Attached files

| file | filename |

|---|---|

| EX-5.1 - OPINION OF MASLON LLP - CREATIVE REALITIES, INC. | fs12016a1ex5i_creative.htm |

| EX-23.1 - CONSENT OF EISNERAMPER LLP - CREATIVE REALITIES, INC. | fs12016a1ex23i_creative.htm |

| EX-23.2 - CONSENT OF BAKER TILLY VIRCHOW KRAUSE, LLP - CREATIVE REALITIES, INC. | fs12016a1ex23ii_creative.htm |

As filed with the Securities and Exchange Commission on May 13, 2016

Registration No. 333-209487

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

AMENDMENT NO. 1 TO

FORM S-1

REGISTRATION STATEMENT UNDER THE SECURITIES ACT OF 1933

CREATIVE REALITIES, INC.

(Exact name of registrant as specified in its charter)

| Minnesota | 41-1967918 | |

| (State or other jurisdiction of incorporation or organization) |

(I.R.S. Employer Identification Number) |

22 Audrey Place

Fairfield, New Jersey 07004

Telephone: (973) 244-9911

(Address, including Zip Code, and Telephone Number, including

Area Code, of Registrant's Principal Executive Offices)

John Walpuck Chief Financial Officer, Chief Operating Officer 22 Audrey Place Fairfield, New Jersey 07004 Telephone: (973) 244-9911 (Name, Address, Including Zip Code,

and Telephone Number, |

Copy to : Paul D. Chestovich, Esq. Maslon LLP 3300 Wells Fargo Center 90 South Seventh Street Minneapolis, Minnesota 55402 Telephone: (612) 672-8305 |

Approximate date of commencement of proposed sale to the public: As soon as practicable after the effective date of the registration statement.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. þ

If this form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act (check one):

| Large accelerated filer ☐ | Accelerated filer ☐ |

| Non-accelerated filer ☐ (Do not check if a smaller reporting company) | Smaller reporting company þ |

CALCULATION OF REGISTRATION FEE

| Title of Each Class of Securities to be Registered | Amount to be Registered (1) | Proposed Maximum Offering Price Per Share | Proposed Maximum Aggregate Offering Price | Amount of Registration Fee (1) |

||||||||||||

| Common stock, $0.01 par value per share | 23,272,184 | $ | 0.28 | (2) | $ | 6,516,211.52 | (2) | $ | 656.18 | (3) | ||||||

| (1) | This registration statement relates to the resale by selling shareholders of shares of our common stock, including shares of common issued on account of convertible promissory notes and accrued interest thereon, upon the exercise of certain outstanding common stock purchase warrants. |

| (2) | Pursuant to Rule 457(o) under the Securities Act, and solely for the purpose of calculating the registration fee. |

| (3) | $469.45 of registration fee previously paid. |

The Registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933, as amended, or until the Registration Statement shall become effective on such date as the Commission, acting pursuant to said Section 8(a), may determine.

The information in this prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any state where the offer or sale is prohibited.

SUBJECT TO COMPLETION, DATED MAY 13, 2016

PROSPECTUS

CREATIVE REALITIES, INC.

23,272,184 Shares of Common Stock

This prospectus relates to the resale of up to 23,272,184 shares of common stock of Creative Realities, Inc. held by or issuable to the selling shareholders listed on page 44 of this prospectus, which figure includes 15,900,546 common shares issuable on account of convertible promissory notes and accrued interest thereon and an aggregate of 6,396,638 shares issuable upon the exercise of certain warrants currently held by the selling shareholders. The common stock covered by this prospectus will be sold at a public offering price of $0.28 per share. At such time as the Company is listed on a recognized inter-dealer quotation system, the selling shareholders may begin to sell the shares covered by the prospectus at prevailing market prices or privately negotiated prices.

We will receive no proceeds from the sale of common stock by the selling shareholders, but will receive proceeds from this offering in the event that any warrants are exercised for cash. If all of the warrants were exercised for cash, we would receive proceeds in an amount up to approximately $1,822,562.

Our common stock is listed on the OTC Markets (OTC Pink) under the symbol “CREX.” On May 11, 2016, the last sale price for our common stock as reported on the OTC Pink was $.19 per share.

We currently have an effective registration statement on Form S-1/A (registration no. 333-201806) relating to the resale of 34,134,781 shares of our common stock, all of which shares of common stock are available for purchase as of May 13, 2016.

The shares of common stock offered by this prospectus involve a high degree of risk. See “Risk Factors” beginning on page 8 for a description of some of the risks you should consider before buying any shares of our common stock offered by this prospectus.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed on the adequacy or accuracy of this prospectus. Any representation to the contrary is a criminal offense.

The date of this prospectus is , 2016

ABOUT THIS PROSPECTUS

Unless otherwise stated or the context otherwise requires, the terms “we,” “us,” “our,” “Creative Realities” and the “Company” refer to Creative Realities, Inc. and its subsidiaries.

You should rely only on the information contained in this prospectus. We have not authorized anyone to provide you with additional or different information. If anyone provides you with additional, different or inconsistent information, you should not rely on it. We are not making an offer to sell securities in any jurisdiction in which the offer or sale is not permitted. You should assume that the information in this prospectus is accurate only as of the date on the front cover of this prospectus regardless of the time of delivery of this prospectus or any exercise of the rights. Our business, financial condition, results of operations, and prospects may have changed since that date. If there is a material change in the affairs of our Company, we will amend or supplement this prospectus.

The industry, market and data used throughout this prospectus have been obtained from our own research, surveys or studies conducted by third parties and industry or general publications. Industry publications and surveys generally state that they have obtained information from sources believed to be reliable, but do not guarantee the accuracy and completeness of such information. We believe that each of these studies and publications is reliable.

i

This summary highlights information contained elsewhere in this prospectus. This summary is not complete and may not contain all of the information that you should consider before deciding whether or not you should exercise your rights. You should read the entire prospectus carefully, including the section entitled “Risk Factors” beginning on page 8 of this prospectus and all other information included in this prospectus in its entirety before you decide whether to purchase any shares offered by this prospectus.

Our Company

Creative Realities, Inc. is a Minnesota corporation that provides innovative digital marketing technology solutions to retailers, brand marketers, venue-operators, enterprises, non-profits and other organizations throughout the United States and a growing number of international markets. Our technology and solutions include: digital merchandising systems, interactive digital shopping assistants and kiosks, mobile digital marketing platforms, digital wayfinding platforms, digital menu board systems, dynamic signage, and other digital marketing technologies. We enable our clients’ engagement with consumers by using combinations of our technology and solutions that interact with mobile, social media, point-of-sale, wireless networks and web-based platforms. We have expertise in a broad range of existing and emerging digital marketing technologies, as well as the following related aspects of our business: content, network management, and connected device software and firmware platforms; customized software service layers; hardware platforms; digital media workflows; and proprietary processes and automation tools. We believe we are one of the world’s leading digital marketing technology companies focused on helping retailers and brands use the latest technologies to create better shopping experiences.

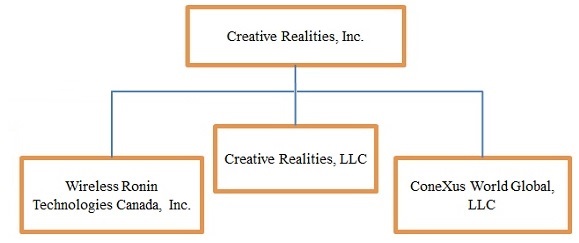

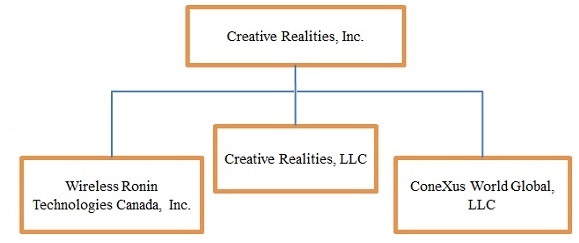

Our main operations are conducted directly through Creative Realities, Inc., and under our wholly owned subsidiaries Creative Realities, LLC, a Delaware limited liability company, Wireless Ronin Technologies Canada, Inc., and ConeXus World Global, LLC, a Kentucky limited liability company.

We seek to generate revenue in this business by:

| ● | consulting with our customers to determine the technologies and solutions required to achieve their specific goals, strategies and objectives; | |

| ● | designing our customers’ digital marketing experiences, content and interfaces; | |

| ● | engineering the systems architecture delivering the digital marketing experiences we design – both software and hardware – and integrating those systems into a customized, reliable and effective digital marketing experience; | |

| ● | managing the efficient, timely and cost-effective deployment of our digital marketing technology solutions for our customers; | |

| ● | delivering and updating the content of our digital marketing technology solutions using a suite of advanced media, content and network management software products; and | |

| ● | maintaining our customers’ digital marketing technology solutions by: providing content production and related services; creating additional software-based features and functionality; hosting the solutions; monitoring solution service levels; and responding to and/or managing remote or onsite field service maintenance, troubleshooting and support calls. |

We seek to generate revenue through these activities through: bundled-solution sales; service fees for consulting, experience design, content development and production, software development, engineering, implementation, and field services; software license fees; and maintenance and support services related to our software, managed systems and solutions.

| 1 |

Our digital marketing technology solutions have application in a wide variety of industries. The industries in which we sell our solutions are established and include hospitality, branded retail, automotive, food service and retail healthcare, but the planning, development, implementation and maintenance of technology-enabled experiences involving combinations of digital marketing technologies is relatively new and evolving. Moreover, a number of participants in these industries have only recently started considering or expanding the adoption of these types of technologies, solutions and experiences as part of their overall marketing strategies. As a result, we remain an early stage company without an established history of profitability.

We believe that the adoption and evolution of digital marketing technology solutions will increase substantially in years to come both in the industries on which we currently focus and in others. We also believe that adoption of our solutions depends upon not only the services and solutions that we provide, but also depends heavily upon the cost of hardware used to process and display content on them. While the costs of hardware configurations and software media players have historically decreased and we believe they will continue to do so at an accelerating rate, flat panel displays and players typically constitute a large portion of the expenditure customers make relative to the entire cost of implementing a digital marketing system implementation and can be a barrier to customer deployment. As a result, we believe that the broader adoption of digital marketing technology solutions is likely to increase, although we cannot predict the rate at which such adoption will occur.

Another key component of our business strategy, especially given the evolving industry dynamics in which we operate, is to acquire and integrate other operating companies in the industry in conjunction with pursuing our organic growth objectives. We believe that the selective acquisition and successful integration of certain companies will accelerate our growth; enable us to aggregate multiple customer bases onto a single business and technology platform; provide us with greater operating scale; enable us to leverage a common set of processes, tools, and cost efficiencies; and ultimately result in higher operating profitability and cash flow from operations. Our management team is actively pursuing and evaluating alternative acquisition opportunities on an ongoing basis. Our management team and Board of Directors have broad experience with the execution, integration and financing of acquisitions. We believe that, based on the foregoing and other factors, the Company can successfully serve as a consolidator of multiple business and technology platforms serving similar markets.

Our company sells products and services primarily throughout North America.

Corporate Organization

Our principal offices are located at 22 Audrey Place, Fairfield, New Jersey 07004, and our telephone number at that office is (973) 244-9911.

The legal entity that is the registrant was originally incorporated and organized as a Minnesota corporation under the name Wireless Ronin Technologies, Inc. in March 2003. Our business initially focused on the provision of expertised digital media marketing solutions to customers, including digital signage, interactive kiosks, mobile, social media and web-based media solutions. As indicated below under the “Recent Acquisitions” caption, we acquired the assets and business of Broadcast International, Inc., a Utah corporation and public registrant, through a merger transaction that was effective as of August 1, 2014. Then on August 20, 2014, we consummated a merger transaction with Creative Realities, LLC, a privately owned Delaware limited liability company, in which we issued a majority of our issued and outstanding shares of common stock. In that merger transaction, we acquired the interactive marketing technology business of Creative Realities that we currently operate. Shortly after that merger, we changed our corporate name from Wireless Ronin Technologies, Inc. to “Creative Realities, Inc.” On October 15, 2015, we acquired the assets and business of ConeXus World Global, LLC, a privately owned Kentucky limited liability company for which we issued preferred and common stock. In that merger transaction, we acquired the systems integration and marketing technology business of ConeXus World that we currently operate.

| 2 |

Our fiscal year ends December 31. Neither us nor any of our predecessors have been in bankruptcy, receivership or any similar proceeding. Our corporate structure, including our principal operating subsidiaries, is as follows:

As of the date of this filing, Broadcast International, Inc. does not conduct any operations.

Recent Developments

Acquisition of ConeXus World Global

On October 15, 2015, we completed the acquisition of ConeXus World Global, LLC for 2,080,000 shares of Series A-1 Convertible Preferred Stock, and the conversion of $823,000 of ConeXus World Global debt into (i) 2,639,258 shares of our common stock, and (ii) $150,000 in principal amount of our convertible debt. As a result of the merger transaction, ConeXus World Global, LLC is now our wholly owned operating subsidiary. The merger was completed by the filing of articles of merger with the Kentucky Secretary of State. ConeXus World Global LLC does not include the operations of ConeXus World EMEA BVBA based on the terms and conditions of the Agreement and Plan of Merger and Reorganization. It is not probable that this Belgian affiliate of ConeXus World Global will be acquired by the Company as part of this transaction.

The debtholders and members of ConeXus received a total of 1,664,000 shares of Series A-1 Convertible Preferred Stock, par value $1.00, and 16,000,000 shares of our common stock, par value $0.01. In accordance with the terms of the amendment to the agreement and plan of merger and reorganization, an additional 416,000 shares of Series A-1 Convertible Preferred Stock and 4,000,000 shares of common stock, collectively referred to as holdback shares, shall be issued immediately upon the reorganization of the capital structure of a Belgian affiliate of ConeXus, as discussed below.

The agreement and plan of merger and reorganization contemplates an ownership matter among the former ConeXus security holders involving an erroneously documented ownership situation related to the Belgian affiliate, with the resolution of such matter, including the reorganization of the Belgian affiliate, subject to the agreement of the Company. Effective February 8, 2016, the Company has extended the period from March 31, 2016 to June 30, 2016 for the ConeXus security holders to resolve such ownership matter, including the reorganization of the Belgian affiliate. The Company believes that the reorganization of the Belgian affiliate is not probable and as such no liability has been recorded for these additional shares, the consideration has not been included in the purchase price allocation and the financial results of the Belgian affiliate have not been included in the consolidated financial statements for the year ended December 31, 2015. The Belgian affiliate is not currently nor is it expected to be under the common control ownership or a variable interest entity of the Company. Notwithstanding the foregoing, Company is involved in discussions and the early stages of negotiations with the Belgian affiliate to pursue the potential acquisition of such affiliate in a separate transaction, independent of the ConeXus World Global, LLC Plan of Merger and Reorganization described herein.

Changes in Management and Board of Directors; New Employment Arrangements

On October 15, 2015, Richard Mills was appointed to our Board of Directors. Mr. Mills also became our Chief Executive Officer. As a result of this appointment, Mr. John Walpuck is no longer our Interim Chief Executive Officer, but retained his titles of Chief Financial Officer and Chief Operating Officer. In connection with the appointment of Richard Mills as the Chief Executive Officer, we entered into an employment agreement with Mr. Mills. Under the employment agreement, Mr. Mills will serve as Chief Executive Officer for a two-year term, which automatically renews for additional one-year periods unless either we or Mr. Mills elects not to extend the term. The agreement provides for an initial annual base salary of $270,000, subject to annual increases but generally not subject to decreases, and includes provisions for the right to receive up to 4,951,557 performance shares of common stock in connection with a series of performance-based requirements. Under the agreement, Mr. Mills is eligible to participate in performance-based cash bonus or equity award plans for our senior executives. Mr. Mills will participate in our employee benefit plans, policies, programs, perquisites and arrangements to the extent he meets applicable eligibility requirements.

| 3 |

In November 2015, Patrick O’Brien was appointed to our Board of Directors.

On August 20, 2014, our directors Steve Birke, Scott Koller and Howard Liszt resigned their positions on our Board of Directors, and Messrs. Paul Price, Alec Machiels and David Bell were appointed by the board to fill the vacancies created by those resignations. At the time of their resignations, Messrs. Birke and Liszt each served on the board’s audit and compensation committees. On the same date, Mr. Scott Koller resigned his position as our Chief Executive Officer but retained the title of President, and Mr. Paul Price was appointed as our Chief Executive Officer. On September 30, 2014, we delivered Mr. Koller a written notice of termination, which termination was effective December 4, 2014. On March 9, 2015, Kent Lillemoe resigned his position on our Board of Directors. On April 13, 2015, the Board of Directors and Paul Price agreed to terminate Mr. Price's employment agreement with the Company without cause. Such termination was effective immediately and effected the immediate removal of Mr. Price from his position as a member of the Board of Directors. Also on April 13, 2015, the Board of Directors appointed John Walpuck as Creative Realities' interim Chief Executive Officer.

Financing Transactions

On October 15, 2015, we together with our subsidiary entities Creative Realities, LLC, ConeXus World Global, LLC, and Broadcast International, Inc., entered into a Factoring Agreement with Allied Affiliated Funding, L.P. Under the Factoring Agreement, Allied Affiliated Funding, or “Allied,” will from time to time purchase approved receivables from us and our subsidiaries up to a maximum amount of $3.0 million. Upon receipt of any advance under the Factoring Agreement, we and our subsidiaries will have sold and assigned all of their rights in such receivables and all proceeds thereof to Allied. The purchase price for receivables bought and sold under the Factoring Agreement is equal to their face amount less a 1.10% base discount. To the base discount is added an additional .037% discount from the face value of a receivable for each day beyond 30 days that the receivable remains unpaid by the account debtor. The base discount is subject to adjustment in the event of changes in the prime lending rate as published by The Wall Street Journal. Allied will provide advances under the Factoring Agreement net of an applicable reserve amount, as specified in the agreement. Our and our subsidiaries’ obligations under the Factoring Agreement are secured by substantially all of our and our subsidiaries’ assets. Allied has the right under the Factoring Agreement to require us to repurchase any receivable earlier sold for a purchase price equal to the face value of the receivable. The Factoring Agreement has an initial term of one year, subject to potential one-year renewals thereafter, unless earlier terminated (or not renewed) in accordance with the agreement. We may terminate the Factoring Agreement at any time prior to the expiration of the initial term (or a renewal period) upon payment to Allied of an early termination fee equal to $37,500.

In addition, we entered into the financing transactions described below in “The Offering.”

The Offering

| Common stock offered | 23,272,184 shares. | |

| Common stock outstanding before offering | 64,686,994 shares. | |

| Common stock outstanding after offering | 87,959,178 shares. | |

| Trading symbol (OTC Pink) | CREX | |

| Risk Factors | Shareholders considering exercising their rights to exercise their warrants or notes and the public should carefully consider the risk factors described in the section of this prospectus entitled “Risk Factors,” beginning on page 8. |

| 4 |

The shares offered hereby relate to the transactions generally described below.

On June 23, 2015, we entered into a Securities Purchase Agreement pursuant to which we offered and sold to an outside party a 14% secured convertible promissory note in the principal amount of $400,000 and an immediately exercisable five-year warrant to purchase up to 640,000 common shares at a per-share price of $0.30 in a private placement exempt from registration under the Securities Act of 1933. This note is secured by a third-party pledge made by Slipstream Communications, LLC (with the collateral being Slipstream Communication’s investment in one of its subsidiaries). The promissory note bears interest at the annual rate of 14% and is payable monthly in arrears with 12% in cash and 2% as additional principal and matures on September 23, 2016. This note is convertible into common stock at a conversion price of $0.28 per share, subject, however, to certain customary beneficial ownership conversion limitations. The unpaid principal and any accrued interest may at any time be converted at the option of the holder into an aggregate of 1,791,311 shares of our common stock, assuming the maximum amount of interest accrues and is converted.

In connection with this June 23, 2015 debt financing (and as part of that same offering), we effected a conversion of the $465,000 principal amount subordinated secured promissory note earlier issued to Slipstream Communications, LLC on May 20, 2015. This note, together with accrued but unpaid interest thereon and a 25% conversion premium, was converted into a 14% secured convertible promissory note in the principal amount of $584,506, together with new five-year warrants to purchase up to 935,210 common shares at the per-share price of $0.30. The 14% convertible promissory note is convertible into 2,617,580 shares of our common stock, assuming the maximum amount of interest accrues and is converted.

On October 15, 2015, we entered into a Securities Purchase Agreement with an accredited investor under which we offered and sold a 14% interest secured convertible promissory note in the principal amount of $500,000 together with an immediately exercisable five-year warrant to purchase up to 892,857 shares of common stock at a per-share price of $0.28, in a private placement exempt from registration under the Securities Act of 1933. The interest is payable 12% in cash and 2% as additional principal amount to the note. The principal balance plus accrued interest of the convertible promissory note is convertible into 2,160,714 shares of our common stock, assuming the maximum amount of interest accrues and is converted. In connection with the offer and sale of the above-described secured convertible promissory note, we paid commissions to a placement agent aggregating $25,000.

Also on October 15, 2015, in connection with the merger with Conexus World Global, we entered into a Securities Purchase Agreement with an accredited investor under which we offered and sold a 14% interest secured convertible promissory note in the principal amount of $150,000 together with an immediately exercisable five-year warrant to purchase up to 267,857shares of common stock at a per-share price of $0.28, in a private placement exempt from registration under the Securities Act of 1933. The interest is payable 12% in cash and 2% as additional principal amount to the note. The principal balance plus accrued interest of the convertible promissory note is convertible into 648,214 shares of our common stock, assuming the maximum amount of interest accrues and is converted

On October 26, 2015, we entered into a Securities Purchase Agreement with an accredited investor under which it offered and sold a secured convertible promissory note in the principal amount of $300 together with a five-year warrant to purchase up to 535,714 shares of common stock at a per-share price of $0.28, in a private placement exempt from registration under the Securities Act of 1933. Our principal subsidiaries — Creative Realities, LLC, Wireless Ronin Technologies Canada, Inc., and Conexus World Global, LLC — were also parties to the Securities Purchase Agreement and are co-makers of the secured convertible promissory note. Obligations under the secured convertible promissory note are secured by a grant of collateral security in all of the personal property of the co-makers pursuant to the terms of a security agreement.

The secured convertible promissory note bears interest at the rate of 14% per annum. Of this amount, 12% per annum is payable monthly in cash, and the remaining 2% per annum is payable in the form an additional principal through increases in the principal amount of the note. Upon the consummation of a change in control transaction of the company or a default, interest on the secured convertible promissory note will increase to the rate of 17% per annum. The secured convertible promissory note matures on April 15, 2017, unless the holder of a note elects to extend the maturity date for an additional six-month period, in which case such note will mature on October 15, 2017. At any time prior to the maturity date, the holder of a promissory note may convert the outstanding principal and accrued and unpaid interest into 1,296,428 shares of our common stock (assuming the maximum amount of interest accrues and is converted) at a conversion rate of $0.28 per share, subject to adjustment. We may not prepay the secured convertible promissory note prior to the maturity date. The secured convertible promissory note contains other customary terms. In connection with the offer and sale of the above-described secured convertible promissory note, we paid commissions to a placement agent aggregating $25,000. In addition, we entered into extension agreements with the holders of two earlier purchased secured convertible promissory notes, dated as of June 23, 2015, containing terms substantially similar to those in the secured convertible promissory note. We entered into the extension agreements primarily to extend the maturity date of those notes to April 15, 2017.

| 5 |

In December, 2015, we entered into an Exchange Agreement with an accredited investor who held a warrant, dated February 18, 2015, for the purchase of up to 1,515,152 shares of our common stock. Pursuant to the Exchange Agreement, we issued 975,000 shares of our common stock to the investor in exchange for the investor’s surrender of the warrant.

On December 28, 2015, we offered and sold to certain accredited investors secured promissory notes in the aggregate principal amount of $1,250,000 and five-year warrants to purchase up to 2,232,143 shares of Creative Realities’ common stock at a per-share price of $0.28 (subject to adjustment), all pursuant to a securities purchase agreement. The gross proceeds totaled $1,250,000. Our principal subsidiaries — Creative Realities, LLC, Wireless Ronin Technologies Canada, Inc., and Conexus World Global, LLC — were also parties to the securities purchase agreement and are co-makers of the secured convertible promissory notes. Obligations under the secured convertible promissory notes are secured by a grant of collateral security in all of the tangible assets of the co-makers pursuant to the terms of an amended and restated security agreement.

The secured promissory notes bear interest at the annual rate of 14% (12% payable in cash and 2% payable in the form of additional principal) with an initial maturity date of April 15, 2017, which may be extended at the sole discretion of each Investor to October 15, 2017. At any time prior to the maturity date, the Investors may convert the outstanding principal and accrued and unpaid interest into 5,275,928 shares of our common stock (the maximum amount of interest accrues and is converted) at a conversion price equal to $0.28 per-share (subject to adjustment).

In connection with the private placement, we and the investors entered into registration rights agreements requiring Creative Realities to file a registration statement, on or prior to February 11, 2016, under the Securities Act of 1933 to register the resale of the shares of its common stock issuable upon conversion of the secured notes and upon exercise of the warrants. On February 11, 2016, we filed a registration statement in accordance with the requirements of the registration rights agreement.

As part of the same convertible note offering we entered into in June and December, 2015, on April 14, 2016, we entered into an additional Securities Purchase Agreement with an accredited investor under which we offered and sold a 14% secured convertible promissory note in aggregate principal amount of $500,000 together with an immediately exercisable five-year warrant to purchase up to 892,857 shares of common stock at a per-share price of $0.28, in a private placement exempt from registration under the Securities Act of 1933.

RISKS RELATING TO FORWARD-LOOKING STATEMENTS

This prospectus contains certain statements that would be deemed “forward-looking statements” under Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. These forward-looking statements reflect managements’ present expectations and estimates regarding future expenses, revenue and profitability, trends affecting our financial condition and results of operations, operating efficiencies, revenue opportunities, potential new markets, the ability of our Company to effectively compete in a highly competitive market, and certain other matters. Nevertheless, and despite the fact that management’s expectations and estimates are based on assumptions management believes to be reasonable and data management believes to be reliable, the Company’s actual results, performance or achievements are subject to future risks and uncertainties, any of which could materially affect the Company’s actual performance. Risks and uncertainties that could affect such performance include, but are not limited to:

| ● | the adequacy of funds for future operations; |

| ● | future expenses, revenue and profitability; |

| ● | trends affecting financial condition and results of operations; | |

| ● | ability to convert proposals into customer orders under mutually agreed upon terms and conditions; | |

| ● | general economic conditions and outlook; |

| 6 |

| ● | the ability of customers to pay for products and services received; | |

| ● | the impact of changing customer requirements upon revenue recognition; | |

| ● | customer cancellations; | |

| ● | the availability and terms of additional capital; | |

| ● | industry trends and the competitive environment; | |

| ● | the impact of the company’s financial condition upon customer and prospective customer relationships; | |

| ● | potential litigation and regulatory actions directed toward our industry in general; | |

| ● | the ultimate control of our management and our Board of Directors by our controlling shareholder, Slipstream Funding, LLC; | |

| ● | our reliance on certain key personnel in the management of our businesses; | |

| ● | employee and management turnover; and | |

| ● | the fact that our common stock is presently thinly traded in an illiquid market. |

These and other risk factors are discussed in Company reports filed with the SEC.

Although we believe that the assumptions forming the basis of our forward-looking statements are reasonable, any of those assumptions could prove to be inaccurate. Given these uncertainties, you should not attribute any certainty to these forward-looking statements. Actual results could differ materially from those anticipated in the forward-looking statements due to risks, uncertainties or actual events differing from the assumptions underlying these statements. We assume no obligation to update any forward-looking statements publicly, or to update the reasons why actual results could differ materially from those anticipated in any forward-looking statements contained in this press release, even if new information becomes available in the future.

Although federal securities laws provide a safe harbor for forward-looking statements made by a public company that files reports under the federal securities laws, this safe harbor is not available to certain issuers, including issuers that do not have their equity traded on a recognized national exchange or The Nasdaq Capital Market. Our common stock does not trade on any recognized national exchange or The Nasdaq Capital Market. As a result, we will not have the benefit of this safe harbor protection in the event of any legal action based upon a claim that the material provided by us contained a material misstatement of fact or was misleading in any material respect because of our failure to include any statements necessary to make the statements not misleading.

| 7 |

Investing in our securities involves a high degree of risk. You should carefully consider the specific risks described below, the risks described in our Annual Report on Form 10-K for the fiscal year ended December 31, 2015 and any risks described in our other filings with the Securities and Exchange Commission, pursuant to Sections 13(a), 13(c), 14, or 15(d) of the Securities Exchange Act of 1934, before making an investment decision. See the section of this prospectus entitled “Where You Can Find More Information.” Any of the risks we describe below could cause our business, financial condition, results of operations or future prospects to be materially adversely affected.

The market price of our common stock could decline if one or more of these risks and uncertainties develop into actual events and you could lose all or part of your investment. Additional risks and uncertainties not currently known to us or that we currently deem to be immaterial also may materially and adversely affect our business, financial condition, results of operations or future prospects. In addition, some of the statements in this section of the prospectus are forward-looking statements. For more information about forward-looking statements, please see the section of this prospectus entitled “Risks Relating to Forward-Looking Statements” above.

RISKS RELATED TO OUR BUSINESS AND OUR INDUSTRY

We have recently incurred losses, and may never become or remain profitable.

Recently, we have incurred net losses, have negative cash flows from operations and have a working capital deficit. We incurred net losses in each of the years ended December 31, 2015 and 2014, respectively. These factors raise substantial doubt about our ability to continue as a going concern. We do not know with any degree of certainty whether or when we will become profitable. Even if we are able to achieve profitability in future periods, we may not be able to sustain or increase our profitability in successive periods.

We have formulated our business plans and strategies based on certain assumptions regarding the acceptance of our business model and the marketing of our products and services. Nevertheless, our assessments regarding market size, market share, market acceptance of our products and services and a variety of other factors may prove incorrect. Our future success will depend upon many factors, including factors which may be beyond our control or which cannot be predicted at this time.

We have limited operating history as a combined company and cannot ensure the long-term successful operation of our business or the execution of our business plan.

We have limited operating history as a combined company since the closing of the merger transactions summarized herein, and our digital marketing technology and solutions are an evolving business offering. As a result, investors have a limited track record by which to evaluate our future performance. Our prospects must be considered in light of the risks, expenses and difficulties frequently encountered by growing companies in new and rapidly evolving markets. We may be unable to accomplish any of the following, which would materially impact our ability to implement our business plan:

| ● | establishing and maintaining broad market acceptance of our technology, solutions, services, and platforms, and converting that acceptance into direct and indirect sources of revenue; | |

| ● | establishing and maintaining adoption of our technology, solutions, services, and platforms in and on a variety of environments, experiences, and device types; | |

| ● | timely and successfully developing new technology, solution, service, and platform features, and increasing the functionality and features of our existing technology, solution, service, and platform offerings; | |

| ● | developing technology, solutions, services, and platforms that result in a high degree of customer satisfaction and a high level of end-customer usage; | |

| ● | successfully responding to competition, including competition from emerging technologies and solutions; | |

| ● | developing and maintaining strategic relationships to enhance the distribution, features, content and utility of our technology, solutions, services, and platforms; | |

| ● | identifying, attracting and retaining talented engineering, network operations, program management, technical services, creative services, and other personnel at reasonable market compensation rates in the markets in which we employ such personnel; and | |

| ● | integration of acquisitions. |

Our business strategy may be unsuccessful and we may be unable to address the risks we face in a cost-effective manner, if at all. If we are unable to successfully accomplish these tasks, our business will be harmed.

| 8 |

Adequate funds for our operations may not be available, requiring us to raise additional financing or else curtail our activities significantly.

We will likely be required to raise additional funding through public or private financings, including equity financings, in 2016. Any additional equity financings may be dilutive to shareholders and may be completed at a discount to the then-current market price of our common stock. Debt financing, if available, would likely involve restrictive covenants on our operations or pertaining to future financing arrangements. Nevertheless, we may not successfully complete any future equity or debt financing. Adequate funds for our operations, whether from financial markets, collaborative or other arrangements, may not be available when needed or on terms attractive to us. If adequate funds are not available, our plans to operate our business may be adversely affected and we could be required to curtail our activities significantly and/or cease operating.

We will be unable to implement our business plan if we cannot raise sufficient capital and may be required to pay a high price for capital.

We will need to obtain additional capital to implement our business plan and meet our financial obligations as they become due. We may not be able to raise the additional capital needed or may be required to pay a high price for capital. Factors affecting the availability and price of capital may include the following:

| ● | the availability and cost of capital generally; | |

| ● | our financial results; |

| ● | the experience and reputation of our management team; | |

| ● | market interest, or lack of interest, in our industry and business plan; | |

| ● | the trading volume of, and volatility in, the market for our common stock; | |

| ● | our ongoing success, or failure, in executing our business plan; | |

| ● | the amount of our capital needs; and | |

| ● | the amount of debt, options, warrants, and convertible securities we have outstanding. |

We may be unable to meet our current or future obligations or to adequately exploit existing or future opportunities if we cannot raise sufficient capital. If we are unable to obtain capital for an extended period of time, we may be forced to discontinue operations.

We expect that there will be significant consolidation in our industry. Our failure or inability to lead that consolidation would have a severe adverse impact on our access to financing, customers, technology, and human resources.

Our industry is currently composed of a large number of relatively small businesses, no single one of which is dominant or which provides integrated solutions and product offerings incorporating much of the available technology. Accordingly, we believe that substantial consolidation may occur in our industry in the near future. If we do not play a positive role in that consolidation, either as a leader or as a participant whose capability is merged in a larger entity, we may be left out of this process, with product offerings of limited value compared with those of our competitors. Moreover, even if we lead the consolidation process, the market may not validate the decisions we make in that process.

| 9 |

Our success depends on our interactive marketing technologies achieving and maintaining widespread acceptance in our targeted markets.

Our success will depend to a large extent on broad market acceptance of our interactive marketing technologies among our current and prospective customers. Our prospective customers may still not use our solutions for a number of other reasons, including preference for static advertising, lack of familiarity with our technology, preference for competing technologies or perceived lack of reliability. We believe that the acceptance of our interactive marketing technologies by prospective customers will depend primarily on the following factors:

| ● | our ability to demonstrate the economic and other benefits attendant our marketing technologies; | |

| ● | our customers becoming comfortable with using our interactive marketing technologies; and | |

| ● | the reliability of our interactive marketing technologies. |

Our interactive technologies are complex and must meet stringent user requirements. Some undetected errors or defects may only become apparent as new functions are added to our technologies and products. The need to repair or replace products with design or manufacturing defects could temporarily delay the sale of new products and adversely affect our reputation. Delays, costs and damage to our reputation due to product defects could harm our business.

Our financial condition and potential for continued net losses may negatively impact our relationships with customers, prospective customers and third-party suppliers.

Our financial condition and potential for continued net losses may cause current and prospective customers to defer placing orders with us, to require terms that are less favorable to us, or to place their orders with competing marketing technology suppliers, which could adversely affects our business, financial condition and results of operations. On the same basis, third-party suppliers may refuse to do business with us, or may do so only on terms that are unfavorable to us, which also could cause our revenue to decline.

Because we do not have long-term purchase commitments from our customers, the failure to obtain anticipated orders or the deferral or cancellation of commitments could have adverse effects on our business.

Our business is characterized by short-term purchase orders and contracts that do not require that purchases be made. This makes forecasting our sales difficult. The failure to obtain anticipated orders and deferrals or cancellations of purchase commitments because of changes in customer requirements, or otherwise, could have a material adverse effect on our business, financial condition and results of operations. We have experienced such challenges in the past and may experience such challenges in the future.

Our continued growth could be adversely affected by the loss of several key customers.

Our largest customers account for a majority of our total revenue on a consolidated basis. We had three and two customers that accounted for 53% and 41% of accounts receivable as of December 31, 2015 and December 31, 2014, respectively. In addition, we had three customers that accounted for 48% and 53% of revenue for the years ended December 31, 2015 and December 31, 2014, respectively. Decisions by one or more of these key customers and/or partners to not renew, terminate or substantially reduce their use of our products, technology, services, and platform could substantially slow our revenue growth and lead to a decline in revenue. Our business plan assumes continued growth in revenue, and it is unlikely that we will become profitable without a continued increase in revenue.

Most of our contracts are terminable by our customers with limited notice and without penalty payments, and early terminations could have a material effect on our business, operating results and financial condition.

Most of our contracts are terminable by our customers following limited notice and without early termination payments or liquidated damages due from them. In addition, each stage of a project often represents a separate contractual commitment, at the end of which the customers may elect to delay or not to proceed to the next stage of the project. We cannot assure you that one or more of our customers will not terminate a material contract or materially reduce the scope of a large project. The delay, cancellation or significant reduction in the scope of a large project or a number of projects could have a material adverse effect on our business, operating results and financial condition.

| 10 |

It is common for our current and prospective customers to take a long time to evaluate our products, most especially during economic downturns that affect our customers’ businesses. The lengthy and variable sales cycle makes it difficult to predict our operating results.

It is difficult for us to forecast the timing and recognition of revenue from sales of our products and services because our actual and prospective customers often take significant time to evaluate our products before committing to a purchase. Even after making their first purchases of our products and services, existing customers may not make significant purchases of those products and services for a long period of time following their initial purchases, if at all. The period between initial customer contact and a purchase by a customer may be years with potentially an even longer period separating initial purchases and any significant purchases thereafter. During the evaluation period, prospective customers may decide not to purchase or may scale down proposed orders of our products for various reasons, including:

| ● | reduced need to upgrade existing visual marketing systems; | |

| ● | introduction of products by our competitors; | |

| ● | lower prices offered by our competitors; and | |

| ● | changes in budgets and purchasing priorities. |

Our prospective customers routinely require education regarding the use and benefit of our products. This may also lead to delays in receiving customers’ orders.

Our industry is characterized by frequent technological change. If we are unable to adapt our products and services and develop new products and services to keep up with these rapid changes, we will not be able to obtain or maintain market share.

The market for our products and services is characterized by rapidly changing technology, evolving industry standards, changes in customer needs, heavy competition and frequent new product and service introductions. If we fail to develop new products and services or modify or improve existing products and services in response to these changes in technology, customer demands or industry standards, our products and services could become less competitive or obsolete.

We must respond to changing technology and industry standards in a timely and cost-effective manner. We may not be successful in using new technologies, developing new products and services or enhancing existing products and services in a timely and cost-effective manner. Furthermore, even if we successfully adapt our products and services, these new technologies or enhancements may not achieve market acceptance.

A portion of business involves the use of software technology that we have developed or licensed. Industries involving the ownership and licensing of software-based intellectual property are characterized by frequent intellectual-property litigation, and we could face claims of infringement by others in the industry. Such claims are costly and add uncertainty to our operational results.

A portion of our business involves our ownership and licensing of software. This market space is characterized by frequent intellectual-property claims and litigation. We could be subject to claims of infringement of third-party intellectual-property rights resulting in significant expense and the potential loss of our own intellectual-property rights. From time to time, third parties may assert copyright, trademark, patent or other intellectual-property rights to technologies that are important to our business. Any litigation to determine the validity of these claims, including claims arising through our contractual indemnification of our business partners, regardless of their merit or resolution, would likely be costly and time consuming and divert the efforts and attention of our management and technical personnel. If any such litigation resulted in an adverse ruling, we could be required to:

| ● | pay substantial damages; | |

| ● | cease the development, use, licensing or sale of infringing products; | |

| ● | discontinue the use of certain technology; or | |

| ● | obtain a license under the intellectual property rights of the third party claiming infringement, which license may not be available on reasonable terms or at all. |

| 11 |

Our proprietary platform architectures and data tracking technology underlying certain of our services are complex and may contain unknown errors in design or implementation that could result in system performance failures or inability to scale.

The platform architecture, data tracking technology and integration layers underlying our proprietary platforms, our contract administration, procurement, timekeeping, content and network management, network services, device management, virtualized services, software automation and other tools, and back-end services are complex and include software and code used to generate customer invoices. This software and code is developed internally, licensed from third parties, or integrated by in-house personnel and third parties. Any of the system architecture, system administration, integration layers, software or code may contain errors, or may be implemented or interpreted incorrectly, particularly when they are first introduced or when new versions or enhancements to our tools and services are released. Consequently, our systems could experience performance failure or we may be unable to scale our systems, which may:

| ● | adversely impact our relationship with customers and others who experience system failure, possibly leading to a loss of affected and unaffected customers; |

| ● | increase our costs related to product development or service delivery; or |

| ● | adversely affect our revenues and expenses. |

Our business may be adversely affected by malicious applications that interfere with, or exploit security flaws in, our products and services.

Our business may be adversely affected by malicious applications that make changes to our customers’ computer systems and interfere with the operation and use of our products or products that impact our business. These applications may attempt to interfere with our ability to communicate with our customers’ devices. The interference may occur without disclosure to or consent from our customers, resulting in a negative experience that our customers may associate with our products and services. These applications may be difficult or impossible to uninstall or disable, may reinstall themselves and may circumvent other applications’ efforts to block or remove them. The ability to provide customers with a superior interactive marketing technology experience is critical to our success. If our efforts to combat these malicious applications fail, or if our products and services have actual or perceived vulnerabilities, there may be claims based on such failure or our reputation may be harmed, which would damage our business and financial condition.

We compete with other companies that have more resources, which puts us at a competitive disadvantage.

The market for interactive marketing technologies is generally highly competitive and we expect competition to increase in the future. Some of our competitors or potential competitors may have significantly greater financial, technical and marketing resources than us. These competitors may be able to respond more rapidly than we can to new or emerging technologies or changes in customer requirements. They may also devote greater resources to the development, promotion and sale of their products than us.

| 12 |

We expect competitors to continue to improve the performance of their current products and to introduce new products, services and technologies. Successful new product and service introductions or enhancements by our competitors could reduce sales and the market acceptance of our products and services, cause intense price competition or make our products and services obsolete. To be competitive, we must continue to invest significant resources in research and development, sales and marketing and customer support. If we do not have sufficient resources to make these investments or are unable to make the technological advances necessary to be competitive, our competitive position will suffer. Increased competition could result in price reductions, fewer customer orders, reduced margins and loss of market share. Our failure to compete successfully against current or future competitors could adversely affect our business and financial condition.

Our future success depends on key personnel and our ability to attract and retain additional personnel.

Our key personnel include:

| ● | Richard Mills, our Chief Executive Officer; |

| ● | John Walpuck, our Chief Financial and Chief Operating Officer; and |

| ● | Alan Levy, our Vice President and Corporate Controller. |

If we fail to retain our key personnel or to attract, retain and motivate other qualified employees, our ability to maintain and develop our business may be adversely affected. Our future success depends significantly on the continued service of our key technical, sales and senior management personnel and their ability to execute our growth strategy. The loss of the services of our key employees could harm our business. We may be unable to retain our employees or to attract, assimilate and retain other highly qualified employees who could migrate to other employers who offer competitive or superior compensation packages.

Unpredictability in financing markets could impair our ability to grow our business through acquisitions.

We anticipate that opportunities to acquire similar businesses will materially depend on the availability of financing alternatives with acceptable terms. As a result, poor credit and other market conditions or uncertainty in financial markets could materially limit our ability to grow through acquisitions since such conditions and uncertainty make obtaining financing more difficult.

Our reliance on information management and transaction systems to operate our business exposes us to cyber incidents and hacking of our sensitive information if our outsourced service provider experiences a security breach.

Effective information security internal controls are necessary for us to protect our sensitive information from illegal activities and unauthorized disclosure in addition to denial of service attacks and corruption of our data. In addition, we rely on the information security internal controls maintained by our outsourced service provider. Breaches of our information management system could also adversely affect our business reputation. Finally, significant information system disruptions could adversely affect our ability to effectively manage operations or reliably report results.

Because our technology, products, platform, and services are complex and are deployed in and across complex environments, they may have errors or defects that could seriously harm our business.

Our technology, proprietary platforms, products and services are highly complex and are designed to operate in and across data centers, large and complex networks, and other elements of the digital media workflow that we do not own or control. On an ongoing basis, we need to perform proactive maintenance services on our platform and related software services to correct errors and defects. In the future, there may be additional errors and defects in our software that may adversely affect our services. We may not have in place adequate reporting, tracking, monitoring, and quality assurance procedures to ensure that we detect errors in our software in a timely manner. If we are unable to efficiently and cost-effectively fix errors or other problems that may be identified, or if there are unidentified errors that allow persons to improperly access our services, we could experience loss of revenues and market share, damage to our reputation, increased expenses and legal actions by our customers.

| 13 |

We may have insufficient network or server capacity, which could result in interruptions in our services and loss of revenues.

Our operations are dependent in part upon: network capacity provided by third-party telecommunications networks; data center services provider owned and leased infrastructure and capacity; the Company’s dedicated and virtualized server capacity located at its data center services provider partner and a geo-redundant micro-data center location; and the Company’s own infrastructure and equipment. Collectively, this infrastructure, equipment, and capacity must be sufficiently robust to handle all of our customers' web-traffic, particularly in the event of unexpected surges in high-definition video traffic and network services incidents. We may not be adequately prepared for unexpected increases in bandwidth and related infrastructure demands from our customers. In addition, the bandwidth we have contracted to purchase may become unavailable for a variety of reasons, including payment disputes, outages, or such service providers going out of business. Any failure of these service providers or the Company’s own infrastructure to provide the capacity we require, due to financial or other reasons, may result in a reduction in, or interruption of, service to our customers, leading to an immediate decline in revenue and possible additional decline in revenue as a result of subsequent customer losses.

We do not have sufficient capital to engage in material research and development, which may harm our long-term growth.

In light of our limited resources in general, we have made no material investments in research and development over the past several years. This conserves capital in the short term. In the long term, as a result of our failure to invest in research and development, our technology and product offerings may not keep pace with the market and we may lose any existing competitive advantage. Over the long term, this may harm our revenues growth and our ability to become profitable.

Our business operations are susceptible to interruptions caused by events beyond our control.

Our business operations are susceptible to interruptions caused by events beyond our control. We are vulnerable to the following potential problems, among others:

| ● | our platform, technology, products, and services and underlying infrastructure, or that of our key suppliers, may be damaged or destroyed by events beyond our control, such as fires, earthquakes, floods, power outages or telecommunications failures; |

| ● | we and our customers and/or partners may experience interruptions in service as a result of the accidental or malicious actions of Internet users, hackers or current or former employees; |

| ● | we may face liability for transmitting viruses to third parties that damage or impair their access to computer networks, programs, data or information. Eliminating computer viruses and alleviating other security problems may require interruptions, delays or cessation of service to our customers; and |

| ● | failure of our systems or those of our suppliers may disrupt service to our customers (and from our customers to their customers), which could materially impact our operations (and the operations of our customers), adversely affect our relationships with our customers and lead to lawsuits and contingent liability. |

The occurrence of any of the foregoing could result in claims for consequential and other damages, significant repair and recovery expenses and extensive customer losses and otherwise have a material adverse effect on our business, financial condition and results of operations.

| 14 |

General global market and economic conditions may have an adverse impact on our operating performance and results of operations.

Our business has been and could continue to be affected by general global economic and market conditions. Weakness in the United States and worldwide economy has had and could continue to have a negative effect on our operating results, including a decrease in revenue and operating cash flow. To the extent our customers are unable to profitably leverage various forms of digital marketing technology and solutions, and/or the content we create, deliver and publish on their behalf, they may reduce or eliminate their purchase of our products and services. Such reductions in traffic would lead to a reduction in our revenues. Additionally, in a down-cycle economic environment, we may experience the negative effects of increased competitive pricing pressure, customer loss, slowdown in commerce over the Internet and corresponding decrease in traffic delivered over our network and failures by our customers to pay amounts owed to us on a timely basis or at all. Suppliers on which we rely for equipment, field services, servers, bandwidth, co-location and other services could also be negatively impacted by economic conditions that, in turn, could have a negative impact on our operations or revenues. Flat or worsening economic conditions may harm our operating results and financial condition.

The markets in which we operate are rapidly emerging, and we may be unable to compete successfully against existing or future competitors to our business.

The market in which we operate is becoming increasingly competitive. Our current competitors generally include general digital signage companies, specialized digital signage operators targeting certain vertical markets (e.g., financial services), content management software companies, or integrators and vertical solution providers who develop single implementations of content distribution, digital marketing technology, and related services. These competitors, including future new competitors who may emerge, may be able to develop a comparable or superior solution capabilities, software platform, technology stack, and/or series of services that provide a similar or more robust set of features and functionality than the technology, products and services we offer. If this occurs, we may be unable to grow as necessary to make our business profitable.

Whether or not we have superior products, many of these current and potential future competitors have a longer operating history in their current respective business areas and greater market presence, brand recognition, engineering and marketing capabilities, and financial, technological and personnel resources than we do. Existing and potential competitors with an extended operating history, even if not directly related to our business, have an inherent marketing advantage because of the reluctance of many potential customers to entrust key operations to a company that may be perceived as unproven. In addition, our existing and potential future competitors may be able to use their extensive resources:

| ● | to develop and deploy new products and services more quickly and effectively than we can; |

| ● | to develop, improve and expand their platforms and related infrastructures more quickly than we can; |

| ● | to reduce costs, particularly hardware costs, because of discounts associated with large volume purchases and longer term relationships and commitments; |

| ● | to offer less expensive products, technology, platform, and services as a result of a lower cost structure, greater capital reserves or otherwise; |

| ● | to adapt more swiftly and completely to new or emerging technologies and changes in customer requirements; |

| ● | to take advantage of acquisition and other opportunities more readily; and |

| ● | to devote greater resources to the marketing and sales of their products, technology, platform, and services. |

If we are unable to compete effectively in our various markets, or if competitive pressures place downward pressure on the prices at which we offer our products and services, our business, financial condition and results of operations may suffer.

| 15 |

RISKS RELATED TO THIS OFFERING AND OUR COMPANY

Because of our early stage of operations and limited resources, we may not have in place various processes and protections common to more mature companies and may be more susceptible to adverse events.

We are in an early stage of operations and have limited resources after incurring a significant amount of restructuring and integration costs. As a result, we may not have in place systems, processes and protections that many of our competitors have or that may be essential to protect against various risks. For example, we have in place only limited resources and processes addressing human resources, timekeeping, data protection, business continuity, personnel redundancy, and knowledge institutionalization concerns. As a result, we are at risk that one or more adverse events in these and other areas may materially harm our business, balance sheet, revenues, expenses or prospects.

Failure to achieve and maintain effective internal controls could limit our ability to detect and prevent fraud and thereby adversely affect our business and stock price.

Effective internal controls are necessary for us to provide reliable financial reports. Nevertheless, all internal control systems, no matter how well designed, have inherent limitations. Even those systems determined to be effective can provide only reasonable assurance with respect to financial statement preparation and presentation. Our inability to maintain an effective control environment may cause investors to lose confidence in our reported financial information, which could in turn have a material adverse effect on our stock price. Importantly, our most recent Annual Report on Form 10-K discloses our finding of material weaknesses in our internal controls. For more information, please refer to Item 9A of our Annual Report on Form 10-K for the year ended December 31, 2015, filed with the SEC on April 4, 2016.

Our controlling shareholder possesses controlling voting power with respect to our common stock and voting preferred stock, which will limit your influence on corporate matters.

Our controlling shareholder, Slipstream Communications, LLC, has beneficial ownership of 40,154,505 shares of common stock, including common shares are beneficially owned by an affiliate of Slipstream Communications named Slipstream Funding, LLC. These shares represent beneficial ownership of approximately 52.72% of our common stock as of the date of this prospectus. As a result, Slipstream Funding has the ability to control our management and affairs through the election and removal of our entire Board of Directors and all other matters requiring shareholder approval, including the future merger, consolidation or sale of all or substantially all of our assets. This concentrated control could discourage others from initiating any potential merger, takeover or other change-of-control transaction that may otherwise be beneficial to our shareholders. Furthermore, this concentrated control will limit the practical effect of your participation in Company matters, through shareholder votes and otherwise.

Our Articles of Incorporation grant our Board of Directors the power to issue additional shares of common and preferred stock and to designate other classes of preferred stock, all without shareholder approval.

Our authorized capital consists of 250 million shares of capital stock. Pursuant to authority granted by our Articles of Incorporation, our Board of Directors, without any action by our shareholders, may designate and issue shares in such classes or series (including other classes or series of preferred stock) as it deems appropriate and establish the rights, preferences and privileges of such shares, including dividends, liquidation and voting rights, provided it is consistent with Minnesota law. The rights of holders of other classes or series of stock that may be issued could be superior to the rights of holders of our common shares. The designation and issuance of shares of capital stock having preferential rights could adversely affect other rights appurtenant to shares of our common stock. Furthermore, any issuances of additional stock (common or preferred) will dilute the percentage of ownership interest of then-current holders of our capital stock and may dilute our book value per share.

| 16 |

Significant issuances of our common stock, or the perception that significant issuances may occur in the future, could adversely affect the market price for our common stock.

Significant actual or perceived potential future issuance our common stock could adversely affect the market price of our common stock. Generally, issuances of substantial amounts of common stock in the public market, and the availability of shares for future sale, including up to 23,272,184 shares of our common stock that are covered by the registration statement of which this prospectus is a part, and issued on account of convertible promissory notes or issuable upon exercise of outstanding warrants, could adversely affect the prevailing market price of our common stock and could cause the market price of our common stock to remain low for a substantial amount of time.

We cannot foresee the impact of potential securities issuances of common shares on the market for our common stock, but it is possible that the market for our shares may be adversely affected, perhaps significantly. It is also unclear whether or not the market for our common stock could absorb a large number of attempted sales in a short period of time, regardless of the price at which they might be offered. Even if a substantial number of sales do not occur within a short period of time, the mere existence of this “market overhang” could have a negative impact on the market for our common stock and our ability to raise additional equity capital.

Our common stock trades only in an illiquid trading market.

Trading of our common stock is conducted on the OTC Markets (OTC Pink). This has an adverse effect on the liquidity of our common stock, not only in terms of the number of shares that can be bought and sold at a given price, but also through delays in the timing of transactions and reduction in security analysts’ and the media’s coverage of us and our common stock. This may result in lower prices for our common stock than might otherwise be obtained and could also result in a larger spread between the bid and asked prices for our common stock.

There is not now and there may not ever be an active market for shares of our common stock.

In general, there has been minimal trading volume in our common stock. The small trading volume will likely make it difficult for our shareholders to sell their shares as and when they choose. Furthermore, small trading volumes are generally understood to depress market prices. As a result, you may not always be able to resell shares of our common stock publicly at the time and prices that you feel are fair or appropriate.

We do not intend to pay dividends on our common stock for the foreseeable future. We will, however, pay dividends on our Series A Convertible Preferred Stock and our Series A-1 Convertible Preferred Stock.

When permitted by Minnesota law, we are required to pay dividends to the holders of our Series A Convertible Preferred Stock and Series A-1 Convertible Preferred Stock, each share of which carries a $1.00 stated value. There are presently approximately 5.9 million shares of Series A Convertible Preferred Stock outstanding and 1.7 million shares of Series A-1 Convertible Preferred Stock outstanding. Our Series A Convertible Preferred Stock and Series A-1 Convertible Preferred Stock entitles its holders to:

| ● | a cumulative 6% dividend, payable on a semi-annual basis in cash unless (i) we are unable to pay the dividend in cash under applicable law, or (ii) we have demonstrated positive cashflow during the prior quarter reported on our Form 10-Q, in which case we may at our election pay the dividend through the issuance of additional shares of preferred stock; |