Attached files

Exhibit 10.09

BETWEEN

THE DEMOCRATIC REPUBLIC OF SAO TOME AND PRINCIPE

REPRESENTED BY THE

AGENCIA NACIONAL DO PETROLEO DE SAO TOME E PRINCIPE

AND

ERHC ENERGY EEZ, LDA

FOR

BLOCK "11"

TABLE OF CONTENTS

|

Clause |

Title |

Page Number |

|

1. |

DEFINITIONS AND INTERPRETATION............................................................................................. |

2 |

|

2. |

BONUSES AND SOCIAL PROJECTS................................................................................................. |

7 |

|

3. |

SCOPE............................................................................................................................................... |

8 |

|

4. |

TERM................................................................................................................................................. |

9 |

|

5. |

COMMERCIAL DISCOVERY AND DECLARATION OF COMMERCIALITY............................................. |

9 |

|

6. |

RELINQUISHMENT OF AREAS......................................................................................................... |

10 |

|

7. |

MINIMUM WORK PROGRAM AND BUDGET..................................................................................... |

11 |

|

8. |

STATE PARTICIPATION................................................................................................................... |

14 |

|

9. |

RIGHTS AND OBLIGATIONS OF THE PARTIES................................................................................. |

15 |

|

10. |

RECOVERY OF OPERATING COSTS AND SHARING OF PETROLEUM PRODUCTION..................... |

17 |

|

11. |

VALUATION OF CRUDE OIL............................................................................................................. |

20 |

|

12. |

PAYMENTS..................................................................................................................................... |

22 |

|

13. |

TITLE TO EQUIPMENT I DECOMMISSIONING................................................................................... |

23 |

|

14. |

EMPLOYMENT AND TRAINING OF NATIONALS OF THE STATE....................................................... |

25 |

|

15. |

BOOKS AND ACCOUNTS, AUDIT AND OVERHEAD CHARGES......................................................... |

26 |

|

16. |

TAXES AND CUSTOMS................................................................................................................... |

28 |

|

17. |

INSURANCE..................................................................................................................................... |

28 |

|

18. |

CONFIDENTIALITY AND PUBLIC ANNOUNCEMENTS....................................................................... |

29 |

|

19. |

ASSIGNMENT................................................................................................................................... |

31 |

|

20. |

TERMINATION................................................................................................................................. |

32 |

|

21. |

FORCE MAJEURE............................................................................................................................. |

33 |

|

22. |

LAWS AND REGULATIONS............................................................................................................. |

34 |

|

23. |

NATURAL GAS................................................................................................................................. |

34 |

|

24. |

REPRESENTATIONS AND WARRANTIES......................................................................................... |

35 |

|

25. |

CONCILIATION AND ARBITRATION................................................................................................... |

36 |

|

26. |

EFFECTIVE DATE............................................................................................................................. |

38 |

|

27. |

REVIEW I RE-NEGOTIATION OF CONTRACT AND FISCAL TERMS................................................... |

38 |

|

28. |

OPERATOR..................................................................................................................................... |

38 |

|

29. |

CONFLICT OF INTERESTS............................................................................................................... |

39 |

|

30. |

NOTICES......................................................................................................................................... |

39 |

|

31. |

LIABILITY......................................................................................................................................... |

40 |

|

32. |

MISCELLANEOUS............................................................................................................................. |

40 |

|

|

|

|

|

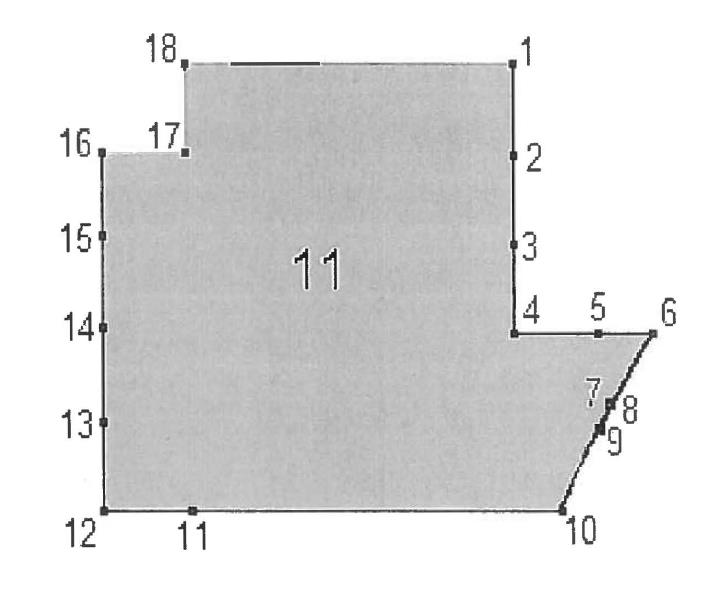

SCHEDULE 1 CONTRACT AREA............................................................................................................... |

42 | |

|

SCHEDULE 2 ACCOUNTING PROCEDURE................................................................................................. |

43 | |

|

SCHEDULE 3 ALLOCATION AND LIFTING PROCEDURE PRINCIPLES....................................................... |

52 | |

|

SCHEDULE 4 PROCUREMENT AND PROJ ECT IMPLEMENTATION PROCEDURES................................... |

56 | |

|

SCHEDULE 5 SALE OF ASSETS PROCEDURE........................................................................................... |

63 | |

|

SCHEDULE 6 FORM OF PARENTAL GUA RANTEE................................................................................... |

64 | |

|

SCHEDULE 7 FORM OF PERFORM ANCE BOND....................................................................................... |

68 | |

1

THIS PRODUCTION SHARING CONTRACT, is made and entered into on this 23rd day of July 2014 by and between:

|

(1) |

THE DEMOCRATIC REPUBLIC OF SAO TOME AND PRINCIPE represented by the Agencia Nacional do Petroleo de Sao Tome e Principe and |

|

(2) |

ERHC ENERGY EEZ, LDA, a company organized and existing under the laws of the Democratic Republic of Sao Tome e Principe whose registered office is at Avenida da Independencia, 392, II/III, C.P. 1092, Sao Tome (the "Contractor"). |

BACKGROUND:

|

(A) |

All Petroleum existing within the Territory of Sao Tome and Principe, as set forth in the Petroleum Law, is natural resources exclusively owned by the State. |

|

(B) |

The Agencia Nacional do Petroleo de Sao Tome e Principe, with the approval of the Government of Sao Tome and Principe, has the authority to enter into contracts for the conduct of Petroleum Operations in and throughout the area, the co-ordinates of which are described and outlined on the map in Schedule 1 of this Contract, which area is hereinafter referred to as the Contract Area. |

|

(C) |

The State wishes to promote Petroleum Operations in the Contract Area and the Contractor desires to join and assist the State in accelerating the exploration and exploitation of potential Petroleum resources within the Contract Area. |

|

(D) |

The Contractor has the necessary financial capability, technical knowledge and ability to carry out the Petroleum Operations hereinafter described in accordance with this Contract, the Petroleum Law and Good Oil Field Practice. |

|

(E) |

Pursuant to and in accordance with the Petroleum Law, this Contract has been entered into by and between the State and the Contractor for the purpose of Petroleum Operations in the Contract Area. |

|

(F) |

ERHC ENERGY EEZ, LDA is hereby designated as the Operator under Clause 28 of this Contract. |

IT IS AGREED as follows:

|

1. |

DEFINITIONS AND INTERPRETATION |

|

1.1 |

Except where the context otherwise indicates or as defined in the relevant petroleum laws or regulations, the following words and expressions shall have the following meanings: |

"Accounting Procedure" means the rules and procedures set forth in Schedule 2;

"Affiliate" means, in respect of a Party, a Person that Controls, is Controlled by, or is under the common Control with, the Party or any such Person, as the case may be;

"Allocation and Lifting Procedures" means the allocation and lifting procedures set forth in Schedule 3;

2

"Appraisal Well" means any well whose purpose at the time of commencement of drilling such well is the determination of the extent or volume of Petroleum contained in a Discovery ;

"Associate" means any Affiliate, subcontractor or other person associated with an authorized person in the conduct of Petroleum Operations.

"Associated Natural Gas" means all Natural Gas produced from a Reservoir the predominant content of which is Crude Oil and which is separated from Crude Oil in accordance with generally accepted international petroleum industry practice, including free gas cap, but excluding any liquid Petroleum extracted from such gas either by normal field separation, dehydration or in a gas plant;

"Available Crude Oil" means the Crude Oil recovered from the Contract Area, less quantities used for Petroleum Operations;

"Barrel" means a quantity or unit of Crude Oil, equal to 158.9874 liters (forty-two (42) United States gallons) at a temperature of fifteen point five six degrees (15.56°) Centigrade (sixty degrees (60°) Fahrenheit) and at one (1) atmosphere of pressure;

"Budget" means the cost estimate of items included in an approved Work Program;

"Calendar Year" or "Year" means a period of twelve (12) months commencing from January 1 and ending the following December 31, according to the Gregorian calendar;

"Commercial Discovery" means any Discovery, which has been declared to be commercial by the Contractor;

"Contract" means this production sharing contract, including its Recitals and Schedules, as amended from time to time through mutual agreement in writing between the Parties hereto;

"Contract Area" means the geographic area within the Territory of Sao Tome and Principe which is the subject of this Contract and as described in Schedule I , as such area may be amended in accordance with the terms herein;

"Cost Oil" means the quantum of Available Crude Oil allocated to the Contractor for recovery of Operating Costs after the allocation of Royalty Oil to the State;

"Control" means, in relation to a Person, the power of another Person to secure:

|

(a) |

by means of the holding of shares or the possession of voting power, directly or indirectly, in or in relation to the first Person; or |

|

(b) |

by virtue of any power conferred by the articles of association of, or any other document regulating, the first Person or any other Person, |

so that the affairs of the first Person are conducted in accordance with the decisions or directions of that other Person;

"Crude Oil" means crude mineral oil and liquid hydrocarbons in their natural state or obtained from Natural Gas by condensation or extraction;

3

"Decommissioning" means to abandon, decommission, transfer, remove and/or dispose of structures, facilities, installations, equipment and other property and other works used in Petroleum Operations in the Contract Area, to clean the Contract Area and make it good and safe, and to protect the environment, as further set out herein, and in the Petroleum Law and other applicable laws and regulations;

"Delivery Point" means the point located within the jurisdiction of the State at which Petroleum reaches (i) the inlet flange at the FOB export vessel, (ii) the loading facility metering station of a pipeline or (iii) such other point within the jurisdiction of the State as may be agreed between the Parties;

"Development Area" means the extent of an area within the Contract Area capable of Production of Petroleum identified in a Commercial Discovery, and agreed upon by the National Petroleum Agency following such Commercial Discovery;

"Discovery" means any geological structure(s),in which after testing, sampling and/or logging an Exploration Well existence of mobile hydrocarbons has been made probable and which structure(s), the Contractor deems worthy of evaluating further by conducting Appraisal operations;

"Effective Date" has the meaning ascribed to it in Clause 26.1;

"Exploration Period" has the meaning ascribed to in Clause 4.1;

"Exploration Well" means a well on any geological structure(s), whose purpose at the time of commencement of such well is to explore for an accumulation of Petroleum whose existence at the time was unproven by drilling;

"Field Development Program" means the program of activities presented by the Contractor to the National Petroleum Agency for approval outlining the plans for the Development of a Commercial Discovery. Such activities include:

|

(a) |

Reservoir, geological and geophysical studies and surveys; |

|

(b) |

Drilling of production and injection wells; and |

|

(c) |

Design, construction, installation, connection and initial testing of equipment, pipelines, systems, facilities, plants and related activities necessary to produce and operate said wells, to take, save, treat, handle, store, transport and deliver Petroleum, and to undertake re-pressurizing, recycling and other secondary or tertiary recovery projects; |

"Force Majeure" has the meaning ascribed to it in Clause 21;

"Government" means the government of Sao Tome and Principe, as provided for in article I 09 of the Constitution;

"LIBOR" means the interest rate at which United States dollar deposits of six (6) months duration are offered in the London Inter Bank Offered Rate, as published in the Financial Times of London. The applicable LIBOR rate for each month or part thereof within an applicable interest period shall be the interest rate published in the Financial Times of

4

London on the last business day of the immediately preceding calendar month. If no such rate is quoted in the Financial Times of London during a period of five (5) consecutive business days, another rate (for example, the rate quoted in the Wall Street Journal) chosen by mutual agreement between the National Petroleum Agency and the Contractor shall apply;

"Minimum Financial Commitment" has the meaning ascribed to it in Clause 7.3(a);

"Minimum Work Obligations" has the meaning ascribed to it in Clause 7.2;

"National Petroleum Account" means the account established in accordance with the Oil Revenue Law;

"National Petroleum Agency" or "Agencia Nacional do Petroleo" means the national regulatory agency established by the Government's Decree-Law 5/2004 of the 30th of June, which is responsible for the regulation and supervision of Petroleum Operations or any agency which succeeds the National Petroleum Agency with respect to some or all of its powers;

"Natural Gas" means all gaseous hydrocarbons and inerts, including wet mineral gas, dry mineral gas, gas produced in association with Crude Oil and residue gas remaining after the extraction of liquid hydrocarbons from wet gas, but not including Crude Oil;

"Oil Revenue Law" means the oil revenue law of the State, Law No. 8/2004 of the 30th of December, as amended, supplemented or replaced from time to time;

"Operating Costs" means expenditures incurred and obligations made as determined in accordance with Article 2 of the Accounting Procedure;

"Parties" or "Party" means the parties or a party to this Contract; "Petroleum" means:

|

(a) |

any naturally occurring hydrocarbon, whether in a gaseous, liquid or solid state; |

|

(b) |

any mixture of naturally occurring hydrocarbons, whether in a gaseous, liquid or solid state; or |

|

(c) |

any Petroleum (as defined above) that has been returned to a Reservoir; |

"Petroleum Law" means the Fundamental Law on Petroleum Operations, Law n° 16/2009, as amended or supplemented from time to time, and regulations made and directions provided under such law;

"Petroleum Operations" means activities undertaken in relation to the Contract Area for the purposes of:

|

· |

the Exploration, Appraisal, Development, Production, transportation, sale or export of Petroleum; |

5

|

· |

the construction, installation or operation of any structures, facilities or installations for the Development, Production and export of Petroleum, or Decommissioning or removal of any such structure, facility or installation; |

"Petroleum Taxation Law" means the Petroleum Taxation Law, Law n° 15/2009, as amended, supplemented or replaced from time to time;

"Proceeds" means the amount in United States dollars determined by multiplying the Realizable Price by the number of Barrels of Available Crude Oil lifted by a Party;

"Production Period" has the meaning ascribed to it in Clause 4.1;

"Profit Oil" means the balance of Available Crude Oil after the allocation of Royalty Oil and Cost Oil;

"Quarter" means a period of three (3) consecutive Months starting with the first day of January, April, July or October of each Year;

"Realizable Price" means the price in United States dollars per Barrel determined in accordance with Clause 11;

"Relinquished Area" means that portion of the Contract Area that is relinquished pursuant to and in accordance with Clauses 5.l (d) and/or 6;

"Reservoir" means a porous and permeable underground formation containing an individual and separate natural accumulation of producible Petroleum that is confined by impermeable rock and/or water barriers and is characterized by a single natural pressure system;

"Retained Area" means that portion of the Contract Area that 1s retained after a relinquishment under Clauses 5.l (d) and/or 6;

"Royalty" or "Royalty Oil" means the quantum of Available Crude Oil allocated to the State, based on a percentage calculated as a function of daily production rates as set forth in Clause 10.1(a);

"State" means the Democratic Republic of Sao Tome and Principe;

"Tax" means the tax payable pursuant to the Petroleum Taxation Law;

"Unassociated Natural Gas" means all gaseous Petroleum produced from Natural Gas Reservoirs, and includes wet gas, dry gas and residual gas remaining after the extraction of liquid Petroleum from wet gas; and

"Work Program" means the work commitments itemizing the Petroleum Operations to be carried out in relation to the Contract Area for the required period as defined in Clause 7.

1.2 Unless the context otherwise requires, reference to the singular shall include the plural and vice versa and reference to any gender shall include all genders.

6

1.3 The Schedules form an integral part of this Contract.

1.4 The table of contents and headings in this Contract are inserted for convenience only and shall not affect the meaning or construction of this Contract.

1.5 References in this Contract to the words "include", "including" and "other" shall be construed without limitation.

1.6 In the event of any inconsistency between the main body of this Contract and any Schedule, the provisions of the former shall prevail.

|

2. |

BONUSES AND SOCIAL PROJECTS |

|

2.1 |

Signature Bonus |

Pursuant to the Memorandum of Agreement made between the State and Environmental Remediation Holding Corp. (ERHC) on 27th of May 1997, renewed on 21st of May 2001 and finally renewed on 2nd April 2003, ERHC awarded block is not subject to the payment of signature bonus.

|

2.2 |

Production Bonuses |

The Contractor shall pay to the State by deposit into the National Petroleum Account production bonuses based on attainment of cumulative Production of Petroleum from each Development Area as follows:

|

Cumulative Production (millions of Barrels or |

Bonus (US$ million) |

|

50 |

10 |

|

100 |

12.5 |

|

200 |

15 |

|

350 |

20 |

|

550 |

25 |

|

2.3 |

The production bonuses provided for in Clause 2.2 shall be payable to the State by deposit into the National Petroleum Account within thirty (30) days of such Production level being first attained in immediately available funds. |

|

2.4 |

The signature and production bonuses provided for in this Clause 2 shall not be recoverable as Cost Oil or deductible for Tax purposes. |

|

2.5 |

Social Projects |

The Contractor commits to undertake social projects during each phase of the Exploration Period valued at a minimum of the amounts below:

|

- |

Phase I: Three Hundred Thousand United States dollars per year (U.S $300,000) for a total of One Million Two Hundred Thousand United States dollars (U.S $1,200,000); |

7

|

- |

Phase II: Five Hundred Thousand United States dollars per year (U.S $500,000) for a total of One Million United States dollars ((U.S $1,000,000); |

|

- |

Phase III: Four Hundred Thousand United States dollars per year (U.S $ 400,000) for a total of Eight Hundred Thousand United States dollars (U.S $800,000). |

If Petroleum is produced from the Contract Area, the Contractor shall undertake additional social projects according to the following schedule:

|

Cumulative Production (millions of Barrels or |

Value (US$ million) of Project |

|

20 |

2 |

|

40 |

4 |

|

60 |

6 |

|

2.6 |

The details of the social projects to be undertaken by the Contractor in accordance with Clause 2.5 shall be determined by agreement between the Contractor and the National Petroleum Agency. Failing such agreement, the Contractor and the National Petroleum Agency shall each submit a proposal to an expert appointed by the World Bank and such expert shall determine which of the two (2) proposals shall be implemented. The Contractor shall be solely responsible for any and all costs and expenses associated with the foregoing expert determination. The value of the projects provided for in Clause 2.5 above shall not be recoverable as Cost Oil or deductible for Tax purposes. |

|

2.7 |

The Contractor shall be responsible for the implementation of all agreed or chosen social projects, which shall be undertaken using all reasonable skill and care. |

|

3. |

SCOPE |

|

3.1 |

This Contract is a production sharing contract awarded pursuant to the Petroleum Law and governed in accordance with the terms and provisions hereof. The conduct of Petroleum Operations and provision of financial and technical requirements by the Contractor under this Contract shall be with the prior approval of or in prior consultation with the National Petroleum Agency as required under this Contract or the Petroleum Law. The State hereby appoints and constitutes the Contractor as the exclusive company (ies) to conduct Petroleum Operations in the Contract Area. |

|

3.2 |

During the term of this Contract, the total Available Crude Oil shall be allocated to the Parties in accordance with the provisions of Clause 10, the Accounting Procedure and the Allocation and Lifting Procedures. |

|

3.3 |

The Contractor, together with its Affiliates, shall provide all funds and bear all risk of Operating Costs and the sole risk in carrying out Petroleum Operations. |

|

3.4 |

The Contractor shall engage in Petroleum Operations solely in accordance with the Petroleum Law, the Petroleum Taxation Law, Good Oil Field Practice and all other applicable laws and regulations. |

8

|

4. |

TERM |

|

4.1 |

Subject to Clause 20, the term of this Contract shall be for a period of twenty-eight (28) years from the Effective Date, with an eight (8) year Exploration and Appraisal period, as extended pursuant to Clauses 5.l (b) and/or (c) (the "Exploration Period") and a twenty (20) year Production period (the "Production Period"). |

|

4.2 |

The Exploration Period shall be divided as follows: |

|

Phase I : |

four (4) years from the Effective Date; |

|

|

|

|

Phase II: |

from the end of Phase I until two (2) years after the end of Phase I; and |

|

|

|

|

Phase III: |

from the end of Phase II until two (2) years after the end of Phase II, as extended pursuant to Clauses 5.1(b) and/or (c). |

|

4.3 |

The Contractor shall commence Petroleum Operations no later than thirty (30) days after the National Petroleum Agency has approved the first Work Program. |

|

4.4 |

Provided the Contractor has fulfilled all of its obligations relative to the current phase of the Exploration Period as described in Clause 7.2, the Contractor may enter the next phase. The Contractor shall provide the National Petroleum Agency with written notice of its intention to enter the next phase of the Exploration Period at least thirty (30) days prior to the end of the relevant phase. The report shall document that the work commitments for the phase are fulfilled. The Ministry may upon application grant an exemption from the work obligation. |

|

4.5 |

Provided the Contractor has fulfilled all of its obligations relative to the current phase of the Exploration Period as described in Clause 7.2, the Contractor may terminate this Contract at the end of any phase during the Exploration Period in accordance with Clause 20.7. |

|

4.6 |

The Contractor shall have the right to produce Petroleum from each Development Area for a period of twenty (20) years from the date the Contractor declares a Commercial Discovery in the relevant area in accordance with Clause 5.1(b). This Contract will terminate with respect to the relevant Development Area at the end of such twenty (20) year period unless the National Petroleum Agency grants an extension on application of the Contractor. The Contractor may, for any Development Area, be granted one (1) or more five (5) year extension periods for a Development Area until all Petroleum has been economically depleted. In connection with any such extensions, the Parties agree to engage in good faith to re-negotiate the commercial terms of this Contract governing the applicable Development Area at least five (5) years prior to the expiration of the initial twenty (20) year period and at least two (2) years prior to the expiration of any subsequent extension period. |

|

5. |

COMMERCIAL DISCOVERY AND DECLARATION OF COMMERCIALITY |

|

5.1 |

The sequence of Petroleum Operations to establish a Commercial Discovery of Petroleum (other than Unassociated Natural Gas) shall be as follows: |

9

|

(a) |

the Contractor shall have a period of up to forty-five (45) days from the date on which the drilling of the applicable Exploration Well terminates to declare whether the Exploration Well has proven a Discovery; |

|

(b) |

the Contractor shall then have a period of two (2) years (unless otherwise agreed by the National Petroleum Agency) from declaration of a Discovery to declare the Discovery either on its own or in aggregation with other Discoveries a Commercial Discovery; |

|

(c) |

if the Contractor declares a Commercial Discovery it shall have a period of two (2) years (unless otherwise agreed by the National Petroleum Agency) from the time the Contractor declares a Discovery or aggregation of Discoveries to be a Commercial Discovery to submit a Field Development Program to the National Petroleum Agency for approval; |

|

(d) |

in the event a Discovery is not determined to be a Commercial Discovery, upon expiration of the period set out in Clause 5.1(b), the State may, provided it gives at least six (6) months' notice, require the Contractor to promptly relinquish, without any compensation or indemnification whatsoever, the area encompassing the Discovery, including all of its rights to Petroleum which may be produced from such Discovery. |

|

(e) |

if a field Development Program is approved by the National Petroleum Agency, the Contractor shall initiate field development and production according to the time schedule outlined in the Program |

|

5.2 |

Unassociated Natural Gas shall be developed in accordance with Clause 23.4. |

|

6. |

RELINQUISHMENT OF AREAS |

|

6.1 |

The Contractor must relinquish the Contract Area or part thereof in accordance with the following: |

|

(a) |

twenty-five percent (25%) of the initial surface area of the Contract Area shall be relinquished at the end of phase 1 of the Exploration Period; |

|

(b) |

a further twenty-five percent (25%) of the initial surface area of the Contract Area shall be relinquished at the end of phase 2 of the Exploration Period; and |

|

(c) |

the remainder of the Contract Area shall be relinquished at the end of phase 3 of the Exploration Period less: |

|

(i) |

any Development Area; |

|

(ii) |

areas for which the approval of a Field Development Program is pending, until finally decided; and |

|

(iii) |

any area reserved for a possible Unassociated Natural Gas Appraisal in relation to which the Contractor is engaged in discussions with the State in accordance with Clause 23.4. |

10

|

6.2 |

Any Retained Area and Relinquished Area shall be single continuous units and delimited by meridians and parallels of latitude expressed in whole minutes of a degree to be approved by the National Petroleum Agency. |

|

6.3 |

Any Relinquished Area shall revert to the State. |

|

6.4 |

Subject to the Contractor's obligations under Clause 7 and its Decommissioning obligations, the Contractor may, at any time, notify the National Petroleum Agency upon three (3) months prior written notice that it relinquishes its rights over all or part of the Contract Area. In no event shall any voluntary relinquishment by the Contractor over all of any part of the Contract Area reduce the Minimum Work Obligations or Minimum Financial Commitment set out in Clause 7. |

|

7. |

MINIMUM WORK PROGRAM AND BUDGET |

|

7.1 |

Within two (2) months after the Effective Date and thereafter at least three (3) months prior to the beginning of each Calendar Year, the Contractor shall prepare and submit for the approval of the National Petroleum Agency, a Work Program and Budget for the Contract Area setting forth the Petroleum Operations which the Contractor proposes to carry out during the ensuing Year, or in case of the first Work Program and Budget, during the remainder of the current Year. |

|

7.2 |

The minimum Work Program for each phase of the Exploration Period is as follows (the "Minimum Work Obligations"): |

Phase I: The Contractor shall:

|

· |

purchase and reprocess all existing 2D seismic within the block; |

|

· |

carry out Geological & Geophysical studies (including AVO, geochemical studies, sequence stratigraphy); |

|

· |

carry out environmental studies; |

|

· |

acquire of magnetic and gravity surveys covering the full block; |

|

· |

acquire, process and interpret a minimum of 2.500 km 2D seismic; |

|

· |

hand over full documentation of the interpretation and an extensive evaluation report covering all relevant stratigraphic levels in the full block, based on all existing 2D data and newly acquired 2D data - to ANP-STP no later than 3 months before the expiry of phase I. |

Phase II: If the Contractor elects to enter phase II, then during such phase II of the Exploration Period the Contractor shall:

|

· |

carry out environmental studies; |

|

· |

acquire, process and interpret 1100 km2 3D seismic data covering all identified prospects in the area; |

|

· |

drill one (1) Exploration Well to a minimum TVD up to the reservoir top; |

|

· |

carry out technical and economical evaluation studies of discoveries and remaining prospectivity |

11

Phase III: If the Contractor elects to enter phase III of the Exploration Period, then during such phase III the Contractor shall:

|

· |

carry out environmental studies; |

|

· |

drill one (1) Exploration Well to a minimum TVD up to the reservoir top; |

|

· |

carry out technical and economical evaluation studies of discoveries and remaining prospectivity. |

|

7.3 |

Minimum Financial Commitments |

|

(a) |

The Contractor shall be obligated to incur the following minimum financial commitment (the "Minimum Financial Commitment"): |

|

Phase I: |

Two Million Five Hundred Thousand United States dollars (U.S $2,500,000) |

|

Phase II: |

Forty Million United States dollars (U.S $40,000,000) |

|

Phase III: |

Forty Million United States dollars (U.S $40,000,000) |

|

(b) |

If the Contractor fulfills the Minimum Work Obligations set forth in Clause 7.2 for each phase of the Exploration Period, then the Contractor shall be deemed to have satisfied the Minimum Financial Commitments for each such phase. |

|

(c) |

If the Contractor fails to complete the Minimum Work Obligations for any phase of the Exploration Period and such commitment has not been moved to the next phase, if any, with the consent of the National Petroleum Agency, then the Contractor shall pay to the State by deposit into the National Petroleum Account (i) the difference between the Minimum Financial Commitment for the then current phase and the amount actually expended in Petroleum Operations for such phase and (ii) eight percent (8%) of the Minimum Financial Commitment for all subsequent phase that are not initiated, as liquidated damages in full and final settlement of all potential claims for breach of this Contract and, subject to Clause 20, this Contract shall automatically terminate. |

|

7.4 |

The Contractor shall be excused from any delay or failure to comply with the terms and conditions of Clauses 7.2 and/or 7.3: |

|

(a) |

during any period of Force Majeure; or |

|

(b) |

if the National Petroleum Agency denies the Contractor permission to drill |

|

7.5 |

The time for performing any incomplete Minimum Work Obligations for any phase of the Exploration Period and the term of this Contract shall be extended by the following periods in the circumstances set out in Clause 7.4: |

|

(a) |

with respect to Clause 7.4(a), for the period during which Force Majeure is in existence; and |

12

|

(b) |

with respect to Clause 7.4(b), for a reasonable time not less than six (6) months to permit the Contractor time to make a revised drilling plan which is satisfactory to the National Petroleum Agency. |

|

7.6 |

Subject to Clause 20, if any circumstance described in clause 7.5 (a) and (b) is not resolved after the time periods specified above, then after consultation with National Petroleum Agency under Clause 7.7 below and consent is not granted, the Contractor shall be liable to pay into the National Petroleum Account an amount corresponding to the unfulfilled work for that phase. |

|

7.7 |

Any unfulfilled Minimum Work Obligation in any phase of the Exploration Period may, with the written consent of the National Petroleum Agency, be added to the Minimum Work Obligation for the next succeeding phase. |

|

7.8 |

Work by the Contractor over and above the Minimum Work Obligations for any phase shall be credited against and reduce the Minimum Work Obligation for the next succeeding phase. |

|

7.9 |

For the purposes of determining whether an Exploration Well or an Appraisal Well has been drilled in accordance with the Minimum Work Obligation, such a well shall be deemed drilled if the minimum total depth has been reached or if any one of the following events occurs prior to reaching the minimum total depth: |

|

(a) |

a Discovery is made and further drilling may cause irreparable damage to such Discovery; |

|

(b) |

basement is encountered; |

|

(c) |

the National Petroleum Agency and the Contractor agree the well is drilled for the purpose of fulfilling the obligation to complete the Minimum Work Obligation; or |

|

(d) |

technical difficulties are encountered which, in the judgment of the Contractor and in accordance with reasonable and prudent international oilfield practice, makes further drilling impracticable, uneconomic, unsafe or a danger to the environment. |

|

7.10 |

The Exploration Period provided in clause 7.2, may be extended for a reasonable time not less than six (6) months to conclude the drilling and testing of any well for which operations have been commenced by the end of such phase; provided that if no Commercial Discovery has been declared by the Contractor during the Exploration Period, as may be extended, this Contract shall automatically terminate. |

|

7.11 |

Performance Bond |

|

(a) |

Within thirty (30) days from the Effective Date of this Contract, the Contractor shall submit a performance bond in a form approved by the National Petroleum Agency and from a reputable international financial institution approved by the National Petroleum Agency to cover the Minimum Financial Commitment for phase I of the Exploration Period. Failure by the Contractor to deliver the |

13

performance bond in as required by and in accordance with this Contract shall render this Contract null and void.

|

(b) |

Should the Contractor satisfy in full the conditions for continuing Petroleum Operations at the end of phase I of the Exploration Period pursuant to Clause 7.2, a replacement performance bond in the same form and from the same international financial institution, unless otherwise agreed by the National Petroleum Agency, shall be submitted within thirty (30) days from the date of the extension to cover the Minimum Financial Commitment for phase II of the Exploration Period. |

|

(c) |

Should the Contractor satisfy in full the conditions for continuing Petroleum Operations at the end of phase II of the Exploration Period, pursuant to Clause 7.2, a replacement performance bond in the same form and from the same international financial institution, unless otherwise agreed by the National Petroleum Agency shall be submitted within thirty (30) days from the date of the extension to cover the Minimum Financial Commitment for phase III of the Exploration Period. |

|

7.12 |

The amount of the performance bond shall be reduced annually by deducting the verified expenditures the Contractor has incurred in the previous year of each phase and shall terminate at the end of each phase, if the Minimum Work Obligations or Minimum Financial Commitment for that phase has been satisfied in full. |

|

7.13 |

Guarantee |

Within thirty (30) days from date of execution of this Contract, the Contractor shall submit a guarantee from a parent company approved by the National Petroleum Agency in the form of Schedule 6 which shall be valid for up to four (4) years after the termination of this Contract.

|

8. |

STATE PARTICIPATION |

|

8.1 |

The State, either through the National Petroleum Agency or any other entity designated by the State, shall have as of the Effective Date a carried fifteen percent (15%) of the Contractor's rights and interest under this Contract. The Contractor shall fund, bear and pay all costs, expenses and amounts due in respect of Petroleum Operations conducted pursuant to this Contract. |

|

8.2 |

The National Petroleum Agency or other entity designated by the State shall become a party to the Joint Operating Agreement in respect of its carried interest referred to in Clause 8.1. |

|

8.3 |

Upon the commencement of commercial Production the Contractor shall be entitled receive one hundred percent (100%) of Cost Oil in order to recover all costs, expenses and amounts paid in respect of Petroleum Operations pursuant to Clause 8.1 and incurred on behalf of the National Petroleum Agency or other entity designed by the State. |

14

|

8.4 |

The National Petroleum Agency or other entity designated by the State shall be entitled to receive fifteen percent (15%) of the Contractor's entitlement to Profit Oil as provided for in Clause 10.1(d). |

|

8.5 |

The National Petroleum Agency or other entity designated by the State shall be entitled, at any time, upon advance written notice to the Contractor to convert its carried interest into a full working participating interest, whereupon the National Petroleum Agency or other entity designated by the State shall be entitled to fifteen percent (15%) of all Available Crude Oil to which the Contractor is entitled under the terms of this Contract. |

|

9. |

RIGHTS AND OBLIGATIONS OF THE PARTIES |

|

9.1 |

In accordance with this Contract, the National Petroleum Agency shall: |

|

(a) |

pursuant to Clause 14, jointly work with the Contractor's professional staff in the fulfillment of Petroleum Operations under this Contract; |

|

(b) |

assist and expedite the Contractor's execution of Petroleum Operations and Work Programs including assistance in supplying or otherwise making available all necessary visas, work permits, rights of way and easements as may be reasonably requested by the Contractor in writing. All expenses incurred by the National Petroleum Agency, at the Contractor's request in providing such assistance, shall be reimbursed to the National Petroleum Agency by the Contractor in accordance with Clause 12. Such reimbursement shall be made against presentation of invoices and shall be in United States dollars. The Contractor shall include such reimbursements in the Operating Costs; |

|

(c) |

have the right to recover from the Contractor all costs which are reasonably incurred for purposes of Petroleum Operations and have been previously agreed with the Contractor; |

|

(d) |

have legal title to and shall keep the originals of all data and information resulting from Petroleum Operations including geological, geophysical, engineering, well logs, completion, production , operations, status reports and any other data and information as that the Contractor may compile during the term of this Contract; provided, however, that the Contractor shall be entitled to keep copies and use such data and information during the term of this Contract; and |

|

(e) |

not exercise all or any of its rights or authority over the Contract Area in derogation of the rights of the Contractor otherwise than in accordance with the Petroleum Law. |

|

9.2 |

In accordance with this Contract, the Contractor shall: |

|

(a) |

promptly pay to the State by deposit into the National Petroleum Account all fees, bonuses, and other amounts due to the State under the terms of this Contract; |

15

|

(b) |

provide all necessary funds for the payment of Operating Costs including funds required to provide all materials, equipment, facilities, supplies and technical requirements (including personnel) whether purchased or leased; |

|

(c) |

provide such other funds for the performance of Work Programs including payments to third parties who perform services to the Contractor in the conduct of Petroleum Operations; |

|

(d) |

prepare Work Programs and Budgets and carry out approved Work Programs in accordance with Good Oil Field Practice with the objective of avoiding waste and obtaining maximum ultimate recovery of Petroleum at a minimum cost; |

|

(e) |

exercise all the rights, comply with all the obligations under the Petroleum Law and any other applicable laws and pay the following fees to the State by deposit into the National Petroleum Account (all expressed in United States dollars): |

|

On application for the Production Period: |

$500,000 |

|

To assign or otherwise transfer any interest during Exploration Period |

$100,000 |

|

To assign or otherwise transfer any interest during Production Period |

$300,000 |

|

On application to terminate this Contract: |

$100,000 |

|

On application for the Contractor to commence drilling: |

$25,000 |

|

(f) |

ensure that all leased equipment brought into the Territory of Sao Tome and Principe for the conduct of Petroleum Operations is treated in accordance with the terms of the applicable leases; |

|

(g) |

have the right of ingress to and egress from the Contract Area and to and from facilities therein located at all times during the term of this Contract; |

|

(h) |

promptly submit to the National Petroleum Agency for permanent custody the originals of all geological, geophysical, drilling, well production, operating and other data, information and reports as it or its Associates may compile during the term of this Contract; |

|

(i) |

prepare estimated and final tax returns and submit the same to the relevant tax authority on a timely basis in accordance with the Petroleum Taxation Law; |

|

(j) |

have the right to lift in accordance with lifting and allocation procedures to be agreed by the Parties within six (6) months prior to the commencement of Production, in accordance with the principles set forth in Schedule 3, and to freely export and retain abroad the receipts from the sale of Available Crude Oil allocated to it under this Contract; |

16

|

(k) |

prepare and carry out plans and programs of the State for industry training and education of nationals of Sao Tome and Principe for all job classifications with respect to Petroleum Operations pursuant to and in accordance with the Petroleum Law; |

|

(l) |

employ only such qualified personnel as is required to conduct Petroleum Operations in accordance with Good Oil Field Practice and in a prudent and cost effective manner giving preference to qualified nationals of Sao Tome and Principe; |

|

(m) |

give preference to such goods, material and equipment which are available in Sao Tome and Principe or services that can be rendered by nationals of Sao Tome and Principe in accordance with the Petroleum Law and this Contract; |

|

(n) |

with its Associates shall, as the case may be, pay all charges and fees as are imposed by law in Sao Tome and Principe. The Contractor and its Associates shall not be treated less favorably from any other Persons engaged in similar petroleum operations in the Territory of Sao Tome and Principe; |

|

(o) |

indemnify and hold the State, including the National Petroleum Agency, harmless against all losses, damages, injuries, expenses, actions of whatever kind and nature including all legal fees and expenses suffered by the State or the National Petroleum Agency where such loss, damage, injury, expense or action is caused by the negligence or willful misconduct of the Contractor, its Affiliates, its sub-contractors or any other Person acting on its or their behalf or any of their respective directors, officers, employees, agents or consultants; |

|

(p) |

not exercise all or any rights or authority over the Contract Area in derogation of the rights of the State or in breach of the Petroleum Law; and |

|

(q) |

in the event of any emergency requiring immediate operational action, take all actions it deems proper or advisable to protect the interests of the Parties and any other affected Persons and any costs so incurred shall be included in the Operating Costs. Prompt notification of any such action taken by the Contractor and the estimated cost shall be given to the National Petroleum Agency within forty-eight (48) hours of becoming aware of the event. |

|

10. |

RECOVERY OF OPERATING COSTS AND SHARING OF PETROLEUM PRODUCTION |

|

10.1 |

The allocation of Available Crude Oil shall be calculated on a Contract Area basis for Royalty Oil, Cost Oil and Profit Oil. This allocation of Available Crude Oil shall be in accordance with the Accounting Procedure, the Allocation and Lifting Procedure and this Clause 10 as follows: |

|

(a) |

Royalty Oil shall be allocated to the State from the first day of Production, based on the daily total of Available Crude Oil from a Contract Area, set at a rate of 2%; |

17

|

(b) |

Cost Oil shall be allocated to the Contractor in such quantum as will generate an amount of Proceeds sufficient for recovery of Operating Costs in each Contract Area. All costs will be recovered in United States dollars through Cost Oil allocation; |

|

(c) |

Cost Oil shall be not more than eighty percent (80) % of Available Crude Oil in each Contract Area less deduction of Royalty Oil in any accounting period; |

|

(d) |

Profit Oil, being the balance of Available Crude Oil after deducting Royalty Oil and Cost Oil shall be allocated to each Party based on the pre-tax, nominal rate of return calculated on a quarterly basis for the Contract Area in accordance with the following sliding scale: |

|

Contractor's Rate of Return for |

Government Share |

Contractor Share |

|

<16% |

0% |

100% |

|

>=16 %< 19% |

10% |

90% |

|

>=19 %< 23% |

20% |

80% |

|

>=23 %< 26% |

40% |

60% |

|

>=26% |

50% |

50% |

|

10.2 |

Beginning at the date of Commercial Discovery, Contractor's rate of return shall be determined at the end of each Quarter on the basis of the accumulated compounded net cash flow for each Contract Area, using the following procedure: |

|

(a) |

The Contractor's net cash flow for a Contract Area for each Quarter is: |

|

(i) |

The sum of the Contractor's Cost Oil and share of Contract Area Profit Oil regarding the Petroleum actually lifted in that Quarter at the Realizable Price; |

|

(ii) |

Minus Operating Costs; |

|

(b) |

For this computation, neither any expenditure incurred prior to the date of Commercial Discovery for a Contract Area nor any Exploration Expenditure shall be included in the computation of the Contractor's net cash flow. |

|

(c) |

The Contractor's net cash flows for each Quarter are compounded and accumulated for a Contract Area from the date of the Commercial Discovery according to the following formula: |

ACNCF (Current Quarter) =

(100% + DQ) x ACNCF (Previous Quarter) + NCF (Current Quarter) 100%

where:

ACNCF = accumulated compounded net cash flow

NCF = net cash flow

18

DQ = quarterly compound rate (in percent)

The formula will be calculated using quarterly compound rates (in percent) of 3,78%, 4.45%, 5.31%, and 5.95%, which correspond to annual compound rates ("DA") of 16%, 19%, 23%, and 26%, respectively.

|

(d) |

The Contractor's rate of return in any given Quarter for a Contract Area shall be deemed to be between the largest DA which yields a positive or zero ACNCF and the smallest DA which causes the ACNCF to be negative. |

|

(e) |

The sharing of Profit Oil from a Contract Area between the State and the Contractor in a given Quarter shall be in accordance with the scale in paragraph (a) above using the Contractor's deemed rate of return as per paragraph (c) in the immediately preceding Quarter. |

|

(f) |

In a given Contract Area, it is possible for the Contractor's deemed rate of return to decline as a result of negative cash flow in a Quarter with the consequence that Contractor's share of Profit Oil from that Contract Area would increase in the subsequent Quarter. |

|

(g) |

Pending finalization of accounts, Profit Oil from the Contract Area shall be shared on the basis of provisional estimates, if necessary, of a deemed rate of return as approved by the National Petroleum Agency. Adjustments shall be effected with the procedure subsequently to be adopted by the National Petroleum Agency. |

|

10.3 |

The quantum of Available Crude Oil to be allocated to each Party under this Contract shall be determined at the Delivery Point. |

|

10.4 |

Each Party shall lift and dispose of its allocation of Available Crude Oil in accordance with the Allocation and Lifting Procedures as provided in Schedule 3. In the event of any reconciliation, the records of the National Petroleum Agency shall be the official, final and binding records. |

|

10.5 |

Allocation of Royalty Oil and State Profit Oil shall be in the form of delivery of Production of Petroleum to the National Petroleum Agency and the National Petroleum Agency or other appropriate authority shall issue receipts for such delivery within thirty (30) days of lifting such Royalty Oil and Profit Oil. These receipts are issued by the National Petroleum Agency or other appropriate authority on behalf of the Government of Sao Tome and Principe. |

|

10.6 |

Any Party may, at the request of any other Party, lift such other Party's Available Crude Oil pursuant to Clause 10.3 and the lifting Party within thirty (30) days shall transfer to the account of the non-lifting Party the Proceeds of the sale to which the non-lifting Party is entitled . Overdue payments shall bear interest at the rate of LIBOR plus two percent (2%). |

|

10.7 |

The State may sell to the Contractor all or any portion of its allocation of Available Crude Oil from the Contract Area under mutually agreed terms and conditions at the Realizable Price. |

19

|

10.8 |

The Parties shall meet as and when agreed in the Allocation and Lifting Procedures to reconcile all Petroleum produced, allocated and lifted during the period in accordance with the Allocation and Lifting Procedures set forth in Schedule 3. |

|

10.9 |

Notwithstanding the above, in lieu of lifting the State's Profit Oil and/or Royalty Oil, the State, upon one hundred eighty (180) days advance notice to the Operator, issued by the National Petroleum Agency, may elect to receive the State's allocation of Profit Oil and/or Royalty Oil in cash based on the Realizable Price rather than through lifting regardless of whether or not the Contractor sells the State's Profit Oil and/or Royalty Oil to a third party. If the State elects to receive cash in lieu of lifting, the Operator shall lift the State's allocation of Profit Oil and/or Royalty Oil and pay into the National Petroleum Account cash in respect of such lifting within thirty (30) days from the end of the month in which the lifting occurred. Every six (6) months, the State may elect to have an entity designated by the State to resume lifting the State's allocation of Profit Oil and/or Royalty Oil upon one hundred eighty (180) days notice to the Operator prior to the date the State elects to have an entity, designated by the State, to resume lifting. |

|

11. |

VALUATION OF CRUDE OIL |

|

11.1 |

Save as otherwise provided in this Contract, Crude Oil Production shall be valued in accordance with the following procedures: |

|

(a) |

On the attainment of commercial production of Crude Oil, each Party shall engage the services of an independent laboratory of good repute to undertake a qualitative and quantitative analysis of such Crude Oil. |

|

(b) |

When a new Crude Oil stream is produced, a trial marketing period shall be designated which shall extend for the first six (6) month period during which such new stream is lifted or for the period of time required for the first ten ( 10) liftings, whichever is longer. During the trial marketing period the Parties shall: |

|

(i) |

collect samples of the new Crude Oil upon which the qualitative and quantitative analysis shall be performed as provided in Clause 11.1(a); |

|

(ii) |

determine the approximate quality of the new Crude Oil by estimating the yield values from refinery modeling; |

|

(iii) |

market in accordance with their entitlement to the new Crude Oil and to the extent that one Party lifts the other Party's allocation of Available Crude Oil, and payments therefore, shall be made by the buyers to the Operator who will be responsible for distributing to the other Parties in accordance with their entitlement, Cost Oil and Profit Oil and the Contractor's accounting shall reflect such revenues, in accordance with Clause 10; |

20

|

(iv) |

provide information to a third party who shall compile the information and maintain all individual Party information confidential, with regard to the marketing of the new Crude Oil, including documents which verify the sales price and terms of each lifting; and |

|

(v) |

apply the actual F.0.B. sales price to determine the value for each lifting which F.O.B. sales pricing for each lifting shall continue, as the Realizable Price, after the trial marketing period until the Parties agree to a valuation of the new Crude Oil but in no event longer than ninety (90) days after conclusion of the trial marketing period. |

|

(c) |

As soon as practicable but in any event not later than sixty (60) days after the end of the trial marketing period, the Parties shall meet to review the qualitative and quantitative analysis, yield and actual sales data. Each Party may present a proposal for the valuation of the new Crude Oil. A valuation formula for the Realizable Price shall be agreed to by the Parties not later than nine (9) months after the first lifting. It is the intent of the Parties that such prices shall reflect the true market value based on arm's length transactions for the sale of the new Crude Oil. The valuation formula, as determined hereinbefore (including the product yield values), shall be mutually agreed within thirty (30) days of the aforementioned meeting, failing which, it shall be referred to a mutually agreed independent expert who shall have the appropriate international oil and gas experience and who will resolve and settle the matter in a manner as he shall in his absolute discretion think fit and the decision of the expert shall be final and binding on the Parties. If, after a period of thirty (30) days, the Parties are unable to agree on the identity of the expert, such expert shall be appointed by the International Centre for Expertise in accordance with the provisions for the appointment of experts under the Rules for Expertise of the International Chamber of Commerce. |

|

(d) |

Upon the conclusion of the trial marketing period, the Parties shall be entitled to lift their allocation of Available Crude Oil pursuant to Clause 10.3 and the Allocation and Lifting Procedures set forth in Schedule 3. |

|

(e) |

When a new Crude Oil stream is produced from the Contract Area and is commingled with an existing Crude Oil produced, which has an established Realizable Price basis, then such basis shall be applied to the extent practicable for determining the Realizable Price of the new Crude Oil. The Parties shall meet and mutually agree on any appropriate modifications to such established valuation basis, which may be required to reflect any change in the market value of the Crude Oils as a result of commingling. |

|

11.2 |

If, in the opinion of either the National Petroleum Agency or the Contractor, an agreed price valuation method fails to reflect the market value of Crude Oil produced in the Contract Area, then such Party may propose to the other Party modifications to such valuation method once in every six (6) months but in no event more than twice in any Calendar Year. The Parties shall then meet within thirty (30) days of such proposal and mutually agree on any modifications to such valuation within thirty (30) days from such meeting, failing which, the issue shall be referred to a mutually agreed independent expert who shall have the appropriate international oil and gas experience |

21

and who will resolve and settle the matter in a manner as he shall in his absolute discretion think fit and the decision of the expert shall be final and binding on the Parties. If after a period of thirty (30) days, the Parties are unable to agree on the identity of the expert, such expert shall be appointment by the International Centre for Expertise in accordance with the provisions for the appointment of experts under the Rules for Expertise of the International Chamber of Commerce.

|

11.3 |

Segregation of Crude Oils of different quality and/or grade shall, by agreement of the Parties, take into consideration, among other things, the operational practicality of segregation and the cost benefit analysis thereof. If the Parties agree on such segregation the following provisions shall apply: |

|

(a) |

any and all provisions of this Contract concerning valuation of Crude Oil shall separately apply to each segregated Crude Oil produced; and |

|

(b) |

each grade or quality of Crude Oil produced and segregated in a given year shall contribute its proportionate share to the total quantity designated in such year as Royalty Oil, Cost Oil and Profit Oil. |

|

12. |

PAYMENTS |

|

12.1 |

The Contractor shall make all payments to the State for which it is liable under this Contract in United States dollars or such other currency agreed between the Contractor and the National Petroleum Agency. Payments shall be made into the National Petroleum Account in accordance with the Oil Revenue Law. Where a payment is made in currency other than United States dollars, the exchange rate used to convert the United States dollars liability into that currency shall be the exchange rate published on the date of payment by the Central Bank of Sao Tome and Principe for Dobras and the Financial Times of London for other currencies. Overdue payments shall bear interest at the annual rate of LIBOR plus two percent (2%) from the due date until the date of actual payment. |

|

12.2 |

The State shall make all payments to the Contractor for which it is liable under this Contract in United States dollars or such other currency agreed between the Contractor and the National Petroleum Agency. Where a payment is made in a currency other than United States dollars, the exchange rate used to convert the United States dollar liability into that currency shall be the exchange rate published on the date of payment by the Central Bank of Sao Tome and Principe for Dobras, and the Financial Times of London for other currencies. Overdue payments shall bear interest at the annual rate of LIBOR plus two percent (2%) from the due date until the date of actual payment. |

|

12.3 |

Any payments required to be made pursuant to this Contract shall be made within ten (10) days following the end of the month in which the obligation to make such payments is incurred. |

22

|

13. |

TITLE TO EQUIPMENT I DECOMMISSIONING |

|

13.1 |

The Contractor shall finance the cost of purchasing or leasing all materials, equipment and facilities to be used in Petroleum Operations in the Contract Area pursuant to approved Work Programs and Budgets and such materials, equipment and facilities, if purchased, shall become the sole property of the State when the Contractor has recovered the cost of such materials, equipment and facilities (as the case may be) in accordance with this Contract or upon its termination, whichever occurs first, free of all liens and other encumbrances. Except as otherwise provided for in the Petroleum Law, the Contractor and the State, including the National Petroleum Agency, shall have the right to use all materials, equipment and facilities exclusively for Petroleum Operations in the Contract Area during the term of this Contract and any extensions thereof. Should the State or the National Petroleum Agency desire to use such materials, equipment and facilities outside the Contract Area, such use shall be subject to terms and conditions agreed by the Parties, provided that it is understood that Petroleum Operations in the Contract Area hereunder shall take precedence over such use by the State or the National Petroleum Agency. The Contractor shall only lease materials, equipment and facilities with the approval of the National Petroleum Agency, such approval not to be unreasonably withheld if such lease is in the best interest of the Petroleum Operations. |

|

13.2 |

The Contractor's right to use such purchased materials, equipment and facilities shall cease with the termination or expiration (whichever is earlier) of this Contract, including any extensions hereof. |

|

13.3 |

The provisions of clause 13.1, with respect to the title of property passing to the State, shall not apply to leased equipment belonging to local or foreign third parties, and such equipment may be freely exported from the Territory of Sao Tome and Principe in accordance with the terms of the applicable lease. |

|

13.4 |

Subject to clause 13.2, all fixed assets purchased or otherwise acquired by the Contractor for the purposes of Petroleum Operations hereunder shall become the property of the State when the Contractor has recovered the cost of such materials, equipment and facilities (as the case may be) in accordance with this Contract or upon its termination, whichever occurs first. Upon termination of this Contract, the Contractor shall hand over possession of such fixed assets to the State in good working order and free of all liens and other encumbrances. |

|

13.5 |

During the term of this Contract, any agreed sales of equipment, land, fixed assets, materials and machinery acquired for the purpose of Petroleum Operations shall be conducted by the Contractor on the basis of the procedure for sale of assets as set forth in Schedule 5, subject to the consent of the National Petroleum Agency. |

|

13.6 |

Decommissioning |

The expenditure for Decommissioning will be estimated on the basis of technical studies undertaken by the Contractor, to be agreed by the National Petroleum Agency, as part of each Field Development Program and revised as necessary.

23

|

13.7 |

Unless otherwise agreed by the National Petroleum Agency, the procedure for the Contractor providing funds to meet its Decommissioning obligations shall be as follows: |

|

(a) |

an amount shall be established on a Contract Area basis, commencing two years after the start of Production Period, on a unit of production basis as follows: |

|

DP = |

(PVDC - DF) * ( P / RP), where: |

|

DP = |

Decommissioning provision for the period (millions of US dollars) |

|

PVDC = |

Present Value of Decommissioning costs (millions of US dollars) |

|

DF = |

Balance of Decommissioning fund at the start of the period (millions of US dollars) |

|

P = |

Crude Oil production in the period (millions of Barrels) |

|

RP = |

Estimated remaining Crude Oil (millions of Barrels) |

|

(b) |

All Decommissioning provisions shall be held in a Decommissioning reserve fund which shall be an interest bearing escrow account jointly established by the Parties at a first class commercial bank or other financial institution in accordance with the Petroleum Law. The bank or financial institution shall have a long term rating of not less than "AA" by Standard and Poor's Corporation or an "Aa2" rating by Moody's Investor Service or a comparable rating by another mutually agreed rating service. |

|

(c) |

For the purposes of calculating the present value of Decommissioning costs, the following formula shall be used: |

|

PVDC = |

EDC / (1 + i)n, where: |

|

PVDC = |

present value of Decommissioning costs |

|

EDC = |

estimated value of Decommissioning costs in nominal terms at the expected date of Decommissioning |

|

i = |

interest rate applicable to the escrow account in the current period |

|

n = |

number of Years between current period and expected date of Decommissioning |

|

13.8 |

The Decommissioning reserve fund shall be used solely for the purposes of paying for Decommissioning activities. No Party may mortgage, pledge, encumber or otherwise use such Decommissioning reserve fund for any purpose whatsoever, except as expressly provided herein or in the Petroleum Law. The Decommissioning reserve fund may be invested in investments approved in advance by the Contractor and the National Petroleum Agency. |

|

13.9 |

The Contractor shall annually meet any shortfall between the actual Decommissioning costs and the Decommissioning reserve fund for any Contract Area, with such amount |

24

to be deposited into the escrow account within thirty (30) days after the end of each Calendar Year.

|

13.10 |

Any balance remaining in any Decommissioning fund after all Decommissioning costs in the Contract Area have been met shall be distributed between the National Petroleum Agency and the Contractor in the same proportion as the allocation of Available Crude Oil at the time of Decommissioning operations. |

|

13.11 |

Decommissioning expenditures incurred under these Decommissioning provisions are both cost recoverable as Contract Area non-capital costs under the Accounting Procedure and deductible for Tax purposes under the Petroleum Taxation Law. |

|

14. |

EMPLOYMENT AND TRAINING OF NATIONALS OF THE STATE |

|

14.1 |

Each Calendar Year the Contractor shall submit a detailed program for recruitment and training for the following Calendar Year in respect of its personnel from Sao Tome and Principe in accordance with the Petroleum Law. |

|

14.2 |

Qualified nationals from Sao Tome and Principe shall be employed in all non specialized positions. |

|

14.3 |

Qualified nationals from Sao Tome and Principe shall also be employed in specialized positions such as those in exploration, drilling, engineering, production, environmental safety, legal and finance. The Contractor shall have the right, subject to applicable laws, rules and regulations, to employ non-nationals of Sao Tome and Principe in such specialized positions where qualified individuals from Sao Tome and Principe are not available, provided that the Contractor shall recruit and train nationals from Sao Tome and Principe for such specialized positions such that the number of expatriate staff shall be kept to a minimum. |

|

14.4 |

Pursuant to Clause 9(k), qualified competent professionals of the National Petroleum Agency shall be assigned to work with the Contractor and such personnel and the Contractor's national personnel from Sao Tome and Principe shall not be treated differently with regard to salaries and other benefits. The Contractor and the National Petroleum Agency shall mutually agree on the numbers of the National Petroleum Agency's staff to be assigned to work with the Contractor. The costs and expenses of such National Petroleum Agency personnel shall be included in Operating Costs. The Contractor shall not be liable for any damages resulting from the negligence or willful misconduct of any National Petroleum Agency employees assigned to work for the Contractor. |

|

14.5 |

The Parties shall mutually agree on the organizational chart of the Contractor which shall include nationals of Sao Tome and Principe in key positions. |

|

14.6 |

No Sao-Tomean employed shall be disengaged without the prior written approval of the National Petroleum Agency, except in the case of gross misconduct by such employee, in which case only prior notice to the National Petroleum Agency will be required. Gross misconduct for the purposes of this Clause shall mean a specific act of very serious wrongdoing and improper behavior which has been investigated and proved by documentary evidence. |

25

|

14.7 |

The Contractor shall spend [point twenty-five percent (0.25%)] of the Operating Costs in each Year of the Exploration Period (subject to a minimum of One Hundred Thousand United States dollars (U.S $100,000) and a maximum of Two Hundred and Fifty Thousand United States dollars (U.S $250,000) in any Calendar Year on scholarships for the training of nationals of Sao Tome and Principe at institutions to be selected by the National Petroleum Agency. In connection with the review of the annual Work Program and Budgets, the National Petroleum Agency may propose additional budgets for training and the National Petroleum Agency and the Contractor may mutually agree to such proposal. |

|

14.8 |

The Contractor shall spend Five Hundred and Fifty Thousand United States dollars (U.S $550,000) in each Calendar Year during the Production Period on scholarships for the training of nationals of Sao Tome and Principe at institutions to be selected by the National Petroleum Agency. In connection with the review of the annual Work Program and Budgets, the National Petroleum Agency may propose additional budgets for training and the Parties may mutually agree to such proposal. |

|

14.9 |

Amounts payable under Clauses 14.7 and 14.8 shall be recoverable as Contract Area non-drilling exploration costs under the terms of the Accounting Procedure. |

|

15. |

BOOKS AND ACCOUNTS, AUDIT AND OVERHEAD CHARGES |

|

15.1 |

Books and Accounts |

|

(a) |

The Contractor shall be responsible for keeping complete books of accounts consistent with Good Oil Field Practice and modem petroleum industry and accounting practices and procedures. The books and accounts maintained under and in accordance with this Contract shall be kept in United States dollars. All other books of accounts, as the Operator may consider necessary shall also be kept in United States dollars. Officials of the National Petroleum Agency and the Contractor shall have access to such books and accounts at all times upon reasonable notice. The accountants of the National Petroleum Agency shall participate in the preparation of all books and accounts maintained under and in accordance with this Contract. |

|

(b) |

All original books of account shall be kept at the registered address or principal place of business of the Contractor in Sao Tome and Principe. |

|

15.2 |

Audits |

|

(a) |

The National Petroleum Agency shall have the right to inspect and audit the accounting records relating to this Contract or Petroleum Operations for any Calendar Year by giving thirty (30) days advance written notice to the Operator. The Operator shall facilitate the work of such inspection and auditing; provided, however, that such inspection and auditing shall be carried out within three (3) Calendar Years following the end of the Calendar Year in question. If not, the books and accounts relating to such Calendar Year shall be deemed to be accepted by the Parties. Any exception must be made in writing within ninety (90) days following the end of such audit and failure to |

26

give such written notice within such time shall establish the correctness of the books and accounts by the Parties.

|

(b) |

The National Petroleum Agency may undertake the inspection and audit in Clause 15.2(a) either through its own personnel or through a qualified firm of chartered accountants appointed for such purpose by the National Petroleum Agency; provided, however, that the transportation and per diem costs of the National Petroleum Agency's own personnel shall be borne by the Contractor as a general administrative cost and shall be cost recoverable. Costs for the qualified firm of chartered accountants shall be borne by the National Petroleum Agency. |

|

(c) |

Notwithstanding that the said period of three (3) Calendar Years may have expired, if the Contractor or any of its employees or any Person acting on its behalf has acted with negligence or engaged in willful misconduct, the National Petroleum Agency shall have the right to conduct a further audit to the extent required to investigate such negligence or willful misconduct in respect of any earlier periods and all costs of such investigation shall be for the account of the Contractor and shall not be cost recoverable. |

|

15.3 |

Materials |