.6$ 482.1$ 182.6$ 178.2$ 69.4$ 3-15 492.4$ 306.2$ 186.1$ 104.7$ 36.8$ GAAP Contract Revenue - % Changes 35.0% 57.4% (1.9)% 70.2% 88.7% Non-GAAP Adjustments Q3-16 - Revenue from businesses acquired in Q4-15 and Q1-16 (30.8)$ (25.9)$ (4.8)$ (0.1)$ (0.2)$ Non-GAAP Organic Contract Revenue Q3-16 633.9$ 456.2$ 177.7$ 178.1$ 69.2$ 3-15 492.4$ 306.2$ 186.1$ 104.7$ 36.8$ Non-GAAP Organic Contract Revenue - % Changes Organic Contract Revenue % Change 28.7% 48.9% (4.5)% 70.1% 88.1% * Includes AT&T, Comcast, CenturyLink, Verizon, and Unnamed customer in both Q3-16 and Q3-15. For Comcast and Unnamed customer, there was no revenue from sinesses acquired in either the current year or prior year period. Appendix: Regulation G Disclosure

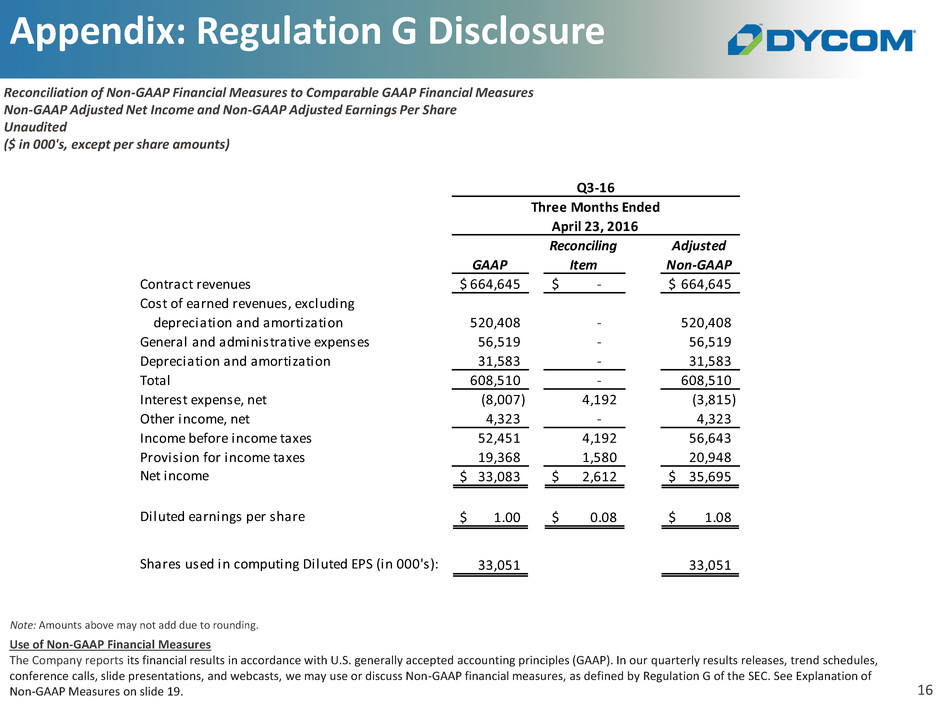

16 Note: Amounts above may not add due to rounding. Reconciliation of Non-GAAP Financial Measures to Comparable GAAP Financial Measures Non-GAAP Adjusted Net Income and Non-GAAP Adjusted Earnings Per Share Unaudited ($ in 000's, except per share amounts) Use of Non-GAAP Financial Measures The Company reports its financial results in accordance with U.S. generally accepted accounting principles (GAAP). In our quarterly results releases, trend schedules, conference calls, slide presentations, and webcasts, we may use or discuss Non-GAAP financial measures, as defined by Regulation G of the SEC. See Explanation of Non-GAAP Measures on slide 19. Appendix: Regulation G Disclosure GAAP Reconciling Item Adjusted Non-GAAP Contract revenues 664,645$ -$ 664,645$ Cost of earned revenues, excluding depreciation and amortization 520,408 - 520,408 General and administrative expenses 56,519 - 56,519 Depreciation and amortization 31,583 - 31,583 Total 608,510 - 608,510 Interest expense, net (8,007) 4,192 (3,815) Other income, net 4,323 - 4,323 Income before income taxes 52,451 4,192 56,643 Provision for income taxes 19,368 1,580 20,948 Net income 33,083$ 2,612$ 35,695$ Diluted earnings per share 1.00$ 0.08$ 1.08$ Shares used in computing Diluted EPS (in 000's): 33,051 33,051 Three Months Ended April 23, 2016 Q3-16

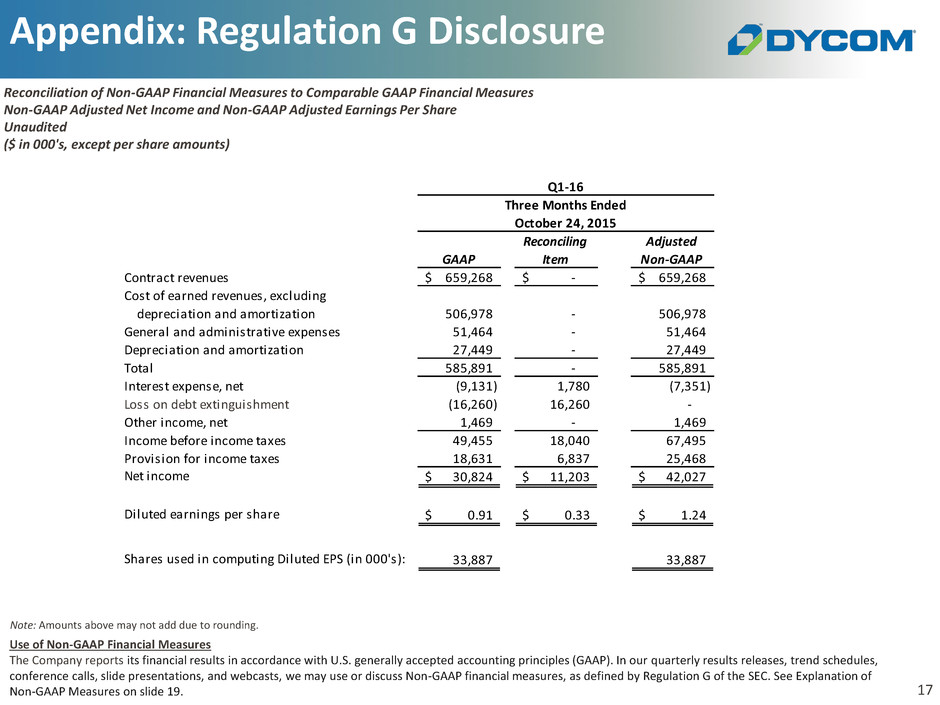

17 Note: Amounts above may not add due to rounding. Reconciliation of Non-GAAP Financial Measures to Comparable GAAP Financial Measures Non-GAAP Adjusted Net Income and Non-GAAP Adjusted Earnings Per Share Unaudited ($ in 000's, except per share amounts) Use of Non-GAAP Financial Measures The Company reports its financial results in accordance with U.S. generally accepted accounting principles (GAAP). In our quarterly results releases, trend schedules, conference calls, slide presentations, and webcasts, we may use or discuss Non-GAAP financial measures, as defined by Regulation G of the SEC. See Explanation of Non-GAAP Measures on slide 19. Appendix: Regulation G Disclosure GAAP Reconciling Item Adjusted Non-GAAP Contract revenues 659,268$ -$ 659,268$ Cost of earned revenues, excluding depreciation and amortization 506,978 - 506,978 General and administrative expenses 51,464 - 51,464 Depreciation and amortization 27,449 - 27,449 Total 585,891 - 585,891 Interest expense, net (9,131) 1,780 (7,351) Loss on debt extinguishment (16,260) 16,260 - Other income, net 1,469 - 1,469 Income before income taxes 49,455 18,040 67,495 Provision for income taxes 18,631 6,837 25,468 Net income 30,824$ 11,203$ 42,027$ Diluted earnings per share 0.91$ 0.33$ 1.24$ Shares used in computing Diluted EPS (in 000's): 33,887 33,887 Three Months Ended October 24, 2015 Q1-16

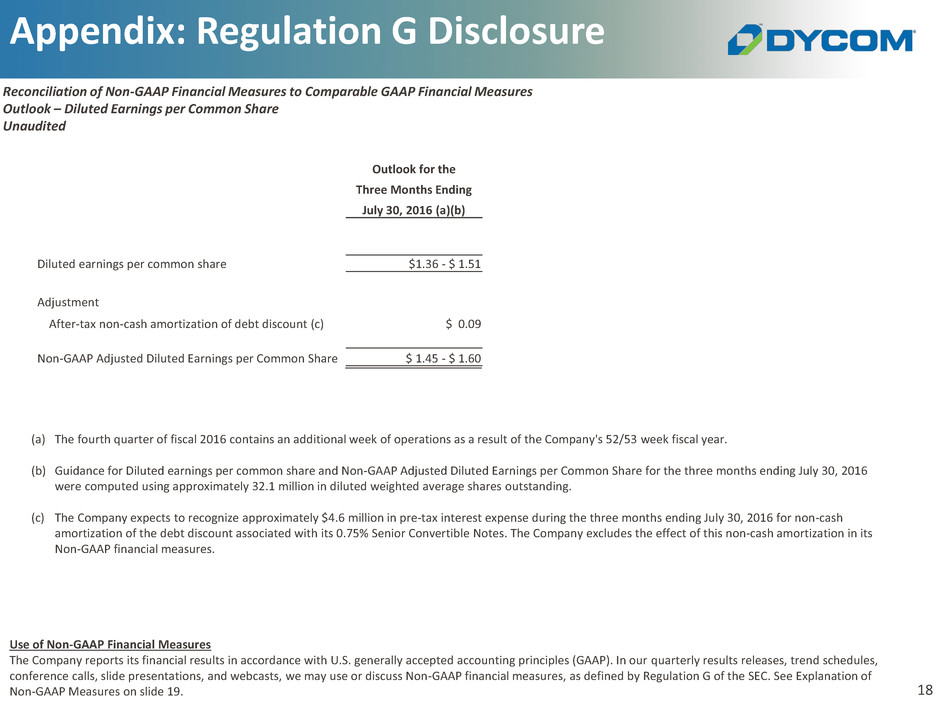

18 Reconciliation of Non-GAAP Financial Measures to Comparable GAAP Financial Measures Outlook – Diluted Earnings per Common Share Unaudited Use of Non-GAAP Financial Measures The Company reports its financial results in accordance with U.S. generally accepted accounting principles (GAAP). In our quarterly results releases, trend schedules, conference calls, slide presentations, and webcasts, we may use or discuss Non-GAAP financial measures, as defined by Regulation G of the SEC. See Explanation of Non-GAAP Measures on slide 19. (a) The fourth quarter of fiscal 2016 contains an additional week of operations as a result of the Company's 52/53 week fiscal year. (b) Guidance for Diluted earnings per common share and Non-GAAP Adjusted Diluted Earnings per Common Share for the three months ending July 30, 2016 were computed using approximately 32.1 million in diluted weighted average shares outstanding. (c) The Company expects to recognize approximately $4.6 million in pre-tax interest expense during the three months ending July 30, 2016 for non-cash amortization of the debt discount associated with its 0.75% Senior Convertible Notes. The Company excludes the effect of this non-cash amortization in its Non-GAAP financial measures. Outlook for the Three Months Ending July 30, 2016 (a)(b) Diluted earnings per common share $1.36 - $ 1.51 Adjustment After-tax non-cash amortization of debt discount (c) $ 0.09 Non-GAAP Adjusted Diluted Earnings per Common Share $ 1.45 - $ 1.60 Appendix: Regulation G Disclosure

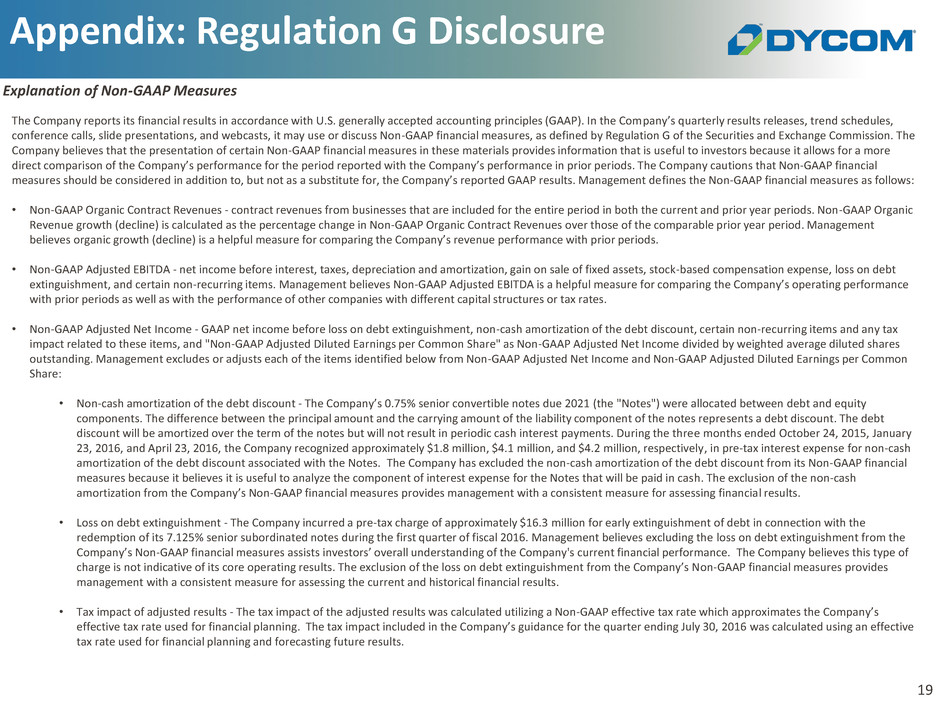

19 Explanation of Non-GAAP Measures The Company reports its financial results in accordance with U.S. generally accepted accounting principles (GAAP). In the Company’s quarterly results releases, trend schedules, conference calls, slide presentations, and webcasts, it may use or discuss Non-GAAP financial measures, as defined by Regulation G of the Securities and Exchange Commission. The Company believes that the presentation of certain Non-GAAP financial measures in these materials provides information that is useful to investors because it allows for a more direct comparison of the Company’s performance for the period reported with the Company’s performance in prior periods. The Company cautions that Non-GAAP financial measures should be considered in addition to, but not as a substitute for, the Company’s reported GAAP results. Management defines the Non-GAAP financial measures as follows: • Non-GAAP Organic Contract Revenues - contract revenues from businesses that are included for the entire period in both the current and prior year periods. Non-GAAP Organic Revenue growth (decline) is calculated as the percentage change in Non-GAAP Organic Contract Revenues over those of the comparable prior year period. Management believes organic growth (decline) is a helpful measure for comparing the Company’s revenue performance with prior periods. • Non-GAAP Adjusted EBITDA - net income before interest, taxes, depreciation and amortization, gain on sale of fixed assets, stock-based compensation expense, loss on debt extinguishment, and certain non-recurring items. Management believes Non-GAAP Adjusted EBITDA is a helpful measure for comparing the Company’s operating performance with prior periods as well as with the performance of other companies with different capital structures or tax rates. • Non-GAAP Adjusted Net Income - GAAP net income before loss on debt extinguishment, non-cash amortization of the debt discount, certain non-recurring items and any tax impact related to these items, and "Non-GAAP Adjusted Diluted Earnings per Common Share" as Non-GAAP Adjusted Net Income divided by weighted average diluted shares outstanding. Management excludes or adjusts each of the items identified below from Non-GAAP Adjusted Net Income and Non-GAAP Adjusted Diluted Earnings per Common Share: • Non-cash amortization of the debt discount - The Company’s 0.75% senior convertible notes due 2021 (the "Notes") were allocated between debt and equity components. The difference between the principal amount and the carrying amount of the liability component of the notes represents a debt discount. The debt discount will be amortized over the term of the notes but will not result in periodic cash interest payments. During the three months ended October 24, 2015, January 23, 2016, and April 23, 2016, the Company recognized approximately $1.8 million, $4.1 million, and $4.2 million, respectively, in pre-tax interest expense for non-cash amortization of the debt discount associated with the Notes. The Company has excluded the non-cash amortization of the debt discount from its Non-GAAP financial measures because it believes it is useful to analyze the component of interest expense for the Notes that will be paid in cash. The exclusion of the non-cash amortization from the Company’s Non-GAAP financial measures provides management with a consistent measure for assessing financial results. • Loss on debt extinguishment - The Company incurred a pre-tax charge of approximately $16.3 million for early extinguishment of debt in connection with the redemption of its 7.125% senior subordinated notes during the first quarter of fiscal 2016. Management believes excluding the loss on debt extinguishment from the Company’s Non-GAAP financial measures assists investors’ overall understanding of the Company's current financial performance. The Company believes this type of charge is not indicative of its core operating results. The exclusion of the loss on debt extinguishment from the Company’s Non-GAAP financial measures provides management with a consistent measure for assessing the current and historical financial results. • Tax impact of adjusted results - The tax impact of the adjusted results was calculated utilizing a Non-GAAP effective tax rate which approximates the Company’s effective tax rate used for financial planning. The tax impact included in the Company’s guidance for the quarter ending July 30, 2016 was calculated using an effective tax rate used for financial planning and forecasting future results. Appendix: Regulation G Disclosure

3rd Quarter Fiscal 2016 Results Conference Call May 25, 2016