Attached files

| file | filename |

|---|---|

| 8-K - 8-K - SUNTRUST BANKS INC | a05162016barclays8-kbody.htm |

2016 Barclays Americas Select Franchise Conference Aleem Gillani, Chief Financial Officer, SunTrust Banks, Inc. May 17, 2016

2 The following should be read in conjunction with the financial statements, notes and other information contained in the Company’s 2015 Annual Report on Form 10-K, Quarterly Reports on Form 10-Q, and Current Reports on Form 8-K. This presentation includes non-GAAP financial measures to describe SunTrust’s performance. We reconcile those measures to GAAP measures within the presentation or in the appendix. In this presentation, we present net interest income and net interest margin on a fully taxable-equivalent (“FTE”) basis, and ratios on an annualized basis. The FTE basis adjusts for the tax-favored status of income from certain loans and investments. We believe this measure to be the preferred industry measurement of net interest income and provides relevant comparison between taxable and non-taxable amounts. This presentation contains forward-looking statements. Statements regarding future levels of the efficiency ratio are forward-looking statements. Also, any statement that does not describe historical or current facts is a forward-looking statement. These statements often include the words “believes,” “expects,” “anticipates,” “estimates,” “intends,” “plans,” “targets,” “initiatives,” “opportunity,” “potentially,” “probably,” “projects,” “outlook” or similar expressions or future conditional verbs such as “may,” “will,” “should,” “would,” and “could"; such statements are based upon the current beliefs and expectations of management and on information currently available to management. Such statements speak as of the date hereof, and we do not assume any obligation to update the statements made herein or to update the reasons why actual results could differ from those contained in such statements in light of new information or future events. Forward-looking statements are subject to significant risks and uncertainties. Investors are cautioned against placing undue reliance on such statements. Actual results may differ materially from those set forth in the forward-looking statements. Factors that could cause actual results to differ materially from those described in the forward-looking statements can be found in Part I, Item 1A., “Risk Factors,” in our Annual Report on Form 10-K for the year ended December 31, 2015 and in other periodic reports that we file with the SEC. Those factors include: current and future legislation and regulation could require us to change our business practices, reduce revenue, impose additional costs, or otherwise adversely affect business operations or competitiveness; we are subject to increased capital adequacy and liquidity requirements and our failure to meet these would adversely affect our financial condition; the fiscal and monetary policies of the federal government and its agencies could have a material adverse effect on our earnings; our financial results have been, and may continue to be, materially affected by general economic conditions, and a deterioration of economic conditions or of the financial markets may materially adversely affect our lending and other businesses and our financial results and condition; changes in market interest rates or capital markets could adversely affect our revenue and expenses, the value of assets and obligations, and the availability and cost of capital and liquidity; our earnings may be affected by volatility in mortgage production and servicing revenues, and by changes in carrying values of our MSRs and mortgages held for sale due to changes in interest rates; disruptions in our ability to access global capital markets may adversely affect our capital resources and liquidity; we are subject to credit risk; we may have more credit risk and higher credit losses to the extent that our loans are concentrated by loan type, industry segment, borrower type, or location of the borrower or collateral; we rely on the mortgage secondary market and GSEs for some of our liquidity; loss of customer deposits could increase our funding costs; we are subject to litigation, and our expenses related to this litigation may adversely affect our results; we may incur fines, penalties and other negative consequences from regulatory violations, possibly even inadvertent or unintentional violations; we are subject to certain risks related to originating and selling mortgages, and may be required to repurchase mortgage loans or indemnify mortgage loan purchasers as a result of breaches of representations and warranties, or borrower fraud, and this could harm our liquidity, results of operations, and financial condition; we face certain risks as a servicer of loans; we are subject to risks related to delays in the foreclosure process; clients could pursue alternatives to bank deposits, causing us to lose a relatively inexpensive source of funding; consumers and small businesses may decide not to use banks to complete their financial transactions, which could affect net income; we have businesses other than banking which subject us to a variety of risks; negative public opinion could damage our reputation and adversely impact business and revenues; we rely on other companies to provide key components of our business infrastructure; competition in the financial services industry is intense and we could lose business or suffer margin declines as a result; maintaining or increasing market share depends on market acceptance and regulatory approval of new products and services; our ability to receive dividends from our subsidiaries or other investments could affect our liquidity and ability to pay dividends; any reduction in our credit rating could increase the cost of our funding from the capital markets; we have in the past and may in the future pursue acquisitions, which could affect costs and from which we may not be able to realize anticipated benefits; we depend on the expertise of key personnel, and if these individuals leave or change their roles without effective replacements, operations may suffer; we may not be able to hire or retain additional qualified personnel and recruiting and compensation costs may increase as a result of turnover, both of which may increase costs and reduce profitability and may adversely impact our ability to implement our business strategies; our framework for managing risks may not be effective in mitigating risk and loss to us; our controls and procedures may not prevent or detect all errors or acts of fraud; we are at risk of increased losses from fraud; a failure in or breach of our operational or security systems or infrastructure, or those of our third party vendors and other service providers, including as a result of cyber-attacks, could disrupt our businesses, result in the disclosure or misuse of confidential or proprietary information, damage our reputation, increase our costs and cause losses; the soundness of other financial institutions could adversely affect us; we depend on the accuracy and completeness of information about clients and counterparties; our accounting policies and processes are critical to how we report our financial condition and results of operation, and they require management to make estimates about matters that are uncertain; depressed market values for our stock and adverse economic conditions sustained over a period of time may require us to write down some portion of our goodwill; our financial instruments measured at fair value expose us to certain market risks; our stock price can be volatile; we might not pay dividends on our stock; and certain banking laws and certain provisions of our articles of incorporation may have an anti-takeover effect. Important Cautionary Statement

3 Investment Thesis Why invest in SunTrust? Investing in Growth Opportunities Strong & Diverse Franchise Improving Returns & Efficiency Strong Capital Position Supports Growth

4 Investing in Growth Opportunities Strong & Diverse Franchise Improving Returns & Efficiency Strong Capital Position Franchise Overview SunTrust is a leading financial institution focused on meeting clients’ needs and improving their financial well-being. Our Company is differentiated by: 1 Size Large enough to compete with the largest banks while still being nimble 2 Diverse Business Strong regional bank with key national businesses and full product capabilities 3 Attractive Footprint Leading market shares in high growth and densely populated markets in the Southeast & Mid-Atlantic 4 Culture A “Client First” culture and a “One Team” approach See Appendix slide #23 for footnotes Key Statistics (Rank)1,2 $20.9B Market Cap ~4.7MM Clients $194B (11th) Assets $152B (10th) Deposits $140B (8th) Loans Ranked #2 For Deposit Market Share in Respective Top 10 MSAs4 23,945 Teammates3 14% 7% SunTrust Peer Median

5 Geographic Presence Regional Businesses • Consumer Banking • Commercial and Business Banking • Consumer Lending (Home Equity, Credit Card) • Private Wealth Management • Retail Mortgage National Businesses • Corporate & Investment Banking • Commercial Real Estate • Consumer Lending (Auto, LightStream) • Specialty Private Wealth Management • Correspondent Mortgage SunTrust has a well-diversified mix of regionally focused businesses (Southeast & Mid- Atlantic) and more nationally oriented businesses Investing in Growth Opportunities Strong & Diverse Franchise Improving Returns & Efficiency Strong Capital Position Los Angeles San Francisco Dallas Houston Atlanta Orlando Miami Tampa Chicago Nashville Memphis Charlotte Richmond Baltimore New York Boston Pittsburgh Ft. Lauderdale Raleigh-Durham Washington, DC San Diego Note: Map is not representative of all SunTrust locations. Regional locations (Southeast and Mid-Atlantic) are generally cities with a significant retail and commercial presence. Cities outside of Southeast and Mid-Atlantic generally contain Wholesale Banking (CIB, CRE) offices

6 Diverse Business Mix1 Investing in Growth Opportunities Strong & Diverse Franchise Improving Returns & Efficiency Strong Capital Position Corporate & Investment Banking 20% Commercial & Business Banking 14% Mortgage 12% Consumer Banking 31% Private Wealth Management 12% Consumer Lending 8% Consumer Banking & PWM 51% • Consumer Banking • Private Wealth Management • Home Equity • Credit Card • Auto Lending • LightStream • Third-Party Partnerships • Specialty Private Wealth Management Wholesale Banking 37% • Commercial & Business Banking • Regional CRE • Affordable Housing • Corporate & Investment Banking • National CRE (REIT, Institutional) Mortgage 12% • Retail • Correspondent • Consumer Direct % of STI Revenue Regional Businesses (Southeast & Mid-Atlantic) National Businesses 1. Based on revenue over the 12 months ending March 31, 2016. Excludes Corporate Other

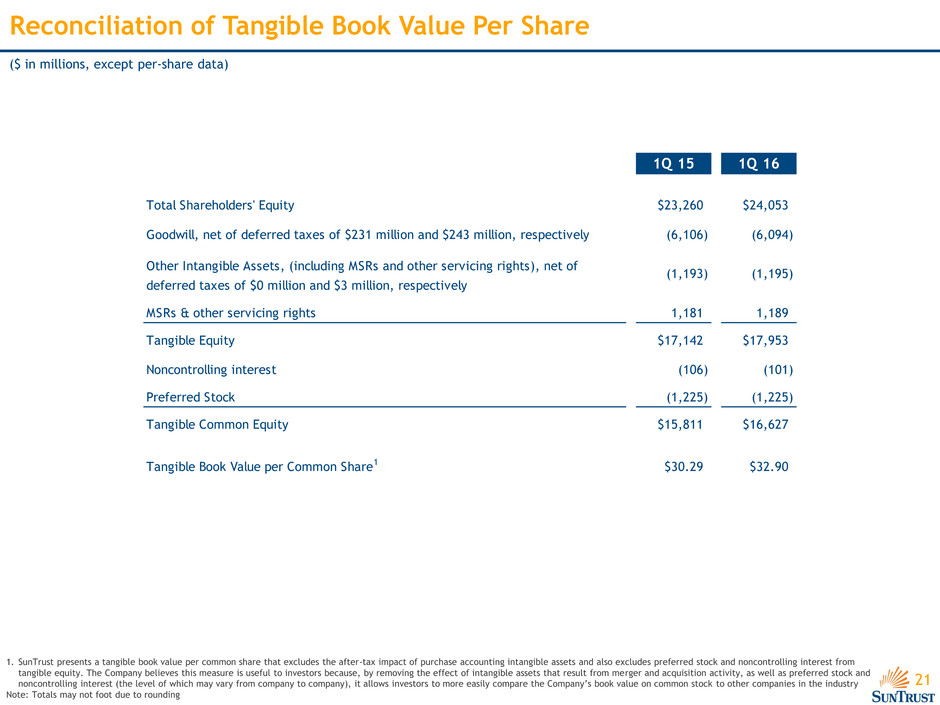

7 $30.29 $32.90 1Q 15 1Q 16 4% 6% Loan Growth Client Deposit Growth $0.78 $0.84 1Q 15 1Q 16 2.83% 3.04% 1Q 15 1Q 16 Strong Start to 2016 Investing in Growth Opportunities Strong & Diverse Franchise Improving Returns & Efficiency Strong Capital Position 1. Book value per share was $42.01 and $44.97 for 1Q 15 and 1Q 16, respectively. See Appendix slide #21 for a reconcilement to book value per share Earnings Per Share Net Interest Margin (growth rates represent 1Q 15 vs. 1Q 16) Tangible Book Value per Share1 Average Loan & Deposit Growth

8 72% 62% 2011 LTM Strategic Consistency Key Strategies Evidence of Success 2011 Ongoing Meet More Client Needs 2011 – LTM CAGRs 9% Investment Banking Income 17% Credit Card Balances1 4% Client Deposits1 1 Adjusted Tangible Efficiency Ratio2 Improve Efficiency 2 Optimize the Balance Sheet & Enhance Returns % Residential-Related Loans3 ROA 3 Investing in Growth Opportunities Strong & Diverse Franchise Improving Returns & Efficiency Strong Capital Position 1. Based on average balances 2. GAAP efficiency ratios were 72.0% and 62.8% for 2011 and LTM, respectively. Please refer to appendix slide #20 for GAAP reconciliations 3. Includes guaranteed residential mortgages, non-guaranteed residential mortgages, home equity products, and residential construction loans based on period-end balances 6% Retail Investment Income 38% 28% 2011 1Q 16 0.38% 1.03% 201 LTM

9 71.7% 68.9% 65.3% 62.9% 62.6% 62.3% < 60% 2011 2012 2013 2014 2015 1Q 16 Long-Term Target Adjusted Tangible Efficiency Ratio1 Efficiency gains create capacity to invest in growth opportunities Investing in Growth Opportunities Strong & Diverse Franchise Improving Returns & Efficiency Strong Capital Position 1. GAAP efficiency ratios were 72.0%, 59.3%, 71.2%, 66.7%, 63.1% and 62.8% for 2011, 2012, 2013, 2014, 2015, and 1Q 16, respectively. Please refer to appendix slide #20 for GAAP reconciliations Reduced Expenses Execute Omni-Channel strategy (invest in digital, reduce physical footprint) Streamline operations infrastructure More efficient deployment of human capital Supplier consolidation Continue to execute Wholesale Banking strategy (add expertise, deepen client relationships via capital markets and T&PS) Grow consumer lending and wealth management Targeted market share gains in Mortgage Revenue Growth The Path to <60%

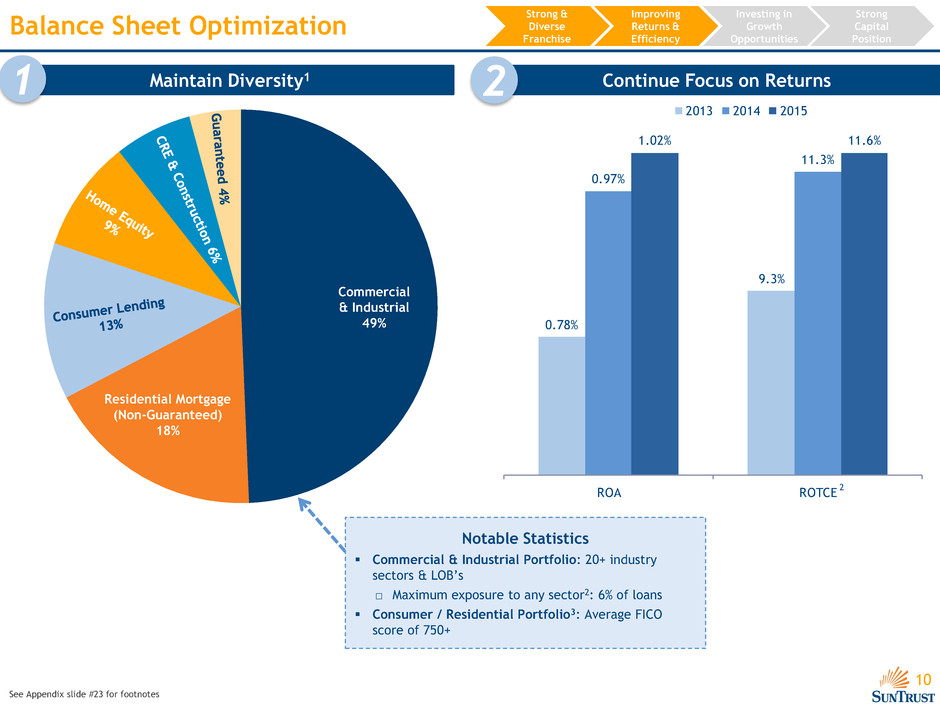

10 Balance Sheet Optimization Investing in Growth Opportunities Strong & Diverse Franchise Improving Returns & Efficiency Strong Capital Position Commercial & Industrial 49% Residential Mortgage (Non-Guaranteed) 18% Maintain Diversity1 1 Continue Focus on Returns 2 2 0.78% 9.3% 0.97% 11.3% 1.02% 11.6% ROA ROTCE 2013 2014 2015 Notable Statistics Commercial & Industrial Portfolio: 20+ industry sectors & LOB’s □ Maximum exposure to any sector2: 6% of loans Consumer / Residential Portfolio3: Average FICO score of 750+ See Appendix slide #23 for footnotes

11 0.19% 0.25% 0.29% 0.31% 0.34% 0.38% 0.42% 0.46% 0.48% 0.49% Peer 1 STI Peer 2 Peer 3 Peer 4 Peer 5 Peer 6 Peer 7 Peer 8 Peer 9 Strong Credit Quality 1Q16 Nonperforming Loan Ratio1 9-Quarter Loss Rate for CCAR 20152 1Q16 Net Charge-Off Ratio Investing in Growth Opportunities Strong & Diverse Franchise Improving Returns & Efficiency Strong Capital Position E&P and OFS 0.9% Midstream and Downstream 1.4% Other 97.6%Energy Risk Manageable3 2.4% of Loans Outstanding with Favorable Mix 0.58% 0.65% 0.70% 0.75% 1.00% 1.10% 1.12% 1.22% 1.29% 1.40% Peer 1 Peer 2 STI Peer 3 Pe r 4 Pe r 5 Pe r 6 Pe r 7 Pe r 8 Pe r 9 4.5% 4.5% 4.6% 4.7% 5.0% 5.2% 5.6% 5.8% 6.5% 6.9% STI Peer 1 Peer 2 Peer 3 Peer 4 Peer 5 Peer 6 Peer 7 Peer 8 Peer 9 See Appendix slide #23 for footnotes

12 1Q 14 1Q 16 $404 $462 2014 LTM $58.9 $70.8 1Q 14 1Q 16 $42.3 $53.6 1Q 14 1Q 16 Wholesale Banking Leverage Differentiated Model… Full Product Capabilities Industry Vertical Expertise Middle Market Focus OneTeam Approach Balance Sheet Universal Banks Regional Banks Boutique Firms …To Drive Continued Long-Term Growth Left Lead Relationships Investing in Growth Opportunities Strong & Diverse Franchise Improving Returns & Efficiency Strong Capital Position Success of the SunTrust OneTeam Approach1 36% increase in capital markets revenue from Commercial Banking, CRE, and PWM clients 49% increase in the number of M&A and syndicated loan transactions from Commercial Banking, CRE, and PWM clients Average Deposits ($B) Average Loans ($B) Investment Banking Income ($MM) 2 1 SunTrust Wholesale Banking 1. Growth rates represent year-over-year growth from 2014 to 2015

13 39% 49% 34% 47% Consumer Self-service Deposits Consumer Paperless Penetration 1Q 15 1Q 16 11.4% 13.9% 1Q 15 1Q 16 Enables… Consumer Banking: Omni-Channel Execution of Omni-Channel Strategy Investing in Growth Opportunities Strong & Diverse Franchise Improving Returns & Efficiency Strong Capital Position Improved Client Experience Increased Revenue Opportunities Digital Sales3 Reduced Cost to Serve 2 1 ATM Digital Contact Center Branch See Appendix slide #23 for footnotes

14 Consumer Lending Opportunities Third-Party Partnerships Credit Card Investing in Growth Opportunities Strong & Diverse Franchise Improving Returns & Efficiency Strong Capital Position LightStream ($ in billions, average balances) National online consumer lending platform Application to close process is simple and fast Over 90% of clients surveyed would recommend LightStream to others Primary partner today: online lender providing financing for home improvement projects Potential for additional partnerships in the future New product offerings introduced in 4Q15 with enhanced reward programs Clients who use multiple SunTrust products are rewarded for their relationship with additional benefits $0.9 $1.1 1Q 15 1Q 16 $1.1 $1.5 1Q 15 1Q 16 $0.9 $2.0 1Q 15 1Q 16 Focused on lending to prime and super-prime clients: average FICO score of 750+ across all 3 products

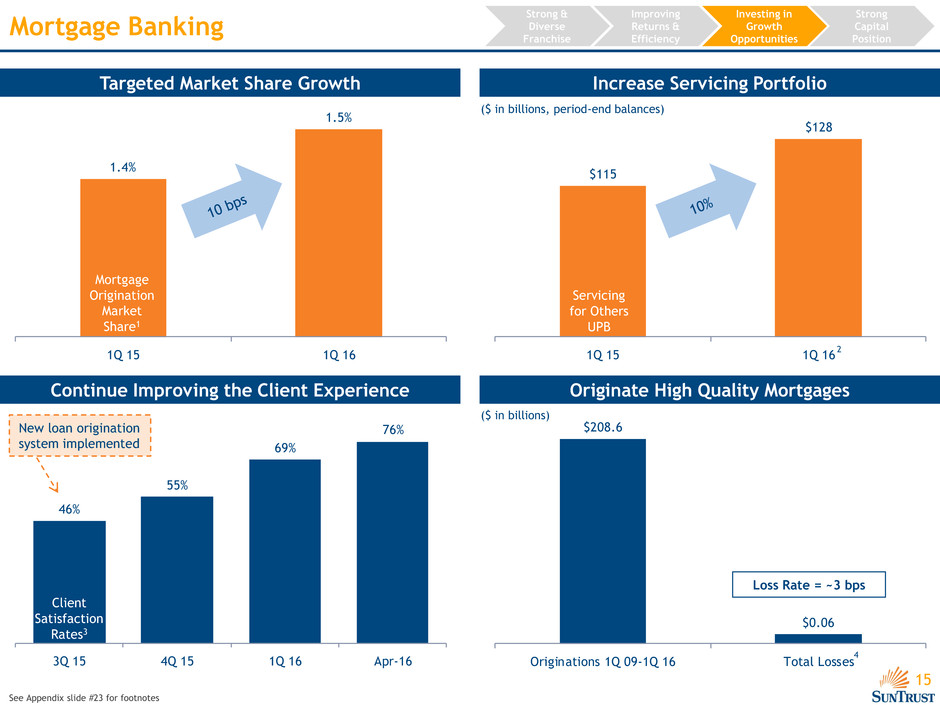

15 1.4% 1.5% 1Q 15 1Q 16 $115 $128 1Q 15 1Q 16 Mortgage Banking Servicing for Others UPB ($ in billions, period-end balances) Mortgage Origination Market Share1 ($ in billions) Targeted Market Share Growth Increase Servicing Portfolio Investing in Growth Opportunities Strong & Diverse Franchise Improving Returns & Efficiency Strong Capital Position 2 $208.6 $0.06 Originations 1Q 09-1Q 16 Total Losses Loss Rate = ~3 bps 4 Originate High Quality Mortgages Continue Improving the Client Experience 46% 55% 69% 76% 3Q 15 4Q 15 1Q 16 Apr-16 Client Satisfaction Rates3 New loan origination system implemented See Appendix slide #23 for footnotes

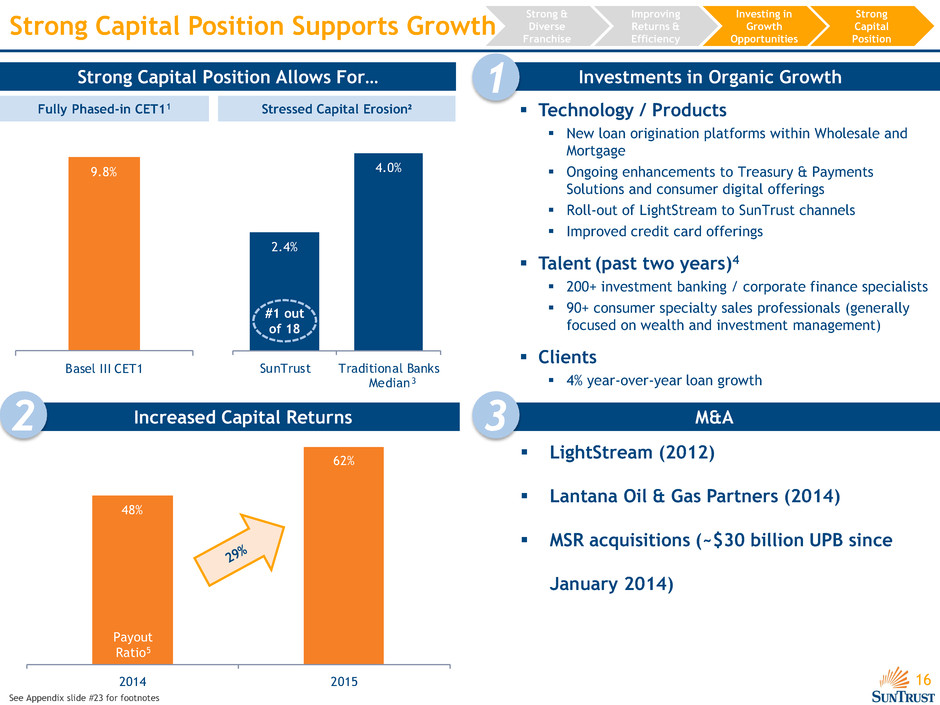

16 48% 62% 2014 2015 Strong Capital Position Supports Growth LightStream (2012) Lantana Oil & Gas Partners (2014) MSR acquisitions (~$30 billion UPB since January 2014) Increased Capital Returns M&A Investments in Organic Growth Fully Phased-in CET11 Stressed Capital Erosion2 Strong Capital Position Allows For… 2.4% 4.0% SunTrust Traditional Banks Median #1 out of 18 3 Investing in Growth Opportunities Strong & Diverse Franchise Improving Returns & Efficiency Strong Capital Position 1 2 3 9.8% Basel III CET1 Payout Ratio5 See Appendix slide #23 for footnotes Technology / Products New loan origination platforms within Wholesale and Mortgage Ongoing enhancements to Treasury & Payments Solutions and consumer digital offerings Roll-out of LightStream to SunTrust channels Improved credit card offerings Talent (past two years)4 200+ investment banking / corporate finance specialists 90+ consumer specialty sales professionals (generally focused on wealth and investment management) Clients 4% year-over-year loan growth

17 Investment Thesis Why invest in SunTrust? Investing in Growth Opportunities Strong & Diverse Franchise Improving Returns & Efficiency Strong Capital Position Supports Growth

Appendix

19 Sector Exposure1 Outstandings Nonaccruals Criticized Accruing Total Criticized Downstream $1.5 $0.2 0% 0% 0% Midstream $4.4 $1.8 2% 7% 9% Upstream (E&P) $2.0 $0.8 37% 45% 82% Drilling / Oilfield Services (OFS) $1.4 $0.5 19% 13% 32% Other $0.1 $0.0 0% 6% 6% Total $9.4 $3.3 13% 17% 29% Criticized Loans Energy: 2.4% Other: 97.6% Energy Portfolio Details ($ in billions) Note: All data as of March 31, 2016. Totals may not foot due to rounding 1. Exposure includes loans outstanding and unfunded commitments Commentary Key portfolio statistics: □ E&P and OFS represent only 38% of the energy portfolio □ Energy reserves / energy loans: 4.6% □ Energy reserves / E&P and OFS loans: 11.9% □ $18 million of charge-offs recognized since October 1, 2015 □ >90% of nonaccrual loans were current as of March 31, 2016 Strong overall collateral coverage Immaterial second lien exposure Robust and experienced team with more than 60 energy specialists, including on-staff petroleum reserve engineers □ Average tenure of 14+ years with SunTrust and 30+ years in risk management Portfolio Overview 2.4% of Total Loans Outstanding Total Loans: $140 billion

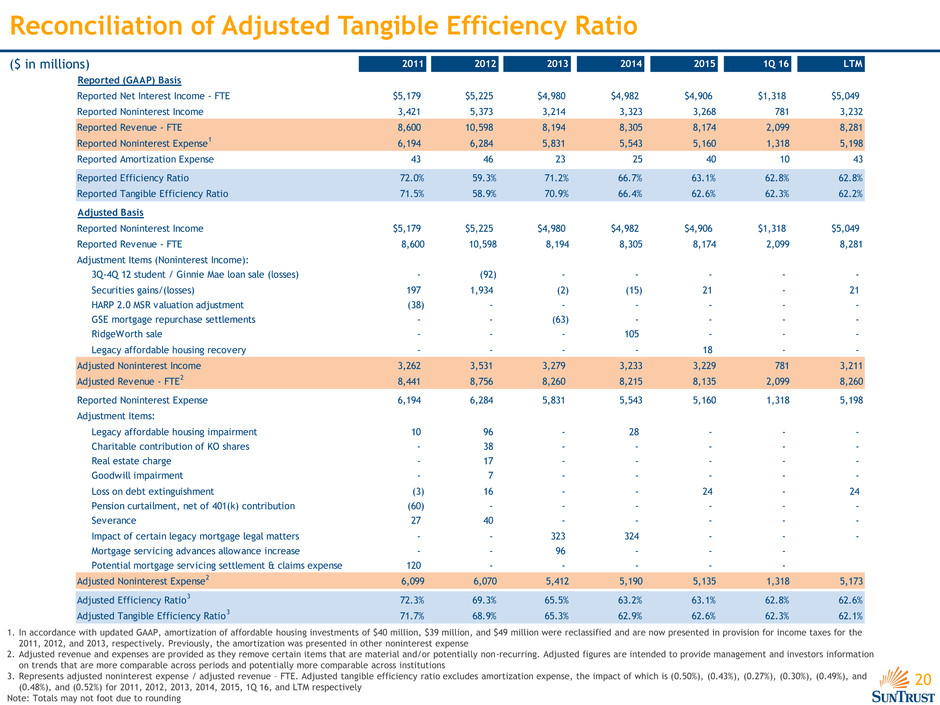

20 Reconciliation of Adjusted Tangible Efficiency Ratio ($ in millions) 1. In accordance with updated GAAP, amortization of affordable housing investments of $40 million, $39 million, and $49 million were reclassified and are now presented in provision for income taxes for the 2011, 2012, and 2013, respectively. Previously, the amortization was presented in other noninterest expense 2. Adjusted revenue and expenses are provided as they remove certain items that are material and/or potentially non-recurring. Adjusted figures are intended to provide management and investors information on trends that are more comparable across periods and potentially more comparable across institutions 3. Represents adjusted noninterest expense / adjusted revenue – FTE. Adjusted tangible efficiency ratio excludes amortization expense, the impact of which is (0.50%), (0.43%), (0.27%), (0.30%), (0.49%), and (0.48%), and (0.52%) for 2011, 2012, 2013, 2014, 2015, 1Q 16, and LTM respectively Note: Totals may not foot due to rounding 2011 2012 2013 2014 2015 1Q 16 LTM Reported (GAAP) Basis Reported Net Interest Income - FTE $5,179 $5,225 $4,980 $4,982 $4,906 $1,318 $5,049 Reported Noninterest Income 3,421 5,373 3,214 3,323 3,268 781 3,232 Reported Revenue - FTE 8,600 10,598 8,194 8,305 8,174 2,099 8,281 Reported Noninterest Expense 1 6,194 6,284 5,831 5,543 5,160 1,318 5,198 Reported Amortization Expense 43 46 23 25 40 10 43 Reported Efficiency Ratio 72.0% 59.3% 71.2% 66.7% 63.1% 62.8% 62.8% Reported Tangible Efficiency Ratio 71.5% 58.9% 70.9% 66.4% 62.6% 62.3% 62.2% Adjusted Basis Reported Noninterest Income $5,179 $5,225 $4,980 $4,982 $4,906 $1,318 $5,049 Reported Revenue - FTE 8,600 10,598 8,194 8,305 8,174 2,099 8,281 Adjustment Items (Noninterest Income): 3Q-4Q 12 student / Ginnie Mae loan sale (losses) - (92) - - - - - Securities gains/(losses) 197 1,934 (2) (15) 21 - 21 HARP 2.0 MSR valuation adjustment (38) - - - - - - GSE mortgage repurchase settlements - - (63) - - - - RidgeWorth sale - - - 105 - - - Legacy affordable housing recovery - - - - 18 - - Adjusted Noninterest Income 3,262 3,531 3,279 3,233 3,229 781 3,211 Adjusted Revenue - FTE 2 8,441 8,756 8,260 8,215 8,135 2,099 8,260 Reported Noninterest Expense 6,194 6,284 5,831 5,543 5,160 1,318 5,198 Adjustment Items: Legacy affordable housing impairment 10 96 - 28 - - - Charitable contribution of KO shares - 38 - - - - - Real estate charge - 17 - - - - - Goodwill impairment - 7 - - - - - Loss on debt extinguishment (3) 16 - - 24 - 24 Pension curtailment, net of 401(k) contribution (60) - - - - - - Severance 27 40 - - - - - Impact of certain legacy mortgage legal matters - - 323 324 - - - Mortgage servicing advances allowance increase - - 96 - - - Potential mortgage servicing settlement & claims expense 120 - - - - - Adjusted Noninterest Expense 2 6,099 6,070 5,412 5,190 5,135 1,318 5,173 Adjusted Efficiency Ratio 3 72.3% 69.3% 65.5% 63.2% 63.1% 62.8% 62.6% Adjusted Tangible Efficiency Ratio 3 71.7% 68.9% 65.3% 62.9% 62.6% 62.3% 62.1%

21 Reconciliation of Tangible Book Value Per Share ($ in millions, except per-share data) 1. SunTrust presents a tangible book value per common share that excludes the after-tax impact of purchase accounting intangible assets and also excludes preferred stock and noncontrolling interest from tangible equity. The Company believes this measure is useful to investors because, by removing the effect of intangible assets that result from merger and acquisition activity, as well as preferred stock and noncontrolling interest (the level of which may vary from company to company), it allows investors to more easily compare the Company’s book value on common stock to other companies in the industry Note: Totals may not foot due to rounding 1Q 15 1Q 16 Total Shareholders' Equity $23,260 $24,053 Goodwill, net of deferred taxes of $231 million and $243 million, respectively (6,106) (6,094) Other Intangible Assets, (including MSRs and other servicing rights), net of deferred taxes of $0 million and $3 million, respectively (1,193) (1,195) MSRs & other servicing rights 1,181 1,189 Tangible Equity $17,142 $17,953 Noncontrolling interest (106) (101) Preferred Stock (1,225) (1,225) Tangible Common Equity $15,811 $16,627 Tangible Book Value per Common Share1 $30.29 $32.90

22 Reconciliation of Common Equity Tier 1 Ratio1 ($ in billions) 1Q 16 Common Equity Tier 1 – Transitional $16.5 Adjustments2 (0.1) Common Equity Tier 1 – Fully phased-in $16.5 Risk-weighted Assets: Common Equity Tier 1 – Transitional $167.1 Adjustments3 1.8 Risk-weighted Assets: Common Equity Tier 1 – Fully phased-in $169.0 Common Equity Tier 1 – Transitional 9.9% Common Equity Tier 1 – Fully phased-in 9.8% 1. The Common Equity Tier 1 ratio is subject to certain phase-in requirements under Basel III beginning in 2015, and as such we have presented a reconciliation of the Common Equity Tier 1 ratio as calculated considering the phase-in requirements (Common Equity Tier 1 – Transitional) to the fully phased-in ratio 2. Primarily includes the phase-out from capital of certain DTAs, the overfunded pension asset, and other intangible assets 3. Primarily relates to the increased risk weight to be applied to mortgage servicing assets on a fully phased-in basis Note: Totals may not foot due to rounding

23 Footnotes Slide #4: 1. Assets, loans, deposits, client, and teammate data as of March 31, 2016; market capitalization as of May 12, 2016 2. Rank is amongst U.S. bank holding companies and excludes non-traditional banks. Asset and loan rankings are sourced via bank holding company regulatory filings (Y-9C) and are as of December 31, 2015. Deposit and branch rankings are sourced via FDIC deposit market share data, and are as of June 30, 2015, pro-forma for completed and pending mergers and acquisitions 3. Represents full-time equivalent employees 4. Source: SNL Financial, as of June 30, 2015, based on top 10 MSAs (by deposits) for each institution. Numerator is company’s total deposits in its top 10 MSAs and denominator is total deposits in those 10 MSAs Note: Peer group includes BBT, CMA, COF, FITB, KEY, MTB, PNC, RF, USB, WFC Slide #13: 1. Consumer self-service deposit transactions include mobile, tablet, and ATM (excludes direct deposit) 2. Refers to paperless statement adoption by consumer clients 3. Defined as all new account center units sales plus national and SunTrust.com unit sales for LightStream Slide #16: 1. Please see Appendix slide #22 to reconcile to GAAP CET1 ratio 2. Represents the difference between the starting and minimum Basel III Common Equity Tier 1 Ratios resulting from the Federal Reserve’s 2015 CCAR severely adverse scenario 3. CCAR 2015 Traditional Banks include BAC, BBT, BBVA, BMO, C, CFG, CMA, FITB, HBAN, JPM, KEY, MTB, PNC, RF, STI, USB, WFC, ZION 4. Represents net hires since January 1, 2014 5. Payout Ratio = (Common Stock Dividends and Share Repurchases) / Net Income Available to Common Shareholders Slide #11: 1. Represents nonaccrual loans divided by total loans (excluding loans held for sale). Source: Company financials as of March 31, 2016 2. Source: Federal Reserve (http://www.federalreserve.gov/newsevents/press/bcreg/bcreg20150305a1.pdf). Represents Federal Reserve’s estimate of loan losses over 9 quarters (as a % of average total loans) in a severely adverse economic scenario 3. E&P = Exploration and Production. OFS = Oilfield Services. Data as March 31, 2016 Note: Peer group include: BBT, CMA, FITB, KEY, MTB, PNC, RF, USB, WFC Slide #15: 1. SunTrust Mortgage’s closed loan volume as a percentage of the average of the total industry closed loan volume, as published by FHLMC, FNMA and the MBA 2. Pro forma for recent acquisition of ~$8 billion UPB of mortgage servicing (~$2 billion of which was incorporated in 1Q 16 balances and ~$6 billion of which will transfer in 2Q 16) 3. Data based on survey of over 800 clients conducted by Gallup. Represents overall client satisfaction with the loan origination process 4. Total losses include net charge-offs for balance sheet loans and repurchase losses for sold loans (represents all loans originated from 1Q 09 through 1Q 16) All Slides: Note: ‘LTM’ refers to the 12 months ended March 31, 2016 Slide #10: 1. Data as of March 31, 2016. Consumer Lending includes consumer direct loans (other than student guaranteed), consumer indirect loans and consumer credit cards. Guaranteed includes guaranteed student loans and guaranteed residential mortgages. Construction includes both commercial and residential construction. Note: totals may not foot due to rounding 2. Return on average common shareholders’ equity was 6.3%, 8.1%, and 8.4% for 2013, 2014, and 2015, respectively. The effect of excluding intangible assets, excluding MSRs ,was 2.9%, 3.3%, and 3.2% for 2013, 2014, and 2015, respectively 3. Not including real estate loans which are classified as C&I 4. Represents weighted average score for 2015. Includes consumer loans, home equity, and residential mortgage. Excludes guaranteed loans