Attached files

| file | filename |

|---|---|

| EX-99.1 - PRESS RELEASE - Walmart Inc. | earningsrelease-4302016.htm |

| 8-K - FORM 8-K - Walmart Inc. | form8-kx4302016.htm |

Wal-Mart Stores, Inc.

Safe harbor and non-GAAP financial measures This presentation contains statements as to Walmart management's guidance regarding the diluted earnings per share from continuing operations attributable to Walmart for the three months ending July. 31, 2016, Walmart U.S.'s comparable store sales and Sam's Club's comparable club sales, excluding fuel, for the 13 weeks ending July 29, 2016 and the third party FCPA-related expenses expected to be incurred for year ending January 31, 2017. Walmart believes such statements are "forward-looking statements" as defined in, and they are intended to enjoy the protection of the safe harbor for forward-looking statements provided by, the Private Securities Litigation Reform Act of 1995, as amended. Walmart's actual results may differ materially from the guidance provided and the underlying assumptions and management's expectations noted above as a result of changes in circumstances, assumptions not being realized or other risks, uncertainties and factors including: • economic, geo-political, capital markets and business conditions, trends and events around the world and in the markets in which Walmart operates; • currency exchange rate fluctuations, changes in market interest rates and commodity prices; • unemployment levels; • competitive pressures; • inflation or deflation, generally and in particular product categories; • consumer confidence, disposable income, credit availability, spending levels, shopping patterns, debt levels and demand for certain merchandise; • consumer enrollment in health and drug insurance programs and such programs' reimbursement rates; • the amount of Walmart's net sales denominated in the U.S. dollar and various foreign currencies; • the financial performance of Walmart and each of its segments; • Walmart's effective tax rate for the quarter ending July 31, 2016 and the factors affecting Walmart's effective tax rate, including assessments of certain tax contingencies, valuation allowances, changes in law, administrative audit outcomes, impact of discrete items and the mix of earnings between the U.S. and Walmart's international operations; • customer traffic and average ticket in Walmart's stores and clubs and on its e-commerce websites; • the mix of merchandise Walmart sells, the cost of goods it sells and the shrinkage it experiences; • the amount of Walmart's total sales and operating expenses in the various markets in which Walmart operates; • transportation, energy and utility costs and the selling prices of gasoline and diesel fuel; • supply chain disruptions and disruptions in seasonal buying patterns; • consumer acceptance of and response to Walmart's stores, clubs, e-commerce websites, mobile apps, initiatives, programs and merchandise offerings; • cyber security events affecting Walmart and related costs; • developments in, outcomes of, and costs incurred in legal proceedings to which Walmart is a party; • casualty and accident-related costs and insurance costs; • the turnover in Walmart's workforce and labor costs, including healthcare and other benefit costs; • changes in accounting estimates or judgments; • changes in existing tax, labor and other laws and changes in tax rates, trade restrictions and tariff rates; • the level of public assistance payments; • natural disasters, public health emergencies, civil disturbances, and terrorist attacks. • Walmart's expenditures for FCPA and compliance related costs; and • outcomes of and costs incurred in legal proceedings to which Walmart is a party. Such risks, uncertainties and factors also include the risks relating to Walmart's operations and financial performance discussed in Walmart's most recent annual report on Form 10-K filed with the SEC. You should read this release in conjunction with that annual report on Form 10-K and Walmart's quarterly reports on Form 10-Q and current reports on Form 8-K subsequently filed with the SEC. You should consider all of the risks, uncertainties and other factors identified above and in those SEC reports carefully when evaluating the forward- looking statements in this release. Walmart cannot assure you that the future results reflected in or implied by any such forward-looking statement will be realized or, even if substantially realized, will have the forecast or expected consequences and effects for or on Walmart's operations or financial performance. Such forward-looking statements are made as of the date of this release, and Walmart undertakes no obligation to update such statements to reflect subsequent events or circumstances. This presentation includes certain non-GAAP financial measures as defined under SEC rules, including net sales, revenue, and operating income on a constant currency basis, Sam's Club comp sales excluding fuel , free cash flow, and return on investment. Refer to Appendix - Non-GAAP Financial Measures for more information about the non-GAAP financial measures contained in this presentation. Additional information as required by Regulation G regarding non-GAAP financial measures can be found in our most recent Form 10-K, Form 10-Q, and our Form 8-K filed as of the date of this presentation with the SEC, which are available at www.stock.walmart.com. 2

Total company Walmart U.S. comps Sam's Club compsFY17 Q2 EPS: • $0.95 to $1.08 13-week period1: • around +1.0% 13-week period1: • Slightly positive 1 13-week period from April 30, 2016 through July 29, 2016, compared to 13-week period ended July 31, 2015. Guidance 3

Wal-Mart Stores, Inc. (Amounts in millions, except share data) Q1 $ Δ1 % Δ1 Total revenue $115,904 $1,078 0.9% Total revenue, constant currency2 $119,426 $4,600 4.0% Net sales $114,986 $984 0.9% Net sales, constant currency2 $118,484 $4,482 3.9% Membership & other income $918 $94 11.4% Operating income $5,275 -$405 -7.1% Operating income, constant currency2 $5,416 -$264 -4.6% Interest expense, net $561 -$263 -31.9% Consolidated net income attributable to Walmart $3,079 -$262 -7.8% Diluted EPS (continuing operations) $0.98 -$0.05 -4.9% 1 Change versus prior year comparable period. 2 See press release located at www.stock.walmart.com and reconciliations at the end of presentation regarding non-GAAP financial measures. 4

Wal-Mart Stores, Inc. Q1 bps Δ1 Gross profit rate 24.7% 60 bps Operating expenses as a percentage of net sales 21.0% 107 bps Effective tax rate 31.8% -61 bps Debt to total capitalization2 40.0% 40 bps Return on investment3,4 15.3% -130 bps 1 Basis points change versus prior year comparable period. 2 Debt to total capitalization is calculated as of April 30, 2016. Debt includes short-term borrowings, long-term debt due within one year, capital lease and financing obligations due within one year, long-term debt, and long-term capital lease and financing obligations. Total capitalization includes debt and total Walmart shareholders' equity. 3 ROI is calculated for the trailing 12 months ended April 30, 2016. 4 See press release located at www.stock.walmart.com and reconciliations at the end of presentation regarding non-GAAP financial measures. 5

(Amounts in millions) Q1 $ Δ1 % Δ1 Receivables, net $5,187 -$626 -10.8% Inventories $44,513 -$1,797 -3.9% Accounts payable $37,997 $773 2.1% Wal-Mart Stores, Inc. 1 Change versus prior year comparable period. 6

(Amounts in millions) Q1 FY17 $ Δ1 Operating cash flow $6,193 $1,747 Capital expenditures $2,209 $6 Free cash flow2 $3,984 $1,741 (Amounts in millions) Q1 FY17 % Δ1 Dividends $1,573 -0.4% Share repurchases3 $2,735 876.8% Total $4,308 131.7% 1 Change versus prior year comparable period. 2 See press release located at www.stock.walmart.com and reconciliations at the end of presentation regarding non- GAAP financial measures. 3 $14.7 billion remaining of $20 billion authorization approved in October 2015. Wal-Mart Stores, Inc. 7

Walmart U.S. (Amounts in millions) Q1 Δ1 Net sales $73,295 4.3% Comparable store sales2 1.0% -10 bps • Comp traffic 1.5% 50 bps • Comp ticket -0.5% -60 bps E-commerce impact3 ~0.2% — bps Neighborhood Market ~7.1% -80 bps Gross profit rate Increase 44 bps Operating expense Increase 141 bps Operating income $4,232 -8.8% 1 Change versus prior year comparable period. 2 Comp sales are on a 13-week basis for the period ended April 29, 2016. 3 The company's e-commerce sales impact includes those sales initiated through the company's websites and fulfilled through the company's dedicated e-commerce distribution facilities, as well as an estimate for sales initiated online, but fulfilled through the company's stores and clubs. 8

Walmart U.S. - financial highlights 9 Sales • +1% comp sales growth led by comp traffic of +1.5%; 2-year stack basis comp sales +2.1%. • Deflation in food negatively impacted comps by approximately 60 basis points versus last year's Q1 comp. • Strength in health & wellness, apparel, home & seasonal, and hardlines. Gross Margin • 44 bps growth in gross margin due to improved margin rates in grocery and health & wellness partially offset by a reduced margin rate in general merchandise, as our continued efforts to improve inventory productivity and drive a better customer experience drove higher markdowns in the first quarter versus last year. • Gross margin also benefited from a continued focus on efforts to reduce costs in operating the business and procuring merchandise, improved shrink and lower transportation costs. Expenses • As expected, expenses increased primarily as a result of initiating the second phase of wage rate increases in February, as well as investments in technology. Partially offsetting these increases were lower utility & maintenance expenses due to a milder winter. Inventory • Total inventory declined 3.5%, and comp store inventory declined by 5.7%, while in-stock levels improved. Format growth • Opened 13 Supercenters (including conversions and relocations) and 20 Neighborhood Markets. • Expanding online grocery to 9 new markets, bringing the total to nearly 40 markets by the end of May.

Walmart U.S. - merchandise highlights Category Comp Comments Grocery1 - low single-digit Continued deflation in food was partially offset by strong traffic in grocery. Better in-stock levels and a focus on assortment drove stronger consumables results, particularly in beauty and pets. Health & wellness + mid single-digit Pharmacy script count growth, along with branded drug inflation led the category higher. OTC benefited from better in-stock levels and a more year-round allergy business. General merchandise2 + low single-digit A focus on basics contributed to strength in apparel, while toys benefited from licensed brands and improved in-stock levels. The addition of Auto Service Center managers and a focus on basics in Tools drove solid results in hardlines, and home benefited from new brands such as Pioneer Woman. Electronics experienced positive comps as a result of better in-stock levels due to lapping last year's port congestion, along with stronger adoption of new technology in TVs. Wireless remains a headwind driven by overall industry declines. Overall, enhanced inventory focus is improving in-stock levels and allowing more space for seasonally-appropriate items. 1 Includes food and consumables. 2 In order to align with how we manage the business, general merchandise now includes entertainment, toys, hardlines, apparel and home/seasonal. 10

Walmart International 1 (Amounts in millions) Reported Constant currency1 Q1 Δ2 Q1 Δ2 Net sales $28,083 -7.2% $31,581 4.3% Gross profit rate Increase 70 bps NP NP Operating income $1,164 8.8% $1,305 22.0% 1 See press release located at www.stock.walmart.com and reconciliations at the end of presentation regarding non- GAAP financial measures. 2 Change versus prior year comparable period. 11

Walmart International - financial highlights 12 Sales • Ten of 11 markets had positive comp sales. Nine of 11 markets had comp sales greater than 4%. • Continued strength at Walmex and in Canada. • Currency exchange rate fluctuations negatively impacted net sales by $3.5 billion, but was a bit lower than anticipated. Operating income • Higher sales, gross profit rate improvement and targeted cost reduction initiatives led to strong growth in operating income on a constant currency basis, led by Walmex and Canada. Expenses • We leveraged expenses in the majority of markets as the focus continued on "We Operate for Less" initiatives. Inventory • A focus on reducing unproductive and obsolete merchandise led to inventory growth that was slower than the growth in net sales, on a constant currency basis.

Walmart International - key markets 1 Results are on a constant currency basis. Net sales and comp sales are presented on a nominal, calendar basis. 2 E-commerce results included for the United Kingdom, Walmex and Canada. E-commerce results are reported separately for Brazil and China and are not included in the table. 3 Change versus prior year comparable period. 4 Comp sales for the United Kingdom are presented excluding fuel. 5 Walmex includes the consolidated results of Mexico and Central America. Country1,2 Comp3 Net sales3 Gross profit rate3 Operating income3Sales Traffic Ticket United Kingdom4 -5.7% -5.0% -0.7% -3.6% Increase Decrease Walmex5 8.6% 2.1% 6.5% 9.5% Increase Increase Canada 6.7% 4.6% 2.1% 8.6% Increase Increase Brazil 4.5% -3.7% 8.2% 1.4% Decrease Decrease China 1.4% -3.8% 5.2% 5.1% Increase Increase 13

Walmart International - key market highlights 14 Walmex • Strong sales momentum for Walmex continued across all formats, divisions, countries and regions, led by strong performances in food and consumables. • Growth in total sales and comp sales significantly outpaced the rest of the self-service market, according to ANTAD. • Sam's Club continued its turnaround with on-going progress in food and consumables, in addition to strong comp sales in general merchandise and electronics. • Higher gross margins, driven by strong inventory management, reduced clearance and good expense management led to strong growth in operating income. Canada • Comp sales were positive for the eighth consecutive quarter. Assortment enhancements led to strong customer traffic. • Gained 100 basis points of market share for the 12-week period ended April 16, according to Nielsen, led by food, consumables, health & wellness and infant. • E-commerce continues to grow, and the expansion of online grocery to the Toronto metro area is performing well. • Even as e-commerce investments continued, the ability to leverage expenses in the core business led to growth in operating income that outpaced growth in sales.

Walmart International - key market highlights (cont.) 15 U.K. • Significant, structural shifts in the market driven by growth in hard discounters and intense price competition, led to continued deflation in food that has now lasted for 20 consecutive months. • Project Renewal remains a focus with the aim to simplify and strengthen the customer offer, reduce costs and drive sales. • The cost analytics program, which is part of Project Renewal, made good progress and delivered savings in line with expectations, and is helping to deliver an improvement in the price position against key competitors. • Improvements in price and product availability throughout the quarter were not enough to overcome traffic and food volume declines in the large store format. • Improvements in working capital and discipline in capital spending led to free cash flow that met expectations.

Walmart International - key market highlights (cont.) China • Good overall results despite challenging macro-economic environment. • A strong performance during Chinese New Year, double-digit growth in gift card loading and continued strengthening in the fresh category led to good sales growth and positive comps. • "We Operate for Less" initiatives continued to deliver results. Through store and DC productivity improvements, expenses grew at a slower rate than sales. • The online grocery service is now in three additional cities, and the cross border e-commerce pilot "Walmart Global Shop" expanded and provides customers with access to a limited selection of trusted imported items and brands. Brazil • High inflation contributed to an economic environment that continues to be challenging. • Strong performance in the wholesale business led to sales growth and the closure of unprofitable stores led to solid comp sales. 16

Sam's Club (Amounts in millions) Without fuel1 With fuel Q1 Δ2 Q1 Δ2 Net sales $12,727 2.9% $13,608 1.0% Comparable club sales3 0.1% -30 bps -1.9% 190 bps • Comp traffic -0.2% — bps NP NP • Comp ticket 0.3% -30 bps NP NP E-commerce impact4 ~0.6% 20 bps NP NP Gross profit rate Increase 18 bps Increase 51 bps Membership income NP 3.9% NP NP Operating income $408 -6.4% $413 -3.3% 1 See press release located at www.stock.walmart.com and reconciliations at the end of presentation regarding non-GAAP financial measures. 2 Change versus prior year comparable period. 3 Comp sales are on a 13-week basis for the period ended April 29, 2016. 4 The company's e-commerce sales impact includes those sales initiated through the company's websites and fulfilled through the company's dedicated e-commerce distribution facilities, as well as an estimate for sales initiated online, but fulfilled through the company's stores and clubs. 17

Sam's Club - financial highlights 18 Sales • Comp sales1 were in-line with guidance at +0.1%. Deflation negatively impacted comp sales by approximately 50 basis points versus last year's Q1 comp. • E-commerce contributed approximately 60 basis points to comp sales. ◦ Club Pickup sales grew more than 30% and represents the fastest growing piece of the business. ◦ Continued strong growth in direct-to-home sales. Gross Margin1 • Investments in membership value continued through price and cash rewards. Despite these investments, gross profit rate increased 18 basis points over last year. Expenses1 • Operating expenses deleveraged during the quarter as investments in people and technology continued. Membership Income • Membership income grew 3.9% over last year. • Plus Member renewals increased more than 30% for the quarter, and Plus penetration was near an all-time high. • Members continued to recognize the value that Sam's Club provides. Member benefits from the 5/3/1 credit card increased more than 50% over last year. Inventory • Inventory grew at a rate slower than sales growth at 50 basis points despite strategic purchases in key categories. 1Excluding fuel. See press release located at www.stock.walmart.com and reconciliations at the end of presentation regarding non-GAAP financial measures.

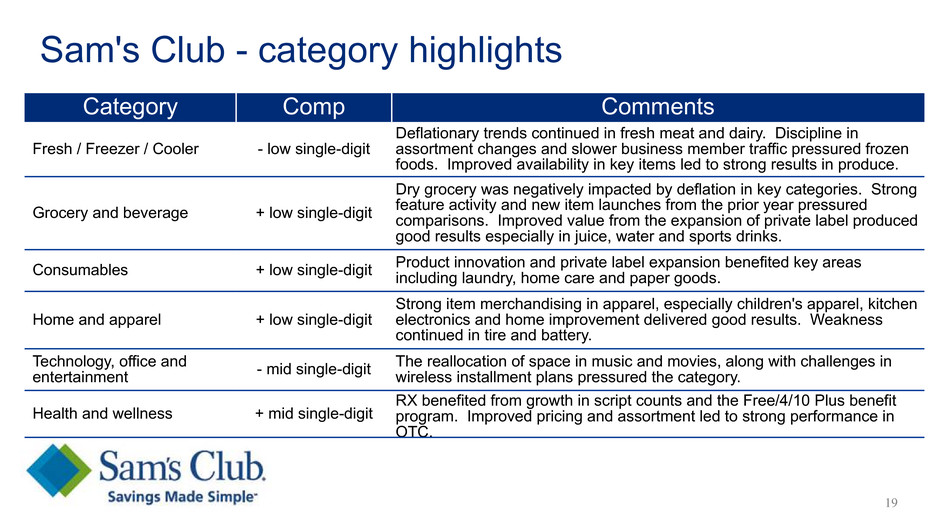

Sam's Club - category highlights 19 Category Comp Comments Fresh / Freezer / Cooler - low single-digit Deflationary trends continued in fresh meat and dairy. Discipline in assortment changes and slower business member traffic pressured frozen foods. Improved availability in key items led to strong results in produce. Grocery and beverage + low single-digit Dry grocery was negatively impacted by deflation in key categories. Strong feature activity and new item launches from the prior year pressured comparisons. Improved value from the expansion of private label produced good results especially in juice, water and sports drinks. Consumables + low single-digit Product innovation and private label expansion benefited key areasincluding laundry, home care and paper goods. Home and apparel + low single-digit Strong item merchandising in apparel, especially children's apparel, kitchen electronics and home improvement delivered good results. Weakness continued in tire and battery. Technology, office and entertainment - mid single-digit The reallocation of space in music and movies, along with challenges in wireless installment plans pressured the category. Health and wellness + mid single-digit RX benefited from growth in script counts and the Free/4/10 Plus benefit program. Improved pricing and assortment led to strong performance in OTC.

Third party FCPA and compliance-related expenses Q1 (Amounts in millions) FY17 FY16 Ongoing inquiries and investigations $21 $25 Global compliance program and organizational enhancements $4 $8 Total $25 $33 • In fiscal year 2017, we expect our third party FCPA-related expenses to range between $100 and $120 million. Recall that these are included in our Corporate and support expenses. 20

Non-GAAP measures - ROI Management believes return on investment (ROI) is a meaningful metric to share with investors because it helps investors assess how effectively Walmart is deploying its assets. Trends in ROI can fluctuate over time as management balances long-term potential strategic initiatives with possible short-term impacts. ROI was 15.3 percent and 16.6 percent for the trailing 12 months ended April 30, 2016 and 2015, respectively. The decline in ROI was primarily due to our decrease in operating income. We define ROI as adjusted operating income (operating income plus interest income, depreciation and amortization, and rent expense) for the trailing 12 months divided by average invested capital during that period. We consider average invested capital to be the average of our beginning and ending total assets, plus average accumulated depreciation and average amortization, less average accounts payable and average accrued liabilities for that period, plus a rent factor equal to the rent for the fiscal year or trailing 12 months multiplied by a factor of 8. When we have discontinued operations, we exclude the impact of the discontinued operations. Our calculation of ROI is considered a non-GAAP financial measure because we calculate ROI using financial measures that exclude and include amounts that are included and excluded in the most directly comparable GAAP financial measure. For example, we exclude the impact of depreciation and amortization from our reported operating income in calculating the numerator of our calculation of ROI. In addition, we include a factor of 8 for rent expense that estimates the hypothetical capitalization of our operating leases. We consider return on assets (ROA) to be the financial measure computed in accordance with generally accepted accounting principles (GAAP) most directly comparable to our calculation of ROI. ROI differs from ROA (which is consolidated net income for the period divided by average total assets for the period) because ROI: adjusts operating income to exclude certain expense items and adds interest income; adjusts total assets for the impact of accumulated depreciation and amortization, accounts payable and accrued liabilities; and incorporates a factor of rent to arrive at total invested capital. Because of the adjustments mentioned above, we believe ROI more accurately measures how we are deploying our key assets and is more meaningful to investors than ROA. Although ROI is a standard financial metric, numerous methods exist for calculating a company's ROI. As a result, the method used by management to calculate our ROI may differ from the methods used by other companies to calculate their ROI. 21

Non-GAAP measures - ROI cont. The calculation of ROI, along with a reconciliation to the calculation of ROA, the most comparable GAAP financial measure, is as follows: Wal-Mart Stores, Inc. Return on Investment and Return on Assets Trailing Twelve Months Ended Trailing Twelve Months Ended April 30, April 30, (Dollars in millions) 2016 2015 (Dollars in millions) 2016 2015 CALCULATION OF RETURN ON INVESTMENT CALCULATION OF RETURN ON ASSETS Numerator Numerator Operating income $ 23,700 $ 26,634 Consolidated net income $ 15,013 $ 16,386 + Interest income 85 108 Denominator + Depreciation and amortization 9,523 9,242 Average total assets1 $ 199,726 $ 201,406 + Rent 2,492 2,763 Return on assets (ROA) 7.5% 8.1% Adjusted operating income $ 35,800 $ 38,747 As of April 30, Denominator Certain Balance Sheet Data 2016 2015 2014 Average total assets1 $ 199,726 $ 201,406 Total assets $ 198,705 $ 200,747 $ 202,064 + Average accumulated depreciation and amortization1 70,639 65,213 Accumulated depreciation and amortization 73,469 67,808 62,617 - Average accounts payable1 37,611 36,786 Accounts payable 37,997 37,224 36,347 - Average accrued liabilities1 19,145 18,246 Accrued liabilities 19,605 18,685 17,807 + Rent x 8 19,936 22,104 Average invested capital $ 233,545 $ 233,691 Return on investment (ROI) 15.3% 16.6% 1 The average is based on the addition of the account balance at the end of the current period to the account balance at the end of the prior period and dividing by 2. 22

Non-GAAP measures - free cash flow We define free cash flow as net cash provided by operating activities in a period minus payments for property and equipment made in that period. Free cash flow was $4.0 billion and $2.2 billion for the three months ended April 30, 2016 and 2015, respectively. The increase in free cash flow was primarily due to improved working capital management. Free cash flow is considered a non-GAAP financial measure. Management believes, however, that free cash flow, which measures our ability to generate additional cash from our business operations, is an important financial measure for use in evaluating the company's financial performance. Free cash flow should be considered in addition to, rather than as a substitute for, consolidated net income as a measure of our performance and net cash provided by operating activities as a measure of our liquidity. Additionally, Walmart's definition of free cash flow is limited, in that it does not represent residual cash flows available for discretionary expenditures, due to the fact that the measure does not deduct the payments required for debt service and other contractual obligations or payments made for business acquisitions. Therefore, we believe it is important to view free cash flow as a measure that provides supplemental information to our Consolidated Statements of Cash Flows. The following table sets forth a reconciliation of free cash flow, a non-GAAP financial measure, to net cash provided by operating activities, which we believe to be the GAAP financial measure most directly comparable to free cash flow, as well as information regarding net cash used in investing activities and net cash used in financing activities. Three Months Ended April 30, (Dollars in millions) 2016 2015 Net cash provided by operating activities $ 6,193 $ 4,446 Payments for property and equipment (capital expenditures) (2,209) (2,203) Free cash flow $ 3,984 $ 2,243 Net cash used in investing activities1 $ (2,119) $ (2,113) Net cash used in financing activities $ (5,432) $ (3,695) 1 "Net cash used in investing activities" includes payments for property and equipment, which is also included in our computation of free cash flow. 23

Non-GAAP measures - constant currency The term "currency exchange rates" refers to the currency exchange rates we use to convert the operating results for all countries where the functional currency is not the U.S. dollar into U.S. dollars. We calculate the effect of changes in currency exchange rates as the difference between current period activity translated using the current period's currency exchange rates, and the comparable prior year period's currency exchange rates. We refer to the results of calculation as the impact of currency exchange rate fluctuations. When we report constant currency operating results, we are reporting operating results without the impact of currency exchange rate fluctuations and without the impact of acquisitions, if any, until the acquisitions are included in both comparable periods. The disclosure of constant currency amounts or results permits investors to understand better Walmart's underlying performance without the effects of currency exchange rate fluctuations or acquisitions. The table below reflects the calculation of constant currency for total revenues, net sales and operating income for the three months ended April 30, 2016. Three Months Ended April 30, Walmart International Consolidated (Dollars in millions) 2016 PercentChange 2016 Percent Change Total revenues: As reported $ 28,356 (7.2)% $ 115,904 0.9 % Currency exchange rate fluctuations1 3,522 3,522 Constant currency total revenues $ 31,878 4.4 % $ 119,426 4.0 % Net sales: As reported $ 28,083 (7.2)% $ 114,986 0.9 % Currency exchange rate fluctuations1 3,498 3,498 Constant currency net sales $ 31,581 4.3 % $ 118,484 3.9 % Operating income: As reported $ 1,164 8.8 % $ 5,275 (7.1)% Currency exchange rate fluctuations1 141 141 Constant currency operating income $ 1,305 22.0 % $ 5,416 (4.6)% 1 Excludes currency exchange rate fluctuations related to acquisitions until the acquisitions are included in both comparable periods. 24

Non-GAAP measures - fuel impact The net sales and operating income of Sam's Club for the quarter ended April 30, 2016, the percentage changes in those financial measures from the prior year period, Sam’s Club’s comparable club sales for the 13-week period ended April 29, 2016 and Sam's Club's projected comparable club sales for the 13-week period ending July 29, 2016, in each case calculated by excluding Sam's Club's fuel sales for such periods, are non-GAAP financial measures. We believe the Sam's Club net sales and operating income for the quarter ended April 30, 2016, the percentage changes in those financial measures from the prior year period, Sam’s Club’s comparable club sales for the 13-week period ended April 29, 2016, and Sam’s Club’s projected fuel sales for the 13-week period ending July 31, 2016, in each case calculated by including Sam’s Club’s fuel sales for such period, are, respectively, the financial measures computed in accordance with GAAP most directly comparable to the non-GAAP financial measures described above. We believe that the presentation of the non-GAAP financial measures with respect to Sam’s Club described above provides useful information to investors regarding Walmart’s financial condition and results of operations because that information permits investors to understand the effect of the fuel sales of Sam's Club, which are affected by the volatility of fuel prices, on Sam's Club's net sales and operating income and on Sam’s Club’s comparable club sales for the periods presented. 25

Non-GAAP measures - fuel impact cont. The table below reflects the calculation of the fuel impact for net sales and operating income for the three months ended April 30, 2016 and 2015. Three Months Ended April 30, (Dollars in millions) 2016 2015 Percent Change Net Sales: Excluding Fuel $ 12,727 $ 12,363 2.9% Fuel Impact 881 1,116 As Reported $ 13,608 $ 13,479 1.0% Operating Income: Excluding Fuel $ 408 $ 436 -6.4% Fuel Impact 5 (9) As Reported $ 413 $ 427 -3.3% The table below reflects the fuel impact for comparable store sales for the 13 weeks ended April 29, 2016 and May 1, 2015. Without Fuel With Fuel Fuel Impact 13 Weeks Ended 13 Weeks Ended 13 Weeks Ended 4/29/2016 5/1/2015 4/29/2016 5/1/2015 4/29/2016 5/1/2015 Sam's Club 0.1% 0.4% -1.9% -3.8% -2.0% -4.2% 26

• Additional information related to reconciliations for our non- GAAP financial measures (ROI, free cash flow, constant currency and Sam’s Club comparable measures) • Unit counts & square footage • Comparable store sales • Terminology • FY 17 earnings dates Additional resources at stock.walmart.com 27