Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - Alliance HealthCare Services, Inc | d195275d8k.htm |

Exhibit 99.1

|

|

Alliance HealthCare Services

NASDAQ: AIQ

May 25, 2016

| 1 |

|

|

|

Disclaimer

During the course of this presentation, the Company may make projections or other forward-looking statements regarding, among other things, our business outlook, operations and strategy; service areas; competition; changes in laws and regulations and the impact of such changes on us; our estimates for future performance and operating results, including future revenues, cash flows and capital requirements. In some cases you can identify these statements by words such as “could,” “may,” “expects,” “anticipates,” “believes,” “intends,” “estimates,” or similar words. These forward-looking statements are based largely on the Company’s current expectations and are subject to a number of known or unknown risks and uncertainties (some of which are beyond the Company’s control). We urge you to review the factors discussed under the caption “Risk Factors” in the Company’s Form 10-K for the year ended December 31, 2015, filed with the Securities and Exchange Commission. In light of these risks and uncertainties, there can be no assurance that the forward-looking statements made during this presentation will in fact be realized. Except as otherwise required by applicable securities laws, we disclaim any intention or obligation to publicly update or revise forward-looking statements, whether as a result of new information, future events or otherwise.

| 2 |

|

|

|

Alliance HealthCare Services Today

Partnering with over

1,000

Hospitals and healthcare providers in 45 states

$473MILLION

In revenue & $131MILLION

In adjusted EBITDA in Fiscal 2015

Complementary businesses align with our vision to provide multiple service lines to a single hospital customer

The leading provider of radiology, oncology and interventional healthcare solutions to hospitals and healthcare providers

OVER

30

YEAR

Track record of successful partnering

Hospital-centric business model aligns with ACA-driven industry change and alternative payment models

| 3 |

|

|

|

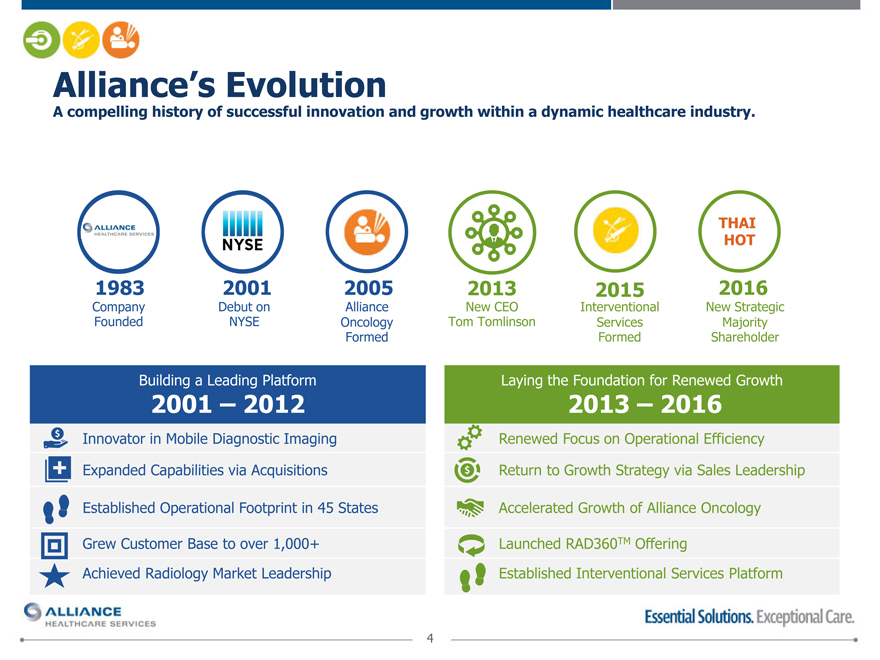

Alliance’s Evolution

A compelling history of successful innovation and growth within a dynamic healthcare industry.

THAI

HOT

1983 2001 2005 2013 2015 2016

Company Debut on Alliance New CEO Interventional New Strategic

Founded NYSE Oncology Tom Tomlinson Services Majority

Formed Formed Shareholder

Building a Leading Platform Laying the Foundation for Renewed Growth

2001 – 2012 2013 – 2016

Innovator in Mobile Diagnostic Imaging Renewed Focus on Operational Efficiency

Expanded Capabilities via Acquisitions Return to Growth Strategy via Sales Leadership

Established Operational Footprint in 45 States Accelerated Growth of Alliance Oncology

Grew Customer Base to over 1,000+ Launched RAD360TM Offering

Achieved Radiology Market Leadership Established Interventional Services Platform

| 4 |

|

|

|

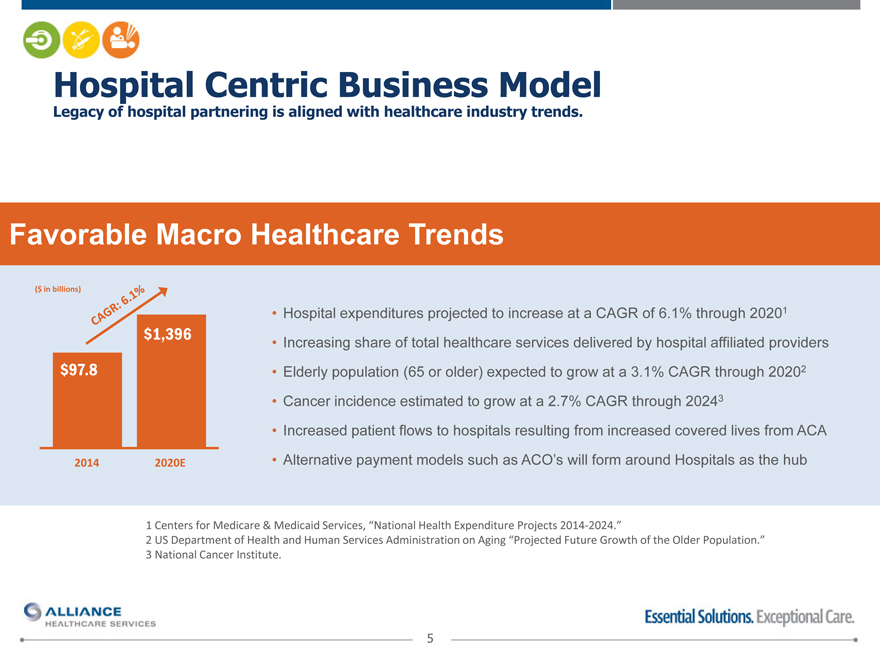

Hospital Centric Business Model

Legacy of hospital partnering is aligned with healthcare industry trends.

Favorable Macro Healthcare Trends

($ in billions)

Hospital expenditures projected to increase at a CAGR of 6.1% through 20201

$1,396 Increasing share of total healthcare services delivered by hospital affiliated providers

$97.8 Elderly population (65 or older) expected to grow at a 3.1% CAGR through 20202

Cancer incidence estimated to grow at a 2.7% CAGR through 20243

Increased patient flows to hospitals resulting from increased covered lives from ACA

2014 2020E Alternative payment models such as ACO’s will form around Hospitals as the hub

| 1 |

|

Centers for Medicare & Medicaid Services, “National Health Expenditure Projects 2014-2024.” |

2 US Department of Health and Human Services Administration on Aging “Projected Future Growth of the Older Population.”

| 3 |

|

National Cancer Institute. |

| 5 |

|

|

|

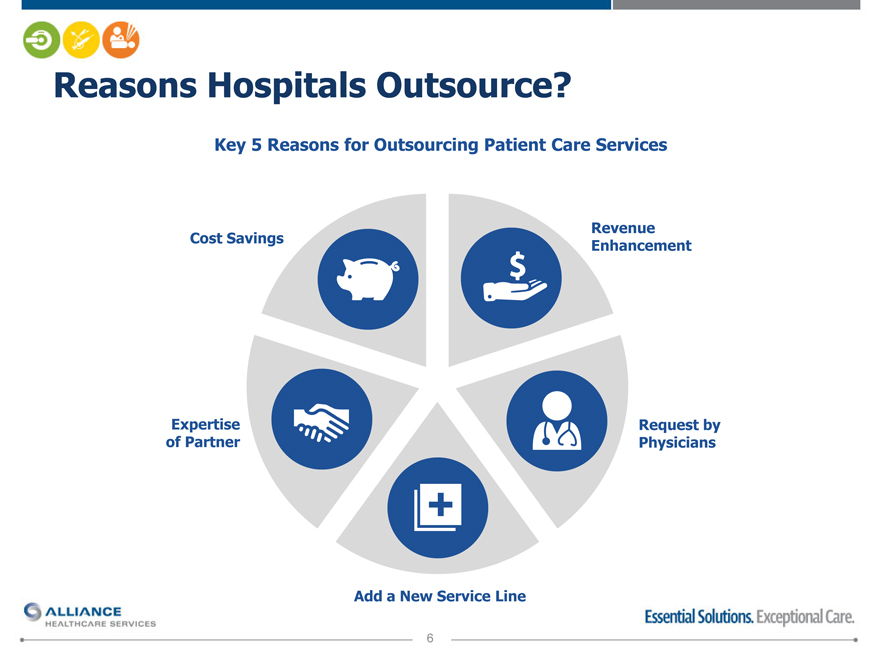

Reasons Hospitals Outsource?

Key 5 Reasons for Outsourcing Patient Care Services

Revenue

Cost Savings Enhancement

Expertise Request by

of Partner Physicians

Add a New Service Line

| 6 |

|

|

|

Blue Chip Customer

Base

Reference-able existing relationships provide credibility to support growth.

| 7 |

|

|

|

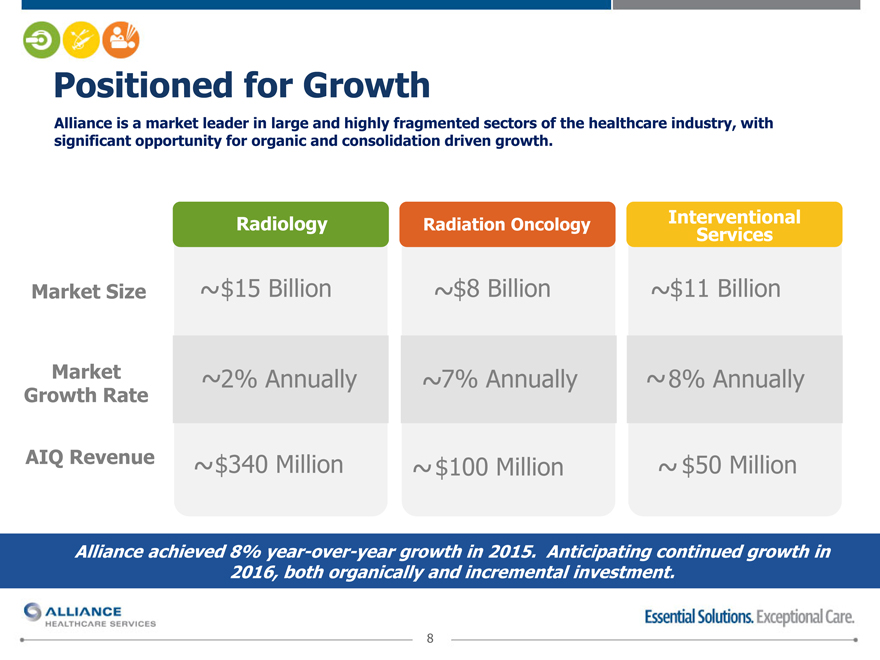

Positioned for Growth

Alliance is a market leader in large and highly fragmented sectors of the healthcare industry, with

significant opportunity for organic and consolidation driven growth.

Radiology Radiation Oncology Interventional

Services

Market Size ~$15 Billion ~$8 Billion ~$11 Billion

Market ~2% Annually ~7% Annually ~ 8% Annually

Growth Rate

AIQ Revenue ~$340 Million ~ $100 Million ~ $50 Million

Alliance achieved 8% year-over-year growth in 2015. Anticipating continued growth in

2016, both organically and incremental investment.

| 8 |

|

|

|

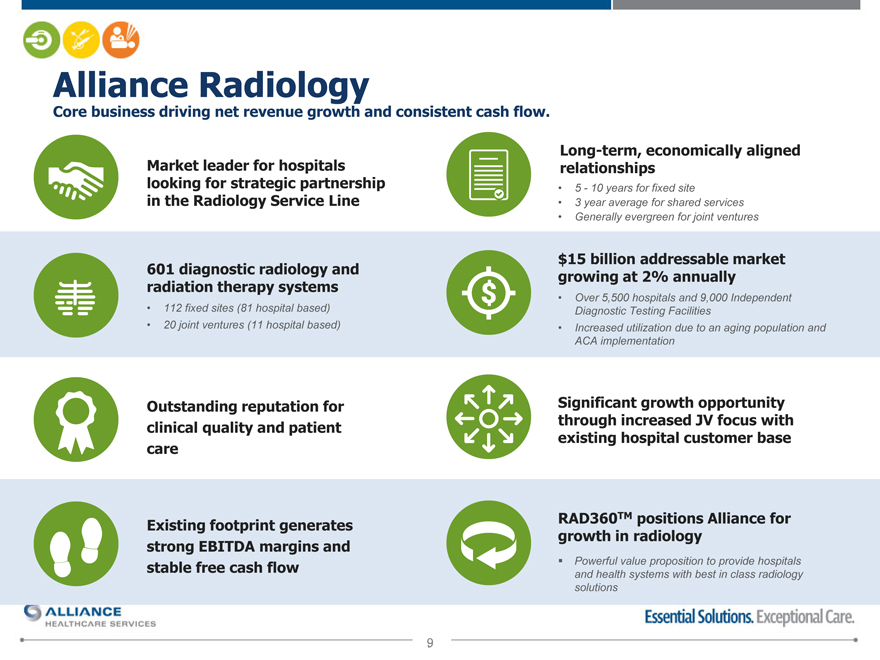

Alliance Radiology

Core business driving net revenue growth and consistent cash flow.

Long-term, economically aligned

Market leader for hospitals relationships

looking for strategic partnership 5—10 years for fixed site

in the Radiology Service Line 3 year average for shared services

Generally evergreen for joint ventures

$15 billion addressable market

601 diagnostic radiology and growing at 2% annually

radiation therapy systems

Over 5,500 hospitals and 9,000 Independent

112 fixed sites (81 hospital based) Diagnostic Testing Facilities

20 joint ventures (11 hospital based) Increased utilization due to an aging population and

ACA implementation

Outstanding reputation for Significant growth opportunity

clinical quality and patient through increased JV focus with

care existing hospital customer base

Existing footprint generates RAD360TM positions Alliance for

strong EBITDA margins and growth in radiology

stable free cash flow Powerful value proposition to provide hospitals

and health systems with best in class radiology

solutions

9

|

|

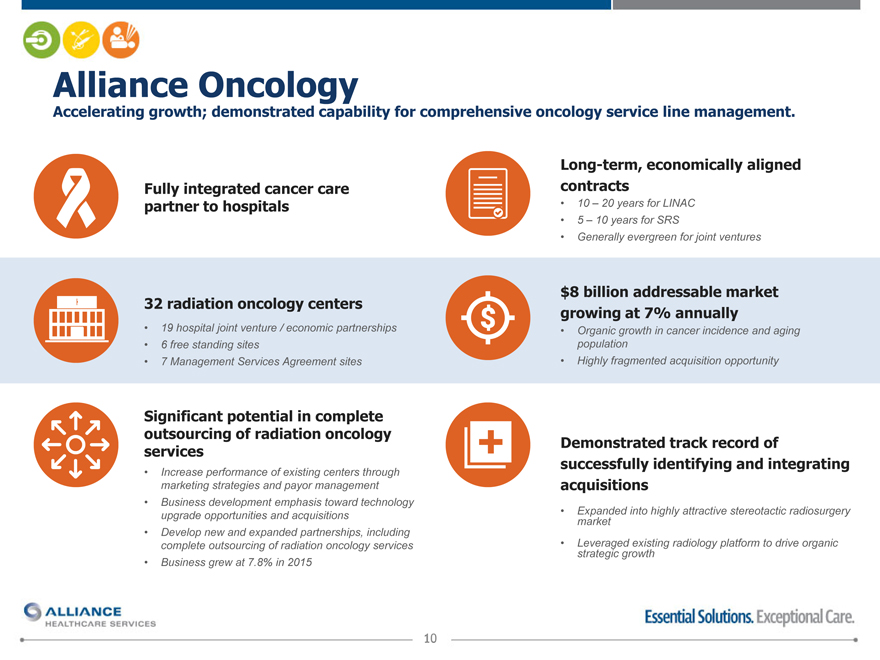

Alliance Oncology

Accelerating growth; demonstrated capability for comprehensive oncology service line management.

Long-term, economically aligned

Fully integrated cancer care contracts

partner to hospitals 10 – 20 years for LINAC

| 5 |

|

– 10 years for SRS |

Generally evergreen for joint ventures

$8 billion addressable market

32 radiation oncology centers growing at 7% annually

19 hospital joint venture / economic partnerships Organic growth in cancer incidence and aging

| 6 |

|

free standing sites population |

| 7 |

|

Management Services Agreement sites Highly fragmented acquisition opportunity |

Significant potential in complete

outsourcing of radiation oncology

services Demonstrated track record of

Increase performance of existing centers through successfully identifying and integrating

marketing strategies and payor management acquisitions

Business development emphasis toward technology

upgrade opportunities and acquisitions Expanded into highly attractive stereotactic radiosurgery

market

Develop new and expanded partnerships, including

complete outsourcing of radiation oncology services Leveraged existing radiology platform to drive organic

strategic growth

Business grew at 7.8% in 2015

10

|

|

Alliance Interventional Partners

Synergistic business segment in a high growth, fragmented market space.

$11 Billion addressable market Attractive reimbursement

growing at 8% annually environment

Highly fragmented market Lower cost to deliver services in an outpatient setting

Market share held by leader is less than 1% Ambulatory Surgical Centers (ASCs) have higher

reimbursement given the facility fee

JV partnerships to expand

geographic footprint Trend of migration to lower cost

Ambulatory Surgical Centers (ASCs)

Acquired The Pain Center of Arizona (February 2015)

and PRC Associates (October 2015) Increased patient satisfaction in an outpatient setting

Incremental revenues in 2015 of $33 million Lower cost to deliver services

Post acquisition synergy opportunities; ancillary Easy to access for patients

services like lab services and diagnostic imaging

Expansion into this segment

Management team with provides cross-sell opportunities to

interventional healthcare drive growth

experience Interventional healthcare patient flow will drive volumes to

the existing diagnostic radiology business

CEO Tom Tomlinson Operational synergies such as patient scheduling and

SVP of Sales Strategy Holly Huso insurance verification

President of Interventional Services Steven Siwek, MD

11

|

|

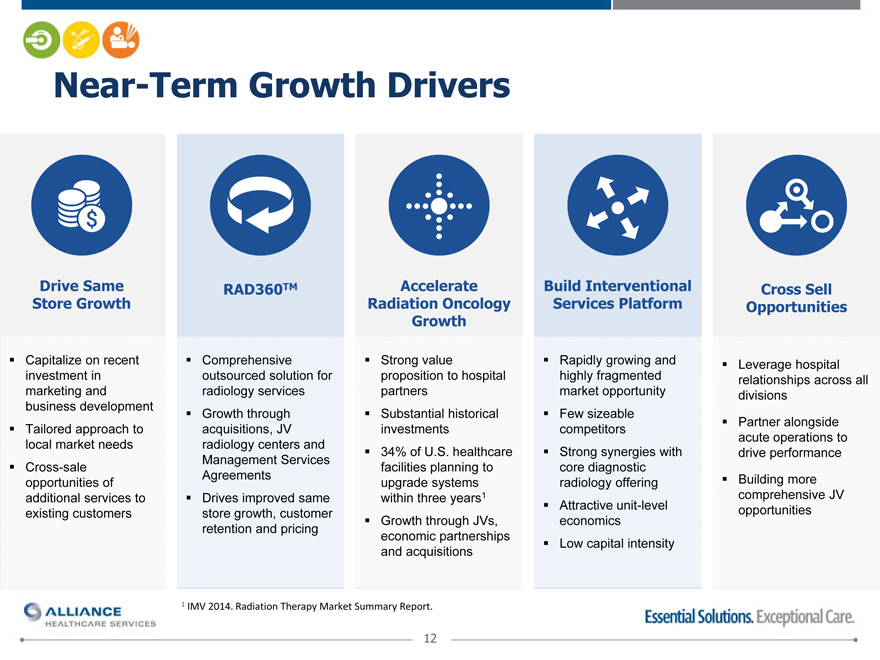

Near-Term Growth Drivers

Drive Same RAD360TM Accelerate Build Interventional Cross Sell

Store Growth Radiation Oncology Services Platform Opportunities

Growth

Capitalize on recent Comprehensive Strong value Rapidly growing and Leverage hospital

relationships across all

marketing and radiology services partners market opportunity divisions

business development Growth through Substantial historical Few sizeable

Tailored approach to acquisitions, JV investments competitors Partner alongside

local market needs radiology centers and acute operations to

Management Services 34% of U.S. healthcare Strong synergies with drive performance

Cross-sale facilities planning to core diagnostic

opportunities of Agreements upgrade systems radiology offering Building more

additional services to Drives improved same within three years1 comprehensive JV

existing customers store growth, customer Attractive unit-level opportunities

Growth through JVs, economics

retention and pricing economic partnerships Low capital intensity

and acquisitions

| 1 |

|

IMV 2014. Radiation Therapy Market Summary Report. |

12

|

|

Return to Growth Strategy

Launched in 2014, the multi-faceted growth strategy has begun to gain traction.

» In 2013, sold 24/7 and terminated loss contracts taking $18M out of revenue base

» Continued progress executing our new growth strategy since 2014, resulting in 8% year-over-year

growth

– Mid-point of 2016 guidance implies growth of 10%

Positive momentum and revenue growth demonstrated last five quarters

Growth despite pricing pressure and concessions of $15M and $8M in revenues in 2015 & 2016, respectively

Annual Revenue Quarterly Revenue

Q/Q Growth

4% 7% 10% 13% 13%

$505—$535

Guidance $124 $124

$121

$473 $119

$449 $436

$109 $111 $110 $110 $109

$105

FY13 FY14 FY15 FY16E Q1 Q1 Q2 Q2 Q3 Q3 Q4 Q4 Q1 Q1

14 15 14 15 14 15 14 15 15 16

13

|

|

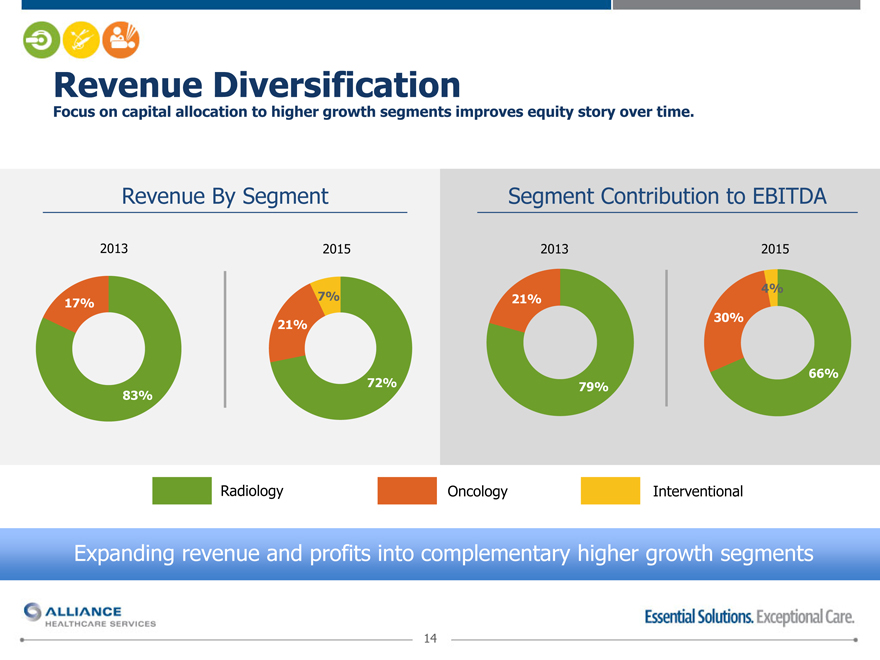

Revenue Diversification

Focus on capital allocation to higher growth segments improves equity story over time.

Revenue By Segment Segment Contribution to EBITDA

2013 2015 2013 2015

7% 4%

17% 21%

21% 30%

66%

83% 72% 79%

Radiology Oncology Interventional

14

|

|

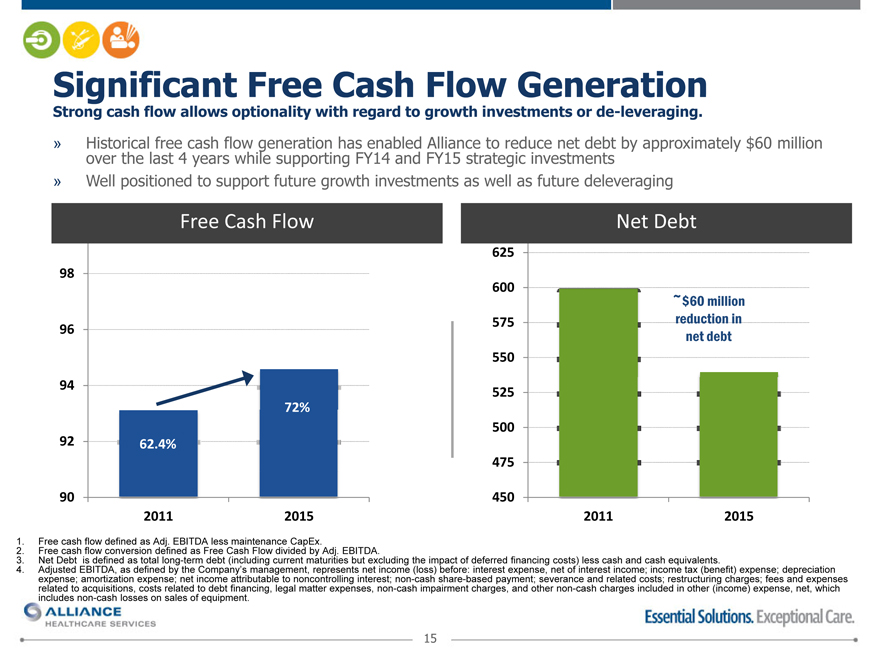

Significant Free Cash Flow Generation

Strong cash flow allows optionality with regard to growth investments or de-leveraging.

»

Historical free cash flow generation has enabled Alliance to reduce net debt by approximately $60 million

over the last 4 years while supporting FY14 and FY15 strategic investments

»

Well positioned to support future growth investments as well as future deleveraging

Free Cash Flow

Net Debt

625

98

600

~$60 million

575

reduction in

96

net debt

550

94

525

72%

500

92

62.4%

475

90

450

2011

2015

2011

2015

1. Free cash flow defined as Adj. EBITDA less maintenance CapEx.

2. Free cash flow conversion defined as Free Cash Flow divided by Adj. EBITDA.

3. Net Debt

is defined as total long-term debt (including current maturities but excluding the impact of deferred financing costs) less cash and cash equivalents.

4. Adjusted EBITDA, as defined by the Company’s management, represents net income (loss) before: interest expense, net of interest income; income tax (benefit) expense; depreciation

expense; amortization expense; net income attributable to noncontrolling interest; non-cash share-based payment; severance and related costs; restructuring charges; fees and expenses

related to acquisitions, costs related to debt financing, legal matter expenses, non-cash impairment charges, and other non-cash charges included in other (income) expense, net, which

includes non-cash losses on sales of equipment.

15

|

|

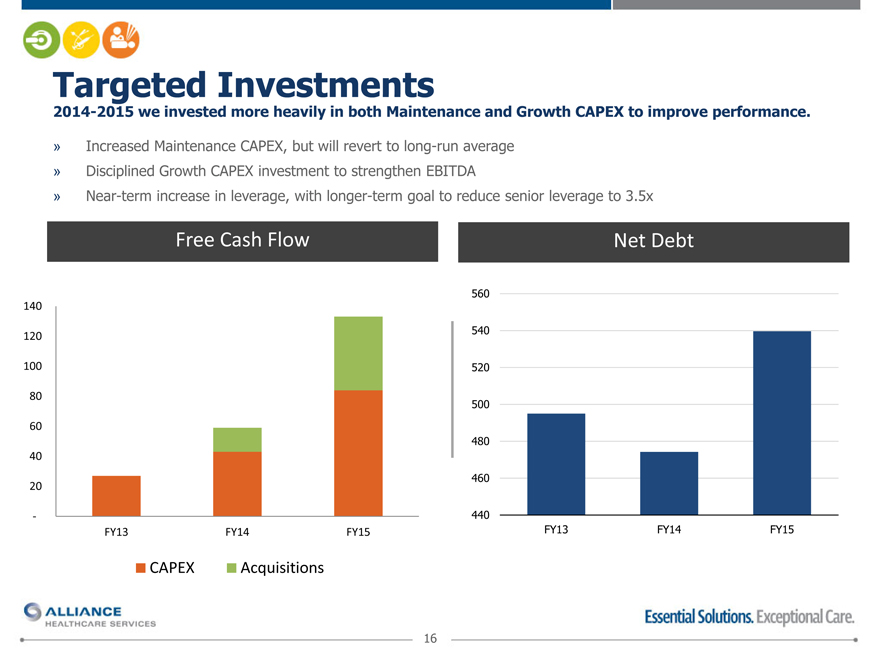

Targeted Investments

2014-2015 we invested more heavily in both Maintenance and Growth CAPEX to improve performance.

» Increased Maintenance CAPEX, but will revert to long-run average

» Disciplined Growth CAPEX investment to strengthen EBITDA

» Near-term increase in leverage, with longer-term goal to reduce senior leverage to 3.5x

Free Cash Flow Net Debt

560

140

120 540

100 520

80

500

60

480

40

460

20

- 440

FY13 FY14 FY15 FY13 FY14 FY15

CAPEX Acquisitions

16

|

|

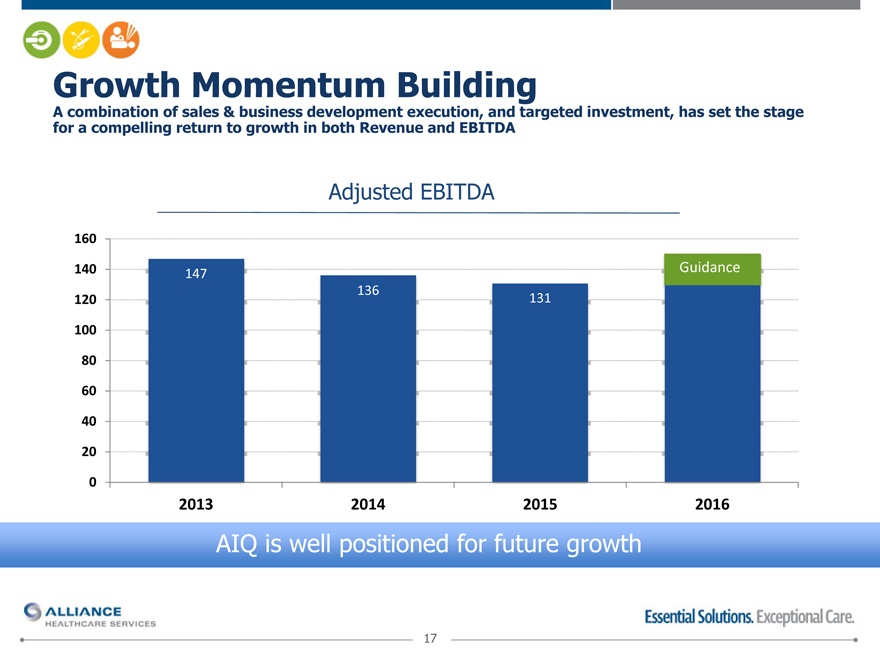

Growth Momentum Building

A combination of sales & business development execution, and targeted investment, has set the stage

for a compelling return to growth in both Revenue and EBITDA

Adjusted EBITDA

160

140 147 Guidance Guidance

136

120 131

100

80

60

40

20

0

2013 2014 2015 2016

17

|

|

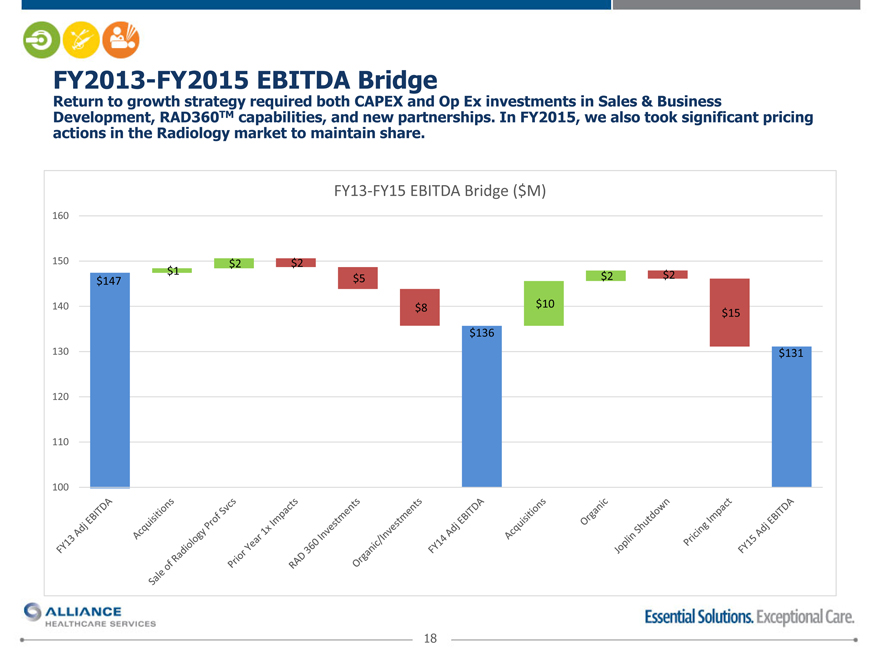

FY2013-FY2015 EBITDA Bridge

Return to growth strategy required both CAPEX and Op Ex investments in Sales & Business

Development, RAD360TM capabilities, and new partnerships. In FY2015, we also took significant pricing

actions in the Radiology market to maintain share.

FY13-FY15 EBITDA Bridge ($M)

160

150 $2 $2

$1

$147 $5 $2 $2

140 $8 $10

$15

$136

130 $131

120

110

100

18

|

|

Positioned for International Opportunities

Transaction Background: Agreement Completed March 29, 2016

51.5% Fujian Thai Hot signed an agreement to purchase approximately 51.5% of shares outstanding

of shares Shares purchased from Oaktree Capital Management, MTS Health Investors and former

outstanding Chairman of the Board

Alliance did not sell any shares in the transaction

Appointed Qisen Huang as Chairman of the Board

Thai Hot has three Board nominees among a board of nine directors

About Fujian Thai Hot

Total assets

exceed Investment holding company based in China, holding diversified portfolio of assets, including large-scale

pharmaceutical company

$13 In 2015, Fujian Thai Hot made healthcare and medical services one of its top priorities, including radiology

Billion and oncology, and it intends to expand healthcare services in mainland China to an underserved healthcare

marketplace

Total assets under management exceed $13 billion

International Benefits

Experience International experience to support future strategic growth in US and in China

Broad expertise to augment and strengthen Alliance’s competitive position and long-term

value proposition

19

|

|

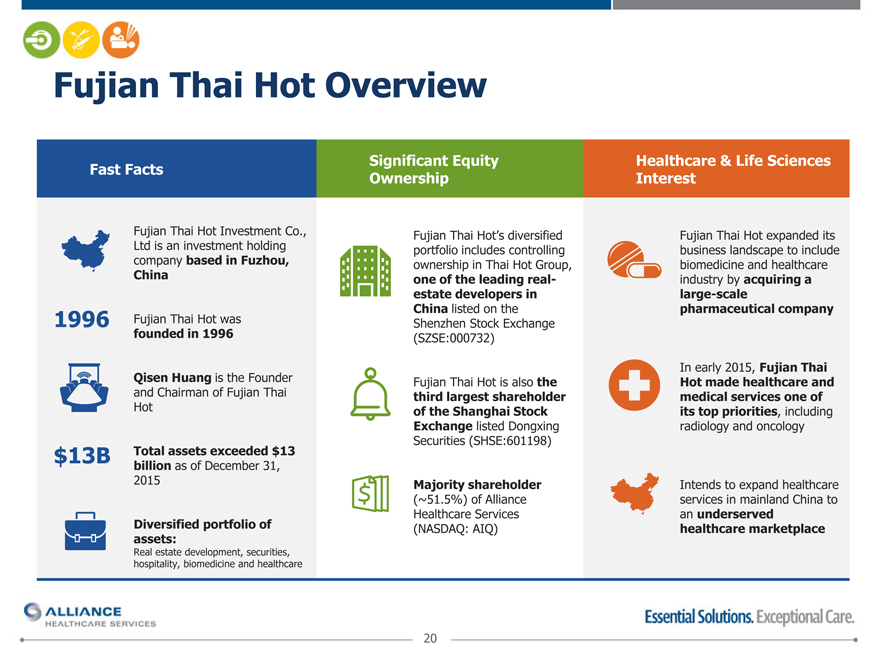

Fujian Thai Hot Overview

Significant Equity Healthcare & Life Sciences

Fast Facts Ownership Interest

Fujian Thai Hot Investment Co., Fujian Thai Hot’s diversified Fujian Thai Hot expanded its

Ltd is an investment holding portfolio includes controlling business landscape to include

company based in Fuzhou, ownership in Thai Hot Group, biomedicine and healthcare

China one of the leading real- industry by acquiring a

estate developers in large-scale

China listed on the pharmaceutical company

1996 Fujian Thai Hot was Shenzhen Stock Exchange

founded in 1996 (SZSE:000732)

In early 2015, Fujian Thai

Qisen Huang is the Founder Fujian Thai Hot is also the Hot made healthcare and

and Chairman of Fujian Thai third largest shareholder medical services one of

Hot of the Shanghai Stock its top priorities, including

Exchange listed Dongxing radiology and oncology

Securities (SHSE:601198)

$13B Total assets exceeded $13

billion as of December 31,

2015 Majority shareholder Intends to expand healthcare

(~51.5%) of Alliance services in mainland China to

Healthcare Services an underserved

Diversified portfolio of (NASDAQ: AIQ) healthcare marketplace

assets:

Real estate development, securities,

hospitality, biomedicine and healthcare

20

|

|

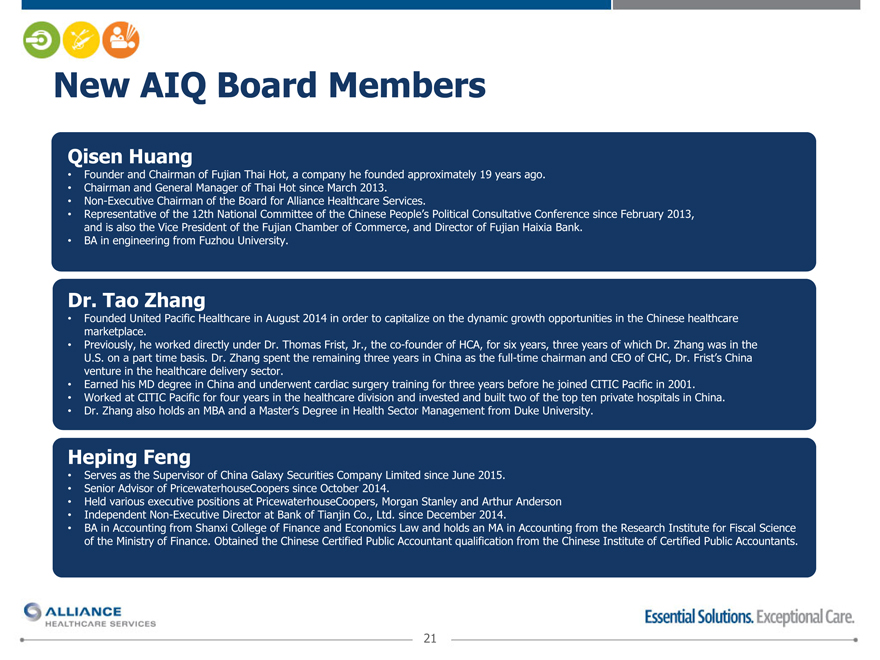

New AIQ Board Members

Qisen Huang

Founder and Chairman of Fujian Thai Hot, a company he founded approximately 19 years ago.

Chairman and General Manager of Thai Hot since March 2013.

Non-Executive Chairman of the Board for Alliance Healthcare Services.

Representative of the 12th National Committee of the Chinese People’s Political Consultative Conference since February 2013, and is also the Vice President of the Fujian Chamber of Commerce, and Director of Fujian Haixia Bank.

BA in engineering from Fuzhou University.

Dr. Tao Zhang

Founded United Pacific Healthcare in August 2014 in order to capitalize on the dynamic growth opportunities in the Chinese healthcare marketplace.

Previously, he worked directly under Dr. Thomas Frist, Jr., the co-founder of HCA, for six years, three years of which Dr. Zhang was in the U.S. on a part time basis. Dr. Zhang spent the remaining three years in China as the full-time chairman and CEO of CHC, Dr. Frist’s China venture in the healthcare delivery sector.

Earned his MD degree in China and underwent cardiac surgery training for three years before he joined CITIC Pacific in 2001.

Worked at CITIC Pacific for four years in the healthcare division and invested and built two of the top ten private hospitals in China.

Dr. Zhang also holds an MBA and a Master’s Degree in Health Sector Management from Duke University.

Heping Feng

Serves as the Supervisor of China Galaxy Securities Company Limited since June 2015.

Senior Advisor of PricewaterhouseCoopers since October 2014.

Held various executive positions at PricewaterhouseCoopers, Morgan Stanley and Arthur Anderson

Independent Non-Executive Director at Bank of Tianjin Co., Ltd. since December 2014.

BA in Accounting from Shanxi College of Finance and Economics Law and holds an MA in Accounting from the Research Institute for Fiscal Science of the Ministry of Finance. Obtained the Chinese Certified Public Accountant qualification from the Chinese Institute of Certified Public Accountants.

21

|

|

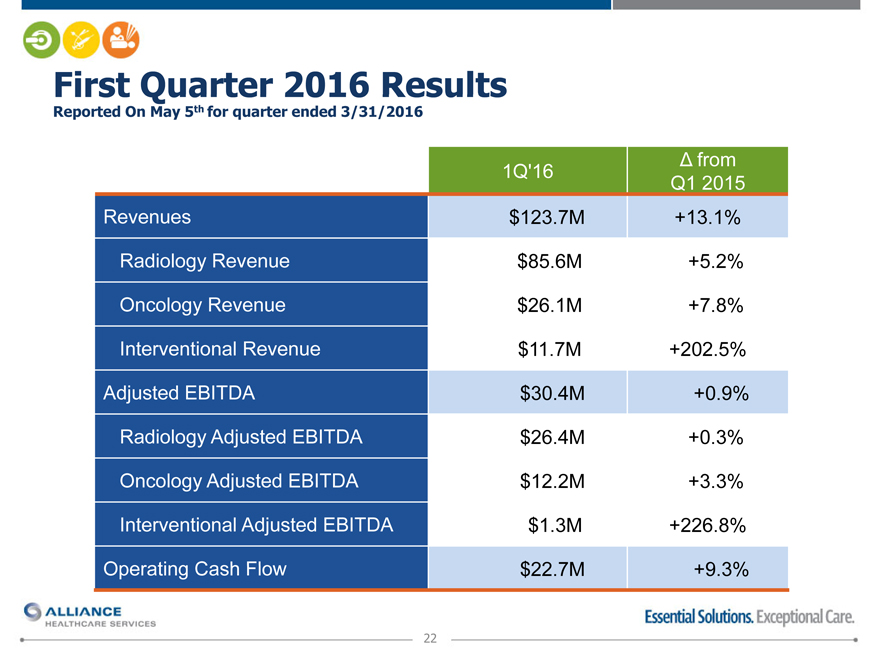

First Quarter 2016 Results

Reported On May 5th for quarter ended 3/31/2016

? from

1Q’16 Q1 2015

Revenues $123.7M +13.1%

Radiology Revenue $85.6M +5.2%

Oncology Revenue $26.1M +7.8%

Interventional Revenue $11.7M +202.5%

Adjusted EBITDA $30.4M +0.9%

Radiology Adjusted EBITDA $26.4M +0.3%

Oncology Adjusted EBITDA $12.2M +3.3%

Interventional Adjusted EBITDA $1.3M +226.8%

Operating Cash Flow $22.7M +9.3%

22

|

|

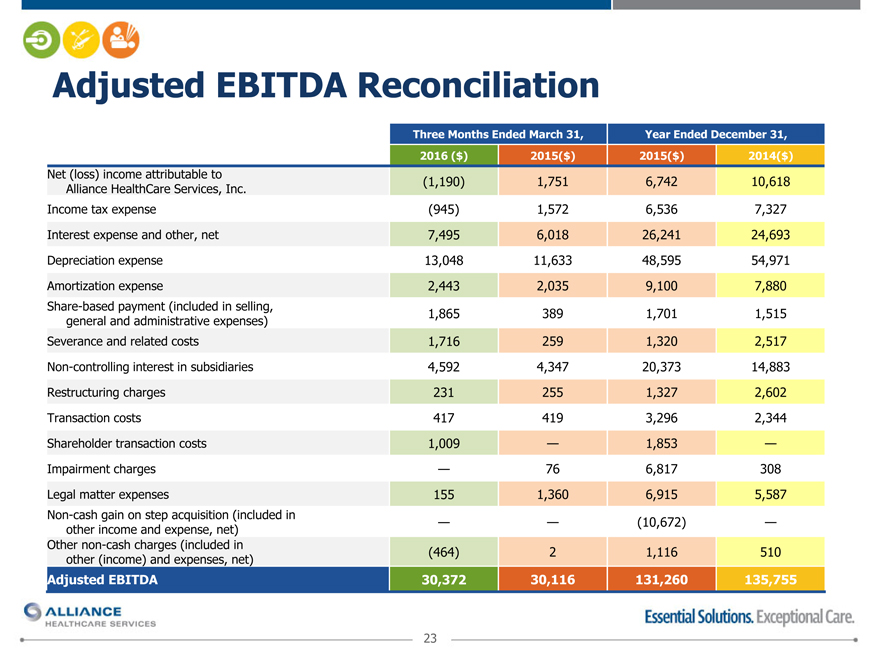

Adjusted EBITDA Reconciliation

Three Months Ended March 31, Year Ended December 31,

2016 ($) 2015($) 2015($) 2014($)

Net (loss) income attributable to

Alliance HealthCare Services, Inc. (1,190) 1,751 6,742 10,618

Income tax expense (945) 1,572 6,536 7,327

Interest expense and other, net 7,495 6,018 26,241 24,693

Depreciation expense 13,048 11,633 48,595 54,971

Amortization expense 2,443 2,035 9,100 7,880

Share-based payment (included in selling, 1,865 389 1,701 1,515

general and administrative expenses)

Severance and related costs 1,716 259 1,320 2,517

Non-controlling interest in subsidiaries 4,592 4,347 20,373 14,883

Restructuring charges 231 255 1,327 2,602

Transaction costs 417 419 3,296 2,344

Shareholder transaction costs 1,009 — 1,853 —

Impairment charges — 76 6,817 308

Legal matter expenses 155 1,360 6,915 5,587

Non-cash gain on step acquisition (included in — — (10,672) —

other income and expense, net)

Other non-cash charges (included in (464) 2 1,116 510

other (income) and expenses, net)

Adjusted EBITDA 30,372 30,116 131,260 135,755

23

|

|

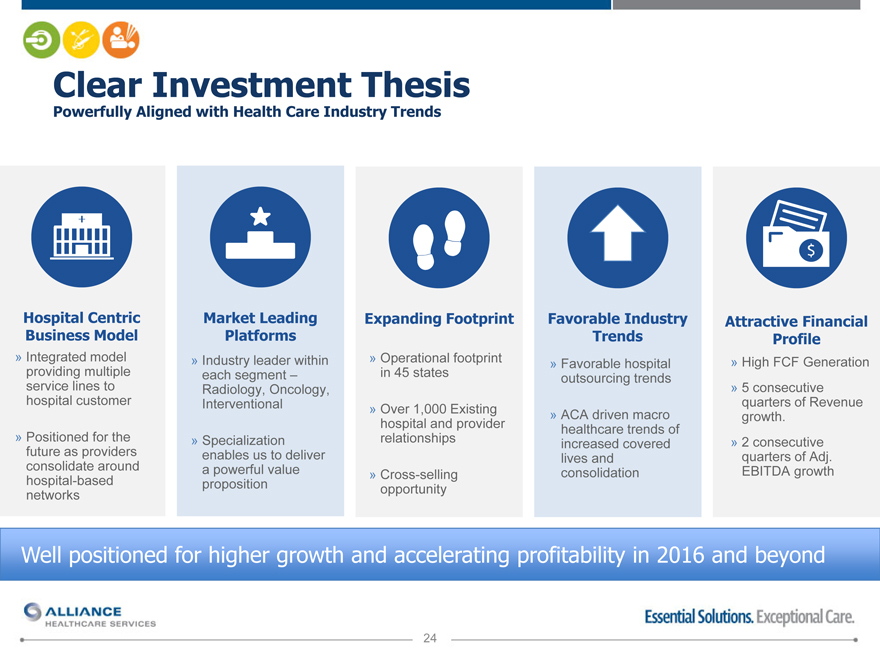

Clear Investment Thesis

Powerfully Aligned with Health Care Industry Trends

Hospital Centric Market Leading Expanding Footprint Favorable Industry Attractive Financial

Business Model Platforms Trends Profile

» Integrated model » Industry leader within » Operational footprint » Favorable hospital » High FCF Generation

providing multiple each segment – in 45 states outsourcing trends

service lines to Radiology, Oncology, » 5 consecutive

hospital customer Interventional » Over 1,000 Existing quarters of Revenue

» ACA driven macro growth.

hospital and provider healthcare trends of

» Positioned for the » Specialization relationships increased covered » 2 consecutive

future as providers enables us to deliver lives and quarters of Adj.

consolidate around a powerful value » Cross-selling consolidation EBITDA growth

hospital-based proposition opportunity

networks

24

|

|

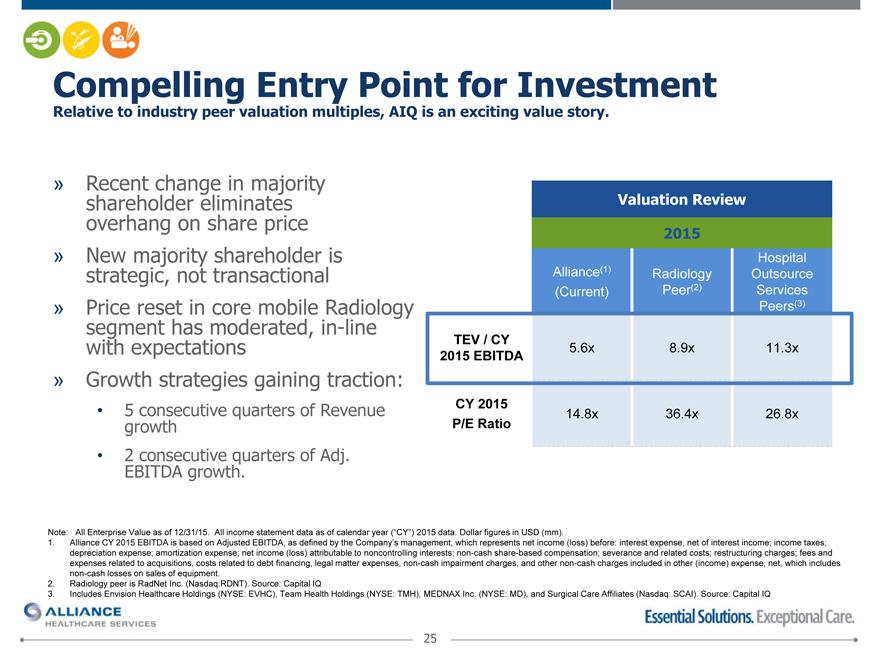

Compelling Entry Point for Investment

Relative to industry peer valuation multiples, AIQ is an exciting value story.

» Recent change in majority

shareholder eliminates Valuation Review

overhang on share price 2015

» New majority shareholder is Hospital

strategic, not transactional Alliance(1) Radiology Outsource

(Current) Peer(2) Services

» Price reset in core mobile Radiology Peers(3)

segment has moderated, in-line

with expectations TEV / CY 5.6x 8.9x 11.3x

2015 EBITDA

» Growth strategies gaining traction:

CY 2015

5 consecutive quarters of Revenue 14.8x 36.4x 26.8x

growth P/E Ratio

2 consecutive quarters of Adj.

EBITDA growth.

Note: All Enterprise Value as of 12/31/15. All income statement data as of calendar year (“CY”) 2015 data. Dollar figures in USD (mm).

1. Alliance CY 2015 EBITDA is based on Adjusted EBITDA, as defined by the Company’s management, which represents net income (loss) before: interest expense, net of interest income; income taxes;

depreciation expense; amortization expense; net income (loss) attributable to noncontrolling interests; non-cash share-based compensation; severance and related costs; restructuring charges; fees and

expenses related to acquisitions, costs related to debt financing, legal matter expenses, non-cash impairment charges, and other non-cash charges included in other (income) expense, net, which includes

non-cash losses on sales of equipment.

2. Radiology peer is RadNet Inc. (Nasdaq:RDNT). Source: Capital IQ

3. Includes Envision Healthcare Holdings (NYSE: EVHC), Team Health Holdings (NYSE: TMH), MEDNAX Inc. (NYSE: MD), and Surgical Care Affiliates (Nasdaq: SCAI). Source: Capital IQ

25

|

|

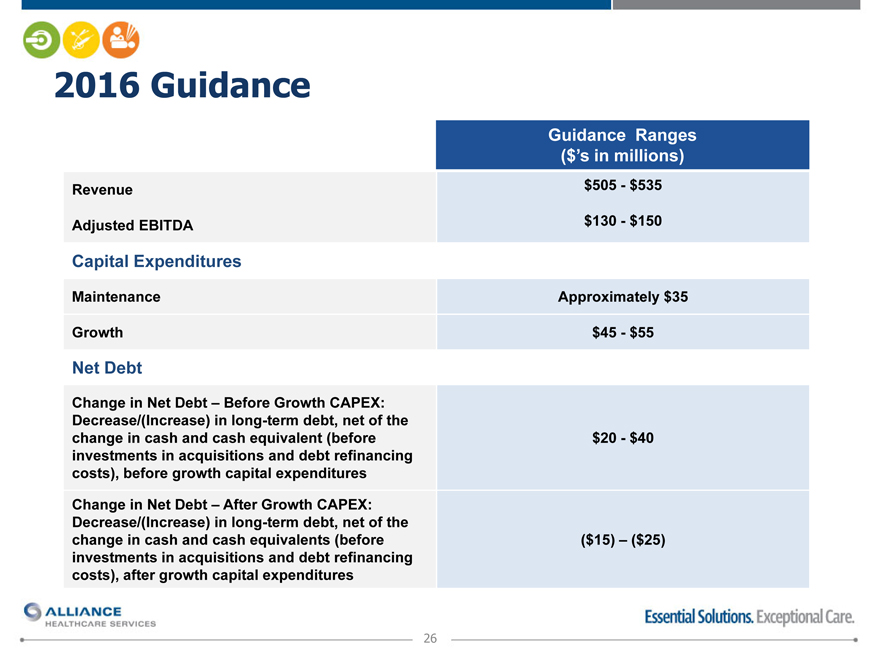

2016 Guidance

Guidance Ranges

($’s in millions)

Revenue $505—$535

Adjusted EBITDA $130—$150

Capital Expenditures

Maintenance Approximately $35

Growth $45—$55

Net Debt

Change in Net Debt – Before Growth CAPEX:

Decrease/(Increase) in long-term debt, net of the

change in cash and cash equivalent (before $20—$40

investments in acquisitions and debt refinancing

costs), before growth capital expenditures

Change in Net Debt – After Growth CAPEX:

Decrease/(Increase) in long-term debt, net of the

change in cash and cash equivalents (before ($15) – ($25)

investments in acquisitions and debt refinancing

costs), after growth capital expenditures

26

|

|

Thank You

www.alliancehealthcareservices-us.com