Attached files

| file | filename |

|---|---|

| 8-K - 8-K - Discover Financial Services | d193679d8k.htm |

2016 Barclays Americas Select Franchise Conference Mark Graf EVP & Chief Financial Officer May 17, 2016 ©2016 DISCOVER FINANCIAL SERVICES Exhibit 99.1

Notice The following slides are part of a presentation by Discover Financial Services (the "Company") and are intended to be viewed as part of that presentation. No representation is made that the information in these slides is complete. Throughout these materials, direct-to-consumer deposits are referred to as DTC deposits or direct deposits. DTC, or direct deposits include deposit products that we offer to customers through direct marketing, internet origination and affinity relationships. DTC, or direct deposits include certificates of deposits, money market accounts, online savings and checking accounts, and IRA certificates of deposit. The information provided herein includes certain non-GAAP financial measures. The reconciliations of such measures to the comparable GAAP figures are included at the end of this presentation, which is available on the Company’s website at www.discover.com and the SEC’s website. The presentation contains forward-looking statements. You are cautioned not to place undue reliance on forward-looking statements, which speak only as of the date on which they are made, which reflect management’s estimates, projections, expectations or beliefs at that time, and which are subject to risks and uncertainties that may cause actual results to differ materially. For a discussion of certain risks and uncertainties that may affect the future results of the Company, please see "Special Note Regarding Forward-Looking Statements," "Risk Factors," "Business – Competition," "Business – Supervision and Regulation" and "Management’s Discussion and Analysis of Financial Condition and Results of Operations" in the Company’s Annual Report on Form 10-K for the year ended December 31, 2015 and "Management’s Discussion and Analysis of Financial Condition and Results of Operations" in the Company’s Quarterly Report on Form 10-Q for the quarter ended March 31, 2016 which is filed with the SEC and available at the SEC's website (www.sec.gov). The Company does not undertake to update or revise forward-looking statements as more information becomes available. We own or have rights to use the trademarks, trade names and service marks that we use in conjunction with the operation of our business, including, but not limited to: Discover®, PULSE®, Cashback Bonus®, Discover Cashback Checking®, Discover it®, Freeze ItSM, Discover® Network and Diners Club International®. All other trademarks, trade names and service marks included in this presentation are the property of their respective owners.

Executive Summary Attractive business model with a solid record of success Delivering strong card growth Driven by more new accounts, wallet share gain and favorable credit results Aided by proprietary network impact on brand, consideration and rewards Utilizing consumer unsecured lending and marketing capabilities to grow non-card assets Leveraging a payments partnership strategy to support Card issuing and position the business for third-party volume growth Creating shareholder value through effective capital management

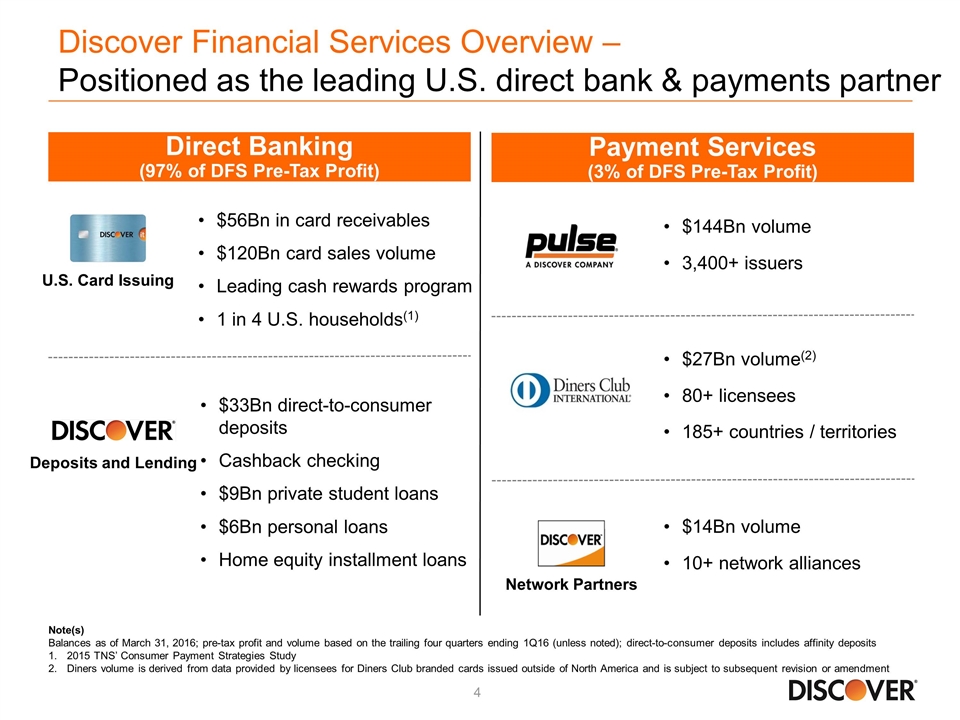

Discover Financial Services Overview – Positioned as the leading U.S. direct bank & payments partner Note(s) Balances as of March 31, 2016; pre-tax profit and volume based on the trailing four quarters ending 1Q16 (unless noted); direct-to-consumer deposits includes affinity deposits 2015 TNS’ Consumer Payment Strategies Study Diners volume is derived from data provided by licensees for Diners Club branded cards issued outside of North America and is subject to subsequent revision or amendment Direct Banking (97% of DFS Pre-Tax Profit) Payment Services (3% of DFS Pre-Tax Profit) U.S. Card Issuing $56Bn in card receivables $120Bn card sales volume Leading cash rewards program 1 in 4 U.S. households(1) Deposits and Lending $33Bn direct-to-consumer deposits Cashback checking $9Bn private student loans $6Bn personal loans Home equity installment loans $14Bn volume 10+ network alliances $144Bn volume 3,400+ issuers $27Bn volume(2) 80+ licensees 185+ countries / territories Network Partners

Discover’s Vision – To be the leading direct bank and payments partner Rewards Discover Proprietary Payment Network Credit Risk Management Customer Service Loyal Customer Base

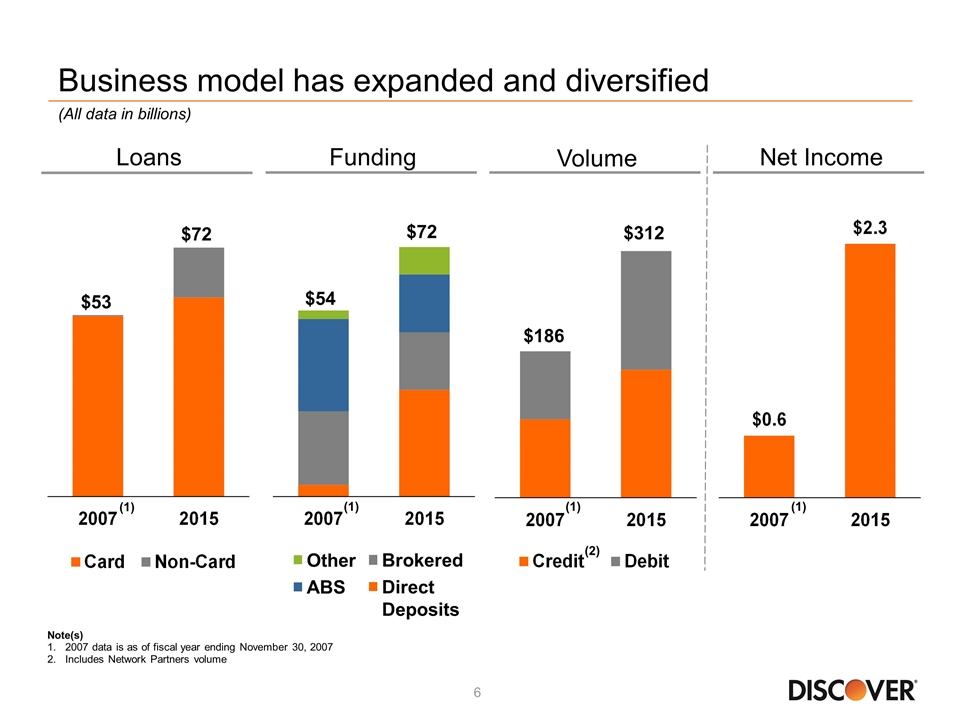

Business model has expanded and diversified Loans Funding Volume Other ABS Brokered Direct Deposits Note(s) 2007 data is as of fiscal year ending November 30, 2007 Includes Network Partners volume Net Income (All data in billions) $53 $72 $54 $72 $186 $312 (2) (1) (1) (1) (1)

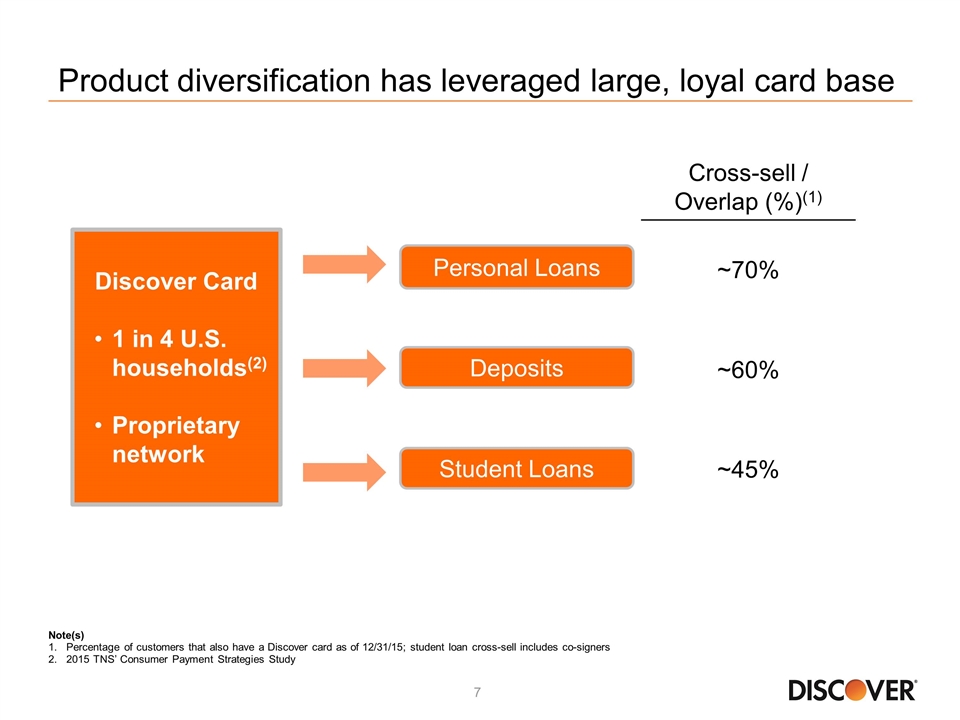

Product diversification has leveraged large, loyal card base Discover Card 1 in 4 U.S. households(2) Proprietary network Student Loans Personal Loans Deposits Cross-sell / Overlap (%)(1) ~70% ~60% ~45% Note(s) Percentage of customers that also have a Discover card as of 12/31/15; student loan cross-sell includes co-signers 2015 TNS’ Consumer Payment Strategies Study

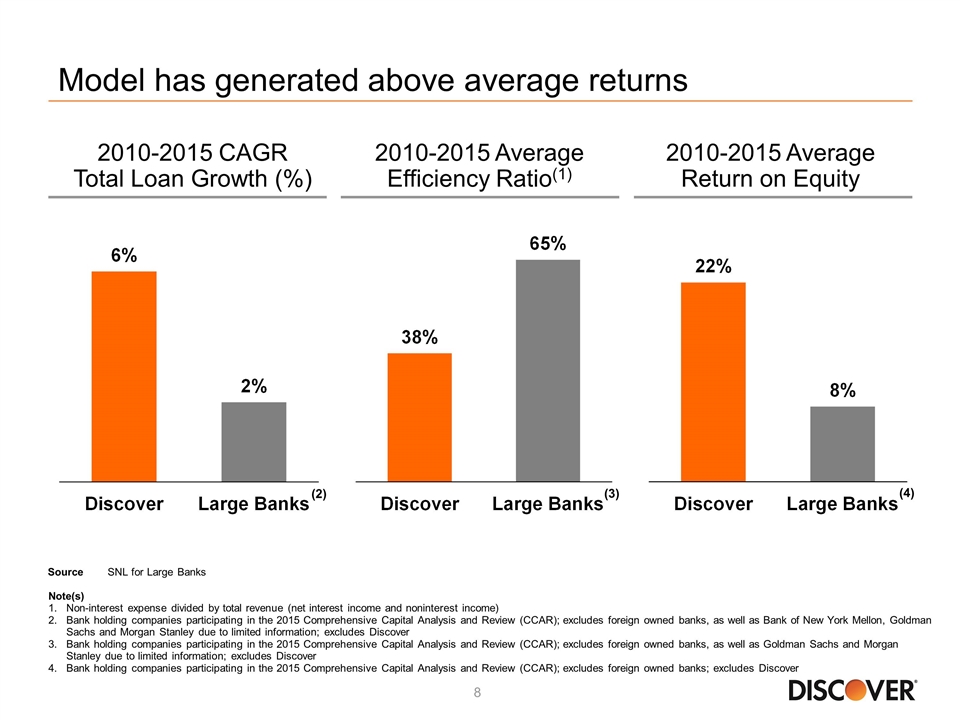

Model has generated above average returns 2010-2015 Average Efficiency Ratio(1) 2010-2015 Average Return on Equity 2010-2015 CAGR Total Loan Growth (%) (3) Note(s) Non-interest expense divided by total revenue (net interest income and noninterest income) Bank holding companies participating in the 2015 Comprehensive Capital Analysis and Review (CCAR); excludes foreign owned banks, as well as Bank of New York Mellon, Goldman Sachs and Morgan Stanley due to limited information; excludes Discover Bank holding companies participating in the 2015 Comprehensive Capital Analysis and Review (CCAR); excludes foreign owned banks, as well as Goldman Sachs and Morgan Stanley due to limited information; excludes Discover Bank holding companies participating in the 2015 Comprehensive Capital Analysis and Review (CCAR); excludes foreign owned banks; excludes Discover (4) Source SNL for Large Banks (2)

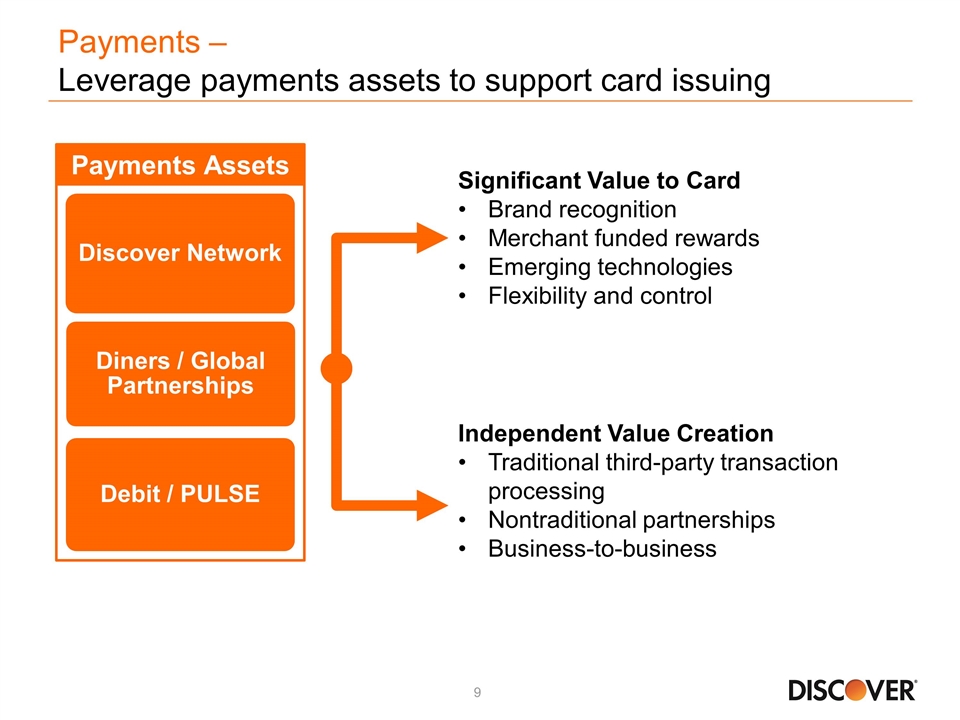

Payments – Leverage payments assets to support card issuing Payments Assets Significant Value to Card Brand recognition Merchant funded rewards Emerging technologies Flexibility and control Independent Value Creation Traditional third-party transaction processing Nontraditional partnerships Business-to-business Discover Network Diners / Global Partnerships Debit / PULSE

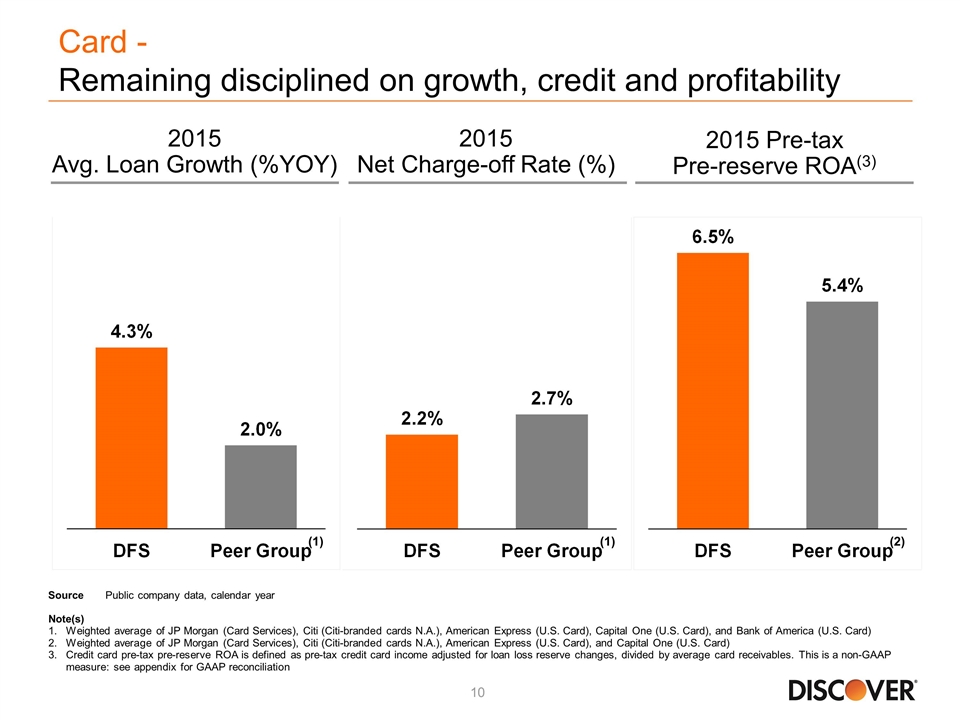

Card - Remaining disciplined on growth, credit and profitability Note(s) Weighted average of JP Morgan (Card Services), Citi (Citi-branded cards N.A.), American Express (U.S. Card), Capital One (U.S. Card), and Bank of America (U.S. Card) Weighted average of JP Morgan (Card Services), Citi (Citi-branded cards N.A.), American Express (U.S. Card), and Capital One (U.S. Card) Credit card pre-tax pre-reserve ROA is defined as pre-tax credit card income adjusted for loan loss reserve changes, divided by average card receivables. This is a non-GAAP measure: see appendix for GAAP reconciliation 2015 Avg. Loan Growth (%YOY) 2015 Net Charge-off Rate (%) 2015 Pre-tax Pre-reserve ROA(3) Source Public company data, calendar year (1) (1) (2) (1)

U.S. Card – Innovation and brand strength are driving growth Innovative Features Freeze ItSM Free FICO® Redeem Any Amount, Any Time Apple Pay Products it it Miles it Secured New! it Chrome NHL (Student)

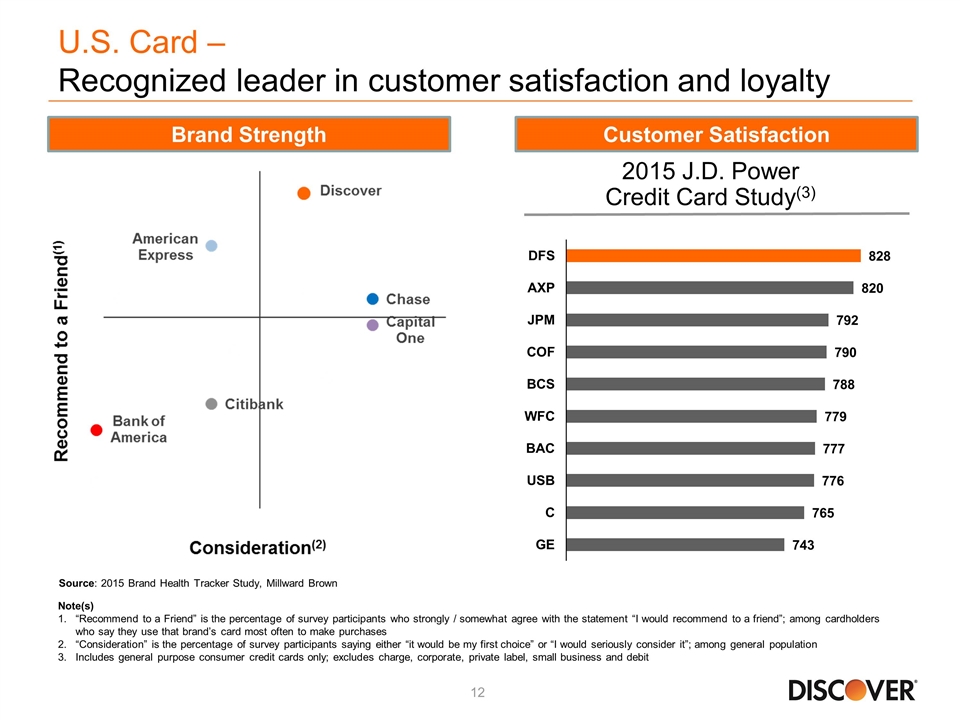

U.S. Card – Recognized leader in customer satisfaction and loyalty 2015 J.D. Power Credit Card Study(3) Note(s) “Recommend to a Friend” is the percentage of survey participants who strongly / somewhat agree with the statement “I would recommend to a friend”; among cardholders who say they use that brand’s card most often to make purchases “Consideration” is the percentage of survey participants saying either “it would be my first choice” or “I would seriously consider it”; among general population Includes general purpose consumer credit cards only; excludes charge, corporate, private label, small business and debit Brand Strength Customer Satisfaction Source: 2015 Brand Health Tracker Study, Millward Brown

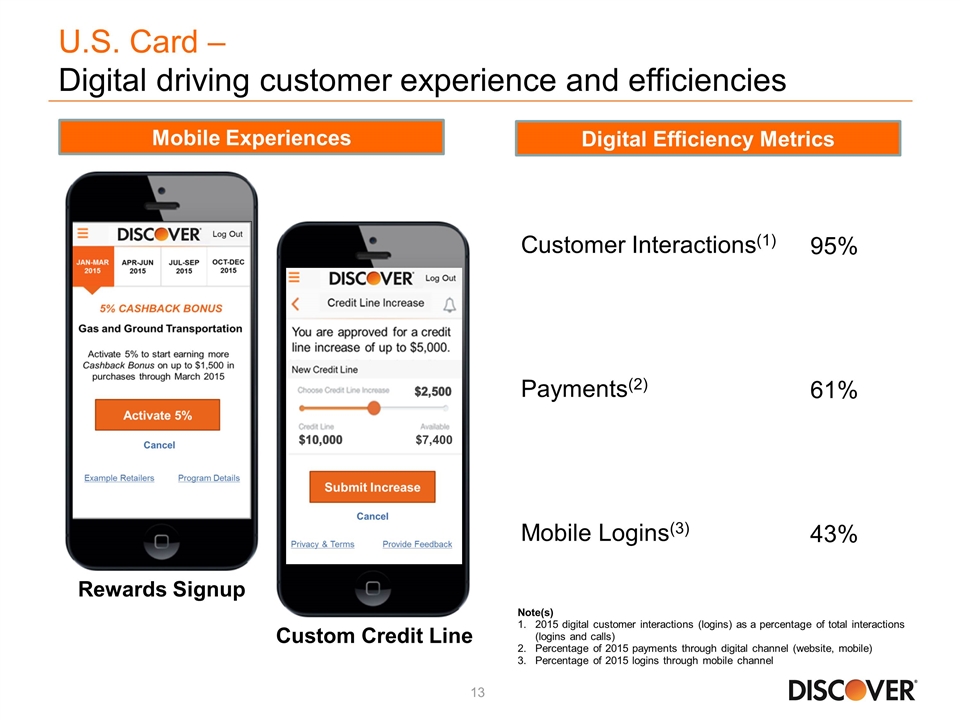

U.S. Card – Digital driving customer experience and efficiencies Customer Interactions(1) Payments(2) Mobile Logins(3) 95% 61% 43% Note(s) 2015 digital customer interactions (logins) as a percentage of total interactions (logins and calls) Percentage of 2015 payments through digital channel (website, mobile) Percentage of 2015 logins through mobile channel Custom Credit Line Rewards Signup Mobile Experiences Digital Efficiency Metrics $7,400 $2,500 $10,000

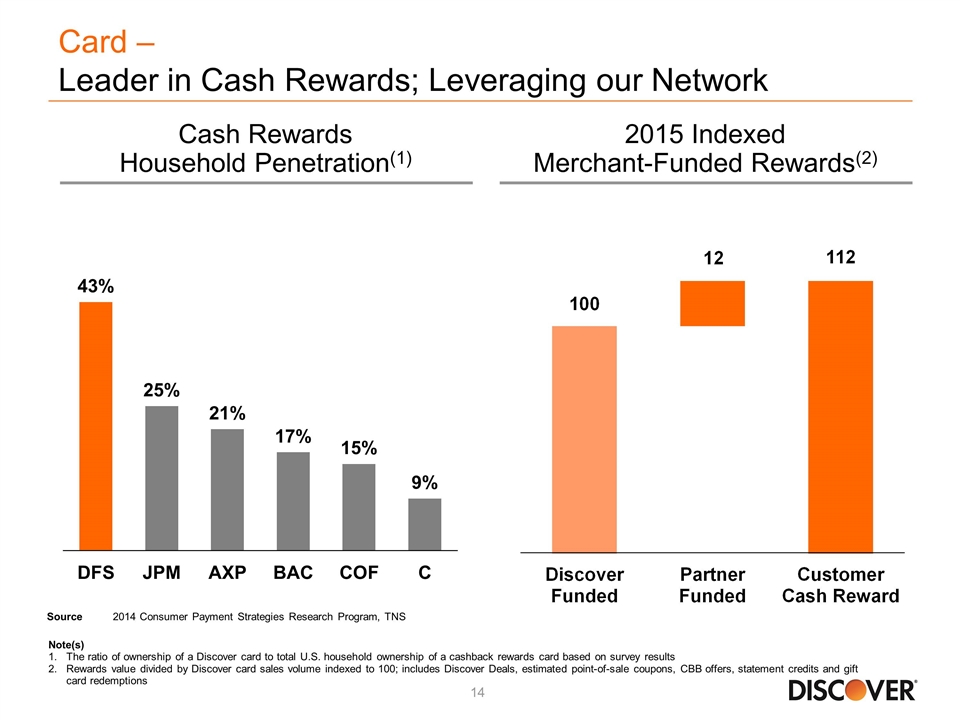

Card – Leader in Cash Rewards; Leveraging our Network 2015 Indexed Merchant-Funded Rewards(2) Cash Rewards Household Penetration(1) Note(s) The ratio of ownership of a Discover card to total U.S. household ownership of a cashback rewards card based on survey results Rewards value divided by Discover card sales volume indexed to 100; includes Discover Deals, estimated point-of-sale coupons, CBB offers, statement credits and gift card redemptions Source2014 Consumer Payment Strategies Research Program, TNS

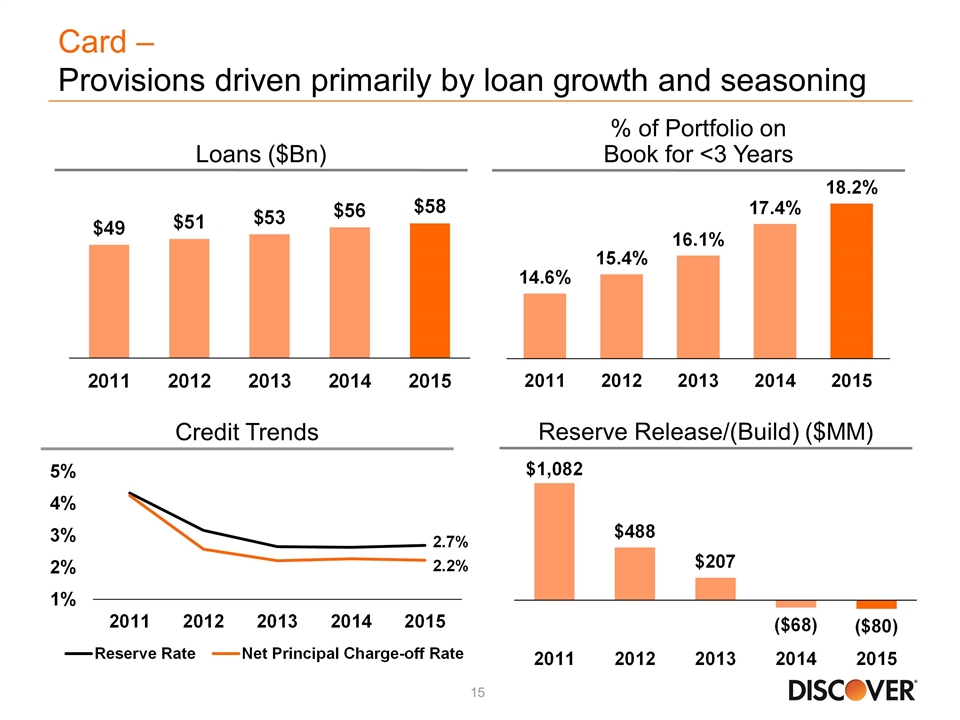

Card – Provisions driven primarily by loan growth and seasoning Loans ($Bn) Reserve Release/(Build) ($MM) Credit Trends % of Portfolio on Book for <3 Years

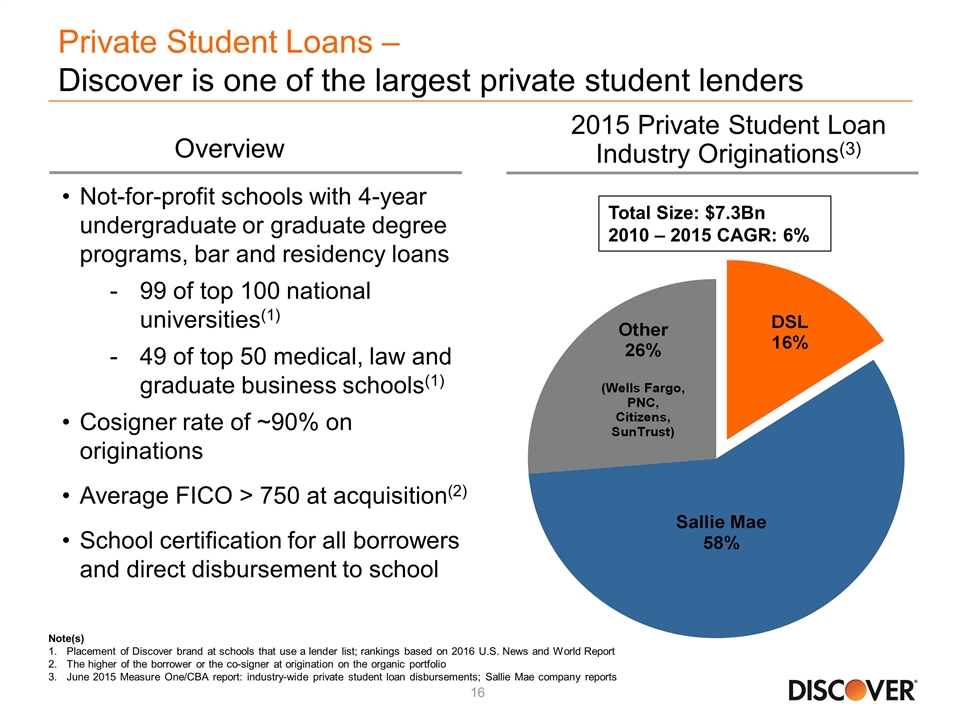

Private Student Loans – Discover is one of the largest private student lenders Overview 2015 Private Student Loan Industry Originations(3) Total Size: $7.3Bn 2010 – 2015 CAGR: 6% Not-for-profit schools with 4-year undergraduate or graduate degree programs, bar and residency loans 99 of top 100 national universities(1) 49 of top 50 medical, law and graduate business schools(1) Cosigner rate of ~90% on originations Average FICO > 750 at acquisition(2) School certification for all borrowers and direct disbursement to school Note(s) Placement of Discover brand at schools that use a lender list; rankings based on 2016 U.S. News and World Report The higher of the borrower or the co-signer at origination on the organic portfolio June 2015 Measure One/CBA report: industry-wide private student loan disbursements; Sallie Mae company reports

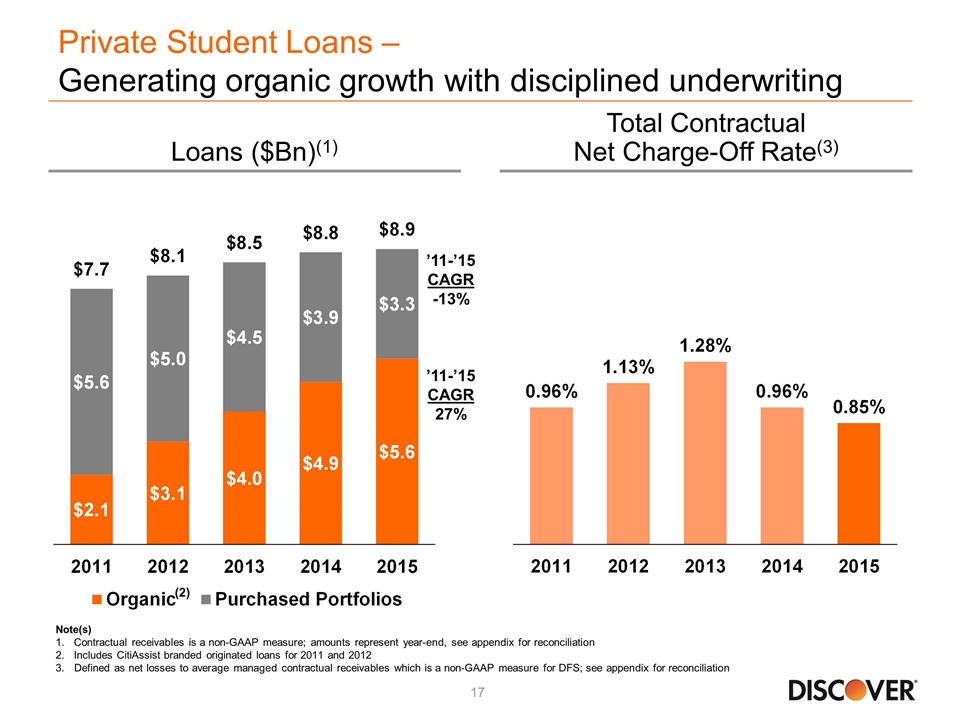

Note(s) Contractual receivables is a non-GAAP measure; amounts represent year-end, see appendix for reconciliation Includes CitiAssist branded originated loans for 2011 and 2012 Defined as net losses to average managed contractual receivables which is a non-GAAP measure for DFS; see appendix for reconciliation Private Student Loans – Generating organic growth with disciplined underwriting Total Contractual Net Charge-Off Rate(3) Loans ($Bn)(1) (2) ’11-’15 CAGR -13% ’11-’15 CAGR 27%

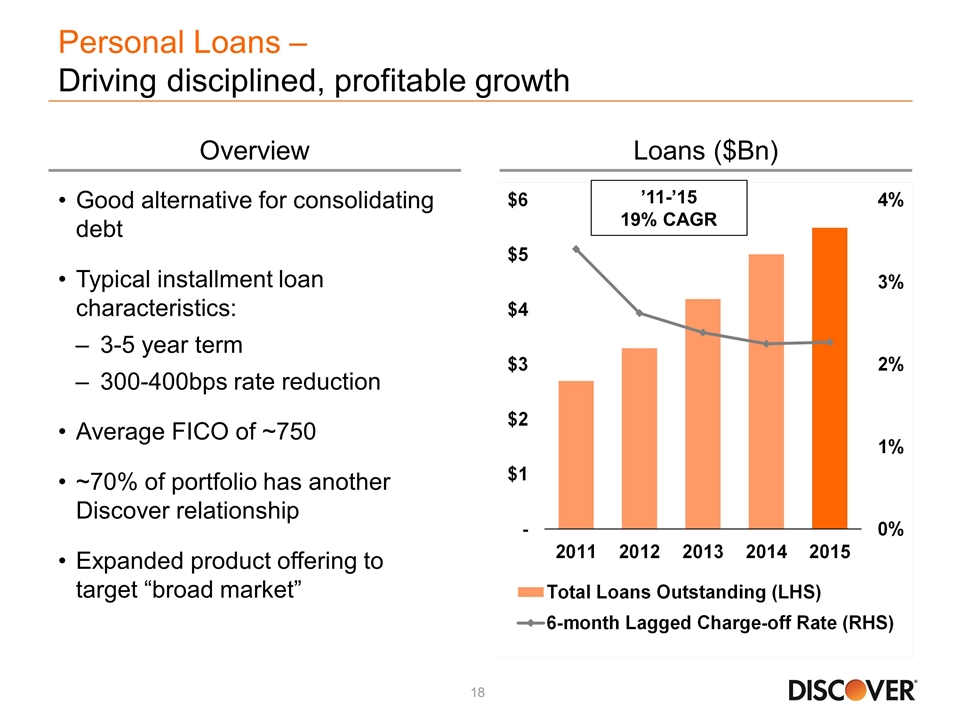

Personal Loans – Driving disciplined, profitable growth Overview Loans ($Bn) Good alternative for consolidating debt Typical installment loan characteristics: 3-5 year term 300-400bps rate reduction Average FICO of ~750 ~70% of portfolio has another Discover relationship Expanded product offering to target “broad market” ’11-’15 19% CAGR

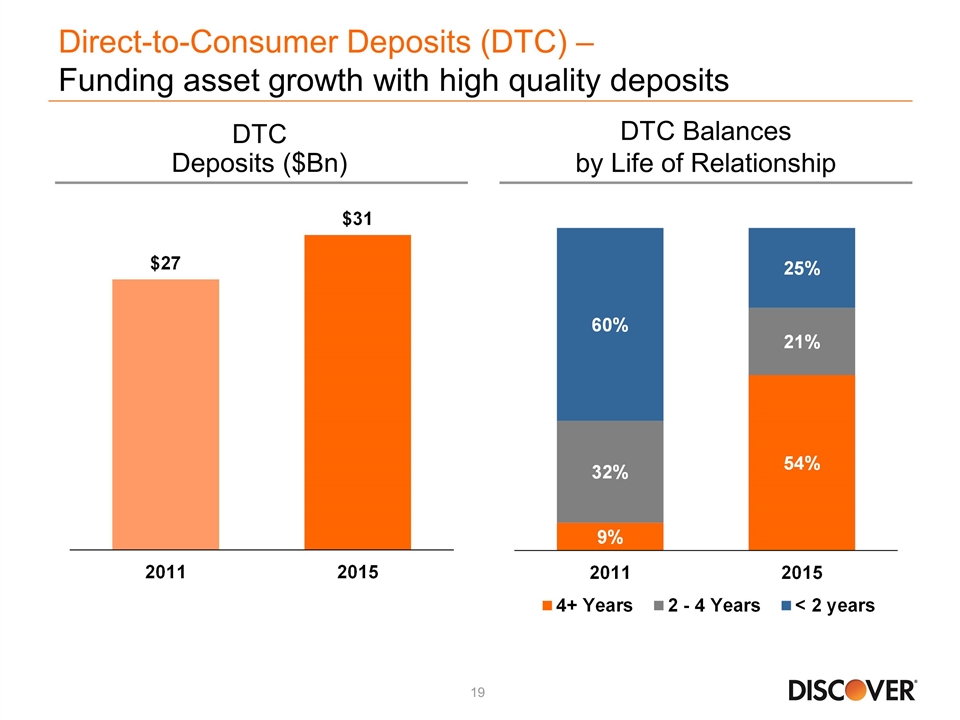

Direct-to-Consumer Deposits (DTC) – Funding asset growth with high quality deposits DTC Deposits ($Bn) DTC Balances by Life of Relationship

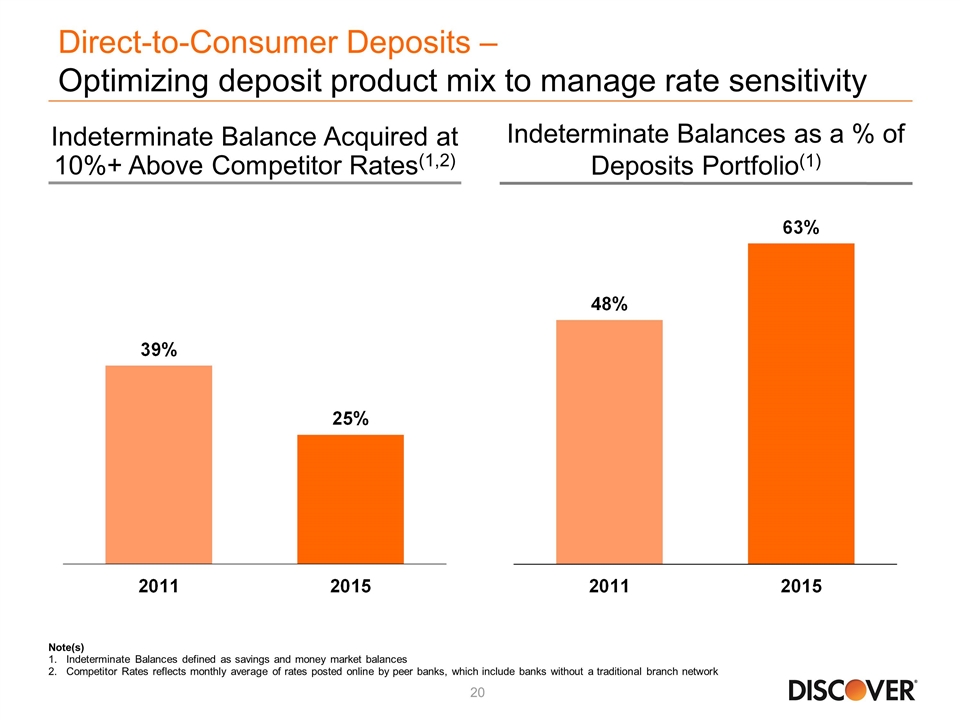

Direct-to-Consumer Deposits – Optimizing deposit product mix to manage rate sensitivity Indeterminate Balance Acquired at 10%+ Above Competitor Rates(1,2) Note(s) Indeterminate Balances defined as savings and money market balances Competitor Rates reflects monthly average of rates posted online by peer banks, which include banks without a traditional branch network Indeterminate Balances as a % of Deposits Portfolio(1)

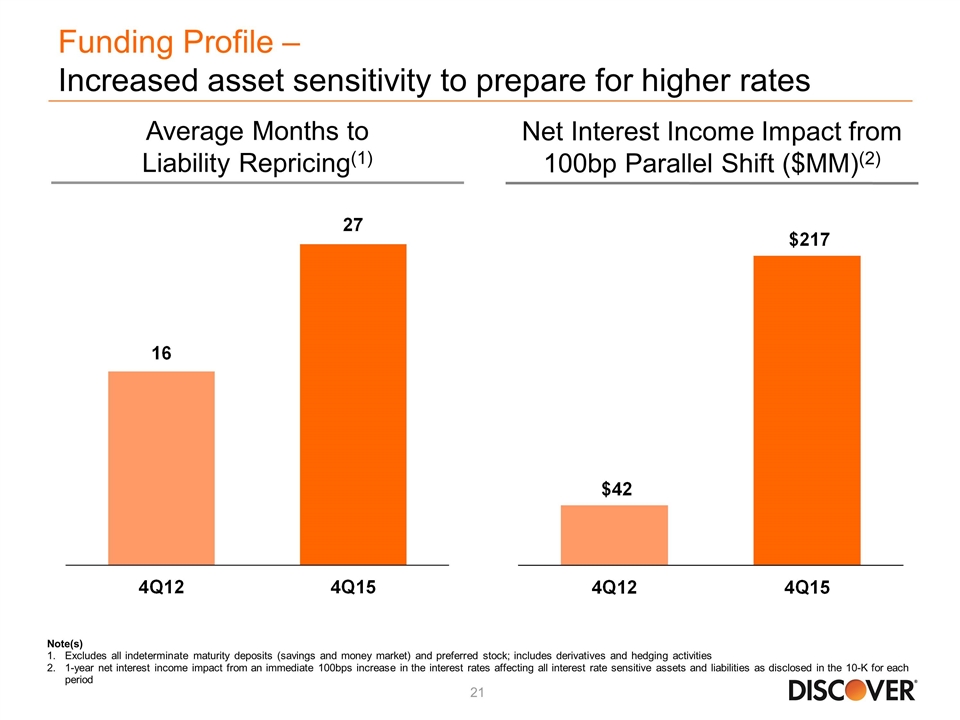

Funding Profile – Increased asset sensitivity to prepare for higher rates Average Months to Liability Repricing(1) Net Interest Income Impact from 100bp Parallel Shift ($MM)(2) Note(s) Excludes all indeterminate maturity deposits (savings and money market) and preferred stock; includes derivatives and hedging activities 1-year net interest income impact from an immediate 100bps increase in the interest rates affecting all interest rate sensitive assets and liabilities as disclosed in the 10-K for each period

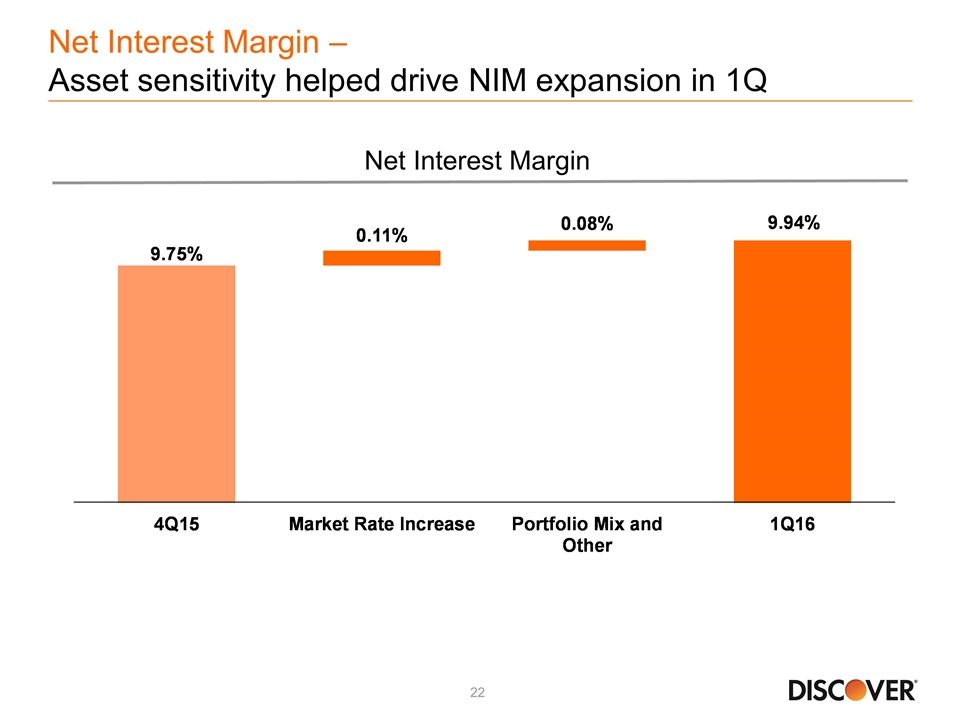

Net Interest Margin – Asset sensitivity helped drive NIM expansion in 1Q Net Interest Margin

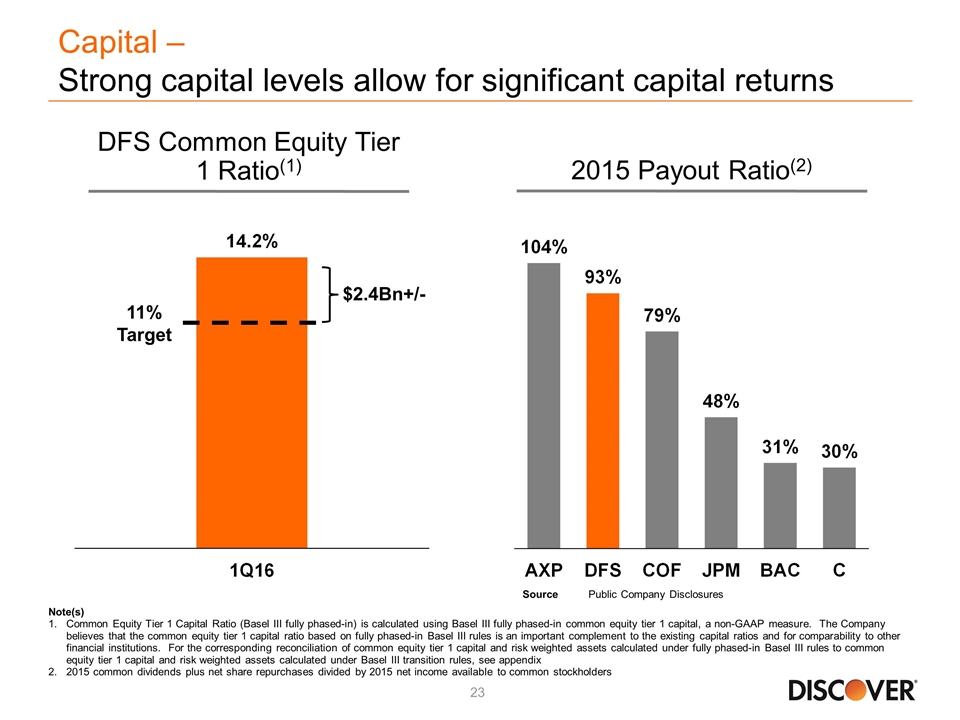

Capital – Strong capital levels allow for significant capital returns Note(s) Common Equity Tier 1 Capital Ratio (Basel III fully phased-in) is calculated using Basel III fully phased-in common equity tier 1 capital, a non-GAAP measure. The Company believes that the common equity tier 1 capital ratio based on fully phased-in Basel III rules is an important complement to the existing capital ratios and for comparability to other financial institutions. For the corresponding reconciliation of common equity tier 1 capital and risk weighted assets calculated under fully phased-in Basel III rules to common equity tier 1 capital and risk weighted assets calculated under Basel III transition rules, see appendix 2015 common dividends plus net share repurchases divided by 2015 net income available to common stockholders DFS Common Equity Tier 1 Ratio(1) 11% Target $2.4Bn+/- 2015 Payout Ratio(2) SourcePublic Company Disclosures

Summary – Key focus areas in 2016 Grow Loans and Revenue Operating Expense Leverage Leverage Payments Assets Enhance Controls & Risk Management Optimize Capital Deployment

Appendix

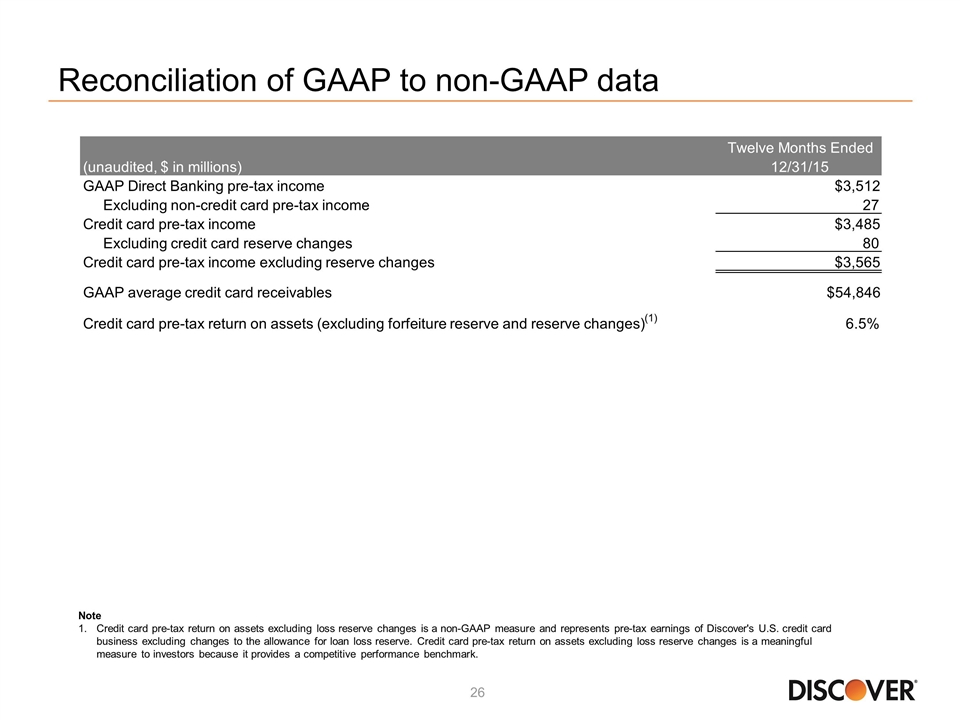

Reconciliation of GAAP to non-GAAP data Note Credit card pre-tax return on assets excluding loss reserve changes is a non-GAAP measure and represents pre-tax earnings of Discover's U.S. credit card business excluding changes to the allowance for loan loss reserve. Credit card pre-tax return on assets excluding loss reserve changes is a meaningful measure to investors because it provides a competitive performance benchmark. Twelve Months Ended (unaudited, $ in millions) 12/31/15 GAAP Direct Banking pre-tax income $3,512 Excluding non-credit card pre-tax income 27 Credit card pre-tax income $3,485 Excluding credit card reserve changes 80 Credit card pre-tax income excluding reserve changes $3,565 GAAP average credit card receivables $54,846 Credit card pre-tax return on assets (excluding forfeiture reserve and reserve changes) (1) 6.5%

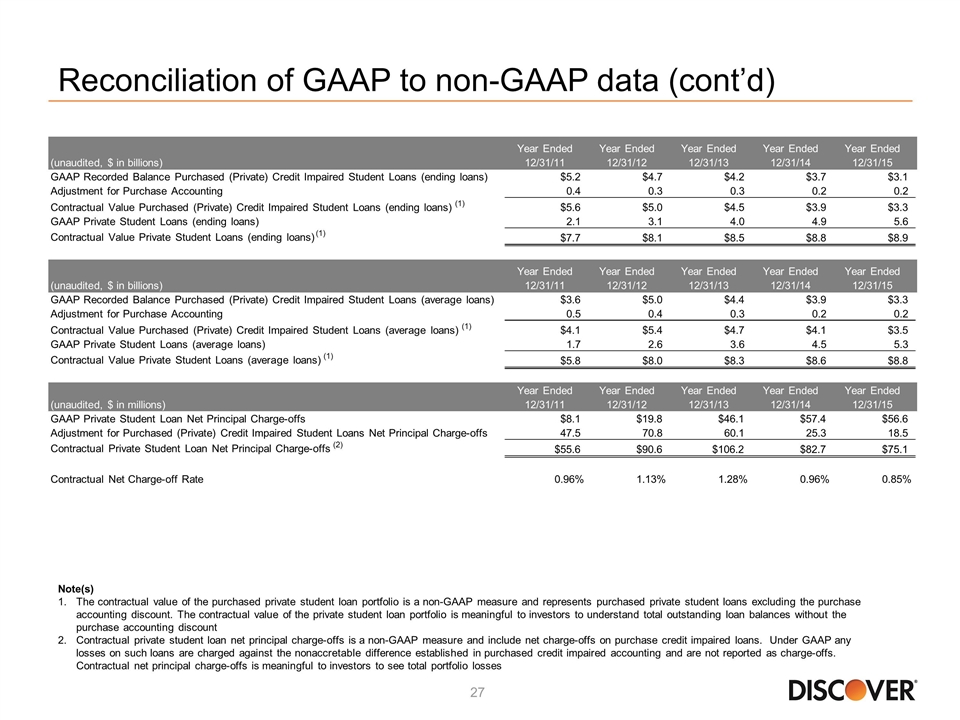

Reconciliation of GAAP to non-GAAP data (cont’d) Note(s) The contractual value of the purchased private student loan portfolio is a non-GAAP measure and represents purchased private student loans excluding the purchase accounting discount. The contractual value of the private student loan portfolio is meaningful to investors to understand total outstanding loan balances without the purchase accounting discount Contractual private student loan net principal charge-offs is a non-GAAP measure and include net charge-offs on purchase credit impaired loans. Under GAAP any losses on such loans are charged against the nonaccretable difference established in purchased credit impaired accounting and are not reported as charge-offs. Contractual net principal charge-offs is meaningful to investors to see total portfolio losses (unaudited, $ in billions) Year Ended 12/31/11 Year Ended 12/31/12 Year Ended 12/31/13 Year Ended 12/31/14 Year Ended 12/31/15 GAAP Recorded Balance Purchased (Private) Credit Impaired Student Loans (ending loans) $5.2 $4.7 $4.2 $3.7 $3.1 Adjustment for Purchase Accounting 0.4 0.3 0.3 0.2 0.2 Contractual Value Purchased (Private) Credit Impaired Student Loans (ending loans) (1) $5.6 $5.0 $4.5 $3.9 $3.3 GAAP Private Student Loans (ending loans) 2.1 3.1 4.0 4.9 5.6 Contractual Value Private Student Loans (ending loans) (1) $7.7 $8.1 $8.5 $8.8 $8.9 (unaudited, $ in billions) Year Ended 12/31/11 Year Ended 12/31/12 Year Ended 12/31/13 Year Ended 12/31/14 Year Ended 12/31/15 GAAP Recorded Balance Purchased (Private) Credit Impaired Student Loans (average loans) $3.6 $5.0 $4.4 $3.9 $3.3 Adjustment for Purchase Accounting 0.5 0.4 0.3 0.2 0.2 Contractual Value Purchased (Private) Credit Impaired Student Loans (average loans) (1) $4.1 $5.4 $4.7 $4.1 $3.5 GAAP Private Student Loans (average loans) 1.7 2.6 3.6 4.5 5.3 Contractual Value Private Student Loans (average loans) (1) $5.8 $8.0 $8.3 $8.6 $8.8 (unaudited, $ in millions) Year Ended 12/31/11 Year Ended 12/31/12 Year Ended 12/31/13 Year Ended 12/31/14 Year Ended 12/31/15 GAAP Private Student Loan Net Principal Charge-offs $8.1 $19.8 $46.1 $57.4 $56.6 Adjustment for Purchased (Private) Credit Impaired Student Loans Net Principal Charge-offs 47.5 70.8 60.1 25.3 18.5 Contractual Private Student Loan Net Principal Charge-offs (2) $55.6 $90.6 $106.2 $82.7 $75.1 Contractual Net Charge-off Rate 0.96% 1.13% 1.28% 0.96% 0.85%

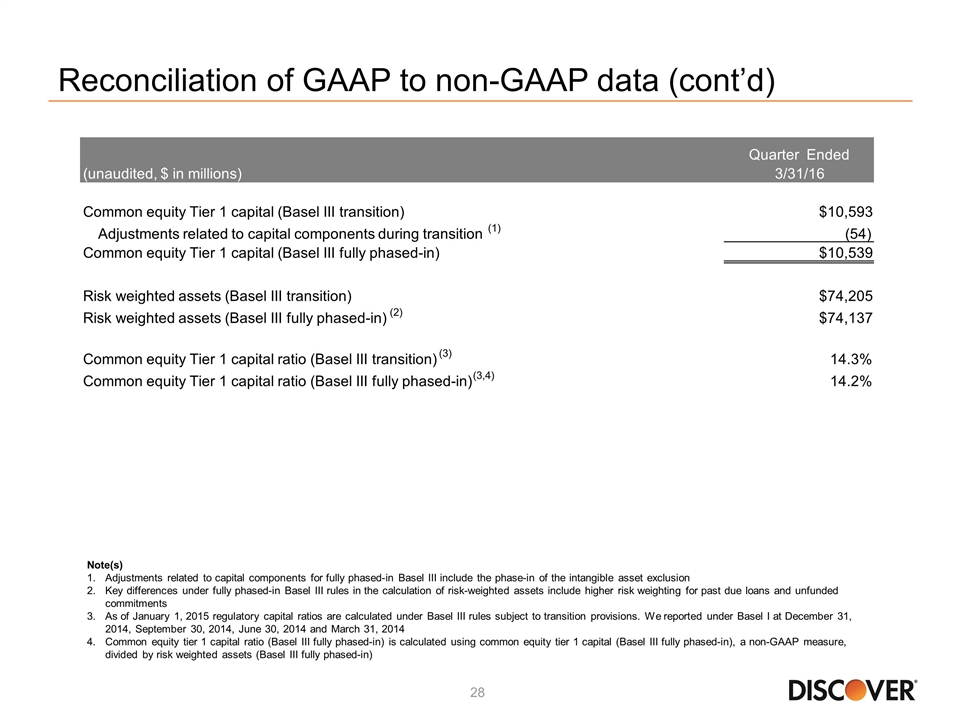

Reconciliation of GAAP to non-GAAP data (cont’d) Note(s) Adjustments related to capital components for fully phased-in Basel III include the phase-in of the intangible asset exclusion Key differences under fully phased-in Basel III rules in the calculation of risk-weighted assets include higher risk weighting for past due loans and unfunded commitments As of January 1, 2015 regulatory capital ratios are calculated under Basel III rules subject to transition provisions. We reported under Basel I at December 31, 2014, September 30, 2014, June 30, 2014 and March 31, 2014 Common equity tier 1 capital ratio (Basel III fully phased-in) is calculated using common equity tier 1 capital (Basel III fully phased-in), a non-GAAP measure, divided by risk weighted assets (Basel III fully phased-in) (unaudited, $ in millions) Quarter Ended 3/31/16 Common equity Tier 1 capital (Basel III transition) $10,593 Adjustments related to capital components during transition (1) (54) Common equity Tier 1 capital (Basel III fully phased-in) $10,539 Risk weighted assets (Basel III transition) $74,205 Risk weighted assets (Basel III fully phased-in) (2) $74,137 Common equity Tier 1 capital ratio (Basel III transition) (3) 14.3% Common equity Tier 1 capital ratio (Basel III fully phased-in) (3,4) 14.2%