Attached files

| file | filename |

|---|---|

| EX-99.1 - EXHIBIT 99.1 - Booz Allen Hamilton Holding Corp | bah033116exhibit991.htm |

| 8-K - 8-K - Booz Allen Hamilton Holding Corp | fy2016q48kearningsrelease.htm |

Fiscal Year 2016 Q4 E A R N I N G S C A L L P R E S E N TAT I O N

Lloyd Howell Executive Vice President, and Incoming CFO Today’s Agenda 1 Curt Riggle Vice President, Investor Relations Introduction Horacio Rozanski President and Chief Executive Officer Management Overview Kevin Cook Executive Vice President, CFO and Treasurer Financial Results Question & Answer Financial Outlook

Disclaimer Forward Looking Safe Harbor Statement Certain statements contained in this press release and in related comments by our management include “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. Examples of forward-looking statements include information concerning Booz Allen’s preliminary financial results, financial outlook and guidance, including forecasted revenue, Diluted EPS, and Adjusted Diluted EPS, future quarterly dividends, and future improvements in operating margins, as well as any other statement that does not directly relate to any historical or current fact. In some cases, you can identify forward-looking statements by terminology such as “may,” “will,” “could,” “should,” “forecasts,” “expects,” “intends,” “plans,” “anticipates,” “projects,” “outlook,” “believes,” “estimates,” “predicts,” “potential,” “continue,” “preliminary,” or the negative of these terms or other comparable terminology. Although we believe that the expectations reflected in the forward-looking statements are reasonable, we can give you no assurance these expectations will prove to have been correct. These forward-looking statements relate to future events or our future financial performance and involve known and unknown risks, uncertainties and other factors that may cause our actual results, levels of activity, performance or achievements to differ materially from any future results, levels of activity, performance or achievements expressed or implied by these forward-looking statements. A number of important factors could cause actual results to differ materially from those contained in or implied by these forward-looking statements, including those factors discussed in our filings with the Securities and Exchange Commission (SEC), including our Annual Report on Form 10-K for the fiscal year ended March 31, 2015, which can be found at the SEC’s website at www.sec.gov. All forward-looking statements attributable to us or persons acting on our behalf are expressly qualified in their entirety by the foregoing cautionary statements. All such statements speak only as of the date made and, except as required by law, we undertake no obligation to update or revise publicly any forward-looking statements, whether as a result of new information, future events or otherwise. Note Regarding Non-GAAP Financial Data Information Booz Allen discloses in the following information Adjusted Operating Income, Adjusted EBITDA, Adjusted Net Income, Adjusted Diluted EPS, and Free Cash Flow which are not recognized measurements under GAAP, and when analyzing Booz Allen’s performance or liquidity as applicable, investors should (i) evaluate each adjustment in our reconciliation of Operating and Net Income to Adjusted Operating Income, Adjusted EBITDA and Adjusted Net Income, and net cash provided by operating activities to free cash flows, and the explanatory footnotes regarding those adjustments, and (ii) use Adjusted EBITDA, Adjusted Net Income, Adjusted Operating Income, and Adjusted Diluted EPS in addition to, and not as an alternative to operating income, net income or Diluted EPS as a measure of operating results with cash flow in addition to and not as an alternative to net cash generated from operating activities as a measure of liquidity, each as defined under GAAP. The Financial Appendix includes a reconciliation of Adjusted Operating Income, Adjusted EBITDA, Adjusted Net Income, Adjusted Diluted EPS, and Free Cash Flow to the most directly comparable financial measure calculated and presented in accordance with GAAP. Booz Allen presents these supplemental performance measures because it believes that these measures provide investors and securities analysts with important supplemental information with which to evaluate Booz Allen’s performance, long term earnings potential, or liquidity, as applicable and to enable them to assess Booz Allen’s performance on the same basis as management. These supplemental performance and liquidity measurements may vary from and may not be comparable to similarly titled measures by other companies in Booz Allen’s industry. No reconciliation of the forecasted range for Adjusted Diluted EPS to Diluted EPS for any period during fiscal 2017 is included because we are unable to quantify certain amounts that would be required to be included in the GAAP measure without unreasonable efforts and we believe such reconciliations would imply a degree of precision that would be confusing or misleading to investors. 2

Fiscal 2016 Fourth Quarter and Full Year Highlights Delivered on top and bottom line annual guidance − Full year of revenue growth following three years of contraction − Record year-end backlog − Record full year book-to-bill Fiscal Year 2016 was a turning point for the firm − Investments were a down payment on the future − Delivered growth in both core US Government and Global Commercial business The need for Agility remains –Fiscal Year 2017 priorities: − Operationalize investments to drive growth − Continue to aggressively pursue opportunities − Achieve success more efficiently 3

Key Financial Highlights Fiscal Year 2016 was an inflection point A year of challenges and opportunities − Turned the end of largest contract into a good news story − Leaned forward and invested in growth − Exceeded revenue guidance and met bottom line guidance Many proof points that our strategy is the right one for the future Significant awards − Best Q4 book-to-bill in 5 years (0.82x) − Best full year book-to-bill since IPO (1.45x) − Best year-end backlog ever ($11.8 billion) Evolving our talent portfolio with double-digit growth in high demand technical skillsets Progressing on our journey to deliver sustainable quality growth 4

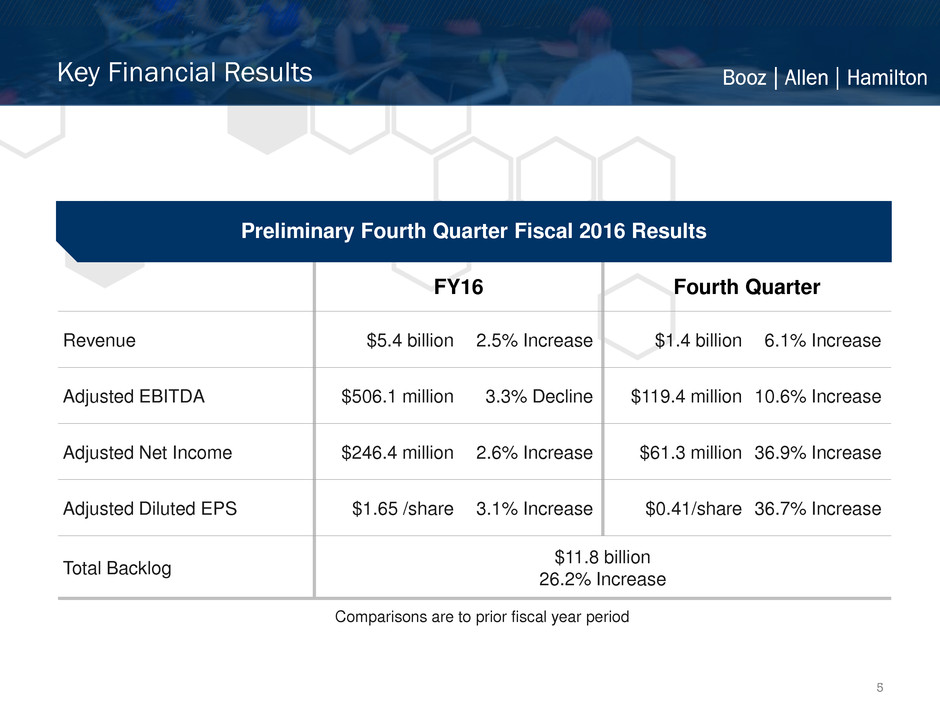

FY16 Fourth Quarter Revenue $5.4 billion 2.5% Increase $1.4 billion 6.1% Increase Adjusted EBITDA $506.1 million 3.3% Decline $119.4 million 10.6% Increase Adjusted Net Income $246.4 million 2.6% Increase $61.3 million 36.9% Increase Adjusted Diluted EPS $1.65 /share 3.1% Increase $0.41/share 36.7% Increase Total Backlog $11.8 billion 26.2% Increase Key Financial Results 5 Comparisons are to prior fiscal year period Preliminary Fourth Quarter Fiscal 2016 Results

Financial Outlook 6 Fiscal 2017 Full Year Outlook Revenue growth forecast: Growth in the Range of Two to Five Percent Diluted EPS forecast (1): $1.60 - $1.70 Adjusted Diluted EPS forecast (1): $1.65 - $1.75 (1) Full Fiscal Year 2017 Estimated Weighted Average Diluted Share Count of 150.0 million shares; assumes an effective tax rate of 40.1%, which does not include federal and state tax credits for which qualification has not yet been established.

Executing Our Strategy Key Objectives of Vision 2020 − Moving closer to the center of our clients’ missions − Increasing the technical content of our work − Attracting and retaining superior talent in diverse areas of expertise − Creating a broad network of external partners and alliances − Leveraging innovation to deliver differentiated, end-to-end solutions Differentiated through the combination of: − Unique mission insight − Consulting know how − Advanced technical capabilities Examples − Affordable Care Act implementation at IRS and CMS − Expansion of Navy business on the West Coast Being recognized as an Essential Partner to our clients 7

Booz Allen Hamilton Holding Corporation Non-GAAP Financial Information 9 “Adjusted Operating Income” represents Operating Income before (i) adjustments related to the amortization of intangible assets, and (ii) transaction costs, fees, losses, and expenses, including fees associated with debt prepayments. Booz Allen prepares Adjusted Operating Income to eliminate the impact of items it does not consider indicative of ongoing operating performance due to their inherent unusual, extraordinary or non-recurring nature or because they result from an event of a similar nature. “Adjusted EBITDA” represents net income before income taxes, net interest and other expense and depreciation and amortization and before certain other items, including: transaction costs, fees, losses, and expenses, including fees associated with debt prepayments. Booz Allen prepares Adjusted EBITDA to eliminate the impact of items it does not consider indicative of ongoing operating performance due to their inherent unusual, extraordinary or non-recurring nature or because they result from an event of a similar nature. “Adjusted Net Income” represents net income before: (i) transaction costs, fees, losses, and expenses, including fees associated with debt prepayments, (ii) adjustments related to the amortization of intangible assets, (iii) amortization or write-off of debt issuance costs and write-off of original issue discount and (iv) any extraordinary, unusual or non-recurring items, net of the tax effect where appropriate calculated using an assumed effective tax rate. Booz Allen prepares Adjusted Net Income to eliminate the impact of items, net of taxes, it does not consider indicative of ongoing operating performance due to their inherent unusual, extraordinary or non-recurring nature or because they result from an event of a similar nature. “Adjusted Diluted EPS” represents Diluted EPS calculated using Adjusted Net Income as opposed to Net Income. Additionally, Adjusted Diluted EPS does not contemplate any adjustments to Net Income as required under the two-class method of calculating EPS as required in accordance with GAAP. “Free Cash Flow” represents the net cash generated from operating activities less the impact of purchases of property and equipment.

Booz Allen Hamilton Holding Corporation Non-GAAP Financial Information 10 (a) Reflects amortization of intangible assets resulting from the Acquisition of our Company by The Carlyle Group. (b) Reflects debt refinancing costs incurred in connection with the refinancing transaction consummated on May 7, 2014. (c) Release of pre-acquisition income tax reserves assumed by the Company in connection with the Acquisition of our Company by The Carlyle Group. (d) Reflects tax effect of adjustments at an assumed marginal tax rate of 40%. (e) Excludes an adjustment of approximately $0.8 million and $3.5 million of net earnings for the three and twelve months ended March 31, 2016 respectively, and excludes an adjustment of approximately $0.6 million and $3.4 million of net earnings for the three and twelve months ended March 31, 2015 respectively, associated with the application of the two-class method for computing diluted earnings per share. (Amounts in thousands, except share and per share data) 2016 2015 2016 2015 Adjusted Operating Income Operating Income 104,508$ 92,560$ 444,584$ 458,822$ Amortization of intangible assets (a) 1,057 1,056 4,225 4,225 Transaction expenses (b) — — — 2,039 Adjusted Operating Income 105,565$ 93,616$ 448,809$ 465,086$ EBITDA & Adjusted EBITDA Net income 65,517$ 43,363$ 294,094$ 232,569$ Income tax expense 26,497 31,917 85,368 153,349 Interest and other, net 12,494 17,280 65,122 72,904 Depreciation and amortization 14,919 15,427 61,536 62,660 EBITDA 119,427 107,987 506,120 521,482 Transaction expenses (b) — — — 2,039 Adjusted EBITDA 119,427$ 107,987$ 506,120$ 523,521$ Adjusted Net Income Net income 65,517$ 43,363$ 294,094$ 232,569$ Amortization of intangible assets (a) 1,057 1,056 4,225 4,225 Transaction expenses (b) — — — 2,039 Release of income tax reserves (c) (5,634) — (53,301) — Amortization or write-off of debt issuance costs and write-off of original issue discount 1,291 1,278 5,201 6,545 Adjustments for tax effect (d) (939) (934) (3,770) (5,124) Adjusted Net Income 61,292$ 44,763$ 246,449$ 240,254$ Adjusted Diluted Earnings Per Share Weighted-average number of diluted shares outstanding 149,559,119 149,867,259 149,719,137 150,375,531 Adjusted Net Income Per Diluted Share (e) 0.41$ 0.30$ 1.65$ 1.60$ Free Cash Flow Net cash provided by operating activities 68,237$ 81,900$ 249,234$ 309,958$ Less: Purchase f property and equipment (20,806) (18,575) (66,635) (36,041) Free Cash Flow 47,431$ 63,325$ 182,599$ 273,917$ Three Months Ended March 31, Fiscal Year Ended March 31, (Unaudited) (Unaudited)