Attached files

| file | filename |

|---|---|

| EX-23.1 - EXHIBIT 23.1 - Fuda Group (USA) Corp | v439215_ex23-1.htm |

| As filed with the Securities and Exchange Commission | on Registration No. 333-208078 |

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Amendment No. 2 to

FORM S-1

REGISTRATION STATEMENT UNDER

THE SECURITIES ACT OF 1933

FUDA GROUP (USA) CORPORATION

(Exact name of registrant as specified in its charter)

SPRUCE VALLEY ACQUISITION CORPORATION

(Former Name of Registrant)

| Delaware | 1041 | 47-2031462 | ||

| State or other jurisdiction | Primary Standard Industrial | (I.R.S. Employer | ||

| incorporation or organization | Classification Code Number) | Identification Number) |

48 Wall Street, 11th Floor

New York 10005, NY, USA

(646) 837-7950

(Address, including zip code, and telephone number, including area code

of registrant’s principal executive offices)

Xiaobin Wu

48 Wall Street, 11th Floor

New York 10005, NY, USA

(646) 837-7950

(Name, address, including zip code, and telephone number,

including area code, of agent for service)

with copies to

Lee W. Cassidy, Esq.

Anthony A. Patel, Esq.

Cassidy & Associates

9454 Wilshire Boulevard

Beverly Hills, California 90212

(949) 673-4510 (tel) / (949) 673-4525 (fax)

Approximate Date of Commencement of proposed sale to the public: As soon as practicable after the effective date of this Registration Statement.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. x

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration number of the earlier effective registration statement for the same offering. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See definitions “large accelerated filer,” “accelerated file,” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

| Large accelerated filer | ¨ | Accelerated filer | ¨ |

| Non-accelerated filer | x | Smaller reporting company | ¨ |

The registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with section 8(a) of the Securities Act of 1933 or until the registration statement shall become effective on such date as the Commission acting pursuant to said section 8(a), may determine.

CALCULATION OF REGISTRATION FEE

| Proposed | ||||||||

| Maximum | Amount of | |||||||

| Title of Each Class of | Aggregate | Registration | ||||||

| Securities to be Registered | Offering Price (1) (2) | Fee (3) | ||||||

| Common Stock, par value | ||||||||

| Par value $0.0001 per share | $ | 200,000,000 | $ | 20,140 | ||||

| (1) | Includes 100,000,000 shares of Common Stock to be sold. | |

| (2) | Estimated solely for the purpose of calculating the registration fee pursuant to Rule 457 of the Securities Act of 1933. | |

| (3) | $20,140 previously paid by electronic transfer. |

EXPLANATORY NOTE

This registration statement and the prospectus therein cover the registration of 100,000,000 shares offered by the Company.

The information contained in this prospectus is not complete and may be changed. A registration statement relating to these securities has been filed with the Securities and Exchange Commission and these securities may not be sold until that registration statement becomes effective. This prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

| PROSPECTUS | Subject to Completion, Dated ______, 2016 |

FUDA GROUP (USA) CORPORATION

100,000,000 shares of Common Stock offered by the Company at $____ per share

This prospectus relates to the offer and sale of 100,000,000 shares of common stock (the “Shares”) of Fuda Group (USA) Corporation (the “Company”), $0.0001 par value per share. No public market currently exists for our common stock.

The Company intends to lists its common stock on NASDAQ when qualified to do so. If available, the Company intends to apply for listing on NASDAQ using the ticker symbol “FUDA” for its common stock.

The maximum number of Shares that can be sold pursuant to the terms of this offering by the Company is (in aggregate) 100,000,000. Funds received by the Company will be immediately available to the Company for use by the Company. Any and all funds received by the Company for sales of Shares by the Company at any time in the offering will be immediately available to the Company. There is no fixed amount or number of Shares that must be reached or sold before any closing or use of any funds can occur.

The Company intends to maintain the current status and accuracy of this prospectus and to allow the Company to offer and sell the Shares for a period of up to two (2) years, unless earlier completely sold, pursuant to Rule 415 of the General Rules and Regulations of the Securities and Exchange Commission. All costs incurred in the registration of the Shares are being borne by the Company. All selling and other expenses incurred by the selling stockholders will be borne by the selling stockholders.

Prior to this offering, there has been no public market for the Company’s common stock. No assurances can be given that a public market will develop following completion of this offering or that, if a market does develop, it will be sustained. The offering price for the Shares has been arbitrarily determined by the Company and does not necessarily bear any direct relationship to the assets, operations, book or other established criteria of value of the Company. The Shares will become tradable on the effective date of the registration statement of which this prospectus is a part.

In the event that the Company does not raise sufficient capital to implements its proposed operations, a prospective investor’s entire investment could be lost.

As a result of shares in this offering, funds will be immediately available, and there will be no refunds to investors from the Company for sales of shares.

The Company qualifies as an “emerging growth company” as defined in the Jumpstart Our Business Startups Act which became law in April, 2012 and will be subject to reduced public company reporting requirements. See “The Company: Jumpstart Our Business Startups Act” contained herein.

The Company does not have any current arrangements and has not entered into any agreements with any underwriters, broker-dealers or selling agents for the sale of the Shares. If the Company can locate and enter into any such arrangement(s), the Shares will be sold through such licensed underwriter(s), broker-dealer(s) and/or selling agent(s).

Assumed Price

To Public

Per Common Stock Share

Offered by Company

NEITHER THE SECURITIES AND EXCHANGE COMMISSION NOR ANY STATE SECURITIES COMMISSION HAS APPROVED OR DISAPPROVED OF THESE SECURITIES OR PASSED UPON THE ADEQUACY OR ACCURACY OF THIS PROSPECTUS. ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENSE.

These securities involve a high degree of risk. See “RISK FACTORS” contained in this prospectus beginning on page 15.

48 Wall Street, 11th Floor

New York 10005, NY, USA

(646) 837-7950

Prospectus dated __________________, 2016

TABLE OF CONTENTS

| 2 |

This summary highlights some information from this prospectus, and it may not contain all the information important to making an investment decision. A potential investor should read the following summary together with the more detailed information regarding the Company and the common stock being sold in this offering, including “Risk Factors” and the financial statements and related notes, included elsewhere in this prospectus.

The Company

The Company, primarily focused on the region of Northeastern China, is concentrated on three thriving channels:

| · | Gold and precious & metal, granite and marble, fluorite and graphite commodities trading. |

| · | Processing and possibly mining of Gold & Precious Metal, Granite/Marble; |

| · | Mergers and Acquisitions Projects. |

However, the only revenues to date have been derived from the trading business segment.

The Company has plans for several international branches and to conduct business globally. Over time, the Company plans to have several subsidiaries, diverse operations and different countries, all grouped together.

The Company is an emergent gold resources company seeking to develop and operate a portfolio of natural assets with reserves of gold and precious metals. The Company seek properties with known mineralization that are currently being mined, which the Company believe it can advance it quickly to increase value. The Company further diversifies into the construction commodities, such as granite and marble, through established vendor and supplier networks. The Company is continually expanding and strengthening its upstream asset resources by seeking and exploring properties in the region. The company will obtain funds to execute its business plan through tranches with the first fund raising round set at $200M.

Corporate History

Since its 2012 launch, the Company has successfully managed to increase its net worth to over $1.5 billion. Established in August 2012, the Company started as a natural resource trading company, with operations concentrated in an area around Dandong City, Liaoning Province, situated in the region of Northeast China. A large percentage of the Company’s customers are industrial wholesalers, government agencies undertaking infrastructure or similar upgrading projects, corporations, renovators and construction companies, as well as stone processing factories.

Subsequently, the Company was incorporated in the State of Delaware in September 2014, and was initially known as the Spruce Valley Acquisition Corporation (“Spruce Valley”). In February 2015, Spruce Valley then changed its name to Fuda Group (USA) Corporation. Thereafter, the Company, in a series of acquisitions (collectively known as the “Acquisitions”), beginning from September 2015 and completed on September 28, 2015, has entered into stock-for-stock acquisition agreements with two companies: Fuda Gold (UK) Limited, (“Fuda UK”), a private company organized under the laws of England and Wales, and Marvel Investment Corporation Limited, (“Marvel”), a private company organized under the laws of Hong Kong.

The Company was established for the purpose of achieving synergy with Fuda UK and Marvel by combining their businesses, organizations, operations, assets and resources. Following agreements from all the parties, the aforementioned Acquisitions have resulted in both Fuda UK and Marvel becoming wholly owned subsidiaries of the Company, the surviving entity. The Company has thereby inherited the respective operations and business plans of both Fuda UK and Marvel.

| 3 |

In October 2009, Marvel was incorporated in Hong Kong. Since its inception, Marvel had conducted minimal business operations until it had acquired Liaoning Fuda Mining Co. Ltd., (“Liaoning Fuda”), which was previously incorporated in China in August 2012, pursuant to an equity transfer agreement executed on February 28, 2015 and later consummated on June 30, 2015. Liaoning Fuda was a granite and marble trading company. With Marvel being a wholly owned subsidiary, the Company now has the ability to diversify its operations into the profitable granite and marble business of the construction material industry.

In May 2015, Fuda UK was incorporated in the United Kingdom, and at its inception, Fuda UK had conducted minimal business operations. Following the Acquisitions, which joined Fuda UK with the organization, the Company has been purchasing and trading gold resources. It has also entered into agreements with gold mine to sort and process their tailings. The Company is currently focusing on the acquisition of viable mines in Northeastern China, and preparing to advance them to the next level with capital injection, productivity, technology know-how of the aforementioned surveyed properties

The Company is headquartered at 48 Wall Street, 11th Floor, New York 10005, NY, USA. The main phone number of the Company is (646) 837-7950.

Business Operations

The Company, focused on the region of Northeast China, is an emergent gold resources company seeking to develop and operate a portfolio of natural assets with reserves of gold and precious metals. The Company further diversifies into the construction commodities, such as granite and marble, through developed vendor and supplier networks. The Company through the acquisition of Marvel continues to expand and strengthen its upstream asset resources by acquiring mining properties in the region.

Since July of 2015, the Company has been exploring, planning, negotiating and engaging in gold trading and processing activities with the vision to execute its main business strategy or mission to purchase gold mining assets and facilities. Specifically, the Company is identifying and purchasing properties in an advanced stage of exploration with known gold or precious mineral deposits. The priority is on locations with certain degrees of drilling, but are under explored, which could rapidly increase in value. An ancillary part of the strategy is to explore merger and acquisition opportunities with other companies in the industry.

At the current preliminary stage of gold and precious metals operations, the Company is purchasing gold ores, powder or sand from various suppliers with the intention to either trade on these or appoint a subcontractor to further extract and process them into bars or other refined products. These gold powder and ores are sourced from other gold mines around Northern China. This interim gold bar processing operation assists the Company to transition to actual mining of its acquired mines in the near future.

In terms of purchased gold ores and other materials, the tonnage is from 1/10 to 5,000 MT and includes gold sand. The grade is as per batch and sample assay report. The pricing is $17.00 (USD) per gram. The price is calculated based on an assay report. The typical material terms with sellers are a one year guarantee supply of 20,000 MT over 12 months. There is a 90 day credit period for settlement of accounts.

Transportation and storage regarding gold is as follows: Transportation from mine direct (gold sand) to outsource processing facility cost is at seller’s cost. Regarding storage, the storage place of the supplier or place of outsource processing facility is the place for storage. For transportation from any processing facility to the Company (gold bars), usually hand pick up is used. Storage of gold bars are kept in the Company’s safe. For pre-arranged buyers, normally these items are picked up by hand by the buyer within 24 hours. There is no processing facility and only outsourced processing facility is used (charging $5.00 USD per gram of extracted gold).

| 4 |

The Company’s management believes that the market demand for natural resources, such as gold, granite and marble, fluorite and graphite will continue to increase. Gold and other precious metals are commodities and will thereby experience times of high and low trading values, but the demand for it as a commodity would be ever present. The same could be said for granite and marble, which would be additionally affected by the economy in terms of the construction industry.

As for the Company’s diversification into marble and granite industry, the Company is executing plans to acquire an open-pit granite mine that employs saw-cutting methods to remove large granite blocks from the quarry. In addition, the Company is also preparing to further process the raw blocks into slabs, pavers, wall claddings, and carvings. These products can be sold to government agencies for infrastructure projects, corporations, granite processing plants, civil engineering companies as well renovation companies.

Commodities prices can be volatile and are generally not considered to be stable over time.

Market Opportunity – Mining Acquisition in China1

FUDA Group USA recognizes that a significant opportunity exists in the natural resources market especially in gold and precious metal. In 2011 Chinese demand for gold (25% of global gold demand) exceeded demand from East Indians (23% of global gold demand) who were previous to that the largest consumers of gold (90.9 metric tons compared to India's 85.6 metric tons, China's represented a doubling over the previous year). That's after China demanded twice as much gold (in the form of bullion imports) as it produced in 2010 (700 tons against 351 tons) a significant feat considering it was by far the largest producer of gold that year. Those trends are ultimately expected to lead to a large international role for Chinese mining companies that recognize the market conditions ripe for foreign deals (expanding their gold reach outside of the country).

Business Strategy

Our business strategy is to widen its market position in gold, fluorite, graphite, granite and marble mining and trading industry by directly acquiring a number of mines throughout Asia. We seek properties with known mineralization that are in an advanced stage of exploration and have previously undergone some drilling but are under-explored, which we believe we can advance quickly to increase value. The execution of our business strategy is based on the amount of funds that we are able to raise. This will be implemented in stages. The ultimate goal is to achieve the mining, production, trading and wholesale and enter into the retail market with our own range of brand name products.

The key success factors in the Mining industry are:

| · | Acquiring explorative mining properties (previously drilled, but under-explored) where the cost of yielding raw materials is less than the market value of those materials; |

| · | Optimizing the company’s value chain; |

| · | Developing a good reputation for transparent business practices and a set of ethics; |

| · | Establishing the Company’s brand name with commodity traders, brokerages and direct buyer; |

| · | Passing savings via the Company’s direct integration through refineries, wholesaling and access to mines; |

| · | Holding a strong track record in supplier - buyer relationship; |

| · | Positioning the Company for future joint ventures and investments; and |

| · | Accessing a highly skilled workforce, as most production activities need to be operated manually in this industry. |

Competition: The 7 Biggest Chinese Mining Companies2

The Company is involved in the businesses of Gold, Silver, Graphite, Fluorite, Granite and Marble which consists of a portfolio of commodities. The Company does not want to be limited in its portfolio in the future, and aspires to become one of the largest miners in China. Thus, the Company considered as benchmarks industry leaders. With future fund raising, the Company plans to develop the resources to compete for natural resources against the listed competitors noted below.

| 5 |

In terms of assessing competition, the Company conducted a search on the 7 largest mining companies at large in China. These companies are formidable and are relevant competitors as they will be selling into the same market as that of the Company. These companies may also have their own operational mines which would almost guarantee a lower cost of goods.

1) China Shenhua Energy Co. Ltd., (HKSE: 1088-OL.HK), is China's biggest coal mining company by extraction volume, with a reported commercial production of about 306 million tons in 2014. China Shenhua Energy with its subsidiaries and affiliated companies are also engaged in coal chemical processing, power generation and delivery, plus rail and sea transportation businesses. China Shenhua Energy reported a consolidated revenue of $38.8 billion.

2) Jiangxi Copper Co. Ltd. is China's largest copper mining company, and one of its largest gold and silver mining companies. It processed more than 1.3 million tons of refined copper, over 28 tons of gold and 625 tons of silver in 2014. Besides from processing various metals and chemicals, Jiangxi Copper also produces copper products such as copper rods, tubes and foil. Jiangxi Copper reported more than $31 billion in consolidated revenue.

3) Shaanxi Coal and Chemical Industry Group Co. Ltd. is a coal mining and processing conglomerate with operations in electric power generation, iron and steel production, heavy equipment manufacturing and an array of other businesses. The company reported gross coal production of nearly 140 million tons in 2014, making it China's third-biggest coal producer by volume. Consolidated revenue amounted to $28.7 billion. Several subsidiary companies are listed on the Shanghai Stock Exchange, including Shaanxi Coal Industry Co. Ltd. and Shaanxi Construction Machinery Co. Ltd.

4) Aluminum Corporation Of China Ltd., (NYSE: ACH), also known as Chalco, is China's largest bauxite mining company. The company refines bauxite ore into aluminum oxide, known as alumina, which is then sold or further processed into primary aluminum. Chalco is the world's second-largest alumina processor by volume, reporting production of about 13.2 million tons in 2014. Output of primary aluminum was about 3.7 million tons. Chalco also fabricates aluminum products and engages in coal production and power generation businesses. It reported a consolidated revenue of more than $22 billion in 2014.

5) China Coal Energy Co. Ltd., (HKSE: 1898-OL.HK), is China's second-biggest coal mining firm, reporting a production of more than 165 million tons of coal in 2014. The company also produces coal-related chemicals, manufactures specialized coal mining equipment and provides coal mine engineering services to other mining companies. China Coal Energy reported consolidated revenue of more than $11 billion.

6) Yanzhou Coal Mining Co. Ltd., (NYSE: YZC), is a coal mining and processing firm with associated operations in railway transportation, coal chemical production and power generation. It operates twelve coal mines in China and another nine mines in Australia with a total of six additional mines set to enter commercial production by 2016. Total coal production amounted to more than 80 million tons in 2014. Yanzhou’s consolidated revenue was more than $9.4 billion.

7) Zijin Mining Group, (HKSE: 2899-OL.HK), is China's biggest gold producer, second-biggest copper producer and major producer of iron and silver ores. In 2014, it produced 175 tons of gold, 411,000 tons of copper, 3 million tons of iron concentrates and 349 tons of silver. It also mines zinc, tungsten, tin, lead, molybdenum and coal. In addition to its domestic mines, Zijin Mining Group has mining operations in Kyrgyzstan, Tajikistan, South Africa and Russia. It reported a consolidated revenue of more than $9.1 billion.

| 6 |

The metals and mining sector in China is represented at the top by large state-owned firms organized to extract and process resources on a provincial or regional scale. The firms in this list mine a wide variety of mineral resources, including coal, bauxite, copper, gold, zinc and iron ore. Most of the companies are also involved in varied business activities that grew out of their mining operations. This list is ranked according to reported revenues in their consolidated financial statements for 2014. Important resource extraction figures from the same year are also noted:

1 World Gold Council. 2013. Gold Demand Trends

2 Investopedia. Sept 2015. Chinese Mining Companies

Some of the company’s current granite/marble competitors in Northern China are: Kuan Dian Manchu Autonomous County Yuanlong Mine, Dandong City Liaoning Province Granite Quarry, Fengcheng City, Liaoning Province, Phoenix Technology Volcanic Stone Company, Jinjiang Xulong Stone Co., Ltd., Kuandian Rongda Industry Co., Ltd, Zhen'an District Dandong City Xin Lee Stone Co., Ltd.

Some of the company’s current gold and precious metal competitors in Northern China are: Zhaojin Mining Industry Co., Ltd, Liaoning Tianli Mining Company Ltd, Real Gold Mining Limited, Liaoning Wulong Gold Mining Co., Ltd, Dandong Zhenan Gold Mine Trustworthiness Cooperative, Paishanlou Gold Mine Company

The Company’s Advantage

Even though the Company has been in operation for only a number of years, it holds certain advantages over its above state-owned competitors. These advantages are:

| · | Experienced management with significant international exposure; |

| · | Outstanding track record in the industry (based on customer reviews and feedback, including positive customer experiences, and a history of financial success and strong performance as a company); |

| · | A vertical integration structure that allows the Company to oversee all areas of the supply chain, ensuring smooth operations and the leveraging of synergies; |

| · | Ability to directly access and associate with multiple mines and refineries; |

| · | Willingness to integrate cutting-edge technology directly into mining techniques to marketing strategy; |

| 7 |

SWOT Analysis

SWOT analysis provides us with an opportunity to examine the internal strengths and weaknesses of the Company. It also allows us to examine the opportunities presented to the Company as well as potential threats.

|

Strengths

· Domination of the supply chain · Full control of inventory · Experienced and knowledgeable management team. · Outstanding business strategy · Track record in mining |

Weaknesses

· Revenues in the industry are cyclical; · Operational challenges in full vertical approach |

|

Opportunities

· Increase in higher income of target market. · xThe addition of other related products and services. |

Threats

· Local and emerging competitors. · Market value of materials are highly volatile · Sales tied to economic growth. |

Mining Activities

The Company’s current operations are in trading and outsourcing of processing of mining output. The Company does not currently operate any mining or processing facility. However, part of the Company’s long-term vision is to enter into this part of the value chain. Hence the description of such operations, below, are prospectively only in nature.

Establish Plant and Facilities: The facility will consist of the processing plant itself with a minimum of 3 CIP tanks, mini-laboratory for assay analysis, firing area, office, provision for canteen and the large remaining portion will be designated as a stockyard. Perimeter fence will cover the entire facility for security purposes.

Manufacturing/Production Plan: A truck will deliver products to the plant using 40 to 50kg used sack containers. Processing will be done on a first come first served basis. Prior to completing the processing, an assay analysis will be conducted to ensure fair processing and to determine the expected amount of gold.

Equipment and Technology: The Company will conduct a series of test to assure the optimal functioning of its machineries before any service from clientele shall be accepted. Operations and dry runs shall operate 24 hours from Monday to Sunday, and 365 days a year, with two allotted days reserved every month for maintenance and downtime.

Variable Labor Requirements: General workers need to be strong and physically fit. Supervisors have, at minimum, experience in ore processing or have previously worked in a processing plant. Assistant manager is an engineer with technical knowledge. Chemists need to have knowledge in basic assay and routine analysis.

Inventory Management: The inventory manager must have a thorough understanding of the principles involved in setting stock levels and the core ability to handle the sheer volume of items on a daily basis.

| 8 |

Management Information Systems:

As other industries are demanding management information systems to increase their ability to manage and analyze every aspect of organizational information, mining industry is also witnessing similar demands on technology. It is crucial for the mining companies to make the transition from traditional methods to technology-enabled business processes. Major focus areas for Fuda Group (USA) include:

| · | Knowledge Sharing |

| · | Safety |

| · | Environmental Impact |

| · | Process Improvement |

| · | Remote operations |

| · | Exploration and production techniques |

| · | Asset management |

| · | Efficiency |

| · | Merger and acquisition |

| · | Mine Automation |

Management Experience

The Company’s management personnel have substantial experience in the areas of precious metals, mining, trading, gold and diamonds. In addition, the Company’s management is buttressed by the strong experience and profiles of its individual management team members:

| Ø | Mihir Sangari: 14 years of experience in the diamond and precious metals trading sectors. He has previous marketing experience with the following companies: Charles Wolf & Sons Inc, New York; Blue Diamonds Inc, New York; Simi-Diam Thailand/Prime Star HK; Al-Othaim Jewelry Saudi Arabia. |

| Ø | Dr. Weiguo Lang obtained his Master’s and Doctorate degrees in Engineering from the University of Saskatchewan, Canada and has more than 20 years of experience in the mining, technology and agriculture sectors. He serves as an Advisor to various Chinese private and government companies involved in mining and mining finance sectors worldwide. He has many years of experiences in mining project development and capital operations. |

| Ø | Dr. Weiguo Lang, Ph.D. is Chief Executive Officer of Ultra Lithium Inc. (Symbol TSX.V:ULI) since August 15, 2015. He is also the Executive Director of Zhongsheng Resources Holdings Limited (Symbol: 2623.HK), primarily responsible for business development and investment. Prior to that, he acted as director for Klondex Mines Ltd. (TSX: KDX; NYSE MKT:KLDX), Agro International Inc., Zhongrun (Tianjin) Mining Development Co., Ltd., Ventek Systems Inc. and Q-Net Technologies Inc (Symbol: QNTI). |

Other Operational Concerns

| Ø | Smooth supply and distribution network |

| Ø | On time order fulfillment and congenial customer service |

| Ø | Research and development on periodic basis |

| Ø | Optimum capacity utilization |

| Ø | Development and implementation of standard quality control procedures |

| Ø | Safety, Health, and Environmental Concerns; knowledge and education of employees and workers |

| Ø | Shrinkage |

Development Plans

The Company has the following long term objectives:

| Ø | To become a technological advanced mining company; |

| Ø | To achieve expertise in production through continuous economies of scale; |

Moreover, the Company’s business strategy is to acquire active mines that are currently in operation. Along with the acquisition, the Company would seek to retain key individuals as well as the current operations team to ensure smooth transition, transfer and continuity of know-how, expertise and management. It will also enable operations to remain optimum, smooth and effective. The Company would also engage consultants to streamline processes and upgrade the technology to improve the effectiveness and efficiency of the mines wherever possible.

| 9 |

| Ø | To build a strong customer base through Management experience in the mining business and networking; |

| Ø | To improve and innovate production techniques through expertise accumulated over time; |

| Ø | To become an active member of World Gold Council; |

| Ø | To impact the Gold industry in total value creation and upholding positive impact of the industry; and |

| Ø | To establish a healthy partnership with stakeholders and winning their trust. |

Growth Strategy: In the mining business, resource replacement and growth is one of the key technical objectives. This can be achieved by direct investment in exploration, or by relying on successful exploration by others, with the intention of subsequent resource acquisition. The Company wishes to expand the exploration base and which shall be possible through investment in the business.

Track Record: The Company has an outstanding track record in the industry (based on customer reviews and feedback, including positive customer experiences, and a history of financial success and strong performance as a company).

Key Milestones

Milestone

| Start Date | Duration (days) | Manager | ||||

| Obtain Funding from sources such as bank loans, private investors and capital-raising | S-1 effective | 180.00 | Founder | |||

| Secure Contracts | 60 days from S-1 effective | 90.00 | Founder | |||

| Initiating Gold Mining & Trading Operations | 14-02-16 | 180.00 | Management Team | |||

| Informal agreements of understanding for purchase into mines | ||||||

| Gold mine | ||||||

| Granite mine | ||||||

| Initiation of operations | 180 days after securing contracts | |||||

| Complete basic assimilation / handover / takeover process |

*These are only estimates. Management may need to change the timelines based on given circumstances

A description of some of the key near-term milestones is discussed below:

Obtain funding: The Company will be attending road shows within and outside the U.S. The Company will also seek out the assistance of investment banks No investment bank is on retainer at the moment. Additionally, the Company will also seek out private investors, institutional investors as well as issue bonds. The Company may consider debt as an option in case funding targets have not been met. The Company has set aside 6 months of fund raising to achieve its target.

Secure contracts: The Company already conducted a number of preliminary feasibility studies on the target mines. As such, once the Company is funded it will need 90 days to complete the acquisition process which includes due diligence and legal paperwork and handover.

Initiating Gold Mining & trading operations: This is the time the Company plans to require in order to assimilate into the acquired mining companies and gain full control of its operations in order to increase output.

Mining: The mines are active and the timelines reflect active mines. The activities that the Company intends to complete after funding in its place is trading and mining operations. The properties that the Company intends to acquire are active mines that are currently producing, have all the necessary permits, which would be transferred. These mines are open to accepting partnerships to further develop their mines, increase output, additional capital injection. They are domestic in nature and the Company would be able to help them with international exposure and exporting opportunities.

MANAGEMENT TEAM

| 10 |

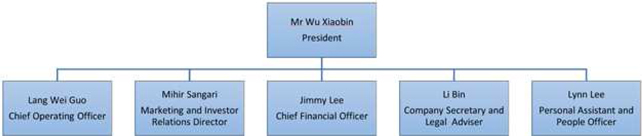

The following is the management team in place for the company.

• Mr. Xiaobin Wu is the President of FUDA Group (USA). He holds a Master of Business Administration Degree from Beijing University. Having been in business for over two decades, he has developed a wide network of business and political contacts in China. He has significant experience providing fiscal, strategic and operational leadership in uniquely challenging situations. Mr. Wu is also a dynamic, results-oriented leader with a strong performance track record.

• Mr. Mihir J. Sangani holds a Degree in Finance from Bombay University, India. Mr. Sangani has significant global marketing & business development experience along with relation investor exposure. Mr. Sangani has managed an over-$200MM portfolio in the area of investment and asset management.

• Mr. Jimmy Lee has a Bachelor of Science Degree in Accounting from the University of Albany. He is well versed with both the US and Asian markets and has deep knowledge of auditing, financial reporting, consulting, taxation, and financial planning.

• Mr Li Bin is a graduate from Fudan University, a renowned Chinese university. Mr. Li finished his Masters Degree and Doctor of Jurisprudence Degree in the United States. Mr. Li externed for the Honorable Ronald Lew of the Central District of California, and is licensed by the State Bar of California to appear before the California Superior Court and Court of Appeal, the federal District Court and Bankruptcy Court for the Central District of California.

• Ms. Lynn Lee is a graduate in Economic and Statistics from the National University of Singapore. She has many years of working experience in international locations within various industries in both public and private sectors, as well as multinational corporations to local companies. She has extensive people management experience and significant organization planning and development know-how.

Together, the above-mentioned professionals form a well-rounded team of leaders that hold all the skills and abilities needed to succeed in the natural resources industry.

Past Financial Performance

The Company has been thriving since its inception – its success easily ascertainable from the tables below. The balance sheet indicates how well it has performed in its last two years of operation. The tables below lists operational expenditure and income. Again, this table demonstrates the high level of success that the Company has achieved in its two years of operation. The fact that it generates considerable revenues indicates the demand for such services. Moreover, FUDA Group USA healthy cash flows show that the Company is safe from a financial crunch.

| 11 |

Fuda Group (USA) Corporation and Subsidiaries

Consolidated Balance Sheets

| December 31, | December 31, | |||||||

| 2015 | 2014 | |||||||

| ASSETS | ||||||||

| Current Assets | ||||||||

| Cash and cash equivalents | $ | 18,178,550 | $ | 466 | ||||

| Accounts receivable, net | 475,041 | 260,624 | ||||||

| Inventory | - | 3,843 | ||||||

| Prepaid rent | 28,254 | 65,058 | ||||||

| Security deposits to suppliers | 996,166 | 1,985,178 | ||||||

| Other receivables | 6,380 | 387,142 | ||||||

| Total Current Assets | 19,684,391 | 2,702,311 | ||||||

| Land, property & equipment (net) | 49,478,802 | 52,286,087 | ||||||

| Other assets | 46,233 | 48,872 | ||||||

| Total Assets | $ | 69,209,426 | $ | 55,037,270 | ||||

| LIABILITIES AND STOCKHOLDERS' EQUITY | ||||||||

| Current Liabilities | ||||||||

| Accounts payable and accrued expenses | $ | 29,014 | $ | 8,420,643 | ||||

| Taxes payable | - | 224 | ||||||

| Due to related parties | 3,631,621 | 1,548 | ||||||

| Other payables | - | 11,472 | ||||||

| Trade financing loans | - | 1,893,264 | ||||||

| Advances from customers | 6,164 | - | ||||||

| Total Current Liabilities | 3,666,799 | 10,327,151 | ||||||

| Total Liabilities | 3,666,799 | 10,327,151 | ||||||

| Commitments & contingencies | - | - | ||||||

| Stockholders' Equity | ||||||||

| Common stock, $0.0001 par value, 480,000,000 shares authorized; | ||||||||

| 105,954,309 shares at December 31, 2015 and 8,200,000 shares at December 31, 2014, respectively | 10,595 | 820 | ||||||

| Additional paid-in capital | 9,579,682 | 9,564,907 | ||||||

| Subscriptions receivable | - | (2,000 | ) | |||||

| Accumulated other comprehensive income | (3,188,494 | ) | 220,712 | |||||

| Statutory reserve | 5,990,116 | 3,493,474 | ||||||

| Accumulated earnings (unrestricted) | 53,150,728 | 31,432,206 | ||||||

| Total stockholders' equity | 65,542,627 | 44,710,119 | ||||||

| TOTAL LIABILITIES AND STOCKHOLDERS' EQUITY | $ | 69,209,426 | $ | 55,037,270 | ||||

| 12 |

Fuda Group (USA) Corporation and Subsidiaries

Consolidated Statements of Operations

| For the Years Ended | ||||||||

| December 31, | December 31, | |||||||

| 2015 | 2014 | |||||||

| Sales | ||||||||

| Affiliated Entities | $ | 8,257,534 | $ | 23,100,627 | ||||

| Third parties | 30,147,357 | 19,417,843 | ||||||

| Total sales | 38,404,891 | 42,518,470 | ||||||

| Cost of sales | ||||||||

| Affiliated Entities | 625,571 | 7,250,258 | ||||||

| Third parties | 11,936,279 | 7,020,073 | ||||||

| Total cost of sales | 12,561,850 | 14,270,331 | ||||||

| Gross margin | 25,843,041 | 28,248,139 | ||||||

| Operating expenses | ||||||||

| Selling, general & administrative expenses | 1,765,257 | 1,231,036 | ||||||

| Total operating expenses | 1,765,257 | 1,231,036 | ||||||

| Income (Loss) from operation | 24,077,784 | 27,017,103 | ||||||

| Other income (expenses) | ||||||||

| Interest income (expenses), net | (1,276 | ) | (346,110 | ) | ||||

| Government rebate | 138,427 | 343,477 | ||||||

| Other income | 229 | - | ||||||

| Total other income (expenses) | 137,380 | (2,633 | ) | |||||

| Income before income tax | 24,215,164 | 27,014,470 | ||||||

| Income tax | - | - | ||||||

| Net income | 24,215,164 | 27,014,470 | ||||||

| Foreign currency translation adjustment | (3,414,934 | ) | (73,259 | ) | ||||

| Comprehensive income | $ | 20,800,230 | $ | 26,941,211 | ||||

| Common Shares Outstanding, basic and diluted | 87,430,953 | 2,201,644 | ||||||

| Net income per share | ||||||||

| Basic and diluted | $ | 0.28 | $ | 12.27 | ||||

| 13 |

Fuda Group (USA) Corporation and Subsidiaries

Consolidated Statements of Cash Flows

| For the Years Ended | ||||||||

| December 31, | December 31, | |||||||

| 2015 | 2014 | |||||||

| Cash flows from operating activities | ||||||||

| Net income | $ | 24,215,164 | $ | 27,014,470 | ||||

| Adjustments to reconcile net income to net cash provided by or used in operating activities: | ||||||||

| Bad debt expense | 261,847 | 15,130 | ||||||

| Shares to be used and issued for compensation | 14,638 | - | ||||||

| Depreciation and amortization | 4,702 | 4,199 | ||||||

| Expenses paid by stockholder and contributed as capital | 712 | 1,698 | ||||||

| Changes in operating assets and liabilities: | ||||||||

| Accounts receivable | (474,909 | ) | 1,055,131 | |||||

| Inventory | 3,838 | 5,598,542 | ||||||

| Prepaid rent | 35,541 | 109,480 | ||||||

| Other receivables | 380,039 | (52,513 | ) | |||||

| Security deposits to suppliers | 955,957 | 2,715,958 | ||||||

| Accounts payable and accrued expenses | (8,381,843 | ) | (5,832,650 | ) | ||||

| Taxes payable | 1,240 | 224 | ||||||

| Other payables | (11,459 | ) | 11,451 | |||||

| Increase/(Decrease) in security deposit | ||||||||

| Advances from customers | 6,424 | - | ||||||

| Other assets | - | (48,815 | ) | |||||

| Net cash provided by operating activities | 17,011,891 | 30,592,305 | ||||||

| Cash flows from financing activities | ||||||||

| Capital withdrawal from owners | - | (40,677 | ) | |||||

| Proceeds from issuance of common stock | - | - | ||||||

| Proceeds/(Repayment) to related party, net | 3,743,217 | (21,059 | ) | |||||

| Proceeds/(Repayments) from trade financing loans, net | (1,891,048 | ) | (2,082,415 | ) | ||||

| Net cash used in financing activities | 1,852,169 | (2,144,151 | ) | |||||

| Cash flows from investing activities | ||||||||

| Purchase of land, property and equipment | (20,776 | ) | (31,633,774 | ) | ||||

| Net cash used in investing activities | (20,776 | ) | (31,633,774 | ) | ||||

| Effect of exchange rate changes | (665,200 | ) | 73,558 | |||||

| NET INCREASE (DECREASE) IN CASH | 18,178,084 | (3,112,062 | ) | |||||

| CASH | ||||||||

| Beginning of period | 466 | 3,112,528 | ||||||

| End of period | $ | 18,178,550 | $ | 466 | ||||

| SUPPLEMENTAL DISCLOSURES OF CASH FLOW INFORMATION CASH PAID FOR: | ||||||||

| Interest | $ | 1,345 | $ | 346,110 | ||||

| Income Taxes | $ | - | $ | - | ||||

| 14 |

Financial Projection: Funding

FUDA Group USA intends to raise $200 million to acquire, either partially or whole, any one or more, in any combination, gold, fluorite, graphite, granite and marble resource mines and facilities. Our ability to acquire these assets depends on the funds that we are able to raised. The approximate value of the properties surveyed are as follows:

Gold: Acquisition of Gold Mine US$350 million. All acquisitions will be checked against reports from the Land Resource Bureau. Acquisition of Gold Sorting and Refinery Facility USD150 million. This money would be used to purchase the facility for the refinery, machinery and technology upgrades.

Granite: Acquisition of Granite Mines US$120 million. The granite mines that we intend to acquire are open-pit mines. Open-pit mines are easier to mine and hence lower operational costs. The mine purchase price includes processing facilities. All acquisitions will be checked against reports from the Land Resource Bureau.

Graphite: Acquisition of Graphite Mine US$230 million. This purchase price includes a processing facility with an estimated worth of USD50 million. All acquisitions will be checked against reports from the Land Resource Bureau.

Fluorite: Acquisition of Fluorite Mine US$150 million. This purchase price includes a processing facility with an estimated worth of USD$20 million. All acquisitions will be checked against reports from the Land Resource Bureau.

With respect to any acquisitions mentioned above, there are no formal agreements currently in place. The Company is basing its projections and estimates only on informal mutual understandings that are in place. The Company has obtained various feasibility reports. Based on the funding achieved, the company will phase the completion of the acquisition plan accordingly.

15

Listing on a National Exchange

Company will apply to list our common stock on The NASDAQ Stock Market. In order for our common stock to be listed, we must fulfill certain listing requirements including a minimum stock price for our common stock. At our Special Meeting of Stockholders held on 1 October, 2015, we received stockholder approval to effect a reverse stock split of our outstanding common stock and to change the allowable exchange ratio to not less than 1-for-4 and not more than 1-for-25. We expect that a reverse stock split would initially result in an increase in the price per share of our common stock and substantially reduce the risk that a U.S. national securities exchange would decline to list our common stock on the basis of failure to meet the exchange’s minimum stock price. No assurances can be given that, even if we satisfy this listing requirement, our listing on The NASDAQ Stock Market or another U.S. national securities exchange will be approved, or that, if our common stock is listed on The NASDAQ Stock Market or another U.S. national securities exchange, we will be able to satisfy the maintenance requirements for continued listing.

Risk Factors

Investing in our common stock involves risks that include the limited operating history, securing adequate capital to continue to expand, maintaining an efficient operating and business model, speculative nature of gold trading, competition, volatile commodity prices and other material factors. For a discussion of these risks and other considerations that could negatively affect the Company, including risks related to this offering and our common stock, see “Risk Factors” and “Cautionary Note Regarding Forward-Looking Statements.”

Corporate Information

Our principal office is located at 48 Wall Street, 11 Floor, New York, NY 10005, and our telephone number is (646) 837-7950. Our website is www.fudagroupusa.com . We expect to make our periodic reports and other information filed with or furnished to the SEC available free of charge through our website as soon as reasonably practicable after those reports and other information are electronically filed with or furnished to the SEC. Information on our website or any other website is not incorporated by reference herein and does not constitute a part of this prospectus.

16

This prospectus relates to the offer and sale of 100,000,000 shares (“Shares”) of common stock of the Company.

.

| Common stock outstanding before the offering | 105,954,309 | (1) | ||

| Common stock for sale by the Company | 100,000,000 | |||

| Common stock outstanding after the offering | 205,954,309 | (2) | ||

| Proceeds to the Company | $ | (3) |

(1) Based on number of shares outstanding as of the date of this prospectus.

(2) Assumes the sale of the maximum number of Shares.

(3) The Company will offer the Shares directly without payment to any officer or director of any commission or compensation for sale of the Shares. The Company will also attempt to locate broker-dealers or selling agents to participate in the sale of the Shares. In such cases, the Company will pay customary selling commissions and expenses of such sales which would reduce the proceeds to the Company.

Any and all funds received by the Company for sales of Shares by the Company at any time in the offering will become immediately available to the Company. There is no fixed amount or number of Shares that must be reached or sold before any closing or use of any funds can occur.

| Use of proceeds | We expect to receive $ million of net proceeds from the sale of the common stock offered by us, after deducting underwriting discounts and commissions and estimated offering expenses. |

| Dividend policy | We do not anticipate paying any cash dividends on our common stock. |

| Listing | We intend to apply to list our common stock on NASDAQ. |

| Risk factors | You should carefully read and consider the information in this prospectus set forth under the heading “Risk Factors” and all other information set forth in this prospectus before deciding to invest in our common stock. |

The Company had no operations or specific business plan until the Acquisitions.

The consolidated statements of operations data for the years ended December 31, 2015 and December 31, 2014, respectively, and the condensed balance sheet data as of December 31, 2015 and December 31, 2014, respectively, are derived from the consolidated audited financial statements of the Company, and related notes thereto included herein.

| Year ended | Year ended | |||||||

| December 31, 2015 | December 31, 2014 | |||||||

| Statement of operations data | ||||||||

| Revenue | $ | 38,404,891 | $ | 42,518,470 | ||||

| Gross profit | $ | 25,843,041 | $ | 28,248,139 | ||||

| Income (Loss) from operations | $ | 24,077,784 | $ | 27,017,103 | ||||

| Net income (loss) | $ | 24,215,164 | $ | 27,014,470 | ||||

17

| At December 31, 2015 | At December 31, 2014 | |||||||

| Balance sheet data | ||||||||

| Cash | $ | 18,178,150 | $ | 466 | ||||

| Other assets | $ | 69,163,193 | $ | 55,036,804 | ||||

| Total assets | $ | 69,209,426 | $ | 55,037,270 | ||||

| Total liabilities | $ | 3,666,799 | $ | 10,327,151 | ||||

| Total members’ equity (deficit) | $ | 65,542,627 | $ | 44,710,119 | ||||

An investment in the Company’s common stock involves a high degree of risk. Investors should carefully consider the following risks and all of the other information contained in this prospectus before the purchase of the Shares. Our business, financial condition and results of operations could be materially and adversely affected by any of these risks. The risks described below are not the only ones facing us. Additional risks not presently known to us or which we consider immaterial also may adversely affect us. If any of the following risks actually occur, the business, financial condition or results of operations of the Company would likely suffer. In this case, the market price of the common stock could decline, and investors may lose all or part of the money their investment.

Risks Related to Our Business

The Company is an early-stage company with a limited operating history, and as such, any prospective investor may have difficulty in assessing the Company’s profitability or performance.

Because the Company (except Fuda Mining Co.) is an early-stage company with a limited operating history, it could be difficult for any investor to assess the performance of the Company or to determine whether the Company will meet its projected business plan. The Company has limited financial results upon which an investor may judge its potential. As a company still in the early stages of its life, the Company may in the future experience under-capitalization, shortages, setbacks and many of the problems, delays and expenses encountered by any early-stage business. An investor will be required to make an investment decision based solely on the Company management’s history, its projected operations in light of the risks, the limited operations and financial results of the Company to date, and any expenses and uncertainties that may be encountered by one engaging in the Company’s industry.

The Company is an early-stage company and has little experience in being a public company.

The Company is an early-stage company and as such has little experience in managing a public company. Such lack of experience may result in the Company experiencing difficulty in adequately operating and growing its business. Further, the Company may be hampered by lack of experience in addressing the issues and considerations which are common to growing companies. As such, the Company’s business performance might likely suffer.

The Company may not successfully consummate or initiate acquisitions.

The ability of the Company to grow through acquisitions (as planned) will depend on a number of factors, including competition for acquisitions, the availability of capital and other resources to consummate acquisitions, and the ability to successfully integrate and train additional staff, including the staff of an acquired company. There can be no assurance that the Company will continue to be able to establish and expand its market presence or to successfully identify suitable acquisition candidates and complete acquisitions on favorable terms.

In addition to facing competition in identifying and consummating successful acquisitions, such acquisitions could involve significant risks, including:

| - | difficulties in the assimilation of the operations, services, and corporate culture of acquired companies, and higher-than-anticipated costs associated with such assimilation; |

| - | over-valuation of acquired companies or delays in realizing or a failure to realize the benefits, revenues, cost savings, and synergies that were anticipated; |

| - | difficulties in integrating the acquired business into information systems, controls, policies, and procedures; |

| - | failure to retain key personnel, business relationships, reputation, or clients of an acquired business; |

| - | the potential impairment of acquired assets; |

| - | diversion of management’s attention from other business activities; |

insufficient indemnification from the selling parties for legal liabilities incurred by the acquired companies prior to acquisition;

| - | the assumption of unknown liabilities and additional risks of the acquired business; and |

18

| - | unforeseen operating difficulties that require significant financial and managerial resources that would otherwise be available for the ongoing development or expansion of existing operations. |

In addition, future acquisitions could materially and adversely affect the Company’s business, financial condition, results of operations, and liquidity. Possible impairment losses on goodwill and intangible assets, or restructuring charges could occur. These risks could have a material adverse effect on the business because they may result in substantial costs to the Company and disrupt its business.

Reliance on third party agreements and relationships is necessary for development of the Company's business.

The Company will need strong third party relationships and partnerships in order to develop and grow its business. The Company will be substantially dependent on these strategic partners and third party relationships. As a result the Company expects to incur additional expenses which could adversely affect the business, financial condition and results of operations.

The Company is an early-stage company and has a limited history of its operations. The Company will need to continue generating revenue in order to maintain sustained profitability. Ultimately, in spite of the Company’s best or reasonable efforts, the Company may have difficulty in generating revenues or remaining profitable.

The Company does not have any independent directors.

All of the directors of the Company are executive officers and/or employees of the Company. As such, the Company does not have any independent oversight or administration of its management and operations. The Company’s decision-making may suffer from the lack of an independent set of directors, since only officers and employees of the Company will make all important decisions regarding the Company.

The Company depends on its management team to manage its business effectively.

The Company's future success is dependent in large part upon its ability to understand and develop the business plan and to attract and retain highly skilled management, operational and executive personnel. In particular, due to the relatively early stage of the Company's business, its future success is highly dependent on its officers, to provide the necessary experience and background to execute the Company's business plan. The loss of any officer’s services could impede, particularly initially as the Company builds a record and reputation, its ability to develop its objectives, and as such would negatively impact the Company's possible overall development.

The Company may face significant competition from companies that serve its industries.

The Company may face competition from other companies that offer similar solutions. Some of these potential competitors may have longer operating histories, greater brand recognition, larger client bases and significantly greater financial, technical and marketing resources than the Company possesses. These advantages may enable such competitors to respond more quickly to new or emerging trends and changes in customer preferences. These advantages may also allow them to engage in more extensive market research and development, undertake extensive far-reaching marketing campaigns, adopt more aggressive pricing policies and make more attractive offers to potential customers, employees and strategic partners. The Company believes that its current and anticipated solutions are, and will be, sufficiently different from existing competition, and that there is limited to no competition in its local area. However, it is nevertheless possible that potential competitors may have or may rapidly acquire significant market share. Increased competition may result in price reductions, reduced gross margin and loss of market share. The Company may not be able to compete successfully, and competitive pressures may adversely affect its business, results of operations and financial condition.

The Company does not maintain certain insurance, including errors and omissions and indemnification insurance.

The Company has limited capital and, therefore, does not currently have a policy of insurance against liabilities arising out of the negligence of its officers and directors and/or deficiencies in any of its business operations. Even assuming that the Company obtained insurance, there is no assurance that such insurance coverage would be adequate to satisfy any potential claims made against the Company, its officers and directors, or its business operations. Any such liability which might arise could be substantial and may exceed the assets of the Company. The certificate of incorporation and by-laws of the Company provide for indemnification of officers and directors to the fullest extent permitted under Delaware law. Insofar as indemnification for liabilities arising under the Securities Act may be permitted to directors, officers and controlling persons, it is the opinion of the Securities and Exchange Commission that such indemnification is against public policy, as expressed in the Act, and is therefore, unenforceable.

19

The Company is subject to the potential factors of market and customer changes.

The business of the Company is susceptible to rapidly changing preferences of the marketplace and its customers. The needs of customers are subject to constant change, as staffing needs are as quick to change as are the businesses of customers. Although the Company intends to continue to develop and improve its products and services to meet changing customer needs of the marketplace, there can be no assurance that funds for such expenditures will be available or that the Company's competition will not develop similar or superior capabilities or that the Company will be successful in its internal efforts. The future success of the Company will depend in part on its ability to respond effectively to rapidly changing trends, industry standards and customer requirements by adapting and improving the features and functions of its services. In the Company’s industry, failure by a business to adapt to the changing needs and demands of customers is likely to render the business obsolete.

Government regulation could negatively impact the business.

The Company’s business segments may be subject to various government regulations in the jurisdictions in which they operate. Due to the potential wide scope of the Company’s operations, the Company could be subject to regulation by various political and regulatory entities, including various local and municipal agencies and government sub-divisions. The Company may incur increased costs necessary to comply with existing and newly adopted laws and regulations or penalties for any failure to comply. The Company’s operations could be adversely affected, directly or indirectly, by existing or future laws and regulations relating to its business or industry.

The Company is susceptible to changes in economic conditions.

Demand for natural resources may decline with changing economic conditions. For example, decline in private construction projects may reduce demand for granite products that the Company operates in. International economic conditions or a slowdown of growth in China or around the globe could harm the Company’s business and operations.

Changes in prices for metals or products will affect the Company’s profitability and operations.

Commodities, such as gold, fluctuate and change in price on a daily basis. Changes in these prices could negatively affect the Company’s operations and profitability.

The Company is dependent on its suppliers, and business difficulty for a supplier could harm the Company’s own business.

The Company relies on its key suppliers. Difficulties that the suppliers experience will burden the Company’s ability to operate. The Company needs to diversify among suppliers, but until such time, the Company is dependent and exposed to the risk of its current key suppliers.

Key suppliers of the Company currently include the following entities:

Junda Mining Co., Ltd.

Xiang An Mining Co., Ltd.

Heng Xu Mining Co., Ltd

Changan Gold Mine

Zhenan Gold Mine

The Company is exposed to seasonal risks in its business and operations.

The Company’s business can encounter seasonal issues from time to time in granite and marble mining as the mining and processing activities can typically be done at year round and during the seasonal periods that construction demand slowed, the mines and processing continued operations and built up inventories to prepare for the periods of higher demand.

The Company has a small financial and accounting organization. Being a public company strains the Company's resources, diverts management’s attention and affects its ability to attract and retain qualified officers and directors.

As a reporting company, the Company is already subject to the reporting requirements of the Securities Exchange Act of 1934. However, the requirements of these laws and the rules and regulations promulgated thereunder entail significant accounting, legal and financial compliance costs which are potentially prohibitive to the Company as it develops its business plan, products and scope. These costs have made, and will continue to make, some activities more difficult, time consuming or costly and may place significant strain on its personnel, systems and resources.

The Securities Exchange Act requires, among other things, that companies maintain effective disclosure controls and procedures and internal control over financial reporting. In order to maintain the requisite disclosure controls and procedures and internal control over financial reporting, significant resources and management oversight are required. As a result, management’s attention may be diverted from other business concerns, which could have a material adverse effect on the development of the Company's business, financial condition and results of operations.

20

The Company's election not to opt out of JOBS Act extended accounting transition period may not make its financial statements easily comparable to other companies.

Pursuant to the JOBS Act of 2012, as an emerging growth company the Company can elect to opt out of the extended transition period for any new or revised accounting standards that may be issued by the PCAOB or the SEC. The Company has elected not to opt out of such extended transition period which means that when a standard is issued or revised and it has different application dates for public or private companies, the Company, as an emerging growth company, can adopt the standard for the private company. This may make comparison of the Company's financial statements with any other public company which is not either an emerging growth company nor an emerging growth company which has opted out of using the extended transition period difficult or impossible as possible different or revised standards may be used.

The recently enacted JOBS Act will also allow the Company to postpone the date by which it must comply with certain laws and regulations intended to protect investors and to reduce the amount of information provided in reports filed with the SEC.

The recently enacted JOBS Act is intended to reduce the regulatory burden on “emerging growth companies. The Company meets the definition of an emerging growth company and so long as it qualifies as an “emerging growth company,” it will, among other things:

be exempt from the provisions of Section 404(b) of the Sarbanes-Oxley Act requiring that its independent registered public accounting firm provide an attestation report on the effectiveness of its internal control over financial reporting;

be exempt from the “say on pay” provisions (requiring a non-binding shareholder vote to approve compensation of certain executive officers) and the “say on golden parachute” provisions (requiring a non-binding shareholder vote to approve golden parachute arrangements for certain executive officers in connection with mergers and certain other business combinations) of the Dodd-Frank Act and certain disclosure requirements of the Dodd- Frank Act relating to compensation of its chief executive officer;

be permitted to omit the detailed compensation discussion and analysis from proxy statements and reports filed under the Securities Exchange Act of 1934 and instead provide a reduced level of disclosure concerning executive compensation; and

be exempt from any rules that may be adopted by the Public Company Accounting Oversight Board requiring mandatory audit firm rotation or a supplement to the auditor’s report on the financial statements.

Although the Company is still evaluating the JOBS Act, it currently intends to take advantage of some or all of the reduced regulatory and reporting requirements that will be available to it so long as it qualifies as an “emerging growth company,”. The Company has elected not to opt out of the extension of time to comply with new or revised financial accounting standards available under Section 102(b) of the JOBS Act. Among other things, this means that the Company's independent registered public accounting firm will not be required to provide an attestation report on the effectiveness of the Company's internal control over financial reporting so long as it qualifies as an emerging growth company, which may increase the risk that weaknesses or deficiencies in the internal control over financial reporting go undetected. Likewise, so long as it qualifies as an emerging growth company, the Company may elect not to provide certain information, including certain financial information and certain information regarding compensation of executive officers that would otherwise have been required to provide in filings with the SEC, which may make it more difficult for investors and securities analysts to evaluate the Company. As a result, investor confidence in the Company and the market price of its common stock may be adversely affected.

If the Company is unable to generate sufficient cash from operations, it may find it necessary to curtail operational activities.

The Company has an extensive business plan hinged on its ability to market and commercialize its products. If the Company is unable to market and/or commercialize its products, then it would not be able to proceed with its business plan or possibly to successfully develop its planned operations at all.

The proposed operations of the Company are speculative.

The success of the proposed business plan of the Company will depend to a great extent on the operations, financial condition and management of the Company. The business operations of the Company remain speculative.

21

The Company’s inability to obtain capital, use internally generated cash, or use shares of the Company’s common stock or debt to finance future expansion efforts could impair the growth and expansion of the Company’s business.

Reliance on internally generated cash or debt to finance the Company’s operations or complete business expansion efforts could substantially limit the Company’s operational and financial flexibility. The extent to which the Company will be able or willing to use shares of common stock to consummate expansions will depend on the Company’s market value from time to time and the willingness of potential sellers to accept it as full or partial payment. Using shares of common stock for this purpose also may result in significant dilution to the Company’s then existing stockholders. To the extent that the Company is unable to use common stock to make future expansions, the Company’s ability to grow through expansions may be limited by the extent to which the Company is able to raise capital for this purpose through debt or equity financings. No assurance can be given that the Company will be able to obtain the necessary capital to finance a successful expansion program or the Company’s other cash needs. If the Company is unable to obtain additional capital on acceptable terms, the Company may be required to reduce the scope of any expansion. In addition to requiring funding for expansions, the Company may need additional funds to implement the Company’s internal growth and operating strategies or to finance other aspects of the Company’s operations. The Company’s failure to (i) obtain additional capital on acceptable terms, (ii) use internally generated cash or debt to complete expansions because it significantly limits the Company’s operational or financial flexibility, or (iii) use shares of common stock to make future expansions may hinder the Company’s ability to actively pursue any expansion program the Company may decide to implement and negatively impact the Company’s stock price.

Costs incurred because the Company is a public company may affect the Company’s profitability.

As a public company, the Company incurs significant legal, accounting, and other expenses, and the Company is subject to the SEC’s rules and regulations relating to public disclosure that generally involve a substantial expenditure of financial resources. In addition, the Sarbanes-Oxley Act of 2002, as well as rules subsequently implemented by the SEC, requires changes in corporate governance practices of public companies. The Company expects that full compliance with such rules and regulations will significantly increase the Company’s legal and financial compliance costs and make some activities more time-consuming and costly, which may negatively impact the Company’s financial results. To the extent the Company’s earnings suffer as a result of the financial impact of the Company’s SEC reporting or compliance costs, the Company’s ability to develop an active trading market for the Company’s securities could be harmed.

It may be time-consuming, difficult and costly for the Company to develop and implement the internal controls and reporting procedures required by the Sarbanes-Oxley Act, when applicable to the Company. The Company’s new members of management as of the reverse merger transaction have no experience operating a public company. The Company may need to recruit, hire, train, and retain additional financial reporting, internal controls, and other personnel in order to develop and implement appropriate internal controls and reporting procedures both domestically and internationally. If the Company is unable to comply with the internal controls requirements of the Sarbanes-Oxley Act, when applicable, the Company may have material weaknesses reported in the Company’s independent accountant’s attestation report on the Company’s internal control over financial reporting required by the Sarbanes-Oxley Act.

The PRC legal system embodies uncertainties that could limit the legal protections available to the Company.

The PRC legal system is a civil law system based on written statutes. Unlike common law systems, it is a system in which decided legal cases have little precedential value. In 1979, the PRC government began to promulgate a comprehensive system of laws and regulations governing general economic and business matters. The overall effect of legislation since 1979 has been a significant enhancement of the protections afforded to various forms of foreign-invested enterprises in China. These laws, regulations, and legal requirements, however, are constantly changing, and their interpretation and enforcement involve uncertainties, which could limit the legal protections available to the Company. In addition, the Company cannot predict the effect of future developments in the PRC legal system, particularly with regard to the internet, including the promulgation of new laws, changes to existing laws, or the interpretation or enforcement thereof, or the preemption of local regulations by national laws. Furthermore, any litigation in China may be protracted and result in substantial costs and diversion of resources and management attention.

No assurance of continued market acceptance.

There is no assurance that the Company’s services or solutions will continued to meet with market acceptance. Moreover, there is no assurance that these services and solutions will continue to have any competitive advantages. Also, there is no assurance that the market reception will be positive. The Company’s industry is characterized by a large and fragmented group of competitors, and as such, there can be no guarantee that the Company will not lose business to its existing or potential new competitors.

22

The Company’s stock price may not track the price of gold or granite.

The prices of commodities fluctuate and are volatile. The Company’s share price may be adversely impacted by changes in the prices of commodities, such as gold or granite. However, the Company’s stock price may not directly track the price of commodities, as price of commodities trade independent of shares in the Company.

Because the Company is based overseas, it may be difficult for investors and others to pursue lawsuits and enforce judgments against the Company.

The Company has operations and its main business headquarters overseas. The management of the Company are primarily based in China. As a result, prospective investors may encounter difficulty in pursuing lawsuits against the Company or its management. Furthermore, judgements against the Company or its management may be challenging to enforce against these parties overseas, because of their presence outside the United States.

The management of the Company may lack experience in new lines of business or operations that the Company explores in the future.

The Company may expand into various business lines or pursue different or new operations. The Company’s management may, however, lack requisite experience in new lines of business or operations that are not presently active or contemplated by the Company.