Attached files

| file | filename |

|---|---|

| 8-K - 8-K - HOLLY ENERGY PARTNERS LP | form8-kxheppresentationmay.htm |

Investor Presentation: May 2016

Holly Energy Partners (NYSE: HEP) 2 Safe Harbor Disclosure Statement Statements made during the course of this presentation that are not historical facts are “forward looking statements” within the meaning of the U.S. Private Securities Litigation Reform Act of 1995. Forward-looking statements are inherently uncertain and necessarily involve risks that may affect the business prospects and performance of HollyFrontier Corporation and/or Holly Energy Partners, L.P., and actual results may differ materially from those discussed during the presentation. Such risks and uncertainties include but are not limited to risks and uncertainties with respect to the actions of actual or potential competitive suppliers and transporters of refined petroleum products in HollyFrontier’s and Holly Energy Partners’ markets, the demand for and supply of crude oil and refined products, the spread between market prices for refined products and market prices for crude oil, the possibility of constraints on the transportation of refined products, the possibility of inefficiencies or shutdowns in refinery operations or pipelines, effects of governmental regulations and policies, the availability and cost of financing to HollyFrontier and Holly Energy Partners, the effectiveness of HollyFrontier’s and Holly Energy Partners’ capital investments and marketing strategies, HollyFrontier's and Holly Energy Partners’ efficiency in carrying out construction projects, HollyFrontier's ability to acquire refined product operations or pipeline and terminal operations on acceptable terms and to integrate any existing or future acquired operations, the possibility of terrorist attacks and the consequences of any such attacks, and general economic conditions. Additional information on risks and uncertainties that could affect the business prospects and performance of HollyFrontier and Holly Energy Partners is provided in the most recent reports of HollyFrontier and Holly Energy Partners filed with the Securities and Exchange Commission. All forward-looking statements included in this presentation are expressly qualified in their entirety by the foregoing cautionary statements. The forward- looking statements speak only as of the date hereof and, other than as required by law, HollyFrontier and Holly Energy Partners undertake no obligation to publicly update or revise any forward-looking statements, whether as a result of new information, future events or otherwise.

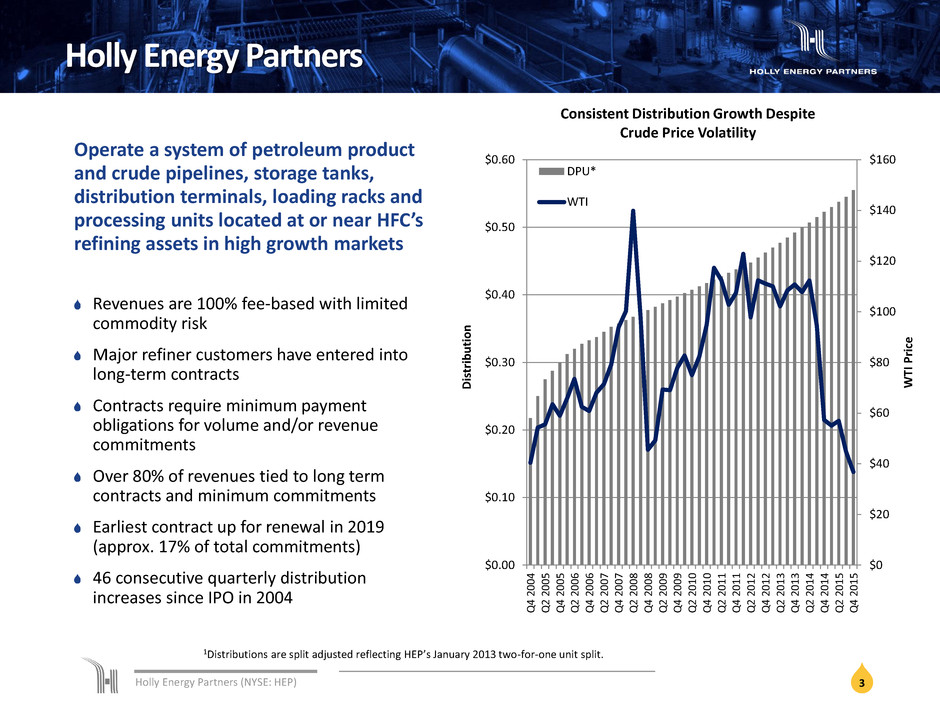

Holly Energy Partners (NYSE: HEP) 3 Holly Energy Partners Operate a system of petroleum product and crude pipelines, storage tanks, distribution terminals, loading racks and processing units located at or near HFC’s refining assets in high growth markets Revenues are 100% fee-based with limited commodity risk Major refiner customers have entered into long-term contracts Contracts require minimum payment obligations for volume and/or revenue commitments Over 80% of revenues tied to long term contracts and minimum commitments Earliest contract up for renewal in 2019 (approx. 17% of total commitments) 46 consecutive quarterly distribution increases since IPO in 2004 $0 $20 $40 $60 $80 $100 $120 $140 $160 $0.00 $0.10 $0.20 $0.30 $0.40 $0.50 $0.60 Q 4 200 4 Q 2 200 5 Q 4 200 5 Q 2 200 6 Q 4 200 6 Q 2 200 7 Q 4 200 7 Q 2 200 8 Q 4 200 8 Q 2 200 9 Q 4 200 9 Q 2 201 0 Q 4 201 0 Q 2 201 1 Q 4 201 1 Q 2 201 2 Q 4 201 2 Q 2 201 3 Q 4 201 3 Q 2 201 4 Q 4 201 4 Q 2 201 5 Q 4 201 5 WTI P ri ce D ist ri b u tio n Consistent Distribution Growth Despite Crude Price Volatility DPU* WTI 1Distributions are split adjusted reflecting HEP’s January 2013 two-for-one unit split.

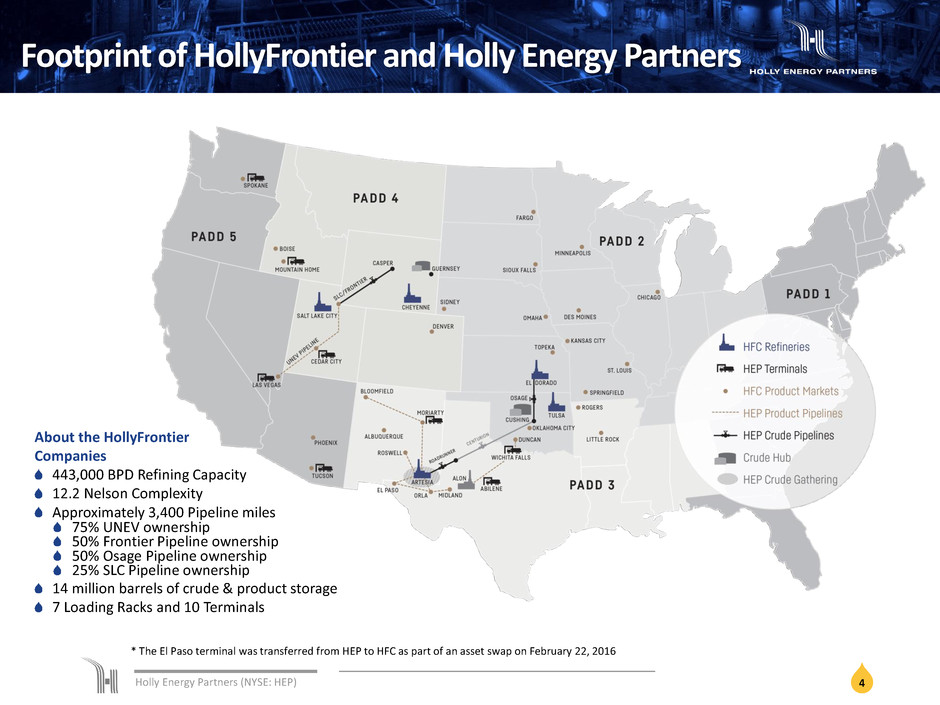

Holly Energy Partners (NYSE: HEP) 4 Footprint of HollyFrontier and Holly Energy Partners About the HollyFrontier Companies 443,000 BPD Refining Capacity 12.2 Nelson Complexity Approximately 3,400 Pipeline miles 75% UNEV ownership 50% Frontier Pipeline ownership 50% Osage Pipeline ownership 25% SLC Pipeline ownership 14 million barrels of crude & product storage 7 Loading Racks and 10 Terminals * The El Paso terminal was transferred from HEP to HFC as part of an asset swap on February 22, 2016

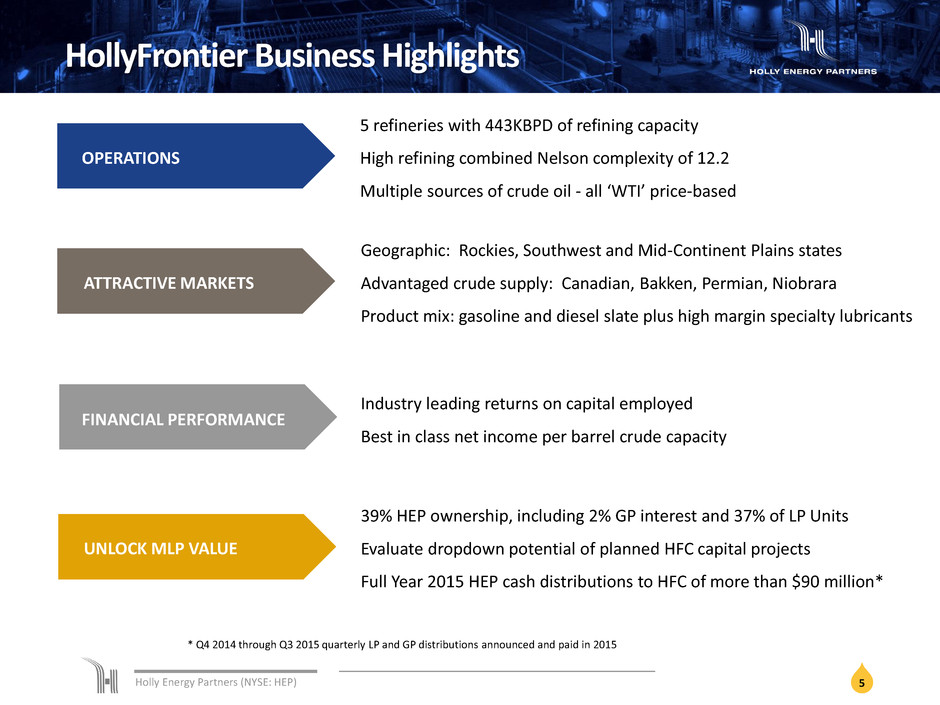

Holly Energy Partners (NYSE: HEP) 5 HollyFrontier Business Highlights 5 refineries with 443KBPD of refining capacity High refining combined Nelson complexity of 12.2 Multiple sources of crude oil - all ‘WTI’ price-based Geographic: Rockies, Southwest and Mid-Continent Plains states Advantaged crude supply: Canadian, Bakken, Permian, Niobrara Product mix: gasoline and diesel slate plus high margin specialty lubricants Industry leading returns on capital employed Best in class net income per barrel crude capacity 39% HEP ownership, including 2% GP interest and 37% of LP Units Evaluate dropdown potential of planned HFC capital projects Full Year 2015 HEP cash distributions to HFC of more than $90 million* OPERATIONS ATTRACTIVE MARKETS FINANCIAL PERFORMANCE UNLOCK MLP VALUE * Q4 2014 through Q3 2015 quarterly LP and GP distributions announced and paid in 2015

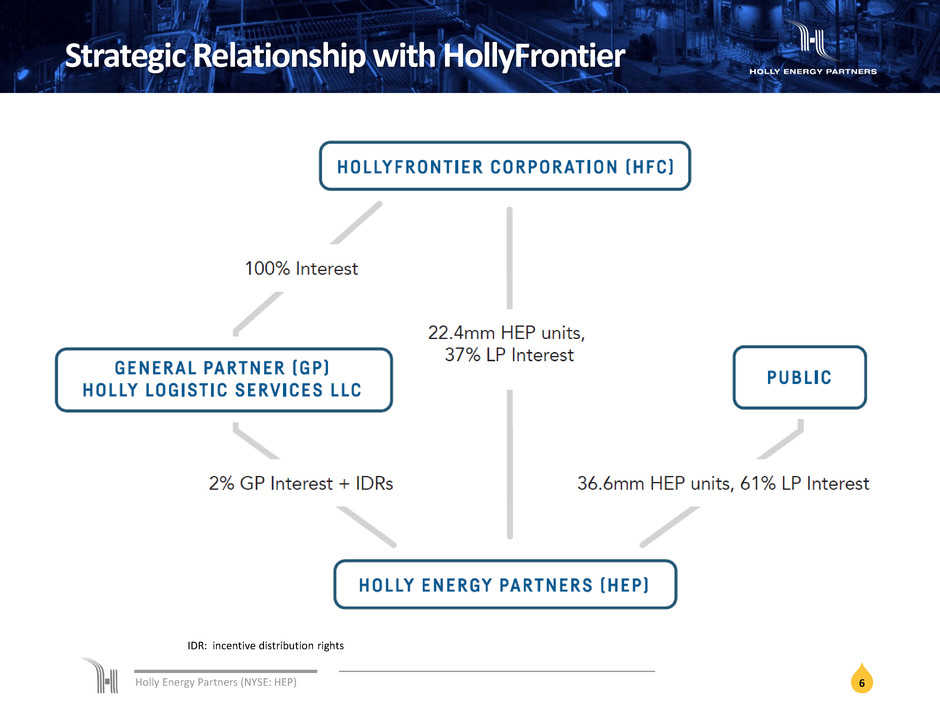

Holly Energy Partners (NYSE: HEP) 6 Strategic Relationship with HollyFrontier IDR: incentive distribution rights

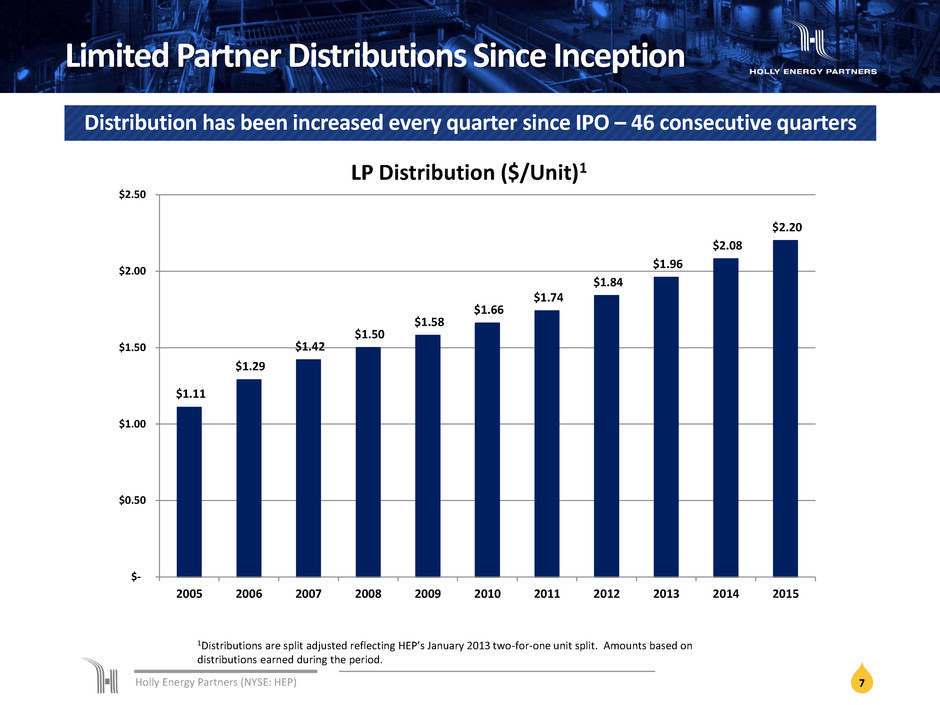

Holly Energy Partners (NYSE: HEP) 7 Limited Partner Distributions Since Inception Distribution has been increased every quarter since IPO – 46 consecutive quarters $1.11 $1.29 $1.42 $1.50 $1.58 $1.66 $1.74 $1.84 $1.96 $2.08 $2.20 $- $0.50 $1.00 $1.50 $2.00 $2.50 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 LP Distribution ($/Unit)1 1Distributions are split adjusted reflecting HEP’s January 2013 two-for-one unit split. Amounts based on distributions earned during the period.

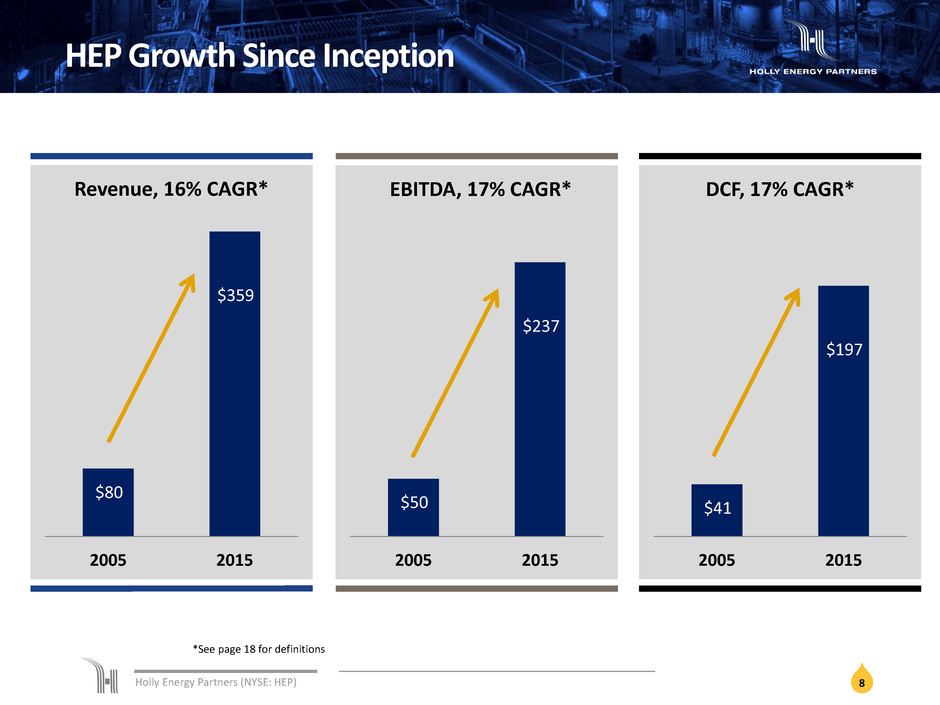

Holly Energy Partners (NYSE: HEP) 8 HEP Growth Since Inception $80 $359 2005 2015 Revenue, 16% CAGR* $50 $237 2005 2015 EBITDA, 17% CAGR* $41 $197 2005 2015 DCF, 17% CAGR* *See page 18 for definitions

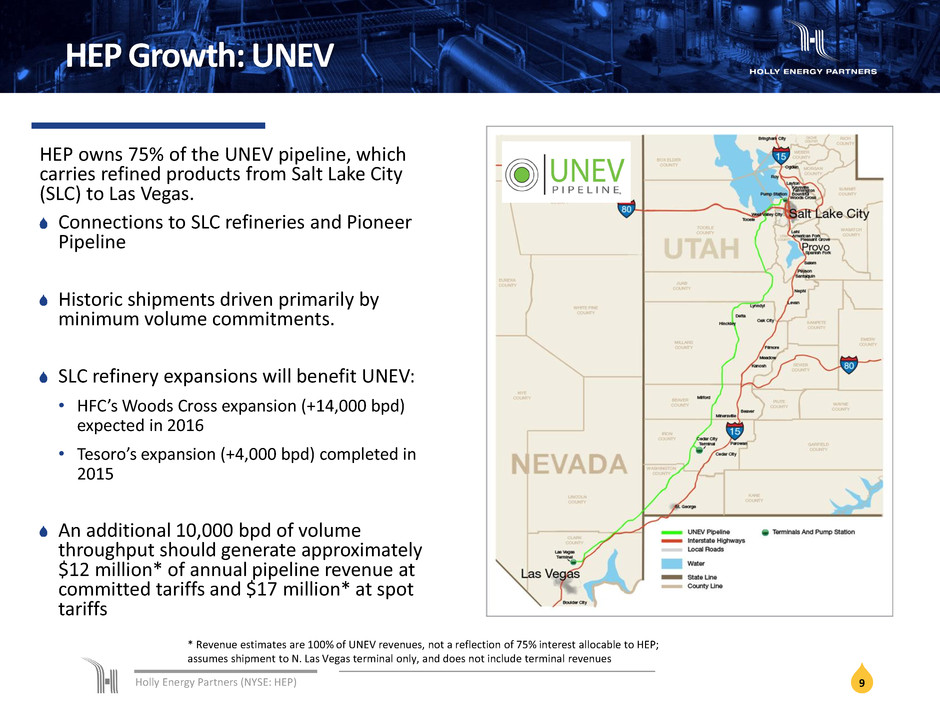

Holly Energy Partners (NYSE: HEP) 9 HEP Growth: UNEV HEP owns 75% of the UNEV pipeline, which carries refined products from Salt Lake City (SLC) to Las Vegas. Connections to SLC refineries and Pioneer Pipeline Historic shipments driven primarily by minimum volume commitments. SLC refinery expansions will benefit UNEV: • HFC’s Woods Cross expansion (+14,000 bpd) expected in 2016 • Tesoro’s expansion (+4,000 bpd) completed in 2015 An additional 10,000 bpd of volume throughput should generate approximately $12 million* of annual pipeline revenue at committed tariffs and $17 million* at spot tariffs * Revenue estimates are 100% of UNEV revenues, not a reflection of 75% interest allocable to HEP; assumes shipment to N. Las Vegas terminal only, and does not include terminal revenues

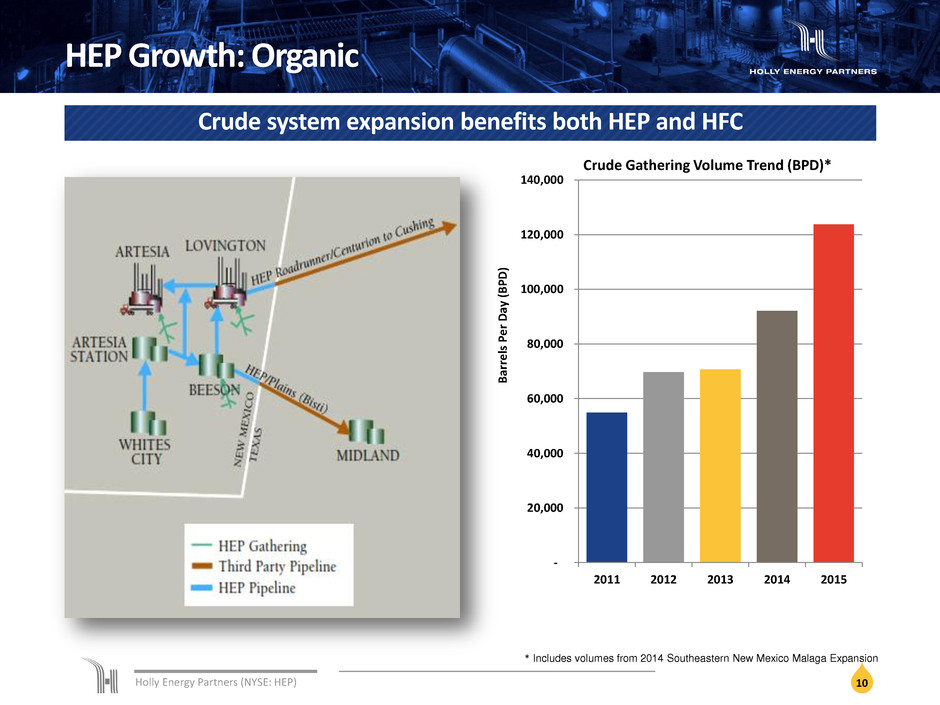

Holly Energy Partners (NYSE: HEP) 10 HEP Growth: Organic * Includes volumes from 2014 Southeastern New Mexico Malaga Expansion Crude system expansion benefits both HEP and HFC - 20,000 40,000 60,000 80,000 100,000 120,000 140,000 2011 2012 2013 2014 2015 B ar re ls Pe r D ay ( B P D ) Crude Gathering Volume Trend (BPD)*

Holly Energy Partners (NYSE: HEP) 11 HEP Growth: Operational Improvements Internal Initiatives $mm Maintenance Management Savings $ 4.5 HEP has identified a set of internal initiatives that we believe should produce approximately $ 14 million of annual incremental cashflow beginning in Project Management Improvements $ 3.0 Power Contracts & Pump Efficiency $ 1.5 Small Capital Projects $ 5.0 TOTAL $ 14.0 2016-17

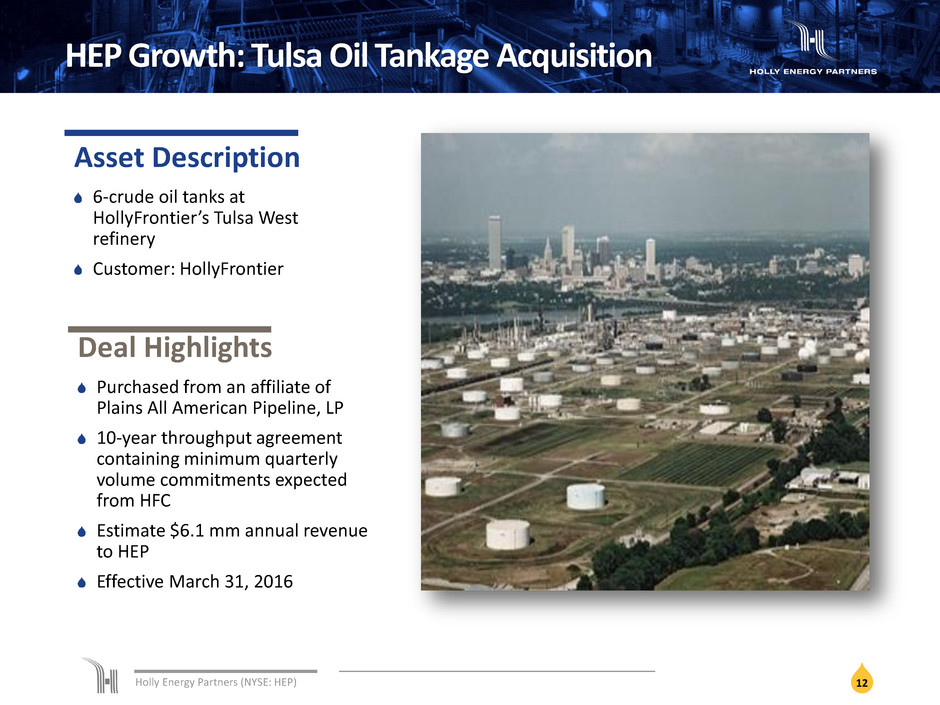

Holly Energy Partners (NYSE: HEP) 12 HEP Growth: Tulsa Oil Tankage Acquisition Asset Description 6-crude oil tanks at HollyFrontier’s Tulsa West refinery Customer: HollyFrontier Deal Highlights Purchased from an affiliate of Plains All American Pipeline, LP 10-year throughput agreement containing minimum quarterly volume commitments expected from HFC Estimate $6.1 mm annual revenue to HEP Effective March 31, 2016

Holly Energy Partners (NYSE: HEP) 13 HEP Growth: El Dorado Dropdown HEP purchased the newly constructed naphtha fractionation and hydrogen generation units at HFC’s El Dorado refinery for total cash consideration of approximately $62.0 MM Naphtha fractionation unit has the capacity to process up to 50K bpd of naphtha into intermediates and blending components Hydrogen generation unit has the capacity to produce up to 17 mmscf/d of hydrogen HEP and HFC entered into 15-year tolling agreements for each respective unit 2016 EBITDA from these tolling agreements expected to be at least $6.9 MM* Both tolling agreements feature minimum volume commitments HFC will own all commodity inputs and outputs; HEP will take no commodity risk * For historical reconciliation, please see the Holly Energy Partners 2015 10-K

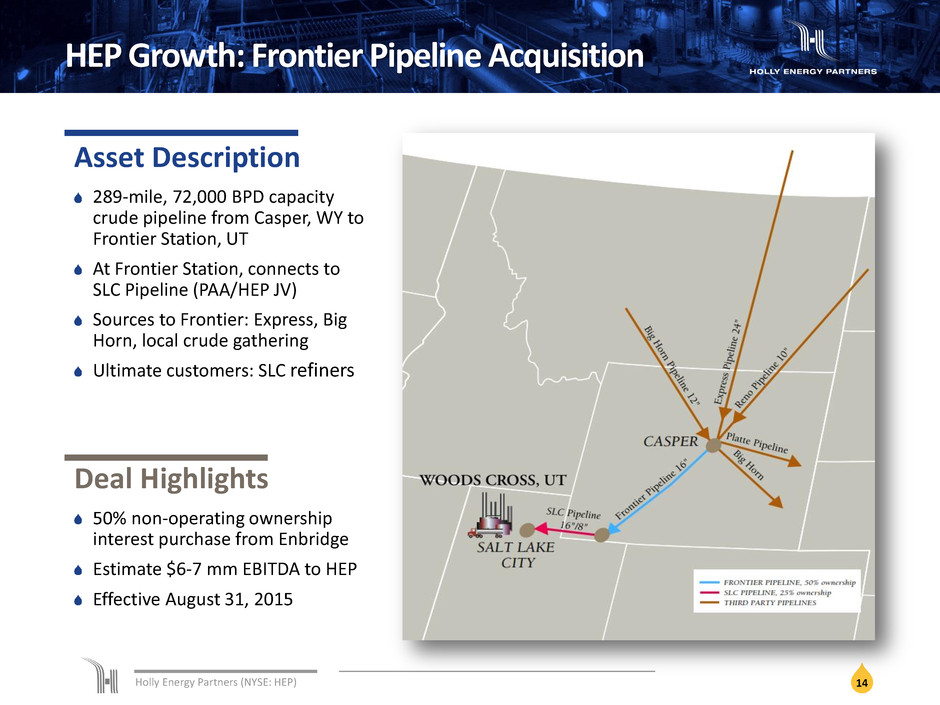

Holly Energy Partners (NYSE: HEP) 14 HEP Growth: Frontier Pipeline Acquisition Asset Description 289-mile, 72,000 BPD capacity crude pipeline from Casper, WY to Frontier Station, UT At Frontier Station, connects to SLC Pipeline (PAA/HEP JV) Sources to Frontier: Express, Big Horn, local crude gathering Ultimate customers: SLC refiners Deal Highlights 50% non-operating ownership interest purchase from Enbridge Estimate $6-7 mm EBITDA to HEP Effective August 31, 2015

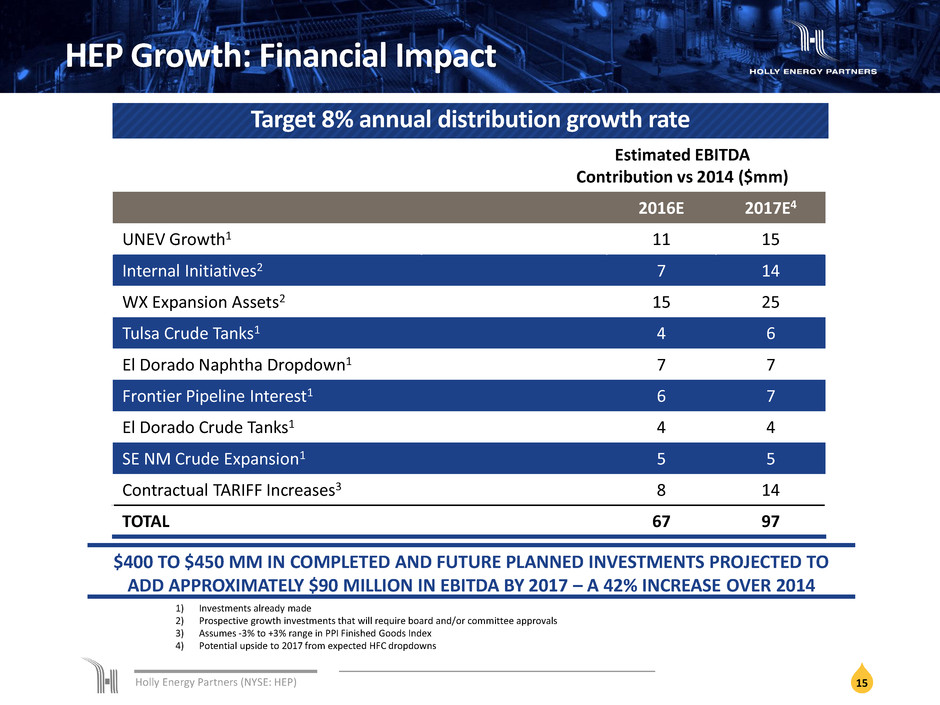

Holly Energy Partners (NYSE: HEP) HEP Growth: Financial Impact 15 Estimated EBITDA Contribution vs 2014 ($mm) 2016E 2017E4 UNEV Growth1 11 15 Internal Initiatives2 7 14 WX Expansion Assets2 15 25 Tulsa Crude Tanks1 4 6 El Dorado Naphtha Dropdown1 7 7 Frontier Pipeline Interest1 6 7 El Dorado Crude Tanks1 4 4 SE NM Crude Expansion1 5 5 Contractual TARIFF Increases3 8 14 TOTAL 67 97 1) Investments already made 2) Prospective growth investments that will require board and/or committee approvals 3) Assumes -3% to +3% range in PPI Finished Goods Index 4) Potential upside to 2017 from expected HFC dropdowns $400 TO $450 MM IN COMPLETED AND FUTURE PLANNED INVESTMENTS PROJECTED TO ADD APPROXIMATELY $90 MILLION IN EBITDA BY 2017 – A 42% INCREASE OVER 2014 Target 8% annual distribution growth rate

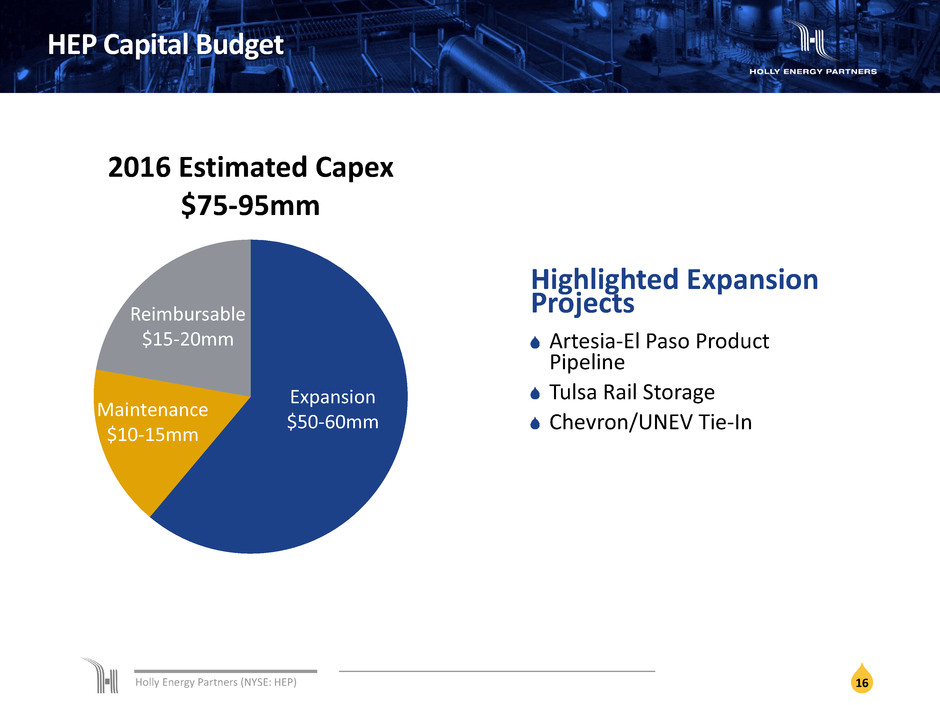

Holly Energy Partners (NYSE: HEP) HEP Capital Budget 16 2016 Estimated Capex $75-95mm Reimbursable $15-20mm Maintenance $10-15mm Expansion $50-60mm Highlighted Expansion Projects Artesia-El Paso Product Pipeline Tulsa Rail Storage Chevron/UNEV Tie-In

Holly Energy Partners (NYSE: HEP) 17 Appendix-HEP Assets Holly Energy Partners owns and operates substantially all of the refined product pipeline and terminaling assets that support HollyFrontier’s refining and marketing operations in the Mid-Continent, Southwest and Rocky Mountain regions of the United States. Approximately 3,400 miles of crude oil and petroleum product pipelines 14 million barrels of refined product and crude oil storage 9 terminals and 7 loading rack facilities in 10 western and mid-continent states 75% joint venture interest in UNEV Pipeline, LLC – the owner of a 400-mile refined products pipeline system connecting Salt Lake area refiners to the Las Vegas product market 50% joint venture interest in Frontier Pipeline Company – the owner of a 289-mile crude oil pipeline running from Casper, Wyoming to Frontier Station, Utah 50% joint venture interest in Osage Pipe Line Company, LLC – the owner of a 135- mile crude oil pipeline from Cushing, Oklahoma to El Dorado, Kansas 25% joint venture interest in SLC Pipeline LLC – the owner of a 95-mile crude oil pipeline system that serves refineries in the Salt Lake City area

Holly Energy Partners (NYSE: HEP) 18 Definitions BPD: Barrels per day CAGR: The compound annual growth rate is calculated by dividing the ending value by the beginning value, raise the result to the power of one divided by the period length, and subtract one from the subsequent result. CAGR is the mean annual growth rate of an investment over a specified period of time longer than one year. DISTRIBUTABLE CASH FLOW: Distributable cash flow (DCF) is not a calculation based upon GAAP. However, the amounts included in the calculation are derived from amounts separately presented in our consolidated financial statements, with the exception of excess cash flows over earnings of SLC Pipeline, maintenance capital expenditures and distributable cash flow from discontinued operations. Distributable cash flow should not be considered in isolation or as an alternative to net income or operating income as an indication of our operating performance or as an alternative to operating cash flow as a measure of liquidity. Distributable cash flow is not necessarily comparable to similarly titled measures of other companies. Distributable cash flow is presented here because it is a widely accepted financial indicator used by investors to compare partnership performance. We believe that this measure provides investors an enhanced perspective of the operating performance of our assets and the cash our business is generating. Our historical distributable cash flow is reconciled to net income in footnote 4 to the table in "Item 6. Selected Financial Data" of HEP's 2015 10-K. DPU: Cash distribution per unit. EBITDA: Earnings before interest, taxes, depreciation and amortization which is calculated as net income plus (i) interest expense net of interest income and (ii) depreciation and amortization. EBITDA is not a calculation based upon U.S. generally accepted accounting principles (“U.S. GAAP”). However, the amounts included in the EBITDA calculation are derived from amounts included in our consolidated financial statements. EBITDA should not be considered as an alternative to net income or operating income, as an indication of our operating performance or as an alternative to operating cash flow as a measure of liquidity. EBITDA is not necessarily comparable to similarly titled measures of other companies. EBITDA is presented here because it is a widely used financial indicator used by investors and analysts to measure performance. EBITDA is also used by our management for internal analysis and as a basis for compliance with financial covenants. Our historical EBITDA is reconciled to net income in footnote 3 to the table in “Item 6. Selected Financial Data” of HEP’s 2015 10-K. KBPD: Thousand barrels per day