Attached files

| file | filename |

|---|---|

| EX-32.2 - EXHIBIT 32.2 - Erin Energy Corp. | q12016exhibit_322.htm |

| EX-32.1 - EXHIBIT 32.1 - Erin Energy Corp. | q12016exhibit_321.htm |

| EX-31.2 - EXHIBIT 31.2 - Erin Energy Corp. | q12016exhibit_312.htm |

| EX-31.1 - EXHIBIT 31.1 - Erin Energy Corp. | q12016exhibit_311.htm |

| 10-Q - FORM 10-Q - Erin Energy Corp. | erin-331201610q.htm |

PROMISSORY NOTE DUE 30 SEPTEMBER 2017

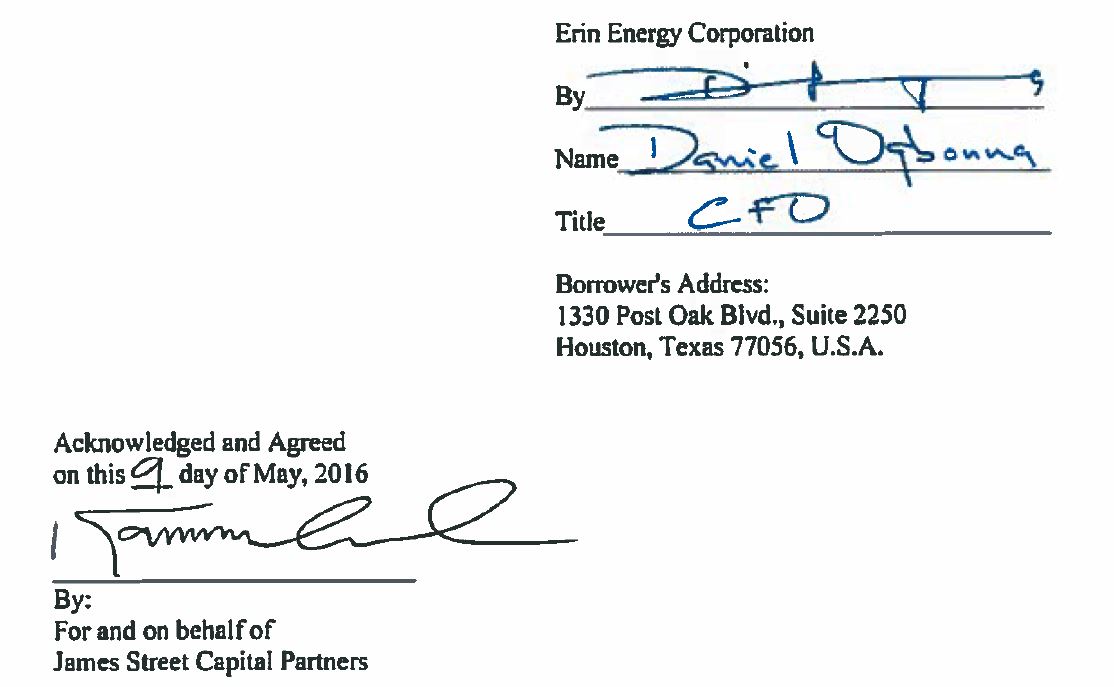

US$10,000,000 Georgetown, Cayman Islands May 9, 2016

As hereinafter provided, Erin Energy Corporation, (the “Borrower”) a Delaware corporation having its principal place of business at 1330 Post Oak Blvd., Suite 2250, Houston, Texas 77056, USA acting herein by and through its duly authorized officers, hereinafter called "Borrower" promises to pay to the order of James Street Capital Partners, (the “Lender”) a company organized and existing under the laws of the Cayman Islands, and having its registered office at P.O. Box 32338 SMB, Genesis Building, 3rd Floor, Georgetown, Grand Cayman, Cayman Islands, BWI, hereinafter called "Lender", for value received, the principal sum of TEN Million Dollars ($10,000,000) lawful money of the United States of America, or such lesser principal amount as may be deemed advanced (the "Loan"), together with interest on any and all amounts remaining unpaid hereon from time to time from the date hereof until maturity at a rate of interest equal to seven percent (7.0%) plus (ii) the LIBOR Rate from this date until paid.

The value received shall be comprised of the following:

(i) | US$3,000,000 for funds disbursed pursuant to Promissory Note dated March 24, 2016 which shall be deemed as fully settled and superseded with this note. |

(ii) | US$1,000,000 for funds disbursed pursuant to Promissory Note dated April 7, 2016 which shall be deemed as fully settled and superseded with this note. |

(iii) | Additional borrowing requests up to the sum of US$6,000,000, but not to exceed US$1,000,000 in any 60-day period, unless specifically agreed in writing by Lender. Drawdown requests shall be submitted to the Lender in a letter signed by the Borrower specifying aggregate amount of the drawdown, the date on which such payment is required, and the location and number of the Borrower’s account to which funds are to be disbursed. |

“LIBOR Rate” means, for any date, a rate per annum equal to the one month London interbank offered rate for deposits in U.S. dollars rounded upwards if necessary to the nearest one one-hundredth (1/100th) of one percent as in effect on such date (or if such date is not a Business Day, as in effect on the immediately preceding Business Day) appearing on the display designated as Reuters Screen LIBOR01 Page, or such other page as may replace LIBOR01 on that service (or such other service as may be nominated as the information vendor by the British Bankers’ Association for the purpose of displaying British Bankers’ Association interest settlement rates for U.S. dollar deposits as the composite offered rate for London interbank deposits). If the aforementioned sources of the LIBOR Rate are no longer available, then the term “LIBOR Rate” shall mean the one month London interbank offered rate for deposits in U.S. dollars rounded upwards if necessary to the nearest one one-hundredths (1/100th) of one percent as shown on the appropriate Bloomberg Financial Markets Services Screen or any successor index on such service under the heading “USD.”

Page | 1

The Borrower shall pay the principal of and accrued, but unpaid interest on this Note on the Maturity Date without limiting in any way the Borrower’s obligation to make prepayments. If any payment or prepayment of principal or interest on this Note shall become due on a day which is not a business day, such payment shall be made on the next succeeding business day and such extension of time shall in such case be included in computing interest in connection with such payment.

“Maturity Date” means September 30, 2017.

Interest on this Note shall be computed on a rate per annum based on a year of 360 days and for the actual number of days (including the first but excluding the last day) elapsed. No interest shall accrue on interest accrued hereunder except and until accrued interest has become past due.

All past due principal and past due accrued interest and all attorneys' fees due under this Note shall bear interest from the date such sums are due until paid at the rate of seven percent (7.0%) plus (ii) the LIBOR Rate from this date until paid.

Borrower may from time to time prepay all or any portion of the outstanding balance of the Loan without penalty or premium. Simultaneously with any prepayment of principal, there must also be paid all interest accrued on the amount of principal so prepaid and all other sums then due hereunder or under any instrument, document or other writing now or hereafter securing or pertaining to this Note. If the original or a copy of this Note shall be placed in the hands of an attorney for collection after the occurrence of any Event of Default hereunder, or for the purpose of being sued upon or established in any manner in any court (including, but not limited to bankruptcy or probate proceedings), or for any other purpose whatsoever in any manner connected with or pertaining to the extension of credit evidenced hereby or any of the Obligors or any property, rights or interests now or hereafter securing this Note, then, in any such event, Borrower promises to pay to the then holder of this Note all attorneys' fees, costs and expenses theretofore, then and thereafter paid or incurred by any holder of this Note in any manner connected with or pertaining to any such attempted collection or establishment or any other acts connected with or pertaining to this Note or the extension of credit evidenced hereby or any of the Obligors (as hereafter defined) or any property, rights or interests now or hereafter securing this Note.

To the maximum extent not prohibited by applicable law, all Obligors severally waive grace, demand, notice of default, notice of intent to accelerate maturity, notice that the holder hereof will not accept late payments, notice of acceleration of maturity, presentment for acceleration, presentment for payment, protest, notice of protest, dishonor or default, and diligence in taking any action with respect to any security or the collection of any sums owing hereon, and consent to and waive notice of any and all renewals, extensions, rearrangements hereof and partial payments hereon and to the release of all or any part of the security herefor or any person or entity liable hereon or herefor under any terms deemed by the holder hereof, in its sole discretion, to be adequate. Any such renewal, extension or rearrangement, or the release of any such security or person or entity, may be made without notice to any of the Obligors and without affecting any security or the liabilities and obligations of any of the Obligors which is not expressly released in writing. The exercise of any right or remedy conferred upon any holder hereof in this Note, or in any instrument, document or other writing now or hereafter securing or otherwise pertaining to this Note or any other indebtedness now or hereafter owing by any of the Obligors to any holder hereof, shall be wholly discretional with such holder, and such exercise of, or failure to exercise, any such right or remedy shall not in any manner affect, impair or diminish the obligations and liabilities of any of the Obligors, or constitute or be deemed a waiver of any such right or remedy or any other

Page | 2

past, present or future right or remedy of any holder hereof. It is further expressly agreed (without in any manner limiting the foregoing) that the acceptance of late payments or the failure to exercise the option to accelerate upon any Event of Default shall not in any manner constitute a waiver of the right to exercise the option to accelerate the maturity of this Note upon the failure to promptly pay any subsequent payment or in the event there exists or thereafter occurs any other or subsequent Event of Default, and no waiver shall be enforceable against the holder of this Note unless such waiver is expressly set forth in writing and duly executed by such holder.

This Note shall be governed by, and construed in accordance with, the laws of the Cayman Islands regardless of the laws that might otherwise govern under applicable principles of conflicts of laws thereof and Borrower submits to the non-exclusive jurisdiction of the Cayman Islands.

This Note shall be binding upon and inure to the benefit of Borrower, Lender and their respective heirs, successors, and assigns, except that Borrower may not assign or transfer any of its rights or obligations under this Note without the prior written consent of Lender.

Borrower hereby represents and warrants to Lender that neither the execution and delivery of this Note, nor the consummation of the transactions herein contemplated, nor compliance with the provisions with, or result in the breach of, or constitute a default under, any indenture, mortgage, deed of trust, agreement or other instrument or contractual obligation to which Borrower is a party or by which it or any of its property may be bound or affected.

Page | 3