Attached files

| file | filename |

|---|---|

| 8-K - 8-K - TRIBUNE MEDIA CO | d187155d8k.htm |

| EX-99.1 - EX-99.1 - TRIBUNE MEDIA CO | d187155dex991.htm |

Q1 2016 Performance Summary MAY 2016 Exhibit 99.2

Cautionary Statement Regarding Forward Looking Statements This presentation contains “forward-looking statements” within the meaning of the federal securities laws. Forward-looking statements are subject to known and unknown risks and uncertainties, many of which may be beyond our control. Forward-looking statements may include, but are not limited to, statements concerning our financial outlook and guidance, including our 2016 forecasted revenues, Adjusted EBITDA and other consolidated and segment financial performance guidance, our real estate monetization strategy, exploration of strategic and financial alternatives and other corporate initiatives, the conditions in our industry, our operations, our economic performance and financial condition, including, in particular, statements relating to our business and growth strategy and product development efforts. Important factors that could cause actual results, developments and business decisions to differ materially from these forward-looking statements are uncertainties discussed below and in the “Risk Factors” section of the Company’s Annual Report on Form 10-K filed with the U.S. Securities and Exchange Commission (the “SEC”) on February 29, 2016. “Forward-looking statements” include all statements that do not relate solely to historical or current facts, and can be identified by the use of words such as “may,” “might,” “will,” “could” “should,” “estimate,” “project,” “plan,” “anticipate,” “expect,” “intend,” “outlook,” “seek,” “designed,” “assume,” “implied,” “believe” and other similar expressions. You are cautioned not to place undue reliance on these forward-looking statements, which speak only as of their dates. These forward-looking statements are based on estimates and assumptions by our management that, although we believe to be reasonable, are inherently uncertain and subject to a number of risks and uncertainties. The following list represents some, but not necessarily all, of the factors that could cause actual results to differ from projected or historical results or those anticipated or predicted by these forward-looking statements: changes in advertising demand and audience shares; competition and other economic conditions including incremental fragmentation of the media landscape and competition from other media alternatives; changes in the overall market for broadcast and cable television advertising, including through regulatory and judicial rulings; our ability to protect our intellectual property and other proprietary rights; availability and cost of quality network, syndicated and sports programming affecting our television ratings; the loss, cost and / or modification of our network affiliation agreements; our ability to renegotiate retransmission consent agreements with multichannel video programming distributors; our ability to expand our Digital and Data business operations internationally; our ability to realize the full value, or successfully complete the planned divestitures of our real estate assets; the incurrence of additional tax-related liabilities related to historical income tax returns; our ability to expand our operations internationally; the timing and administration by the FCC of a potential auction of spectrum and our ability to monetize our spectrum through sales channel sharing arrangements or relocations; the incurrence of costs to address contamination issues at sites owned, operated or used by our businesses; adverse results from litigation, governmental investigations or tax-related proceedings or audits; our ability to settle unresolved claims filed in connection with our and certain of our direct and indirect wholly-owned subsidiaries’ Chapter 11 cases and resolve the appeals seeking to overturn the bankruptcy court order confirming the First Amended Joint Plan of Reorganization for Tribune Company and its Subsidiaries; our ability to satisfy pension and other postretirement employee benefit obligations; our ability to attract and retain employees; the effect of labor strikes, lock-outs and labor negotiations; our ability to realize benefits or synergies from acquisitions or divestitures or to operate our businesses effectively following acquisitions or divestitures; our ability to successfully execute our business strategy, including our exploration of strategic and financial alternatives to enhance shareholder value; the financial performance of our equity method investments; the impairment of our existing goodwill and other intangible assets; compliance with government regulations applicable to the television and radio broadcasting industry; changes in accounting standards; the payment of cash dividends on our common stock; impact of increases in interest rates on our variable rate indebtedness or refinancings thereof; impact of foreign currency exchange rate changes; our indebtedness and ability to comply with covenants applicable to our debt financing and other contractual commitments; our ability to satisfy future capital and liquidity requirements; our ability to access the credit and capital markets at the times and in the amounts needed and on acceptable terms and other events beyond our control that may result in unexpected adverse operating results. In addition, in light of these risks and uncertainties, the matters referred to in the forward-looking statements contained in this presentation may not in fact occur. Any forward-looking information presented herein is made only as of the date of this presentation and we undertake no obligation to update or revise any forward-looking statement as a result of new information, future events or otherwise, except as otherwise required by law.

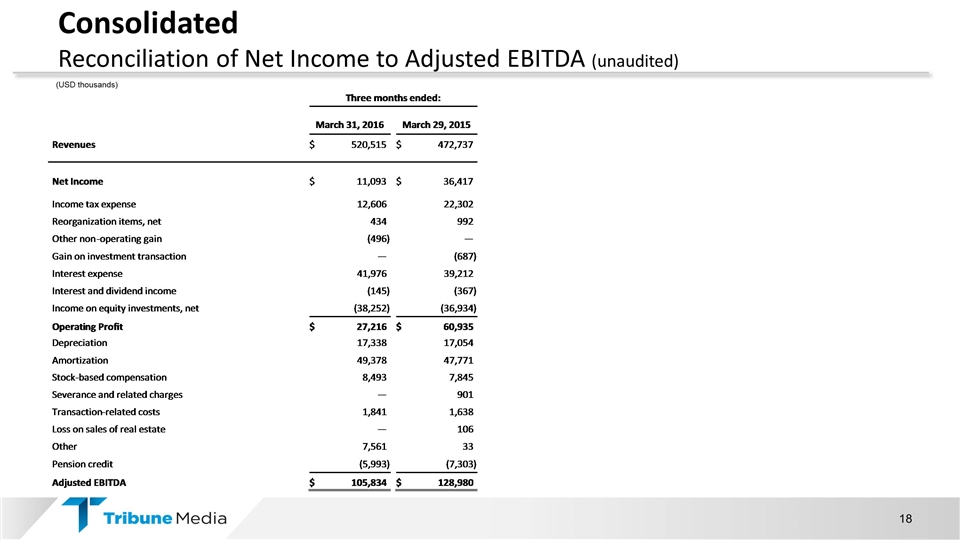

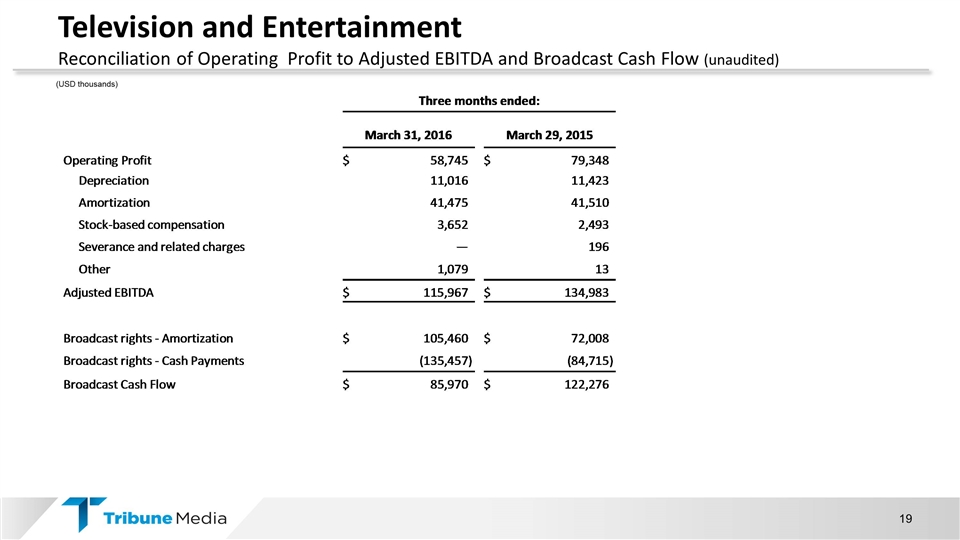

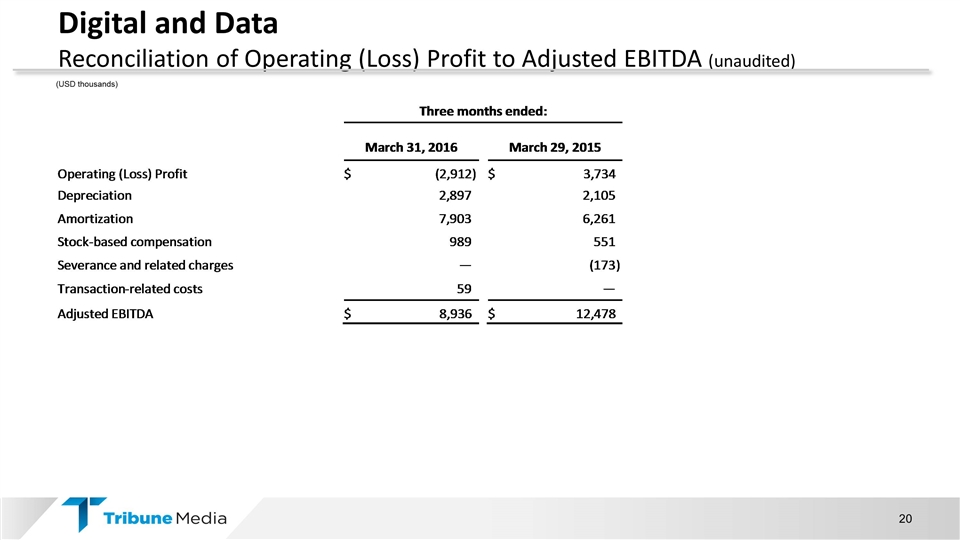

Non-GAAP Financial Measures This presentation includes a discussion of Adjusted EBITDA and Adjusted EPS for the Company and Adjusted EBITDA for our operating segments (Television and Entertainment, Digital and Data, and Corporate and Other) and presents Broadcast Cash Flow for our Television and Entertainment segment. Adjusted EPS, Adjusted EBITDA and Broadcast Cash Flow are financial measures that are not recognized under accounting principles generally accepted in the U.S. (“GAAP”). Adjusted EPS is calculated based on net income (loss) before investment transactions, loss on extinguishment of debt, certain adjustments to income on equity investments, net, certain special items (including severance), non-operating items, gain (loss) on sales of real estate, goodwill and other intangible asset and program impairments and other non-cash charges and reorganization items per common share. Adjusted EBITDA for the Company is defined as net income (loss) before income taxes, investment transactions, loss on extinguishment of debt, interest and dividend income, interest expense, pension expense (credit), equity income and losses, depreciation and amortization, stock-based compensation, certain special items (including severance), non-operating items, gain (loss) on sales of real estate, goodwill and other intangible asset and program impairments and other non-cash charges and reorganization items. Adjusted EBITDA for the Company’s operating segments is calculated as segment operating profit plus depreciation, amortization, pension expense (credit), stock-based compensation, goodwill and other intangible asset and program impairments and other non-cash charges and certain special items (including severance). Broadcast Cash Flow for the Television and Entertainment segment is calculated as Television and Entertainment Adjusted EBITDA plus broadcast rights amortization expense less broadcast rights cash payments. We believe that Adjusted EBITDA and Broadcast Cash Flow are measures commonly used by investors to evaluate our performance with that of our competitors. We also present Adjusted EBITDA because we believe investors, analysts and rating agencies consider it useful in measuring our ability to meet our debt service obligations. We further believe that the disclosure of Adjusted EPS, Adjusted EBITDA and Broadcast Cash Flow is useful to investors as these non-GAAP measures are used, among other measures, by our management to evaluate our performance. By disclosing Adjusting EPS, Adjusted EBITDA and Broadcast Cash Flow, we believe that we create for investors a greater understanding of, and an enhanced level of transparency into, the means by which our management operates our company. Adjusted EPS, Adjusted EBITDA and Broadcast Cash Flow are not measures presented in accordance with GAAP, and our use of these terms may vary from that of others in our industry. Adjusted EPS, Adjusted EBITDA and Broadcast Cash Flow should not be considered as an alternative to net income, operating profit, revenues, cash provided by operating activities or any other measures derived in accordance with GAAP as measures of operating performance or liquidity. The tables at the end of this presentation include reconciliations of consolidated Adjusted EPS and Adjusted EBITDA and segment Adjusted EBITDA and Broadcast Cash Flow to the most directly comparable financial measures calculated and presented in accordance with GAAP. No reconciliation of the forecasted range for Adjusted EBITDA on a consolidated or segment basis for fiscal 2016 is included in this release because we are unable to quantify certain amounts that would be required to be included in the GAAP measure without unreasonable efforts and we believe such reconciliations would imply a degree of precision that would be confusing or misleading to investors.

Tribune Media A diverse combination of media assets that meaningfully touch millions of people every day, including compelling content in news and entertainment, significant broadcast distribution, an emerging cable network, and a cutting-edge digital and data business. Broadcast: 42 owned or operated broadcast television stations in major markets across the country. WGN America: A national, general entertainment cable network airing high quality original content, whose reach is approaching 80 million households. Digital and Data: Growing global metadata business, powering some of the biggest media brands in the world. Real Estate and Investments: 77 real estate properties and equity investments in a variety of media, online and other properties.

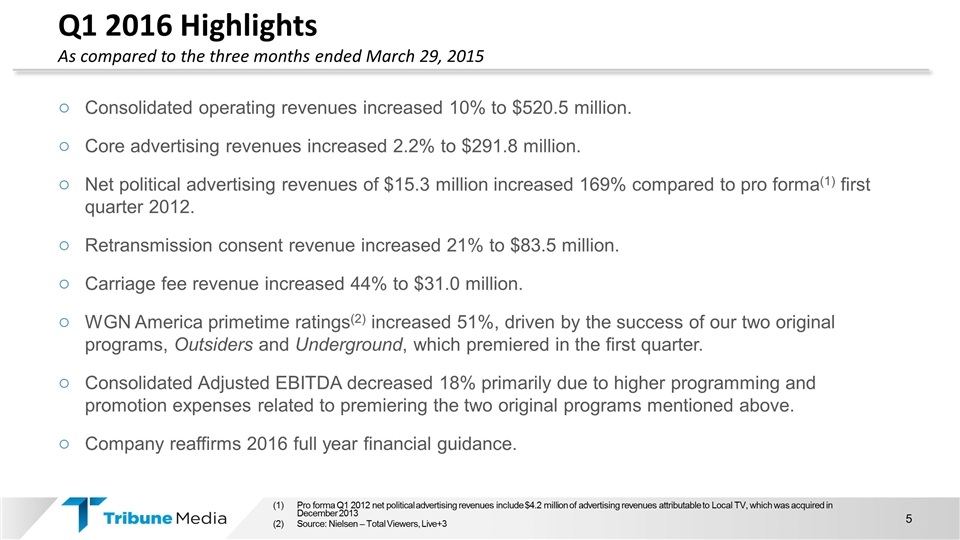

Q1 2016 Highlights As compared to the three months ended March 29, 2015 Consolidated operating revenues increased 10% to $520.5 million. Core advertising revenues increased 2.2% to $291.8 million. Net political advertising revenues of $15.3 million increased 169% compared to pro forma(1) first quarter 2012. Retransmission consent revenue increased 21% to $83.5 million. Carriage fee revenue increased 44% to $31.0 million. WGN America primetime ratings(2) increased 51%, driven by the success of our two original programs, Outsiders and Underground, which premiered in the first quarter. Consolidated Adjusted EBITDA decreased 18% primarily due to higher programming and promotion expenses related to premiering the two original programs mentioned above. Company reaffirms 2016 full year financial guidance. Pro forma Q1 2012 net political advertising revenues include $4.2 million of advertising revenues attributable to Local TV, which was acquired in December 2013 Source: Nielsen – Total Viewers, Live+3

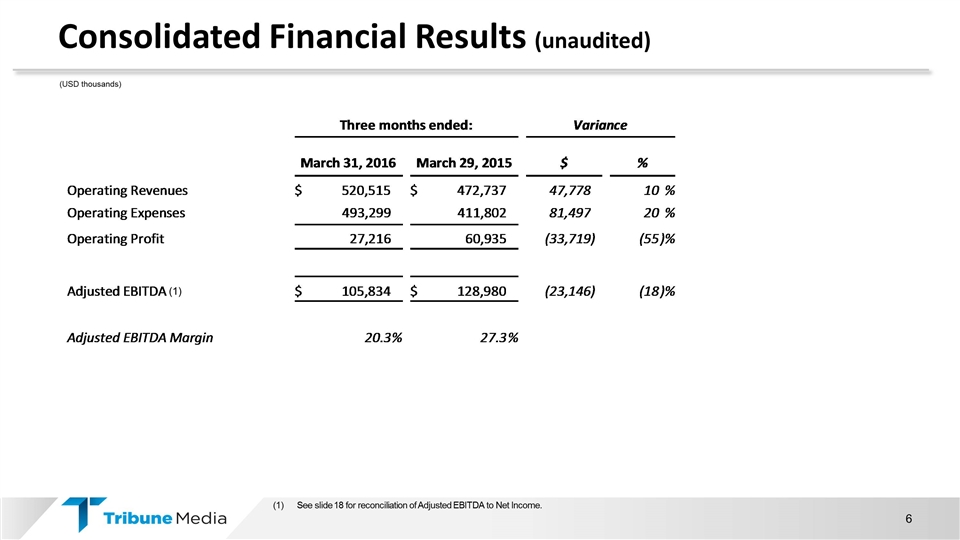

Consolidated Financial Results (unaudited) (USD thousands) See slide 18 for reconciliation of Adjusted EBITDA to Net Income. (1)

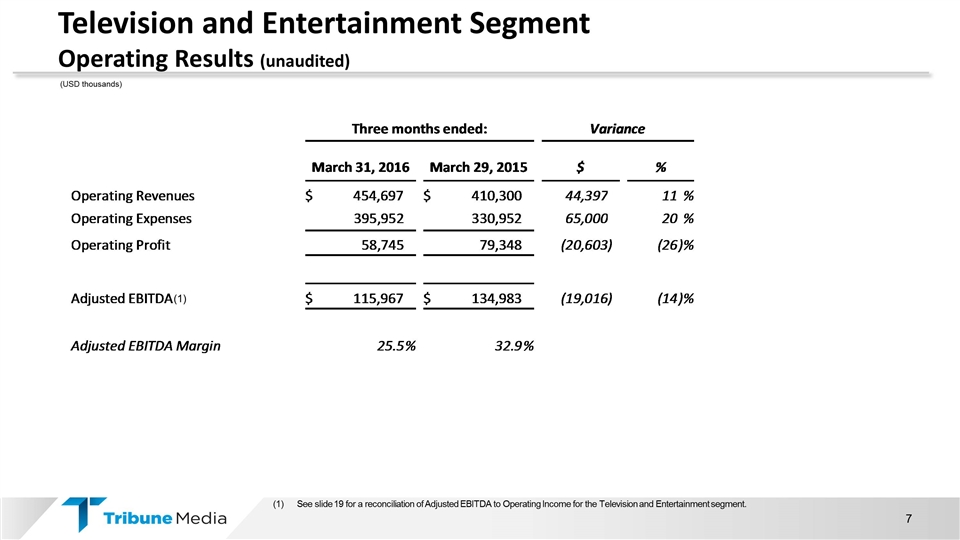

Television and Entertainment Segment Operating Results (unaudited) (USD thousands) See slide 19 for a reconciliation of Adjusted EBITDA to Operating Income for the Television and Entertainment segment. (1)

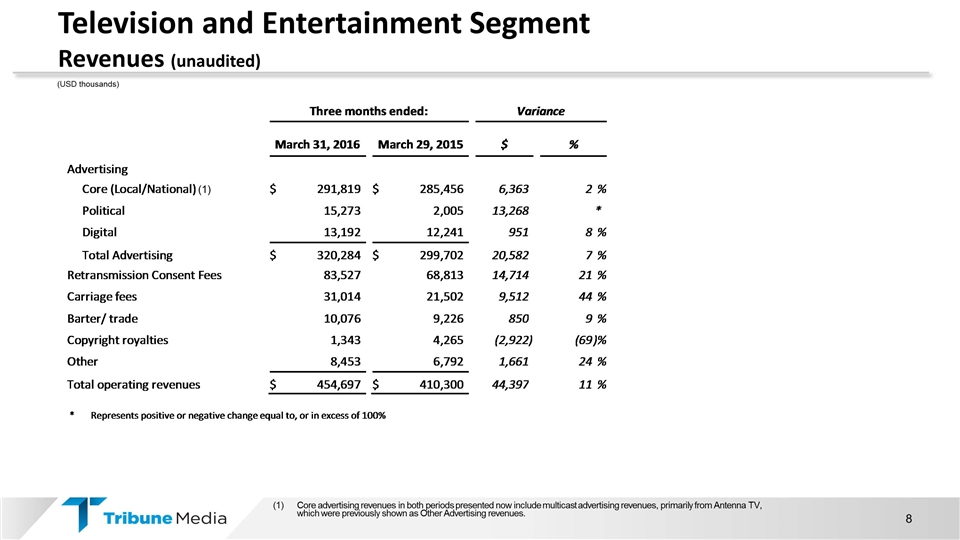

Television and Entertainment Segment Revenues (unaudited) (USD thousands) Core advertising revenues in both periods presented now include multicast advertising revenues, primarily from Antenna TV, which were previously shown as Other Advertising revenues. (1)

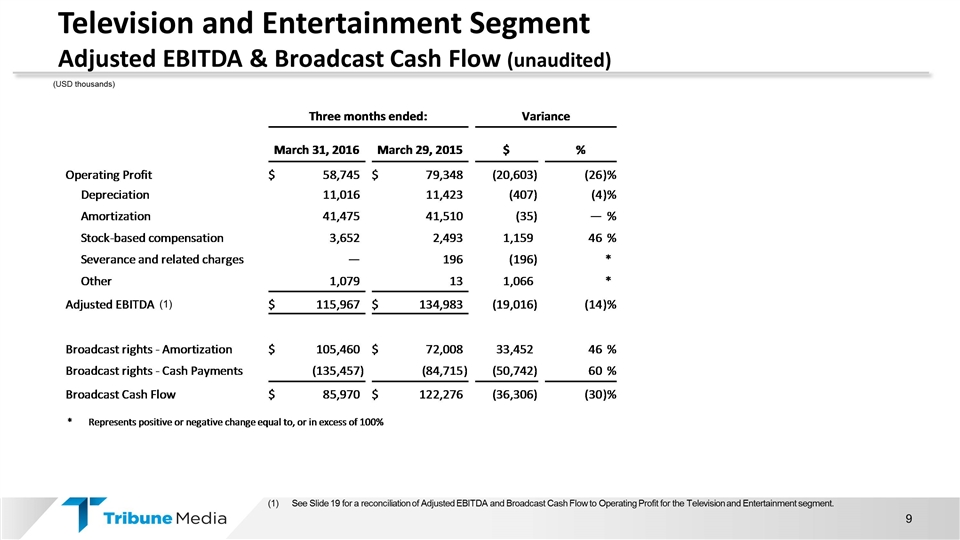

Television and Entertainment Segment Adjusted EBITDA & Broadcast Cash Flow (unaudited) (USD thousands) See Slide 19 for a reconciliation of Adjusted EBITDA and Broadcast Cash Flow to Operating Profit for the Television and Entertainment segment. (1)

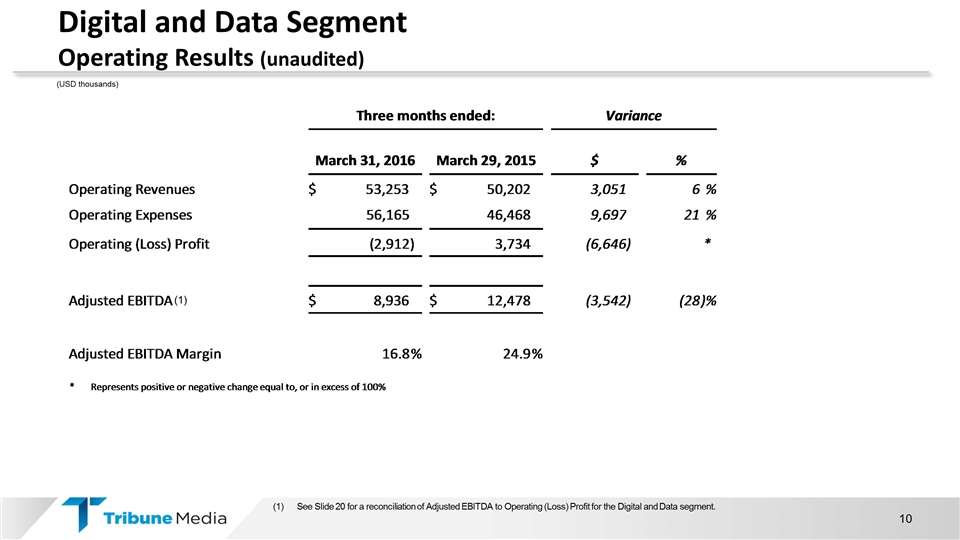

Digital and Data Segment Operating Results (unaudited) (USD thousands) See Slide 20 for a reconciliation of Adjusted EBITDA to Operating (Loss) Profit for the Digital and Data segment. (1)

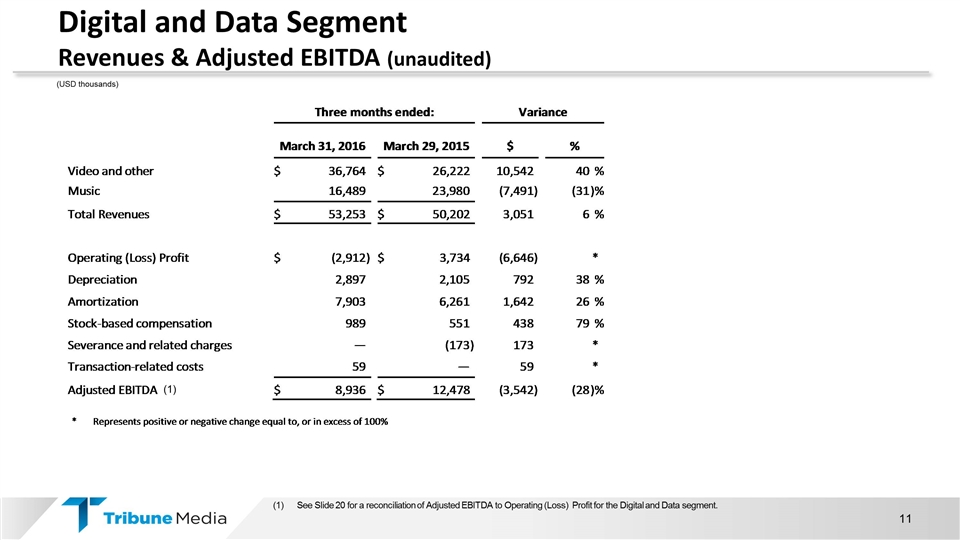

Digital and Data Segment Revenues & Adjusted EBITDA (unaudited) (USD thousands) See Slide 20 for a reconciliation of Adjusted EBITDA to Operating (Loss) Profit for the Digital and Data segment. (1)

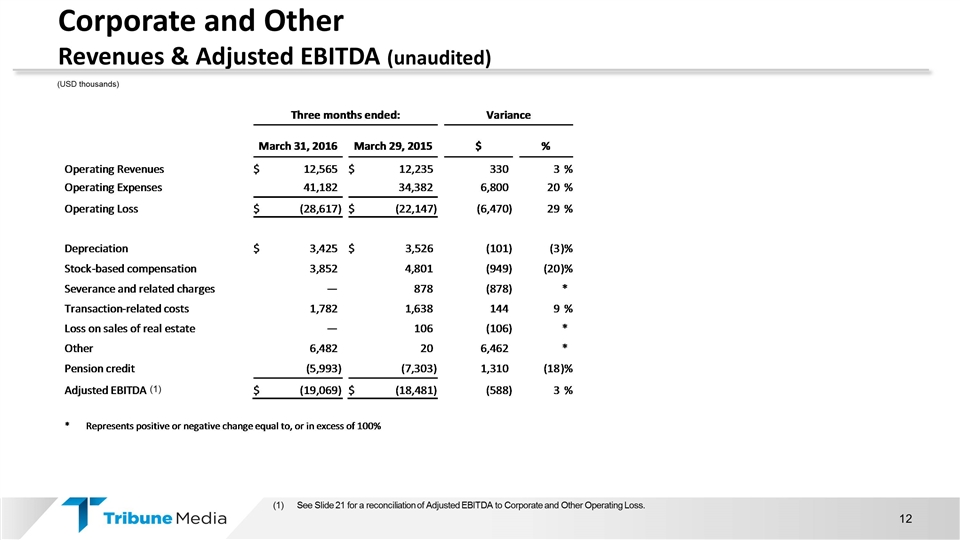

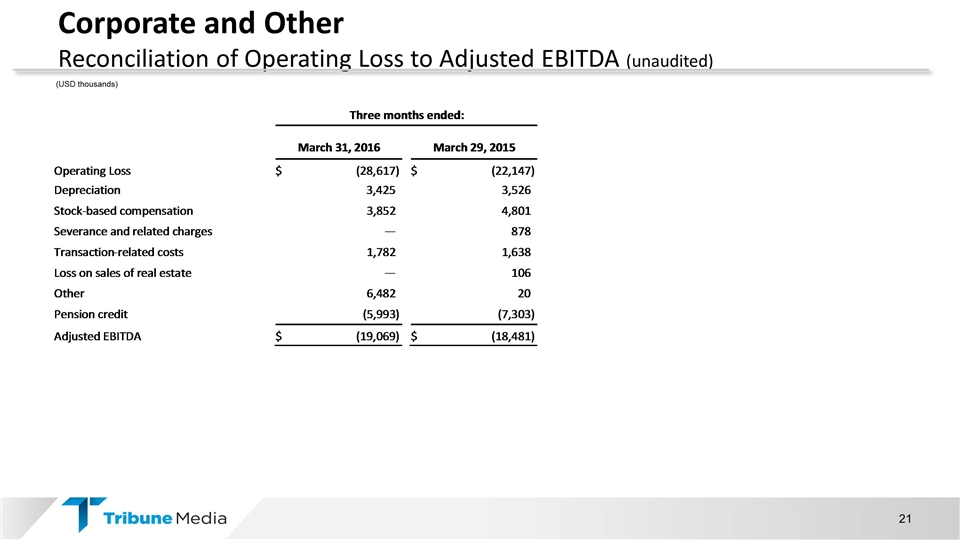

Corporate and Other Revenues & Adjusted EBITDA (unaudited) (USD thousands) See Slide 21 for a reconciliation of Adjusted EBITDA to Corporate and Other Operating Loss. (1)

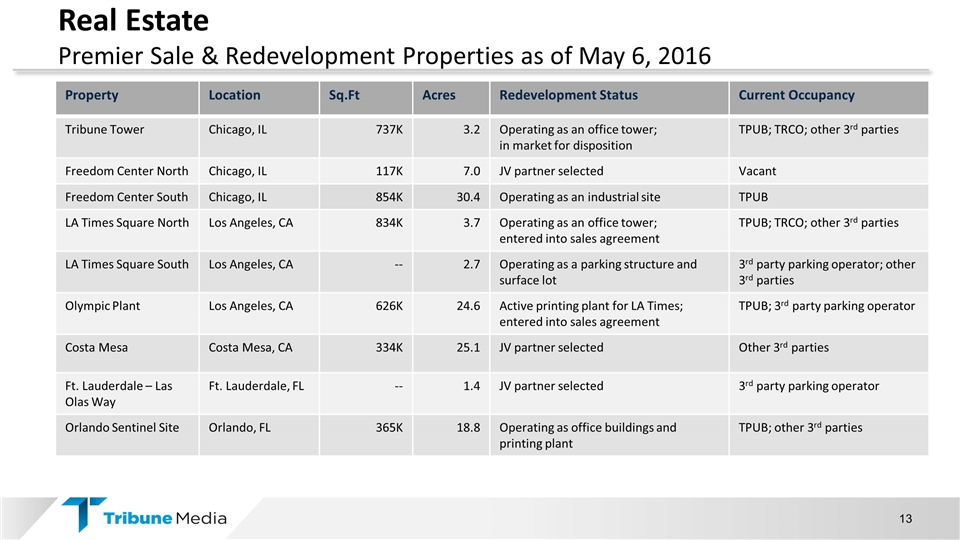

Real Estate Premier Sale & Redevelopment Properties as of May 6, 2016 Property Location Sq.Ft Acres Redevelopment Status Current Occupancy Tribune Tower Chicago, IL 737K 3.2 Operating as an office tower; in market for disposition TPUB; TRCO; other 3rd parties Freedom Center North Chicago, IL 117K 7.0 JV partner selected Vacant Freedom Center South Chicago, IL 854K 30.4 Operating as an industrial site TPUB LA Times Square North Los Angeles, CA 834K 3.7 Operating as an office tower; entered into sales agreement TPUB; TRCO; other 3rd parties LA Times Square South Los Angeles, CA -- 2.7 Operating as a parking structure and surface lot 3rd party parking operator; other 3rd parties Olympic Plant Los Angeles, CA 626K 24.6 Active printing plant for LA Times; entered into sales agreement TPUB; 3rd party parking operator Costa Mesa Costa Mesa, CA 334K 25.1 JV partner selected Other 3rd parties Ft. Lauderdale – Las Olas Way Ft. Lauderdale, FL -- 1.4 JV partner selected 3rd party parking operator Orlando Sentinel Site Orlando, FL 365K 18.8 Operating as office buildings and printing plant TPUB; other 3rd parties

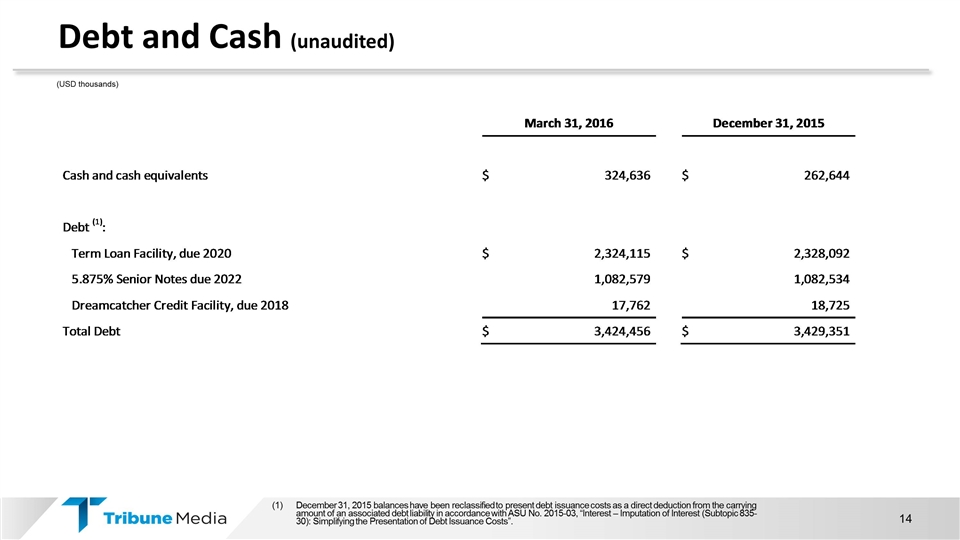

Debt and Cash (unaudited) (USD thousands) December 31, 2015 balances have been reclassified to present debt issuance costs as a direct deduction from the carrying amount of an associated debt liability in accordance with ASU No. 2015-03, “Interest – Imputation of Interest (Subtopic 835-30): Simplifying the Presentation of Debt Issuance Costs”.

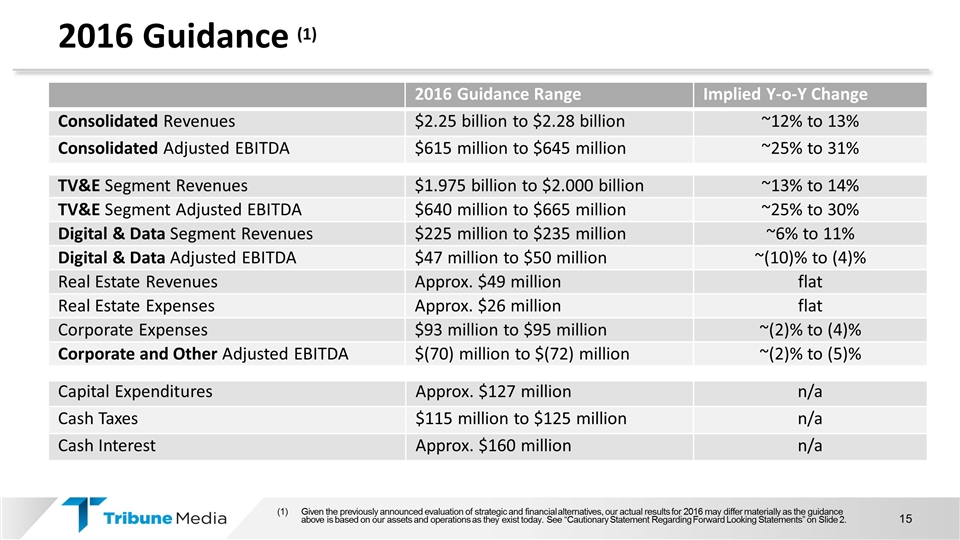

Capital Expenditures Approx. $127 million n/a Cash Taxes $115 million to $125 million n/a Cash Interest Approx. $160 million n/a 2016 Guidance (1) TV&E Segment Revenues $1.975 billion to $2.000 billion ~13% to 14% TV&E Segment Adjusted EBITDA $640 million to $665 million ~25% to 30% Digital & Data Segment Revenues $225 million to $235 million ~6% to 11% Digital & Data Adjusted EBITDA $47 million to $50 million ~(10)% to (4)% Real Estate Revenues Approx. $49 million flat Real Estate Expenses Approx. $26 million flat Corporate Expenses $93 million to $95 million ~(2)% to (4)% Corporate and Other Adjusted EBITDA $(70) million to $(72) million ~(2)% to (5)% Given the previously announced evaluation of strategic and financial alternatives, our actual results for 2016 may differ materially as the guidance above is based on our assets and operations as they exist today. See “Cautionary Statement Regarding Forward Looking Statements” on Slide 2. 2016 Guidance Range Implied Y-o-Y Change Consolidated Revenues $2.25 billion to $2.28 billion ~12% to 13% Consolidated Adjusted EBITDA $615 million to $645 million ~25% to 31%

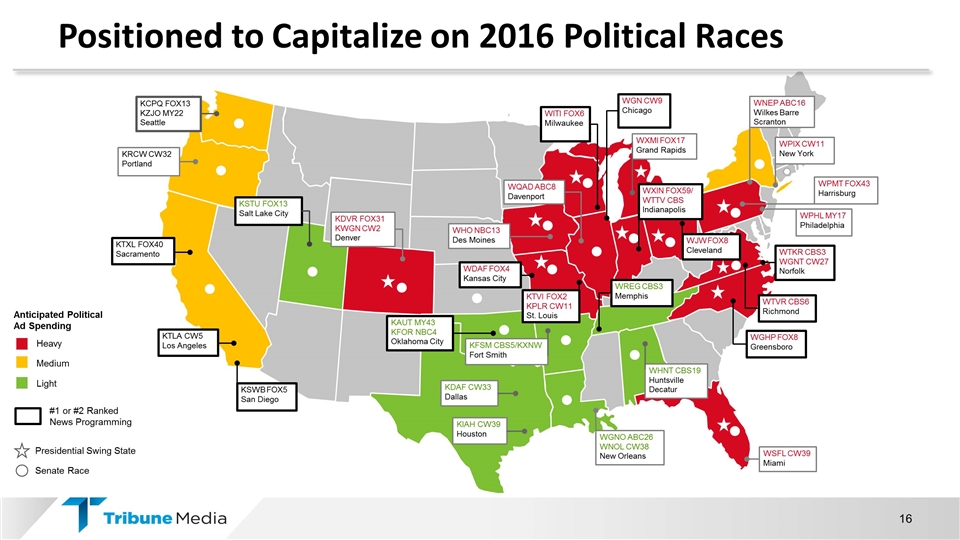

Positioned to Capitalize on 2016 Political Races Heavy Medium Light KTLA CW5 Los Angeles KTXL FOX40 Sacramento KRCW CW32 Portland KSTU FOX13 Salt Lake City KDVR FOX31 KWGN CW2 Denver WQAD ABC8 Davenport KCPQ FOX13 KZJO MY22 Seattle WDAF FOX4 Kansas City KDAF CW33 Dallas KIAH CW39 Houston WHO NBC13 Des Moines KAUT MY43 KFOR NBC4 Oklahoma City KFSM CBS5/KXNW Fort Smith WHNT CBS19 Huntsville Decatur WSFL CW39 Miami WGHP FOX8 Greensboro WTVR CBS6 Richmond WGNO ABC26 WNOL CW38 New Orleans WTKR CBS3 WGNT CW27 Norfolk WITI FOX6 Milwaukee WGN CW9 Chicago WPHL MY17 Philadelphia WXMI FOX17 Grand Rapids KTVI FOX2 KPLR CW11 St. Louis WPMT FOX43 Harrisburg WPIX CW11 New York WNEP ABC16 Wilkes Barre Scranton WJW FOX8 Cleveland WREG CBS3 Memphis KSWB FOX5 San Diego WXIN FOX59/ WTTV CBS Indianapolis Anticipated Political Ad Spending Presidential Swing State Senate Race #1 or #2 Ranked News Programming

Non-GAAP Reconciliations

Consolidated Reconciliation of Net Income to Adjusted EBITDA (unaudited) (USD thousands)

Television and Entertainment Reconciliation of Operating Profit to Adjusted EBITDA and Broadcast Cash Flow (unaudited) (USD thousands)

Digital and Data Reconciliation of Operating (Loss) Profit to Adjusted EBITDA (unaudited) (USD thousands)

Corporate and Other Reconciliation of Operating Loss to Adjusted EBITDA (unaudited) (USD thousands)

Q1 2016 Performance Summary MAY 2016