Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - Macquarie Leasing Pty Ltd | d153784d8k.htm |

Exhibit 99.1

Australia and New Zealand Banking Group Limited

ABN 11 005 357 522

Half Year

31 March 2016

Consolidated Financial Report

Dividend Announcement

and Appendix 4D

|

The Consolidated Financial Report and Dividend Announcement contains information required by Appendix 4D of the Australian Securities Exchange (ASX) Listing Rules. It should be read in conjunction with ANZ’s 2015 Annual Report, and is lodged with the ASX under listing rule 4.2A.

|

| RESULTS FOR ANNOUNCEMENT TO THE MARKET | APPENDIX 4D |

| Name of Company: | Australia and New Zealand Banking Group Limited ABN 11 005 357 522 |

Report for the half year ended 31 March 2016

| Operating Results1 | AUD million | |||||||||||||

| Operating income |

¨ | 0% | to | 10,265 | ||||||||||

| Net statutory profit attributable to shareholders |

ò | -22% | to | 2,738 | ||||||||||

| Cash profit2 |

ò | -24% | to | 2,782 | ||||||||||

| Dividends3 | Cents per share |

Franked amount4 per share | ||||||

| Proposed interim dividend |

80 | 100% | ||||||

| Record date for determining entitlements to the proposed 2016 interim dividend |

10 May 2016 | |||||||

| Payment date for the proposed 2016 interim dividend |

1 July 2016 | |||||||

Dividend Reinvestment Plan and Bonus Option Plan

Australia and New Zealand Banking Group Limited (ANZ) has a Dividend Reinvestment Plan (DRP) and a Bonus Option Plan (BOP) that will operate in respect of the 2016 interim dividend. For the 2016 interim dividend, ANZ intends to provide shares under the DRP and BOP through the issue of new shares. The ‘Acquisition Price’ to be used in determining the number of shares to be provided under the DRP and BOP will be calculated by reference to the arithmetic average of the daily volume weighted average sale price of all fully paid ANZ ordinary shares sold in the ordinary course of trading on the ASX during the ten trading days commencing on 13 May 2016, and then rounded to the nearest whole cent. Shares provided under the DRP and BOP will rank equally in all respects with existing fully paid ANZ ordinary shares. Election notices from shareholders wanting to commence, cease or vary their participation in the DRP or BOP for the 2016 interim dividend must be received by ANZ’s Share Registrar by 5.00pm (Australian Eastern Standard Time) on 11 May 2016. Subject to receiving effective contrary instructions from the shareholder, dividends payable to shareholders with a registered address in the United Kingdom (including the Channel Islands and the Isle of Man) or New Zealand will be converted to Pounds Sterling or New Zealand Dollars respectively at an exchange rate calculated on 13 May 2016.

| 1 | Unless otherwise noted, all comparisons are to the half year ended 31 March 2015. |

| 2 | Cash profit excludes non-core items included in statutory profit and is provided to assist readers in understanding the result of the ongoing business activities of the Group. The non-core items are calculated consistently period on period so as not to discriminate between positive and negative adjustments and fall into one of the three categories: gains or losses included in earnings arising from changes in tax, legal or accounting legislation or other non-core items not associated with ongoing operations of the Group; treasury shares, revaluation of policy liabilities, economic hedging and similar accounting items that represent timing differences that will reverse through earnings in the future; and accounting reclassifications between individual line items that do not impact reported results, such as policy holder gross up. Cash profit is not a measure of cash flow or profit determined on a cash basis. The net after tax adjustment was an addition to statutory profit of $44 million made up of several items. Refer pages 91 to 96 for further details. |

| 3 | There is no foreign conduit income attributed to the dividends. |

| 4 | It is proposed that the interim dividend will be fully franked for Australian tax purposes (30% tax rate) and carry New Zealand imputation credits of NZD 10 cents per ordinary share. |

| AUSTRALIA AND NEW ZEALAND BANKING GROUP LIMITED | ABN 11 005 357 522 |

CONSOLIDATED FINANCIAL REPORT, DIVIDEND ANNOUNCEMENT AND APPENDIX 4D

Half year ended 31 March 2016

|

CONTENTS

|

PAGE

| |

| Section 1 – News Release |

5 | |

| Section 2 – Summary |

9 | |

| Section 3 – Strategic Review |

19 | |

| Section 4 – Group Results |

21 | |

| Section 5 – Divisional Results |

49 | |

| Section 6 – Geographic Results |

83 | |

| Section 7 – Profit Reconciliation |

91 | |

| Section 8 – Condensed Consolidated Financial Statements |

97 | |

| Section 9 – Supplementary Information |

129 | |

| Definitions |

148 | |

| ASX Appendix 4D Cross Reference Index |

151 | |

| Alphabetical Index

|

152

| |

|

|

||

This Consolidated Financial Report, Dividend Announcement and Appendix 4D has been prepared for Australia and New Zealand Banking Group Limited (the “Company” or “Parent Entity”) together with its subsidiaries which are variously described as “ANZ”, “Group”, “ANZ Group”, “the consolidated entity” “the Bank”, “us”, “we” or “our”.

All amounts are in Australian dollars unless otherwise stated. The information on which the Condensed Consolidated Financial Statements are based have been reviewed by the Group’s auditors, KPMG. The Company has a formally constituted Audit Committee of the Board of Directors. The signing of the Condensed Consolidated Financial Statements was approved by resolution of a Committee of the Board of Directors on 2 May 2016.

When used in this Results Announcement the words “estimate”, “project”, “intend”, “anticipate”, “believe”, “expect”, “should” and similar expressions, as they relate to ANZ and its management, are intended to identify forward-looking statements. Readers are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date hereof. ANZ does not undertake any obligation to publicly release the result of any revisions to these forward-looking statements to reflect events or circumstances after the date hereof or to reflect the occurrence of unanticipated events.

| AUSTRALIA AND NEW ZEALAND BANKING GROUP LIMITED | ABN 11 005 357 522 |

This page has been left blank intentionally

| AUSTRALIA AND NEW ZEALAND BANKING GROUP LIMITED | ABN 11 005 357 522 |

| News Release |

|

ANZ reports 2016 Half Year Result1

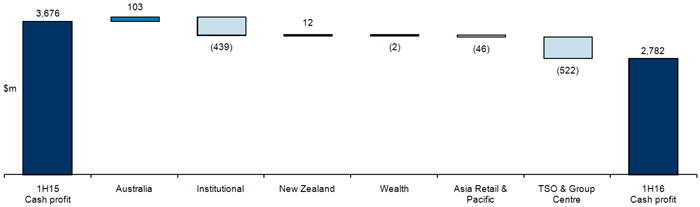

ANZ today announced a statutory profit after tax for the half year ended 31 March 2016 of $2.7 billion down 22% and a cash profit2 of $2.8 billion down 24%, following a $717 million net charge primarily related to initiatives to reposition the Group for stronger profit before provisions growth in the future.

Excluding these Specified Items (see page 3), allowing for better comparison with previous periods, adjusted pro-forma cash profit3 was $3.5 billion down 4% and profit before provisions was up 5%.

The Interim Dividend of 80 cents per share fully franked is down 7% reflecting a move to gradually consolidate ANZ’s dividend payout ratio within its historic range of 60-65% of annual cash profit4 which provides a conservative, sustainable and fully franked dividend base for the future. The Final Dividend for FY16 is expected to be at least the same as the Interim Dividend in cents per share.

The result reflects a strong performance in ANZ’s Australian and New Zealand consumer and small business franchises and challenging market conditions in Institutional Banking including higher provisions in the resources sector and in related industries.

Significant progress was also made in streamlining and simplifying ANZ to ensure the bank is future ready. This included a particularly strong expense management outcome, improved capital efficiency and initiatives to accelerate momentum and deliver future benefits including a restructuring charge and a change to the application of accounting policy to accelerate software amortisation.

| Selected Group Financial Information | ||||||||||||

| Earnings ($m) | 1H15 | 2H15 | 1H16 | |||||||||

| Statutory basis |

||||||||||||

| Profit before credit impairment and tax |

5,637 | 6,075 | 4,786 | |||||||||

| Statutory Profit |

3,506 | 3,987 | 2,738 | |||||||||

| Cash basis |

||||||||||||

| Profit before credit impairment and tax |

5,592 | 5,567 | 4,837 | |||||||||

| Cash Profit |

3,676 | 3,540 | 2,782 | |||||||||

| Earnings Per Share (cents) |

134 | 127 | 96 | |||||||||

| Return on Equity (%) |

14.7 | 13.3 | 9.7 | |||||||||

| Adjusted Pro-forma3 |

||||||||||||

| Profit before credit impairment and tax |

5,468 | 5,459 | 5,737 | |||||||||

| Adjusted Pro-forma Profit |

3,638 | 3,507 | 3,499 | |||||||||

| Operating expenses to income (CTI, %) |

45.5 | 46.4 | 45.0 | |||||||||

| Net Interest Margin (%) |

2.02 | 2.02 | 2.01 | |||||||||

| Earnings Per Share (cents) |

132 | 126 | 121 | |||||||||

| Return on Equity (%) |

14.5 | 13.2 | 12.2 | |||||||||

| Balance sheet ($b) |

1H15 | 2H15 | 1H16 | |||||||||

| Gross Loans and Advances (GLAs) |

562 | 574 | 566 | |||||||||

| Total Risk Weighted Assets |

387 | 402 | 388 | |||||||||

| Customer Deposits |

436 | 445 | 447 | |||||||||

| Leverage Ratio (%) |

NA5 | 5.1 | 5.1 | |||||||||

| Common Equity Tier 1 Ratio (%) |

8.7 | 9.6 | 9.8 | |||||||||

| Common Equity Tier 1 Ratio Internationally Comparable Basel 3 (%) |

12.1 | 13.2 | 14.0 | |||||||||

| Asset Quality |

1H15 | 2H15 | 1H16 | |||||||||

| Total Credit Impairment Charge as a % of avg GLAs (%) |

0.19 | 0.24 | 0.32 | |||||||||

| Collective Provision as a % of Credit RWAs (%) |

0.86 | 0.85 | 0.86 | |||||||||

| Gross impaired assets as a % of GLAs (%) |

0.48 | 0.47 | 0.51 | |||||||||

| Other |

1H15 | 2H15 | 1H16 | |||||||||

| Full time equivalent staff (FTE) |

51,243 | 50,152 | 48,896 | |||||||||

5

| AUSTRALIA AND NEW ZEALAND BANKING GROUP LIMITED | ABN 11 005 357 522 |

ANZ Chief Executive Officer Shayne Elliott said: “This result reflects a challenging period for banking and we have taken the opportunity to move decisively and adapt to the changing environment by building a simpler, better capitalised and more balanced bank.

“We have strong underlying drivers in our Australia and New Zealand consumer and small business franchise and we have seen good early progress in transforming Institutional Banking. This has been supported by prudent capital management and tight control of costs with total expenses, excluding the impact of Specified Items, being lower for the first time in seven halves.

“Banking is however continuing to experience rapid shifts in technology, customer expectations and regulation against a backdrop of low economic growth, volatile financial markets and rising credit costs. Our priority is to take bold action to ensure ANZ is fit and ready for this future.

“This means for the immediate future we are in a period of consolidation, simplification and transition. We have a clear plan and we have made significant progress this half through a focus on four strategic priorities,” Mr Elliott said.

|

Strategic Priorities

|

1H16 Progress Highlights

| |||||||

|

1. |

Create a simpler, better capitalised, better balanced and more agile bank.

Reduce operating costs and risks by removing product and management complexity, exiting low return and non-core businesses and reducing our reliance on low-return aspects of Institutional banking in particular. Further strengthen the balance sheet by rebalancing our portfolio. |

• |

Reduced 1H16 dividend providing foundation for a conservative, sustainable, fully franked pay-out ratio of 60-65% of cash profit4 | |||||

|

• |

Lower absolute operations costs (-2% pcp) and lower FTE (-5% pcp). | |||||||

|

• |

Reduced Risk Weighted Assets by 3% ($14 billion) - primarily low return Institutional Asia lending. | |||||||

|

• |

Sold Esanda dealer finance portfolio and Oasis. | |||||||

|

• |

Taken $138 million restructuring charge to underpin further simplification and productivity. | |||||||

|

• |

Repositioned minority investments in Asia as Group assets, valuation adjustments made. | |||||||

|

• |

Supported Bank of Tianjin listing and subsequent dilution in holding to ~12%. | |||||||

|

• |

Merged Asia Wealth with Asia Retail and commenced a strategic review.

| |||||||

|

2. |

Focus our efforts on attractive areas where we can carve out a winning position.

Make buying and owning a home or starting, running and growing a small business in Australia and New Zealand easy. Be the best bank in the world for customers driven by the movement of goods and capital in our region. |

• |

New organisation structure and Executive Committee aligned with focus areas. | |||||

|

• |

Merged Wealth distribution activities with core Retail to align priority segments. | |||||||

|

• |

Simplified and re-focused Institutional. | |||||||

|

• |

Established new Digital Banking Division to support growth in priority areas. | |||||||

|

• |

Moved to #3 market share in Australian Home Loans.

| |||||||

|

3. |

Drive a purpose and values led transformation of the Bank.

Creating a stronger sense of core purpose, ethics and fairness, investing in leaders who can help sense and navigate a rapidly changing environment. |

• |

Signed up to ABA conduct review. | |||||

|

• |

Launched review of recruitment and remuneration. | |||||||

|

• |

Invested in MIT Digital Leadership Program. | |||||||

|

• |

Uncompromising approach to enforcing ANZ’s Code of Conduct.

| |||||||

|

4. |

Build a superior everyday experience for our people and customers in order to compete in the digital age.

Build more convenient, engaging banking solutions to simplify the lives of customers and our own people. |

• |

Maile Carnegie appointed from Google to lead Digital. | |||||

|

• |

First Australian bank to launch Apple Pay, augmenting existing Android Pay plans. | |||||||

|

• |

New software capitalisation treatment recognises the nature and speed of digital change and supports innovation. | |||||||

|

• |

Implementation of multi-channel digital platform for Australian Retail banking to support improved customer experience.

| |||||||

6

| AUSTRALIA AND NEW ZEALAND BANKING GROUP LIMITED | ABN 11 005 357 522 |

Capital and Dividend. The actions being taken to simplify the business, rebalance our portfolio, divest non-core assets and increase capital efficiency in the Institutional loan book assisted the Group to generate 76 basis points of capital during the half. Further benefits are expected in future periods.

The Interim Dividend is 7% lower than the prior comparable period 1H15, reflecting actions undertaken to reshape ANZ and a normalisation of the credit cycle. The dividend payout ratio during the half of 84% primarily reflects the impact of specified items. On an adjusted pro-forma basis the ratio is 67%.

Consistent with ANZ’s normal practice, it is expected the Final Dividend for FY16 will be at least the same as the Interim Dividend in cents per share terms.

ANZ recognises the stability of the Group’s payout ratio and ability to fully frank dividends are critical considerations for shareholders. Following a period of dividend payout ratio expansion in the Australian banking sector, ANZ will gradually consolidate to its historic range of 60-65% of annual cash profit. This setting better reflects the changed banking environment in which we operate and the greater demands for capital.

Specified Items. During the half the Group sold the Esanda Dealer Finance portfolio and also recognised the impact of a number of items collectively referred to as ‘Specified Items’ which form part of the Group’s cash profit.

These specified items are (on an after tax basis): an accounting change to the application of the Group’s software capitalisation policy ($441 million), impairment of the Group’s investment in AmBank ($260 million), a net gain in relation to Bank of Tianjin ($29 million) and Group restructuring expenses ($101 million), as well as the Esanda dealer finance sale ($56 million). An information pack on these changes is on anz.com within the 1H16 results materials.

ANZ, by lifting the software capitalisation threshold and directly expensing more project related costs, has introduced a greater level of discipline into the management of technology investment. The change, effective from 1 October 2015, of itself does not impact the Group’s total spend on technology but better aligns the application of ANZ’s policy with the rapidly changing technology landscape, increased pace of innovation in financial services and the Group’s own evolving digital strategy. These changes bring forward the recognition of software expense resulting in lower amortisation charges in future years.

A restructuring charge of $138 million (pre-tax) was recognised in the half which will underpin further productivity in the second half and future years, through reducing complexity and aligning the Group to the changing emphasis on Institutional and International businesses.

Credit Quality. The total provision charge of $918 million ($892 million individual provision charge $26 million collective provision charge) is consistent with ANZ’s ASX disclosure of 24 March and equates to a 32 basis point loss rate. The loss rate is trending towards the long term average from historically low levels. Gross impaired assets were $2.9 billion up 6%, with new impaired assets flat compared to the prior half.

While the overall credit environment remains broadly stable, ANZ has continued to see pockets of weakness associated with low commodity prices in the resources sector and in related industries. Increased provision charges in the first half include charges related to a small number of Australian and multi-national resources related exposures.

Video interviews with Shayne Elliott and Acting Chief Financial Officer Graham Hodges regarding today’s 2016 Half Year result announcement are available at www.bluenotes.anz.com.

| For media enquiries contact: | For investor and analyst enquiries contact: | |

| Paul Edwards + 61-434-070101 | Jill Campbell, Tel: +61-412-047448 | |

| Stephen Ries +61-409-655551 | Cameron Davis, Tel: +61-421-613819 |

Footnotes:

| 1. | All comparisons are First Half Financial Year 2016 compared to First Half Financial Year 2015. |

| 2. | Cash profit excludes non-core items included in statutory profit and is provided to assist readers in understanding the results of the ongoing business activities of the Group. The net after tax adjustment was an addition to statutory profit of $44 million comprised of several items. |

| 3. | Pro-forma refers to Cash Profit adjusted to remove the impact of ‘Specified items’ including the impact of software capitalisation policy changes, Asia Partnership impairment charge (AmBank) and gain of cessation of equity accounting (Bank of Tianjin), restructuring expenses, sale of Esanda Dealer Finance portfolio. Further detail provided in the ANZ Half Year 2016 consolidated Financial Report p14. |

| 4. | Previously 65 to 70 per cent of cash profit. |

| 5. | APRA introduced amendments in May 2015 to enable calculation of the leverage ratio. |

7

| AUSTRALIA AND NEW ZEALAND BANKING GROUP LIMITED | ABN 11 005 357 522 |

This page has been left blank intentionally

8

SUMMARY

CONTENTS

Section 2 – Summary

Statutory Profit Results

Cash Profit Results

Key Balance Sheet Metrics

Cash Profit Results - FX Adjusted

Cash Profit Results - Adjusted Pro-forma, FX adjusted

Other Non-financial Information

9

SUMMARY

Statutory Profit Results

| Half Year

|

Movement

| |||||||||||||||

| Mar 16 $M |

Sep 15 $M |

Mar 15 $M |

Mar 16 v. Sep 15 |

Mar 16 v. Mar 15 | ||||||||||||

| Net interest income |

7,568 | 7,478 | 7,138 | 1% | 6% | |||||||||||

| Other operating income

|

2,697

|

|

3,372

|

|

3,102

|

|

-20%

|

|

-13%

| |||||||

| Operating income |

10,265 | 10,850 | 10,240 | -5% | 0% | |||||||||||

| Operating expenses |

(5,479)

|

|

(4,775)

|

|

(4,603)

|

|

15%

|

|

19%

| |||||||

| Profit before credit impairment and income tax |

4,786 | 6,075 | 5,637 | -21% | -15% | |||||||||||

| Credit impairment charge |

(904)

|

|

(685)

|

|

(494)

|

|

32%

|

|

83%

| |||||||

| Profit before income tax |

3,882 | 5,390 | 5,143 | -28% | -25% | |||||||||||

| Income tax expense |

(1,140) | (1,397) | (1,629) | -18% | -30% | |||||||||||

| Non-controlling interests

|

(4)

|

|

(6)

|

|

(8)

|

|

-33%

|

|

-50%

| |||||||

| Profit attributable to shareholders of the Company |

2,738

|

|

3,987

|

|

3,506

|

|

-31%

|

|

-22%

| |||||||

| Earnings per ordinary share (cents) | Half Year

|

Movement

| ||||||||||||||||||

| Reference Page |

Mar 16 | Sep 15 | Mar 15 |

Mar 16 |

Mar 16 | |||||||||||||||

| Basic |

109 | 94.8 | 143.4 | 128.0 | -34% | -26% | ||||||||||||||

| Diluted |

109

|

89.7

|

|

134.9

|

|

124.6

|

|

-34%

|

|

-28%

| ||||||||||

| Half Year

| ||||||||||||

| Reference Page |

Mar 16 | Sep 15 | Mar 15 | |||||||||

| Ordinary share dividends (cents) |

||||||||||||

| Interim - 100% franked1 |

108 | 80 | - | 86 | ||||||||

| Final - 100% franked1

|

|

108

|

|

-

|

95

|

-

| ||||||

| Total - 100% franked1 |

108 | 80 | 95 | 86 | ||||||||

| Ordinary share dividend payout ratio2 |

108 | 85.2% | 69.2% | 67.9% | ||||||||

| Preference share dividend ($M) |

||||||||||||

| Dividend paid3

|

|

108

|

|

-

|

-

|

1

| ||||||

| Profitability ratios |

||||||||||||

| Return on average ordinary shareholders’ equity4 |

9.5% | 15.0% | 14.0% | |||||||||

| Return on average assets |

0.61% | 0.91% | 0.85% | |||||||||

| Net interest margin

|

2.01%

|

2.04%

|

2.04%

| |||||||||

| Efficiency ratios |

||||||||||||

| Operating expenses to operating income |

53.4% | 44.0% | 45.0% | |||||||||

| Operating expenses to average assets

|

1.22%

|

1.09%

|

1.11%

| |||||||||

| Credit impairment charge/(release) |

||||||||||||

| Individual credit impairment charge ($M) |

878 | 645 | 439 | |||||||||

| Collective credit impairment charge/(release) ($M)

|

26

|

40

|

55

| |||||||||

| Total credit impairment charge ($M) |

113 | 904 | 685 | 494 | ||||||||

| Individual credit impairment charge as a % of average gross loans & advances5 |

0.31% | 0.23% | 0.16% | |||||||||

| Total credit impairment charge as a % of average gross loans & advances5

|

0.31%

|

0.24%

|

0.18%

| |||||||||

| 1. | Fully franked for Australian tax purposes and carry New Zealand imputation credits of NZ 10 cents per ordinary share for the proposed 2016 interim dividend (2015 final dividend: NZ 11 cents, 2015 interim dividend: NZ 10 cents). |

| 2. | Dividend payout ratio is calculated using the proposed 2016 interim, 2015 final and 2015 interim dividends. |

| 3. | Represents dividends paid on Euro Trust Securities (preference shares) issued on 13 December 2004. The Euro Trust Securities were bought back by ANZ for cash at face value and cancelled on 15 December 2014. |

| 4. | Average ordinary shareholders’ equity excludes non-controlling interests and preference shares. |

| 5. | Loans & advances as at 30 September 2015 include Esanda Dealer Finance assets divested to Macquarie Group Limited in the March 2016 half. |

10

SUMMARY

Cash Profit Results1

| Half Year | Movement | |||||||||||||

| Mar 16 $M |

Sep 15 $M |

Mar 15 $M |

Mar 16 v. Sep 15 |

Mar 16 v. Mar 15 | ||||||||||

| Net interest income |

7,568 | 7,478 | 7,138 | 1% | 6% | |||||||||

| Other operating income

|

2,748 | 2,864 | 3,057 | -4% | -10% | |||||||||

| Operating income |

10,316 | 10,342 | 10,195 | 0% | 1% | |||||||||

| Operating expenses

|

(5,479)

|

(4,775)

|

(4,603)

|

15%

|

19%

| |||||||||

| Profit before credit impairment and income tax |

4,837 | 5,567 | 5,592 | -13% | -14% | |||||||||

| Credit impairment charge

|

(918)

|

(695)

|

(510)

|

32%

|

80%

| |||||||||

| Profit before income tax |

3,919 | 4,872 | 5,082 | -20% | -23% | |||||||||

| Income tax expense |

(1,133) | (1,326) | (1,398) | -15% | -19% | |||||||||

| Non-controlling interests

|

(4)

|

(6)

|

(8)

|

-33%

|

-50%

| |||||||||

| Cash profit

|

2,782

|

3,540

|

3,676

|

-21%

|

-24%

| |||||||||

| Earnings per ordinary share (cents) | ||||||||||||||

| Half Year | Movement | |||||||||||||

| Reference

Page |

Mar 16 | Sep 15 | Mar 15 |

Mar 16 |

Mar 16 v. Mar 15 | |||||||||

| Basic |

39 | 95.9 | 126.8 | 133.6 | -24% | -28% | ||||||||

| Diluted |

39

|

90.7

|

119.8

|

129.9

|

-24%

|

-30%

| ||||||||

| Half Year | ||||||||

| Reference Page |

Mar 16 | Sep 15 | Mar 15 | |||||

| Ordinary share dividends |

||||||||

| Ordinary share dividend payout ratio2

|

40

|

83.9%

|

77.9%

|

64.7%

| ||||

|

Profitability ratios |

||||||||

| Return on average ordinary shareholders’ equity3 |

9.7% | 13.3% | 14.7% | |||||

| Return on average assets |

0.62% | 0.81% | 0.89% | |||||

| Net interest margin |

24 | 2.01% | 2.04% | 2.04% | ||||

| Profit per average FTE ($)

|

55,889

|

69,214

|

72,421

| |||||

|

Efficiency ratios |

||||||||

| Operating expenses to operating income |

53.1% | 46.2% | 45.1% | |||||

| Operating expenses to average assets

|

1.22%

|

1.09%

|

1.11%

| |||||

|

Credit impairment charge/(release) |

||||||||

| Individual credit impairment charge ($M) |

33 | 892 | 655 | 455 | ||||

| Collective credit impairment charge/(release) ($M)

|

34

|

26

|

40

|

55

| ||||

| Total credit impairment charge ($M) |

33 | 918 | 695 | 510 | ||||

| Individual credit impairment charge as a % of average gross loans & advances4 |

0.31% | 0.23% | 0.17% | |||||

| Total credit impairment charge as a % of average gross loans & advances4

|

0.32%

|

0.24%

|

0.19%

| |||||

| Cash profit/(loss) by division/geography (in AUD) | Half Year | Movement | ||||||||||

| Mar 16 $M |

Sep 15 $M |

Mar 15 |

|

Mar 16 v. Sep 15 |

Mar 16 v. Mar 15 | |||||||

| Australia |

1,753 | 1,706 | 1,650 | 3% | 6% | |||||||

| Institutional |

632 | 893 | 1,071 | -29% | -41% | |||||||

| New Zealand |

578 | 561 | 566 | 3% | 2% | |||||||

| Wealth |

261 | 346 | 263 | -25% | -1% | |||||||

| Asia Retail & Pacific |

53 | 45 | 99 | 18% | -46% | |||||||

| TSO and Group Centre

|

(495)

|

(11)

|

27

|

large

|

large

| |||||||

| Cash profit by division |

2,782

|

3,540

|

3,676

|

-21%

|

-24%

| |||||||

|

|

||||||||||||

| Australia |

1,830 | 2,269 | 2,147 | -19% | -15% | |||||||

| Asia Pacific, Europe & America |

259 | 492 | 743 | -47% | -65% | |||||||

| New Zealand

|

693

|

779

|

786

|

-11%

|

-12%

| |||||||

| Cash profit by geography

|

2,782

|

3,540

|

3,676

|

-21%

|

-24%

| |||||||

| 1. | Cash profit excludes non-core items included in statutory profit and is provided to assist readers in understanding the result of the ongoing business activities of the Group. Refer to page 91 for the reconciliation between statutory and cash profit. |

| 2. | Dividend payout ratio is calculated using the proposed 2016 interim, 2015 final and 2015 interim dividends. |

| 3. | Average ordinary shareholders’ equity excludes non-controlling interests and preference shares. |

| 4. | Loans & advances as at 30 September 2015 include Esanda Dealer Finance assets divested to Macquarie Group Limited in the March 2016 half. |

11

SUMMARY

Key Balance Sheet Metrics

| As at |

Movement | |||||||||||||

| Reference Page |

Mar 16 | Sep 15 | Mar 15 |

Mar

16 |

Mar 16 v. Mar 15 | |||||||||

| Capital adequacy |

||||||||||||||

| Common Equity Tier 1 |

||||||||||||||

| - APRA Basel 3 |

44 | 9.8% | 9.6% | 8.7% | ||||||||||

| - Internationally Comparable Basel 31 |

44 | 14.0% | 13.2% | 12.1% | ||||||||||

| Credit risk weighted assets ($B) |

132 | 334.3 | 349.8 | 339.7 | -4% | -2% | ||||||||

| Total risk weighted assets ($B)

|

132

|

388.3

|

401.9

|

386.9

|

-3%

|

0%

| ||||||||

|

Balance Sheet: Key Items |

||||||||||||||

| Gross loans & advances ($B)2 |

565.9 | 574.3 | 562.2 | -1% | 1% | |||||||||

| Net loans & advances ($B)2 |

561.8 | 570.2 | 558.2 | -1% | 1% | |||||||||

| Total assets ($B) |

895.3 | 889.9 | 860.1 | 1% | 4% | |||||||||

| Customer deposits ($B) |

446.8 | 444.6 | 436.1 | 0% | 2% | |||||||||

| Total equity ($B) |

56.5 | 57.4 | 52.1 | -2% | 8% | |||||||||

| Leverage Ratio

|

46

|

5.1%

|

5.1%

|

n/a

|

0%

|

n/a

| ||||||||

| Half Year Average | Movement | |||||||||||||

| Balance Sheet: Key Items | Mar 16 | Sep 15 | Mar 15 | Mar 16 v. Sep 15 |

Mar 16 v. Mar 15 | |||||||||

| Liquidity Coverage Ratio

|

42

|

126%

|

124%

|

118%

|

2%

|

7%

| ||||||||

| As at | Movement | |||||||||||||

| Reference Page |

Mar 16 | Sep 15 | Mar 15 | Mar 16 v. Sep 15 |

Mar 16 v. Mar 15 | |||||||||

|

Impaired assets |

||||||||||||||

| Gross impaired assets ($M) |

35 | 2,883 | 2,719 | 2,708 | 6% | 6% | ||||||||

| Gross impaired assets as a % of gross loans & advances2 |

0.51% | 0.47% | 0.48% | |||||||||||

| Net impaired assets ($M) |

35 | 1,645 | 1,658 | 1,594 | -1% | 3% | ||||||||

| Net impaired assets as a % of shareholders’ equity |

2.9% | 2.9% | 3.1% | |||||||||||

|

Individual provision ($M) |

113 | 1,238 | 1,061 | 1,114 | 17% | 11% | ||||||||

| Individual provision as a % of gross impaired assets |

42.9% | 39.0% | 41.1% | |||||||||||

| Collective provision ($M) |

113 | 2,862 | 2,956 | 2,914 | -3% | -2% | ||||||||

| Collective provision as a % of credit risk weighted assets

|

0.86%

|

0.85%

|

0.86%

|

|||||||||||

|

Net Assets |

||||||||||||||

| Net tangible assets attributable to ordinary shareholders ($B) |

48.8 | 48.9 | 43.6 | 0% | 12% | |||||||||

| Net tangible assets per ordinary share ($)

|

16.77

|

16.86

|

15.75

|

-1%

|

6%

| |||||||||

| 1. | See page 45 for further details regarding the differences between APRA Basel 3 and Internationally Comparable Basel 3 standards. |

| 2. | Loans & advances as at 30 September 2015 include Esanda Dealer Finance assets divested to Macquarie Group Limited in the March 2016 half. |

| Net loans and advances by division/geography | As at | Movement | ||||||||||

| Mar 16 $B |

Sep 15 $B |

Mar 15 $B |

Mar

16 |

Mar 16 v. Mar 15 | ||||||||

| Australia |

320.0 | 313.7 | 297.6 | 2% | 8% | |||||||

| Institutional |

125.6 | 142.2 | 144.9 | -12% | -13% | |||||||

| New Zealand |

97.2 | 95.2 | 97.7 | 2% | -1% | |||||||

| Wealth |

7.3 | 7.1 | 6.9 | 3% | 6% | |||||||

| Asia Retail & Pacific |

11.9 | 12.5 | 11.6 | -5% | 3% | |||||||

| TSO and Group Centre

|

(0.2)

|

(0.5)

|

(0.5)

|

-60%

|

-60%

| |||||||

| Net loans and advances by division3

|

561.8

|

570.2

|

558.2

|

-1%

|

1%

| |||||||

| Australia |

386.8 | 381.2 | 362.8 | 1% | 7% | |||||||

| Asia Pacific, Europe & America |

69.1 | 85.1 | 88.4 | -19% | -22% | |||||||

| New Zealand

|

105.9

|

103.9

|

107.0

|

2%

|

-1%

| |||||||

| Net loans and advances by geography3

|

561.8

|

570.2

|

558.2

|

-1%

|

1%

| |||||||

| 3. | Loans & advances as at 30 September 2015 include Esanda Dealer Finance assets divested to Macquarie Group Limited in the March 2016 half. |

12

SUMMARY

Cash Profit Results – FX Adjusted

The following tables present the Group’s cash profit results neutralised for the impact of foreign currency translation. Comparative data has been adjusted to remove the translation impact of foreign exchange movements by retranslating prior period comparatives at current period foreign exchange rates. Refer to page 37 for further details on the impact of exchange rate movements.

Cash Profit - March 2016 Half Year vs March 2015 Half Year

| Half Year |

Movement | |||||||||||||||

| Actual | FX unadjusted |

FX impact |

FX adjusted |

FX unadjusted |

FX impact |

FX adjusted | ||||||||||

| Mar 16 $M |

Mar 15 $M |

Mar 15 $M |

Mar 15 $M |

Mar 16 v. Mar 15 |

Mar 16 v. Mar 15 |

Mar 16 v. Mar 15 | ||||||||||

| Net interest income |

7,568 | 7,138 | 77 | 7,215 | 6% | 1% | 5% | |||||||||

| Other operating income

|

2,748

|

3,057

|

149

|

3,206

|

-10%

|

4%

|

-14%

| |||||||||

| Operating income |

10,316 | 10,195 | 226 | 10,421 | 1% | 2% | -1% | |||||||||

| Operating expenses

|

(5,479)

|

(4,603)

|

(115)

|

(4,718)

|

19%

|

3%

|

16%

| |||||||||

| Profit before credit impairment and income tax |

4,837 | 5,592 | 111 | 5,703 | -14% | 1% | -15% | |||||||||

| Credit impairment charge

|

(918)

|

(510)

|

(5)

|

(515)

|

80%

|

2%

|

78%

| |||||||||

| Profit before income tax |

3,919 | 5,082 | 106 | 5,188 | -23% | 1% | -24% | |||||||||

| Income tax expense |

(1,133) | (1,398) | (25) | (1,423) | -19% | 1% | -20% | |||||||||

| Non-controlling interests

|

(4)

|

(8)

|

(2)

|

(10)

|

-50%

|

10%

|

-60%

| |||||||||

| Cash profit

|

2,782

|

3,676

|

79

|

3,755

|

-24%

|

2%

|

-26%

| |||||||||

Cash Profit - March 2016 Half Year vs September 2015 Half Year

| Half Year |

Movement | |||||||||||||||

| Actual | FX unadjusted |

FX impact |

FX adjusted |

FX unadjusted |

FX impact |

FX adjusted | ||||||||||

| Mar 16 $M |

Sep 15 $M |

Sep 15 $M |

Sep 15 $M |

Mar 16 v. Sep 15 |

Mar 16 v. Sep 15 |

Mar 16 v. Sep 15 | ||||||||||

| Net interest income |

7,568 | 7,478 | 32 | 7,510 | 1% | 0% | 1% | |||||||||

| Other operating income

|

2,748

|

2,864

|

103

|

2,967

|

-4%

|

3%

|

-7%

| |||||||||

| Operating income |

10,316 | 10,342 | 135 | 10,477 | 0% | 2% | -2% | |||||||||

| Operating expenses

|

(5,479)

|

(4,775)

|

(37)

|

(4,812)

|

15%

|

1%

|

14%

| |||||||||

| Profit before credit impairment and income tax |

4,837 | 5,567 | 98 | 5,665 | -13% | 2% | -15% | |||||||||

| Credit impairment charge

|

(918)

|

(695)

|

(8)

|

(703)

|

32%

|

1%

|

31%

| |||||||||

| Profit before income tax |

3,919 | 4,872 | 90 | 4,962 | -20% | 1% | -21% | |||||||||

| Income tax expense |

(1,133) | (1,326) | (28) | (1,354) | -15% | 1% | -16% | |||||||||

| Non-controlling interests

|

(4)

|

(6)

|

1

|

(5)

|

-33%

|

-13%

|

-20%

| |||||||||

| Cash profit |

2,782

|

3,540

|

63

|

3,603

|

-21%

|

2%

|

-23%

| |||||||||

13

SUMMARY

Cash Profit Results – Adjusted Pro-forma, FX adjusted

During the March 2016 half, the Group sold the Esanda Dealer Finance portfolio and recognised the impact of a number of items collectively referred to as ‘specified items’ which form part of the Group’s cash profit. The tables on the following pages present the Group’s FX adjusted cash profit adjusted for these items to assist readers to understand the estimated growth rates of the ongoing business performance of the Group. The “Cash Profit Results - Adjusted Pro-forma, FX adjusted” are not subject to review or audit by the external auditor.

| ¡ | Esanda Dealer Finance divestment |

On 1 November 2015, the Group sold the Esanda Dealer Finance portfolio with the majority of the business transferred by 31 December 2015. Pro-forma results have been prepared on the assumption that the sale which occurred during the March 2016 half took effect from 1 October 2014, effectively restating the Group’s cash profit for each of the March 2015, September 2015 and March 2016 halves.

| ¡ | Software capitalisation changes |

During the March 2016 half, the Board resolved to amend the application of the Group’s software capitalisation policy by increasing the threshold for capitalisation of software development costs to $20 million, reflecting the increasingly shorter useful life of smaller items of software, and directly expensing more project related costs.

For software assets at 1 October 2015 with an original cost below the revised threshold, the carrying values were expensed through an accelerated amortisation charge of $556 million (recognised in TSO & Group Centre). Of this, $88 million would otherwise have been amortised in the March 2016 half (i.e. the half year amortisation charge increased by $468 million).

In addition, application of the software capitalisation changes also increased other operating expenses by $161 million for the March 2016 half relating to software development costs that would otherwise have been capitalised and amortised in future periods.

Going forward, these changes will result in higher project expenditure being expensed in the profit and loss which will be offset by lower amortisation charges.

| March 2016 Half Year | ||||||||

| Accelerated amortisation $M |

Amortisation $M |

Application of policy to new project expenditure $M |

Total impact $M | |||||

| Operating expense increase/(decrease) by division |

||||||||

| Australia |

- | (13) | 49 | 36 | ||||

| Institutional |

- | (26) | 30 | 4 | ||||

| New Zealand |

- | (7) | 17 | 10 | ||||

| Wealth |

- | (14) | 19 | 5 | ||||

| Asia Retail & Pacific |

- | (4) | - | (4) | ||||

| TSO and Group Centre

|

556

|

(24)

|

46

|

578

| ||||

| Total

|

556

|

(88)

|

161

|

629

| ||||

| ¡ | Asian minority investment adjustments |

During the March 2016 half, the Group recognised a $260 million impairment to its equity accounted investment in AMMB Holdings Berhad (Ambank) bringing the carrying value in line with value-in-use calculations (refer Note 1 (v) of the Condensed Consolidated Financial Statements).

On 30 March 2016, Bank of Tianjin (BoT), an equity accounted investment, completed a capital raising and listing on the Hong Kong Stock Exchange through an Initial Public Offering (IPO). As the Group did not participate in the capital raising, its ownership interest decreased from 14% to 12%. As a consequence, the Group ceased equity accounting the investment in BoT and commenced accounting for the investment as for as an available-for-sale asset. A net gain of $29 million was recognised in relation to the remeasurement of the investment to fair value and recycling the associated equity accounted reserves.

| ¡ | Restructuring |

The Group is in the process of evolving its strategy, including reshaping of the workforce to reduce complexity and duplication, and to align with its changing emphasis on Institutional and Wealth businesses, restructure of Retail Asia and Pacific and delayering and simplification in TSO and Group Centre. A restructuring expense of $138 million was recognised in the March 2016 half.

| Half Year

| ||||||

| Restructuring expense by division | Mar 16 $M | Sep 15 $M | Mar 15 $M | |||

| Australia |

22 | 2 | - | |||

| Institutional |

51 | 6 | 2 | |||

| New Zealand |

2 | 1 | 2 | |||

| Wealth |

13 | - | 1 | |||

| Asia Retail & Pacific |

12 | - | - | |||

| TSO and Group Centre

|

38

|

12

|

5

| |||

|

Total

|

138

|

21

|

10

| |||

14

SUMMARY

Cash Profit Results - Adjusted Pro-forma, FX adjusted

| March 2016 Half Year |

March 2015 Half Year |

Mar 16 v. Mar 15 | ||||||||||||||||||||||||||||

| Cash profit | Software capitalisation changes |

Asian minority investment adjust |

Restructuring | Esanda Dealer Finance |

Adjusted pro-forma |

Cash profit | Restructuring | Esanda Dealer Finance |

FX impact | Adjusted pro-forma, FX adj |

Adjusted pro- forma, FX unadj |

Adjusted pro-forma, FX adj | ||||||||||||||||||

|

Cash Profit - March 2016 v March 2015 |

||||||||||||||||||||||||||||||

| Net interest income |

7,568 | - | - | - | (31) | 7,537 | 7,138 | - | (130) | 77 | 7,085 | 8% | 6% | |||||||||||||||||

| Other operating income

|

2,748

|

-

|

231

|

-

|

(78)

|

2,901

|

3,057

|

-

|

(25)

|

149

|

3,181

|

-4%

|

-9%

| |||||||||||||||||

|

Operating income |

10,316 | - | 231 | - | (109) | 10,438 | 10,195 | - | (155) | 226 | 10,266 | 4% | 2% | |||||||||||||||||

| Operating expenses

|

(5,479)

|

629

|

-

|

138

|

11

|

(4,701)

|

(4,603)

|

10

|

21

|

(115)

|

(4,687)

|

3%

|

0%

| |||||||||||||||||

|

Profit before credit impairment and income tax |

4,837 | 629 | 231 | 138 | (98) | 5,737 | 5,592 | 10 | (134) | 111 | 5,579 | 5% | 3% | |||||||||||||||||

| Credit impairment charge

|

(918)

|

-

|

-

|

-

|

13

|

(905)

|

(510)

|

-

|

69

|

(5)

|

(446)

|

large

|

large

| |||||||||||||||||

|

Profit before income tax |

3,919 | 629 | 231 | 138 | (85) | 4,832 | 5,082 | 10 | (65) | 106 | 5,133 | -4% | -6% | |||||||||||||||||

| Income tax expense |

(1,133) | (188) | - | (37) | 29 | (1,329) | (1,398) | (3) | 20 | (25) | (1,406) | -4% | -5% | |||||||||||||||||

| Non-controlling interests

|

(4)

|

-

|

-

|

-

|

-

|

(4)

|

(8)

|

-

|

-

|

(2)

|

(10)

|

-50%

|

-60%

| |||||||||||||||||

| Cash profit

|

2,782

|

441

|

231

|

101

|

(56)

|

3,499

|

3,676

|

7

|

(45)

|

79

|

3,717

|

-4%

|

-6%

| |||||||||||||||||

|

March 2016 Half Year |

March 2015 Half Year |

Mar 16 v. Mar 15 | ||||||||||||||||||||||||||||

| Cash profit | Software capitalisation changes |

Asian minority |

Restructuring | Esanda Dealer Finance |

Adjusted pro-forma |

Cash profit | Restructuring | Esanda Dealer Finance |

FX impact | Adjusted pro-forma, FX adj |

Adjusted pro- forma, FX unadj |

Adjusted pro-forma, FX adj | ||||||||||||||||||

|

Profit before income tax by division - March 2016 v March 2015 |

||||||||||||||||||||||||||||||

| Australia |

2,505 | 36 | - | 22 | (19) | 2,544 | 2,359 | - | (65) | - | 2,294 | 11% | 11% | |||||||||||||||||

| Institutional |

880 | 4 | - | 51 | - | 935 | 1,497 | 2 | - | 50 | 1,549 | -38% | -40% | |||||||||||||||||

| New Zealand |

804 | 10 | - | 2 | - | 816 | 787 | 2 | - | (10) | 779 | 3% | 5% | |||||||||||||||||

| Wealth |

359 | 5 | - | 13 | - | 377 | 368 | 1 | - | (1) | 368 | 2% | 2% | |||||||||||||||||

| Asia Retail & Pacific |

67 | (4) | - | 12 | - | 75 | 128 | - | - | 8 | 136 | -41% | -45% | |||||||||||||||||

| TSO and Group Centre1

|

(696)

|

578

|

231

|

38

|

(66)

|

85

|

(57)

|

5

|

-

|

59

|

7

|

large

|

large

| |||||||||||||||||

|

Profit before income tax |

3,919 | 629 | 231 | 138 | (85) | 4,832 | 5,082 | 10 | (65) | 106 | 5,133 | -4% | -6% | |||||||||||||||||

| Income tax expense & non-controlling interests

|

(1,137)

|

(188)

|

-

|

(37)

|

29

|

(1,333)

|

(1,406)

|

(3)

|

20

|

(27)

|

(1,416)

|

-4%

|

-6%

| |||||||||||||||||

| Cash profit

|

2,782

|

441

|

231

|

101

|

(56)

|

3,499

|

3,676

|

7

|

(45)

|

79

|

3,717

|

-4%

|

-6%

| |||||||||||||||||

| 1. | Cash profit for TSO and Group Centre in the March 2016 half includes the accelerated amortisation for all divisions resulting from the software capitalisation changes and the net gain on divestment of the Esanda Dealer Finance portfolio. |

15

SUMMARY

Cash Profit Results - Adjusted Pro-forma, FX adjusted

| March 2016 Half Year | September 2015 Half Year |

Mar 16 v. Sep 15 | ||||||||||||||||||||||||||||

| Cash profit | Software capitalisation changes |

Asian minority investment adjust |

Restructuring | Esanda Dealer Finance |

Adjusted pro-forma |

Cash profit | Restructuring | Esanda Dealer Finance |

FX impact | Adjusted pro-forma, FX adj |

Adjusted pro-forma, FX unadj |

Adjusted pro-forma, FX adj | ||||||||||||||||||

| Cash Profit - March 2016 v September 2015 | ||||||||||||||||||||||||||||||

| Net interest income |

7,568 | - | - | - | (31) | 7,537 | 7,478 | - | (125) | 32 | 7,385 | 3% | 2% | |||||||||||||||||

| Other operating income

|

2,748

|

-

|

231

|

-

|

(78)

|

2,901

|

2,864

|

-

|

(26)

|

103

|

2,941

|

2%

|

-1%

| |||||||||||||||||

|

Operating income |

10,316 | - | 231 | - | (109) | 10,438 | 10,342 | - | (151) | 135 | 10,326 | 2% | 1% | |||||||||||||||||

| Operating expenses

|

(5,479)

|

629

|

-

|

138

|

11

|

(4,701)

|

(4,775)

|

21

|

22

|

(37)

|

(4,769)

|

-1%

|

-1%

| |||||||||||||||||

|

Profit before credit impairment and income tax |

4,837 | 629 | 231 | 138 | (98) | 5,737 | 5,567 | 21 | (129) | 98 | 5,557 | 5% | 3% | |||||||||||||||||

| Credit impairment charge

|

(918)

|

-

|

-

|

-

|

13

|

(905)

|

(695)

|

-

|

61

|

(8)

|

(642)

|

43%

|

41%

| |||||||||||||||||

|

Profit before income tax |

3,919 | 629 | 231 | 138 | (85) | 4,832 | 4,872 | 21 | (68) | 90 | 4,915 | 0% | -2% | |||||||||||||||||

| Income tax expense |

(1,133) | (188) | - | (37) | 29 | (1,329) | (1,326) | (6) | 20 | (28) | (1,340) | 1% | -1% | |||||||||||||||||

| Non-controlling interests

|

(4)

|

-

|

-

|

-

|

-

|

(4)

|

(6)

|

-

|

-

|

1

|

(5)

|

-33%

|

-20%

| |||||||||||||||||

| Cash profit

|

2,782

|

441

|

231

|

101

|

(56)

|

3,499

|

3,540

|

15

|

(48)

|

63

|

3,570

|

0%

|

-2%

| |||||||||||||||||

|

March 2016 Half Year |

September 2015 Half Year |

Mar 16 v. Sep 15 | ||||||||||||||||||||||||||||

| Cash profit | Software capitalisation changes |

Asian minority investment adjust |

Restructuring | Esanda Dealer Finance |

Adjusted pro-forma |

Cash profit | Restructuring | Esanda Dealer Finance |

FX impact | Adjusted pro-forma, FX adj |

Adjusted pro-forma, FX unadj |

Adjusted pro-forma, FX adj | ||||||||||||||||||

| Profit before income tax by division - Mar 2016 v Sep 2015 | ||||||||||||||||||||||||||||||

| Australia |

2,505 | 36 | - | 22 | (19) | 2,544 | 2,427 | 2 | (68) | - | 2,361 | 8% | 8% | |||||||||||||||||

| Institutional |

880 | 4 | - | 51 | - | 935 | 1,256 | 6 | - | 1 | 1,263 | -26% | -26% | |||||||||||||||||

| New Zealand |

804 | 10 | - | 2 | - | 816 | 779 | 1 | - | 4 | 784 | 5% | 4% | |||||||||||||||||

| Wealth |

359 | 5 | - | 13 | - | 377 | 399 | - | - | - | 399 | -6% | -6% | |||||||||||||||||

| Asia Retail & Pacific |

67 | (4) | - | 12 | - | 75 | 68 | - | - | (1) | 67 | 10% | 12% | |||||||||||||||||

| TSO and Group Centre1

|

(696)

|

578

|

231

|

38

|

(66)

|

85

|

(57)

|

12

|

-

|

86

|

41

|

large

|

large

| |||||||||||||||||

|

Profit before income tax |

3,919 | 629 | 231 | 138 | (85) | 4,832 | 4,872 | 21 | (68) | 90 | 4,915 | 0% | -2% | |||||||||||||||||

| Income tax expense & non-controlling interests

|

(1,137)

|

(188)

|

-

|

(37)

|

29

|

(1,333)

|

(1,332)

|

(6)

|

20

|

(27)

|

(1,345)

|

1%

|

-1%

| |||||||||||||||||

| Cash profit

|

2,782

|

441

|

231

|

101

|

(56)

|

3,499

|

3,540

|

15

|

(48)

|

63

|

3,570

|

0%

|

-2%

| |||||||||||||||||

| 1. | Cash profit for TSO and Group Centre in the March 2016 half includes the accelerated amortisation for all divisions resulting from the software capitalisation changes and the net gain on divestment of the Esanda Dealer Finance portfolio. |

16

SUMMARY

Other Non-financial Information

| As at

|

Movement

| |||||||||||||||

| Mar 16 | Sep 15 | Mar 15 | Mar 16 v. Sep 15 |

Mar 16 v. Mar 15 | ||||||||||||

|

Full time equivalent staff information |

||||||||||||||||

| Full time equivalent staff (FTE) |

48,896 | 50,152 | 51,243 | -3% | -5% | |||||||||||

| Assets per FTE ($M)

|

18.3

|

|

17.7

|

|

16.8

|

|

3%

|

|

9%

| |||||||

| Half Year |

Movement | |||||||||||||||

| Mar 16 | Sep 15 | Mar 15 | Mar 16 v. Sep 15 |

Mar 16 v. Mar 15 | ||||||||||||

|

Shareholder value - ordinary shares |

||||||||||||||||

| Share price ($) |

||||||||||||||||

| - high |

29.17 | 37.25 | 37.19 | -22% | -22% | |||||||||||

| - low |

21.86 | 26.38 | 30.47 | -17% | -28% | |||||||||||

| - closing |

23.46 | 27.08 | 36.64 | -13% | -36% | |||||||||||

| Closing market capitalisation of ordinary shares ($B) |

68.4 | 78.6 | 101.3 | -13% | -32% | |||||||||||

| Total shareholder returns (TSR)

|

-10.2%

|

|

-21.9%

|

|

19.9%

|

|

-53%

|

|

large

| |||||||

| As at Mar 16

| ||||||||||||||||

| Credit Ratings | Short-Term | Long-Term | Outlook | |||||||||||||

| Moody’s Investor Services |

P-1 | Aa2 | Stable | |||||||||||||

| Standard & Poor’s |

A-1+ | AA- | Stable | |||||||||||||

| Fitch Ratings

|

F1+

|

|

AA-

|

|

Stable

| |||||||||||

17

SUMMARY

This page has been left blank intentionally

18

STRATEGIC REVIEW

Strategic Review1

Our strategy is to use the strength of our Australian and New Zealand foundations, regional connectivity and a focus on providing market-leading service and insights, to better meet the needs of our customers and capture opportunities linked to trade and capital flows.

The strategy has three key elements – creating the best bank in Australia and New Zealand for home owners and small businesses, building the best bank in the world for clients driven by trade and capital flows between Australia and New Zealand and Asia, and establishing common, digital-ready infrastructure to provide great customer experience, agility, scale and control. The strategy is underpinned by disciplined resource allocation, strong leaders and an engaged workforce. ANZ is committed to maintaining high standards of ethics and conduct in the way it deals with customers, stakeholders and its own staff.

ANZ’s approach to sustainability supports the achievement of our business strategy by guiding the way we make decisions and conduct business in all of the markets in which we operate. Our decision making processes take into account the social and environmental impacts of ANZ’s operations and prioritise building trust and respect amongst all of our stakeholders. Details of ANZ’s approach to sustainability, including the identification and management of material issues and sustainability risks and opportunities, are available in the Corporate Sustainability review. The 2015 review was published on anz.com in December 2015, and an update on our progress in 2016 will be released on 3 May 2016.

In the first half of financial year 2016 cash profit decreased by 24%. A number of items impacted the result this half, excluding these, Cash Profit - Adjusted Pro-forma, FX adjusted2 decreased 6% to $3.5 billion, with income growth of 2% and flat expenses being offset by a $459 million increase in the credit impairment charge. The increase in the credit impairment charge was mainly due to an increase in the individual provision charge resulting from a small number of Australian and multi-national resources related exposures. The collective impairment charge remained low in absolute terms at $29 million. Loss rates increased from historic lows and are in line with the long term average.

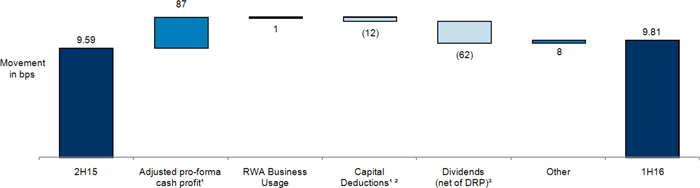

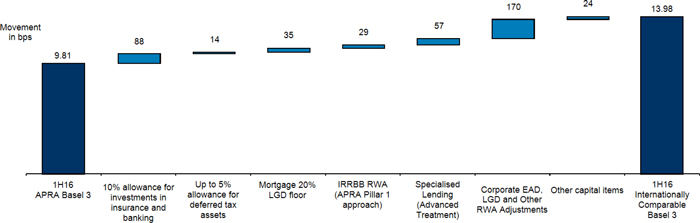

The Common Equity Tier 1 (CET1) ratio on an APRA basis was 9.8% at 31 March, up 22 basis points (bps), which equates to 14.0% on an Internationally Comparable Basel 3 basis, placing ANZ within the top quartile of international peer banks. We declared a fully franked dividend of 80 cents per share, 7% lower than the March 2015 interim dividend. The resetting of the dividend better reflects the changing banking environment in which we operate and the greater demands for capital.

Strategic Progress

Over the course of the half, ANZ delivered strong growth in retail banking in Australia and steady growth across most portfolios in New Zealand, while the Institutional business was once again impacted by challenging market conditions.

| • | Retail banking in Australia and New Zealand continued to deliver market share gains and strong earnings growth, with income up 15% and 5% (NZD) respectively and costs were well contained resulting in lower cost to income ratios (CTI). Provisions were up slightly in both markets. In Australia, we continued to invest in NSW and our digital capabilities, with our Multi-Channel Platform program going live during the half. |

| • | With the exception of Small Business, conditions were more challenging for our Corporate & Commercial Banking segments in both key geographies, with revenues falling 5% in Australia and 2% in New Zealand due to ongoing margin compression and the Esanda Dealer Finance divestment in Australia. Costs were well contained in response, but increasing provisions saw cash profits fall in both markets. |

| • | We are the leading Institutional bank in Australia and New Zealand (Source: Peter Lee) and the number four Corporate bank in Asia (Source: Greenwich Associates). However, challenging economic conditions saw lending margins fall a further 4 bps driven by margin compression in Loans and Specialised Finance. Trade Finance revenues were down as a consequence of active risk weighted asset (RWA) management. Credit impairment charges increased by $235 million, impacted by small number of Australian and multi-national resources related exposures. In response, we have accelerated the restructure of the division, simplifying the business and prioritising the use of our balance sheet. FTE reduced 6%, while RWAs reduced by $14 billion through targeted reduction of assets that were dilutive to returns. We anticipate this trend to continue into the second half. |

| • | Our in-house regional delivery network is a source of ongoing competitive advantage. The network is enabling the transformation of key business activities and delivery of productivity improvements while driving a more consistent, higher quality experience for our customers. The regional delivery centres provide full service regional coverage across our operating time zones helping to drive lower unit costs, improve quality and lower risk. |

| • | Since the September 2015 half, ANZ’s generated $3.1 billion of net organic capital and paid out $3 billion (net of reinvestment) in dividends. The Group CET1 ratio increased by 22 bps to 9.8% or 14% on an internationally comparable basis at 31 March, which is within the top-quartile of Basel Group 1 Banks. We expect our APRA CET1 ratio to remain around 9% post implementing the mortgage RWA change in July 2016. |

| 1. | Unless otherwise noted, the Strategic Review is reported on a cash profit basis. All comparisons are to the half year ended 31 March 2015 and not adjusted for the impact of foreign currency translation. |

| 2. | Adjusted Pro-forma, FX adjusted includes the following specified items: software capitalisation changes, impairment of investment in Ambank, gain on cessation of equity accounting for BoT, restructuring costs, and the Esanda Dealership Finance divestment. Comparative data is adjusted to remove the translation impacts of foreign exchange movements. |

19

STRATEGIC REVIEW

This page has been left blank intentionally

20

GROUP RESULTS

CONTENTS

Section 4 – Group Results

Group performance

Net interest income

Other operating income

Operating expenses

Technology infrastructure spend

Software capitalisation

Credit risk

Income tax expense

Impact of foreign currency translation

Earnings related hedges

Earnings per share

Dividends

Economic profit

Condensed balance sheet

Liquidity risk

Capital management

Leverage ratio

Other regulatory developments

21

GROUP RESULTS

Non-IFRS information

The Group provides additional measures of performance in the Consolidated Financial Report & Dividend Announcement which are prepared on a basis other than in accordance with accounting standards. The guidance provided in Australian Securities and Investments Commission (ASIC) Regulatory Guide RG230 has been followed when presenting this information.

Cash profit

Cash profit represents ANZ’s preferred measure of the result of the ongoing business activities of the Group, enabling readers to assess Group and Divisional performance against prior periods and against peer institutions. To calculate cash profit, the Group excludes non-core items from statutory profit (refer to Definitions for further details). The adjustments made in arriving at cash profit are included in statutory profit which is subject to review within the context of the external auditor’s review of the Condensed Consolidated Financial Statements. Cash profit is not subject to review or audit by the external auditor, however, the external auditor has informed the Audit Committee that the adjustments have been determined on a consistent basis across each period presented.

The Group Results section is reported on a cash profit basis.

| Half Year

|

Movement

| |||||||||||

| Mar 16 $M |

Sep 15 $M |

Mar 15 $M |

Mar 16 v. Sep 15 |

Mar 16 v. Mar 15 | ||||||||

| Statutory profit attributable to shareholders of the Company |

2,738 | 3,987 | 3,506 | -31% | -22% | |||||||

| Adjustments between statutory profit and cash profit1 |

||||||||||||

| Treasury shares adjustments |

(29) | (95) | 79 | -69% | large | |||||||

| Revaluation of policy liabilities |

(14) | (6) | (67) | large | -79% | |||||||

| Economic hedges |

128 | (165) | (14) | large | large | |||||||

| Revenue and net investment hedges |

(39) | (179) | 176 | -78% | large | |||||||

| Structured credit intermediation trades

|

(2) | (2) | (4) | 0% | -50% | |||||||

| Total adjustments between statutory profit and cash profit1

|

44 | (447) | 170 | large | -74% | |||||||

|

Cash Profit

|

2,782 | 3,540 | 3,676 | -21% | -24% | |||||||

| 1. | Refer to pages 91 to 96 for analysis of the adjustments between statutory profit and cash profit. |

| Group Performance | Half Year

|

Movement

| ||||||||||

| Mar 16 $M |

Sep 15 $M |

Mar 15 $M |

Mar 16 v. Sep 15 |

Mar 16 v. Mar 15 | ||||||||

| Net interest income |

7,568 | 7,478 | 7,138 | 1% | 6% | |||||||

| Other operating income

|

2,748 | 2,864 | 3,057 | -4% | -10% | |||||||

|

Operating income |

10,316 | 10,342 | 10,195 | 0% | 1% | |||||||

| Operating expenses

|

(5,479) | (4,775) | (4,603) | 15% | 19% | |||||||

|

Profit before credit impairment and income tax |

4,837 | 5,567 | 5,592 | -13% | -14% | |||||||

| Credit impairment charge

|

(918) | (695) | (510) | 32% | 80% | |||||||

|

Profit before income tax |

3,919 | 4,872 | 5,082 | -20% | -23% | |||||||

| Income tax expense |

(1,133) | (1,326) | (1,398) | -15% | -19% | |||||||

| Non-controlling interests

|

(4) | (6) | (8) | -33% | -50% | |||||||

|

Cash profit

|

2,782 | 3,540 | 3,676 | -21% | -24% | |||||||

| Half Year

|

Movement

| |||||||||||

| Cash profit/(loss) by division | Mar 16 $M |

Sep 15 $M |

Mar 15 $M |

Mar 16 v. Sep 15 |

Mar 16 v. Mar 15 | |||||||

|

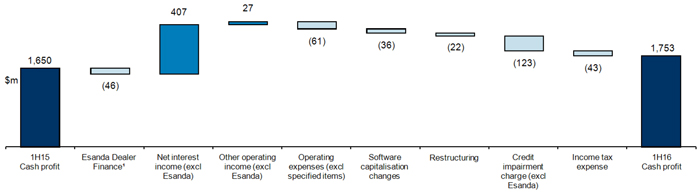

Australia |

1,753 | 1,706 | 1,650 | 3% | 6% | |||||||

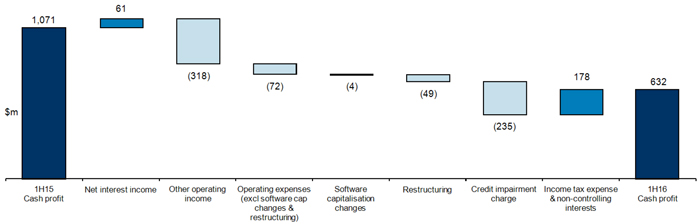

| Institutional |

632 | 893 | 1,071 | -29% | -41% | |||||||

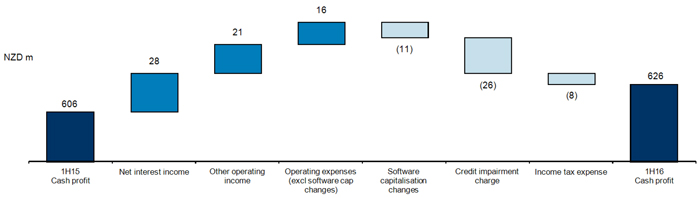

| New Zealand |

578 | 561 | 566 | 3% | 2% | |||||||

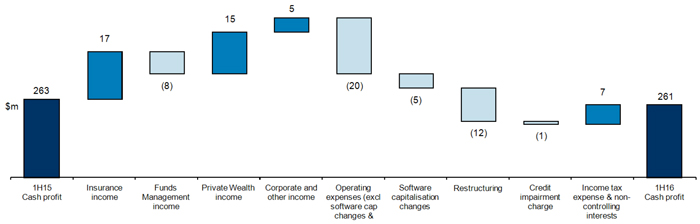

| Wealth |

261 | 346 | 263 | -25% | -1% | |||||||

| Asia Retail & Pacific |

53 | 45 | 99 | 18% | -46% | |||||||

| TSO and Group Centre

|

(495) | (11) | 27 | large | large | |||||||

|

Cash profit

|

2,782 | 3,540 | 3,676 | -21% | -24% | |||||||

22

GROUP RESULTS

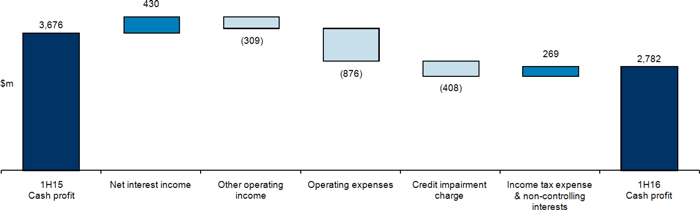

Group Cash Profit – March 2016 Half Year v March 2015 Half Year

| ¡ | March 2016 v March 2015 |

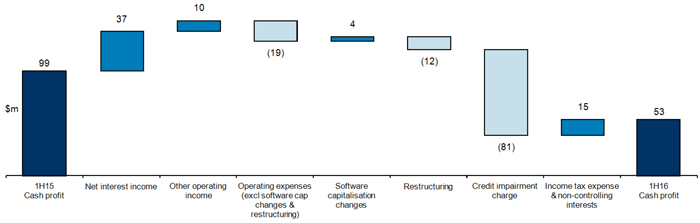

Cash profit decreased 24% compared to the March 2015 half mainly due to a number of specified items: software capitalisation changes, Asian minority investment adjustments, restructuring expenses, and the Esanda Dealer Finance divestment. Excluding these items, and the impact of foreign currency translation, cash profit decreased 6%.

| • | Net interest income increased $430 million (6%) with 7% growth in average interest earning assets, partly offset by a 3 basis point decrease in net interest margin. $77 million of the increase in net interest income was due to foreign currency translation impact. The $52.2 billion increase in average interest earning assets reflected a $17.0 billion foreign currency translation impact and lending growth of $20.5 billion, primarily in Australia and New Zealand home loans. |

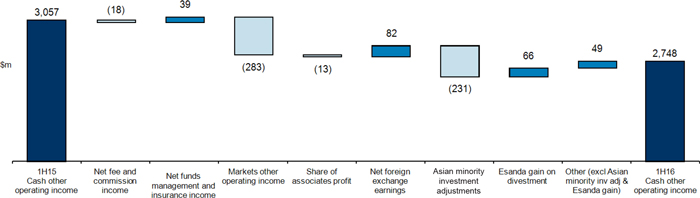

| • | Other operating income decreased $309 million (10%) with foreign currency translation having a $149 million favourable impact. Adjusting for this, other operating income decreased by $458 million. The decrease was mainly due to a $331 million reduction in Markets other operating income and a $260 million impairment of the investment in Ambank, partially offset by $82 million increase in net foreign exchange earnings, the $66 million gain on Esanda Dealer Finance divestment, and $29 million gain on cessation of equity accounting for BoT. |

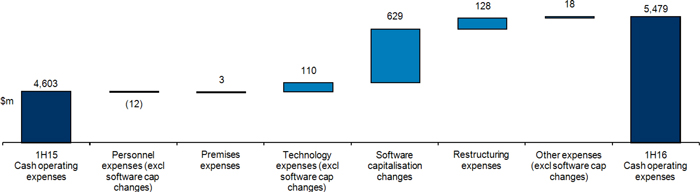

| • | Operating expenses increased $876 million (19%) mainly due to $629 million increase relating to the software capitalisation changes, $128 million increase in restructuring charges and a $115 million foreign currency translation impact. Adjusting for these items, operating expenses were flat. |

| • | Credit impairment charges increased $408 million (80%) due to a $437 million (96%) increase in the individual credit impairment charge, mainly from a small number of Australian and multinational resource related exposures, increases in Small Business Banking and Regional Business Banking together with lower recoveries, partially offset by a $29 million decrease in the collective impairment charge. |

| ¡ | March 2016 v September 2015 |

Cash profit decreased 21% compared to the September 2015 half year mainly due to the specified items outlined above. Excluding these items, and the impact of foreign currency translation, cash profit decreased 2%.

| • | Net interest income increased $90 million (1%) with 3% growth in average interest earning assets, partly offset by a 3 basis point contraction in net interest margin. $32 million of the increase in net interest income was due to foreign currency translation impact. The $22.7 billion increase in average interest earning assets reflected a $5.7 billion foreign currency translation impact and lending growth of $4.6 billion, primarily in Australia and New Zealand home loans. |

| • | Other operating income decreased by $116 million (4%) with foreign currency translation having a $103 million favourable impact. Adjusting for this, other operating income decreased by $219 million (7%). The decrease was mainly due to the $260 million impairment of the investment in Ambank, partially offset by a $75 million increase in net foreign exchange earnings, $66 million gain on Esanda Dealer Finance divestment and $29 million gain on cessation of equity accounting for BoT. |

| • | Operating expenses increased $704 million (15%) mainly due to the $629 million increase relating to the software capitalisation changes, $117 million increase in restructuring charges and $37 million increase due to foreign currency translation impact. Adjusting for these items, operating expenses decreased by $79 million (1%) reflecting the 3% decrease in FTE. |

| • | Credit impairment charges increased $223 million (32%) due to a $237 million (36%) increase in individual credit impairment charges mainly from a small number of Australian and multinational resource related exposures, partially offset by a $14 million decrease in the collective credit impairment charge. |

23

GROUP RESULTS

Net interest income

| Half Year

|

Movement

| |||||||||||

| Group | Mar 16 $M |

Sep 15 $M |

Mar 15 $M |

Mar 16 v. Sep 15 |

Mar 16 v. Mar 15 | |||||||

| Cash net interest income |

7,568 | 7,478 | 7,138 | 1% | 6% | |||||||

| Average interest earning assets |

754,391 | 731,739 | 702,203 | 3% | 7% | |||||||

| Average deposits and other borrowings |

587,235 | 567,709 | 551,805 | 3% | 6% | |||||||

| Net interest margin (%) - cash

|

2.01 | 2.04 | 2.04 | -3 bps | -3 bps | |||||||

| Group (excluding Markets) |

||||||||||||

| Cash net interest income |

7,006 | 6,878 | 6,631 | 2% | 6% | |||||||

| Average interest earning assets |

556,107 | 546,007 | 529,707 | 2% | 5% | |||||||

| Average deposits and other borrowings |

453,137 | 436,702 | 420,878 | 4% | 8% | |||||||

| Net interest margin (%) - cash |

2.52 | 2.51 | 2.51 | 1 bps | 1 bps | |||||||

| Half Year

|

Movement

| |||||||||||

| Cash net interest margin by major division | Mar 16 $M |

Sep 15 $M |

Mar 15 $M |

Mar 16 v. Sep 15 |

Mar 16 v. Mar 15 | |||||||

| Australia |

||||||||||||

| Net interest margin (%) |

2.54 | 2.53 | 2.54 | 1 bps | 0 bps | |||||||

| Average interest earning assets |

317,540 | 306,816 | 294,368 | 3% | 8% | |||||||

| Average deposits and other borrowings |

172,779 | 164,732 | 162,688 | 5% | 6% | |||||||

| Institutional |

||||||||||||

| Net interest margin (%) |

1.15 | 1.20 | 1.19 | -5 bps | -4 bps | |||||||

| Average interest earning assets |

312,961 | 305,902 | 292,914 | 2% | 7% | |||||||

| Average deposits and other borrowings |

233,729 | 231,655 | 227,460 | 1% | 3% | |||||||

| New Zealand |

||||||||||||

| Net interest margin (%) |

2.37 | 2.44 | 2.52 | -7 bps | -15 bps | |||||||

| Average interest earning assets |

98,741 | 94,624 | 92,395 | 4% | 7% | |||||||

| Average deposits and other borrowings

|

67,540 | 63,996 | 62,314 | 6% | 8% | |||||||

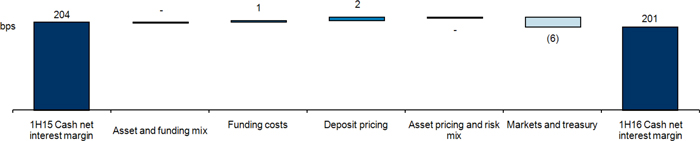

Group net interest margin – March 2016 Half Year v March 2015 Half Year

| ¡ | March 2016 v March 2015 |

Net interest margin (-3 bps)

| • | Asset mix and funding mix (0 bp): favourable mix impact from a higher proportion of capital and run-off of lower margin trade loans offset by the adverse asset mix impact from the Esanda Dealer Finance divestment. |

| • | Funding costs (1 bp): favourable wholesale funding costs. |

| • | Deposit competition (2 bps): benefit from deposit repricing, particularly term deposits. |

| • | Asset competition and risk mix (0 bp): improved Australian Home Loan margins following repricing offset by lending margin compression in New Zealand and lower spreads within Institutional and Commercial lending. |

| • | Markets and treasury (-6 bps): adverse impact of lower earnings on capital from lower interest rates and growth in lower margin liquidity portfolios in Markets. |

24

GROUP RESULTS

Average interest earning assets (+$52.2 billion or +7%)

| • | Average gross loans and advances (+$29.0 billion or +5%): excluding the impact of foreign currency translation, growth was $20.5 billion or +4% driven by growth in Australia and New Zealand home loans as well as growth in New Zealand Commercial lending. This was slightly offset by a decline in Trade loans due to active portfolio reduction and strategic repositioning of that business, as well as the Esanda Dealer Finance divestment. |

| • | Average trading and available-for-sale assets (+$10.9 billion or +12%): excluding the impact of foreign currency translation, growth was $8.4 billion or +9% driven by growth in the liquidity portfolio. |

| • | Average cash (+$5.6 billion or +12%): excluding the impact of foreign currency translation, growth was $2.0 billion or +4% driven by management of liquidity requirements. |

| • | Average collateral paid (+$3.2 billion or +42%): excluding the impact of foreign currency translation, growth was $2.6 billion or +33%. |

Average deposits and other borrowings (+$35.4 billion or +6%)

| • | Average deposits and other borrowings (+$35.4 billion or +6%): excluding the impact of foreign currency translation, growth was $17.7 billion or +3% driven by growth in Retail and Commercial customer deposits across both Australia and New Zealand. |

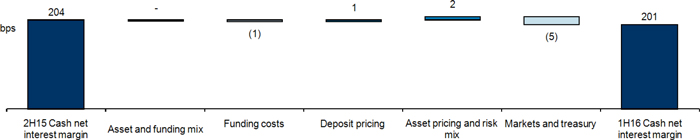

Group net interest margin – March 2016 Half Year v September 2015 Half Year

| ¡ | March 2016 v September 2015 |

Net interest margin (-3 bps)

| • | Asset mix and funding mix (0 bp): favourable mix impact from higher proportion of capital and run-off of lower margin trade loans offset by the adverse asset mix impact from the Esanda Dealer Finance divestment. |

| • | Funding costs (-1 bps): adverse impact of increased wholesale funding costs. |

| • | Deposit competition (1 bp): benefit from deposit repricing, particularly in Australia and Asia. |

| • | Asset competition and risk mix (2 bps): improved margins, particularly in Home Loans following repricing, partly offset by lower Commercial and Institutional lending spreads. |

| • | Markets and treasury (-5 bps): adverse impact of lower earnings on capital from lower interest rates and growth in lower margin liquidity portfolio in Markets. |

Average interest earning assets (+$22.7 billion or +3%)