Attached files

| file | filename |

|---|---|

| EX-1.1 - EX-1.1 - Amplify Snack Brands, INC | d189956dex11.htm |

| EX-5.1 - EX-5.1 - Amplify Snack Brands, INC | d189956dex51.htm |

| EX-21.1 - EX-21.1 - Amplify Snack Brands, INC | d189956dex211.htm |

| EX-23.1 - EX-23.1 - Amplify Snack Brands, INC | d189956dex231.htm |

Table of Contents

As filed with the Securities and Exchange Commission on May 16, 2016.

Registration No. 333-211173

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Amendment No. 1

to

FORM S-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

Amplify Snack Brands, Inc.

(Exact name of Registrant as specified in its charter)

| Delaware | 2000 | 47-1254894 | ||

| (State or other jurisdiction of incorporation or organization) |

(Primary Standard Industrial Classification Code Number) |

(I.R.S. Employer Identification Number) |

500 West 5th Street, Suite 1350

Austin, Texas 78701

512.600.9893

(Address, including zip code, and telephone number, including area code, of Registrant’s principal executive offices)

Thomas Ennis

Chief Executive Officer

Amplify Snack Brands, Inc.

500 West 5th Street, Suite 1350

Austin, Texas 78701

512.600.9893

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Copies to:

| Bradley C. Weber, Esq. Andrew T. Hill, Esq. Goodwin Procter LLP 135 Commonwealth Drive Menlo Park, CA 94025 650.752.3100 |

LizabethAnn R. Eisen, Esq. Cravath, Swaine & Moore LLP Worldwide Plaza 825 Eighth Avenue New York, New York 10019 212.474.1000 |

Approximate date of commencement of proposed sale to the public: As soon as practicable after this registration statement becomes effective.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act, check the following box: ¨

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer”, “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one)

| Large accelerated filer | ¨ | Accelerated filer | ¨ | |||

| Non-accelerated filer | x (Do not check if a smaller reporting company) | Smaller reporting company | ¨ | |||

CALCULATION OF REGISTRATION FEE

|

| ||||||||

| Registered | Amount to be Registered(1) |

Proposed Maximum Aggregate Offering Price Per Share(2) |

Proposed Maximum Aggregate Offering Price(2) |

Amount of Registration Fee(3) | ||||

| Common Stock, $0.0001 par value per share |

11,500,000 | $13.58 | $156,170,000 | $15,727 | ||||

|

| ||||||||

|

| ||||||||

| (1) | Includes 1,500,000 shares of additional shares of common stock that the underwriters have the option to purchase. |

| (2) | Estimated solely for the purpose of calculating the registration fee pursuant to Rule 457(c) under the Securities Act of 1933, as amended, based upon the average of the high and low sales prices of the registrant’s common stock as reported by the New York Stock Exchange on May 11, 2015. |

| (3) | The registrant previously paid $10,070 of the registration fee with the initial filing of this registration statement. |

The registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933, or until the registration statement shall become effective on such date as the Commission, acting pursuant to said Section 8(a), may determine.

Table of Contents

The preliminary prospectus is not complete and may be changed. The selling stockholders may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This preliminary prospectus is not an offer to sell these securities and the selling stockholders are not soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

Subject to completion, dated May 16, 2016

10,000,000 Shares

Common Stock

The selling stockholders identified in this prospectus, which include certain of our directors, are offering 10,000,000 shares of common stock. We are not selling any shares of common stock under this prospectus and we will not receive any proceeds from the sale of shares to be offered by the selling stockholders.

Our common stock is listed on the New York Stock Exchange under the symbol “BETR.” On May 13, 2016, the last reported sale price of our common stock on the New York Stock Exchange was $12.83 per share.

We are an “emerging growth company” as defined under the federal securities laws and, as such, are eligible for certain reduced public company reporting requirements. See “Prospectus Summary—Implications of Being an Emerging Growth Company” on page 9 and “Risk Factors” on page 19 to read about factors you should consider before buying shares of our common stock.

Neither the Securities and Exchange Commission nor any other regulatory body has approved or disapproved of these securities or passed upon the accuracy or adequacy of this prospectus. Any representation to the contrary is a criminal offense.

| Per Share | Total | |||||||

| Public Offering Price |

$ | $ | ||||||

| Underwriting Discounts and Commissions(1) |

$ | $ | ||||||

| Proceeds to Selling Stockholders (Before expenses) |

$ | $ | ||||||

| (1) | See “Underwriting” for additional information regarding underwriting compensation. |

The underwriters have the option to purchase up to an additional 1,500,000 shares from the selling stockholders at the public offering price less the underwriting discount. We will not receive any proceeds from the exercise of the underwriters’ option to purchase additional shares.

The underwriters expect to deliver the shares to purchasers on or about , 2016 through the book-entry facilities of The Depository Trust Company.

| Goldman, Sachs & Co. | Jefferies | Credit Suisse |

SunTrust Robinson Humphrey

| Piper Jaffray | William Blair | Oppenheimer & Co. |

Prospectus dated , 2016

Table of Contents

Table of Contents

Prospectus

| 1 | ||||

| 19 | ||||

| 47 | ||||

| 49 | ||||

| 50 | ||||

| 51 | ||||

| 52 | ||||

| 53 | ||||

| 61 | ||||

| 64 | ||||

| 69 | ||||

| CERTAIN MATERIAL U.S. FEDERAL INCOME TAX CONSEQUENCES TO |

71 | |||

| 75 | ||||

| 81 | ||||

| 81 | ||||

| 81 | ||||

| 82 |

Neither we, the selling stockholders, nor any of the underwriters have authorized anyone to provide any information or to make any representations other than those contained or incorporated by reference in this prospectus or in any free writing prospectuses we have prepared. We, the selling stockholders, and the underwriters take no responsibility for, and can provide no assurance as to the reliability of, any other information that others may give you. This prospectus is an offer to sell only the shares offered hereby, but only under circumstances and in jurisdictions where it is lawful to do so. The information contained or incorporated by reference in this prospectus is current only as of its date.

Unless otherwise specified or the context requires otherwise:

The terms “we”, “us”, “our” and the “Company” mean Amplify Snack Brands, Inc., a Delaware corporation, and its consolidated subsidiaries;

The term “All Commodity Volume” or “ACV” means the measurement of a product’s distribution (or distribution on promotion) weighted by the overall dollar retail sales attributable to the retail location distributing such product; a retail location would be counted as having sold the product or product group if at least one unit of the product was scanned for sale within the relevant time period; we believe this metric provides a measurement of retail penetration that takes into account the importance of selling through retail locations with higher overall retail sales volumes;

The terms “Better-For-You” or “BFY” are industry terms not defined by the Food and Drug Administration and refer to foods that have some characteristics that cause consumers to view them as a healthier alternative to conventional food products; there is not a single definition of Better-For-You and we believe each individual customer may view Better-For-You characteristics differently, but common characteristics may include one or more of the following: products that are lower in salt, products that are lower in sugar, products that are lower in fat, products that are made without

i

Table of Contents

ingredients containing genetically modified organisms (or GMOs), products made with fewer ingredients, products made with simpler ingredients, products made with more recognizable ingredients, products that are organic, products that are viewed as natural, products that do not include artificial ingredients, preservatives or flavors, products that are major allergen-free, products that are Kosher, products that are vegetable-based, products that are vegan or products that are gluten-free;

The term “Boundless Nutrition” means Boundless Nutrition LLC, a Texas limited liability company and our wholly-owned subsidiary, which we acquired on April 29, 2016;

The term “Corporate Reorganization” means the series of transactions that occurred immediately prior to our IPO, as described under the heading “Prospectus Summary—Corporate Information and Structure and IPO”;

The term “December 2014 Special Dividend” means the $50.0 million of borrowings under our term loan under the credit agreement that SkinnyPop Popcorn LLC entered into on July 17, 2014, which provided for a $150.0 million term loan facility and a $7.5 million revolving facility (the “Credit Agreement”) and the subsequent distribution of $59.8 million we paid to Topco in December 2014, which then distributed such amount to its members. For further information, see Item 7 “Management’s Discussion and Analysis of Financial Condition and Results of Operations” in our Annual Report on Form 10-K for the fiscal year ended December 31, 2015, filed with the Securities and Exchange Commission, or the SEC, on March 29, 2016, or the 2015 10-K, and Note 9 in the accompanying Notes to Consolidated Financial Statements contained in Item 8 in our 2015 10-K incorporated by reference herein;

The term “Founder Contingent Compensation” means our agreement, made in connection with the Sponsor Acquisition and memorialized in the Founders’ ongoing employment agreements, under which the Company paid the Founders (i) additional cash consideration of $20.0 million based on the Company’s achievement of certain contribution margin benchmarks during the year ended December 31, 2015, and (ii) $4.5 million towards the obligation related to the estimated tax savings to the Company associated with the tax deductibility of the payments under these employment agreements. The remaining obligation after this payment totals $2.2 million, which we expect to satisfy with a final payment in the second half of 2016;

The term “Founders” means Andrew S. Friedman and Pamela L. Netzky, the founders of the business conducted by SkinnyPop Popcorn LLC at the time of the Corporate Reorganization;

The term “IPO” means our initial public offering that commenced on August 5, 2015 in which 15,000,000 shares of our common stock were sold by selling stockholders to the public at a price of $18.00 per share;

The term “May 2015 Special Dividend” means the $22.5 million of borrowings under our term loan and revolving credit loan under our Credit Agreement and the subsequent distribution of $22.3 million we paid to Topco in May 2015, which then distributed such amount to its members. For further information, see Item 7 “Management’s Discussion and Analysis of Financial Condition and Results of Operations” in our 2015 10-K incorporated by reference herein, and Note 9 in the accompanying Notes to Consolidated Financial Statements contained in Item 8 in our 2015 10-K incorporated by reference herein;

The term “Paqui” means Paqui LLC, a Texas limited liability company and wholly-owned subsidiary of SkinnyPop Popcorn LLC, which we acquired in April 2015;

The term “Performance Bonus Payments” means our payment in connection with our IPO of $500,000, $350,000 and $300,000 to Messrs. Ennis, Goldberg and Shiver, respectively, and $350,000 allocated to other employees of the Company;

ii

Table of Contents

The term “Predecessor” means the business of SkinnyPop Popcorn LLC prior to the Sponsor Acquisition;

The term “Pro Forma Year Ended December 31, 2014 (Unaudited)” means the unaudited pro forma condensed consolidated statement of income for the year ended December 31, 2014 giving pro forma effect to the Sponsor Acquisition, the December 2014 Special Dividend and the May 2015 Special Dividend as if such transactions had occurred on January 1, 2014. For further information, see “Unaudited Pro Forma Consolidated Financial Information” contained in Item 7 “Management’s Discussion and Analysis of Financial Condition and Results of Operations” in our 2015 10-K incorporated by reference herein, which includes a comparative presentation showing all pro forma adjustments made to our historical statements of income for the Predecessor and Successor periods in accordance with the rules and regulations of the SEC;

The term “retail location” means, as used in the determination of All Commodity Volume and Total Distribution Points by an industry source, a retail location (such as a store) that is counted in databases of that industry source and where a product has sold at least once in the applicable time period being measured;

The term “sales velocity” means the total product retail sales per million dollars of annual ACV of retail locations selling the product; we believe this metric is relevant to understanding our business because it represents the retail sales efficiency for a product in relation to its distribution; using the ACV of stores selling a product means this measure controls for store size, and can be used to determine how well a product sold while controlling for weighted distribution;

The term “SkinnyPop” means either the entity SkinnyPop Popcorn LLC or our product line and brand, SkinnyPop Popcorn, as the context requires;

The term “Sponsor” or “TA Associates” means investment funds affiliated with TA Associates Management, L.P. and its affiliates, a leading growth private equity firm;

The term “Sponsor Acquisition” means the series of transactions that were consummated in July 2014 pursuant to which (1) SkinnyPop Popcorn LLC became a wholly-owned subsidiary of the Company by way of a merger and (2) SkinnyPop Popcorn LLC was thereafter converted from an Illinois limited liability company into a Delaware limited liability company;

The term “Successor” means the business of the Company and its consolidated subsidiaries, including SkinnyPop Popcorn LLC, following the Sponsor Acquisition;

The term “Topco” means TA Topco 1, LLC, a Delaware limited liability company, which was the top parent entity of our business prior to the consummation of the Corporate Reorganization; and

The term “Total Distribution Points” or “TDPs” means the distribution of a brand, or product aggregate, while taking into account the number of retail locations and Universal Product Codes, or UPCs, selling within that brand or aggregate; the calculation is the sum of ACV across UPCs, and we believe this metric provides a relative indication of retail penetration factoring in both UPC count and retailer size.

Amounts and percentages appearing in this prospectus have been rounded to the amounts shown for convenience of presentation. Accordingly, the total of each column of amounts may not be equal to the total of the relevant individual items. All references to our business and products (1) prior to April 2015 refer only to SkinnyPop, (2) for the period from April 2015 to April 2016 refer to SkinnyPop and Paqui and (3) after April 29, 2016, refer to SkinnyPop, Paqui and Boundless Nutrition. The Predecessor and Successor financial data has been prepared on different accounting bases and therefore the sum of the data for the two reporting periods should not be used as an indicator of our full year performance.

iii

Table of Contents

INDUSTRY AND MARKET DATA

Information contained in this prospectus or incorporated by reference herein contains statistical data, estimates and forecasts that are based on independent industry publications, such as those published by Mintel Group Ltd, or Mintel, Nielsen Holdings N.V., or Nielsen, and Information Resources, Inc., or IRI, or other publicly available information, as well as other information based on internal sources. Unless we indicate otherwise, the information contained herein or incorporated by reference from IRI is based in part on data reported through its Syndicated Market Advantage service of retail sales, market share, category and other data for categories and segments of U.S. brands and outlets that have or sell products with attributes of Salty Snacks and Popcorn/Popcorn oil for the years 2010 to March 2016. This information is interpreted solely by us, and is neither all-inclusive nor guaranteed by IRI. Without limiting the generality of the foregoing, specific data points from IRI may vary considerably from other information sources. Although we believe that the third-party sources referred to in this prospectus are reliable and the information generated internally is accurate, neither we, nor the underwriters nor the selling stockholders have independently verified any of the information from third-party sources. While we are not aware of any misstatements regarding any information presented in this prospectus, estimates, in particular, as they relate to projections, involve numerous assumptions, are subject to risks and uncertainties, and are subject to change based on various factors, including those discussed in “Risk Factors” and elsewhere in this prospectus.

TRADEMARKS

This prospectus contains references to our trademarks and service marks and to those belonging to other entities. Solely for convenience, trademarks and trade names referred to in this prospectus may appear without the ® or ™ symbols, but such references are not intended to indicate, in any way, that we will not assert, to the fullest extent under applicable law, our rights or the rights of the applicable licensor to these trademarks and trade names. We do not intend our use or display of other companies’ trade names, trademarks or service marks to imply a relationship with, or endorsement or sponsorship of us by, any other companies.

Our primary trademarks include “SKINNYPOP”, “SKINNYPACK”, “THE BIG SKINNY”, “PAQUI”, “DON’T WORRY BE PAQUI” and “OATMEGA BAR” and all of which are registered in the United States with the U.S. Patent and Trademark Office. Certain of our trademarks are also registered or pending registration in foreign jurisdictions, including Australia, Canada, China, India, Japan, Mexico, Russia, Turkey, and the European Union. Other trademarks and trade names referred to in this prospectus are the property of their respective owners.

iv

Table of Contents

This summary highlights selected information that is presented in greater detail elsewhere, or incorporated by reference, in this prospectus. This summary does not contain all of the information you should consider before investing in our common stock. You should read this entire prospectus carefully, including “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” in our 2015 10-K, our Quarterly Report on Form 10-Q for the quarter ended March 31, 2016, filed with the SEC on May 4, 2016, or the First Quarter 10-Q, incorporated by reference herein, and our consolidated financial statements and the related notes incorporated by reference herein, before making an investment decision.

Our Company

Amplify Snack Brands is a high growth, snack food company focused on developing and marketing products that appeal to consumers’ growing preference for Better-For-You, or BFY, snacks. Our vision is to become a global leader in great tasting BFY snacks. Our anchor brand, SkinnyPop, is a rapidly growing, highly profitable and market leading BFY ready-to-eat, or RTE, popcorn brand. Through its simple, major allergen-free and non-GMO ingredients, SkinnyPop embodies our BFY mission and has amassed a loyal and growing customer base across a wide range of food distribution channels in the United States. SkinnyPop’s continued success and robust financial characteristics, combined with our experienced and talented management team, position us to become an industry-leading BFY snacking company that capitalizes on the potential of great-tasting and high-quality BFY snack brands that we create and acquire. To that end, in April 2015, we acquired Paqui, an emerging BFY tortilla chip brand, and in April 2016, we acquired Boundless Nutrition, which manufactures and distributes Oatmega protein snack bars and Perfect Cookie products. Paqui’s and Boundless Nutrition’s products have many of the same key taste and BFY attributes as SkinnyPop. These acquisitions allow us to leverage our infrastructure to help us grow into adjacent snacking sub-segments with innovative BFY brands. We believe that our focus on building a portfolio of exclusively BFY snack brands differentiates us and will allow us to leverage our platform to realize material synergies across our family of BFY brands, as well as allow our retail customers to consolidate their vendor relationships in this large and growing category.

We target sizable global and U.S. markets, with Nielsen estimating global retail snack sales to be in excess of $370 billion and North American retail snack sales in excess of $120 billion, which included 2% growth for the twelve months ended March 31, 2014. IRI is projecting total U.S. snack sales to grow $35 billion in the next five years. We estimate the U.S. salty snack segment to be in excess of $20 billion in annual retail sales and that it will grow approximately 3% to 4% per year through 2020. To date, our focus has been on developing brands in the rapidly growing BFY sub-segment of snacks. We believe that within the salty snack segment, BFY-focused brands are taking share from conventional brands, and we estimate that BFY-focused brands experienced aggregate growth in excess of 10% in 2015. We believe a variety of favorable consumer trends, including a greater focus on health and wellness, increased consumption of smaller, more frequent meals throughout the day and a strong preference for convenient BFY products, will continue to drive both strong overall snacking growth as well as the continued outperformance of BFY products within the overall market. Over time, we expect to explore the development and acquisition of additional BFY brands within other U.S. and global segments of the overall snacking market.

Our SkinnyPop brand, established in 2010, embodies our BFY mission while also providing rapid revenue and earnings growth, robust margins, and strong cash flows to help facilitate further investments in organic and inorganic growth opportunities. We believe SkinnyPop continues to take

1

Table of Contents

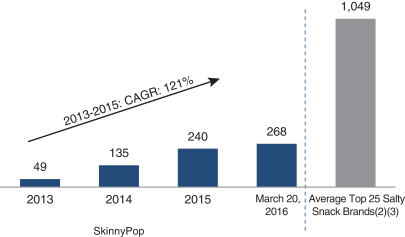

meaningful market share from a variety of sizable sub-segments of the overall U.S. salty snack segment, although the brand competes most directly in the RTE popcorn sub-segment of salty snacks. The overall U.S. popcorn sub-segment is estimated at $2.0 billion in 2015 and grew 5.1% over the prior year. The approximately $1.1 billion RTE popcorn sub-segment is the fastest growing sub-segment within U.S. salty snacks and has grown at a compound annual growth rate of 14.0% from 2010 to 2015. The RTE popcorn sub-segment experienced a growth in sales of 21.1% for the 12 weeks prior to March 20, 2016 compared to the 12 weeks prior to March 22, 2015 according to IRI data. Within RTE popcorn, SkinnyPop was the fastest growing brand of scale in 2015, increasing its share of the sub-segment by 4.2 percentage points to 16.4% and accounting for 50% of total sub-segment growth. According to IRI data, SkinnyPop has continued its momentum in the RTE popcorn sub-segment for the 12 weeks prior to March 20, 2016 compared to the prior year period, with sales growth of 35.3% and an increase in RTE popcorn share of 2.0 percentage points to 19.2% for the period. Additionally, our market share increased to 16.9% over the 52 weeks prior to March 20, 2016, representing a 3.3 percentage point increase compared to the prior year period. SkinnyPop’s growth has been driven by continued gains in both distribution and sales velocity. According to IRI data, between 2013 and March 20, 2016, SkinnyPop’s sales velocity accelerated from $70 to $183, even as ACV increased from 32.7% to 73.6% over the same period, underscoring the brand’s ability to grow store level productivity even as we increased the number of retail locations where SkinnyPop is available. Despite our recent growth and a market-leading BFY presence, we believe significant opportunities remain for continued growth. For example, as of March 20, 2016, SkinnyPop’s household penetration, which represents the percentage of households that have purchased SkinnyPop over the prior 52 weeks, stood at 7.9% compared to an average of approximately 24.1% for the top 25 salty snack brands by dollar retail sales according to IRI data. SkinnyPop also has the opportunity to grow by increasing its product range in stores where the brand already has some existing presence. Our products are offered in the natural and conventional grocery, drug, convenience, food service, club, mass merchandise and other channels. As of March 20, 2016, SkinnyPop’s Total Distribution Points stood at approximately 268, versus an average of 1,049 TDPs for the top 25 leading salty snack brands. In addition, from March 22, 2015 to March 20, 2016, the average number of SkinnyPop items sold per store increased from 2.5 to 3.4.

Total Distribution Points(1)

| (1) | Total Distribution Points is an IRI metric used to illustrate the distribution of a brand while taking into account the number of UPCs selling within that brand. TDPs are not determined by reference to any GAAP financial measure over any period. |

| (2) | The top 25 salty snack brands are those brands with the highest dollar retail sales for the 52 weeks prior to March 20, 2016 according to IRI data. |

| (3) | As of March 20, 2016. |

2

Table of Contents

Company Growth and Performance

We have experienced strong financial performance over the past several years, including:

| • | Net sales increased from $132.4 million for the pro forma year ended December 31, 2014 (unaudited) to $183.9 million for the year ended December 31, 2015, representing growth of 39.0%, and increased from $44.3 million for the three months ended March 31, 2015 to $54.3 million for the three months ended March 31, 2016, representing growth of 22.7%; |

| • | Strong gross profit and Adjusted EBITDA (as defined below) margins of 58.6% and 44.5%, respectively, for the year ended December 31, 2013, 56.1% and 44.2%, respectively, for the Pro Forma Year Ended December 31, 2014 (Unaudited), 56.0% and 40.7%, respectively, for the year ended December 31, 2015, 55.1% and 43.4%, respectively, for the three months ended March 31, 2015 and 52.3% and 36.0%, respectively, for the three months ended March 31, 2016; |

| • | Net income under GAAP decreased from $24.8 million in the year ended December 31, 2013 to $13.6 million for the Pro Forma Year Ended December 31, 2014 (Unaudited), representing a decrease of 45%, decreased from $13.6 million for the Pro Forma Year Ended December 31, 2014 (Unaudited) to $9.9 million for the year ended December 31, 2015, representing a decrease of 27.4% and increased from $4.9 million for the three months ended March 31, 2015 to $8.4 million for the three months ended March 31, 2016, representing an increase of 71.3%; |

| • | Adjusted EBITDA increased from $24.8 million in the year ended December 31, 2013 to $58.5 million in the Pro Forma Year Ended December 31, 2014 (Unaudited), representing growth of 136.0%, increased from $58.5 million in the Pro Forma Year Ended December 31, 2014 (Unaudited) to $74.9 million in the year ended December 31, 2015, representing growth of 27.9% and increased from $19.2 million for the three months ended March 31, 2015 to $19.6 million for the three months ended March 31, 2016, representing an increase of 1.7%; and |

| • | Cash from operating activities was $26.3 million for the Predecessor period from January 1, 2014 to July 16, 2014, $12.7 million for the Successor period from July 17, 2014 to December 31, 2014, $47.0 million for the year ended December 31, 2015, and $(8.6) million for the three months ended March 31, 2016 and operating cash flow less capital expenditures was $26.1 million for the Predecessor period from January 1, 2014 to July 16, 2014, $12.5 million for the Successor period from July 17, 2014 to December 31, 2014, $46.2 million for the year ended December 31, 2015 and $(8.8) million for the three months ended March 31, 2016, driven by our asset-light and outsourced manufacturing model, which requires low levels of capital investment. The decrease in cash provided by operating activities for the three months ended March 31, 2016, was driven by a $23.0 million payment made to our Founders in March 2016 related to the Founder Contingent Compensation. |

Industry Overview

Nielsen estimates the global snack market, as of March 2014, was in excess of $370 billion in annual retail sales, and growing at 2% annually when adjusted for inflation. Mintel estimates that nearly 94% of all Americans snack at least once per day, half of adults snack two to three times per day and 24% of millennials snack at least four times per day.

The SkinnyPop and Paqui brands currently compete in the salty snack segment, which includes products such as potato chips, tortilla chips, popcorn, cheese snacks, pretzels, corn snacks and meat snacks. IRI and Mintel estimate that the salty snack segment totaled approximately $22 billion and $24 billion in U.S. retail sales, respectively, in 2015. Mintel forecasts that popcorn will grow at 5.3% per year through 2020, serving as the second fastest growing product within salty snacks and trailing only meat snacks which is projected to grow at 5.7% per year over the same period. While we do not

3

Table of Contents

currently offer products in the potato chip, cheese snack, pretzel, corn snack or meat snack sub-segments, we may consider entering these markets in the future. We believe leading BFY brands within the salty snack segment grew at a rate in excess of 10% in 2015, significantly outpacing overall salty snack segment growth in the United States.

IRI estimates that total retail sales of popcorn in the United States were approximately $2.0 billion for 2015. In the 52 weeks prior to March 20, 2016, the RTE popcorn sub-segment grew by 14.0% to approximately $1.1 billion in retail sales, while the microwave popcorn sub-segment declined by 3.7% over the same period to $820 million in retail sales. We believe that this growth has largely been achieved by converting consumers from conventional salty snack products to RTE popcorn, as consumers become aware of the great taste and healthier characteristics offered by RTE popcorn. Some of the growth has also been achieved by consumers’ changing preference for RTE popcorn compared to traditional popcorn. RTE popcorn has emerged as a convenient, BFY snack in recent years, driven by both the overall BFY segment growth and improvements in product ingredients and packaging. We believe consumers are increasingly purchasing RTE popcorn because of their historical familiarity with traditional popcorn and because of consumer trends towards BFY snacks.

IRI estimates that total retail sales of tortilla chips in the United States were approximately $4.9 billion for the 52 weeks prior to March 20, 2016, making it one of the most purchased snacks in the U.S. IRI also estimates that the tortilla chip sub-segment grew at a compound annual growth rate of 4.8% between 2010 and 2015; and that the sub-segment grew at 3.8% in the 52 weeks ended March 20, 2016 compared to the prior 52 weeks. Paqui’s growth has been driven by gains in its distribution and sales velocities. For the 52 weeks prior to March 20, 2016, Paqui’s sales velocity accelerated from $4.7 to $15.8 even as ACV increased from 6.7% to 26.0% and Total Distribution Points increased 330.5% to approximately 98 according to IRI data. Given the fragmented nature of the BFY tortilla chip sub-segment, we believe that there is a significant opportunity to create a market-leading and great-tasting BFY brand.

Beyond popcorn and tortilla chips, there are several other sizable sub-segments within salty snacks such as potato chips, cheese snacks, pretzels and corn snacks at approximately $7.7 billion, $2.1 billion, $1.3 billion and $1.2 billion, respectively, in total retail sales in the United States in 2015 according to IRI and Mintel data. There is a significant potential opportunity to grow sales across multiple large categories as consumers are increasingly substituting BFY snacks within these categories. The growth of BFY snacks will continue to be supported by increased consumer focus on healthier lifestyles, as 60% of people who snack wish for more healthy options including 70% of households with children according to Mintel data. 33% of people who snack agree that there are not enough conveniently packaged snacks such as individual portions according to Mintel data. We believe that we are well positioned to benefit from these market trends and preferences in the coming years.

Our Competitive Strengths

We believe the continued growth and profitability of our company will be driven by the following

competitive strengths:

| • | BFY-focused snacking platform: With SkinnyPop as the anchor brand in our BFY-focused snacking platform, we believe that we will be able to increase our share of the large and growing global snack industry. We believe that, in addition to the strength of the SkinnyPop brand, we are well positioned to capitalize on several strengths as we continue to expand our platform. |

4

Table of Contents

| • | Strong consumer appeal of our SkinnyPop Brand: The SkinnyPop brand is a leading RTE popcorn brand with strong consumer loyalty and one of the fastest growing brands in the entire salty snack segment. SkinnyPop’s BFY positioning is reinforced through our unique packaging, which communicates the key attributes of our brand including a simple, short ingredient list that is major allergen-free and contains only non-GMO ingredients. According to IRI data, SkinnyPop has the highest level of repeat purchase in the RTE popcorn sub-segment and one of the highest rates of repeat purchase relative to overall salty snacks segment leaders. In addition, according to a 2015 study done by the Company, brand aided awareness of SkinnyPop has increased 17 percentage points to 78% and brand favorability has increased 14.8 percentage points to 80.3%. |

| • | Highly attractive brand for retailers: SkinnyPop’s premium price point and strong sales velocities generate a high level of dollar profits relative to the shelf space our SkinnyPop products occupy, making these products highly attractive to a diverse set of retailers across various distribution channels. We primarily sell our products through the natural and conventional grocery, club, drug, mass merchandise and convenience channels. According to IRI data, retail sales of SkinnyPop grew in each of these channels during the 52 weeks prior to March 20, 2016 compared to the 52 weeks prior to March 22, 2015, and SkinnyPop retail sales represented 16.9% of the aggregate RTE popcorn sales in these channels during the 52 weeks prior to March 20, 2016. Because of our brand loyalty and high-quality products, we believe there are strong growth prospects for us in each of these channels, in addition to a variety of alternative channels of distribution we are actively pursuing. |

| • | Attractive financial profile: We have a strong financial profile characterized by net sales growth of 137.6%, 39.0% and 22.7%, gross profit margin of 56.1%, 56.0% and 52.3% and Adjusted EBITDA margin of 44.2%, 40.7% and 36.0% in the Pro Forma Year Ended December 31, 2014 (Unaudited), the year ended December 31, 2015, and the three months ended March 31, 2016, respectively. Our gross profit and Adjusted EBITDA margins have been strong over time. We are also highly cash generative given our outsourced manufacturing model, which requires modest capital investment, and relatively low net working capital. |

| • | Culture of innovation: Because of our focus and ability to identify innovative BFY brands and nurture them through our talented team and expanding infrastructure, we believe we are attractive to entrepreneurs who are looking for a strategic partner, as evidenced by the continued involvement of the founders after the acquisitions of SkinnyPop, Paqui and Boundless Nutrition. |

| • | Experienced SkinnyPop team: We have established a well-regarded, experienced management team who possess both entrepreneurial and classically-trained skill sets gained through their extensive branded consumer products experience. |

| • | Established infrastructure: We have the ability to leverage our sales force and strong relationships with our retail customers and distributors to help our brands gain distribution; leverage our operations team for improved demand planning and additional margin opportunities; leverage our suppliers for purchasing and marketing resources for brand building; and leverage our existing back-office personnel and systems. |

Our Growth Strategies

We intend to continue growing net sales and profitability through the following growth strategies:

| • | Expand distribution through new customer wins: We plan to capitalize on the strength of our SkinnyPop brand, positive market trends and our attractive retailer economics in order to |

5

Table of Contents

| penetrate new customers and increase the number of stores carrying our SkinnyPop, Paqui and Boundless Nutrition brands. Based on IRI data, management estimates that, as of December 27, 2015, SkinnyPop currently has less than 26% retail penetration within the more than 250,000 potential U.S. retail locations. |

| • | Continue to increase shelf space with existing customers: While SkinnyPop is highly attractive to retail customers given its premium price and attractive sales velocities, as of March 20, 2016, the average retail location carries only 3.4 of our UPCs per store compared to approximately 5.9 for our largest RTE popcorn competitors. We will continue to capitalize on our strong consumer appeal and attractive economics to retailers to increase UPCs per retailer and improve and increase our shelf space with both existing and new customers. |

| • | Continue to grow awareness and expand household penetration: Consumers who purchase SkinnyPop have a strong affinity for the brand as evidenced by our high level of repeat purchase, which has remained consistent, even as SkinnyPop has continued to gain customers. However, IRI data as of March 20, 2016 indicates that for the prior 52 weeks, only 7.9% (compared to 6.1% for the 52 weeks prior to March 22, 2015) of households have purchased SkinnyPop compared to 24.1% of households purchasing the top 25 salty snack brands. According to the same IRI data, we rank near the top of the category in dollar growth and item productivity, but rank lower on total dollar sales, which we believe provides evidence that we have room to grow within the category. We intend to continue increasing our household penetration through marketing, including product sampling, social media tools and advertising, to educate consumers about our brands and benefits of our BFY snacks. |

| • | Continue product innovation and brand extensions: We intend to improve and strengthen our product offering by creating new and innovative flavors, packaging alternatives and additional products, while maintaining a focus on simple ingredients and BFY snacks that appeal to consumers. |

| • | Leverage platform to expand in attractive snacking categories: We intend to expand our business through the introduction of additional brands and products in the BFY snacking segment in order to generate incremental growth opportunities and synergies. We are actively looking to identify and evaluate new acquisition opportunities to complement our platform. |

| • | Pursue international expansion opportunities: According to Nielsen, North America represents approximately one-third of the global snacking market, and recent trends in North America, including a focus on BFY products, are becoming more prevalent globally. We believe our brands will resonate with consumers in markets outside North America. To that end, we sent our first shipment of products to Mexico in April 2016 and expect to expand our business to the United Kingdom in the third quarter of 2016. |

Recent Developments

On April 29, 2016 we completed the acquisition of Boundless Nutrition, LLC. Based in Austin, Texas, Boundless Nutrition manufactures and distributes its Oatmega protein snack bars and Perfect Cookie products to natural, grocery, mass and foodservice retail partners across the United States. This acquisition expands our portfolio of great tasting BFY brands. IRI estimates that the snack bar sub-segment totaled approximately $5.9 billion in U.S. retail sales which represented 4.6% growth over the 52 weeks prior to March 20, 2016. In addition, based on unaudited internal financial reporting, Boundless Nutrition’s sales have increased more than 100% during the year ended March 31, 2016 compared to the year ended March 31, 2015, at least partially due to growth at mass accounts such as Walmart and Target (where Oatmega brand currently has four and nine facings, respectively). We

6

Table of Contents

believe that both the Oatmega and Perfect Cookie brands represent a strong entry into the snack bar sub-segment and healthy cookie sub-segment, respectively. Mintel estimates that 79% of millennials aged between 25 and 34 consume snack bars and 77% of adults buy snack bars for their children with snack bar consumers rating protein as an essential nutrition attribute.

The aggregate purchase consideration of the Boundless Nutrition acquisition was approximately $20.8 million, and we may be required to pay additional consideration of up to $10 million in 2019. We borrowed $12.0 million under the revolving credit facility to partially fund the acquisition. The financial information in this prospectus does not give pro forma effect to the acquisition of Boundless Nutrition. The Company management evaluated the impact to the Company’s financial statements of the acquisition of Boundless Nutrition and concluded that the impact was not significant enough to require or separately warrant the inclusion of pro forma financial results inclusive of Boundless Nutrition under applicable SEC rules and regulations or under GAAP.

Risk Factors Summary

Our business is subject to numerous risks and uncertainties, including those highlighted in “Risk Factors” immediately following this prospectus summary. These risks include, but are not limited to, the following:

| • | Changes in consumer preferences and discretionary spending may have a material adverse effect on our brand loyalty, net sales, results of operations and financial condition. |

| • | Consumers’ loyalty to our brands may change due to factors beyond our control, which could have a material adverse effect on our business and operating results. |

| • | We rely on sales to a limited number of distributors and retailers for the substantial majority of our net sales, and the loss of one or more such distributors or retailers may harm our business. |

| • | Sales of a limited number of SkinnyPop products and flavors contributed almost all of our historical profitability and cash flow. A reduction in the sale of our SkinnyPop products would have a material adverse effect on our ability to remain profitable and achieve future growth. |

| • | We currently depend primarily on one third-party co-manufacturer with one location to manufacture the substantial majority of our products. The loss of this co-manufacturer or the inability of this co-manufacturer to fulfill our orders would adversely affect our ability to make timely deliveries of our product and would have a material adverse effect on our business. |

| • | We do not have any contracts with our customers that require the purchase of a minimum amount of our products. The absence of such contracts could result in periods during which we must continue to pay costs and service indebtedness with reduced sales. |

| • | Because we rely on a limited number of raw materials to create our products and a limited number of third-party suppliers to supply our raw materials, we may not be able to obtain raw materials on a timely basis, at cost effective pricing or in sufficient quantities to produce our products. |

| • | Our reputation as a producer of BFY products may be diminished due to real or perceived quality or health issues with our products or a change in consumers’ perception of what is BFY itself, which could have an adverse effect on our business and operating results. BFY is an industry term and not defined by the Food and Drug Administration. |

| • | We rely, in part, on our third-party co-manufacturers to maintain the quality of our products. The failure or inability of these co-manufacturers to comply with the specifications and requirements of our products could result in product recall and could adversely affect our reputation. |

7

Table of Contents

| • | Our gross profit and Adjusted EBITDA margins may be impacted by a variety of factors, including but not limited to variations in raw materials pricing, retail customer requirements and mix, sales velocities and required promotional support. |

| • | Period-to-period comparisons may not be meaningful given the Sponsor Acquisition of SkinnyPop by TA Associates in 2014, the Paqui acquisition and the acquisition of Boundless Nutrition and may not be representative of our future performance. |

| • | A number of our products rely on independent certification that they are non-GMO, gluten-free or Kosher and the loss of any such certification could harm our business. |

Our Principal Stockholder

Following this offering, TA Associates will beneficially own approximately 46.1% of our issued and outstanding common stock (44.3% if the underwriters’ option to purchase additional shares is exercised in full). TA Associates will be able to exercise a significant level of control over all matters requiring stockholder approval, including the election of directors, amendment of our certificate of incorporation and approval of significant corporate transactions. This control could have the effect of delaying or preventing a change of control of our company or changes in management and will make the approval of certain transactions difficult without the support of TA Associates. Furthermore, TA Associates may have interests that conflict with, or are different than, those of other stockholders. See “Risk Factors—Risks Related to Ownership of Our Common Stock and this Offering” and “Principal and Selling Stockholders”. Additionally, we have entered into a stockholders agreement and a registration rights agreement with entities affiliated with TA Associates in connection with our IPO. For more information regarding these agreements, see “Certain Relationships and Related Party Transactions—Stockholders Agreement” and “Description of Capital Stock—Registration Rights”.

Founded in 1968, TA Associates is one of the oldest and largest growth private equity firms in the world. TA Associates invests in growing private companies in exciting industries, with the goal of helping management teams build their businesses into great companies. With approximately $24 billion raised since inception and over four decades of experience, TA Associates offers its portfolio companies strategic guidance, global insight, strategic acquisition support, recruiting assistance and a significant network of contacts, in addition to sound financial backing.

Corporate Information and Structure and IPO

We were originally organized as SkinnyPop Popcorn LLC, an Illinois limited liability company, in 2010. In July 2014, we completed the Sponsor Acquisition, pursuant to which SkinnyPop Popcorn LLC became a wholly-owned subsidiary of the Company and SkinnyPop Popcorn LLC was thereafter converted into a Delaware limited liability company.

Prior to the consummation of our IPO, a series of related reorganization transactions (hereinafter referred to as the “Corporate Reorganization”) occurred in the following sequence:

| • | TA Topco 1, LLC, or Topco, the former parent entity of the Company, liquidated in accordance with the terms and conditions of Topco’s existing limited liability company agreement, or the Topco Liquidation. The holders of existing units in Topco received 100% of the capital stock of the Company, which was allocated to such unit holders pursuant to the distribution provisions of the existing limited liability company agreement of Topco based upon the liquidation value of Topco. Since Topco was liquidated at the time of our IPO, the implied liquidation value of Topco was based on the IPO price of $18.00 per share. Topco ceased to exist following the Topco Liquidation. |

8

Table of Contents

| • | The Company entered into a tax receivable agreement, or TRA, with the former holders of units in Topco pursuant to which such holders received the right to future payments from the Company. In December 2015, all of the former holders of units of Topco collectively assigned their interests to a new counterparty. |

Immediately following the Corporate Reorganization, 15,000,000 shares of common stock of the Company were sold by selling stockholders to the public at a price of $18.00 per share. The selling stockholders (formerly holders of units in Topco), which included certain of our directors and officers, received all the proceeds from the sale of shares in the IPO. The Company did not receive any proceeds from the sale of shares in the IPO. Immediately following the IPO, former holders of units in Topco collectively owned 53,656,964 shares of common stock of the Company and 6,343,036 shares of the Company’s restricted stock, which were subject to vesting conditions.

Following the consummation of the Corporate Reorganization, Amplify Snack Brands, Inc. became a holding company, and its sole material asset is 100% of the membership units in SkinnyPop. As the sole and managing member of SkinnyPop, the Company operates and controls all of the business and affairs of SkinnyPop, Paqui and any other subsidiaries of the Company, through which we conduct our business. The Company consolidates the financial results of its subsidiaries, including SkinnyPop and Paqui. Pursuant to the limited liability company agreement of SkinnyPop, the Company has the right to determine when distributions will be made to the Company and the amount of any such distributions.

For more information regarding the Sponsor Acquisition, see “Management’s Discussion and Analysis of Financial Condition and Results of Operations” in our 2015 10-K incorporated by reference herein, “Risk Factors” and all of our audited consolidated financial statements and related notes incorporated by reference herein.

For more information on the Corporate Reorganization and ownership of our common stock, see Notes 1 and 10 in the accompanying Notes to Consolidated Financial Statements contained in Item 8 in our 2015 10-K incorporated by reference herein, and “Principal and Selling Stockholders”.

Our principal executive offices are located at 500 West 5th Street, Suite 1350, Austin, Texas 78701, telephone 512.600.9893. Our website address is www.amplifysnackbrands.com. Information contained on or that can be accessed through our website does not constitute part of this prospectus and inclusions of our website address in this prospectus are inactive textual references only.

Implications of Being an Emerging Growth Company

As a company with less than $1.0 billion in revenue during our last fiscal year, we qualify as an “emerging growth company” as defined in the Jumpstart Our Business Startups Act of 2012, or the JOBS Act. An emerging growth company may take advantage of specified reduced reporting requirements that are otherwise applicable generally to public companies. These provisions include:

| • | an option to present only two years of audited financial statements and only two years of related management’s discussion and analysis in the registration statement of which this prospectus is a part; |

| • | an exemption from compliance with the auditor attestation requirement on the effectiveness of our internal control over financial reporting for so long as we qualify as an “emerging growth company”; |

9

Table of Contents

| • | an exemption from compliance with any requirement that the Public Company Accounting Oversight Board may adopt regarding mandatory audit firm rotation or a supplement to the auditor’s report providing additional information about the audit and the financial statements for so long as we qualify as an “emerging growth company”; |

| • | reduced disclosure about our executive compensation arrangements for so long as we qualify as an “emerging growth company”; and |

| • | exemptions from the requirements to obtain a non-binding advisory vote on executive compensation or stockholder approval of any golden parachute arrangements for so long as we qualify as an “emerging growth company”. |

We will remain an emerging growth company until the earliest to occur of: the last day of the fiscal year in which we have more than $1.0 billion in annual revenue; the date we qualify as a “large accelerated filer”, with at least $700 million of equity securities held by non-affiliates; the issuance, in any three-year period, by us of more than $1.0 billion in non-convertible debt securities; or the last day of the fiscal year ending after the fifth anniversary of our IPO. We may choose to take advantage of some, but not all, of the available benefits under the JOBS Act. We are choosing to irrevocably “opt out” of the extended transition periods available under the JOBS Act for complying with new or revised accounting standards, but we intend to take advantage of the other exemptions discussed above. Accordingly, the information contained herein may be different than the information you receive from other public companies in which you hold stock. See “Risk Factors—Risks Related to Ownership of Our Common Stock and this Offering” which describes that we are an emerging growth company, and we cannot be certain if the reduced disclosure requirements applicable to emerging growth companies will make our common stock less attractive to investors.

10

Table of Contents

THE OFFERING

| Common stock offered by the selling stockholders |

10,000,000 shares. |

| Underwriters’ option to purchase additional shares from the selling stockholders |

Up to 1,500,000 shares. |

| Common stock to be outstanding immediately after this offering |

74,814,003 shares. |

| Use of proceeds |

The principal purpose of this offering is to facilitate an orderly distribution of shares for the selling stockholders. The selling stockholders, which include certain of our directors, will receive all the proceeds from the sale of shares in this offering. We will not receive any proceeds from the sale of shares in this offering. |

| Concentration of ownership |

Upon the consummation of this offering, our executive officers and directors and stockholders holding more than 10% of our capital stock, and their affiliates, will beneficially own, in the aggregate, approximately 61.4% of our outstanding shares of common stock (59.4% if the underwriters’ option to purchase additional shares is exercised in full). |

| Lock-up agreements |

The selling stockholders and the officers and directors of the Company will be subject to customary lockup agreements with a duration of 90 days. See “Underwriting”. |

| Listing trading symbol |

“BETR”. |

The number of shares of common stock to be outstanding after this offering is based on 74,814,003 shares outstanding as of March 31, 2016, and excludes:

| • | 300,000 shares of our common stock issuable upon the exercise of options outstanding as of March 31, 2016, at a weighted average price of $11.32 per share; |

| • | 195,829 shares of our common stock subject to restricted stock units outstanding as of March 31, 2016; and |

| • | 5,328,905 shares of common stock reserved for future issuance under our 2015 Plan. |

Except as otherwise indicated, all information in this prospectus assumes no exercise by the underwriters of their option to purchase up to an additional 1,500,000 shares of common stock from the selling stockholders in this offering.

11

Table of Contents

SUMMARY CONSOLIDATED FINANCIAL AND OTHER DATA

The following tables set forth our historical consolidated financial and other data. We have derived the summary (1) statements of income data for the year ended December 31, 2013 and the period from January 1, 2014 to July 16, 2014 for the Predecessor (as discussed below) and for the period from July 17, 2014 to December 31, 2014 and the year ended December 31, 2015 for the Successor (as discussed below), and (2) balance sheet data as of December 31, 2014 and December 31, 2015 from our audited consolidated financial statements and related notes included in our 2015 10-K that is incorporated by reference herein. We have derived the summary (1) statements of income data for the three months ended March 31, 2015 and the three months ended March 31, 2016 for the Successor and (2) balance sheet data as of March 31, 2016 from our unaudited condensed consolidated financial statements included in our First Quarter 10-Q that is incorporated by reference herein. Our unaudited interim condensed consolidated financial statements were prepared on a basis consistent with our audited consolidated financial statements and include, in management’s opinion, all normal recurring adjustments necessary for the fair presentation of the financial information set forth in those statements that are incorporated by reference herein.

Our financial data prior to the date of the Sponsor Acquisition, which are the year ended December 31, 2013 and the period January 1, 2014 to July 16, 2014, are presented as the financial data of the Predecessor, which includes the results of the then-existing SkinnyPop Popcorn LLC. The financial data after the date of the Sponsor Acquisition, which is the period July 17, 2014 to December 31, 2014 and the year ended December 31, 2015, are presented as the financial data of the Successor. The balance sheet data as of December 31, 2014 and December 31, 2015 are presented as the balance sheets of the Successor. The Successor and Predecessor financial data have been prepared on different accounting bases and therefore the sum of the data for the two reporting periods should not be used as an indicator of our full year performance.

After the consummation of the Sponsor Acquisition, the Company along with its subsidiary SkinnyPop Popcorn LLC, are referred to collectively in this prospectus as the “Successor”. Prior to the consummation of the Sponsor Acquisition, SkinnyPop Popcorn LLC is referred to in this prospectus as the “Predecessor”. We applied Financial Accounting Standards Board, or FASB, Accounting Standards Codification Topic 805, “Business Combinations” on July 17, 2014, the closing date of the Sponsor Acquisition, and as a result, the merger consideration in the Sponsor Acquisition was allocated to the respective fair values of the assets acquired and liabilities assumed from the Predecessor. The fair value of identifiable intangibles totaled approximately $265.3 million and amortization of finite-lived intangibles was approximately $1.9 million for the Successor period July 17, 2014 to December 31, 2014 and $4.2 million for the year ended December 31, 2015. As a result of the application of acquisition method accounting, the Successor balances and amounts presented in the audited consolidated financial statements and footnotes are not comparable with those of the Predecessor. Our historical results are not necessarily indicative of the results that may be expected in the future, and our interim results are not necessarily indicative of the results to be expected for the full year or any other period.

You should read the following selected consolidated financial data below in conjunction with Item 7 “Management’s Discussion and Analysis of Financial Condition and Results of Operations” in our 2015 10-K and First Quarter 10-Q incorporated by reference herein, “Risk Factors” and all of our audited consolidated financial statements and related notes incorporated by reference herein.

The Pro Forma Year Ended December 31, 2014 (Unaudited) is derived from the “Unaudited Pro Forma Condensed Consolidated Financial Information” in our 2015 10-K incorporated by reference herein and is included for informational purposes only and does not purport to reflect the results of operations of Amplify Snack Brands, Inc. that would have occurred had the Sponsor Acquisition, the

12

Table of Contents

December 2014 Special Dividend or the May 2015 Special Dividend occurred on January 1, 2014. The Pro Forma Year Ended December 31, 2014 (Unaudited) (as more fully described in Item 7 “Unaudited Pro Forma Condensed Consolidated Financial Information” in our 2015 10-K incorporated by reference herein) contains a variety of adjustments, assumptions and estimates, is subject to numerous other uncertainties and the assumptions and adjustments as described in the notes accompanying the unaudited pro forma condensed consolidated financial information incorporated by reference into this prospectus and should not be relied upon as being indicative of our results of operations had the Sponsor Acquisition, the December 2014 Special Dividend and the May 2015 Special Dividend occurred on the dates assumed.

| Predecessor | Successor | Pro Forma | Successor | |||||||||||||||||||||||||

| (In thousands) |

Year Ended December 31, 2013 |

January 1, 2014 to July 16, 2014 |

July 17, 2014 to December 31, 2014 |

Combined Year Ended December 31 2014 |

Year Ended December 31, 2015 |

Three months ended March 31, 2015 |

Three months ended March 31, 2016 |

|||||||||||||||||||||

| Statement of Income Data: |

||||||||||||||||||||||||||||

| Net Sales |

$ | 55,710 | $ | 68,353 | $ | 64,004 | $ | 132,357 | $ | 183,915 | $ | 44,275 | $ | 54,345 | ||||||||||||||

| Cost of goods sold |

23,054 | 29,429 | 28,724 | 58,153 | 80,972 | 19,866 | 25,927 | |||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

| Gross Profit |

32,656 | 38,924 | 35,280 | 74,204 | 102,943 | 24,409 | 28,418 | |||||||||||||||||||||

| Operating expenses |

||||||||||||||||||||||||||||

| Sales & marketing expenses(1) |

5,938 | 5,661 | 6,977 | 12,638 | 18,527 | 3,618 | 5,679 | |||||||||||||||||||||

| General & administrative |

1,960 | 1,394 | 13,611 | 27,238 | 46,261 | 9,032 | 5,432 | |||||||||||||||||||||

| Loss on change in fair value of contingent consideration(3) |

— | — | — | — | 1,521 | — | — | |||||||||||||||||||||

| Sponsor acquisition-related expenses(4) |

— | 1,288 | 2,215 | 510 | — | — | — | |||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

| Total operating expenses |

7,898 | 8,343 | 22,803 | 40,386 | 66,309 | 12,650 | 11,111 | |||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

| Operating income |

24,758 | 30,581 | 12,477 | 33,818 | 36,634 | 11,759 | 17,307 | |||||||||||||||||||||

| Interest expense |

— | — | 4,253 | 12,884 | 12,428 | 2,955 | 3,026 | |||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

| Income before income taxes |

24,758 | 30,581 | 8,224 | 20,934 | 24,206 | 8,804 | 14,281 | |||||||||||||||||||||

| Income tax expense |

— | — | 3,486 | 7,326 | 14,321 | 3,900 | 5,879 | |||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

| Net income |

$ | 24,758 | $ | 30,581 | $ | 4,738 | $ | 13,608 | $ | 9,885 | $ | 4,904 | $ | 8,402 | ||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

| Basic and diluted earnings per share/unit(5) |

$ | 61,895.01 | $ | 76,452.74 | $ | 0.07 | $ | 0.20 | $ | 0.13 | $ | 0.07 | $ | 0.11 | ||||||||||||||

| Basic and diluted weighted average shares/units outstanding(5) |

400 | 400 | 68,716,568 | 68,716,568 | 74,747,605 | 74,449,844 | 74,838,937 | |||||||||||||||||||||

| Cash Flow Data: |

||||||||||||||||||||||||||||

| Cash from (used in) operating activities |

$ | 22,469 | $ | 26,339 | $ | 12,719 | $ | 39,058 | $ | 46,999 | $ | 14,142 | $ | (8,561 | ) | |||||||||||||

| Cash used in investing activities |

(456 | ) | (278 | ) | (294,630 | ) | (294,908 | ) | (8,607 | ) | (370 | ) | (193 | ) | ||||||||||||||

| Cash (used in) provided by financing activities |

(19,362 | ) | (28,533 | ) | 287,526 | 258,993 | (25,256 | ) | (2,500 | ) | (2,563 | ) | ||||||||||||||||

| Other Financial Information (Non-GAAP): |

||||||||||||||||||||||||||||

| Adjusted EBITDA |

$ | 24,805 | $ | 31,947 | $ | 26,592 | $ | 58,539 | $ | 74,892 | $ | 19,231 | $ | 19,556 | ||||||||||||||

| Adjusted EBITDA margin |

44.5 | % | 46.7 | % | 41.5 | % | 44.2 | % | 40.7 | % | 43.4 | % | 36.0 | % | ||||||||||||||

| Operating cash flow less capital expenditures |

$ | 22,013 | $ | 26,061 | $ | 12,541 | $ | 38,602 | $ | 46,222 | $ | 13,772 | $ | (8,754 | ) | |||||||||||||

| (1) | Sales and marketing expenses include salaries and wages, commissions, broker fees, bonuses and incentives and other marketing and advertising expenses. |

| (2) | General and administrative expenses include salaries and wages, founder employment costs, depreciation of property and equipment, professional fees, amortization of intangible assets, insurance, travel and other operating expenses. |

13

Table of Contents

| (3) | In addition to the base purchase price consideration paid at closing for Paqui in April 2015, the acquisition agreement requires us to pay additional earn-out consideration contingent upon the achievement of a defined contribution margin in 2018. At December 31, 2015, we re-measured the acquisition-date fair value of the contingent consideration based on a revised forecast of Paqui operating results in 2018, which resulted in a non-cash loss of approximately $1.5 million. |

| (4) | In the predecessor period from January 1, 2014 to July 16, 2014, Sponsor Acquisition-related expenses include (i) a $0.5 million payment and related expenses, paid to an advisor to the Predecessor in connection with the Sponsor Acquisition, and (ii) transaction bonuses of $0.8 million paid to employees in connection with the Sponsor Acquisition. |

| (5) | Refer to Note 2 in the accompanying Notes to Consolidated Financial Statements contained in Item 8 in our 2015 10-K and Note 2 in the accompanying Notes to Condensed Consolidated Financial Statements contained in Item 1 in our First Quarter 10-Q, incorporated by reference herein, for an explanation of the method used to calculate basic and diluted earnings per unit/share and basic and diluted weighted average units/shares outstanding used in the computation of the per unit/share amounts. |

| Successor | ||||||||||||

| (In thousands) | December 31, 2014(1) |

December 31, 2015(1) |

March 31, 2016 |

|||||||||

| Balance Sheet Data: |

||||||||||||

| Cash and cash equivalents |

$ | 5,615 | $ | 18,751 | $ | 7,434 | ||||||

| Working capital(2) |

1,182 | (20,478 | ) | (11,166 | ) | |||||||

| Property and equipment, net |

746 | 2,153 | 2,284 | |||||||||

| Other assets(3) |

312,206 | 316,929 | 315,866 | |||||||||

| Total assets |

335,514 | 357,932 | 349,340 | |||||||||

| Indebtedness(4) |

196,623 | 198,211 | 195,865 | |||||||||

| Other liabilities |

6,343 | (5) | 97,720 | (6) | 99,252 | (6) | ||||||

| Total shareholders’ equity |

121,168 | 15,423 | 24,617 | |||||||||

| (1) | In April 2015, the FASB issued Accounting Standards Update, or ASU, No. 2015-03, Interest—Imputation of Interest (Subtopic 835-30): Simplifying the Presentation of Debt Issuance Costs. The amendments in ASU No. 2015-03 require an entity to present debt issuance costs in the balance sheet as a direct deduction from the carrying value of the related debt liability, rather than as an asset. The recognition and measurement guidance for debt issuance costs are not affected by the amendments. Effective January 1, 2016, we adopted ASU No. 2015-03 and applied the new guidance retrospectively, as required. As a result, we reclassified $3.4 million and $2.9 million at December 31, 2014 and December 31, 2015, respectively, of deferred financing costs, net from Other assets to a deduction from Indebtedness in the table above. The retrospective changes made to the December 31, 2014 and December 31, 2015 balance sheet data in the table above were not made to the 2015 10-K incorporated by reference herein. |

| (2) | Working capital is equal to the sum of current assets less the sum of current liabilities. |

| • | Current assets consist of cash and cash equivalents, accounts receivable- net, inventories, prepaid expenses, income tax receivable and other current assets. |

| • | Current liabilities consist of accounts payable and accrued liabilities, current portion of indebtedness, Founder Contingent Compensation discussed more fully in Notes 1 and 2 in the accompanying Notes to Consolidated Financial Statements contained in Item 8 in our 2015 10-K incorporated by reference herein and Note 2 in the accompanying Notes to Condensed Consolidated Financial Statements contained in Item 1 in our First Quarter 10-Q incorporated by reference herein, and the current portion of the tax receivable obligation discussed more fully in Note 10 in the accompanying Notes to Consolidated Financial Statements contained in Item 8 in our 2015 10-K incorporated by reference herein and Note 2 in the accompanying Notes to Condensed Consolidated Financial Statements contained in Item 1 in our First Quarter 10-Q incorporated by reference herein. |

| (3) | Consists of goodwill, intangible assets- net, deferred tax assets- net and other non-current assets. |

| (4) | Consists of the current and non-current portion of indebtedness. |

| (5) | Represents the recognizable portion of Founder Contingent Compensation as of December 31, 2014, which was based on the maximum potential obligation allowable under the employment agreements. For further information regarding Founder Contingent Compensation, see Notes 1 and 2 in the accompanying Notes to Consolidated Financial Statements contained in Item 8 in our 2015 10-K incorporated by reference herein. |

| (6) | Consists of deferred tax liabilities- net, contingent consideration, equity awards liability, non-current portion of the tax receivable obligation and other non-current liabilities. For further information regarding the tax receivable obligation, see Note 10 in the accompanying Notes to Consolidated Financial Statements contained in Item 8 in our 2015 10-K incorporated by reference herein and Note 2 in the accompanying Notes to Condensed Consolidated Financial Statements contained in Item 1 in our First Quarter 10-Q incorporated by reference herein. |

14

Table of Contents

Non-GAAP Financial Measures

We include Adjusted EBITDA and operating cash flow less capital expenditures, which we refer to as the non-GAAP metrics, in this prospectus because they are important measures upon which our management assesses our operating performance. We use Adjusted EBITDA as a key performance metric because we believe it facilitates operating performance comparisons from period-to-period by excluding potential differences primarily caused by variations in capital structures, tax positions, the impact of depreciation and amortization expense on our fixed assets and intangible assets and the impact of equity-based compensation expense. In addition, our credit agreement contains financial maintenance covenants, including a total funded debt ratio and a minimum fixed charge ratio, that use Adjusted EBITDA as one of their inputs. We include operating cash flow less capital expenditures in this prospectus because we believe capital expenditures are essential to maintaining our operational capabilities and are a recurring and necessary use of cash. We view operating cash flow less capital expenditures as a key performance metric because it reflects changes in, or cash requirements for, our working capital needs, and is useful in evaluating the amount of cash available for discretionary investments. Because such non-GAAP metrics facilitate internal comparisons of our historical operating performance on a more consistent basis, we also use them for business planning purposes, to incentivize and compensate our management personnel, and in evaluating acquisition opportunities. In addition, we believe the non-GAAP metrics and similar measures are widely used by investors, securities analysts, ratings agencies and other parties in evaluating companies in our industry as a measure of financial performance and debt-service capabilities.

Our use of non-GAAP metrics has limitations as an analytical tool, and you should not consider it in isolation or as a substitute for analysis of our results as reported under GAAP. Some of these limitations are:

| • | Adjusted EBITDA metric does not reflect our cash expenditures for capital equipment or other contractual commitments; |

| • | Although depreciation and amortization are non-cash charges, the assets being depreciated and amortized may have to be replaced in the future, and Adjusted EBITDA does not reflect capital expenditure requirements for such replacements; |

| • | Adjusted EBITDA metrics may not reflect changes in, or cash requirements for, our working capital needs; |

| • | Adjusted EBITDA does not reflect the interest expense or the cash requirements necessary to service interest or principal payments on our indebtedness; |

| • | Operating cash flow less capital expenditures does not reflect other non-discretionary expenditures such as mandatory debt service requirements or acquisition consideration paid that could impact residual cash flow available for discretionary expenditures; and |

| • | Other companies, including companies in our industry, may calculate Adjusted EBITDA and other non-GAAP measures differently, which reduces their usefulness as a comparative measure. |

In evaluating non-GAAP metrics, you should be aware that in the future we will incur expenses similar to the adjustments in this presentation. Our presentation of any non-GAAP metrics should not be construed as an inference that our future results will be unaffected by these expenses or any other expenses, whether or not they are unusual or non-recurring items. When evaluating our performance, you should consider the non-GAAP metrics alongside other financial performance measures, including our net income and other GAAP results.

15

Table of Contents

Adjusted EBITDA