Attached files

| file | filename |

|---|---|

| 8-K - 8-K - Synchrony Financial | a8-k1q1651716barclaysameri.htm |

Barclays Americas Select Franchise Conference May 17, 2016 Exhibit 99.1

2 This presentation contains certain forward-looking statements as defined in Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, which are subject to the “safe harbor” created by those sections. Forward-looking statements may be identified by words such as “outlook,” “expects,” “intends,” “anticipates,” “plans,” “believes,” “seeks,” “targets,” “estimates,” “will,” “should,” “may” or words of similar meaning, but these words are not the exclusive means of identifying forward-looking statements. Forward-looking statements are based on management’s current expectations and assumptions, and are subject to inherent uncertainties, risks and changes in circumstances that are difficult to predict. As a result, actual results could differ materially from those indicated in these forward-looking statements. Factors that could cause actual results to differ materially include global political, economic, business, competitive, market, regulatory and other factors and risks, such as: the impact of macroeconomic conditions and whether industry trends we have identified develop as anticipated; retaining existing partners and attracting new partners, concentration of our platform revenue in a small number of Retail Card partners, promotion and support of our products by our partners, and financial performance of our partners; higher borrowing costs and adverse financial market conditions impacting our funding and liquidity, and any reduction in our credit ratings; our ability to securitize our loans, occurrence of an early amortization of our securitization facilities, loss of the right to service or subservice our securitized loans, and lower payment rates on our securitized loans; our ability to grow our deposits in the future; changes in market interest rates and the impact of any margin compression; effectiveness of our risk management processes and procedures, reliance on models which may be inaccurate or misinterpreted, our ability to manage our credit risk, the sufficiency of our allowance for loan losses and the accuracy of the assumptions or estimates used in preparing our financial statements; our ability to offset increases in our costs in retailer share arrangements; competition in the consumer finance industry; our concentration in the U.S. consumer credit market; our ability to successfully develop and commercialize new or enhanced products and services; our ability to realize the value of strategic investments; reductions in interchange fees; fraudulent activity; cyber-attacks or other security breaches; failure of third parties to provide various services that are important to our operations; our transition to a replacement third-party vendor to manage the technology platform for our online retail deposits; disruptions in the operations of our computer systems and data centers; international risks and compliance and regulatory risks and costs associated with international operations; alleged infringement of intellectual property rights of others and our ability to protect our intellectual property; litigation and regulatory actions; damage to our reputation; our ability to attract, retain and motivate key officers and employees; tax legislation initiatives or challenges to our tax positions and state sales tax rules and regulations; a material indemnification obligation to GE under the tax sharing and separation agreement with GE if we cause the split-off from GE or certain preliminary transactions to fail to qualify for tax-free treatment or in the case of certain significant transfers of our stock following the split-off; obligations associated with being an independent public company; regulation, supervision, examination and enforcement of our business by governmental authorities, the impact of the Dodd-Frank Wall Street Reform and Consumer Protection Act and the impact of the Consumer Financial Protection Bureau’s regulation of our business; changes to our methods of offering our CareCredit products; impact of capital adequacy rules and liquidity requirements; restrictions that limit our ability to pay dividends and repurchase our common stock, and restrictions that limit Synchrony Bank’s ability to pay dividends to us; regulations relating to privacy, information security and data protection; use of third-party vendors and ongoing third-party business relationships; and failure to comply with anti-money laundering and anti- terrorism financing laws. For the reasons described above, we caution you against relying on any forward-looking statements, which should also be read in conjunction with the other cautionary statements that are included elsewhere in this presentation and in our public filings, including under the heading “Risk Factors” in Synchrony Financial’s (the “Company”) Annual Report on Form 10-K for the fiscal year ended December 31, 2015, as filed on February 25, 2016. You should not consider any list of such factors to be an exhaustive statement of all of the risks, uncertainties, or potentially inaccurate assumptions that could cause our current expectations or beliefs to change. Further, any forward-looking statement speaks only as of the date on which it is made, and we undertake no obligation to update or revise any forward-looking statement to reflect events or circumstances after the date on which the statement is made or to reflect the occurrence of unanticipated events, except as otherwise may be required by law. Non-GAAP Measures In order to assess and internally report the revenue performance of our three sales platforms, we use measures we refer to as “platform revenue" and “platform revenue excluding retailer share arrangements.” Platform revenue is the sum of three line items in our Condensed Consolidated Statements of Earnings prepared in accordance with U.S. generally accepted accounting principles ("GAAP"): “interest and fees on loans,” plus “other income,” less “retailer share arrangements.” Platform revenue and platform revenue excluding retailer share arrangements are not measures presented in accordance with GAAP. To calculate platform revenue, we deduct retailer share arrangements but do not deduct other line item expenses, such as interest expense, provision for loan losses and other expense, because those items are managed for the business as a whole. We believe that platform revenue is a useful measure to investors because it represents management’s view of the net revenue contribution of each of our platforms. Platform revenue excluding retailer share arrangements represents management’s view of the gross revenue contribution of each of our platforms. These measures should not be considered a substitute for interest and fees on loans or other measures of performance we have reported in accordance with GAAP. The reconciliation of platform revenue, and platform revenue excluding retailer share arrangements, to interest and fees on loans for each platform is included at the end of this presentation in “Appendix-Non-GAAP Reconciliations.” We present certain capital ratios. Our Basel III Tier 1 common ratio, calculated on a fully phased-in basis, is a preliminary estimate reflecting management’s interpretation of the final Basel III capital rules adopted in July 2013 by the Federal Reserve Board, which have not been fully implemented, and our estimate and interpretations are subject to, among other things, ongoing regulatory review and implementation guidance. This ratio is not currently required by regulators to be disclosed, and therefore is considered a non-GAAP measure. We believe this capital ratio is a useful measure to investors because it is widely used by analysts and regulators to assess the capital position of financial services companies, although this ratio may not be comparable to similarly titled measures reported by other companies. The reconciliation of each component of our capital ratios included in this presentation to the comparable GAAP component at March 31, 2016 is included at the end of this presentation in “Appendix-Non-GAAP Reconciliations.” We also present a measure we refer to as “tangible common equity” in this presentation. Tangible common equity itself is not a measure presented in accordance with GAAP. We believe tangible common equity is a more meaningful measure to investors of the net asset value of the Company. The reconciliation of tangible common equity, to total equity reported in accordance with GAAP is included at the end of this presentation in “Appendix- Non-GAAP Reconciliations.” Disclaimers

Business Overview

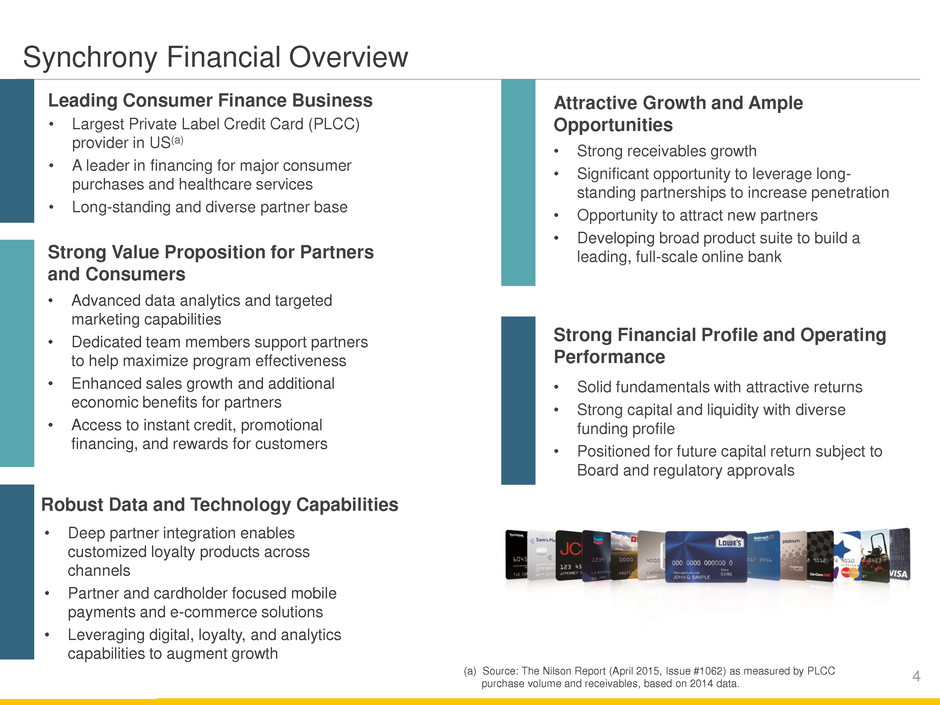

4 Synchrony Financial Overview Strong Value Proposition for Partners and Consumers • Advanced data analytics and targeted marketing capabilities • Dedicated team members support partners to help maximize program effectiveness • Enhanced sales growth and additional economic benefits for partners • Access to instant credit, promotional financing, and rewards for customers Attractive Growth and Ample Opportunities • Strong receivables growth • Significant opportunity to leverage long- standing partnerships to increase penetration • Opportunity to attract new partners • Developing broad product suite to build a leading, full-scale online bank Strong Financial Profile and Operating Performance • Solid fundamentals with attractive returns • Strong capital and liquidity with diverse funding profile • Positioned for future capital return subject to Board and regulatory approvals Leading Consumer Finance Business • Largest Private Label Credit Card (PLCC) provider in US(a) • A leader in financing for major consumer purchases and healthcare services • Long-standing and diverse partner base (a) Source: The Nilson Report (April 2015, Issue #1062) as measured by PLCC purchase volume and receivables, based on 2014 data. Robust Data and Technology Capabilities • Deep partner integration enables customized loyalty products across channels • Partner and cardholder focused mobile payments and e-commerce solutions • Leveraging digital, loyalty, and analytics capabilities to augment growth

5 Partner-Centric Business with Leading Sales Platforms (a) Platform revenue for period 2Q15 through 1Q16, $ in millions. Platform revenue is the sum of “interest and fees on loans,” plus “other income,” less “retailer share arrangements”. See non-GAAP reconciliation in appendix. (b) $ in billions, as of March 31, 2016. $7,685 $45.1 $1,745 $13.4 $1,742 $7.3 Payment Solutions Retail Card CareCredit Platform Revenue(a) Loan Receivables(b) Private label credit cards, Dual Cards™ & small business credit products for large retailers Promotional financing for major consumer purchases, offering private label credit cards & installment loans Promotional financing to consumers for elective healthcare procedures & services

6 26% Long-Standing Partnerships (a) As of March 31, 2016. (b) Platform revenue is the sum of “interest and fees on loans,” plus “other income,” less “retailer share arrangements”. See non-GAAP reconciliation in appendix. (c) Excludes certain credit card portfolios that were sold or have not been renewed which represented 1% of our total Retail Card platform revenue for the year ended December 31, 2105. 4% 5% 23% Partners (c) 16% 23% 2019 2018 2017 2021 1 3 2 2 2020 28% 2022+ 5 10 Length of Major Partner Relationships (Years) (a) Last Renewal 37 2014 22 2014 19 2014 18 2014 16 2013 16 2013 11 2015 8 2015 90% 2019+ Contractual Expiration(a) $ in millions, % of 2015 Retail Card Platform Revenue(b) 0% 2016 0

7 Expansive Opportunity (a) (a) Source: Nilson. $873 Billion of U.S. Credit Card Receivables $48 $52 $57 $61 2011 2012 2013 2014 $ in billions • Majority of growth is organic • Targeted marketing programs, digital capabilities, and value propositions helped drive organic growth Strong Receivables Growth $807 $810 $834 $873 2011 2012 2013 2014 +3% CAGR +9% CAGR • SYF comprises ~7% of credit card receivables Significantly Outpacing Industry Growth $ in billions

8 1.5% 2.6% 2.7% 0.6% 7.6% 1.6% 9.2% 2.9% 7.5% 9.4% 10.1% 9.8% Mass Electronics Healthcare Apparel/Dept. Home Furniture $531 $278 $223 $213 $213 $77 2012-2014 Market Growth Rate 2012-2014 Synchrony Financial Purchase Volume Growth Rate 2014 Market Size ($ in billions) • Over 80 years of retail heritage • Significant scale across platforms • Robust data capture enables more customized offers • Analytics and data insights help drive growth • Joint executive management of programs—1,000+ SYF FTEs dedicated to drive partner sales • Collaboration with partners ensures sales teams are aligned with program goals • Economic benefits and incentives align goals and drive profitable program growth Deep Integration Drives 2-3x Market Growth Rate Sources for market data: Kantar Retail (2014 Mass & Apparel/Dept. market projections); IBIS World Research Group; CareCredit industry research; Joint Centers for Housing Studies, Harvard University; Consumer Electronics Association.

9 $7.4 $8.0 $9.2 $11.0 $13.0 $15.7 $18.3 $19.7 $21.3 $24.4 $27.6 $29.7 $32.5 1Q13 2Q13 3Q13 4Q13 1Q14 2Q14 3Q14 4Q14 1Q15 2Q15 3Q15 4Q15 1Q16 Growth Strategy Competitive rates and superior service afforded by low cost structure of online bank Opportunity to further leverage cross-sell opportunities with cardholder base Expand product suite – checking, debit, bill payment, small business deposit accounts Enhance Synchrony Bank Perks program High Customer Satisfaction Scores Ally Source: Chadwick Martin Bailey, internally commissioned; April 2015 78 16 6 76 18 5 53 40 6 47 38 15 47 39 15 Satisfied Ambivalent Unsatisfied 63 34 3 COF WFC JPM AXP Strong Direct Deposit Growth $ in billions Fast-Growing Online Bank

Robust Data, Analytics and Digital Capabilities

11 Proprietary Closed-Loop Network Advantages Customer Merchant Acquirer Network Issuer General Purpose Card and Co-Branded Cards Synchrony Financial Closed Loop Network for PLCC and Dual CardTM Citi Capital One Chase Date Merch. Channel Brand Cat./SKU $ 4/2/16 Belk In- Store DKNY Women’s Shoes 468XUTY $83.44 4/9/16 Belk Mobile Coach Women’s Handbags 229HHREO $212.17 Date Merch. Channel Brand Cat./SKU $ 4/2/16 Belk $83.44 4/9/16 Belk $212.17 Enables Valuable Data Capture and Eliminates Interchange Fees • Limited data can be collected by the card issuer when a General Purpose Credit Card or traditional co-branded card is used • When Synchrony Financial Private Label Credit Cards or Dual CardsTM are used in-store, the transaction runs on our network • Valuable incremental data capture occurs on transactions that run over the Synchrony Financial closed loop network - Brand or category - SKU-level data - Channel: in-store, online, or mobile - Receive SKU or category-level data on 70-75% of network transactions • No interchange fees when Synchrony Financial Private Label Credit Cards or Dual CardsTM are used over our network

12 Channel Contribution Data Analytics Driving Actionable Insights • Understand performance and opportunity by region • Optimize field sales investment to maximize sales • Sales and profitability trends by: - Product category - Region - Customer segment - Coupon issuance, redemption • Ability to identify over/underperforming markets Deep Portfolio and Campaign Insights Field Sales Optimization *illustrative data *illustrative data

13 (a) Source: US Census Bureau, Quarterly Retail E-Commerce Sales, 4th Quarter 2015. E-Commerce sales are sales of goods and services where an order is placed by the buyer or price and terms of sale are negotiated over an Internet, extranet, Electronic Data Interchange (EDI) network, electronic mail, or other online system. Payment may or may not be made online. (b) As compared to 1Q15. Strong Online Sales Growth Innovative Digital Capabilities Online Sales Growth Rate • Significant experience with online retailers • Online sales growth outpacing U.S. average • Overall online sales penetration rate exceeds the U.S. average • Investment in innovative digital capabilities is helping to drive growth—online sales were up 29% in 1Q16 (b) U.S. E-Commerce Sales Year-Over-Year Growth Rate(a) Synchrony Online Sales Year-Over-Year Growth Rate Expanding Digital Capabilities • Investing in enhanced user experience • Mobile applications deliver customized features including rewards, retail offers and alerts Wallet-Agnostic Strategy—Offering Choice to Retail Partners and Consumers Benefits to Synchrony Financial and Our Customers • Preserving unique benefits and value propositions • Synchrony Financial continuing to capture valuable customer data on our network • Developing proprietary solutions like Digital Card • Developed mobile platform that can be rapidly integrated across retailers and wallets 18% 20% 21% 24% 29% 15% 14% 15% 15% 10% 15% 20% 25% 30% 1Q15 2Q15 3Q15 4Q15 1Q16

Performance & Strategic Priorities

15 $1,979 $2,109 $2,214 2013 2014 2015 4.68% 4.51% 4.33% 2013 2014 2015 Net Earnings $ in millions Loan Receivables $ in billions, period-end balances CAGR 9% Net Charge-Offs (b) % of average loan receivables Platform Revenue (a) $ in millions $9,422 $10,126 $10,833 2013 2014 2015 CAGR 7% Improved 35 bps $57.3 $61.3 $68.3 2013 2014 2015 (a) Platform revenue is the sum of “interest and fees on loans,” plus “other income,” less “retailer share arrangements”. See non-GAAP reconciliation in appendix. (b) Includes loan receivables held for sale. CAGR 6% Strong Operating Performance

16 (a) Segment data for AXP-U.S Consumer Services and COF-Domestic Card. Other data-total company level. (b) SYF yield calculated as loan receivable yield less net charge-off rate. AXP-U.S. Consumer Services yield calculated as total card member loan yield less net charge-off rate on card member loans (ex-HFS). Other peer information calculated as credit card yield less net charge-off rate on credit cards. (c) CET1 ratios are on an estimated, fully phased-in basis. See non-GAAP reconciliation in appendix. 30.4% 39.8% 47.3% 61.1% SYF DFS COF AXP Efficiency Ratio (a) Risk-Adjusted Yield (b) 16.4% 10.3% 10.1% 8.9% SYF COF DFS AXP 20.4% 16.6% 4.4% 3.9% COF SYF DFS AXP Purchase Volume Growth (a) Liquidity % of Assets (e) 18.9% 18.3% 18.2% 13.7% SYF DFS AXP COF 17.5% 14.2% 12.0% 10.9% SYF DFS AXP COF CET1 Ratio (c) Strong Margins Significant Growth Strong Balance Sheet Loan Receivables Growth (d) 14.1% 13.0% 4.0% (15.7)% COF SYF DFS AXP (d) Segment data for AXP-U.S Consumer Services (ex-HFS), COF-Domestic Card, and DFS-Credit Card. SYF-total company level. (e) For AXP, DFS, and SYF calculated as: (cash and cash equivalents + investment securities) / total assets. COF calculated as: (cash and cash equivalents + AFS securities) / total assets. Sources: Company filings and SNL. Risk-adjusted yield, efficiency ratio, and liquidity % of assets metrics involved calculations by SYF based upon company filings. Purchase volume and loan receivables growth are 1Q16 vs. 1Q15. Peer Comparison: 1Q16 (b)

17 19% 8% 20% 20% 61% 72% • Synchrony Financial controls underwriting and credit line decisions • Focus on stronger underwriting has led to higher quality portfolio - 72% of loan receivables have FICO > 660 Stronger Portfolio U.S. consumer FICO (a) Delinquency Performance 30+ days past due as a % of period-end loan receivables 4.09% 3.79% 3.85% 1Q16 1Q15 1Q14 (a) Prior to 3Q12 a proprietary scoring model was used and converted to a FICO equivalent score. 4.22% 1Q13 601-660 661+ 2008 1Q16 ≤ 600 ≤ 600 601-660 661-720 721+ At origination Disciplined Underwriting FICO, consumer accounts opened since beginning of 2010 40% 38% 21% 1% Focus on Higher Quality Asset Base

18 Strategic Priorities Grow our business through our three sales platforms Position business for long-term growth Operate with a strong balance sheet and financial profile Leverage strong capital position Expand robust data, analytics and digital capabilities • Grow existing retailer penetration • Continue to innovate and provide robust cardholder value propositions • Add new partners and programs with attractive risk and return profiles • Accelerate capabilities: marketing, analytics and loyalty • Continue to leverage SKU level data and invest in CRM to differentiate marketing capabilities • Deliver leading capabilities across digital and mobile technologies • Build Synchrony Bank into a leading full-scale online bank—develop broad product suite to increase loyalty, diversify funding and drive profitability • Explore opportunities to expand the core business (e.g., grow small business platform) • Maintain strong capital and liquidity • Deliver earnings growth at attractive returns • Organic growth, program acquisitions, and start-up opportunities • Establish dividend and share repurchase programs, subject to Board and regulatory approvals • Invest in capability-enhancing technologies and businesses

Appendix

20 ($ in millions) Mar 31, Jun 30, Sep 30, Dec 31, Mar 31, Dec 31, Dec 31, Dec 31, Mar 31, 2015 2015 2015 2015 2016 2013 2014 2015 2016 Platform Revenue Total: Interest and fees on loans $3,140 $3,166 $3,379 $3,494 $3,498 $11,295 $12,216 $13,179 $13,537 Other income 101 120 84 87 92 500 485 392 383 Retailer share arrangements (660) (621) (723) (734) (670) (2,373) (2,575) (2,738) (2,748) Platform revenue $2,581 $2,665 $2,740 $2,847 $2,920 $9,422 $10,126 $10,833 $11,172 Retail Card: Interest and fees on loans $2,337 $2,335 $2,508 $2,594 $2,614 $8,317 $9,040 $9,774 $10,051 Other income 86 107 70 76 79 419 407 339 332 Retailer share arrangements (651) (606) (708) (723) (661) (2,331) (2,530) (2,688) (2,698) Platform revenue $1,772 $1,836 $1,870 $1,947 $2,032 $6,405 $6,917 $7,425 $7,685 Payment Solutions: Interest and fees on loans $403 $412 $442 $462 $457 $1,506 $1,582 $1,719 $1,773 Other income 5 4 5 3 4 36 32 17 16 Retailer share arrangements (8) (14) (13) (10) (7) (36) (41) (45) (44) Platform revenue $400 $402 $434 $455 $454 $1,506 $1,573 $1,691 $1,745 CareCredit: Interest and fees on loans $400 $419 $429 $438 $427 $1,472 $1,594 $1,686 $1,713 Other income 10 9 9 8 9 45 46 36 35 Retailer share arrangements (1) (1) (2) (1) (2) (6) (4) (5) (6) Platform revenue $409 $427 $436 $445 $434 $1,511 $1,636 $1,717 $1,742 Twelve Months Ended Non-GAAP Reconciliation The following table sets forth each component of our platform revenue for periods indicated below. Quarter Ended

21 Non-GAAP Reconciliation The following table sets forth a reconciliation of each component of our capital ratios to the comparable GAAP component at March 31, 2016. COMMON EQUITY MEASURES GAAP Total common equity .................................................................................................... Less: Goodwill ............................................................................................................... Less: Intangible assets, net ............................................................................................. Tangible common equity ........................................................................................................ Adjustments for certain deferred tax liabilities and certain items in accumulated comprehensive income (loss) ................................................................ Basel III – Common equity Tier 1 (fully phased-in) ............................................................ Adjustments related to capital components during transition ........................................ Basel III – Common equity Tier 1 (transition) ................................................................... Risk-weighted assets – Basel III (fully phased-in) .............................................................. Risk-weighted assets – Basel III (transition) ....................................................................... $13,204 (949) (702) $11,553 281 $11,834 265 $12,099 $67,697 $66,689 $ in millions at March 31, 2016