Attached files

| file | filename |

|---|---|

| 8-K - CURRENT REPORT - DELTA AIR LINES, INC. | delta_8k.htm |

Exhibit 99.1

Delta: Delivering Sustainable Results May 16, 2016

Statements in this presentation that are not historical facts, including statements regarding our estimates, expectations, beliefs, intentions, projections or strategies for the future, may be "forward - looking statements" as defined in the Private Securities Litigation Reform Act of 1995. All forward - looking statements involve a number of risks and uncertainties that could cause actual results to differ materially from the estimates, expectations, beliefs, intentions, projections and strategies reflected in or suggested by the forward - looking statements. These risks and uncertainties include, but are not limited to, the cost of aircraft fuel; the impact of rebalancing our hedge portfolio, recording mark - to - market adjustments or posting collateral in connection with our fuel hedge contracts; the availability of aircraft fuel; the effects of terrorist attacks or geopolitical conflict; the possible effects of accidents involving our aircraft; the restrictions that financial covenants in our financing agreements will have on our financial and business operations; labor issues; interruptions or disruptions in service at one of our hub or gateway airports; disruptions or security breaches of our information technology infrastructure; our dependence on technology in our operations; the effects of weather, natural disasters and seasonality on our business; the effects of an extended disruption in services provided by third party regional carriers; failure or inability of insurance to cover a significant liability at Monroe’s Trainer refinery; the impact of environmental regulation on the Trainer refinery, including costs related to renewable fuel standard regulations; our ability to retain management and key employees; competitive conditions in the airline industry; the effects of extensive government regulation on our business; the sensitivity of the airline industry to prolonged periods of stagnant or weak economic conditions; and the effects of the rapid spread of contagious illnesses. Additional information concerning risks and uncertainties that could cause differences between actual results and forward - looking statements is contained in our Securities and Exchange Commission filings, including our Annual Report on Form 10 - K for the fiscal year ended Dec. 31, 2015. Caution should be taken not to place undue reliance on our forward - looking statements, which represent our views only as of May 16, 2016 and which we have no current intention to update. In this presentation, we will discuss certain non - GAAP financial measures. You can find the reconciliations of those measures to comparable GAAP measures on our website at delta.com Safe Harbor 2

Delta: Delivering Sustainable Results Addressing Near - Term Issues t o Drive Long - Term Success Continuing to Deliver on Aggressive Targets Maintaining Disciplined Capital Deployment Strategy • Strong brand with consistent execution and a focus on the customer has Delta in the top 10% of S&P Industrials on EPS growth, free cash flow, and ROIC • Reducing planned capacity growth to below 2% for 2H16 and deferring 4 widebody deliveries from 2018 to 2019/20 - allows Delta to address current fuel and revenue headwinds, while positioning the company to achieve its long - term goals • Continuing to invest in the business for the long - term, de - risking the balance sheet through pension funding and debt repayment, while returning at least 70% of free cash flow to shareholders – announcing 3 rd consecutive 50% dividend increase and $375M ASR to help us achieve this target • Delta has successfully transformed the business model to differentiate itself operationally, financially, and with best in class products and services in order to drive sustainable results through the cycle 3

Strong Brand Drives Revenue Premium • Building a brand that embodies what customers value, improves loyalty, enables segmentation, and drives a sustainable revenue premium to the industry • The investments Delta is making in the business will enhance the customer experience while also improving efficiency 4 103% 107% 107% 108% 109% 110% 2011 2012 2013 2014 2015 1Q16 Delta Passenger Unit Revenue vs. Industry Average 20.2% 27.2% 31.1% 33.5% 37.8% 40.2% 2011 2012 2013 2014 2015 2016 YTD Domestic Net Promoter Score

Continued Momentum With Corporate Travelers 5 • Volumes across most corporate sectors remain positive, although fares continue to be depressed 5 4 1 1 1 1 1 2009 2010 2011 2012 2013 2014 2015 Corporate travelers are recognizing Delta’s high quality product and service… …Resulting in solid increases in volumes this year 2016 Morgan Stanley Global Corporate Travel Survey Business Travel News Survey Footprint Lift Product Reliability Price 2016 Delta Delta Delta Delta Delta 2015 Delta Delta Delta Delta Delta 2014 United United/Delta Delta Delta Delta YTD Ticket Volumes/ Revenue vs Prior Year 2% 4% 1% 3% 3% 3% 5% 5% (4%) (2%) (1%) (3%) (4%) (2%) 1% 2% Total Other Automotive Technology Financial Services Business Services Media Health Care Revenue Volume

Reducing Capacity Plan For T he Second Half Of 2016 6 System Capacity Growth YoY • Capacity growth slows to below 2 % for 2H16 driven by actions across all regions • Domestic growth will be reduced from 4%+ during the first three quarters to 2.5% for 4Q – Capacity moderates in each quarter this year • International capacity will be flat to down in 2H for the 2nd year in a row – Atlantic capacity will come down from 3 - 4% during the summer to flat for the winter IATA season – Latin capacity growth will turn negative in the second half of 2016 – Pacific will see capacity reductions in 4Q for the third consecutive year 5.4% 4.5% 4.0% 2.5% 1Q16 2Q16E 3Q16E 4Q16E Domestic Capacity Growth YoY • Removing ~1 point of planned capacity growth for 4Q16 to address rising fuel prices and improve our unit revenue trajectory 2 - 3% <2% ~5% ~3% ~(1%) 1H16E 2H16E Syst. Dom. Int’l Int’l - ~flat Dom. Syst.

The Path To Positive PRASM 7 • Broad commercial initiatives should result in Delta being the first network carrier to return to positive unit revenue growth later this year - an important indicator that margins and cash flows are sustainable regardless of the direction of fuel prices Domestic • Deceleration of growth in 4Q with reductions focused on underperforming markets • Continued benefit from Branded Fares as Comfort+ as a fare product is implemented for May and beyond • Ongoing targeted initiatives to reduce exposure to dilutionary fares Latin • Currency improvement in Brazil drives both better demand and higher fares – expect Brazil RASM to turn positive in winter 16/17 • Already achieving positive RASM in Mexico and Caribbean • Adjusting capacity in Central America, targeting markets that are underperforming due to high competitive capacity levels Pacific • Winter capacity down 15% Yo2Y, with reductions focused on underperforming markets • Yen decline from 120 to 110 turns currency to tailwind and improves Japan Beach market demand • Surcharge related headwinds lessen in 4Q16 Atlantic • Currency turns to tailwind in 3Q due to euro and pound strengthening • Business cabin revenues up during peak leisure summer with continued momentum anticipated in 2H16 • Delta’s winter capacity is flat Yo2Y – industry capacity outstripping demand due to outsized growth by Middle East carriers and ULCCs

Consistently Improving Our Performance • Delta’s focus on its long - term financial goals has driven improving returns and materially de - risked the balance sheet, while allowing for increasing shareholder returns Note: Delta ROIC reflects benefit of NOLs; Adjusted for special items Foundation in place to produce high - quality, sustainable returns for shareholders Return on Invested Capital Adjusted Net Debt Capital Returns to Shareholders $9.4B $7.4B $7.0B 2009 2013 1Q15 1Q16 1.5% 15.1% 22.3% 31.6% 2009 2013 LTM 1Q15 LTM 1Q16 2009 2013 LTM 1Q15 LTM 1Q16 $1.7B $2.9B $350M 8 $17.0B

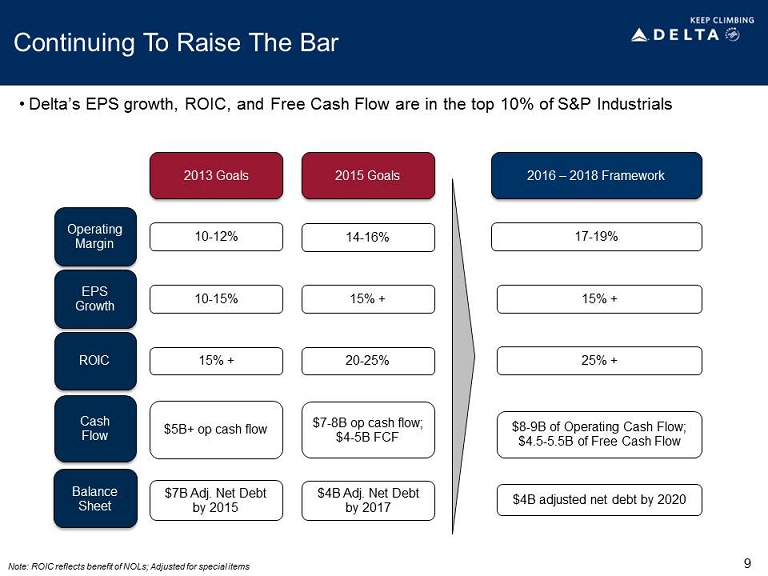

9 Continuing To Raise The Bar • Delta’s EPS growth, ROIC, and Free Cash Flow are in the top 10% of S&P Industrials 14 - 16% Operating Margin EPS Growth ROIC Cash Flow 2013 Goals 2015 Goals 10 - 12% 10 - 15% 15% + 15% + 20 - 25% $5B+ op cash flow $7 - 8B op cash flow; $4 - 5B FCF $7B Adj. Net Debt by 2015 $4B Adj. Net Debt by 2017 2016 – 2018 Framework 17 - 19% 15% + 25% + $4B adjusted net debt by 2020 $8 - 9B of Operating Cash Flow; $ 4.5 - 5.5B of Free Cash Flow Balance Sheet Note: ROIC reflects benefit of NOLs; Adjusted for special items

The Path To Continued Outperformance • Delta has a strong track record of solid execution with a large pipeline of initiatives in place to deliver solid top - line growth, while maintaining our cost discipline Revenue Growth Strong Cash Flow Cost Productivity Capacity Discipline Targeting revenue growth through a continued unit revenue premium driven by network and product innovation, improving corporate share, leveraging investments in NY/SEA/LAX, expanding international partnerships, and growing our brand Maintain disciplined approach to capacity with system growth below 2 % annually. Domestic growth achieved through higher gauge Productivity focus across the business keeps non - fuel unit cost growth below 2% . Upgauging benefits will continue with average gauge expected to increase by an additional 7% by 2020 Expecting over $8B in operating cash annually, with ~50% allocated to investments in the business to support long - term earnings growth . Resulting $ 4.5 - 5.5B in free cash flow will be used to further strengthen the balance sheet, while returning at least 70% of free cash flow to shareholders 10

11 Strong Cash Generation Differentiates Delta • Plan contemplates continued strong cash generation, with ~$25 billion of operating cash flow produced over the next three years Operating and Free Cash Flow • Strong cash generation funds investments in the future , reductions in leverage , and capital returns to owners • Capital spending in $3.3 - 3.7B range – Capex has built in flexibility with a target to not exceed 50% of operating cash flow – Delta will have replaced ~50 % of the mainline fleet between 2014 - 2020 • Increase in expected capex allows Delta to address upcoming fleet retirements, while continuing to reduce 50 - seaters and upgauge the domestic fleet – Full retirement of MD - 88 fleet over the next 5 years – Opportunistic aircraft pricing will drive strong returns • Resulting free cash flow is targeted between $4.5 - 5.5B per year Note: Adjusted for special items $1.6B $0.8B $2.1B $3.7B $3.8B $0B $2B $4B $6B $8B 2011 2012 2013 2014 2015 Free Cash Flow Operating Cash Flow

Fleet Strategy Driving Improving Efficiency • Fleet strategy focused on narrowbody replacements to drive improved efficiency; deferring 4 widebody deliveries from 2018 to 2019/20 Average Network Gauge • Recent orders aimed at narrowbody fleet replacement – C Series, 737 - 900s, and A321s offer better unit costs, while enhancing customer experience – Orders allow for continued 50 - seat reductions, while fully addressing MD - 88 replacements over the next 5 years • Maintain significant capacity flexibility given the number of narrowbody aircraft in the fleet that exceed 25 years of age • Eliminating inefficient 747 fleet allows Delta to better serve today’s international network, driving better revenue performance while reducing costs • Delta is deferring 4 A - 350s from 2018 to 2019/20, making delivery schedule more consistent with expected pace of international market improvement 12 Unit Cost Upgauge Benefit 750 mi Stage | $2.25 Fuel 50 - Seat 76 - Seat 100 - 110 Seat Small Narrowbody Large Narrowbody - 12% - 10% - 7% - 9% $50 $75 $100 $125 $150 40 60 80 100 120 140 160 180 200 Cost per Seat Aircraft Seat Count (Includes CS100) (Includes additional A321s) 127 133 143 2012 2015 2020E 5% 7 %

Cash Taxes Well Below Book Tax Expense • Delta currently expects to utilize its $ 9 billion of NOLs and is well positioned to absorb cash taxes in 2018 • Taxable income is expected to be significantly lower than pre - tax book income over the next five years driven by, among other things: – Accelerated depreciation expense on long - lived assets – Actual pension funding in excess of book pension expense • 2016 taxable income is expected to be ~$3B lower than 2016 pre - tax book income • Slowing debt repayment and lower interest expense will provide a source of cash for tax payments – Debt funding including interest and repayments reduced by nearly $2.5B since 2010 • Effective book tax rate is estimated at 35% going forward 13 2015 Book Income vs. Taxable Income 2015 Pre-tax Income Tax Expense @ 37% $5.9B $2.2B Equivalent Taxable Income Hypothetical Cash Taxes @ 37% $3.2B $1.2B Cash Taxes ~20% of Pre - tax Income Note: Cash taxes assume no NOL deduction; Adjusted for special items

Continuing To Reduce Debt At A Measured Pace • Investment grade balance sheet provides Delta with flexibility, reduces financial risk, and should drive sustainable results through the economic cycle • Targeting $4B adjusted net debt by 2020 – Pace allows for more focus on pension funding, while continuing to prioritize shareholder returns • Balance sheet progress recognized with investment grade rating by Moody’s – One notch away from investment grade by S&P and Fitch • Roughly $10B in debt reduction since 2009 has reduced interest expense by $900M • Delta currently has nearly $6B in unencumbered assets - new aircraft deliveries increase this amount and further improve financial flexibility 14 Adjusted Net Debt $17B ~$ 6B $4B 2009 2016E 2020 Target Interest Expense: $1.3B ~$400M ~$200M Note: Adjusted for special items

Proactively Addressing Pension Obligation • Delta’s pension contributions are above required levels and should result in Delta getting to an 80% funded status by 2020 15 Pension Funded Status 40% 60% 80% 100% 120% 2016E 2018E 2020E Funded status at current discount rate (4.6%) Funded status assuming increased rates (+200bps) Pension Expense • Plan to contribute ~$1.2B annually to the pension through 2020 • A 200 basis point increase in discount rates would result in pension being fully funded in 2021 • Funding pension above the required rate provides future flexibility as it lowers mandatory contributions and pension expense – $500M annual minimum required contribution - declined by over $200M since 2010 and will continue to move lower – Pension expense will decline at an accelerating pace before inflecting to income in 2019 ($300) ($150) $0 $150 $300 2016E 2018E 2020E

Commitment T o Consistent Shareholder Returns • Announcing 3 rd consecutive 50% increase to the dividend since initiated in 2013 • Plan to complete remaining $3B of 2015 share repurchase authorization by May 2017, including $375M ASR in the June 2016 quarter Regular dividend i ncreased to $625 million per year Plan to complete $5 billion share r epurchase a uthorization by May 2017 • Dividend represents a long - term commitment to consistently return cash to our owners • Annual dividend per share will increase to $0.81, from $0.54, in the September quarter – representing a 2% yield at the current stock price • Delta has demonstrated a willingness to accelerate buybacks with excess free cash flow • 3 rd share repurchase authorization to be completed ahead of schedule Share Repurchases Annual Dividend Run - Rate 16 $ 185M $280M $ 420M $ 625M 2013 2014 2015 2016 $250M $250M $850M $1,150M $1,050M $1,800M 2013 2014 2015 1H16 2015-17 Authorization ($5B) 2014-16 Authorization ($2B) 2013-16 Authorization ($500M) Note: Annual Dividend Run - Rate calculation based on Q1 2016 share count

• Performance is consistent with high quality industrial peers, but current valuation overprices risk Delta Is A Compelling Investment ~$5B of FCF $1.4B of FCF 17 Note: High quality industrial transports include CHRW, CSX, EXPD, FDX, KSU, NSC, R, UNP, UPS; Adjusted for special items $42 $104 $105 $111 Current Stock Price DAL @ High Qual. Ind. Trans. EV/EBITDA Multiple DAL @ High Qual. Ind. Trans. P/E Multiple DAL @ High Qual. Ind. Trans. Free Cash Flow Multiple +165% +155% +150% Implied Delta Stock Price at High Quality Industrial Transport Valuation Multiples

| 18 |

Non-GAAP Financial Measures

Delta sometimes uses information ("non-GAAP financial measures") that is derived from the Consolidated Financial Statements, but that is not presented in accordance with accounting principles generally accepted in the U.S. (“GAAP”). Under the U.S. Securities and Exchange Commission rules, non-GAAP financial measures may be considered in addition to results prepared in accordance with GAAP, but should not be considered a substitute for or superior to GAAP results. The tables below show reconciliations of non-GAAP financial measures used in this presentation to the most directly comparable GAAP financial measures.

Forward Looking Projections. Delta is unable to reconcile certain forward-looking projections to GAAP as the nature or amount of special items cannot be estimated at this time.

Return on Invested Capital

Delta presents return on invested capital as management believes this metric is helpful to investors in assessing the company’s ability to generate returns using its invested capital and as a measure against the industry. Return on invested capital is adjusted total operating income divided by average invested capital.

| Last Twelve Months Ended March 31, | Year Ended December 31, | |||||||||||||||

| (in billions, except % of return) | 2016 | 2015 | 2013 | 2009 | ||||||||||||

| Adjusted book value of equity | $ | 17.9 | $ | 17.6 | $ | 15.4 | $ | 12.9 | ||||||||

| Average adjusted net debt | 7.0 | 7.8 | 10.5 | 16.8 | ||||||||||||

| Average invested capital | $ | 24.9 | $ | 25.4 | $ | 25.9 | $ | 29.7 | ||||||||

| Adjusted total operating income | $ | 7.8 | $ | 5.7 | $ | 3.9 | $ | 0.5 | ||||||||

| Return on invested capital | 31.6% | 22.3% | 15.1% | 1.5% | ||||||||||||

Adjusted Net Debt

Delta uses adjusted total debt, including aircraft rent, in addition to long-term adjusted debt and capital leases, to present estimated financial obligations. Delta reduces adjusted debt by cash, cash equivalents and short-term investments and hedge margin receivable, resulting in adjusted net debt, to present the amount of assets needed to satisfy the debt. Management believes this metric is helpful to investors in assessing the company’s overall debt profile. Management has reduced adjusted debt by the amount of hedge margin receivable, which reflects cash posted to counterparties, as we believe this removes the impact of current market volatility on our unsettled hedges and better reflects the continued progress we have made on our debt initiatives.

| (in billions) | March 31, 2016 | March 31, 2015 | December 31, 2013 | December 31, 2009 | ||||||||||||||||||||

| Debt and capital lease obligations | $ | 8.5 | $ | 9.6 | $ | 11.2 | $ | 17.2 | ||||||||||||||||

| Plus: unamortized discount, net and debt issuance costs | 0.1 | 0.1 | 0.5 | 1.1 | ||||||||||||||||||||

| Adjusted debt and capital lease obligations | $ | 8.6 | $ | 9.7 | $ | 11.7 | $ | 18.3 | ||||||||||||||||

| Plus: 7x last twelve months' aircraft rent | 1.8 | 1.7 | 1.5 | 3.4 | ||||||||||||||||||||

| Adjusted total debt | 10.4 | 11.4 | 13.2 | 21.7 | ||||||||||||||||||||

| Less: cash, cash equivalents and short-term investments | (2.9 | ) | (3.6 | ) | (3.8 | ) | (4.7 | ) | ||||||||||||||||

| Less: hedge margin receivable | (0.5 | ) | (0.4 | ) | – | – | ||||||||||||||||||

| Adjusted net debt | $ | 7.0 | $ | 7.4 | $ | 9.4 | $ | 17.0 | ||||||||||||||||

| 19 |

Operating Cash Flow, adjusted

Delta presents adjusted operating cash flow because management believes adjusting for the following items provides a more meaningful measure for investors. Adjustments include:

Hedge deferrals. During the March 2015 quarter, we effectively deferred settlement of a portion of our hedge portfolio until 2016 by entering into fuel derivative transactions that, excluding market movements from the date of the transactions, would provide approximately $150 million in cash receipts during the September 2015 quarter and $150 million in cash receipts for the December 2015 quarter. Additionally, these transactions require approximately $300 million in cash payments in 2016 (excluding market movements from the date of the transactions). By effectively deferring settlement of a portion of the original derivative transactions, the restructured hedge portfolio provides additional time for the fuel market to stabilize while adding some hedge protection in 2016. Operating cash flow is adjusted to include these deferral transactions in order to allow investors to better understand the net impact of hedging activities in the periods shown.

Hedge margin. Operating cash flow is adjusted for hedge margin as we believe this adjustment removes the impact of current market volatility on our unsettled hedges and allows investors to better understand and analyze the company’s core operational performance in the periods shown.

Reimbursements related to build-to-suit facilities. Management believes investors should be informed that these reimbursements for build-to-suit leased facilities effectively reduce net cash provided by operating activities and related capital expenditures.

| Year Ended December 31, | ||||||||||||||||||||

| (in billions) | 2015 | 2014 | 2013 | 2012 | 2011 | |||||||||||||||

| Net cash provided by operating activities (GAAP) | $ | 7.9 | $ | 4.9 | $ | 4.5 | $ | 2.5 | $ | 2.8 | ||||||||||

| Adjustments: | ||||||||||||||||||||

| Hedge deferrals | 0.4 | – | – | – | – | |||||||||||||||

| Hedge margin | (0.8 | ) | 0.9 | – | – | – | ||||||||||||||

| Reimbursements related to build-to-suit leased facilities | (0.1 | ) | – | – | – | – | ||||||||||||||

| SkyMiles used pursuant to advance purchase under AMEX agreement | – | – | 0.3 | 0.3 | – | |||||||||||||||

| Net cash provided by operating activities, adjusted | $ | 7.4 | $ | 5.8 | $ | 4.8 | $ | 2.8 | $ | 2.8 | ||||||||||

Free Cash Flow

Delta presents free cash flow because management believes this metric is helpful to investors to evaluate the company's ability to generate cash that is available for use for debt service or general corporate initiatives. Adjustments include:

Hedge deferrals. During the March 2015 quarter, we effectively deferred settlement of a portion of our hedge portfolio until 2016 by entering into fuel derivative transactions that, excluding market movements from the date of the transactions, would provide approximately $150 million in cash receipts during the September 2015 quarter and $150 million in cash receipts for the December 2015 quarter. Additionally, these transactions require approximately $300 million in cash payments in 2016 (excluding market movements from the date of the transactions). By effectively deferring settlement of a portion of the original derivative transactions, the restructured hedge portfolio provides additional time for the fuel market to stabilize while adding some hedge protection in 2016. Free cash flow is adjusted to include these deferral transactions in order to allow investors to better understand the net impact of hedging activities in the period shown.

Hedge margin. Free cash flow is adjusted for hedge margin as we believe this adjustment removes the impact of current market volatility on our unsettled hedges and allows investors to better understand and analyze the company’s core operational performance in the periods shown.

| 20 |

Free Cash Flow (cont.)

| Year Ended December 31, | ||||||||||||||||||||

| (in billions) | 2015 | 2014 | 2013 | 2012 | 2011 | |||||||||||||||

| Net cash provided by operating activities | $ | 7.9 | $ | 4.9 | $ | 4.5 | $ | 2.5 | $ | 2.8 | ||||||||||

| Net cash used in investing activities | (4.0 | ) | (2.5 | ) | (2.7 | ) | (2.0 | ) | (1.5 | ) | ||||||||||

| Adjustments: | ||||||||||||||||||||

| Hedge deferrals | 0.4 | – | – | – | – | |||||||||||||||

| Hedge margin | (0.8 | ) | 0.9 | – | – | – | ||||||||||||||

| Net purchases of short-term investments and other | 0.3 | 0.4 | – | – | 0.3 | |||||||||||||||

| SkyMiles used pursuant to advance purchase under AMEX agreement | – | – | 0.3 | 0.3 | – | |||||||||||||||

| Total free cash flow | $ | 3.8 | $ | 3.7 | $ | 2.1 | $ | 0.8 | $ | 1.6 | ||||||||||

| Five year average | $ | 2.4 | ||||||||||||||||||

Pre-Tax Income and Income Tax Expense, adjusted for special items

Delta adjusts for the following items to determine pre-tax income and income tax expense, both adjusted for special items, for the reasons described below:

Mark-to-market ("MTM") adjustments and settlements. MTM adjustments are defined as fair value changes recorded in periods other than the settlement period. Such fair value changes are not necessarily indicative of the actual settlement value of the underlying hedge in the contract settlement period. Settlements represent cash received or paid on hedge contracts settled during the period. These items adjust fuel expense to show the economic impact of hedging, including cash received or paid on hedge contracts during the period. Adjusting for these items allows investors to better understand and analyze our core operational performance in the periods shown.

Restructuring and other. Because of the variability in restructuring and other, the adjustment for this item is helpful to investors to analyze the company’s recurring core performance in the periods shown.

Virgin Atlantic MTM adjustments. We record our proportionate share of earnings from our equity investment in Virgin Atlantic in other expense. We adjust for Virgin Atlantic's MTM adjustments to allow investors to better understand and analyze our core financial performance in the periods shown.

| Year Ended | ||||||||

| December 31, 2015 | ||||||||

| Pre-Tax | Income | |||||||

| (in millions) | Income | Tax | ||||||

| GAAP | $ | 7,157 | $ | (2,631 | ) | |||

| Adjusted for: | ||||||||

| MTM adjustments and settlements | (1,301 | ) | 479 | |||||

| Restructuring and other | 35 | (13 | ) | |||||

| Virgin Atlantic MTM adjustments | (26 | ) | 9 | |||||

| Total adjustments | (1,292 | ) | 475 | |||||

| Non-GAAP | $ | 5,865 | $ | (2,156 | ) | |||

| 21 |