Attached files

| file | filename |

|---|---|

| EX-2.1 - AGREEMENT AND PLAN OF MERGER - Sunshine Bancorp, Inc. | d191247dex21.htm |

| EX-10.1 - FORM OF VOTING AGREEMENT BY AND AMONG SUNSHINE BANCORP, INC. - Sunshine Bancorp, Inc. | d191247dex101.htm |

| EX-99.1 - PRESS RELEASE - Sunshine Bancorp, Inc. | d191247dex991.htm |

| EX-10.2 - FORM OF VOTING AGREEMENT BY AND AMONG FBC BANCORP, INC. - Sunshine Bancorp, Inc. | d191247dex102.htm |

| 8-K - FORM 8-K - Sunshine Bancorp, Inc. | d191247d8k.htm |

May 10, 2016 Strategic Partnership of Sunshine Bancorp, Inc. and FBC Bancorp, Inc. Exhibit 99.2

Forward-Looking Statements Cautionary Statements Regarding Forward Looking Statements Certain statements contained herein are “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. Such forward-looking statements may be identified by reference to a future period or periods, or by the use of forward-looking terminology, such as “may,” “will,” “believe,” “expect,” “estimate,” “anticipate,” “continue,” or similar terms or variations on those terms, or the negative of those terms. Forward-looking statements by their nature address matters that are, to different degrees, uncertain, such as statements about the potential timing or consummation of the proposed transaction or the anticipated benefits thereof, including, without limitation, future financial and operating results. The Company and FBC caution readers that these and other forward-looking statements are not guarantees of future results and are subject to risks, uncertainties and assumptions that could cause actual results to differ materially from those expressed in any forward-looking statements. Important risk factors that may cause such a difference include, but are not limited to risks and uncertainties related to (i) the ability to obtain shareholder and regulatory approvals, or the possibility that they may delay the transaction or that such regulatory approval may result in the imposition of conditions that could cause the parties to abandon the transaction, (ii) the risk that a condition to closing of the Merger may not be satisfied; (iii) the ability of the Company and FBC to integrate their businesses successfully and to achieve anticipated cost savings and other synergies, (iv) the possibility that other anticipated benefits of the proposed transaction will not be realized, including without limitation, anticipated revenues, expenses, earnings and other financial results, and growth and expansion of the new combined company’s operations, and the anticipated tax treatment, (v) potential litigation relating to the proposed transaction, (vi) possible disruptions from the proposed transaction that could harm the Company’s or FBC’s business, including current plans and operations, (vii) the ability of the Company or FBC to retain, attract and hire key personnel, (viii) potential adverse reactions or changes to relationships with clients, employees, suppliers or other parties resulting from the announcement or completion of the Merger, (ix) potential business uncertainty, including changes to existing business relationships, during the pendency of the Merger that could affect the Company’s and/or FBC’s financial performance, (x) certain restrictions during the pendency of the Merger that may impact the Company’s or FBC’s ability to pursue certain business opportunities or strategic transactions, (xi) changes in the economic environment, (xii) competitive products and pricing, (xiii) fiscal and monetary policies of the U.S. Government, (xiv) changes in government regulations affecting financial institutions, including compliance costs and capital requirements, (xv) changes in prevailing interest rates, (xvi) credit risk management and asset-liability management and (xvii) the availability of and costs associated with sources of liquidity. These risks, as well as other risks associated with the proposed transaction, will be more fully discussed in the joint proxy statement/prospectus that will be included in the registration statement on Form S-4 that will be filed with the SEC in connection with the proposed transaction. While the list of factors presented here is, and the list of factors to be presented in the registration statement on Form S-4 are, considered representative, no such list should be considered to be a complete statement of all potential risks and uncertainties. Unlisted factors may present significant additional obstacles to the realization of forward-looking statements. Neither the Company nor FBC assumes any obligation to provide revisions or updates to any forward-looking statements, whether as a result of new information, future developments or otherwise, should circumstances change, except as otherwise required by securities and other applicable laws.

Forward-Looking Statements No Offer or Solicitation This communication is not intended to and shall not constitute an offer to sell or the solicitation of an offer to sell or the solicitation of an offer to buy any securities or a solicitation of any vote of approval, nor shall there be any sale of securities in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction. No offer of securities shall be made except by means of a prospectus meeting the requirements of Section 10 of the Securities Act of 1933, as amended. Additional Information and Where to Find It In connection with the proposed transaction, the Company and FBC will be filing documents with the SEC, including the filing by the Company of a registration statement on Form S-4, and the Company and FBC intend to mail a joint proxy statement regarding the proposed transaction to their respective shareholders that will also constitute a prospectus of the Company. After the registration statement is declared effective, the Company and FBC plan to mail to their respective shareholders the definitive joint proxy statement/prospectus and may also file other documents with the SEC regarding the proposed transaction. This document is not a substitute for the joint proxy statement/prospectus or registration statement or any other document which the Company or FBC may file with the SEC. Investors and security holders of the Company and FBC are urged to read the registration statement, the joint proxy statement/prospectus and any other relevant documents, as well as any amendments or supplements to these documents, carefully and in their entirety when they become available because they will contain important information. Investors and security holders may obtain free copies of the registration statement and the joint proxy statement/prospectus (when available) and other documents filed with the SEC by the Company and FBC through the web site maintained by the SEC at www.sec.gov or by contacting the investor relations department of the Company or FBC at the following: Andrew Samuel Dana Kilborne Sunshine Bank Florida Bank of Commerce 813-659-8622 407-246-7772 a.samuel@mysunshinebank.com dkilborne@fbcbank.com Participants in the Merger Solicitation The Company, FBC and certain of their respective directors, executive officers and employees may be deemed to be participants in the solicitation of proxies in respect of the proposed transaction and related matters. Information regarding the Company’s directors and executive officers, including a description of their direct interests, by security holdings or otherwise, is contained the Company’s definitive proxy statement filed with the SEC on March 24, 2016. Additional information will be available in the registration statement on Form S-4 and the joint proxy statement/prospectus when they become available. The preceding email message may be confidential or protected by the attorney-client privilege. It is not intended for transmission to, or receipt by, any unauthorized persons. If you have received this message in error, please (i) do not read it, (ii) reply to the sender that you received the message in error, and (iii) erase or destroy the message. Legal advice contained in the preceding message is solely for the benefit of the Foley & Lardner LLP client(s) represented by the Firm in the particular matter that is the subject of this message, and may not be relied upon by any other party.

Immediate and double-digit EPS accretion Minimal initial tangible book dilution with an earnback within 3 years Accelerates profitability trajectory Deploys a portion of excess capital while maintaining a strong pro forma capital position Strategic Rationale Strategic Rationale Financially Attractive Low Risk Opportunity Meets our disciplined acquisition strategy 0.23% cost of funds driven by a 42% demand deposit portfolio Grows footprint throughout the attractive I-4 corridor across Florida Successful Board and management team with strong community ties Thorough due diligence process completed on the loan portfolio Management team has significant acquisition experience Culturally aligned with a similar customer base Retention of key management to support integration and future growth potential Source: SNL Financial Data as of or for the three months ended 3/31/16

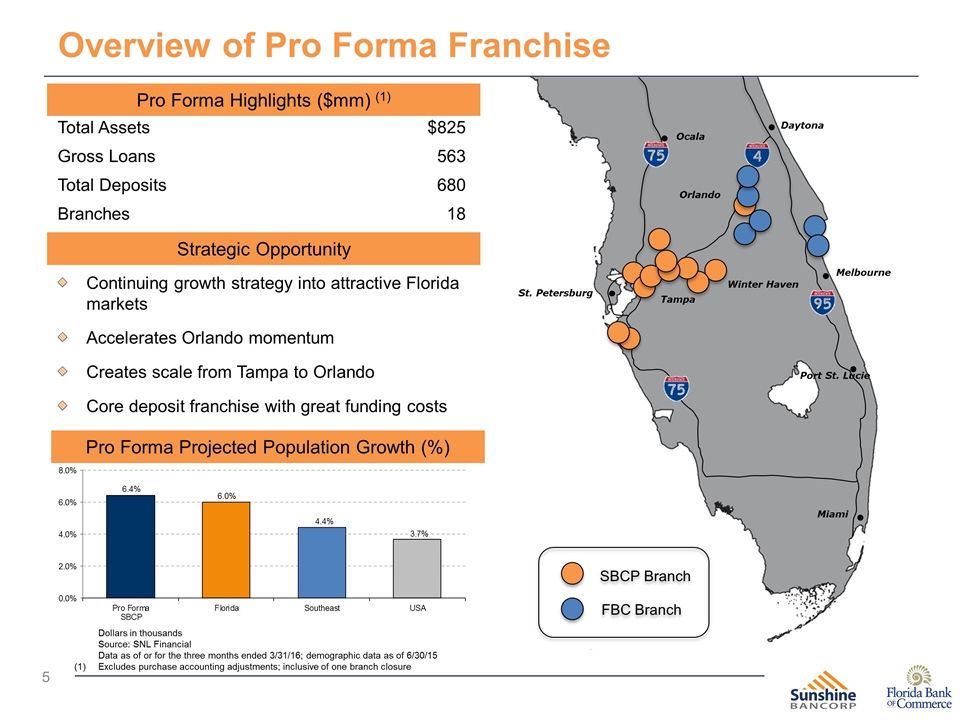

Total Assets $825 Gross Loans 563 Total Deposits 680 Branches 18 Continuing growth strategy into attractive Florida markets Accelerates Orlando momentum Creates scale from Tampa to Orlando Core deposit franchise with great funding costs St. Petersburg Orlando Winter Haven Miami Port St. Lucie Ocala SBCP Branch FBC Branch Overview of Pro Forma Franchise Dollars in thousands Source: SNL Financial Data as of or for the three months ended 3/31/16; demographic data as of 6/30/15 Excludes purchase accounting adjustments; inclusive of one branch closure Pro Forma Highlights ($mm) (1) Strategic Opportunity Tampa Daytona Melbourne Pro Forma Projected Population Growth (%)

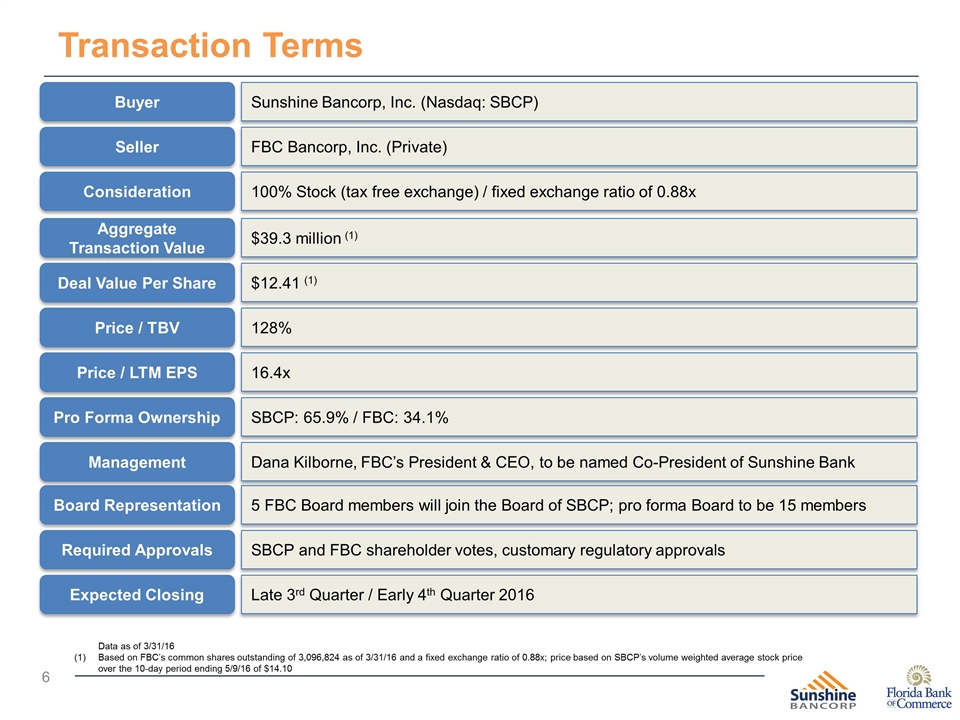

Transaction Terms Data as of 3/31/16 Based on FBC’s common shares outstanding of 3,096,824 as of 3/31/16 and a fixed exchange ratio of 0.88x; price based on SBCP’s volume weighted average stock price over the 10-day period ending 5/9/16 of $14.10 Buyer Sunshine Bancorp, Inc. (Nasdaq: SBCP) Seller FBC Bancorp, Inc. (Private) Consideration 100% Stock (tax free exchange) / fixed exchange ratio of 0.88x Aggregate Transaction Value $39.3 million (1) Deal Value Per Share $12.41 (1) Price / LTM EPS 16.4x Pro Forma Ownership SBCP: 65.9% / FBC: 34.1% Board Representation 5 FBC Board members will join the Board of SBCP; pro forma Board to be 15 members Required Approvals SBCP and FBC shareholder votes, customary regulatory approvals Late 3rd Quarter / Early 4th Quarter 2016 Expected Closing Price / TBV 128% Management Dana Kilborne, FBC’s President & CEO, to be named Co-President of Sunshine Bank

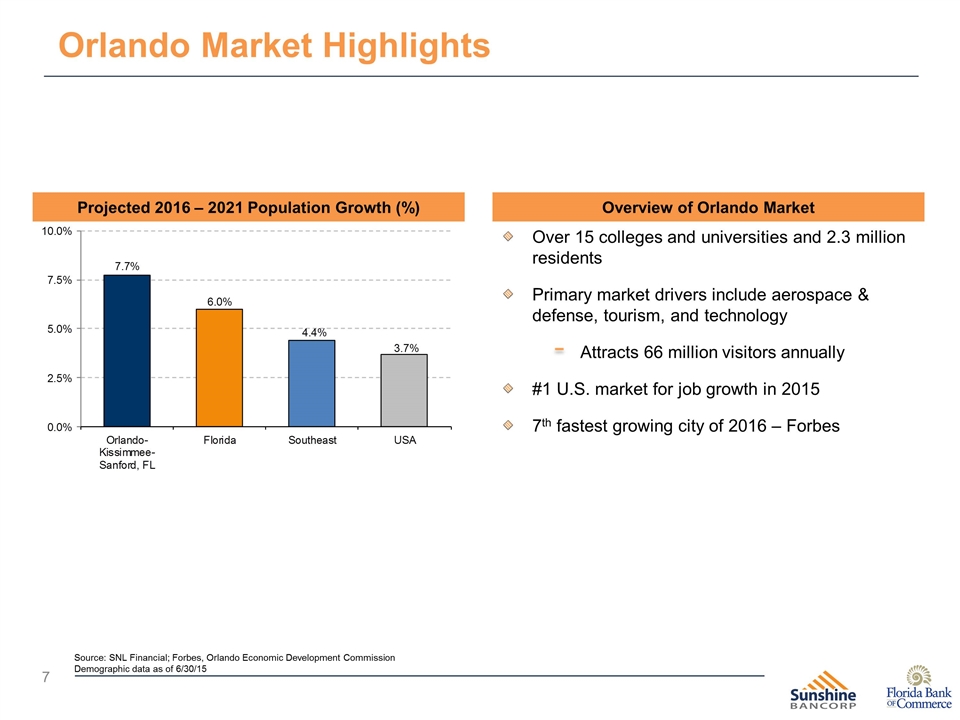

Orlando Market Highlights Source: SNL Financial; Forbes, Orlando Economic Development Commission Demographic data as of 6/30/15 Overview of Orlando Market Over 15 colleges and universities and 2.3 million residents Primary market drivers include aerospace & defense, tourism, and technology Attracts 66 million visitors annually #1 U.S. market for job growth in 2015 7th fastest growing city of 2016 – Forbes Projected 2016 – 2021 Population Growth (%)

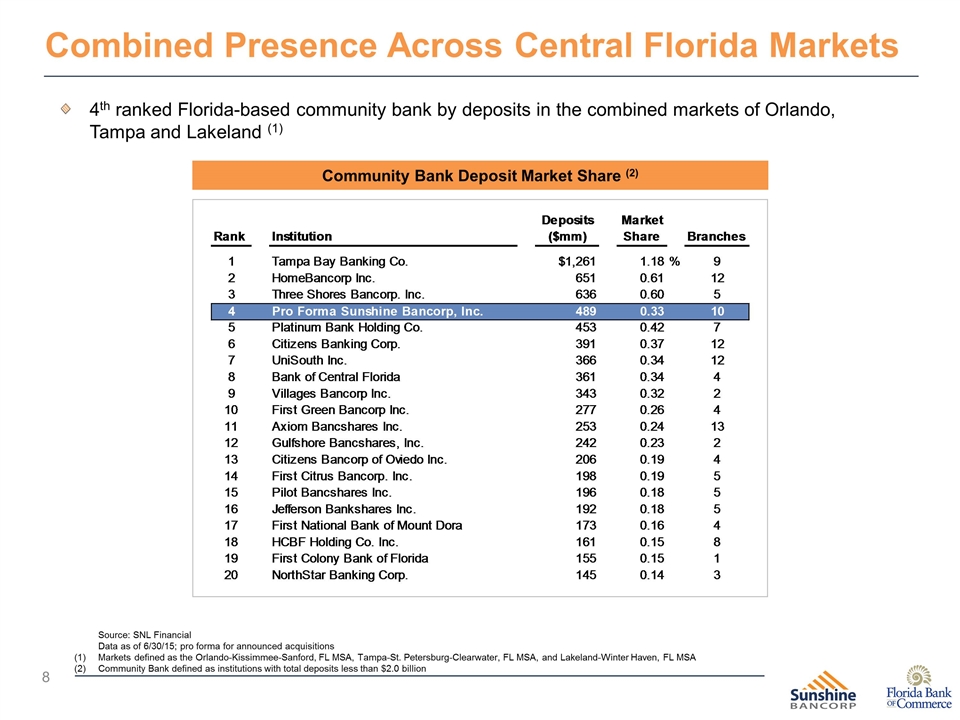

Combined Presence Across Central Florida Markets Source: SNL Financial Data as of 6/30/15; pro forma for announced acquisitions Markets defined as the Orlando-Kissimmee-Sanford, FL MSA, Tampa-St. Petersburg-Clearwater, FL MSA, and Lakeland-Winter Haven, FL MSA Community Bank defined as institutions with total deposits less than $2.0 billion Community Bank Deposit Market Share (2) 4th ranked Florida-based community bank by deposits in the combined markets of Orlando, Tampa and Lakeland (1)

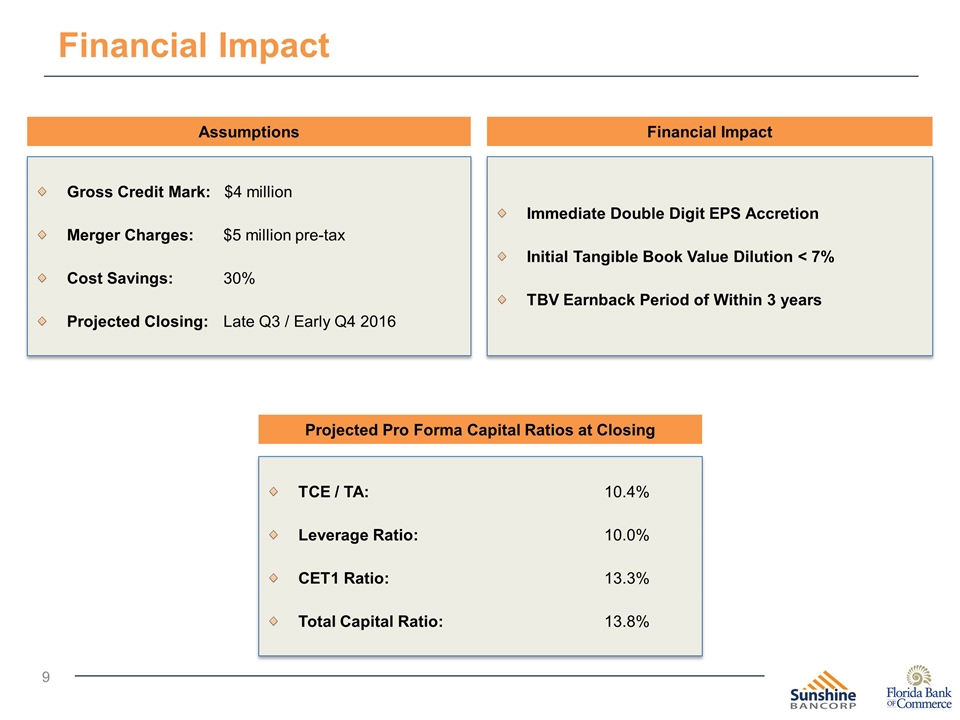

Financial Impact Financial Impact Assumptions Projected Pro Forma Capital Ratios at Closing Gross Credit Mark: $4 million Merger Charges: $5 million pre-tax Cost Savings:30% Projected Closing:Late Q3 / Early Q4 2016 Immediate Double Digit EPS Accretion Initial Tangible Book Value Dilution < 7% TBV Earnback Period of Within 3 years TCE / TA: 10.4% Leverage Ratio: 10.0% CET1 Ratio: 13.3% Total Capital Ratio: 13.8%

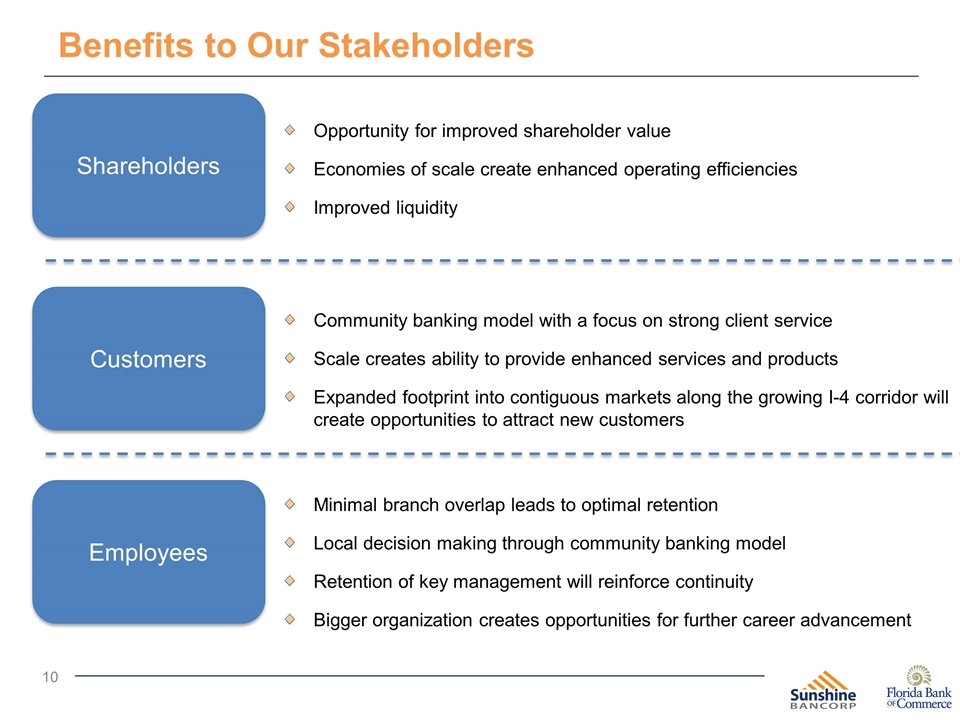

Benefits to Our Stakeholders Shareholders Customers Employees Opportunity for improved shareholder value Economies of scale create enhanced operating efficiencies Improved liquidity Community banking model with a focus on strong client service Scale creates ability to provide enhanced services and products Expanded footprint into contiguous markets along the growing I-4 corridor will create opportunities to attract new customers Minimal branch overlap leads to optimal retention Local decision making through community banking model Retention of key management will reinforce continuity Bigger organization creates opportunities for further career advancement

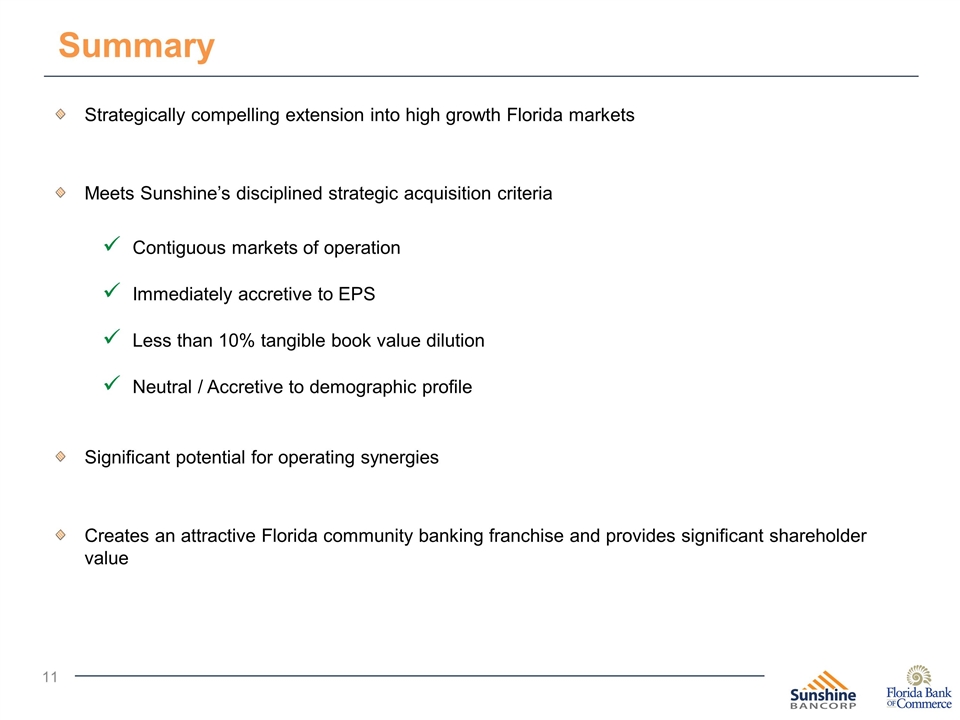

Summary Strategically compelling extension into high growth Florida markets Meets Sunshine’s disciplined strategic acquisition criteria Contiguous markets of operation Immediately accretive to EPS Less than 10% tangible book value dilution Neutral / Accretive to demographic profile Significant potential for operating synergies Creates an attractive Florida community banking franchise and provides significant shareholder value

Appendix

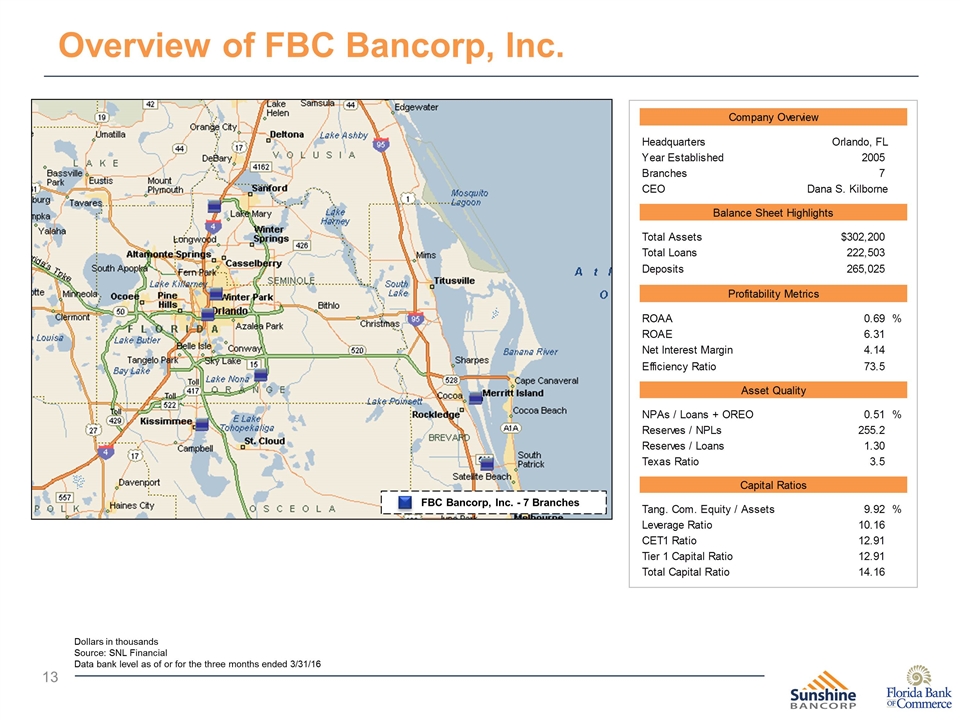

Overview of FBC Bancorp, Inc. Dollars in thousands Source: SNL Financial Data bank level as of or for the three months ended 3/31/16 FBC Bancorp, Inc. - 7 Branches

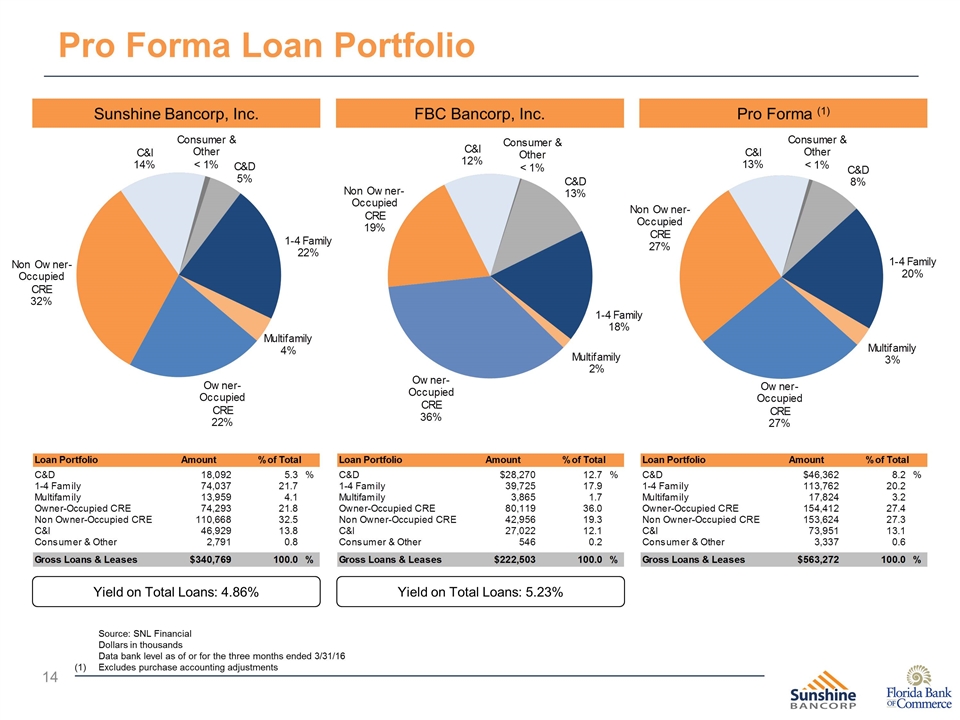

Source: SNL Financial Dollars in thousands Data bank level as of or for the three months ended 3/31/16 Excludes purchase accounting adjustments Pro Forma Loan Portfolio Sunshine Bancorp, Inc. FBC Bancorp, Inc. Pro Forma (1) Yield on Total Loans: 4.86% Yield on Total Loans: 5.23%

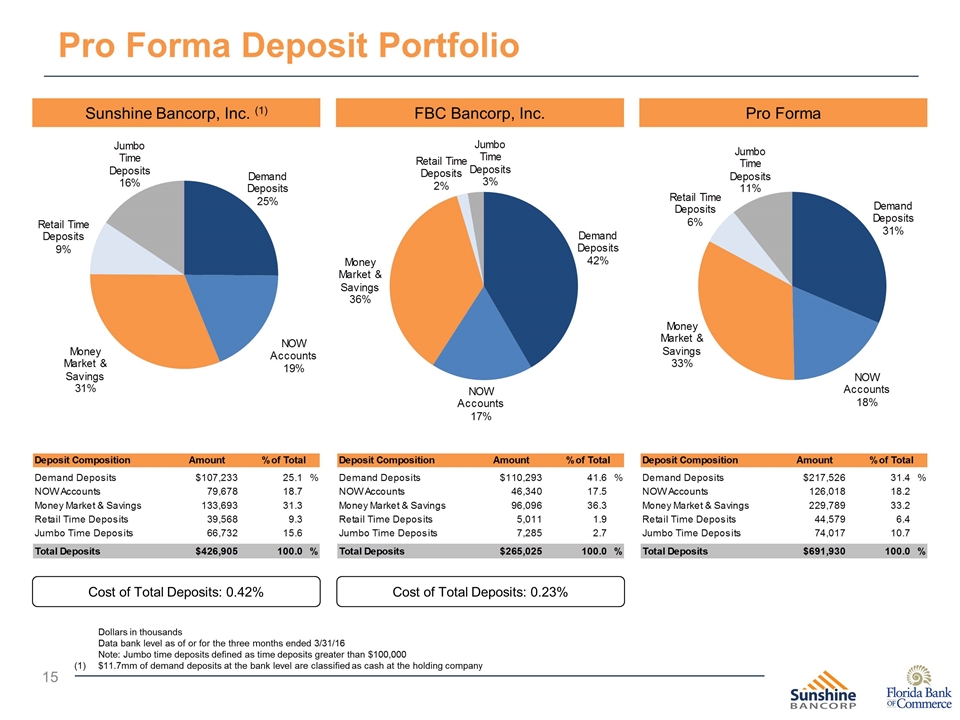

Cost of Total Deposits: 0.42% Cost of Total Deposits: 0.23% Pro Forma Deposit Portfolio Sunshine Bancorp, Inc. (1) FBC Bancorp, Inc. Pro Forma Dollars in thousands Data bank level as of or for the three months ended 3/31/16 Note: Jumbo time deposits defined as time deposits greater than $100,000 $11.7mm of demand deposits at the bank level are classified as cash at the holding company

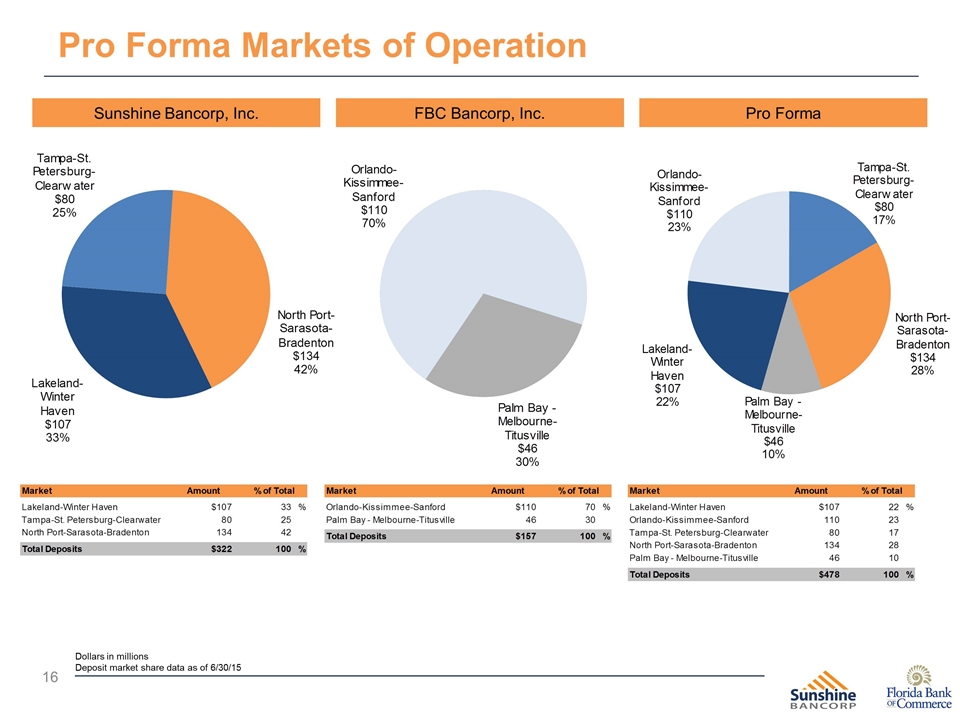

Pro Forma Markets of Operation Sunshine Bancorp, Inc. FBC Bancorp, Inc. Pro Forma Dollars in millions Deposit market share data as of 6/30/15