Attached files

| file | filename |

|---|---|

| EX-31.01 - EX-31.01 - FAIRCHILD SEMICONDUCTOR INTERNATIONAL INC | d119469dex3101.htm |

| EX-31.02 - EX-31.02 - FAIRCHILD SEMICONDUCTOR INTERNATIONAL INC | d119469dex3102.htm |

| EX-32.01 - EX-32.01 - FAIRCHILD SEMICONDUCTOR INTERNATIONAL INC | d119469dex3201.htm |

| EX-32.02 - EX-32.02 - FAIRCHILD SEMICONDUCTOR INTERNATIONAL INC | d119469dex3202.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-K/A

(Amendment No. 2)

| x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 27, 2015

OR

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission File Number 001-15181

Fairchild Semiconductor International, Inc.

(Exact name of Registrant as specified in its charter)

| Delaware | 04-3363001 | |

| (State or other jurisdiction of incorporation or organization) |

(I.R.S. Employer Identification No.) | |

| 1272 Borregas Avenue, Sunnyvale, CA | 94089 | |

| (Address of principal executive offices) | (Zip Code) | |

Registrant’s telephone number, including area code: (408) 822-2000

Securities registered pursuant to Section 12(b) of the Act:

Common Stock, par value $.01 per share

(Title of each class)

NASDAQ Stock Market

(Name of each exchange on which registered)

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes x No ¨

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Act. Yes ¨ No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes x No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company (as defined in Rule 12b-2 of the Exchange Act).

| Large accelerated filer x | Accelerated filer ¨ | Non-accelerated filer ¨ | Smaller reporting company ¨ |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ¨ No x

The aggregate market value of the voting stock held by non-affiliates of the registrant as of June 28, 2015 was $2,064,994,388.

The number of shares outstanding of the Registrant’s Common Stock as of February 21, 2016 was 113,576,543.

EXPLANATORY NOTE

In accordance with General Instruction G(3) of Form 10-K, this Amendment No. 2 to Fairchild Semiconductor International, Inc.’s Annual Report on Form 10-K for the year ended December 27, 2015 (the “Form 10-K”) is being filed solely for the purpose of filing the Items comprising Part III of the Form 10-K. Amendment No. 1 to the Form 10-K, filed with the Securities and Exchange Commission on April 25, 2016, did not include Exhibits 31.01, 31.02, 32.01 and 32.02, which exhibits are included herewith. Except for the inclusion of those exhibits and corresponding changes to the Exhibit Index and this paragraph, this amendment does not modify the Form 10-K or Amendment No. 1 thereto.

1

PART III

| ITEM 10. | DIRECTORS, EXECUTIVE OFFICERS AND CORPORATE GOVERNANCE |

Director Experience and Qualifications

The nominating and governance committee of our board of directors reviews with the board, on an annual basis, the requisite skills and characteristics of new and existing board members as well as the composition of the board as a whole. This assessment includes members’ independence, as well as consideration of their business and industry experience, skills and areas of expertise, diversity and age, in the context of the needs of the board. The board and the nominating and governance committee then consider these and a variety of other factors in evaluating potential new director candidates and considering incumbent directors for renomination to the board. More specifically, the nominating and governance committee evaluates candidates based on the candidates’ level and diversity of experience and knowledge (including with respect to gender and ethnic diversity, and with specific application to the semiconductor industry and issues relevant to the company), skills, education, reputation and integrity, professional stature and other factors that may be relevant depending on the particular candidate and the need, size and composition of the board at a particular time, including the need to have a broad mixture of skills, experience and perspectives on the board. The board also has determined that it is important to have directors with skills and experience in product design, manufacturing, sales and marketing, finance, international business experience and experience in our customer and application markets. Accordingly, one or more of these factors may be given more weight in a particular case, no single factor would be viewed as determinative, and the committee has not specified any minimum qualifications that the committee believes must be met by any particular nominee. The nominating and governance committee and the board monitor and assess the composition of the board and the commitment to diversity of its members by referring to gender and ethnic diversity in the review and discussion of new director candidates and when assessing the composition of the board. The experience and qualifications included in this section provide the basis for the company’s belief that each director possesses the skills, attributes and expertise necessary to serve as a director.

CHARLES P. CARINALLI, Age 67, became a director in February 2002. He has over 41 years of experience in the semiconductor industry. From 1999 to 2001, he was Chairman and Chief Executive Officer of Adaptive Silicon, Inc., a fabless semiconductor company. From 1996 to 1999 he was President and Chief Executive Officer of Wavespan Corporation. He previously worked in several management and executive positions with National Semiconductor Corporation from 1970 to 1996, including as Senior Vice President and Chief Technical Officer from 1992 to 1996. Mr. Carinalli is also a director of Extreme Networks, Inc. and was previously a director of Atmel Corporation.

As a result of his experience in the semiconductor industry, Mr. Carinalli has significant experience in and an understanding of semiconductor technology, emerging market opportunities, new product development processes and related management and organizational issues, as well as senior executive experience with a large semiconductor manufacturing company. Mr. Carinalli’s public company board experience also contributes to his familiarity with current issues that assists in identifying and addressing governance practices at the company.

RANDY W. CARSON, Age 65, became a director in March 2010. From 2000 to February 2009, Mr. Carson served as Chief Executive Officer of the Electrical Group of Eaton Corporation, a global diversified industrial manufacturer and technology leader in

2

electrical components and systems for power quality, distribution and control. Mr. Carson retired from Eaton in May 2009 following ten years with the company. Prior to Eaton Corporation, Mr. Carson held several executive positions with Rockwell International. Mr. Carson is also a director of Nordson Corporation and was previously a director of Graftech International Ltd.

Mr. Carson has senior executive experience managing large, multi-billion-dollar global businesses, as well as direct experience in important power markets we serve. Mr. Carson’s public company board experience also contributes to his familiarity with current issues that assists in identifying and addressing governance practices at the company.

TERRY A. KLEBE, Age 61, became a director in May 2011. From February 2010 through April 2011, Mr. Klebe served as Vice Chairman of Cooper Industries plc, a multinational manufacturing company with over 100 manufacturing facilities across the globe and businesses that ranged from high technology and software to electrical components and solutions. From November of 2002 to May of 2010, Mr. Klebe served as the Senior Vice President and Chief Financial Officer of Cooper Industries. Prior to his appointment as CFO, Mr. Klebe served in various senior level positions at Cooper Industries including Senior Vice President, Strategic Sourcing and Chief Information Technology Officer. Prior to joining Cooper Industries in 1995, Mr. Klebe was a partner at Ernst & Young LLP. In addition to his role at Cooper Industries, Mr. Klebe formerly served as a director and Chairman of the Audit Committee of the parent company of Apex Tool Group, a global company with $1.5 billion in revenue and operations throughout the world. Mr. Klebe also serves as a trustee of Pneumo Abex Trust.

Mr. Klebe has senior executive experience managing global businesses as well as direct experience in finance, accounting and auditing, global sourcing, mergers and acquisitions, and business systems across a global manufacturing company.

ANTHONY LEAR, Age 68, became a director in September 2008. He was Senior Vice President and Regional Executive of NXP Semiconductors, an international semiconductor manufacturing company, from its spin-off from Philips Semiconductors in October 2006 until his retirement in July 2007. He was previously Senior Vice President and General Manager, Greater China, at Philips Semiconductors from 2003 to 2006. Prior to that, he was Chief Executive Officer of SSMC, a privately held silicon wafer foundry company in Singapore.

Mr. Lear joined Philips Electronics in 1996 as Senior Vice President and General Manager of the semiconductor division in Germany and previously held senior management positions at Seagate Microelectronics, Integrated Power Semiconductors and Texas Instruments. He has served as a director on a number of company boards, including Advanced Semiconductor Manufacturing Ltd. (ASMC), a Shanghai-based public company, and two privately held joint venture companies in China, T3G and Jilin NXP Semiconductor Ltd. Mr. Lear has over 40 years of high-tech and semiconductor industry experience with an extensive background in operations, technology and business strategy management. He has senior executive experience managing large international businesses and direct experience managing businesses in China for an international semiconductor company.

CATHERINE P. LEGO, Age 59, became a director in August 2013. Since 1992, she has been the founder of Lego Ventures LLC, a firm that provides consulting services to early-stage electronics companies in the areas of finance, strategic planning and corporate business development. She was previously the general partner and founder of The Photonics Fund, LLP, an early stage venture capital investment firm focused on investing in components, modules and systems companies for the fiber optics telecommunications market from 1999 to 2009. Ms. Lego was also general partner at Oak Investment Partners, a venture capital firm, from 1981 to 1992. Prior to Oak Investment Partners, she practiced as a Certified Public Accountant with Coopers & Lybrand. Ms. Lego is also a director of SanDisk Corporation and Lam Research Corporation.

Ms. Lego has extensive experience working with advanced technology companies and semiconductor companies specifically. In addition to her finance and venture capital experience, Ms. Lego also has extensive public company experience. She has served on the board of SanDisk from 1989 to 2002 and again from 2004 to the present. She has also been on the board of Lam Research since 2006. She serves as chair of the audit committee at SanDisk. In addition to her current board assignments, she has previously served on the board of directors of ETEC Corporation, a producer of electron beam lithography tools; Uniphase Corporation (presently JDS Uniphase Corporation) and Micro Linear Corporation, a fabless analog semiconductor company.

KEVIN J. McGARITY, Age 70, has been a director since November 2005. From 1988 to 1999, he served as Senior Vice President of Worldwide Marketing and Sales for Texas Instruments Incorporated. In addition, during his career with Texas Instruments, he also had responsibility for global semiconductor information technology and quality, and spent five years based in Europe in a variety of managerial positions. He is currently a consultant to global companies in the semiconductor industry. He was previously a director of Altera Corporation.

3

Mr. McGarity has experience with and an understanding of international semiconductor businesses generally, and semiconductor sales and marketing specifically. He also is experienced and knowledgeable in high-performing technology-based manufacturing companies. Mr. McGarity’s public company board experience also contributes to his familiarity with current issues that assists in identifying and addressing governance practices at the company.

BRYAN R. ROUB, Age 74, became a director in March 2004. He was Senior Vice President and Chief Financial Officer of Harris Corporation, an international communications equipment and systems company, from 1984 until his retirement in 2006. He was previously Executive Vice President-Finance at Midland-Ross Corporation. Prior to that, he was a member of the audit staff of Ernst & Ernst. He is a past Chairman of Financial Executives International (FEI) and a member of the American Institute of CPAs.

Mr. Roub has significant experience in finance, accounting and auditing matters, from both the business management and public accounting perspectives, as well as senior executive management experience in a large, global manufacturing company.

RONALD W. SHELLY, Age 72, became a director in June 1998. Until his retirement in 1999, he was employed by Solectron Texas, an electronic manufacturing services company, where he served as its President from April 1996 until his retirement. Mr. Shelly has more than 35 years of experience in the semiconductor industry. Prior to joining Solectron, he was employed by Texas Instruments for 30 years, most recently as Executive Vice President of Custom Manufacturing Services.

Through his more than 35 years of experience in the semiconductor industry, Mr. Shelly has significant experience with and an understanding of the management of large, global semiconductor operations, including specifically with respect to manufacturing, logistics and customer service issues and the operational and organizational issues involved.

MARK S. THOMPSON, Age 59, became a director in May 2005. He has been Chief Executive Officer of Fairchild Semiconductor since May 2005 and chairman of the board of directors since May 2008. He has been President of the company since May 2005, except for the period from September 2012 to November 2014. Prior to joining the company in December 2004, Mr. Thompson was Chief Executive Officer of Big Bear Networks, Inc. He was previously Vice President and General Manager of Tyco Electronics, Power Components Division and, prior to its acquisition by Tyco, was Vice President of Raychem Corporation’s Electronics OEM Division. He is also a director of American Science and Engineering, Inc. and was previously a director of Cooper Industries plc.

Mr. Thompson has over 25 years of high-technology industry experience. Mr. Thompson has an understanding of all aspects of the company, including management leadership, strategy development, day-to-day operations, product line management and new product and technology development, manufacturing, customer applications, electronic systems and components, distribution and other sales channels, business processes, international operations and global markets. He also has previous senior management experience in the power electronics industry. Mr. Thompson’s public company board experience also contributes to his familiarity with current issues that assists in identifying and addressing governance practices at the company.

Executive Officers

The following table provides information about our executive officers.

| Name |

Age | Executive Officer Since |

Title | |||

| Mark S. Thompson |

59 | 2005 | Chairman of the Board of Directors, President and Chief Executive Officer | |||

| Mark S. Frey |

62 | 2006 | Executive Vice President, Chief Financial Officer and Treasurer | |||

| Chris Allexandre |

41 | 2014 | Senior Vice President, Worldwide Sales and Marketing | |||

| Paul D. Delva |

53 | 2003 | Senior Vice President, General Counsel and Corporate Secretary | |||

| Steve Fu |

51 | 2015 | Senior Vice President and Chief Strategy Officer | |||

| Marion Limmer |

51 | 2015 | Senior Vice President, Discrete Power Solutions Group | |||

| Gaurang Shah |

47 | 2015 | Senior Vice President, Analog Power Group | |||

| Wei-Chung Wang |

50 | 2015 | Senior Vice President, Manufacturing Operations |

Mr. Thompson, Mr. Frey, Mr. Delva and Ms. Limmer have each been employed by Fairchild for at least five years. Prior to joining Fairchild in 2012, Mr. Fu was employed by Maxim Integrated Products, Inc. as head of corporate strategy and investments. Prior to joining Fairchild in 2013, Mr. Allexandre was employed by Texas Instruments Incorporated as vice president of sales and

4

applications for Europe, Middle East and Africa. Prior to joining Fairchild in 2013, Mr. Wang was employed by Maxim Integrated Products, Inc. as managing director, foundry management. Prior to joining Fairchild in 2014, Mr. Shah was employed by Texas Instruments Incorporated as a vice president and business unit general manager.

Section 16(a) Beneficial Ownership Reporting Compliance

Section 16(a) of the Securities Exchange Act of 1934 requires the company’s directors and executive officers, and persons who own more than 10% of the company’s common stock, to file reports of ownership and changes in ownership of the common stock and other equity securities of the company with the Securities and Exchange Commission and the Nasdaq Stock Market. Based solely on our review of the copies of such reports received by the company and any written representations that no other reports were required, we believe that all officers, directors and 10% stockholders complied with all applicable Section 16(a) filing requirements during 2015, except that one report on Form 4 for Mr. Allexandre, reporting the vesting of 17,500 restricted stock units and the corresponding receipt by Mr. Allexandre of 10,923 shares of common stock (net of shares withheld for taxes), was filed after the applicable filing deadline due to an administrative error by the company, and one report on Form 4 for Mr. Wang, reporting the vesting of 4,000 performance units and the corresponding receipt by Mr. Wang of 2,496 shares of common stock (net of shares withheld for taxes), was filed after the applicable filing deadline due to the fact that he became an executive officer only one day before that deadline and, as a result, filing credentials for Mr. Wang were not obtained, and the filing could not be made, until after the deadline.

Governance at Fairchild Semiconductor – Senior Officer Code of Business Conduct and Ethics

We have a Code of Business Conduct and Ethics that applies to all directors, officers and employees, including our chief executive officer, our chief financial officer and our chief accounting officer. Our Code of Business Conduct and Ethics is posted on our website, as will be any amendments or waivers, and can be accessed by visiting our investor relations website at http://investor.fairchildsemi.com and clicking on “Code of Business Conduct and Ethics” in the “Corporate Governance” section of the right-hand navigation column.

Corporate Governance, Board Meetings and Committees – Audit Committee

The board of directors has a standing audit committee. The current chairman of the audit committee is Mr. Klebe and the other members are Mr. Carson, Mr. Lear and Mr. Roub. Our board of directors has determined that all members of the audit committee satisfy both Nasdaq and SEC standards for independence. The board has also determined that each member of the audit committee is financially sophisticated under current Nasdaq standards and that Mr. Klebe and Mr. Roub qualify as “audit committee financial experts” under applicable SEC rules.

| ITEM 11. | EXECUTIVE COMPENSATION |

Compensation Discussion and Analysis

The following is a discussion of our 2015 compensation program for the following executive officers named in the Summary Compensation Table below (our “named executive officers” or “NEOs”):

| Mark S. Thompson |

Chairman, President and Chief Executive Officer | |

| Mark S. Frey |

Executive Vice President, Chief Financial Officer and Treasurer | |

| Gaurang Shah |

Senior Vice President, Analog Power Group | |

| Chris Allexandre |

Senior Vice President, Worldwide Sales and Marketing | |

| Paul D. Delva |

Senior Vice President, General Counsel and Corporate Secretary | |

5

2015 Financial Results and Compensation Overview

Despite lower revenues from a challenging demand environment, particularly in weaker-than-expected industrial, appliance and consumer end markets and in greater China, Fairchild delivered solid financial performance in 2015 while completing our manufacturing consolidation initiatives. Our financial performance, and its effect on executive compensation, were as follows:

| • | we achieved 71% of our goal for adjusted earnings before interest and taxes* (“Adjusted EBIT”), so NEOs received cash incentive awards equal to 71% of their respective annual cash incentive opportunities; and |

| • | we achieved 55% of our goal for adjusted cash flow from operations net of capital expenditures* (“Adjusted Free Cash Flow”), so NEOs received 55% of the target number of 2015 performance stock units (PUs) available. |

The following table provides additional details on our 2015 financial performance compared to our goals at the threshold, target and maximum award levels for the applicable compensation plans:

| 50% Goal (Threshold) |

100% Goal (Target) |

150% Goal (Maximum) |

2015 Results | |||||

| Adjusted EBIT Goals and Performance ($ millions) (applicable to cash incentive award plans) |

50 | 130 | 200 | 83.7 (71%) | ||||

| Adjusted Free Cash Flow Goals and Performance ($ millions) (applicable to performance-based equity incentive plans) |

100 | 225 | 265 | 112.1 (55%) |

In addition, we believe we continued to improve our equity compensation practices through the development of total shareholder return (“TSR”) equity awards that we granted for the first time in 2015. For more information on these programs, see below under “Elements of Compensation—Equity Incentive Awards.”

Our Executive Compensation Philosophy

Our compensation committee, in consultation with the board, designs, establishes and oversees the company’s executive compensation philosophy and programs. The committee establishes all elements of compensation paid to the CEO and reviews and approves all elements of compensation paid to executive officers, including the NEOs, as well as other other senior executives. Our compensation philosophy is to align executive compensation with the company’s strategic objectives, financial performance and shareholder value. We believe it is in our stockholders’ interests to attract, motivate and retain highly qualified individuals in critical positions by providing competitive compensation opportunities. Most significantly, our compensation philosophy strives to align pay with performance. The committee believes that the performance goals we set for our executive officers should be challenging and aligned with the company’s strategic objectives.

Role of Independent Compensation Consultant

The compensation committee engages Radford Surveys and Consulting (“Radford”), an AON/Hewitt company, as its independent compensation consultant. In its role as independent compensation consultant, Radford participates in committee meetings and provides compensation advice to the committee. In 2015, Radford provided advice and recommendations to the committee on the competitiveness of executive officer compensation levels, whether the committee should make revisions or additions to the company’s peer group, goal metrics and bonus design, the compensation mix between cash and equity, the design of equity awards, including the development and design of the company’s new TSR-based restricted stock units (“TSRs”) in 2015, developments and customary practices in high technology company

| * | Adjusted EBIT and Adjusted Free Cash Flow are non-GAAP financial measures. See “Use of Certain Non-GAAP Financial Measures” below. |

6

compensation programs, including change-in-control severance plans, change-in-control retention programs, employment contracts, legislation and regulation affecting executive compensation, and the impact of the global economy on executive compensation and director compensation. This included attending meetings, and providing surveys, data analysis and other compensation related services. Also, the company’s human resources team supplements the work of Radford and the committee. In connection with the company’s agreement to be acquired by ON Semiconductor Corporation in November 2015, Radford advised the committee in connection with the adoption of related executive and non-executive retention awards and programs, the adoption of the Change in Control Severance Plan and related amendments to the company’s employment agreement with Mr. Thompson. For more information, see “—Executive Severance Arrangements,” “Employment Agreements—Mark S. Thompson,” “Potential Payments Upon Termination or Change in Control—Arrangements with Mr. Thompson” and “Potential Payments Upon Termination or Change in Control—Change in Control Severance Plan” below.

Peer Group and Competitive Positioning

The compensation committee reviews each element of executive compensation for NEOs and other executive officers, compared to compensation levels for comparable positions at a peer group of companies. The committee, in consultation with Radford, annually assesses the composition of our peer group to ensure that it generally reflects the employment markets in which the company participates. In 2015, the committee took several factors into consideration in assessing the suitability of the company’s peer group. Specifically, the committee addressed the impact of industry consolidation and increases in peer group market capitalization resulting from increasing equity values. Based on the advice provided by Radford, as well as consideration of the views of proxy advisory firms, the committee determined that it would revise the company’s peer group to focus more on companies with market capitalizations that were more in line with that of the company. As a result, the committee made the following additions and deletions to our peer group during 2015:

| Deletions from the Peer Group | Additions to the Peer Group | |

|

International Rectifier Corporation (acquired in 2015) |

Cirrus Logic, Inc. | |

| Spansion, Inc. (acquired in 2015) |

Silicon Laboratories, Inc. | |

| Synaptics, Inc. |

As a result, our peer group for 2016 consists of the following 16 companies:

| Atmel Corporation |

Diodes Incorporated |

Microchip Technology, Inc. |

Silicon Laboratories, Inc. | |||

| Cirrus Logic, Inc. |

Intersil Corporation |

Microsemi Corporation |

Skyworks Solutions, Inc. | |||

| Cree, Inc. |

Marvell Technology Group, Ltd. |

ON Semiconductor Corporation |

Synaptics, Inc. | |||

| Cypress Semiconductor Corporation | Maxim Integrated Products, Inc. |

Qorvo, Inc. |

Synopsys, Inc. |

In 2015, Radford provided the committee with two sources of market compensation data (we refer to these as the “Radford data”):

| • | Public disclosure data from our peer group of companies, comprised mainly of proxy statement data relating to compensation reported by our peer group companies; and |

| • | Radford survey data for semiconductor and high technology companies. |

7

The compensation committee believes that peer group comparisons and other market compensation data provide important insights and understanding of the market. It further believes that a successful compensation program should afford the committee the flexibility to apply its judgment to respond to changing market conditions and to make some qualitative determinations of individual accomplishments. To that end, the committee does not use the market compensation data rigidly, but rather uses it, together with other considerations, to inform the committee’s judgment in reconciling program objectives with retaining and rewarding valued employees in a dynamic market. The committee considers Radford data and the CEO’s recommendations with respect to the compensation of the other named executive officers. It may also be influenced by factors that vary from year to year. These factors are not based on any specific formula or weighting, but typically include the company’s performance in the prior year, total shareholder return, the executive’s performance, contribution and experience in the prior year and in general, the amount and value of vested and unvested equity held by the executive, equity expense affordability and the company’s current budget for merit-based salary increases. In addition to these factors, the committee also considers the results of our annual advisory vote on executive compensation. The committee believes this process enables it to respond to dynamics in the market and provides it with the flexibility to maintain and enhance our executive officers’ engagement, focus, motivation and enthusiasm based on the committee’s judgment, exercised on the basis of all of the above factors and considered in the light of the company’s operating environment and needs.

Advisory Vote on Executive Compensation

At our annual stockholders’ meeting in 2015, we conducted our annual advisory vote on executive compensation, commonly known as “say-on-pay,” as stated in the Compensation Discussion and Analysis and Summary Compensation Tables of our 2015 Proxy Statement. The results of that advisory vote were as follows:

| Shares Voted | Percentage of Votes Cast |

|||||||

| Votes For |

98,820,079 | 96.9 | % | |||||

| Votes Against |

2,910,213 | 2.9 | % | |||||

| Abstentions |

194,723 | 0.2 | % | |||||

| Broker non-votes* |

6,926,208 | |||||||

| * | Broker non-votes reflect shares that, under applicable stock exchange rules, could not be voted on the proposal because brokers or other nominees holding the shares did not receive voting instructions from beneficial owners suitably in advance of the meeting. Because shares that cannot be voted are considered not legally present and entitled to vote on say-on-pay proposals (although they may be considered present and entitled to vote on other proposals), they are not counted for purposes of the say-on-pay proposal, and thus have no effect in determining whether the say-on-pay proposal is approved. Broker non-votes are included in the table above for the sake of completeness. |

In each of the past three years, our compensation programs have received greater than 96% support in say-on-pay voting. While the committee views the results of these advisory votes as an affirmation of our compensation programs, the committee nevertheless continually endeavors to improve the alignment of our plans with company performance. For example, in 2015 the committee modified our equity compensation program for executive officers to incorporate long-term goals contingent upon outperforming the total return of the PHLX Semiconductor Sector Index. For further discussion on these changes to our equity compensation program, see “Elements of Compensation—Equity Incentive Awards” below.

8

Use of Certain Non-GAAP Financial Measures

With respect to the financial targets used in our compensation plans, the committee has used both Adjusted EBIT and Adjusted Free Cash Flow in 2015 and in previous years and believes that these measures and certain additional metrics provide effective indicators of Fairchild’s operating performance and management effectiveness. Both Adjusted EBIT and Adjusted Free Cash Flow are measures that are not prepared in accordance with generally accepted accounting principles (“non-GAAP financial measures”) which are reconciled to comparable GAAP measures in a manner generally consistent with the manner in which such measures are reconciled in our financial statements. For additional information, see the discussion included in Items 6 and 7 of this annual report on Form 10-K for the year ended December 27, 2015, filed with the SEC on February 25, 2016, and available in the Investor Relations section of our website at https://www.fairchildsemi.com/about/investors/sec-filings/.

Tax Considerations

Section 162(m) of the U.S. Internal Revenue Code imposes a $1 million limit on the deductibility of compensation paid to certain executive officers of public companies, unless the compensation qualifies as “performance-based” compensation under the Internal Revenue Code. While the committee has traditionally considered the tax consequences to the company and its executives in determining appropriate levels of executive compensation, tax considerations have not been the primary driver of the company’s compensation policies. Tax considerations can be complex and are subject to many factors that are beyond the committee’s and the company’s control (such as changes in the tax laws and regulations or interpretations thereof and the timing and nature of various decisions by executives regarding options and other rights). Executive officers receive cash incentive awards, if earned, in the form of incentive bonuses pursuant to our 2007 Stock Plan. Accordingly, cash incentive awards paid to our named executive officers may qualify as performance-based compensation within the meaning of Section 162(m). While the committee believes that the ability to deduct executive compensation is important to our stockholders, it further believes that it is important to retain a certain amount of flexibility in the way it structures compensation programs for our named executive officers. Therefore, while the committee intends to attempt to structure our compensation programs in compliance with the performance-based criteria set forth in Section 162(m) when appropriate, there can be no assurance that all our compensation programs will meet those criteria and be fully deductible.

Stock Ownership Guidelines

Since 2008 we have maintained stock ownership guidelines for our executive officers to help ensure they maintain an equity stake in the company, and by doing so, appropriately link their interests with those of other stockholders. The level of ownership required for each executive officer is listed below. Only owned shares count toward the requirement. Unvested equity awards do not count. An executive officer is required to achieve these stock ownership levels within five years after the first January 1 date following the date he or she becomes an executive officer. Executive officers who are promoted to a higher grade level have five years from the first January 1 date following the date of promotion to achieve the higher ownership level.

| Level |

Shares | |||

| Chief Executive Officer |

120,000 | |||

| Executive Vice President |

30,000 | |||

| Senior Vice President |

10,000 | |||

| Vice President |

5,000 | |||

As of March 27, 2016, all of our executive officers were in compliance with our stock ownership guidelines.

9

Elements of Compensation

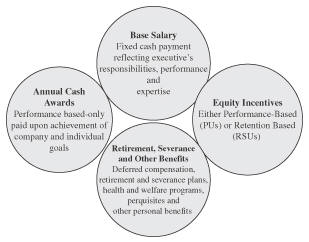

Compensation for our named executive officers is generally comprised of the following elements:

Base Salary. The committee views base salary as an important retention tool and generally targets the median range of comparable positions among our peer group as provided by Radford. The compensation committee utilizes data it receives from Radford as a guide in determining the base salary of our executive officers. In addition to the Radford data, the committee may take into account certain factors that are specific to the contributions made by an individual executive. Specifically, the committee may determine, in the exercise of its judgment, to reward an individual’s contributions to the company’s success, especially in cases where the committee believes the contribution affects key factors that positively impact shareholder value. In most cases, the committee, in consultation with Radford and (for NEOs other than the CEO) the CEO, weighs the following factors in determining base salary and whether any adjustments to base salary should be made from year to year: (i) the performance of the executive in the preceding year, (ii) the executive’s current base salary relative to the peer group, (iii) Radford’s projection of anticipated increases in the overall market and (iv) the company’s budget for merit-based salary increases. The following table shows our NEOs’ base salaries in 2014 and 2015.

| 2014 Base Salary (1) ($) |

2015 Base Salary (1) ($) |

Percentage Increase | ||||||||

| Mark S. Thompson |

775,000 | 775,000 | 0% | |||||||

| Mark S. Frey |

395,565 | 399,521 | 1% | |||||||

| Gaurang Shah (2) |

375,000 | 378,750 | 1% | |||||||

| Chris Allexandre (3) |

341,144 | 334,554 | (Note 3) | |||||||

| Paul D. Delva |

313,431 | 322,834 | 3% | |||||||

| (1) | Base salaries are stated above on an annualized basis. Base salary increases, if any, generally take effect in April of each year. In addition, base salary payments made during a year may reflect payroll periods that do not correspond exactly to the same year. Therefore, for a given year, the annualized base salary shown above may not match the base salary actually paid in that year, as reported in the Summary Compensation Table. |

| (2) | Mr. Shah joined the company in August 2014. |

| (3) | In 2014 Mr. Allexandre was based in Europe and paid in euros. The amount shown for Mr. Allexandre for 2014 reflects the U.S. dollar equivalent of his base salary, calculated using an average conversion rate during 2014 of 0.75 euros to 1 U.S. dollar. |

Annual Cash Incentive Awards. Our NEOs have an opportunity to earn annual cash incentive awards conditioned on achieving financial performance goals approved by the compensation committee at the beginning of each year. The terms and conditions of these awards, which are granted to executive officers under the incentive bonus provisions of the 2007 Stock Plan, are identical to those applicable to other senior executives and managers under the Enhanced Fairchild Incentive Plan (“EFIP plan”). Both plans utilize the same criteria and performance metrics to determine achievement. Executive officers receive annual cash incentive awards pursuant to the 2007 Stock Plan so that these awards may qualify as performance-based compensation under Section 162(m) of the Internal Revenue Code. For more information about the committee’s consideration of the tax deductibility of executive compensation, see “Tax Considerations” above.

10

The amount of each NEO’s annual cash incentive award in any year is based on a combination of two factors. First, each NEO is assigned an opportunity level expressed as a percentage of the NEO’s base salary. For 2015, these opportunity levels were as follows:

| Annual Cash Incentive Award Opportunity Level as % of Base Salary | ||

| Mark S. Thompson |

150% | |

| Mark S. Frey |

90% | |

| Gaurang Shah |

70% | |

| Chris Allexandre |

70% | |

| Paul D. Delva |

60% |

Second, at the beginning of each year the compensation committee, in consultation with and based on the advice of Radford and the CEO, establishes a corporate financial performance goal. In 2015, as in prior years, we used Adjusted EBIT as the corporate financial performance goal for annual cash incentive awards. The goal is expressed in terms of three levels: 50% or “Threshold,” 100% or “Target” and 150% or “Maximum.” For 2015, the committee established the following Adjusted EBIT goals:

| Goal for Annual Cash Incentive Award |

50% Goal (Threshold) |

100% Goal (Target) |

150% Goal (Maximum) |

|||||||||

| 2015 Adjusted EBIT (in millions) |

$ | 50 | $ | 130 | $ | 200 | ||||||

In addition, for NEOs and other executive officers other than Mr. Thompson, the compensation committee approves individual performance goals, which are also expressed in terms of 50%, 100% and 150% levels. In approving these individual goals, the committee consults with Radford and the CEO.

In February of each year, the compensation committee reviews the company’s financial performance for the preceding fiscal year and determines the extent to which the company achieved the corporate financial performance goal. The committee, in consultation with the CEO, also reviews an assessment of NEOs’ individual performance goal achievement. Following these assessments, each NEO’s achievement percentage is established. This achievement percentage is then multiplied by the NEO’s incentive opportunity level and base salary earned during the year to determine the amount of the award. Cash incentive awards are typically paid in February of the year following the year in which they are earned.

11

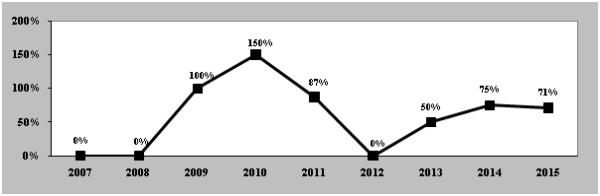

The compensation committee has historically set high thresholds for financial performance goals applicable to cash incentive awards. Over an eight-year period beginning in 2008, the achievement of the corporate financial performance goal applicable to annual cash incentive bonuses has averaged approximately 67%. The following chart displays historical financial goal achievement for our annual cash incentive plans:

Corporate Financial Performance Goal Achievement for Annual Cash Incentive Awards, 2007-2015.

Equity Incentive Awards. We use equity compensation to further align the interests of our NEOs with those of our stockholders. The committee believes that equity-based incentives provide our NEOs with a financial stake in the company’s performance and an incentive to manage the company in the long-term interest of the stockholders. Since 2009, we have transitioned away from the use of traditional stock options, electing instead to use a combination of restricted stock units (“RSUs”) and performance-based awards that we refer to as performance units (“PUs”), structured as follows:

| • | Restricted Stock Units or RSUs give recipients the right to receive shares of common stock (one share per unit), subject to vesting that generally occurs in one-quarter increments on each of the first four anniversaries of the grant date, if the recipient remains employed by the company on the respective vesting dates. RSUs are not subject to performance goals. Recipients receive one share of stock per vested RSU promptly following each vesting date. RSUs vest in full upon the occurrence of a change in control, regardless of whether the recipient remains employed following the change in control. |

| • | Performance Units or PUs give recipients the right to receive shares of common stock (one share per unit), subject to the company’s achievement of a corporate financial performance goal established for the year of grant. We currently use Adjusted Free Cash Flow as the measure for that goal. Recipients receive a target number of PUs on the grant date, typically in early March. After the end of the year, the final number of PUs is determined and can range from 0% to 150% of the target number depending on goal achievement. Granted PUs typically vest in one-third increments on each of the first three anniversaries of the grant date, if the recipient remains employed by the company on the respective vesting dates. Recipients receive one share of stock per vested PU promptly following each vesting date. PUs vest in full upon the occurrence of a change in control, regardless of whether the recipient remains employed following the change in control. |

For 2015, the committee established the following Adjusted Free Cash Flow goals for performance units:

| 50% Goal (Threshold) |

100% Goal (Target) |

150% Goal (Maximum) |

||||||||||

| Adjusted Free Cash Flow Goals (in millions) |

$ | 100 | $ | 225 | $ | 265 | ||||||

RSUs and PUs each employ time-based vesting to incentivize NEOs to create long-term shareholder value. Additionally, time-based vesting enhances employee retention rates. As a general rule, RSUs granted as part of the company’s annual grant have a vesting period of at least four years, and PUs have a vesting period of at least three years.

Total Shareholder Return or “TSR” Awards. While our PU awards have historically been contingent upon the achievement of aggressive annual goals, the compensation committee has endeavored to find a model that measures performance over a longer term, to complement PU awards focused on one-year performance metrics. In 2015, the committee commissioned Radford to help develop an alternative equity award that would provide incentives for long-term performance. In evaluating the alternatives, the committee considered various total shareholder return award models that would provide an incentive for long-term increases in the value of our stock. According to Radford’s data, such awards typically evaluate a company’s stock price performance on either an absolute basis or on a relative basis. While absolute plans focus on a company’s year-over-year performance, relative plans compare the company’s performance to that of a peer group or related index. After detailed analysis and consultation with Radford, the committee decided upon a relative award model that would compare the company’s total stockholder return to the total stockholder return of the PHLX Semiconductor Sector Index (commonly known as the “SOX”) over a three-year period. The SOX is a modified market capitalization-weighted index composed of companies primarily involved in the design, distribution, manufacture and sale of semiconductors.

The committee chose to measure long-term performance on a relative basis for several reasons. First, judging the company’s performance on a relative basis insures that management would only be rewarded if shareholder value increases at a rate that exceeds

12

that of the peer index. In other words, a five percent increase in value may be viewed less favorably when compared to a market that has increased at a rate of eight percent, as compared to a market that has increased by two percent. Accordingly, the committee believes that TSRs should not reward management for stock performance that is less than the index. Second, judging the company’s performance relative to an index enhances the company’s ability to retain quality management since superior performance relative to the index would be rewarded, even in the face of overall market declines. While this does suggest that, under certain circumstances, management will receive equity awards when our stock price decreases, the committee believes that outperforming the index over time provides stockholders with the best indication of management’s effectiveness, when stated in terms of shareholder value.

As with our other incentive awards, including annual cash incentive awards and annual PU grants, we structured our TSRs in terms of 50% “Threshold,” 100% “Target” and 150% “Maximum” performance levels.

How We Determine Incentive Compensation Awards. The committee, in consultation with Radford, begins the process of determining equity awards in October of the preceding year by comparing our equity compensation programs to those of our peer group. Radford prepares a Long-Term Incentive Value Assessment for the committee that allows the committee to target equity compensation around the 50th percentile of our peer group. The committee meets again in December and reviews Radford’s update on market compensation data based on its survey data. The committee then reviews the long-term incentive compensation of each of the company’s NEOs to determine market competitiveness. Based upon this analysis, management presents a preliminary estimated share request to the committee for their consideration.

In reaching a final decision on the amount of equity compensation our executives should receive, the committee takes numerous factors into consideration. As referenced above, market alignment and competitiveness are key factors the committee considers in setting equity compensation levels. In addition to these factors, the committee places significant weight on the dilutive impact equity issuances have on our stockholders. In assessing dilution, the committee considers the annualized effect of equity compensation by analyzing the equity “burn rate” over a one and three year period. Burn rate, in its simplest form, is determined by dividing the projected number of shares to be issued to employees by the weighted average number of shares outstanding. The committee also considers the aggregate impact of all past equity compensation grants by looking at the company’s equity compensation “overhang.” Overhang is determined by dividing all outstanding equity grants and shares available for future grants by the total number of shares outstanding. The resulting percentage provides the committee with insight into the long-term cost of the company’s equity compensation programs over time. In setting the number of equity awards to be granted to a participant, we first determine the total number of shares of stock underlying all awards. Fifty percent of that number is reflected in grants of RSUs, and 50% in grants of PUs. In the case of executive officers, 50% of the PU grant is reflected in TSRs.

Ongoing Equity Compensation Grant Practices. The compensation committee has adopted a written policy for the process of granting equity compensation awards. The committee approves all equity grants to executive officers and has delegated to the CEO and Senior Vice President of Human Resources the ability to make other grants. Our annual equity award cycle occurs promptly after the first board meeting of the year (typically in February) and the compensation committee approves the actual grant date when it meets prior to the board meeting. Equity grants for promotion or retention or to newly hired employees typically occur on the 15th day of the month following the effective date of the promotion, retention or hire, or on one or more other dates specified in advance by the company. If the equity award is a stock option, the exercise price of an option is the closing price of the company’s common stock on the Nasdaq on the date of grant. Our stock plan prohibits the grant of any option with an exercise price lower than the grant date closing price, with one limited exception in the case of grants related to substitute awards in mergers and acquisitions.

13

The following table provides a year-over-year comparison of RSUs, PUs and TSRs awarded to our named executive officers over the past four years.

| 2015 Equity Awards (#) | 2014 Equity Awards (#) | 2013 Equity Awards (#) | 2012 Equity Awards (#) | |||||||||||||||||||||||||||||||||

| TSRs (1) | PUs (2) | RSUs | PUs (2) | RSUs | PUs (2) | RSUs | PUs (2) | RSUs | ||||||||||||||||||||||||||||

| Mr. Thompson |

80,000 | 70,771 | (3) | 125,000 | 163,590 | (3) | 125,000 | 165,000 | 150,000 | — | 125,000 | |||||||||||||||||||||||||

| Mr. Frey |

18,750 | 10,313 | 37,500 | 41,625 | 37,500 | 49,500 | 45,000 | — | 30,000 | |||||||||||||||||||||||||||

| Mr. Shah (4) |

— | 16,500 | 30,000 | — | — | — | — | — | — | |||||||||||||||||||||||||||

| Mr. Allexandre (4) |

12,500 | 6,875 | 25,000 | 27,750 | 25,000 | — | — | — | — | |||||||||||||||||||||||||||

| Mr. Delva (4) |

10,000 | 5,500 | 20,000 | 22,200 | 20,000 | 33,000 | 30,000 | — | — | |||||||||||||||||||||||||||

| (1) | In March 2015, the company granted TSRs to all then-appointed executive officers, including Messrs. Thompson, Frey, Allexandre and Delva. Mr. Shah was appointed an executive officer in July 2015, and thus was not an executive officer at the time of those TSR grants. TSRs stated above reflect the number of awards at target. |

| (2) | Except as described in Note 3 below, performance units (PUs) shown reflect the number of PUs actually granted based on achievement of the PU performance goal for the applicable year. The company achieved 55%, 111% and 110% performance for the PU goal in 2015, 2014 and 2013, respectively. For 2012, all available PUs were forfeited because the minimum performance goal was not achieved. |

| (3) | PUs shown for Mr. Thompson in 2015 and 2014 include 26,771 PUs and 24,840 PUs, respectively, earned by Mr. Thompson in respect of financial and stock price performance in those years pursuant to Mr. Thompson’s Long-Term Incentive Agreement. Grants of these PU awards were made in March 2016 and March 2015, respectively. For more information on these PUs and Mr. Thompson’s Long-Term Incentive Agreement, see “Employment Agreements—Long-Term Incentive Agreement with Mr. Thompson” below. |

| (4) | Mr. Shah joined the company in 2014 and was not an NEO in 2014. Mr. Allexandre joined the company in 2013 and was not an NEO in 2013. Mr. Delva was not an NEO in 2012. |

Retirement and Other Benefits. We offer all of our U.S.-based employees (including NEOs) a qualified deferred compensation plan in the form of a 401(k) defined contribution plan, which provides for matching contributions equal to 100% of the first 3% of pay contributed to the plan and 50% of the next 2% of pay contributed to the plan. In addition, we offer eligible U.S.-based employees (including NEOs) a nonqualified deferred compensation plan in the form of a non-qualified Benefits Restoration Plan (BRP), in compliance with the Employee Retirement Income Security Act of 1974 (ERISA). Like the 401(k) plan, the BRP provides for matching contributions equal to 100% of the first 3% of pay contributed to the plan and 50% of the next 2% of pay contributed to the plan. Both plans provide participating employees (including NEOs) a tax-advantaged way to save for retirement and enhance our ability to attract and retain key employees. Account balances under each plan are driven by employee and company contributions, but employees make their own investment decisions. Company stock is not an investment option under these plans.

We offer a variety of health and welfare programs to all eligible employees. NEOs generally are eligible for the same benefit programs as other employees. The health and welfare programs are intended to encourage a healthy lifestyle and protect employees against catastrophic loss. Our health and welfare programs include medical, wellness, dental, vision, disability, life insurance and accidental death and dismemberment insurance.

Perquisites and Personal Benefits. We provide NEOs and other executive officers with limited perquisites and other personal benefits, as reflected in the “All Other Compensation” column of the Summary Compensation Table below. The compensation committee believes these perquisites and personal benefits are reasonable and consistent with the company’s overall compensation program, because they better enable the company to attract and retain key employees. The compensation committee reviews and approves perquisites and other personal benefits provided to the executive officers, including NEOs. For all current NEOs, these benefits include the cost of accidental death and dismemberment insurance, long-term care and short-term and long-term disability insurance, executive physicals and relocation benefits. In addition, Mr. Thompson is reimbursed for tax and financial planning, life insurance premiums and certain medical costs.

Executive Severance Arrangements

The committee believes competitive severance benefits are appropriate and necessary to provide employees, including executives and NEOs, with a measure of financial security in the event their employment is terminated without cause, including in the context of a change in control. The committee periodically reviews with Radford the structure, design and compensation levels of our named executive officers’ severance and change in control arrangements, and compares them to peer group and survey data provided by Radford. The committee also considers, in consultation with its advisors, including Radford, more subjective factors which in the committee’s judgment are important in contributing to the effectiveness of executive severance arrangements, such as pre-existing contractual arrangements, the general industry environment and its effect on the likelihood of a change in control, the

14

need to maintain management continuity and stability in times of greater uncertainty which typically accompany a change in control, or the possibility of a change in control, and the likelihood that certain executives would continue to be employed following a change in control. Based on these and other considerations, we maintain the following severance plans and arrangements for NEOs:

| • | Our Executive Severance Policy provides severance benefits to designated executives before a change in control, including all executive officers and NEOs other than Mr. Thompson (whose severance benefits are provided under his employment agreement as described below), in the event the executive’s employment is terminated by the company without cause (as defined in the policy). These benefits generally include a lump-sum payment of between nine months’ and one year’s base salary, depending on the rank of the executive, and continuation of medical insurance coverage for the same time period. The policy does not provide for accelerated vesting of unvested equity awards. No benefits are provided under the Executive Severance Policy if the executive voluntarily resigns, regardless of the reason. As a condition to receiving benefits under the policy, the executive must sign a customary release of claims in favor of the company. For more information, see “Potential Payments Upon Termination or Change-in-Control—Executive Severance Policy” below. |

| • | In connection with our pending acquisition by ON Semiconductor Corporation, which we agreed to on November 18, 2015, we adopted the Change in Control Severance Plan to provide additional protections to certain executives (including all NEOs and other executive officers other than Mr. Thompson) in connection with the ON Semiconductor acquisition or another change-in-control transaction. Under the Change in Control Severance Plan, upon a termination of employment without cause by the company or by the executive for good reason (as those terms are defined in the plan), either of which occurs within 24 months after the change in control, NEOs (other than Mr. Thompson) are entitled to a lump-sum payment equal to the sum of base salary and target annual cash incentive opportunity, plus a prorated annual incentive award at target for the year in which termination occurs. NEOs are also entitled to continued health insurance coverage for 12 months after termination. As a condition to receiving these and other benefits under the plan, the executive must sign a customary release of claims in favor of the company. For more information, see “Potential Payments Upon Termination or Change-in-Control—Change in Control Severance Plan” below. |

| • | In addition to benefits that may be paid pursuant to the Executive Severance Policy or Change in Control Severance Plan, the 2007 Stock Plan provides that, in the event of a change in control of the company, all outstanding and unvested equity awards, including those held by executive officers and NEOs, will become fully vested, regardless of whether the executive’s employment is affected by the change in control. For more information, see “Potential Payments Upon Termination or Change-in-Control—Change-in-Control Provisions of 2007 Stock Plan” below. |

| • | Our employment agreement with Mr. Thompson provides severance benefits in the event Mr. Thompson’s employment is terminated by the company without cause or by Mr. Thompson for good reason (as those terms are defined in the agreement). In case of such a termination outside the context of a change in control, Mr. Thompson is entitled to receive two times his annual base salary and target annual incentive opportunity. In the event of a termination of employment up to 6 months before or 12 months after a change in control, Mr. Thompson is entitled to receive three times his annual base salary and target annual incentive opportunity. Mr. Thompson is also entitled to continued health insurance coverage for him and his eligible dependents for two years following the effective date of termination, whether or not a change in control is involved. In connection with our pending acquisition by ON Semiconductor Corporation, we amended Mr. Thompson’s employment agreement to align some of its provisions with those of the Change in Control Severance Plan, including to provide a prorated annual incentive award at target for the year in which termination occurs. See “Potential Payments Upon Termination or Change-in-Control—Arrangements with Mr. Thompson” below. |

The foregoing discussion of the relevant provisions of the Executive Severance Policy, the Change in Control Severance Plan, the 2007 Stock Plan, Mr. Thompson’s employment agreement, and the amendment to Mr. Thompson’s employment agreement, do not purport to be complete and are qualified in their entirety by reference to the applicable portions of the discussion below under “Potential Payments Upon Termination or Change-in-Control” as well as to the full text of the respective policies, plan, agreement and amendment, which are included as Exhibits 10.02, 10.36, 10.27, 10.24 and 10.37, respectively, of this annual report on Form 10-K, and which exhibits are incorporated herein by reference.

Processes for Setting Goals and Compensation

Our goal setting process for a given year generally begins in the later months of the preceding fiscal year. During this period, the committee reviews the compensation programs of our peers and the market generally. Radford provides the committee with guidance on the performance metrics that, in the committee’s judgment based on Radford’s input, tend to have the greatest influence on

15

increasing shareholder value. Based on a 2013 study, Radford concluded that more than 70% of our peers utilize performance metrics that focus primarily on income or profitability. Also, approximately half of our peers at that time used some variant of revenue and revenue growth, while a much smaller percentage used earnings per share to measure performance. In addition to the peer group study, Radford also provides guidance on those financial variables believed to favorably impact stock price movement and shareholder value. Finally, Radford conducts an annual analysis of the executive compensation programs of our peer group with the goal of developing a high degree of relative alignment between the company and its peers. In setting performance goals, the committee continually strives to develop goals that are both responsive to evolving market conditions and align executive pay with performance.

The committee’s process for determining other changes in our compensation programs usually begins around the midpoint of the preceding year with a review of market compensation information. The Radford market compensation survey compares our executive compensation policies and practices to those of our specific peer group. In conducting this analysis, Radford merged the data from our specific peer group with general market data compiled for the Radford Survey. Additionally, for 2015, Radford also provided the committee with market insight into the use of TSR performance-based equity awards as a means of measuring management’s long-term performance.

In February of 2015, the compensation committee approved the following annual target compensation for our named executive officers. Assuming target performance, our NEOs had the potential to earn the amounts set forth in the following table for fiscal 2015:

| Base Salary (1) |

Annual Cash Incentive Opportunity Level (Target) |

Annual Cash Incentive Opportunity at Target (2) |

Total Shareholder Return Awards (TSRs) (at Target) (#)(3) |

Performance Units (PUs) (at Target) (#) (4) |

Restricted Stock Units (RSUs) (#) (5) |

Long-Term Incentive Compensation (6) |

||||||||||||||||||||

| Mr. Thompson |

$ | 775,000 | 150% | $ | 1,162,500 | 80,000 | 80,000 | 125,000 | $ | 1,162,500 | ||||||||||||||||

| Mr. Frey |

$ | 399,521 | 90% | $ | 359,569 | 18,750 | 18,750 | 37,500 | ||||||||||||||||||

| Mr. Shah |

$ | 378,750 | 70% | $ | 265,125 | — | 80,000 | (7) | 30,000 | |||||||||||||||||

| Mr. Allexandre |

$ | 334,554 | 70% | $ | 234,188 | 12,500 | 12,500 | 25,000 | ||||||||||||||||||

| Mr. Delva |

$ | 322,834 | 60% | $ | 193,700 | 10,000 | 10,000 | 20,000 | ||||||||||||||||||

| (1) | Reflects annual base salaries approved in February 2015 and effective in April 2015, shown on an annualized basis. Accordingly, amounts shown may not reflect salary amounts actually paid during 2015 as reported in the Summary Compensation Table. |

| (2) | Reflects base salary (stated on an annualized basis as shown above) multiplied by the NEO’s cash incentive opportunity level at target. Actual cash bonuses are based on the amount of base salary earned during the year multiplied by the level of achievement for Adjusted EBIT, which is the financial performance goal applicable to annual cash incentive awards. The company achieved 71% of its goal for Adjusted EBIT in 2015. |

| (3) | Reflects total shareholder return awards (TSRs) available at the 100% target level, subject to achieving the performance goal established for TSRs. TSRs vest in full based on achievement of the goal at the end of the three-year measurement period, or earlier upon certain events. Mr. Shah did not receive TSRs in 2015 because he was not an executive officer on the 2015 TSR grant date. |

| (4) | Reflects performance units (PUs) available at the 100% target level, subject to achieving the financial performance goal established for PUs. The company achieved 55% of that goal in 2015. Accordingly, NEOs received 55% of the number of PUs stated above. PUs vest in one-third increments on each of the first three anniversaries of the grant date, or earlier upon certain events. |

| (5) | Restricted stock units (RSUs) vest in one-quarter increments on each of the first four anniversaries of the grant date, or earlier upon certain events. |

| (6) | Reflects the total dollar value of cash and equity compensation that Mr. Thompson could have earned at target for the 2015 measurement period as a result of our financial performance and our stock price performance under the terms of Mr. Thompson’s Long-Term Incentive Agreement. Assumes stock performance multiplier of 1.0. Half of the amount shown would be payable in a deferred cash award, and half in the form of PUs. All cash amounts and PUs granted under Mr. Thompson’s Long-Term Incentive Agreement vested in full and were paid to Mr. Thompson on March 10, 2016. The actual dollar value of cash and equity awards Mr. Thompson received for 2015 was $1,072,987, half of which was paid in cash and half in an award of 26,711 PUs in March 2016. See “ Employment Agreements—Long-Term Incentive Agreement with Mr. Thompson” below. |

| (7) | Includes a one-time award of 50,000 PUs to Mr. Shah on March 3, 2015, made in connection with his hiring by the company in 2014, which award was subject to the 2015 PU performance goals, and subject to vesting over two years following the grant date, or earlier upon certain events. See “Employment Agreements—Employment Letter with Mr. Shah” below. |

16

Summary Compensation Table

The following table shows the compensation paid to or earned by our named executive officers during the years indicated.

| Year | Salary ($) | Stock Awards ($)(1) |

Non-Equity Incentive Plan Compensation ($)(2) |

All Other Compensation ($)(3) |

Total ($) | |||||||||||||||||

| Mark S. Thompson |

2015 | 780,742 | 5,457,494 | (4) | 1,361,870(5) | 37,387 | 7,637,493 | |||||||||||||||

| Chairman, President and Chief Executive Officer |

2014 | 780,742 | 3,908,438 | 1,307,813 | 38,579 | 6,035,572 | ||||||||||||||||

| 2013 | 769,231 | 4,200,000 | 581,250 | 38,431 | 5,588,912 | |||||||||||||||||

| Mark S. Frey |

2015 | 402,949 | 1,296,750 | 254,710 | 26,763 | 1,981,172 | ||||||||||||||||

| Executive Vice President, Chief Financial Officer and Treasurer |

2014 | 397,178 | 1,041,750 | 265,212 | 24,219 | 1,728,359 | ||||||||||||||||

| 2013 | 381,463 | 1,260,000 | 172,820 | 23,442 | 1,837,725 | |||||||||||||||||

| Gaurang Shah (6) |

2015 | 378,815 | 524,400 | 187,809 | 15,020 | 1,106,044 | ||||||||||||||||

| Senior Vice President, Analog Power Solutions |

||||||||||||||||||||||

| Chris Allexandre (7) |

2015 | 343,486 | 864,500 | 163,288 | 184,065 | 1,555,339 | ||||||||||||||||

| Senior Vice President, Worldwide Sales and Marketing |

2014 | 333,222 | 694,500 | 111,160 | 2,087 | 1,140,969 | ||||||||||||||||

| Paul D. Delva |

2015 | 321,854 | 691,600 | 136,603 | 18,408 | 1,168,465 | ||||||||||||||||

| Senior Vice President, General Counsel and Corporate Secretary |

2014 | 312,475 | 555,600 | 140,096 | 54,343 | 1,062,514 | ||||||||||||||||

| 2013 | 302,257 | 840,000 | 91,291 | 34,892 | 1,268,440 | |||||||||||||||||

| (1) | Amounts in the “Stock Awards” column reflect the estimated grant date fair value of awards made during the applicable year. The company did not grant stock option awards to these NEOs in the years shown. Fair value estimates for RSUs and PUs are based on the closing market price of shares of our common stock on the date of grant. The fair value of each TSR at the date of grant was estimated using the Monte-Carlo simulation model. Fair value estimates for PUs and TSRs reflect target performance achievement levels. The following table shows fair value estimates for PUs and, for 2015, TSRs, at maximum performance achievement levels. TSRs were not granted in 2014 or 2013. Because Mr. Shah was not an NEO at the time of the 2015 TSR grants, he did not receive TSRs in 2015. See Note 12 (Stock-based Compensation) to our Consolidated Financial Statements included in Item 8 of this annual report on Form 10-K. See also the discussion of PUs and TSRs in “Compensation Discussion and Analysis.” |

| 2015 ($) | 2014 ($) | 2013 ($) | ||||||||||||||

| TSRs | PUs | PUs | PUs | |||||||||||||

| Mark S. Thompson |

2,097,600 | 2,097,600 | 2,604,374 | 3,150,000 | ||||||||||||

| Mark S. Frey |

491,625 | 491,625 | 781,313 | 945,000 | ||||||||||||

| Gaurang Shah |

— | 786,600 | ||||||||||||||

| Chris Allexandre |

327,750 | 327,750 | 520,875 | |||||||||||||

| Paul D. Delva |

262,200 | 262,200 | 416,700 | 630,000 | ||||||||||||

| (2) | Reflects cash incentive awards paid to NEOs pursuant to the 2007 Stock Plan. In 2015 the company achieved 71% of its Adjusted EBIT goal established for these awards. Accordingly, NEOs received 71% of their opportunity level. Amounts are shown for the year in which the relevant award was earned; award amounts are paid in February of the following year. |

| (3) | For 2015, “All Other Compensation” consisted of the following components: |

| Basic Life Insurance |

Basic AD&D |

Executive LTC |

Executive LTD |

401(k) Match |

BRP Match |

Relocation | Total | |||||||||||||||||||||||||

| Mark S. Thompson |

$ | 1,116 | $ | 75 | $ | 4,957 | $ | 1,500 | $ | 11,854 | $ | 17,885 | — | $ | 37,387 | |||||||||||||||||

| Mark S. Frey |

$ | 384 | $ | 75 | $ | 6,544 | $ | 1,500 | $ | 7,196 | $ | 11,064 | — | $ | 26,763 | |||||||||||||||||

| Gaurang Shah |

$ | 545 | $ | 75 | — | — | $ | 14,400 | — | — | $ | 15,020 | ||||||||||||||||||||

| Chris Allexandre |

$ | 502 | $ | 75 | — | — | $ | 9,779 | — | $ | 173,709 | $ | 184,065 | |||||||||||||||||||

| Paul D. Delva |

$ | 465 | $ | 73 | $ | 3,758 | $ | 1,500 | $ | 7,149 | $ | 5,463 | — | $ | 18,408 | |||||||||||||||||

| (4) | Includes the following stock awards to Mr. Thompson: 80,000 PUs at target, 125,000 RSUs, 80,000 TSRs at target and 26,771 PUs earned in 2015 pursuant to Mr. Thompson’s Long-Term Incentive Agreement. The actual grant of the award of 26,771 PUs occurred in March 2016 and vested in full in March 2016, in accordance with the agreement governing that award. See “Employment Agreements – Long-Term Incentive Agreement with Mr. Thompson” below. |

17

| (5) | Reflects cash incentive award of $825,376 and deferred cash award earned pursuant to Mr. Thompson’s Long-Term Incentive Agreement of $536,494, in each case earned for the 2015 measurement period. Amounts are recorded in the year in which the relevant performance measure was achieved. Cash awards under Mr. Thompson’s Long-Term Incentive Agreement, including the award earned for 2015, were paid to Mr. Thompson in March 2016 in accordance with the agreement governing that award. See “Employment Agreements—Long-Term Incentive Agreement with Mr. Thompson” below. |

| (6) | Mr. Shah joined the company in 2014 and was not an executive officer in 2014. |

| (7) | In 2014 Mr. Allexandre was based in Europe and paid in euros. Amount shown for Mr. Allexandre for 2014 reflects the U.S. dollar equivalent calculated using an average annual conversion rate for 2014 of 0.75 euros to 1 U.S. dollar. Mr. Allexandre was not an executive officer in 2013. |

Fiscal 2015 Grants of Plan-Based Awards

The following table provides information about grants of plan-based awards during 2015 to the executive officers named in the Summary Compensation Table.

| Estimated Future Payouts Under Non-Equity Incentive Plan Awards (6) |

Estimated Future Payouts Under Equity Incentive Plan Awards (PUs and TSRs) (1) |

All Other Stock Awards: Number of Shares of |

Grant-date Fair Value of Stock |

|||||||||||||||||||||||||||||||||

| Name |

Grant Date | Threshold ($) |

Target ($) |

Maximum ($) |

Threshold (#) |

Target (#) |

Maximum (#) |

Stock or Units (#)(2) |

and Option Awards ($)(3) |

|||||||||||||||||||||||||||

| Mark S. Thompson |

|

3/3/2015 3/3/2015 3/3/2015 3/5/2015 |

(4) |

581,250 | 1,162,500 | 1,743,750 |

|

40,000 40,000 — — |

|

|

80,000 80,000 — 24,840 |

|

|

120,000 120,000 — — |

|

|

— — 125,000 — |

|

|

1,398,400 1,337,600 2,185,000 435,942 |

| |||||||||||||||

| Mark S. Frey |

|

3/3/2015 3/3/2015 3/3/2015 |

|

179,784 | 359,569 | 539,353 |

|

9,375 9,375 — |

|

|

18,750 18,750 — |

|

|

28,125 28,125 — |

|

|

— — 37,500 |

|

|

327,750 313,500 655,500 |

| |||||||||||||||

| Gaurang Shah |

|

3/3/2015 3/3/2015 3/3/2015 |

(5)

|

132,563 | 265,125 | 397,688 |

|

15,000 25,000 — |

|

|

30,000 50,000 — |

|

|

45,000 75,000 — |

|

|

— — 30,000 |

|

|

524,400 874,000 524,400 |

| |||||||||||||||

| Chris Allexandre |

|

3/3/2015 3/3/2015 3/3/2015 |

|

117,090 | 234,181 | 351,271 |

|

6,250 6,250 — |

|

|

12,500 12,500 — |

|

|

18,750 18,750 — |

|

|

— — 25,000 |

|

|

218,500 209,000 437,000 |

| |||||||||||||||

| Paul D. Delva |

|

3/3/2015 3/3/2015 3/3/2015 |

|

96,850 | 193,700 | 290,551 |

|

5,000 5,000 — |

|

|

10,000 10,000 — |

|

|

15,000 15,000 — |

|

|

— — 20,000 |

|

|

174,800 167,200 349,600 |

| |||||||||||||||

| (1) | Reflects number of performance units (PUs) granted as part of the annual grant and number of total shareholder return awards (TSRs) granted as part of the annual grant. Except as noted in note 5 and 6 below, PUs vest in one-third increments on the first three anniversaries of the grant date, or earlier in certain events including a change in control. Vested PUs and TSRs result in the delivery of one share per unit promptly following the vesting date. For more information, see “Elements of Compensation—Equity Incentive Awards” above. |