Attached files

| file | filename |

|---|---|

| 8-K - 8-K - 2016 Q1 EARNINGS CALL TRANSCRIPT AND SLIDES - MOSAIC CO | a8-k2016xq1earningscalltra.htm |

| EX-99.1 - EXHIBIT 99.1 - 2016 Q1 EARNINGS CALL TRANSCRIPT - MOSAIC CO | exhibit991-2016q1earningsc.htm |

The Mosaic Company Earnings Conference Call – First Quarter 2016 May 4, 2016 Joc O’Rourke, President and Chief Executive Officer Rich Mack, Executive Vice President and Chief Financial Officer Laura Gagnon, Vice President Investor Relations

Safe Harbor Statement This document contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Such statements include, but are not limited to, statements about the Wa’ad Al Shamal Phosphate Company (also known as MWSPC) and other proposed or pending future transactions or strategic plans and other statements about future financial and operating results. Such statements are based upon the current beliefs and expectations of The Mosaic Company’s management and are subject to significant risks and uncertainties. These risks and uncertainties include but are not limited to risks and uncertainties arising from the ability of MWSPC to obtain additional planned funding in acceptable amounts and upon acceptable terms, the timely development and commencement of operations of production facilities in the Kingdom of Saudi Arabia, the future success of current plans for MWSPC and any future changes in those plans; difficulties with realization of the benefits of our long term natural gas based pricing ammonia supply agreement with CF Industries, Inc., including the risk that the cost savings initially anticipated from the agreement may not be fully realized over its term or that the price of natural gas or ammonia during the term are at levels at which the pricing is disadvantageous to Mosaic; customer defaults; the effects of Mosaic’s decisions to exit business operations or locations; the predictability and volatility of, and customer expectations about, agriculture, fertilizer, raw material, energy and transportation markets that are subject to competitive and other pressures and economic and credit market conditions; the level of inventories in the distribution channels for crop nutrients; the effect of future product innovations or development of new technologies on demand for our products; changes in foreign currency and exchange rates; international trade risks and other risks associated with Mosaic’s international operations and those of joint ventures in which Mosaic participates, including the risk that protests against natural resource companies in Peru extend to or impact the Miski Mayo mine; changes in government policy; changes in environmental and other governmental regulation, including expansion of the types and extent of water resources regulated under federal law, greenhouse gas regulation, implementation of numeric water quality standards for the discharge of nutrients into Florida waterways or efforts to reduce the flow of excess nutrients into the Mississippi River basin, the Gulf of Mexico or elsewhere; further developments in judicial or administrative proceedings, or complaints that Mosaic’s operations are adversely impacting nearby farms, business operations or properties; difficulties or delays in receiving, increased costs of or challenges to necessary governmental permits or approvals or increased financial assurance requirements; resolution of global tax audit activity; the effectiveness of Mosaic’s processes for managing its strategic priorities; adverse weather conditions affecting operations in Central Florida, the Mississippi River basin, the Gulf Coast of the United States or Canada, and including potential hurricanes, excess heat, cold, snow, rainfall or drought; actual costs of various items differing from management’s current estimates, including, among others, asset retirement, environmental remediation, reclamation or other environmental regulation, Canadian resources taxes and royalties, or the costs of the MWSPC, its existing or future funding and Mosaic’s commitments in support of such funding; reduction of Mosaic’s available cash and liquidity, and increased leverage, due to its use of cash and/or available debt capacity to fund financial assurance requirements and strategic investments; brine inflows at Mosaic’s Esterhazy, Saskatchewan, potash mine or other potash shaft mines; other accidents and disruptions involving Mosaic’s operations, including potential mine fires, floods, explosions, seismic events or releases of hazardous or volatile chemicals; and risks associated with cyber security, including reputational loss, as well as other risks and uncertainties reported from time to time in The Mosaic Company’s reports filed with the Securities and Exchange Commission. Actual results may differ from those set forth in the forward-looking statements. 2

Summary 3 Mosaic is Well Positioned to Weather the Cycle Balance sheet and operational flexibility Expect robust demand for both P&K in 2016 Not the first cycle Mosaic External Environment Strong US Dollar Elevated channel inventories Declining farm incomes Lower raw materials costs Perception of oversupply

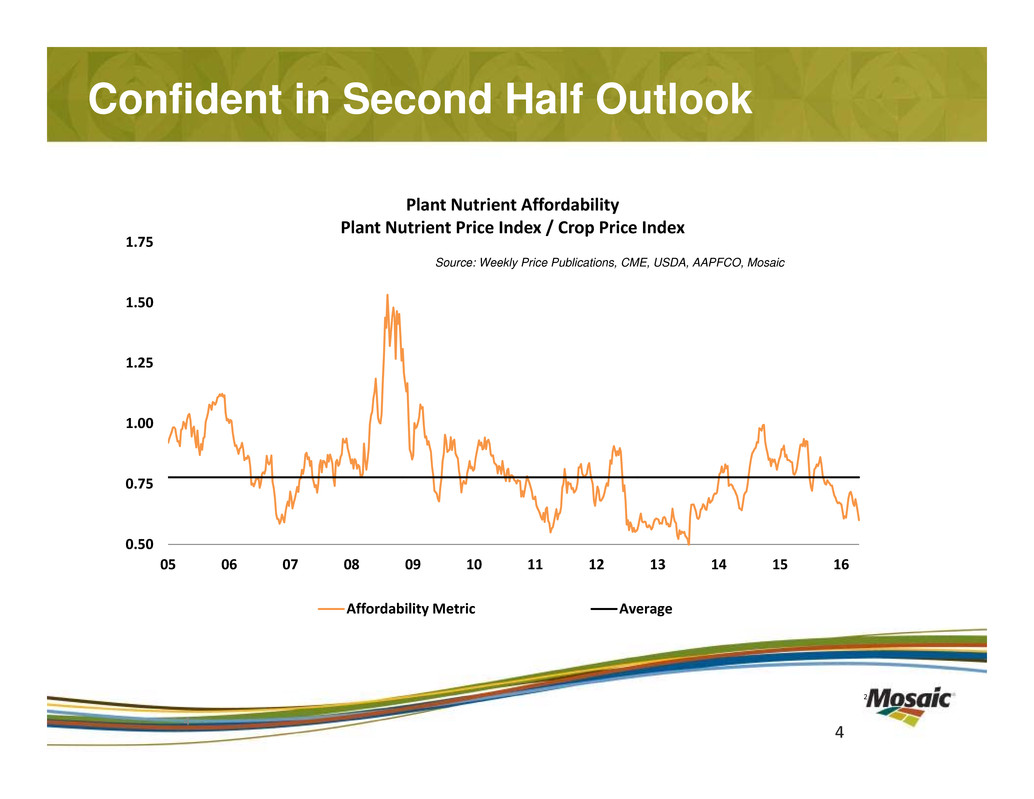

Confident in Second Half Outlook 2 4 0.50 0.75 1.00 1.25 1.50 1.75 05 06 07 08 09 10 11 12 13 14 15 16 Plant Nutrient Affordability Plant Nutrient Price Index / Crop Price Index Affordability Metric Average Source: Weekly Price Publications, CME, USDA, AAPFCO, Mosaic 4

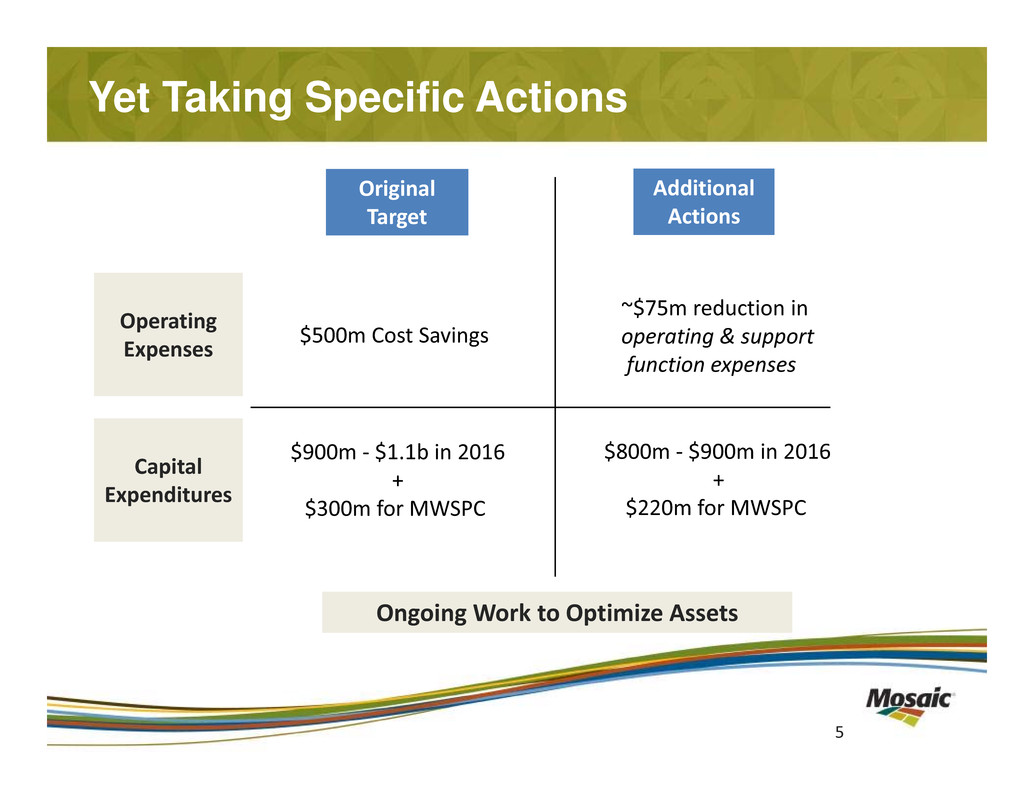

Yet Taking Specific Actions 5 Operating Expenses Capital Expenditures Original Target Additional Actions $500m Cost Savings ~$75m reduction in operating & support function expenses $900m ‐ $1.1b in 2016 + $300m for MWSPC $800m ‐ $900m in 2016 + $220m for MWSPC Ongoing Work to Optimize Assets

Financial Results Review

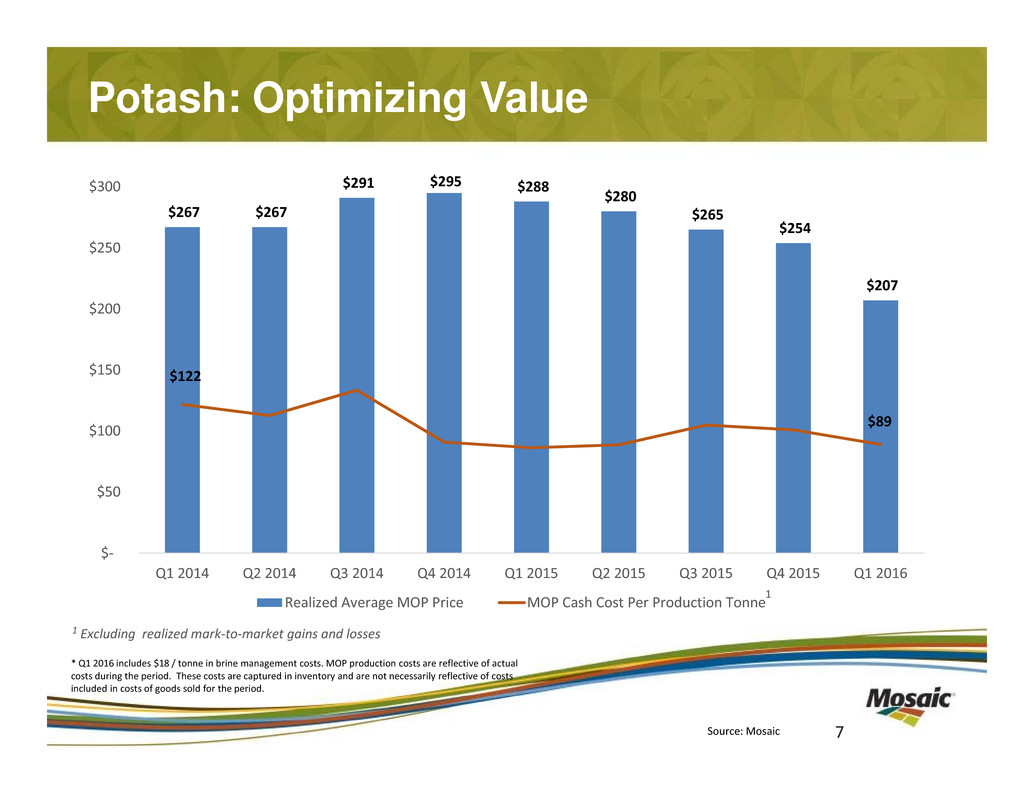

Potash: Optimizing Value 7Source: Mosaic $267 $267 $291 $295 $288 $280 $265 $254 $207 $122 $89 $‐ $50 $100 $150 $200 $250 $300 Q1 2014 Q2 2014 Q3 2014 Q4 2014 Q1 2015 Q2 2015 Q3 2015 Q4 2015 Q1 2016 Realized Average MOP Price MOP Cash Cost Per Production Tonne 1 1 Excluding realized mark‐to‐market gains and losses * Q1 2016 includes $18 / tonne in brine management costs. MOP production costs are reflective of actual costs during the period. These costs are captured in inventory and are not necessarily reflective of costs included in costs of goods sold for the period.

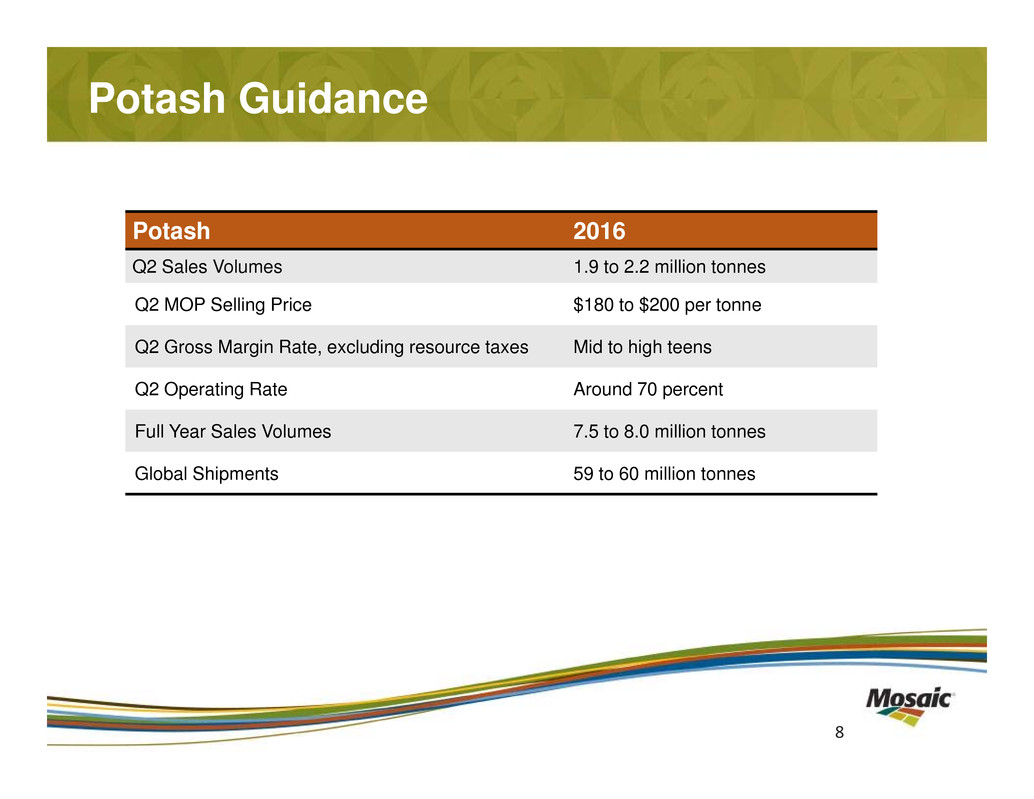

Potash Guidance Potash 2016 Q2 Sales Volumes 1.9 to 2.2 million tonnes Q2 MOP Selling Price $180 to $200 per tonne Q2 Gross Margin Rate, excluding resource taxes Mid to high teens Q2 Operating Rate Around 70 percent Full Year Sales Volumes 7.5 to 8.0 million tonnes Global Shipments 59 to 60 million tonnes 8

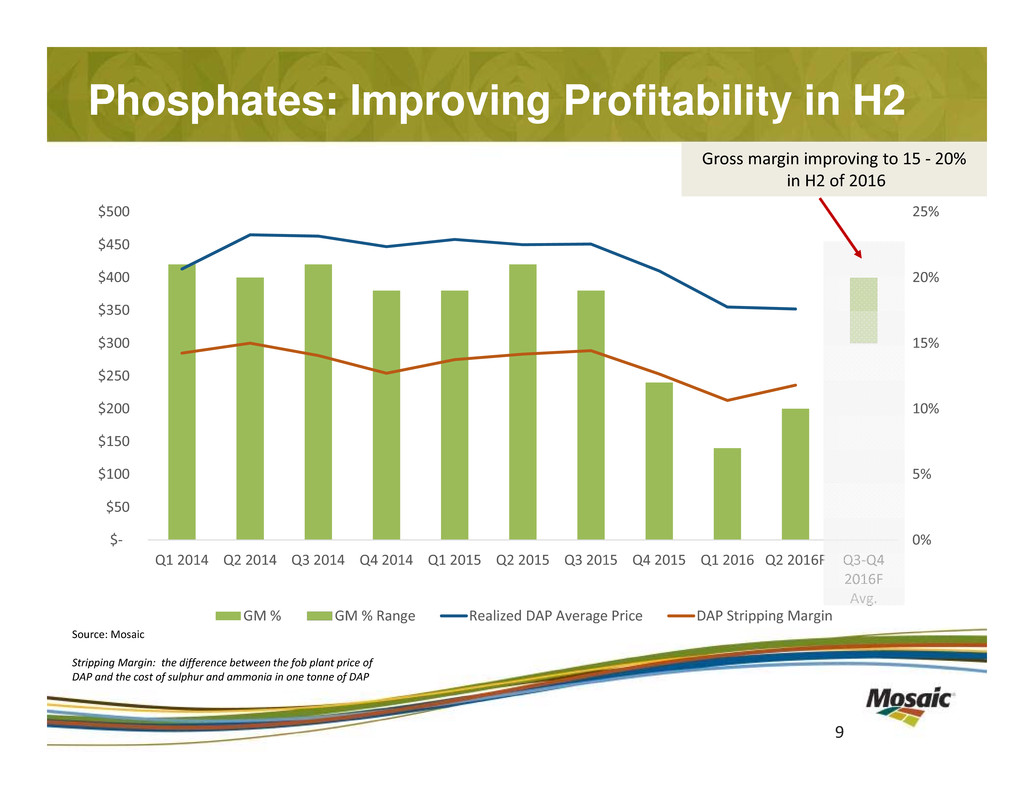

0% 5% 10% 15% 20% 25% $‐ $50 $100 $150 $200 $250 $300 $350 $400 $450 $500 Q1 2014 Q2 2014 Q3 2014 Q4 2014 Q1 2015 Q2 2015 Q3 2015 Q4 2015 Q1 2016 Q2 2016F Q3‐Q4 2016F Avg. GM % GM % Range Realized DAP Average Price DAP Stripping Margin Phosphates: Improving Profitability in H2 9 Gross margin improving to 15 ‐ 20% in H2 of 2016 Source: Mosaic Stripping Margin: the difference between the fob plant price of DAP and the cost of sulphur and ammonia in one tonne of DAP

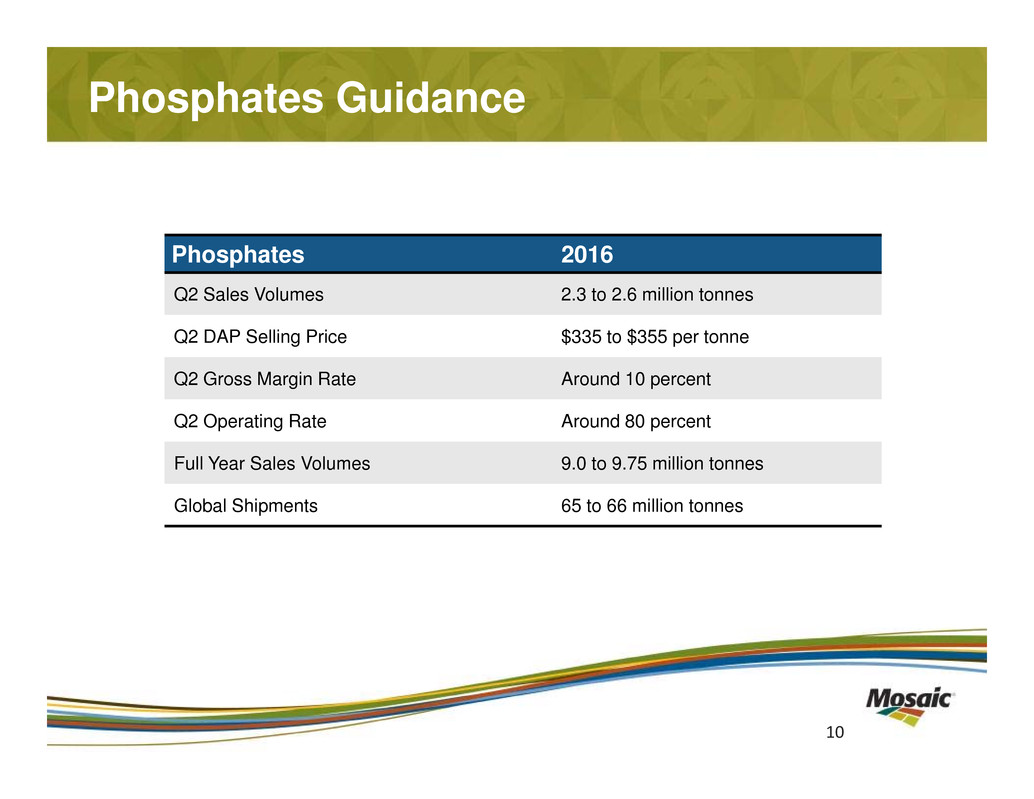

Phosphates Guidance Phosphates 2016 Q2 Sales Volumes 2.3 to 2.6 million tonnes Q2 DAP Selling Price $335 to $355 per tonne Q2 Gross Margin Rate Around 10 percent Q2 Operating Rate Around 80 percent Full Year Sales Volumes 9.0 to 9.75 million tonnes Global Shipments 65 to 66 million tonnes 10

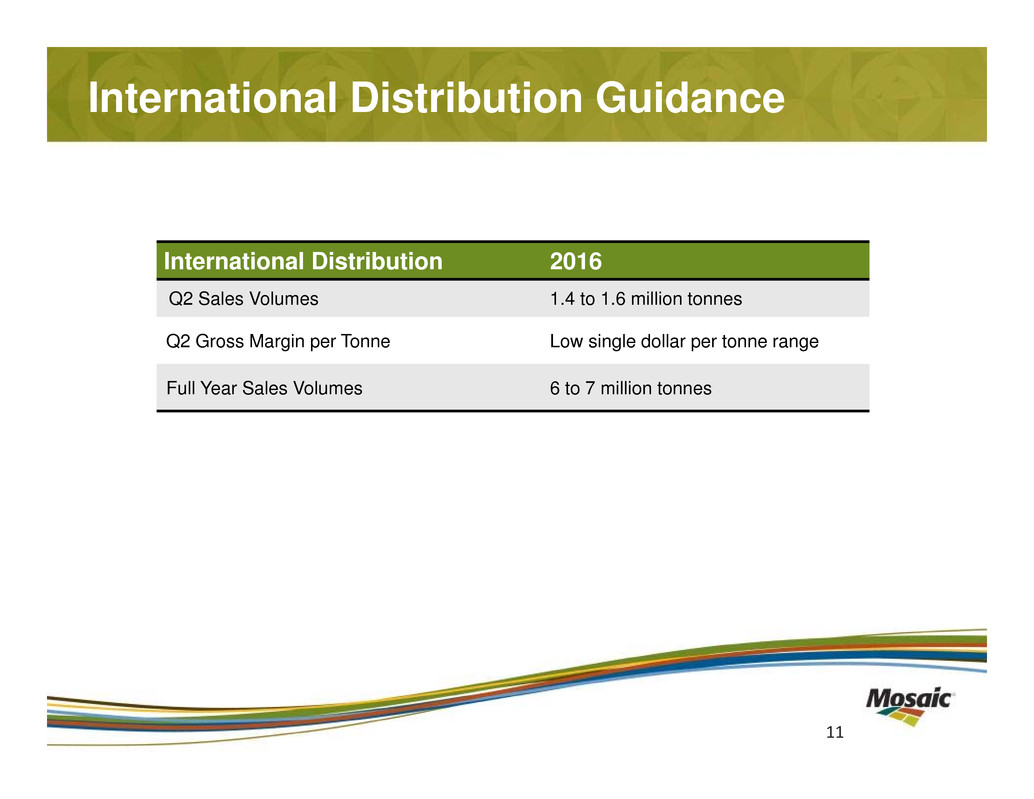

International Distribution Guidance International Distribution 2016 Q2 Sales Volumes 1.4 to 1.6 million tonnes Q2 Gross Margin per Tonne Low single dollar per tonne range Full Year Sales Volumes 6 to 7 million tonnes 11

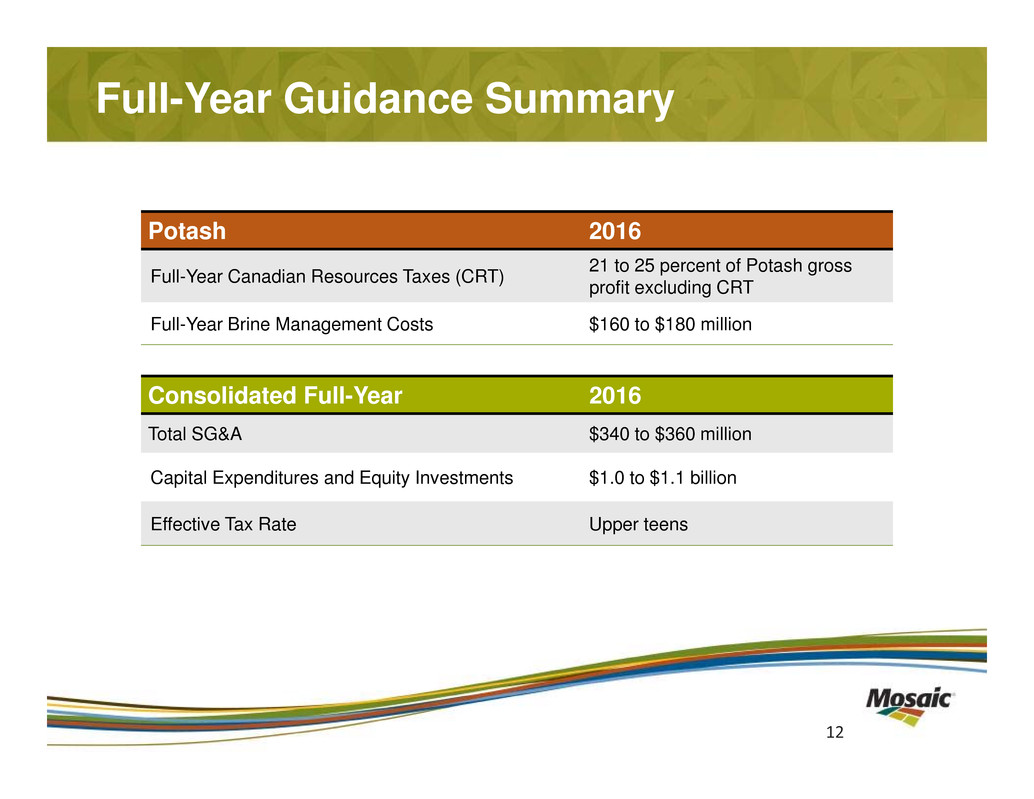

Full-Year Guidance Summary Consolidated Full-Year 2016 Total SG&A $340 to $360 million Capital Expenditures and Equity Investments $1.0 to $1.1 billion Effective Tax Rate Upper teens 12 Potash 2016 Full-Year Canadian Resources Taxes (CRT) 21 to 25 percent of Potash gross profit excluding CRT Full-Year Brine Management Costs $160 to $180 million

Closing Commentary

Thank You The Mosaic Company Earnings Conference Call – First Quarter 2016 May 4, 2016

Appendix

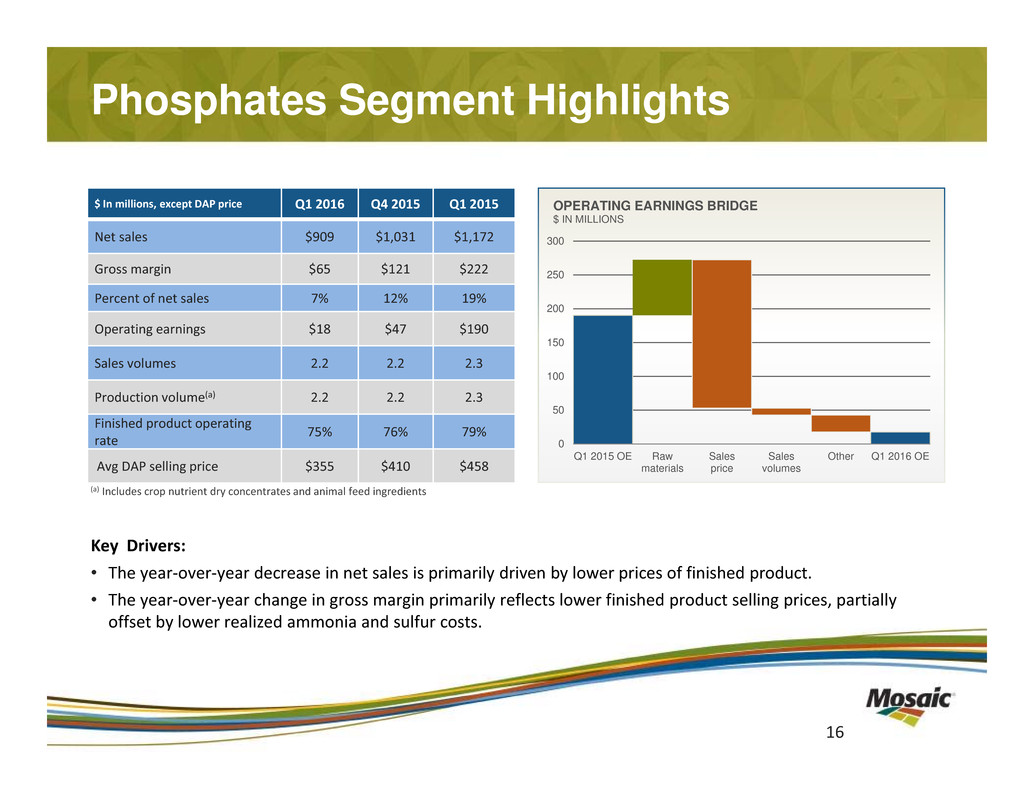

Phosphates Segment Highlights Key Drivers: • The year‐over‐year decrease in net sales is primarily driven by lower prices of finished product. • The year‐over‐year change in gross margin primarily reflects lower finished product selling prices, partially offset by lower realized ammonia and sulfur costs. $ In millions, except DAP price Q1 2016 Q4 2015 Q1 2015 Net sales $909 $1,031 $1,172 Gross margin $65 $121 $222 Percent of net sales 7% 12% 19% Operating earnings $18 $47 $190 Sales volumes 2.2 2.2 2.3 Production volume(a) 2.2 2.2 2.3 Finished product operating rate 75% 76% 79% Avg DAP selling price $355 $410 $458 (a) Includes crop nutrient dry concentrates and animal feed ingredients 0 50 100 150 200 250 300 Q1 2015 OE Raw materials Sales price Sales volumes Other Q1 2016 OE OPERATING EARNINGS BRIDGE $ IN MILLIONS 16

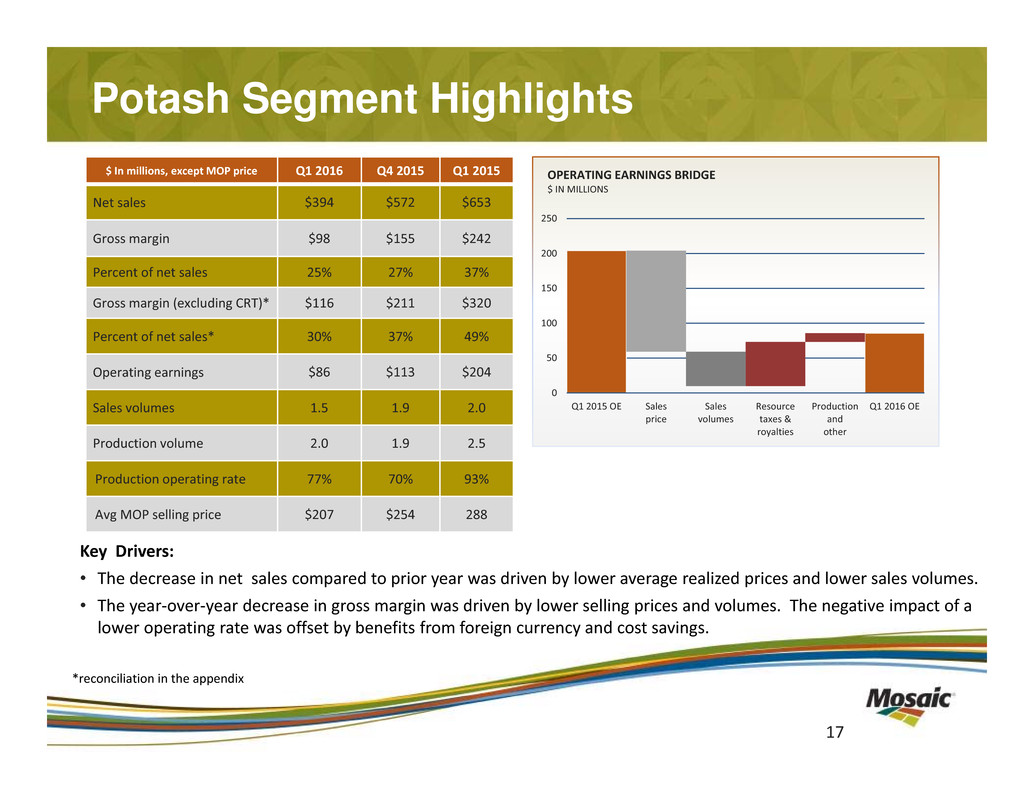

Potash Segment Highlights Key Drivers: • The decrease in net sales compared to prior year was driven by lower average realized prices and lower sales volumes. • The year‐over‐year decrease in gross margin was driven by lower selling prices and volumes. The negative impact of a lower operating rate was offset by benefits from foreign currency and cost savings. 17 $ In millions, except MOP price Q1 2016 Q4 2015 Q1 2015 Net sales $394 $572 $653 Gross margin $98 $155 $242 Percent of net sales 25% 27% 37% Gross margin (excluding CRT)* $116 $211 $320 Percent of net sales* 30% 37% 49% Operating earnings $86 $113 $204 Sales volumes 1.5 1.9 2.0 Production volume 2.0 1.9 2.5 Production operating rate 77% 70% 93% Avg MOP selling price $207 $254 288 0 50 100 150 200 250 Q1 2015 OE Sales price Sales volumes Resource taxes & royalties Production and other Q1 2016 OE OPERATING EARNINGS BRIDGE $ IN MILLIONS *reconciliation in the appendix

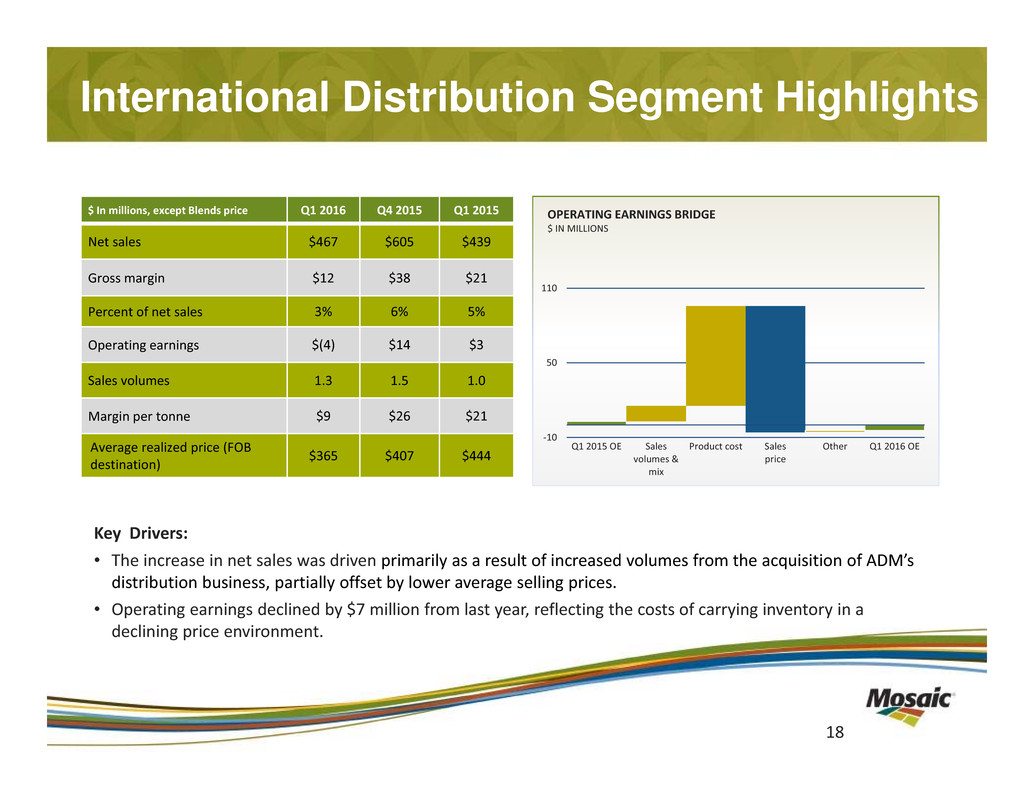

International Distribution Segment Highlights Key Drivers: • The increase in net sales was driven primarily as a result of increased volumes from the acquisition of ADM’s distribution business, partially offset by lower average selling prices. • Operating earnings declined by $7 million from last year, reflecting the costs of carrying inventory in a declining price environment. 18 $ In millions, except Blends price Q1 2016 Q4 2015 Q1 2015 Net sales $467 $605 $439 Gross margin $12 $38 $21 Percent of net sales 3% 6% 5% Operating earnings $(4) $14 $3 Sales volumes 1.3 1.5 1.0 Margin per tonne $9 $26 $21 Average realized price (FOB destination) $365 $407 $444 ‐10 50 110 Q1 2015 OE Sales volumes & mix Product cost Sales price Other Q1 2016 OE OPERATING EARNINGS BRIDGE $ IN MILLIONS

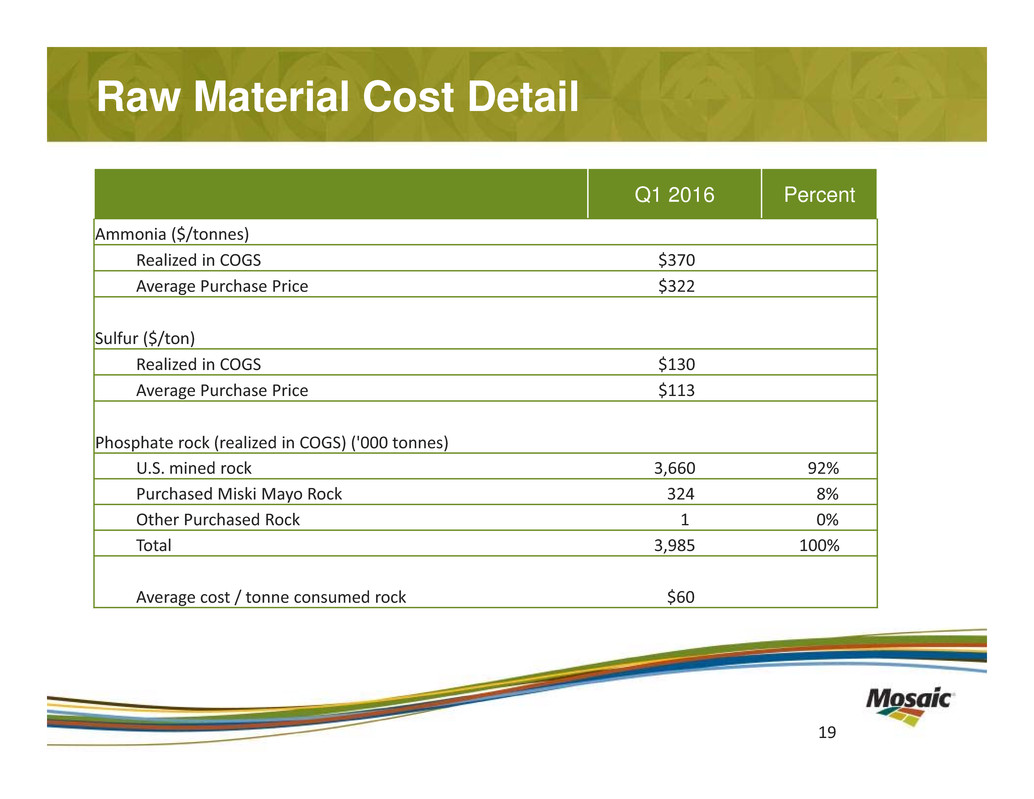

Q1 2016 Percent Ammonia ($/tonnes) Realized in COGS $370 Average Purchase Price $322 Sulfur ($/ton) Realized in COGS $130 Average Purchase Price $113 Phosphate rock (realized in COGS) ('000 tonnes) U.S. mined rock 3,660 92% Purchased Miski Mayo Rock 324 8% Other Purchased Rock 1 0% Total 3,985 100% Average cost / tonne consumed rock $60 Raw Material Cost Detail 19

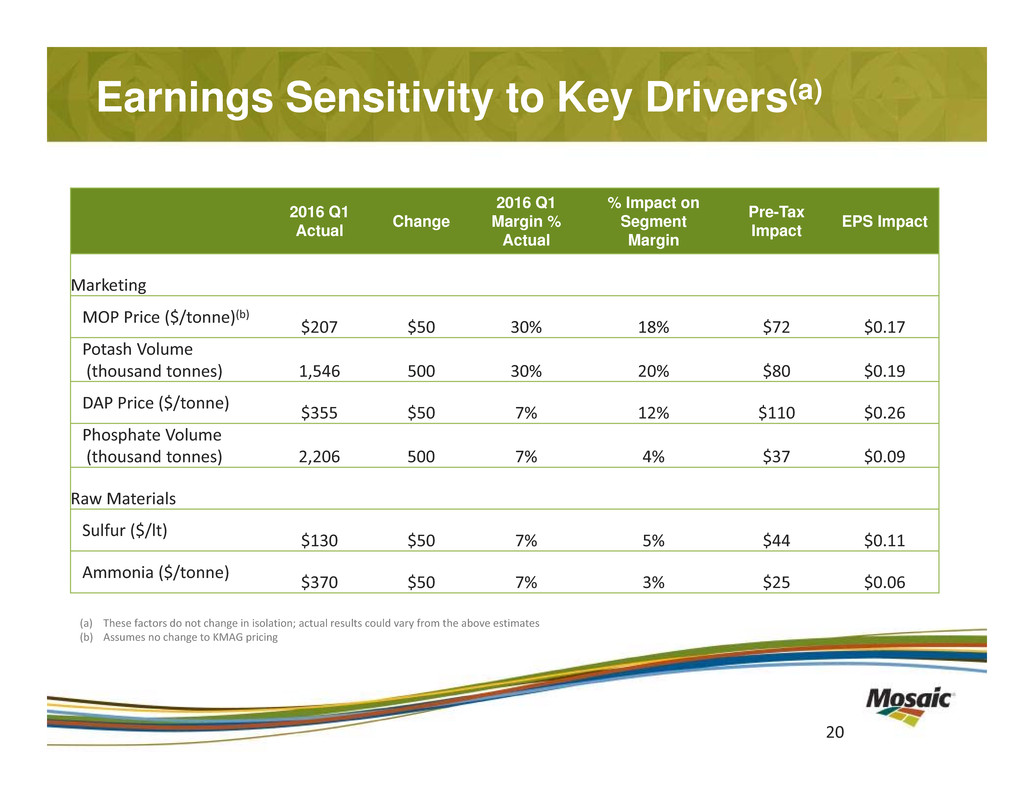

(a) These factors do not change in isolation; actual results could vary from the above estimates (b) Assumes no change to KMAG pricing Earnings Sensitivity to Key Drivers(a) 20 2016 Q1 Actual Change 2016 Q1 Margin % Actual % Impact on Segment Margin Pre-Tax Impact EPS Impact Marketing MOP Price ($/tonne)(b) $207 $50 30% 18% $72 $0.17 Potash Volume (thousand tonnes) 1,546 500 30% 20% $80 $0.19 DAP Price ($/tonne) $355 $50 7% 12% $110 $0.26 Phosphate Volume (thousand tonnes) 2,206 500 7% 4% $37 $0.09 Raw Materials Sulfur ($/lt) $130 $50 7% 5% $44 $0.11 Ammonia ($/tonne) $370 $50 7% 3% $25 $0.06

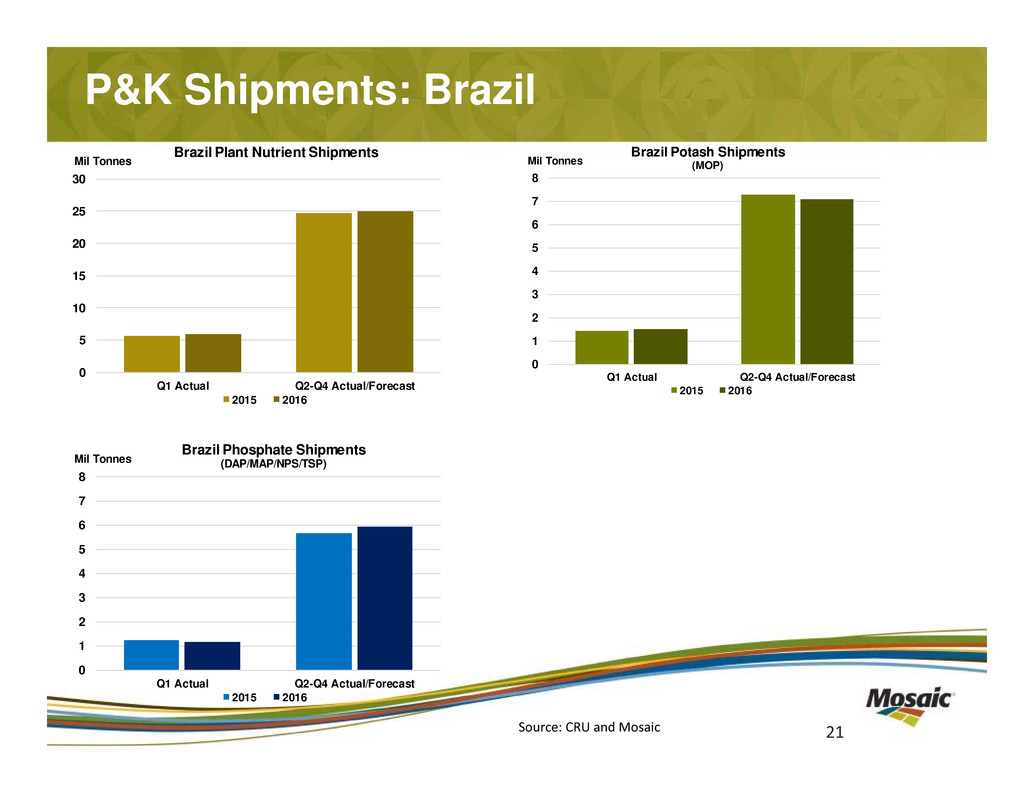

P&K Shipments: Brazil 0 5 10 15 20 25 30 Q1 Actual Q2-Q4 Actual/Forecast Mil Tonnes Brazil Plant Nutrient Shipments 2015 2016 0 1 2 3 4 5 6 7 8 Q1 Actual Q2-Q4 Actual/Forecast Mil Tonnes Brazil Phosphate Shipments (DAP/MAP/NPS/TSP) 2015 2016 0 1 2 3 4 5 6 7 8 Q1 Actual Q2-Q4 Actual/Forecast Mil Tonnes Brazil Potash Shipments (MOP) 2015 2016 21Source: CRU and Mosaic

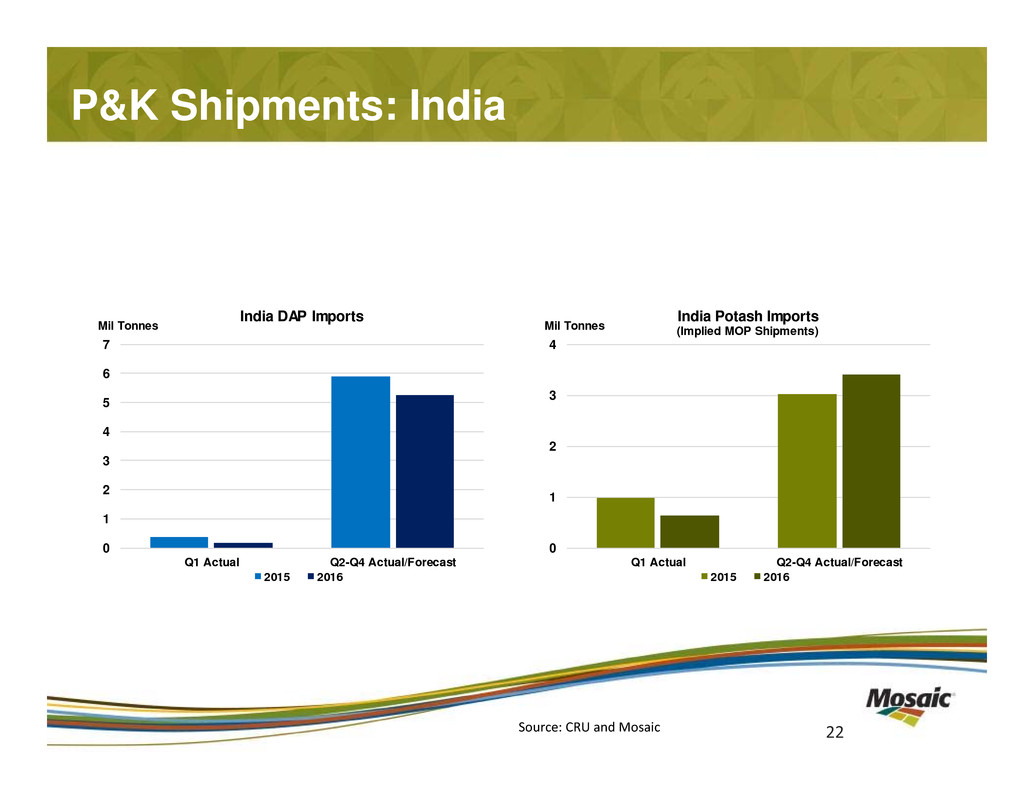

P&K Shipments: India 0 1 2 3 4 5 6 7 Q1 Actual Q2-Q4 Actual/Forecast Mil Tonnes India DAP Imports 2015 2016 0 1 2 3 4 Q1 Actual Q2-Q4 Actual/Forecast Mil Tonnes India Potash Imports (Implied MOP Shipments) 2015 2016 22Source: CRU and Mosaic

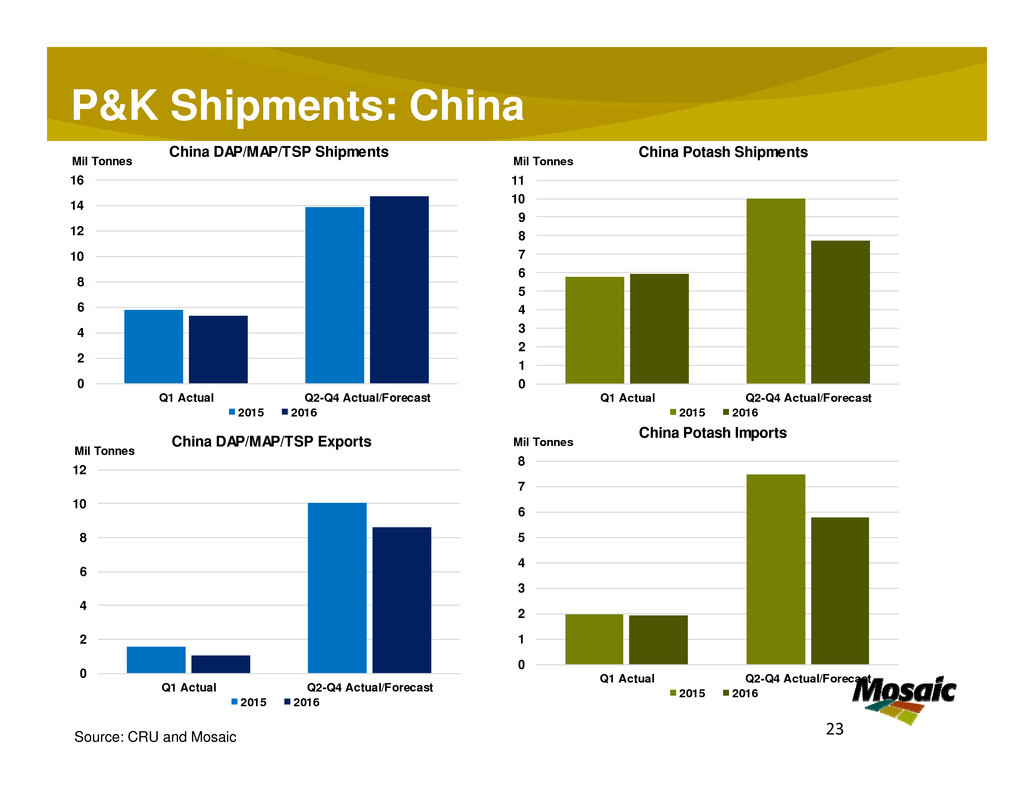

P&K Shipments: China 0 2 4 6 8 10 12 14 16 Q1 Actual Q2-Q4 Actual/Forecast Mil Tonnes China DAP/MAP/TSP Shipments 2015 2016 0 2 4 6 8 10 12 Q1 Actual Q2-Q4 Actual/Forecast Mil Tonnes China DAP/MAP/TSP Exports 2015 2016 0 1 2 3 4 5 6 7 8 9 10 11 Q1 Actual Q2-Q4 Actual/Forecast Mil Tonnes China Potash Shipments 2015 2016 0 1 2 3 4 5 6 7 8 Q1 Actual Q2-Q4 Actual/Forecast Mil Tonnes China Potash Imports 2015 2016 23Source: CRU and Mosaic

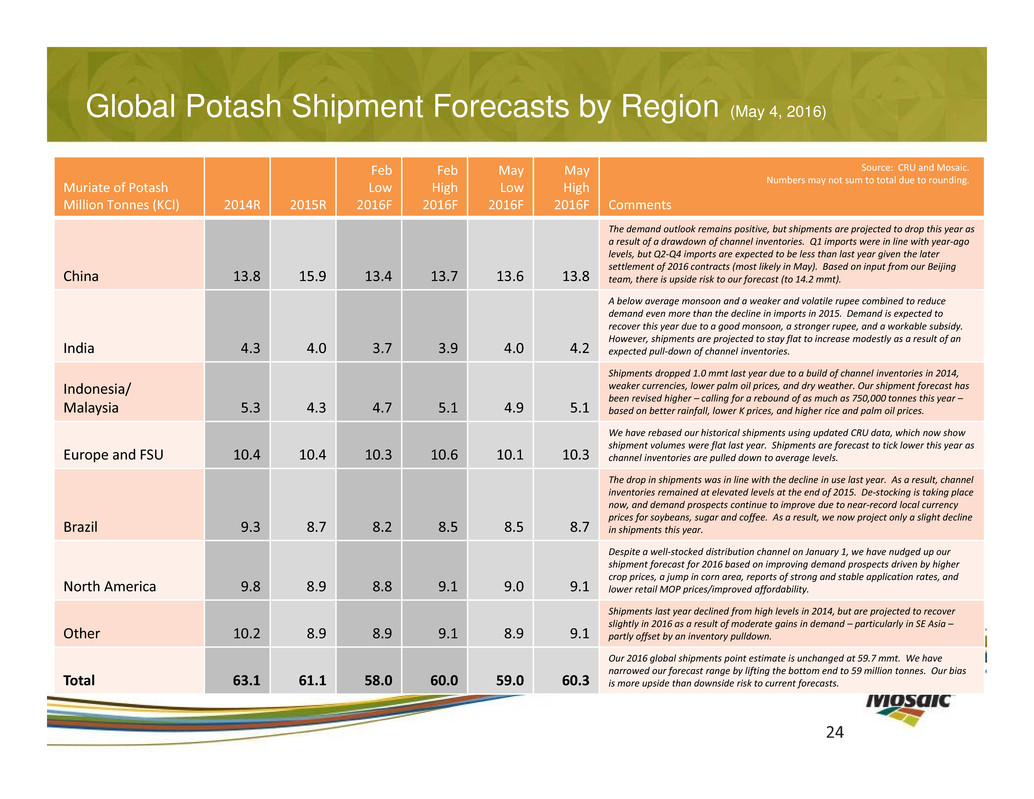

Global Potash Shipment Forecasts by Region (May 4, 2016) Muriate of Potash Million Tonnes (KCl) 2014R 2015R Feb Low 2016F Feb High 2016F May Low 2016F May High 2016F Comments China 13.8 15.9 13.4 13.7 13.6 13.8 The demand outlook remains positive, but shipments are projected to drop this year as a result of a drawdown of channel inventories. Q1 imports were in line with year‐ago levels, but Q2‐Q4 imports are expected to be less than last year given the later settlement of 2016 contracts (most likely in May). Based on input from our Beijing team, there is upside risk to our forecast (to 14.2 mmt). India 4.3 4.0 3.7 3.9 4.0 4.2 A below average monsoon and a weaker and volatile rupee combined to reduce demand even more than the decline in imports in 2015. Demand is expected to recover this year due to a good monsoon, a stronger rupee, and a workable subsidy. However, shipments are projected to stay flat to increase modestly as a result of an expected pull‐down of channel inventories. Indonesia/ Malaysia 5.3 4.3 4.7 5.1 4.9 5.1 Shipments dropped 1.0 mmt last year due to a build of channel inventories in 2014, weaker currencies, lower palm oil prices, and dry weather. Our shipment forecast has been revised higher – calling for a rebound of as much as 750,000 tonnes this year – based on better rainfall, lower K prices, and higher rice and palm oil prices. Europe and FSU 10.4 10.4 10.3 10.6 10.1 10.3 We have rebased our historical shipments using updated CRU data, which now show shipment volumes were flat last year. Shipments are forecast to tick lower this year as channel inventories are pulled down to average levels. Brazil 9.3 8.7 8.2 8.5 8.5 8.7 The drop in shipments was in line with the decline in use last year. As a result, channel inventories remained at elevated levels at the end of 2015. De‐stocking is taking place now, and demand prospects continue to improve due to near‐record local currency prices for soybeans, sugar and coffee. As a result, we now project only a slight decline in shipments this year. North America 9.8 8.9 8.8 9.1 9.0 9.1 Despite a well‐stocked distribution channel on January 1, we have nudged up our shipment forecast for 2016 based on improving demand prospects driven by higher crop prices, a jump in corn area, reports of strong and stable application rates, and lower retail MOP prices/improved affordability. Other 10.2 8.9 8.9 9.1 8.9 9.1 Shipments last year declined from high levels in 2014, but are projected to recover slightly in 2016 as a result of moderate gains in demand – particularly in SE Asia – partly offset by an inventory pulldown. Total 63.1 61.1 58.0 60.0 59.0 60.3 Our 2016 global shipments point estimate is unchanged at 59.7 mmt. We have narrowed our forecast range by lifting the bottom end to 59 million tonnes. Our bias is more upside than downside risk to current forecasts. Source: CRU and Mosaic. Numbers may not sum to total due to rounding. 24

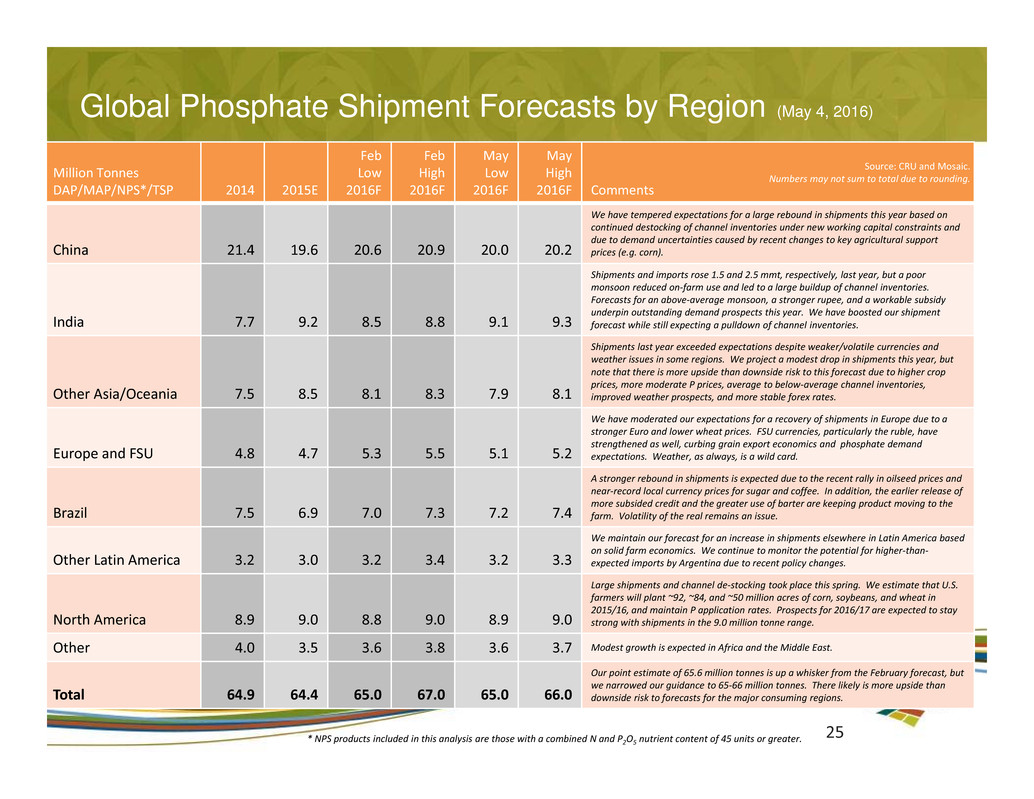

Global Phosphate Shipment Forecasts by Region (May 4, 2016) Million Tonnes DAP/MAP/NPS*/TSP 2014 2015E Feb Low 2016F Feb High 2016F May Low 2016F May High 2016F Comments China 21.4 19.6 20.6 20.9 20.0 20.2 We have tempered expectations for a large rebound in shipments this year based on continued destocking of channel inventories under new working capital constraints and due to demand uncertainties caused by recent changes to key agricultural support prices (e.g. corn). India 7.7 9.2 8.5 8.8 9.1 9.3 Shipments and imports rose 1.5 and 2.5 mmt, respectively, last year, but a poor monsoon reduced on‐farm use and led to a large buildup of channel inventories. Forecasts for an above‐average monsoon, a stronger rupee, and a workable subsidy underpin outstanding demand prospects this year. We have boosted our shipment forecast while still expecting a pulldown of channel inventories. Other Asia/Oceania 7.5 8.5 8.1 8.3 7.9 8.1 Shipments last year exceeded expectations despite weaker/volatile currencies and weather issues in some regions. We project a modest drop in shipments this year, but note that there is more upside than downside risk to this forecast due to higher crop prices, more moderate P prices, average to below‐average channel inventories, improved weather prospects, and more stable forex rates. Europe and FSU 4.8 4.7 5.3 5.5 5.1 5.2 We have moderated our expectations for a recovery of shipments in Europe due to a stronger Euro and lower wheat prices. FSU currencies, particularly the ruble, have strengthened as well, curbing grain export economics and phosphate demand expectations. Weather, as always, is a wild card. Brazil 7.5 6.9 7.0 7.3 7.2 7.4 A stronger rebound in shipments is expected due to the recent rally in oilseed prices and near‐record local currency prices for sugar and coffee. In addition, the earlier release of more subsided credit and the greater use of barter are keeping product moving to the farm. Volatility of the real remains an issue. Other Latin America 3.2 3.0 3.2 3.4 3.2 3.3 We maintain our forecast for an increase in shipments elsewhere in Latin America based on solid farm economics. We continue to monitor the potential for higher‐than‐ expected imports by Argentina due to recent policy changes. North America 8.9 9.0 8.8 9.0 8.9 9.0 Large shipments and channel de‐stocking took place this spring. We estimate that U.S. farmers will plant ~92, ~84, and ~50 million acres of corn, soybeans, and wheat in 2015/16, and maintain P application rates. Prospects for 2016/17 are expected to stay strong with shipments in the 9.0 million tonne range. Other 4.0 3.5 3.6 3.8 3.6 3.7 Modest growth is expected in Africa and the Middle East. Total 64.9 64.4 65.0 67.0 65.0 66.0 Our point estimate of 65.6 million tonnes is up a whisker from the February forecast, but we narrowed our guidance to 65‐66 million tonnes. There likely is more upside than downside risk to forecasts for the major consuming regions. Source: CRU and Mosaic. Numbers may not sum to total due to rounding. * NPS products included in this analysis are those with a combined N and P2O5 nutrient content of 45 units or greater. 25

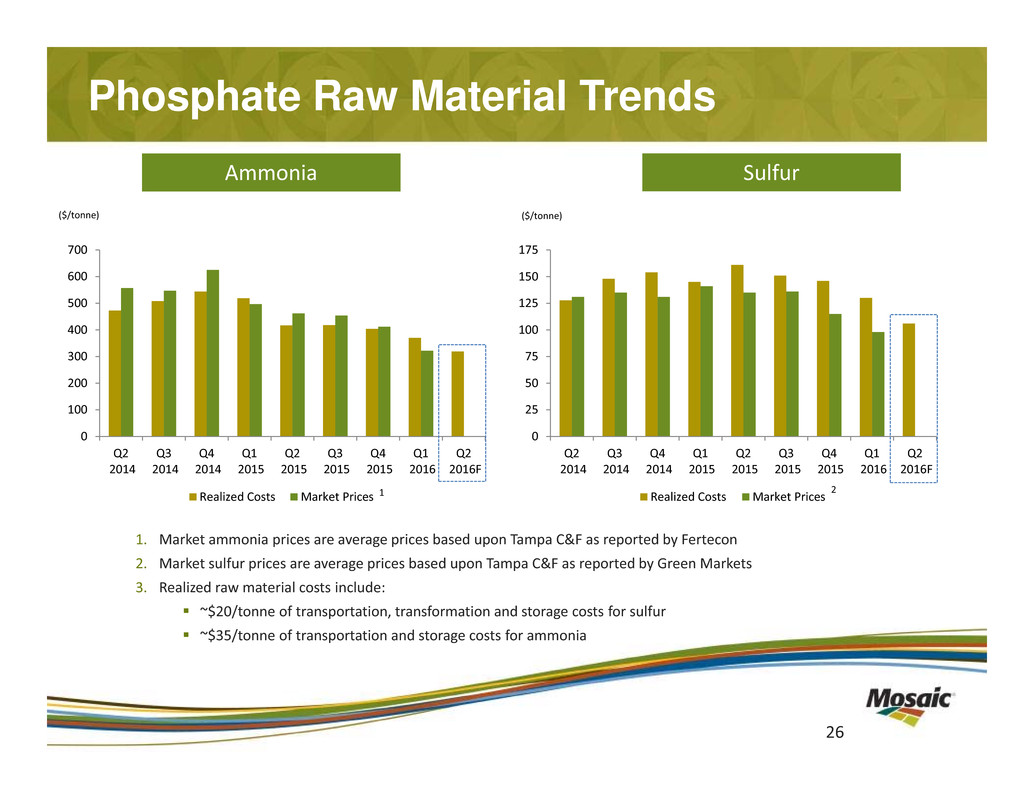

0 25 50 75 100 125 150 175 Q2 2014 Q3 2014 Q4 2014 Q1 2015 Q2 2015 Q3 2015 Q4 2015 Q1 2016 Q2 2016F Realized Costs Market Prices 0 100 200 300 400 500 600 700 Q2 2014 Q3 2014 Q4 2014 Q1 2015 Q2 2015 Q3 2015 Q4 2015 Q1 2016 Q2 2016F Realized Costs Market Prices Phosphate Raw Material Trends Ammonia Sulfur ($/tonne) ($/tonne) 1. Market ammonia prices are average prices based upon Tampa C&F as reported by Fertecon 2. Market sulfur prices are average prices based upon Tampa C&F as reported by Green Markets 3. Realized raw material costs include: ~$20/tonne of transportation, transformation and storage costs for sulfur ~$35/tonne of transportation and storage costs for ammonia 26 1 2

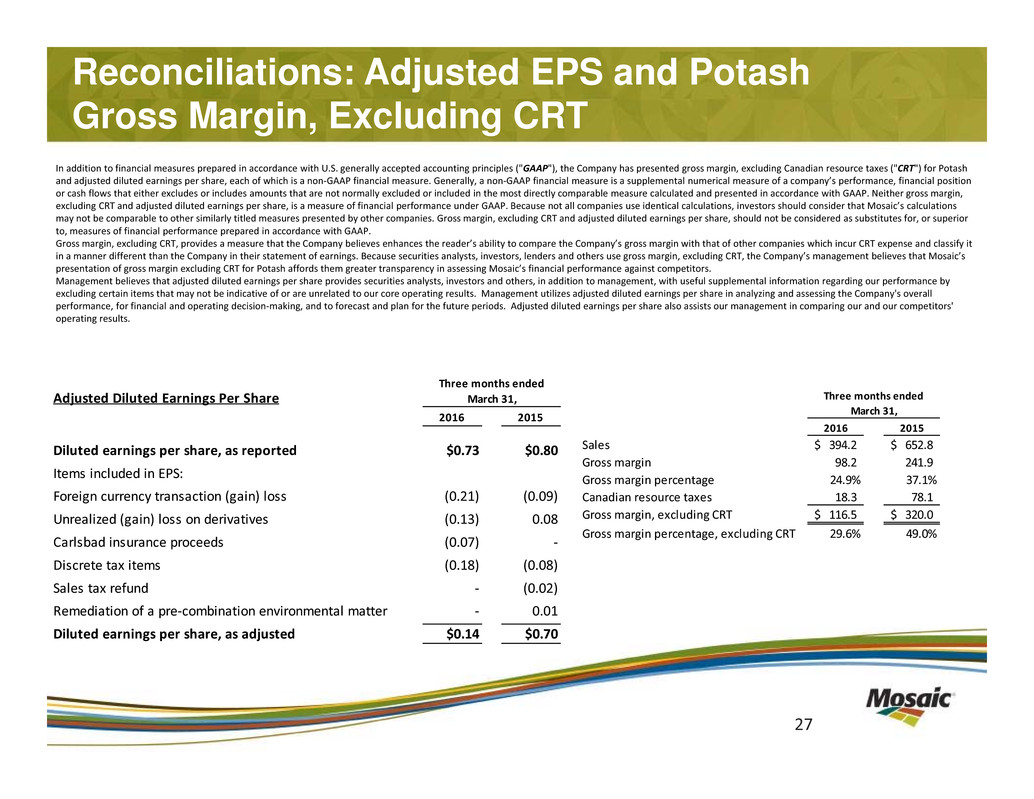

Reconciliations: Adjusted EPS and Potash Gross Margin, Excluding CRT 27 In addition to financial measures prepared in accordance with U.S. generally accepted accounting principles ("GAAP"), the Company has presented gross margin, excluding Canadian resource taxes ("CRT") for Potash and adjusted diluted earnings per share, each of which is a non‐GAAP financial measure. Generally, a non‐GAAP financial measure is a supplemental numerical measure of a company’s performance, financial position or cash flows that either excludes or includes amounts that are not normally excluded or included in the most directly comparable measure calculated and presented in accordance with GAAP. Neither gross margin, excluding CRT and adjusted diluted earnings per share, is a measure of financial performance under GAAP. Because not all companies use identical calculations, investors should consider that Mosaic’s calculations may not be comparable to other similarly titled measures presented by other companies. Gross margin, excluding CRT and adjusted diluted earnings per share, should not be considered as substitutes for, or superior to, measures of financial performance prepared in accordance with GAAP. Gross margin, excluding CRT, provides a measure that the Company believes enhances the reader’s ability to compare the Company’s gross margin with that of other companies which incur CRT expense and classify it in a manner different than the Company in their statement of earnings. Because securities analysts, investors, lenders and others use gross margin, excluding CRT, the Company’s management believes that Mosaic’s presentation of gross margin excluding CRT for Potash affords them greater transparency in assessing Mosaic’s financial performance against competitors. Management believes that adjusted diluted earnings per share provides securities analysts, investors and others, in addition to management, with useful supplemental information regarding our performance by excluding certain items that may not be indicative of or are unrelated to our core operating results. Management utilizes adjusted diluted earnings per share in analyzing and assessing the Company's overall performance, for financial and operating decision‐making, and to forecast and plan for the future periods. Adjusted diluted earnings per share also assists our management in comparing our and our competitors' operating results. 2016 2015 Sales 394.2$ 652.8$ Gross margin 98.2 241.9 Gross margin percentage 24.9% 37.1% Canadian resource taxes 18.3 78.1 Gross margin, excluding CRT 116.5$ 320.0$ Gross margin percentage, excluding CRT 29.6% 49.0% Three months ended March 31, Adjusted Diluted Earnings Per Share 2016 2015 Diluted earnings per share, as reported $0.73 $0.80 Items included in EPS: Foreign currency transaction (gain) loss (0.21) (0.09) Unrealized (gain) loss on derivatives (0.13) 0.08 Carlsbad insurance proceeds (0.07) ‐ Discrete tax items (0.18) (0.08) Sales tax refund ‐ (0.02) Remediation of a pre‐combination environmental matter ‐ 0.01 Diluted earnings per share, as adjusted $0.14 $0.70 Three months ended March 31,