Attached files

| file | filename |

|---|---|

| EX-32.1 - EX-32.1 - SOLARCITY CORP | scty-ex321_18.htm |

| EX-31.1 - EX-31.1 - SOLARCITY CORP | scty-ex311_16.htm |

| EX-10.21 - EX-10.21 - SOLARCITY CORP | scty-ex1021_762.htm |

| EX-10.19J - EX-10.19J - REQUIRED GROUP AGENT ACTION 11 - SOLARCITY CORP | scty-ex1019j_669.htm |

| EX-31.2 - EX-31.2 - SOLARCITY CORP | scty-ex312_6.htm |

| 10-Q - 10-Q - SOLARCITY CORP | scty-10q_20160331.htm |

| EX-10.19M - EX-10.19M - REQUIRED GROUP AGENT ACTION 14 - SOLARCITY CORP | scty-ex1019m_671.htm |

| EX-10.19L - EX-10.19L - REQUIRED GROUP AGENT ACTION 13 - SOLARCITY CORP | scty-ex1019l_858.htm |

| EX-10.10O - EX-10.10O - TENTH REVOLVER AMENDMENT - SOLARCITY CORP | scty-ex1010o_630.htm |

| EX-10.22 - EX-10.22 - CREDIT AGREEMENT - SOLARCITY CORP | scty-ex1022_620.htm |

| EX-10.21A - EX-10.21A - SOLARCITY CORP | scty-ex1021a_763.htm |

| EX-10.10P - EX-10.10P - ELEVENTH REVOLVER AMENDMENT - SOLARCITY CORP | scty-ex1010p_631.htm |

| EX-32.2 - EX-32.2 - SOLARCITY CORP | scty-ex322_14.htm |

Exhibit 10.19k

CONFIDENTIAL TREATMENT REQUESTED

Certain portions of this document have been omitted pursuant to a request for Confidential Treatment and, where applicable, have been marked with “[***]” to indicate where omissions have been made. The confidential material has been filed separately with the Securities and Exchange Commission.

REQUIRED GROUP AGENT ACTION NO. 12

This REQUIRED GROUP AGENT ACTION NO. 12 (this “Action”), dated as of February 29, 2016, is entered into by and among Megalodon Solar, LLC, a Delaware limited liability company (the “Borrower”), [***], a Delaware limited liability company, Bank of America, N.A., as the Collateral Agent (the “Collateral Agent”) and as the Administrative Agent (the “Administrative Agent”) and each of Bank of America, N.A. (“BA Agent”), Credit Suisse AG, New York Branch (“CS Agent”), Deutsche Bank AG, New York Branch (“DB Agent”), ING Capital LLC (“ING Agent”), KeyBank National Association (“KB Agent”) and National Bank of Arizona (“NBAZ Agent”, and collectively with BA Agent, CS Agent, DB Agent, ING Agent and KB Agent, the “Group Agents”), as Group Agents party to the Loan Agreement, dated as of May 4, 2015 (as amended, the “Loan Agreement”), by and among the Borrower, the Administrative Agent, the Collateral Agent, the Group Agents, the Lenders and the other parties from time to time party thereto. As used in this Action, capitalized terms which are not defined herein shall have the meanings ascribed to such terms in the Loan Agreement.

A.Pursuant to the Loan Agreement, the Lenders have agreed to extend credit to the Borrower, in each case pursuant to the terms and subject to the conditions set forth in the Financing Documents.

B.Pursuant to Section 9.14 of the Loan Agreement, the Borrower has requested that the Group Agents provide their consent to (i) the release of the Systems described on Annex 1 attached hereto and all related rights and assets held by the [***] Subject Fund (“[***]”) as of the date of this Action (such Systems and related rights and assets, collectively, the “Released Assets”) and (ii) immediately following such release, the distribution of the Released Assets by [***] to the Borrower, by the Borrower to the Member and by the Member to SolarCity [***], the direct parent of the Member, in each case, free and clear of any Lien or other right, claim or interest in favor of the Collateral Agent or the Secured Parties under the Collateral Documents or otherwise (collectively, the “Applicable Transactions”).

C.The Lenders are willing to provide their consent to the Applicable Transactions on the terms and subject to the conditions set forth in this Action.

Accordingly, in consideration of the mutual agreements herein contained and other good and valuable consideration, the sufficiency and receipt of which are hereby acknowledged, and subject to the conditions set forth herein, the parties hereto hereby agree as follows:

1Required Group Agent Action No. 12

[***] Confidential treatment has been requested for the bracketed portions. The confidential redacted portion has been omitted and filed separately with the Securities and Exchange Commission.

Section 1.Consent. Subject to the satisfaction of the Consent Requirements (as defined in Section 3 of this Action), each Agent and Lender party hereto, by its signature below, (i) consents to the Applicable Transactions, (ii) directs the Collateral Agent to carry out the terms and provisions of this Action and (iii) acknowledges and agrees that the requirements of Section 2.1(f)(iii)(C) of the Loan Agreement have been satisfied in all respects in connection with the prepayment referred to in Section 3(a)(i) hereof.

Section 2.Release; Covenants. Upon satisfaction of the Consent Requirements, without any further action by any party:

(a)the security interest granted to the Collateral Agent by [***] pursuant to the Borrower Subsidiary Party Security Agreement with respect to the Released Assets (and any related rights and assets specified in Section 3 thereof) shall automatically terminate and be released and all rights to the Released Assets shall revert to [***];

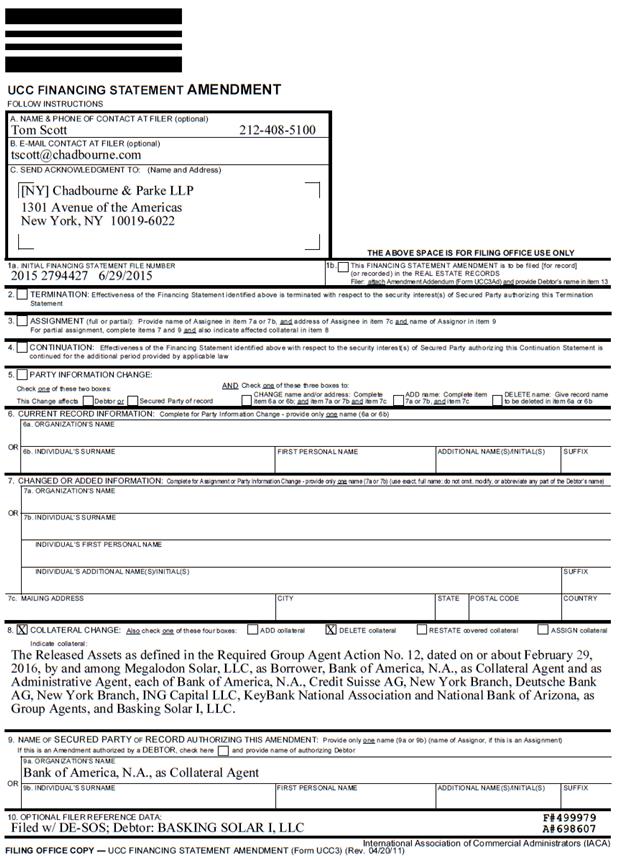

(b)the Collateral Agent authorizes the Borrower, [***] or any other party on behalf of the Borrower or [***], to file UCC financing statement amendments relating to the Released Assets in the form attached hereto as Annex 2 and to prepare and file any additional financing statement amendments and other instruments and documents in form and substance reasonably satisfactory to the Collateral Agent evidencing the consummation of the Applicable Transactions;

(c)notwithstanding anything to the contrary contained in the Financing Documents, the lien and security interest granted by the Borrower under the Security Agreement shall not attach to the Released Assets when held by the Borrower and the Released Assets shall not at any time constitute Collateral under the Security Agreement;

(d)notwithstanding anything to the contrary contained in the Financing Documents, the lien and security interest granted by the Member under the Member Pledge shall not attach to the Released Assets when held by the Member and the Released Assets shall not at any time constitute Collateral under the Member Pledge; and

(e)the Collateral Agent shall, at the sole cost and expense of the Borrower, procure, deliver or execute and deliver to the Borrower, from time to time, all further releases, termination statements, financing statement amendments, certificates, instruments and documents, each in form and substance satisfactory to the Borrower and the Collateral Agent, and take any other actions, as reasonably requested by the Borrower or that are required to evidence the consummation of the Applicable Transactions.

Section 3.Effectiveness. This Action shall become effective on the date (the “Effective Date”) on which the following conditions (collectively, the “Consent Requirements”) are satisfied:

(a)the Borrower has paid or has caused to be paid to the Administrative Agent the following (collectively, the “Release Payment”) at or before 2:00 p.m. (Eastern Time) on February 29, 2016 (the “Payment Time”) to the account set forth in Annex 3 hereto:

2Required Group Agent Action No. 12

[***] Confidential treatment has been requested for the bracketed portions. The confidential redacted portion has been omitted and filed separately with the Securities and Exchange Commission.

(i)notwithstanding the provisions set forth in Section 2.1(f)(i) of the Loan Agreement, prepayment of $[***] of the outstanding principal amount of the Loans as of the Payment Time, to be allocated among the Lenders by the Administrative Agent as set forth in Annex 4 hereto; and

(ii)payment of $[***] of the outstanding interest accrued as of the Payment Time with respect to the principal amount described in clause (i) above;

(b)the Administrative Agent shall have received counterparts of this Action, duly executed and delivered by the Borrower, [***] and each Group Agent;

(c)the Borrower shall have delivered a duly completed Borrowing Base Certificate to the Administrative Agent; and

(d)all representations and warranties of the Borrower in Section 4 of this Action and all representations and warranties of the Borrower in the Borrowing Base Certificate delivered pursuant to Section 3(c) of this Action shall be true and correct in all material respects as of the Effective Date, other than those representations and warranties that are modified by materiality by their own terms, which shall be true and correct in all respects as of the Effective Date (unless such representation or warranty relates solely to an earlier date, in which case it shall have been true and correct in all material respects as of such earlier date).

Notwithstanding any failure or inability of the Borrower to satisfy any of the foregoing conditions set forth in Sections 3(c) or (d) of this Action, upon the satisfaction of the conditions set forth in Sections 3(a) and (b) of this Action, (i) all right, title and interest of the Collateral Agent and the Secured Parties in and to the Released Assets shall transfer to and vest in [***] and any assignee of [***] without any further action required and (ii) none of the Released Assets shall be “Collateral” under or for purposes of the Loan Agreement or any other Financing Document; provided that the Agents shall be entitled to assert claims against the Borrower as a result of any breach by the Borrower of any of representations, warranties, covenants or statements made by the Borrower in this Action.

Section 4.Representations and Warranties. The Borrower hereby represents and warrants as of the Effective Date:

(a)the Borrower has duly authorized, executed and delivered this Action, and none the Borrower’s execution and delivery hereof nor the performance hereof or the consummation of the Applicable Transactions (i) will be in conflict with or result in a breach of the Borrower’s Organizational Documents, (ii) will materially violate any other Legal Requirement applicable to or binding on the Borrower or any of its respective properties, (iii) will result in any breach of or constitute any default under, or result in or require the creation of any Lien (other than Permitted Liens) upon any of the Collateral under any agreement or instrument to which it is a party or by which the Borrower or any of the Collateral may be bound or affected, or (iv) will require the consent or approval of any Person, which has not already been obtained;

3Required Group Agent Action No. 12

[***] Confidential treatment has been requested for the bracketed portions. The confidential redacted portion has been omitted and filed separately with the Securities and Exchange Commission.

(b)this Action is a legal, valid and binding obligation of the Borrower, enforceable against the Borrower in accordance with its terms, except as may be limited by applicable bankruptcy, insolvency, moratorium, reorganization or other similar laws affecting the enforcement of creditors’ rights generally and subject to general equitable principles (regardless of whether enforceability is considered in a proceeding in equity or at law);

(c)no Default or Event of Default has occurred and is continuing or will result from the Release Payment or the consummation of the Applicable Transactions;

(d)no Bankruptcy Event has occurred with respect to SolarCity;

(e)no Material Adverse Effect has occurred or is continuing since the immediately preceding Borrowing Date, and, to the Borrower’s Knowledge, no event or circumstance exists that could reasonably be expected to result in a Material Adverse Effect; and

(f)after giving effect to the Applicable Transactions and the Release Payment, the Borrower is in compliance with the Borrowing Base Requirements.

Section 5.Reference to and Effect on Financing Documents. Each of the Loan Agreement and the other Financing Documents is and shall remain unchanged and in full force and effect, and, except as expressly set forth herein, nothing contained in this Action shall, by implication or otherwise, limit, impair, constitute a waiver of, or otherwise affect the rights and remedies of the Administrative Agent or any of the other Secured Parties, or shall alter, modify, amend or in any way affect any of the terms, conditions, obligations, covenants or agreements contained in each of the Loan Agreement and any other Financing Document. This Action shall also constitute a “Financing Document” for all purposes of the Loan Agreement and the other Financing Documents.

Section 6.Incorporation by Reference. Sections 10.5 (Entire Agreement), 10.6 (Governing Law), 10.7 (Severability), 10.8 (Headings), 10.11 (Waiver of Jury Trial), 10.12 (Consent to Jurisdiction; Service of Process), 10.14 (Successors and Assigns) and 10.16 (Binding Effect; Counterparts) of the Loan Agreement are hereby incorporated by reference herein, mutatis mutandis.

Section 7.Expenses. The Borrower agrees to reimburse the Administrative Agent in accordance with Section 10.4(b) of the Loan Agreement for its reasonable and documented out-of-pocket expenses in connection with this Action, including reasonable and documented fees and out-of-pocket expenses of legal counsel.

Section 8.Construction. The rules of interpretation specified in Section 1.2 of the Loan Agreement also apply to this Action, mutatis mutandis.

4Required Group Agent Action No. 12

[***] Confidential treatment has been requested for the bracketed portions. The confidential redacted portion has been omitted and filed separately with the Securities and Exchange Commission.

IN WITNESS WHEREOF, the parties hereto have caused this Action to be duly executed by their respective authorized officers as of the day and year first written above.

|

MEGALODON SOLAR, LLC, |

|

as the Borrower |

|

|

|

|

|

By: /s/Lyndon Rive |

|

Name: Lyndon Rive |

|

Title:President |

|

|

|

|

|

[***], |

|

as a Subject Fund |

|

|

|

|

|

By: /s/Lyndon Rive |

|

Name: Lyndon Rive |

|

Title:President |

[Signature Page to Required Group Agent Action No. 12]

[***] Confidential treatment has been requested for the bracketed portions. The confidential redacted portion has been omitted and filed separately with the Securities and Exchange Commission.

|

as a Group Agent |

|

|

|

|

|

By: /s/Sheikh Omer-Farooq |

|

Name: Sheikh Omer-Farooq |

|

Title:Managing Director |

|

CREDIT SUISSE AG, NEW YORK BRANCH, |

|

as a Group Agent |

|

|

|

|

|

By: /s/Erin McCutcheon |

|

Name: Erin McCutcheon |

|

Title:Vice President |

|

|

|

By: /s/Patrick J. Hart |

|

Name:Patrick J. Hart |

|

Title:Vice President |

|

DEUTSCHE BANK AG, NEW YORK BRANCH, |

|

as a Group Agent |

|

|

|

|

|

By: /s/Vinod Mukani |

|

Name:Vinod Mukani |

|

Title:Director |

|

|

|

By: /s/Evelyn Peters |

|

Name:Evelyn Peters |

|

Title:Vice President |

|

ING CAPITAL, LLC, |

|

as a Group Agent |

|

|

|

|

|

By: /s/Thomas Cantello |

|

Name:Thomas Cantello |

|

Title:Director |

|

|

|

By: /s/Polina Gerasimova |

|

Name:Polina Gerasimova |

|

Title:Director |

[Signature Page to Required Group Agent Action No. 12]

[***] Confidential treatment has been requested for the bracketed portions. The confidential redacted portion has been omitted and filed separately with the Securities and Exchange Commission.

|

KEYBANK NATIONAL ASSOCIATION, |

|

as a Group Agent |

|

|

|

|

|

By: /s/Benjamin C. Cooper |

|

Name:Benjamin C. Cooper |

|

Title:Vice President |

|

NATIONAL BANK OF ARIZONA, |

|

as a Group Agent |

|

|

|

|

|

By: /s/Kate Smith |

|

Name:Kate Smith |

|

Title:Vice President |

|

BANK OF AMERICA, N.A. as the Administrative Agent and the Collateral Agent

By: /s/Darleen R. DiGrazia Name:Darleen R. DiGrazia Title:Vice President

|

BANK OF AMERICA, N.A. |

as the Administrative Agent and the Collateral Agent |

|

|

By: /s/Darleen R. DiGrazia |

Name:Darleen R. DiGrazia |

Title:Vice President |

|

BANK OF AMERICA, N.A. |

|||||||

|

as the Administrative Agent and the Collateral Agent |

|||||||

|

|

|||||||

|

|

|||||||

|

By: /s/Darleen R. DiGrazia |

|||||||

|

Name:Darleen R. DiGrazia |

|||||||

|

Title:Vice President |

[Signature Page to Required Group Agent Action No. 12]

[***] Confidential treatment has been requested for the bracketed portions. The confidential redacted portion has been omitted and filed separately with the Securities and Exchange Commission.

RELEASED ASSETS

|

InstallationID |

JobID |

MarkeTypeName |

FinanceOptionName |

City |

State |

Zip |

Utilityname |

SystemSize |

MonthlyPaymentsQuantity |

AnnualEscalator |

|

[Customer data omitted] |

||||||||||

[***] Confidential treatment has been requested for the bracketed portions. The confidential redacted portion has been omitted and filed separately with the Securities and Exchange Commission.

UCC-3 TERMINATION STATEMENTS

[***] Confidential treatment has been requested for the bracketed portions. The confidential redacted portion has been omitted and filed separately with the Securities and Exchange Commission.

[***] Confidential treatment has been requested for the bracketed portions. The confidential redacted portion has been omitted and filed separately with the Securities and Exchange Commission.

Account Information

|

Pay to: |

[***] |

|

Bank |

[***] |

|

ABA No. |

[***] |

|

Account No. |

[***] |

|

Account Name |

[***] |

|

Ref. |

[***] |

[***] Confidential treatment has been requested for the bracketed portions. The confidential redacted portion has been omitted and filed separately with the Securities and Exchange Commission.

SCHEDULE OF PRINCIPAL PREPAYMENT ALLOCATIONS

|

Lender |

Share of Prepayment |

|

Bank of America, N.A. |

$[***] |

|

Credit Suisse AG, Cayman Islands Branch |

$[***] |

|

Deutsche Bank AG, New York Branch |

$[***] |

|

ING Capital, LLC |

$[***] |

|

KeyBank National Association |

$[***] |

|

National Bank of Arizona |

$[***] |

|

Total |

$[***] |

[***] Confidential treatment has been requested for the bracketed portions. The confidential redacted portion has been omitted and filed separately with the Securities and Exchange Commission.